CHARTING NEW WATERS

June 24-27

Fernandina Beach, FL

The IBA and OBL reunite to navigate uncharted waters, setting the course for new possibilities in banking.

This Guide is Sponsored By:

June 24-27

The IBA and OBL reunite to navigate uncharted waters, setting the course for new possibilities in banking.

This Guide is Sponsored By:

Join Joan Woodward as she shares her economic, public policy and political outlook in this data-driven analytical presentation. She will also discuss the most pressing challenges facing Congress and the Biden Administration throughout 2024. What do higher interest rates, coupled with elevated inflation mean for your organization and can the U.S. avoid a recession? Will legislation recently passed by Congress, such as the Inflation Reduction Act and the CHIPS Act, bring relief to consumers and businesses? Joan will explore those issues, as well as look at what the upcoming election might mean for insurance, tax policy and the economy.

Joan Woodward also serves as President of The Travelers Institute. She is a member of the company’s Management Committee, Operating Committee, and the Environmental, Social, and Governance (ESG) Committee. She also serves on The Diversity Council and the Travelers Foundation Board. She is the current Chairperson of the Travelers Community Connections Campaign.

What strategies are your peers pursuing over the next two years? Which competitors and threats keep them up at night? How many are focused on embedding banking (outbound) into 3rd parties? How many are focused on embedding fintech (inbound) into digital experiences? Which fintechs are banks embedding? And what about niche strategy? Join Lee Wetherington for a revealing look at where your peers are headed, why and what new opportunities are being presented by the ecosystem disruption reshaping financial services.

Join FDIC Vice Chairman Travis Hill for updates on the agency’s rulemaking agenda, as well as other regulatory and market developments. The session will begin with open comments and include a fireside chat with association staff. There will also be an opportunity for attendees to ask questions on site.

Travis Hill is the Vice Chairman of the FDIC Board of Directors. He has served in this role since January 5, 2023. Previously, he worked at the FDIC from 2018 to 2022, as Deputy to the Chairman for Policy and before that as Senior Advisor to the Chairman. In these roles, among other responsibilities, he oversaw and coordinated regulatory and policy initiatives at the agency and advised the Chairman on regulatory and policy matters. Prior to joining the FDIC, Hill served as Senior Counsel at the United States Senate Committee on Banking, Housing, and Urban Affairs, where he worked from 2013 to 2018. While there, he participated extensively in the drafting and negotiating of numerous bipartisan bills.

