Connecting the business products world March 2024 Nina Skramstad, Lyreco Norway INTERVIEW l Nectere in liquidation l ACCO Brands restructures l Supply chains under pressure – again l Health and well-being in the workplace l Viscom potential l Industry update: where is the volume? l Ambiente 2024 review l European Office Products Awards shortlist INSIDE THIS ISSUE Seizing opportunities Richard

Scharmann

Big Interview: A glass half-full approach

As CEO of PBS Holding, Richard Scharmann has been the trailblazer of a business model in our industry that was once unusual – controversial even – but is now standard fare: the multichannel approach. During his 16 years in charge, Scharmann has orchestrated and integrated over 20 acquisitions. It is this persistent M&A activity which has catapulted PBS forward across its Central and Eastern European locations, particularly in recent years when digitisation has resulted in steady revenue declines in traditional product categories. Further industry consolidation is the way forward, he believes – among other things...

INTERVIEW: ALL THINGS BEING EQUAL

I’m excited about creating great working days – for everyone. I strongly believe in driving more diversity into [Lyreco], not just because it’s ethically correct but because it gives us an advantage. Varied and contrasting opinions are a tool for businesses to make good decisions.

Meeting customer needs is the core of everything we do. We have to keep our finger on the pulse to be ready for the next challenge. Whatever it may be, I’m certain it will also be an opportunity – it’s just a question of attitude.

18 Big Interview

Challenges aside, Richard Scharmann remains upbeat about the future of PBS Holding

26 Focus

After stabilising in 2023, supply chain costs are soaring again following attacks in the Red Sea

28 Interview

Women in senior leadership positions remain rare in our space. The only way is up, says Lyreco’s Nina Skramstad

32 Category Update

Well-being at work: why employers should strive for a happy, healthy and productive workforce

36 Category Update Viscom – a category full of potential for those embracing it

38 Research

Taking a look at the forthcoming The State Of The Business Products Industry 2023-2024 study

40 Ambiente

After a tricky start in 2023, this year’s Ambiente put the event firmly on the map

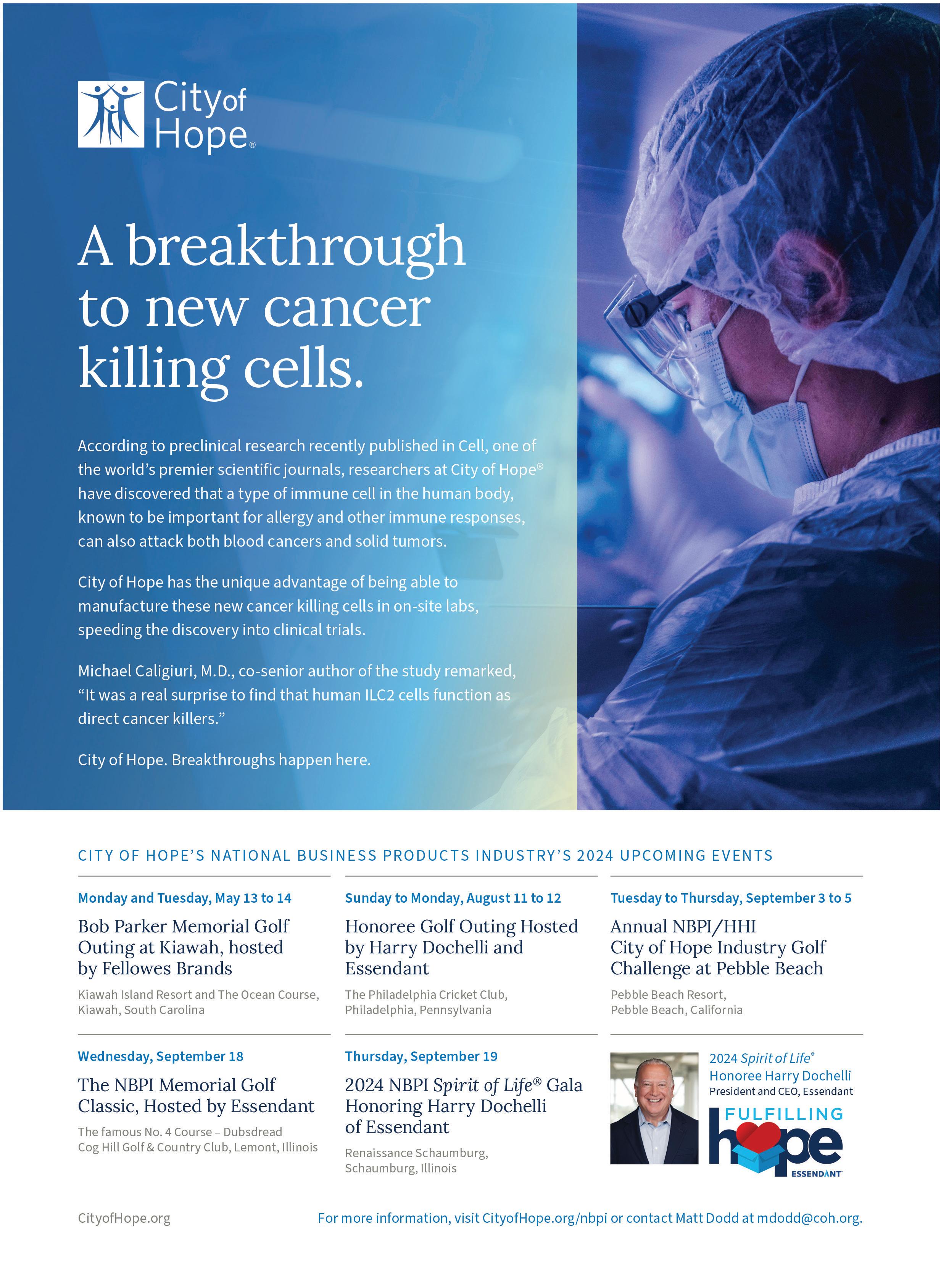

42 Review: City of Hope Tour/Hall of Fame Dinner Industry peers convened in California in support of City of Hope. OPI speaks to Spirit of Life Honouree Harry Dochelli

44 Preview: European Office Products Awards

The shortlist is out: who is in the running to win an EOPA in 2024?

REGULARS

50

March 2024 3

CONTENTS

Comment

News

Green Thinking News 16 OPI Small Talk 48 5 minutes with... Claudia Lioumbas

5

6

14

Final Word Steve Danziger

The OPI team

EDITORIAL

Editor

Heike Dieckmann

+44 1462 422 143 heike.dieckmann@opi.net

News Editor

Andy Braithwaite

+33 4 32 62 71 07 andy.braithwaite@opi.net

Assistant Editor

Kate Davies kate.davies@opi.net

Workplace360 Editor

Michelle Sturman michelle.sturman@workplace360.co.uk

Freelance Contributor David Holes david.holes@opi.net

SALES & MARKETING

Chief Commercial Officer

Jade Wilson jade.wilson@opi.net

Commercial Development Manager

Chris Armstrong chris.armstrong@opi.net

Head of Media Sales

Chris Turness +44 7872 684746 chris.turness@opi.net

Digital Marketing Manager

Aurora Enghis aurora.enghis@opi.net

EVENTS

Events Manager

Lisa Haywood events@opi.net

PRODUCTION & FINANCE

Head of Creative

Joel Mitchell joel.mitchell@opi.net

Finance & Operations

Kelly Hilleard kelly.hilleard@opi.net

PUBLISHERS

CEO

Steve Hilleard +44 7799 891000 steve.hilleard@opi.net

Director

Janet Bell

+44 7771 658130 janet.bell@opi.net

Executive Assistant

Debbie Garrand

+44 20 3290 1511 debbie.garrand@opi.net

Follow us online

Twitter: @opinews Linkedin: opi.net/linkedin

Facebook: facebook.com/opimagazine

Podcasts: opi.net/podcast App: opi.net/app

Typically, the early part of a new year doesn ’ t kick off with an abundance of celebrations. This year was different for the OPI team for several reasons. Let ’ s start with January: may I just say a massive ‘ congratulations ’ to our Assistant Editor Kate Davies who finished her Master ’ s degree in journalism with distinction – superbly done, Kate!

Also in January, my colleague Michelle Sturman and her team celebrated the one-year milestone of sister publication Workplace360. A lot of blood, sweat and tears – figuratively speaking – have gone into this new publication for the UK workplace supplies industry. But so worth it, I ’ m sure everyone would agree.

