booklet ESG

June,2024

June,2024

Dearreaders,

as a student organization for susitainable development “oikos” Warsaw we would like to present you our newest project - the ESG Booklet. Thisbrochureaimstoprovideyouvaluableinformationregardingthe future of business in the view of changes related to ESG reporting. Afterreadingourworkyouwillgainknowledgeaboutthemeaningof ESG acronym, available courses for people wanting to learn more about transparency and sustainability in business and answers to important questions given by experts from Colliers, Allegro and Materiality.

“Oikos” Warsaw is the only Polish chapter of an international student organization called “oikos international”. We educate about sustainable development both in business and in everyday lives. In this project, thanks to partnership with Colliers, but also with Allegro and Materiality we would like to share with you opinions and perspectivesofspecialistsfromdifferentareas.

Creators of this booklet, members of “oikos” Warsaw and collaborating student organization for ESG, are truly passionate people who treat their role of promoting conscious and responsible businessveryseriously.InthenameofourwholeorganizationIwould like to kindly invite you to read this brochure and I hope you will find someinterestinginfomrationaboutESG.

Presidentof“oikos”Warsaw ZofiaSzajnerESG reporting is non-financial reporting by companies, which covers three areas of activity: E - environmental, S - social, and Ggovernance [1]. You can learn more about each of these three ESG areasinotherarticlesinthisbooklet.

As of January 1st, 2024, the CSRD, which replaces the previous NFRD,tookeffect.Accordingtothepreviousdirective,companies employing more than 500 people and being public interest entitiesweresubjecttonon-financialreportingobligations,which means....Withthenewdirective, the group of companies covered by the obligation will graduallyexpand.Largeentities already reporting will have to apply new reporting standards in their reports for 2024. A year later,in2026,reportsfor2025will have to be published by large companies, i.e. those that meet atleasttwoofthreecriteria: balancesheettotalofmorethan€20million,netrevenuesofmore than €40 million, number of employees of more than 250. Lastly, smallandmedium-sizedlistedcompanies (excluding listed microenterprises) will be subject to the reporting obligation. They will have toreportforthefirsttimein2026[2].

The CSRD stipulates that information on sustainability reporting willmostlikelybeincludedintheentity'sgeneralactivityreports. The directive also states that activity reports will be published in XHTMLformat.

Companies will be required to include the following aspects in ESG reports: strategy and business model with reference to sustainable development management and organization in relation to sustainable development assessmentofthematerialityofsustainabilityimpacts,risksand opportunities implementationmeasures,includingpolicies,goals,actionsand plans,resourceallocation performanceindicators

European Sustainability ReportingStandards or socalled ESRS are European sustainability reporting standards prepared on behalf of the European Commission by the EuropeanFinancial

ReportingAdvisoryGroup-EFRAG.Accordingtothem,companieswill presentinformationonenvironmental,socialandhumanrightsissues andcorporategovernanceintheirmanagementreports[3].

The ESRS standards are structured in a modular way, meaning that theyincludeseparatebutrelatedelementsdescribedbelow.

Thisisacross-cuttingstandardthatdoesnotcontainanyindicators, butonlydescribesthegeneralprinciplesforusingthestandardsand creatingESGreportsinaccordancewiththeESRS.

The second cross-cutting standard contains a set of mandatory 12 disclosures, concerning general information about the reporting entity, its strategy, management methods, as well as the materiality analysisconductedforthereport.

The first group of thematic standards relates to the environment. It consists of standards on climate change (E1), pollution (E2), water and marine resources (E3), biodiversity and ecosystems (E4), resourceuseandthecirculareconomy(E5).

The first group of thematic standards relates to the environment. It consists of standardsonclimatechange (E1), pollution (E2), water and marine resources (E3), biodiversity and ecosystems (E4), and resource use and thecirculareconomy(E5).

The next group relates to social topics. It includes standards for employment (S1), employees in the value chain (S2), the social environment(S3),andconsumersandendusers(S4).

The last group of standards is governance standards. It includes standardsonbusinesspractices.

The ESRS introduce very detailed rules for non-financial reporting. Preparing a non-financial report will be the most challenging for entities with little or no experience in the area of non-financial reporting.Withthisinmind, itisworthensuringthatentitiesbecome familiar with ESRS as soon as possible and, most importantly, begin thesustainabilitytransformationoftheirbusinessmodelearly[4].

WiththeCSRDwillcomesomechanges.Oneofthemostsignificantis that non-financial reports will be subject to mandatory auditing, and the provision of false information will be subject to criminal and financialliability.

The directive also introduces the principle that sustainability reporting will require attestation by a certified auditor or independent accredited certifier.

Among other things, reports will be checked for compliance with ESRSstandards. In the first stage, there will be an audit of reports at the level of the so-called limited level of assurance. And in the second, it will be raised to the level of reasonable assurance, to ultimately achieve a similar level of assurance for reporting as for financialreporting.

Another significant change is the introduction of the principle of double materiality, according to which companies have been obliged to provide information not only necessary to illustrate their situation, but also those necessarytounderstandtheimpactofthe company ' s activities on environmental, social, human rights, anticorruptionandanti-briberyissues[5].

Theinformationprovidedinthereportswillhavetoberelevantfroma financial perspective, as well as the impact of the organization's activitiesoneachofthethreeESGareas.Financialmaterialityisabout makingtheinformationrelevanttoexternalstakeholdersandhelping them make decisions such as investments. The impact materiality perspective, on the other hand, is about looking at how a company affectsitsenvironment.

Following the principle of dual materiality, the company determines whichoftheESRSthematicstandardsitwillincludeinthereport.Ifit choosestoomitanystandard,itwillhavetojustifythatchoice[6].

ThepurposeofESGreportingistoprovidetransparentinformationto investors, stakeholders and the public about the environmental, socialandcorporategovernanceimpactsofacompany'soperations. The reporting obligation is quite a requirement for companies. However, it carries significant benefits, such as improving a company 'simage,bettermanagingrisksor,aboveall,contributingto sustainabledevelopment.

[1]M Chmielewska(2023)Raportowanieniefinansowe-raportowanieESGadyrektywaCSRD [2]CSRD-CorporateSustainabilityReportingDirective [3]KompasESG(2023)CzymjestdyrektywaNFRDijakwpływanaraportowanieESG

[4]Envirly(2024)Sprawozdawczośćzrównoważonegorozwoju-coprzyniesiedyrektywaCSRD? [5]StowarzyszenieInwestorówIndywidualnych(2012)CotojestESPIiEBI?

