EDITORIAL

Editor-in-chief

Said Masoud Almashani

Executive Vice President and Group Editor Mayank Singh

Editor Oommen John P

DESIGN

Director Production – Print & Digital

Ramesh Govindaraj

Chief Photographer

Rajesh Rajan

Cover concept

Rakesh Radhakrishnan

MARKETING

Associate Advertising Director

Shivkumar Gaitonde

Business Manager

Dhanish Pillai

CORPORATE

Chief Executive Officer

Atulya Sharma

Distribution United Media Services LLC

Published by

United Press & Publishing LLC

PO Box 3305, Ruwi, Postal Code - 112 Muscat, Sultanate of Oman

Tel: (968) 24700896, Fax: (968) 24707939

Website: www.umsoman.com

All rights reserved. No part of this publication may be reproduced without the written permission of the publisher. The publisher does not accept responsibility for any loss occasioned to any person or organisation acting or refraining as a result of material in this publication. OER accepts no responsibility for advertising content.

Copyright © 2025 United Press & Publishing LLC

Printed by Oman Printers & Stationers Ltd. Co. S.P.C.

Correspondence should be sent to:

Oman Economic Review

United Media Services

PO Box 3305, Ruwi 112, Sultanate of Oman

Fax: (968)24707939

Website: www.oerlive.com

For editorial enquiries: 99884854

For advertising enquiries: 99267159

OER’s annual listing of the 100 Most Influential CEOs in Oman highlights exceptional leaders who have attained remarkable success through their vision and determination.

With a deep understanding of key market trends, they excel at guiding their organisations through challenges while capitalising on emerging opportunities. Their proactive mindset and steadfast commitment serve as an inspiration for aspiring executives. According to PwC’s 28th Annual Global CEO Survey, 58 per cent of CEOs around the world expect global economic growth to increase over the next 12 months. The report, which surveyed 4,701 CEOs across 109 countries and territories, including in Bermuda and the Caribbean, also finds that 42 per cent expect to increase headcount by 5 per cent or more in the next 12 months – more than double the proportion who expect headcount decreases (17 per cent), and up from 39 per cent last year. Within the global Financial Services sector, 64 per cent of CEOs believe economic growth globally will increase, and in the Caribbean region, 67 per cent of CEOs agree it will improve.

The most successful companies are steered by CEOs who share a crucial characteristic: meticulous attention to detail. These accomplished leaders possess a long-term vision focused on creating lasting value and employ various strategies to ensure no detail is overlooked. They inspire their teams to unite towards common goals while adeptly adapting to shifting market dynamics and customer needs. Their influence extends beyond their leadership roles, rooted in their achievements and transformative capabilities. Ultimately, their success lies in their ability to balance short-term and long-term objectives while remaining true to their core values and vision.

The selection process for the top 100 CEOs was thorough, involving months of research and due diligence by the OER team. While we do not consider the 100 Most Influential list to be exhaustive, we hope our readers will find it highly informative.

John

Sign up for OERLive's daily WhatsApp updates on economy, lifestyle, and technology. Send us a WhatsApp message with the word “OERLIVE” on 91242930

Your cover story on Oman’s Largest Corporates for 2024 made an interesting read. In the year ending December 2024, the revenues of Oman’s 20 largest companies rose by RO293mn compared to 2023. The total revenues for the OER Top 20 companies reached RO10,496mn, reflecting a three percent increase. However, overall corporate performance in 2024 was impacted by substantial losses incurred by several firms, leading to a 17 percent decline in profits, which fell to RO1,342mn from RO1,615mn in 2023. As of December 2024, the total market capitalisation of the OER Top 20 companies stood at RO10,019mn, marking a notable increase of approximately 45 percent from 2023, largely due to several significant initial public offerings (IPOs) in 2024. However, by March 31, 2025, this market cap decreased to RO9,510mn. The OER Top 20 companies accounted for 36 percent of the total market capitalisation of the Muscat Securities Market (MSM), which totalled RO27.6bn at the end of December 2024. In terms of market performance throughout 2024, the MSM demonstrated robust growth, bolstered by these new listings. The total market capitalization of the Exchange increased by 16 percent, reaching RO27.6bn, with gains exceeding RO3.9bn. This growth contributed to an 11 percent rise in total trading value for the year, while the number of traded securities surged by 45 percent, indicating a vibrant trading environment.