There’s certainly an overriding theme that grabbing opportunities and celebrating successes as they arise is the way to go

Then, in mid-February, yours truly looked back on an incredible 25 years at OPI – never a dull moment and it ’ s true what everybody says about our sector: it ’ s all about the people. Thank you to Steve Hilleard for giving me the chance to continue to improve my knowledge of the English language with every single edition of OPI –there ’ s always something new. Steve, in fact – with plenty of support from my fantastic colleagues – will be taking my place on this page for the next issue as I ’ ll be going on a short medical leave of absence.

Back to celebrations and moving into March: a very warm welcome to Jade Wilson who has just joined OPI as Chief Commercial Officer. Having known Jade for many years as a customer, I ’ m very much looking forward to working with him from the OPI side of the fence.

I hope you will enjoy this issue of OPI There ’ s certainly an overriding theme that grabbing opportunities and celebrating successes as they arise is the way to go. Good luck, of course, to all the companies and individuals shortlisted for this year ’ s European Office Products Awards (see page 44) – may the best ones win on 12 March in Amsterdam.

On a final note, please don ’ t forget that all of our content is also available on the OPI app – so scan the QR code and get your business supplies fix wherever you are.

March 2024 5

The carrier sheet is printed on Satimat Silk paper, which is produced on pulpmanufactured wood obtained from recognised responsible forests and at an FSC® certified mill. It is polywrapped in recyclable plastic that will biodegrade within six months. No part of this magazine may be reproduced, copied, stored in an electronic retrieval system or transmitted save with written permission or in accordance with provision of the copyright designs and patents act of 1988. Stringent efforts have been made by Office Products International to ensure accuracy. However, due principally to the fact that data cannot always be verified, it is possible that some errors or omissions may occur. Office Products International cannot accept responsibility for such errors or omissions. Office Products International accepts no responsibility for comments made by contributing authors or interviewees that may offend. COMMENT

opportunities – and

Seize the

celebrate

Office Products International Ltd (OPI) Focus House, Fairclough Hall, Halls Green, Hertfordshire SG4 7DP, UK Tel: +44 20 7841 2950

OPI is printed in the UK by

www.carbonbalancedpaper.com CBP0009242909111341 CELEBRATING: KATE DAVIES, OPI ASSISTANT EDITOR Get all the news and features first with the OPI app. Download now!

Analysis: End of the road for Nectere

As expected, the UK dealer services group has officially gone into liquidation

Just as the last issue of OPI was going to press in January, it was confirmed that Nectere was experiencing “substantial difficulties”. A few days later, the following statement was received from OT Group (OTG), the minority shareholder of the dealer services organisation:

“In December 2023, the board of Nectere conducted a comprehensive review of the business and its financial position. It is with deep regret that it concluded the company was insolvent and would require significant investment to continue operating.

“The board engaged Begbies Traynor to review all possible alternative options. In January 2024, the board formally resolved that steps should be taken to place the company into creditors’ voluntary liquidation.”

A meeting held on 1 February duly rubberstamped the motion to wind up Nectere, with the company owing non-preferential creditors in excess of £4.5 million ($5.7 million), almost £3.4 million of that to trade creditors. The largest of these was OTG at £2.4 million.

Also in the red were numerous Nectere partners, which were not paid their dues for December 2023 when the company ceased trading without warning. These resellers –mostly micro or very small businesses – were in an extremely vulnerable position. Under its business model, Nectere invoiced clients and then forwarded the money onto the partners after deducting its fee.

SLIPPERY SLOPE

Nectere’s downfall occurred less than 12 months after the business was acquired in a management buyout (MBO) from founder Paul Musgrove and his wife Serena. This transaction had been some time in the making. In fact, the Musgroves are thought to have had little

day-to-day involvement in the business since mid-2022 due to health issues – hence the appointment of Mike O’Reilly as Managing Director in May of that year.

While the MBO was being finalised, Nectere began to explore alternative wholesaler arrangements, unhappy with what it viewed as “cost issues” with main partner VOW. It secured a new deal with OTG’s Spicers and started discussing implementation in December 2022.

This process was accelerated a couple of months later when, according to Nectere, VOW reduced its credit cap by £1.25 million “without notice”, which “severely impacted the company’s ability to trade effectively”.

At the time, Spicers was experiencing its own issues due to a new ERP implementation at owner OTG. This caused Nectere dealers to suffer from a lack of product availability and below-par service levels. Certain members left the group, adding more financial pressure.

DWINDLING MEMBERS

Membership had already taken a hit due to the pandemic; pre-COVID numbers of around 220 had shrunk to about 140 by early 2023. With a model based on wafer-thin margins, scale was crucial – when a partner left, that revenue had to be replaced or offset by a reduction in costs. Neither happened; in fact, costs are thought to have increased significantly.

There is widespread disappointment – even anger – in the UK business products sector about how the demise of Nectere was handled

With its new partner struggling, OTG announced an investment in Nectere. However, as supply issues carried on into the second half of 2023, Nectere continued to accrue losses despite the additional funding.

There was still a belief the group could be turned around, and OTG brought in experienced industry exec Adam Noble at the end of October. Just a few weeks later, it was nevertheless concluded that the business would not see the year out without further significant investment. As this was not forthcoming, Begbies Traynor was put in place and the rest, as they say, is history.

There is widespread disappointment – even anger – in the UK business products sector about how the demise of Nectere was handled, in particular as regards the total absence of communication from both the company’s management and OTG.

6 www.opi.net NEWS

Jade Wilson joins OPI senior management team

OPI has restrengthened its senior management team following the recent departure of the company’s former Chief Commercial Officer (CCO) Chris Exner.

With effect from 1 March, the position of CCO at OPI is occupied by Jade Wilson. Another well-respected and highly experienced executive, Wilson joined OPI from sales and marketing agency Highlands where he was Managing Director Europe.

Wilson has enjoyed a distinguished and varied career in the business supplies industry, working in a variety of sales and business development roles for Staples Advantage UK, Stat Plus, Integra Business Solutions as well as The Business Performance Group – which was acquired by Highlands in 2014.

As CCO, Wilson will have lead responsibility for delivering growth

in several key areas of the OPI business, including events where the company has identified several opportunities to diversify and expand its existing portfolio across multiple regions in the world.

He will also oversee a significant drive to deliver growth in memberships and subscriptions, and in service offerings such as research, recruitment and executive search.

Commenting on the appointment, OPI CEO Steve Hilleard said: “Despite the substantial challenges and transformations unfolding across our industry, we are confident these circumstances present new opportunities. The addition of Jade will help us to effectively advance these projects and further enrich the already unparalleled array of services we offer to the global business and workplace supplies industry.”

Wilson added: “Having been a satisfied customer of OPI for many years, I am now looking forward to working within the company itself, enhancing its portfolio of services and driving diversification and expansion across several continents.”

ACCO Brands announces restructuring

ACCO Brands is implementing a three-year restructuring and cost savings plan that includes a rejig of its reportable business units.

The programme – which aims to achieve annualised savings of at least $60 million – incorporates initiatives to “simplify and delayer the company’s operating structure and reduce costs through headcount reductions, supply chain optimisation, global footprint rationalisation and better leveraging of sourcing capabilities”.

As a result of these actions, ACCO said it will improve its speed of execution and bring key leaders closer to customers.

One of the core changes is a move to two operating and reporting segments: Americas will include the US, Canada, Brazil, Mexico and Chile, while the International segment comprises EMEA, Australia, New Zealand and Asia.

Two company veterans will head the new units. Patrick Buchenroth has

been named VP of Americas. A former CFO of MeadWestvaco’s Consumer and Office Products division –acquired by ACCO in 2012 – he was most recently in charge of ACCO’s International division.

Meanwhile, EMEA President Cezary Monko will now have added responsibility for Australia, New Zealand and Asia.

“These [initiatives] will better position the company for long-term sustainable and profitable growth,” said CEO Tom Tedford. “The cost reduction actions as well as a renewed focus on innovation and new product development will provide fuel for reinvestment and an improved growth trajectory for the long term.”

The $60 million in savings include $12 million related to the previously announced closure of the Sidney (NY) facility in the US. That decision led to a $9 million charge, while ACCO now expects to record a further restructuring charge for the 2023 financial year of around $13 million, mainly for employee termination and benefit costs. Cash outlays in 2024 and 2025 are expected to be $18 million and $8 million, respectively.

