RISK MANAGMENT

WHAT TO DO ABOUT RETIREMENT?

MEMBER PROFILE: JOHN DANIEL BLACKLISTED STRENGTHENING SAFETY CULTURE WITH TECHNOLOGY

WHAT TO DO ABOUT RETIREMENT?

MEMBER PROFILE: JOHN DANIEL BLACKLISTED STRENGTHENING SAFETY CULTURE WITH TECHNOLOGY

Features and benefits

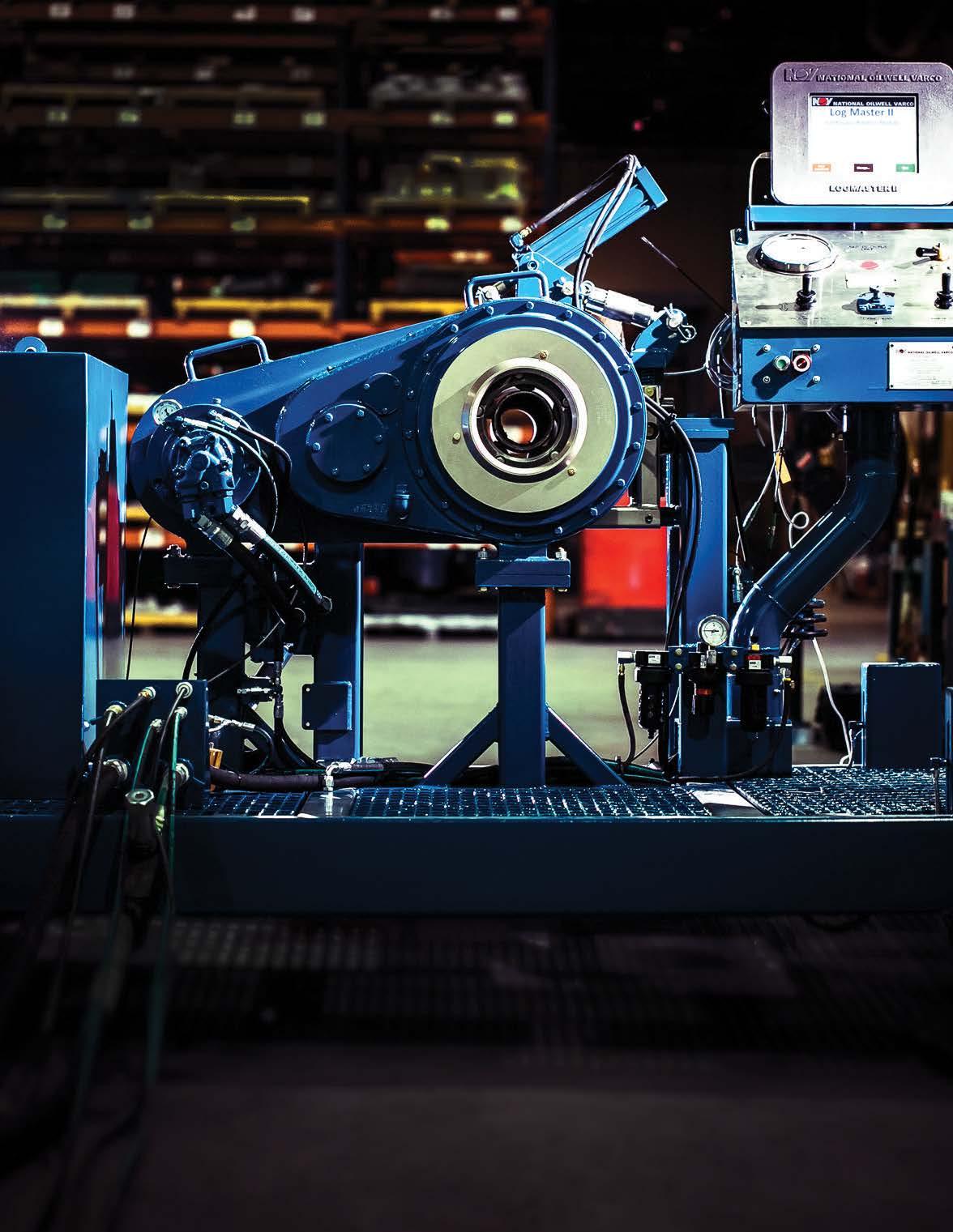

NOV Gill Services models 500, 600, and 700, along with our Peck-O-Matic™ series bucking units, are world renowned for their durability and reliability in providing continuous turn make and break operations. These units are built for speed, efficiency, and are relied upon to perform in the most demanding conditions.

Peck-O-Matic bucking units cover the entire range of pipe and couplings from 15/16 to 23 in. OD. All units feature an efficient closed head design, a contamination-free oil bath lubrication system and precise torque control. Standard units are available in either skid or frame mounted varieties, and come complete with a hydraulic power unit and control console enabling safe and efficient operation by one person.

• Hydraulic load cell to register torque applied to pipe

• Air shift for high and low operation

Contact bob.smith@nov.com for more information.

• Air shift for back-up to engage jaws

• Wide Jaw Floating back-up on Models 500 and 600

Executive Director: Kenny Jordan kjordan@aesc.net; (713) 781-0758

Editor: Brian Blake, B2design B2_OKC@yahoo.com

Production & Design: Astrea Creative kristen@astreacreative.com; (405) 219-4397

Contributing Writers: Mark Crawford, Andy Maslowski, Al Pickett, Chip Minty

AESC: www.aesc.net

Oilfield Theft: www.stopoilfieldtheft.com

Unless expressly stated otherwise, all editorial and advertising material published is the opinion of the respective authors and/or companies involved and should not be construed as official action by or approved by the Publisher or the Association. No part of this publication may be reproduced in any form without the express written consent of the publisher. If available, extra copies of the current issue are $4.00 and back issues are $8.00. All prices for U.S.A. © 2019 all rights reserved.

Foreign Subscriptions: Canada and Mexico $100/year, all other non-U.S. addresses $200/year.

CHANGE OF ADDRESS: Please send copy of mailing label with new address to Well Servicing, 121 E. Magnolia, Suite 103, Friendswood, TX 77546

Official publication of the Association of Energy Service Companies. Editorial, business and advertising offices: 121 E. Magnolia, Suite 103, Friendswood, TX 77546; (713) 781-0758 or (800) 692-0771; Fax (713) 781-7542

Well Servicing (USPS 537-670) (ISSN 0043-2393) is published bimonthly by Workover/Well Servicing Publications, Inc., 121 E. Magnolia, Suite 103, Friendswood, TX 77546.

A wholly owned subsidiary of the Association of Energy Service Companies. Periodicals postage paid at Houston, Texas and additional mailing offices.

POSTMASTER: Send address changes to Well Servicing, 121 E. Magnolia, Suite 103, Friendswood, TX 77546

Volume 62, Number 1 January / February 2020

10 22 24

STRENGTHENING SAFETY CULTURE WITH TECHNOLOGY

As you read this, we are nearly two months into 2020 and it feels like the calendar is moving rapidly. We are looking forward to the AESC Winter Meeting in Galveston. Once again, it will feature excellent speakers and relevant topics.

The AESC has a number of committees that are working on specific initiatives and are closely following relevant issues. Are you a well service provider? Do you provide services or equipment to well service companies? Last summer, the Executive Committee and the Board of Directors embarked on a plan to develop a Well Control Curriculum and seek accreditation for it. Both the Curriculum Committee and the Accreditation Committee have started this important work. I cannot imagine an area more important to well servicing given the focus on JSAs and SOPs by E&P Companies.

We believe another organization will provide this guidance if the AESC does not take a lead role. We need current members’ involvement and we need well service providers outside our group to join and support this important work. Do you want others determining best practices for your well service business?

We are closely following radioactive source security. Do you own radioactive sources? Do you provide services to source users? There are many activities happening in this area. A number of regulatory agencies are looking closely at radioactive sources for their potential use in terrorist activity. We have been told that if there is an event involving sources, it is likely the use of radioactive sources will cease immediately. This would have a devastating effect on any industry using radiation.

Within the AESC membership, it could affect wireline, pumping and tubular inspections, as well as a host of other service providers. Horizontal drilling has reduced and changed the use of logging sources, but many independent wireline companies still depend on sources for re-completion work on legacy wells. Sometime in the near future, we expect security measures will include a requirement for a combination of a source antitampering warning system and a GPS tracking system.

Pacific Northwest National Labs (PNNL) is actively involved in the development of a well logging Mobile Source Transit Security (MSTS) solution for the oil and gas industry. When their representatives spoke at our conference in August 2019, they highlighted their work and held an open discussion with the wireline providers in attendance. On that day, AESC members clearly said that any program that had a tremendous cost would cause providers to cease providing the service. Kenny Jordan has been active for the AESC and our logging industry, providing expert testimony to give us a voice in the outcome.

