December 2012 General presentation and overview

This business approach does not oblige its addressees to enter into negotiations or to conclude further agreements with NovEnergia II – Energy & Environment (SCA) SICAR. The information contained herein does not have any guarantee of return of the investment and/or profitability.

NovEnergia II – Energy & Environment (SCA) SICAR makes no representation or warranty, express or implied, as to, or assume any responsibility for, the accuracy, reliability or completeness of any of the information contained herein or any other information supplied by NovEnergia II – Energy & Environment (SCA) SICAR or the assumptions on which it is based or shall be under any obligation to update or correct any inaccuracy in the information contained herein or any other information supplied by NovEnergia II – Energy & Environment (SCA) SICAR or be otherwise liable to addressees or any other person in respect of the information contained herein or any such information

The entity which receives this dossier is obliged (a) to use any and all (but not limited to) commercial, financial, technical and/or legal information whether disclosed in writing, orally, visually, electronically or by any other means contained herein only for the purpose of this business approach, (b) to keep strictly confidential and secret any and all information contained herein and which may further receive from NovEnergia II – Energy & Environment (SCA) SICAR under the business approach and (c) not to disclose it or any part of it - directly or indirectly - to any third party and to provide the necessary means to prevent unauthorized disclosure.”

General presentation and overview

Portugal – Pinhal Interior (146 MW)

Portugal – Pinhal Interior (146 MW)

An international expertise in renewable energy

Wind, Solar and Hydro projects

NovEnergia Group is dedicated to the promotion of renewable energy

World-wide development: Luxembourg, Portugal, Spain, Italy, France , Bulgaria, Hungary, Poland, Romania & South Africa

An integrated actor :

Prospection

Development

Project identification Technical and environmental studies , authorisations , building permits , grid connection

Investment Operation

Non-recourse project financing

Construction, engineering, operation and maintenance

General presentation and overview

NovEnergia: Past & Future

The NovEnergia Group was incorporated in 2001 through the constitution of a Luxembourg based SICAV named NovEnergia 2010. Presently, the Group is managed by NovEnergia General Partner, a Luxembourg based company owned by the 7 members of the Board (see below “The Management Team”).

NovEnergia 2010 SICAV played its role in the renewable energy sector in Portugal acquiring important shares and controlling the management of two key players of the renewable energy sector in Portugal: Generg and Finerge.

Later on, NovEnergia coordinated and participated in the creation of ENEOP – Eolicas de Portugal, a consortium with two major utilities (EDP and Endesa) and the leader in wind turbine innovation (the German Enercon). ENEOP won the national wind energy tender of Portugal for 1200 MW and the constitution of an industrial cluster (led by ENERCON) that will produce and install 200 turbines per year.

In 2007 NovEnergia decided to go international, and the Group incorporated a new Fund – NovEnergia II (SCA) SICAR – a Luxembourg based SICAR. NovEnergia II acquired all the assets of the former NovEnergia 2010. By June 2012, its net assets reached 480 Million Euros controlling more than 1 Billion Euros of investments across Europe.

NovEnergia is now on the process of creating the NovEnergia Holding that will consolidate all the assets and raising new capital to develop a robust pipeline of projects in late stages of development. The capital increase that is now underway has been approved for a total of 500 Million Euros. Until now a total of 124,3 Million Euros of contribution has already been made, leaving 375,7 Million Euros available for additional investors.

General presentation and overview

Ten years of continuous growth – a snapshot

General presentation and overview Evolution of NovEnergia’s value per share since inception Euros 0 20.000 40.000 60.000 80.000 100.000 120.000 Unit value Novenergia II SICAR Unit value Novenergia 2010 Internal Rate of

2001 2006 2012 NovEnergia 2010 SICAV NovEnergia II SICAR 15.0 % EUR milllion 2001 2012 Equity Value 13 486 Annual Revenues - 205 EBITDA - 162 Total Assets - 1.500 Portfolio in Development - > 1.000 1

Return

The Management Team

The NovEnergia Group was conceived and founded by a group of experts around Carlos Pimenta who have spent the past 20 years promoting energy efficiency and renewable energies in different ways (political responsibilities, academic research and projects, consulting, energy production), contributing to establish the current framework for independent renewable energy production at the Portuguese and EU level.

30 years experience in the energy and environment sector (EU, Eastern Europe & South America). Professor of Energy Economics at the University of Paris and Director (1985-2007) of a Master degree Program on Energy Economics and Energy Policy.

