Once poised to become one of the biggest Islamic Banks in Pakistan, BankIslami is now at a crossroads. On the 15th of November, one of the bank’s major shareholders, the JS Group, announced its intention to acquire 51% shareholding in the bank and consolidate its control.

So why is the JS Group now looking to acquire BankIslami and take over its manage ment? For starters, there is the very real wave of Islamic Banking that has overrun the industry in Pakistan. The rise of Meezan Bank and pivots towards providing Shariah compliant services by others such as Faysal Bank have all pointed towards a huge market. On top of that, for nearly two decades now BankIslami has been run by multiple large shareholders and the resulting inefficiencies have cripple its decision-making and stunted its growth.

With the incumbent government also

announcing its intention of moving towards an interest-free banking system, the field is changing rapidly. A day after the public an nouncement of intention (PAI) was submitted by Next Capital Limited, both BIPL and JSBL confirmed the acquisition announcement. However, the final sale will be made after approval from the state bank.

The JS Group currently controls 29.05% shareholding in BankIslami, which is the largest shareholding that any group or individual has in the bank. However, they still need at least 21.95% more shares to reach the magic number of 51% which will give them control and ownership. Will the JS Group succeed in its acquisition and be able to become the largest Islamic bank in the country as it once envisioned?

The JS Group has been involved in BankIslami from the very beginning. In fact, they were its original sponsors when the bank was concep

tualized by Jahangir Siddiqui & Company Limited and the Randeree family in late 2003. On September 26, 2005, Dubai Bank joined the sponsors and became one of the founding shareholders of BankIslami by investing 18.75% in the total Capital. After approval by the State Bank of Pakistan (SBP), BankIslami Pakistan Limited was incorporated on October 18, 2004 and became the first Bank to receive the Islam ic Banking license under the Islamic Banking policy of 2003 on March 31, 2005.

BankIslami principally operates as a licensed and full-fledged Scheduled Islamic Commercial Bank. It offers various Shariah compliant services to its clients which includes Corporate & Commercial Financing, SME & Agriculture Financing, Consumer Financing, Trade Finance, Retail Banking, Investment Banking, Treasury Services, Digital Delivery Channels and Cash Management & Employee Banking Services.

BankIslami Pakistan Limited made a public offering of Rs. 400 Million, at par, in March 2006. This was the first primary issue

I think the motivation behind JS Bank’s intention to acquire BIPL is to merge both entities and make it a full-fledged Islamic bank. The potential of superior returns by Islamic banks because they are not obligated to pay minimum deposit rate. The government is also focusing on Islamic banking, and these banks are gaining around 1% market share every year.

Fahd Rauf, head of research at Ismail Securities

by a Bank in over a decade in Pakistan.

The Initial public offering (IPO) of BankIslami received overwhelming response from the general public as the applications received were 9 times higher than offered, fetching nearly Rs. 3.5 Billion, against the demand of Rs. 400 Million. The State Bank of Pakistan declared BankIslami Pakistan Limited as a Scheduled Bank with effect from March 17, 2006. BankIslami started its Banking operations on 7th April 2006.

By the end of 2014, the Bank hit 213 branches in 80 cities nationwide, and in 2015, the SBP approved the amalgamation of KASB Bank with and into BankIslami. With this amalgamation, all 104 branches of KASB Bank were merged into BankIslami making it the country’s 11th largest banking network with 317 branches in 93 cities in a short span of 9 years. Currently, the Bank has 340+ branches in 123 cities of Pakistan.

Before the recent Nov 2022 sale of its 13.01% stake by Emirates NBD Bank PJSC to the Randaree family and JS Bank, BankIslamic had four major shareholders. Currently, BankIslami has 3 major shareholders. The table below shows the previous and new major shareholding.

The Randaree family comprises Mr. Ahmed Goolam Mahomed Randeree & Mr. Shabbir Ahmed Randeree who are the sponsors of BankIslami in their personal capacity. The history of the Randeree family can be traced back to Jersey in 1975, an Island country near the coast of North-west France, the largest of the Channel Islands, an archipelago in the English Channel. The Randeree family’s core business activities are concentrated in the Real Estate and Banking sectors, starting from the UK and USA which then spread to the Middle East and a select number of Far East and African destinations.

The Group, established in 1975 is a Family Investment Office with over 30 years of experience in Real Estate and Banking. The Group has its investments primarily in the UK, USA, South Africa, India and Pakistan. They are one of the pioneer sponsors of AlBaraka Islamic Bank, South Africa, Islamic Bank of Britain, European Islamic Investment Bank and the Islamic Bank of Asia.

As of Nov 2022, the Randaree family owns 215,930,466 shares or 19.48% sharehold ing in BankIslami.

The JS Group was founded by Jahangir Siddiqui in 1970. In the 5 decades since, Mr. Siddiqui has become one of the biggest players in the financial sector of Pakistan. Under his leadership, JS Bank became one of the largest commercial banks in Pakistan. JSCL was established in 1991 as the holding company of JS Group, one of the largest and most diver

sified financial services groups in Pakistan. The Group interests are spread over various sectors including asset management, commercial banking, insurance, stock brokerage, consumer credit rating, media and transport. JSCL also owns controlling shares in a Conventional Bank, JS Bank Limited.

As of Nov 2022, the JS Group holds 29.01% shareholding in BankIslami and is looking to acquire a further 21.95% to get a 51% controlling share.

Ali Hussain founded SAJ Capital Man agement Ltd. and Sajjad Foundation. Presently, Mr. Hussain is Chairman for BankIslami Pakistan Ltd. and Managing Director at SAJ Capital Management Ltd. Ali Hussain received a graduate degree from Stanford University and an undergraduate degree from The California State University. He has strategic investments in the financial sectors of Pakistan, Europe & USA. He has overall 41 years of professional experience and specializes in incubating, acquiring and managing technology companies and converting them into growth champions in Singapore, USA, Germany, UK and Canada.

He joined BankIslami as director in 2011 and is now the chairman of BankIslami. As of Nov 2022, Ali Hussain and his capital manage ment company collectively have 270,186,754 shares or 24.37% shareholding in BankIslami.

Before the announcement of the inten tion of acquisition, on Nov 11, two curious buying activities were seen of BIPL shares. The Randaree family, sponsor shareholders of BankIslami, and JS Bank bought the full 13.01% shareholding of Emirates NBD Bank PJSC in BankIslami. Out of this 13%, the Randaree family bought 5.22% while JS Bank bought 7.79% paid-up capital.

It should be noted that under the Bank

ing Companies Ordinance 1962, the State Bank of Pakistan (SBP) regulates share acquisitions of banking companies. Any acquisition of more than 5% in a bank requires the prior approval of the SBP. JS Bank received this approval on Oct 05 this year while the Randaree family got this approval on Oct 28. Furthermore, any mergers or acquisitions of banking companies also requires the approval of the state bank, an approval which is yet to be given by SBP before it can make its acquisition of BankIslami final.