At the summer meeting, I announced my goal to add 50 new AESC members. I will be rolling out a membership drive across all AESC chapters. There will be cash at stake for the scholarship programs and bragging rights for the winning chapter. Stay tuned!!

Please stay safe out there and support AESC member businesses.

God Bless You and God Bless America!

121 E. Magnolia, Suite 103, Friendswood, TX 77546 (713) 781-0758 or (800) 692-0771

PRESIDENT’S OUTLOOK

EXECUTIVE DIRECTOR’S CORNER

WELL SERVICE RIG COUNT

SAFETY CORNER

MEMBER PROFILE

John Daniel MARKET REPORT

• Financial Industry Losing Patience with Oil and Gas Drillers

• Hope on the Horizon, but not Around the Corner, Industry Experts Say

• Despite Lower Prices, Production Setting Records

• Renewable Energy Nudging at Coal for Second Place

CONGRESSIONAL SPOTLIGHT

Rep. Paul Gosar, DDS (R) Arizona's 4th District GOLF TOURNAMENT

The Association of Energy Service Companies (AESC), for which the Well Servicing magazine is the association voice, is undergoing some changes that will provide efficiencies for both the membership and governance of the association. For the past six months, Gay Wathen has led an intensive review of the committee structure within the association to identify what works, and what doesn’t. The effort included making recommended changes to the committee structure so it will better serve not only the membership, but also the industry.

The AESC has had 15 standing committees: Associates-AC, Business Analysis-BA, Health Safety Environmental-HSE, Human Resources-HR, Insurance-IN, Legal-LG, Membership-MS, Oilfield Trucking-OT, Political Affairs-PA, Pressure Pumping-PP, Small BusinessSB, State Caucus-SC, Technical-TE, Wireline/Well Logging-WL, and Workforce-WF.

Each of these was reviewed with their respective committee’s input and a recommendation for reorganization was made to the board of directors. The board voted to reorganize the committee structure to better serve the current needs of the association and the industry.

The changes identified were to: 1) dissolve the Small Business Committee, 2) create the Marketing and Industry Committee, which will take the role of the membership and social media subcommittee, and 3) create the Professional Business Services Committee, which will combine Human Resources, Insurance, Legal and Workforce Development (these respective former committees are now subcommittees to the Professional Business Services Committee. The Pressure Pumping Committee will be dissolved as a committee and placed under the Technical Committee as a subcommittee.

With these changes, a charter for each of the committees is now being developed. The charter will provide direction for future committee leadership and members. With that, the association will also be soliciting participants for each of the committees. The committees are only as successful as the participants within the committees and the particular projects they are working on or assigned. For instance, the HSE committee is currently working on a water transfer best practices for the industry, and it is also time to review and update the current Green Book (Best Practices for Well Servicing). The Technical Committee is working on a new Well Control standard specific to Well Servicing operations in cased hole, and also updates to the Hydraulic Torque/Tong Manual. The Professional Business Services Committee will be updating the Master Services Agreement (MSA) as well as working with PetroEd on a link for high school students who have completed oilfield specific courses, trying to place them within the industry workforce. The Marketing and Industry Committee is developing the social media identity for the association.

The association is also currently evaluating its chapter structure. We will be evaluating the viability of each chapter, and determining if we can consolidate or streamline where necessary and where it makes geographic sense. There will be recommendations to the Board of Directors going forward to this effect.

All the changes that are being undertaken are being done with the ultimate goal of better serving our membership and the industry. We are only as successful as our membership participation at the chapter and committee levels. GET INVOLVED. VOLUNTEER AND ASSIST US IN OUR EFFORTS!

Kenny Jordan

AESC EXECUTIVE DIRECTOR

Welcome to the Association of Energy Service Companies (AESC) Service Rig Count. This service is being provided by the AESC and is published in each issue of Well Servicing magazine and now may be accessed directly on the AESC website (www.aesc.net). Click the three lines in the top left-hand corner to expand the menu, then click AESC Rig Counts in the menu.

Canadian rig count was provided by Topco Oilsite Products, but effective for the June 2016 Rig Count, they are no longer providing that service so it has been removed from the count.

Active Rig The rig is active if, on average, it is crewed and worked every day during the month.

Available Rig The rig is available if a rig has a crew and is ready to work, but is not working.

Idle Rig The rig is idle if the rig is capable of being put to work in less than 48 hours and does not require spending in excess of $50,000 to activate it, and does not have a crew currently assigned.

Stacked Rig The rig is stacked if the rig does not have a crew assigned and could not be put to work without significant investment in repairs and additional equipment in excess of $50,000.

By Bill Walker, Director of Environmental Health and Safety for Halcón Resources Corporation and Josh Ortega, Director of Industry Affairs at PEC/Veriforce

Nearly two decades ago, oil and gas industry operators, contractors, and educators banded together to form SafeLand USA (SafeLandUSA.org). The organization aims to reduce the potential for worker injuries while also eliminating the redundant operator-specific safety orientations required of workers entering or returning to work.

The SafeLand USA Orientation, delivered through a nationwide network of accredited instructors, has become the industry standard contractor for Health and Safety Orientation in the U.S. Upstream Oil and Gas Industry. More than 1.4 million workers have attended the SafeLand USA orientation that provides awareness of the hazards they may face at work, rather than compliance training. During this time (2010-2018), the industry’s Total Recordable Injury Rates (TRIR) declined from 1.2 to 0.4. While the decline is not exclusively a result of the SafeLand orientation, the organization’s efforts were a strong contributing factor.

To ensure continued success, The SafeLand USA Advisory Group is focused on continuous improvement. New data regarding oil and gas workplace injuries provides insights on the effectiveness of risk prevention measures, and SafeLand is committed to improving injury and Serious Injury Fatality (SIF) precursor prevention by providing consistent, high-quality, fundamental safety education.

SafeLand’s success is attributed to the curriculum delivery, assessment and other administrative requirements of the program. Coursework is consistent, widely recognized and relied upon by small and large operators and contractors who support the use of the SafeLand USA Orientation to reduce accidents by ensuring new and transferred workers are well-versed in the hazards inherent to their jobs.

Another component of SafeLand’s effectiveness is that its coursework is delivered through commercial and company-developed programs that are part of a vast instructor network. The Energy Training Council (ETC), International Association of Drilling Contractors (IADC), and PEC/Veriforce, deliver the SafeLandUSA-accredited safety orientation program through a nationwide network of accredited safety trainers, company in-house training programs and training providers. Together, these organizations comprise the largest safety and compliance network in the industry.

Entering a new decade, SafeLand has recognized two defining shifts that are helping to shape the organization as it evolves its orientations and delivery to meet modern needs, changing workforce demographics and new safety paradigms:

• Refining safety education – Safety professionals have long believed that reducing the rate of minor injuries would also reduce the incidence of more serious injuries and fatalities. However, data from The NIOSH Fatalities in Oil and Gas Extraction (FOG) database and a recent International Association of Oil and Gas Producers’ (IOGP) report shows that although worker injury rates have declined over time, serious injury and fatal accident rates have not declined at the same rate.

The industry has discovered that many serious injuries and fatalities are related to and may be prevented by following Life-Saving Rules, part of an initiative taken by IOGP to protect workers from fatalities by providing them with actions to protect themselves and others. SafeLand is working to include Life-Saving Rules in its orientations and is committed to improving industrywide adoption of education aimed at reducing the rate of potentially deadly incidents.

• Addressing student demographics – The industry’s workforce is aging. A younger workforce, heavily comprised of millennial-aged workers, is the new majority. Many are new to the industry, bringing with them varying degrees of safety knowledge and best practices. Raised on technology, they are accustomed to learning through different modalities. SafeLand USA is working to accommodate these new learning preferences.

In the coming year and beyond, SafeLand USA will continue to strengthen its role as a collaborative organization focused on protecting the oil and gas industry’s workers and their environment. For more information on SafeLand USA, visit www.safelandusa. org or email info@safelandusa.com.

Bill Walker

Bill Walker is Director of Environmental Health and Safety for Halcon Resources Corporation. He is a Certified Industrial Hygienist and a Certified Safety Professional. He is the current Chairman of SafeLandUSA.

Josh Ortega

Josh Ortega is Director of Industry Affairs for PEC/Veriforce. With more than 25 years of industry experience, he is a Professional Member of ASSP and certified by BCSP, and the previous chairman of SafeLandUSA.

By Al Pickett Contributing Writer

The “journey is just as important as the destination.”

This is Ron Byrd’s advice to well servicing companies when he discusses risk management with them.