[6]R Kamiński(2023)RaportowaniezrównoważonegorozwojuprzedsiębiorstwwświetleregulacjiUniiEuropejskiej [7]KPMG(2024)RaportowanieESG-czymsąESRSiwjakisposóbrozpocząćichwdrażanie?

[8]R Kamiński(2023)DyrektywaParlamentuEuropejskiegoiRady2464/2022wodniesieniudosprawozdawczościna temat zrównoważonegorozwojuprzedsiębiorstwirozporządzeniaKomisjiEuropejskiejdotyczące“taksonomii”- założeniaicele [9]GrantThornton(2023)RaportowanieESG-jakiezmianyprzyniesie2024rok?

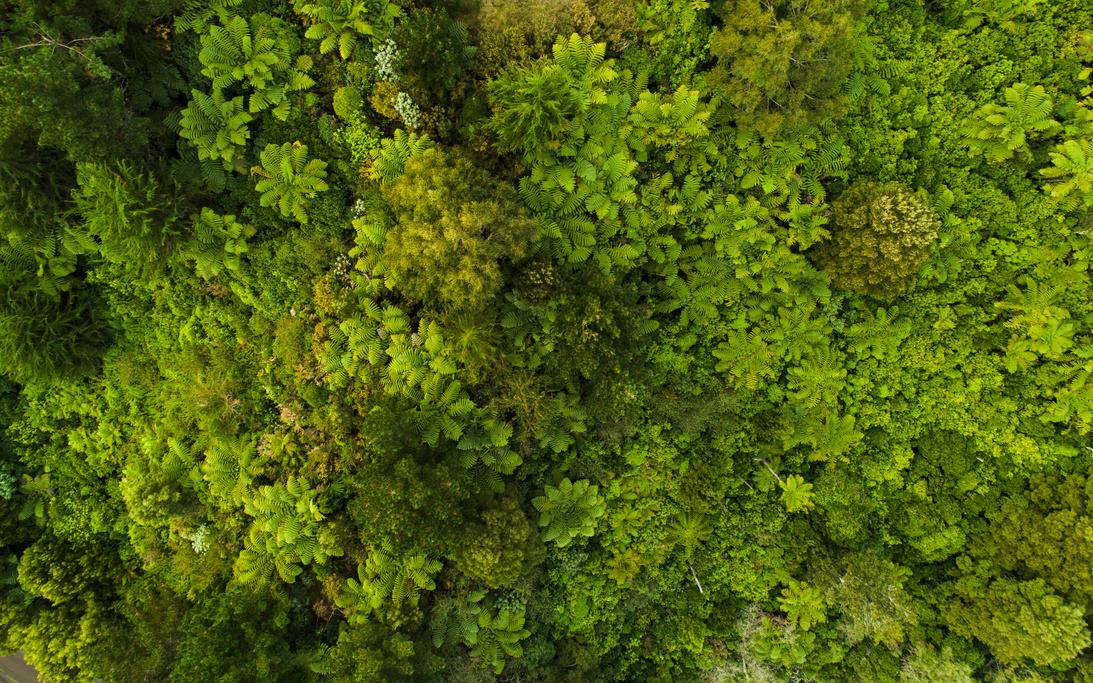

Environment. This is the first pillar addressed by the new reporting guidelines introduced by the European Union through the CSRD Directive. This document aims to steer companies toward more sustainable value creation than has been the case before. The term ESGitselffirstappearedasearlyas2004inUNpublications[1],butstill noteveryoneknowswhatthelettersstandfor.It'san acronymforthe three pillars (Environment, Social, Governance) within which organizations are committed to making changes for the good of the planet and society. The following article is the first of three parts in whichwewilldecipherthisenvironmentalacronym.

Environmental indicators allow monitoring how an organization's activities affect its environment. There are 4 categories: climate change, natural resources, pollution and waste, as well as environmentalopportunity.[2]

This is a category that focuses on the size of an organization's carbonfootprintandCO2emissions.Amongotherthings,thestaffin charge of calculating these quantities create special analyses of directemissions

(fuel combustion in the organization's energy, technology and transportation sources, as well as emissions related to the loss of refrigerants from, for ex. room air-conditioning equipment) and indirect emissions (energy emissions generated outside the organizationrelatedto

purchasedelectricity,heat,processsteam,refrigeration,andrelated to raw materials, services or products purchased by the organization).[3]Inaddition,itisimportanttoexaminethescaleat which the organization is financing activities aimed at transforming itintoamoresustainableone.Inthebudget,thereshouldbefunds meanttoreducenegativeenvironmentalimpacts.

The predisposition of an organization to be severely affected by climate change is also included in this category. Monitoring such indicators allows the organization itself to adapt its strategy to climate challenges and risks, but also allows to compare organizations among themselves. [4] This will make it possible to createappropriateassistanceprogramsforsectorsmostdependent onenvironmentalstability.

The next category takes into account the analysis of how organizations manage their resources. Firstly, indicators should monitor so-called water stress. This means that water should be usedinsuchawaythatitdoesnotviolatethelimitofitsavailabilityin a given region over a certain period of time. Exceeding this limit, causes water stress and leads to destabilization of the stressed area inthelongterm.[5]Amongtheresourcesthatshouldbemeasuredis alsotheuseofland.Inthissubcategory,itisimportanttotakecareto preserve the biodiversity of organisms and to cultivate the land responsibly,

which does not lead to its destruction. It is alsoimportanttochoosetherightsourcesof raw materials. Currently, there are documents that, for the manufacturing industry, set specific ranges for the amount ofsubstancesthatcanbeused,includingthe RoHS Directive [6] (restricts the use of hazardous substances), and the REACH Regulation [7] (restricts the use of chemicals).

The next category indicates how organizations should monitor the amount of pollution produced and how to manage it. The productionrateoftoxicemissionsandwasteisneededtodetermine thelevelofenvironmentaldegradation ofwater,landandairdueto productionprocesses.

Itisalsoimportantfororganizationstohaveasystemformanaging waste, including electronic waste. Proper disposal of electronic equipment is very important to reduce the negative impact on ecosystems. What's more, creating packaging that is as recyclable as possible and requires the use of as few materials also falls into thiscategory.

