07 07 Those pesky $25,000 dollars a month - this week in Pakistan’s business and economics twitterverse 10 Rates that kill: How banks blew their capital on PIBs 15 15 Banks that don’t bank 20 ICI: I see, do you? 24 Time to think Uzair Younus 25 25 Trouble at power plants Irfan Akhtar 26 Taxing the financialisation of automobiles Ammar H. Khan 28 The curious case of nano lending apps 15 28 10 CON TENTS Publishing Editor: Babar Nizami - Editor: Khurram Husain - Joint Editor: Yousaf Nizami Assistant Editors: Abdullah Niazi I Sabina Qazi - Sub-Editors: Mariam Zermina | Basit Munawar Editor Multimedia: Umar Aziz - Video Editors: Talha Farooqi I Fawad Shakeel Reporters: Ariba Shahid I Taimoor Hassan l Shahab Omer l Ghulam Abbass l Ahmad Ahmadani Shehzad Paracha l Aziz Buneri | Maliha Abidi | Daniyal Ahmad | Ahtasam Ahmad | Asad Kamran Chief of Staff: Maliha Abidi - Regional Heads of Marketing: Mudassir Alam (Khi) | Zufiqar Butt (Lhe) | Malik Israr (Isb) Business, Economic & Financial news by 'Pakistan Today' Contact: profit@pakistantoday.com.pk Profit

07SOCIAL MEDIA ROUNDUPThose pesky $25,000 dollars a month this week in Pakistan’s business and economics twitterverse Pakistan houses 2.8% of the world’s population but makes up 8% of the world’s unbanked population. Draws questions on the regulator and banking sector as to why the growth in financial inclusion has remained stagnant. $25000 is no joke. Maybe PR companies in Pakistan might be able to charge the rates they want now.

Who run the world? Dollars. You can take every necessary step curb dollar world still find a way cough

08 SOCIAL MEDIA ROUNDUP Who would’ve thought teams could ever beat slack? 14 August and 75th year of independence. A 75% off sale would be amazing. But then again, can brands afford that? More importantly, can you afford to spend more money while thinking you’re saving? We keep coming back to the same problem every few days. How does one increase inflows and decrease outflows?

to

outflows but the

for you to

them up.

will

10

CENTRAL BANK

12

What happened in 2021? In its Financial Stability Review, the SBP noted that the market showed high interest in government securities. The SBP reported that Banks’ investments grew by 22.0 percent. This was noticeably lower than the recorded growth of 33.5 percent last year. While the pace of investment slowed down, the share of investments in banks’ assets grew to 48.4 percent by the end of Dec-21 from 47.5 percent a year earlier. What is import ant is that more than 90 percent of the total investments were made in Federal Government Securities during CY21. Investments rose in PIBs while the stock of MTB remained muted in CY21 which goes in line with the government’s goal to increase the debt maturity profile. In the previous 5 years, a notable rise in MTB investments was last observed in CY17 . The SBP adds that combined offers in all tenors of fixed rate PIBs were almost 4 times, with an offer to target ratio of 3.9, in auctions of Q2CY21. The market’s interest in fixed-rate PIBs remained intact after the rise in the SBP policy rate in Q3 and Q4 of CY21. In response to the hike, banks offered higher bidding rates as they built in the expectation of further policy rate hikes. As a result, the government picked up fewer PIBs than its target in H2CY21. This is roughly the same time you probably heard Shaukat Tarin boil down on banks and threat en Koonda.However, after an increase in the policy rate and a change in forward guidance, the market showed increased interest in quarterly coupon floating rate PIBs in Q3CY21 and Q4CY21. As per the SBP, the offer to target ratios were 3.45 and 2.45 respectively. Keeping the high rates in mind, the government also ac cepted higher than target amounts of floating rate PIBs in H2CY21. This is seen as a strategy to lengthen the maturity of the government’s borrowing profile.

-

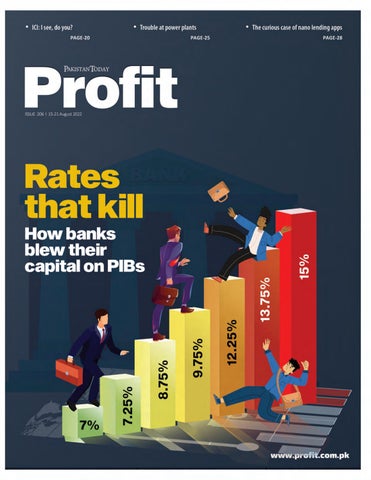

By Ariba Shahid All through last year, the State Bank of Pakistan (SBP) was involved issued what they called “forward guidance” on interest rates. It is, to be fair to the SBP, a pretty standard practice among central banks around the world. Forward guidance was their outlook on where inflation, and interest rates, were likely to go in the future. The practice has been around in different shapes and forms since the 1990s, but was introduced as “forward guidance” by the Bank of England in 2013. Essentially, the concept is that if the central bank announces its outlook of the economy and what monetary policy course it will likely be taking, it gives house holds, businesses, and investors early insight into what the interest rates are going to look like, allowing them to take precautionary or proactive measures. In the SBP’s case, however, taking the nation into confidence over its outlook of the economy has backfired at times. Largely because, as experts and market participants have complained time and again, the SBP’s guidance has been ambiguous and ineffectively communicated.Essentially, the markets just didn’t believe in the way they should. This issue aggravated further when the SBP played just a little fast and loose with the purpose of forward guidance and tried to use it to calm the markets by assuring them that the policy rate would continue to be accommodating. As a result, banks felt that investing in PIBs and MTBs was the right choice. Some are locked in longer tenors. Some of those banks, however, are suffering more than others. For instance, BOP, HBL, MCB, UBL, BAFL, ABL, NBP, and SBL increased their reliance on PIBs compared to MTBs if we look at it in terms of the proportion of investments. Some banks chose to rely on PIBs more than others such as BOP, MCB, and BAFL. You can see this in the “Investment in instruments as a proportion of total investment” table.

Banks, however, chose to strengthen their position by moving away from their favorite 3-year quarterly-coupon floating rate bond in Q3CY21, and moving into 2- a year floating rate bond in Q4CY21. This is because the rate of return on this 2-year bond is reset on a fortnightly basis and paid quarterly. This brings down the duration risk of changes in interest rates. A rate-and-volume variance analysis reveals that lower interest rates adversely influenced interest earnings on investments while the rise in earnings was solely driven by volume. Revaluation losses As a result of this “forward misguid ance”, some banks are having trouble meeting their Capital Adequacy Ratio (CAR) and loss-making bonds are eating into their equity. Banks bought fixed-rate bonds when the policy rate was lower. However, following a rise in the policy rate, the return of the bond seems meager. This becomes important when you keep the inflation rate in mind and the negative real interest rate available. These bonds won’t fetch a great price in the secondary market either. As the theory goes, the price of a fixed-rate bond moves inversely to its yield – when the yield goes up, the price of a fixed-rate bond goes down.

