Treat your Ferrero Rochers the way you do your oil imports. Let them be imported indiscriminately and forget this categorisation of essential imports and non-essential imports to begin with. The current decision to clamp down on some import categories was taken because there aren’t enough dollars to go around, so we can’t even import essentials. That wouldn’t have been a problem had the foreign exchange market been left unfettered and the rupee been left to slide to its actual value versus the US dollar.

This was the gist of acclaimed economist Atif Mian in a recent thread on twitter, where he publicly opposed the government’s decision to ban non-essential imports. The reasons he cited were prudent, not because he’s partial to Ferrero Rochers (he doesn’t even live here, and he didn’t even take the italian confectionery item’s name) but because if governments were to start classifying imports, they would soon be faced with the task of deciding the fate of items that weren’t as clearly non-essential as the aforementioned chocolates. This would lead to arbitrary decisions and gatekeeping and, as is almost always the case in this neck of the woods, immense corruption, with industry lobbyists trying to grease senior bureaucratic palms to move their particular product off from one column to the other. Even if there weren’t any corruption, there would be lobbying of the ‘honest’ kind, as we famously saw when anchor person Ghareeda Farooqi’s tweet about the difficulty of getting imported dog food for her pet prompted the PML(N)’s heir apparent Maryam Nawaz to tweet to the then finance minister Miftah Ismail to ‘look into it.’

Even if one were to have absolutely principled mandarins, not susceptible to bribes or personal influence, they can still make wrong decisions. A lot of those non-essential items are key inputs for exporters; this is cut down on exports. And even on the other end of the trade

deficit, what about the curtailment of imports? Some critical equipment for the Thar coal power project has been declared as non-essential. An irony, because once said projects were to start producing power, Pakistan would be importing lesser fuel for its thermal power plants.

Atif Mian then goes on to extrapolate from these initial points to painting a rather gloomy picture of the time to come, leading to lesser tax revenue, much higher fiscal deficit (since the government’s dues are to remain the same) and a vicious negative feedback loop which could be difficult to wrest oneself away from.

All good points. And I broadly agree.

But I do have some issues with his thesis. You see, Atif has clubbed together two issues: rupee devaluation and import restriction. That the government has had to do the latter because it was fixated on the former. There’s some merit in this reasoning; they’re closely related. But they aren’t the exact same thing. Personally, I am also in favour of letting the rupee be. But curbing (some, carefully selected non-essential) imports temporarily, and letting the rupee slide isn’t an either-or choice.

After all, didn’t the responsible Miftah also employ a somewhat similar strategy? Letting the rupee breathe a little and, at the same time, spell out a list of items that were off the table to import? Agreed his list was more concise, but the forex reserves situation then wasn’t this dire either.

Let’s play out the counterfactual. An Atif-approved finance minister lets the dollar go up to its presumably natural value. Imports are now considerably more expensive and exports more competitive. So imports should come down, and exports should go up. Hence, no need to restrict imports and we don’t have a balance of payments crisis on our hands. Right?

But things aren’t all that clean. Imports would immediately be more expensive, whereas

exports would take some time to increase in volume. During this adjustment time, since devaluation would have made imports more expensive, in the Pakistani context, it would have led to much higher inflation. The SBP would have handled this with the one trick it knows: hiking interest rates. This would further slow economic activity and yield lesser taxes for the government. This, coupled with the need for paying out even higher subsidies for the most affected (and recently unemployed) would lead to an even higher fiscal deficit.

Meanwhile, all of the government’s previous expenditures are still where they are.

And let’s be realistic, the improved current account situation is not going to generate enough dollars to even pay off the foreign debt obligations.

Pretending that letting the rupee slide is some sort of silver bullet that will take care of the larger rut that we are in, is reductive and simplistic. If we let the rupee go, but if we couple it with selective import restrictions, we can ensure lessened pressures on the dollar, so the rupee’s slide won’t be as sharp as it would be in what Atif Mian proposes.

Now let us turn our attention to someone who espouses neither Atif Mian’s point of view, nor the Miftah-ish strategy that I espoused above, And that is the man in the hot seat himself, the finance minister.

There is an attempt in the greater economic commentariat to draw Ishaq Dar like a stick figure with no shades, who has a near Freudian obsession with the value of the rupee, and he views any depreciation as some sort of affront to his honour. And that this is the sum total of his economic reasoning. That people seriously believe this is more funny than the caricature of Dar that is presented to us.

Economics is a science, yes, based on Karl Popper’s scientific method. But then there are also differences of opinion in science. But this isn’t even economics that we are talking about. This is public policy. Much like even a broken clock

is correct twice a day, even seemingly ridiculous policy directives can have at least some redeeming features. And even the best of them can have some unintended consequences that can metastasize into something quite horrid.

All policies have costs. As Harry Truman famously said, “Give me a one-handed economist. All my economists say ‘on hand...’, then ‘but on the other…” There is no one right policy.

Let us evaluate Dar from that angle:

We are a democracy, and politicians don’t play to a gallery of policy wonks on twitter. They don’t even play to the rest of twitter, for that matter. They look at the Average Joe, whose ends are getting tougher to meet every passing day. If there is a government in place that has significant political capital, this lot can bear some difficult-but-necessary decisions, but only to a point. After that, one cannot explain the nuances of international trade, of LCs and foreign exchange reserves when it comes to people who are finding it difficult to buy fuel and groceries.

If a deal with the IMF is to come through, and we hear that it just might, Dar finally letting go of the rupee would lead to a slide much smaller than it would have, had it been let go in the absence of the economic confidence that an IMF program brings with it.

The problem with Dar’s strategy is that it has taken way too long for the IMF to come and the current limbo to resolve.

Yes, Ishaq Dar’s particular brand of management has led things to this pass, but Atif Mian’s prescription would certainly have led to more inflation. And between the two of them, we know who the inflation hawk is: the politician, not the academic.

By Nisma Riaz

By Nisma Riaz

Over the course of the past two months, one of Pakistan’s largest industries has been running from pillar to post in a desperate attempt to secure raw materials.

From writing letters to the prime minister to knocking at the doors of the US Ambassador in Islamabad for help Pakistan’s textile industry is, to put it mildly, in shambles.

Not enough cotton was grown in the country this year on account of the floods to meet the demands of textile manufacturers. And with Lines of Credit closed due to the ongoing economic crisis, importing the cotton is proving to be a herculean task.

And textiles is not the only industry getting swirled up into the fast-growing tornado of doom and default. With dollar reserves falling to drastic levels, talks with the International Monetary Fund (IMF) dragging on at a painfully sluggish pace, friendly countries no longer reposing faith in Pakistan’s

sincerity in implementing economic reforms, and help seeming far out, Pakistan’s industries are teetering on the edge right alongside the macroeconomy.

But is it as simple as all that? Can we really just say “it’s the economy stupid” and chalk up the dire straits our industries find themselves in to the economic mismanagement of our political leadership? That is what the business community would have you believe. At a recent event, former chairman of the Karachi Chamber of Commerce and Industry (KCCI) symbolically presented “the keys” to Karachi’s industry to SBP Governor Jameel Ahmed. We can’t run our businesses in these conditions, he said, maybe you’ll have better luck doing so.

The sentiment is clear, and to a large extent it is true. In its efforts to shore up reserves the government has made it hell to import vital items. But there is also an understanding that different industries in Pakistan often operate with a marked lack of foresight. “Their habit tends to be to make hay while the sun shines, and when times turn bad, ask

the government to bail them out with tax breaks and subsidies and other such things,” explains Khurram Hussain, a senior business journalist and former editor at Profit.

For a long time, this is how our industries have chosen to operate: make quick buck when the opportunity presents itself with no care for contingencies for the future and make a whole lot of ruckus when things aren’t going your way. Decades of finding light at the end of the tunnel either through aid or government assistance have trained our business owners to be shortsighted. The only problem is, sometimes when you’re looking at a dark tunnel there isn’t light at the end of it because you’re staring down a shotgun barrel.

As Pakistan continues to struggle, there is an opportunity for introspection for the business community. Profit spoke to industry leaders, economists, and experts to try and understand how the ongoing crisis has impacted textiles — the largest export-oriented sector of Pakistan — and what the coming days might look like.