The European Union has released new standards and guidelines for the appearance, construction and transportation of packages, and compliance with them will be directly reflected in one of the ESG environmental indicators.[8]

Theterm"environmentalopportunity"referstoakindofhopebrought by modern economic solutions. During a sustainable transformation, newsourcesofvalueareneededthatalloworganizationstobecome more environmentally friendly, but at the same time maintain their competitiveness. [9] Environmental opportunities are created by newICTtechnologies,greenbuildingandrenewableenergy,among others.Eachoftheseindustriesisfocusedonprovidingcutting-edge solutionstocomplexenvironmentalproblemsrelatedto,forexample, excessivegreenhousegasemissionsorirresponsiblemanagementof water resources. As metrics designed to monitor organizations, they relyonreportingwhatandhowmanysolutionsarebeingintroduced into the company ' s operations to increase its commitment to sustainability.

Theindicatorsdescribedarecrucialnotonlyfortheorganizationitself, which uses them to improve its strategy and the way it operates. Stakeholders who operate in the organization's environment are increasingly interested in the organization's actual impact on the environment, as society views this topic as very important. [10] However, in the context of sustainable development, which economiesshouldstrivefor,environmentalindicatorsareonlypartof the important topics to be analyzed. We invite you to read the following articles, which will decipher the other letters of the ESG acronymforyou.

sources

[1]TheCorporateGovernanceInstitute-WhatisthehistoryofESG?

[2]PWC-ESG,what’sitallabout?

[3]TerazŚrodowisko-Jakwyliczyćśladwęglowy?

[4]EuropeanEnvironmentalAgency-ClimateChangeVulnerabilityIndex

[5]EuropeanEnvironmentalAgency-WaterStressDefinition

[6]EuropeanCommission-RoHSDirective

[7]EuropeanUnion-Registration,Evaluation,AuthorisationandRestrictionofChemicals

[8]EuropeanUnion-PackagingandPackagingWaste

[9]D.B.Neele-Environmentalopportunity/analysisoncorporatestrategy/performance

[10]TheEuropeanInvestmentBankClimateSurvey2022-2023

In an era of intense globalization, the concepts of sustainability and corporate social responsibility are becoming known as crucial cornerstones in the market. These are undoubtedly key elements determiningthesuccessofagivencompany.ThesecondpillarofESG (Social)focusesontheimpactofacompany'sactivitiesonsociety.It groups together a rich range of undertakings including employee rights, as well as business relations with customers and investors, andinvolvementinlocallifeandenvironmentalprotection.

Caring for the community is undeniably an integral part of the sustainability outline, which plays an important role in defining aspects of responsible corporate activity. Indicators belonging to the "S" group mainly touch on relations with employees, involvement in the development of local social groups, environmental protection, protectionofhumanrights,socialdiversityandbusinessethics.Itis extremely important to state that the well-being of the working people should be as important a priority as the profits of a given company.Itispeoplewhoaretheheartofanyorganization.

The systematic implementation of the above principles guarantees companies a long-term relationship with the surrounding community, and will help promote important ethical values - essential in this dayandage.

With absolute conviction, the presence of a social pillar in the ethical management of a company will facilitate many benefits such as a positive reputation, a competitive advantage in the market,trengtheningtrustamongconsumersandincreasingthe motivation of employees, thanks to whom the company exists. The importance of this concept stems from the observation that moderncorporationsaremuchmoresociallyconscious.

Ofcourse,theiractivitiesare,toahugeextent,selectedinawaythat positively influences their success, but increasingly important is the desiretohavearealimpactontheenvironmentinwhichacompany operates.

The rights of employed workers, as well as business owners, are an integral factor in any enterprise.Thisisduetothefact thatemployerswhoconstantly take care of the safety and well-being of their subordinates not only contribute to better operationalperformance,but alsobuildapositiveimageoftheorganizationinthemarket. The same applies to equal opportunities and adherence to the principles of non-discrimination, i.e. eliminating beliefs regarding gender, origin, age, sexual orientation, disability, among others. Employers are required to provide employees with safe facilities with ahighstandardofhygieneandergonomics.

Investmentintrainingisanotherimportantaspectoforganizational development.Thedevelopmentofemployeecompetencies,effective human capital management and company safety are increasingly dependent on entrepreneurs. Such a need shapes conditions favorable to the reconstruction of competitive advantages and structuresthatefficientlyrealizetheneedsofnotonlyemployees,but also employers. The chance to participate in general development workshops and educational programs increases the commitment, productivity, quality of performance of employees, which in turn translates into further results. The goal is to significantly increase the effectiveness of the use of the principles of ethical values in the management of the organization with particular emphasis on the conceptsofsustainabilityandsocialresponsibility.

Governance concepts may seem obvious but they are often difficult to explain with formal definitions. The same is true of the issue of corporate governance, the third pillar of ESG. The term can be partially understood by intuition, but the exact explanation of its meaning proves a bit more problematic. So I will try to do so succinctlyinthistext.

Corporate governance actually means a number ofdiverseissuesinthearea of corporate management, the interconnectedness of which, as well as the relationship to issues of environmentalandsociali

Impact of the company, determine stakeholder confidence in a key way. Fulfilling corporate governance standards is, in a sense, a sufficient condition for positive perception of a company ' s actions. In short: a company must play fair and earn the trust of its environment. But what specific actions can it take to earn it? It is necessary here to point out what issues the mythical letter "G" actuallyrefersto.

The authors of the text published by the WSE, "Guidelines for ESG Reporting. A Guide for Companies" divide them into two broader categories. The first is related to the sphere of responsible management,i.e.theareaconcerningtheobservanceofprocedures andtransparentinformationpolicy,

thecorrectselectionandcontrolofthecompany'shighestbodies,as well as respect for the rights of shareholders, including minority shareholders. The second, in turn, concerns business ethics, that is, the company ' s code of ethics, anti-corruption policy and the availability of mechanisms for reporting violations. In addition, an area mentioned separately in the guide, but also framed by corporategovernance,isdatasecurity[1].

It is best to navigate through these intricate meanders of concepts one at a time. It is worth starting with the first issue mentioned, highlevel governance. For a company ' s actions to be considered consistentwithcorporategovernance,itmusttreatitsmostinfluential stakeholdersfairly.Thismeansthatthepositionofnoneofthemmust be particularly privileged. In practice, it is a matter of balancing the powers of management and the board of directors, transparency and diversity in the personnel structure of these bodies, as well as a responsiblecompensationpolicy so that it does not exacerbate the stratification between the company ' s management and lowerrankingemployees.

Equally important is the aspect of the company ' s policy toward shareholders. The pattern of corporate governance calls for shaping theshareholdingstructureasdiversifiedaspossible,sothatitisnot toodominatedbyoneentity.Inaddition,itisimportanttorespectthe rightsofallshareholders,whichismanifested,amongotherthings,in anopenpolicyofaccesstogeneralmeetings.

