business supplies and beyond

business supplies and beyond

business supplies and beyond

business supplies and beyond

One of the big themes running through this issue is technology. Every year, Workplace360 makes a point of shining the spotlight on the industry’s technology solutions providers – giving them a platform to share not only what they’re working on, but also to highlight the broader trends shaping the digital future of our sector. This year is no exception.

What’s clear is that tech suppliers have been busier than ever. Over the past 12 months, we’ve seen a flurry of innovation: updates to existing platforms, entirely new

That’s how you do an interview – with a proper Yorkshire brew in hand! Workplace360 CEO Steve Hilleard (right) headed to Otley to sit down with Superstat Managing Director Alex Dunn (left) for this issue’s In conversation with...

EDITORIAL

Workplace360 Editor

Michelle Sturman 020 7841 2950

News Editor

Andy Braithwaite +33 4 32 62 71 07

Assistant Editor Kate Davies

OPI Editor

Heike Dieckmann

EVENTS

Events Manager

Lisa Haywood

apps designed to streamline workflows and a growing wave of ventures into the world of AI. From automation and analytics to smarter ordering systems and digital collaboration tools, technology is becoming the beating heart of the workplace supplies channel.

It all bodes exceedingly well for the future – provided dealers are ready to embrace these advances and make technology a central part of their business strategy. Those that do will be well placed to harness its full potential (read Power play on page 34)

One dealer that has truly embedded technology into almost every facet of its operation is Dublinbased Purple Panda. As founder Gavin Kelly explained to me, every customer interaction is “analysed, tracked and personalised” to enhance the overall experience.

Just as crucially, the digital systems behind the scenes are constantly refined in collaboration with ECI Software Solutions and the company’s own in-house e-commerce specialists. The business has also fully embraced AI-driven analytics and automation to optimise performance and efficiency (read Purple reign on page 10).

As the year winds down, awards season heats up with the BOSS Awards (2025 shortlist on page 6) and the Stationers’ Innovation Excellence Awards (read Gold standard on page 50). Wishing all those shortlisted the very best of luck!

Michelle Sturman, Editor

SALES & MARKETING

Head of Media Sales

Chris Turness 07872 684746

Chief Commercial Officer Jade Wilson 07369 232590

Digital Marketing Manager Aurora Enghis

PRODUCTION & FINANCE

Head of Creative

Joel Mitchell

Finance & Operations

Kelly Hilleard

Ross Jones highlights cleaning and catering as the next growth categories for dealers

24 Talking point

Exertis Supplies Managing Director Matt Balcombe discusses how it’s business as usual as the wholesaler enters a new chapter 30 Thought leadership

Gary Naphtali reveals how change creates new business opportunities and growth

48 Heart of the industry

The workplace supplies sector once again unites in the Lake District to support cancer research

49 Heart of the industry

The Ride of Life 2025 raised vital funds for cancer research, while the Summer Clachan brought Old Friends together in Manchester for a lively evening of fellowship

50 Heart of the industry

John Livingston explains why the Stationers’ Company Warrant remains the ultimate mark of quality

54 Exposed!

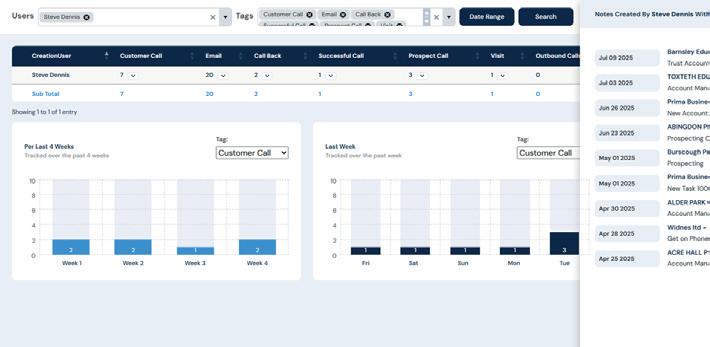

Oliver Rowles, Prima Software

JGBM’s Carol Clarke explores how personal courage shapes leadership, drives smart risk-taking and builds resilient, innovative teams SMEs are creating agile, inspiring offices that rival larger corporates, reveals Alex Kerr

The BOSS Federation has revealed the shortlist for its annual awards taking place in November. The shortlist is as follows:

Brand Excellence

• Fellowes Brands

• Kensington EQ

• Pilot Pen UK

• The Cheeky Panda

Business Leader of the Year

• Adam Huttly, Red-Inc

• Andrew Gale, evo Group

• James Mckeever, Sovereign Business Solutions

Campaign of the Year

• Avery: Every Space

• Fellowes Brands: The WorkLife Coach

• Nemo Office Club: Keep It Local

• Nescafé: Let’s Partner Up for Good

• P-Wave: NHS England Cancer Awareness Partnership

Dealer of the Year (over £5 million)

• ACS Group

• Costcutters UK (Seated Furniture)

• Quills Group

• The Business Supplies Group

• United UK

Dealer of the Year (under £5 million)

• Aston & James

• Office Shop Direct

• The Office Works (Nationwide)

Diversity and Inclusion Award

• Essity

• Exertis Supplies

• Lyreco UK & Ireland

• SC Johnson Professional

E-business Award

• Durable UK

• evo Group

Independent Retailer Award

• Axminster Printing

• JPS Stationers

• Morgans Stationery

New Product of the Year

• Durabin Eco Range

• Dymo Label Manager 640CB

• Grace & Green Period Kits

• Katrin XL Dispenser

• Leitz IQ OptiMax Shredder

• Nescafé Barista

• Tork OptiServe

Outstanding Team of the Year

• Avery UK Customer Service Team

• Banner Stoke Team

• Exertis Supplies Operations Team

• Lyreco UK & Ireland Sustainability and Social Value Team

• Office Power Buying Team

• YPO Supply Chain Team

Professional of the Year

• Alex Winstanley, Banner

• Julie Hadley, evo Group

• Shona Patterson, VOW Wholesale

• Simon Weavers, The Cheeky Panda

Rising Star of the Year

• Amy Mettam, Banner

• Amy Remmer, VOW Wholesale

• Ashley Ainley, YPO

• Jade Young, Red-Inc

• Lisa Denby, Superstat

• Oliver Rowles, Prima Software

• Paige Morgan, Premier Vanguard

• Ross Ayley, Durable UK

Service Provider of the Year

• Comgem

• Dynamic Office Solutions

• Prima Software

• United UK

Sustainable Leadership Award

• ACCO Brands

• evo Group

• ExaClair

• MBM Omega

• Red-Inc

• The Cheeky Panda

Wholesaler of the Year

• Dynamic Office Solutions

• Exertis Supplies

• JGBM

• VOW Wholesale

The 2025 BOSS Awards – of which Workplace360 is a sponsor – will take place on 27 November at the Kimpton Clocktower Hotel in Manchester.

Codex has been named one of Ireland’s Best Managed Companies for the third consecutive year. The Dublin-based workplace solutions provider was recognised at the 2025 Deloitte Best Managed Companies Awards, placing it among the country’s bestperforming organisations.

Codex said that the award reflects its people-first approach, which this year has included a new partnership with autism charity AsIAm and the launch of a neurodivergent office products design and fit-out service. The company has also invested in employee wellbeing with initiatives such as a staff gym and progressive annual leave policies.

According to CEO Patrick Murphy, the recognition underlines the efforts of Codex’s employees and the support of its customers. He added that new partnerships and services launched this year will help the company maintain its values while continuing to grow.

Integra Business Solutions and Office Friendly have announced the completion of their merger, creating a new entity called BLOC Group. It will be headed by Managing Director Jeanette Caswell (ex-Office Friendly) and Chairman Aidan McDonough (ex-Integra). Other key staff positions and further company details had not been made public at the time of going to press.

Integration of the two businesses is already well underway with a new membership portal, BLOCHub, being constructed to provide members with easy access to all BLOC services, solutions and self-serve content.

According to BLOC, its members can expect innovative marketing, smarter purchasing opportunities, invaluable technology partnerships and support, together with sustainability and training programmes.

McDonough commented: “By combining the strengths of two market-leading organisations, we have created an unrivalled platform of expertise and support.”

Caswell added: “We are incredibly excited about the future as BLOC and the benefits our combined resources, industry-leading solutions and new initiatives will bring to our members and key partners.”

The BOSS Federation has introduced a programme called NextGen Mentoring. The initiative – created by the BOSS Leaders of the Future committee – aims to connect experienced professionals with emerging talent across the workplace supplies industry.

Supported by the evo Foundation, the programme aims to foster meaningful career development and knowledge sharing across generations of professionals.

Free for BOSS members, NextGen Mentoring is menteeled, meaning that it’s up to the mentee to initiate contact and drive the relationship.

