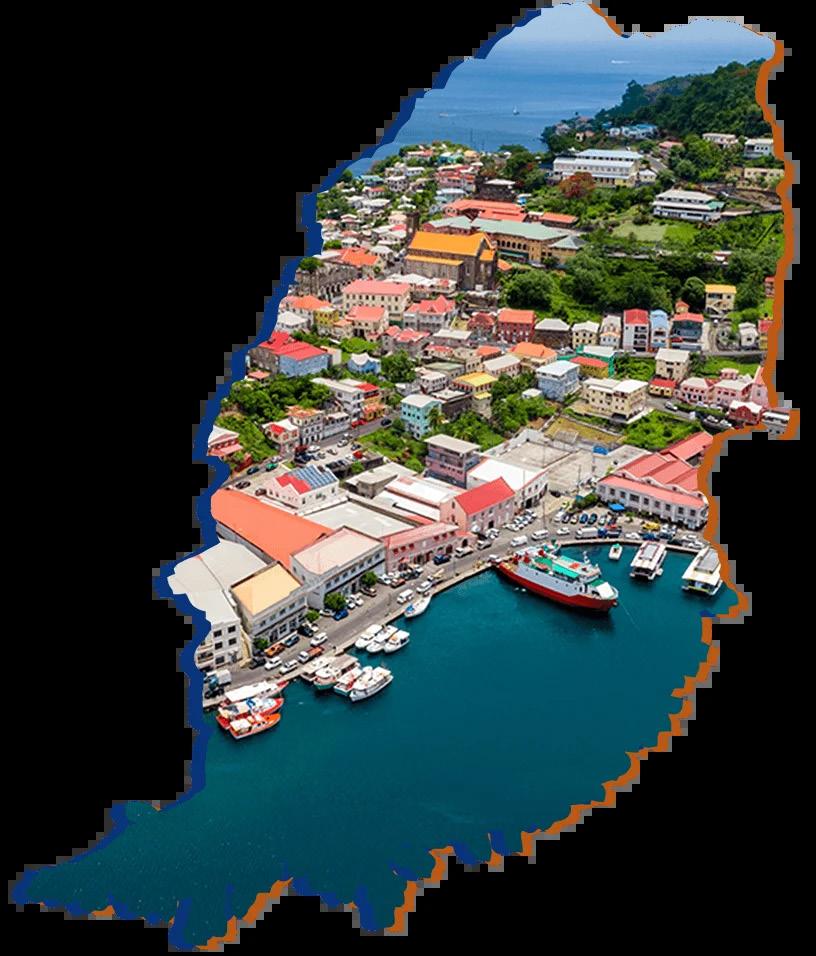

With an economy supported by strong legislative and regulatory frameworks, a robust foreign investment program, and political stability, Grenada’s investment climate is thriving

Writer: Lily Sawyer | Project Manager: Krisha Canlas

An increasingly attractive investment destination, Grenada has certainly recovered from the prior impacts of the COVID-19 pandemic, which saw the country’s tourism-driven economy decline.

Bouncing back, 2022 saw Grenada’s GDP grow by a robust 7.3 percent, followed by a healthy 4.8 increase the following year. This is due, in part, to the strong performance of the tourism, manufacturing, and construction sectors during this period.

Today, one of the fundamental objectives of Grenada’s government is to promote private sector and foreign direct investment (FDI) activity on the island to facilitate continued economic growth.

Specifically, Grenada continues to experience a wave of FDI through its highly successful Citizens by Investment (CBI) program, which was introduced in 2014 as an investment migration scheme offering participants a second citizenship through investment. It was subsequently rebranded to the Investment Migration Agency (IMA) in 2024 to emphasize due diligence and attract local support.

The program has seen unprecedented applications and continues to provide support for stakeholders looking to navigate the island’s business landscape.

In addition to IMA, Grenada offers a comprehensive range of investment incentives, including investment allowances, deductible expenditures, and customs duty exemptions.