Issues of business ethics apply to all of a company ' s activities, but in order to evaluate its actions in this area, formalization of the principlesprofessedbythecompanyisneeded.Forthisreason,itisa very important element of corporate governance for a company to present a clear code of ethics. Equally important is the company ' s anti-corruptionstrategy, which can be part of a broader document defining standards of conduct or published separately. It indicates whatactionsthecompanyintendstotakeintypicalsituationswhere there is a risk of corruption. In addition, the company should have specific corrective procedures and make available to stakeholders a clear mechanism for reporting legal or ethical violations, which shouldensureefficiencyandanonymity.

Another indispensable element of corporate governance is the protectionofpersonaldataofemployees,customersandsuppliers. A key task of the company in this area is to prevent their leakage, which places demands on the implementation and proper use of cyber security systems. In addition, the company should clearly inform stakeholders of the purpose and scope of the processing of theirdata,andallowforthewithdrawalofconsentstothisprocedure inaccordancewiththelaw.

Ensuring a company ' s compliance with corporate governance principles requires the ability to evaluate its actions through standardizedprocedures.Accordingly,regulatorsareenactingfurther legislation aimed at enabling reliable comparisons of companies' actions in this area. In the European Union, such an instrument is the European Sustainability Reporting Standards[2]. They are effective under a European Commission regulation adopted in July 2023 and impose ESG reporting obligations on some of the largest companies asearlyas2024.Corporategovernanceissuesareaddressedbyone ofthedirective'sthematicareas:Z1"BusinessConduct."

The common denominator of corporate governance activities is to increase stakeholder confidence in the company. Ultimately, this is expected to stimulate business growth through the favourable view of investors, as well as enable the company to reduce negative impacts andgeneratecertain

benefitsforitsenvironment.Inaddition,compliancewithstandardsin thisarea increasesthecredibilityofthecompany'spositiveactions on environmental and social issues. The legislation currently being enacted at the European level to regulate and standardize corporate actions on corporate governance issues confirms that the issue is becoming increasingly serious. Everything indicates that the future is marked by the letter "G," so I hope that this text will be helpful in understandingitssignificance.

[1]GiełdaPapierówWartościowychwWarszawie(2023)WytycznedoraportowaniaESG:Przewodnikdlaspółek [2]MinisterstwoFinansów(2023)EuropejskieStandardySprawozdawczościZrównoważonegoRozwojuprzyjęte.

ESG (environment, society and governance) today opens up many newavenuesforgrowth,bothforindividualsandforcompaniesand organizations. It is not only a key issue related to responsible business conduct, but also an important factor influencing investment strategies, corporate reputation and relations with customersandstakeholders.

There are a growing number of opportunities to gain knowledge in this area in order to be able to effectively manage ESG aspects and usethemasatoolforprofessionalsuccess.Oneofthemostpopular solutions are onlinecourses. No wonder - with their accessibility and diversity, they attract a multitude of followers. Such training courses offer, among other things, an introduction to ESG, ESG analysis in finance, knowledge of sustainable investments or a sustainable business model. Such courses allow participants to gain valuable qualificat

SpecializedcoursesfocusingonspecificaspectsofESG,suchasESG risk management, sustainability reporting, social auditing or green technologies, are also available on the market. Their purpose is to deepenknowledgeandskillsinaparticularESG-relatedarea.Training courses on sustainable disign or sustainable architecture are an interestinginitiative.

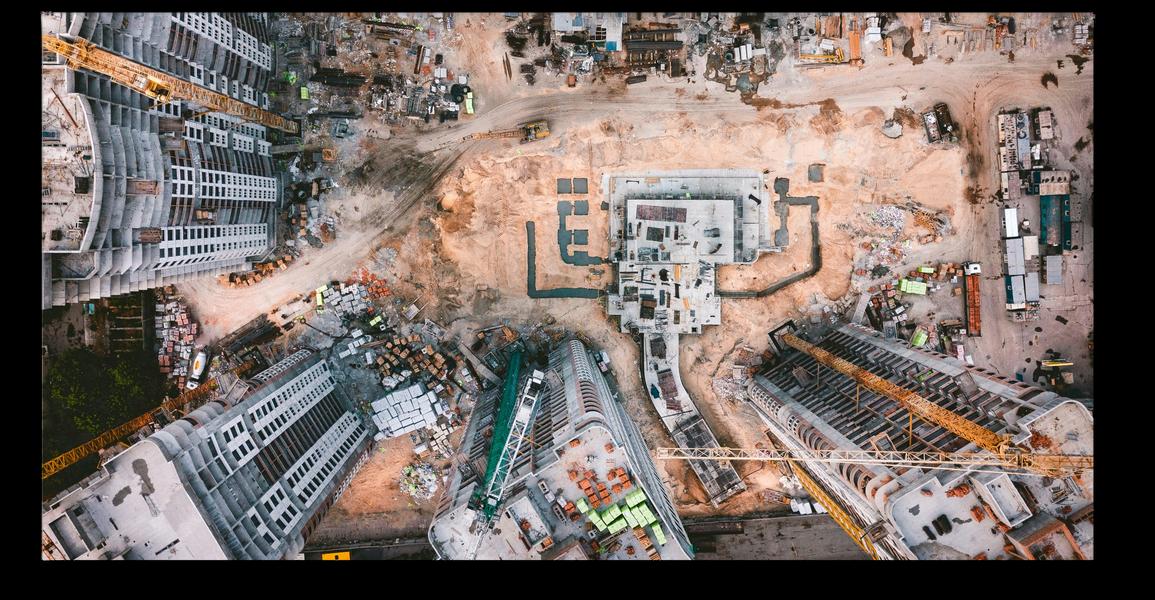

Inthecaseofcoursesfordesign,classesfocusondesigningproducts, services and infrastructure with sustainability in mind. Their goal is to shape design skills in accordance with ESG principles, minimize environmental impact and promote innovative and eco-friendly solutions. Sustainable architecture courses, meanwhile, offer knowledge on how to design and construct buildings in accordance with sustainable development principles, such as energy efficiency, use of renewable energy sources, efficient use of natural resources, andcreationofuser-andenvironment-friendlyspaces.

Another important element in ESG's activities is certification, which means not only an increase in knowledge and skills, but also prestige or access to a network of professionals. By holding such a document, an entrepreneur increases the trust of customers and investors, which can be crucial or business development and building a positivereputation.

