What began in 1972 as a small IBM typewriter supplies dealership has since transformed into a billion-dollar powerhouse in wholesale distribution and third-party logistics (3PL).

At its wholesale core, what is now known simply as Distribution Management (DM) is predominantly focused on the print and imaging space, but its 3PL business continues to scale impressively across a spectrum of categories.

DM President and CMO Greg Welchans, in tandem with CEO Sean Fleming and an expansive and highly experienced executive team, has helped to successfully steer this growing ship since 2001.

Essendant will concentrate on channels where it sees growth potential: jan/san, foodservice, enterprise accounts, e-tailers and tech resellers. These customers do not require wrap-and-label, allowing it to operate a lower-cost fleet and a more consolidated distribution centre (DC) network; this will still enable 98% US coverage within two days using into-stock and drop-ship fulfilment models.

OP will remain in the assortment, but [will be] geared towards the needs of non-dealer customers. Stocked furniture will also be discontinued.

16 Big Interview

Distribution Management is eyeing category expansion as well as acquisitions in a rapdidly changing marketplace

24 Focus

More information and reaction to Essendant’s strategic decision to drop the IDC’s OP channel

27 Feature

Out with the old, in with the new: our everevolving Top 100 list has seen seismic changes again over the past year

36 Category Update

The stamping sector is not known for moving at breakneck speed, but opportunities remain

38 Category Update

Paper-based packaging options are moving from niche to norm as sustainability demands continue to ramp up

42 Research

Should HR and IT departments unite to create synergies and a better staff experience? It looks like it

44 Preview: Industry Week ’25

There will be many talking points at the biggest event in the US business supplies calendar – one or two of them not exactly planned

46 Preview: Climb of Life 2025

The UK business supplies industry once more takes to the Lake District hills in staunch support of the Institute of Cancer Research

Editor

Heike Dieckmann +44 1462 422 143 heike.dieckmann@opi.net

News Editor

Andy Braithwaite +33 4 32 62 71 07 andy.braithwaite@opi.net

Assistant Editor

Kate Davies kate.davies@opi.net

Workplace360 Editor

Michelle Sturman

michelle.sturman@workplace360.co.uk

Chief Commercial Officer

Jade Wilson +44 7369 232590 jade.wilson@opi.net

Head of Media Sales

Chris Turness +44 7872 684746 chris.turness@opi.net

Commercial Development Manager Chris Armstrong chris.armstrong@opi.net

Digital Marketing Manager Aurora Enghis aurora.enghis@opi.net

EVENTS

Events Manager Lisa Haywood events@opi.net

Head of Creative

Joel Mitchell

joel.mitchell@opi.net

Designer James Upright james.upright@opi.net

Finance & Operations

Kelly Hilleard kelly.hilleard@opi.net

CEO Steve Hilleard +44 7799 891000 steve.hilleard@opi.net

Director

Janet Bell

+44 7771 658130 janet.bell@opi.net

Executive Assistant

Debbie Garrand debbie.garrand@opi.net

Follow us online

LinkedIn: linkedin.com/company/opimagazine

Website: opi.net App: opi.net/app X: @opinews

What is that saying again? It never rains but it pours. Maybe that’s not entirely appropriate – who is to say how calamitous recent events will turn out to be – but I would argue that the US business products space has definitely had quite the time of it lately.

In the aftermath of big news – and no doubt Essendant exiting the OP dealer channel (page 24) and ODP Corporation being acquired (page 6) is very big news indeed – there usually follows a prolonged ‘wait and see’ quiet period, punctuated largely by speculation. The team at OPI – perhaps most acutely our News Editor, Andy Braithwaite – has been hard at work catching up with industry leaders to gather and digest some insider information.

The US business products space has definitely had quite the time of it lately

Curiously, huge industry announcements seem to happen around OPI press days – in this column in September’s issue, I talked about Andy anxiously anticipating ODP’s latest financials and a possible sale revelation. That didn’t happen, but just a few weeks on... Isn’t there another saying: bad things come in threes? Let’s hope not.

One thing is for sure: the ink on the pages of our Top 100 feature (page 27) is barely dry and I’m already wondering how this who’s who in our space will evolve in the coming months. I would hazard a guess that the trajectory in recent years of just under 20% turnover annually will continue apace. The somewhat concerning point here is that consolidation, for one, shows no sign of slowing – across the board.

This needn’t be a bad thing. Consolidation often – aside from when it’s purely a succession issue – suggests all manner of inherent inefficiencies in the organisations coming together. But, adjacent categories muscling in aside, where in our Top 100 are the start-ups and newcomers that spur innovation? They may, of course, not last, as we’ve seen many times in the past, but they propel new thinking.

The proverbial rocket that will have a profound effect on our industry seems to come not from people or organisations but from AI! I hope to see many of you at our OPI European Forum in London in early October, where this fascinating topic will be covered in some detail.

Cédrik Longin will be one of the speakers at the event. For now, check out his thoughts on the opportunities of AI, specifically for SMEs, in our Final Word (page 50).

Just before this issue of OPI went to press, The ODP Corporation (ODP) announced that it will be acquired by private equity firm Atlas Holdings.

Atlas will pay $28 per share in cash for ODP. This represents a premium of 34% on its closing price on 19 September and values the reseller at around $1 billion. When the deal closes – mostly likely before the end of the year – ODP will become a privately held company and be delisted from the NASDAQ stock exchange.

ODP CEO Gerry Smith (pictured) said the transaction represented a “substantial premium” for shareholders – even though the sale price for the whole company is what Staples offered for the retail business four years ago and, at the end of 2023, ODP’s stock was trading at $58.

He added: “Atlas brings an understanding of our industry, along with the operational expertise, resources and track record of supporting its companies, which will

In August, ADVEO initiated insolvency proceedings in an effort to find a buyer. The French multichannel operator – which operates reseller brands Plein Ciel, Calipage, Buro+ and Top Office as well as a purchasing group called Carip – has been under the ownership of private equity firm Sandton Capital Partners since mid-2019.

Sister company ADVEO Benelux was acquired by Austria’s PBS Holding in August of last year, but Sandton has presumably been

unable to find a buyer for its French business units without first entering creditor protection.

Court documents show that ADVEO France’s efforts to find a solution to its worsening financial situation go back more than 12 months. In June 2024, it appointed an independent arbitrator to work with creditors and key stakeholders. Despite agreements reached during this five-month period, the group’s owner decided the best way forward was to enter formal insolvency proceedings.

fast-forward our B2B growth initiatives and strengthen our position as a trusted partner to our customers.”

Atlas Managing Partner Michael Sher commented: “Atlas has a long history of transitioning public companies into successful private enterprises and we are uniquely positioned to do just that with The ODP Corporation – an iconic American company.”

He continued: “ODP’s leadership has already taken several steps to mitigate the challenging retail environment and we are the right partners to support [its] continued evolution in its next chapter.”

Atlas owns and operates almost 30 companies that generate more than $20 billion in combined annual sales. Its portfolio includes stationery supplier TOPS and tissue manufacturer Marcal Paper as well as other businesses in the pulp, packaging and distribution sectors. However, it does not own any retail organisations.

One of its operating partners is former Staples Contract division chief Jay Baitler, who also serves on the TOPS advisory board.

The move into administration has resulted in a leadership change. Chairman Hervé Milcent has been replaced by Claude Bergeron, the owner of a Lyon-based advisory and restructuring firm. He will now be working with the administrators to find a purchaser (or purchasers) while keeping ADVEO running.

Interested parties had until 26 September to submit their proposals.

Jan/san, packaging and foodservice distribution giants Imperial Dade and BradyPLUS are to combine, creating an organisation with annual revenue estimated at around $10 billion.

Few details of the transaction have been revealed, although it was confirmed that Bain Capital, Kelso,

Advent, Warburg Pincus, FEMSA, the Tillis family and management are the capital partners involved and will have board representation. FEMSA – former owner of Envoy Solutions, which merged with Brady in 2023 to form BradyPLUS – separately confirmed it will have a 19% stake in the new entity.

RAJA Office has decided to go to market under a single brand in southern Europe, meaning it will phase out two well-known local names. The France-based group has confirmed that JPG (France) and Kalamazoo (Spain) will rebrand to Mondoffice – the name of RAJA Office’s Italian unit – by the spring of 2026.

Together, these three companies employ 800 people, serve over 320,000 customers and generate combined annual revenue of around €300 million ($330 million).

Mondoffice is also the name of the new private label brand for France, Spain and Italy. Launched in September, it will offer 1,000 top-selling products in categories such as paper, pens, furniture, hygiene and cleaning.

When RAJA acquired parts of Staples Solutions in 2019, its strategy was to reinvigorate local brands such as JPG. It appears challenging market conditions and the need to generate economies of scale have led to a change of heart.

It has been a tumultuous few weeks for Netherlands-based office products manufacturer Jalema, part of the T3L Group.

In August, the company halted production at its two sites and was placed into administration after running into financial difficulties. At the time, CEO Peter Achterberg told OPI he was confident the business would be back up and running before too long.

That proved to be the case in early September, after administrators approved two separate transactions for assets of the Jalema BV entity. A new company called T3L Benelux has been established. Headed by Achterberg, this includes the Reuver manufacturing facility in the south of the Netherlands.

RAJA Office – which also includes Viking – is present in ten European countries, operates six distribution centres and generates annual sales of almost €800 million.