Ronald Theodore, CEO of the Grenada Investment Development Corporation, outlines the organization’s critical role in facilitating investment on the island, alongside plans to continue its targeted investment model, infrastructure development, and policy advocacy going forward

North America Outlook (NA): Firstly, could you introduce us to the Grenada Investment Development Corporation, including your three strategic business units? How do they nurture and promote Grenada as a prime investment and business development location?

Ronald Theodore, CEO (RT): The Grenada Investment Development Corporation (GIDC) was established in 1985, and on 1st March this year, we’ll be celebrating our 40th anniversary. I strongly believe that, over these 40 years, we have made a solid impact on Grenada’s economy.

As an organization, GIDC has three strategy-based business units – the Investment Promotion Agency (IPA), the Business Development Center (BDC), and the Facilities Business Unit (FBU).

Through our business units, we see ourselves doing more than just promoting investment. While most

Caribbean countries have an active IPA, we have other units that comprise GIDC; thus, we see ourselves as more of an economic development agency.

First and foremost, the IPA promotes and facilitates investment on the island, assesses investors, advises on the do’s and don’ts, and provides information on Grenada’s legal and regulatory framework.

We also facilitate the grant of incentives to qualifying investments. The IPA is additionally involved in aftercare, providing post-investment support.

Elsewhere, we are heavily involved in policy advocacy. By meeting with investors and businesspeople alike, we have a clear understanding of what they would like to see happening in Grenada’s business environment, and we make policy recommendations to the government on potential changes inclusive of investment incentives and tax reforms.

The BDC, meanwhile, works with micro, small, and medium-sized enterprises (MSMEs).

GIDC has a suite of packages and services on offer to allow MSMEs to grow from strength to strength, not only assisting with business name registration and company incorporation, but playing an instrumental role in providing training to MSMEs through its two training centers, where individuals are trained in several areas such as QuickBooks, record-keeping, business plan development, and customer services. Training is carried out either by GIDC or external facilitators. Most of our training is demand-driven and based on the requirements of our MSMEs.

We carry out diagnostic studies and advise on pricing and costing for MSMEs in addition to a suite of packages. Then, there is grant assistance, through which we help entrepreneurs complete the sometimes cumbersome grant forms.

Meanwhile, the FBU has three business parks –Frequente, St. Patrick’s, and Seamoon – and we remain the largest landlord on the island with approximately 60 tenants.

The FBU occupies 285,000 square feet (sqft) of commercial space on 38 acres of land across the three parks. Various operations take place, including agroprocessing, manufacturing, and business process

outsourcing (BPO), and our role is to ensure tenants are satisfied while continuing to make new space available for emerging businesses.

GIDC’s shared services provide support to strategic business units, namely financial, human resource management, legal, research, and monitoring and evaluation.

NA: What did GIDC initially set out to achieve when it was established as the Grenada Industrial Development Corporation back in 1985? How have you evolved since?

RT: GIDC was established to assist investors doing business on the island and play a critical role in facilitating investment incentives.

When we were first established, there were pieces of legislation which allowed investors to benefit from incentive support, both within the manufacturing and hotel sectors, which at that time were the two main areas investments facilitated.

Back then, GIDC’s approach was very reactive –investors would decide to invest on the island, and we would assist them with incentive support and in securing necessary consents and licenses.

Its strategic goal is to promote local and foreign investment, facilitate and strengthen entrepreneurial development within the growth sectors of Grenada’s economy, which comprise:

1. Tourism and hospitality services – Focusing on niche areas such as boutique hotels and the marina sector.

2. Agribusiness – With a focus on adding value to local produce such as fishing and fresh produce and developing farming through methods such as hydroponics and vertical farming.

3. Health and wellness – Targeting investments in retirement homes and wellness and rejuvenation centers.

4. Information and communication technology (ICT) –With a focus on further expanding our BPO sector.

5. Energy development – With a focus on renewable energy opportunities such as solar, wind, and geothermal, as well as assembling solar panels and water heaters.

GIDC’s BDC was established in 2005 to provide muchneeded business support to MSMEs.