Renshaw joins PPS

Product Promotion Services (PPS) has welcomed Sharon Renshaw to its sales team.

She brings extensive knowledge with 30 years’ experience in the workplace supplies industry, including sales roles at Office Friendly and VOW Wholesale.

After more than a year as Head of Commercial Sales, Keeley Shepherd (left) will be leaving ExaClair later this year to pursue new opportunities within the industry. Meanwhile, company veteran Sam Bell (right) has been appointed Account Manager.

BOSS role for Viking’s Stafford

Sam Stafford, Head of HR at Viking UK & Ireland, has been appointed Chair of the BOSS People & Culture Forum. Stafford – an experienced HR leader – said that she is committed to strengthening collaboration across the HR profession and supporting organisations as they navigate an increasingly complex people landscape.

Promotion for Prima’s Clarke

Prima Software has promoted Molly Clarke to the position of Customer Care Manager.

Clarke joined the company in 2017 as a 17-year-old apprentice on the support desk. After completing her apprenticeship, she moved into a full-time role, later becoming Customer Care Supervisor – and now takes on the responsibility of leading the team in her new role.

Evolve IP appoints Global Sales Director

Evolve IP has named Alex Finn as its new Global Sales Director. Finn, who brings extensive experience in enterprise technology and partner-led sales, will be responsible for driving the company’s global sales strategy, strengthening relationships with partners and accelerating growth in new and existing markets – including the UK.

Public sector procurement organisation Crown Commercial Service (CCS) is preparing a formal tender notice for a new pan-government digital marketplace. CCS is seeking a platform provider to primarily service low-complexity spend on goods and services within public sector organisations.

The initiative covers a wide range of product categories, including stationery, office supplies and equipment, furniture, occupational safety, janitorial, education supplies, arts and crafts, first aid, packaging and branded uniforms.

Draft documents indicate that the chosen supplier must ensure that no more than 10% of deliverables ordered by buyers are its ownbrand goods. CCS is also requiring “proactive support” for government goals, such as encouraging SMEs and voluntary, community and social enterprises to register as vendors.

CCS said that the marketplace aims to reduce costs, improve procurement efficiency and simplify sourcing processes across government. It is intended to replace fragmented legacy systems with a more unified, scalable infrastructure.

The agreement is expected to run for four years from July 2026 and is valued at up to £1.2 billion. CCS plans to issue a formal tender notice on 28 November.

In other CCS updates, it recently confirmed the award of places on the government’s new £900 million print framework. The contract – which includes MFDs, MPS and digital workflow software solutions – is for a duration of four years and has been divided into five lots. Most of these were multiple supplier awards, with contractors including Canon, Konica Minolta, Kyocera, HP Inc, Ricoh and Xerox.

However, Lot 1 (estimated at £150,000) was a single-supplier award for an online purchasing solution. This lot – which was for MFDs and basic print management software – was weighted 100% on price and went to Canon. One of the awardees on the £20 million vendor-neutral consultancy services lot was Paragon Customer Communications, which acquired Office Depot UK & Ireland (now Paragon Business Essentials) last year.

The BOSS Business Supplies Charity (BBSC) has been named Small Charity of the Year at the annual awards of the Association of Charitable Organisations (ACO). The trophy was presented to BBSC Chair Kelly Hilleard (right), Trustee Sara Bennett (centre) and Secretary Liz Whyte (left) at an awards ceremony at BMA House in London as part of ACO’s 2025 annual conference.

“This award belongs to every trustee, volunteer and industry partner who continue to support people in the business supplies community when they need it most,” said Hilleard, adding: “Thank you for believing in us.”

Business services and print solutions provider Paragon has announced a new name for Office Depot UK, 12 months after acquiring the company as part of the wind-up of OT Group. As of 1 September, the reseller is officially known as Paragon Business Essentials, a move that its parent company says formalises its full integration.

In a press release, Paragon stated: “This rebrand marks a fresh chapter for the business that reflects our shared commitment to innovation, quality and delivering exceptional value for clients. [Paragon Business Essentials] will be a central hub for everything a workplace needs, including office supplies, cleaning and catering items, furniture and print solutions.”

Paragon COO Clem Garvey added: “Having business essentials as part of our extensive range of solutions means we can continue to support businesses of all sizes and help our clients navigate their evolving workplace needs with a single, trusted partner.”

Paragon said that the addition of the Business Essentials unit positions it as a one-stop shop and “eliminates the need for [customers] to manage multiple suppliers and invoices”. One development highlighted was the expansion of the product catalogue from 40,000 to 60,000 items.

Ryman and Robert Dyas add photo prints

Ryman and sister company Robert Dyas have signed a five-year partnership with photo printing specialist CEWE.

The agreement will see CEWE’s Photostations installed in the majority of Ryman and Robert Dyas stores, with the rollout due to be completed this autumn. The move follows a successful trial and will bring instant photo and ID printing services to more than 200 UK high streets.

The Photostations offer instant photo printing, biometric-compliant ID photo services and access to CEWE’s full product range via integrated online ordering.

The rollout forms part of the Theo Paphitis Retail Group’s broader strategy to enhance the in-store experience and introduce new valueadded services.

When Purple Panda launched in 2019, it wasn’t just another dealer entering the Irish market; it was the strategic outcome of two businesses joining forces. Gavin Kelly – who had founded workplace products dealer Purple Hippo two years earlier, after leaving Viking –merged his start-up with the OP supplies arm of Bryan S Ryan, a long-established local name in print and MPS.

The foundations of Purple Panda lie firmly in Kelly’s determination to create a brand that would cut through the noise: “I wanted something that was going to stand out,” he explains. Inspired by the likes of moonpig.com, he knew a distinctive name would spark curiosity and linger in customers’ minds.

Purple Hippo was simple to spell, memorable and easy to spot in an inbox or on Google. The choice of purple was deliberate, breaking away from rivals’ colour palettes. Kelly notes that purple appeals to both men and women, and a high proportion of buyers have turned out to be female.

The quirky name opened doors, transforming cold calls into meaningful conversations, with prospects intrigued rather than dismissive. And when it came time

c. €9 million CURRENT SALES

to merge with Bryan S Ryan, Kelly was keen to retain that sense of fun and freshness. After hours with a marketing agency, inspiration struck in the final minutes of a long day: Panda.

“We literally moved from a purple hippo to a purple panda,” laughs Kelly. Customers made the transition easily, though those used to Bryan S Ryan’s more corporate identity were initially taken aback. The move, however, has proved its worth.

In just six years, Purple Panda has scaled close to the €9 million mark – an impressive trajectory given the challenges of COVID, Brexit, global conflicts and even shipping blockages. From the outset, the business drew on experience and clear direction. Kelly had already cut his teeth at Viking, giving him a sharp sense of what worked – and what didn’t. He took the best elements of his corporate background – structure, analytics and customer service expectations – and brought them into a more agile, energetic environment.

A talented team of 23 now helps steer Purple Panda. The company operates predominantly on a drop-ship model, with more than 80,000 SKUs spanning furniture, technology, facilities, stationery, signage and catering. A small warehouse supports next-day delivery on high-volume items, while efficiency is driven by lean operations, real-time availability and automated postorder communication.