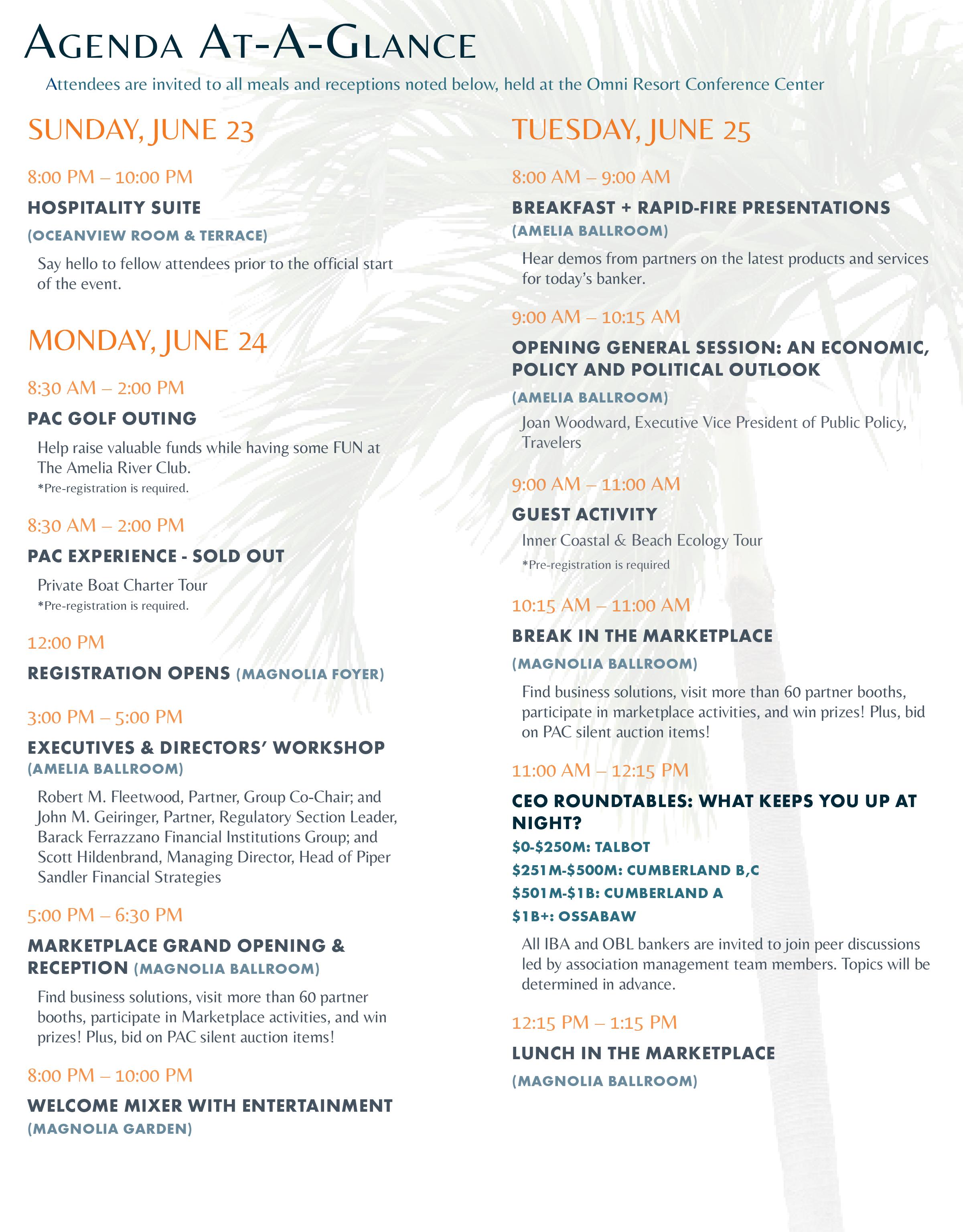

1:15 PM – 2:30 PM

SALUTE TO LEADERSHIP (ILLINOIS ONLY) (AMELIA BALLROOM)

The IBA Annual Business Meeting and Award Ceremony.

8:00 PM – 10:00 PM

HOSPITALITY SUIT E (OCEANVIEW ROOM & TERRACE)

Relax and unwind after a day of learning at a reception to close out the day. PAC Silent Auction winners will be announced. Need not be present to win.

Politics is not a spectator sport – and neither is this special event. After a full day at the Convention, attendees can reconnect for a lively reception that will include announcing the winners of the PAC Silent Auction, which will be taking place in the Marketplace throughout the event – all while making an impact on the industry. Proceeds benefit the Illinois Bankers PAC and Ohio BankPac.

BID DURING EACH BREAK IN THE MARKETPLACE ON MONDAY & TUESDAY. FINAL BIDS WILL BE ACCEPTED, AND WINNERS ANNOUNCED AT THE HOSPITALITY SUITE ON TUESDAY, JUNE 25 AT 9:00 P.M. IN THE OCEANVIEW ROOM/TERRACE (HOTEL SIDE).

Illinois Bankers PAC and Ohio BankPac would like to THANK everyone who participated in the additional PAC programs throughout the event, including the PAC Golf Outing and the Private Boat Charter Tour.

Disclaimers

Illinois Bankers PAC: A copy of our report filed with the State Board of Elections is (or will be) available on the Board’s official website (www.elections.il.gov) or for purchase from the State Board of Elections, Springfield, Illinois. All contributions to Illinois Bankers PAC are voluntary. You may refuse to contribute without reprisal. Contributions to Illinois Bankers PAC are not tax deductible.

Ohio BankPAC: Ohio BankPac accepts personal contributions only. No corporate donations are accepted. All contributions are voluntary. You have the right to refuse.