Such certificates are, for example, CFA Institute ESG or CFA UK Certificate in ESG Investing. Unfortunately, earning an ESG certification comes at a cost, which can be significant. The total expense can range from several to as much as a dozen thousand zlotys. The price consists of, among other things, the registration fee, thecostofcoursesoreducationalmaterialsandexaminationcosts.

It is worth noting the educational offerings of some universitiessome of them provide the opportunity to study both at the undergraduate and graduate level, the program of which is linked to the idea of ESG. . These majors may educate in sustainability management,sustainablefinanceorenvironmentalstudies.

A characteristic of such studies is interdisciplinarity; they often combine economics, social sciences or science and technology to provide the most comprehensive approach to ESG possible. While attending such a course, through multiple research projects, cooperationwithcompaniesororganizationsworkinginthesphereof sustainable development, the student is able to gain a large dose of practicalknowledgeandanetworkofinternationalcontacts.

Another option is corporate training; some companies or organizations offer ESG training for their employees to increase their awareness of sustainability topics, responsible investment principles and socially responsible practices. The purpose of such training is to tailor ESG to the company ' s needs. Employees' knowledge of these topics allows a company to act more ethically and conduct its business nment.

Educational programs are a common initiative for public sector employees: aimed at civil servants, public employees and policymakerstoincreasetheirknowledgeofESG-relatedpoliciesand practices. These programs can cover topics such as urban planning, waste management, nature conservation or emergency management.

Workshops and seminars are also held on specific ESG-related issues, which may include the climate crisis, labor rights, resource extraction and exploitation, or corporate social responsibility (CSR). Participants in such workshops discuss the aforementioned sample topics and share their experiences and opinions on the latest trends andrelatedinnovations.

As you can see - the idea of ESG is increasingly popular in many fields. The principles of sustainable development open up many new opportunities for development. Applying them in practice, creates a goodprognosisforthefuture.

InterviewColliersPoland-questionsansweredby

AndrzejGutowski-DirectorCEE|Sustainability ServicesWhat do you think the development of ESG in Polish business will looklikeinthenextfewyears?

ESG topics are developing extremely fast - it is estimated that in the next 3 years about 4,000 Polish companies will be forced to publish reports on sustainability and non-financial areas. Competence and experience in ESG topics are therefore increasingly in demand and sought after. However, sustainability itself is not limited to reporting. ESG sets new areas for companies to compete in, it can mean transforming or modifying current services, monitoring relevant suppliermetrics,orsettingnewscopesofcooperationwithcustomers -allofthisopenscompaniestonewfieldsofactivity,which,however, require specialists - and I suspect there will be a race for such employeesinthecomingyears.

Whatisthecurrentimportance of environmental building certificationsinyourbusiness?

Buildingcertificationsareavery important aspect of our services - for many years it has been environmental certifications(suchasLEEDor

or BREEAM) and wellbeing certifications (e.g.: WELL) issued for buildings that have brought innovative environmental and social requirementstothemarket.

Building certifications allow their owners or developers to independentlyverifythestandardofabuilding,butontheotherhand, they represent a huge resource of good practices and solutions for the real estate sector. Due to the usefulness of certifications, which are an easy way to verify and assess how a building can fit into the requirementsoffunds,ownersortenants,theirpopularitycontinuesto grow, covering more real estate sectors - offices, warehouses, shoppingcentersorresidentialprojects.

How do you assess the degree to which companies in the industry are prepared for the upcoming sustainability reporting requirements?

Weobserveaveryhighdegreeofdifferentiationamongcompaniesontheonehand,financialinstitutionsandlargelistedcompaniesare the obvious leaders and are preparing strongly for reporting, but on theotherhand,themajorityofthemarketisstillnotfullyawareofthe impending legislation and requirements. I expect, however, that companies will become more and more active, especially the closer wegetto2025,asdatafromthatyearmustbereportedin2026byall large organizations, including OTC ones, not yet covered by the nonfinancial reporting requirement. Seeing as how much time is needed to prepare for reporting, developing materiality analyses or streamlininginformationchannels,companiesmaywakeuptoolate.

WhatdoyouthinkaboutthedirectionofEUregulationsandwhatdo youexpectfrompotentialindustrystandardsundertheESRS?

Reportingstandards(ESRS)havealreadybeenpublished.Companies will only be able to report on material aspects and indicators under the ESRS, which is a significant change from the initial plans and the requirementtoreportonthefullsuiteofindicators.

Regulationsarecertainlymovinginthedirectionoftransparencyand access to ESG data - since these are to be competitive areas on which companies will build business strategies, access and data quality will be key. Hence the evolving regulations and reporting requirements,underSFDR,CSRDorTaxonomy.

Inyourexperience,doclientsintherealestateindustryhavehigher expectationsforsustainabilityand/orESGmetrics?

The real estate sector has a very strong impact on the environment, and hence real estate companies have a higher responsibility. Basically every company owns or leases a property, hence this elementofthevaluechainwillalwaysbeimportant,ifonlyintermsof CO2 emissions. But as in the rest of the market - the awareness and attitude of companies in the sector varies widely - some organizations see it as an opportunity, others see it as a risk, others waitfordevelopments.

What is the job of a sustainability or ESG expert in your industry? Recently, you can see many offers for just suchaposition....

Duetoverystrong impactrealestate companieshavea higher responsibility

Sustainability experts can cover a wide area - in the context of realestate,itwillmostoftenbe about issues of conducting green building or space certification, developing real estate strategies, decarbonization plans and assessing buildings to support reporting needs or compliance with theTaxonomy-anEUtoolforassessing"green"economicactivities.

Howdoyouassessthelevelofeducationandawarenessaboutthe newESGguidelines?

It is very difficult to keep pace in terms of knowledge of the new ESG guidelines and areas. Further specialization of ESG experts is to be expected - topics even limited to the real estate sector can range from technologies supporting reporting, monitoring consumption on buildings or counting the carbon footprint, through analyses of building accessibility and its impact on occupant comfort, through assessment of subcontractors, decarbonization of organizations and buildingstoformalESGreportingitself.Thenumberofdirectives,good practices and regulations is very large, and growing rapidly. In contrast, the wave of sustainability is just now gaining height, it is worth entering the topic now and co-creating market standards and practices.

naBielska I Editor:WiktoriaKulesza

naBielska I Editor:WiktoriaKulesza

InterviewAllegro-questionsansweredby

AnnaGoraczka-ESG&SustainabilityGroup ManagerI would like to start by emphasizing how I understand sustainability and ESG. As I understand it, the term is about transforming a company 'sresponsibilityandoperations,notjustitscommunications. In effect, ESG requires fundamental changes in the business, processes and the way people work in a company like Allegro, but also in other collaborating companies. Therefore, the competencies needed for the job include the ability to influence others, understanding of the business, courage, perseverance and patience. This is because transformations take time, they do not happen overnightorevenwithinamonth,butoftentakeyears.

