7 minute read

Regulating capital formation

Will increased transparency aid investor confidence?

By Ahtasam Ahmad

Advertisement

Capital formation has become an essential part of the strategy for growing modern day businesses. The capital markets provide these business opportunities to raise financing to embark on a journey of growth and expansion. However, the corporation at times, blinded by self interest, may mislead investors by painting a rosy picture of their business prospects. In these cases, the role of the regulator is important as it recommends legislation to protect the interest of investors while also ensuring that ease of doing business is not compromised in the process. Security Exchange Commission of Pakistan (SECP) in an attempt to achieve the aforementioned, has published a concept note to enhance the transparency of further issue of share capital by moving towards a more disclosure based regime while also streamlining the process by benchmarking against comparable international markets. The experts in the subject matter have analyzed it to be an attempt to revamp a regulation that was becoming obsolete. However, they have criticized the lack of use cases presented by the commission in its proposal.

There are multiple avenues for existing companies in Pakistan, especially the listed ones, to raise further equity capital. The most popular one is the right issue which has enabled the listed companies to raise around Rs 49 Billion during the current year as per SECP.

Right issue, as the name suggests, gives the right to the existing shareholders to subscribe to additional capital being offered. The offer is made in proportion to the existing holding pattern of the shareholders and thus, prevents dilution of control of the existing investors.

A method, other than right issue, that the law permits the companies to raise equity capital through is offering equity to private investors. This method also enables the company to accept non-cash consideration for shares issued. This method has also been used in case of debt restructuring that enables the company to issue shares to financial institutions as a repayment of its debt obligation.

Further, the Law of the land also provides for the issuance of stock options to employees. This allows the company to raise capital while simultaneously offering an incentive to the workforce by enabling them to buy shares at a preferential rate.

Regulation for further issuance of share capital

It was permissible for the companies under the Companies Act 2017 to raise further share capital subsequent to initial public offering or the capital raised at the time of incorporation. However, the procedural details for such were missing which led to each entity itself shaping up the procedures of raising capital. Therefore, to standardize the way equity was raised and to mitigate risk, the SECP published the further issue of share capital regulation in 2018 and an updated version in 2020.

The aim of the aforementioned regulations was to streamline the process of capital formation while also enhancing investor confidence through steps like detailing about the purpose of raising capital and the utilization of proceeds.

Triggers and the regulatory amendments

While the existing regulations helped standardize the capital formation structure, they failed to address some key issues. These included; minimal disclosures for right issues which in cases were as high as 1000% of the existing share capital, No provision was there for cancellation of an issue, Shortcomings in the valuation reports in cases where the consideration received was other than cash (e.g. shares issued to purchase a manufacturing plant), procedural complexities in employee share issuance.

In order to counter these issues a number of changes are proposed to the regulation by the SECP. One of them is an adoption of disclosure-based regime that as per the commission includes, preparation of offering documents containing enhanced disclosures, seeking public comments, comments of the Apex and Front-line regulators and publishing final offering document after incorporating the comments.

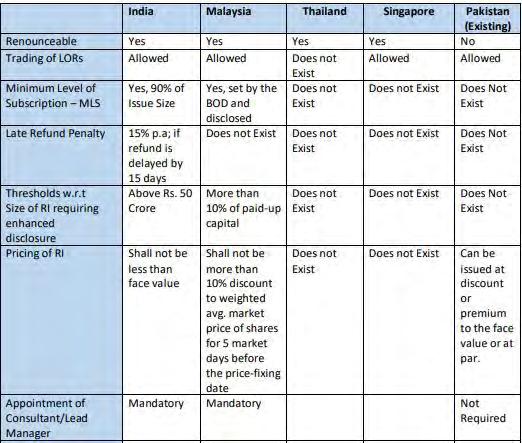

The purpose of revamping the existing disclosures is to provide more information to the investors for decision making while also aligning the local regulations with regional best practices.