Our industrial park facilities in Frequente, Seamoon, and St. Patrick’s continue to be prime locations for entrepreneurs, as demonstrated by a steady increase in occupancy rates.

We are currently constructing a 40,000 sqft building to provide additional commercial space for businesses to operate. Construction commenced in September 2024 and is expected to be completed in June 2025.

We are also seeking further land that can be developed to expand our park facilities and constantly looking at opportunities and creative ways to grow the stock of buildings within our parks.

From the promotional side of things, we’ve become

increasingly involved in marketing Grenada as an investment destination. We are cognizant of the benefits of FDI, so our approach toward investment is now more targeted, utilizing investment opportunity profiles.

As we target investors for our priority sectors based on their specific investment interests, we will be developing bankable specific opportunity profiles with clear details on investments, return on investment (ROI), and payback periods.

VISION – To be globally recognized as a highly-rated, innovative economic development corporation.

MISSION – GIDC strives to continue contributing to Grenada’s socio-economic development by:

• Adopting a targeted approach to promoting investment opportunities

• Providing superior investor facilitation and entrepreneurial development services

• Advocating for a supportive enabling environment for investors to develop and grow business, trade, and industries.

GOAL – To promote local and foreign investment and facilitate and strengthen entrepreneurial development within the growth sectors of Grenada’s economy.

We’ll continue our work in this area throughout 2025 and beyond as we realize that a targeted approach to investment is definitely necessary.

In short, our role has certainly evolved since 1985. This is reflected not only in changes to our name but also in the impact we’ve had on the economy in terms of job creation and attracting FDI.

NA: What is your current take on Grenada’s economy? What recent challenges or opportunities have you faced?

RT: I’d say Grenada’s economy is diverse, and this has contributed to its growth over the years.

While tourism is a major contributor, the agriculture sector plays an instrumental role in economic growth. We continue to be a major exporter of spices such as nutmeg, cinnamon, and more – Grenada is known as the ‘Spice Isle’. Meanwhile, the export potential of our fish is also notable.

When it comes to education, our accredited medical school, St. George’s University (SGU), has continued to contribute tremendously to the economy since its establishment in July 1976. One statistic I am particularly proud of is that approximately one out of every 100 doctors currently practicing in the US is an SGU graduate.

We also have our IMA, which promotes our robust CBI program and assists investors to obtain enhanced global mobility and other benefits of being a Grenadian citizen. Overall, our economy is diverse and doesn’t solely rely on a single aspect, but it also has challenges. From an investment perspective, Grenada’s population of just 110,000 is considerably small. However, investors must also consider external markets – we are part of the Caribbean, so you’re actually looking at a combined population of over 44 million.

There is also the issue of the cost of electricity, however this presents an opportunity for alternative and renewable energies to augment these costs.

Natural disasters also have the potential to negatively impact our investment landscape. Although the island lies on the outskirts of the hurricane belt, last year Hurricane Beryl caused some devastation to our tourism and agriculture sectors. This presented the opportunity to rebuild – and rebuild better.

We are aware of these challenges as we continue to promote investments, cognizant that Grenada is, indeed, a preferred location for investment.

There are several things that make us an attractive investment destination, from the stability of our government to our excellent quality of life. It’s also very easy to do business on the island, repatriate profits, and move currencies. The abundance of investment opportunities to be explored is also of great importance.

In life, there are always challenges, but we constantly strive to improve, enabling a conducive business environment.

“THROUGH OUR ACTIONS, WE HOPE TO REMAIN DYNAMIC, RELEVANT, AND AN EFFECTIVE CONTRIBUTOR TO GRENADA’S ECONOMY”

– RONALD THEODORE, CEO, GRENADA INVESTMENT DEVELOPMENT CORPORATION

NA: How do you represent the collective interests of your members?

INVESTMENT FACILITATION – Through the IPA, GIDC offers robust solutions for stakeholders looking to navigate the island’s business landscape.

BUSINESS DEVELOPMENT – The BDC acts as a gateway for entrepreneurs to thrive in Grenada, providing technical assistance, training, and support for start-ups.