It all starts with developing a strategy and planning for longterm development. The goals we pursue are not set by me individually, but at the level of theentireorganisation.Ineffect, these are not ESG goals, but companygoals.

Many company employees work to achieve these goals, even if their positions are not directly ESG-related. My daily job is to monitor progress, motivate and support others in this long journey of transformation.

For example, in order to reduce a company ' s carbon footprint, it is necessarytochangethewaytheorganisationoperates,especiallyin in-house operations, warehousing and transport. These are typically the areas with the largest carbon footprint, but often unnoticed by consumers. Transformation involves working with the employees responsible for these areas to understand the need for change and introducenewwaysofdoingthings,e.g.lookingatwaystoreducethe amountofenergyusedorobtainenergyfromrenewablesources. ESG work is all about working on people's attitudes and behaviours andmotivating

What does it look like to engage with employees who are not necessarily directly involved in ESG and sustainability-oriented activities?

Employee engagement starts with setting common goals and strategies for the company. It is important to identify areas of importance to the company and priorities for transformation. However, in order to achieve this, it is essential to include the diverse perspectives of employees and other stakeholders, even those who are not familiar with the concept of ESG. As part of this process, we conducted a survey with more than 5,000 employees and other stakeholderssuchassellersandbuyers.Basedontheirfeedback,the Boardapprovedthecompany'spriorities.Thisgaveuslegitimacyto

continue working on these issues. When moving on to the implementation of activities, it is important to be close to the operationsandthepeopleresponsibleforthearea.Theyaretheones who have the knowledge and experience necessary for effective transformation. Understanding the business and knowing the operationsarekeytoeffectiveESGmanagement.Forexample,oneof our priorities is to strive for sustainable packaging in our own operations, so we enter into discussions on how to improve this aspectwithallthosewhohaveaninfluenceonthepurchaseoruseof packaging. Only by working closely with employees and understanding our processes and business needs can we achieve sustainability success. Only then can we effectively manage the transformation and bring about positive change. Collaboration, dialogue and knowledge of both people and business are the foundationsofsuccessfulESGandsustainabilityengagement.

From the perspective of a sustainability expert, what do you think thelabourmarketdemandisforpeopleinthisfield?

WearecurrentlyseeingdemandforESGexpertsgrowingatthespeed of light on recruitment portals. This is mainly due to new EU regulationsthatwillaffectanincreasingnumberofactors.Inaddition, regulations are changing all the time which means that ESG experts will have to continuously learn and adapt to changing requirements. While some competencies may be lacking today, it is worth remembering that these skills can be acquired through courage, perseverance,humility,knowledgeofbusinessprocessesandadesire for continuous improvement. It is important to remember that ESG reportingisonlypartoftheprocess.Therefore,itwillbeimportantnot only to report, but also to lead real transformations, motivate employees, oversee processes and, above all, collaborate. Soon, the demand for people leading ESG transformations may be as high as forreportingexperts.

Haveyouconductedresearch or examined how important

Allegro’s engagement in sustainabilityisforitsusersbothsellersandbuyers?

DemandforESG expertsisgrowing withlightspeed

Kantar's research shows that the majority of Poles recognise the urgent need for action on sustainability, however they often lack knowledge of specific ways in which they can contribute to this transformation. The same applies to both Allegro customers and sellers. That is why we have decided not only to educate, but also to provide ready-made solutions. Our aim is to make sustainability the default choice, eliminating decision-making discomfort for customers. Our activities include the introduction of eco-friendly packagingforsellersandthepromotionofparcelmachinedeliveries, which generate a carbon footprint over 30% lower than courier deliveries straight to homes. We want our solutions to be easily accessible,responsibleandconvenientforeveryone.

Turningabittoyourcompany'splansforthefuture,whatESGareas doyouprimarilyplantoaddressandfocusoninthefuture?

TheseareaswillbeclearlyvisibleinourlatestESGreportpublishedat theendofMay.Ourplansstemfromtheobjectivessetonthebasisof a dual materiality analysis. Undoubtedly, the main area is decarbonisation, endorsed through the Science Based Targets initiative,includingambitiousemissionreductiontargetsof38%inour own operations. We want to transform our business in ways that are notalwaysvisibletothecustomer,butareinternallyrelevant,relating to renewable energy, fleet and the circular economy. Packaging and circularity is another important aspect of our environmental responsibilitythatwealsopayattentionto.Inthereport,wehave

What do you as a company think about the changes in EU regulations and what do you expect from potential industry standardsundertheESRS?

Indeed, regulations are changing and the whole industry, as I hear today,isveryfocusedonthenumberofindicatorstoreport.Thereisa lot of excitement around this topic, especially when the number of indicatorsismentioned,whichgoesashighas1,400or1,800.However, we are taking a very pragmatic approach. We are not starting from scratch because we have been reporting for several years. We have doneadualmaterialityanalysisandweknowwhatisapriorityforus. anticipating the regulations, we are preparing to report according to the ESRS. By reviewing the list of areas that are relevant to our business, we are aligning ourselves with the requirements of the directive.Ourpreviousexperiencefacilitatesthisprocess.

In general, how do you assess the level of knowledge and preparation of the people who will now be responsibleforreporting,notonlyin yourcompany,butalsohowitlooks inPolishbusinessingeneral?

Today, the CSRD guidelines, as well as the ESRS with their specific indicators and definitions, are now readily available to anyone interested. The speed at which this information is absorbed by business depends mainly on the companies themselves and the people managing the process. It seems to me that the level of knowledgeonthesubjectisalreadyquitehigh,giventhepresenceof CSRD topics at many conferences and panel discussions. However, it isnowtimetoseehowtheoreticalknowledgetranslatesintopractice.