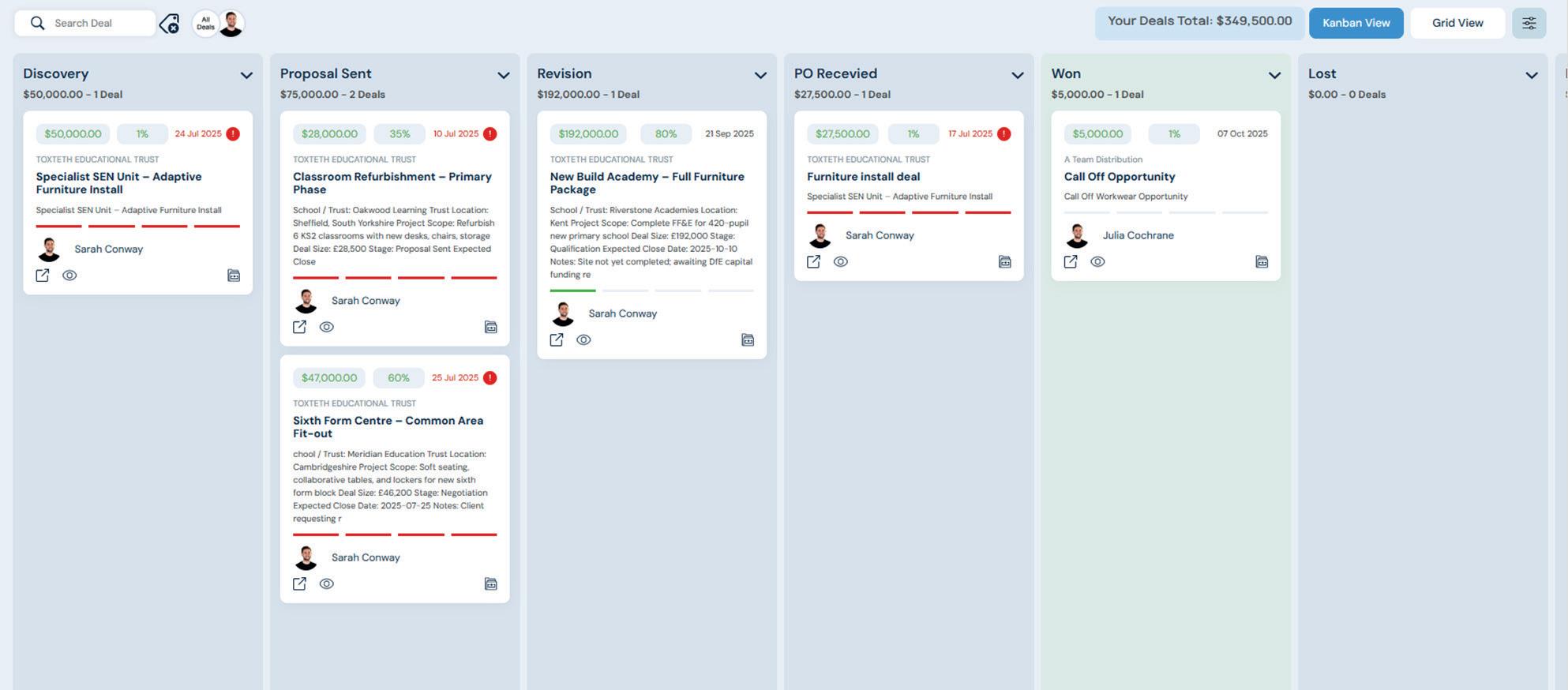

Crucially, the dealer is now focused on sustainable growth, prioritising stability over churn and price-driven leads. “We’re now getting the right type of customer –those not purely based on price – and they’re the ones that we want because they’re more stable,” says Kelly. Technology underpins Purple Panda’s strategy. Every stage of the customer journey – from first click to delivery – is analysed, tracked and personalised. The dealer uses AI tools, including ChatGPT, alongside its own in-house platforms to validate orders, flag errors before they become problems and even suggest faster product alternatives to keep next-day delivery on track.

This commitment to problem-solving has sparked a string of innovations: branded delivery tracking featuring a panda in a van, phone routing systems that automatically connect clients with their account manager and a customer scoring tool that highlights satisfaction levels in real time. Kelly reveals that when the team does encounter a problem, they always aim to find a solution rather than simply accepting it.

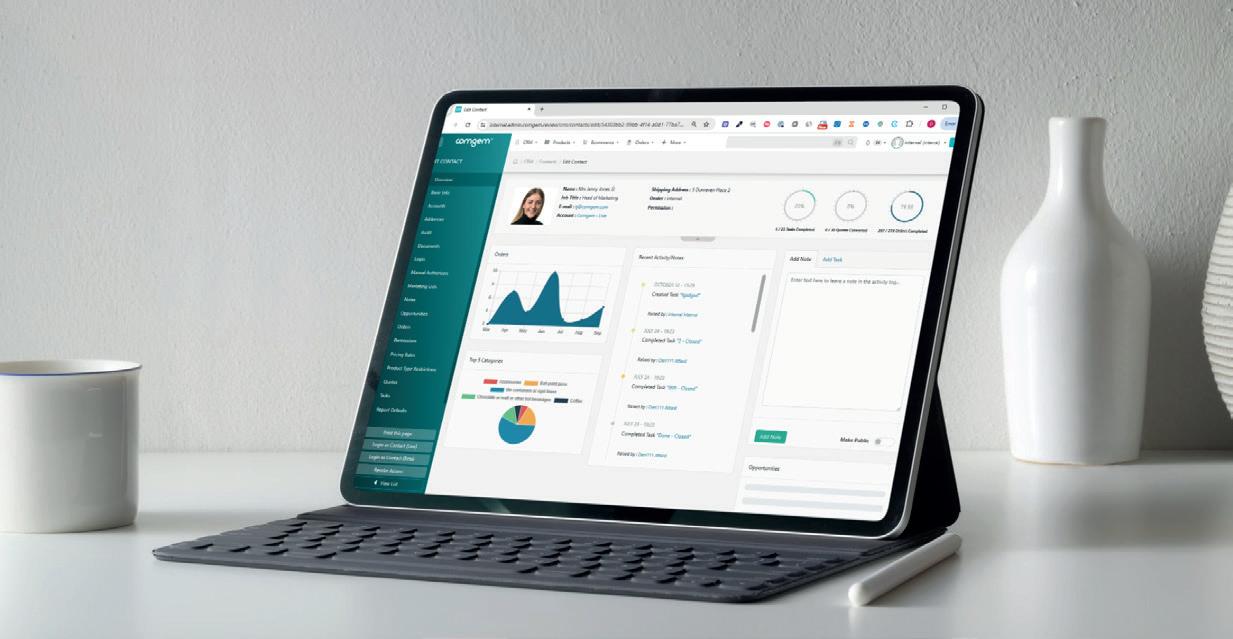

Purple Panda runs on ECI’s EvolutionX e-commerce platform, with its in-house e-commerce team continuously optimising layouts, filters, cross-sells and navigation. All agents are in-house and, over the past 12 months, operations have been structured around three pillars: reactivation, retention and acquisition.

This development work has enabled the dealer to deliver what Kelly calls “hyper-personalised” service: “If you don’t want us to call you, we won’t call you. If you don’t want us to email, we won’t.

“However, we’ll step in at the right moment if we notice a change in behaviour. We want each customer to have a unique experience.”

At Purple Panda, customer data isn’t just collected – it’s connected, processed and acted upon, all within a single platform. Automated workflows and AI-powered tools such as call summaries, scheduled callbacks and personalised outreach allow agents to focus on direct customer engagement rather than administrative tasks.

We’re now getting the right type of customer – those not purely based on price

These insights feed straight into customer communications. Emails and calls are triggered by behaviour, ensuring timely engagement without overloading prospects. “AI takes the call and will summarise it. If a callback is mentioned, it will schedule it automatically, so the agent can concentrate on the conversation. It isn’t taking a job away – it’s making it easier. It’s like having an extra set of eyes across all customer touchpoints,” adds Kelly.

The dealer serves every type of customer – from one-person businesses to multisite organisations with hundreds of locations, spanning SMEs, charities, education and retail groups.

Yet Purple Panda has a clear target: customers spending at least €3,000 a year. Every lead is assessed and prioritised using data-driven forecasts, taking into account factors such as staff numbers and office footprint. It is for this reason that Kelly believes

Purple Panda can match – and even surpass – larger competitors in growth and levels of profitability in the next 12-18 months: “It’s how we box clever compared to others. It’s always about the data and being as efficient as possible.”

Today, roughly 75% of sales occur online, reflecting a customer base that is comfortable with self-service. Account management remains a premium offering for key clients, accounting for around 5-10% of day-to-day interactions. “We want to control the narrative and make it easy for customers to transact themselves, while ensuring that every call has a clear objective,” Kelly says.

Interestingly, catalogues continue to play a significant role in the company’s marketing strategy. These printed or digital catalogues are not only a reference tool but also a proactive sales instrument, with new editions automatically added to an order. This way, the dealer can identify customers that haven’t placed an order within a specific timeframe and follow up accordingly.

Purple Panda has also branched into office fit-outs and interiors, a strategic move launched two years ago to complement its core office supplies business. “Our interiors side could be bigger than our main business in a couple of years if it keeps growing,” predicts Kelly.

The company offers a full-service solution, covering everything from furniture, flooring, painting and ceilings to electrics, air conditioning and plants. Projects are tailored to client needs, from functional modern offices to bespoke, design-led environments.

With a healthy pipeline and around 15 new leads per month, the interiors arm is thriving. “We can cherrypick the jobs we want, ensuring quality and maintaining our brand reputation,” notes Kelly.

The interiors business places strong emphasis on showcasing its work. The recently redesigned site demonstrates completed projects with videos, images and case studies, allowing potential clients to visualise outcomes. Augmented reality tools even let customers see furniture and layouts in their own locations, making decision-making interactive and precise. This redesign is being rolled out across the Purple Panda website, creating more ‘storefronts’ and incorporating additional product details, videos and images.

Much like most dealers, the continually contracting OP market has pushed the team to explore other categories. Alongside the interiors business, Purple Panda is seeing accelerated demand in facilities and catering – from hygiene essentials and jan/san products to coffee, snacks and disposable tableware – with this

category now accounting for a substantial portion of monthly revenue.