Meanwhile, former Jalema owner Joan Westendorff has acquired the factory in Hoogezand in the north of the country. This business will operate as Atlanta, its former name before the acquisition by Jalema. A commercial agreement is in place for T3L to purchase products made by Atlanta, but Westendorff will also look to increase his customer base over time.

Achterberg said growth areas for T3L Benelux included ramping up production of Helit-branded items following Tarifold’s purchase of Maped Germany’s OP assets in July. Jalema’s ‘rescue’ was also good news for T3L USA, due to significant business in the graphics market in the country, he added.

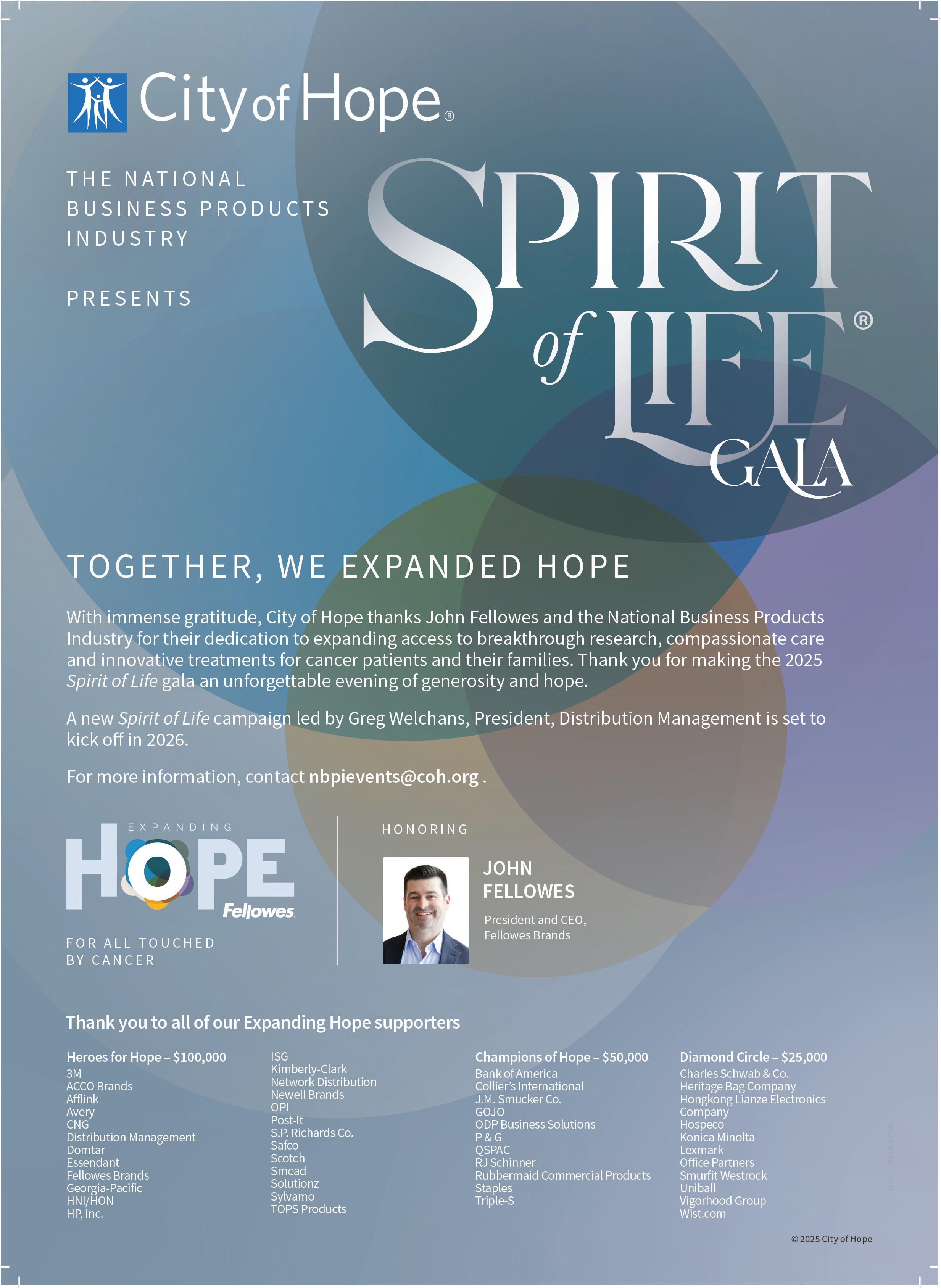

Popular US business products executive Barry Lane has called time on his career at Avery after an incredible 42 years with the company. He joined Avery Dennison in July 1983 and officially left the vendor on 31 August 2025.

During his tenure, Lane held various sales leadership roles in the commercial, superstore and retail channels throughout North America. Additionally, he has been a champion of the independent dealer channel, actively participating in the development of the sector.

He served as President of the Business Solutions Association – and received its Leadership Award in 2022 – and on the board of AOPD as well as on various supplier councils. Back in 2015, he was the recipient of the prestigious City of Hope Hall of Fame award.

Lane is not retiring, but told OPI he will take some time before determining the next chapter in his professional life.

International Paper’s (IP) decision to convert a paper machine at its Riverdale site in the US state of Alabama will have an impact on Sylvamo.

Since it was spun off from IP in 2021, Sylvamo has had a paper supply agreement with its former owner in relation to Riverdale. The mill – via its number 16 paper machine (PM16) – currently supplies Sylvamo with around 260,000 short tons a year of cut-size uncoated freesheet.

In August, IP confirmed that PM16 would be converted to produce containerboard, with the $250 million project

Australian paper and packaging firm Opal is suing the Victoria state government for more than A$400 million (US$264 million) over the closure of its Maryvale mill. The company – formerly known as Australian Paper –had pulled out of graphic paper manufacturing in 2023 after its supplier was forced to halt eucalyptus timber production in an area inhabited by an endangered species of possum.

Opal was unable to source viable alternative wood supplies and closed its white pulp and paper production at the Maryvale Mill in early 2023, resulting in the loss of more than 400 jobs across Australia.

Now, the company has filed a complaint with the Supreme Court of Victoria alleging the state’s government breached a long-standing wood supply agreement for the Maryvale location. It is seeking A$402 million in damages to offset what it called a “substantial loss”.

Opal said it had attempted to reach a negotiated outcome with the state’s government. However, after almost three years of discussions, the manufacturer stated it has been “left with no choice but to proceed with a court-determined outcome”.

expected to be completed by the third quarter of 2026. However, Sylvamo will lose the Riverdale volume well before this time, when IP takes the machine offline to begin the conversion work.

In a presentation, Sylvamo said it had “various options to mitigate impacts to our customers”. It is currently assessing which of these are “economically viable and work best under the evolving economic and tariff conditions”, but may redirect volume to the US from its mills in Brazil and Europe.

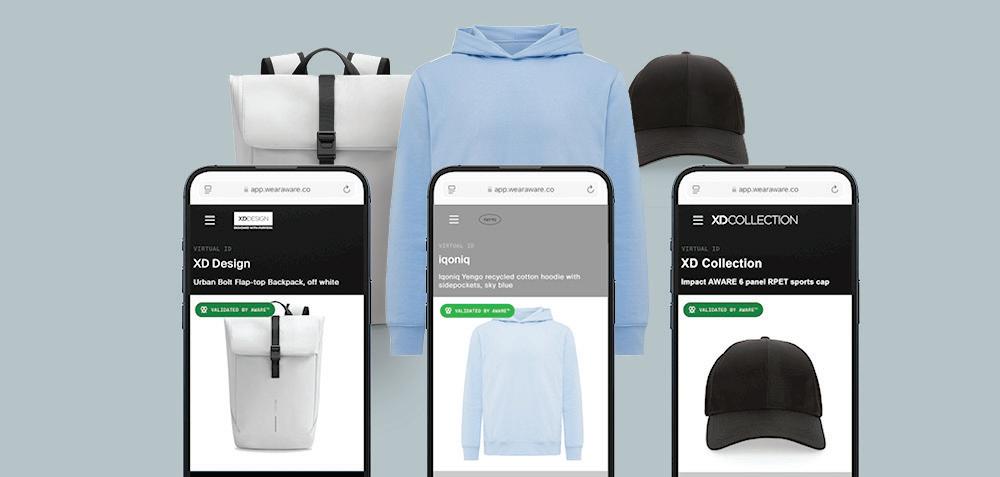

Investment firm Platinum Equity – owner of leading Australian business products vendor Winc – is targeting the European promotional products sector. In June, the private equity group announced that it was in exclusive negotiations to acquire Solo, a European market leader in customisable B2B products.

With a team of 1,600 employees across Europe and Asia, plus a European distribution network, France-based Solo’s portfolio includes wearables, textile accessories and a range of products such as drinkware, bags and luggage, stationery and tech accessories.

At the time, Platinum said the transaction represented an attractive platform for organic growth and strategic acquisitions. It also confirmed it would look to expand geographically and into new product categories.

Now, the firm has signed a definitive agreement to acquire XD Connects, a designer and supplier of corporate gifts and custom-branded merchandise.

Founded in 1986 and headquartered in Rijswijk, Netherlands, XD Connects serves more than 5,000 B2B resellers and distributors, primarily across Europe. Offering a broad assortment of items, the company operates an in-house printing and fulfilment centre as well as a design studio and sourcing office.