From a theoretical point of view, I believe we are well prepared, but practical challenges still lie ahead. These mainly concern the quality and reliability of the data collected and auditing, which is becoming more and more restrictive when it comes to non-financial reports. Thisisabigchangeintheapproachandresponsibilityofcompanies, which may not yet be fully realised. At Allegro, we have already started to ask ourselves questions about the source and reliability of the data and the processes for collecting it, but many in the industry maystillbeunawareofthefullextentofthechangesthatmandatory auditingandgreateraccountabilityfornon-financialreportingbrings. I hope that these changes will lead to more reliable and transparent reporting,whichwillbeappreciatedbythebusinesscommunityasa whole. HowdoyouthinkESGwilldevelopinthecomingyearsinPoland?

Inordertounderstandthistransformationwell,weneedtogobacka few steps to the time when the CSR (Corporate Social Responsibility) revolution began. In Poland, this process started a few or a dozen years ago through various initiatives that focused mainly on social activities, but also on responsibility towards the environment. These programmestopromotesocialengagementwereveryimportant,but they did not cover the broad spectrum that ESG now defines. The transformation from CSR to ESG is about embedding ESG principles firmly into business processes. This approach focuses more strongly on transforming thinking, also integrating aspects of CSR, such as acting for social good. However, ESG goes further, focusing on measurementandnotlimitingitselftothesocialresponsibilityaspect alone. Looking to the future, I expect ESG to evolve towards value creation. This approach involves the full integration of the financial andnon-financialaspectsofacompany,meaningthatthecompany createsvaluethatinvestorsarepreparedtovalueandcustomers

are willing to support through their purchases. I believe we are just in the middle of this transformation from CSR to ESG, and further towards value creation. This approach emphasises that a company that incorporates ESG aspects is more resilient to crises, and has greatermarketvalue.Iseethistransformationasbuildingthevalueof a company based on the full integration of financial and nonfinancialaspects.

How do you think communication between stakeholders and decision-makersinESGimplementationshouldbedeveloped?

From my point of view, the key issue in communication is to be attentive, and to look for common areas of cooperation, looking not onlyatshort-termgoalsbutalsoatlong-termscenariosforchange. In the context of stakeholder communication and cooperation, it is worth emphasising long-term cooperation, taking into account a widerangeofaspectsanddiversestakeholders.Stakeholderscanbe notonlycustomers,butalsocommunitiesaffectedbythecompany's activities or the ecosystem as a whole. It is also worth remembering that a stakeholder is also our planet, which can be seen as a silent stakeholder, not always expressing its thoughts verbally. Mindfulness incommunicationiskey,involvinglisteningtoeachotherandlooking positivelytothefuture.Thisisimportantforbuildinglong-termvalue, which is not just limited to financial value, but also includes social value and well-being. Building this value is based on considering the long-termoutlookandactivelylisteningtotheneedsofstakeholders.

InterviewMateriality-questionsansweredby PiotrBiernacki-ESG ManagingPartner

InrelationtoyourmanyfunctionsatEUlevel,whatdoyouthinkof thedirectionEUregulationistaking?

IhavebeenfollowingthecreationofregulationsatEUlevelforseveral decades,sinceIwasstillstudyingattheWarsawSchoolofEconomics and at foreign universities, including French universities. On the other hand,Ihavebeenparticipatinginthecreationoftheseregulationsfor a good few years, including within EFRAG. Let me summarize it this way: the last few years have given us a lot of regulations on sustainable development, above all linked to the main development strategy of the European Union. When Ursula von der Leyen took over the presidency of the European Commission, the European Green Deal was developed and announced. This actually resulted in numerous directives and regulations, including on sustainable development. Iobservedand

participated in the creation of regulationsforthefinancialsector of banks, insurance companies and investment firms in the contextofsustainablefinanceand the associated obligations for companies. There have been manysuchregulations,someof which are already in force, such as the EU's taxonomy of environmentally sustainable activities, while others will not come into force until this year or next year, such as the sustainability reporting obligationsforlargecompanies.

Inmyopinion,theseregulationsdidnotnecessarilycomeaboutinthe order in which they should have, but today, when we have passed mostofthem,Ithinkthattheyareformingacertainwholeandthata well-thought-out system is being created. We will only see the real effects of these regulations in at least two years, but the regulatory changes are clearly moving in the right direction. Unfortunately, with so many regulations, there is a fear that either the Union will stop halfwayandtheywillnotbecompletedortheywillnotenterintoforce intheambitiousforminwhichtheywereplanned.

Howmanycompanieswantedtoreportpriortotheintroductionof theobligationbytheEuropeanUnionandwhichmeasuresdidthey caremostabout?

The sustainability reporting obligation, introduced by the CSRD (Corporate Sustainability Reporting Directive), comes into effect from 2024andwillgraduallycovermoregroupsofcompaniesin2025and 2026. Historically, on the other hand, we have already had one obligationtoreportso-callednon-financialinformation.Thedirective that introduced it covered only the largest listed companies and financialinstitutions.InPolandtherewereabout150ofthese,whichis relatively few compared to the number of all companies in the country.IntheEuropeanUnion,itwasabout11,000ofthelargestlisted companies, and in principle only these companies reported. In addition to the companies obliged to report, there were perhaps a fewdozenothercompaniesthatvoluntarilyreportedonsustainability issues.Unfortunately,priortotheintroductionofmandatoryreporting for large listed companies, these reports were of a communication and PR nature, meaning that companies basically chose what they wanted to include in them and described their various positive initiatives. There was relatively little reliable reporting on climate issues, the environment, people or human rights, because no one supervisedwhatcompaniespublishedintheirreports.Reportswere

not audited by auditors. Those reports that the largest listed companies were showing were already under some supervision. The Office of the Financial Supervision Authority (UKNF) checked that the reportswerepublished,whiletheywerenotyetsubjecttoaudit-this was voluntary. For this reason, many companies today are in for a shock, as it turns out that the report is not only to show the positive aspects, but the actual state of affairs, both positive and negative. Opportunities and risks, the negative impact on people or the environment must be described, as well as how this negative impact is reduced and what positive measures are taken. All these changes andtheobligationtoauditareonlyintroducedbytheCSRD.

In your opinion, what industry is facing the biggest changes and challenges with regard to reporting and the increasingly new EU directives?

