6 minute read

Will Cash Margins curtail imports at the cost of digitisation?

The current account deficit is in dire straits. But what are we willing to give up on for its sake?

By Ahtasam Ahmad

Advertisement

Those at the helm of the country’s administration have newfound admiration for the telecommunication and the IT sector. In almost every address to the public on the revival of the economy, praises for the sector are part of the agenda and emphasizing on its potential is a recurring theme. Further, proactive policy making like in the case of Digital Pakistan Policy, Cloud First Policy and Draft Broadband Policy makes one believe that probably the government is willing to see this transition through.

However, the ground reality is completely different. The Telecommunications sector has seen a chain of events starting from the government tracking back on its promise of reduced withholding tax to the latest implementation of 100 percent cash margin on equipment imports of the sector.

The measure comes as an attempt to curb current account deficit through discouraging imports. However, it fails to distinguish between consumption based imports and equipment imports that are part of a collective effort to develop the country’s infrastructure, specially in the case of IT and Telecommunication sector.

Imposition of Cash Margin

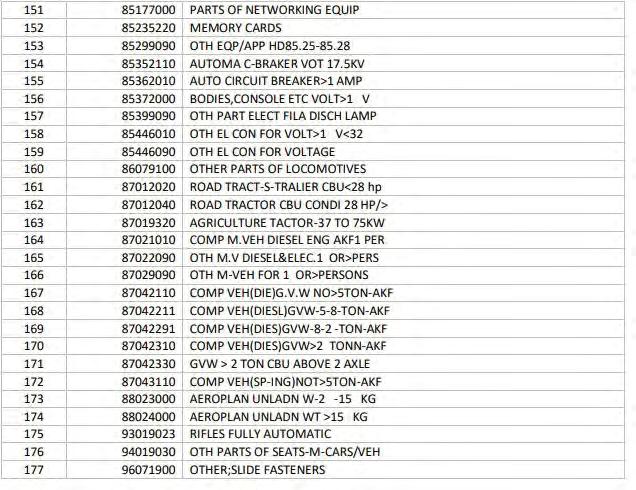

The State Bank of Pakistan (SBP) last month notified the imposition of a 100 percent cash margin on import of 177 items. The list of items also includes power equipment for telcos, lithium batteries, routers, main telecom equipment, telecom parts and servers.

The cash margin requirement means that the importer of specified goods will have to deposit the total value of their goods with a commercial bank before opening a letter of credit. This is a tool widely employed to discourage imports and to ease up the downward pressure on currency. However, the targeted imports of such restrictions are usually non-essential and luxury ones. The latest margins requirements include automobile and textile imports alongwith the telecom equipment.

Problem for the Telcos

As per a letter of Ministry of Information Technology and Telecommunication (MOITT) to the SBP, “The decision of SBP impacts 90% of the Telecom imported equipment that will have a severe impact on the liquidity situation as well as the funding requirement for the telcom business.”

“Needless to mention that telecom

Irfan Wahab, CEO of Telenor

equipment being imported is neither manufactured locally nor falls into the category of a luxury item.” The letter further added.

The official communication aptly explains the underlying problem. Majority of the telecom service providers of the country are owned by foreign entities. Therefore, they have to plan their expenditure and timing of it in advance for timely sanction of funding from their global parent company. However, in this case, regulatory changes midway through their financial year not only disrupts the planning process but also poses a challenge to the liquidity of the telecom operators.

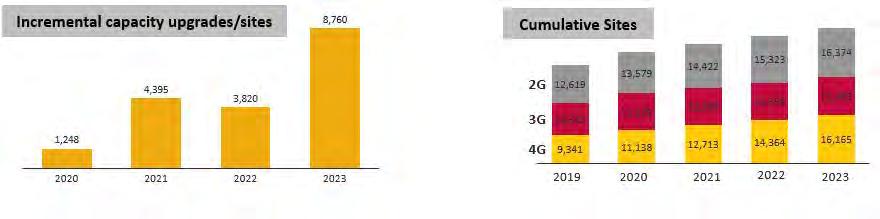

An example is Jazz, the leading operator of telecommunication services in the country. The telco is ramping investment in the sector, primarily to develop infrastructure, contrary to many of its competitors. Jazz alone invested PKR 14.9 billion under its 4G ambitions during the first quarter of 2022, taking its overall investment in Pakistan to US$10.2 billion. A majority of its capital expenditure during the latest quarter ended was on the addition of approximately 500 new 4G sites.

