Quarterly Market Review

FIRST QUARTER 2025

Our Quarterly Market Review features world capital market performance and a timeline of events for the past quarter. It begins with a global overview, then features the returns of stock and bond asset classes in the US and international markets. We wrap things up with a quarterly topic or theme we feel is important to share.

FIRST QUARTER 2025

KEY TAKEAWAYS

Quarterly Market Summary

World Stock Market Performance

Randomness of Returns

QUESTION OF THE QUARTER

Part 1: How do you choose the investments in my portfolio?

MARKET COMMENTARY

Fixed Income

US Stocks

International Developed Stocks

Emerging Markets Stocks

Country Returns

HARRY MARKOWITZ

FIRST QUARTER 2025

From Rally to Reality

What started as a strong continuation of 2024’s market rally quickly lost steam. U.S. stocks stumbled by quarterend, while international markets found their footing. From trade tensions to AI tremors, the first few months of 2025 packed plenty of plot twists.

Tariffs Are Back – Investors Noticed

With the new administration came a fresh wave of tariff talk. The U.S. signaled or imposed new levies on imports from China, Mexico, Canada, and the EU, raising concerns about trade wars 2.0. Markets don’t like uncertainty, and these headlines didn’t help.

Foreign Stocks to the Rescue?

While U.S. stocks dipped, global markets stepped up. Developed markets surged 6.2%, and emerging markets gained 2.93%. For diversified investors, it was a helpful reminder: opportunity doesn’t stop at the border.

Bonds Behaving Like Bonds Again

Amid all the noise, bonds quietly did their job. Bonds rose 2.78%, and Treasury yields fell as investors sought safety. Sometimes boring is beautiful.

The Fed Hits Pause, But Inflation Doesn’t

The Fed held rates steady, citing an uncertain outlook and stubborn inflation. The rate-cut party might be delayed, but it’s not off the calendar just yet.

First Quarter 2025 Index Returns

US Stock Market International Developed

ot reflect the expenses associated with the management of an actual portfolio. Market segment (index representation) as follo ws: Bond Index, US Stock Market (Russell 3000 Index), International Developed Stocks (MSCI EAFE Index), Emerging Markets Fran k Russell Company is the source and owner of the trademarks, service marks, and copyrights related to the Russell Indexes.