Acquisitions are also firmly on the agenda, though Kelly is taking a pragmatic approach. Potential targets must already have an online presence aligned with the company’s systems to ensure efficiency. The dealer is also considering adding service-based businesses – cleaning, hospitality or niche technology providers, for example – that can be easily integrated into Purple Panda’s data-driven processes. “It could be a business completely leftfield and in any sector,” Kelly says.

It’s always about the data and being as efficient as possible

Looking beyond Ireland, Purple Panda is now preparing to expand into the UK. The strategy is deliberate: rather than managing the market remotely, the company plans to establish a local team to deliver a genuine, on-the-ground presence. Initially targeting specific cities, the expansion aims to replicate the Irish model, with competitive pricing and efficient service supported by experienced staff.

“It’s about being seen as a local company in the UK, employing local people and genuinely going after the business there,” explains Kelly. The launch is planned for early 2026, serving as a test bed to refine processes, assess market potential and replicate the efficiency and impact of the Irish operation.

PERCENTAGE

Alex Dunn, Managing Director of Superstat, sat down with Steve Hilleard, CEO of Workplace360, to explore three decades of dealer-first thinking, the evolution of the business and the practical strategies that have kept the dealer group relevant and trusted in an ever-shifting market

Workplace360: Can you walk us through from your first role at Superstat to leading the business today?

Alex Dunn: I first joined Superstat in 1994 on a summer job after returning from university abroad, completely skint. My father had founded the business with Chris Collinson, whom I already knew, and I went in as his office junior. I loved it – especially organising Superstat’s first little conference in the marketing suite at Spicers.

After finishing my degree, I returned to organise the next year’s conference and on my second day back, Chris asked if I wanted a proper job and I said yes. That was the interview process and I’ve been here ever since.

For 20 years, I worked alongside Chris as he grew the business into a genuine success story, with my father, Ivan, supporting behind the scenes as Chairman. Chris retired in 2016 and now we are a board of three directors – Karly Haley, Richard Lockley and me.

W360: What is the current ownership structure?

AD: Superstat is privately owned. I hold the majority of shares in conjunction with Karly and Richard. Karly has held her shares for as long as I’ve held mine and Richard’s stake is in the process of being finalised.

W360: Thinking back to 1994, when you were in the office making tea, how has the group evolved over the past three decades?

AD: The group grew out of a local OP wholesaling business run by Chris and my father. They noticed that when dealers joined buying groups, a lot of their spend just vanished. To cut a long story short, they started engaging with those buying groups, attending their exhibitions and it worked well.

At the time, most large groups focused on bigger dealers, leaving a gap to support the smaller end of the market. Superstat began by targeting relatively small dealers, but within just a year or two, we had more than 100 members, some turning over millions.

The essence of what we do remains unchanged: bringing dealers and suppliers together to grow the business, putting the dealer first, supporting their growth and encouraging them to use our initiatives and work with our suppliers. Those principles have endured for 30 years.

What has changed over the years is that we no longer try to do too much, but when we decide to do something, we really do it properly.

W360: How many dealers are currently on board?

AD: Over 200.

W360: Is that moving in any particular direction?

AD: No, it’s bizarrely holding very steady. There is some consolidation, as you know, but we signed a new dealer just last week.

W360: You mentioned that the group’s original objectives have remained consistent over the past 30 years. What are the main focus areas today when engaging with dealers?

AD: The big one is sustainability. We’ve just launched our eco offering and that’s attracting a lot of attention.

Much of our focus is on new product areas, introducing new suppliers and [...] marketing and sales training

W360: Is it in addition to a standard programme or something you’re just rolling out?

AD: We’ve been rolling it out slowly and presented it at the conference with some of the dealers that are piloting it with us.

Dealers are telling us they feel there is a lot of talk going on around this issue within the industry, but that they need something tangible to show their customers right now. They also want to work towards being greener and genuinely making a difference, but you can’t change your whole business overnight.

Our solution provides a recognised standard without demanding an onerous amount of time or money to chuck at it straightaway.

W360: Any other strategic priorities?

AD: Much of our focus is on new product areas, introducing new suppliers and providing support with marketing and sales training in those categories.

W360: What would you say is the rate of decline in consumption of what we’d call traditional OP?

AD: Between 5-10%, although some categories are seeing double-digit declines.

W360: Are your dealers managing to fill that gap and if so, which adjacent categories are proving popular within the Superstat universe?

AD: Overall, they’ve plugged those gaps – and some have done fantastically well. A few haven’t, but on the whole, topline sales have remained steady. Dealers are constantly adapting and heading off in different directions. Furniture is a major growth area and some have really pushed into workwear and PPE, as well as catering and hygiene. Print remains a strong seller for certain dealers and at our recent conference, I spoke to a couple having great success in AV.

W360: What were some of the highlights from your recent conference? How was the mood and what were you hoping to convey?

AD: First and foremost, it was just an absolute joy –the mood was extremely positive, attendance was excellent and feedback from both dealers and suppliers was fantastic. We had a brilliant speaker who inspired everyone, but the most impactful sessions were when dealers themselves were at the centre of discussions. Peer-to-peer learning is far more powerful than anything I or a supplier could present.

Of course, not everyone attended. Some dealers are very hands-on, so even a single driver being unavailable can mean the managing director has to step in. Others might have preconceptions about these kinds of events – worrying about what to wear or not knowing anyone. But once they attend, they see how welcoming and enjoyable it is, and how valuable it is to take time out to think about their business.

The main objective is to provide a friendly environment where dealers and suppliers can come together and spend a day thinking, learning and sharing experiences and inspiration. Dealers that attend really hand-picked themselves and were focused on growing their business, exploring new product areas and making the most of the support on offer.

Our approach is very much a menu and we don’t dictate anything to anyone

W360: The industry is at a bit of a tipping point and needs to show a collective movement towards new opportunities. If vendors are relatively new to our sector, you want them to see an engaged reseller base. AD: I don’t disagree. We had a number of suppliers in what we call new product areas. They’re not new to most dealers, but I keep an eye on whether they’re getting value from the event and what the engagement has been like for them – because for some, it isn’t an obvious fit. Some are ex-OP, so they know the trade; but for others, it’s a whole new world.

I’d say all the suppliers, vendors and exhibitors were blown away by the level of engagement because for them it’s a high-quality audience of owners and decision-makers in the room who are all genuinely there to seek out new opportunities to grow their business.

W360: Talking about engagement, can you walk us through some of the services the group offers? Is it one size fits all?

AD: Our approach is very much a menu and we don’t dictate anything to anyone. Most dealers tell us they need help with something. Some members might only use one initiative that’s useful to them and that’s fine. Even if only 50 out of 200 use a particular service, that counts as a success. We take the time to find out what that thing is. It could be our sustainability programme, sales training or even our catalogue.

W360: I take it that’s not a full line catalogue?

AD: No, it’s a short-range in an A5 format with a good, better and best selection, offered either street-priced or unpriced. About 50 dealers still use it, roughly split 50:50 between the two pricing options.

W360: I suppose Amazon drives a lot of pricing. Does it come up in conversation much with dealers?

AD: Amazon is definitely taking business from our dealers, although it’s hard to quantify. We’ve tested

buying office stationery from Amazon and the pricing and service vary wildly when orders are fulfilled by different vendors. So independent dealers have plenty in their armoury to compete with Amazon when it comes to service.

W360: Amazon Business has been very much focused on FTSE 250 companies and other large public procurement organisations. Are you concerned it might move further down the funnel into SMEs, which are presumably the heartland of your dealers’ trade?

AD: I’m sure Amazon is already eating into that segment significantly and it will only continue to do so. It’s hard to know exactly what is happening.

However, my take is that if Amazon Business is focusing on the top end of the market while also cleaning up at the bottom, supplying microbusinesses and individuals, there’s still a middle ground of SMEs in the 20-50 office worker bracket where independent dealers traditionally have a lot to offer.

W360: Your compatriots at Nemo Office Club run a ‘buy local’ campaign. Do you think there’s scope for a wider industry initiative?

AD: Yes, I don’t see why not – we’d certainly support something like that.

W360: Returning to online, what’s your view on the digital capabilities of your members?

AD: They all have e-commerce platforms – many have had them for some time. But, as with all SME businesses, there’s a wide spectrum of digital marketing expertise.

Some are naturally brilliant at social media, while others tell us they struggle to find the time when there are other things they could be doing that give a more measurable result. Being hands-on, owner-managed businesses, even something such as sending a weekly email to existing customers can be a challenge to maintain consistently.

W360: Presumably you offer a service that tailors this or manages it for them?