Currently, not only have the bonds fallen in value, but the difference between the bond’s yield and the rate at which it is being financed, the carry, is also negative. Banks want these loss-making bonds reclassified to Held to Ma turity (HTM) at cost. Right now they belong to the Available for Sale (AFS) portfolio. Every time the AFS trades at a discount to the book value, banks lose out on Tier 2 Capital. This is important because Tier 2 capi tal ratio helps determine how much risk-taking activity the bank can undertake, such as giving

-

Ammar Habib Khan, Economist

CENTRAL BANK out loans or fresh investments in securities. Without reclassification, banks will have their hands tied concerning lending and invest ments. The reclassification will make it easier for them to meet their CAR and also help keep tier 2 capital ratio up, say treasurers at banks. We’ve covered this in detail previously. Is the SBP really the hero? Believe it or not, several treasurers have confirmed that the SBP’s forward guidance resulted in them going heavy into PIBs and in longer tenors at the beginning of CY21. Treasurers claim that sometimes the decisions to go long in PIBs were influenced by the SBP urging them to do so. “The pressure to into PIBs was consid erable, especially given the repeated forward guidance being issued by the State Bank and their forecast that inflation will remain in the 7-9 percent range over the medium term” one executive from the treasury of a big bank tells Profit.Essentially, following the ballooning revaluation needs of banks, the SBP is allowing a one-time reclassification of the loss-making bonds to the HTM portfolio. Profit has not received any confirmation from the SBP about this. However, sources explain that permission for revaluation will be granted on a caseto-case basis. Because it is not for the entire banking sector, there is no need for a circular to be issued.Youwould assume that the SBP is a hero because it is letting banks reclassify their loss es, essentially a loss-making endeavor on their part. You might also be thinking that profits and losses are part of the game and the SBP is being extra kind to the banks by allowing this reclassification. However, treasurers claim that the SBP’s forward guidance and push on intense push on treasurers resulted in these decisions being made. How was the SBP so chill? If we look at the available data, released by the SBP itself, it seems like the SBP did not expect rates to rise the way they did. As per the SBP Financial Stabili ty Review, “The banks remain largely immune to interest rate risk due to both adequate capital cushions and contained exposures to interest rate risk (in terms of relatively short repricing duration and maturity) of these securities, which mainly comprise short-term MTBs and floating rate PIBs and have deep and active secondary markets.”

In the Financial Stability Review, the SBP talks about a sensitivity analysis which shows that even though the banking sector faces a decline in its aggregate CAR (from 16.7 percent at the end of Dec-21 to 15.2 percent) under a severe but hypothetical shock to interest rates i.e. 300 bps increase in the yield curve (up to 10-year maturities), most of the banks continue to meet the minimum CAR requirement.Itisimportant to note that the policy rate has increased by 525 basis points since December 2021 which has also moved the yield curve upwards. Moreover, back in December 2021, the country had a negative real interest rate. “There is a reason it’s called a stress test. Considering the volatility in our interest rate cycles, a 300 bps nudge is a walk in a park, not a stress test,” says Ammar Habib Khan, Econo mist. Khan adds, “300 bps is what was needed to go back to baseline considering the negative real rates, this isn’t a stress test appropriate for that time period.”

All you need is to sacrifice dividend One such bank executive availing of the reclassifying facility confirmed to Profit “We would certainly avail it as this would provide us necessary leeway in our balance sheet and ratios to continue to grow and also protect us against any further unprecedented/ unusual shocks, if There is a reason it’s called a stress test. Considering the volatility in our interest rate cycles, a 300 bps nudge is a walk in the park, not a stress test. 300 bps is what was needed to go back to baseline considering the negative real rates, this isn’t a stress test appropriate for that time period

In December the SBP claimed, “On an aggregate basis, due to strong capital cushions, the banking sector has adequate capabilities to withstand any severe shocks to interest rates.”

-

The hypothetical analysis shows just how vulnerable some banks are as a result.

and

any, from the market. There’s no downside of using/ availing this confession for sure”. He added that the SBP would caution the banks to a dividend limitation. However, that too is not set in stone. “That’s the only constraint but for that SBP requires prior approval from them. If the ratios are good then the SBP will not stop from paying dividends.” The source however clarifies that the approval for the dividend is not explicitly mentioned but that’s generally the case. “The dividend can be paid other than the leeway that this concession will create in the retained earnings of the bank,” says the source. This however proves to be a lesson for the banks to not take the SBP’s words at face value. Conducting risk analysis, being realistic about the macroeconomic environment, and doing your research are important in making the right banking decisions. After all, if banks can’t manage to do well while investing in the safest form of investments, then that leaves a lot to the imagination. n

TEXTILES14 CENTRAL BANK

Data credits: Ismail Iqbal Securities FRIM Ventures

By Ariba Shahid Abank is defined as a financial institution licensed to receive deposits and make loans. Banks can also provide other financial services such as wealth management, currency exchange, and lockerWhilestorage.thereare different banks such as re tail banks, commercial banks, corporate banks, and investment banks, they can also be classified as conventional and Islamic banks. Some are private sector banks and some are owned by the government. The central bank is the banks’ bank and regulates the sector. These are some common features of banks across the world. Banks, however, operate to earn profit for shareholders. They do this by charging interest on loans and other debt they provide to borrowers.They also carry out investment activities, and can invest in government securities or companies they feel are a good bet. However, in the absence of the ability to borrow from the cen tral bank, the government of Pakistan is a major borrower from the government. It doesn’t just walk into a bank and apply for a loan. Instead, banks buy government securities in the form of Market Treasury Bills (MTBs) and Pakistan Investment Bonds (PIBs). (See box 1) Investment in government securities supports the liquidity position of banks. It also augments their earnings. However, this exposes banks to risks associated with interest rate changes.

Banksthatdon’t bank

Some banks are just government lending arms, especially now that the government can’t borrow from the central bank

Some banks slowly cut down on banking F or the purpose of this story, we are not only ranking the banks in terms of the advances to deposits ratio (ADR) and loan to deposits ratio

15BANKS

-

How does the government borrow from banks?

MTBs are debt issued by the government with a tenor of one year or less. PIBs typically have a tenure of longer than one year and are generally issued with maturities of three, five, 10, 15, and 20 years. Investors receive interest semiannually. They are coupon-bearing instruments and are issued in scripless form. This means that there is no physical form.There are also some other terms to understand, such as the difference between permanent, floating, and unfunded debt. Permanent debt includes medium and long-term debt such as treasury bonds, or investment bonds that take longer to mature with tenors of three, five, 10, 15, and 20 years. They are sold through primary dealers at auctions, usually on a quarterly basis. Primary dealers are banks or other financial institutions (in Pakistan, they are only banks) that are appointed by the SBP to participate in government securities auctions. As a general principle, the longer the duration for the bond to mature, the higher the yield one would receive due to the risk associated with time. These are called Pakistan Investment Bonds or PIBs for short. Floating debt is made up of short-term borrowing in the form of treasury bills or MTBs, which mature in a year or less, available in 3, 6, and 12 month. Investors get the full amount on maturity while these are often sold at a discount to their face value, and are zero-coupon securities. The difference between the selling price, discount value, and the price at maturity is the interest earned on a treasury bill. They are sold through primary dealers in auctions on a fortnightly basis. This is not to be confused with floating rate debt, which just means that the interest rate on that debt is not fixed. Floating rate debt can be of any tenure.

“This change (in lending strategy) primarily came about post the financial crisis of 08-09. ADR levels used to be north of 70%. In came the crisis and banks saw a dramatic increase in NPLs and infection ratios” Faizan Kamran Khan, CEO at FRIM Ventures

BOX# 1

In Bank Al Habib’s case, a 10% decline in IDR is simply because they had one of the highest IDRs in 2012 of 73% which has been brought down to 63% in 2021.

-

Also, while the Bank of Khyber is showing a meager 7% increase in the IDR, it is important to note that it has pulled up its IDR to 83% in 2021. On a sectoral basis, the IDR has in creased from 51% in 2012 to 70% in 2021. This shows the move in bank interest towards government securities. While IDRs have increased, the ADR has remained largely flat.