Out of the 3 major shareholders of the bank, JS & Co seems to be the one taking the lead on controlling the majority shareholding of the bank, a move that can prove to be a major competition to other Islamic Banks in Pakistan.

The timeline:

1. Nov 11: Emirates Bank sells 13.01% shareholding to JS Bank (7.79%) and Randaree family (5.22%)

2. Nov 15: Next Capital Limited submits public announcement on behalf of JS Bank to acquire more than 51% shareholding in BankIslami Pakistan Ltd

3. Nov 16: JS Bank and BankIslami confirm the announcement

Despite being profitable, the revenues and profits produced by BankIslami were not remarkable. According to Suleman Maniya, head of advisory at Vector Securities, “The problem with Bank Islami has always been that there are 3-4 major shareholders which hinders decision-making and prevents any of the shareholders from

investing too much effort to improve the business. It would have been the second largest Islamic bank after MCB but BankIslami couldn’t catch up pace. With one shareholder having majority control, decision making would be easier and JS Group could scale up its Islamic operations and create value for themselves.”

BankIslami was at one time poised to become the largest Islamic Bank in the coun try. But it has been left behind by MCB and Meezan Islamic banks.

Sana Tawfik, senior analyst at Arif Habib Limited, says, “The recent announcement of intention to acquire a stake in BIPL by JSBL hints towards the possibility of converting it into an Islamic subsidiary. We believe this goes in line with JSBL’s growth strategy.”

Fahad Rauf, Head of Research at Ismail Securities, says, “I think the motivation behind JS Bank’s intention to acquire BIPL is to merge both entities and make it a full-fledged Islamic bank. The potential of superior returns by Islamic banks because they are not obligated to pay minimum deposit rate. The government is also focusing on Islamic banking, and these banks are gaining around 1% market share every year. However, the fate of the new merged entity will depend on who is put in charge of the Bank because JS bank has done well compared to BankIslami.”

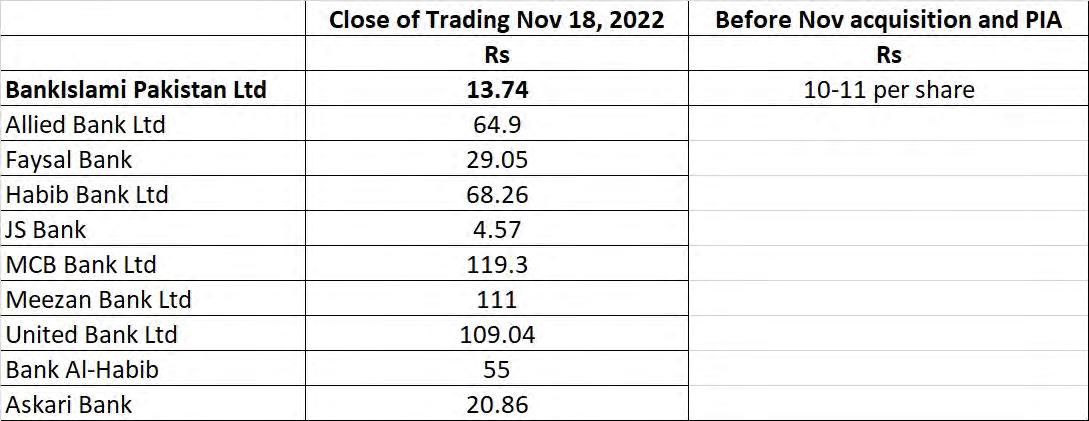

In the banking sector, BankIslami has one of the lowest share prices among the commercial banks, but higher than that of JS bank. Before the November acquisition of shares by the Randaree family and JS Bank and the public announcement of acquisition, the average share price of BIPL was around Rs 10-11 per share. Currently, it is trading at Rs 13.71. At the same time, JS Bank share price at close of

weekly trading was Rs 4.57 per share. For full comparison with 10 other major commercial banks, take a look at the share price compari son table.

Additionally, the financials of BankIs lami have remained relatively stable, neither showing too much improvement nor showing too much decline. In the first nine-months (Jan-Sep) of 2022, BankIslami reported a net profit of Rs2.85 billion compared to Rs 2.13 billion in the previous year. Earnings per share of the bank increased to Rs 2.57 in the nine-month period compared to Rs 1.92 in the previous year. Although these earnings show some promise, they haven’t grown as much when compared to Meezan bank and other Islamic banking windows.

The shares of BIPL are currently trading at their lowest price which makes it an opportune time to buy the bank as an investment decision.

The final acquisition of BIPL into JS bank will be subject to obtaining the requisite regulatory approvals from the State Bank of Pakistan (SBP). In the case these approvals are not given, the public announcement to buy BIPL can be withdrawn.

For the JS Group, there is also the question of where to buy the remaining 21.95% shares from in order for it to reach 51% share holding in BIPL. We expect that JS Group will buy these shares from the two other major shareholders of BIPL, the Randaree family and Ali Hussain. Although the final price is yet to be disclosed, JS Bank will probably have to pay an above market price to the two major shareholders in order to get more control of the bank from them. n

“The recent announcement of intention to acquire a stake in BIPL by JSBL hints towards the possibility of converting it into an Islamic subsidiary. We believe this goes in line with JSBL’s growth strategy.”