AD: Yes – we provide a ‘done-for-you’ service, tailored to how much the dealer wants it personalised to their business. Social media posts and email marketing are sent out come rain or shine, with consistent timing and branding. There are clear economies of scale, so it can be delivered very cost-effectively.

Some business owners are hesitant to get involved in social media marketing because they don’t know where to start. With a platform and a track record of posts being shared for them, they can contribute more

easily. If they’ve got news or something personal to share, they’re not going in cold and risking a post that might look out of place.

W360: How many of your dealers take up that service?

AD: Funnily enough, about 50.

W360: And the rest?

AD: A very small percentage handle it themselves, and at a really high level, but many dealers tell us they struggle for consistency – whether it’s sending out a regular email or posting on social media. They’re always busy and it’s often a job that gets pushed to the bottom of the pile.

W360: How are these businesses staying afloat? If they’re not communicating with customers, somebody else will be.

AD: I agree that the bigger companies especially are relentless in their marketing and smaller independents are not always as consistent. But some tell us they look at what gets churned out and think they’d rather not do anything at all than put something out that doesn’t represent their personality. It’s something that we can help with: we want to give dealers ‘big company’ consistency in their marketing communications, but at the same time, you’ve got to preserve the individual identity of each dealer.

W360: Are there any standout success stories across your dealer network that you highlight to prospective members considering joining or switching allegiances?

AD: Absolutely. The most inspirational stories are where a dealer has focused on a new market or product area and really gone all in. Without naming names, the successful ones are investing to some extent in time, stock or expertise and taking it very seriously – and getting very good at it.

W360: For a dealer that decides to focus heavily on a new product area, what value does Superstat offer?

AD: In any new product area, we often help by connecting dealers with relevant suppliers – those with quality products, strong service and the right profile within the supply chain. Dealers could research this themselves, but having relationships already in place, with deals and terms set up, can be a real shortcut.

We also provide marketing support, which over the past two years has focused on different product areas. We can help dealers market these areas effectively.

Specialist sales training is another key area. A lot of sales training can be very product focused and forget to teach people how to sell.

Our priority is first to provide a sales process – a technique and approach for being more successful – and then tailor it to a new product area. It’s about combining a solid sales process with targeted product knowledge.

W360: Who at Superstat is tasked with becoming a guru in these adjacent product categories?

AD: It’s very much a team effort. Whoever manages a particular supplier relationship will drive that side, with our sales training expert researching the area, working with the supplier and bringing the training up to our Sales Academy standard. Product knowledge is important, but getting the sales process right is the key. Giving people too much detail on a product can almost be a bad thing.

W360: I guess content is pretty key to expanding the dealer community into different product categories and opportunities.

AD: Totally. It’s an area we’re immensely proud of. We create our content in-house, designed to engage consumers in a way that grabs attention without being overly salesy. We don’t lead with products or special offers. Offers have their place and may feature further down a communication, or not at all; but we lead with original content created weekly, tailored as much as needed to a dealer’s business.

We have an in-house style and see very low unsubscribes, with open rates well above the industry standard. Part of that comes from having good data – it comes directly from the dealers. These are actual customers and prospects, not purchased lists. For example, we send out 35,000 emails a week to real people who buy workplace supplies, with content we hope is genuinely worth reading, rather than saying, “Punched pockets are now just £1.99.”

W360: I get those emails as a consumer and wonder why they are still pumping out all that stuff.

AD: I’ve had that debate with a lot of people over the years. They’ll say, “Well, the promotional email I sent had more success than yours,” and it’s hard to argue – the sales spike is there in the stats. But that’s not what we’re trying to achieve. We want to enhance the relationship between the dealer and the consumer – to position them as businesses that people want to deal with and as helpful experts, perhaps in a particular area.

W360: No one’s going to get rich driving the price down on punched pockets.

AD: No, but that’s the kind of thing some focus on.

W360: Let’s talk about some of your supplier connections. Obviously, you’ve got a quite tight one with Exertis Supplies.

AD: We’d known the late Tim Holmes for decades, going back to his time at ACCO Brands. We stayed in touch while he was at Lyreco and then as he moved to Exertis Supplies. Quite frankly, when Spicers went under, we had a conversation with Tim. We’d been looking to

do something, but we had a solus arrangement with Spicers which I didn’t feel we could just breach or walk away from.

W360: Does Exertis’s no-frills model inhibit dealers to some extent or is it just a fact of life that they’re using multiple wholesalers now, given the expansion into adjacent categories?

AD: I don’t think it limits them. Over-duplicating traditional OP isn’t the right approach – especially when there are another 60,000 SKUs they could be selling, depending on which tangent they pursue. Dealers decide where to buy and many of our members use VOW as their main supplier.

W360: So, Exertis recently got a new managing director and new owners. Does that give you any sleepless nights?

AD: I’ll be honest – it was a bit of a shock. While both changes are perfectly understandable, having them happen simultaneously raised an eyebrow. That said, wholesalers have traditionally changed hands over the decades and that’s rarely sinister unless there’s something fundamentally wrong with the organisation – which, of course, has happened in the past.

We really liked Andrew Beaumont as the previous Managing Director and had a great rapport with him, but we also really like his replacement, Matt [Balcombe]. He seems like a great guy and definitely brings a certain energy to the role.

W360: How would you like to see Exertis evolve under the new Aurelius ownership?

AD: The new premises at Elland give Exertis the opportunity to get more involved in what we call newer product areas and dealers are very receptive to that. There’s now room to move, improve service and add extras – such as pick-and-wrap – which our members

Dealers have never relied on the exclusivity of their products […] it’s not how they distinguish themselves

have come to expect. One thing I would say about Exertis is that when it commits to something, it really does it properly – under-promising and over-delivering.

W360: What’s your view – and that of your dealer members – on the size of evo Group and, more importantly, its diversified channel model?

AD: Some dealers object to buying from a competitor or competing with their supplier – however you want to frame it. Others take a more pragmatic approach, focusing on the supply proposition in front of them at that moment.

W360: While we’re on the topic, there’s also the move from vendors to D2C – whether through branded stores on Amazon or their own e-commerce sites. Are your dealer customers getting disillusioned by that?

AD: I think it’s just part of what the internet brings and there’s not a lot you can do about it. Dealers have never relied on the exclusivity of their products – it’s always been a commoditised range – and it’s not how they distinguish themselves.

W360: What are your thoughts on collaboration between dealer groups?

AD: We have good relationships with our competitors and work with them in certain areas, particularly where

collaboration benefits both dealers and suppliers. It’s a bit like a dealer group on a grander scale and we’re up for that where it makes sense.

I do quite like the element of competition, though, and having more dealer groups adds differentiation in the market.

W360: What’s your view on the Office Friendly and Integra merger for the industry as a whole?

AD: Honestly, what I think is not important. If their members feel it’s a good idea and benefit from it, then good luck to them. As I said, I quite like having other groups around.

W360: Do you think we’re going to see more consolidation, now that two of the five dealer groups have joined forces?

AD: There will be more, whether that’s at the dealer, dealer group or wholesaler level. But dealers are agile and well placed to make micro changes on a daily basis. They have a track record of succeeding despite macroeconomic trends and headwinds that aren’t in their favour.

So yes, there will be change and consolidation, but our membership is resilient. They’ve proven time and again that it’s not wise to write them off, as many people have over the time I’ve been doing this.

W360: What about BPGI? We don’t hear much about it anymore – is it still relevant and important?

AD: It’s still relevant to us as it’s a bit like a buying group model but on a larger scale. While there’s a clear benefit for our members, we’ll certainly continue to support it. It’s also been a way for me to get to know other people doing the same job, whether in the UK or abroad. I hesitate to call it networking, but it’s about having those conversations with peers.

W360: Sticking with consolidation, I guess it’s inevitable that some dealers in your group, given their age profile, are starting to consider their exit. What role does Superstat play as a dealer owner nears retirement?

AD: We’ve been helping dealers with acquisitions for 30 years and have probably seen anywhere from 50 to 100 go through. Generally, our dealer owners are quite youthful, so they’re more likely to be acquisitive than looking to sell. But it’s not always about age or retirement – I was talking to a dealer recently who’s looking to emigrate and start afresh abroad and ultimately wants to sell the business.

It’s invariably a win-win situation. The selling dealer realises value for the heart and soul they’ve put into the business; while it’s an excellent growth opportunity for the buyer, who might bolt on £500,000 or £1 million worth of sales – the equivalent of gaining a large number of new customers.

W360: Thinking about the future, what are the main challenges facing the independent dealer channel?

AD: Some of this we’ve already touched on, such as the decline in traditional OP, but also a flat economy and certainly people’s working habits. That decline in volume has been ongoing for years, although it’s probably been masked to some extent by price inflation, with turnover maintained artificially to some extent.

