Whether you’re just starting out, getting ready to retire or somewhere in between, Ohnward Bank & Trust has personal banking options perfect for you.

Ohnward Bank & Trust offers a number of checking account options so you can choose the one that fits your needs.

Kasasa Cash – A free account that allows you to earn interest on balances and refunds on ATM fees nationwide when certain requirements are met.*

Kasasa Cash Back – A free account that pays cash back on debit card purchases and refunds on ATM fees nationwide when certain requirements are met.*

Standard Checking – Features no-cost, no minimum balance, and no maintenance fees.

Supreme Club Checking – An interest-bearing account with special features and benefits for customers 55 and older.

Health Savings Account (HSA) – A special checking account that offers tax savings for those covered under high-deductible health insurance plans.

Savings Saving is easy with an Ohnward savings account. Multiple account choices allow you to customize your accounts to help achieve your savings goals.

Kasasa Saver – A free account linked to your Kasasa Cash or Kasasa Cash Back account.

Savings Account – Our savings account features a variable interest rate and no fee with a $100.00 monthly minimum balance.

Kids Club Savings Account – Children 12 and younger can begin saving and learning about money with our special Kids Club account. No minimum deposit and no required balance.

Christmas Club – Set aside funds for holiday spending using our Christmas Club savings account. Checks are issued in October, just in time for the shopping season.

Our experienced lenders will work with you to ensure you are getting personal service and the best loan for your individual needs.

Auto Loans – Finance your new or used vehicle with a community bank you trust. Take advantage of our pre-approval to save time and hassle at the dealership.

Consumer Loans – Ohnward offers convenient financing for recreational vehicles, boats, education, vacations, furniture, or other personal needs.

Mortgage Loans – We have several options to match your goals to the best possible terms, including Conventional, Adjustable-rate (ARMs), FHA, VA, USDA, Iowa Finance Authority, construction, bridge, land loans, and more. Our mortgage preapproval program ensures you can shop with peace of mind, knowing you have financing in place.

Home Equity Loans and Lines of Credit (HELOC) –Ohnward offers both fixed-rate and variable line of credit (HELOC) home equity loans. Rates are typically only slightly higher than a mortgage loan, and funds can be used for a number of expenses, such as home improvements, education, debt consolidation, and more.

Agricultural Loans – We provide Eastern Iowa farmers with personalized loans for operating, livestock, machinery, facilities, and real estate financing needs.

Commercial Loans – Our lenders are knowledgeable about SBA guaranteed loans and other types of commercial loans for equipment, working capital, and real estate.

Student Loans – We have partnered with ISL Education Lending to offer a supplemental private student loan program to assist with the cost of education.

Ohnward Bank & Trust offers a suite of private banking services designed to provide personalized financial services.

Customized Credit Solutions

Deposit and Cash Management Services

Wealth and Estate Planning

Business Solutions

Our credit cards offer convenience and selection. Choose rewards of cash, travel, and merchandise, or stick to a simple low rate, no frills card.

Online Banking – Access your accounts anytime day or night, right from your computer. Pay bills, view check images, stop payments, transfer funds, order checks, and more!

eStatements – A secure, convenient way to view current and past bank statements through your online banking account.

Mobile Banking – Bank on-the-go with our Ohnward Mobile App. Deposit checks, view transactions, check balances, transfer funds, pay bills, and more, right from your smartphone.

Mobile Wallet – Make purchases at stores and participating apps with a quick tap of your phone.

Text Banking – Receive account balances, history, and transfer funds between accounts.

Telephone Banking – Access account information 24 hours a day by calling 1-866-319-0244.

Ohnward offers ample ways to build your wealth.

Money Market – Enjoy unlimited deposits and no monthly fee with a $1,000.00 minimum daily balance.

Certificates of Deposit – A safe, guaranteed return on your investment makes our CDs a great option to help you save for the future. Flexible maturities from six months to five years.

Money Builder Certificate of Deposit – Funds are invested for a full year before maturity in return for a higher interest rate. Additional deposits can be made at any time. CDARS – Allows you to enjoy full FDIC insurance on deposit amounts that exceed current FDIC limits.