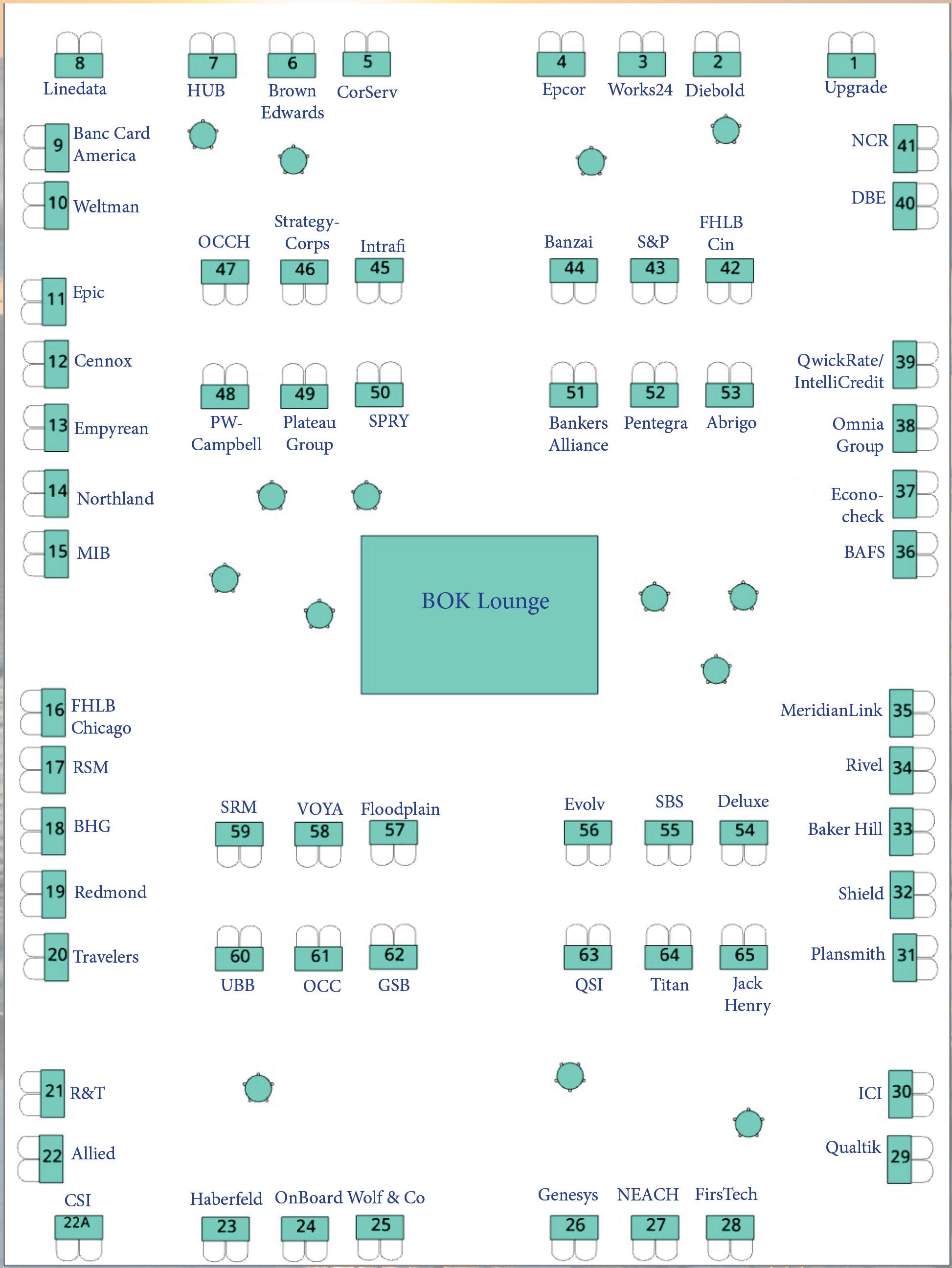

Set sail for the Marketplace where treasures untold await!

Join the crew, explore the bounty of exhibits and uncover the finest innovations the seven seas have to offer! Don’t miss your chance to plunder knowledge, forge alliances and fill yer chest with the riches of discovery. Arrrrg, see ye there!

Follow the treasure map to collect “X Marks the Spot” cards from each exhibitor for a chance to win a $500 Southwest gift card and a progressive art piece being created throughout the event.

The more mateys (arrg - exhibitors) you meet - the more chances to win!

Be

Be sure to visit with our service providers and let them know we appreciate their support!

MARKETPLACE HOURS

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

Abrigo enables more than 2,400 U.S. financial institutions to support their communities through technology and advisory services that grow loans and deposits and optimize risk. Abrigo’s platform centralizes the institution’s data, creates a digital user experience, and delivers efficiency for scale and profitable growth. Abrigo’s team of industry experts can give your institution the guidance needed to stay on the path towards increased profitability. From portfolio risk and CECL to BSA/ AML, our advisory services team helps you solve problems.

» Allied Payment Network .......................

............................

Allied Payment Network believes that “moving money matters.” Its mission is to provide banks and credit unions with world-class payments tools that help establish them as the heart of the communities they serve. With a real-time, open-network model guiding its Universal Payments vision, its suite of online and mobile solutions includes online billpay, P2P, PicturePay®, BizPay, PortalPay, A2A, and Vault. For more information, visit www.alliedpayment.com.

» BAFS ...................................................

BAFS (Business Alliance Financial Services) is a privately-owned company that provides financial institutions with the best of commercial lending software and services – an industry-first combination. Whether you need to utilize our proprietary lending software, our full-service, on-call commercial lending expertise, or something in between, BAFS will meet you where you are to grow your business and make your institution a leader in the commercial lending space. We provide packages, suite services, and stand-alone services so that we can be of service at whatever scale you need. Providing top-quality service to our clients and their communities is at the core of everything we do, and that’s why our team at BAFS is our greatest asset.

Baker Hill is in the business of evolving loan origination by combining expertise in technology with expertise in banking. Built on decades of walking alongside community banks as they provide vital resources to their communities, Baker Hill is lending evolved. » Banc Card of America ...........................

Banc Card is an all-in-one business solution for community banks working with more than 700 community banks in 26 states. We offer local face-to-face service to their bank partners and customers when it comes to an all-in-one fintech and payment processing solution.

Be sure to visit with our service providers and let them know we appreciate their support!