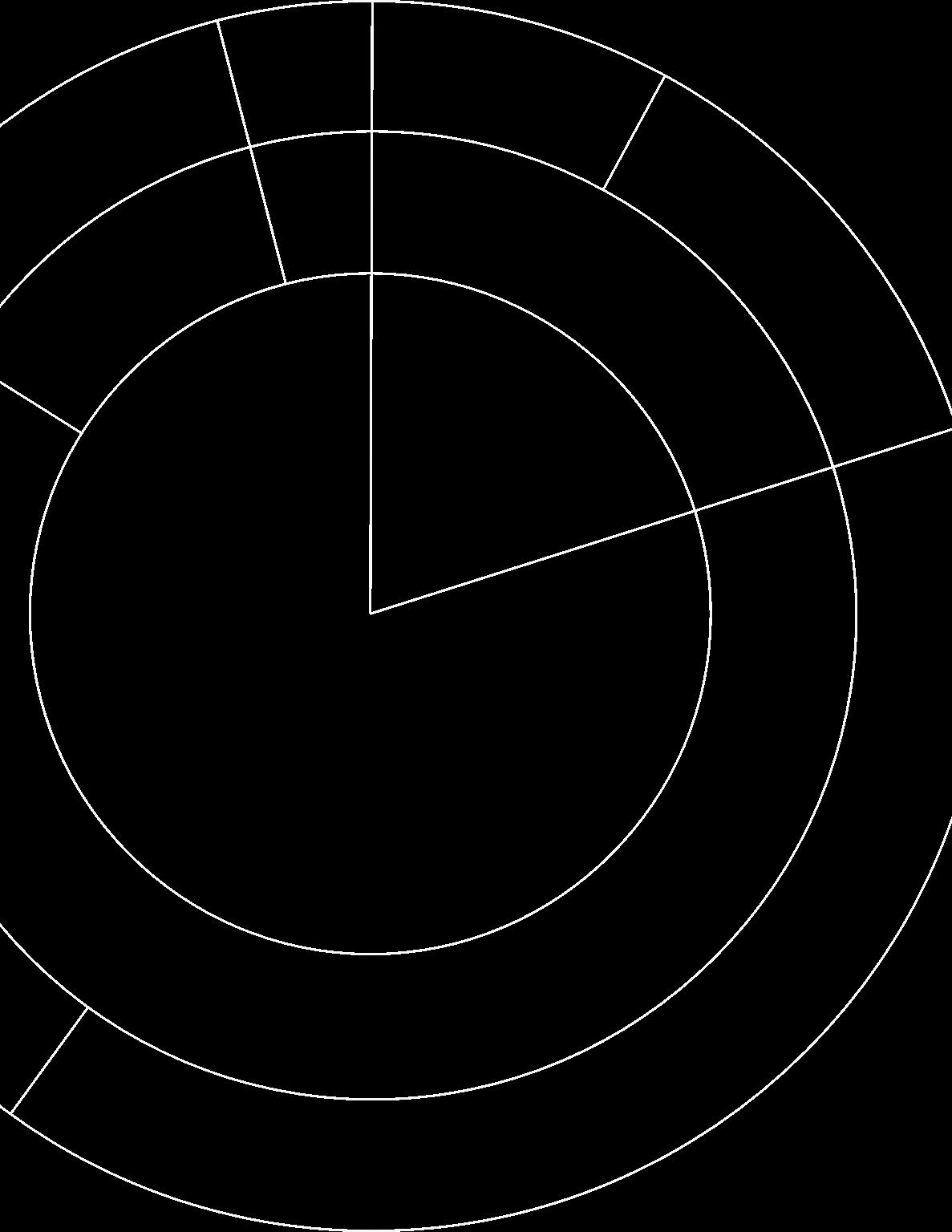

All Country World Index with selected headlines from 1Q25

"Inflation Ticks Up to 2.9%, but Underlying Price Gains Are Muted"

"Hiring Blew Past Expectations With 256,000 Jobs Added"

"UK Bond Yields Hit Highs Not Seen Since 1998"

"Los Angeles Fire Damage Likely to Be Costliest in US History"

"Trump Sworn In, Declares New ‘Golden Age’ for America"

"Israel, Hamas Agree to a Deal to Pause Fighting in Gaza"

"US GDP Grew 2.5% in 2024, Helped by Consumer Spending"

"Fed Stands Pat on Rates, Entering New Wait-and-See Phase"

"Tech Stocks Sink in Broad AI Rout Sparked by China’s DeepSeek"

"Hiring Slows but Remains Solid, With Economy Adding 143,000 Jobs"

Graph Source: MSCI ACWI Index (net dividends). MSCI data © MSCI 2025, all rights reserved. Index level based at 100 starting It is not possible to invest directly in an index. Performance does not reflect the expenses associated with management of an

"Trump Imposes Global 25% Aluminum

"Inflation Up in Freezing

"Apple Earmarks $500 Billion for US Expansion"

"Inflation Heated January, Freezing the Fed"

Remains Imposes 25% Steel, Aluminum Tariffs"

1 YEAR (Q2 2024 – Q1 2025)

"Nvidia’s Bumper Sales Show AI Bonanza’s Strength"

"Trump Administration Seeks Deeper Cuts to Federal Workforce"

"House Passes GOP Budget Plan as Holdouts Relent"

"Senate Passes Bill Averting Shutdown, After Critical Boost From Democrats"

"Inflation Cooled to 2.8% in February, Lower Than Expected"

"Tech Shares Lead Stock Slide as Recession Talk Roils Markets"

"ECB Cuts Rates to Guard Stalled Economy Against Tariff Threats"

"Stocks Extend Tumble as Trump’s Tariffs Spark Retaliation" "China Sets Strong Growth Target as It Hits Back at US Tariffs"

starting January 2000. actual portfolio. Past performance is not a guarantee of future results.

"US Stocks Post Worst Quarter Since 2022 on Threat of Trade War"

"Fed Dims Economic Outlook, Citing Uncertainty Over Tariffs"

Returns as of March 31, 2025

reflect the expenses associated with the management of an actual portfolio. See Disclosures for additional details.

PART 1: INVESTMENT OBJECTIVE

Andrew Miller, CFP® Founder & CEO

What do you need your money to do for you?

