U D G E T

Decoding Rs18 9tr federal budget

In par tnership with Profit T h u r s d a y, 1 3 J u n e , 2 0 2 4 I 6 Z i l - H a j j , 1 4 4 5 R s 2 0 0 0 | Vo l X I V N o 3 4 4 I 8 Pa g e s I Ka r a c h i E d i t i o n PR OFIT S ta f f R e p o R t

INANCE Minister Muhammad Aurangzeb presented the first federal budget of the incumbent government on Wednesday with a total outlay of Rs 18 9 trillion amidst ruckus from the opposition benches as well as deepening fault lines within the government coalition The budget session began two hours late because the Pakistan Peoples Party (PPP) expressed its discomfort with attending the session because they had not been consulted regarding the budget A government delegation led by the Deputy Prime Minister managed to convince the PPP members to attend the session but the party’s Chairman stayed away from proceedings The budget for the upcoming year aims for a modest 3 6 per cent GDP growth, and sets an ambitious Rs13tr tax collection target raising taxes on salaried classes and removing tax exemptions for the rest Aurangzeb acknowledged the challenges faced by Pakistan’s economy, which had been struggling with depleted foreign reserves a 40 per cent depreciation of the rupee stagnant economic growth and soaring inflation that pushed citizens below the poverty line The budget was an interesting one for Prime Minister Shehbaz Sharif in particular The last federal budget was also presented by his government but he was not around to see it through completely because of the six month stint of the caretaker setup He is now following up with a budget that is quite similar to the last one in that it focuses almost entirely on meeting the conditions of the IMF which Pakistan is pursuing an even larger bailout package with REVENUES AND EXPENDITURES The federal budget for fiscal year 2025 has a total outlay the sum of expenditures and net lending of funds of Rs 18 877 trillion, representing a 30pc increase from the previous year ’s budget The government has proposed Rs 17 203 billion for current expenditure in the FY25 budget a substantial 29pc increase from the previous year To meet these expenditures, they have set an ambitious target of over Rs 13 trillion from taxation They have also tried to bolster non-tax revenue, a significant move being the increase of the Petroleum Development Levy (PDL) which the government increased by Rs 20 to Rs 80 at maximum capacity The government is hoping to collect a massive Rs 1 3 trillion through the levy even though it will mean a significant increase in the price of petrol Interest payments or debt servicing have surged 34pc to Rs9 775 billion consuming more than half of total budget outlay and becoming like last few years the government’s single largest expense Of that defence expenditure constitutes Rs2 122bn 17 6pc higher than last year s budget, making up 1 71pc of GDP, largely unchanged from last year Pakistan’s total revenue for fiscal year 2025 is budgeted at Rs17 815 billion After accounting for provincial transfers of Rs7 438 billion the net revenue stands at Rs10 377 billion representing a significant 48 7pc increase from the previous year Aurangzeb highlighted the urgency of tax system reforms citing Pakistan’s lagging tax-to-GDP ratio compared to other countries The prime minister is closely monitoring the digitalisation of tax policies and FBR’s administrative reforms Our goal is to broaden the tax net without burdening existing taxpayers ” Aurangzeb said C O N T I N U E D O N PA G E 03 g P P P C h i e f a v o i d s a t t e n d i n g s e s s i o n , c l a i m s p a r t y m a y n o t n e c e s s a r i l y v o t e i n f a v o u r o f b u d g e t g A m b i t i o u s t a r g e t o f o v e r R s 1 3 t r s e t f o r t a x c o l l e c t i o n i n f a c e o f r i s i n g e x p e n d i t u r e s G O V T E

E

D

H A

D T O

H R

ISLAMABAD a h m a d a h m a da N i Petrol prices will rise as expected in the wake of the federal budget for the next fiscal year, mainly because the government has decided to increase the maximum petroleum levy on petroleum products by Rs 20 from Rs 60 to Rs 80 This target represents a significant increase of Rs 321 billion from the revised estimate of Rs 960 billion for the current fiscal year 2023-24 The petroleum levy is a major source of income for the government While this hike will boost federal revenue it is also expected to further raise the already high prices of petroleum products Already inflationary pressures have caused the usage of petrol to fall over the past year and as the Pakistan Economic Survey 2023-24 revealed the usage of fuel dropped by nearly 8% in the past fiscal year So how exactly will this increased levy mean for petrol prices? And was it the best route for the government to take? How the pricing works Petrol prices in Pakistan are determined by a number of factors The main input is the international price of crude oil, which is imported into the country by oil refineries which then process it and turn it into fuel The price of fuel after processing is what is known as the ex-refinery price But then other things get tagged along onto this A margin is added to make sure the price is uniform throughout the country and not cheaper in areas close to the refinery distributors naturally take a cut and then dealers and petrol pumps also charge their own service premiums On top of this, the government also takes a cut The current petroleum levy is Rs 40 which up until this budget could have gone up to a maximum of Rs 60 The government has now increased this maximum levy by Rs 20 to Rs 80 per litre As we mentioned at the beginning the government is not good at collecting taxes because there is only one tax collector with not enough infrastructure to keep an eye on everything So the levy is charged to the end consumer and directly transferred to the FBR Will the IMF be happy with this? The IMF has long held, and correctly so that this is a counterproductive system The fund s argument is that a VAT system should be implemented in which the value added at each stage of a product getting to the end consumer should be taxed Without getting into too many details this would mean the refinery would be charged a tax first then the transporters then the distributors and so on and so forth until the final price hits the markets and the tax is passed on to the consumer This would not just mean that the tax on petrol would not be arbitrarily set (as the petrol levy is right now) it would also help document the economy better As part of this, the IMF wants the government to increase the sales tax on petrol at different stages In the previous budget the fund had recommended 18% GST be charged on petrol products But this poses a problem for the government Pet ro l pric es do om ed t o s pike as go vt rais es pet ro leum levy. W ill go vt be able t o c o llec t R s1 . 3t r fro m it? C O N T I N U E D O N PA G E 03 PR OFIT S h a h N awa z a l i Two businessmen discussion analysis sharing calculations about the company budget and financial planning together on desk at the office room Every year, the federal government announces a federal budget and the news media reports on it The budget itself is a bunch of numbers that may or may not mean much to the people listening However these numbers have a huge impact on the lives of not only the taxpayers but every citizen of the country Profit explains how a common man can make sense of the Rs 18 87 trillion budget announced today in the parliament house Central to a country s economic policy is the annual budget PR OFIT a b d u l l a h N a z As Muhammad Aurangzeb took the podium to deliver his budget speech, a lot would have been on his mind Would the heckling from the opposition benches get to him? Would he manage to read through the entire speech without stumbling on the complications of financial terms in Urdu? How would the IMF react to his ministry’s proposed budget for the next one year? But one question that might just have been front and centre in his mind was his recent trip to China In fact, Mr Aurangzeb’s budget speech was originally slated for Friday PR OFIT S ta f f R e p o R t In his budget speech Wednesday the Finance Minister said that the zero ratings exemptions and red u c e d r a t e s w e r e g o i n g t o b e eliminated These exemptions are a burd e n o n t h e g o v e r n m e n t a s t h e i r r e v e n u e s a r e r e d u c e d w h i l e i t also has an impact on the socio e c o n o m i c d e v e l o p m e n t o f t h e country Due to this, there is a proposal being made to eliminate these exemptions on many of the items Some of these items are going to go to a reduced rate while the standard rate of 17% will be implemented on the others The details will come when the Finance Bill is published later