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

Compliance Alliance’s board of directors is made up of the CEOs of State Bankers Associations representing 75% of states across the nation. C/A offers a family of services that includes Compliance Hub, Assurance Services, and Virtual Partners. Compliance Hub is a subscriptionbased regulatory and consumer compliance advisory with access to live hotlines to attorneys, proprietary tools, educational webinars, and unlimited document reviews. Assurance Services is our independent group of certified bank auditors offering regulatory compliance audits, including recommendations for program enhancements to improve future safety and soundness. Virtual Partners is a shared-service model using bank-dedicated compliance officers to monitor and guide your compliance program remotely. »

Banzai is an education platform with a focus on financial literacy. We serve communities by providing unparalleled financial literacy education to schools, and we serve our partners by providing access to invaluable marketing insights and meaningful CRA opportunities.

»

Since 2001, BHG Financial has originated more than $14 billion in loan solutions to top-quality borrowers, which community banks can purchase via the BHG Loan Hub. More than 1,525 bank partners have trusted in this program as a proven source of interest income and diversification for their bank.

» BOK................bokfinancial.com/landing-pages/financial-institution........LOUNGE

BOK Financial Securities, a registered broker/dealer in all 50 states and the full-service brokerage subsidiary of BOK Financial Corporation (NASDAQ: BOKF), consists of two separate divisions: BOK Financial Advisors and BOK Financial Securities.

» Brown Edwards CPAs ...........................

Brown Edwards’ financial institution accounting services help management improve procedures, reduce risk exposure, and improve earnings. Our team, with over 40 years of banking experience will design a specific program for your organization’s needs while providing best practices and cost-effective outsourced services. Our services include financial statement audits, internal audits & information technology audits, information technology risk assessment, loan reviews, allowance validation, internal control risk assessment, and ACH and BSA compliance

Be sure to visit with our service providers and let them know we appreciate their support!

MARKETPLACE HOURS

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

Cennox specializes in centrally managed solutions for our clients. Directly employed field technicians provide national coverage with local knowledge for all major EOM banking equipment. We deliver FLM/SLM & remote monitoring services, as well as branch transformation & new branch projects and security solutions. Cennox banking solutions include, but not limited to: Self-Service, Conventional, & Back-Office Equipment Refurbishing, Purchasing, Rigging, Installation, FLM/SLM – Remote Resolve/Repair – Preventative Maintenance Servicing, Crypto Currency, Smart Safe, Security, Compliance Surveys, Equipment Cleaning, Signage, Banking Supplies, & more.

» Comptroller of the Currency ................. occ.gov ............................................ 61

To ensure that national banks and federal savings associations operate in a safe and sound manner, provide fair access to financial services, treat customers fairly, and comply with applicable laws and regulations.

» CorServ, Inc ......................................... corservsolutions.com ........................ 5

CorServ provides payment card issuing programs for credit, virtual, debit and prepaid cards enabling Banks and Fintechs to deliver and embed payment card capabilities for their commercial, business, and consumer customers. CorServ’s secure hosted programs combine our credit, compliance, servicing, and marketing expertise with our modern online solution and open APIs. Our Bank and Fintech clients benefit from Interchange, loan interest, and fees from the payment cards. For more information, please visit http://www.corservsolutions.com/.

» CSI ...................................................... www.csiweb.com.............................22A

As a forward-thinking software provider, Computer Services, Inc. (CSI) helps community and regional banks, as well as organizations worldwide, solve their customers’ needs through open and agile technologies. In addition to its nearly 60-year reputation for personalized service, CSI is shaping the future of banking by swiftly deploying advanced solutions that help its customers rival their competition.

» Data Business Equipment, Inc. .............. databusinessequipment.com ............. 40

DBE, a family-owned company rooted in exceptional service, has been bringing transforming solutions to the market since 1968. DBE supports our clients through differentiating products and services to improve their position in the market. From thoughtful solution consultation, to implementation, service and ongoing support, everything DBE does is designed to drive the best possible experience and outcomes for our clients.

» Deluxe ................................................ deluxe.com ....................................... 54

Being successful in today’s financial arena means being flexible to the ever-changing demands and preferences of your account holders. With Deluxe Financial Services, you’ll find the programs and services you need to meet those demands, drive revenue, manage compliance and create meaningful, long-lasting relationships with your customers.

Be sure to visit with our service providers and let them know we appreciate their support!

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

Diebold Nixdorf, Incorporated (NYSE: DBD) is a world leader in enabling connected commerce for millions of consumers each day across the financial and retail industries. Its software-defined solutions bridge the physical and digital worlds of cash and consumer transactions conveniently, securely and efficiently. As an innovation partner for nearly all of the world’s top 100 financial institutions and a majority of the top 25 global retailers, Diebold Nixdorf delivers unparalleled services and technology that are essential to evolve in an ‘always on’ and changing consumer landscape. » Econocheck.