Former President of SIIF do Brazil (EDF-EN Group) and of the European Small Hydro Association. Former Advisor to the Portuguese Secretary of State of Energy. Chairman of the Consultative Energy and Environment Committee of the European Commission (1997-2000).

Large know-how in several branches of the energy sector. Director of Endesa Group companies in Portugal, in particular of companies dedicated to renewables and co-generation. Member of the Board of ENEOP. President of COGEN Portugal.

Professor at the Technical University of Lisbon and of Economics and Energy Policy. Analyst and supervisor of several public and academic organisations involved in energy research. Coordinator of the Portuguese National Carbon Plan 2005-2007.

Henri Baguenier, Chairman

Álvaro Martins

Henri Baguenier, Chairman

Álvaro Martins

General presentation and overview

Álvaro Brandão Pinto, CEO

The Management Team

Albert

Mitjá

Former General Director of Energy of Catalonia Autonomous Region, and advisor to the European Commission and UNESCO.

Aníbal Fernandes

Considerable experience in all branches of the energy sector, from oil to gas to wind energy. Former Director of Galp Power and CEO of Transgás Atlântico; former advisor to the Portuguese Government, in charge of the introduction of natural gas in Portugal.

CEO of ENEOP, the largest wind energy consortium and industrial cluster in Portugal.

Armando Nunes

Financial and Capital markets expert since 1990. Former CEO of Banco Mello Capital Markets Group of Companies. Former member of the Board of the Portuguese Association for Pension Funds and of the Portuguese Association of Asset Managers. Economics degree, Master in European Studies and MBA.

Carlos Pimenta

Carlos Pimenta has spent his career defending environmental issues and sustainable development. He was Secretary of State for the Environment/Natural Resources and Fisheries in the 1980’s in Portugal and member of the Portuguese and European Parliaments from 1985 to 1999. He is also a former Board Member of EDF Energies Nouvelles and one of the co-founders of the Globe program.

During his time at the European Parliament, he was a negotiator of the Kyoto protocol and a key promoter of the EU’s renewable energy policy. He is currently a Board Member of several renewable energy companies and a member of the EU Energy Advisory Forum.

Ottavio Lavaggi

Expert in International Finance and Tax Systems. Former international civil servant of the European Union. Former member of the Italian Parliament.

General presentation and overview

NovEnergia Group Structure

Presence in 10 countries

* The country holdings are being transferred into NovEnergia Holding that has just been incorporated

General presentation and overview NovEnergia II Energy & Environment (SCA) SICAR (Luxembourg) NE2S (Services Company) Lusenerg (Portugal) Generg SGPS ENEOP 23 SPVs 23 SPVs Boneca NovEnergia II España 7 SPVs Eneryo (France) 5 SPVs (France) NovEnergia II Bulgaria Eko Novenergii 6 SPVs NovEnergia II Hungary 3 SPVs NovEnergia II Italian Portfolio NEI S.r.l. 4 SPVs HFV S.p.A. 11 SPVs NovEnergia II Bucuresti NovEnergia Poland 1 SPV South Africa

100% 100% 90% 80% 70% 70% 100% 100% 57,5% 50-100% 86% 70% 100% 100% 50% 100% 73% 20% 90-100% 100% 100% 100% 100% 35% 85% NovEnergia Holding (Luxembourg)

NovEnergia Group: near 800 MW in Operation

General presentation and overview

Capacity in operation (Nov 30th 2012) Capacity in operation (expected 2015) Consolidated Revenues Total capacity (MW) Total capacity (MW) 2011 (M€) 2012E (M€) 2015E (M€) Portugal 671 728 130 154 178 Spain 24 24 15 15 18 Italy 77 216 12 25 60 France 15 80 1 7 23 Eastern Europe Countries 10 80 - 1 23 South Africa - 90 - - 9 TOTAL 797 1.187 158 204 311

Investments to perform & company growth

Expected capacity in operation (MW) year end 2012 2013 2014 2015 Spain 24 24 24 24 France 15 15 55 80 Italy 77 98 181 216 Portugal 672 728 728 728 Eastern Europe Countries 10 30 80 80 South Africa - - - 90 Total 798 895 1.097 1.187 M EUR 2012E 2013E 2014E 2015E 2016E 2017E Revenues 204 220 274 311 329 352 EBITDA 162 175 215 245 261 280 Net Result (after minorities) 19 17 14 20 23 48 Net Fixed Assets 1.285 1.448 1.548 1.574 1.562 1.446 Current Assets 215 239 282 307 278 294 Total Assets 1.500 1.687 1.830 1.881 1.840 1.740 Financial Debts 1.010 1.147 1.327 1.387 1.127 1.028 Short-term liabilities 48 78 73 71 62 63 Total Equity 443 462 429 422 651 650 Total Equity and Liabilities 1.500 1.687 1.830 1.881 1.840 1.740 General presentation and overview Portugal – Manteigas (6,5 MW)