And why our businesses need to develop more foresight if they wish to operate in Pakistan

Lines of Credit. It is one of those phrases that most people only learn when there is something wrong with them.

Very briefly put for those not in the knowhow, when any product is imported into Pakistan a letter of credit (LC) guarantees that payment will be made to the foreign suppliers after the goods have been received and cleared by Customs. These letters are issued by regular commercial banks. So if you are an importer, you will pay your bank and they will issue an LC and give it to the company that is shipping the product to Pakistan. The LC is then presented and the bank releases the payment in dollars.

Now here’s the rub. Since LCs are issued by banks, the State Bank of Pakistan (SBP) can control them. As the regulator, the central bank can boss around commercial banks and tell them what to issue LCs for and what not to issue LCs for. For example, when the incumbent government first took over one of their first courses of action was to announce that automo bile importers needed to get special permission

directly from the SBP before LCs would be opened for them. As Pakistan’s reserves continued to plummet, in a desperate attempt to keep dollars in the country, the SBP became stingy with LCs.

This was a massive problem for an import-oriented industry like Pakistan. A number of industries started facing issues. And while industries like automobiles were in a quandary, there were graver issues when LC issues started arising for essential commodities such as wheat, maize, and medicines. In the middle of all this, the textile industry occupies a special place. It is Pakistan’s largest export-oriented industry, which means they bring dollars into the country. But what do you do when your biggest exporter suddenly needs to import its raw materials?

Profit asked Dr Aadil Nakhoda, assistant professor at the Institute of Business Administration (IBA), to elaborate upon why the Government, and the State Bank particularly, are restricting the textile sector’s imports if it constitutes an upward of 60% of our exports?

goods. The idea is to cut the demand of imports in order to not only reduce the CAD but also alleviate the pressure on the exchange rate of the Pakistani rupee.”

As it stands, this seems to be a circular problem because the inability to import raw materials due to the lack of foreign currency will translate into the inability to export goods. As we have already established above, the textile industry is the single most important sector for Pakistan’s exports, making it equally important for wealth generation. According to Zaman, “Last year, out of the $31 billion, almost 20 billion dollars worth of exports were made by the textile industry.” The government is reluctant/ unable to open LCs for essential imports. As a consequence of this, the size of the industry has been brought to its knees. In turn, it can be predicted that in the near future the industry’s inability to export textile goods will ultimately lead to an even worse foreign trade and currency crisis, while also swelling unemployment rate across the country.

Despite being one of the largest industries and exporting sectors in Pakistan, textile manufacturers have failed to safeguard themselves from a long impending economic crisis and now stand helpless in face of adversity. Pakistan’s domestic cotton production has declined to a historic low this year, dropping to 5 million bales for the current year mainly due to heavy rains and floods. The estimated cotton production losses have been worth more than $2 billion. This domestic cotton production is significantly shorter than the textile sector requirements as the textile industry of Pakistan consumed nearly 15 million bales of cotton last year, and the current season anticipated demand indicates that about 10 million bales will need to

o how has the industry responded? Over the past two months a series of letters from the All Pakistan Textile Mills Association (APTMA), the industry as-

“The problem is at macro level. Our cotton production has been declining and we had to import cotton. The same has not changed. Ideally, the textile industry should have been at the forefront of integrating cotton supply chains and achieving backward integration to ensure supply security, but they never did that”

Ammar H. Khan, Macroeconomist and Chief Risk Officer at Karandaaz Pakistan

“The textile industry never prepares for any downturns in demand as the industry is fragile and not very strong with diversified interest . They do not have sufficient resources to fall on and limited to sales revenue to survive”

Naveed Gulzar, ex-Chairman APTMA

sociation for textile manufacturers that lobbies for them, have demanded that the government help them out in their pursuit to import cotton.

Read more: In desperate bid for cotton, textile manufacturers turn to US Ambassador

Earlier this month, APTMA’s patron in chief, Gohar Ijaz, had sent a letter to US Ambassador to Pakistan Donald Blome making a desperate plea for a soft loan for the import of cotton from the US. This is not the only indicator of the disaster that the textile industry has on their hands. Two days before the letter to Blome, APTMA also appealed to the Finance Minister and on the 23rd of December they appealed to the Prime Minister of Pakistan, regarding the same issue. In the letter to the Finance Minister, APTMA informed Dar that the industry is on the brink of shutting down due to the shortage and lack of raw materials.

Towards the end, the letter urged Dar to intervene and resolve the issue or risk losing an estimate of $8 billion worth of profits from the import of $4 billion. In an attempt to preserve current foreign reserves in an economy rapidly heading towards defaulting, should the govern-

ment allow forgoing double the worth of future profits? The obvious answer is no. Despite Dar’s reassuring tweet, textile manufacturers continue to scramble for help. However, in seeking the government’s assistance, they might be flogging a dead horse.

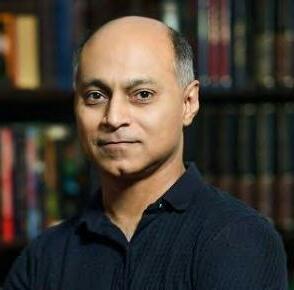

Before we dive into the intricacies of the issue, it is important to first understand the significance of US cotton in Pakistan’s imports. According to Dr Aadil Nakhoda, Assistant Professor of Economics at IBA, “Before 2017, Pakistan was primarily dependent upon the imports of Indian raw cotton as it constituted a higher proportion in total imports of raw cotton. However, this has now been replaced by US cotton as relations with India have deteriorated. Pakistan imported more than $575 million worth of US cotton in 2021, increasing at 18% per annum in the last five years.” He added that Pakistan stands as the third largest importer of

US cotton after China and Vietnam, importing approximately 10% of its total world exports. This means that cotton trade is not only important to Pakistan, but the US as well.

“Furthermore, with more than $3 billion worth of clothing articles destined to the US from Pakistan, the cotton trade between Pakistan and US becomes ever more important, especially for Pakistan,” says Nakhoda. Therefore, we can safely conclude that our textile industry relies upon US cotton as an important input for Pakistani textile products exported to the US and elsewhere, explaining APTMA’s desperation to acquire cotton immediately.

Confirming Nakhoda’s point, APTMA Chairman, Hamid Zaman told Profit that, “Pakistan requires a lot more cotton than it can grow locally. Due to this, we have become one of the largest buyers of US cotton, which is also arguably the best cotton.”

extile remains the main sector for Pakistan’s exports. Our complete supply chain of cotton involves spinning, weaving, and garment-making, for the end product to finally be ready for export. 80% of our industry includes non-integrated sectors, whereby everyone plays their parts in the value addition of textile goods.” says APTMA Chairman Hamid Zaman.

Last year Pakistan’s textile industry used over 15 million bales of cotton including, both imported and locally produced cotton, according to Zaman. After value addition, Pakistan exported over $50 billion worth of cotton produce. However, this year, where there should have been 7 to 8 million bales of cotton, there are only 4 to 5 million bales. This is due to the loss of cotton crops in the flooding disaster that followed 2022 monsoons.

“This year we just have an estimated 4.5 million bales of locally produced cotton, so we

Why are Pakistan’s textile manufacturers in an import debacle?

“There is a very marked lack of foresight in how they operate. Their habit tends to be to make hay while the sun shines, and when times turn bad, ask the government to bail them out with tax breaks and subsidies and other such things”

Khurram Husain, Former Editor of Profit

will require some 10 million bales to be imported.” The issue becomes pressing when we realise that the stock of cotton that our local cotton manufacturers have right now is depleting very quickly and so is their buying power to import more. “For now the industry is functional because of forward booking, so the raw materials ordered before are still available, however, if we don’t get more urgently, we will experience shortages across the country. This will hurt our exports more than anything else and worsen the foreign reserve situation, while also worsening the unemployment situation.”

This same point was also made clear in APTMA’s letter to the US Ambassador. “The impact on employment of the shutdowns is already significant and would be catastrophic if the situation is not brought under control by supplying raw cotton to the textile mills,” reads the letter.