-

16 (LTD) but we will also look at a change in strategy over the years (see box 3). To look at the change in strategy, we’ve looked at the difference in the ADR ratios between 2012 and 2021. A simplistic method, but it gets the job done, especially when we consider the average ADR ratio in 2012 was 57% and is 55% as of 2021. The graph shows that Samba Bank Limited (SBL) made the biggest move into cutting back on providing loans followed by JS Bank Limited (JSBL), Bank Al Habib Limited (BAHL), Meezan Bank Limited (MEBL), Bank of Khyber (BOK), Bank Alfalah (BAFL), and Habib Bank Limited (HBL). Habib Metropolitan Bank (HMB) and MCB Bank Limited (MCB) have made no changes in strategy. Whereas, Askari Bank Limited (AKBL), Allied Bank Limited (ABL), Bank of Punjab (BOP), United Bank Limited (UBL), Faysal Bank Limited (FABL), Stan dard Chartered Pakistan Limited (SCBPL), Soneri Bank Limited (SNBL), and National Bank Pakistan (NBP) have cut back also now.

The limitations of this exercise, however, are such that banks such as FABL which show a 14% decline in ADR ratio sported a high ratio in 2021 of 79% and cut down to 65% which is still higher than the sector av erage. That is why a table with the ratios has been attached for better comparison. Another ratio we are choosing to look at is the IDR. This shows how banks have increased their investments in government securities“IDRprimarily.isabitdeceptive because banks also invest in government securities by bor rowing from SBP,” says Fahad Rauf, Head of Research at Ismail Iqbal Securities. This means banks borrow to make investments and use means beyond their deposits, such as Open Market Operations (OMOs).This analysis was interesting as it showed that nearly all banks that we looked at had increased their exposure to invest ments. Samba Bank, Askari Bank, Soneri Bank, National Bank of Pakistan, UBL, Bank Alfalah, Allied Bank, Standard Chartered, Faysal Bank, Habib Metro Bank, Bank of Khyber, and Bank of Punjab increased their IDR over the span of 2012 and 2021. Bank Al Habib, MCB, HBL, JS Bank, and Meezan Bank decreased.Again, it is important to look at details such as Standard Chartered Bank has increased its IDR to 119%, meaning it is borrowing to meet its investment needs more than its counterparts.

BANKS

Khan also explains that since the crisis, most banks have reduced their focus on loans and concentrated on investments. “And why not? The government has been the largest borrower and offers risk-free lucrative spreads.”Rauf however highlights the need to consider the customer basket while talking about lending. “There are very limited corpo rates or groups that meet the criteria for lending. A large part of our economy is informal. Currency in circulation has been increasing continuously and there is no proper docu mentation in most cases,” he adds. Another key factor pushing banks away from lending are hurdles they face with recov ery. “It is important to consider our foreclosure process. Banks have a lot of collateral but are not able to sell them due to legal implica tions,” says Rauf.

Fahad Rauf, Head of Research at Ismail Iqbal Securities

What are the Advances to Deposit Ratio and the Investments to Deposits Ratio?

Why do banks like securitiesgovernmentsomuch?

P akistani banks are often called rent seekers because they focus more on income through investment in government securities than to lend to consumers. This is because lending to con sumers comes with a risk, regardless of how big or small they are. Investing in government security is risk-free. You will always get your money bank and an interest income with it. The decision of rates and tenors, however, decides whether the investment is fruitful or not. See box 2.“It’s clear that banks have a concerted focus towards mobilizing deposits towards risk-free instruments. And from their perspective, why not?” says Faizan Kamran Khan, CEO of FRIM Ventures. “This change primarily came about post the financial crisis of 08-09. ADR levels used to be north of 70%. In came the crisis and banks saw a dramatic increase in NPLs and infection ratios,” he adds. Rauf explains that prior to the global financial crisis (GFC), during Musharraf’s government, Pakistan received large foreign inflows in the form of foreign direct invest ment (FDI) and aid. “Back then the govern ment did not need to borrow desperately from banks. As a result, banks chose the lending path.” “Post the GFC our economy derailed and has not improved much. The large fiscal deficits, lack of consistent FDI, and rising debt levels have limited our financing options. Hence we are more dependent on local banks to fund the fiscal deficit.”

What does the SBP think about concen tration in government securities? In its financial stability review 2020, the SBP analysed the impact of investments in government securities on banks’ earnings. It came to the conclusion that the government’s reliance on the banking sector has steadily increased for fiscal needs. As a result, it has influenced the balance sheet structure of the “Post the GFC our economy derailed and has not improved much. The large fiscal deficits, lack of consistent FDI, and rising debt levels have limited our financing options. Hence we are more dependent on local banks to fund the fiscal deficit”

-

The advances to deposits ratio (ADR) measures loans (advances) as a percentage of deposits. A ratio of 100% or less shows that the bank is funding all its loans from deposits rather than relying on wholesale funding. Wholesale funding is funding from capital markets or other banks. The ADR Is also called the loan to deposits ratio (LTD). To calculate the ADR, divide a bank’s total amount of loans by the total amount of deposits for the same peri od. For banks, loans are assets and deposits are liabilities If the ratio is too high, it means that the bank may not have enough liquidity to cover any unforeseen fund requirements. Conversely, if the ratio is too low, the bank may not be earning as much as it could be. The ratio can also be used to gauge how well a bank is performing in regard to attracting and retaining customers. The ADR, however, does not measure the quality of the loans that a bank has issued. The ADR also does not reflect the number of loans that are in default or might be delinquent in their payments. For the purpose of this story, we will be looking at ADR as a means to see whether a bank is choosing to lend more to customers or is choosing an investment in a government securities-backed approach. Investment to deposit ratio shows which amount of deposit is used to invest. This could be in MTBs or PIBs, and can also be in companies in the form of shares.

BOX# 3

bankingThesector.review points out that the high concentration of assets in government secu rities provides necessary support to banks’ earnings against business cycles particularly in downturn times. The SBP, however, also finds a flaw in this arrangement. The report adds that the persistence of fiscal deficits and high demand for bank credit might have affected the risk appetite of banks. This behaviour has weakened the true economic role of financial intermediation that banks are supposed to perform.“This bears far-reaching repercussions for the future economic growth of the country,” read the review. The SBP called the maintained solven cy backed by higher exposure in risk-free securities a low risk-taking move on the part of banks. And says this is an inefficient alloca tion of the capital banks have. The SBP however stated that banks need to “strike a balance between financial stability and due risk-taking”. The central bank deems it essential for effective financial intermediation between general savers and private sector enterprises. The SBP called for banks to enhance their role in the provision of credit to the private sector, especially to private enterpris es and high-potential sectors such as SMEs, Agriculture, and Mortgage Finance. While the SBP regulates banks, it also pointed out that the reason banks choose to go down this path is that there is a demand from the government. The review says that the government needs to broaden its revenue base and look for alternate sources of funding for its fiscal needs to reduce reliance on the bankingThissector.essentially will address the public sector crowding out that borrowers face when applying for bank credit or loans. The review concluded by stating that collaboration between policymakers and market participants is essential to promote savings in the economy and develop a vibrant capital market for effective intermediation. Crowding out the people that need loans the most T he crowding-out effect suggests rising public sector spending drives down private sector spending. In this case, increased government borrowing is crowding out the private sector. Why lend to private participants when you have the government, and if you do lend to private businesses, why not make the most of it by lending to blue chips? After all, why not? What is safer than betting on the government – especially in times of crisis? Is this where the government stands up and presents itself as a guarantee and merely uses commercial and Islamic banks as an intermediary vehicle to loan out to the small guys? In the end, one has to question who is looking out for the little guy. What about the real economy? When will the SMEs be able to walk into a bank and get a loan? The answer is simple, when banks stop acting as a government lending arm and start to behave like banks. n Data credits: Ismail Iqbal Securities and FRIM 18 BANKS

Why doesn’t the government borrow directly from the central bank?