Roth and Traditional IRA – Roth IRAs allow after tax dollars to be saved for retirement. Traditional IRAs offer immediate tax benefits with qualified contributions being tax deductible.

Coverdell Education Savings Account – A beneficial nondeductible account that features tax-free withdrawals for the specific purpose of a child’s higher education expenses.

Simplified Employee Pension (SEP) – A retirement investment plan to assist small business owners and farmers with retirement plans for themselves and their employees.

Let Ohnward Bank & Trust help you start, grow, and manage your business.

Ohnward Bank & Trust offers a number of business checking account options so you can choose the one that fits your needs. Debit cards can be added for fast and secure access to account funds.

Business Checking – Small businesses will love the ease of this account that provides checking services for accounts with low balances and minimal activity.

• $500.00 daily collected balance or $2,000.00 monthly average balance

• No monthly fee when minimum balance maintained

• First 75 debits and 300 deposited items free

• Includes monthly eStatements with check images and online banking

Commercial Business Checking – Convenient account for mid to large businesses with heavy account activity.

• $2,500.00 daily collected balance or $5,000.00 monthly average balance

• No monthly fee when minimum balance maintained

• First 150 debits and 1,000 deposited items free

• Includes monthly eStatements with check images and online banking

Commercial Super NOW Checking – Special account available for sole-proprietors, non-profits, and government entities.

• $2,500.00 daily collected balance*

• No monthly fee when minimum balance maintained*

• First 75 debits and 300 deposited items free

• Interest paid on balances over $2,500.00

• Includes monthly eStatements with check images and online banking

*waived for documented non-profits

Our experienced lenders will work with you to ensure you are getting personal service and the best loan for your business.

Commercial Loans – Our lenders are knowledgeable about SBA guaranteed loans and other types of commercial loans for equipment, working capital, and real estate.

Agricultural Loans – We provide Eastern Iowa farmers with personalized loans for operating, livestock, machinery, facilities, and real estate financing needs.

Lines of Credit – Establishing a line of credit ensures you have fast access to cash to address any business expense that arises.

Commercial Real Estate and Construction Loans – We have several options to match your goals to the best possible terms.

Manage your accounts with our convenient, secure electronic banking services.

Basic Business Online Banking – Access your accounts anytime day or night, right from your computer. Pay bills, transfer funds, access bank statements, and more!

Treasury Management Solutions – Our Treasury Management team delivers a comprehensive suite of services for your business. Originate ACH electronic transactions and direct deposit payroll, utilize positive pay and ACH debit filter. Enjoy advanced business online banking with multiple users’ accessibility, flexible user rights management, restricted access, multiple account control, remote deposit capture, and more. eStatements – A secure, convenient way to view current and past bank statements though your online banking account.

Mobile Banking – Bank on-the-go with our Ohnward Mobile App. Deposit checks, view transactions, check balances, transfer funds, and more, right from your smart phone.

Autobooks

a convenient tool that allows small business owners to send invoices, accept payments, and keep track of customers directly through online banking.

There are ample ways to build your wealth with Ohnward Bank & Trust.

Savings Account – Saving is easy with an Ohnward savings account. Multiple account choices allow you to customize your accounts to help achieve your savings goals.

Certificates of Deposit – CDs are a fixed rate, safe and secure investment product. We offer flexible maturities ranging from six months to five years. Interest is compounded and credited semi-annually.

CDARS – Certificate of Deposit Account Registry Service (CDARS) offers a safe, convenient opportunity to put your money to work. All funds are protected by FDIC insurance.

Money Market Account – Enjoy unlimited deposits and no monthly fee with a $1,000.00 minimum daily balance.

Sweep Account – Make the most of your money with this special cash management account designed to provide higher interest rates on excess funds. Funds over a targeted balance are automatically transferred and invested on a daily basis.

Repurchase Agreements and Repo Sweeps – Talk to our experienced staff to determine if these additional investment account options are right for you. Deposits under this agreement are protected or collateralized by providing a security interest in a U.S. Treasury or Agency security owned by the bank.