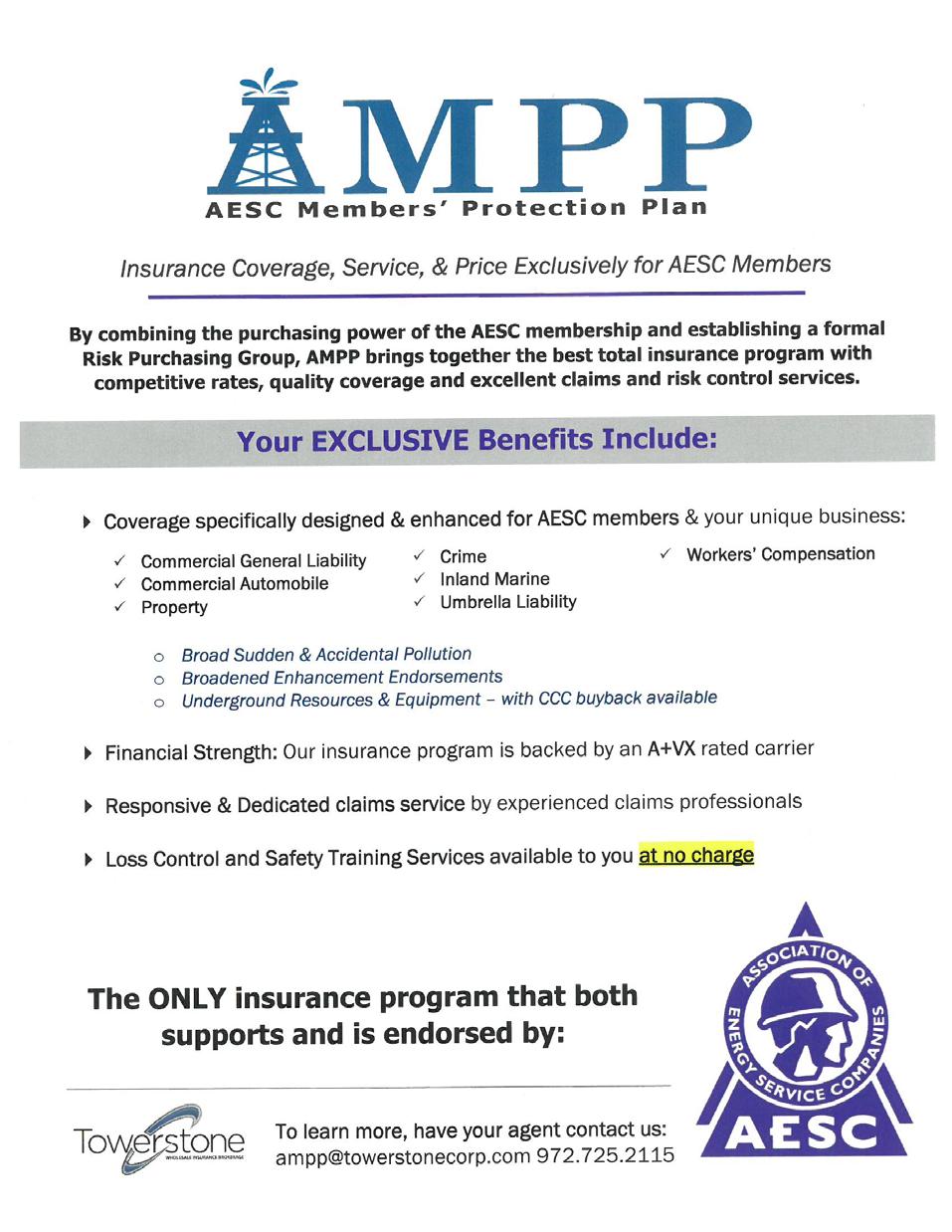

“I had someone in the industry tell me recently that ‘driving is the most dangerous thing we do. I am going to get that right’,” said Byrd, who is the director of risk control for Towerstone, a specialty wholesale insurance broker helping clients manage construction, energy, environmental, property and other specialty risks. “Service companies don’t have trouble following all the rules when they are on the well site, but it is when they drive off location that is the problem.”

Carol Randall agrees. She is the president of Houston-based Berkley Oil and Gas, a company dedicated to providing insurance to the oilfield services sector across the country.

“The lease site is controlled,” she points out. “But every time you send an employee on the road, they encounter third parties over which you have no control.”

In today’s litigious environment, well servicing and other energy-related companies are increasingly under the spotlight, according to Randall.

“When you give the keys to your company vehicle to your employee, you are potentially placing the future of your company at risk,” she continued. “There is a scary trend of increased litigation out there today. Oil and gas companies are held to a higher standard of responsibility when driving on the roads. With the whole social media reaction to oilfield traffic, there is a real feeling that it is the oil and gas industry’s fault, especially in the Permian Basin where there is so much truck traffic.”

It is not just well servicing rigs or heavier vehicles that are the problem, either. Randall says that of the companies who have suffered bad losses involving fatalities, about half were with heavy vehicles and the other half involved pickups.

So what can well servicing companies do to mitigate risk for their drivers on the road? Byrd and Randall weighed in with their suggestions for risk management.

“There is not a well servicing company that doesn’t have a safety manual,” Randall said. “When I talk to customers, I ask them ‘Will your policies and procedures in that manual mitigate your auto exposure? If there is an at fault auto accident, do you terminate the employee?’ You have to have policies and procedures around driving company vehicles that are clear, that are understood by your managers and employees, and that you adhere to with no exceptions. You should have a driver’s agreement signed by every employee that sets out the terms and conditions for the use of your auto. This includes a signed agreement from employees that are prohibited from driving your company vehicle.”

Recently, a major company with 250 trucks that announced in December it was leaving the oil and gas industry in the Permian Basin and shutting down because of significant loss activity. They said they can no longer afford the insurance because of the losses.

Byrd agrees it is important to have clear policies and goals, but he adds that many companies fall short on the follow-up.

“Training is all over the place, too,” he offered. “Some companies do a lot, some very little. I would guess 98% of companies don’t follow up on how their employees are driving.”

“Safety people are so busy; it is such a difficult job,” he said. “I have spoken to over 300 companies in the last year, and I start with the same question: What do you do to follow up on your employees’ driving? They may go to the well site and trail them for a little ways, making sure they have their seat belt on and they aren’t on the cell phone.”

GPS in trucks that companies can monitor whether their drivers are speeding or excessively braking can be beneficial, according to Byrd, but that doesn’t have much impact if the information isn’t being monitored consistently.

“The safety person may get the information, but he doesn’t have the authority over the driver,” Byrd explained. “He needs to get that information to the supervisor of the driver, making sure the reports are given to the right person in the chain of command.”

Byrd says he knows of two companies that are no longer in business because of accidents.

“It is hard to get insurance companies to write policies for driving for the well service industry,” he added. “We used to have hundreds of companies who would write policies. Now there are only a handful writing those policies because the price keeps going up. I know of one company that used poor judgment with its compliance of DOT (Department of Transportation) regulations and had a couple of crashes. Their insurance went up three times to $1 million instead of $350,000. They can’t afford that.”

Randall says companies need not only a safety culture but also a safety religion so it is on the mind of every

employee every day.

“You can’t stop (accidents) completely,” she admits, “but having a culture around safety will make a huge difference when you are brought into litigation.”

It all begins by hiring people you trust, Randall says. She recommends a best practice of checking Motor Vehicle Records before hiring an employee and then monitoring those records all year.

“The other challenge is the mindset that you are concerned only with DOT regulated vehicles and don’t pay attention to pickups or non-DOT regulated vehicles,” she emphasized. “That is a problem. You need to have the same policy for all vehicles.”

Training is critical, too. In addition to proper hiring practices, Byrd claims companies need to hire the most experienced drivers. Some companies will hire you if you get a CDL license. He says companies need to do drug testing, criminal background checks and review driving records.

“If I had a company, every person would have to have some sort of driving test,” Byrd continued. “Every time you get behind the wheel, you need to tell yourself to drive safely and not to get distracted. That is the number one reason people have accidents.”

Randall says companies need to assess the exposure to the company when their employees are on the road.

“I have a sign on my desk that reads ‘A good plan well executed is better than a great plan poorly executed’,” he said. “A good plan is to follow up effectively.”

This literally can determine whether or not a company can afford to stay in business.

Chip Minty

retirement is only enjoyable if it ’ s built on a solid financial foundation

People look forward to retiring all their lives, but once they get there, they frequently have no idea what to do next. Sure, the first few months are easy enough with all the golf games, time with the grandkids and the extended vacations.

But sooner or later, retirement can get complicated, and like any other occupation, people need an old hand to show them the ropes. Questions about money management, tax protection, insurance strategies and business liquidation are common.

Before the excitement of this next chapter in life starts, it may be time to find a team of experts to help plot a course and point out the types of financial potholes that can cost unsuspecting retirees thousands of dollars in savings.