F

X T

N

S

N

I M F W I T

S 1 8 . 9 T R I L L I O N B

C O N T I N U E D O N PA G E 03 Aurangzeb tries to prop up SIFC as foreign investment outlook remains bleak C O N T I N U E D O N PA G E 03 Govt does away with sales tax exemptions How hard will this hit industr y? C O N T I N U E D O N PA G E 02 PTI, JI, businessmen dub ‘IMF dictated’ budget lethal, poisonous ISLAMABAD/LAHORE/KARACHI S ta f f R e p o R t Reacting to the federal budget, main opposition parties, including Pakistan Tehreek-e-Insaf (PTI) and Jamaat-iIslami, All-Pakistan Anjuman-e-Tajran, and chambers of commerce of different major cities including Karachi Faisalabad Sialkot and Rawalpindi rejected the budget They termed the IMF-dictated and tax-heavy Federal Budget 2024-25 as a lethal and poisonous for the inflation-stricken people, which would have devastating effects on the economy and the common man, triggering a storm of inflation ‘BUDGET NOTHING BUT ECONOMIC MURDER OF PEOPLE The PTI Spokesperson in a statement said that the anti-people budget of the federal government was nothing but an economic murder of the people as it would badly impact the routine life of ordinary people of the country because it would result in a sharp increase in prices unemployment and poverty He said that the current budget was actually an IMF dictated budget and the government had no role in its preparation that was the reason there was no relief for the countrymen rather it would further exacerbate the public woes, adding that an ambitious target of GDP growth rate of 3 6% had been set for the next fiscal year whereas the World Bank predicted the growth rate would not exceed 2 4 percent PTI spokesperson noted that the target of 12 percent inflation rate was completely unrealistic and unachievable C O N T I N U E D O N PA G E 03

CONTINUED FROM PAGE

grow 4% on average over 2024-25 slightly slower than in 2023 Growth in low-income economies is expected to accelerate to 5% in 2024 from 3 8% in 2023 However the forecasts for 2024 growth reflect downgrades in three out of every four low-income economies since January In advanced economies growth is set to remain steady at 1 5% in 2024 before rising to 1 7% in 2025 Four years after the upheavals caused by the pandemic, conflicts, inflation, and monetary tightening, it appears that global economic growth is steadying,” said Indermit Gill, the World Bank Group’s Chief Economist and Senior Vice President However growth is at lower levels than before 2020 Prospects for the

world s poorest economies are even more worrisome They face punishing levels of debt service constricting trade possibilities and costly climate events Developing economies will have to find ways to encourage private investment, reduce public debt, and improve education, health, and basic infrastructure The poorest among them especially the 75 countries eligible for concessional assistance from the International Development Association will not be able to do this without international

The

Thursday 13 June 2024 | KARACHI 02 NEWS PR OFIT n e w s D e s k

H E World Bank has forecasted that Pakistan’s growth is expected to pick up to 2 3% in FY2024-25 and 2 7% in FY2025-26 According to the World Bank s latest Global Economic Prospects report, it is expected that industrial activity and confidence will increase as a result of easing import restrictions and the implementation of reform packages Activity in Pakistan has improved but remains subdued with output set to expand 1 8% in FY2023-24 (July 2023 to June 2024), following a contraction of 0 2% in the previous fiscal year Industrial production picked up in late 2023 to early 2024 after import controls were relaxed following an improvement in the country s foreign reserve positions Policy uncertainty remains elevated despite easing from levels seen during bouts of political uncertainty over the last two years Moreover monetary and fiscal policies have remained tight and together with import and capital controls aimed at fostering stability have continued to constrain activity In Pakistan, inflation has moderated over the past year due to high base effects coupled with the stabilization of the exchange rate, but it remains high read the report S O U T H A S I A R E G I O N Growth in the South Asia (SAR) region is estimated to have increased to 6 6% in 2023, largely driven by faster growth in India In early 2024, while private sector activity picked up in several countries, including Pakistan and Sri Lanka it remained weak Industrial activity was disrupted in Bangladesh partly due to ongoing import restrictions In India, growth is estimated to have picked up in FY2023/24 (April 2023 to March 2024) Industrial activity, including manufacturing and construction was stronger than expected alongside resilient services activity which helped offset a slowdown in agricultural production partly caused by monsoons In Bangladesh, growth is set to slow in FY2023/24

private

higher

demand

also

remained below

levels Growth in Bhutan and Nepal is also set to rise, partly reflecting recoveries in tourism and remittances Growth in SAR is projected to slow to 6 2% in 2024 and stay at that rate over 2025-26 mainly reflecting steady growth in India The projections for 2024-25 are higher than expected in January, primarily because of an upward revision in investment growth by 0 9 percentage point on average over these two years Growth in the region excluding India is expected to pick up to 3 9 percent in 2024 and to 4 4 percent in 2026 In India, growth of 6 7 percent per year, on average, is projected for the three fiscal years beginning in FY2024/25 Despite a moderation from a high base investment growth is expected to be stronger than previously envisaged and remain robust over the forecast period, with strong public investment anticipated to be accompanied by private investment In Bangladesh, growth is projected to increase slightly to 5 7 percent in FY2024/25 and 5 9 percent in FY2025/26 In addition to an increase in private consumption because of easing inflation the implementation of large investment projects will support a pickup in overall investment G r o w t h i s a l s o p r o j e c t e d t o r i s e i n Bhutan and Nepal partly reflecting strong output in the hydropower sector Strengthe n e d a c t i v i t y i n M a l d i v e s w i l l b e s u pp o r t e d b y t h e e x p a n s i o n o f a n international airport in 2025 In Sri Lanka, the economy is expected to expand by 2 2 percent in 2024 and then reach 3 percent in 2026 assuming successful debt restructuring negotiations and the implementation of structural reforms In contrast the economy of Afghanistan is set to remain fragile, with high unemployment, food insecurity, and poverty Downside risks to the baseline forecast include commodity price spikes resulting from supply disruptions caused by the possible escalation of geopolitical tensions and intensification of armed conflicts In countries with elevated government indebtedness, abrupt fiscal consolidation could cause larger adverse effects on growth Some countries also run the risk of financial instability because of the large holdings of sovereign debt by domestic banks Climate-change-related natural disasters and weaker-than-projected growth in major trading partners are additional downside risks Upside risks include stronger-than-expected growth in the United States and a faster-than-expected slowdown in global inflation that is not associated with weaker activity W o R l D B a n k f o R e c a S t S Pa k i S ta n ’ S G R o W t h at 2 . 3 % i n f Y 2 0 24 - 2 5 KARACHI r e u t e r s Pakistan is unlikely to buy liquefied natural gas (LNG) cargoes on the spot market until at least the beginning of winter in November due to oversupply and high prices petroleum minister Musadik Malik revealed Extreme temperatures across Asia have pushed countries to seek more cargoes of LNG to address higher power demand, driving spot prices to their highest since mid-December Asia spot LNG last traded at $12 00 per million British thermal units (mmBtu) on Friday However LNG demand in the second largest south Asian LNG buyer was subordinate to supplies the minister told Reuters, despite heatwaves baking the country of 300 million people with temperatures surging to a near-record ”The question of getting more LNG when we can’t sell the amount of LNG that we already are obtaining from our long-term contracts it does not apply Musadik stated Annual power use in Pakistan, which gets over a third of its electricity from natural gas, is expected to fall consecutively for the first time in 16 years, due to higher tariffs curbing household consumption Poor and middle class households are still feeling the impact of the International Monetary Fund s (IMF) bailout of Pakistan last year which contributed to higher retail prices A series of power tariff hikes over 12 months was a key part of the IMF programme which ended in April Industrial demand has also remained tepid due to a cloudy economic outlook Pakistan which last bought a spot LNG cargo in late 2023 cancelled its spot LNG tender for delivery in January Malik attributed the cancellation to oversupply, adding that there were not a lot of customers at current LNG spot prices Malik said Pakistan was keen to adopt more renewable energy to cut its import bill and exposure to geopolitical shocks The country suffered widespread power outages due to its inability to buy expensive LNG after prices surged due to Russia’s invasion of Ukraine “Any country that is importing $15-18 billion of fuel how can it be sustainable when the total exports are south of $30 billion? So we have to move away from the imported elements such as LNG, he said Pakistan was also trying to access less expensive natural gas by building a pipeline with Iran, but was wary of sanctions, he said “We basically are trying to work out the solution whereby we can have access to less expensive gas but in a manner which does not invoke any sanctions on Pakistan It all depends on legal interpretations, he said From our perspective, we don t want to get into litigation and we don’t want to get sanctioned ” PR OFIT n e w s D e s k The global economy is expected to stabilise for the first time in three years in 2024 but at a level that is weak by recent historical standards, according to the World Bank’s latest Global Economic Prospects report Global growth is projected to hold steady at 2 6% in 2024 before edging up to an average of 2 7% in 2025-26 That is well below the 3 1% average in the decade before COVID-19, read the report The forecast implies that over the course of 2024-26 countries that collectively account for more than 80% of the world s population and global GDP would still be growing more slowly than they did in the decade before COVID-19 Overall, developing economies are projected to