-

There was initially a ban on government borrowing from the SBP under the IMF program till September 2022; however, following the SBP Act, the government has now given up and agreed to permanently close the door to this option through legislation.“The bank shall not extend any direct credit to or guarantee any obligations of the government, or any govern ment-owned entity or any other public entity”, states the clause. In case you’re wondering why can’t the government just borrow infinite amounts from the central bank itself –because it increases the money supply rapidly which drives up inflation. Borrowing has to be done against some collateral. As per the Act Section 409 C, the SBP shall not purchase securities issued by the government or any government-owned entity, or any other public entity in the primary market. The Central Bank may purchase such securities in the second ary market. Following this, the government is now dependent on the private market to raise debt. This sometimes gives the banks more power than the government would hope for. 2

BOX#

I

ICI Pakistan ICI Pakistan Limited is a manufacturing and trading company whose primary business segments are Polyester, Soda Ash, Chemicals, Pharmaceuticals, and Animal Health.The company also has two subsidiaries, NutriCo Morinaga (Private) Limited, which is a joint venture with Japanese Morinaga Milk Industry Co, which manufactures Morinaga infant formula, and a wholly-owned subsidi ary, ICI Pakistan PowerGen Limited, that was set up in 1991 to supply power for the con sumption of the company’s Sheikhupura based polyester plant. see, do you?

The company’s financial year started with a bang as it eyes significant structural changes in the coming months

O n the first of August, the month Pakistan celebrates a landmark of 75 years of independence from British colonial rule, came the end of an era that predated the country’s existence. One of the last active vestiges of global imperial rule is set to disappear as Imperial Chemical Industries (ICI), one of the best known brands in corporate Pakistan, and indeed for many years around the world, announced their intention to change their name.To be sure, ICI Pakistan was no longer run by the imperial colonisers of old, but the name had been retained because of its brand value even under new local ownership. It was bittersweet for the company, with the name change being announced alongside solid results for financial year 2022 that saw a greater than 50% growth in reve nue and a 70% increase in operating profits. The company announced that it intended to rename ICI Pakistan to Lucky Core Industries Limited. The change, if implemented, would mark the end of the ICI name in Pakistan, which was the last territory in the world to still hold on to the name that once spanned across the world during the colonial era. If anyone has been following the recent developments at the Pakistan Stock Ex change (PSX), they are likely to have come across a few significant updates including making decisions regarding expansion, disin vestments, investments.

20 By Ahtasam Ahmad

Major producedchemicalsinPakistan (Source: PACRA)

-

CORPORATES

Source: ICI Pakistan website

The company did so well during those years that back in 1995, its international parent, ICI PLC, made its largest ever overseas invest ment in Pakistan, to set up a manufacturing facility of Pure Tperethalic Acid (PTA) at Port Qasim.However, In 2008, the global parent of ICI was bought out by Dutch paints and chemicals giant AkzoNobel, following which ICI Pakistan became part of AkzoNobel worldwide. The global acquisition marked an end to a multina tional British giant and an icon from the era of industrialisation.ICIbythetime it was acquired, was struggling to live up to its legacy. There were several reasons for this. Some considered the spin-off of its pharmaceutical and agrochemical businesses in 1993 to be the starting point for its downfall.According to an article published in Telegraph on January 2, 2008, “ICI’s decline can be traced back to 1991, when the acquisitive industrialist Lord Hanson bought a 2.8pc stake.

ICI’s history is rich, and reads almost like a story

This story begins before Partition, in 1944, in Khewra, district Jhelum. It is when the company started the produc tion of soda ash, a precursor to several industrial chemicals. After 1947, ICI incorporated its Pakistan assets under Khewra Soda Ash Company Ltd, which was set up in 1952, and in 1966 the company was renamed ICI Pakistan. At least one ICI subsidiary has been listed on the Karachi Stock Exchange since July 1957. The post-Nationalisation era under Bhutto was fraught with fears. Many Pakistani businesses shifted focus to trading as investors lost confidence to set up manufacturing facilities in the country. However, ICI continued to thrive with the backing of its international parent. Also, for those who grew up in the 80 and 90s especially, it will be remembered that ICI was the main source of human capital development. Alongside CitiBank, ICI was the employer of choice for educated Pakistanis. Asif Jooma, CEO of ICI, while addressing the Leaders at LUMS conference in 2018 stated, “ICI was a significant leader feeder for the economy and it continues to be. If you do a quick scan of the corporate landscape of Pakistan, you would invariably find people that have in some shape or form been associated with ICI during their careers.”

The threat of a takeover galvanised the board and, two years later - after seeing off Lord Hanson - they decided to crystallise the value he had spotted in its fast-growing pharmaceutical arm by spinning it off as Zeneca. By then, the remaining ICI business was in the low-growth field of bulk chemicals, an area that was dominated by cheaper producers in the Far East.”

For others, multiple factors, including a risk-averse strategy, internal management rifts, and bad investments, were the architects of ICI’s downfall.Further, challenges faced by ICI Plc at the global level were creating constraints for its ICI was a significant leader feeder for the economy and it continues to be. If you do a quick scan of the corporate landscape of Pakistan, you would invariably find people that have in some shape or form been associated with ICI during their careers Asif Jooma, Chief Executive, ICI

The company held on to the ICI brand name as it believed that there was significant brand equity to be taken advantage of. This was the same reason why AkzoNobel retained the ICI name in Pakistan while dissolving it globally. According to an article published in 2008 in the Telegraph, “In Britain, where Akzo is already established and ICI’s client problems five years ago ultimately led to its unravelling, an unsenti mental break from the past is likely. Elsewhere, the ICI name still carries valuable currency –particularly in the former Asian colonies where Akzo has no notable presence.”

The Telegraph, Jan 2, 2008

PerformanceFinancial

Source: ICI Pakistan Annual report 2021

In 2010, AkzoNobel international decided to focus on the paints business, its global specialty, and spin off chemicals business. The spin-off, labeled a “demerger”, was completed in May 2012, creating two separate companies in Pakistan: AkzoNobel Pakistan and ICI Pakistan, though, at the time, both were owned by the global AkzoNobel. The process to find a buyer for ICI Pakistan began in June 2012 and ended with the Yunus Brothers Group (YBG) – the industrial conglomerate that owns Lucky Cement, KIA Lucky Motors, and Yunus Textiles among others – winning the bid to buy out the industrial chemicals business that was the new ICI Pakistan.Thefoundation stone for YBG was laid back in 1962, as a company trading in textiles, rice, and other commodities. In 1981, the group first ventured into the manufacturing space by setting up a textile mill, Lucky Textile Mills.

Leaping from success to success, it established multiple textile units across the country before diversifying in 1994 to cement manufacturing creating Lucky Cement. Next, the company di versified by acquiring ICI in 2012, as mentioned earlier, and entered the automobile business by setting up KIA Lucky Motors, a Joint venture with Korean automobile Manufacturer, KIA.

22 Pakistani subsidiary. One such step was the dis investment of the soda ash and fiber business at the international level which, for the Pakistani subsidiary, was a major revenue driver. Thus, the Pakistani soda ash and fibre business became more of a regional concern rather than a global strategicBackpriority.in2012, Jooma wrote an article for Business Recorder, stating, “Investment by ICI PLC as a strategic imperative became short and scarce as it struggled with its own repositioning and consequent debt and its newly acquired portfolio from Unilever had no significant potential in the Pakistani market. This was par ticularly detrimental to the regional businesses’ soda ash/polyester fibre, which required regular investment to maintain market position and cost competitiveness by expanding the scale of operation. This imperative became even more critical in this period as protective tariffs began to be lowered which unleashed vicious Asian competition wishing to dump products to fill up their huge expensive capacities. This phenom enon continued from time to time into the new millennium as well.”