NEWS March 2024 7

Jade Wilson

ON THE MOVE

Pilot names President

Fumio Fujisaki, a 40-year company veteran and former Managing Director of Pilot Corporation of Europe, will become President of the Japan-based vendor from 28 March.

New CEO at Apogee

HP Inc-owned Apogee has appointed former CFO James Clark (left) as its new CEO. He takes over from Aurelio Maruggi, who will leave the business after four years.

Departure from RAJA Office/Viking Europe

Director of Purchasing and Assortment Rogier Koning has left RAJA Office/Viking Europe after nine years. Sharon Tan succeeds him on an interim basis.

TD SYNNEX names

European leader

TD SYNNEX has appointed Miriam Murphy as President of its European business, effective 8 April. Before a two-year stint at NTT, she had spent over 20 years at Avnet and Tech Data – both entities now fall under the TD SYNNEX umbrella.

Staff change at ExaClair

National Account Manager Garry Wright will leave Exacompta’s UK subsidiary ExaClair on 29 March for CTS Wholesale. Keeley Shepherd, currently at 3M, will join ExaClair as Head of Commercial Sales in April.

Ex-Office Depot exec joins Wilkhahn

Germany-based furniture manufacturer Wilkhahn has appointed Raffael Reinhold (left) as CEO, effective 1 February. The former Managing Director of Office Depot Europe succeeds Thomas Mänecke who left after two years in the role.

Durable Scandinavia announces exit

Durable has confirmed that its Managing Director for Scandinavia, Lena Möller, will leave on 19 April. She joined the company in 2012 as CFO before being promoted to Managing Director in 2018.

COLOP closes UK branch

Stamp manufacturer COLOP has decided to restructure its UK operations in a move that will see the closure of its Birmingham facility and the business transfer to distribution partner Greenstik Materials.

The agreement with Greenstik – a leading supplier in the crafting segment – came into effect on 1 February. COLOP UK Managing Director Chris Deighton, along with three colleagues, will be transferring over to Greenstik. There will be a transition period that will culminate in the closure of COLOP’s site in Birmingham on 31 March.

Deighton commented: “While this is a significant change, it makes good sense for the business and will allow us to continue to grow and be a force within the UK market. For me personally, I will be able to become more customer-facing moving forward.”

COLOP’s UK business has its roots in the Mark C Brown and William Jones Clifton companies that were acquired in 2006 and 2009 respectively, with COLOP UK officially established in 2013. The vendor moved to its Birmingham HQ in May 2019.

Staples develops breakroom offering

Staples’ B2B business in the US has launched a new breakroom drinks and snacks brand. Called Pick Me Up Provisions, the brand debuted with a range of coffee pods developed in partnership with Keurig. According to trademark documents, other items include snacks such as chocolate, protein bars and ice cream.

Pick Me Up Provisions items are currently available on the Staples.com, Staples Advantage and Quill websites. Additionally, they are being sold on the Walmart marketplace by Staples-owned seller MyOfficeInnovations.

The brand is also being offered as part of a coffee brewer programme from a reseller called Total Coffee. This new service includes installation and maintenance as well as the supply of a variety of beverage options.

NEWS 8 www.opi.net

Ryan Boyington

ODP CEO back at the helm

The ODP Corporation (ODP) CEO Gerry Smith returned to work at the start of February after a health-related leave of absence.

Smith stepped away from the business last September after undergoing a medical procedure. Now he is back, Joe Vassalluzzo, who handled the CEO responsibilities during Smith’s absence, has returned to his role as Independent Non-Executive Chairman on the ODP board.

“I would like to thank everyone for the support they showed during my leave, and especially to Joe for stepping in and leading the company during my absence,” said Smith.

He added that he was eager to continue driving ODP’s corporate transformation and maximising value for the group’s stakeholders. While Smith was away, shareholder AREX Capital Management called for the company to be broken up; ODP has yet to publicly address the points raised in the ‘AREX plan’.

New name for Armor Print Solutions

Aftermarket print supplies and solutions vendor Armor Print Solutions has unveiled a new brand identity: Altkin. CEO Gerwald van der Gijp revealed the name during a presentation at the recent Remanexpo event in Frankfurt.

He said the move embodied the company’s “collective mission to provide alternative pathways to impactful change”. Along with the new brand comes a product and services offering that is based on four pillars: products, care, tech and tailored.

The rebrand comes a few months after the purchase of Germany-based THS. This created a business with 700 employees and annual revenues of around €90 million ($97.5 million). Van der Gijp said he will aim to increase the top line by 30% over the next two years through a mix of organic growth and more acquisitions.

ON THE MOVE

Guillotin back in OP sector

Former Spicers and ADVEO exec Philippe Guillotin has been appointed to the new role of Country Manager at Comercial del Sur-owned CS Comlandi. The group said it is preparing to expand its position within the French market.

Amazon Business head takes leave

Amazon Business VP Alexandre Gagnon will temporarily step away from the company in April to spend time with his family. It’s not been confirmed how long he will be on leave for, but experienced Amazonian Shelley Salomon will take over in his absence.

Safco makes national accounts hire

US vendor Safco Products has named Vonnie Provinzino as Senior Manager for National Accounts. She is well known in our industry through her 12 years in various B2B sales and marketing roles at 3M.

Raflatac exec takes on UPM role

UPM has appointed Antti Jääskeläinen to take temporary charge of its Communication Papers division. He will also continue as EVP at UPM Raflatac until a full-time Head of Communication Papers is found.

New President at Supply Chimp

US dealer Supply Chimp has appointed Joe McKenna (left) as President following the decision last year of co-founder and shareholder Isaac de la Fuente to focus on other business interests. McKenna brings with him a strong background in e-commerce.

Leadership role for Boyington

Ryan Boyington was promoted to the role of President at Storey Kenworthy – which includes the Workspace furnishings business – at the beginning of this year. He now oversees all day-to-day operations at the US dealer.

NEWS March 2024 9

Gerry Smith

Ricoh/ Toshiba Tec JV set for July start

More details of the joint venture (JV) between print OEMs Ricoh and Toshiba Tec have been revealed.

Last year, the companies agreed to merge their multifunction printer manufacturing and development units. Now, the final details of the JV have been confirmed by both firms’ boards of directors.

The new business will be known as ETRIA and officially come into being on 1 July 2024. It will be headed by Katsunori Nakata, currently General Manager of Ricoh’s Office Printing division. Meanwhile, the land and buildings associated with France-based Toshiba Tech Europe Imaging Systems’ manufacturing facilities – not originally included in the deal – will be transferred to ETRIA.

The new JV – owned 85% by Ricoh and 15% by Toshiba Tec – will supply products to both OEMs, but each firm will continue to handle sales individually.

Dutch regulators look at Bol marketplace

The Netherlands Authority for Consumers and Markets (ACM) has launched an investigation into online platform Bol following reports that it gives preferential treatment to itself and certain other business users.

The ACM said it had been informed by multiple businesses that allege their products are less visible on the online platform, even if they offer the best price and/or quality. These organisations claim the selections of Bol itself and other sellers are given preferential treatment. In addition, there are reports the online platform uses data from businesses in order to strengthen its own position.

In response, Bol said it will fully cooperate with the ACM probe, adding that staff were working hard to provide the watchdog with “all the necessary information to ensure the investigation runs smoothly”.

New CEO at Staples Canada

Staples Canada has promoted Rachel Huckle to CEO, effective 1 March 2024. With more than 20 years’ experience in the retail sector, Huckle joined Staples Canada as Chief Retail Officer in 2019 and was named COO three years later. She will now oversee over 300 retail stores, the company’s digital and services business, and B2B arm Staples Professional.

“Rachel has played a pivotal role in our transformation to The Working and Learning Company,” Staples Canada said. “Under her guidance, it has expanded its products and services to provide more value and selection for consumers, grown its B2B offerings serving Canadian businesses of a range of sizes, and forged important strategic partnerships that have significantly enhanced the business itself.”

As well as remaining on the Staples Canada board, outgoing CEO David Boone will act as an advisor to the reseller’s owner, Sycamore Partners.

Antalis ups packaging interest

Antalis has signalled its ambition to develop its packaging business. The distributor has already made three acquisitions in Europe at the start of 2024.