t

(July 2023 to June 2024) Elevated inflation has dampened real wage growth and weighed on

consumption and

borrowing costs have weighed on

In Sri Lanka activity has strengthened and tourism and remittances have

recovered, though they have

pre-pandemic

support

added

this

economies

expected to remain poorer

was

the eve of the pandemic in 2019

high

fragile-

report further

that

year, one in four developing

is

than it

on

This proportion is twice as

for countries in

and conflict-affected situations

01 W H AT I S B E I N G I M PA C T E D? In order to get some idea of how some of the goods and services will be impacted, we can see the categories that were created for the application of sales tax Z E R O R AT E D E X E M P T I O N S Currently pharmaceuticals books and newspapers agriculture produce and medical supplies are exempt from any application of sales tax Once these taxes are implemented, it can be seen that the pharmaceutical industry will see its prices going up leading to a higher hospital bill Agriculture produce is an input in many industries and it can be expected that food related industries like wheat and rice and textile industries related to cotton will see an increase in prices Lastly, books and newspapers will also get expensive which will impact the cost of education related to children Z E R O R AT E D I N D U S T R I E S Zero rate industries mainly consist of exports and office stationery The industries that are involved in exporting their goods will see a rise in prices Some of the top exports of the country are textile meats sporting goods chemicals sugar and cotton As these are being implemented on export only goods local investors will not be impacted, however, the competitiveness of these companies will be undermined in the international market Offices will also be impacted as office related stationery will see a rise in its cost R E D U C E D S A L E S TA X In terms of reduced sales tax, the industries of local imports and produce for exports, sugar and certain plant and machinery levy a tax rate of 3%, 5%, 8% and 10% for different goods These tax exemptions being withdrawn will have ripples being felt throughout the economy Imports being made for exports categorize a large part of the economy and with these imports being taxed the export industry will have their inputs taxed at a higher rate As the sugar industry is taxed, juices, candies, jams, jellies and cold drinks will see a rise in their prices as well With plant and machinery being taxed at a higher rate capital expenditure carried out by the companies will see their costs increasing which will be passed on to the consumers These expenditures can span different sectors and industries so it is hard to pin down S TA N D A R D R AT E In terms of the standard rate services of banking, construction, shipping, telecom, advertising and event organization, hotels and restaurants are liable to pay a sales tax of 13% 15% and 16% Lastly all goods including imports are charged a sales tax rate of 17% After the exemptions are taken away many of these sectors will see their rates increase to 17% Global economy expected to stabilise first time in three years: World Bank Govt does away with sales tax exemptions. How hard will this hit industry? g I N D U S T R I A L A C T I V I T Y A N D C O N F I D E N C E W I L L I N C R E A S E A S A R E S U LT O F E A S I N G I M P O R T R E S T R I C T I O N S , R E P O R T Pa ki s t a n u n l i ke l y to b u y s p o t L N G i n s u m m e r d e s p i te s i m m e r i n g h e at Tax exemptions and concessions cost govt Rs3.88tr in 2023-24 Gov t allocates Rs267.95b for power sector in PSDP 2024-25 CONTINUED FROM BACK PAGE This substantial investment highlights the government s focus on bolstering the power infrastructure, improving electricity distribution efficiency, and advancing renewable energy projects across the country These allocations demonstrate a clear commitment to addressing the power sector s challenges and ensuring a reliable and efficient energy supply for the nation O N G O I N G S C H E M E S: For ongoing projects, significant allocations include: Rs 4 500 million each for the 220/132 Kv GIS substation Dhabiji and the 220 Kv Haripur Substation Rs 6,000 million for the 220Kv Swabi Substation Rs 6,500 million for the 500 Kv Allama Iqbal Industrial City Rs 1 424 360 million for electrification works in various valleys of district Chitral Rs 4 536 225 million for the 220 kV Quaid-eAzam Apparel and Business Park Grid Station Rs 38,000 million for the installation of the 2×600 MW Coal Fired Power Project GENCO-I (Jamshoro) Rs 3 808 million for the Power Distribution Enhancement Investment Program-II Rs 4 499 million for the electricity distribution efficiency improvement project (MEPCO) Rs 3,691 509 million for the electricity distribution efficiency improvement project (HESCO) Rs 2,600 million for the 500 kV Matiari Moro-R Y Khan transmission line N E W S C H E M E S: For new projects the budget earmarks: Rs 6 250 million for land acquisition for the installation of a 1200 MW solar power plant in Layyah Rs 4,500 million for electricity distribution improvement Rs 6 000 million for the installation of an assets performance management system on 100 kV and 200 kV distribution transformers O T H E R N O TA B L E A L L O C AT I O N S: The budget also includes significant funding for power evacuation and infrastructure upgrades: Rs 34 148 335 million for the evacuation of power from Dasu Hydropower Project (HPP) Stage-1 Pakistan’s unemployment rate stands at 6.3% with 4.51 million jobless Youth unemployment in age group of 15-24 is the highest at 11 1% PR OFIT M o n to r i n g D e s k 5 6 million Pakistanis are expected to be unemployed this year marking a concerning increase of 1 5 million since 2021 Agriculture sector employs 37 4% while services sector employs 37 2% of 72 million workforce Pakistan s unemployment rate stands at 6 3%, with an unemployed population of 4 51 million according to the Economic Survey 2023-24 released on Tuesday The survey based on the latest available Labour Force Surveys (LFS) 2020-21 reports that the total labour force is 71 76 million, with 48 5 million in rural areas and 23 2 million in urban areas The employed labour force is 67 25 million, comprising 45 7 million rural and 21 5 million urban workers As per a news report the employment structure in Pakistan has evolved with technological transformation shifting employment from the agriculture sector (37 4%) to industry and services The services sector, now the largest growing sector, employed 37 2% of the workforce in 2020-21 Youth unemployment (aged 15-24) is the highest at 11 1% with 10 0% for males and 14 4% for females The 25-34 age group follows with a 7 3% unemployment rate, where 5 4% of males and 13 3% of females are unemployed Female unemployment is notably higher, especially among the 15-24 age group Over 13 53 million Pakistanis were working abroad in over 50 countries until April 2024 Approximately 96% of these workers have found employment in Gulf Cooperation Council countries, particularly Saudi Arabia and the UAE, contributing significantly to Pakistan’s economy through remittances In 2023 the Bureau of Emigration and Overseas Employment (BE&OE) and Overseas Employment Corporation (OEC) registered 862 625 workers for overseas employment a 4% increase from 2022 Saudi Arabia employed 49 5% (426,951) of these workers, followed by the UAE with 26 7% Oman, Qatar Bahrain and Malaysia also employed a significant number of Pakistani workers on the other hand according to the Economic Survey Pakistan s population growth rate at national level is 2 55% Despite comprising some 50% of population, women s participation in country’s labour force is considerably lower than that of men In contrast the growth rate in urban areas is 3 65% which is higher than population growth rate in rural areas 1 90% due to rural-urban migration The population density increased from 260 88 persons per square km in 2017 to 303 in 2023 Additionally, the average household size has decreased from 6 39 in 2017 to 6 30 in 2023 PR OFIT M o n i to r n g D e s k Total tax exemptions, concessions, zerorating, and special tax treatments to various businesses, sectors, lobbies, and investors cost the government Rs3 879 2 billion in 2023-24 up from Rs2 239 6 billion in 2022-23 This reflects an increase of Rs1 639 6 billion compared to the previous fiscal year The tax expenditure report for 2024, issued on Tuesday, revealed a 73% increase in the cost of tax exemptions compared to the previous fiscal year The report did not include revenue losses from tax exemptions for industrial units in former tribal areas Of the total Rs3,879 2 billion in exemptions for 2023-24, sales tax exemptions on local supplies of petroleum products accounted for Rs1 257 513 billion The Economic Survey 2023-24 highlighted that sales tax exemptions caused the highest revenue loss compared to income tax and customs duty exemptions Sales tax exemptions totaled Rs2,858 721 billion, customs duty exemptions Rs543 521 billion and income tax exemptions Rs476 960 billion The exemption on petroleum products imports caused an additional revenue loss of Rs81 225 billion The fixed sales tax regime on cellular mobile phones resulted in a revenue loss of Rs33 057 billion in 2023-24, up from Rs1 021 billion in 2022-23 The Federal Board of Revenue (FBR) reported a revenue loss of Rs214 billion from sales tax exemptions on imports in 2023-24 down from Rs257 billion in 2022-23 Sales tax exemptions on local supplies caused a revenue loss of Rs461 billion in 2023-24, an increase of over Rs328 billion from the previous year Income tax exemptions amounted to Rs476 9 billion up from Rs423 9 billion an increase of Rs53 billion Customs duty exemptions cost Rs543 5 billion in 2023-24, up from Rs521 7 billion, an increase of Rs21 8 billion The survey did not mention revenue losses from exempt business income for independent power producers (IPPs) or capital gains Tax credits resulted in a revenue loss of Rs24 374 billion in 2023-24 down from Rs52 133 billion in 2022-23 Income tax exemptions from special provisions of the Income Tax Ordinance resulted in a revenue loss of Rs62 756 billion in 2023-24, down from Rs68 841 billion in 2022-23 Exemptions from total income had a revenue impact of Rs293 460 billion Exemptions available to government income caused a revenue loss of Rs57 517 billion while deductible allowances caused a loss of Rs5 912 billion, down from Rs14 506 billion The reduction in income tax rates had revenue implications of Rs25 492 billion in 2023-24 up from Rs24 444 billion in 2022-23 g S A L E S TA X E X E M P T I O N S O N P E T R O L E U M P R O D U C T S M A J O R CO N T R I B U TO R TO R E V E N U E LO S S