Houston-based Portfolio Advisory Council, LLC was established in 1986 as an independent registered advisory firm, offering comprehensive financial and retirement planning services. Four members of the Portfolio Advisory team recently shared their perspectives on retirement with Well Servicing.

Retirement is all about playing and pursuing passions, they say. Golf, tennis or other hobbies take center stage, as people have time to serve their communities, do charity work and do what they’ve always wanted to do.

However, retirement is only enjoyable if it’s built on a solid financial foundation, said Philip Moran, certified financial planner.

“You must have confidence you’ll have the funds,” he said. “Life is much more enjoyable if you don’t have to worry about money.”

James Hamilton, an accredited investment fiduciary, says every family has their own set of expenses, assets, income and goals. If they aren’t sure about how much savings is necessary for retirement, they should get some guidance.

There’s a spending pattern among most retired people, the team says. Early on, it’s driven by lifestyle decisions, and later, by medical expenses.

“Most people spend more dollars early in retirement,” Moran said. “Some people will have a dream trip they’ve thought about for years, and some people want to move or remodel their homes. But as time moves on, most people spend less as their lifestyles become simpler.”

Saving enough for retirement is only the first step, they say. How they manage their money during retirement is just as important.

“Investment performance is critical,” Moran said, “but so are decisions affecting income. Everyone should be aware of their options for claiming social security. A decision as simple as when to take social security can make a difference of thousands of dollars a month.”

Meanwhile, investing decisions can make or break 30 years of retirement, Moran said. Many people are too conservative and watch their assets depreciate.

People need the right mix of income and growth in their investments.

Make a good plan at the beginning and stick with it, said Wendy Korman, a certified public accountant.

“When your paycheck stops, what will be your income?” she said. “How much income will your assets produce? Figure out your income and expense budget, then meet with your financial planner to set up a workable plan. Don’t rule out working part time, as earning income will give you more flexibility.”

Certified Financial Planner Thomas Sutton said there are a couple basic rules to live by once a plan is in place.

Rule one: Remember that the highest priority is to remain financially independent. Passing on an inheritance should be a low priority. Children and grandkids are better off with parents remaining financially independent, he said. If that means disinheriting your children, then do it. Rule two: Don’t pay attention to the propaganda in the news media.

“The news media creates fear and stops people from investing,” he said.

Hamilton agrees. Many retirees let the daily deluge of misinformation affect their investment decisions, he says.

“Bad news sells. You won’t hear good news from the news media.”

Meanwhile, spend less than you earn, Hamilton said. Lifestyle must be built around your income and assets. And, don’t forget taxes, CPA Korman said.

“Proper planning can minimize tax consequences. A dollar paid to Uncle Sam does not provide you with a capital gain, a dividend or an airplane ticket,”

Control your tax bracket, she said. This not only affects the taxes you pay, but Medicare Part B premiums are also based on income. Tax brackets also affect capital gains and dividend tax rates. Many couples can have $100,000 of annual income yet pay zero tax on their long-term capital gains and qualified dividends. This does not happen by accident.

“Shrewd planning is the ticket,” said Certified Financial Planner Moran. “Take your income from the correct account, and you can pay less taxes. Take the income from the wrong account, and you’ll pay Uncle Sam. Choose wisely.”

Good planning will allow you options to control your tax bracket, Sutton said.

“In the big picture, there are three kinds of accounts; accounts that are taxable every year, accounts that are not taxed, and accounts that are tax deferred,” he said. “Don’t make a mistake with Uncle Sam. He is not a benevolent uncle. He prefers that you pay more tax.”

The team says that business owners have the most options for saving money in attractive tax-advantaged retirement plans, but few take advantage of them.

Most owners end up with an expensive plan that was modeled after an employee retirement benefit. Knowledgeable advisors custom-design plans to benefit the owners.

“We’ve designed plans where the business owner receives over $100,000 of tax-deductible contributions every year. Don’t settle for an off the shelf plan,” said Sutton.

So, what about insurance?

Many people ask about the need for insurance, Moran said. People should insure what they can’t afford to lose, but they should be careful. A family can go broke buying insurance.

“The need for life insurance is generally reduced for people in retirement,” he said. “Life insurance is primarily necessary to cover a financial obligation, and most retirees have fewer obligations.”

Like insurance, deciding when to retire is an individual thing.

Some people don’t get to decide when they’re going to retire. Those decisions may come in the midst of a downturn or cutback. For others, it’s a choice, but that doesn’t mean the process is any easier.

“In order for a business owner to retire, the business must be sold, and selling a business can be an opportunity or a trap,” Sutton said. “Good financial and legal counsel is important, so start planning early.”

Leaving a business can be financially and emotionally challenging, Korman said. It’s hard for some owners to say goodbye to clients and customers, and some can’t get a good price for their businesses.

Selling can be complicated, Hamilton said.

“Valuation is difficult and can vary greatly from year to year,” he said. “Finding a buyer willing and able to pay fair value is difficult, and unfortunately, many owners wait too long. Health problems creep up, forcing distress sales or liquidation.”

Finally, after all the financial planning is finished, the team says it’s important for people to reflect on what they’re going to do with their time. People need a plan for that, too.

“Retirement isn’t for everybody,” Moran says. “Sometimes, work is a passion. Sometimes, work is fun. Just be sure to have some fun every day.”

If people are confident in their situations, they can enjoy life, and that’s important because we only have so much time, Hamilton said.

Retirement can be a wonderful time in life, Sutton said, just remember to be careful.

“Don’t pull the mask from the Lone Ranger, and don’t fall off the boat,”Moran he said.

The Portfolio Advisory team can be reached at 713-574-6015 or www.pacadvisory.com.

By Mark Crawford, contributing writer

Raised in Pittsburgh, John Daniel’s favorite activities were scouting and soccer. In fact, his entire family earned Eagle Scout awards. His father also spent about 30 years in the United States Marine Corps. “Sharing those values with me as I grew up helped me develop a discipline that has served me well over the years,” says Daniel.

Daniel’s first career was in finance. After graduating from high school, he enrolled in undergraduate studies at Lehigh University where he majored in finance, driven by his desire to be an investment banker on Wall Street. When he could not land the jobs for which he had hoped, Daniel returned to Pittsburgh and started his professional career as a commercial banker with PNC Bank. After four years at PNC Bank, he left to get an MBA degree at the University of North Carolina. However, midway through his first year of school, a professional connection from PNC Bank landed him a job with Key Energy Services, where he worked from 2000 to 2008. While there, Daniel completed his MBA degree at Tulane University.

“During this time, Key’s headquarters was in New Jersey, the other energy capital of the world,” said Daniel. “Frankly, at age 26, I didn’t recognize the significance and/or mistake of having an oil service headquarters in New Jersey. But life is full of lessons, and I learned a lot about what not to do early in my energy career. That has helped me tremendously on my career path over the last 20 years.”

After leaving Key in 2008, he was hired by Simmons Energy, a division of Piper Sandler, where he worked in the energy investment banking arm of the company. “We are basically split into two groups at Simmons,” he says. “The research department, where I work, and the banking department, which you would call if you wanted to buy/sell a business or needed any type of financing advice.”

Daniel is the managing director of the research department, where he writes equity research reports on companies primarily in the oil service, E&P, midstream, and refining sectors. “For my work, I focus on companies tied to the well service industry, pressure pumping, coiled tubing, and land drilling sectors,” he said.

Daniel describes his job as being an investigative reporter in the oilfield. He tries to meet as many people as possible and listen to everyone’s views. He

then assesses all the input and formulates a view of where the business is going. “The more people I talk to, the better the final research product will be,” he says. “Like a reporter, however, I cannot reveal my sources. If I do, the flow of information tends to slow down. Ultimately, my hope is the research we develop helps our clients make money with their investments.”

Daniel enjoys the multiple facets of research. Some analysts, he notes, are fantastic at financial modeling and digging deep into company financials. “Others, like me,” he says, “are more externally focused and love doing fact finding and then trying to assess what all the facts mean. Clients tend to want both approaches, so it’s good to have that type of balance within a research shop.”

On days when he is in Houston, Daniel tries to be in the office by 6:00 a.m. and typically leaves between 5:00 to 6:00 p.m. “I’ll spend time writing notes or calling folks in the industry or calling clients to discuss the industry,” he says. “Our clients are investors with mutual funds or hedge fund companies who buy and sell stocks.”

On other days, he is out in the field, visiting companies to learn more about current business trends. “I prefer to be in the field as I hate Excel,” he says. “The best part of the job is the people. I love meeting new folks in the industry and enjoy learning about the companies they work for and their individual work experiences.”