ICI is the second largest chemical manufacturer listed on the PSX. While its group company, Lucky Cement is the 10th largest company on the stock market in terms of market capitalisation. The company filed its financial results for the year ended 30 June 2022 in the first week of August. It clocked in net revenue of around PKR 100 billion, which was 52% higher compared to the preceding year. Operating profits also grew by 72% to PKR 13.8 billion. As a result, the consolidated net earnings increased by PKR 3.66 billion to PKR 8.86 billion. The majority of the revenues were earned by the group holding company, ICI Pakistan Limited, whose standalone figure was around 87% of the total turnover. The company benefited from recovering demand and was able to post impressive figures despite the one-off super tax (the primary reason for the fall in net profit margin in 2022). Furthermore, the company declared PKR 15 dividend per share even after announcing its intention to acquire Lotte Chemicals which indicates a strong cash flow position. Historically, ICI Pakistan has shown decent growth in terms of revenue. Between 2001 “ICI’s decline can be traced back to 1991, when the acquisitive industrialist Lord Hanson bought a 2.8pc stake. The threat of a takeover galvanised the board and, two years later - after seeing off Lord Hanson - they decided to crystallise the value he had spotted in its fast-growing pharmaceutical arm by spinning it off as Zeneca. By then, the remaining ICI business was in the low-growth field of bulk chemicals, an area that was dominated by cheaper producers in the Far East”

Once members have approved the new name, ICI Pakistan must file the special reso lution and amended company documents with the registrar. The law states, “Where a company changes its name, the registrar shall enter the new name on the register in place of the former name, and shall issue a certificate of incorpo ration altered to meet the circumstances of the case and, on the issue of such a certificate, the change of name shall be complete.”

CORPORATES

As per the Companies Act 2017, “A company may, by special resolution and with approval of the registrar signified in writing, change its name.”

A special resolution is a tool used to get the approval of members in a general meeting on any matter except for the consideration of financial statements and the reports of the board and auditors, the declaration of any dividend, the election and appointment of directors in place of those retiring and the appointment of the auditors and fixation of their remuneration.

“Where a company changes its name, it shall, for a period of ninety days from the date of issue of a certificate by the registrar under sub-section (1), continue to mention its former name along with its new name on the outside of every office or place in which its business is car ried on and in every document or notice referred to in section 22,” the law further adds.

Moreover, it has no implications on any ongoing legal proceedings against the company. As per ICI, the final curtain on the name change will be drawn at the end of the calendar year 2022, contingent on receiving the requisite approvals. n

However, the name change does not affect the rights and obligations of the company’s creditors, debtors, or any other stakeholder.

-

-

Recent events

In August last year, the company acquired an additional 11% stake in NutriCo Morinaga Pakistan, bringing it under the umbrella of the ICI Pakistan group as a subsidiary, due the total stake of the manufacturing giant increasing to However,51%.afew months later, in July this year, the joint venture partner in the infant dairy business, the Japanese partner, Morinaga Milk, sent a conditional offer to buy one-third of the share capital from other partners against consideration of $56.6 million. ICI’s board has approved the sale of 26.5% shares (out of the 51% holding) in the subsidiary for $45 million. This translates into a payment of $2.07 per share. The transaction is subject to shareholders’ approval that would be sought in the company’s upcoming annual general meeting scheduled to take place on the 27th of September. However, the restructuring didn’t stop here. A week after the initial announcement to sell off a partial stake in NutriCo Morinaga Pakistan, the company was again in the market, but this time to buy something. It filed a notification with the stock exchange announcing its intention, as per the letter, “to acquire approximately 75.01% share holding comprising 1.135 billion shares of Lotte Chemical Pakistan.” Lotte is another prominent player in Pakistan’s chemical industry, and buy ing a controlling stake in the company would allow ICI to cement its position in the market. The way forward As ICI’s board has resolved to change its name from “ICI Pakistan Limited” to “Lucky Core Industries Limited,” it seems that the brand equity of the once global giant has diminished. Pretty much, like the size of the ICI logo on the Dulux paint (The brand name of the paint manufacturing di vision of ICI that was retained by AkzoNobel). “This change will align the company’s name with its holding company, Lucky Cement Limited, which is a part of the Yunus Brothers Group (YBG). The proposed name draws on the strength of the Lucky brand, a leading, progressive, and diversified conglomerate.” (Read the announcement letter.) Profit reached out to corporate law experts to understand the rationale behind this step and the regulatory procedure to be fol lowed for materialising the change of name. The response was that it was a routine transaction, and companies prefer having a similar name for their subsidiaries to fortify the group’s goodwill.

to 2011, the company was part of multinational groups and grew by 11.65% per year, on average. The growth rate slowed a bit under YBG as the company was only able to expand its revenues by around 10.19% on an annual basis between 2012 to 2022. However, under the control of local owners, the group’s efficiency increased on the back of a better understanding of the Pakistani market. The gross profit margin went from 16% in 2011 to 21% in 2022. While the operating margins increased from 7% to 14% during the same period.

Case in point, First Microfinance Bank renamed itself HBL Microfinance Bank, at the beginning of this calendar year, to benefit from the good will of its patron, HBL.

The ultimate loser in this system is the ordinary Pakistani citizen. But the citizenry is also not without blame: for far too long, Pakistanis have followed wolves who have taken them to the slaughterhouse time and time again. The trick that they fell for is as old as history – blinded by base emotions and their own biases, they have allowed the ruling class to divide and conquer them. They have embraced the divisions sown in society with ease, drinking out of the poisoned chalices of sectarian, ethnic, and religious division. As the ongoing political and economic crisis shows, the status quo is reaching a breaking point. While status quo elites celebrate securing enough funding from the usual patrons to live another day, all the signals point to the fact that the Sick Man of South Asia can no longer muddle along.

Industrialists and business leaders, rather than embracing the core tenets of market capitalism, seek protections and rents.

Paid for by an increasingly burdened citizenry, these rents are divvied up between the kleptocratic elite and then funneled abroad, enriching the real estate developers in Dubai, luxury retailers in London, and private wealth bankers in Switzerland.

Time to think Uzair Younus

Instead, they choose to rule through patronage and backroom deals, going to the masses only when there is a need to improve their bargaining position in the testosterone-dominant drawing rooms of Islamabad and Rawalpindi.

24 COMMENT

Something, somewhere, has to give.

While men in uniform bravely confront a diverse range of threats confronting their homeland, embracing martyrdom in the process, those leading them prefer to secure their own retirement package; the most influential of these men choose to not even spend a day within their homeland after retiring from a position of power and prestige, seeking a better life in greener pastures across the Arabian Sea and beyond.

The biggest hope for Pakistan is its next generation. This generation is connected to the world and does not take no for an answer. It will be the most potent force in Pakistani politics moving forward, meaning that it can drive change at an unimag inable pace. But this younger generation also faces significant challenges: it has experienced nothing except the secular decline of Pakistan’s economy, about 25% of them are illiterate (almost 50% if you look at women), and face a crisis of opportunity and inclusion. To change their own and Pakistan’s destiny, this emerging generation must take matters into its own hands. Trusting the old guard, especially the tired old men who have been around the block forever, is going to bring nothing but disaster. The question is: as Pakistan marches towards 100 years of indepen dence, will its young generation trust itself, and not the old guard, to unite the country and embrace the idea of Jinnah’s Pakistan?