Econocheck transforms the way customers view their banking relationship — and the way institutions deliver value. Our customized solutions offer the enhanced services prized most by consumers and businesses, including identity & data security, cell phone protection, accidental death & dismemberment coverage, credit monitoring, entertainment discounts, health savings, and financial management tools. For partners, that means more recurring revenue and measurable gains in customer retention. Listening, delivering, partnering, growing – the Econocheck way for over 50 years.

Empyrean’s software allows financial institutions to take control of their balance sheet management, scenario planning, and risk/performance analysis in a single integrated software platform. The company offers a host of modules, including asset and liability management, liquidity stress testing, deposit analytics, budgeting, and profitability. Empyrean works with over 600 financial institutions ranging from under $100 million to over $200 billion in assets.

EPCOR provides payments expertise through education, advice and member representation to over 1,800 financial institutions and payment system participants. We assist members with maintaining compliance, reducing risk and enhancing the overall operational efficiency of the payment systems through audits, risk assessments, consulting services and customized education.

The IBA Advantage 401(k), powered by EPIC Retirement Plan Services, uses a Group Investment Trust which pools the assets of participating plans. This provides scale and purchasing power resulting in reduced pricing of plan administrative services and investments. Full fiduciary protection for a plan sponsor is provided by a 3(38) Investment Manager and a Discretionary Trustee. And, unlike a MEP, each adopting plan operates individually allowing for customized plan design best suited to each employer. Ask us for a no-cost, independent analysis of your current retirement plan to see how it compares to The IBA Advantage 401(k).

Be sure to visit with our service providers and let them know we appreciate their support!

MARKETPLACE HOURS

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

Evolv, Inc. offers a complete menu of payment processing and digital marketing solutions to businesses of every size and industry type. Since 1997, we’ve empowered firms across the nation to accept payments safely and efficiently. Our full suite of payment processing and digital marketing solutions increase sales while decreasing costs and mitigating risks. Our friendly and reliable in-house customer service supports our solutions.

“The mission of the Federal Home Loan Bank of Chicago is to partner with our members in Illinois and Wisconsin to provide them competitively priced funding, a reasonable return on their investment in the Bank, and support for community investment activities.

We are one of 11 Federal Home Loan Banks chartered by the U.S. Congress in 1932 to promote homeownership. Our members include banks, thrifts, credit unions, insurance companies, and community development financial institutions throughout our district.”

»

The Federal Home Loan Bank of Cincinnati is part of the Federal Home Loan Bank System, a national network of 11 Federal Home Loan Banks and more than 6,700 member financial institutions. Services include Short and Long-Term Advances, Mortgage Purchase Program, Housing Program, and Correspondent Services.

FirsTech Inc. has been a multi-faceted payment solutions and technology firm since 1984. FirsTech’s Financial Institution Technology Solutions include Electronic Payments, Mobile Solutions, Telephone Payments, In-Person Payments, Remittance Processing, Merchant Services, and many more. FirsTech is a leading technology partner that assists clients in achieving their business objectives. » Floodplain Consultants, Inc. ................. floodplain.com ..................................

Floodplain Consultants (FCI), a flood zone certification provider, provides extra service and accuracy via a site visit policy on all borderline properties at no additional charge. By partnering with clients, FCI reduces staff workload, increases customer satisfaction, reduces the risk of costly compliance problems, and helps improve the lender’s bottom line.

Genesys Technology Group was founded in 2007 as an advocate for the community bank and took the guesswork out of core contract negotiations. Genesys offers fully managed renewal negotiations and core vendor services. Genesys also specializes in the evaluation of missioncritical fintech and third-party systems. Furthermore, Genesys provides ongoing support such as invoice audit services, conversion management, new product installation, and project management.

Be sure to visit with our service providers and let them know we appreciate their support!

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

Since 1945, the Graduate School of Banking at the University of Wisconsin-Madison has educated professionals and created leaders in the banking industry. GSB currently offers a Graduate School of Banking, Human Resource Management School, Bank Technology Management School, Bank Technology Security School, Financial Managers School, Sales and Marketing School, and the GSB Online Seminar Series.

» Haberfeld ............................................

Haberfeld works with banks to significantly grow primary banking relationships, resulting in additional low-cost deposits, recurring non-interest income, and loan volume. Partners add 2x more checking openings through a complete strategy that aligns frontline execution with datadriven marketing. Clients gain more ROA/ROE compared to peers, have lower cost of funds, and better manage margin compression.

