13 minute read

Karachi Electric: Financial misstatements?

The name of the electric company has been making the rounds in several newspapers after a former board member wrote a letter to the Pakistan Stock Exchange (PSX) concerning Karachi electric. In response the company has initiated a case against the former for defamation

By Asad Ullah Kamran

Advertisement

On January 10 this year, the Securities and Exchange Commission of Pakistan (SECP) received a letter from one Asad Ali Shah. The letter alleged that KE, the company that holds a virtual monopoly over Karachi’s electricity generation, transmission and distribution, has been fudging their numbers.

“There are material misstatements in the financial statements of Karachi Electric (KE), which render them misleading,” reads the letter that has stirred up quite the storm in Pakistan’s energy sector. What kind of misstatements in the financials is Mr Shah alleging? In his letter he states that in financial statements for the period ending September last year, “the aggregate amount of revenue and receivables recognised in respect of write-offs amounted to Rs 53.5 billion.”

These “write-offs” are the tariff differentials that the government of Pakistan pays to companies like KE. Since there is a difference between the electricity tariff paid by consumers and the allowable costs of electricity utilities determined by the regulator, NEPRA, the centre ends up paying back this tariff differential.

In short: the letter is claiming that KE has written up a higher bill for the federal government than is due and has also overstated cumulative profits by a massive amount of Rs 53.5 billion. What makes the letter so deadly? For starters, Asad Ali Shah formerly sat as director on the board of Karachi Electric and his concerns have been seconded by another board member by the name of Naveed Ismail. On top of that, Shah is former president of the Institute of Chartered Accountants Pakistan (ICAP) and managing partner at Deloitte Pakistan — meaning he has a professional understanding of the numbers and balance sheet.

How has KE responded? First by asking for time to respond from the Pakistan Stock Exchange (as a publicly listed company it has a duty to its shareholders to keep them informed about such allegations) and then by suing Shah in the Sindh High Court for damages to the tune of Rs 5 billion.

While the court has restrained Shah from continuing his crusade and expressing his concerns while the case is heard, the issue at hand thus concerns the management of a company that controls the electricity supply to Pakistan’s largest city which is home to more than 16 million people and is a vital cog in the national economy.

More about the letter…

The letter states that, for numerous years, KE has engaged in improper recognition of revenue and receivables from the government in relation to its write offs of trade receivables — which the KE management claims are to be paid by the government as a tariff differential subsidy.

To get a better understanding of what we’re talking about first we must understand the tariff differential subsidy. According to a definition from PIDE it is essentially the difference between the electricity tariff inclusive of certain surcharges paid by consumers and the authorised costs of electrical companies as defined by NEPRA.

For further simplification look at it this way; NEPRA sets the price of a unit of electricity for the distribution company at say Rs 20 based on estimations and forward looking calculations for the cost of energy. However, due to any number of reasons the cost of electricity in real time rose to Rs 25, however, the distribution company is only allowed to charge Rs 20.

This is an oversimplified explanation of the Tariff Differential Subsidy. The difference between the two prices [Rs 5] is then paid to the distribution company by the government in the form of this subsidy.

In the most recent quarterly financial statements produced by the company for the period ending September 30, 2022, the total amount of revenue and receivables recorded in respect of write-offs for the tariff differential subsidy was Rs 53.5 billion, according to the letter written by Shah.

The foundation of Shah’s argument is that a significant portion of the receivables claimed by KE are not valid and do not meet the legislative standards of the NEPRA consumer service manual or are not recognised under the criteria of International Financial Reporting Standard (IFRS) 15.

What is IFRS 15 you ask ?

According to the official definition published on the foundation’s website, “IFRS 15 establishes the principles that an entity applies when reporting information about the nature, amount, timing and uncertainty of revenue and cash flows from a contract with a customer.”

These standards have been written so that “entities have common accounting rules that allow financial statements to be consistent, reliable, and comparable between every business in any country.”

This essentially means that according to Shah, KE has allegedly been publishing exaggerated figures for revenues and receivables inconsistent with international practices. This would in turn hype up the share price of the company.