-

OPINION

Pakistan is celebrating 75 years of independence. A country made free not by revolution but by reason is undergoing one of the worst crises it has ever faced. The driving force of the ongoing upheaval is a betrayal of the values that the first generation of Pakistanis, led by Jinnah himself, rep resented. So long as Pakistanis continue to betray these core values espoused by the forgotten generation, the country and its society will at best muddle along and at worst spiral out of control. As I argued in a previous column published for this magazine months ago, “Jinnah, one of the greatest constitutional minds of his era, could not have imagined in his wildest dreams that his great achievement would end up as a society ruled by men who represented values that he abhorred the most.” As Pakistanis celebrate whatever little there is to celebrate about Pakistan reaching this milestone, it is important to take a moment and reflect on what Pakistan has become and what it was supposed to be. Let’s start with the core principle of constitutionalism, which was near and dear to Jinnah’s heart. He secured independence for a significant proportion of the subcontinent’s Muslims by argument, waging war through moral, political, and constitutional weapons at his disposal. Today, his successors have abandoned these just, potent weapons and adopted cynical strategies, seeking to secure power by propagating lies, sowing hatred, and dividing society. In the Islamic Republic of Pakistan, underprivileged men and women go missing, spending their best and most productive years in dark cells. The judiciary, whose job is to uphold the letter and spirit of the law, and protect the most vulnerable members of society, ignore this daily injustice, preferring instead to engage in a cynical game of power being played by a kleptocratic elite. Politicians, whose job is to represent their constituents and make efforts to improve their lives, ignore their electoral promises.

The writer is Director of the Pakistan Initiative at the Atlantic Council, a Washington D.C.-based think tank, and host of the podcast Pakistonomy. He tweets @uzairyounus.

Some of this money finds its way back to Pakistan through “donations” given for revolutionary political causes.

25COMMENT

Hydel power did not fail to amuse us as well. According to what we know so far, the newly constructed Neelum Jhelum Power Plant is shut due to a problem in the water tunnels. And the plant may not be up and running anytime in the near future. Consultants for this project as well as Guddu should be taken to task for failing to perform their due diligence in design and construction reviews.

n the last few weeks, there have been a slew of reports about plant failures and power assets going offline one after the other like the consistent rain wreaking havoc in Pakistan. It shouldn’t be surprising when industrial best practice standards for asset management are not being followed in utility companies and government run power plants. However, the rate of failure during this period makes it conspicuous when many power plants are already under shutdown due to high prices of furnace oil and coal. On August 8, 2022 at the Rawat Grid Station, two single phase transformers (three connected together to make a three phase auto unit) caught fire. Videos of the local staff trying to extinguish fire in a very unprofessional way made headlines on social media. People running around in shalwar kameez, without any safety apparel are seen in the video. Fire fighters are using water to extinguish oil-based fire; another startling aspect of this ghastly story. Seventy plus years of running the national grid and we haven’t trained people to take care of a transformer fire. This piece is being written while investigations are ongoing. While conjectures abound, a senior NTDC official points to technical issues being the root cause of the disaster. Let’s keep our fingers crossed we find out what really happened especially since this wasn’t the first incident of an autotransformer fire. We had a similar failure in the Sheikhupura grid last winter. Last week, the over 1,200MW combined cycle Haveli Bahadur Shah power plant went offline. This high performance, newly built plant was recently in the headlines with reports suggesting that the government was considering selling it to an interested Middle East ern company. Many conspiracy theories will prop up now. Although authorities have put restrictions on plant employees to stay hushed, we got to know that two auxiliary transformers are damaged – one is completely done & dusted. Going back about two weeks, the newly-built 900 MW combined cycle power plant, called BQPS III, suffered severe gas turbine damage during its trial run. News coming out of K-Electric suggests that turbine blades got damaged.

Irfan Akhtar OPINION

-

The writer is an Electrical Engineer with over 25 years of experience in the Power & Energy sector. He is currently serving as Director Project at 2.6 GW Solar PV power plant

-

Trouble at the power plants

I

Do you think this is it? No sir, wait, there’s more. We had the Guddu Combined Cycle Power Plant fire incident in mid-July that shook the nation. The 747 MW power plant’s generator was burnt to ashes reportedly causing a PKR 15 billion loss to the exchequer. Rain was mentioned as the root cause of the fire. Seriously! Rain? Why didn’t they design the generator hall for sustaining rain? Why did rainwater reach the electrical circuits? And now coming to the million dollar question: Why did the fire-fighting system not work to save the most expensive asset of a power plant? Unconfirmed news is that the fire-fighting system was out of operation. We have talked about thermal power stations and grid incidents.

So now we wonder, what is the problem? Are we unable to prepare the correct design specifications for the assets we are installing? Or are we being sold assets of poor quality due to lack of local expertise? For a poor country like Pakistan can we afford to commit this crime? Are we not following internationally adopted Asset Management standards like ISO 55000 and best practices? Perhaps, all of these are the reasons behind our failing assets. This brings us to an important question to be put to the decision makers: Do you have an Asset Life Cycle Management plan in place in utilities and power plants? Asset life cycle starts from needs analysis, de sign specifications, procurement, correct installation, right commissioning, prudent operations, skillful maintenance and condition assessment. Open google and type asset management plan for, say the Australian Power network, or any other for that matter. You will almost immedi ately find pdf files of Strategic Asset Management Plans for international utilities and power plants. They will show you details of the assets they own, the conditions they are in, and the plan for replacement of aged assets, overhauling of assets and condition monitoring. We don’t have any such thing in place. In 1978, United Airlines did a study on failure of their key assets – Aeroplanes – and ended up developing a framework for Reliability Centered Maintenance (RCM) which is the cornerstone of Asset Management these days. RCM and AM are now adopted by all electrical utility companies, and power generation companies. The International Standards Organization (ISO) has published a detailed standard known as ISO 55000. The western world has managed to build asset repositories for roads, bridges, railways, dams, and all other infrastructure assets but we haven’t even started, and it is 2022. To sum it up, our utilities need to adopt the asset management concepts in letter and spirit, develop trained and skilled workforce, utilise latest techniques and tools, engage experienced consultants from the local private sector, companies abroad and especially Pakistanis who have served in multinationals around the globe. There is no dearth of resources, what we perhaps lack is the ‘will’ to improve. With meagre foreign currency reserves & practically no FDI, we can ill afford such catastrophes in our poor country. Otherwise, our national exchequer and money taken out of taxes from Pakistanis will keep going down the drain and we might eventually return to the darkness of the stone age.

Taxing offinancialisationtheautomobiles

Ammar H. Khan

OPINION

The writer is an macroeconomistindependent and energy analyst.

try. Due to such a market structure, there is never any shortage of orders for the industry, as it takes anywhere between six months to one year to get delivery of an automobile which is a generation or two behind the rest of the world. This is life under an oligopolistic market structure propped up by a protectionist regime.

T he lopsided market structure of automobiles was discussed in this space a few months back in which we hypothesised that automobiles have essentially become an asset class preferred by investors as a proxy for an appreciating US$. In absence of any other asset classes which can closely track the ap preciation of the US$, and preserve capital in real terms, investors have gravitated toward automobiles as a preferred asset class. Furthermore, in the absence of the ability to acquire US$ due to multiple restrictions on its acquisition, and a liquidity crisis, automobiles became an easy hedge to preserve the value of one’s investment in real terms. Given the oligopolistic nature of the industry, and the absence of any imports (primarily due to excessive duties, and arbitrary bans due to a sovereign liquidity crisis), the bargaining power is skewed in favor of automobile manufacturers. Due to such a skew in bargaining power, automobile manufacturers have substantial pricing power which enables them to increase the prices of automobiles whenever there is any major depreciation of the PKR against major currencies. Any depreciation of PKR or increase in key input prices is immediately followed up by an increase in the price of automobiles. As prices are downward sticky, an appreciation of PKR or a reduction in input prices does not lead to a drop in prices mainly due to the ability of the manu facturers to exert pricing power and the absence of any competi tion through imported automobiles. In effect, the nature of the industry has changed such that instead of manufacturing automobiles, it is also inadvertently cre ating an asset class that closely tracks any appreciation in foreign currency, better than any other asset classes available in the coun