COMMITTEE SUGGESTS CLOSURE, MERGER, OR HANDING OVER SOME GOVT DEPARTMENTS TO PROVINCES

TCONTINUED FROM PAGE 01

It is in this document that a government decides whether it will increase or decrease its expenditure in a particular sector The government also projects the revenues that it will collect through taxes and other sources in the budget and it is based on those estimates that the government allocates budgets to different sectors ministries and provinces So making a budget is an accounting exercise with underlying policy objectives The accounting exercise is divided into 6 essential steps namely, Preparation, Authorization, Execution, Reporting and Monitoring, Review and Policy setting This sounds a well-rounded approach to tackle the exercise however oftentimes the miscalculation in the first two steps renders the last 3 utterly moot A good example of that would be the last federal budget of FY24 which was changed majorly within days after being presented in the parliament The annual budget statement

(ABS) is the main document for the federal budget After the preparation and authorization the ABS makes its way to the senate and eventually to the public In terms of expenditures, the ABS categorically differentiates between “Receipts” and “Expenditures” R E V E N U E S/R

and the government during that year Combined these resources constitute federal gross receipts This means that the provincial share is deducted to arrive at net federal receipts available to finance the federation’s expenditures For the upcoming fiscal year Pakistan’s net fiscal revenue receipts is estimated to be at 10 377 trillion Meanwhile

fiscal year was Rs 40 billion For the Natural Gas Development Surcharge (GDS), which is the difference between the prescribed and sale price of gas that goes to the provinces the government projects Rs 25 618 billion next year This is down from the original budget of Rs 40 billion and the revised estimate of Rs 27 169 billion for the current year The Auditor General of Pakistan (AGP) is auditing the GDS claims of Sui Northern Gas Pipeline Limited (SNGPL) and Sui Southern Gas Company (SSGC) to confirm the actual collections The government also plans to collect Rs 3 537 billion through the PL on Liquefied Petroleum Gas (LPG) in fiscal year 2024-25 slightly up from the revised target of Rs 3 516 billion for the current year The original budget for PL on LPG for this year was significantly higher at Rs

PTI, JI, businessmen dub ‘IMF dic tated’ budget lethal, poisonous

to Rs 12970 billion which is a very cruel move of the government

He pointed out that non-tax revenue, which was a major source of inflation, had been surged to Rs 3,587 billion, adding the budget deficit, which according to the Federal Finance Minister would be 6 9 percent of the GDP, would go to the highest level in history PTI Spokesperson feared that the abolishment of tax exemptions on exporters would adversely affect domestic exports, besides the increase in tax on real estate sector would not only cause panic in the market but also encourage transactions through cash He went on to say that after paying the

money to the provinces the income of the federal government will be Rs 9119 billion which is insufficient to pay only Rs 9775 billion as interest PTI Spokesperson stated that for the first time, the pension bill has been increased of the civil government expenditure of Rs 839 billion to 1014 billion, adding that the salaried class has been strangled by increasing the tax rate from 35 to 45 percent and changing the tax slabs PTI Spokesperson stated that for the first time the tax on the real estate sector has been increased to 15% and for the poor section of non-filers to 45%, adding that inclusion of late filer category was another stupid move by the government He said that surprisingly Rs593 billion were allocated for the Benazir Income Support Program benefiting families only 9 3 to 10 million adding that in contrast to Shahbaz Sharif ’s claim of earmarking Rs1 800 billion for the agriculture package allocating only Rs5 billion was mere a joke

Thursday 13 June 2024 KARACH NEWS 03 PR OFIT A P P

H E high-level committee constituted to reduce the government s expenditures recommended on Wednesday to close, merge, or hand over some government departments to provinces It also recommended that government should introduce a contributory pension mechanism for newly-appointed employees and abolish the vacancies lying vacant for over a year Headed by the Deputy Chairman of the Planning Commission (PC) and comprising federal Cabinet, Establishment, and Power secretaries Dr Qaiser Bangali Dr Farrukh Saleem and Muhammad Naveed Iftikhar presented its preliminary report to Prime Minister Shehbaz Sharif containing its short and medium-term recommendations at a meeting held to discuss the reduction in government s expenses and the size of its infrastructure The committee suggested engaging the private sector for service delivery in the government departments, besides banning unnecessary travel of government officials to reduce expenditures by promoting teleconferencing Moreover the official vehicles should be withdrawn from the officers availing the monetisation facility it added Based on the said recommendations the prime minister constituted a high-powered committee instructing it to furnish a comprehensive report within 10 days, considering the best global practices Prime Minister Shehbaz expressed the hope that the recommendations by the highpowered committee would help save billions of rupees for the national kitty Federal cabinet members Ahsan Iqbal, Ahad Khan Cheema Muhammad Aurangzeb, Ali Pervaiz Malik, PM s Coordinator Rana Ehsan Afzal and relevant senior officers attended the meeting