Our credit cards provide your business a variety of card options to fit your preferences. Cards can be issued to individual employees with credit and cash limits set by the business owner.

563-673-5711

4726

The team at Ohnward Bank & Trust is committed to providing personalized service and sound advice to make your home financing process simple and stress-free. Our mortgage bankers have an average of 18 years of industry experience, and our mortgage operations team has an average of 26 years experience. From pre-qualification to closing and beyond, our knowledgeable team will tailor your loan to fit your individual needs and always have your best interests in mind.

Local Decision-Making: At Ohnward, we prioritize local decision-making through our in-house underwriting process, enabling swift approvals and efficient processing.

Dedicated Point of Contact: From pre-approval to closing and beyond, you benefit from a single point of contact.

Reflective Service: Our service is a reflection of your business values. We understand that a positive experience fosters client loyalty and referrals. We strive to deliver exceptional service at every step of the process.

Services & Products: With a comprehensive range of products and services, including in-house lending, we empower you to make informed financing decisions tailored to your needs and preferences.

Transparency and Reliability: We prioritize transparency and reliability to ensure that financing remains the least stressful aspect of your home buying experience. Our track record speaks for itself – we have never caused a missed closing.

Ohnward Bank & Trust’s interest-earning checking accounts are an easy way to put your money to work for you while also maintaining access to funds.

Kasasa checking accounts provide competitive rewards and benefits, along with local, personalized service. Let us help you select the account that best fits your individual needs.

Kasasa Cash*

Our free Kasasa Cash high-yield checking account allows you to earn interest on balances, plus many other benefits. This account is ideal for individuals who like the security of keeping higher balances in their account, and still want to earn interest on their funds.

• Earn higher interest on balances up to $15,000 when eligibility requirements are met

• No minimum balance to earn rewards

Kasasa Saver

• Refunds on ATM fees nationwide

• Free debit card

• Free mobile banking and eStatements

Our free Kasasa Cash Back account pays cash back on everyday debit card purchases. This account is ideal for individuals who keep lower account balances and use their account regularly.

• Earn cash back on debit card purchases when eligibility requirements are met

• Earn up to $9 cash back each month

• No minimum balance to earn rewards

• Refunds on ATM fees nationwide

• Free debit card

• Free mobile banking and eStatements

Compliment your Kasasa checking account with a Kasasa Saver. When you earn your Kasasa Checking rewards, you get a higher Kasasa Saver rate too. A free Kasasa Saver account offers:

• Higher rates on balances up to $35,000

• No minimum balance to earn higher rate

• Earn interest even if you don’t meet the checking account eligibility requirements that month

* To earn your rewards, just do the following activities and transactions in your Kasasa Checking account each qualification cycle:

• Receive your monthly statement electronically (eStatements)

• Have 10 or more point of sale debit card purchases posted and settled in your account

• Have at least one direct deposit or ACH auto debit posted and settled in your account

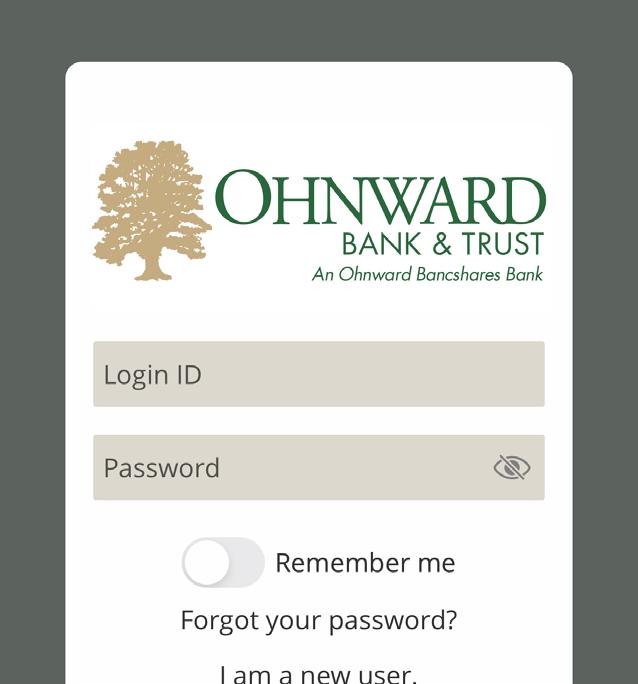

Mobile banking is a secure and convenient way to manage your finances. Download and enroll quickly and easily on your computer or mobile device.