The government is busy working to reduce the rate of inflation, so my concern would be a combination of an ongoing reduction in volumes, coupled with price deflation. That could really hit turnover and cause a problem that we can’t solve quickly – another reason for us to be robust in growing new areas.

W360: Challenges aside, you came away fairly buoyed by the conference you ran. What was driving that enthusiasm?

AD: It’s hard to pinpoint exactly – perhaps just a sense of camaraderie that comes from taking time out of the day-to-day to reflect on what you’ve achieved and what you want to achieve next. Talking to like-minded people about what works and what hasn’t, engaging with suppliers who are there to grow their business and help you with yours – and, of course, having a bit of fun along the way.

There was a real energy in the room that reinvigorates your belief in this industry and the

dealer channel we operate in. You look around and think, “Actually, this isn’t all that bad.”

W360: If it’s not all that bad, I guess you’ll be sticking around a little longer. What are the biggest lessons you’ve learned since taking the top role?

AD: I once read a quote, and to paraphrase: “As a managing director, I want to try to be of some help and not a total hindrance to the team around me.”

W360: Don’t get in the way of your team.

AD: At the end of the day, someone’s got to make the decision, but it’s important to involve everyone and let them have their say. I won’t be here forever and there are younger people coming through. I was reading about The Entertainer – the founder is retiring and handing over control of the business through an employee ownership trust. That’s something I’d love to do: create a future for members, suppliers and the internal team who operate Superstat. That would be amazing.

Another lesson I’ve learned is that the people actually doing the job are best placed to find the solutions –not the manager. Personally, I still want to take this business to another level, develop the offering to customers, scale the business and provide an exciting future for the team around me.

W360: Sounds good. Thanks, Alex.

Ross Jones, founder of RJJones Consulting ross@rjjonesconsulting.com

Ross Jones examines the growth reality you shouldn’t ignore

The OP core is not collapsing, but it is no longer the engine. For most dealers, general office products (GOP) still make up about 80% or more of sales. Yet category growth is anaemic. The UK Office Supplies Market Size & Outlook, 2024-2033 report reveals a 26% decline between 2022 and 2024, with GOP forecast to return to only around 1.6% CAGR through to 2030.

By contrast, professional cleaning supplies are expected to grow by 12-15% per year over the same period, driven by a permanently elevated focus on hygiene post-pandemic. Similarly, catering products (non-food) show solid, though more modest, growth of 3.7-6.5% CAGR through to 2035, with even the most pessimistic models forecasting an outperformance of GOP’s predicted 1.6% growth.

The conclusion is clear: to maintain an attractive top-line trajectory, cleaning and catering must be

part of your portfolio. Put simply, success will not come from convincing existing buyers to consume significantly more paper or pens. It will instead come from acquiring new customers with adjacent, growing baskets – and cleaning and catering are the most accessible and scalable categories for dealers today.

Before moving into the heady world of cleaning products, I worked in catering equipment. Towards the end of my time in that sector, I served on the senior team at the Nisbets-owned Uropa Brands. Back then, our world and the workplace supplies world barely touched. We had never heard of VOW Wholesale, Exertis Supplies or EO Group because those ecosystems did not collide.

That is not the case now. The recent tie-up between EO Group and Uropa is a testament to the convergence. When I was at Uropa, more than 1,000 dealers were actively buying catering products. I would be amazed if more than 1-2% of those overlapped with the 1,000-plus traditional OP dealers supplied by wholesalers in our channel. That gap represents a clear greenfield opportunity.

As the walls come down, a new playing field opens. Those dealers that act first to extend their reach will capture a disproportionate share. Win the historically retail- or Amazon-focused buyers with cleaning and catering, then layer on the category you already know best: GOP.

Cleaning and catering are the most accessible and scalable categories for dealers today

I won’t go into too much detail here on entering these categories – perhaps I can convince the Workplace360 team to give me another slot for that! – but it’s as simple, and as complex, as defining a core range, developing a proposition within your business and aligning your sales and marketing activities behind it.

For now, here are some basics so you don’t have to learn the hard way. Three pitfalls to avoid:

1. Treating cleaning like another paper line. It is outcome led, not just price led.

2. Launching too wide. Depth in the right SKUs beats breadth you cannot support.

3. Overlooking the ‘install’ value on catering products. Coffee and sundries follow a similar sales cycle to cleaning. However, the wider basket of catering items (tableware, tea/coffee-making equipment, etc) offers the potential for a large ‘install’ value that could equal a year’s worth of cleaning products, or more.

The previous issue of Workplace360 included reaction to the news that Exertis IT – and therefore the Exertis Supplies office supplies wholesaling business – was being sold to private equity firm Aurelius in a deal worth around £100 million. With the transaction expected to close on 31 October, Exertis’ management team is bound by regulatory conditions about what it can and cannot say. However, in late September, there was widespread speculation in workplace supplies circles that the business had seen its credit insurance lifted – leading to rumours of a possible cash flow crisis.

Recognising the need for proactive communication to the market in a sector where news travels fast, Exertis Supplies Managing Director Matt Balcombe approved a press release. In that document, he admitted there had been credit insurance issues, but these had only affected a “small number” of suppliers.

During a follow-up interview with Workplace360 a few days later, Balcombe sought to put these comments into a clearer context. “What we’ve experienced is specific credit insurers reducing or withholding insurance

to some of our vendor partners, while they complete their own reviews,” he explained.

“This is entirely normal during a change of ownership and we are working on solutions with our partners to ensure minimum disruption to the essential services we provide to our customers. We’re talking about a single-digit number of vendors.

“It’s a very small proportion of our supplier base and so far, we’ve found ways to continue trading without interruption,” he confirmed.

We are working on solutions with our partners to ensure minimum disruption

He added: “What’s been really encouraging is how flexible and pragmatic our partners have been. They understand it’s part of the process and value the longterm relationship. Deliveries are coming in every day and orders are being fulfilled as usual.”

Exertis Supplies Managing Director Matt Balcombe quashes rumours the wholesaler is under threat from credit insurance withdrawals. By Andy

Braithwaite

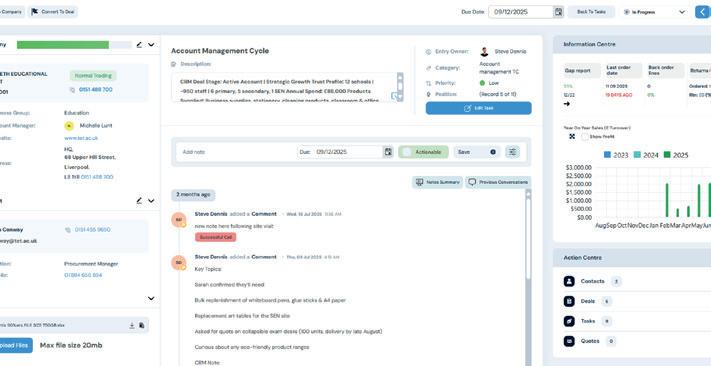

While the sale to Aurelius has dominated recent headlines, Balcombe has spent his first few months in charge quietly overseeing an extensive internal transformation that began under the leadership of his predecessor, Andrew Beaumont. Exertis Supplies, he noted, is well into the first phase of a three-year growth plan that focuses on areas such as customer alignment and operational efficiency.

A major component has been the reorganisation of the sales and commercial functions. The company has divided its customer base into three main groups, each paired with sales representatives best suited to clients’ preferred way of working.

“Some customers want a highly data-driven relationship – price feeds, stock updates and back-order visibility,” said Balcombe. “Others prefer more hands-on conversations about tenders or category advice. Every customer now has a named account manager, which I believe is unusual in the market.”

Supporting that new model are four Centres of Excellence covering commercial management, purchasing, pricing, and data and marketing – overseen by Ben Appleby. Two of these (pricing, and data and marketing) are newly created and have led to the addition of six specialist roles.

“The goal,” explained Balcombe, “is to bring real expertise to how we use data, set up products and manage pricing, freeing up the commercial team to spend more time with vendors and customers.”

We want to be visible, approachable and part of the conversation

Operationally, Exertis Supplies is maximising its connection with the broader Exertis IT distribution network, particularly through the 33,000-location automated pick tower at Burnley Bridge in Lancashire.

“This facility allows us to handle ink and toner more efficiently and frees up 4,000 pick locations at Elland for traditional OP,” said Balcombe, adding: “The two sites complement each other well and give us 24/7 capability when we need it.”

The move to Elland – a 130,000 sq ft facility completed in early 2024 – has also improved flexibility and space utilisation. “It’s given us room to expand the range and to host customers in a modern environment. We’ve had a lot of people through the site in recent months,” he noted.