In research, he adds, there is constant pressure to be correct in your findings because incorrect conclusions can cause clients to lose money. “In our business,” he says, “the term is ‘making a call’ and like anyone, I want to get it right. Therefore, the challenge is getting over the fear of being wrong. That’s hard to do, but as I age, I realize that no one is always right. As long as your reasoning is sound, and you are willing to admit

when you are incorrect, people generally understand and give you the benefit of the doubt.”

The hardest part about the equity research business today is the lack of investor interest in oil service stocks. When considering stock price performance for the sector, or the mass number of bankruptcies and/ or corporate restructurings, “it is easy to understand why investors want to stay away from the oil and gas sector,” he said. “In response, inbound calls from investors wanting to discuss trends in energy and oil service have dried up.” This makes Daniel’s job more challenging. Additionally, the growing focus by the investment community to invest in companies that are ESG friendly creates even more pressure on energy stocks because of the perception by outsiders that the oil and gas industry is not environmentally friendly.

CHALLENGES FOR 2020 AND BEYOND

Daniel believes the biggest challenge for the well service industry is its structural fragmentation. “There are simply too many service providers given the current level of E&P capital spending,” he states. “The good news is we are finally seeing signs of consolidation, but much more will be needed.”

Assuming larger players decide not to sell stacked equipment and that the current rate of consolidation continues into 2020, “normalization” will likely start to unfold. “The industry needs to achieve higher pricing, but not so much so that it incentivizes unwarranted new build speculation,” said Daniel. “As for how this impacts the research business, I think the need for industry market intelligence, as well as benchmarking, will remain important. Research takes on a more prominent role as companies delve deep into their respective strategic planning endeavors and it is always fun to assist them when help is needed.”

One of Daniel’s most valued resources for his industry research is the AESC itself. His first experience was in 2009, at Lake Tahoe, where he gave his first presentation as a representative of Simmons Energy. “I was quite nervous,” he recounts, “but nobody threw tomatoes at me.”

Since then, he has spoken at multiple AESC events over the years and always looks forward to meeting new members and hearing their stories.

“For me, the biggest benefit of my AESC membership is the ability to meet others in the sector and learn from their experiences,” said Daniel. “In light of the current market woes, now is the time when all well service companies should take on a more active role within the AESC.”

BEST PIECE OF ADVICE YOU HAVE EVER RECEIVED Tell the truth.

FAVORITE AUTHOR

I enjoy Billy Graham’s books.

FAVORITE QUOTE

“Dare to be great.”

FAVORITE MOVIE

Band of Brothers HBO series HOBBIES/INTERESTS

Cooking BBQ

FAVORITE GETAWAY

Switzerland

PEOPLE WOULD BE SURPRISED TO LEARN THAT . . .

My parents have consecutive social security numbers.

By Chip Minty

At a time when drillers can tap vast expanses of shale rock layers and bring forth what seems like endless supplies of oil and natural gas, they are now facing a new kind of rock that few companies can crack.

Hardened by weak energy prices, defaults, bankruptcies and sagging bond returns, banks and energy investors are turning away from oil and natural gas producers, creating a credit crisis that is slowing production activity across the country.

Meanwhile, the winds of climate change are blowing in the financial industry as a growing number of large banks are being pressured by environmental groups to stop investing in oil and natural gas exploration.

According to a report from Hayes and Boone’s Energy and Restructuring Practice Group, 2019 was not a good year for the oil and natural gas industry. The firm cites 50 energy company bankruptcies in just the first nine months of 2019, topping the bankruptcy pace set in 2018 when 48 energy companies failed over the full course of the year.

And the storm may continue as debts come due and lenders lose interest in a market where higher oil prices are a distant memory.

Citing data from Moody Investment Services, Bloomberg reports American oil and gas producers have about $93 billion in debt coming due by the end of 2023.

If oil prices were $100 per barrel, as they were in 2014, this might not be a problem. However, today’s market is only about half that, and there are signs investors are wondering how the industry will pay the money back, industry watchers say.

When the oil slump began five years ago, the subsequent cash crunch forced many companies to seek help from private equity firms, hedge funds and others. But those lifelines are not likely to be available again, KeyCorp Energy Analyst Leo Mariani told Bloomberg.

“The credit markets were open,” he said. “Now, the thinking is, if oil never returns to $100, do I really want to refinance these guys.”

The attitude has changed since the last downturn, energy strategist Michael Bradley told Oilprice.

Investors are no longer interested in helping drillers grow their shale production. Now, they’re looking for profits and money returned to shareholders, Bradley said.

Most people are saying we don’t want you to spend money on growth. We want you to give the money back because you guys are a bunch of dummies,” he said.

Bradley believes $30 billion to $40 billion in bonds held by energy companies are now at risk. These companies have little choice but to seek bankruptcy protection and restructuring if they hope to see another oil boom, he said.

As drillers face a changing financial climate, the banking industry is coming to terms with the climate change issue, and at least one major bank has succumbed to its pressure.

At the end of 2019, Goldman Sachs announced it would no longer finance new oil exploration or drilling in the Arctic, becoming the first U.S. bank to make that decision. The bank’s move came amid pressure from Native American groups that have been pushing Wall Street to stop financing oil and natural gas projects in some of the world’s fastest warming regions, according to Oilprice.

In addition to Goldman Sachs, groups are targeting JPMorgan Chase, which has financed more fossil fuel projects than any other financial institution in the world, Oilprice reports. Others include Wells Fargo, Bank of America, Citigroup and Morgan Stanley. Together, those banks have loaned the fossil fuel industry nearly a half trillion dollars since the Paris Climate Accord was ratified in 2015.

By Chip Minty

With the ravages of 2019’s stagnant oil and natural gas market in the rear-view mirror, many in the industry are looking for good news this year. But the potential for change may still be a long way off, industry watchers say.

“The outlook for 2020 does not look great,” said Dan Eberhart, a Forbes contributor and energy company executive. “Oil prices could fall even further before seeing any meaningful recovery, unless OPEC deepens its cuts.”

Once the industry makes it through the next year or so, relief may be on the horizon, he said.

“It’s the 2021-2025 timeframe where things could get more interesting. Experts generally agree that growth in U.S. shale oil production is now slowing. New shale supplies have single-handedly been satisfying the increase in global oil demand over the past two years, but that trend could be in jeopardy starting as early as next year,” said Eberhart, who is CEO of Canary, one of the largest privately owned oil field service companies in the United States.

Those views are affirmed by the U.S. Energy Information Administration’s latest outlook, which predicts tightening domestic oil supplies in 2021 as production in the U.S. slows. Globally, the agency says world production will fall by nearly 200,000 barrels per day in 2021, as OPEC members sustain production cuts to support higher oil prices.

The agency shares a similar outlook for natural gas, saying U.S. gas prices will fall in 2020, but they should rebound next year.

Beginning in mid-2020 and into 2021, the EIA expects falling U.S. oil production to drive the market higher, with an average WTI price of $59.50 per barrel in 2020 and $61.50 in 2021.

“The pace of the shale slowdown is a critical determinant in global oil market activity in the coming year,” Eberhart said, “but opinions vary widely on the subject.”

While the EIA expects U.S. oil production to grow by 12 million barrels per day in 2020, other industry watchers believe that estimate is too bullish, he said. U.S. producers cut drilling activity sharply in 2019, demonstrating more capital discipline amid persistently low prices and an investment community that is reluctant to loan drillers more money.

Meanwhile, the industry’s inventory of drilled but uncompleted wells is falling fast. Producers are bringing on wells to maintain their production without having to hire drilling rigs. That may change soon, Eberhart said.

He cited a recent Raymond James report that indicates the industry’s inventory of drilled but uncompleted wells could reach critically low levels as early as February. When that happens, producers will have to go back to drilling, a prospect many operators may not be able to afford.

Some industry watchers expect oil production growth to slow this year and perhaps even stall in 2021, adding fuel to the EIA’s outlook for higher WTI prices next year.

Meanwhile, U.S. natural gas producers have become so efficient and productive that they find themselves in a glut that may take a while to fade, the EIA says. Additionally, demand from the power industry is expected to fall in 2020 and 2021, partly as a result of growing energy production from renewables.

Demand from industrial users will be nearly 5 percent higher in 2020, then remain at that level through 2021 as U.S. production declines by nearly 1 percent next year. Natural gas prices will average $2.33 per million British thermal units in 2020, then rise by 9 percent in 2021 due to declining production growth, the EIA says. Through it all, Eberhart sees dynamics in the market that could bring a turnaround after a half dozen years of challenging times.

“Investors would be wise to remember that oil is a cyclical commodity. It won’t stay lodged at recent levels forever. And if you look closely, it’s not hard to see how oil prices could rally substantially over the next two to five years.”

By Chip Minty

Despite an industry-wide drilling slowdown, U.S. oil production continues its march through record territory, posting a new all-time high for 2019, and the U.S. Energy Information Administration forecasts more record-breaking production in 2020.