Mobile banking is a secure and convenient way to manage your finances. Download and enroll quickly and easily on your computer or mobile device.

1. Search - Ohnward Bank & Trust

1. Search - Ohnward Bank & Trust

2. Click ‘Get’ or ‘Install’ to download

2. Click ‘Get’ or ‘Install’ to download

3. Our app will now appear on your mobile device!

3. Our app will now appear on your mobile device!

It’s easy! Simply enter the same Login ID and Password you use for your Online Banking account.

It’s easy! Simply enter the same Login ID and Password you use for your Online Banking account.

Don’t have one? That’s okay! Click ‘Enroll now’ and follow the necessary instructions.

Don’t have one? That’s okay! Click ‘Enroll now’ and follow the necessary instructions.

NOTE: The first time you log-in using your device you will be required to receive a secure access code. Please wait a few seconds for the communication, input and submit!

NOTE: The first time you log-in using your device you will be required to receive a secure access code. Please wait a few seconds for the communication, input and submit!

1. Menu > Settings

1. Menu > Settings

2. Statement Delivery

2. Statement Delivery

3. Select ‘eStatements’

3. Select ‘eStatements’

4. Enter email address for statement availability notifications

4. Enter email address for statement availability notifications

5. Accept & Save

5. Accept & Save

After enrollment you may access eStatements immediately!

After enrollment you may access eStatements immediately!

NOTE: The first time you view your statements you will be prompted to receive a code. Simply copy and paste the code into the designated field in order to continue.

NOTE: The first time you view your statements you will be prompted to receive a code. Simply copy and paste the code into the designated field in order to continue.

This convenient security preference makes logging into your Mobile Banking easier than ever!

This convenient security preference makes logging into your Mobile Banking easier than ever!

1. Menu > Settings

1. Menu > Settings

2. Security Preferences

2. Security Preferences

3. Turn ON Touch ID

3. Turn ON Touch ID

4. Continue

4. Continue

5. Insert Login ID & Password

5. Insert Login ID & Password

6. Authorize

6. Authorize

Are you currently paying your bills via paper checks or your desktop computer? Simply follow a few easy steps to pay these on your mobile device!

Are you currently paying your bills via paper checks or your desktop computer? Simply follow a few easy steps to pay these on your mobile device!

1. Menu > Settings

1. Menu > Settings

2. Bill Payment

2. Bill Payment

3. Select the appropriate account

3. Select the appropriate account

4. Enroll in Bill Pay

4. Enroll in Bill Pay

Click ‘Manage my bills’ to add companies or individuals.

Click ‘Manage my bills’ to add companies or individuals.

1. Menu > Mobile Deposit > Mobile Deposit Enrollment

1. Menu > Mobile Deposit > Mobile Deposit Enrollment

2. Complete Mobile Deposit Enrollment

2. Complete Mobile Deposit Enrollment

3. Log Out and Log back In

3. Log Out and Log back In

4. Menu > Mobile Deposit > Deposit Check

4. Menu > Mobile Deposit > Deposit Check

Ohnward Bank & Trust offers lending expertise and financial service support to help your agricultural business grow.

We’ve been supporting ag and rural Iowa for over 100 years. We understand the unique challenges that farmers face, and we’re here to help you plan for a successful, long-term future operation. We provide products and advice specifically designed to meet the needs of each individual farmer and producer, so you and your family can secure funds for your operation, expand or improve financial performance, or make plans for retirement or succession.

Let our experienced and knowledgeable staff assist you with financing for:

• Real estate

• Working capital

• Crop

• Livestock

• Machinery and equipment

• Building and renovating facilities

• Farm management

• and more

Ohnward Bank & Trust’s ag lending team will go the extra mile to help you reach your financial goals. Contact us today to get started!