Highlands promotes Starosto Highlands has named Candie Starosto to the role of Senior Director, Strategic Accounts in the US. Starosto joined the company ten years ago and has helped to expand business across key national accounts.

Role change for DM’s Monte White

Distribution Management (DM) has promoted Monte White to President of its Wholesale Division. In this new position, White will oversee DM’s wholesale sales teams and be responsible for all vendor-related functions across its wholesale product categories, including product management, purchasing and vendor operations.

New Chair at Office National

Australian dealer group Office National has appointed Kylie Sprott as non-Executive Director and Chair. Sprott is an experienced executive – particularly in the areas of HR, business operations and M&A.

Carmichael joins Kimberly-Clark

Former Nestlé Canada CEO John Carmichael is the new President of Kimberly-Clark North America. He will oversee the company’s personal care, family care and professional products across the US and Canada.

New COO at Xerox

Louie Pastor (pictured), formerly Xerox’s Chief Administrative Officer and Global Head of Operations, became the OEM’s COO on 1 September. He took over from John Bruno, who is now CEO of National Veterinary Associates. Bruno will stay on the Xerox board and chair the Lexmark integration committee.

Staedtler names UK MD

Thomas Randrup (pictured) will join Staedtler UK as Managing Director on 6 October. His appointment follows Philip Wesolowski’s promotion to Managing Director of the vendor’s EMEA region earlier this year.

Randrup is an experienced sales executive whose career has included 16 years at model kits and hobby articles manufacturer Revell.

ISG adds to marketing team

Independent Suppliers Group (ISG) has announced the appointment of Dan Scheidt as Supplier Marketing Specialist.

Scheidt has more than ten years’ experience of B2B marketing strategy. He most recently worked for the US subsidiary of home appliances manufacturer Beko.

MBM’s Ford retires

After over 30 years with US-based vendor MBM – a subsidiary of Ideal brand owner Krug & Priester – VP of Strategic Sales Wanda Ford will retire on 31 October. Meanwhile, Jim Dingemanse has been promoted to Director of Strategic Accounts.

Newell names Commercial President

Newell Brands has promoted Rob Posthauer to the role of President of its Commercial unit. He was already General Manager of the division, having joined Newell in 2021.

Posthauer will oversee the vendor’s B2B brands – which include Rubbermaid Commercial Products, Rubbermaid (Organisation), Quickie, Mapa Professional and Spontex.

MillerKnoll appoints COO and CMO

MillerKnoll has named company veteran and CFO Jeff Stutz to the newly created role of COO. He assumes responsibility for the furniture giant’s International Contract division, global manufacturing and distribution operations, and the company’s Europe-based brands.

Meanwhile, Jenny Olsen was recently hired as CMO. She joined MillerKnoll from Caleres, a $3 billion portfolio of global footwear brands.

Director Kai-Uwe Heuer (pictured) left Büroring in August due to a disagreement over the future direction of the German dealer group. Heuer had played a key role in the development of the ‘new’ Büroring, alongside former CEO Frank Eismann.

Chris Exner has been appointed by PBS Network as its Sales Ambassador for the UK. The former ACCO Brands, OPI and ExaClair exec officially started in his new role on 1 August. He will be responsible for spearheading the UK market entry of the e-commerce and data solutions provider.

Katun has named Elie Choukroun as Deputy General Manager of its EMEA region. With over 30 years of leadership experience in the print and IT industries, he was most recently President of Ricoh France.

At Katun, Choukroun’s responsibilities will include growing sales of its Arivia brand of multifunction printers.

Our research highlights a persistent challenge for UK SMEs: accessing finance remains difficult

Douglas Grant, Group CEO, Manx Financial Group

£40 billion

Amount Amazon will invest in the UK over the next three years

AOPD receives emergency services contract

AOPD has been awarded a national contract by Savvik Buying Group, a US cooperative serving emergency services and public safety agencies.

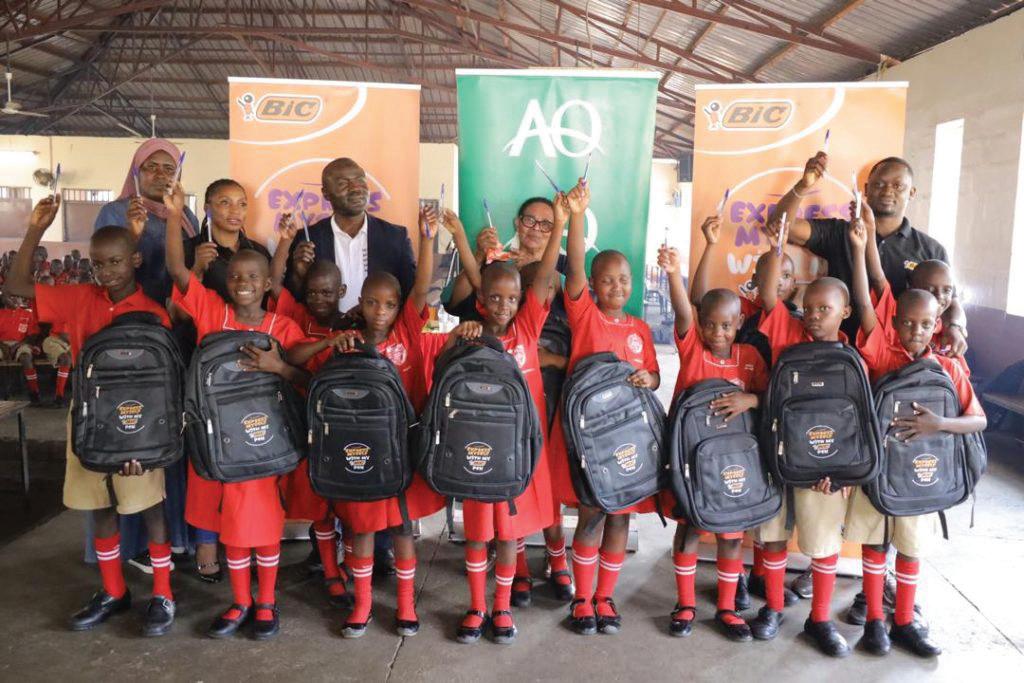

BIC promotes education in Africa

BIC has concluded the fourth edition of its penmanship programme in Uganda. The Express Myself with My BIC Pen campaign benefitted 11,000 students as part of a wider initiative to support handwriting and education across Africa.

42%

Retailers in Germany that think social media will be the most important advertising platform by 2030

Domtar to idle US mill

Domtar is indefinitely idling its Grenada, Mississippi, newsprint mill due to declining market demand, affecting around 100 staff.

80%

US and multinational companies that adjusted their ESG strategies in 2025

PICTURE OF THE MONTH

The BOSS Business Supplies Charity (BBSC) has been named Small Charity of the Year at the Association of Charitable Organisations awards. The trophy was presented to (pictured, from left) Secretary Liz Whyte, Trustee Sara Bennett and BBSC Chair Kelly Hilleard.

The International Organization for Standardization (ISO) and the Greenhouse Gas Protocol (GHG Protocol) have announced a strategic partnership designed to streamline sustainability reporting by aligning existing

Kimberly-Clark Professional (KCP) has introduced Thrive, a sustainability service designed to help businesses divert waste from landfills and track progress towards environmental goals.

Through the Thrive Dispenser Service, KCP collects qualifying used plastic dispensers directly at customer sites and prepares them for shipment. Old dispensers, as well as leftover dry paper products, are then sent to a sustainability partner to be processed into an alternative fuel for use in cement and building material production.

The programme is available to commercial clients in the US and Canada which replace 100 or more eligible dispensers. As part of the service, KCP installs new Scott, Kleenex or ICON units to exchange the old ones.

In addition, customers receive traceable reporting and an environmental impact achievement certificate, helping them to measure and demonstrate their landfill diversion results.

“Our customers are looking for practical, measurable ways to meet their sustainability goals,” said Susan Gambardella, President of KCP. “Thrive offers a solution that’s easy to implement and makes a tangible, positive impact towards waste reduction.”

GHG standards and jointly developing new ones. The agreement, revealed on 9 September, means ISO’s 1406X standards and the GHG Protocol’s Corporate Accounting and Reporting, Scope 2 and Scope 3 Standards will be integrated into a unified set of co-branded international guidelines.

The partnership also includes work on a joint product carbon footprint standard to support companies seeking more detailed emissions data across their value chain.

Both organisations said the collaboration aims to reduce complexity, improve consistency and provide a common global framework for emissions accounting. The move follows calls from policymakers, investors and business groups – including the B7 community and the International Sustainability Standards Board – for more alignment in climate-related topics.

ISO and GHG Protocol standards have been widely adopted across the world, underpinning regulatory frameworks and sustainability reporting initiatives. The joint approach is expected to simplify processes for companies and support broader decarbonisation efforts.

The Paper and Packaging Board (PPB), a US-based research and promotion organisation, is to be wound down following a member referendum.

The PPB – established in 2014 – is funded through a levy on domestic manufacturers and importers but is overseen by the US Department of Agriculture’s (USDA) Agricultural Marketing Service.

In mid-July, the USDA held a continuance referendum for the programme, which had an annual budget of around $20 million. This required a majority of manufacturers/ importers – which also had to represent a majority of the volumes of paper and paper-based packaging – to vote in favour. However, just 26.5% of eligible domestic manufacturers and importers, accounting for 9.6% of the volume represented in the referendum, did so. As a result, it is now in the process of being closed down.