Adrian Murphy, MQ

Innovation in technology is no longer just about what is new — it is about what is meaningful. In a world driven by rapid digital transformation, breakthroughs like artificial intelligence, blockchain, and quantum computing are pushing the boundaries of what is possible. But beyond the headlines and hype, the real opportunity lies in how we apply these technologies to solve real-world problems and improve lives. As we move forward, it is essential to align innovation with purpose. That means designing AI that is not only powerful, but ethical and transparent. It means building smart systems that support sustainability, and creating digital tools that are accessible to all — not just the privileged few. The next chapter of innovation should be shaped not just by what we can build, but by what we should build.Collaboration will be key. Whether it is between governments and startups, researchers and industry leaders, or technologists and communities — progress happens when diverse minds come together with a shared vision. By fostering a culture that supports experimentation, continuous learning, and responsible design, we can ensure technology serves humanity, not the other way around. Moreover, embracing emerging technologies such as generative AI, spatial computing, and biotechnology offers exciting possibilities, but also new challenges. It requires us to rethink education, workforce development, and regulatory frameworks to keep pace with change.

Organizations that prioritize agility and human-centred innovation will be best positioned to lead this transformation. Ultimately, the future of innovation is not just about inventing what is next. It is about reimagining what is possible — thoughtfully, inclusively, and with impact. By committing to this vision, we can create a world where technology empowers individuals, strengthens communities, and drives sustainable growth for generations to come.

Oman’s Industrial Strategy 2040 is all set to drive economic diversification

Ilham Al Hamaid, General Manager, Corporate Banking, Bank Muscat shares how the bank has been a pioneer in offering state-of-the-art and innovative services and solutions for Corporate Banking customers