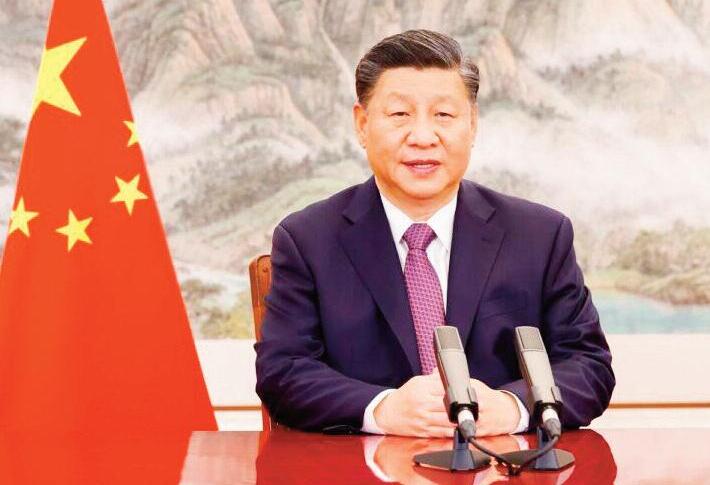

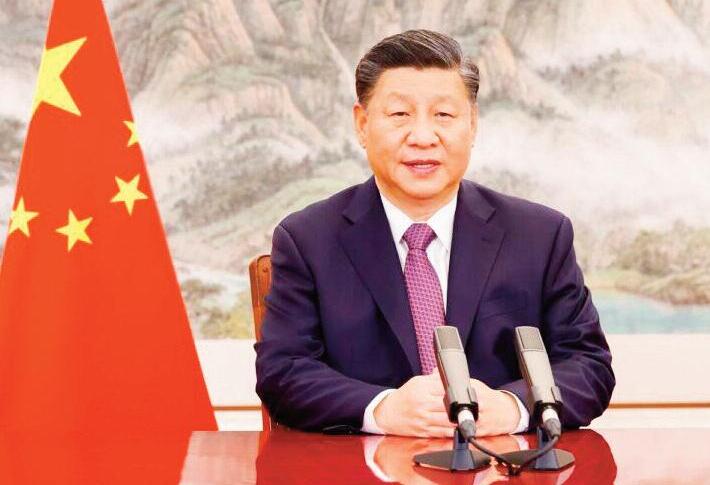

D e c o d i n g R s 1 8 . 9 t r fe d e r a l b u d g e t Sindh Gov t to present 2024-2025 budget on June 14 PR OFIT M o n to r i n g D e s k The Sindh government is set to present its fiscal year 2024-2025 budget on June 14 Chief Minister Murad Ali Shah will present the provincial budget According to media reports the budget will propose a 10% to 15% increase in salaries for Sindh s government employees No funds will be allocated for new development schemes; instead, the budget will focus on releasing funds for ongoing projects In contrast, the federal government will unveil its budget for the next financial year 2024-2025 on Wednesday The federal budget comes a day after the government announced that economic growth of 2 4% for the current year would fall short of the 3 5% target, despite a 30% increase in revenues over the previous year Both fiscal and current account deficits are reportedly under control Gov t sets aside over Rs79b to support IT sector growth. Will it amount to anything more than irrelevant IT Parks? CONTINUED FROM BACK PAGE The establishment of IT Parks underscores the government's focus on creating dedicated hubs with advanced facilities for startups and tech companies alike, which can attract domestic as well as international firms But Pakistan has an abundance of such IT Parks some of which are underutilized The country has 43 such parks located in 20 cities Last month, Prime Minister Shahbaz Sharif approved the establishment of 10 new IT Parks to be completed by next year Besides investment in IT Parks Rs20 billion was proposed to be invested in Digital Information Infrastructure Under its Digital Information Infrastructure Initiative, the government plans to enhance its capabilities to identify and block cyber threats to critical digital infrastructure Additionally Rs7 billion has been allocated for the digitalization of the Federal Board of Revenue (FBR) to expand the tax base and enhance revenue collection through advanced systems This could lead to a more transparent and efficient tax system which will increase government revenue Moreover Rs2 billion has been proposed for the Pakistan Software Export Board (PSEB) doubling last year s investment This funding will support student internships in IT companies which will help create a skilled workforce, and incentivize IT exporters According to the Pakistan Economic Survey 2023-24 the IT industry currently generates annual exports of around $2 6 billion To meet the ambitious target of $15 billion in annual exports within the next five years the sector needs to produce at least 200,000 specialized IT professionals Pakistan s ICT industry is robust, with over 20,000 IT and IT-enabled services companies registered with the Securities and Exchange Commission of Pakistan (SECP) The ICT export remittances have shown impressive growth, rising from $339 million to $2 283 billion during FY2024 (JulyMarch) compared to the same period last year In March 2024 alone, ICT services export remittances surged to $306 million a 36% increase from March 2023 Gov t extends hand to IMF with Rs18.9tr budget CONTINUED FROM PAGE 01 The government has set an ambitious tax collection target for the Federal Board of Revenue (FBR) at Rs12 970 billion a 38pc increase from last year s goal Aurangzeb expressed the government s commitment to tackling inflation, a top priority, and noted significant progress in reducing price pressures “Inflation had surged to 38pc a year ago with food inflation reaching 48pc causing hardships for low-income households I m pleased to report that our improved economic strategy has successfully brought inflation down,” Aurangzeb said The government has set an inflation target at 12pc for next fiscal year aiming to rein in prices P S D P C O N C E R N S The government has allocated Rs3 792 2 billion for the Public Sector Development Programme (PSDP) in FY25, a 40pc increase from last year ’s Rs2,709 billion The total federal PSDP which includes state-owned enterprises and public-private partnerships has received a boost with an allocation of Rs1 696 billion representing a 47 5pc increase from last year s Rs1,150 billion Provincial PSDP allocation, on the other hand, has risen 34 4pc to Rs2,095 billion, up from Rs1 559 billion in the previous year However this remained a sensitive subject because of the PPP Earlier PPP leader Khurshid Shah speaking to reporters said the party had reservations with regard to the Public Sector Development Programme (PSDP) budget and that the PPP should have been taken into confidence for the budget “It was decided that the PSDP for the four provinces would be decided together he said while speaking to the media We are in the same boat If something goes wrong, it would be not just for the PML-N, but for us as well [as allies],” the PPP leader said, adding that the decision to not take part in the speech was to protect their party CONTINUED FROM PAGE 01 It was the trip to China undertaken by the prime minister accompanied by a large cohort of business leaders that caused some uncertainty about when the budget would be presented The trip clearly took priority for the Sharif administration particularly since foreign investment from China has been one factor that the government has regularly relied on particularly in the past 15 years since the China Pakistan Economic Corridor (CPEC) has been active But the results of the trip were less than ideal The finance minister alluded to the trip during his speech and tried his hardest to present the best possible picture Foreign investment is important for our debt repayments and for Pakistan s image In this regard, conversations with brotherly and friendly countries are ongoing and are at an advanced stage I would like to mention the Prime Minister s recent visit to China, which was meant to rejuvenate CPEC and bring about phase ii Chinese Companies are being offered Special Economic Zones and Pakistani companies are also being offered the chance to make Joint Ventures with Chinese business entities PAKISTAN HITS A WALL IN CHINA? The comments in the speech made it sound like Pakistan was right on the brink of a breakthrough But between the lines one can see that the Pakistani delegation returned from China nearly empty handed This does not mean that diplomatic relations with China are strained In fact the delegation was met with a warm welcome and the Prime Minister met with President Xi Jinping and other top officials in Beijing but Chinese investors seemed reluctant to trust Pakistan as a reliable place to put their money in As the finance minister explained, the government and Pakistani business people attended a conference in Shenzhen with 97 Chinese companies but failed to sign any MOUs The claim was that these were under discussion in different sectors including iron and steel, Mobile Solar Cells, EVs, automobiles, and manufacturing, but only six MOUs were actually signed by the Board of Investment with six different Chinese companies for B2B collaboration It is a dire state of affairs since Pakistan is desperate for foreign investment to boost its foreign exchange reserves Some light needs to be shed on the role of the Special Investment Facilitation Council (SIFC) as well During his speech, Mr Aurangzeb made it a point to praise the council “Here I would like to acknowledge the role of the SIFC which is playing a key role in bringing investment from GCC countries in areas such as livestock, mining, and agriculture, he said The problem here has been that the SIFC, which was meant to provide foreign investors with a stable body to deal with removed from the rapidly changing political landscape of Pakistan has failed to attract any significant investment Since the SIFC was announced in June 2023, Net Foreign Direct Investment has not risen significantly and has continued to follow the same trends it has seen since around June 2020 when Pakistan’s economy began to overheat in earnest and inflation and political tensions were climbing At the start of June 2023 when the SIFC was announced, the 12-month moving average of Net Foreign Direct Investment was at around $150 million in Pakistan In the one year since this average amount actually fell significantly twice and the last major inflow was when Suzuki decided to delist from the Stock Exchange, which was actually them taking a step back from Pakistan At the end of the year, the overall amount was still at $150 million meaning it had not risen at all T H E P O S I T I V E S There have been some serious hopes however, that the SIFC will be able to get some investment into Pakistan In May this year, the UAE allocated $10 billion for investment in Pakistan’s promising economic sectors The announcement comes following talks between UAE President His Highness Sheikh Mohamed bin Zayed Al Nahyan and Pakistan Prime Minister Shehbaz Sharif in Abu Dhabi The Prime Minister later announced that this investment would come through the SIFC and would be managed as such However, since no amounts have been transferred yet it has not had an impact on the actual foreign investment numbers coming into Pakistan A u r a n g ze b t r i e s t o p r o p u p S I F C a s fo r e i g n i nve s t m e n t o u t l o o k r e m a i n s b l e a k g A L S O R E CO M M E N D S I N T R O D U C I N G A CO N T R I B U TO RY P E N S I O N M E C H A N I S M F O R N E W LYA P P O I N T E D E M P LOY E E S , A N D A B O L I S H I N G T H E VAC A N C I E S LY I N G VAC A N T F O R O V E R A Y E A R