Furthermore, Zaman informed Profit that a lot of the cotton that was ordered earlier is now stuck at the ports. “Where banks had agreed to import it, they are now refusing to honour the L/Cs.” This further exacerbates the problem because uncleared shipments mean penalties that are multiplying by the day. “In the last month, we have incurred over Rs.2 billion worth of penalties and detention charges on the imported cotton that is being held at the ports.” This makes it apparent that the textile industry is getting tossed with curveballs from every direction, creating an economic crisis of a very high magnitude. However, according to recent news, the government has waived demurrage charges for stuck containers. Even though this news offers some consolation, there is no certainty of whether this decision will be successfully implemented or not.

To put it simply, not only is the industry struggling to import more raw materials, but the ones already imported are also inaccessible. Why is this happening? Well, the reason is rapidly depleting foreign reserves. Even though the government has demonstrated support, they remain

unsuccessful in assigning the proper priorities to enable the textile industry to obtain required raw materials.

So far we have established the cause of the country’s import crisis. Nevertheless, it is still unclear what outcome to expect. Dr Nakhoda told Profit that the most likely consequence of restricting imports of raw materials and intermediate goods for an export-oriented industry is the likelihood of erosion of the industry’s competitiveness, thereby further hurting the economy.

Similar to Nakhoda’s response, Zaman also said that, “We do not see a solution at the moment. Even though we have met with government officials at every level in the past month, they all seem helpless.” he refused to elaborate further, since the issue has become highly politicised now. However, he did add that “The government could not prioritise just one kind of import over others. The situation is quite critical at the moment and if we are unable to find a solution soon enough, we will experience industry wide shutdowns.” So, this much is clear

that this issue has a great potential to worsen Pakistan’s economic conditions and put an entire swathe of the population at risk for unemployment.

Hamid Zaman asserted that the possibility of the industry shutting down will result in 40% of the country’s workforce being unemployed and 60% of the imports to be lost. He said that “The economy that is already headed towards default will reach there faster.”

We asked Dr Nakhoda how the current import restrictions are likely to reduce the overall export potential of the textile sector, to which he replied, “With availability of much needed raw cotton becoming scarce due to these restrictions, exports are likely to be affected. There is already a decline in exports as the large-scale manufacturing index also reports a downward trend.” Nakhoda believes that these conditions will definitely reduce the export potential of the sector.

He continued, “It will disrupt established trading relationships that may have helped boost exports. A lot of production nowadays is based on contracts that involve using particular types of raw materials sourced from specific countries. There are quality measures and certifications that are involved in production which need to be met, which reduce the ability of exporters to shift to different sources. Such abrupt measures to curtail imports hurt the ability of exporters to improve their trading relationships and increase exports.”

It is fair to inquire why the industry had failed to prepare for this crisis, considering that our economy has been spiralling downward for the past few years? According to industry experts, this situation has been predictable since 2021, so why were there no safeguards in place to save themselves from this current debacle?

Why did the textile industry not prepare for this disaster?

“We do not see a solution at the moment. Even though we have met with government officials at every level in the past month, they all seem helpless”

Hamid Zaman, Chairman APTMA

Zaman told Profit that, “Pakistan has been experiencing a shortage of cotton for the last few years. Our spinners and weavers have been importing raw materials from all over the world, including West Africa, Brazil, South America and the US.” This statement confirms that Pakistan’s cotton production has been diminishing way before the flooding disaster of 2022.

Zaman also said that, “We had anticipated the current crisis of getting raw materials due to both the economic condition of Pakistan and the recent flooding disaster.”

Profit asked Naveed Gulzar, ex-chairman APTMA to share his insights on the matter, to which he said, “In economics all boom is followed by recession . The textile industry was booming in 2021 and with tariff facilities, a lot of industries invested in new machinery. However, due to post covid supply chain issues, along with the events transpiring after the Ukraine war, demand became distorted and new capacities were shut.” Gulzar further shared that, “The textile industry never prepares for any downturns in demand as the industry is fragile and not very strong with diversified interest . They do not have sufficient resources to fall on and limited to sales revenue to survive”

Meanwhile industry experts were open to sharing their two cents on the matter. Ammar H. Khan, Macroeconomist and Chief Risk Officer at Karandaaz Pakistan, told Profit, “This was very much predictable. They generated record revenue and profits during 2021. They also got substantial concessional financing post covid.” Then why did they not prepare accordingly? Habib said that, “The problem is at macro level. Our cotton production has been declining and we had to import cotton. The same has not changed. Ideally, the textile industry should have been at the forefront of integrating cotton supply chains and achieving backward integration to ensure supply security, but they never did that.”

Likewise, Khurram Husain, ex-Editor at Profit, voiced a similar assumption, saying that, “The best I can say is that our business community in general, and textile exporters included, live in the moment and don’t really spare much effort to see the direction in which things are moving and what might be coming down the road. There is a very marked lack of foresight in how they operate.” He elaborated that, “Their habit tends to be to make hay while the sun shines, and when times turn bad, ask the government to bail them out with tax breaks and subsidies and other such things.” Seems like old habits die hard and APTMA’s habits have come back to bite them in the posterior.

Gulzar informed Profit that textile manufacturers are in continuous dialogue with the government. He said that, “We have had several

Dr. Aadil Nakhoda, Assistant Professor at IBA

meetings with the government. Even though they want to help out, they have no idea how to rescue the industry, with the current economic crisis.” According to Gulzar, there is no apparent solution to the problem, other than incurring more debt for the time being.

Current APTMA Chairman, Zaman resonated with Gulzar, informing Profit that “We have met with US officials and their delegations. These meetings led to positive responses. However, despite this show of support, nothing has been done yet. Our appeal to the US ambassador requests that they should give us credits or soft loans to keep the industry afloat. This debt has certain clauses, such as America giving Pakistan loans for importing American commodities. This proves to be a win-win situation for both parties.” Zaman shared that APTMA has high hopes regarding this letter because a similar deal was made with the US in the 90’s and keeping that precedent in mind, the possibility of this endeavour bringing relief seems high.

In an attempt to mitigate the crisis, textile manufacturers and other organisations including APTMA, met with the governor of the State Bank of Pakistan on Monday, 16 January 2023. Zaman told Profit that in this meeting “We had a one-point agenda which was to ask for SBP’s assistance in getting the imports cleared.” Another request made during the meeting was the appointment of 200 million dollars every month for the next three months to be prioritised for cotton importing.

Zaman believed that other than their conditions being met, “The only other outcome will be an absolute disaster, second to the recent flooding in the country’s history.”

On the other hand, Dr Nakhoda has a different solution in mind. He informed Profit that it is not just the textile industry that is suffering. “The issue with the clearance of L/ Cs is too widespread within the economy. A major quick fix to this issue is to accept the terms of the IMF and quickly resume the

much needed financing.” Whereas, this seems like a viable solution to Pakistan’s economic crisis, the question remains whether our Finance Minister will be willing to swallow his pride for the greater good of the country?

Further, Nakhoda added that, “The imports for those exporters who sell most of their output abroad should be allowed based on the fact that they can avail financing in lieu of their export receipts. However, the issue is that several exporters are facing challenges, such as in customs clearance, even though they have the required financing to import the raw materials. Also, exporters, who have better established businesses and a longer history of trading with the US can approach their customers to finance their imports of raw materials and intermediate goods.”

However, Nakhoda argued that these measures may erode competitiveness as it makes Pakistani businesses more susceptible to higher costs of financing, given the risks with economic outlook. So, according to Dr Nakhoda “The ultimate solution is to seek IMF financing and then avail credit lines as well as other funds from multilateral organisations and bilateral partners to alleviate the balance of payment concerns.”

All of this brings us to a very simple conclusion. A crisis of biblical proportions is brewing in Pakistan’s largest manufacturing sectors. The verdict on whether or not this manifests will be out in the days to come. Of these sectors, the largest is also one of the noisiest. As the government fiddles its thumbs in negotiation with the IMF, Pakistan’s textile industry is watching with bated breath whether or not the guillotine will come down on its neck in the days to come. Despite their constant attempts to seek aid and assistance from the government and US officials, the issue stands unresolved. Only time will tell as the industry waits not so patiently for a verdict on the matter.

n

“A major quick fix to this issue is to accept the terms of the IMF and quickly resume the much needed financing”

After a wait of about a little over 9 months, the State Bank of Pakistan (SBP) has finally decided to raise the curtain on the successful applicants that have been allowed to set up the much anticipated digital banks. The objective is simple and oft repeated: Pakistan has a huge unbanked population with access to finance statistics nothing short of being terrible. The central bank has been edging towards increasing the financial inclusion numbers and it has been gunning to do so by moving its focus on digital financial services.