Sana Tawfik, senior analyst at Arif Habib Limited

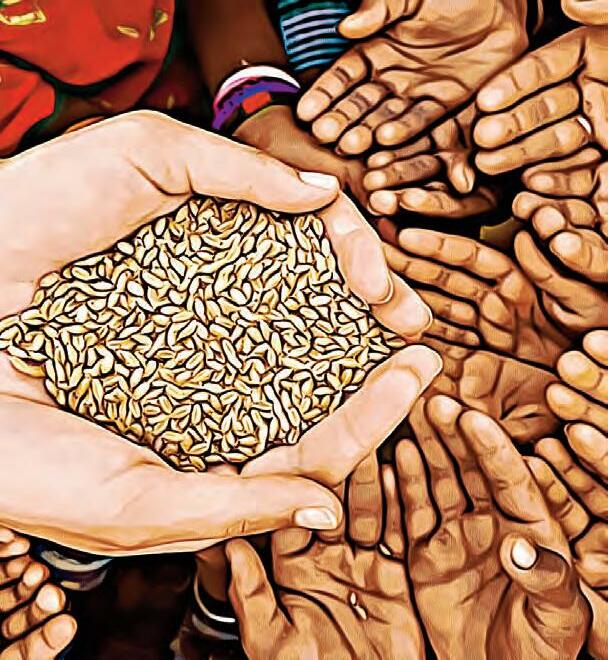

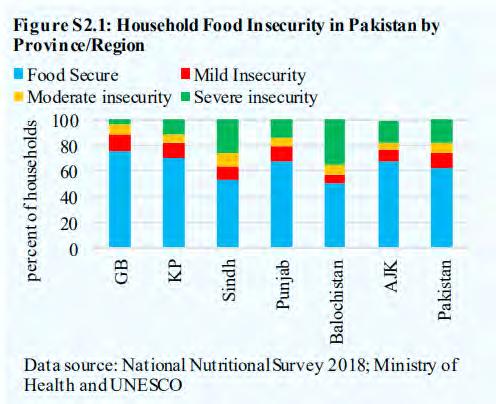

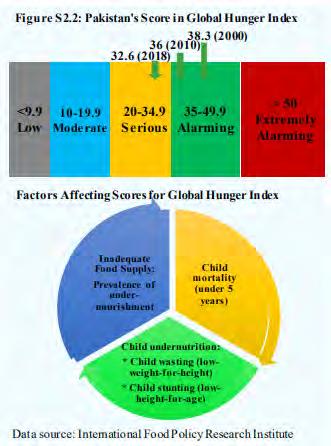

Pakistan has a problem. In an international ranking of the Global Hunger Index (GHI) this year, the country ranked 92 out of 116 nations, with its hunger categorised as ‘serious.’ Pakistan currently faces a scenario in which it is largely food sufficient but not food secure.

Despite Pakistan being ranked at 8th in producing wheat, 10th in rice, 5th in sugarcane, and 4th in milk production, a 2019 report of the State Bank of Pakistan (SBP) showed that nearly 37% of households in Pakistan are food insecure. In the three years since the SBP’s report, matters have only worsened. Food price inflation in Pakistan has been in double digits since August 2019. The cost of food has been 10.4-19.5% higher than the previous year in urban areas and 12.6-23.8% in rural areas, according to figures published by the Pakistan Bureau of Statistics.

So how does a country with one of the largest agrarian economies in the world find itself unable to sufficiently provide food for nearly 40% of its population? For decades, agriculture has been neglected and people’s earnings have been hit by one economic crisis after another. On top of this, particularly in the past decade or so, climate change related disasters and changes in the environment have resulted in our already neglected agriculture becoming less competitive.

To identify and look into Pakistan’s food security woes, Profit has used the exam ples of different crops, regions, and policies to identify four different crises threatening Pakistan’s food security. We will begin with Pakistan’s reliance on imports for some of its most important food imports, taking oilseeds as an example. This will be followed by looking at the dearth of research and development that holds Pakistani farmers back from growing these crops themselves. Finally, we will look at the big kahuna — climate change, before asking one last question: Even if we manage to grow more food despite this, do we have the infrastructure and the supply-chain to handle it?

But before we get into this, it is important to understand the meaning and nuances behind the concept of national ‘food security.’

It sounds baffling that a country with the capability of producing food sufficient not just for itself but also to export would be facing food security issues. Despite the fact that Pakistan produces vast quantities of major staple and nonstaple food crops, the

state of food security in the country is inade quate.

According to the UN’s Food and Agri culture Organization (FAO), the concept of food security is flexible, but is widely believed to “exist when all people, at all times, have physical, social and economic access to suf ficient, safe and nutritious food which meets their dietary needs and food preferences for an active and healthy life.”

In short, for a country to be considered food sufficient it does not just have to produce a sufficient amount of food, but that food should be easily available, affordable, and of a quality that meets basic nutritional require ments. For a reliable level of food security, it is vital that the access and affordability of food is not affected by shock events such as floods and economic crises that result in inflation.

The concept is not difficult to grasp, but it is so simple that it often gets lost in the cracks. Food is the most basic building block of human life. The quality and quantity of caloric intake of a population affects its overall productivity, standard of living, and most importantly happiness and satisfaction.

While access to food is a basic, fundamental human right there is a way to put an economic cost on food insecurity. The lack of food security has strong economic implications. According to a special section of the SBP’s annual report from 2019-20, the state of food security has strong linkages with the state of human capital in the country. The Food

and Agriculture Organisation of the United Nations has also estimated that a high rate of malnutrition can cost an economy around 3-4% of GDP. In the case of Pakistan, estimates suggest that malnutrition and its outcomes cost the economy 3% of GDP (US$ 7.6 billion) every year.

To put this in very mathematical terms, malnutrition and food insecurity manifests in the shape of high child mortality rates, prevalence of zinc and iodine deficiencies, stunting, and anaemia, which lead to deficits in physical and mental development that weakens labour productivity and loss of future labour force in the country.

On a much more human level, however, the lack of food security means a whole lot of misery, hunger, and anguish. According to the State of Food Security and Nutrition in the World report for 2020, prevalence of undernourishment in Pakistan is 12.3% and an estimated 26 million people in Pakistan are undernourished or food-insecure. Pakistan’s children have suffered and are continuing to suffer. Malnutrition from an early age results in consequences that last entire lifetimes.

Add on top of that a high population growth and unfavourable water and climat ic conditions and you have a scenario that threatens to spill over and cause mayhem. Pakistan is barely maintaining its current food security level of just over 60%. According to the SBP report mentioned earlier, “of the 36.9 percent of the households in Pakistan labelled

as “food insecure”, 18.3 percent face “severe” food insecurity.”

Concerns over food security may increase at an alarming rate over the next two or three decades. This will also mean that the overall fiscal and balance-of-payments cost will also escalate just to maintain the current level of food security in the country.

This is a tough one to crack. Pakistan produces a lot of its food on its own. When it comes to vital crops like sugarcane, wheat, and rice farmers are regularly backed by support prices and manage to produce enough to export as well. However, some of our most basic caloric inputs are imported with very little attention being paid to growing them domestically. And there is no example more pertinent than oilseeds.

Oilseeds is a term used to describe any kind of seeds or plant product that can be compressed to extract and produce oil for cooking – basically the raw product for edible oil. Oilseeds have two purposes. The first is to produce edible oil for cooking purposes. The other is to produce ‘meals’ using the mulch and byproducts of the compression process that are then fed to livestock including poultry and cattle.

This makes them a very important and diverse crop. The most used kind of oilseeds come from palm and soy trees, but sunflowers, cotton, and mustard all also produce seeds that can be compressed to produce edible oil. Despite the apparent diversity and some of these crops being indigenous to Pakistan, a large majority of our edible oil is imported.

In Pakistan, nearly 90% of the import of oilseeds is constituted by palm and soybean oilseeds. In its recently released report for the first quarter of the FY 2021-22, the SBP includ ed a special section on rising palm and soybean imports. According to the report, Pakistan’s palm and soybean-related imports stood at US$ 4 billion in FY21, rising by 47% year-onyear, compared to compound average growth of 12.3% in the last 20 years.

Pakistan’s reliance on these two oilseeds is not out of sync with global trends, and some of the largest producers of canola and sunflower – which are the third and fourth most consumed vegetable oils in the world – still rely heavily on palm and soybean.

The problem in Pakistan is that we have failed to adapt to the change. Instead of growing palm and soybeans locally, we have been relying on imports – which has resulted in the whopping $4 billion import bill we currently have for oilseeds. So what is stopping us from growing oilseeds locally?