We’ve all been there – watching a savings account grow slower than a Monday morning, wondering how to turn those dollars into something more meaningful.

Maybe you’re saving for a home. Planning for college tuition. Or simply hoping to retire without having to pinch pennies. The truth? Investing is one of the most powerful tools to turn those goals into reality. But there’s no onesize-fits-all strategy.

Your investment experience is as unique as your fingerprint—and your strategy should be too.

That’s why we start with you.

What Do You Need Your Money to Do?

Think of it like gardening: You can throw seeds in the dirt and hope for the best. Or you can be intentional. Before planting, a good gardener asks, “What do I want to grow?”

Investing works the same way. Whether you’re aiming to protect your savings, generate income, or grow long-term wealth, your goals shape every decision. And those goals depend on time.

Some require quick access to cash. Others are years down the road. Your investment objective should reflect the timeline of each goal and your comfort with risk.

• Protecting principal (emergency funds, low-risk investments like high-yield savings accounts or money markets)

• Saving for milestones (car, home purchase, starting a business)

• Generating income (through dividends, bonds, or rental income for those living off their investments)

• Building a nest egg (to sustain your lifestyle once you stop working)

When your strategy is built around your goals, it becomes easier to tune out the noise and stay grounded—even when markets get bumpy.

Example: If you’re planning to buy a car in three months, you probably don’t want that money exposed to a 20% market drop. Not because you don’t like growth—but because you don’t want to take unnecessary risk.

That brings us to…

1. We want more money, not less. 2. We want less risk, not more.

Pretty simple, right? But investing well means knowing you can’t have one without the other.

If risk didn’t matter, we’d all pile into the highest-return investments and call it a day. But that’s not how real life – or real investing –works.

We weigh both risk and reward. We think about timing. We think about consequences. We think about what could go wrong.

A successful investment strategy isn’t about avoiding risk – it’s about managing it well. Enough growth to reach your goals. Enough stability to stay on track, even when the market doesn’t cooperate.

1. Savings.

2. Time.

3. A strategy to combine different types of investments effectively.

Your job?

Save. And give it time.

Our job?

Build the right portfolio to support your goals.

We start by asking:

What do you need your money to do?

That question forms the foundation for everything else. Once we understand your financial picture and personal preferences, we’ll craft an investment strategy that fits –whether it’s conservative, aggressive, or somewhere in between.

We’ll even determine which investments belong in which accounts, so your entire portfolio works together toward what matters most.

Have you ever panicked during a market drop? Or felt tempted to chase a “hot” stock?

Without clear goals, it’s easy to make emotional, short-term decisions. But when you’re anchored in purpose – when you know why you’re investing – the noise fades into the background.

Write down your goals. The more specific, the better. “Save $50,000 for a home in 3 years” > “Save money”

Match each goal to its timeline. Cash for short-term needs. Stocks for long-term growth.

Let OLIO handle the heavy lifting. We’ll design, implement, and manage your portfolio—so you can stay focused on your life.

Investing isn’t about luck or timing. It’s about tending to your financial garden with intention.

Plant the right seeds. Give them time. Trust the process.

"Someone is sitting in the shade today because someone planted a tree a long time ago." – Warren Buffett

FIRST QUARTER 2025

Key Takeaways

Bonds posted a positive performance with the Bloomberg US Aggregate Bond Index rising by +2.78%. This was largely driven by lower interest rates and a flattening yield curve. Notably, there was strong demand for short-term bonds.

Overall, bonds provided a steady performance, attracting investors looking for stability in a volatile market.

Interest Rates Across Issuers (%)

US Treasury Yield Curve

03/31/25 03/31/24 03/31/20

Period Returns

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. See Disclosures for additional details.

FIRST QUARTER 2025

Key Takeaways

US stocks declined in the first quarter, with the Russell 3000 Index returning -4.72%.

The market reacted to slowing economic growth and uncertainty surrounding the Federal Reserve's policies.

Large-cap value stocks led the market, while small-cap growth stocks underperformed. These trends suggest investors were favoring more stable, income-generating stocks over riskier, high-growth ones.

Large Cap Value

Mid Cap Value

Mid Cap

Large Cap

Marketwide

Mid Cap Growth

Small Cap Value

Small Cap

Large Cap Growth

Small Cap Growth

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. See Disclosures for additional details.