The businesses bought are 100 Metros in Portugal, Baltics distributor Pakella and Italy-based Tecnoprimaf. Together, they represent around €54 million ($58 million) in additional annual sales for Antalis.

Stewart Superior signs South Africa deal

UK-based business and consumer products vendor Stewart Superior is set to sell into the South African market. The company has signed a distribution agreement with local manufacturer and distributor Republic Lifestyle. The news comes shortly before Amazon begins operations in the country.

Stewart Superior Managing Director Geoffrey Betts commented: “It’s a perfect time for us to open in South Africa and Republic Lifestyle is an excellent fit for us. This further expands our global operation and reach, and is an exciting time for the company.”

NEWS 10 www.opi.net

Katsunori Nakata

Rachel Huckle

Geoffrey Betts

BradyIFS and Envoy Solutions rebrand corporate identity

The new go-to-market name for the merged BradyIFS and Envoy Solutions jan/san, industrial packaging and foodservice reseller businesses has been revealed.

At a kick-off event, the organisation introduced the BradyPlus name, promising to create a legacy built on 140 years of history and the combination of 62 heritage brands. The ‘B’ in the logo incorporates a bee which is being used in marketing messages, for example in the social media hashtag #FollowTheBee.

The newly revealed corporate identity is currently being rolled out across different brand touchpoints.

OWG makes double acquisition

Swiss business products group Office World Group (OWG) – owned by MTH Retail in Austria – has bought local trading company Sesco Trading and online reseller schuldiscount.ch from local entrepreneurs Peter and Andreas Steffen.

The deal – for which financial details were not disclosed – was signed in early February and closed on 1 March.

OWG CEO Johann Pintarich called the acquired businesses a “perfect fit”. He said the move will broaden and complement OWG’s existing product portfolio, especially in the calculator, office technology and stationery categories.

“We already have a very good sales network supplying resellers and large online retailers as well as smaller stationery shops and schools. Through the takeover of Sesco Trading and schuldiscount.ch, we can expand further and serve our customers even better,” he added.

Andreas and Peter Steffen – nearing retirement age – will remain active in the business until the integration is completed.

NEWS March 2024 11

Johann Pintarich (l) and Peter Steffen

Every time a customer buys a printer, it’s an investment for us. And if this customer doesn’t print enough or doesn’t use our supplies, it’s a bad investment

Enrique Lores, CEO, HP Inc

RAJA celebrates 70 years

Around 700 people from all over Europe attended an event in Paris in February to mark the 70th anniversary of packaging and business products reseller RAJA Group.

The company was co-founded by the mother of current CEO Danièle Kapel-Marcovici in 1954.

HP inks Real Madrid sponsorship deal

HP Inc has announced a global technology sponsorship agreement with iconic football club Real Madrid. As part of the multiyear deal – reportedly worth around €45 million ($48 million) – HP is the first brand to have its logo appear on the Real Madrid uniform sleeve in the club’s 121-year history.

1949

The year US-based vendor C-Line Products (originally The Chicago Desk Pad Company) was established. Congratulations on its 75th anniversary!

$49 million

Expenses incurred by Clorox in H2 2023 in relation to last August’s cyberattack

Master’s distinction for Kate Davies OPI Assistant Editor Kate Davies graduated with a Master’s degree – achieving a distinction – on 18 January. She studied journalism at Kingston University near London, UK.

$140 billion

Third-party seller fees charged by Amazon in 2023

BOSS Business Supplies Charity thanks patrons

Over 100 patrons and guests attended the BOSS Business Supplies Charity Patrons’ Dinner at Stationers’ Hall in London, UK, in February. The charity’s Chair Martin Wilde thanked supporters for a successful 2023 and referred to its ambition to help even more people in 2024.

Wilde also announced that next year’s Centenary Dinner will be held at King’s College in Cambridge on 26 March 2025.

NEWS 12 www.opi.net IN BRIEF

PICTURE

OF THE MONTH

Static Control argues for right to repair

Aftermarket components supplier Static Control Components (SCC) has submitted comments to the US Federal Trade Commission (FTC) in support of a petition for consumers’ right to repair.

Last November, the US Public Interest Research Group Education Fund and iFixit delivered a petition to the FTC calling for it to initiate a rulemaking on the right to repair. In early January of this year, the FTC invited interested parties to comment, giving them until 2 February to do so.

SCC responded, urging the FTC to implement a ruling that would “secure the right of consumers to obtain aftermarket components to repair and maintain the products they purchase, and the right of aftermarket companies to compete with OEM suppliers to produce those aftermarket components”.

SCC contended that the print remanufacturing industry has been in decline largely due to “unfair competition” from OEMs. Among other things, it cited firmware updates which lock out aftermarket cartridges.

While SCC promoted the environmental benefits of remanufactured cartridges, it did not comment on cheap, new-build compatibles that are flooding the market. These, arguably, have hit remanufacturers just as hard as OEM tactics and are, by and large, single-use items that end up in landfills.

Of course, this would have been awkward for SCC, given that it’s owned by Ninestar, a major producer of aftermarket compatibles. Nevertheless, in its comments to the FTC, SCC did refer to its previous litigation against Lexmark – which is now, for all intents and purposes, a sister company under the Ninestar umbrella.

UPM Raflatac hits certification target early

UPM Raflatac has reached its 2030 responsible sourcing and climate targets six years early. It announced that all papers used in its labelling materials are now certified under third-party forest certification schemes.

The manufacturer noted that the quickly evolving regulatory environment is putting growing pressure on companies to improve the traceability of their raw materials and their responsible sourcing practices. By having all its papers certified under FSC, PEFC or PEFC-endorsed forest certification systems, UPM Raflatac said it can support its customers in achieving their responsible sourcing targets.

Essity recognised on Corporate Knights list

To coincide with the World Economic Forum in Davos, Switzerland, Corporate Knights has published its annual Global 100 list – with Essity again recognised as one of the world’s most sustainable companies.

The evaluation is based on 25 KPIs. These include sustainable revenue and investment, taxes paid, carbon productivity, and racial and gender diversity.

Essity was ranked 68th compared with 52nd place last year. Topping the list was Australian waste management firm Sims.

Renewable energy milestone for Epson

As of December 2023, Epson has achieved the use of entirely renewable electricity across its global sites. With an annual electricity consumption of approximately 876 GWh, it expects this change to reduce CO2 emissions by about 400,000 tonnes per year.

The company said it’s the first in the Japanese manufacturing sector to make the move to 100% renewables, with the achievement marking a significant step towards its Environmental Vision 2050.

Recycled aluminium switch for edding

Writing instruments manufacturer edding is switching from conventional to recycled aluminium for the production of its permanent markers.

In recent months, edding and its partner, Linhardt, have made technical advances to introduce alternative materials into the manufacturing process. As a result, the most popular colours of edding 3000 permanent markers are now made using 100% post-consumer recycled (PCR) aluminium.

By the end of 2024, it expects the majority of its products to be produced using PCR aluminium. Existing stock will – as far as possible –be sold before the new products are put on sale.

14 www.opi.net GREEN THINKING

Extracts from interviews with exhibitors at Ambiente 2024

– by Andy Braithwaite

IMPRESSIONS FROM the show floor

Walter Johnsen CEO, Acme United

Our European business had a good finish to last year and we have started 2024 with what we believe is momentum. One headwind in 2023 was the continued reduction of inventory by our customers. This appears to have worked its way through and, at this point, we’re seeing good order growth across the board.

In Europe, the first aid category is only about 10% of our sales, so we will give this more emphasis. We have deep expertise in this segment and I would envision that, five years from now, it could represent 30-35% of European revenue – possibly more if we make an acquisition.

Globally, first aid is a very good business for us and one we’re continuing to invest in.

Frank Indenkämpen, Executive Managing Director, Novus Dahle

We had some product lines last year where we were growing predominantly due to price increases. However, when you have the right products and access to the relevant markets, you can still grow volumes as well. Therefore, for 2024, we have a very ambitious – but not unrealistic – development plan because there will be price stability.

That said, I am concerned by the geopolitical situation and the turmoil in many western democracies. People might assume this 16 www.opi.net

doesn’t have any relevance to selling office products, but it does: it has a severe impact on trade, negotiations, relationships and the ability to move products freely.

As such, there are a lot of question marks right now. At Ambiente, you meet professionals in their respective fields who are happy to be there, believe in strong relationships and want to do business. This leads to optimism despite what we see on the political stage.