Most buyers are looking to park idle capital, and sell off the automobile at a substantial premium at the time of delivery – this enables them to lock tax-free profits, often covering, and even overcompensating for any loss in value of the PKR. It is estimated that more than PKR 180 billion of customer advances have been deposited with various automobile manufacturers – such is the level of demand for automobiles. Considering the market structure, the demand looks inelastic, as the same is not being driven by consumer preferences for an automobile but to extract the financial benefit that exists through a hedging depreciation of the PKR. In such a scenario, it gets difficult, or simply unaffordable for consumers who actually want a car as a mode of transportation, rather than as a store of value, or as a hedge against a depreciating currency.Toreset the market structure, it is imperative that the financialisation of automobiles is discouraged. The same can be done through the imposition of capital gains taxes on sale of new automobiles. A consumer buying an automobile to use as a mode of transport will not be selling the same within a few weeks, mean while, an investor would be selling the same to lock profits from the same. Imposing a substantial capital gains tax (and obviously closing all loopholes to avoid the same) if a new car is sold within 12 months would disincentivise such activity, and hopefully redi rect freed-up capital towards more productive avenues, while not creating a scenario that mimics inelastic demand in the short run. The higher the tax rate, the greater the disincentive, as that would essentially mean that the time value of money is negative. The capital gains tax can even be at an extreme of greater than 70%, to aggressively discourage a secondary market for new cars in the near term such that prices readjust. It is through the imposition of capital gains taxes in the secondary market that some order can be restored. It is essential to note here that this may not affect organic demand in the primary market, however, this would reduce any demand induced by the financialisation of automobiles. A more traditional approach would be opening up automobile imports and reducing duties on the same, which would have a fairly instantaneous impact on local automobile prices. However, the same would lead to noise from the oligopoly, and would also use up precious foreign exchange reserves, which are in short supply in the near term. The lopsided structure of the automobile market has been further skewed. Policy interventions are critical to reducing the oligopolistic nature of the market through greater competition. Similarly, disincentivising the allocation of capital which induces greater demand would also assist in balancing out the supply and demand of automobiles, rather than creating a fairly vertical demand curve in absence of any policy interventions.

26 COMMENT

The entry of a two nano lending companies has left the financial services industry baffled. The question on everyone’s mind is how on Earth did these two nano lending companies accumulate more users than the decades-old mobile money wallets? These new nano lending companies have also managed to disburse more loans to retail customers than some of the established microfinance companies. For the sake of this story, we are focusing on just two nano lending companies, while in reality you might have heard about the several others out there. The reason why we’re focusing on these two is because they are the only nano lending companies that are licensed by the SECP to legally carry out digital nano lending business. One of them is Seedcred Financial Services which runs the digital lending app Barwaqt, and the other is Sarmaya Microfinance Private Limited, which runs apps EasyLoan and PkLoan. By far, the biggest in the business is Barwaqt whose management claims they have approximately 10 million downloads of the app. Seedcred, the patron of Barwaqt, is owned by Fintech OPay Pakistan which is part of the Nigerian Fintech OPay valued at $2 billion. OPay is backed by some global VC giants such as SoftBank and Sequoia Capital. The fintech company raised $400 million in funding in August last year. Barwaqt’s scale matters because 10 million downloads were achieved in a year. The management of the company further claimed in conversations with Profit that they have serviced 2 million borrowers and PKR 16 billion worth of loans disbursed. Compared to the number of downloads and the short time span of a year, this is significant. The SECP, however, has different num bers. According to them, the total borrowers financed by eight NBFC were 551,000 until March 2022, with PKR 11 billion disbursed by all of these entities combined. When the discrepancy was brought to Barwaqt, they stood by their claim which means Barwaqt could have more borrowers and disbursed more loans than the entire industry it operates in. To add to the confusion, an article published in Dawn in July, 2022 carried a third set of numbers, claiming Barwaqt has 8 million “clients” with PKR 4 billion disbursed.

So what’s making this growth possible? Briefly put, there is a lot of scope for lending in Pakistan because commercial banks have largely shunned this market. For commercial banks, it does not simply make a business case to serve customers seeking such nano loans, which range from Rs5,000 to 50,000. According to Abrar Ameen, the CEO of SeedCred Financial Services, their average loan size is PKR 7,000. For commercial banks, the cost of serving these customers is high and such consumers are also very risky to lend to since most of them do not have a solid credit history to assess credit worthiness. In case of microfinance banks too, the cost of serving these customers is high and hence the interest rates are very high and getting approved for loans is a cumbersome process with a lot of paperwork involved. Consequently, access to credit for Paki stanis according to the World Bank has hovered at around 13% only of the total population. The opportunity, alone, however, does not fully address the growth trend of nano lending apps. This is where the mention of questionable practices of nano lenders get a mention: while they have been able to grow, these apps haven’t been following fair business practices such as transparent disclosure of terms and conditions to customers and aggressive and unique loan recovery tactics which can be called unethical.

The curious case of nano lending apps

28

By Taimoor Hassan & Ariba Shahid

It seems reliable numbers on what exactly is going on within the nano lending space are difficult to come by.How are these numbers impressive? Well, established fintech companies JazzCash and EasyPaisa both have 10 million plus downloads each. They, however, managed to accumulate these downloads over decades of existence in Pakistan’s financial sector. And according to the Mobilink Microfinance Bank’s (the bank behind JazzCash) financials available publicly, its total loan disbursement grossed up to PKR 10-12 billion in According2021. to a senior official at EasyPaisa, the growth of nano lending apps such as Barwaqt is an eye opener to the potential of nano lending. Had they known this earlier on, “EasyPaisa would have structured their nano lending product differently.”

The set of customers that gets enticed to apply for these nano loans are possibly the poorest segments of society, with irregular pays and no savings: in short desperate. They could be taking out a loan for an emergency for which they would have no savings to spend. It is the people that are desperate for mon ey that are prone to exploitation by loan shark lenders. It is exactly to stop this exploitation that the financial sector is heavily regulated.

From the information received, the borrower’s father was called at least five times in a day for recovery of the loan of his son, when it was fullyAnotherpaid.

The case of our EasyLoan borrower was resolved by the company after some aggressive complaining and after the regulator intervened when there was a national level hue and cry about these apps acting like mobsters. EasyLoan also took action against those call centre agents who were resorting to aggressive tactics for recovery after a meeting of licensed lenders was called and the SECP raised concernsThe nano lenders have their own version,

How are these apps predatory?

This has been helped by a regulator, the Securities and Exchange Commission of Pakistan (SECP), which regulates companies broadly but does not regulate finance companies particularly. It was only after a deluge of complaints on social media that the SECP began to look into the mal practices of nano lenders and ordered corrective actions.

While the SECP has taken some soft action against the registered entities to keep their supposedly predatory ambitions in check, it is the actual loan sharks, the unregistered apps, against which disgruntled consumers cannot enforce any legal action which are operating unabatedly.

“It is Rs500 for the day if 75% of loan re covery targets assigned to an agent are achieved. It is Rs1,000 if 90% is achieved. I am a student and many of the call centre agents are students like me. To achieve their targets, some of them get carried away and use harsh language to achieve their targets,” he said.