The first problem we have with that is

that our traditional oilseed varieties are not specifically bred or farmed for oilseed purposes. The most indigenous oilseed we have is cotton, which is grown primarily for its precious fibres. However, cotton production has been down on the back of weak seeds and the cotton seeds once extracted from the fibre are often disposed of instead of used to extract oil.

There are other locally produced oilseeds in Pakistan as well. Canola, groundnut, sesame, castor and linseed, are the major crops used in edible oil and oilseed meal production. Despite having higher oil extraction rates of 42% and meal extraction rate of 58%, Canola’s area un der cultivation had gradually declined between 1967 and 2016. In recent years, Canola is being encouraged in Punjab through a cash subsidy package introduced in FY 2017-18 as a result of which acreage and production more than doubled between FY 2017-18 and FY 2018-19.

The other option is to grow palm and soybean locally. Attempts have been made to do this but have summarily failed. In 1994, a survey was conducted by the National Agriculture Research Council (NARC) which surveyed 3.86 million hectares in Sindh, of which most were coastal districts feasible to grow soybeans. The survey checked humidity, soil conditions, and existing land usage as perimeters and decided that around 1.65 million hectares were considered suitable for growth in varying degrees.

Yet the issues for growing new kinds of crops such as palm and soybean are the same as the ones holding back indigenous crops. There is an absolute lack of scientific knowledge

and input in our agriculture. Which is what brings us to our next problem — research and development.

R&D. It is a buzz-term that you will find everywhere in organisations, think tanks, and government departments. But in the field of agriculture, it is an oft touted but rarely implemented mantra. One of the most important things to understand is that as the world’s population has grown, more land has had to be brought under cultivation to meet humanity’s caloric needs.

And as the world has progressed, this has required a serious scientific approach. Research in the field of agriculture has led to mechanisation of farms, the development of seeds that give higher yields and are more resistant to different weather conditions, and areas before thought uncultivable have been turned into rich sources of food. The primary role of agricultural research is to heighten knowledge and improve technology. It height ens understanding of the interactions and interdependence between production systems and farming communities. This requires a holistic and interdisciplinary approach to problem identification, analysis and solution-finding.

This has been entirely missing in Pakistan. A major reason for the food price inflation in recent times are increasing input costs for

agriculture over the past two years. Higher fuel prices and the devaluation of the rupee have led to a rise in costs in both fertiliser and seeds. Prices increase more in rural areas because commodities are diverted to cities due to higher profit margins, and because of the higher cost of imported items such as pulses and cooking oil.

Some of these situations are largely out of the control of farmers and provincial agricultural departments. However, low yields and production losses due to climatic changes have also had a detrimental impact on commodity prices. These factors could have been avoided if Pakistan had robust agricultural research organisations focused on producing better quality seeds, providing farmers with better techniques, and tailoring solutions for different regions. While organisations such as the Pakistan Agricultural Research Council (PARC) do exist, their role is vastly underplayed. Until a scientific approach can be taken to try and resolve the issue, there is very little that can actually be done.

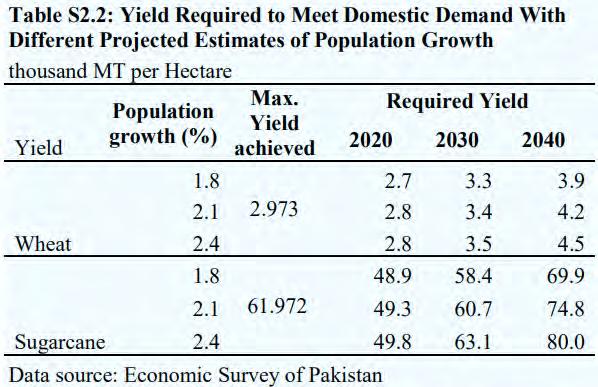

As things stand, Pakistan may face an issue of even self-sufficiency in the coming years. And even if we manage to stay sufficient, that does not guarantee food security. A country is considered food secure if food is not only available, but is also accessible, nutritious, and stable, regardless of its origin. Pakistan provides support to its farmers on various levels, particularly when it comes to crucial crops such as wheat. However, even this may become difficult.

According to the SBP special report, land extension is not an option anymore for Pakistan, and in the presence of current cropping practices, water shortages and expected climatic changes, it will be chal lenging to improve yields substantially. This means Pakistan’s best bet is to invest heavily in research and development in the hopes that we can produce research that allows us to grow high-yield crops with a tolerance for rapidly changing climate conditions. And that is what brings us to our next time-bomb, and perhaps the biggest one there is — climate change.

The main reason behind it? Climate change has resulted in a gargantuan increase in the amount of monsoon rainfall that Sindh and Balochistan have seen this year. The two provinces saw the highest amount of water fall from the skies in living memory, recording 522% and 469% more than the normal downpour this year according to the met department.

Change has warned that the frequency of such extreme weather conditions will increase in the future, causing a severe risk to Pakistan’s food security. The Asian Development Bank projects sharp declines in key food and cash crops (such as wheat, sugarcane, rice, maize, and cotton) in the coming years due to rising cultivating costs and climate change.

You’ve heard it before, you will hear it again, and we will tell you this ad nauseam: Climate change isn’t com ing, it is here. If there was need for any other proof, then all you have to do is look at this year’s disastrous flooding. The water ravaged millions, destroyed crops, levelled entire villages, displaced 33 million people, and caused an estimated $40 billion in damages all over the country.

The effects are devastatingly clear. Pakistan was hit with a major wave of climate-change related activity that resulted in death, destruction and total annihilation in some areas. And this will by far not be the only time the issue strikes us. According to UNES CAP, Pakistan could lose more than 9% of its annual GDP due to climate change. Severe heat waves and untimely rains have also severely impacted Pakistan’s agricultural production. The Intergovernmental Panel on Climate

And the problem is all encompassing. On the one hand, there is increased rainfall and erratic weather patterns that our farmers are unable to keep up with because they do not have the resources to do so. On the other hand, there is a much more critical hold that changing weather patterns have on the jugular vein of Pakistan’s agriculture.

In addition to the many historic reasons for the state of the Indus River, climate change is causing direct consequences already, adding

Climate change — it ain’t ticking, it just went boom

another layer of complexity to an already troublesome issue. What is clear is that the early effects are already visible. In an arti cle published in the journal for Global and Planetary Change, a report on the state of the Tibetan Plateau published a few years ago reads that the region has faced “evident climate changes, which have changed atmospheric and hydrological cycles and thus reshaped the local environment.”

To put that into perspective, more than 1.4 billion people depend on water from the Indus, Ganges, Brahmaputra, Yangtze, and Yellow rivers which are fed by these water towers. Without an effective policy on how to manage and handle this crisis, Pakistan does not stand a chance on the food security front.