Peter Achterberg, Sales Director, T3L Group

Our change to the Djois go-to-market brand has been well received and regarded as a success.

It’s always a risk [to rebrand] but we were well supported by an agency; even some of our core customers had recommended a move to a completely new name instead of taking one of the historical brands. This was something of an eye-opener for me because I thought they would have preferred one of our existing company names, but the conclusion was that some of these are quite regional.

It is clear some traditional office categories are in secular decline, filing being one where we have a last-man-standing approach.

However, we are now doing piggy banks and key chains following our acquisition of Poul Willumsen last year. It’s a totally different channel but, at the end of the day, it’s injection moulding, which fits perfectly with our Jalema production know-how.

SMALL TALK

Walter Johnsen

Frank Indenkämpen

Peter Achterberg

Marcus Bohn, European Key Account Manager, tesa

The sustainability movement is unstoppable and everybody needs to transform. We will constantly renew our assortment, exchanging existing products for more sustainable solutions, but without jeopardising quality. There is no alternative and our approach is: “We didn’t come this far just to come this far.”

For tesa, sustainability is a process that began in 2010 and we believe we have a story to tell with our ongoing journey. And we are not just selling ‘me too’ products, but are developing brand-building initiatives and adding resources to enter new markets in Europe where we feel we can bring additional value.

Gaetano Gaglio, Director, International Key Accounts, edding

One of the highlights for edding at Ambiente 2024 revolved around our strong focus on sustainability. At the show, we officially launched our permanent 3000 marker made from recycled aluminium (see also Green Thinking, page 14). The story around recycled plastics is well known, but for metals such as aluminium it is a more difficult process; however, it is a challenge we have now mastered.

The reaction has been very positive because it fits perfectly with the strategies of the majority of our customers when it comes to areas such as CO2 emissions and life cycle assessments.

Martina Heiland, Head of Communications, Durable Ambiente 2024 has been an opportunity for us to show our new EFFECT range for the first time. It is an assortment of sustainable desk accessories made from 60% recycled PET felt material.

Durable aims to be a responsible company – that is why we have developed our re:think sustainability strategy around four pillars: refuse, reduce, reuse and recycle.

It was good to see more companies from the workplace sector at this year’s Ambiente. It helped us to reinforce the idea of ‘new work’ and present comprehensive concepts to visitors. We showed products in home, office and learning environments to demonstrate how they can be adapted to different situations.

Stuart Seymour, European Sales & Marketing Director, Hopax

Many of our distributor partners said they would attend Ambiente, which is why we exhibited both last year and again in 2024.

In 2023, we were in Hall 4.2, which was very different in terms of many more people walking around and visiting the booth. But despite there being better traffic, visitors weren’t necessarily our potential customers. This year in Hall 2.0, while it was quieter, it was also more refined and I’m sure the quality of our meetings was higher.

As regards sustainability, I have been passionate about the idea of Hopax moving forward on this topic and our parent company in Taiwan has been very supportive. Our first sustainable development goals were established in 2020 and we are transparent about the progress being made through our third-party audits.

My personal view is that it won’t be politicians who make a difference as to whether the planet gets better. It will be manufacturers and the supply chain which can offer an environmentally friendly option. There’s a long way to go, but I’m convinced we’re travelling in the right direction –and exactly where the market wants us to go.

For our overall Ambiente review, see page 40.

March 2024 17 SMALL TALK Ambiente 2024

Marcus Bohn

Gaetano Gaglio

Stuart Seymour

Martina Heiland

half-full A GLASS APPROACH

Against the backdrop of a declining industry, PBS Holding’s Richard Scharmann remains steadfastly upbeat about the opportunities out there

Richard Scharmann needs little introduction. As CEO of Austria-based PBS Holding, he has been the trailblazer of a business model in our industry that was once unusual – controversial even – but is now standard fare: the multichannel approach. He heads an organisation which has carved out market leadership positions in several Central and Eastern European countries.

During his 16 years in charge, Scharmann has orchestrated and integrated over 20 acquisitions. It is this persistent M&A activity that has catapulted PBS forward, particularly in recent years when digitisation has resulted in steady revenue declines in traditional product categories. All the entities with the group remain refreshingly autonomous, fostering an entrepreneurial spirit which is rewarded with a results-driven stake in the company.

OPI’s Steve Hilleard met up with Scharmann on a grey – very British, some might say – day in London in January. The word ‘consolidation’ was never far from the topic of conversation...

OPI: Some time ago, you described your job to us as “running a service business that deals with products nearly everyone needs”. You also said the best thing about our industry was “creating exciting business concepts based on boring products”. Are both statements still true?

Richard Scharmann: Yes, unfortunately they are still boring products, but there’s a fair bit of momentum in our sector now which is exciting.

There are some big issues. The secular decline of the products we sell is a nightmare and we have to find ways to address this. I believe we have three different options. One

is – and everyone is doing it – introducing new products: jan/san, PPE, etc. But it’s still difficult to compensate for the decline of lever arch files by selling more gloves, so this tactic alone is not working.

The second choice is finding new customers for your existing portfolio. With this approach, you’re tackling different markets and alternative customer groups, getting acquainted with marketplaces, etc. There is quite a learning curve here and it’s more of a long-term strategy as success doesn’t happen overnight.

The third one – and, in my opinion, the fastest way forward – is M&A.

OPI: It’s interesting you haven’t mentioned expanding into more services. Is that not on your radar?

RS: The environment has changed quite significantly. Speeding up processes and face-to-face contact with customers used to be a key element of our success – strong relationships, unbeatable service offerings, next-day delivery and 99% product availability. But these things are becoming less important.

Now we question the need for next-day delivery because of cost increases as well

18 www.opi.net BIG INTERVIEW

If there is a customer, we’re eager to sell. Wholesale, resell, direct – who cares?

as a more sustainable approach to market. Personal contact is also making way for AI-driven conversations with customers in order to manage expenditure efficiently.

The biggest challenge at present is a declining market and huge cost increases. As such, there’s not much room for expanding service content, which would mean adding more people and providing services someone has to pay for. The whole definition of ‘service’ is different from what it was five to ten years ago.

OPI: Tell me about PBS Holding’s footprint in 2024, geographically and in terms of the channels you operate in. You were one of the first true multichannel operators in our industry, a model that’s been adopted by many across the globe.

RS: We are in eight countries: Austria, Germany, Poland, the Czech Republic,

Slovakia, Hungary, Slovenia and Italy. The business split is half-half – 50% wholesale and 50% direct business – although the boundaries are getting quite blurred as everybody is selling to everyone. Essentially, if there is a customer, we’re eager to sell. Wholesale, resell, direct – who cares?

We are continuously opening new channels in our existing markets, so even if the original footprint is wholesale, it’s never the end of the story. The acquisition of the international accounts business from Staples Solutions, for instance, gave us the opportunity to introduce the direct model to the German market. That’s been significant.

OPI: Have you not had a direct business in Germany for a while?

RS: Not really. It was mainly wholesale – about 98%. But now the direct operation in the country is interesting for us. Overall, we are doing around €120 million ($130 million) in Germany; out of that, approximately €20-€25 million is the global accounts business.

OPI: How do you define where your responsibility as a direct reseller stops

BIG INTERVIEW Richard Scharmann March 2024 19

Richard Scharmann

because it butts up against your duty to your wholesale customers?

RS: Well, we start getting into trouble when a dealer calls me, it’s as simple as that.

OPI: Does that happen often?

RS: In Austria, as an example, we’re the leading wholesaler as well as reseller, and I would say it happens once or twice a year at worst. The likes of Viking and Printus also operate here and I believe there’s room for everybody to grow and compete against each other. It’s not a real issue.

OPI: What are your most important markets?

RS: Out of a total of about €450 million in sales, in terms of top line, it’s Germany with, as I said, €120 million. Austria comes close with €100 million, followed by Poland with €75 million and the Czech Republic with €70 million. Slovakia and Hungary are both heading in the direction of €30 million.

Italy is about the same, but we only started there – from scratch – three years ago. But we’re looking to more aggressively grow in this market with M&A and will be announcing a new project very soon. We’re the number two in

Italy but with quite a gap to the top player. We intend to significantly close that gap this year.

I’m actually working on four M&A projects right now because the market is under such pressure and opportunities are plentiful.

OPI: What determines a good M&A fit?