France

PV : 15 MW; 20 MWp

Hungary

Poland

Wind : 40 MW

Portugal (Boneca & Generg )

Hydro : 33 MW

Wind : 620 MW; 56 MW

PV : 18 MW

Spain

PV : 24 MW

Italy

Wind : 90 MW

Romania

Wind : up to 100 MW

International Portfolio

Wind : 4 MW; 165 MW

PV : 73 MW ; 20 MWp

Bulgaria

Wind : 200 MW

PV : 10 MW

Country Headquarters

Local Offices

Technology : MW in operation; under development/construction

General presentation and overview

Portugal: Generg & Eneop

Home Office - Lisbon

Generg is the 3rd renewable energy operator in Portugal

In 2006, the ENEOP consortium won the national wind energy tender for 1200 MW

8 MW Wind in

NovEnergia

Lusenerg Generg Eneop Eólica da Boneca Portfolio of ENEOP Capacity Part owned by GENERG Wind farms in operation 918 MW 184 MW Wind farms in construction / development 282 MW 56 MW Portfolio of GENERG Capacity Hydro in operation 33 MW Wind farms in operation 436 MW PV in operation 18 MW 100% 35% 57,5% 20%

in Portugal

operation General presentation and overview

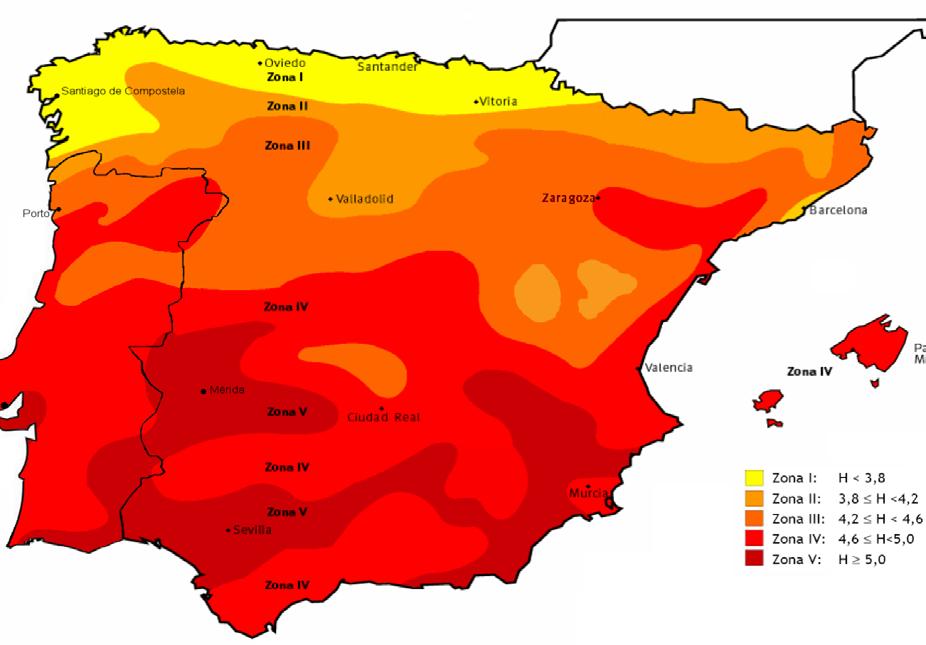

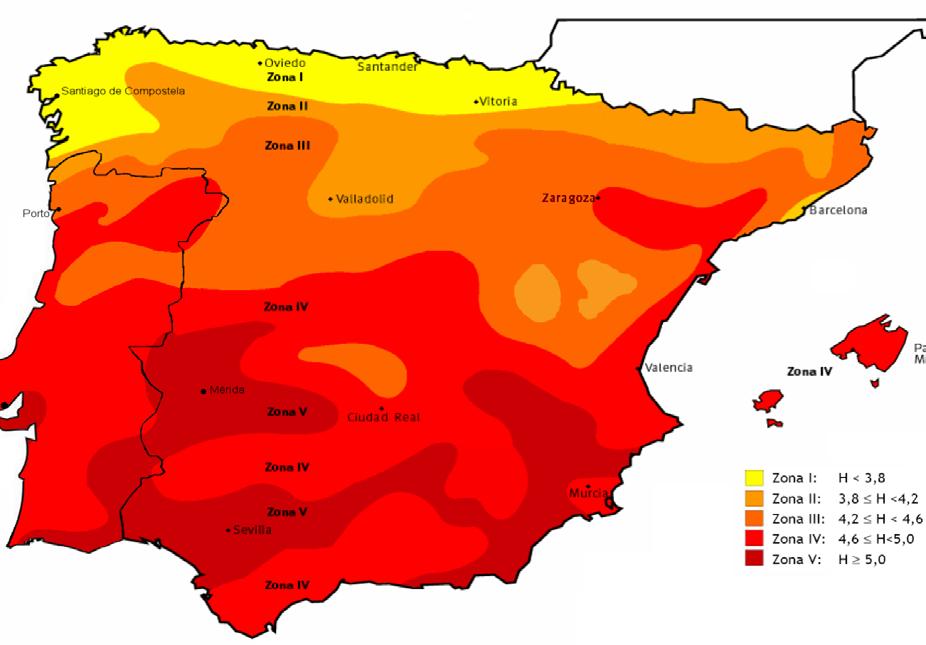

Spain: 7 PV projects in operation

Home Office – Barcelona

Spain is one of the most mature markets in Europe for renewables, with more than 20 GW of wind and 4 GW of PV installed at the end of 2010. NovEnergia has invested strongly in PV, with 7 projects in operation representing a portfolio of 24 MWp (investment of 166 M€)

Location Capacity– structure/tracking

Mora La Nova

1.54 MWp – 1 axis

Villares del Saz

3.37 MWp – no tracker

Barrax

1.66 MWp – 2 axes

Lobón