The reality is Pakistan has been a country with a serious food deficit problem for the last three to four dec ades. Despite the natural advantages that the country has in the shape of fertile land, access to fresh water, and a rich history of farming practices it has suffered in this regard mostly because of a lack of political will to improve and adapt agricultural practices with the times. Pakistan remains behind on value addition and storage, which means we waste a lot of produce and end up having to import food we could simply grow at home, and actually even export.

Some of the problems behind why Pakistan has faced these kinds of issues are well known. Farmers are not encouraged to use modern farming methods, they are not provided with better seeds that are resistant

to disease, and they tend to focus more on cash crops and less on farming for subsistence since the demand for money and services is high. This often leads to there being food shortages in rural areas where the food is actually grown rather than in urban centres – perhaps one of the reasons why Pakistan’s food security risks stay out of the media and more importantly, out of public discourse.

These are issues we have discussed al ready. So the question then is, even if they were somehow to be solved overnight, does Pakistan have the infrastructure to cope with successful harvests? Weak supply chain infrastructure, changes in demographics, currency devaluation and transition towards the market economy are some factors contributing to food inflation in Pakistan. Think of these three factors this way: If there are no storage facilities then the supply chain is incredibly feeble, if people move from rural to urban areas then there are fewer people working on the land, and the pivot towards a market economy means farmers now need cash more than they do produce. This causes them to plant more cash crops that they can sell immedi ately and then buy other products. The problem with this is that since much of the other products are not being grown, they become more expensive and the farmers themselves can no longer afford them. Just this year, Pakistan was faced with a

strange conundrum in which its farmers had ended up growing too many potatoes. The Federal Committee on Agriculture had fixed a target of 5.96 million tonnes of the crop for Punjab on 546,000 acres – an average of 273 maunds per acre. However, according to the Punjab Crop Reporting Service, the acreage has grown up to 740,000 acres — an increase of around 35.90%.

By May, things were in motion. A record crop had been harvested — more than twice the size of the harvest in previous years with 8.5 million tonnes of potatoes produced in FY 2021-22 in Punjab alone. As a result, the export of potatoes rose by 10% from Pakistan according to data from the commerce ministry. export value rose 9.8% to $87.39 million in 2020–21, up from $79.59 million the previous year. However, farmers were once again facing the brunt of the problem. They had far too many potatoes and, as a result, the prices in the market were low. There can only be so much demand, and even the 10% increase in exports was not enough to cover the overall increase in the potato crop which had risen by nearly 40%.

To sum it up, Pakistan’s agriculture has suffered from a lack of attention for decades. The country’s natural resources, soil fertility, and robust rivers have kept Pakistan in the running as a solid agrarian economy for almost its entire existence. However, shortsighted ness has meant that successive governments have been very comfortable allowing things to run as is without investing in the future. As the population has increased, climate change has dug in its claws, and water scarcity has started hitting farmers, it is quickly becoming apparent that we have fallen behind. Immediate attention is needed, but only time will tell whether decision makers realise the urgency before it is too late. n

Since January 2019, Pakistan has had a cumulative inflation of 67.4% as measured by the Consumer Price Index. Prices of some items may have increased much more during the same period. A commodity super cycle eroded purchasing power of the PKR, making even the most basic staples and necessities more expensive.

Prices are downward sticky, which suggests that once they increase, it’s difficult for them to fall as the market readjusts itself. A sustained level of inflation keeps the adjustment process running on a perpetual basis, resulting in second, third, and more rounds of price spikes, eventually resulting in sustained double-digit inflation, or even hyperinflation, as can be seen in some economies.

The government through band-aid solutions tries to alleviate such inflationary pressures by providing subsidies and run ning perpetual deficits, funded by an increasing quantity of debt. As the amount of debt increases, fueling growth in money supply, an economy eventually reaches an inflection point where there is too much cash seeking too few goods. As the same goods are not available in the local economy, because supply was never allowed to increase through adverse policy decisions, such goods are then imported. A greater demand for imported goods exerts a downward pressure on the local currency, which makes everything else more expensive in an increasingly import-dependent economy.

In-effect, inflation is the worst kind of indirect tax. A government that cannot take prudent fiscal decisions chooses the

The writer is an independent macroeconomist and energy analyst.

lowest hanging fruit of running perpetual deficits, and funding the same by more borrowing – the cost of which is disproportion ately paid by the most vulnerable segments of society.

As per the latest available household survey, it is estimated that expenditure on food made up roughly 50% of a household’s total income. An increase in food inflation disproportionately affects household budgets, particularly of the most vulnerable segments, who then have to resort to cutting down on caloric consumption. In a country where almost 40% of children are stunted and there is rampant malnutrition, this remains a phenomenal systemic failure of the state, which can’t even feed its population.

As inflation is irreversible, and wages only adjust in real terms with productivity, households that do not have access to quality education, or jobs that instill productivity are at a permanent disadvantage. Inflation does not only result in erosion of Purchasing Power permanently for such households, it also permanently pushes such households below the poverty line. It adversely affects lifestyles, and puts the future generations who are already disadvantaged at risk.

The state has failed in feeding its population. By adapting policies that affect the most vulnerable, and enriching those at the top, it has created an economic and social structure that resembles the society depicted in the Hunger Games, wherein only the Capitol has all the wealth and power, and remains oblivious to the suffering of everyone else. Our country is also being run by pockets of influence in a few cities, which ensures that all policy making serves the interests of a few thousand households rather than the remaining millions living in the country.

It is time for some introspection. The state needs to decide whether it exists for the citizens of this country, or it is just an administrative extension serving the interests of a few thousand households. Even most reading this, or being able to read and understand this piece belong to the same households, and are equally complicit. We have all failed the people of this country, and it does not seem to be getting better anytime soon.

If the state needs to work for its people, it needs to transition towards a broad based taxation regime and must arrest the growth of money supply. It needs to redirect capital towards more productive avenues that are export oriented and enhance productivity, rather than encouraging a cash based economy that plays a critical role in driving inflation, and eroding purchasing power permanently.

In the early 1980s, as he carried banners of the Lakson Tobacco Company on his motorbike through the dusty roads of Lahore, Chaudhry Abdul Jabbar must have looked indiscernible from the sea of daily wage workers carrying their logistical loads all over the city.

But this young man had a unique vision and purpose that set him apart from his many peers in the rat race that is urban life. Over the course of the 1980s and 90s, he would come to dominate the world of on-air advertising and become a powerhouse in Pakistan’s media. A man who came to be known by the name thaikaydar.

To those in the media fraternity, Jabbar Thaikaydar was a household name. He was the person that changed how business was done in Pakistani media. To most outside the media business, he was a largely unknown figure, and the news of his passing on the 11th of November this year will not have been noticed beyond a glance.

Yet how did this young man from Sahiwal come to be one of the most powerful people in the media business in Pakistan? Profit looks back at the life of this self-made rural man who turned dust and stones into gold.

It is a story as typical as they come. Right after completing his intermediate exams, Abdul Jabbar left his hometown Sahiwal to earn a better means of income in the city of Lahore. Once in the provincial capital, he found himself involved in the advertising business.