RS: It’s three main pillars. The first, and most important, is the management fit. We need the right team in place to develop our business, because the DNA of PBS is quite specific.

We are very dependent on local initiatives and responsibilities. It’s the reason we have local shareholdings in place – I have no clue how to handle and manage a Polish business in the best way. As such, we need locals who know how to do it, and we are happy to give them a shareholding in return.

Without this kind of entrepreneurship in place, it won’t work within the PBS group. If they are not shouting for help, nobody’s interfering in their business.

Second, there has to be a regional fit and also compatibility of business model, so that we can support the business in terms of IT, product data, purchasing agreements and so on. It’s always essential to generate synergies.

BIG INTERVIEW

20 www.opi.net

The third one is a multichannel approach. It would be tricky for us to deal with a company that has a focus solely on one customer channel and is not flexible enough to open up to the full scale of opportunities in the market.

OPI: If I looked back on the many deals I’ve witnessed in my long OPI career, I would argue most have not been successful. They were driven by the need to generate synergistic cost savings which have ultimately ripped the heart out of the business that was acquired. How do you manage this tricky balancing act?

RS: Well, first of all, I have been lucky. I’ve been CEO for the past 16 years and closed 20 acquisitions. Not every deal was super successful, but eventually we recouped all the money invested at the very least.

As I mentioned, the critical part is the people. Picking the right individuals, seeing their capabilities and an eagerness to go the extra mile makes a huge difference – it’s even more important than the potential synergies we see.

This was clearly the case for us in Poland. I had been looking at the country for three or four years, analysing six, seven, eight different companies – I couldn’t find the perfect fit. Then I found the person I wanted to manage the Polish market, but I had no company.

The upshot was we built our presence from scratch. We went greenfield together and put a business plan in place, saying that if we just grew organically but did a proper job, it would take us eight years to break even.

Picking the right individuals, seeing their capabilities and an eagerness to go the extra mile makes a huge difference

The question was: was that management person ready to join in as a shareholder? Eight years means a lot of investment. Of course, we supported him intensively, but he too had to open up his bank account and put money on the table – effectively taking part of the risk.

This was the starting point for Poland and we fully anticipated it would take seven to eight years to get to a top line of around €10 million. Things turned out quite differently because we acquired another business 18 months after we started. And reached breakeven point two years later.

Now the Polish company is one of our best-performing subsidiaries, both from a top and bottom-line perspective.

OPI: What are the valuation expectations of business owners looking to sell their business, and what are your expectations in terms of what you’re prepared to pay?

RS: This is changing all the time. We hardly saw any activities during COVID as everyone was busy just staying in business. Then we had the supply chain issues and nobody was eager to acquire, followed by high inflation when operators were making good money on the back of it – at least the ones that knew how to. Many improved their bottom line and felt no reason to sell.

Now we’re back to reality. Business is declining again and there are no major supply chain issues. People start thinking: “Will I survive the next three years?” A year ago, companies that would have been interesting to us were either very expensive or not quite ready to sell. Now they’re knocking on our door, asking to come back to the negotiating table.

It seems to be a race to get out before everything crashes completely. This, naturally, is having an influence on valuation.

OPI: You’re painting quite a miserable picture here.

RS: Or, if you flip it, it’s an opportunity. What I’m saying is that, at present, we are back to reasonable expectations.

OPI: You seem to be venturing into the realms of buying businesses that are distressed, or potentially could be distressed down the line. How does that fit with the three pillars you’ve just referred to?

RS: The question is: what is the root cause for ending up in this position? Most of our acquisitions were businesses that had problems in their operations. We saw the synergies and knew how to realise them. Also having the management potential and freeing this up can really make a difference.

We have many examples of this. Four years ago, we bought Office Depot Europe’s best-performing businesses: the Czech Republic and Slovakia. It was the reason Aurelius sold these two components off separately; it knew they were an asset.

Over these four years, we have improved the bottom line five times. From day one, we made the managing director a shareholder. Beforehand, he was just awaiting orders and saying: “Well, I have to have a good top line to keep the parent company happy – the rest is up to them to sort out.” Now he’s chasing the bottom line – it’s an entirely different approach.

OPI: Is your man a shareholder of the whole of PBS Holding or just that local subsidiary?

BIG INTERVIEW Richard Scharmann March 2024 21

Richard Scharmann

RS: The local one. He is looking after his own organisation, with his own structures. Our shareholdings are limited to 25%; PBS still has the controlling majority of the business. But for this shareholder, it’s a substantial investment with considerable risks – and benefits if it’s a profitable enterprise.

OPI: We’ve talked a bit about the top and bottom lines. How is PBS Holding performing currently – against the rather depressing picture of a declining market?

RS: In 2023, revenue overall grew about 3.5%. The first four months of the year were quite nice; the rest was a nightmare, to be honest. Things started going down in May, June and July, and they never picked up again. We ended up minus 10% in Q4, compared to 2022. It was the same at the beginning of 2024 –down 10%. It will be a tricky year in terms of controlling cost and margins due to inflation and new tariffs. I don’t expect any organic growth – it’s impossible with 10% declines and more costs. M&A is the only solution.

OPI: What’s the focus? Fill-in acquisitions in your existing markets or further geographic expansion?

RS: The priority is fill-in, as we know exactly what’s going on in those markets, the potential

synergies and the likely impact on market positioning. That said, all the big tickets such as Staples and Depot in Europe are gone. As such, it’s more about smaller, local companies. We have efficient processes in place to integrate these kinds of companies.

OPI: To my knowledge, you’ve always bought traditional businesses within the OP industry rather than venturing into adjacent markets such as safety or jan/san. Is that deliberate?

RS: My capability has limitations in terms of experience and know-how of these other segments and the risk is much bigger. Safe ground is important to us, therefore looking into new and exciting but unfamiliar verticals doesn’t spring to mind at first glance.

We’re dipping our toes for now by adding these products to the portfolio and learning about certain categories. But yes, to take a big step forward and get the experience of skilled people, you need to buy into it.

OPI: Let’s talk about the contract space where Lyreco and RAJA are also key players. Have we finally lost, as an industry, some of the aggressive pricing that went on under the old Staples and Depot? You have first-hand experience of this, I guess.

BIG INTERVIEW

22 www.opi.net

RS: I certainly hope so, and you’re right. As mentioned, we acquired the international contract business from Staples and you get presented with all the marketing stuff as an interested buyer. It’s utterly removed from reality in terms of the margins you can make. And it’s not due to weaker purchasing power –we are quite competitive in this area.

When we started, the margins were around 13%, so clearly loss-making – you’re burning cash on a daily basis. Over the past 18 months, we’ve improved this to 25%, finally starting to make money, but it’s taken a while. We had to be quite straightforward with our customers because they weren’t just incremental changes – tiny steps weren’t sufficient.

All the talk about volume eventually resulting in profit is the stuff of fairy tales

These two global players didn’t just go bust because of the American way of management they wanted to introduce to Europe. There was poor operational management in place too. All the talk about volume eventually resulting in profit is the stuff of fairy tales.

I have conversations on a daily basis with German operators of all kinds looking for solutions, be that through merging, acquiring or whatever.

OPI: What’s driving this difficulty?

RS: Germany is going down faster than other countries. From an industry point of view, there’s a kind of recession in Germany, which we also feel in our direct business. It’s definitely been a reality check post COVID – no more subsidies, huge pressure on the cost base and on margins, not making money and banks not eager to invest another euro.

Companies were still generating 3-4% profits two years ago – it was down to 0% in 2023 and we’re expecting a really tough year ahead.

OPI: Opportunistic acquisition targets for you then in the coming months?

RS: I see it this way, yes. But these are tough conversations, for sure, especially when you’re dealing with very old, family-driven businesses. We bought Hofmann + Zeiher three years ago – it had taken me four years to negotiate that deal with this wholesaler.

There are not many regional players left and none of them, I believe, are over €6 million in sales, so we’re coming down to small numbers.

OPI: Are you aiming to become a true European – global even – contract player? Your current footprint doesn’t suggest so. RS: Absolutely we are. On a global level, we’re covering close to 40 countries. Outside Europe, we have partners in the US and Canada, South Africa, Asia and Australia, so we can certainly handle global contracts.

I wouldn’t call it a clear strategy to become the most important player in the contract space, but it’s part of our service offering to customers. You need a solid base and a skilled team to manage these kinds of accounts. And a competitive partner network.