For the sake of brevity, we will keep the context short: traditional banking requires opening branches at locations that are remote and opening such branches with a sizable capital expenditure does not make a business case for conventional banks. These are the locations where conventional banks could do much more through their digital leg of banking. Contrary to this, banks have not been able to roll out

meaningful digital financial services to improve Pakistan’s financial inclusion statistics.

The State Bank has since been gunning to pave inroads for new age banking players such as fintech startups and introduced different regulatory regimes. The regulatory framework for electronic money institution (EMI) licences was announced in 2019. Earlier, the PSO/PSP licences were introduced and in January 2021, the central bank itself launched Pakistan’s first instant payment system RAAST. In the beginning of 2022, the regulatory framework for digital banks was announced and by March, the State Bank received as many as 20 applications from leading banks such as HBL, UBL, Alfalah and JS, microfinance banks, domestic fintech companies, foreign fintech companies and large business groups that formed a consortium with partners that know banking.

The prime objectives of the central bank with regards to digital banks are to promote financial inclusion and improve access to credit for unserved and underserved segments, affordability of digital financial services, new finan-

cial technologies and innovation, fostering new set of customer experience and developing the digital ecosystem. The framework allowed two types of licences: digital retail bank (DRB) and digital full bank (DFB).

DRBs would cater to the retail segment like individual customers and small and medium businesses, whereas DFBs may deal with corporate, commercial and retail customers. Both licences were open to existing banks, international fintech companies and domestic ones such as EMIs, and business groups with a fintech or banking partner. As per the requirement by the central bank, DRBs are required to have minimum capital of Rs1.5 billion at the time of pilot, Rs2 billion at commercial launch, Rs2.5 billion in the first year after commercial launch, Rs3 billion in the second year and Rs4 billion in the third year.

Likewise, DFBs, which can target corporate customers, need a minimum capital of Rs6.5 billion at pilot stage, Rs8 billion in the first year after commercial launch and Rs10 billion in the second year. In this backdrop, the central bank evaluated the 20 applicants on

various parameters that included fitness and propriety, experience and financial strength; business plan; implementation plan; funding and capital plan; IT and cybersecurity strategy and outsourcing arrangements, etc. “Further, all the applicants were given the opportunity to present their business case to SBP,” the central bank said.

After an exhaustive process lasting a little less than 10 months that involved presentations after presentations by applicants, interviews, lobbying and deliberations by the committee at the SBP that decided these licences, the central bank announced names that got the NOC to set up five digital banks. These names are EasyPaisa, KT Bank, Hugo Bank, Raqami and Mashreq Bank. The State Bank is yet to confirm to Profit how many of these, and which ones, are setting up digital retail banks (DRB) and which ones would be digital full banks (DFB).

The understanding in the industry is that all five of these applicants would be setting up DRBs and according to a senior source in the industry, two out of these five would be setting up Islamic banking operations, meaning they will be Shariah compliant, while three of them would be conventional.

There is excitement surrounding the announcement and there is also nervousness. It could lead to something meaningful that would change the financial services industry for good or it could be a miss of epic proportions. We don’t know that yet. But what we do have now are five names and what each of them is capable of doing in this space.

The first in line is EasyPaisa, a mobile wallet which leverages a network of branchless banking agents by virtue of being a subsidiary of Telenor Bank to provide financial services to the unserved and underserved segments. EasyPaisa is backed by telco Telenor and Chinese Ant Financial, which owns the biggest fintech in the world AliPay.

But things have not been great at Telenor Bank and EasyPaisa. The microfinance that

owns EasyPaisa has been running losses. Telenor Bank’s accumulated losses stood at a whopping Rs44 billion by end of the third quarter of 2022. The bank received an equity injection of $30 million, of which $15 million is expected to be received in November 2022 and the remaining in 2023.

One of its main sponsors, the Chinese fintech company Ant Financial, has recently been looking to sell its stake in Telenor Bank and exit Pakistan altogether, after patiently supporting it throughout difficult times.

In fact, banks like MCB Bank had been in the process of conducting due diligence of Telenor Bank to buy Ant’s stake. So what could have possibly led to the regulator being considerate towards EasyPaisa for the licence?

While the SBP has refused to comment on what were the considerations behind granting an NOC to individual applicants, some considerations are obvious. Firstly, EasyPaisa has really been a success story in financial services and has really increased financial inclusion in the country — the core objective of the digital banks.

Secondly, from a regulators perspective, it would not look nice if a company like Ant Financial exits Pakistan because there were too many losses. Ant Financial is part of the Chinese AliBaba Group and according to a source in the industry, Ant Financial has brought in about $300 million FDI into Pakistan for EasyPaisa operations. Letting a company like this exit Pakistan does not augur well for Pakistan.

From an Telenor Bank/EasyPaisa and Ant Financial’s perspective, they already have the use cases for individuals and micro and small businesses. And if limitations of the microfinance bank are removed by acquiring a digital bank licence, losses can be controlled.

For instance, to comply with the regulatory requirements of the digital bank licence, Telenor Bank, which has 56 branches across the country, would be bringing it down to 25 branches, the maximum number of branches a digital bank is allowed to operate, and eventually shutting down all branches after a period of three years.

Under the microfinance bank licence, the

regulations require operating branches which increases costs. “Under the microfinance bank regulations, if an entity is giving out a loan to someone at a particular location, there needs to be a branch within a 50 kilometre radius of that location,” Mudassar Aqil, the CEO of Telenor Bank and EasyPaisa tells Profit.

In fact, Mudassar cites the limitation with respect to operating a minimum number of physical branches which is removed by a digital bank licence as one of the key reasons why EasyPaisa required the digital bank licence. The digital bank licence further removes limitations with regards to the size of loans that can be disbursed which can improve the topline.

All this makes a compelling case for Ant Financial to double down on EasyPaisa with a $35 million commitment (the minimum capital requirement for five years) and for the regulator to give them the licence and keep Ant Financial in Pakistan.

So now that they have got the NOC to set up a digital bank, what does EasyPaisa plan to do with it? Mudassar Aqil says that for all practical purposes, EasyPaisa had been operating as a digital bank before but under a microfinance licence. Payments, lending, all of it can be done on the EasyPaisa app. They operate a wallet and could lend to individuals and small businesses but with some limitations.

So the first step would be the conversion from the microfinance licence of Telenor Bank to the digital bank licence. “In the second phase, the use cases that will be developed and besides ones that we have now, would be targeting freelancers and small businesses,” says Mudassar Aqil.

“In the case of individual customers, there is a lot of scope for innovative products and there are many exciting things that we are working on,” Mudassar said, without divulging specific details. “RAAST QR is going to be a big opportunity, we will leverage that. We will also leverage our relationship with retail merchants. And then we will build a value proposition of credit in this. This is one area we are specifically looking at.”

EasyPaisa’s plans also include launching,

“In the second phase, the use cases that will be developed and besides ones that we have now, would be targeting freelancers and small businesses. In the case of individual customers, there is a lot of scope for innovative products and there are many exciting things that we are working on”

Mudassar Aqil, CEO of Telenor Bank and Easypaisa

if regulations allow, fractional gold saving products for women. The fractional gold saving product will allow women that can not buy expensive gold products in one go, to invest fractional amounts, say Rs100 each day, in gold. Furthermore, through its app, EasyPaisa plans to enable opening of accounts with asset management companies without any paperwork.

EasyPaisa would be setting up a digital retail bank (DRB). Mudassar says they are squarely focused on small and medium enterprises, where the gap in financial services exists so conversion to a digital full bank licence might not be the way to go for EasyPaisa. Further, Mudassar confirmed that their operations have been conventional and would remain the same under the digital bank licence, while they could consider opening window operations for Islamic services in the future.

While we are at it, EasyPaisa’s competitor, JazzCash, was also one of the applicants for a digital bank licence but couldn’t get it despite strong credentials such as in the fields of experience in financial services, strong backers in Veon and promotion of financial inclusion in the country.