Consumers are reveling at the prospect of continuing cheap fuel for their gas-guzzling SUVs and muscle cars as the EIA reports U.S. gasoline demand hit a record high last summer, reaching 9.93 million barrels per day.

Market watchers are scratching their heads, however, wondering when the shale revolution will finally take a pause from its meteoric growth. After all, the price of oil is nothing to brag about, and it hasn’t been for several years.

Still, U.S. production continues to climb, eclipsing the 13 million-barrel-per-day mark last fall, and the EIA forecasts average daily oil production will reach a record 13.3 million barrels per day in 2020, and 13.7 million in 2021.

The EIA acknowledges the U.S. rig counts are down. In fact, they are down a lot. Houston-based Baker Hughes reported in January that 676 rigs were drilling for oil, down nearly 190 rigs from January 2019.

This is not surprising considering WTI averaged in the mid $50s last year. It’s part of the reason why banks and other lenders have turned away from new drilling projects.

So why is output continuing to climb? The EIA says drillers have improved rig efficiency and technology advancements have improved well productivity.

Others say producers are tapping their DUCs, or wells that have been drilled, but were not completed. Producers have banked thousands of DUCs over the years, and now they are coming in handy, allowing production growth without the cost of drilling new wells.

Through the course of 2019, producers gradually increased the number of DUCs they are completing each month, said Seeking Alpha writer Zoltan Ban. Starting with only four DUC completions last March, producers increased to more than 200 DUC completions in September.

Through November of last year, producers had completed about 800 DUCs in 2019, said Ban, a commodities investment columnist who has been contributing to Seeking Alpha for seven years. At some point within the next year and a half, Ban says the industry will no longer have enough DUCs

to support production growth. When that happens, production is likely to decline.

Whatever the reason is behind the growth, there seems to be agreement that output will slow within the next year or two.

The EIA forecasts production will decline over the next couple of years. In 2020, average daily output will grow by 1 million barrels, down from a growth rate of 1.3 million barrels in 2019. In 2021, the growth rate will be 0.4 million barrels.

What does this mean for oil prices? Over the longer term, the EIA expects Brent and WTI to start rising into the $60 range, provided OPEC members don’t increase production.

While the EIA predicts higher prices will spur another cycle of growth, others question whether producers can climb back into record territory.

In a recent interview on CNBC, market consultant Chris Weafer said many people are concerned that U.S. production growth might have reached its peak. Commodities writer Ban counts himself among that group.

“There are few prospects for better days ahead,” Ban says. “With the growth story largely gone, there are few compelling reasons to consider investing in the sector, especially given the oil and gas price outlook for the next few years.”

This is a familiar sentiment the industry has heard from Wall Street many times in the past, and, each time, the industry has come roaring back, so time will tell.

By Chip Minty

For the first time in history, the United States has the capacity to generate more power from renewable energy sources than it can from coal, according to a 2019 Federal Energy Regulatory Commission (FERC) report.

If that’s not a harbinger of coal’s pending demise as an American energy resource, famed conservative investor Warren Buffett may have dealt an affirming blow when he turned his back on coal last fall, saying wind and solar are more economical.

With renewables flexing their muscle against coal, when will wind, solar and other renewables set their sights on natural gas? Some experts and advocates say that day could be just around the corner.

It turns out 2019 was a banner year for the renewable energy industry, breaking into the national energy conversation like never before with proclamations of victory over coal, the most politically vulnerable of the fossil fuels.

Media ranging from CNN and The Financial Times to Oilprice.com have reported on PacifiCorp’s plans to shut down Wyoming coal plants in favor of new wind and solar generation facilities. The electric utility is the largest grid operator in the Western U.S., and it is owned by Buffett’s Berkshire Hathaway holding company.

In an Integrated Resource Plan filed with states last October, PacifiCorp said it plans to phase out the coalburning power stations it owns in Wyoming in favor of a combination of renewable generation capacity and energy storage technology. The company cited the decision as a cost-cutting measure, pointing out that it would be cheaper to close the plants and switch to wind and solar than to keep them running.

The report was not welcome news in Wyoming, which supplies 40 percent of the nation’s coal, according to The Financial Times. Gov. Mark Gordon responded in December by asking the state’s utility regulator to investigate the PacifiCorp plan.

The power provider’s strategic shift was a shock to many, considering PacifiCorp is the largest holding in Berkshire Hathaway’s energy portfolio.

The news also sparked headlines questioning the future of coal amid the rapid growth of renewable energy.

“America’s coal industry has already been left in the dust by natural gas,” proclaimed CNN business writer Matt Egan. “Now it’s under immense pressure from the renewable industry.”

Egan cited a 2019 FERC report that indicates the renewable energy sector has a slightly larger installed power generation capacity than coal.

But the FERC report only measured capacity and not the amount of power the two actually generate.

This is where coal still reigns supreme over the entire renewables portfolio, including hydropower, wind, solar and biomass.

According to the U.S. Energy Information Administration, more than 27 percent of the nation’s power is generated from coal, while about 17 percent is derived from renewables. Advocates admit that renewable generation will not surpass coal on an annual basis anytime soon, but they say the day will come.

Meanwhile, advocates are setting their sights on when renewables overtake natural gas, and at least one group suggests it won’t be long.

Based in Boulder, Colo., the Rocky Mountain Institute says the cost effectiveness of renewables could overtake natural gas as soon as 2035.

“We find that the natural gas bridge is likely already behind us,” the organization said in a September 2019 report.

The organization says further investment in natural gas pipelines and power plants could leave tens of billions of dollars in flux as the economics of renewable generation improves, creating a cost advantage over gas.

Investment advisor Morningstar Financial agrees that a showdown is on the horizon.

Natural gas will grow its foothold as the nation’s leading fuel for power generation through 2030 while renewables take over second place, Morningstar said in an October 2019 analysis.

“We think this sets up a battle for market share by the end of the next decade: natural gas versus renewable energy.”

“Renewable energy has policy momentum, and its costs are now competitive with natural gas generation, even at today’s low gas prices and without tax subsidies. But gas generators offer grid reliability, a key competitive advantage.”

So, which one wins? We already know where Warren Buffett’s money will be.

By Brian Blake

AS A KEY MEMBER IN REPUBLICAN LEADERSHIP IN THE HOUSE, WHAT ARE SOME OF THE ISSUES YOU ARE MOST INTERESTED IN AND CONCERNED ABOUT?

I’m interested in any issue that affects the western states and rural America because so many of these entities have been forgotten. We all want affordable energy; we all want clean water; we all want a healthy workforce. We need to change the rules and regulations so everyone can participate. Everyone can be an entrepreneur.

Those of us west of the Mississippi have fewer votes. These are teaching moments. We need to teach them why the west is so special. We are a critical part of the interface of America! We are all about solutions and what it takes to get to a yes.

OVER THE LAST DECADE, THE UNITED STATES HAS DRAMATICALLY INCREASED DOMESTIC PRODUCTION OF OIL AND GAS. IN YOUR OPINION, WHAT EFFECT HAS THIS HAD ON U.S. NATIONAL SECURITY?

First of all, this has taken us to where we belong as the leader of the world in oil and gas production. It takes that away from Russia and China, and helps the U.S. in dictating foreign policy. We are truly exporting freedom beyond our borders because our oil and gas is cleaner and more efficient.

Plus, it brings benefits back to our taxpayers and our schools. The whole thing is phenomenal.

SOME PRESIDENTIAL CANDIDATES HAVE PLEDGED TO HALT OIL AND GAS LEASING ON FEDERAL

LANDS AND BAN HYDRAULIC FRACTURING. DO YOU THINK THESE CANDIDATES WOULD FOLLOW THROUGH WITH THESE PROMISES AND DO YOU THINK THEY ARE AWARE OR CONCERNED ABOUT THE IMPACT ON U.S. JOBS AND ENERGY SECURITY?

Yes, absolutely they would follow through. We’re already seeing that in California and New Mexico.

The impact of banning this would be significant. During the previous administration, we only had two percent growth. Now, we’re second to no one. This is truly empowering.

The Democrats need “victims” who are dependent upon the government. Today, however, jobs are trying to find you!

Things are upbeat and we need everyone on the same team. We’re the leader in climate change directives. It’s truly a renaissance.

WHAT IS THE PUBLIC LANDS RENEWABLE ENERGY DEVELOPMENT ACT AND HOW WILL IT BENEFIT INDUSTRY AND STATES?

Public Lands Renewable Energy Development Act will help to streamline the permitting process for all energy projects on public lands, including solar, wind and geothermal. And, it helps the public by getting money back for these states. This is all about what are you for, not what are you against.

WHAT ARE YOUR THOUGHTS ABOUT THE GREEN NEW DEAL AND LEGISLATIVE EFFORTS TO ADDRESS CLIMATE CHANGE?