The PPB’s goal was to promote the use of paper products and paper-based packaging by highlighting how their sustainable nature, the industry’s practices and recycling efforts contribute to a healthier planet.

UPM has upped its sustainable packaging efforts. Firstly, in close collaboration with Royal Vaassen, the company has developed Barryrwrap, a fibre-based alternative to plastic and aluminium packaging.

The collection of food-safe barrier papers offers strong resistance to oxygen and moisture while remaining fully recyclable and compatible with existing ranges. UPM’s Solide Lucent packaging paper is used as the base for the new solution.

The Barryrwrap range includes: Everest, which offers protection for instant coffee and dry foods; Lyner, designed for composite cans containing crisps, powders and spices; Elbrus, aimed at powdered products such as soups and herbs; and Electric, developed for chocolate and other high-barrier goods.

In another development, UPM Adhesive Materials – formerly UPM Raflatac – has received official RecyClass recognition for its RW85C adhesive, confirming compatibility with both HDPE container and PET bottle recycling streams. This achievement means label materials with RW85C adhesive are now approved as releasable in natural and white HDPE container recycling and as alkali/water releasable in PET bottle recycling.

“As legislation [...] evolves and sustainability expectations grow, we’re staying ahead of the curve. By collaborating with RecyClass, we can deliver label solutions that meet strict recyclability criteria,” said Przemysław Sawa, Director of Consumer Label Solutions, EMEIA at UPM Adhesive Materials.

Emerald Ecovations has announced a platform to support middle-market manufacturers and distributors.

Citing supply chain consolidation and tariff pressures, the sustainable products supplier said it is offering manufacturers and converters direct access to its renewable raw materials. These will be available for distribution in minimum quantities “designed to accommodate organic growth”.

For distributors, Emerald is giving direct access to over 370 products, of which more than 80% are made in the US. In addition, licensed distributors can obtain marketing and metric reporting assets along with private label options.

For manufacturers and converters, the vendor is offering its raw materials, including its Tree Free pulp and paperboard. Emerald said competitive pricing and domestic production will provide “much-needed autonomy from integrated manufacturers that continue to squeeze the supply chain”.

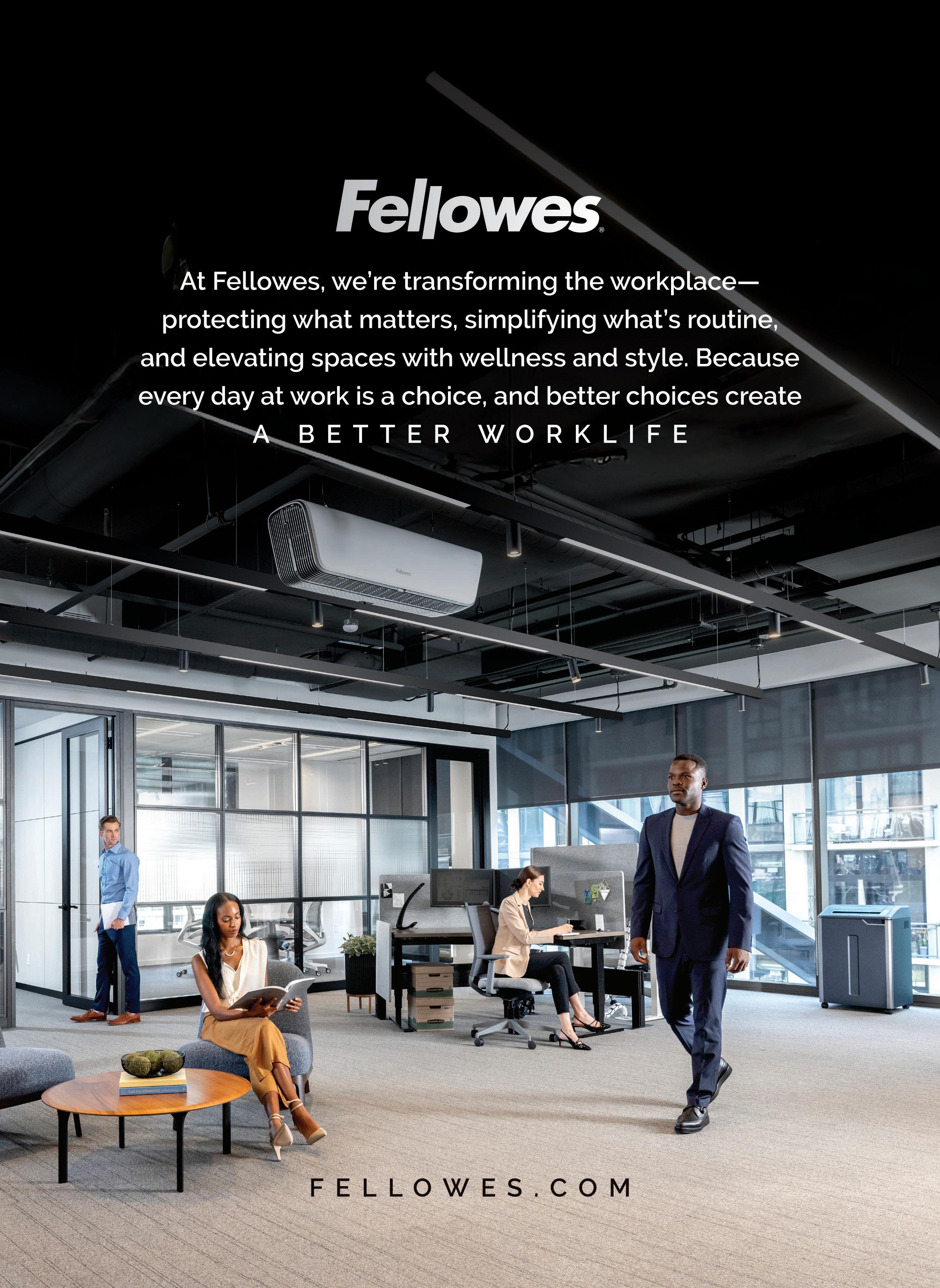

With over 16 consecutive years of growth under its belt, Distribution Management is eyeing category expansion and acquisitions in a rapidly changing marketplace

What began in 1972 as a small IBM typewriter supplies dealership has since transformed into a billion-dollar powerhouse in wholesale distribution and third-party logistics (3PL). At its wholesale core, what is now known simply as Distribution Management (DM) is predominantly focused on the print and imaging space, but its 3PL business continues to scale impressively across a spectrum of categories

At the heart of DM’s success is a blend of customer service, technology-driven efficiency and resilience – a formula which has enabled the company to weather economic crises, natural disasters, the COVID-19 pandemic and general market volatility.

DM President and CMO Greg Welchans, in tandem with Sean Fleming – CEO and nephew of company founder Tom Fleming – and an expansive and highly experienced executive team (see page 20), has helped steer this ever-growing ship since 2001. He recently caught up with OPI’s Heike Dieckmann, reflecting on his own career, the company’s evolution, growth strategies and the competition. The future, he says, still holds plenty of promise for all parts of the business.

Understanding that small package distribution was our core strength, [Sean] created DM Fulfillment

OPI: We interviewed you and Sean before, but that was some time ago, so can you provide a bit of a recap of your own career and the history of the company? I have come across two major dates – one referring to 1991 and another going back further to 1972. Could you shed some light?

Greg Welchans: Let me start with how I got into the industry. I had been recruited to play American football in college and met a gentleman named Jim Miller in 1981. Remember The Corporate Coach? Jim was one of our industry’s icons in the 1970s and 1980s and ran a dealership called Miller Business Systems in Arlington, Texas.

Jim was paired with me as my city host to kind of sell me the virtues of living in Arlington during my university years and beyond. He was a big personality and his business was doing about $2 million at the time. We both loved football, particularly the local Green Bay Packers, and really hit it off.

I started working for Jim part-time, picking and packing office supplies and moving carts around the warehouse. One day, the

sales manager came up to me and asked if I was interested in selling OP full-time after graduating. I was, so in 1986 I began knocking on doors in Dallas with catalogues in the back of my car. When Jim sold the business to BT Office Products in 1992, I left and was recruited by Jay Mutschler into Office Depot. Several other well-known companies followed –Corporate Express, USOP and, eventually, ECI. When I tried to sell ECI software to Supplies Network, it didn’t buy any but offered me a job instead. That was in 2001. The rest, as they say, is history.

I appreciate how the organisation’s history can be confusing. Tom Fleming founded a company called All-state Business Machines (ABM), a dealer selling IBM typewriter supplies, in 1972 – Tom had previously worked for IBM for a number of years. When IBM spun off Lexmark in 1991, he decided to add a wholesale component – partially because he felt what was available at the time in print and imaging wholesale support wasn’t good enough – and named it Supplies Network. That was the 1991 date.

Being both a reseller and wholesaler at the same time – quite common now, of course – was difficult, unthinkable even, at the time. ABM and Supplies Network were separate holding companies under the parent umbrella company Distribution Management: different P&L, separate management, etc.

OPI: Shortly after ABM Federal was sold in 2011 and you focused purely on distribution, DM Fulfillment Services was launched – your first foray into 3PL, I believe. How did this model come about?

GW: There was a general assumption that the print and imaging space was going to decline. It led to the question: what is at the core of our business – do we want to be an IT wholesaler or a distributor?

Meanwhile, our CEO Sean had noticed the sheer amount of packages showing up at his house – from all over the US. Understanding that small package distribution was our core strength, he created DM Fulfillment to capitalise on the potential of the evolving e-commerce landscape.