So why couldn’t JazzCash cut it for the licence? Multiple sources in the industry said that it could be because JazzCash is owned by a telco, Jazz, and works with Mobilink Microfinance Bank as a partner. Meanwhile EasyPaisa is owned by a microfinance bank. Being owned by a telco comes with its baggage of interests of the telco superseding that of fintech. Whereas in the case of a bank, the interests are aligned.

Aamir Ibrahim, the CEO of Jazz, did not comment on specific reasons why JazzCash was not able to get the licence while EasyPaisa was, when contacted by Profit. He, however, did feel the process was not fair, without giving any specific details. Nonetheless, Aamir is ready to move on and his team at Jazz also conveyed to Profit that they have accepted the State Bank’s decision because the digital banks regime is bigger than Jazz or any individual company.

“We welcome the new entrants & hope that collectively we can pave the way for greater financial inclusion & build the digital banking & payments ecosystem,” wrote Aamir

Ibrahim on Twitter on January 14.

The second in the list is KT Bank which is going to be set up by a consortium of three companies. The first of these consortium allies is Kuda Technologies which operates and owns Kuda Bank operational in the UK and Nigeria, and which has grown to become the biggest fintech company in the country with nearly 5 million customers. Kuda Bank was valued at $550 million in their last funding round in August 2021. Its money app allows payments, savings and investment options and the bank lends through Kuda Microfinance Bank

The other partner is Pakistan’s Fatima Fertilizer, and The City School being the third equity partner. KT Bank could have a strong use case in agri-financing. In fact, access to credit in agriculture is one of the areas the SBP has been focused on and government owned banks such as Zarai Taraqiati Bank, tasked to improve agricultural financing, have not been able to live up to the promise.

Fatima Fertilisers, which is part of one of the biggest industrial conglomerates in the country, has excellent exposure to farmers and their financial requirements. According to a high-ranking official at one of the fintech companies that we spoke to, the problem of reliable data is solved in agriculture through partners like Fatima Fertilisers. “They know how much fertiliser is needed per acre, they know the purchase cycles and there is ready availability of documents of land ownership for lending purposes.”

Fatima Group has for some time been interested in buying a bank. They were one of the bidders for acquiring Samba Bank. And tried to acquire it through the EMI TAG that Fatima Ventures was an investor in. Wallet operations of the digital bank could be used for disbursing salaries of thousands of employees of Fatima Group as well as the City School, besides making payments to vendors and farmers in case of Fatima Group.

The team at Kuda Technologies had a busy schedule and couldn’t take out the time for an interview until the publication of this article, for a more comprehensive view on their plans for Pakistan.

Hugo Bank is also going to be set up by a consortium of three companies: Getz Bros, Atlas Consolidated, and M&P. Getz Bros is primarily in the business of distribution of pharmaceuticals, agricultural, biomedical, technical and consumer products.

Atlas Consolidated on the other hand owns Singaporean fintech company HugoSave, which is a digital bank in Singapore that offers saving, spending and investment options. M&P (Mueller & Phipps) is a logistics company involved in the business of courier and COD deliveries.

Kamran Nishat, the CEO of M&P, did not respond to Profit’s request for an interview for a comprehensive view on what the digital bank licence means for them. According to sources in the industry, M&P had earlier been deliberating about getting an electronic money institution (EMI) licence but chose not to because EMIs, because they can not lend directly, would have a problem generating profits.

M&P is actually one of the biggest partners of EasyPaisa through its branches which act as agents for EasyPaisa. These branches could be turned into bank branches of its own under the digital bank licence, from where cash-in and cash-out could be done, as well as places where loans could be obtained. Further, they could get into the business of COD financing and pay merchants upfront for COD orders.

Mashreq Bank is one of the largest conventional banks in the Middle East and also has a brickand-mortar presence in Pakistan. Mashreq Bank’s digital bank offerings in the middle east include specialised banking solutions for startups and SMEs, and calls itself the “Best Digital Bank” in the MiddleEast.

A financial services industry expert, with tonnes of experience, in background conversations with Profit, said that Mashreq Bank is a success story in the UAE. “The State Bank wanted new people, new players and new technologies coming in the financial services

“We welcome the new entrants & hope that collectively we can pave the way for greater financial inclusion & build the digital banking & payments ecosystem”

Aamir Ibrahim, CEO of Jazz

sector. Mashreq Bank fits that criteria.”

“Digital Banks are a $250-300 million dollar game. Its not a $10 or $20 million dollar game. Initial capital may be $25 million but this is not where it is going to end so you need to have deep pockets to be a bank,” he says. “Mashreq Bank fits the bill of deep pockets, Mashreq Bank fits the bill of innovation they are going to bring, fits the bill of expertise in financial services.”

Mashreq Bank is the oldest private bank in the MiddleEast, having been founded in 1967. Its founder, Abdul Aziz Ghurair, sits on a multibillion dollar fortune according to Forbes and the bank is majority owned by the Ghurair family – one of the richest families in the MiddleEast – through two different investment firms.

On the technology side, “Mashreq has been investing in technology and has been known for its innovation in this market for a good 50 years,” said Subroto Som, former head of Retail Banking Group for Mashreq Bank in an interview. “We were the first ones to bring a digital only bank for retail called neo. We are the first to bring a digital only bank for the small businesses called NeoBiz.”

“NeoBiz is initially aimed at startups and small businesses. We have a large number of them coming to life in the UAE. And they particularly find it very difficult to open a bank account for their financial transactions. They have to visit a branch multiple times and it could take anywhere between three days to 25 days to open an account,” says Som.

“With NeoBiz, you don’t need to visit a branch and it could be open within a day or at max three days. Once an account is opened, for all your transactions, the app NeoBiz is sufficient.”

Pakistan has now an estimated 800 or more startups. And they could make use of a digital banking platform like NeoBiz in Pakistan. According to the CEO of a leading fintech company in Pakistan, what Mashreq Bank could do in the MiddleEast might not be replicated easily in the Pakistani market. “Think of NeoBiz as being a product for the developed world, while Pakistan belongs to the developing world,” he says. “For Pakistan, they might

have to come up with different offerings.”

Mashreq Bank did not respond to Profit’s request for an interview to understand their plans for a digital bank in Pakistan. .

eing set up by a consortium of two Kuwaiti companies, Raqami - derived from Urdu word Raqam (money) - is the fifth applicant which received the central bank’s blessings to start a digital bank. The group behind Raqami comprises the oldest and one of the world’s biggest sovereign wealth funds, the Kuwait Investment Authority through Pakistan-based Pak-Kuwait Investment Company (PKIC). KIA has $738 billion in assets under management. The other equity partner is also a Kuwait-based company, Enertech Holding Co. which is a developer, investor and operator in the energy sector.

What is different at Raqmi is that none of the companies that will be setting up the consortium have experience running a financial services institution, unlike all of the other companies that have been granted a licence. What they do have is extraordinary financial heft. But how was that enough to set-up the bank?

The State Bank regulations with regards to digital banks allows a person savvy in financial services and financial technologies to set up a digital bank, preferably with equity partners. That person in this case is none other than Nadeem Hussain, a financial services industry veteran.

To Nadeem’s credit is the creation of Tameer Microfinance Bank (now Telenor Bank) and EasyPaisa. As his brainchild, Easypaisa put itself on the map and the ship was steered by Nadeem until he successfully (and lucratively) exited after Ant Financial came in. Today, the success of EasyPaisa is presented as a case study at leading business schools like INSEAD and at international development organisations like International Finance Corporations. Nadeem Hussain is also the founder of Planet N, a technology focused investment firm, and sits on the board of Planet N portfolio startups in Pakistan. In fact in June 2021, PKIC invested $3 million into Planet N to boost investments in startups.

Nadeem’s credentials are nothing short of stellar which should certainly qualify him to set up a digital bank. He has, however, faced a conflict of interest situation because in July of 2022, the president of Pakistan appointed 10 members to the board of the State Bank. One of the persons appointed to the board was Nadeem Hussain, raising a natural conflict of interest in his appointment because of his interest in Planet N which has investments in fintech companies and because he was one of the applicants for a digital bank licence. Nadeem resigned from the position on January 11 citing the same conflict of interest.

“The Central Bank Board is not part of the Licencing awarding process. It’s is entirely a management decision. In fact they came to know about the successful applicants when it became public knowledge,” Nadeem told Profit.