The write-offs for the tariff differential subsidy basically point to the amount that is unrecoverable from the customers of KE for electricity already supplied. This amount is then to be collected from the government through multi-year tariff adjustments and, therefore, is recorded as a “receivable” which is a current asset in the financial statements of the company.

Profit reached out to several sources in regards to this matter however officials preferred not to go on record considering the fact that the matter is a legal case. In essence Shah says that the receivable from a consumer, does not meet the legal or accounting standards to be recognised as such in the financial statements of the company.

According to an industry expert while talking to Profit on the condition of anonymity stated that this practice props up the receivables of the company artificially which in turn gives an inaccurate share value, if the allegations have any substance to them.

He further went on to explain that both parties can have something to potentially gain given the precarious nature of the case. The source further went on to mention the recent saga of Adani and Hindenburg.

Furthermore, Shah in his letter argued the recording of “hook connections” or more commonly known as kundas in the amounts relating to the write off claims is “clearly illegal” referencing a letter from NEPRA to KE in February of 2014. The letter according to Shah rules that these connections were illegal, and in violation of terms and conditions of the tariff.

He supported his argument in the letter by quoting KE own accounting policy, stating the 2021 annual report of the company Shah writes that, “revenue is recognised on supply of electricity to consumers based on meter readings”. Obviously hook connections aren’t metered, therefore, cannot be recorded as a revenue.

The IFRS argument…

Shah explains in the letter that according to applicable accounting rules of IFRS-15, it is prohibited to recognise revenue without first determining the customer’s ability and desire to pay the dues.

“In evaluating whether collectability of an amount of consideration is probable, an entity shall consider only the customer’s ability and intention to pay that amount of consideration when it is due.” [IFRS 15]

Furthermore, before this happens the customer has to be first identified so a legally binding contract can be in place. If we take a look at the section of “Revenue from Contracts with Customers” in the IFRS-15, this is a five step model that has to be followed prior to the recognition of revenue and receivable. The first step reads, “Identify the contract with the customer”.

To allegedly bypass this rule, according to the former board member, “a very complex policy of write offs of receivables was made by the management, approved by the board in consultation with the auditors…”. Within this policy the definition of the consumer given was “illegal and illogical” according to Shah.

Conclusively, if you can’t identify a consumer then you can’t sign an agreement with them which can be litigated in a court of law in case of default. This in essence would mean these revenues and receivables cannot be recorded in financial statements.

The KE definition

“The consumer/customer will primarily be the premises to which the electricity was supplied and in certain cases would be the person who actually consumed the electricity (mainly in the case of tenants).”

Shah in his letter argues that a consumer cannot be a premises under the fundamentals of contract law, NEPRA law, or accounting standard of IFRS-15, for the simple reason that you cannot have a legal contract with a premises.

Because electricity, like any other supplier, must be based on legally enforceable contracts, therefore the question of misrepresentation emerges.

NEPRA Service Manual argument…

The NEPRA definition

“Means a person or his successor-in —interest who purchases or receives electric power for consumption and not for delivery or re-sale to others, including a person who owns or occupies a premises where electric power is supplied;”

Furthermore, Shah has contested the billing of claims to the government for which the power company lacks the necessary customer identification documents or agreements of electricity supply, and related documents as stipulated in the consumer service manual.

Casting further doubt on the matter, Shah goes on to state in the letter that these claims aren’t valid due to the simple fact that they do not meet the legal requirements prescribed in the NEPRA consumer service manual that also define the consumer as a “person”.

Shah also mentions that a more responsible approach would have been to not recognise such claims in the financial statements unless NEPRA officially approved such sums post due procedure.

Write off claims to NEPRA

Now these write-offs have to be determined and vetted by NEPRA before the government of Pakistan pays the subsidy to the company. However, these claims have been pending determination by NEPRA since 2019, when the regulator wrote the first of multiple letters to the company that “further deliberation is required in respect of the above mentioned claims before these can be allowed as an adjustment in tariff”.

The issue of the admissibility of KE write-off claims has been ongoing and “waiting determination” by NEPRA for several years. This reinforces the fact that its chances of recovery are slim. One of Shah’s arguments in the letter is that despite this, KE has continued to recognise such revenue and receivable in full, which are also in contravention of IFRS 15 core principles.