E C E I P T S Receipts or revenue consists of balances of all budgetary receipts, e g Revenue Receipts, External Receipts, Public Account Receipts Revenue receipts contain all the tax and non-tax revenue to be collected by the FBR

the total receipts is estimated at its highest ever Rs 24 38 trillion Total revenue receipts both tax and non-tax add up to around Rs 17 815 It s important to note that the distribution of revenue between the federal government and the provinces is guided by the principles laid out in the NFC Award The award determines the share of each province in the federal revenue pool based on factors such as population backwardness revenue generation capacity, and other socioeconomic indicators While this award has been highly criticised by economic experts at various levels the provincial share in this year ’s budget turned out to be Rs 7 438 trillion It is important to note that this amount is not only more than the total income tax estimated to be collected by all filers (Rs 5 4 trillion but also at par with the total indirect taxes Pakistan is estimated to collect during this year i e Rs 7 45 trillion Additional resources in receipts may include privatisation proceeds plus credit from the banking sector to finance government expenditures CONTINUED FROM PAGE 01 One of the biggest earners for the federal government is in fact petrol The government actually budgeted in a way that it expected to collect nearly Rs 900 billion from the petroleum levy But the sales tax on petrol would be subject to the NFC award which means the government would have to share the spoils with the provinces F I N A N C E B I L L’S P R O V I S I O N S According to the Finance Bill 2024 the maximum petroleum levy rate will now be Rs 80 per liter an increase of Rs 20 per liter over the previous rate of Rs 60 on both petrol and high-speed diesel The levy on Light Diesel Oil (LDO), High octane blending component (HOBC), and E-10 gasoline will also increase by Rs 25 per liter to Rs 75 per liter Originally the budget for the current year set the PL target at Rs 869 billion Thus, the new target is a 47 4% increase over the previous year s goal and it is expected that prices of petroleum products will be increased due to increase in the rate of PL Additionally the government aims

maintain the Gas Infrastructure Development Cess (GIDC) collection at Rs 2 5 billion for the fiscal year 202425 the same as the revised target for 2023-24 The original budget for GIDC in the current

12 billion Additionally, the budget for fiscal year 2024-25 includes Rs 25 billion to be retained as a discount on local crude oil prices the same as the revised estimate for the current year but up from the original budget of Rs 20 billion The budget for next year proposes a decrease in the royalty on crude oil and an increase in the royalty on natural gas for provinces The royalty on crude oil is set at Rs 58 654 billion for next year up from the revised estimate of Rs 57 017 billion for the current year The royalty on natural gas is budgeted at Rs 103 751 billion for the next year, compared to the revised target of Rs 93 567 billion and the original budget of Rs 75 billion for 2023-24 The budget also includes Rs 28 billion for a windfall levy on crude oil up from the Rs 20 billion budgeted for the current year The windfall levy on gas is budgeted at Rs 400 million, an increase from Rs 220 million this year Miscellaneous receipts from oil and gas companies are expected to generate Rs 1 528 46 billion next year compared to a revised target of Rs 1,197 8 billion and the original estimate of Rs 1,141 billion for the current year Petrol prices doomed to spike as govt raises petroleum lev y. Will govt be able to collec t Rs1.3tr from it? Despite assurances, salaried class burdened with more tax responsibilit y CONTINUED FROM BACK PAGE This is an increase of 23 5% in terms of rate of increase As income reaches Rs 6,000,000 on an annual basis, the tax expense was Rs 1,095,000 which would be Rs 1,365,000 This would mean that an effective tax rate of 18 3% will go to 22 8% The employees would see an increase in expense of 24 7% Even though the increase for the tax slabs between Rs 1,200,000 and Rs 6,000,000 has decreased, they are still seeing an increase in their tax expense of more than 25% which means that they will bear some of the pain of the new taxation policy As the tax slabs keep increasing the rate of increase falls in terms of the expense being borne by the employee At an annual salary of Rs 12,000,000, the employee used to pay tax of Rs 3,195,000 and will now end up paying Rs 3,465,000 This takes his effective tax rate from 26 6% to 28 9% In terms of increase this is only an increase of 8 5% The last slab covered by the law is for people earning more than Rs 24 000 000 annually They will see their tax expense increase by 3 7% from Rs 7,395,000 to Rs 7,665,000 Their effective tax rate will go from 30 8% to 31 9% CONTINUED FROM PAGE 01 He stated that the budget would trigger a storm of inflation due to heavy taxes on the people adding that on the dictations of the IMF the tax target was increased by 48%

to

IN a sense, this is the first Budget presented by a Shehbaz government It had presented one before, in fact the Budget running out on June 30 but that was almost presented while staring down the barrel of a dissolution to be followed by a general election It had been a time for a Budget in which the mouths of the coffers would be thrown open but they were not Similarly this Budget was expected to be a scorcher as the Finance Minister who was making his maiden presentation, was still involved in negotiations with the IMF, from whom a package was urgently required It remained to be seen whether the Budget would meet its requirements

The petroleum levy has been increased by Rs 20 or Rs 25 per litre, meaning that the government wants to keep fuel at its peak Of course, if international oil prices also go up, the levy would remain However, the General Sales Tax has not been increased At the same time, the Federal Board of Revenue has been set an ambitious target of Rs 13 trillion, including upward revisions in the income tax Retailers have been spared a dreaded turnover tax

An interesting aspect of the taxation measures has been the zero-rating of materials used in solar panels inverters and lithium-ion batteries That seems directed to encourage the manufacture locally of solar panels in the teeth of Energy Ministry resistance and campaign for the reversal of the present policy of adoption of solar power The impression also came through that the IMF favoured some sort of revision of the current policy, as the distribution companies were finding that consumers switching to solar power had led to their already weak financial positions weakening even further As the IMF places great store by the circular debt issue, it has taken the side of the power companies The problem is that, among all sectors and industries, the power industry is in a state of flux in which the traditional power generation companies are the past, but are still very influential

One of the components missing in the Budget was how to achieve a major increase in exports

Without such an increase there is no hope of escaping the debt trap in which the country is enmeshed With Rs 9 8 trillion earmarked for debt servicing just over half of the total no-development outlay of Rs 18 9 trillion, the Budget was clearly not an easy one to make It avoided putting much further burden on the populace, though that is to damn with faint praise

Dedicated to the legac y of late Hameed Nizami

S u f i s m i n I s l a m

to be shunned altogether for spiritual benefits Islam

Calling a spade a spade

SO deeply has tasawwuf or the Sufi interpretation of Islam been ingrained in the Muslim psyche and since such a long time back that it is considered by many especially so in the Indian subcontinent but by no means there only to be the true Islam Anybody who even suggests therefore that Sufism is more accurately categorized as a parallel religion than as the most popular interpretation of Islam exposes himself to unpleasant epithets It is true that all manifestations of the revealed religion have had mystical streams Why something as legal as Judaism has had one! Islam is no exception This was inevitable considering the human propensity of blending various items into a mixture whether they mix well or at all But this does not change the fact that Sufism (mysticism) and revealed religions are essentially two completely different things There are, no doubt any number of similarities between the two in terms of practices or derived beliefs but all such similarities are merely superficial when one considers the quite irreconcilable differences between their respective foundations Not only is Sufism not based on the Quran and the Sunnah, it contradicts them on the foundational concepts of God, Prophethood and Revelation and the Hereafter Those who dispute this either do not have the foggiest idea about Islam or know next to nothing about mysticism; probably both

When it is said that Sufism is a parallel religion it does not mean that there is no good in it whatsoever Nor that no good man has ever been associated with it Incidental good can emerge from almost anything That does not mean that all those things are worth advocating Even a broken clock is right twice a day As for good folks there have been many from the Sufi tradition There have been numerous decent human beings hailing from the atheism camp as well; as well as belonging to all the theistic interpretations under the sun for that matter What does that prove though?