Picking up from social media, people have simply been mad. The nano lending apps have been under a barrage of criticism for some time now for being loan sharks - a term first used during the American Civil War and is characterised by lending on exorbitant interest rates and violent collection practices. It had been characterised as such because loan sharking involved lending of illicit money and was a feature of criminal enterprises, and therefore, operated outside the ambit of state laws. Since no legal contracts could be enforced, lending such money used to be very high risk and carried very high interest rates. Collection practices for such loans included resorting to violent tactics to make recoveries as formal law enforcement channels could not be involved in collection of such loans. In fact in Pakistan, setting up microfinance banks was to keep people from being exploited by loan sharks operating informally, using illicit money to lend out loans and then recovering them through the threat of violence. In Profit’s own interaction with an actual loan shark, the latter would not even disclose his name on the phone. The loan shark was cautious about speaking to the publication, reinforcing our notion that he was operating outside legal channels. This context is important when discussing the new age nano lending apps. One set of these apps operates within the regulatory framework, that is they are licensed by the SECP to do such business legally. The other set of apps operates outside the regulatory framework, are not licensed by the SECP and are hence, illegal. According to the list shared with Profit by SECP, companies that are licensed to do such lending are SeedCred Financial Services (Barwaqt) and Sarmaya Microfinance (EasyLoan and PkLoan). The list of apps that are not registered by the SECP but are still involved in nano lending business illegally is a long one. The SECP shared names of 13 illegal apps that were not authorised to carry out lending business, with an additional four apps identified by Profit. These apps include Flexi Money, Zephla, EasyMoney, Qarza Loan, WeCash, Rapid Credit, AiCash, EasyCash Loans, Fori Qarz, Fori Money, Fair Loans, Plati Loans, Olive Cash, Superb Loans, UrCash and MyCash. Among these 17, only two are no longer on Playstore. Collectively, these apps have down loads amounting to over 2.2 million. The dichotomy of these apps is important because one set of these apps is completely ille gal, which is how loan sharks operate. The other set of apps has some features of loan sharks but are not illegal. In fact, by operating as licensed entities, the regulator seeks to keep predatory practices in check. These apps, however, have arguments that they are not predatory in the first place because of how this financing works.

Agent from EasyLoan’s loan recovery cell said that the Rs4,200 payment that was made five times had not really gone towards the repayment of loan amount but towards some extension charges. And that the loan amount was still pending. Mind you that the borrower in question had to ask someone who was well educated to figure out what was going on and sort out the matter. Borrowers often don’t really understand these loans before they take them perhaps because of overall illiteracy. Bear also in mind that sometimes low income workers take out such loans and then reach out to people they work for, misrepresent that they are being exploited and ask for financial help from them. In a recent example that this reporter witnessed, a blue collar worker misrepresented that he was getting recovery calls from FINCA Microfinance Bank because he had missed a payment and needed financial help in repayment of his loan.When the bank was contacted, the borrower in question had successfully completed his loan repayments and had taken another loan on which he was on time on his payments. In fact, when he was told that the bank would be called to verify the veracity of his claim, he withdrew his request for financial help.

The point here being that when in poverty, false complaining to secure financial help is real. It could be to individuals and authorities. The SECP has told Profit that some of the complaints received by them regarding nano lending apps were dismissed because these complaints were unfounded. The SECP did not however share the number of complaints that were dismissed. Back to our EasyLoan guy.

Anatomy of a loan shark

In a conversation with Profit, one call cen ter agent at EasyLoan responsible for recoveries, without disclosing his name, said that there is no guideline from the company pushing agents to resort to threats for recovery of loans. However, agents receive a commission for meeting recovery targets which acts as an incentive to recover loans under all circumstances.

TECHNOLOGY

feature of these apps is that when applying for a loan, these apps ask for permissions to access contacts, calls logs and even pictures. The borrowers, perhaps because of their desperate circumstances and illiteracy, go ahead with giving such permissions and only realize what it means when the close ones in their circles are called for recoveries of loans.

There has been hue and cry of unfair terms and exploitation by these lenders as far as the markup rates and fees charged by them goes. They are also seen to have been violating best business practices such as transparency and ethical recoveries. The experience of one of the borrowers from the EasyLoan app was narrated to us with statements. The borrower took a loan of Rs16,800 from the app on May 17, 2022, and made five payments of Rs4,200 each between May 17 and June 16, paying Rs21,000 in total as per the terms of the loan repayment. That’s 25% interest in over a month. What followed later was unexpected.

-

-

While actions have been taken against the registered lenders to tone down their supposed predatoriness, no substantial action has been taken by the SECP against the illegal apps which we earlier categorised as actual loan sharks be cause they operate completely outside the ambit of the law. The SECP has only said that they can not directly take down these apps. Instead, it has sent requests to relative authorities to take them down, without specifying who these authorities were.

If such a case persists long enough, the licensed ones would be at a disadvantage by being part of the formal regulatory system, under which orders by regulators would suppress their competitiveness. It’s hard to compete against illegal apps that are operating without any consequences. n

Nanolenders is that they charge these rates for a payback period of a month, and for annu alised rate to take effect the borrower would have to keep on taking loans with the payback period of a month, for the entire year for it to be considered an extremely predatory rate. The act of piling on loans for a year is itself a highly unlikely scenario. In our conversation with Abrar Ameen, the CEO of SeedCred Financial Services, annualizing a monthly interest rate and calling it predatory is a mistake because their lending cycle is not on an annual“Ourbasis.product ends in 30 days. No one is giving or taking out a loan for a year. If we were giving out a loan for a year, we would also have set our rates based on 6-month or 1-year KIBOR and some spread,” says Abrar. “If there was KIBOR available for a week, our nano lending rates would have been accord ing to that KIBOR rate,” he adds. What Abrar says makes sense but nanolending apps have been under criticism for giving out incomplete disclosures as well. Charging interest rates even if they are high is not a prob lem as long as these rates, as well as other fees, are disclosed fairly. The SECP has since ordered these apps to give complete disclosures. When calculating markups or percentage returns, nanolenders such as Barwaqt have to account for return on equity, costs associated with business and the risk of default. Therefore, the interest rates in their case are high. These three elements cannot be avoided, which drives up the markup rate but is not exploitative, Abrar argues, seconding it with the argument that the markup charged by them is now almost as much as what the microfinance banks Forcharge.borrowers that are not delinquent on their payment, the markup rate goes down as they take out more loans and their limits also increase. The percentage of repeat borrowers with Barwaqt is 60%, Abrar says. On the recovery part, Abrar says that being a licensed entity they have legal channels avail able for recovery of loans, the costs associated with such recoveries are high compared to the size of the loans. While reading this, imagine sending police after a borrower who has borrowed a meager Rs5,000 from Barwaqt. In such a scenario, repetitive calls are the only way to ensure recovery. Abrar does not condone aggressive and harassing behavior but says calling customers is the only way to recover such loans.

-

So far, only two of the 17 illegal apps have been taken down. This means the majority of the actual loan sharks are still operational.

TECHNOLOGY30 however.First of all, a disclaimer: Sarmaya Microfinance, the company behind EasyLoan is understood to have, according to a Dawn article, markup rates in the 20 per cent range for a month. On an annualized basis, it would be 240% for the year. In a conversation with Profit, an official from SECP also vouched that their internal audit revealed that Sarmaya Microfinance rates were not predatory and were in the 20 per cent range. Barwaqt on the other hand charges mark up rates that are in the 40 per cent range for a month, and close to 500% on an annualised basis. Even 40% is an industry standard, with some of the microfinance banks charging similar rates.

Additional reporting by Ahtasam Ahmad

The SECP said that they wouldl share these numbers with Profit. They were not received till the filing of this story. What an SECP official also asserted on a call with Profit was that many complaints from users were not actually complaints of any wrongdoing, as mentioned above. These were just customers angry for no particular reason. In fact the official also asserted that the entire social media campaign was blowing the issue out of proportion and that the things were not that bad.

The SECP also asserts that the number of complaints have been declining since the actions ordered by them, but did not disclose how many complaints were registered overall and historical numbers to back the claim of the declining trend.