Visit www.ohnwardbank.bank to learn more!

*Account transactions and activities may take one or more days to post and settle to the account and all must do so during the qualification cycle in order to qualify for the account’s rewards. The following activities do not count toward earning account rewards: ATM-processed transactions, transfers between accounts, and debit card purchases processed by merchants and received by the bank as ATM transactions. “Qualification cycle” means a period beginning one business day prior to the first day of the current statement cycle through one day prior to the close of the current statement cycle. When your Kasasa Cash eligibility requirements are met during a qualification cycle, Kasasa Cash balances up to $15,000 receive an APY of 4.00%; and balances over $15,000 earn 0.15% interest rate on the portion of the balance over $15,000, resulting in a range from 4.00% to 0.73% APY depending on the account’s balance (0.73% is a weighted average APY, assuming a hypothetical daily balance of $100,000, with 4.00% APY paid on the first $15,000 and 0.15% APY paid on the next $85,000). When your attached Kasasa Cash or Kasasa Cash Back eligibility requirements are met during a qualification cycle, Kasasa Saver balances up to $35,000 receive an APY of 0.50%; and balances over $35,000 earn 0.15% interest rate on the portion of the balance over $35,000, resulting in a range from 0.50% to 0.27% APY depending on the account’s balance (0.27% is a weighted average APY, assuming a hypothetical daily balance of $100,000, with 0.50% APY paid on the first $35,000 and 0.15% APY paid on the next $65,000). When Kasasa Cash Back eligibility requirements are met during a qualification cycle, you will receive 3.00% cash back on debit card purchases that post and settle to the account during that cycle period. A maximum of $9.00 cash back may be earned per qualification cycle. You will receive reimbursements for nationwide third-party ATM fees incurred on your Kasasa Cash or Kasasa Cash Back account during the qualification cycle in which you qualified. An ATM receipt must be presented within 30 calendar days of the statement cycle for reimbursements of individual ATM fees of $5.00 or higher. We will refund a maximum total of $30 in ATM fees per qualification cycle. Interest, ATM fee reimbursements, and cash back will be credited to

your Kasasa Cash or Kasasa Cash Back account on the last day of the statement cycle and then automatically transferred to your Kasasa Saver account on the following day. Consequently, when linked to the Kasasa Saver account, the interest earned within the Kasasa Cash account does not compound since it is automatically transferred to the Kasasa Saver account. When linked to Kasasa Saver, and your Kasasa Cash eligibility requirements are met, balances up to $15,000 in your Kasasa Cash account receive a non-compounding APY of 3.93%; and balances over $15,000 earn 0.15% interest rate on the portion of the balance over $15,000, resulting in a non-compounding range from 3.93% to 0.72% APY depending on the account’s balance (0.72% is a weighted average APY, assuming a hypothetical daily balance of $100,000, with 3.93% APY paid on the first $15,000 and 0.15% interest rate paid on the next $85,000). When Kasasa Cash or Kasasa Cash Back eligibility requirements are not met ATM fees are not refunded, all balances in your Kasasa Cash account and in your Kasasa Saver account earn 0.05% APY and 0.05% APY respectively, and no Kasasa Cash Back payments are made. APY = Annual Percentage Yield. APYs accurate as of 7/18/2023. Rates and rewards are variable and may change after account is opened. Fees may reduce earnings. Account approval, conditions, eligibility requirements, limits, timeframes, enrollments, and other requirements apply. If you do not opt in for online statements within 60 days of account opening, or if you opt out of online statements at any time, we reserve the right to reclassify your account to a non-Kasasa account. You must make a deposit to open a Kasasa Cash, Kasasa Cash Back, or Kasasa Saver account. We reserve the right to limit Kasasa Cash and Kasasa Cash Back accounts to two each per social security number and Kasasa Saver accounts to four per social security number. There are no recurring monthly service charges or fees to open or close this account. A Kasasa Cash or Kasasa Cash Back account is required to have a Kasasa Saver account. A linked Kasasa Saver account is required for automatic savings. Contact a bank representative for additional information, details, restrictions, processing limitations and enrollment instructions.