FIRST QUARTER 2025

Key Takeaways

International developed stocks performed strongly in the first quarter, with the MSCI World ex USA Index rising by +6.20%. This positive performance was bolstered by gains in Europe and Japan, alongside easing inflation pressures.

Large-cap value stocks outperformed, particularly in regions benefiting from economic recovery and stable inflation rates.

Ranked Returns

Large Cap Value

Mid Cap Value

Large Cap

Marketwide

Small Cap Value

Mid Cap

Small Cap

Mid Cap Growth

Large Cap Growth

Small Cap Growth

World Market Capitalization

International Developed $22.1 trillion

Period Returns

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. See Disclosures for additional details.

FIRST QUARTER 2025

Key Takeaways

Emerging markets rose by +2.93% during the quarter, as seen in the MSCI Emerging Markets Index. A weaker US dollar provided a supportive backdrop for these markets, although performance varied by country.

Poland led with strong gains, while Israel was among the weaker performers. Larger, value-oriented companies continued to attract investor interest.

Ranked Returns

Large Cap Value

Mid Cap Growth

Large Cap

Marketwide

Mid Cap

Large Cap Growth

Mid Cap Value

Small Cap Value

Small Cap

Small Cap Growth

World Market Capitalization

Past performance is not a guarantee of future results. Indices are not available for direct investment. Index performance does not reflect the expenses associated with the management of an actual portfolio. See Disclosures for additional details.

Past performance is no guarantee of future results. Country returns are the country component indices of the MSCI All Country Wo All Country World Index. MSCI index returns are net dividend. Indices are not available for direct investment. Their performance does Frank Russell Company is the source and owner of the trademarks, service marks and copyrights related to the Russell Indexes. Se

World Index for all countries except the United States, where the Russell 3000 Index is used instead. Global is the return of t he MSCI does not reflect the expenses associated with the management of an actual portfolio. MSCI data © MSCI 2024, all rights reserv ed.

See Disclosures for additional details.

Past performance is no guarantee of future results. This information is intended for educational purposes and should not be considered a recommendation to buy or sell a particular security.

Investment advisory services are offered through OLIO Financial Planning, LLC (“OLIO”). This communication is not to be directly or indirectly interpreted as a solicitation of investment advisory services to residents of another jurisdiction unless otherwise permitted. The contents of this communication and any accompanying documents are confidential and for the sole use of the recipient. They ar e not to be copied, quoted, excerpted or distributed without express written permission of the author. The underlying data has been obtained from sources considered to be reliable: the information is believed to be accurate, but there is no assurance that it is so.

Please inform us of any changes to your financial situation, your goals, tolerance for investment risk or other matters relat ing to your personal finances. Please notify us in the future if there are ever any changes to your financial situation or investment obj ectives.

I M P O R T A N T N O T E S

Source: YCharts as of 09/30/2024. YCharts, Inc. (“YCharts”) is not registered with the U.S. Securities and Exchange Commission (or with the securities regulatory authority or body of any state or any other jurisdiction) as an investment adviser, broker -dealer or in any other capacity, and does not purport to provide investment advice or make investment recommendations by or through the conten t (the “Content”) found on ycharts.com (the “Site”) or otherwise. The Site and the Content are provided for the sole purpose of enab ling users to conduct investment research. Other uses of the Site and the Content are expressly prohibited.

©2018 YCharts, Inc. All Rights Reserved. The information contained herein: (1) is proprietary to YCharts, Inc. and/or its con tent providers; (2) may not be copied, reproduced, retransmitted, or distributed; and (3) is provided “AS IS” with all faults and is not warranted to be accurate, complete, or timely. YCHARTS, INC. AND ITS CONTENT PROVIDERS EXPRESSLY DISCLAIM, TO THE FULLEST EXTENT PERMITTED BY APPLICABLE LAW, ANY WARRANTY OF ANY KIND, WHETHER EXPRESS OR IMPLIED, INCLUDING WARRANTIES OF MERCHANTABILITY, FITNESS FOR A PARTICULAR PURPOSE, ACCURACY OF INFORMATIONAL CONTENT, OR ANY IMPLIED WARRANTIES ARISING OUT OF COURSE OF DEALING OR COURSE OF PERFORMANCE. Neither YCharts, Inc. nor its content providers are responsible for any damages or losses arising from any use o f this information. Past performance is no guarantee of future results.