Essentially, all advertising space in the big city was owned by someone or the other. This means that to put up billboards, or ban ners between electricity poles, or even flex ads on trees you have to pay rent to someone or the other. But since you can’t individually pay rent for all of these spots, what most places do is give out their advertising space on thaika. That was the role Jabbar found himself in. He would buy up advertising space in and around Gadaffi stadium before sports events, and corporations wanting to hang their banners and posters in the area would approach Jabbar who would give them rates and help them set-up their marketing campaigns.

Always on the lookout for growth, Jabbar took these humble beginnings and kept his eye on the bigger picture. In the 1980s and 90s, there was no bigger advertising avenue than television. Except things worked differently in the world of tv adverts. Back in the day, there was only really one channel which was the state-run PTV. The channel allotted fixed slots for programs and the evening slot of 5:00-6:00 pm was not the most ideal for viewership, and therefore for commercials. But Jabbar did something revolutionary.

He brought his old school thaikaydari style of making money off of physical advertis ing space and brought it to broadcast media. He bought 50% of the one-hour advertising airtime PTV offered between 5:00-6:00 pm on lease.

Except instead of selling this one hour to advertisers directly, he used that time to air sporting events. Through this coverage, he gained the attention of the biggest corpora tions of the time. He eventually managed to get the Lakson Tobacco Company to bankroll the airing of kabbadi. That’s right, the very same Lakson Tobacco Company whose adverts Jabbar once carried around on his bike were now the main sponsors behind the shake-up in the media industry he was responsible for. That is when he came to be known as Jabbar Thaikaydar, as his business idea made ripples in the industry.

From here, slowly but surely, Jabbar increased the scale of his contracting and eventually started buying time for weekend slots on PTV and sublet it to private production houses to air their dramas. He became a genius in TV production that earned him the contract of PTV’s biggest programme Nelaam Ghar, which was renamed to Tariq Aziz Show under his production in 1990s.

But Jabbar was silent in his journey and let only his success make the noise. In a conversation with Raihan Merchant, a former employee of Abdul Jabbar and a veteran in the

media and communications business, Profit learned that Jabbar was extremely secure and confident in his work. “He was not scared of competition. When I started my own business, I was technically going to be his competition (against his Matrix media buying house). But to me he was a benefactor and he always acted like it. He linked me with the Di rector Marketing and Director Finance at PTV and guaranteed me their support when I was starting out with my agency PMC,” mentioned Merchant. “He always wanted to nourish the quality, and so he welcomed anyone who wished to enter the market with open arms.”

Somewhere around 1998 and 2000 Jabbar came up with another innovation in broadcast media. After gaining a contract of three years from PTV, he launched PTV Prime -- a channel exclusively for Pakistani dias poras living in the UK and USA. He used to record capsules of four to five hour long pro grams on digital tapes in Pakistan and parcel them to the UK and USA where the program and channel would run on their local cables. With this launch, PTV Prime became the face of Pakistan globally.

“He is responsible for the big breaks of many media personalities,” mentioned Sarmad Sufian, host of the PTV Prime’s flagship show Dream Saturday. The channel and the program gained so much viewership that many young artists strived for a feature. The show intro duced many stars for the first time on screen, including Atif Aslam, who also recently shared the clip of the show on his Facebook.

The only thing greater than his business acumen was his way of living life. Speaking to some of Abdul Jabbar’s close aides, Profit learned that he was known for humility and simplicity. “Despite making big bucks in the business he never forgot his roots. He used to travel in economy and you could never tell that he is one of the media giants just by look ing at him,” recalled a colleague who wished to stay anonymous.

“Even amongst his own shows he used

to sit behind in the audience. We used to ask him to come forward and let the audi ence know who he was but he would always respond ‘nai mey aithayi changa’ (I’m alright just here)”, mentioned his colleague who worked closely with him in ATV.

Merchant, who was a young media professional in PTV in the 1990s said that Jabbar was a solution oriented person. “Working within the strict bureaucratic structures of PTV was not always easy. Oftentimes I’d be frustrated about things and he would just remind me to calm down, take the matter in his own hands and negotiate the problem with higher ups,” recalls Merchant.

Abdul Jabbar was an industry giant. He became the first one to launch privately owned terrestrial channels such as ATV, which soon came under partnership with PTV after its booming profitability. It was during the same time that he launched another privately owned satellite channel known as A-Plus which focused on entertainment content.

But like any other businessman, Jabbar also faced his fair share of lows. In his last years he found his businesses under extreme financial constraint. In 2021, numerous cases were lodged against him and his channel Public News for the nonpayment of employees salaries. This time was extremely difficult for him. “He was stressed and all he would talk about was repayment of his loans,” mentioned another media veteran. “It was our time to pay him back,” said Raihan Merchant, who made advance payments to the channel to pay the due salaries of the employees.

Many of his close aides believed that his simplicity was often taken for granted. Some of them even claimed that his financial dips owed to certain individuals in the indus try who used him for personal gains. Profit reached one of those individuals but could not receive a response. What is undeniable, however, is that Jabbar left a mark set in stone on Pakistan’s media landscape. n

Somewhere around 1998 and 2000 Jabbar came up with another innovation in broadcast media. After gaining a contract of three years from PTV, he launched PTV Prime -- a channel exclusively for Pakistani diasporas living in the UK and USA. He used to record capsules of four to five hour long programs on digital tapes in Pakistan and parcel them to the UK and USA where the program and channel would run on their local cables. With this launch, PTV Prime became the face of Pakistan globally.

After narrowly scoring a visa right before the IMF and World Bank Group Annual Meetings 2022 were due to begin, I found myself in Washington DC in early Octo ber 2022 to attend. This year’s meeting was important. Not only were we in an ongoing fund programme but the country was also ravaged by a flood.

You’re probably wondering why I’m writing this in the middle of November rather than immediately after the meetings. I wanted to wait for the outcome of the meeting, if there was going to be one.

Things have not been easy for Pakistan. My first few conversations with people in line for registration, other journalists at the press centre, and delegates waiting to listen to panel discussions when they begin were of a similar pattern. Every time I’d introduce myself and say I was from Pakistan, I was met with a similar response.

“Oh man! You guys got it real bad these days,” said a delegate that sat with me as we waited to hear a panel discussion on Debt Restructuring.

This got me thinking.

Do we really have it bad enough for most countries to know we have it bad? Did we really become relevant enough in public discourse? Then it hit me, this is not the good kind of relevance. You can argue that there is no such thing as bad publicity but being known for its constantly crisis-struck condition isn’t the best possible scenario for Pakistan.

In the last review, the IMF provided Pakistan with $1.2 billion. On October 13, during one of the press briefings on the region, Jihad Azour, Director of the Middle East and Central Asia Department at the IMF stated that the IMF would be fielding a mission in Novem

The writer is a business journalist at Profit. She can be reached at ariba. shahid@pakistantoday. com.pk or at twitter. com/AribaShahid

ber after the annual meetings to Pakistan in order to start preparing the authorities for the next review.