2.81 MWp – no tracker

Bonete

5.8 MWp – 2 axes

Fuente Álamo

5.2 MWp - 1 axis

Almansa

3.23 MWp - 1 axis

General presentation and overview

Italy: a large and developing portfolio

Home Office – Rome

Since 2007, NovEnergia’s local team has managed to:

develop a vast portfolio of several wind and PV projects, representing around 150 MW and 100 MW, respectively.

Build and start the operation of a 4 MW wind project

Close a strategic partnership with F2i (a national public/private infrastructure fund created by the Italian government in 2007) for the co-investment of 100 MW of PV projects. As of August 31st this joint venture (HFV) held a total of 64 MW in operation.

Build and start the operation of 22 MW of PV plants – of which 20 MW have already been transferred into the HFV partnership.

General presentation and overview Projects Capacity PV in operation 73 MW PV under development / analysis 20 MW Wind farms in operation 4 MW Wind farms under development / analysis 165 MW Total portfolio 262 MW

View of Puglia plant (4MWp)

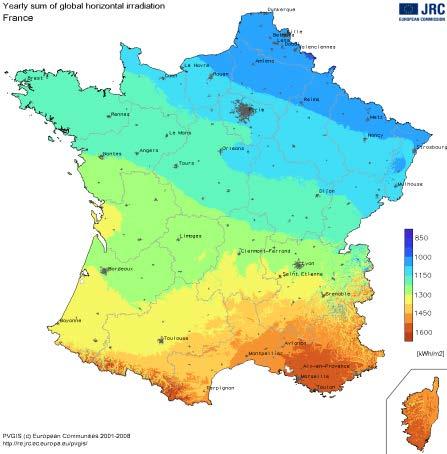

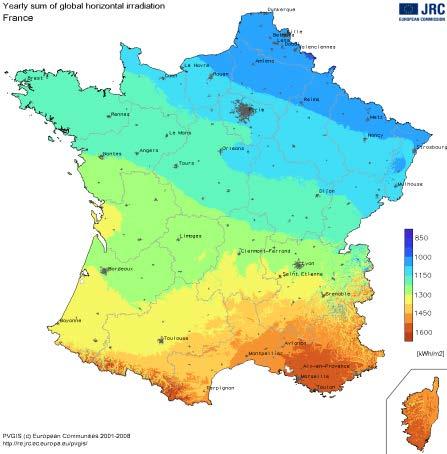

France: 5 PV projects in operation

Home Office – Paris

Since 2008, NovEnergia’s affiliate - Eneryo - has managed to develop a strong portfolio of PV plant projects representing 50 MW in the south of France and Building integrated photovoltaics (BIPV) projects representing 10 MW

8 MW of PV and 0,3 MW of BiPV have begun production in September 2011 and an additional 6,6 MW of several projects have started operation during the 1st semester of 2012.