For further information regarding the use of this report, please go to: ycharts.com/about/disclosure

Indices are not available for direct investment. Their performance does not reflect the expenses associated with the manageme nt of an actual portfolio. Past performance is not a guarantee of future results. Index returns are not representative of actual portf olios and do not reflect costs and fees associated with an actual investment. Actual returns may be lower.

Cash Equivalents: The Bloomberg U.S. Treasury Bills: 1-3 Months Index tracks the market for treasury bills issued by the U.S. government with time to maturity between 1 and 3 months. US Treasury bills are issued in fixed maturity terms of 4, 8, 13, 17, 26 and 52 weeks. The U.S. Treasury Bills: 1 -3 Months Index is a component of the US Short Treasury Index.

Short-Term Bonds: The Bloomberg US Government/Credit 15 Year Index applies the rules of the Bloomberg 1 -5 Yr Gov/Credit Index, which tracks USD-denominated, investment grade, fixed-rate bonds, including treasuries, governmentrelated and corporate issues, with at least one, and up to, but not including, five years until final maturity.

Intermediate-Term Bonds: The Bloomberg US Aggregate Bond Index is a broad-based flagship benchmark that measures the investment grade, US dollar denominated, fixedrate taxable bond market. The index includes Treasuries, government-related and corporate securities, fixed rate agency MBS, ABS and CMBS (agency and non-agency). Provided the necessary inclusion rules are met, US Aggregate -eligible securities also contribute to the multi -currency Global Aggregate Index and the US Universal Index.

Long-Term Bonds: The Bloomberg US Long Government/Credit Total Return Index tracks non -securitized securities including investment grade, treasuries, and government/corporate securities. This index can serve as a benchmark for a portfolio or set of securities that contain fixed income exposure that matches the characteristics of this index.

Corporate Bonds: The Bloomberg US Corporate Index covers performance for United States corporate bonds. This index serves as an important benchmark for portfolios that include exposure to investment grade corporate bonds.

High Yield Bonds: The Bloomberg US Corporate High Yield Index covers performance for United States high yield corporate bonds. This index serves as an important benchmark for portfolios that include exposure to riskier corporate bonds that might not necessarily be investment grade.

Municipal Bonds: The Bloomberg Municipal Index serves as a benchmark for the US municipal bond market. Investors will use this index to benchmark against portions of their portfolio that are allocated in fixed income securities.

Treasury Bonds: The Bloomberg US Treasury is a benchmark for the United States treasury bond.

TIPS: The Bloomberg US TIPS Total Return index measures US Treasury Inflation Protected securities.

Global Bonds ex US: The Bloomberg Global Aggregate exUSD Index measures the performance of global investment grade bonds. This index does not include bonds from the US. This characteristic allows this index to serve well for tracking international bond exposure.

Emerging Market Bonds: The Bloomberg Emerging Markets USD Aggregate Bond Index is a flagship hard currency Emerging Markets debt benchmark that includes fixed and floating-rate US dollar-denominated debt issued from sovereign, quasi-sovereign, and corporate EM issuers. Country eligibility and classification as Emerging Markets is rules-based and reviewed annually using World Bank income group and International Monetary Fund (IMF) country classifications.

US Stocks: The Russell 3000 Index is a capitalizationweighted stock market index, maintained by FTSE Russell, that seeks to be a benchmark of the entire U.S stock market. It measures the performance of the 3,000 largest publicly held companies incorporated in America as measured by total market capitalization and represents approximately 98% of the American public equity market.

International Stocks: The MSCI ACWI ex USA index covers the major developed and emerging market countries. However, it does not include the United States stock market. This is in an important benchmark for investors analyzing how the markets outside of the United States are doing.

Emerging Market Stocks: The MSCI Emerging Markets Index captures large and mid-cap representation across 25 Emerging Markets (EM) countries. The index covers approximately 85% of the free float-adjusted market capitalization in each country.

Commodities: The Bloomberg Commodity Total Return index is composed of futures contracts and reflects the returns on a fully collateralized investment in the BCOM. This combines the returns of the BCOM with the returns on cash collateral invested in 13-week (3 Month) U.S. Treasury Bills.

Real Estate: The S&P Global REIT serves as a comprehensive benchmark of publicly traded equity REITs listed in both developed and emerging markets.