As online sales continued to grow and the need for drop-shipping to consumers increased, we definitely felt this was the right direction for us.

OPI: You then had a big rebrand in 2022, essentially combining the two components of DM – 3PL and wholesale.

GW: That’s correct. Supplies Network was a great brand for many years but we had evolved

our product offering beyond supplies into print hardware – the wholesale business had already changed to DM Print and Imaging. Just Distribution Management – as set up by Tom to be the parent company in 1991 – was a better fit for all parts of the business. It didn’t narrow us down to anything, just ‘distribution’. As long as the product fits our shipping model, there are no restraints and we can go in any direction we want to.

OPI: What is the ratio now, in sales terms, of wholesale versus 3PL?

GW: Print and imaging – still the bulk of our wholesale business – is about 95% of total revenue, which is plus $1 billion now. The fulfilment business is the rest.

While this appears heavily skewed towards wholesale, you have to bear in mind that it’s a different model of revenue. On the wholesale side, we own the product, so we have the cost of goods plus margin we recognise as revenue.

On the fulfilment side, we don’t own the inventory. Let’s say it’s Criquet shirts. The vendor owns the stock; our revenue is derived from what we charge to receive it into our warehouse, hold it there, pick and pack it, and ship it out if vendors choose to use our freight options. This will all add up to a small charge per shirt as a revenue line for us. It might not be much, but because of the transaction volumes, gross profit lines are more attractive.

OPI: What part of the company is on the up?

GW: All of it. We’ve been growing for 53 years and this growth now comes from both our wholesale and fulfilment business.

OPI: To be growing in print is quite an achievement. Within the print and imaging segment, how is your MPS business doing?

GW: The same – it’s increasing. It paused a little during COVID because people left the office, but now they are finally coming back and page counts are rising, we’re on a good trajectory again. MPS is also a real differentiator for us and sets us apart from the competition.

OPI: We’ll get to the competition a bit later. Let’s talk about product. On the wholesale side, how much have you diversified from print and imaging? Jan/san, breakroom, safety, furniture – all those categories dealers are expanding into…

GW: It’s still predominantly print – both consumables and hardware – and that’s where we are real experts. But we have expanded the range through our e-commerce platform. This also links to our 3PL business. We may have

a fulfilment customer selling sewing machines through us, for example. We might feasibly buy that inventory and resell it online.

I say sewing machines because we deal with Brother on the print side, so it’s an easy extension because of the relationship we already have.

OPI: Is there a 3PL sweet spot product?

GW: When we started, it was almost everything as we had to figure it all out. Now we’re a bit more discerning and discovered that we are really strong in hard dimension, small package distribution.

A toner cartridge is a good example: it has fixed dimensions and comes in a box. Liquids work well too – because they come in fixed dimension containers. We ship FIJI Water globally and Perfect Hydration across the US, especially into retail.

Clothing is another niche which works for us. Whatever we ship has to be conveyorable so that we can be really cost effective.

OPI: I’m struggling with soft materials – you mentioned shirts and clothing in general –compared with solid water bottles or boxes of toner. Where is the compatibility?

GW: A shirt isn’t shipped as a shirt and usually the packaging is dictated by the manufacturer. A shirt, when it’s ordered, is put into a box or even into an envelope –pre-packed, ready to go. This fits well with our shipping model.

OPI: What would be an example of something that is unsuitable?

GW: Anything loose; anything that’s smelly, gooey or flammable. We don’t handle hazardous materials, batteries, perishables or anything requiring strict temperature regulation, so nothing hot, nothing cold, nothing chemically unstable.

OPI: Is there a target consumer for the fulfilment business? You’ve just referred to retail for water.

GW: No. It really is omnichannel and completely up to the manufacturers – they are our customers. The products could be found on the physical shelves at Walmart and virtually in its e-commerce system, but not on Amazon or in Kroger – or vice versa. We integrate with whoever customers want us to integrate with.

Let’s say the shirt company wants to get into Nordstrom, a department store chain in the US. We’re integrated with Nordstrom, so can give the vendor the opportunity to get into the company’s e-commerce platform as well as on its retail shelves.

OPI: How important are giants like Walmart and Amazon to you?

GW: From a print and wholesale perspective, they are marginal. Our manufacturers primarily ship to them and we may act as backfill but we don’t sell anything through those channels ourselves in the print space. However, they are very important for our fulfilment customers.

OPI: What is your logistics infrastructure?

GW: We have four primary US locations and one international hub outside Chicago from which we ship globally.

OPI: I believe you’re highly advanced in terms of automation and robotics.

GW: Yes, we use robots to pick orders which has made us considerably more cost effective

We are really strong in hard dimension, small package distribution

and efficient. Wholesale is a low-margin business, especially in the print category, and if you don’t manage and control your costs well, profitability can vanish quickly.

Some categories fit robots perfectly, others don’t. In our warehouses, you’ll see a wholesale toner cartridge and a fulfilment product side by side. Stock is organised based on how quickly it needs to be picked – or not. Both products go into the same box on the robot – it’s very clever.

OPI: Where do you envisage the biggest opportunities in terms of further use of AI in your operations?

GW: We view AI as a tool to use in our MPS break/fix model. It would be a first-tier solution for someone looking to fix a printer. A dealer could offer this as a branded service to its customers. The end user could type in an error code and receive an answer back from our knowledge base without any human involvement. AI will ultimately be used in many parts of our business – product selection, inventory control, etc.

OPI: How much potential do you see in 3PL? What does the competition look like in this space, for instance?

GW: 3PL is a very fragmented business in the US. Many players lack the expertise and technology needed to move beyond being a small operator. We have 15 programmers on staff writing integrations all day long and we’re integrated with about 90 different retailers nationwide. Our ERP and warehouse management systems are proprietary so we are highly flexible in everything we do – distributors using off-the-shelf systems struggle to match this.

We recognise a lot of acquisition opportunities in this sector.

OPI: Would it be fair to say that Essendant’s Connected Commerce initiative is a similar 3PL model to yours? Office Depot’s Veyer springs to mind too.

GW: We’ve never run into either of those companies as competitors to our fulfilment business. But it’s a pretty big world out there. The 3PL space could certainly be regarded as an opportunity to save themselves – grow where there’s growth and move away from the declines as much as possible.

OPI: Interesting you should say this, given that Essendant has very recently announced its retreat from the office supplies dealer channel (see also Focus,

page 24). What is your early days take on this bombshell declaration?

GW: This was an unexpected announcement and a shock to the industry, for sure. At this point we can’t really gauge the ultimate effect it will have on our business – or anyone else’s. We don’t even really know what categories mean ‘office products’ to Essendant. Obviously, the IDC will continue to exist so we hope dealers will see us as a viable solution in the print category.

OPI: What about the wholesale side – who are you up against? The biggest name that springs to mind is TD SYNNEX. What about S.P. Richards (SPR) and Essendant in its previous – actually still current until the end of October – incarnation?

GW: You’re right – TD SYNNEX is our main competitor and a formidable one at that. Essendant and SPR are not primary competitors in the print and imaging category – they are generalists, we are specialists. The OP channel used to be a bigger portion of our business – hence the competition was different too – but now its model of how products are bought and shipped doesn’t match what we do.

OP dealers often get their inventory overnight from the likes of SPR or Essendant. They put it on their own trucks and deliver it to customers. This last-mile service has been their competitive advantage for years. But it’s not cost effective.

Ours is a drop-ship model because the copier channel – we also refer to it as the business technology association space – is different. Copier dealers definitely don’t want inventory – they want product shipped directly to their customers.

OPI: What’s your drop-ship rate?

GW: About 95%. And we don’t have a fleet –everything goes via carrier, be that UPS, FedEx or a myriad of other operators. For our 3PL business, we also have Amazon trucks that back up to our facilities and we fill their trucks.

In the B2C environment, customers pick the type of delivery they want – next day, two days, seven days – and their decision dictates which carrier we’re going to use.

We still see explosive growth in print and imaging

OPI: How close are you to Independent Suppliers Group (ISG) and its dealers?

GW: It’s a very good relationship. We had a great meeting with James [Rogers] and the ISG team earlier this year and I will, in fact, be speaking at Industry Week in November (see also Event, page 48)

Our print and imaging business with ISG dealers is up in the double digits this year –we’ve really nurtured these partnerships.Of course, for these products, resellers typically have to go through distribution unless they’re authorised resellers with the likes of HP. I’ve just referred to the drop-ship model: I’m convinced this is becoming more attractive to many dealers in the business supplies space –particularly for their more remote customers. We have a lot to offer in this regard.

James is a smart guy and knows the strengths and weaknesses of everyone involved.

OPI: Talking of HP, how would you describe your vendor relationships?

GW: We have fantastic partnerships. We focus on the print space and because we do, the organisations we deal with love us: their world is our world. These vendors are as important to us as our customers and we treat them with the respect they deserve.

As regards HP: we didn’t wholesale HP hardware ten years ago. In 2024, we were the vendor’s number one hardware distributor in the US. We’ve also been HP’s top distributor in consumables for the past three years.

OPI: Plenty of consolidation in this space.

GW: Definitely. Lexmark and Xerox has just happened, of course. We’re the largest

distributor for Lexmark and we have massively expanded our relationship with Xerox, so the deal is not going to affect us negatively. Consolidation will continue, no doubt, and I’m hoping we will benefit from it.