Further there is a proposed regulation for imposition of lock-in clause on the sponsors. The board of directors of issuing company will decide the minimum level of subscription for the right issue to be successful (cannot be less than 90% of the amount intended to be raised) and the directors of the company will undertake to subscribe to their proportions of share while the unsubscribed portion would be taken up by a an underwriter that cannot backout. Further, to ensure the subscriptions process is completed successfully, an additional concept of application supported by blocked accounts. As the name suggests, the concept is similar to having an escrow account to secure transaction money while the process of right issue takes place. As per Profit’s sources in SECP this clause is to oblige the sponsors and prevent them from backing out from an issue.

Rizwan Manai, a senior corporate law advisor based out of Karachi, while talking to Profit stated, “ The (existing) regulation itself is becoming obsolete and the changes made by SECP are a proactive measure to address issues prevalent in the country’s corporate sector. However, as per my knowledge, there has not been any big case of sponsors or underwriters backing out of an issue and it seems like the SECP has proposed the relevant clause to prevent anyone from exploiting the loophole in the law.”

The proposed regulations also include an exit opportunity to the shareholders in case the issuer changes the purpose of proceeds utilization. As per Profit’s sources in the SECP, there have been multiple instances where proceeds were raised through right issue for particular projects, disclosed as per the law, however, not all funds were expended for that purpose and amounts were diverted to fund other business activities.

As per the proposed regulation, “In exceptional circumstances, the issuer may change the purpose of proceeds’ utilization subject to passing of special resolution and offering an exit opportunity to dissenting shareholders who have not agreed to the change in utilization of proceeds.”

Further, the responsibility to monitor proper utilization of funds is given to the external auditor of the company. As per the proposed regulation, “The Statutory Auditors shall monitor the proceed utilization till 95% of the proceeds are utilized in the manner referred to in the final offer letter, and shall submit a quarterly report to the issuer. The issuer will include the report, along with its comments, if any, in its quarterly financial statements.”

The procedures for cancelation of a right issue have also been stated out in the proposal. However, commenting on this, Rizwan Manai told Profit, “As far as the cancellation of right issues is concerned. The law already states that if an issue is not subscribed to within a certain period, it will lapse. However, SECP is of the opinion that regulations were necessary for such unsubscribed issues so that it is kept up-todate regarding instances of such cancellation.”

Dr. Ikram ul Haq, corporate law practitioner and advocate supreme court of Pakistan, commented on the proposed changes, “The proposed regulations do not state that in peculiar situations, how these issues were mitigated. Further, GAP analysis pertains to current regulations applicable in Pakistan with International best practices. How these practices are relevant in Pakistan is again an issue and needs to be considered. Every solution must have an issue log so that the relevant situation (suggested) is evaluated in proper perspective. However, the cases which have highlighted the need for such regulation haven’t been disclosed.”

Additionally, the proposed regulation also specifies the minimum contents of valuation reports and procedural requirements to be complied by the issuer for issuance of shares by way of other than cash. Explaining the rationale behind this amendment, Rizwan Manai told Profit, “Valuations are a very judgemental thing and their credibility is always under doubt. Therefore, additional disclosures are a necessity to maintain the trust of the investors.”

An important amendment that has been proposed is the approval for issuance of shares to employees through Employee Stock Option Schemes. Last year, the SECP inserted the section 83A to the companies act that permitted private companies to issue shares to its employees as a part of their compensation package. However, before the insertion of the aforementioned clause, issuance of shares to employees was a difficult task for the private entities as according to the law their existing shareholder had the right to first refusal of such shares which made it possible for them to block the issuance to employees.

The newly proposed amendments are a follow up on the procedure for issuance of shares to employees. Profit reached out to legal experts who were of the opinion that this step was taken to facilitate the startup sector that has grown substantially in the recent past and needs to retain top talent through such fringe benefits as they are cash strapped in the initial years of their existence.

The new regime, if implemented in its existing shape and form will bring more transparency to the process of capital formation and prevent investor exploitation. However, the increased compliance will add to the time it takes to complete the whole process. While some legal experts are of the view that by imposing these regulations, SECP is attempting to formulate company law in a manner similar to capital markets regulations which is against the ease of doing business narrative. n