Now that Raqami has successfully received the licence, what does it plan to do? Firstly, Raqami is going to be a Shariah compliant digital retail bank (DRB) which will be setting up its Shariah board soon. Secondly, it would be focusing on creating use cases for providing access to finance to kiryana merchants.

“We are a lending bank. We will be lending to SMEs, to agriculture. We will be leading in lending, not in payments. Payments is also important but we will be prioritising lending,” says Nadeem Hussain, who is the executive director of Raqami and would serve as the CEO of Raqami for the first two years. “We will be doing data-based lending instead of collateral-based lending.”

Raqami would also be focused on open banking, allowing any player in the industry to connect with Raqami through APIs. “Startups for instance, if they want to lend and have data, we would open our platform to them,” says Nadeem.

Having spent so much time in the financial services industry, Nadeem has developed this optimism that anything can be done in the financial services industry if the use cases are thought out ingeniously. In that, he counts customer journeys as being very important.

“Why would someone want to open an

“Mashreq has been investing in technology and has been known for its innovation in this market for a good 50 years. We were the first ones to bring a digital only bank for retail called neo. We are the first to bring a digital only bank for the small businesses called NeoBiz”

Subroto Som, former head of Retail Banking Group for Mashreq Bankof Raqami

account with me if I am giving the same customer journey as a commercial bank?”

A main point of pessimism surrounding digital banks is that the wealthy customers are all captured by conventional banks, leaving a population that is relatively very less wealthy for digital banks to be able to accumulate healthy deposits. Nadeem has that confidence that it can be done, citing the example of EasyPaisa that today boasts deposits worth Rs 32 billion and millions in transactions. “EasyPaisa successfully increased their deposits because their use case targets the unserved and underserved. It all depends on what you offer,” says Nadeem.

Industry officials and central bank sources are all united on one point: existing commercial banks do not need digital banking licences. There is nothing that a digital banking licence would allow them to do that they cannot already do with their current full banking licences. One of the industry sources also said that all the banks that applied would have been qualified to get the DRB licence and deciding which one should get it would have been a problem. And if one of them got it, it would not be okay with the other banks.

But perhaps the most important point in why banks possibly could not get a licence, according to an industry expert, is that the banks could have possibly used the licence to expand their existing portfolios instead of creating new ones, thus limiting the possibilities and affecting SBP’s objectives with regards to digital banks and giving sense that the banks planned to use this licence to remove one competitor from the list. On the other hand, new companies would have made a better use of the licence by incorporating new technologies and creating products and that would actually target the unserved and underserved segments of the population.

Banks have long been complaining that because of their legacy operations, they don’t have the DNA for digital financial services at their respective banks and through the digital bank licence, they could set up an all digital entity to fix the issue. This explanation falls short of being rational. Because the non-existence of the digital DNA is a bank issue which should be fixed within the bank, and the central bank should not bear any responsibility of fixing it.

On the other hand, some of the fintech companies in Pakistan are relatively new and might not have the required experience in delivering digital financial services in the Pakistani market. For instance all the EMIs are less than two years old. While the regulations allow the EMIs to convert to a digital bank licence if they have a minimum one year experience of delivering digital financial services, the regulations say that the SBP may advise them to have “an extended period of experience if the EMI’s performance is not considered satisfactory by the SBP.

Nigerian fintech company OPay, for example, was not able to get SBP’s approval to set up a digital bank despite having the backing of SoftBank and Sequoia Capital because, according to a source at the company, they are relatively new in Pakistan and haven’t been able to deliver satisfactory performance on their current business of PoS acquiring. Secondly, the Nigerian fintech company seems to have a lack of commitment to the digital bank regime and is actually scrambling to get its hands on any licence.

OPay is seeking a PSO/PSP licence, and EMI licence and at the same time it is gunning to buy a microfinance bank. “To top it off, one of OPay’s subsidiaries, SeedCred, has recently attracted negative press and attention on social media for its nano lending operations which are considered exploitative,” the source said.

SeedCred has recently been making highlights because of the deceptive marketing, predatory rates and aggressive recovery tactics through their app Barwaqt. One of the most hyped international fintech companies that was an applicant for the digital bank licence,

South Africa-based Tyme Bank, which has all the required credentials to set up a digital bank in Pakistan, reportedly could not get the licence because of their requirements of banking on cloud for which regulations did not exist. The situation here gets more complicated.

You see the rumour mill has been churning some interesting stuff. That the State Bank might be announcing two more digital bank licences soon, increasing the number from five to seven. One of these would be given to Tyme Bank while the other to DBank of former SAPM Tania Aidrus. The speculation gets stronger that the central bank might be announcing two more licences because the SBP has announced a framework for banking on cloud, which hints at an arrangement for accommodating Tyme Bank for a licence.

Why cloud? Because banks and fintech companies face issues with scaling due to lack of adequate infrastructure to support computing functions. With cloud, financial institutions can move their computing functions and data to domestic or international cloud service providers for improved services.

The State Bank has not officially confirmed or denied if two more NOCs are on the cards. .

None of this means that all the candidates that have been granted NOC will be able to set up digital banks successfully if the SBP is not satisfied with what’s to come. The next step of the process requires setting up an unlisted public limited company - all SBP regulated entities are set up as public unlisted companies - with the Securities and Exchange Commission of Pakistan (SECP) within a time period of six months. After this, the applicants would be applying for an in-principle approval of the State Bank, followed by pilot operations, leading to the commercial launch. If at any point in time, the State Bank is not satisfied with the operations of these banks, the SBP could increase the time for pilot operations or revoke it altogether, in case of any serious breach of rules. n

“We are a lending bank. We will be lending to SMEs, to agriculture. We will be leading in lending, not in payments. Payments are also important but we will be prioritising lending. We will be doing data-based lending instead of collateral-based lending”

Nadeem Hussain, CEO

Unpacking

By Muhammad Raafay KhanOn the main Hyderabad road, Mirpurkhas, Sindh, is a piece of land that measures 3.45 acres. It lies in the main commercial area of the city and is estimated to be worth between PKR 300 million to 1,200 million. The property belongs to Mirpurkhas Sugar Mills Limited (MIRKS). In April 2021, the sugar mill tried to sell the land but what would have been a normal asset disposal turned into a legal battle involving some shareholders of the company, the Securities and Exchange Commission of Pakistan (SECP), and the sugar mill.

Some shareholders believed that the property was being undervalued by the com-

pany and the sale was being carried through non-transparent means. Soon after, the SECP got involved. After the company failed to satisfy the regulatory body, the SECP threatened to initiate an investigation into the sale of the property. But in October of last year, the sugar mill obtained a stay order from the Sindh High Court (SHC), effectively restraining the SECP from starting any formal investigation.

Profit tries to understand the complex tale of the legal battle between the two parties.

MIRKS is one of the many subsidiaries of the Ghulam Faruque Group (GFC). The late Ghulam Faruque (1899-1992) was a

prominent and respected name in the industrial and financial sectors of Pakistan who as the Chairman of the Pakistan Industrial Development Corporation has often been credited with spearheading Pakistan’s industrial revolution. He founded the group and oversaw its successful growth and development on the basis of the values he espoused.

Established in 1964, Faruque (Pvt) Limited is the parent company of GFC which serves as an investment arm for the group. Some companies in the group include MIRKS, Cherat Packaging, Cherat Cement Company, Madian Hydropower, Zensoft, Greaves Pakistan, Unicol, and Unienergy, among others.

MIRKS was incorporated in 1964 and its principal activity is manufacturing and selling of sugar. It started sugar production in

February 1966 with an initial cane crushing capacity of 1,500 tonnes of cane per day. Over the decades, the company has evolved itself as one of the top quality sugar producers in Pakistan. With a daily crushing capacity of 12,500 MT, MIRKS is among the top sugar mills of Sindh Province.

The company’s factory is located about 230 km from the port city of Karachi, in Mirpurkhas and is listed on the Pakistan Stock Exchange (PSX). It is one of the most efficient sugar mills in Pakistan. Moreover, it is involved in development of higher yield sugarcane varieties on its 351 acres experimental farms and in adjoining areas of mills. Mr Arif Farque is the Chairman of the board of directors (BoD) while Mr Aslam Faruque is the Chief Executive (CEO) of the company.