The auditors

A.F. Ferguson & Co (AFF) are the official auditors of KE and are a part of the global network PriceWaterhouseCoopers (PWC). They are considered to be one of the largest professional services firms in Pakistan, and regarded as one of the most reliable.

Shah states in his letter that, “I was personally trained with, and worked in this firm for eight years from 1981 to 1988.” He went on to say that due to the credibility of the firm he and other directors “accepted the explanation regarding appropriateness of revenue recognition of write-off claims in the initial period.”

The former board member expressed serious concerns in the letter about how AFF handled this audit, as it appears to have ignored the “material misstatements in the financial statements, clearly in violation of applicable accounting standards and have been issuing inappropriate audit reports stating that KE financial statements gave a true and fair view.”

In the letter Shah expresses that there was a “conflict of interest and independence” when it came to the auditor. The fact that the auditor was providing both valuation services and consultation in determining the policy of write offs and working out the figure to be written off as well.

Furthermore, the former board member says that “AFF… had acted as advisor and represented KE before NEPRA, doing the advocacy work, including KE’s request that all its write-offs should be allowed as part of the tariff”.

This role of AFF providing both auditing and consultation services is peculiar, especially considering the fact that the company was able to earn enormous amounts of money from this, explains a source requesting anonymity. According to Shah, the company’s “audit fees was Rs 28.5 million whereas its aggregate fees for verification of write offs amounted to Rs 765 million, or 27 times of normal audit fees.”

Additionally, in the former board members investigation, he was able to learn that “approximately Rs 70 million was paid to AFF for such advisory services.”

KE responds

Following the letter written by Asad Ali Shah on the 10th of January, KE initiated a case against the former board member for, “libelous content being shared and circulated by the defendant (Asad Ali Shah) with ulterior motives…”.

According to the case filed by KE, the company has also claimed that the allegations levelled by the former board member were, “solely aimed at adversely affecting the investor confidence”.

The company also pointed out that the former board member approached the Pakistan Stock Exchange and not the Securities and Exchange Commission of Pakistan regarding the allegations of financial misstatements is “glaring proof that the letter and emails have been issued with mala fide intent and with ulterior motives”.

The company further went on to say that the allegations levelled by the former board member are “neither in the public interest as the bare allegations are unproved and unsubstantiated and instead of approaching the relevant regulators by following the due process…”.

Complementing this point, KE also pointed out that, as a board member Asad Ali Shah had signed a written agreement acknowledging his “understanding and acceptance of the contents of the [KE’s] code of conduct”. This means that the former board member was obligated by law to the “duty of confidentiality”, even after the conclusion of employment for a period of five years.

The IFRS argument

The company in response to allegations relating to the recognition of consumers through proper documentation like CNICs etc. in line with IFRS-15, is “impractical”. This according to the company had been communicated to NEPRA as well.

Thereafter, the authority had specifically removed the CNIC condition for claiming write-off in the multi year tariff in its decision from July of 2018. Therefore KE is not in violation of the IFRS-15 as the write-offs can be claimed by the company even in the absence of proper documentation like CNIC’s.

Treatment of write offs

According to the filing by KE, in response to the allegation pertaining to the treatment of bad debts, the company references NEPRA’s decision from March in 2017 stating “that the Authority considers that actual write off against private sales, is genuine cost of petitioner’s business”.

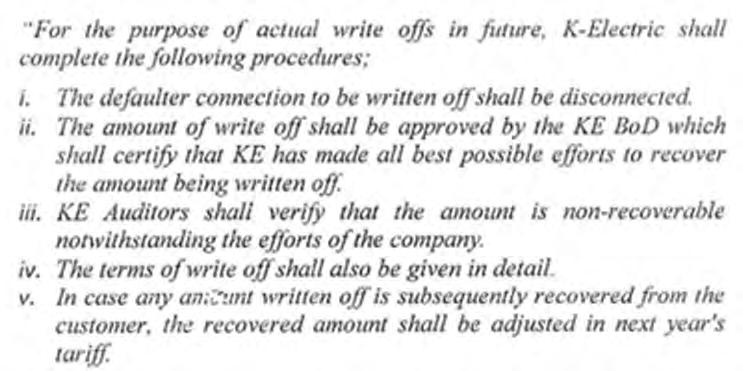

Therefore KE argues that these “write offs were recognised as a genuine cost of the business as per the Nepra’s decision”. Hence the argument that these claims were invalid is debunked through Nepra’s own orders as per the company’s claim. The conditions of these write-offs as per the Nepra letter are as follows.