This particular business currently runs at around €70 million. It would be nice to significantly increase it; but as long as we can secure our customer base and develop from there, step by step, I’m fine with that.

OPI: You said your largest markets are Germany and Austria. Germany in particular has been challenging, with some of the larger players really struggling in recent years. What are your thoughts on that particular geography?

RS: It’s the most difficult market for us because wholesale is so troubled as a result of the declines. Dealers are going out of business and consolidation is speeding up.

OPI: We have a fair few dealer group/ wholesaler combos in our industry –Soennecken or Quantore in continental Europe – or wholesalers closely aligned with a group, such as VOW and Office Friendly in the UK. Is this something you would be looking at?

RS: Not really, it wouldn’t be the right approach for us. I also believe you cannot develop these kinds of models today because you won’t get the support from the industry.

Soennecken manages its business based on very old contracts and has a strong market position; you would not get the same conditions as a new player launching this model.

OPI: We spoke briefly about next-day delivery, the push for sustainability and how they correlate. Can you encourage customers to procure more sustainably – a delivery every week or fortnight, better use of packaging, fleets of vehicles, etc?

RS: From an operational and systems point of view, this would be so easy for us. But the possibility is ignored by customers, especially the big accounts. Big German corporates, for instance, are usually very strict – they want to see all the certificates, have sustainable product solutions as a certain percentage of their procurement, etc.

BIG INTERVIEW Richard Scharmann March 2024 23

Richard Scharmann

We then tell them orders could be placed and deliveries made in a much smarter – and more sustainable – way. Would they be open to trying this? The clear answer is ‘no’ because it’s not convenient. You can draw your own conclusions from this.

OPI: I hear what you’re saying. But all the legislation – in terms of sustainability goals – that’s going to be passed down by governments or the EU will surely have an impact eventually on how customers buy.

RS: It has to. We see it in our own organisation because we have to comply with certain ESG rules and, from 2025, we will have to start reporting more details about our strategy.

The requirements are all clearly laid out as regards reducing your carbon footprint significantly by 2030, further by 2040, and so on. We did all the analysis with our consultants, debating how we could meet the targets. The upshot is, it seems impossible and that’s not just our opinion but the consensus at a European level.

OPI: Product sourcing from Asia must be a big topic in that context.

RS: It’s significant. It doesn’t make sense to start making certain products in Europe – it won’t happen at scale.

OPI: This leads me to Interaction. You’ve been a member of this wholesaler alliance, which gives you the Q-Connect brand, for many years. What are the benefits you derive from your participation?

RS: It’s simple – private label is all about volumes. Sourcing the right amounts from the right factories makes it really competitive for us because it’s done at a European level with the other partners. And everything is managed by Interaction – the contracts, the listings, the product offerings. The relationship has been hugely beneficial for us.

As markets become tougher, brands are less important to the end customer and there’s more room for private label. I’d go as far as to say that there’s more pressure to grow private label share in an organisation to stay competitive and manage cost levels properly.

OPI: Nearly time to wrap up. What keeps you awake at night?

RS: Let me begin by saying what doesn’t. About six months ago, I stopped looking at volume developments – it drives you crazy as the only reasonable expectation is that we’ll be out of business in five years’ time.

Instead, I focus on margins, pricing strategies and things like that. We will still be selling less, but can manage it in a different way. There will always be new trends and different patterns. As long as I see more opportunities than threats, I sleep pretty well. I’m sure we will stay busy for the next five years.

OPI: And then? There’s plenty of Richard Scharmann career left and you seem happy doing what you’re doing.

RS: I am. And who knows what kind of role PBS itself will play in the consolidation game.

As long as I see more opportunities than threats, I sleep pretty well

OPI: Some big players up for grabs still…

RS: We won’t consolidate them, no way. On the other hand, could PBS be bought? I can’t really see it, as the main players have a fairly clear profile and I don’t see a natural fit. I’m talking about Lyreco and RAJA here, of course.

For more from the interview, including topics such as AI, Amazon and hybrid working, see our exclusive Xtra content in the March issue on opi.net

What we are doing right now is identifying and investing in high-potential candidates from within the group in all countries and supporting them in extensive five-year training programmes. We are looking for future leaders, with a view to making them future shareholders. It’s succession planning across the entire group and its portfolio.

OPI: Sounds like a well-thought-out plan. Thank you Richard.

BIG INTERVIEW

24 www.opi.net

SHIPPING in the SPOTLIGHT

While container costs have soared recently, all the signs suggest the current crisis will not reach 2021 proportions – by

Andy Braithwaite

Readers of OPI will need little reminding of the importance the Red Sea plays in the international movement of goods. In 2023, the Suez Canal handled 12-15% of all global trade, according to the United Nations Conference on Trade and Development (UNCTAD).

Many will also remember the March 2021 incident involving the container ship Ever Given, which blocked the canal for six days and caused widespread disruption to supply chains. The region is currently back in the spotlight after a series of attacks on vessels by Yemen-based Houthis, leading major shipping firms to shun the Suez Canal and take much longer routes around the Cape of Good Hope.

As well as adding about ten days to average shipping times from Shanghai to major European ports, the extended route can add up to $1 million in extra fuel costs. One concern is what impact this will have on container prices.

MONITORING COSTS

The $500 surge in average container spot freight rates during the last week of 2023 was the highest-ever weekly increase, notes UNCTAD. In its World Container Index (WCI), maritime research firm Drewry said the composite rate for a 40-ft container on 18 January 2024 was almost $3,800. This was the highest on record when excluding the pandemic years of 2020-2022.

However, as of mid-February 2024, costs were beginning to come down, according to the WCI. In any case, they certainly didn’t reach anywhere near the levels seen at the end of 2021 when they peaked at almost $10,400.

The global supply chain remains fluid and demand and supply are steady

Vincent Clerc, CEO of shipping giant Maersk, asserts that the current situation is fundamentally different to the previous one and will therefore play out very differently as well.

“COVID disruptions occurred from a sudden surge in demand which resulted in congestions and bottlenecks on the land side that clogged up the global supply chain,” he said on Maersk’s recent earnings call.

“The Red Sea disruption, from a shipping perspective, is a rerouting of cargo on longer routes. We see no sign of congestions, bottlenecks or shifts in demand; the global supply chain remains fluid and demand and supply are steady.”

INDUSTRY RESPONSE

Stuart Seymour, European Sales & Marketing Director at self-adhesives products manufacturer Hopax is keeping a close eye on the situation. “[The Red Sea crisis] impacts both the customers which buy directly from Hopax [in Taiwan] and those that prefer to have the stock from our warehouse in Europe,”

26 www.opi.net

FOCUS

he told OPI at the recent Ambiente show in Frankfurt, Germany.

“For the latter, we of course still have to bring that product in. We are currently seeing a three-week delay for [containers] being diverted around the south of Africa. On top of that, there has been an increase in costs and general delays in shipping finished goods when production has been completed.”

RETURN TO NORMAL?

On 8 February, Clerc stated the Red Sea situation was still in an “escalation phase”. It’s hard to predict when this will end but, regardless of the duration, he expects the overcapacity in the container market to continue to drive down prices. In one scenario the company has devised, container prices are forecast to return to October 2023 levels by the end this year, even if the crisis is ongoing.

However, this is not necessarily good news. He warned: “The cost of transport will remain high as long as the network needs to sail along the longer routes. Passing on these significant cost increases […] is one of our key tasks at the moment.”

We stand by our prices that we’ve negotiated with distributors

Seymour believes it is important not to have a knee-jerk reaction in terms of passing these higher freight prices onto customers.

“The increase in shipping costs is still relatively recent. We stand by our prices that we’ve negotiated with distributors because we understand the importance of being consistent,” he stated.

Of course, if the situation in the Red Sea persists, the inevitable impact on supplier costs will have to be reflected in the market. But this will more likely be the topic of

conversation later in the year. Seymour is cautiously optimistic the crisis will be over sooner rather than later.

Like several other suppliers OPI spoke to at Ambiente, Hopax is mitigating the impact of the longer lead times by relying on safety stock. This is acting as a buffer and helping the company to manage the situation without having to resort to the unwanted, expensive contingency plan of bringing in products by air.

For Acme United CEO Walter Johnsen, “uncertainty always raises the cost”, and the current situation in the Red Sea is a good example of that. He also highlighted the water level problems in the Panama Canal, another key shipping artery.