OPI: Are you mostly focused on the OEMs?

GW: Yes. There was a time when we sold a lot of compatible product. I think the OEMs have done a good job managing this and also stamping out the clones, which we want nothing to do with.

OPI: Where is the biggest potential for DM?

GW: Everywhere. Despite the fact there’s a decline in the number of pages being printed, we still see explosive growth in print and imaging. It’s a $24 billion industry so the addressable market is huge.

We also have several sub-segments in this category which are worth exploring more extensively. We’ve dabbled in large format printing, for instance, but it’s not been a big part of our business. This alone is a $200-$300 million opportunity we could participate in.

Barcoding is another area – there’s huge potential to expand on what we’re doing already as a result of e-commerce.

OPI: Where else are you headed with DM – what’s in the pipeline already and what is further down the track?

GW: As I said, we want to get into other print-related categories and we’re going to be pretty aggressive in that. We’re also going to acquire. We’ve not done much of that in the past, but are at a scale now where it makes sense. We could get into safety or perhaps medical supplies – there are no firm plans; everything is on the radar. So overall: category expansion and acquisition from both a wholesale and fulfilment perspective.

OPI: Is there a time plan?

GW: In the future.

OPI: (laughs) That’s not very specific.

GW: Product expansion is happening now, but the acquisition part takes time, as you know.

OPI: You can but ask! There’s one other issue I wanted to highlight about DM as an entity. I recently re-watched the late Tom Fleming video made for the company’s 50th anniversary. He spoke a fair bit about the various natural disasters it had faced over the years and how it managed to survive them, not least because of the resilience DM’s people have shown during some really testing times. You must have come a long way in terms of your disaster management. GW: We absolutely have. I wasn’t here for the fire or the flood – they were before my time. But the company not only survived but thrived following those setbacks. I would argue it is part of our DNA, our culture, not only to

succeed in business but also to do right by our customers as well as our staff.

The COVID crisis is another example – and I would 100% say it was a disaster for all of us. We never lost money during that time and we never let an employee go.

I genuinely think that the challenges we’ve faced have made [our people] even more loyal

We have some incredibly long-standing employees at DM. We have walls of fame in the building which spotlight people with more than ten, 20 or 30 years of service. I genuinely think that the challenges we’ve faced have made them even more loyal. People want to be a part of the future of the company that’s looked after them – and our customers – as best as it possibly can.

With the 3PL side, we also manage other organisations’ inventory – if we don’t get their products out the door, it could ruin their business. It adds another layer of responsibility. I’d say we’re well prepared for disaster recovery now.

OPI: My last point, and something very close to the hearts of many in our industry: City of Hope. John Fellowes has just handed you the baton as the next Spirit of Life Honouree. I know it’s early days and we’ll discuss this more as your fundraising year progresses, but any thoughts for now?

GW: For a start, I can’t believe they’ve asked me to follow in the footsteps of legends such as Jamie Fellowes, Wayne Beacham and Joe Templet. I guess there are fewer legends now!

OPI: You’re being very modest.

GW: I really feel that way. It’s an honour to even be considered, for sure. But I also believe that we’re at an inflection point with City of Hope: we have to widen the fundraising scope, be that in terms of industries involved or people within those sectors. John very much made a point of the latter during his tenure, considerably deepening fundraising engagement within organisations.

Perhaps my somewhat unique vantage point is the copier channel, which historically hasn’t participated much beyond the realms of HP, Lexmark and Xerox. This will be a real focus for me – let’s get the likes of Sharp, Toshiba, Konica Minolta, Kyocera and Ricoh involved in City of Hope and see what we can do together.

I’m immensely looking forward to the year ahead – there’s a lot to do.

Essendant’s withdrawal from the OP dealer channel has thrown up a new set of challenges for independent resellers – by Andy Braithwaite

Wholesaler Essendant dropped a bombshell in early September when it announced it was pulling out of the independent OP dealer channel in the US.

The news came to light in a customer letter in which CEO Dave Rickard called it a “strategic decision” which formed part of a “long-term strategy to optimise operations and strengthen our service”. Most OP dealers were given a 60-day transition period – during which Essendant will “operate as normal” – before the change takes effect at the beginning of November.

Speaking to OPI, Rickard said the decision reflected the economics of the long-established ‘wrap-and-label’ delivery model. He described this as “very high cost and, frankly, unprofitable for us”, adding that it had been this way for “an extended period of time”.

While the OP dealer channel represents about one-quarter of Essendant’s sales, Rickard stressed the segment has not generated any profit and he does not foresee this portion of the business turning profitable either.

Instead, Essendant will concentrate on channels where it sees growth potential: jan/ san, foodservice, enterprise accounts, e-tailers and tech resellers. These customers do not require wrap-and-label, allowing it to operate a lower-cost fleet and a more consolidated distribution centre (DC) network; this will still enable 98% US coverage within two days using into-stock and drop-ship fulfilment models.

OP will remain in the assortment, but with a “much tighter focus” and geared towards the needs of non-dealer customers. Stocked furniture will also be discontinued, Rickard confirmed, and it appears some private brands – including Universal – will be dropped as well.

Many dealers saw the writing on the wall and started making changes in anticipation

Essendant has been a pillar for independent dealers for decades, but the news did not seem to catch everyone completely off guard. Guernsey Chairman David Guernsey told OPI that it “came as no big surprise” and his dealership had a plan in place.

Another industry veteran, Workplace Solutions Association Executive Director Mike Tucker, expected consequences for Essendant and the IDC after the wholesaler’s owner, Sycamore Partners, acquired pharmacy retailer Walgreens.

“Many dealers saw the writing on the wall and started making changes in anticipation –and are better off for it,” he stated.

Highlands Partner Seth Raley noted that Essendant “has long signalled a desire to diversify beyond the office channel”, although he didn’t anticipate the shift – which he called a “bold, strategic decision” – happening so soon. He added: “To its credit, Essendant seems to be handling the transition respectfully by working closely with S.P. Richards [SPR].”

Clearly, all eyes are now on SPR, the other – and soon-to-be only – broadline OP wholesaler in the US. President Jason Horst was quick to provide a statement to OPI: “At SPR, independent dealers are a core focus of our future business strategy. Our promise is to remain unwavering in our role as a trusted partner, always focused on delivering value and support. We know many of our customers are family businesses and, as a family-owned company ourselves, we deeply understand that responsibility.”

He continued: “Whether with our long-standing partners or new relationships, SPR is prepared to adapt alongside the market and continue leading in service to the OP community.”

With question marks over SPR’s ability to handle the extra volume that is coming its way, Horst provided some important details regarding the leasing of several locations Essendant is exiting.

“As part of our commitment [to the IDC], we are taking on expanded DCs in Los Angeles, Chicago, New Jersey and Orlando, and annexes in Sacramento and Boston – giving SPR access to larger, more advanced facilities.

“These expanded centres enable us to handle greater volume, broaden our product offerings and scale to meet the evolving needs of our customers. Together, these locations strengthen our national network and position SPR to deliver even better service to both current and future customers.”

Raley is also optimistic that SPR can step up, claiming it has “steadily gained strength” since being acquired by Central National Gottesman in 2024. “The combination of fresh leadership with industry veterans has created real momentum,” he said. “We’re confident SPR will rise to the challenge of absorbing the business Essendant is exiting and are actively supporting our clients to help make the transition successful.”

It’s a sentiment shared by Guernsey, who believes SPR “will come through”, although he – along with others – is expecting challenges in the short term.

One organisation with an important role to play in a post-Essendant OP world is Independent Suppliers Group (ISG). CEO James Rodgers positions ISG as both offering competitive access to product and being a business resource.

He described Essendant’s decision as “a monumental change” but one that could

also be a “meaningful catalyst” for positive developments among ISG’s members and IDC suppliers. The group had been kept in the loop about the situation, which meant some “actions” could be taken ahead of time.

As Tucker noted, stockless dealers – large and small – that relied on Essendant will be “hurt the worst”, with smaller resellers with no stocking capabilities being “in most danger”.

Rodgers sees an opportunity for these resellers to change a business model that relied so heavily on the wrap-and-label service, believing there are more options to diversify.

In the UK, when dealer services group Nectere – consisting mostly of small, stockless operations – collapsed in 2024, larger, tech-enabled independents stepped in to offer other ordering and delivery options. There are signs this type of model is emerging in the US too, with reports of an ODP Business Solutions Federation dealer providing this service.

We’re confident SPR will rise to the challenge

According to Highlands’ Raley, Essendant’s exit could accelerate consolidation within the IDC. “Strong, well-managed dealers will likely seize the moment to expand their footprint by acquiring smaller operations,” he suggested.

Another area to face disruption is national accounts. OPI understands that Essendant’s Vertical Markets Group – described a few years ago as “a billion-dollar opportunity” – is being dismantled.

One organisation impacted by this is AOPD. Executive Director Angela Sumner Price told OPI: “We are working diligently to help smooth the transition by cross-referencing products for former Essendant dealers, providing meaningful solutions and suggestions, and assisting our members in shifting their AOPD corporate contract business to SPR.”

There are still many unanswered questions and IDC stakeholders are working hard to deal with the fallout. The situation should start to become clearer in time for ISG’s Industry Week, taking place in Denver, Colorado, in early November (see Event, page 44)

As ISG board member Jordan Kudler stated: “Never has there been a more important time for us to get together. It’s critical we meet with our vendors and collaborate with our fellow members to learn how they plan to navigate their way through this challenging time.”