During the last financial year of the company ending September 2022, MIRKS diversified its operations by investing in a paper and board project. The project aims to enhance the business prospects of the company by making it even less reliant on sugar production while benefiting from the synergies that come with diversification. The trials were completed by December 2022 and commercial production is expected to commence from March 2023.

From the start of crushing season 2021-22, a track and trace system has been implemented by the Federal Board of Revenue (FBR) on the sugar sector to ensure electronic monitoring of manufacturing and sales of sugar. Through this, tax stamps are placed on every sugar bag produced and no dispatch can

be made from the sugar mill without affixing the stamps. The company was among the first few mills in Sindh that implemented the Track and Trace System.

However, big companies such as MIRKS often have to face multiple challenges not only in business but also in the legal space. As a publicly listed company on the PSX, MIRKS has to follow certain rules and procedures in order to ensure transparency in its business for the overall value creation for its many shareholders. This story focuses on one such challenge for the company which has brought it into the public limelight.

On April 7, 2021, the BoD of Mirpurkhas Sugar Mills decided to sell “its immovable (residential) property situated in Deh 109, Tappo Taluka and Registration District Mirpurkhas,” according to a notice shared to the PSX at the time. The notice of the possible sale left out many details such as the size of property, valuation, details of possible buyers, etc, which were picked up on by a shareholder of the company, Zubair Sodha.

Sodha wrote a letter to the company and the SECP asking the company to provide details of the asset disposal. He asked why the company didn’t take approval from the shareholders to sell the land under section 183(3) of the Companies Act which states that any

“sizable asset” worth at least 25% of the assets in that class cannot be sold by the company without approval from the shareholders in a general meeting (AGM or EGM). He also questioned the valuation of the land by saying that it is a commercial area now situated at Main Hyderabad Road in Mirpurkhas city, whereas the company mentions it as “residential”.

The letter further stated that the valuation of the property according to local brokers in the city was between Rs 600-750 million whereas the total market capitalisation of the company was Rs 1.4 billion at the time of the letter, sizable enough to require the company to have approval in a general meeting before selling it.

According to the MIRKS’s annual report for the year ended September 2021, the property in question (measuring 3.45 acres and covered area 6,825 sq.ft) was valued at Rs 300,564,000. The valuation was carried out by independent valuers M/s. K.G. Traders (Pvt) Limited to determine the present (realisable) market value by enquiring from local active realtors.

Furthermore, according to the sales agreement made on April 24, 2021 and not disclosed to the PSX, the property was sold for Rs 750 million (for privacy concerns we have refrained from using the name of the purchaser). The company argued that the property had fetched a way higher market value for sale than its present valuation, which is a good thing.

The purchaser made an advance payment of Rs 51 million at the time of agreement with the remaining 699 million to be paid in equal instalments at the end of every month from April 2021 until March 2022. The transfer of ownership was expected to be completed on June 30, 2022, after completion of all payments but was stopped due to inquiries from the SECP.

Following Sodha’s letter, the SECP lodged a complaint against MIRKS asking for clarifications about the property disposal. The company replied that it had followed all proper procedures based on the advice of a reputable audit firm which concluded that no approval was required from shareholders to sell the property in question as the said property did not meet the test of “sizable part” as provided under s. 183(3) of the Companies Act, 2017.

MIRKS replied that the Companies Act identifies the class of assets as “fixed assets”. Since the total value of fixed assets at September 30, 2020 was Rs 2,478 million and the value of the property was Rs 300 million, comprising 12.12% which is less than the 25% requirement, the disposal of the asset did not meet the test of the “sizable part” requirement.

But the SECP had its own interpretation of the “sizable part” law. It said that the

asset needs to be worth 25% of its own class of assets, meaning that if a piece of land is at least 25% of the total value of all the lands owned by the company, then it passes the “sizable part” test and needs approval from the shareholders before its disposal. The SECP further said that the aggregate carrying value of the ‘land and building’ class of assets (to which the Volkert House belongs) was Rs 965 million. And if the Rs 300 million amount is used, which is the market value given by the company in its books, then the Volkert house forms 31% of the class of assets, thus passing the ‘sizable part’ rule. Both the company and the SECP seem to have a different interpretation of the law.

MIRKS answered all of the queries raised by the SECP. It also provided historical revaluations of the property which the company does every three years. In 2014, the market value of the Volkert house was Rs 254 million which increased to Rs 403 million in 2017, and decreased to Rs 300 million in 2020. Common knowledge dictates that properties usually increase in value over time, but when Profit reached out to the company to explain the devaluation, it received no comments.

Profit also asked the company for the time period when the 3.45 acres Volkert House turned into a commercial property from a residential property, if it ever did? The company again gave no comments.

In reply to an assertion by the shareholder Sodha, that the transaction was being done through covert means, the company rejected the accusation and answered that the management was being approached by non-serious parties for some time who only wanted to gather information. This led the management to engage in private negotiations with serious buyers which led to the execution of a beneficial agreement for all shareholders because the company was able to fetch a higher-than-market price for the property (Rs 750 million).

Since the company had previously claimed that it sold the property to the highest bidder, the SECP naturally asked for the details of all the bids received by the company for verification. But MIRKS refused this request on the grounds that it was an excessive request and that real estate transactions normally involve verbal offers and are only documented when the transaction is intended to be implemented. This seems to imply that there is no written record of all the five offers received by the company and no way to verify whether it actually sold the property to the highest bidder or not. But what the company reveals next (unintentionally, perhaps) sheds more light on this point.

On September 3, 2021, MIRKS said that as a private company it was under no obligation to sell the property to the highest bidder but to sell at any amount deemed fair by the

company. This statement by the company seems to contradict the decisions made by the BoD in its meeting on April 7, where the board gave its approval to sell the property to the “highest bidder” from the five parties which expressed interest. This also implies that contrary to what the company claimed previously, it did not actually sell the property to the highest bidder and even if it did, it has no proof of it!

And going by this logic, it also raises suspicions on the company’s claim that it sold the property for a higher price than its market value. According to our sources, other land evaluators in the area have put the market value of the land to Rs 1.1 to Rs 1.2 billion, approximately 300 million more than the Rs 750 million price at which the Volkert House was sold. Meaning that the company could have gotten an additional Rs 300 million (if not more) for itself and its shareholders had it sold the property for the highest value. It seems that the shareholders might have actually lost from this sale. Why did all of this happen? That is a question the company must answer itself.

The back and forth between the sugar mill and SECP continued after which the SECP sent a show cause notice to the company on September 23, 2021. It asked the sugar mill to again explain the discrepancies and warned to open an investigation now if the company did not provide satisfactory explanations.

But the company rejected all accusations, and on October 21, 2021, as an aggrieved party, it challenged the show cause notice before the Sindh High Court (SHC). The SHC suspended the notice and also restrained the SECP from taking any adverse action against the company. Since the stay order obtained by the company through the SHC, there has been no new legal challenges for the company.

There has no been no hearing since October 2021 against the stay order obtained by the company. In any developed country, if a regulatory body such as the SECP had been restricted from its conducting investigation, it would have aggressively pursued to vacate the stay order. However, the SECP seems to have let the stay order be as is instead of working to vacate it.

Profit reached out to the company to explain its version of the story but the company replied that it can give no further comments at the time before the Annual General Meeting (AGM) of the company, to be held on Saturday, January 21, 2023. In order to give a fair representation to the company to give its version, we waited until publishing this story after the AGM.

Profit attended the AGM where it noticed that the CEO Mr. Aslam Faruque attended the meeting online from afar and put forward the COO Mr. Wasif Khalid as

the main face of the company to answer all questions. This raises doubts about the CEO’s capability and knowledge about the company. Interestingly, the independent director Mr. Muhammad Izqar Khan did not even attend. This raises a big question, does the independent director of National Investment Trust (NIT) and State Life Insurance, which are both public companies, not care about the investments made by the public to ask MIRKS any question which might safeguard the interest of the public?

In reply to a shareholder question during the AGM, Mr. Wasif said that the ownership of the 3.45 acres land has been transferred to the purchaser and that it will be reflected in the books of the current financial year ending September 2023.