Taylor Advisors, Inc. is a balance sheet management-consulting firm and an SEC-registered investment advisor servicing financial institutions. We are not a brokerage firm but a team of investment analysts and balance sheet consultants to bank executives. We work with senior officers, ALCO members, and board members to provide advice, strategies, and education in the areas of investment, liquidity, asset/liability, and risk management. »

Since 1994, ICI Consulting has been a leading bank advisor nationwide. ICI is a consulting firm that supports financial institutions by providing core processing assessments, contract negotiation, gap analyses, vendor evaluations, and conversion services. ICI Consulting is well known for saving clients time and money during core processing & ancillary systems evaluations and negotiations with the providers of these business-critical solutions. » IntraFi Network ................................... IntraFi.com ....................................... 45

Having built the largest bank network of its kind, we’re a trusted ally to community banks that never competes with banks for their customers and that helps them to attract and maintain valuable customer relationships, grow reciprocal deposits, manage liquidity and generate fee income, diversify funding, and reduce collateralization. Work with the market leader to grow profitability and increase franchise value.

IntraFi Network’s innovative balance-sheet management solution — known ICS, CDARS and IntraFi Funding — empowers institutions to increase profitability, grow franchise value, manage liquidity more easily, and serve customers better.”

Be sure to visit with our service providers and let them know we appreciate their support!

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

Jack Henry™ is a well-rounded financial technology company that strengthens the connections between people and their financial institutions through technology and services that reduce the barriers to financial health – with the purpose of empowering people and communities to gain the financial freedom to move forward. Visit jackhenry.com to learn more.

» Linedata ..............................................

Linedata is a global provider of software and technology solutions for a range of financial services sectors including lending, leasing, institutional funds, savings, insurance, hedge funds and service offers such as analytics and business process outsourcing. Our lending, leasing and syndication solutions allow financial institutions to originate, service and manage ongoing risk while increasing processing efficiency and reducing risk. As a result, Linedata clients are able grow and provide an exceptional experience to their employees and customers.

At MeridianLink, we connect all sizes of financial institutions and fintech companies to better technology, better service, better people, and better solutions to streamline experiences so your members and customers can live better lives. We solve complex problems with powerful yet practical solutions.

Midwest Independent BankersBank provides a wide array of correspondent banking and audit services to financial institutions throughout the Midwest.

NCR Voyix Digital Banking offers an intuitive digital banking user experience to over 600 community FIs.Customers appreciate our modern intuitive design giving our apps an average of 4.8 stars. The bank can serve consumer & business segments on one digital platform managed from one back-office administrative tool. Our core-agnostic cloud-based architecture allows the bank to integrate seamlessly to over 180+ pre-integrated fintechs and solutions. » NEACH Payments Group ....................... neachgroup.com ............................... 27

A leading force in payments consulting, NEACH Payments Group (NPG) transcends geographical boundaries to bring our insights to the forefront. With a proven track record of empowering financial institutions, businesses, and third-party providers, our industry-certified experts combine banking and payments experience to offer unparalleled audits, meticulous risk assessments, and transformative payments consulting. As no company or engagement is the same, NPG goes beyond conventional solutions, providing your organization a tailored approach to managing payment system risk, improving compliance, and fueling business improvement. Partner with NPG for a transformative journey towards success.

Be sure to visit with our service providers and let them know we appreciate their support!

MARKETPLACE HOURS

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

Northland Securities, Inc., Member FINRA/SIPC, Registered with SEC/MSRB, is a full-service B/D, offering investment and financial services for financial institutions, government entities, non-profit organizations, and individual investors. Northland is a leading underwriter of tax-exempt bonds and bank-qualified securities in the Midwest.

»

OCCH, a nonprofit corporation, provides CRA Qualified tax advantaged investments to large and small banks alike. To date OCCH has invested over $4.25B in over 46,500 affordable housing units across Ohio. An investment in an OCCH sponsored equity fund meets the Investment Test under CRA while providing investors with a market rate of return through the purchase of low income housing tax credits.

» OnBoard ..............................................

OnBoard streamlines governance with a secure board portal that features user-friendly design, intuitive meeting creation tools, insightful analytics, and real-time collaboration. »

Founded in 1943, today with assets of nearly $15 billion, Pentegra is a leading provider of qualified and non-qualified plan, fiduciary outsourcing, BOLI and institutional investment solutions to clients and advisor-partners nationwide. With more than 75 years of industry knowledge and insights in developing bank retirement plan solutions designed to attract, retain and reward the talent needed to ensure your bank’s success and drive more successful retirement plan outcomes for your employees.

» Plansmith Corporation ......................... plansmith.com ..................................

We’ve worked with thousands of banks and credit unions who have struggled with competition, change, and the need to grow. Plansmith has helped more than 1,300 financial institutions improve decision-making with integrated software for strategic planning, market analytics, budgeting and risk analysis coupled with expert advisory services. Schedule your discovery call today!

» PWCampbell ........................................ PWCampbell.com ..............................

PWCampbell is a full-service firm offering design-build, branch experience, and consulting services to the financial industry. Our vast experience lies within architecture, interior design, preconstruction, construction, branded environments, and award-winning technology solutions. Our Best in Class service and “open door” relationship with our clients are the cornerstones of the business. Backed by over a century of experience, we have the passion and vision to take your project to the next level.