Another development has been a move into Ireland. The company opened a warehouse and sales operation in Dublin earlier this year, initially with around 6,500 SKUs and a small local team serving both the Republic and Northern Ireland.

“We’d traded into Ireland from the UK for years, but post-Brexit that became more complicated and

expensive. Having stock on the ground gives customers a faster and more cost-effective option,” said Balcombe. A partner event is planned in Dublin for February 2026 to showcase suppliers to the Irish market.

Across the UK and Ireland, Balcombe has spent much of his first few months on the road. “I’ve met around 200 customers and vendors since March,” he said. “Those conversations are invaluable – they tell us what we’re doing right and where we can do better.”

The company’s emphasis on collaboration has also led to service innovations. One recent project involved a dealer focused on sustainability goals. “We now consolidate their orders and deliver direct to the end customer using a white-glove carrier service,” Balcombe explained.

He added: “Goods go to the right floor, packaging is removed and everything arrives ready for use. It reduces transport miles and helps the reseller provide a premium experience.”

Exertis Supplies is likewise stepping up engagement with dealer software partners such as Prima Software and ECI Software Solutions, supporting joint events and user meetings. “It’s still a face-to-face industry,” said Balcombe. “We want to be visible, approachable and part of the conversation.”

Balcombe’s focus through the transition period is on execution and stability. “We’re delivering the changes we’ve committed to and continuing to invest,” he said. “Customers can expect the same service, the same people and the same reliability.”

With the sale to Aurelius imminent, the Managing Director remains outward-looking. A series of customer initiatives are planned, including the company’s first ‘12 Days of Christmas’ event at Elland and a programme of regional visits into 2026.

He concluded: “The message we’re giving to our partners is that it’s business as usual – and we’re investing for growth.”

What once involved a bitter coffee and a sugary snack has evolved into a carefully curated experience that helps staff to feel genuinely valued. By Kate Davies

On the surface, breakrooms provide employees with the chance for a well-earned pause in a busy day. Beyond that, they play a far bigger role in supporting individuals, strengthening teams and boosting company performance.

As Janinne Taylor, Head of Marketing & Product Development at Morleys Design, explains: “Modern breakrooms – whether in schools or offices – are evolving into vibrant hubs for connection, featuring quiet zones for relaxation and opportunities to step away from packed schedules.” Her colleague, Managing Director Adam Smith, adds that hybrid working is a key factor driving this shift. As a way of enticing staff back on-site, many companies are redesigning breakroom spaces to promote better work-life balance and make the office a more attractive proposition.

42% of UK workers say protein content is part of their thinking when choosing lunch Healthy Eating in the Office 2025, Just Eat

TrueStart Coffee CEO Helena Hills puts it simply: “The breakroom isn’t just about fuelling work; it’s about fuelling culture. It’s the little everyday rituals, like making a round of coffees, that knit teams together and make hybrid work feel human.”

Gensler’s Global Workplace Survey 2025 highlights the need for more people-focused spaces, revealing that only 14% favour a corporate office. Most prefer settings with a different feel, such as nature retreats (14%), coffee shops (10%) or a residential atmosphere (9%).

As a result, dealers are being asked to help design areas that are capable of promoting both collaboration and relaxation. Morleys Design reports strong demand for furniture with a resimercial aesthetic – pieces that combine the comfort of home with the durability of commercial use.

Dynamic Office Solutions has also responded to this trend, introducing a café and bistro range alongside UKmade soft seating. “These products not only enhance the look and feel of breakrooms and kitchens but also encourage staff to take meaningful breaks,” explains Managing Director Nicola Speers.

Not every client has large areas to work with, however. CEP Office Solutions Communications & Marketing Manager Marie-Amélie Dufour notes that the company has seen growing interest from businesses with limited space, particularly in their kitchens or break areas. To meet these requirements, CEP has developed compact solutions that are suited to small environments. These include streamlined equipment, storage solutions and waste bins.

“We are seeing a decline in large-format, multicompartment storage solutions,” adds Dufour. “In this context, CEP has revised its 2025 offering by removing a large-format storage station in favour of more flexible solutions that are better suited to modern spaces.”

It’s the little everyday rituals […] that knit teams together

Coffee culture is central to the modern breakroom. Coffee’s Fourth Wave analysis – by global market intelligence firm Mintel – reveals that more remote workers now own specialty brewers such as single-cup and pour-over systems, signalling a wider demand for premium coffee.

Gen Z, in particular, is driving coffee’s ‘fourth wave’, valuing quality and more inclusive, uplifting experiences.

These expectations are now filtering into workplaces. “People are looking for energy, positivity and a little bit of joy from their daily brew,” Hills says, adding: “A vibrant breakroom stocked with exciting, great-tasting coffee says, ‘We care about our people,’ while a dusty jar of generic instant sends the opposite message.”

As younger employees push back against overly complicated coffee options, dealers have an opportunity to simplify choices and make purchasing easier.

TrueStart has been helping customers to navigate the sometimes-confusing world of coffee machines by working with trusted partners to supply them alongside the coffee itself, giving buyers a single point of contact for everything hot beverage-related.

This focus on meeting employee preferences extends beyond coffee, as hydration in general is also being re-evaluated. Demand is rising for low-sugar soft drinks that offer a boost without the crash. A popular option is the MOJU Shot range from MBM Omega, which has become a regular choice in offices aiming to support wellness without sacrificing taste, according to Managing Director James Morton.

Workplace snacks are also reflecting employees’ health priorities as employers respond to growing calls for more nutritious options. A 2025 Just Eat study of more than 1,000 UK workers found that 65% are more focused on health and nutrition now than five years ago, and many report that these attitudes are now spilling into their office eating habits.

Protein has become particularly important, with 42% of respondents saying that protein content is part of their thinking when choosing lunch, while 20% cite it as their main consideration. In practice, one in six workers are now being offered protein bars at work, while one in seven can pick up high-protein yoghurts.

Meanwhile, Mintel’s The Rise of Fiber research positions fibre as the next essential ingredient in healthy eating, noting that the ongoing social media trend of ‘fibermaxxing’ encourages consumers to increase their daily intake in creative and appealing ways.

Morton sees these dynamics as more than nutritional choices, viewing them as part of a wider movement in the workplace: “It’s about more than snacks; it’s about creating a sense of belonging and reinforcing company culture through small, everyday gestures.”

The dealer’s Healthier Options range, launched in 2024, includes lentil-based snacks, protein-rich treats,

of employees favour a coffee shop

Global Workplace Survey 2025, Gensler 10%

vitamin-infused drinks and gut-healthy kefir. It has proved especially popular with city centre corporates, with clients noting stronger engagement from employees and a heightened appreciation for healthier, more diverse choices.

Today, health also equals hygiene, and this directly influences whether employees feel comfortable using communal breakrooms. If standards fall short, morale, collaboration and productivity can all take a hit.

Brands are therefore responding with data-driven solutions. Tork’s Vision Cleaning, for example, uses realtime insights from connected dispensers to highlight when and where service is needed. This allows for more efficient cleaning and fewer complaints, ultimately improving hygiene standards and employee satisfaction.

The Cheeky Panda Sales Director Simon Weavers suggests that the tactile experience of hygiene also matters: “Bamboo materials offer softness, absorbency and strength that staff feel and appreciate.”

Even with increased awareness of hygiene, misconceptions can still persist. A common assumption, according to SC Johnson (SCJ) Professional, is that workplace hygiene solutions are just consumer products repackaged at a higher cost. SCJ stresses they are professional-grade solutions designed to meet workplace challenges, supported by certifications. Clarifying this helps facilities managers see the value of the investment.

While professional cleaning systems can cost more upfront, they’re typically more cost-effective over time. Dealers that can quantify these savings and demonstrate ROI are better placed to win tenders and build longerlasting relationships.

In the breakroom, clients increasingly expect their coffee, furniture or paper towels to come with credible, trusted eco-credentials. Recycling rates, carbon data or independent accreditations can help customers demonstrate progress on their ESG goals.

• Always bundle a tasting into every proposal

• Highlight circularity numbers and results

• Focus first on coffee and hygiene improvements, before phasing in furniture and technology

• Use visuals and case studies to show how a compact space can be transformed

• Sell replenishment, preventative maintenance and recycling collections for recurring revenue

Furniture is a prime example of how sustainability is reshaping the breakroom. Morleys Design’s Titan Retold chair, made from 100% recycled plastic, saves 15 tonnes of plastic annually. The company also audits furniture for refurbishment, repurposing or donation.

“We prioritise UK-based manufacturers, use reduced packaging and work with transport providers focused on low-carbon operations,” says Taylor, adding: “The response has been overwhelmingly positive. Schools and colleges welcome sustainability as part of their social responsibility commitments.”