These cellular sites consist of network and power equipment including base stations, microwave radio equipment, switches, antennas, transceivers, batteries and rectifiers all of which are imported as the country doesn’t have local manufacturing facilities.

The company further has plans to spend a cumulative figure of Rs. 38 billion in 2022 and Rs.48 billion as part of its network rollout strategy as per its budgeting documents obtained by Profit. The cost implication of imposing 100 percent cash margins is difficult to ascertain. However, as per VEON’s (Parent company of JAZZ) internal data, their cost of capital for investments in Pakistan is around 18.24% (see calculation below) which means that if equipment worth Rs 10-11 billion is imported at a credit term of 6 months, a 100 percent cash margin requirement would mean additional financing cost of around Rs 1 billion for the company. All this adds up to the cost of doing business in the country and acts as a deterrent to foreign investment.

Irfan Wahab, the CEO of Telenor, while in an interview with Profit also stated that the cost of doing business was having an adverse effect on the sustainability of their business Telco’s annual rollout plans and may impede the expansion of 4G network, while adversely impacting liquidity and funding requirements for the network expansion. The referred equipment is core for the continuity of telecom systems in the country. With immediate change in regulatory requirements, the cash outflow which was expected to happen later in the year has to be made immediately which has a direct impact on the liquidity and financial health of the company.”

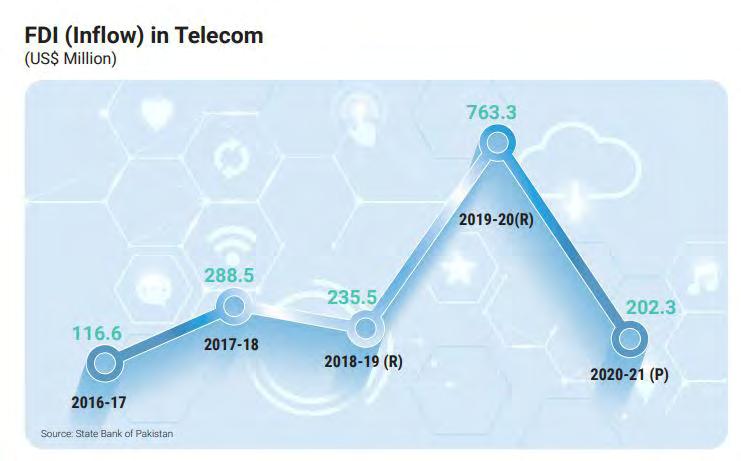

It is acknowledged by all stakeholders

Source: VEON Business Plan for Pakistan 2020-21

model. “If we consider the sustainability of business, our key cost elements are in U.S. dollars which is insane for a country like ours. It made sense back in 2004 when we entered into the market as an international investor, but now we are a player here. We are earning here. Our customers are paying us in rupees.”

“All our equipment which we need to procure has to come from international markets in dollars. So if we could buy, say, ten base stations earlier, now we can only afford eight because of that.” He further added.

Profit also got hold of the official communication of Pakistan Telecommunication Authority with the SBP. The letter read out, “It would not be out of place to highlight that telecom operators devise annual rollout plans for expansion of their networks as per license obligations. However, sudden imposition of 100% cash margin by SBP is a serious concern for that the telecom sector will play a pivotal role in changing the economic tide in favor of Pakistan. However, measures like the one recently imposed by the State Bank undermines the efforts of those involved in the sector and discourages further participation which is evident from the gliding Foreign Direct Investments. It is extremely important that short term fiscal goals should not come at the cost of long-term policy objectives. n

Loser, out of touch, uncle-type finance minister doesn’t even know how to lose fortune in crypto

In yet another example of dinosaurs running the national economy, Dr Miftah Ismail, the incumbent finance minister, has revealed that he has absolutely no idea how to sink in huge amounts of money in cryptocurrency. “Let me me be very honest,” he said frankly, in response to a question about the hottest fintech development that has razed a number of retirement plans, at a function in Washington DC. “I don’t know much about it.”

The frank admission, bordering on the shameless, that he had no idea about how to invest government revenue in the volatile financial technology, a key currency of which lost 99% of its value in a single month, is very concerning.

“It is about time that the League-make babaas relinquish their posts, and hand things over to those of us who know the future,” said former finance minister Asad Umar.

“Ummm….blockchain,” he added, apropos of nothing.