Be sure to visit with our service providers and let them know we appreciate their support!

MARKETPLACE HOURS

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

QSI provides turnkey delivery of NCR ATM and ITM solutions and is NCR’s largest financial partner in the U.S. We offer remote access services for patch management, anti-virus, and more. Titan Armored offers branch cash and ATM/ITM cash replenishment, among other services. QSI is a fullservice bank equipment company (video, alarm, drive-up, safes). No long-term service contracts. Outsourcing available.

Qualtik helps commercial loan portfolio managers accelerate and deepen their analysis, reporting, and risk management capabilities. Using Qualtik’s software solution provides lenders deep visibility into their commercial loan portfolio through intuitive, interactive dashboards. Lenders can efficiently filter and stress their portfolio in real time, then drill in to analyze individual assets and generate reports for their concentrations and 300/100% capital ratios.

» QwickRate/IntelliCredit ........................ qwickrate.com ..................................

QwickRate® has spent three decades providing community banks with innovative and affordable solutions that help make bankers’ lives easier, their work faster, and their business more successful.

The QwickRate CD Marketplace for non-brokered funding and investing enables fast connections to over 3,000 institutions so banks can proactively manage liquidity needs. IntelliCredit™ provides Smart Loan Review™ services uniquely combining deep credit expertise and an online, realtime portal for substantial time savings. Plus, a Portfolio Analyzer solution helps banks identify emerging hotspots and detect risk earlier. QwickAnalytics®delivers compelling online research on all banks, performance analytics, and regulatory compliance tools, including CECLSolver™. Contact ricki.dagosta@qwickrate.com for a demo or more information.

» R&T Deposit Solutions .......................... rnt.com ............................................ 21

R&T Deposit Solutions successfully completed a planned business combination on June 1st, 2022. Headquartered in New York City, and now doing business as RNTS, the combined firm has over $200 billion in assets under administration (AUA) and now offers a wider range of innovative tech-enabled services to help banks and wealth managers meet their unique cash sweep, deposit funding, and securities-based lending needs. Since 1974 and 2004, respectively, R&T and TBS have been helping many of the largest global financial institutions to achieve their business objectives. By delivering consistent results on behalf of their clients, both firms have achieved sustained business growth and have earned market-leading reputations for exceptional client service, collaborative engagement, and flexibility.

Be sure to visit with our service providers and let them know we appreciate their support!

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

Rivel’s CXLign Banking Benchmarks (customer service measurement and alignment) helps banks by providing a clear, objective view of what customers and prospects think. Since customer loyalty is a bank’s primary asset, it must be measured to improve it. We help banks pinpoint strengths and challenges based on the views of their customers and prospects. We put ratings in context, showing exactly how your scores compare to competitors within your local trade area.

RSM’s purpose is to deliver the power of being understood to our clients, colleagues and communities through world-class audit, tax and consulting services focused on middle market businesses. They are focused on developing leading professionals and services to meet their client’s evolving needs in today’s ever-changing business environment.

»

With margin pressures, increased regulatory focus, and evolving customer preferences, it is crucial that you have access to the data and tools your bank needs to perform. At S&P Global Market Intelligence, we provide essential intelligence to help you navigate the challenges of today’s banking industry.

SBS CyberSecurity helps business leaders identify and understand cybersecurity risks to make more informed and proactive business decisions. Since 2004, SBS has been dedicated to assisting organizations with implementing valuable risk management programs and mitigating cybersecurity risks.

With its purpose-built AML/BSA compliance management platform, Shield Compliance is transforming the way financial institutions automate processes, manage risk, comply with regulators, satisfy operational demands, and unlock new revenue associated with serving the legal cannabis industry.

» Spry,

Spry helps you market and manage your brand with absolute efficiency. We’re a brand optimization partner for our clients. We believe in the wisdom of disciplined budget management, smart solutions that win team compliance, and thoroughly efficient brand management.

Be sure to visit with our service providers and let them know we appreciate their support!

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

SRM (Strategic Resource Management) has helped 1,000+ financial institutions add more than $5 billion of value to their bottom line in areas such as payments, digital transformation, core processing, artificial intelligence, digital assets, and overall operating efficiency. SRM – now in its 30th year in business – has lowered costs, created revenue opportunities, increased productivity, and provided a competitive edge for clients in an environment of constant and accelerating change.

»

StrategyCorps works with hundreds of financial institutions nationwide to deliver mobile and online consumer checking solutions that enhance customer engagement and increase fee income. This includes two premier products CheckingScore, an analytical tool that ranks each customers total financial productivity, and a customizable BaZing mobile rewards app that delivers thousands of local merchant discounts and name-brand national retailer offers to their mobile phone, among other protection benefits.