While Pakistan expected the Fund to be a little more accommodating than usual in light of the floods and let it be more fiscally irresponsible, the chances seemed unlikely. “We were saddened by the loss of human as well as livelihood in Pakistan with the flood and we present, and we reiterate our condolences for the people of Pakistan. As you know, the Fund has been very supportive of Pakistan over the last period. We have a program with Pakistan that has been extended and increased in size. This is to help Pakistan deal with the confluence of shocks starting with the Covid crisis where we provided additional flexibility,” said Azour.

He went on to add that the Fund is relying on the World Bank and UNDP to assess the damages of the flood and the repercussions on public finance and the impact on the economy and on society. He also answered a question on the petrol price subsidy Pakistan witnessed at the beginning of the year. “… As in other parts of the world, subsidies that are targeted to support certain items have proved not to be very effective. I would say it has proved to be very regressive. Therefore, we are encouraging Pakistan as well as other countries to move from an untargeted subsidy that is a waste of resources and to dedicate those resources to those who need it. I will give you one simple example. The region spends on social protection 2% of GDP, and in certain cases what countries are spending on subsidies could be double of that.”

The very fact that the IMF is convinced Pakistan cannot hand out frivolous subsidies on fuel anymore can be seen by the fact that earlier this week the Economic Coordination Committee (ECC) decided to increase the petroleum levy to Rs 50 per litre. The committee also allowed up to $15 barrel premium on highspeed diesel to private oil marketing companies for the months of November and December.

While Ishaq Dar claims he knows how to negotiate with the Fund as he has a 25-year track record of doing so (for context, I am 26); we can clearly see he has not managed to win them over with his historic relationship charm.

Adding to this Dar was presented with a summary by the Federal Board of Revenue (FBR) asking him to impose a 17% sales tax on high octane keeping in mind that sales tax on petroleum goods was reduced to 0% in February 2022 and has come in the way of FBR achieving its targets for the year.

The very fact that Pakistan could not use the flood as a reason to keep the levy low for long, or that the FBR is feeling the brunt of not meeting targets in an already fiscal-challenged nation shows that the IMF has asked Dar to get his house in order and that there will be no over accommodative stance from the Fund and the World Bank.

stance, Pakistan had to accomplish all condi tions attached to the Resilient Institution for Sustainable Economy (RISE-II) programme to be able to receive a $450 million loan from the World Bank. The Asian Infrastructure In vestment Bank (AIIB) also granted approval to co-finance $450 million bringing the funding to $900 million.

case for Pakistan, of course, is different. Any semblance of progress is highly politicised and eventually brought back to what it was in the past prior to reform.

Pakistan has had its fair share of aid over the past few years, however, at a time when more than 33 million people are impacted by the floods in Pakistan you’d expect a massive influx of funds no questions asked. The economy, already cash-strapped and reserve hungry, found itself at a critical point during the floods in need of support, especially in the case of reserves. That, however, was not the case. For in

Previously under the RISE-I program of $500 million for Pakistan, the World Bank had focused on improving fiscal management and fostering growth and competitiveness. The RISE assisted the government in im proving intergovernmental fiscal architecture to enable the country to improve its fiscal position.

The phrase is usually two steps forwards, one step back. That implies, as we all know, you’re still moving ahead, slowly but surely ahead. The

A prime example of this is the SBP Act which called for autonomy of the central bank. Speaking off the record with various members of the Fund who had worked on the autonomy of central banks in the region, a running joke was how the central bank of Pakistan may continue to be autonomous on paper but not so in practice.

The very fact that the rupee is strengthening while import cover remains a little over one month shows just how dire the situation is. Adding to this, the limita tion of LCs, limiting FX outflows, etc show just how weak the rupee really is. Despite all that, it is strengthening.

In the past, the central bank on behalf of the finance ministry has urged banks to run losses in order to reverse FX depreciation in the rupee. That goes to show how autonomy and independence are a joke in practice.

Adding to this, various members of the Fund that look into Pakistan joked about how they’ve dealt with more than six different people heading the finance ministry and the only reason the number isn’t eight is because Miftah Ismail and Dar are repeat finance ministers within a span of five years.

With such a perception, one has to wonder what value the political gimmickry and fiery speeches in public rallies have. In reality, that gentleman sitting next to me during the Debt Restructuring discussion indeed had it right.

As my wild trail of thoughts came to an end, flashing back at every wrong repeated economic decision made over the past few years, I nodded my head and said, “Yes, we do have it bad. However, deep down I believe someday we will leave this spiral. Sooner rather than later.” n

Is it really jumping through hoops?

One step forward, two steps back

On the 15th of November this year, a writ-petition was filed in the Lahore High Court challenging a newly inserted section to the Income Tax Ordinance of 2001. The new section, title 7E, was a seemingly harmless inclusion to the tax ordinance that allowed the Federal Board of Revenue (FBR) to collect income taxes on immovable property.

But according to the writ petition, and other similar cases that are currently being

contested in the high court, the inclusion of section 7E is a more sinister move that may in part go against the 18th Amendment to the constitution.

The new law mandates that every property which is not in the use of the owner, will be “deemed” by the FBR as bearing a rent equivalent to 5% of the total market value to the property. This “deemed rental income” would be taxed at a rate of 20%. In simple words, every property owner would have to pay a tax equivalent to 1% of the market value of his property to the federal government.

The idea to tax unused immovable

property in itself is not a bad one. Property is generally a great means of storing wealth in Pakistan and largely remains undocumented and untaxed. The issue here is that with the FBR imposing and collecting this tax, the feder al government is in essence collecting property tax. While the FBR has claimed and is arguing in court that this is an income tax and not a tax on property, the lines are blurry.

What is interesting here is that the earlier mentioned writ petition has been filed by Ahmad Iqbal Chaudhry, former mayor of Narowal, in the interest of local government representatives. According to him, property tax

If the FBR is found to be taxing property, it will go against the spirit of the 18th amendment, and weaken the struggle for local governments

is the domain of local governments as given to them by the 18th Amendment, and that section 7E represents an attempt by the federation to tap into a tax revenue stream that should rightfully belong to local bodies.

Filed through counsels Umer Ijaz Gilani and Usama Khawar Ghumman, the petition asserts that the even though tax levied under newly inserted Section 7E of the Income Tax Ordinance, 2001 has been cleverly disguised by the FBR as an “income tax”, it is not a tax on income. It is a property tax. Property taxes represent the single most important source of revenue of local governments all over the world.

In Pakistan, unfortunately, the devolution of powers has not been completed and there is no empowered third tier of democracy. This in turn means that fiscal devolution is still a pipedream. For now, Iqbal’s petition has not been filed in court because jurisdiction must first be determined between the federal and provincial governments. However, the writ petition does make an interesting case for the empowerment of local bodies and their current status in Pakistan.