FBU - Accommodates both local and foreign investors, providing best-in-class mixed-use facilities to ensure sustainable business growth.

We recently revised our incentives framework to be performance-based and compliant with the World Trade Organization (WTO) rules and obligations. So yes, we have done a lot of work in terms of creating and fostering an environment that facilitates doing business on the island.

RT: There are several players within Grenada’s investment generation system and we try to work closely with each player.

The Inland Revenue Division, National Insurance Scheme, Physical Planning Unit, Department of Labor, and Grenada Bureau of Standards, among others, are all involved in investment generation on the island, so GIDC must establish a strong network and collaborate effectively with each player for the common good.

To ensure that the interests of all our clients and investors (existing and potential) are met, we disseminate relevant information via various mechanisms including social media.

In addition, through our targeted approach to investment, we reach out to existing and potential investors within our priority sectors who may be looking to expand, diversify, or obtain investment, compile said information, and approach investors looking for equity, a joint venture (JV), or shares opportunities.

NA: How do your best-in-class mixed-use facilities, such as your business parks, facilitate the development of sustainable business in Grenada?

RT: I say this with a smile on my face – GIDC facilities are deemed a preferred location to establish operations. In

addition to the location and aesthetics, our rental rates are more competitive.

We’re currently looking for opportunities to expand the parks, including creative methods to build out additional space, inclusive of JV arrangements between the private sector and GIDC. We also have some vacant land available which could be ideal for investors to build out themselves.

I am always pleased when considering the multiplier effect that our business parks have on our economy.

NA: Finally, how do you see Grenada’s economic climate developing in the next five years, and how do you plan to action GIDC’s key priorities going forward?

RT: I believe Grenada’s economy will continue on a positive growth trajectory. The current numbers in terms of investment inquiries are strong, which is a clear indication of investors’ confidence.

Over the last five years, I’ve only seen these numbers increase, both from domestic and foreign sources.

Grenada’s CBI program continues to attract investment, and we anticipate additional investment in other sectors apart from hotel and real estate.

There is definitely a need to enhance Grenada’s food security, and this presents investment opportunities within the agriculture and agribusiness sectors. There are opportunities to diversify from traditional methods of farming to alternatives such as vertical farming and hydroponics.

Our government is committed to the development of a state-of-the-art hospital. Land has already been secured for construction, which is set to commence in 2026. This development will transform Grenada’s health and wellness sector and attract investment in other niche opportunities such as retirement homes and rejuvenation centers.

From GIDC’s perspective, we will continue a targeted approach to investment during 2025 and beyond. Our outreach must be accompanied by developed opportunity

“OUR ECONOMY IS DIVERSE AND DOESN’T SOLELY RELY ON A SINGLE ASPECT”

– RONALD THEODORE, CEO, GRENADA INVESTMENT DEVELOPMENT CORPORATION

profiles that clearly outline each project investment cost, ROI, and payback periods.

In terms of the enabling environment for investors, efforts will be made to continue to enhance and streamline the existing incentive regime to ensure it is dynamic and meets the needs of investors as well as the processes and procedures to obtain consents and licenses.

There are several events in 2025 where we will ensure our presence, including the World Expo 2025 in Osaka, Japan and the AfriCaribbean Trade and Investment Forum that will be held in Grenada this July.

As it relates to entrepreneurial development, we will continue to promote entrepreneurship, especially among young people, and actively have outreach programs at our schools.

AUSTRALIAN ENERGY PRODUCERS

We will also continue to enhance the infrastructure within our parks to ensure we remain a preferred location for businesses to establish and grow.

Tel: 0000000000 xxxxxxxxxx@xxxxxxxxxxxx www.xxxxxxxxxxxxxxx.com.au

1st March marked 40 years of GIDC’s existence, and we look forward to the next 40. Through our actions, we hope to remain dynamic, relevant, and an effective contributor to Grenada’s economy.

Tel: 1 (473) 444-1033 to 35 contactus@gidc.gd www.gidc.gd

Tel: 1 (473) 444-1033 to 35 contactus@gidc.gd www.gidc.gd