Probablyforallindustriesthetransitiontomandatoryreportingisjust as big a challenge, because these are new obligations and completely new standards. It is worth noting, for example, that the international financial reporting standards, according to which large companies report, were created over several decades and companies gradually learned them. Training was needed so that all chief accountants, finance directors, financial controlling and other employeeslearnedit.Herewearetalkingaboutaone-offimposition of 12 standards on companies, for all of them at once, and in a short while sectoral standards will be added, and there will in turn be around40ofthem.Iwouldnotdividethesechallengesbysector,but ratherinthecontextoflistedandnon-listedcompanies.

orallofthematonce,andinashortwhilesectoralstandardswillbe added,andtherewillinturnbearound40ofthem.Iwouldnotdivide these challenges by sector, but rather in the context of listed and non-listed companies. Listed companies already have some experience, perhaps not as detailed reporting, but nevertheless they are not starting from scratch. By contrast, for many private, unlisted companies,thiscomesasacompletesurprise.Ifearthatsomeofthe large private companies do not yet know that these obligations are coming,eventhoughitisalreadybeingwrittenaboutinthespecialist media. A major challenge for all large companies will be to find experts to help them implement these responsibilities, because the competence within the companies is mostly not there. I say this perhaps not only in terms of reporting itself, but even more broadly. Themanagementofsustainabilityissuesisabroadareainwhichone can specialise in topics such as greenhouse gas emissions and decarbonisation, circular economy, management of raw materials, materials and waste, as well as labour rights, human rights, among others.Forthetimebeing,therearereallyfewexpertsinthisfield.The field of sustainability and reporting is, in my opinion, an area where therewillclearlybeaneedforspecialists,whileatthesametimeitis difficulttofindcoursesorpostgraduatestudiesatuniversitiestotrain thenecessarystaff.

Forallindustriesthetransitionto mandatoryreportingisabig challenge

Do you think ESG work is and is becoming a new potential career pathforstudents?

Definitelyyes.ThisisexemplifiedatMATERIALITYbypeoplewhocame touswhentheywerestillintheirfourthorfifthyearofuniversity

Bythetimetheygraduatedfromuniversity,theyhadalreadystarted working for us, then progressed all the way, and some have even beenwithusformorethanfiveyearsandhavemanagedtoadvance tomanageriallevel.Theyarealreadyconsultantswhoadvisevarious companiesand,infact,averylargepartofthiseducation(orevenall ofit)insustainabilitytheyhavealreadyreceivedwhileworkingforus, because they are people from very different faculties - from economics and a more strict area (e.g. finance, data management), to environmental (e.g. environmental protection, waste management),toarchitecture,civilengineeringorpsychology.Notall ofthemcametousattheendoftheirstudiesorrightafter,someonly after an initial career pursued in other companies. In my opinion, it is not necessary to have a specific field of study to deal with sustainability, because today it is difficult to find such full bachelor's andmaster'sdegreesthatonlydealwithsustainability.Itisimportant to get people who specialise in different areas and have a general understandingofsustainability.

Itisimportanttogetpeoplewhospecialisein differentareasandhaveageneral understandingofsustainability.

Do you think Polish companies will cope with the upcoming obligationsrelatedtothenewreportingstandards?

Ithinktheywilleventuallycope,onlyIamafraidthatthisdoesnotyet mean reports for 2025. The timing of the start of the regulations in 2025 for 3,500 companies may be tough and it is the lack of specialiststhatwillbecomeakeyproblem.Asinmanyotherareas,it is possible to take a minimalist approach to this reporting, i.e. simply doing the obligation minimally, or it is possible to take a more ambitiousapproach.Unfortunately,however,Ithinkthatthe

number of companies that take a more ambitious approach will be rathersmallatthebeginning,andtherearetwootherfactorsatplay here. The first is that I have noticed that different companies are much more willing to start looking at sustainability when they feel pressure from their customers or from financial institutions. The secondfactor,ontheotherhand,isthatwhenwecarryoutstudiesof materiality,risksandopportunitiesregardingsustainability,itisatthe initial stage of defining them that CEOs notice the need to confront the risks identified, because they are serious and they did not see such a threat before.Active management decisions are made to counteract negative impacts, as well as to stand out from the competition on a ‘we must be better’ basis in terms of regulatory compliance.Theprocessofcollectinginformationforreportstriggers manyotherprocesseswithincompaniesthatmakesustainabilitynot something beside the business, some additional cost or side activity, but a topic that permeates every element of the company ' s operations.

InwhichareaofESGdoyouthinkPolishcompanieshavemadethe mostprogress?

Ithinkthebiggestprogressisnoticeableinthemoststructuredarea, which is climate change, specifically the calculation of greenhouse gas emissions. A few years ago, hardly any companies knew how to count greenhouse gas emissions, and if they did, they only took into account their direct emissions (the so-called scope one). Then they learnt to count scope two, and now a great many of these major companies already know how to count the entire emissions from all three scopes. Of course, numerically this is still probably rather fewer companies than the sum of those that already report regularly, but here I see progress. A few years ago, together with Michal Stalmach, we developed a study to analyse the climate awareness of companies,andinthisstudyweanalysedthereportsofthe150

largest listed companies and assessed whether they report emissions, to what extent, how accurately, whether this data is audited, and so on. This is a very precise study conducted by the Association of Listed Companies and the Reporting Standards Foundation, and we as MATERIALITY participate in it. Looking at the results from 2017 to 2023, there is clear progress, but the current highest level is still the minimum required by the new regulations. Furthermore, the question of whether companies are reducing their negative environmental impact and how, is a topic for a completely differentstudy.

How do you assess the readiness of Polish regulators to adapt EU regulationstoPolishlaw?

Firstly,thesearetheEUregulations,morepreciselythedirective,soit has to be implemented into our regulations and here we have fresh information. At the end of April, the Ministry of Finance presented a draft law implementing the directive for public consultation and the whole legislative process has started. Theoretically, we should implementthisdirectivebythemiddleoftheyear,butIamafraidthis is not realistic in the case of Poland. However, I think that probably mostoftheEUMemberStateswillhavesomedelays.Moreover,many of the regulations on sustainable development at EU level are issued intheformofregulations.Theyaredirectlyapplicable,i.e.theydonot need to be implemented in Poland into our legislation, they simply becomeeffectiveonaspecificdate.However,theroleofthePFSA,for example, with its supervision of listed companies that historically reportnon-financialinformation,andinashortwhilewillbereporting on sustainable development, is important here. The FSA is indeed starting to do more and more over time. At the moment, officials are waiting for companies' reports and sending letters to companies indicating non-compliance with regulations, while also asking questionsastowhythisisthecase.Ithinkwewillgraduallyadjustto this,asPolandisgenerallyquiteefficientinimplementingmostofthe EU directives. In my opinion, compared to other EU countries, we are notthebest,butwearenotatthebottomeither.

KlaudiaŚwiątek

KlaudiaUrbaniak

DominikaMachul LidiaSurgiel