In reply to our question whether the company will face any new legal challenges in relation to the sale of the land after it obtained a show cause notice in October of last year, the management avoided directly answering the question and simply repeated that the transfer of property ownership will be reflected in the books of the current financial year.

It is unclear at the moment what the future of this case holds because the company has refused to clearly comment on questions related to the case. Mirpurkhas Sugar Mills has obtained a stay order and since the SECP has not challenged the stay order, the company has been given a free reign to continue business as usual. The shareholders who are questioning the company’s decision to dispose of its property will have to raise their concerns with the management some other time.

MIRKS could have avoided all this trouble had it only been more open about the Volkert House transaction in the general meeting of its shareholders. The company has a free float of 39.13% (6,072,768 shares) trading in the PSX. This means that the general public has shares worth over Rs 600 million in the sugar mill. Although, it is not the majority shareholding, it is sizable enough for the company to be more open before the shareholders about large transactions.

This case may serve as a lesson to conduct all inquiries and business decisions which might affect the stakeholders openly. Anything deemed less than transparent can land the parties in time-consuming legal hurdles which can disrupt their normal course of business, whether any party is found guilty or not. n

Sources of information: Pakistan Stock Exchange (PSX), Sindh High Court Suit no. 2434/2021, company’s annual reports.

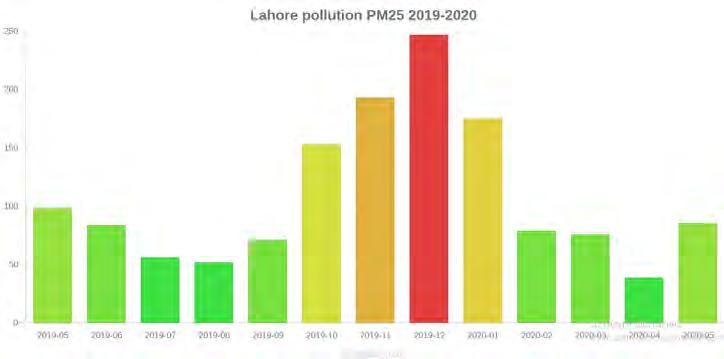

Pakistanis have another reason to worry, and it isn’t the economy. Air quality has been deteriorating over the past years and on the morning of January 18, 2023, Lahore and Karachi took the top two spots of having the worst air quality in the world

Karachi took the number one spot followed by Lahore on the morning of the 18th according to IQAir that measures air quality. It must be noted though that these rankings are constantly changing and vary based upon different factors.

The two cities from Pakistan took the top two spots in the category of the worst air quality globally, that is the amount of pollution or particulate matter in the air you breathe.

The fact that air quality in Pakistan is poor is not a huge secret; when huge levels of pollution are coupled with zero regulation it becomes a recipe for disaster. As of January 19, 2023, Lahore ranks number six and Karachi ranks at number 10 on the “air quality and pollution city ranking,” of IQAir. All of us encounter thick clouds of smoke and piles of garbage around our cities. We’ve grown up with it, but it is absolutely hazardous to one’s health especially over long periods of time.

Air quality can practically be determined visually, when the air is clean, it is clear and includes only trace amounts of solid particles and chemical contaminants. Poor air quality, with high levels of pollutants, is frequently foggy and

hazardous to health and the environment.

If one has ever seen the city from a vantage point, it is normal to mistake the grey haze for clouds. This is actually air pollution hovering above. But after a spell of rain, the air looks cleaner, significantly improving visibility.

The Air Quality Index (AQI) is used to describe air quality because it is based on the concentration of pollutants in the air at a certain location. The AQI is broken into six categories with 50-point increments. Each category represents a distinct level of public health concern. Consider the AQI to be a yardstick with a scale of 0 to 500. The higher the AQI value, the worse the air pollution and the greater the health risk. For example, an AQI value of 50 or less indicates healthy air quality, but an AQI number more than 300 indicates hazardous air quality. For reference, according to IQAir Karachi as of Jan-

uary 19 has an AQI value of 158 whereas Lahore stands at 161. These values fall in the category of being unhealthy for everyone and not just a particular segment of the population suffering from any complications related to breathing.

Air quality databases compile measurements from official, crowd-sourced, and satellite-derived air quality monitors to determine the AQI. Based on the accuracy and type of pollution measured, these databases may weigh data differently.

In 2021, the United Nations Environment Program and IQAir collaborated to create the first real-time air pollution exposure calculator, which integrates worldwide measurements from certified air quality monitors in 6,475 locations across 117 nations, territories, and regions.

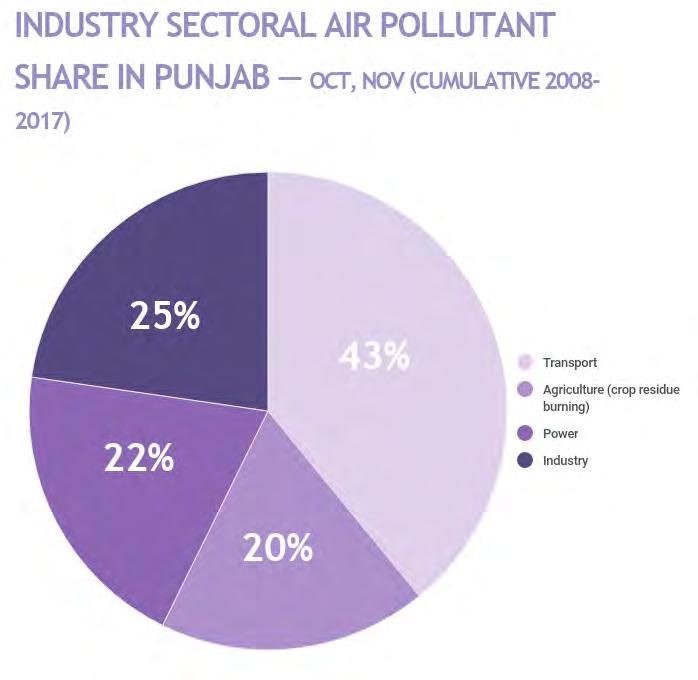

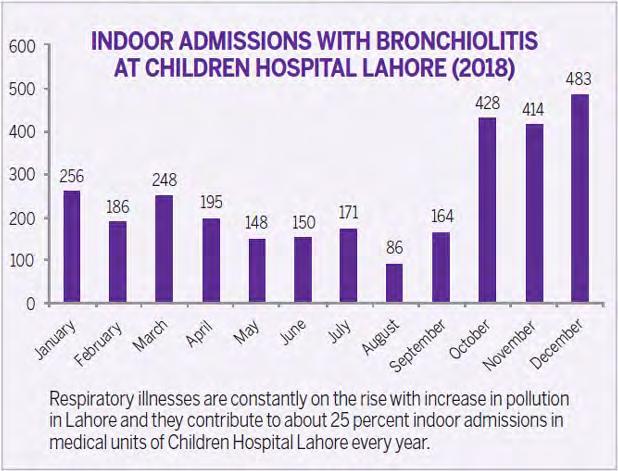

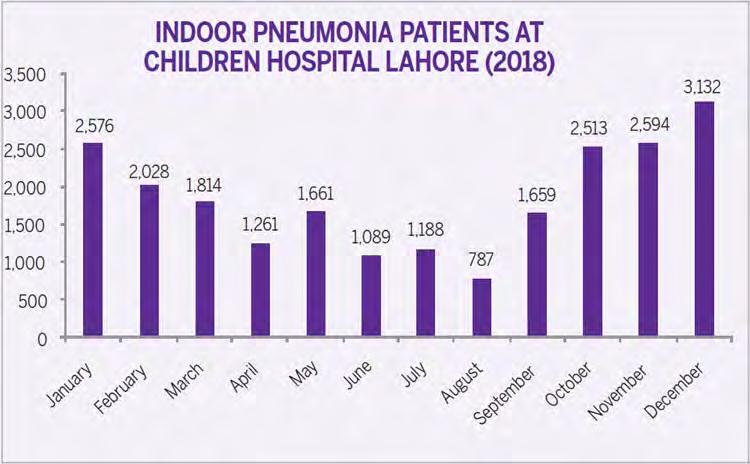

The database prioritises specific readings and uses artificial intelligence to compute the hourly exposure of nearly every country’s population to air pollution.