That there could be great superficial similarity despite fundamental differences can be illustrated by considering (for instance) the stance of Sufism and Islam on material comforts Both teach that corporeal gains are not worth compromising one s integrity for But Sufism bases this on its broader contention that worldly desires are great evils in themselves, ideally

m b r a c i n g A r t i f i c i a l I

in stark contrast, uses the exact same word (khair) for good as well as a man s income It only stresses the need to be responsible while pursuing worldly success Similarly, Sufism has many other (apparently) good things going for it: its monasteries have been sources of food shelter and education for centuries; numerous Sufi sheikhs have served as spiritual guides and mentors to multitudes of disciples tending to their material, spiritual as well as psychological needs All this is commendable But for it to be called a stream of Islam, Sufism must share Islam’s fundamentals; which unfortunately it does not by a long stretch

The sources of Islam are the Quran (for doctrine) and the Sunnat (for practice) – both transmitted via Prophet Muhammad (peace be upon him) As for Sufism, the Prophet never taught or practised any of it The Sufis realize that the inability to properly ground their doctrines and practices is a serious shortcoming on their part They tend to solve this problem in one of three ways First: resorting to the private- or the esoteric- interpretation of the Quran where any of its verses can be given any arbitrary meaning that suits the interpreter This solution hardly merits a comment Second: by claiming that although they do not apparently derive their interpretation from the Prophet (PBUH), he is the source of it nevertheless–the way a melon inside the darkness of the earth grows by benefiting from the heat of the sun without knowing about the process (the famous melon analogy) This raises one question: How come these melons figured it out then?

The third explanation is that in addition to the religion he passed on publicly, the Prophet also taught Sufism, privately and in secret, to a select group; and an unbroken chain has continu(PBUH) that if he fails to deliver God s undiluted and unadulterated message to everybody he will not have fulfilled his mission This last rationalization leads directly to the class structure involved in the teachings of Sufism to this day In Sufi circles therefore, there is one religion for the masses, another for the elite, and yet another for the super-elite Their professed doctrines change dramatically according to their audience; and they are especially careful about whom they take into confidence regarding the more controversial of their teachings The Sufis ambivalence regarding Mansoor al-Hallaj is illustrative He is revered in their circles The complaint against him, however, is that he should not have divulged the secret in public The problem is not with what he said but with where he said it

There is this unfor tunate tendency among many Muslims to

criticism against any of their beliefs as motivated by ulterior

Ulterior motives and mala fide are facts of life , but only God

whether they are there in any given case . As far as mere

tals are concerned then, the criticism still has to be addressed

n t e l l i g e n c e

Atial to disrupt industries, create new job categories, and alter work, with countries leading in AI innovation potentially gaining economic advantages The race for AI dominance in geopolitics raises concerns about arms races technological espionage and power imbalances AI integration into military systems raises ethical and strategic questions about autonomous weapons and cyber warfare Ethical

policymakers, businesses, and societies, necessitating effective governance and collaboration to harness its benefits while mitigating its risks With a growing youth population Pakistan is at the precipice of a transformative era driven by technological advancements AI represents the emulation of human intelligence processes by machines, encompassing technologies such as machine learning, natural language processing, and computer vision Its applications are far-reaching altering the way we live work and interact

The AI age is also transforming the employment model in Pakistan presenting both challenges and opportunities for the youth As AI disrupts traditional job roles, individuals must adapt to new skill-sets that require creativity, critical thinking, and adaptability Upskilling and reskilling initiatives are crucial to equip the youth with the competencies demanded by the AI-driven economy Access to AI education and training programmes provides young individuals with the tools and skills necessary to thrive in an increasingly digital world AI holds the potential to drive innovation and entrepreneurship among Pakistani youth With the rise of AI-powered startups and initiatives young innovators are harnessing the technology to address pressing societal challenges and create meaningful solutions However, the proliferation of AI raises concerns and challenges for Pak-

istan s youth The rapid pace of technological advancement risks exacerbating existing inequalities, particularly in terms of access and opportunity Disparities in digital literacy and infrastructure may widen the gap between urban and rural youth hindering inclusive development and socioeconomic progress Ethical considerations surrounding AI loom large necessitating careful deliberation and regulation to ensure responsible and equitable deployment By grappling with these ethical dilemmas and navigating the ethical dimensions of AI Pakistani youth can chart a path towards inclusive and sustainable development in the 21st century The integration of AI may initially lead to job displacement, but proactive measures can mitigate these effects by fostering an environment conducive to innovation and entrepreneurship AI-driven efficiencies can enhance productivity potentially offsetting job losses with new opportunities in emerging sectors such as data analytics machine learning and robotics Emerging job opportunities emerge as AI permeates various industries, demanding specialized skill-sets Data scientists, AI engineers, cybersecurity specialists, and digital transformation experts are among the roles in high demand Encouraging STEM education equips youth with the skills needed to thrive in these domains

The private sector plays a pivotal role in driving AI adoption and fostering youth employment by investing in research and development, facilitating industry-relevant training programs, internships and mentorship initiatives The government’s responsibility is to craft policies that facilitate a smooth transition to the AI-driven economy promoting digital literacy vocational training, and entrepreneurship Universities serve as incubators of talent, preparing the youth for the challenges and opportunities presented by AI Curricula should be updated to incorporate AI-related subjects providing students with practical skills and hands-on experience Partnerships with industry enable universities to offer internships co-op programs and industry projects, ensuring graduates are equipped with the skills sought after by employers Parents and society play a crucial role in

shaping the aspirations and career choices of the youth Encouraging a culture of lifelong learning and embracing change fosters resilience and adaptability, while destigmatizing vocational education and non-traditional career paths promotes diversity in the workforce Meanwhile, the broader community has a crucial role in influencing the career choices and ambitions of young individuals fostering a mindset of continuous learning and embracing diverse career paths Destigmatizing vocational education and promoting diverse career options ensure inclusivity and provide opportunities for all segments of society Collaboration among stakeholders is vital as Pakistan navigates the AI revolution By embracing innovation investing in human capital and fostering an inclusive ecosystem Pakistan can harness AI s transformative potential for sustainable economic growth and societal development Government support should be allocated for AI research and development, with centres of excellence and grants for universities and research institutions Industry collaboration should be encouraged with internship programs apprenticeships and partnerships with tech companies To promote entrepreneurship, a conducive environment should be created, offering incentives like tax breaks, grants, and incubation centres A robust digital infrastructure should be built including high-speed internet connectivity and data centres Skills development should be implemented with training programmes and workshops to upskill the workforce in AI technologies A clear regulatory framework should be developed, addressing ethical and privacy concerns while fostering innovation International collaboration should be encouraged to share best practices and resources in AI development and implementation Public awareness should be raised about the benefits and risks of AI, and lifelong learning and professional development should be encouraged By following this roadmap, Pakistan can position itself to capitalize on AI opportunities and become a leader in the new world order of technology

The writer has a PhD in Political Science and is a visiting faculty member at QAU Islamabad He can be reached at zafarkhansafdar@yahoo com and tweets @zafarkhansafdar

International collaboration should be encouraged to share best practices and resources in AI development and implementation Public awareness should be raised about the benefits and risks of AI, and lifelong learning and professional development should be encouraged By following this roadmap, Pakistan can position itself to capitalize on AI opportunities and become a leader in the new world order of technology

Insane loadshedding

Tentative schedule

04 Thursday 13 June 2024

Lahore – Ph: 042-36300938, 042-36375965 I K arachi – Ph: 021-32640318 I Islamabad – Ph: 051-2204545 I Web: www pakistantoday com pk I Email: editorial@pakistantoday com pk 2 0 2 4

2 5 b u d g e

COMMENT

-

t

Editor Pakistan Today Babar Nizami Editor Profit

Founding Editor

M A Niazi

Arif Nizami (Late)

C O N S I S T E N T LY insufficient water and gas supplies have disturbed the people of North Karachi financially and psychologically as they have to purchase gas cylinders and water tankers at exorbitant rates as a matter of routine The relevant authorities should resolve these issues immediately UZAIR HUSSAIN SIDDIQUI KARACHI Public safet y I N a recent incident, armed assailants shot dead two cousins, a teacher and a farmer, near Bukshapur in Kashmore The criminals easily escaped police pickets without resistance, which has eroded public confidence in the law-enforcement mechanism An urgent action is needed against such brazen lawlessness JAMALUDDIN BANGWAR KASHMORE

Deprived citizens

THE period of loadshedding in parts of Lyari has gone up to over 15 hours per day This is insane There can be no justification at all The situation is affecting the mental and physical health of the residents The value of their properties has dropped significantly due to this very issue which means the residents are now bound to stay because they cannot plan to sell their houses and move to some other area in search of mental peace Several complaints have been lodged with all the relevant authorities but nothing has brought about any positive change in the situation The only reason cited constantly by K-Electric (KE) is line losses By KE s own account, the recovery rate from the area is 70pc Now, how are people supposed to act against line losses? KISHEN HARIDAS KARACHI