I believe the climate has always been changing. And, while man has played a part in it, there is no reason

for us to run around like Chicken Little screaming “The sky is falling!”

The Green New Deal is an assault on fossil fuels, yet wildfires cause more pollution.

When you look at the Paris Climate Report, you can see that no country has met their goals. The U.S., however, is making great strides. We have cleaner emissions because of technology. If China and India were held to our standards, we could all enjoy a breath of fresh air (no pun intended!).

We need to change the way we are thinking to empower people, not encumber them. We should embrace dynamic forestry because the forests are the best filters for our planet.

WITH THE 2020 ELECTION QUICKLY APPROACHING, WHAT ARE SOME OF THE MOST IMPORTANT ENERGY ISSUES THAT POLICY MAKERS AND VOTERS SHOULD BE CONSIDERING AS THEY WEIGH THEIR OPTIONS IN LOCAL, STATE AND FEDERAL ELECTIONS?

We are an exceptional country, one where there are rewards for taking a chance. There is power in business and you have a say in your destiny. The president is delivering on what he said, but we need to make sure the government is not overreaching.

We can have our energy, our tourism and protect our endangered species with an “all of the above” mentality regarding our public lands. People need to understand the issues because they can fix this, not the federal government.

When it comes to land, water and minerals, we do it better than any other country in the world. Environmental protection is important, and we should do it the American way, not like China or anyone else. For us to pay for public lands, we need businesses. We cannot count on the government (and we know communism doesn’t work). Everyone has to have skin in the game.

This election is about empowerment. There is a way, but we cannot act like victims. The sky is not falling. I want clean air and clean land. We can get there, but we have to empower people, not block their progress.

We cannot get there by creating more regulations, more rules, and more fines. The Western Caucus has turned a corner. From the north, east, south and west, we have a breadth of skillsets. We listen to each other, and we empower people to get things done. This is why people are following the caucus. It’s all about success, not failure. +1.713.849.7400 wellcontrol.com Follow us:

At one time, energy was a non-partisan issue. Both parties agreed that we need additional supply to provide higher standards of living for all Americans. Times are changing and traditional carbon-based fuels are under greater scrutiny in the age of increased climate activism.

The real issue is one of money. Conventional banking services, along with private equity, have funded the growth of unconventional oil and gas, but these institutions are now restricting the industry’s access to capital. Moreover, activists are adding additional pressure by pushing for broad divestment from carbon-based fuels. In the following paragraphs, I will discuss the role of financing in the expansion of America’s unconventional revolution along with changes in market conditions that required firms to be more circumspect in their investments. Moreover, I will briefly talk about campaigns focused on divestment of oil and gas companies by financial firms.

Between 1980 and 2010, North American production lost more and more ground to other international producers. More specifically, in 1980, North America was responsible for 20% of world crude production. By 2010, that figure had fallen to 15% of the world total.

For decades, American producers were accustomed to a diminishing role in the global market. In the early part of this decade, the role of the United States began to change because of the growth and development of unconventional oil and gas. Energy scarcity was a prevalent anxiety during the preceding decades and a type of energy euphoria began to set in.

Many policy makers began to believe the United States could become energy independent and remove one of the greatest threats to America’s economic growth. The promise of unconventional oil and gas and the profits from production caused many financial firms to increase their funding of projects. The new “energy revolution” would “provide all kinds of investment opportunities.” The private equity industry raised over $185 billion between 2009 and 2015. Demand

for participation was so great that numerous funds collected more money than they requested. Between 2004 and 2013, annual capital spending for the world’s 18 largest oil companies increased almost four-fold, from $90 billion to $356 billion. The oil and gas industry, flush with investment cash, went on a shopping spree. E&P companies implemented aggressive development plans, which required more services from drilling and oilfield service contractors. For instance, in October 2014, the crude oil drilling rig count hit an all-time high of 1609 working rigs. Well servicing rigs reported all-time highs around the same time as well. In late 2014, it all came crashing down with OPEC’s refusal to take supply off the market to counteract growing global oil storage.

In the aftermath of the first shale boom, market participants, investors and industry critics were more circumspect about the future of the industry. It became clear that market forces still governed commodities such as oil and natural gas. The market would have to correct itself before the industry could move forward.

By 2015, banks began to re-adjust their lending practices and lessen their exposure to the oil and gas space. Regulators required banks to re-assess their portfolios and adjust their lending. As a result, it created a financing vacuum for smaller independent producers, which led to a growth of private equity and hedge fund investment in companies with prime positions in the Permian Basin. In 2016, U.S. oil and gas producers raised $56.6 billion in additional capital. U.S. producers responded by increasing output by 36% between January 2017 and December 2018.

As the unconventional revolutions concluded its first decade, analysts began to question the underlying assumptions about U.S. production growth. For nearly a decade, companies were plowing more and more capital into projects with very little returns to investors. On average, the industry had negative cash flow per barrel of oil equivalent produced. Banks had restricted available credit lines to oil companies. Now, private equity and hedge funds started requiring

Wyatt Boutwell

their E&P partners to spend within cash flow and focus on profitability rather than raw production growth. And, smaller producers are left with limited options as they look to the future. Their borrowing base has been diminished, their best assets have been drilled and they have maximized the amount of savings they can extract from their contractors. They are confronted with an economic “keep it in the ground” movement as the financing structures will slow down production. Investor activism is merging with economic realities to broaden the campaign to prevent oil and gas production.

The economic headwinds are being compounded by campaigns to undercut the financial framework of oil and gas. While fundamental financial analysis scrutinizes a firm’s financial viability, activism makes a value judgment that the oil and gas industry should not exist and then strategizes on methods for undercutting its viability. Divestment is one such strategy.

Financial divestment on the part of the environmental left began in earnest in 2011. Initially, it was a studentled movement that focused on removing fossil fuel investments from university endowments. With the help of environmental advocacy groups such as 350.org, the divestment movement expanded into the broader financial services space. In 2014, assets committed to divestment totaled $52 billion. By 2018, this number had grown by over 22,000 percent to over $11 trillion or 16 percent of global equity markets. Some financial firms believe the oil and gas industry must re-think its business plan to avoid replicating the demise of the coal industry. More specifically, one Goldman Sachs report noted that activist divestment was very successful in eroding the valuation of coal companies, and the activists have shifted their attention to oil and natural gas.

The result of divestment reduces marketability for publicly-traded oil and gas stocks and investment interest in their privately-held counterparts. Surprisingly, the movement hasn’t had the desired effect on the financing structures of the super-majors (Exxon Mobil, Chevron, etc.) because, as Bill Gates observed recently, they are awash with cash. It does

add burden to heavily leveraged market participants and may restrict oil and gas development in the United States through financing constraints for smaller companies.

Divestment activists are eager to remove carbon emission and believe that divesting publicly traded companies in the developed world will make a significant impact on emissions. They may have good intentions, but their approach will lead to higher emissions. National oil companies (NOCs) (i.e. National Iranian Oil, China National Petroleum Corporation, etc) are responsible for 90% of the world’s oil production and their ownership structures are immune to divestment strategies. If successful, divestment will result in the most environmentally sound producers being sidelined while NOCs absorb their market share. The NOCs will produce more oil and gas in the least environmentally sensitive manner. More production from the worst producers is counterproductive to the goals of divestment activism. Alas, the consequences of divestment are often lost on its proponents.

The oil and gas industry is facing challenges – both old and new. Shale caused a euphoria that allowed many companies to live beyond their means. Euphoria was followed by increased scrutiny by the sector’s creditors. Some would say this paradigm is as old as the industry itself.

The new, and more troubling, reality is that divestment activists have discovered new tools for opposing oil and gas development. The power of the purse strings has been a tool for culling the bad actors in an industry, and has now been weaponized by divestment groups to destroy the industry as a whole.

A company’s culture is its beating heart — the set of values, mission and brand that guides every decision and allows the company to thrive. It just makes good business sense for health and safety to be part of that culture.

But how do we gauge safety culture?

For too long, companies have driven safety culture with top-down policies and programs. With this approach, most of the company’s “safety” happens in an office, isolated from the field and the workers it intends to safeguard. Verbose policy documents are written, sign-in sheets are filed and stacks of reports are archived after weeks of delays.

Instead, safety should connect everyone in an organization. Employees should be on the lookout for issues. Supervisors should be aware of critical issues immediately. Employees should be engaged and receive timely and measured feedback. Open issues should be tracked and addressed. Equipment inspections should be up-to-date and important information should be distributed in real time.

Never-ending advancements in networks, hardware, and software development allow companies to strengthen as they simplify, improve their bottom lines, and foster a healthy, organic, and genuine culture of safety.