Look out for feedback from Industry Week ’25 in the next issue of OPI

This year’s OPI Top 100 once again highlights transformation, resilience and a fair bit of volatility

Change at the top of the global business supplies industry was a defining feature of last year’s OPI

Top 100. And here we go again: a significant number of long-serving executives have stepped aside, making way for a wave of new entrants, all set to shape our sector.

Among the most notable departures is Sarah Hunter, who left Australia’s Officeworks after six years in the job. Meanwhile, in Europe, Arnold Theuws stepped down after 17 years as Managing Director of Netherlands-based cooperative Quantore.

Officeworks’ parent company Wesfarmers opted for a familiar face to succeed Hunter, turning to John Gualtieri of fellow group retailer Kmart, while Quantore’s board looked outside the industry for a successor to Theuws.

Consolidation has once again played its part in shaping this year’s Top 100. In the UK, all eyes are on the merger of dealer groups Integra Business Solutions and Office Friendly, which is expected to receive final regulatory clearance shortly. Will we be talking about a similar transaction between the two leading groups in Australia this time next year?

UK wholesaler Exertis remains on our list following the confirmation of its acquisition by private equity firm Aurelius – due to close shortly. However, dropping out this year is French operator ADVEO after private equity owner Sandton Capital Partners put the group into administration.

Wholesaling in the US, of course, has been in the news recently (see Focus, page 24). Two new entrants from this channel are Jason Horst (S.P. Richards) and Dave Rickard (Essendant), but the companies – for so long direct competitors – now appear to be on differing trajectories as far as the IDC is concerned.

Essendant’s shock decision to exit the OP channel underlines the growing importance of categories such as jan/san, packaging and foodservice in the reseller community. Areas including MRO and warehouse supplies have also featured in the Top 100 for some time and this year we welcome a new face at US reseller Global Industrial.

Anesa Chaibi – appointed CEO earlier this year – is repositioning the company around strategic accounts and higher-margin growth opportunities, with tariffs and supply chain complexity high on her agenda.

The Top 100 is not just a roll call of senior execs – it is a snapshot of a sector in flux

Women leaders, in fact, are making their mark across the broader B2B landscape in North America. At Staples Inc, Rachel Huckle has moved from Canada to take charge of the US business, while Ashley Hubka has been building Walmart Business into a very credible challenger to Amazon Business, led by Shelley Salomon.

Angela Sumner Price, meanwhile, has permanently taken over the reins at US independent dealer national accounts organisation American Office Products Distributors (AOPD).

With 17 new entries over the course of the year – many highlighted in the following pages – our list illustrates both the scale of transition in and the resilience of the industry. Always somewhat subjective, naturally, the Top 100 is not just a roll call of senior executives – it is a snapshot of a sector in flux, where continuity and renewal sit side by side.

Felix Brunner succeeded Johann Pintarich as CEO of Switzerland’s leading office supplies and office technology provider, Office World Group (OWG), in November 2024. Brunner joined OWG in March 2023 but had previous experience of the business: from 2013-2017, he acted as a board adviser and led the turnaround programme for several subsidiaries within the retail division of the Migros Group, including OWIBA, ahead of its sale to Austria-based MTH Retail Group.

The group comprises a broad range of entities: iba, which focuses on B2B clients; Office World, serving both B2B and B2C customers through a strong online presence and 14 physical stores; and Tramondi, a specialist in managed print services.

The vision is clear, asserts Brunner: “We aim to be a full-service provider for all office supplies and services in Switzerland.” To support this, the company is actively expanding its product range to include categories such as facilities management, food and catering, and shipping and packaging.

In addition to operating physical retail outlets and various online shops, OWG further provides tailor-made and modular solutions. Through its wholesale brand, Office World Trade, the company is a trusted partner to more than 2,000 speciality retailers and retail chains across the country.

Office World Trade was created through the merger of the former entities Ecomedia, Oridis and Papedis, enabling OWG to offer a complete product and service portfolio to its retail customers and strengthen its position as a leading operator.

We aim to be a full-service provider for all office supplies and services in Switzerland

“The new organisation enables us to respond to the challenges of a demanding retail environment and to support all our partners with attractive terms and compelling outsourcing services,” says Brunner, adding: “With novooo, OWG also offers a new, affordable and modern high-quality own brand that covers any categories customers may need in the office or home office or for school.”

One major development in the UK dealer group landscape this year was the announcement to merge Integra Business Solutions and Office Friendly into a new organisation called BLOC, which stands for Building Leadership, Opportunity and Collaboration. The transaction has been approved by shareholders of both groups and is now awaiting final sign-off from the competition authorities, expected shortly after this issue of OPI

The new entity will bring together more than 220 UK and Ireland dealers, with the aim of creating greater scale, improving services and building a united community for the independent channel.

At the helm of BLOC are two seasoned industry figures. Jeanette Caswell has been named Managing Director. She has spent her entire career in the industry, starting

at Viking and Office Depot in the late 1990s before moving to Spicers, where she spent 12 years, ultimately as Director of Marketing. After a spell at Staples Solutions, Caswell became Office Friendly Managing Director in 2021.

Working alongside Caswell as Chairman of BLOC will be Aidan McDonough, who celebrated 30 years with Integra in 2024. A steadfast advocate for the IDC, McDonough is also the long-serving Chair of BPGI and the incoming Chair of UK trade association BOSS Federation.

Both leaders stress the complementary strengths of their organisations – from Integra’s purchasing and catalogue expertise to Office Friendly’s digital marketing and sustainability programmes. As Caswell puts it: “We’re presented with so much opportunity to grow with the combined skill sets we have.”

Anesa Chaibi became CEO of US MRO and business products reseller Global Industrial in February 2025, succeeding interim boss Richard Leeds, who had been standing in following last year’s departure of Barry Litwin.

Chaibi brings over three decades of experience across public and private equity-backed companies. She previously held senior roles at CoolSys, Warburg Pincus, Optimas Solutions, HD Supply Facilities Maintenance and General Electric, and served as Operating Partner and Chief Transformation Officer at Coalesce Capital Management.

Headquartered in Port Washington, New York, Global Industrial – formerly Systemax – is a $1.3 billion distributor with a heritage stretching back to 1949. The company serves more than 400,000 customers across North America with hundreds of thousands of SKUs in categories such as storage and shelving, material handling, safety, janitorial, HVAC and furniture. Around 60% of transactions are e-commerce driven, while its private label brands – growing at approximately 15% over the past five years – now account for around 40% of sales.

Chaibi took the helm at a challenging time. The company reported softer results at the beginning of 2025, with SMB customers under pressure and tariffs creating significant

Andrew Gale has overseen a transformation at UK multichannel operator evo since becoming CEO at the end of 2022. This culminated in an MBO earlier this year that saw private equity firm Endless exit after 16 years of ownership. The deal was backed by new lenders Leumi and Close Brothers with a £93 million ($126 million) refinancing package, giving the group the stability to pursue its next growth phase.

Gale, who first joined the business – then known as Vasanta – in 2008 as Financial Controller, has been instrumental in driving evo’s turnaround. EBITDA has doubled in the past two years, with record results in both 2023 and 2024. Last year, the group generated sales of £503 million and maintained gross margins at 30%.

Highlights included contract wins at Banner and VOW, a turnaround at Complete, acquiring

disruption across the supply chain. Since then, however, she has sharpened the reseller’s strategy to prioritise larger, high-touch clients which generate higher margins. This focus helped deliver a 3.2% revenue increase in Q2 2025 to $359 million, with record gross margin of 37.1%.

Chaibi’s message to employees and investors has been clear: “We need to make it easier for our customers to engage and do business with us, allowing us to deliver greater value to them and become an extension of their teams,” she stated.

To that end, she is driving simplification, empowering staff to make real-time decisions and investing in the sales organisation. Growth will be anchored in specialisation and expansion – targeting priority accounts more intentionally while broadening product categories – supported by a strong balance sheet and an appetite for strategic M&A.

the 5 Star brand and strong contributions from Premier Vanguard and Ireland.

The MBO has created opportunities for broader ownership at evo too. In August, 330 employees became shareholders after taking up the chance to invest in the company. “Evo is – and will be – a business run and majority-owned by the people who do the graft,” Gale commented. Looking ahead, Gale has ruled out breaking up the group and is committed to a multichannel, multisales model via its portfolio of brands. One particular area where he has identified growth potential is the e-trading channel. The plan is not only to increase the number of UK marketplaces evo trades on, but also to expand into continental Europe.

Evo is – and will be – a business run and majority-owned by the people who do the graft

JOHN GUALTIERI, OFFICEWORKS

When Sarah Hunter announced in June that she was leaving Australian retailer Officeworks after six years as Managing Director, parent company Wesfarmers turned to one of its experienced execs to succeed her. In August, John Gualtieri, CEO of Kmart and Target – both also part of the Wesfarmers stable – took the top job at the operator.

Gualtieri joined Kmart in 2008 following a 20-year stint at major local department store chain Myer. He started out as Divisional Merchandise Manager for the Home Division and was named COO of Kmart in 2016. In 2021, he became CEO. Following the simplification of the operating model for both Kmart and Target, he then became CEO of both entities in 2023.