» The

At the Omnia Group, we recognize that a financial institution’s workforce is its most valuable asset. With 39 years of expertise in personality analysis, we empower companies to maximize their teams’ potential. Through our simple assessments, customized reports, and personalized coaching, we equip leaders with the tools they need to foster continuous growth, development, and inspiration among their employees. Our comprehensive approach extends beyond the initial hiring process, offering ongoing support and valuable insights at every stage of the employee lifecycle. Recognizing the unique culture and objectives of each financial institution, we understand that productive and motivated talent is instrumental in achieving business goals. As a trusted and accessible partner, we are dedicated to empowering organizations to unlock the full potential of their workforce and drive success in the dynamic financial services sector.

» The Plateau Group, Inc. ........................ 800plateau.com ............................... 49

The Plateau Group, Inc., itself and through it’s subsidiaries, underwrites and delivers integrated insurance and debt protection products and services to help increase fee income and minimize risk. Their unique focus helps banks identify opportunities and plan for success. They support these goals with a comprehensive system including education, complete administrative support and ongoing program analysis.

Be sure to visit with our service providers and let them know we appreciate their support!

MARKETPLACE HOURS

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

The Redmond Company, your premier design/build partner, has completed 800+ financial institution projects. Experts in Prescriptive Consumer Analytics, Market Analysis, Trade Area Analysis, Branch Deployment Studies, Site Identification and Acquisition, Brand Integration, Architecture and Construction. Redmond uses advanced analytics to identify your optimal market, trade area, area of influence and site, using “The Science of Where” and Prescriptive Consumer Analytics. Ultimately, increasing the potential profitability and ROI of your facility by selecting the best and most profitable location. Let our award-winning team help you increase the potential profitability of your facilities, improve employee productivity and enhance consumer experiences.

»

Titan specializes in armored car cash replenishment to ATMs, ITMs and TCRs, as well as branch cash delivery services. We take the added step to ensure that each of our skilled employees are cross trained to fully understand the equipment, because our mission is to provide service and security.

» Travelers........travelers.com/business-insurance/financial-institutions

Travelers Knows Financial Institutions and has dedicated policies which offer flexible insurance options. Our coverage options include D&O, EPL, Fiduciary, Cyber, Professional Liability, Financial Institution Bonds, ID Fraud Expense Reimbursement and a full portfolio of Property/Casualty coverages!

United Bankers’ Bank is proud to be the nation’s first and the upper Midwest’s most prominent Bankers’ Bank, serving over 1,000 community banks from the Pacific Northwest to the Great Lakes.

Upgrade partners with banks for access to prime consumer assets as a complement to internal banking strategies and goals, including the management of liquidity, balance sheet diversification, or NIM pressure. Through a digital, online channel, Upgrade provides banks balance sheet and asset liability management solutions. In addition, Upgrade sweeps brokered deposits from high yield savings accounts based on the fed funds effective rate to help fund organic growth or other asset generation strategies for banks in need of liquidity but who may be unable to make other deposit sources work for return targets. » Voya

The Voya Bank Advisory Group works with community and regional banks seeking to enter the broadly syndicated senior loan market. Using Voya’s access and support, the bank develops a customized Commercial & Industrial loan portfolio in line with the bank’s credit standards and regulatory expectations. The floating rate loans can help manage interest rate exposure and diversify loan portfolios.

Be sure to visit with our service providers and let them know we appreciate their support!

Monday 5:00 pm - 6:30 pm Tuesday 10:15 am - 11:00 am & 12:15 pm - 1:15 pm

Wednesday 7:30 am - 8:30 am & 10:00 am - 10:45 am

» Weltman, Weinberg & Reis Co., LPA ....... weltman.com .................................... 10

Young & Associates, Inc. has provided consulting, outsourcing, and educational services to community financial institutions nationwide and overseas for over 40 years. They offer a widearray of products and services, covering all the major areas of banking, such as risk management, strategic, capital, and liquidity planning, mergers and acquisitions, internal audit, branching and expansion, lending and loan review, information technology, recruiting and human resources, marketing, and regulatory compliance.

» Wolf and Company ............................... wolfandco.com ................................. 25

Wolf & Company is a national CPA and business consulting firm with a regional feel, providing assurance, tax, risk management, and business consulting services to nearly 400 institutions across the United States. With over a century of experience working with financial institutions, we pride ourselves on personalized client service and unparalleled guidance that includes direct involvement from our senior management combined with responsive service from our multi-disciplinary team. Our diverse clients represent financial institutions ranging from de novo community banks to large national institutions facing unprecedented regulatory scrutiny. Through our collaborative service strategy, we understand our clients’ challenges and opportunities, and work with them to achieve their business goals while navigating potential obstacles. A complete description of our firm is provided through our web page at www.wolfandco.com.

Works24 .............................................. works24.com .................................... 3

Clients tell us what a pleasure it is to create and manage productions using our intuitive Works24 online system. Fresh content is critical, and Works24 makes it possible to go live with new audio or video content in minutes. In fact, it’s so easy, even a CEO can do it!

Jeremy