T H E Balochistan Public Service Commission (BPSC) had announced the positions of Tehsildar and Naib-Tehsildar back in 2022 After facing some legal challenges the commission advertised them again a couple of months ago Many aspiring candidates have been preparing for the said exams for more than a year now The BPSC has kept them in a state of confusion which is causing depression and stress among them This incomprehensible strategy is a source of pain and sleepless nights among the unem- ployed youth The commission should at least announce a tentative schedule for the exams so that the aspirants may have some idea about what lies ahead ENGR MUHAMMAD ABID KHAN ZHOB

tage IN Sindh, people are facing several challenges, but the most disheartening is the shortage of the life-saving anti-rabies vaccine In Sindh, patients are forced to go to Hyderabad for treatment According to the total number, 423 in October and 1226 in November patients were brought to Hyderabad for treatment Moreover Sindh is not the only province where health facilities are unavailable but unlike the rest of the country people are facing these problems A report occurred of severe shortage in Peshawar earlier this year The health authorities blame the unavailability of the vaccine Furthermore, rabies is one of the worst problems in Pakistan, that is underreported and undersigned ESSIYAN DAD SINGABAD E d i t o r ’ s m a i l Send your letters to: Letters to Editor Pakistan Today 4-Shaarey Fatima Jinnah Lahore Pakistan E-mail: letters@pakistantoday com pk Letters should be addressed to Pakistan Today exclusively

Rabies vaccine shor

RT I F I C I A L intelligence (AI) is a transformative force that is reshaping societies worldwide AI has the poten-

considerations include privacy, bias, accountability, and human rights impact Robust governance frameworks are needed to ensure responsible AI development and deployment AI can transform various aspects of society but there are concerns about job displacement, inequality, and social cohesion The rise of AI presents both opportunities and challenges for

E

Dr ZAFAr KHAN SAFDAr

In the Quran and the Sunnah there is none of this distinction Levels of understanding would naturally vary from individual to individual but their teachings remain exactly the same whether it is a recent revert or a man who has been Muslim all his long life The Quran is wonderfully consistent from cover to cover; and so is the Sunnah Despite the popularity of the Sufi interpretation calling it traditional Islam (as its enthusiasts so like to do when they pitch it against Political Islam say) is misleading It is old, no doubt, but reference to the word traditional inevitably gives rise to questions such as: Which tradition? Tradition starting where? When? For what significance can a tradition have if it does not go back far enough? In summary Sufism is a parallel religion despite the continuing popularity of the Sufi interpretation of Islam and the fact that its adherents outnumber those of other interpretations put together For these matters can hardly be settled on the basis of how many men happen to be on which side Majorities and minorities, while they legitimately decide which party forms a government do not amount to anything when it comes to issues such as this Islam is that which is contained in the Quran and the Sunnah This will be true even if one Muslim in the whole world adheres to it There is this unfortunate tendency among many Muslims to dismiss criticism against any of their beliefs as motivated by ulterior motives Ulterior motives and mala fide are facts of life but only God knows whether they are there in any given case As far as mere mortals are concerned then the criticism still has to be addressed If someone wants to repudiate the parallel religion position, one must do so on the basis of arguments from the Quran and the Sunnah, not by attacking the critic Sadly, the latter is all that enthusiasts of Sufism ever do The author is a connoisseur of music literature and food (but not drinks) He can be reached at www facebook com/hasanaftabsaeed HASAN AFTAB SAEED

dismiss

motives.

mor

knows

Pa ki s t a n’s yo u t h e m p l oy m e nt o d y s s e y

A strategic alliance or tactical bluff?

to threaten going nuclear

MO S C O W brought up the possibility of using nuclear weapons in Ukraine once again However, deploying such weapons involves several critical factors First the weapons must be deliverable meaning they need to reach their target accurately Second the target must be valuable enough to justify the use of such a powerful weapon, ideally causing minimal damage to nearby friendly cities

The most important thing is that the country launching the attack must be confident that its enemy cannot or will not respond with a nuclear attack The uncertainty about how the attacked country might respond, the ability of the attacker to survive a counterattack, and whether the initial strike would be devastating enough are significant unknowns This uncertainty is a major reason why nuclear weapons have not been used since the bombings of Hiroshima and Nagasaki Russia s threats to use nuclear weapons are more about creating fear than actual plans to use them The main goal is to make the USA and its allies reconsider their support for Ukraine by raising the stakes of the conflict Despite the repeated threats Russia has not followed through with a nuclear attack largely due to the many uncertainties involved More interesting is China s reaction to Russia’s threats Initially, China maintained a neutral stance on the Ukraine conflict, even abstaining from a United Nations vote condemning the war rather than supporting Russia However as the war dragged on and China s relationship with the USA worsened

China s position shifted The need for a strong ally and economic partner became more pressing, and Russia fit this role At the same time, Russia began to realize that it would not easily win the war in Ukraine and might not win at all Like China Russia s biggest challenge was the USA Moscow s recent nuclear threats are part of a strategy to increase the perceived risks for the USA in supporting Ukraine The complexity and risks associated with a nuclear strike combined with the strategic and political dynamics involving China and the USA highlight why these threats are more about posturing than immediate action This ongoing situation underscores the complicated balance of power and the high stakes involved in the Ukraine conflict

An alliance goes beyond just a press release and a handshake although it is often mistaken as such It involves real cooperation and the creation of complementary weapons and forces to defeat a common enemy While there are non-military alliances, every alliance assumes that both sides have, or can obtain, the necessary tools to successfully wage war when needed The main goal of any alliance is to significantly strengthen a joint force Many have assumed that Russia and China would form an alliance to challenge or weaken the USA However, this has not happened The USA, supported by its NATO allies, posed a land challenge to Russia In theory, Russia could have used Chinese troops in the Ukraine war but the distance between the two countries

made logistics difficult Moreover China s primary interest was to prevent the USA from blockading its ports or creating a defensive line of islands Additionally, China and Russia have a contentious history, marked by numerous invasions and conflicts After a clash on the Ussuri River China formed an anti-Russian agreement with the USA in the 1970s which included an intelligence-gathering post for the USA in China Given their tense history, it was surprising when, after Russia hinted at using nuclear weapons, China suggested that using them against the USA was reasonable This created a verbal alliance between the two countries without any real commitment China is known to be a nuclear power and U S intelligence monitors the situation closely Therefore, China s statement did not change the overall dynamics Speculating on China’s purpose, it seems that Russia might be facing peace talks that President Vladimir Putin has already discussed China likely does not want to deal with a more confident USA By temporarily aligning with Russia and mentioning the nuclear option, China aimed to create the perception of a strong alliance with Russia, while also signaling that it does not fully trust the US capabilities Alliances are complex and involve much more than simple agreements They require material cooperation and the ability to create a powerful joint force The assumed RussiaChina alliance to weaken the USA has not materialized, due to logistical challenges and a history of conflict China’s recent statements about nuclear weapons create a superficial alliance with Russia mainly as a strategic move to manage the balance of

Modi the authoritarian will have to learn to compromise

The shif t from collec tive Cabinet responsibilit y to one individual has ended and the shif t back has begun

cause of course they will listen to what concerns them Modi has an advantage over alliances of the sort that began just after P V Narasimha Rao s government fell And that advantage is that he has 240 MPs His predecessor as NDA leader three-time Prime Minister Atal Behari Vajpayee had only 180 MPs in his last term That meant more vulnerability to allies to the point where the alliance itself was becoming the news There was a fascinating report in February 1999 about Vajpayee sending defence minister George Fernandes to assuage AIADMK leader and NDA partner Jayalalitha George Fernandes flew to Chennai to her Poes Garden residence with the BJP s Pramod Mahajan after he was given an appointment But they were not given an audience Instead, Jayalalitha admonished Fernandes over the intercom and they left Another news story from November 2001 headlined “Mamata sulks over PM refusal for Cabinet berth reported how the TMC boycotted a Cabinet meeting after joining the NDA The BJP s then president, Jana Krishnamurthy, said: How can somebody expect to become a minister immediately? There are our own MPs aspiring to be ministers and they have been waiting for quite a while The reference was to two BJP Lok Sabha MPs from Delhi Madan Lal Khurana and Sahib Singh Verma who had been waiting for ministerships and they were also sulking