Gualtieri has been instrumental in executing Kmart’s transformation in recent years. He is now charged with leading Officeworks “into its next phase of growth”. And at the end of his first month in charge –although the reporting period

Jason Horst took on the role of President of S.P. Richards (SPR) in early 2025, succeeding Andrew Wallach, who continues as CEO of parent company Central National Gottesman (CNG).

Having already served as SPR’s Chief Commercial Officer since 2024, Horst was well positioned to step into the top job at the wholesaler, bringing with him comprehensive industry know-how and a forward-looking perspective.

Horst’s career spans over three decades across the global paper, distribution and business products sectors. It began in 1994 when he joined Champion International Paper and managed national accounts for the Hewlett Packard Paper division. After Champion was acquired by International Paper, Horst transitioned to Frank Parsons, a mid-Atlantic dealer now part of The Supply Room.

In 2001, he co-founded a global sourcing and distribution venture, achieving significant growth over seven years before it was bought by what is now The Navigator Company. There, he took on the role of General Manager

had ended prior to his arrival – Gualtieri was able to announce another positive set of full-year results. For the 12 months ended 30 June 2025, the Australian reseller generated revenue of A$3.56 billion (US$2.3 billion) and operating profit of A$212 million – respective year-on-year increases of 3.8% and 1.9%.

The second half of the financial year actually saw a slowdown in both the top and bottom lines, but Gualtieri’s tenure is off to a good start, with the retailer referring to “solid growth momentum” in the first eight weeks of the new reporting year.

Now with 173 stores in the country – after opening five outlets and closing three over the past 12 months – Officeworks is hoping to grow its network by a further six locations in the year ahead.

Gualtieri and his team will no doubt be keeping a keen eye on what Amazon is doing on its home turf, as the e-commerce giant has upped its activities in Australia with the launch of Amazon Business and further logistics capabilities.

for North America, strengthening Navigator’s presence in the market.

Joining CNG in 2014 as VP and Commercial Director, Horst led the CN Business Products team, overseeing global sourcing and sales operations in the US, Canada and Europe.

Following CNG’s acquisition of SPR in early 2023, he played a central role in expanding the wholesaler’s retail and e-commerce capabilities, while enhancing its paper portfolio.

As President, Horst brings his broad experience to bear in guiding SPR through a hugely dynamic market. Known for his strategic mindset and customer-first approach, he is focused on expansion and new channel development.

It’s all about simplifying complexity [...] in a rapidly changing marketplace

He comments: “At SPR, we are committed to supporting the independent dealer community while accelerating growth in segments such as jan/san, furniture, e-commerce and government. It’s all about simplifying complexity so we can be the trusted, long-term partner our customers and suppliers need in a rapidly changing marketplace.”

Ashley Hubka has led Walmart Business since its official launch in early 2023, overseeing the retail giant’s push into the fast-growing B2B e-commerce segment. A former management consultant who spent six years at Cimpress/ Vistaprint, she joined Walmart in 2017 and held senior strategy and development roles before taking on her current position of General Manager.

Walmart Business began with a curated range of 100,000 items across seven categories, targeting small firms and non-profits. Hubka positioned the initiative as a way to simplify procurement and reduce costs for time-pressed organisations, stating: “Our focus is to remove complexity in purchasing, lower costs and give our clients more opportunities to serve their customers and communities.”

Since then, the offer has expanded significantly, branching out into services such as Walmart Business Print and bulk purchasing options.

Public sector procurement is another important growth channel. In 2024, Walmart Business was named sole supplier on a $250 million contract run by OMNIA Partners’ NCPA division.

Hubka’s division is closely linked with Walmart’s broader digital operations. While specific numbers for Walmart Business have not been revealed, the retailer’s marketplace sales rose nearly 20% in Q2 of its latest financial year. Initiatives such as AI-driven seller tools and and omnichannel fulfilment have enhanced its overall proposition.

Our focus is to remove complexity in purchasing, lower costs and give our clients more opportunities

Rachel Huckle was appointed CEO of Staples Inc in August 2025, succeeding John Lederer, who returned to his role as Executive Chairman. This happened after Lederer added the feather of Executive Chairman at Walgreens to his cap, the pharmacy retailer having recently been acquired by Staples’ owner, Sycamore Partners.

Huckle’s move to the US follows six years with Staples Canada, where she began as Chief Retail Officer in 2019, rising to COO in 2022 and then CEO two years later. She is credited with helping to reposition the Canadian operation as ‘The Working and Learning Company’ through a programme of digital transformation, service expansion and supply chain improvements.

Now, Huckle is tasked with leading Staples’ US operations, which span retail, B2B, services and brands such as Staples, Staples Business, Quill and Staples Promotional Products.

The US retail arm, a 940-store network under the leadership of Marshall Warkentin since early 2025, is deepening its shift towards services. Initiatives include partnerships with CLEAR for TSA PreCheck

enrolment – expected to be in 400 stores by year-end – as well as expanded printing solutions, new store-within-store concepts with Verizon and Stanton Optical, and increased shipping and returns services. These projects are designed to boost foot traffic and make Staples “a place where customers need to get something done”.

On the B2B side, Staples recently completed the integration of HiTouch Business Services – acquired back in 2018 – into Staples Business and forged a partnership with workplace platform Crafty to expand its reach in the food and beverage category. Meanwhile, the company has relaunched its iconic Easy Button to highlight the breadth of its solutions across retail and B2B.

“I’m energised by the opportunity ahead with Staples Inc,” said Huckle on her appointment. “The company is strong, with momentum across retail, B2B, services and brands. I look forward to building on that success – driving growth, deepening our impact in the communities we serve and continuing to shape the future to make it easy for our customers to be successful.”

Angela Sumner Price was confirmed as the permanent Executive Director at US independent dealer national accounts organisation AOPD in July 2025. She had been in charge on an interim basis since 2024 following the retirement of Mark Leazer, who had held the position since 2016.

Sumner Price joined AOPD in 2002 as a Sales and Marketing Administrator and over the past 23 years has occupied a number of roles of increasing responsibility. Prior to being named interim Executive Director, she had served as General Manager and Director of National Operations & Marketing.

She now leads all aspects of the network’s operations, including dealer and business partner engagement, marketing strategy and contract management. During her interim tenure, she had already led the renewal of one of AOPD’s largest contracts, OMNIA Partners. Most recently, she secured a

national contract with Savvik Buying Group, a leading public safety group purchasing organisation in the US.

The agreement further expands AOPD’s reach by providing Savvik members – there are over 17,000, including emergency medical services providers, fire departments and law enforcement agencies – with access to AOPD’s portfolio of products and services.

Jan van de Wouw officially took over as Managing Director of Netherlands-based cooperative, dealer group and wholesaler Quantore on 1 June 2025. He succeeded long-time leader Arnold Theuws, who spent 23 years at the organisation – 17 of those as Managing Director – and will continue in a part-time advisory role until mid-2026.

Van de Wouw is a seasoned retail and distribution executive with more than 30 years’ experience. From 2016 to 2024, he was CEO of United Holding, the parent company behind soft-franchise consumer electronics formats Electro World and Dé Witgoed Specialist. His earlier career included senior positions at D-rt Group (D-Reizen and VakantieXperts), Polare, Sport 2000, Ahold and BP.

He admits he knew little of Quantore before joining, but was immediately impressed by the cooperative’s modern and highly automated distribution centre in Beuningen – an operation benchmarked among the

Sumner Price’s strategic vision centres on identifying new growth opportunities through innovation, technology and collaborative initiatives. On the collaboration note, AOPD for the first time this year will be joining Independent Suppliers Group at Industry Week in early November (see Event, page 44). It’s a partnership that, she says, “will provide attendees with an extraordinary experience, featuring cutting-edge product showcases, insightful educational sessions and valuable networking opportunities”.

Standing still in this industry truly means going backwards

best worldwide. This logistical strength, he believes, will be key to driving growth in a shrinking market.

Shaped by declining demand for traditional OP, digitalisation and international competition, this market is a challenging one. Quantore has already taken steps to consolidate and scale, acquiring specialist ink and toner wholesaler Supplies Service Partner earlier this year. For van de Wouw, such moves are essential: “Standing still in this industry truly means going backwards,”

His priorities for the development of Quantore include forging new partnerships and ensuring that the cooperative continues to add value through service, e-commerce and marketing support. Collaboration remains central to his approach – both within the group and across its membership – as he looks to build on Theuws’ legacy and define a sustainable future for the group.

Margaret De Francesco General Manager, Dynamic Supplies

Trevor Girnun Managing Director, Waltons

NEW John Gualtieri Managing Director, Officeworks

Adam Joy CEO, Office National

Peter Kelly CEO, Winc

Amie & Belinda Lyone Co-CEOs, COS

Craig Noyle & Gary McCluskey Directors, Inovocom

Brad O'Brien CEO, Office Choice

NEW Mark Stirton CEO, The Warehouse Group

Anne-Marie Sutton CEO, NXP

Paul Yardley Managing Director, GNS Wholesale Stationers

NEW Matthew Balcombe Managing Director, Exertis Supplies

Tim Beaumont Managing Director, Nemo Office Club

Carlos & Rafael Benavides Managing Directors, Comercial del Sur

Laurent Bertrand CEO, Lacoste Dactyl Bureau & École

Kenneth Borup CEO, Lomax

Udo Böttcher Managing Director, Böttcher

Robert Brech Managing Director, Kaut-Bullinger

NEW Felix Brunner CEO, Office World Group

Ralf Bühler CEO, Conrad Electronic

Rui Carvalho CEO, Firmo