KE states that the write off policy is based on these conditions after consultations with stakeholders and auditors of the company. Furthermore, answering the violation of the IFRS-15 rules, the company quotes the accounting principle of accrual which states “that revenue should be recorded when due rather than when received”.

Person or premises?

According to the Shah letter, the definition of a consumer in the KE policy is fundamentally “flawed and illogical”. The former board member had argued that the policy is not limited to a “natural person and extends to premises”.

Rebuking this claim, the company states that due to the nature of the power utility business in Pakistan, “electric supply is associated with the premises as occupants of the premises keep changing in the form of owners/tenants”.

The definition in the manual provides some room for ambiguity in the definition when it states, “...including a person who owns or occupies a premises where electric power is supplied”.

This is further supported by the authority’s service manual which states that, “the consumer who sells their houses, shops, industries, seasonal factories, etc. without making payment of electricity bills, KE shall recover the arrears from the new occupants of the defaulting premises”.

Kunda (Hook) connections

As far as Hook connections are concerned the company explains that these connections are divided into two broad categories, firstly are the contractual connections which are essentially registered hook connections and secondly are the ones that count as unidentified theft.

According to the KE explanation the first category of connections are registered and sanctioned through documentation. This is done by allotting consumer numbers to consumers of temporary supply, street vendors etc who do not have a fixed premises.

Whereas in the second category, the connections are unregulated and unregistered without the knowledge or permission of KE. The company elaborates on this saying that it only recognises the connections that fall in the first category, where a valid contractual relationship exists. The implication the revenue is being recognised for unidentified electricity theft is false according to the company.

“Mala fide” intentions of Asad Ali Shah?

The phrase Mala Fide is derived from Latin;’mal’ means ‘bad’ and ‘fide’ means ‘faith’. Mala fide refers to bad faith. A mala fide action is one that is undertaken with dishonest intent; a person tries to mislead or deceive.

According to the suit initiated by KE, the company expresses that the former board member “has not only maligned the reputation of [KE], but has also tarnished the reputation of one of the oldest established accounting firms in Pakistan…”.

The company also pointed out the fact that these allegations have been levied by a former board member which a “layman” not familiar with the technicalities and nuances of the law is likely to believe as opposed to allegations by a stranger.

The company goes on to say considering the fact that proper channels of communication concerning anomalies were not followed are a telltale sign that these allegations were disseminated with the intention of creating “feelings of animosity and hatred amongst the public against [KE]”. This claim by the company is supported by the fact that “no formal complaint was made by [Asad Ali Shah] before any relevant authority or forum” prior to the letter written to the PSX.

The company goes on to say that, “this letter has been issued by [Asad Ali Shah] for the purposes of market manipulation…”, the practice of market manipulation is considered to be illegal according to the law.

The most interesting fact to notice in this entire situation is that Shah apart from being a board member of KE was also on the board of directors at SECP. While talking to Profit sources close to the matter also noted that the commission is the primary body concerned with regulation and it was not approached by the former board member either, which leaves some unanswered questions.

A. F. Ferguson & Co.

As a general practice, auditors don’t discuss any cases or policy related issues with the media, due to obvious potential legal repercussions. Having said that, Profit still reached out to the company for comment but failed to get a definitive response.

To make matters worse, auditors don’t even have a communications department to handle such situations, which makes it difficult to formally contact the company for a comment. However, Profit was able to talk to a former employee of the company. According to Ahtasam Ahmed, former senior associate at the company, “matters pertaining to estimations and provisions are subject to the auditor’s judgement.”

He further went on to say, “therefore, it is quite possible that two professionals might not see eye to eye when it comes to treatment of such accounting matters. Yet, in line with standard audit procedures, these matters are disclosed in the audit report as Key audit matters while for listed entities, a quality review partner is also engaged to ensure that significant matters are dealt according to the applicable financial reporting and auditing standards”. n