Important solar resources in the south of France

An experienced and dynamic team

and

General presentation

overview

Lorrain (3,8 MW)

Bulgaria: a strategic emerging market

Home Office – Sofia

Feed-in tariffs for Wind and PV projects have been recently defined, finalising the legal framework revision

Strong resources of wind, sun and hydro

Small penetration of large players

NovEnergia is developing around 200 MW of Wind farms projects all over Bulgaria. 10 MW of PV have already started operation in Dabovo.

DRAGOMAN, 30 - 40 MW Wind

RAKOVO, 30 - 50 MW Wind

MOMCHILGRAD, 40 - 50 MW Wind

SVILENGRAD, 60 - 100 MW Wind

DABOVO – 10 MW PV

DABOVO – 10 MW PV

General presentation and overview

Dabovo (10 MW)

Poland: a mature but still promising market

NovEnergia has acquired the rights for a 20 MW wind project. An additional capacity of 20 MW can be secured in the same location in the months that follow.

Construction works for the first 20 MW will start in the beggining of 2013.

Analysis in other projects are ongoing.

GLUCHOW Wind Farm, 20 MW + 20 MW

General presentation and overview

Promising markets

Other Eastern countries are markets with significant potential but different characteristics:

Hungary

Many interesting projects but the feed-in tariff is subject to restrictive national tenders

3 wind projects representing a capacity of about 90 MW

30 MW are fully developed

NovEnergia’s strategy: Develop projects while waiting for the definition of a stable support mechanism

Romania

Large untapped potential but some uncertainty remains regarding the green certificate scheme

A partnership with a local company is under study

The associated portfolio would represent up to 120 MW (wind and hydro)

NovEnergia’s strategy: Build strong partnership with local players

NovEnergia is ready to enter markets all around the world, namely

South Africa: together with local partners NovEnergia is preparing to participate is the national tender for new capacity – up to 90 MW are under final stages of analysis for presentation in the tender and could start construction by in 2014.

Brazil and the rest of Latin America (the management team has strong local contacts that can present very interesting opportunities), Middle East and Asia – prospects could reach above 300 MW of capacity.

General presentation and overview

Key data

Name Type

Legal Structure

Term Investment Strategy

Commitment

Size Advisor

Custodian Manager

Investor Committee

Co-investment rights

NovEnergia II – Energy & Environment

SICAR (Umbrella) established in Luxembourg

Société en Commandite par Actions (SCA)

March 2017 + 2 years

Energy and Environment Projects

353 million already drawdown; remaining increase of up to 376 million

Presently above EUR 485 million

BIZ Valor Sociedade Corretora, SA (Portuguese Financial Cie)

CACEIS Bank Luxembourg, Luxembourg (Credit Agricole Group)

NovEnergia General Partner (Lux)

3-4 meetings per year (1 representative per investor above EUR 10m + 1)

Held by investors with commitments > EUR 30 m

General presentation and overview

A large panel of reference investors

By November 2012, the capital invested in the fund by key actors of the Portuguese and European financing sectors reaches more than € 353 million Among the main historical investors are:

• Banco de Portugal The Central Bank of Portugal (through its Pension Fund)

•

Three major Foundations

Philanthropic foundation dedicated to four main fields: arts, education, science and human development, with a assets of € 2.9 billion.

Financial institution created to contribute to the development of Portugal by financial and strategic support for innovative projects thanks to the cooperation between American and Portuguese civil societies. Its capital in 2006 was €140 million.

Implementation and support of cultural, educative, artistic, philanthropic and social initiatives, focused on Portugal and Macau.

• Four large Portuguese Financial Groups:

A large panel of reference investors

More recently 3 new reference investors entered NovEnergia:

• Champalimaud Foundation

• Portugal Telecom (through its Pension Funds)

• Instituto de Seguros de Portugal - the supervising authority for the insurance sector (through 2 of its Managed Funds)

Other reference investors are:

BIZ Valor Asset management, Montepio Nacional das Farmacias, Caixagest.

As a commitment sign to the investors the NovEnergia General Partner is also a shareholder since inception, with a share of around 3% in the Capital of NovEnergia.

General presentation and overview

Contacts General presentation and overview NovEnergia II – Energy & Environment (SCA) SICAR Luxembourg: 5 allée Scheffer L-2520 Luxembourg www.novenergia.com Portugal – Caramulo (90 MW)

Portugal – Pinhal Interior (146 MW)

Portugal – Pinhal Interior (146 MW)