In June 2022, the short-lived Hamza Shehbaz administration in Punjab passed a local government act that was the latest in a series of laws that have tried and failed to empower local governments in the prov ince. The act stripped the chief minister of his discretionary power to dissolve local councils, placed land development authorities under the jurisdiction of Municipal Councils, placed or ganisations like WASA and TEPA, and perhaps most importantly put local taxation under the control of the mayors of each district.

Over time, the spirit of local government in Punjab has tried to take root and has been consistently thrown to the wind with very little regard. The details of all of the laws, their merits, demerits, and why they have not been imple mented yet have been covered in great detail.

Read more: The great local government gambit

The crux of the matter, however, is that local government makes sense. We are not

speaking here specifically of any local govern ment acts that have been passed in Pakistan, but generally of a third tier of democracy as a concept. It is a more efficient administrative system and adds another tier to the democratic process, making accountability and access to said administrators a less arduous process than it currently is. It also allows communities to look out for and administer themselves in accordance with their own best interests, and leave legislators in the assemblies to the more important task of actually legislating instead of being caught up in gali mohalla riff raff.

But more than just being a third tier of democracy, having a local bodies system means having a new economic process. In essence, it is not just a new administrative stratification, but also involves the dispensation and spending of money. Things such as education and health that people automatically look towards the provincial government for would now be handled by local representatives. Perhaps most crucially, the ability of local governments to collect taxes and release their own schedule of taxation allows them to make their own money and spend it on themselves rather than waiting for the benevolence of the provincial or federal government.

Currently in Pakistan, the system that operates rather than local body governments is a bloated, vain, and self-contradictory bureau cracy where rather than elected representatives controlling local issues, the district is in essence the fief of a government appointed district

“Property tax is a local government tax and should constitutionally remain in the control of local governments. In Pakistan, the majority of taxes are collected by the federation up to around 90%. Out of the rest of the 10%, only 2% is collected by local governments while the remaining 8% is collected by provincial governments”

Usama Khawar Ghumman, lawyer

commissioner (DC). This not just centralises authority, but means locals with a better understanding of the area’s politics and requirements are not in charge of decision making.

But for any sort of local government system to be successful, the most crucial element is how these governments will fund themselves. The most important element in this is their ability to effectively collect taxes. The most important source of revenue for these local administrations is property tax, which is what the FBR is now being accused of trying to take over. And that is where the current clash originates from.

roperty tax is a local government tax and should constitutionally remain in the control of local gov ernments. In Pakistan, the major ity of taxes are collected by the federation up to around 90%. Out of the rest of the 10%, only 2% is collected by local governments while the remaining 8% is collected by provincial governments,” says Usama Khawar Ghumman, one of the counsels for Ahmad Iqbal Chaudhry pursuing the case in the Lahore High Court. “This ratio is the reverse of the global trend. In most mature democracies, you will always find that the majority of the taxes are actually collected by local governments.”

“If local governments are truly empowered then their primary mode of income is property tax. This is a pretty standard practice across the globe. Just look at the United States, where you have this concept that your worth is determined by your area code. Local governments should have the ability to tax property and this new provision from the FBR is a property tax. If local governments are elected and allowed to collect these taxes, they will be able to resist the overreach of the federation. We are not saying that property should not be taxed in our case but that it should be the domain of local bodies. Fiscal devolution is vital actual devolution of power.”

The point he makes is a pertinent one. The FBR in response to the writ position told Profit that the case did not have any merit. “The petitions are already being heard, and the Sindh High Court has already dismissed such petitions. The LHC is hearing the case on a dai ly basis and the FBR and the Attorney General are defending the law,” claims Afaque Qureshi, a member of the board’s IR policy department.

What the FBR is pointing towards is the fact that a similar case has also been filed on behalf of the provincial government. And as Ghumman himself admits, their case has not gone forward until the matter is decided between the province and Islamabad. Howev er, they claim their stance is a more principled

one, and that the case will go forward soon. “I have filed a writ petition in the Lahore High Court asserting that the Federation is eating up revenues which rightfully belong to local governments,” said Ahmad Iqbal in a recent series of tweets.

“It is a property tax. The primary tax that funds municipal and local services. Property taxes represent the single most important source of revenue of local governments all over the world. This is the first time that the FBR has intruded into the domain of property taxes. Unless this intrusion is checked the fiscal future of local governments would be jeopardised, violating the object and purpose of Article 140A of the Constitution. The new law mandates that every property which is not in the use of the owner, will be “deemed” by the FBR as bearing a rent equivalent to 5% of the total market value to the property. This “deemed rental income” would be taxed at a rate of 20%,” he wrote.

“There is a good reason behind this allocation of legislative powers: it is local government not the federal government which is best placed to provide property owners with the services required for adding value to their property such as drinking water, sewerage, waste mgmt, streetlights, sidewalks, parks etc.”

In a press statement issued after the petition was filed, the complainants also claimed that the provinces have consist ently allocated the revenues derived from property tax to the respective local governments where the said properties are situated. The right of local governments to the revenue generated from property taxes has remained enshrined in law since the insertion of Section 7-E in the Urban Immovable Property Act through Punjab Finance Ordinance, 1971.

“This practice has been so consistently followed by all the provinces of Pakistan that it may now be said to have attained the status

of a constitutional convention. Therefore, the encroachment by the Federal Government in the domain of property tax is not only a violation of the rights of provinces, it also represents a violation of the rights of local governments,” it reads.

This, of course, is a pointed legal argu ment. The reality of the situation is that even the provincial government allocating funds to local bodies by utilising property tax is not an ideal situation. Local governments are supposed to act as the most functional and on-ground tier of elected administration in the country, and vital to how they fulfil their role is their ability to collect and spend taxes as they see fit. As elected representatives, it becomes all the more important that they have free and fair access to this major stream of revenue. They can then best spend the money collected from this property tax both for the upkeep of that property and its surrounding areas.

Think of it like this. If there are two identical areas, and both are under different local governments, it will be in the interest of property owners in this area to elect and hold administrators accountable. So if Area A has a local government that is more efficient and spends money better on upkeep, as a result of the improvement in that area the proper ty prices there will go up. Meanwhile if the administration in Area B is less desirable, then along with neglect property values will fall as well. This is the most basic building block of democracy that encourages grassroot participation and empowers communities to take charge of their own affairs.

Local governments are a major political and economic issue in the country. Time and again they have been removed, rendered toothless, or given no attention or funds at all. To make a country like Pakistan governable, it is vital to empower these governments — both constitutionally and morally. The courts will decide what becomes of the writ petition and the rights of the local bodies in this matter, but what this does go to show is that there is still a very long road ahead.

n

“It is a property tax. The primary tax that funds municipal and local services. Property taxes represent the single most important source of revenue of local governments all over the world. This is the first time that the FBR has intruded into the domain of property taxes. Unless this intrusion is checked the fiscal future of local governments would be jeopardised”

Ahmad Iqbal Chauhdhry, former mayor of Narowal