PRIORITIZE REPORTING AND USE DATA FOR CHANGE

It isn’t uncommon for safety culture to be based strictly on a reduction of injuries, motor vehicle accidents, or other unwanted incidents. These measurables are important, but if the focus is only on past incidents, the opportunity to learn from the things that did not occur, but could have, is lost.

The reporting of the big stuff is usually done well, but consider prioritizing close calls, near misses and general observations. Analyzing this information can provide greater insight into how well your safety program is really performing. Use this data to drive changes where they are most needed and reduce the chance of future injuries or hazards.

Behavior-based safety programs, such as near miss and observation reporting, give workers the opportunity to work their “safety” muscles by reporting things they see, both safe and unsafe. Situations occur every day that may not be actual incidents, but are seen as significant to the worker experiencing the event. These near miss events are the best “free and damage-less” lessons we can learn and are vital for a strong and safe work environment.

The key to good, frequent participation is to provide a quick and convenient method for workers to submit reports and have access to information. Making note of a safety issue needs to be as easy as posting to Facebook. Traditional paper forms or unnecessary questions are hurdles that restrict the ease of reporting. Technology easily replaces paper forms, creating a quick and easy way to increase worker participation, improve data quality and expedite improvement.

Many safety programs rely on assumptions made by leadership because they do not have access to the necessary information to make informed decisions. Real, raw, useful safety information comes from the front lines, not the boardroom.

Technology has an opportunity to significantly impact culture by getting everyone involved, which leads to more accurate understanding of the attitudes, conditions and actions of the workplace. Front line workers know the shortfalls better than anyone. Whether it is a lack of resources, insufficient training, or improper tools, shortfalls are well known by the workers who experience them firsthand.

If left ignored, shortfalls create inefficiencies, cost money and put workers in an unsafe position as they perform tasks in a “last resort” mentality. Knowing the shortfalls, providing timely communication and applying the necessary fixes will strengthen not only safety culture, but also service quality and operational efficiency.

For the reporting process to positively affect safety culture, timely feedback is essential. Many groups implement safety reporting, but few actually use the data. Front line workers need feedback, whether in the form of appreciation, correction, direction or simple discussion. Coaching makes a difference, and leadership must know how, what and when to coach. The simple phrase “Great catch” can stick with someone for a long time and not only makes it clear they did the right thing by reporting the issue, but encourages them to repeat the behavior.

Feedback should come straight from company leadership, which means a safety administrator (or any other company official) calls, texts, emails, or talks in-person with the employee about a report. Email works especially well when one official can copy in other officials to discuss and praise a good report. Digital reporting systems make this easy by simply replying to digital alerts. This is something paper cannot do.

A key component of effective feedback is timeliness. Nothing is more damaging to safety culture than “crickets”, so provide feedback quickly.

Ensuring equipment is functioning properly and is safe for use is a critically important part of the reporting process. Some safety equipment requires frequent inspection, which must be documented. Examples include fall protection assets, fire extinguishers, and catwalk systems. Equally important is the pre-use inspection for equipment such as forklifts, cranes and other heavy equipment. Equipment safety is critical to achieve overall workplace safety, and is certainly part of the advancement of a safety culture.

The use of technology can assist with upkeep, provide proactive reminders when inspections need to occur, as well as the ability to complete and document. For those working around equipment, quick access to historical data and equipment details help to ensure compliance. If any item fails inspection, technology can automatically notify key personnel who can then

remove the equipment from service as needed. Drop the spreadsheets and paper inspections and let the system manage and document inspection schedules.

When environmental, health and safety departments function like a well-oiled machine, it’s easier for all workers to understand their roles and contribute to safety programs. Technology creates an easier path to standardization. It engages employees at every level, making it easy to submit reports, distribute tasks and access to up-to-date information.

Standardization does not have to be complicated, but it should be customizable. Whether working with web or app-based tools, the best technology is wet cement. Software should allow modification of terminology, processes and procedures to reflect the company’s culture. Software should work for you, not the other way around.

Technology provides a better way… and ultimately becomes the heartbeat for a positive safety culture.

BITCO knows oil and gas. When times get tough, BITCO has been there. Since 1917, BITCO has been offering high quality insurance protection and services to industries at the core of the American economy- with the stability you need and deserve.

If you’re looking for broad insurance protection for your business at competitive rates, look no further than BITCO. We understand your business, and we tailor insurance packages specifically for today’s energy companies.

CHAD TAYLOR

DANIEL GONZALES

ANTONIO D e L a FUENTA President of Operations

Northgate Country Club 17110 Northgate Forest Dr. Houston, TX 77068

March 30, 2020 9:00 am Calcutta 11:00 am Tee Time

3-Man Scramble Format, Fee Includes: Golf Fee, Range Balls, Breakfast, Lunch, Mulligans & Door Prize Tickets.

(2 Team Reg, Program & Course Recognition)

$1500 (1 Team Reg, Program & Course Recognition)

(Program & Course Recognition)

(Program & Course Recognition)

We are also in need of cook teams!! If you are interested please contact Mark Reed for more information.

Make Checks payable to: AESC Scholarship Fund

• Mail to: AESC, Attn: Roni Ashley, 121 E. Magnolia Street, Suite 103, Friendswood, TX 77546

• Email rashley@aesc.net or fax form to 713/781-7542.

• More Info Contact:

• Gay Wathen, 713-301-6610 or gay.wathen@nov.com

• Mark Reed, 713-480-9721 or mreed@mustangcat.com

The Internal Revenue Service requires the AESC Scholarship Fund to substantiate charitable contributions of $250 or more by w ritten acknowledgment. In addition, quid pro quo contributions in excess of $75 are deductible only to the extent that the contribut ion exceeds he value of any goods or services provided by the charity. The AESC Scholarship Fund must provide a good faith estimate of th e value of any goods or services provided. For purposes regarding individual entry fees, the AESC estimates the value provided to be 50% of the fee. The AESC does not represent itself as an expert on tax matters. Please retain a copy of this registration for tax pu rposes. All participants should verify the tax implications regarding all non ‐profit events.

The East Texas Chapter met in January in Kilgore to hear Meg Chase speak about the political climate in the Louisiana Legislature, and update the group on how that might impact the oil and natural gas industry in Louisiana and Texas.

Chase, a representative of the Louisiana Oil and Gas Association, provided a favorable forecast for the industry in 2020, which was good news to hear, said East Texas Chapter Chair Brent Hill.

In other news, Hill says the chapter has started planning a skeet shooting event to raise funds for the chapter and the AESC scholarship program.

“More details about the event will be coming,” he said. For updates, contact Hill at bhill@higginbotham.net.

The North Texas Chapter is partnering with the North Texas Exploration and Production Safety Network for its future meetings, said Chapter Chairman Chad Tregellas.

The group’s first meeting will be Feb. 21, and will feature a safety presentation from Phillip Williams, a subject matter expert on North American occupational health and safety laws and regulations.

An implementation manager for SHOEBOX Ltd., Williams focuses on the design and delivery of innovative hearing testing solutions as part of a customer hearing conservation program. He also promotes compliance with laws and regulations pertaining to hearing healthcare programs associated with SHOEBOX products and services.

He will speak to the group about hearing conservation and testing.

OSHA Compliance Assistance Specialist J.P. Walsh also will be on hand to give the group an update on federal health and safety laws and regulations, Tregellas said.

WILLISTON BASIN OPENS NEW YEAR WITH FEBRUARY MEETING

The Williston Basin Chapter is looking forward to an active 2020 by kicking off the new year with its first meeting on Feb. 20, said Chapter Chairman Lucas Giovig.

“The Williston Basin Chapter is restarting regular meetings in February,” he said. “The first meeting will be at the Mainstay Suites in Williston, North Dakota.”

He said members can contact him at lgjovig@gowireline.com for more information.

Members of the Natchez Chapter will hear perspectives on the health of the oil and natural gas market going into 2020, said Natchez Chapter Chairman Matt Brough.

On Feb. 18, the chapter will welcome oil and gas market expert Peyton Feltus, president of Randolph Risk Management, an independent consultancy that provides price risk management to producers, processors, marketers and end users of crude and natural gas.

Brough said Feltus, a native of Natchez, speaks to the chapter once a year to update members about market conditions.

GULF COAST CHAPTER TO HOST AESC’S NATIONAL GOLF TOURNAMENT

The Gulf Coast Chapter helped the AESC’s national office start a committee last year to restart the Bobby Gill Golf Tournament. The 2019 event served as the AESC’s National Scholarship Tournament, said Chapter Chairman Jordan West.

“Due to its great success at the Northgate Country Club, we will be helping them again this year,” West said.

The event will be held on Monday, March 30 at Northgate Country Club in Houston.

Members of the AESC’s California Chapter mobilized in January to attend a public hearing held by the Kern County Board of Supervisors in Bakersfield. Issues involved recent state initiatives that could destroy California’s oil and natural gas industry.