Consumables are following suit. CEP’s bamboo storage solution for coffee capsules, for instance, saw growth of over 792% between 2024 and 2025, underlining demand for simple, sustainable items.

and presenteeism. Given this, enhancing wellbeing and hygiene in communal areas is not just good for employees – it also protects the bottom line.

Suppliers are committed to bringing wellbeing to life and every innovation helps. TrueStart Coffee independently lab tests its products for consistent caffeine levels, helping staff feel more in control of their energy levels without risking mid-afternoon crashes.

Meanwhile, The Cheeky Panda points out how bamboo-based hygiene products are naturally antiviral and hypoallergenic, making them a better fit for staff with skin sensitivities or allergies.

Similarly, The Cheeky Panda has expanded its offering with hand towel dispensers featuring automatic cutting systems to reduce overconsumption, save costs and minimise waste.

Breakrooms are also being shaped by a stronger focus on inclusion and accessibility. As Taylor explains, heightadjustable tables, wider walkways and lightweight chairs make spaces easier to navigate. Additionally, neurodiverse-friendly designs such as quiet pods and acoustic furniture help to reduce sensory overload, while natural materials create more restorative environments. Taken together, these design choices acknowledge that not everyone recharges in the same way, supporting wellbeing for all employees.

The business case for promoting wellbeing is just as strong as the cultural one. The Institute for Public Policy Research estimates that the hidden cost of workplace sickness rose by £30 billion in the UK from 2018-2023, predominantly through lost productivity

These innovations [...] deliver valuable information into consumption trends

Technology is being incorporated into the breakroom experience, transforming convenience and connectivity. Digital platforms for pre-ordering meals and techintegrated furniture let employees relax or catch up without being tied to their desks.

Dynamic’s Speers notes that charging points in soft seating and breakroom furniture are quickly becoming standard. This versatility means that employees can use the breakroom for downtime or informal meetings –depending on their individual needs.

For MBM Omega, the biggest draw is data-driven insights. Morton explains: “We’re seeing rising interest in smart vending, cashless payments and app-based restocking. These innovations don’t just enhance convenience; they deliver valuable information into consumption trends.”

The breakroom category is a layered sale – quick wins come from consumables, richer margins via equipment and furniture and long-term value through service, data and sustainability. Above all, it’s where a positive working culture happens – and that role has only grown in hybrid working models as employers redesign spaces to draw staff back to the office.

As Advantia Managing Director Steve Carter concludes, simply sharing a coffee with colleagues “provides that inclusive, community-type feel” which remote working can’t replicate.

ENTRIES ARE NOW BEING ACCEPTED IN THE FOLLOWING CATEGORIES:

l Business Product of the Year

l Sustainability Excellence – Vendor and Reseller

l Marketing Campaign of the Year

l Best Workplace

l Online Reseller of the Year

l Vendor of the Year

l Reseller of the Year

l Wholesaler of the Year

l Young Executive of the Year

l Executive of the Year

l Business Leader of the Year

l Industry Achievement

Winning an award can make a real difference to your business, so be sure to get involved. Simply complete an entry form online at www.opi.net/EOPA2026 or email your nominations to awards@opi.net. The closing date for entries is Friday 14 November 2025

it’s now or never!

There has never been a better time than now to target and win new business. There – I’ve said it. I’ve been dying to get that off my chest. Amid some of the toughest economic conditions many of us have faced – or ever will – I’ve decided to take the plunge and say something positive.

New business is crucial for any organisation –whether that’s from existing clients or opportunities with brand-new ones. Without it, staying afloat is a struggle, let alone prospering. So, is it a case of survival of the fittest?

Perhaps; though, in truth, it probably never has been any different. This time, however, with a seemingly endless stream of disappointing economic news and even gloomier predictions, there is the likelihood of greater existing client revenue pressures than we’ve seen for a while – particularly if you operate in a flat or contracting market, such as traditional office supplies.

As consultants specialising in sales growth services, I can tell you that the number one reason clients seek our support is the need to generate new revenue – and it’s not just limited to workplace supplies; this happens across every sector.

Why is that? One major factor is that operational costs have risen and will continue to increase. New business growth will help to compensate for these mounting costs. Another factor is that existing client

spend is either static or declining and your customers are feeling the same pressures as you are.

I would hope that by now, you are well on your way to a more diversified customer offering across the portfolio of products and services – one that provides the opportunity to sell more to existing clients. This is the first rule of a new business strategy: focus on growing what you already have. We’ve already published a handful of articles on this, designed to inspire the desire to make this happen.

The good news – at least from a new business perspective – is that this diversified solution is now, or very soon will be, more attractive to your customers than it has likely ever been. They will be more receptive to reducing costs through consolidation. They may also have fewer staff and therefore will be increasingly time

Gary Naphtali is a director at Sales Perfect

poor, making the prospect of managing fewer suppliers a very welcome relief.

The vast majority of companies are being forced to review what they do, become more efficient and costeffective and/or deliver greater value for money. Step one is to recognise that we need to be proactive. That means taking the initiative to existing clients rather than waiting for them to come to you.

It’s about revisiting product sectors you haven’t sold to them before and restating the benefits of singlesource supply – whether that’s furniture, FM, print, PPE or anything else currently off their radar. It’s about reassessing the mix of own-brand and alternative products and plugging the gaps.

It’s about helping clients to reduce their overall spend by spending more with you. That might even mean proposing a margin decrease on existing products if it secures additional ranges and increases average order values. The benefit is even greater if you can work with them to lower the cost to serve. In short: take the game to them.

We also need to be mindful of our pet clients coming under attack. If you’ve enjoyed a healthy relationship with those customers and even healthy margins, the chances are that somebody will target them as potential

new accounts. Ask yourself: which of your clients would you go after if you were a competitor?

If you are reading this thinking that you have an unbreakable relationship with your key clients, remember this: change may be forced upon them, too. Revisit those relationships and make sure you are connected at every level in the decision-making chain.

Ask yourself: which of your clients would you go after if you were a competitor?

I like to use the burglar analogy. If you had to break into your own house, how would you do it? That’s exactly what a burglar would work out – and it highlights your weakest point.

We have covered this in previous articles, but it bears repeating: now is the time to push forward and be proactive with existing customers, using your expanded solution. Most of all, though, with current customers, don’t be defensive.

Let’s get back to new business. Where do we start? Here’s a simple question for you: as a business owner or salesperson, how much brand-new revenue do you need just to stand still? In other words, if spend from existing clients is expected to slip, what level of new income is required to replace it? It may seem like a really obvious question, but you’d be amazed at how infrequently it is asked.

I spoke with a potential client recently who told me that they had a new business growth target of 10% for the year. So I asked how much existing business they expected to lose. Their answer? None. There were no current contracts about to expire, no ‘at-risk’ customers and the purchasing base was made up of secure, regular, established clients. The sales force was settled and experienced. “But what about change?” I asked. “Something always changes.”

In this particular client’s industry, the natural attrition rate was around 6-8%. Therefore, it would probably lose that proportion of customers through no fault of its own, no matter how good it was. To simply ‘stand still’, the new business target should have been at least 8% –just to be sure.

And that’s a fact of sales: something will happen that’s beyond your control. It will affect your client and potentially affect you as well. No matter what the current circumstances, things won’t stay the same.

The good news? Change is the biggest driver of new business opportunities there is. Without it, there is little need to look for alternatives; no reason to consider consolidation or incentive to seek new solutions. That’s why today’s economic climate should be seen for what it is: a forced wave of change. And change is magic pixie dust for growth.

Just don’t be fooled into thinking that you can stand still without it – because you almost certainly can’t. If you want to grow 10%, you will need to achieve double that to allow for this attrition. If this doesn’t happen, that’s great – but please factor it into your plans.

The most positive aspect of change is that it really does open the door to something brand-new – business that you’ve never had before or that has been with a competitor for years because the relationship has been stronger than the commercial dynamic. Has that shifted? Is change happening to them or their organisation? Most probably.

So, re-target them. Approach people you’ve engaged with previously – you may find that the door is just ever-so-slightly further open than before. And once you’re in? That’s the easy bit. Then you can win; but so can the other five companies that have been let in too.

What you have to do, of course, is increase your chances by making yours the most impressive offering on the table. How? Savings, service, personality, products? All of the above – and more. But that’s exactly what your competitors will do too, isn’t it? Maybe they will, maybe they won’t – you can’t control that.

What you can control is how you make your proposition as relevant as possible. To do that, you need to make sure that your salespeople know all the components of your offering and understand which parts to ‘sell’. I call this the ‘component proposition’.

Change is the biggest driver of new business opportunities there is

Buyers expect suppliers to provide the products needed, the service desired and proof that they can deliver on their promises