“The Los Angeles and Long Beach ports on the US West Coast are being heavily used again. We’re hopeful they won’t become congested the way they were, but it could happen. However, whereas the Suez Canal could go back to normal if we get the proper peace initiatives in place, it’s hard to do things with water and the Panama Canal.”

IMPACT ON IMPORTS

The Red Sea challenge is not just about shipping products from Asia to Europe; it has also led to disruptions and higher costs moving in the other geographic direction. One analyst on the recent Sylvamo earnings calls questioned whether this could result in an increase in paper imports from Europe ending up in North America.

For Sylvamo CFO John Sims, this is not currently happening, although he admitted it’s “hard to tell” what the exact implications of the crisis could be beyond increased freight costs. The longer transit times from Asia could affect the supply balance in Europe.

He noted that the company was seeing a decrease of paper imports into the continent. This, in turn, means more domestic supply has to stay onshore to serve any needs which may arise. Indeed, Sylvamo is forecasting lower import levels for both Europe and North America this year, which should benefit itself and other manufacturers in those regions.

While the current crisis is another unwanted event for the supply chain, it is certainly not an unprecedented situation. The capacity issues that were partly to blame for the 2021 bottlenecks no longer exist. As such, it is likely container prices will continue to fall, even if there is no immediate remedy to the attacks on shipping in the region.

However, it further underlines the need for a resilient and flexible supply chain. No doubt, it will also lead to more vendors and suppliers looking closely at nearshoring opportunities.

March 2024 27 FOCUS Supply Chain

DREWRY WORLD CONTAINER INDEX ($ FOR 40-FT CONTAINER)

ALL THINGS being equal

Having just one woman in the boardroom is still a common sight in our industry. Nina Skramstad has been that one woman and is on a mission to increase diversity at Lyreco Norway

Moving with the times is a difficult endeavour in any traditional business. As regards gender equality, while women are certainly climbing the ladder more frequently than they have done historically, there is some way to go before we see balanced gender representation at the top table.

That’s why, in March 2023, OPI put together its first-ever Influential Women list, highlighting 50 of the most inspirational female leaders in the business supplies sector (see Special Feature, OPI March 2023, page 30)

This year, to coincide with International Women’s Day on 8 March, OPI’s Kate Davies spoke to one of these Influential Women –Nina Skramstad, Managing Director at Lyreco Norway. With three decades of experience – ten in business supplies – Skramstad talked fervently about the advantages of and need for diversity in society in general and businesses in particular.

Looking to the future, Skramstad is full of optimism. She doesn’t dwell on the endless wave of challenges, instead looking for ways to flip them into positives. Whether it’s equality, the incoming Gen Z workforce, hybrid working or AI, she views each hurdle as an opportunity.

OPI: Let’s start with the elephant in the room: as one of OPI’s Influential Women, how do you think the business supplies industry is doing in terms of gender equality?

Nina Skramstad: I wouldn’t actually focus on why inequality exists. The cause isn’t as important as putting it right for a better future.

There’s certainly room for improvement in terms of gender balance and not just in our industry. I’ve been alone as a woman in meetings and management my entire career. There are millions of women in the workforce and strong females in group positions, but few leaders in commercial and operational roles.

More women than ever want the responsibility of management and are ready to deal with the demands that come with leadership, so let’s help them. Companies should be utilising this great resource.

OPI: Can you define your leadership style?

NS: The notion of a ‘dream team’ speaks to what’s important to me as a leader. It’s a vision to become one team and there are three pillars to it. The first is a performance culture.

In my view, you’re not a dream team if you’re not focused on results. Developing the people I work with to become the best they can be is crucial to how I think about leadership.

The second pillar is collaboration. When the baton is exchanged between different departments, those exchanges need to be smooth. Take football, for instance: players train to trust their team and make a pass without even looking. It’s the same for my team. I want people to feel safe and trusting enough in their environment to be daring.

The last pillar is team spirit, unity and fun. I’m passionate about celebrating the milestones together under the umbrella of shared values, ethics, diversity and vision.

OPI: Please tell me a bit more about your career background.

NS: I’ve been working in big companies for almost 30 years, initially in marketing communications and product development. After a few years, I increasingly felt that I wanted to ‘get my hands dirty’ in an operational role.

I joined Staples Solutions Norway in 2014 for this reason. I started as Managing Director

28 www.opi.net

INTERVIEW

for Staples Retail and Online, then progressed to the total Norwegian business, including corporate, SMB, wholesale, retail and online. Lyreco entered the picture in 2021 as an acquirer of the business and I was asked to take on the entire Norway organisation.

OPI: In terms of the broader context of diversity, how do you think Lyreco Norway –and the country as a whole – is doing?

NS: I’m in a very liberal country with strict laws against discrimination. Lyreco conducts a Great People Survey annually. This polls all the teams in every Lyreco location to discover what’s being done well and where there could be improvement.

In 2023, 94% of the Lyreco Norway team rated the business as excellent for diversity and inclusion. We compared the results with other Norway-based companies and scored above average.

OPI: You mentioned the acquisition in 2021. What did Staples Solutions bring to Lyreco?

NS: Both sides brought a wide and varied skillset that we needed to leverage in the best possible way. On the surface, the merger was a match made in heaven. In truth, the different approaches to running a business brought both advantages and challenges.

Staples Solutions targeted big customers, both public and private, along with a lot of tender bid work. Conversely, Lyreco was about having feet on the street and strengthening customer relationships, making it marginally stronger in the SMB market. We had to find a common way of going to market together.

I’m proud to say we’re now past the ‘them and us’ stage. There’s occasionally an atmosphere of ‘we did it like this before’, but that’s not a bad thing. In fact, it helps us ensure we’re working in the best way possible and are always mindful of alternatives.

OPI: Can you share more about your routes to market?

NS: Broadly speaking, there are two ways to market – corporate and SMB. In Norway, the public sector is huge and therefore corporate is a big part of our business. On top of this, we have field and inside sales. Lyreco Norway and Sweden also have retail stores – the only two countries that do. We additionally have an open online channel and a wholesale business.

It’s a different set-up compared with other Lyreco locations, partially because Norway is a small country. With a population of 5.5 million, we need innovative ways to reach the market along with a wide assortment to be profitable.

OPI: What does the competitive landscape look like for you?

NS: We have two main competitors in the Norwegian market – Norengros and Maske/ Opti Group – with almost the same set-up in terms of approach to market and assortment.

94%of the Lyreco Norway team rated the business as excellent for diversity and inclusion

The target audience is quite similar and we face the same challenges and opportunities. All this means building on our USPs is a priority. A lot of it is around price but it’s also about delivering a fulfilling customer experience. That’s where we have the edge.

OPI: What are the main challenges?

Nina Skramstad

Nina Skramstad

NS: With surging transportation and energy costs, it’s been mayhem in terms of market conditions over the past year. An issue for local operators, given the country’s small size and the need to import, has been the weakening of the currency, the Norwegian krone.

With P&L pressures, big players – including those in retail – have been diversifying into different target audiences such as the SMB segment. They’re trying to capture what they view as a more profitable market section with special credit cards, loyalty programmes, etc.

These players have big muscles. For instance, one competitor has around 275 stores in Norway compared with our 21. As such, it’s easier for customers to visit a competitor’s store. But a deep knowledge of customers’ needs as well as of products and their safe sourcing should never be underestimated. We have experience and assortment variety on our side.

In the long term, I believe our expertise better prepares us for the future than newcomers which might be rattled by challenges we already know how to overcome.

March 2024 29 INTERVIEW Nina Skramstad

OPI: Are you keeping an eye on Amazon’s presence in Scandinavia?

NS: We’d be mad not to. It’s still only present in Sweden, but Amazon and other pure online players are on our radar. In my view, achieving a totally customer-centric approach with these models is an issue. I believe in our model, which uses a combination of digital and physical. Lyreco’s vision is ‘A great working day. Delivered’, which recognises that work is changing and the need for complete solutions.

OPI: How do you achieve this?

NS: We all know about hybrid working and that employers are looking to create more interaction within the workplace. Many of our customers are asking for services which will attract employees back to the office.

Lyreco has the distribution rights for Nespresso Professional in Norway, for example. Having that extra little exclusive coffee can entice staff back. It’s imperative employers provide small perks like this now –they have a real impact on the bigger picture.