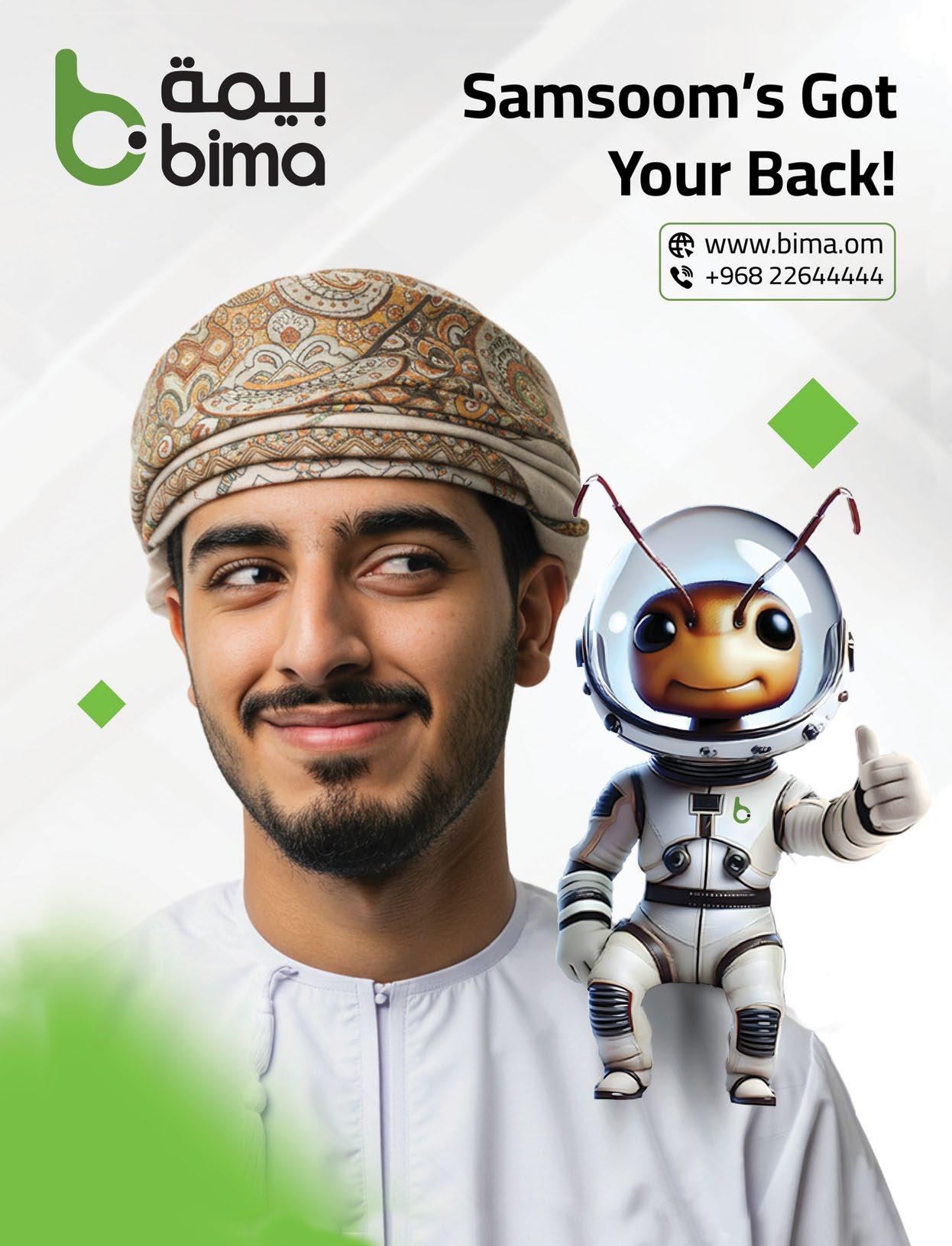

Through one of the nation’s most ambitious campaigns – Space Samsoom – Bima is redefining how Oman experiences insurance

Securado, a trusted cybersecurity organisations in banking, oil and gas, and manufacturing in Oman, has introduced a unique cybersecurity framework called

Oil prices rose as investors awaited news from US-China trade talks in hopes that a deal could boost the global economic outlook and subsequently fuel demand

The St. Petersburg International Economic Forum 2025 (SPIEF) continues to affirm its status as a major global platform for economic dialogue. Till date, representatives of over 137 countries and territories have confirmed their participation in the Forum organised by the Roscongress Foundation

Oman LNG

Oman LNG signed an agreement with Vitol Asia Pte. Ltd. to optimise Oman LNG’s LNG supply portfolio, marking another significant step in strengthening its global partnerships

Bank Muscat, the leading financial services provider in the Sultanate of Oman, announced that it successfully managed series 9 of the Sovereign Sukuk Issuance launched by the Oman Sovereign Sukuk Company, with a total value of RO100mn. The sukuk carries a 7-year maturity and offers an annual profit rate of 4.65 per cent. Bank Muscat was appointed as the official issue manager and collecting bank for the subscription, in collaboration with other local financial institutions. This mandate reinforces the bank’s leadership in executing major investment transactions within the Sultanate and across GCC capital markets. The Oman Sovereign Sukuk Company had opened the subscription window from May 27 to June 1, 2025, with the sukuk settlement scheduled for June 4, 2025. The sukuk was priced within a competitive yield range, with an average yield of 4.625 per cent, a minimum yield of 4.57 per cent, and a maximum yield of 4.64 per cent, reflecting strong investor confidence and market stability. The sukuk payouts will be made semi-annually on June 4 and December 4 each year until maturity on June 4, 2032. The issuance witnessed participation from all categories of investors, retail as well as institutional. The sukuk is structured in accordance with Sharia-compliant principles and is fully tradable on the Muscat Stock Exchange (MSX) at prevailing market prices. All allocation details and investor records will be maintained and administered by Muscat Clearing and Depository Company, as the central registrar and depository for the sukuk.

Commenting on the occasion, Khalifa Abdullah Al Hatmi, Deputy General Manager, Investment Banking and Capital Markets at Bank Muscat, expressed

pride in collaborating with the team at Oman Sovereign Sukuk Company and the Ministry of Finance, Sultanate of Oman for this successful issuance. He noted, “The Bank’s appointment as the official issue manager for the sukuk issuance is a testament to the company’s trust in Bank Muscat’s capabilities and leadership in managing major investment transactions for a range of corporate and institutional clients. The Bank, represented through its Investment Banking and Capital Markets division, has extensive experience in structuring and executing large-scale capital market deals, both on debt as well as equity side, and its specialised team is wellequipped to navigate evolving market dynamics and complexities. Bank Muscat is committed to supporting the growth of local financial markets by offering a comprehensive suite of banking and financial solutions tailored to institutional and retail customers alike.” The selection of Bank Muscat as the issue manager underscores its strong local, regional, and international reputation among individuals, corporates, and financial institutions.

In line with its ongoing commitment to supporting sustainable development initiatives with lasting social impact, Bank Nizwa, the leading and most trusted Islamic bank in the Sultanate of Oman, has announced the signing of a Memorandum of Understanding (MoU) with the Health Endowment Foundation (ATHAR). This strategic partnership aims to enhance the role of the health endowment sector in promoting inclusive development, aligned with the national priorities outlined in Oman Vision 2040. The agreement was signed by Khaled Al Kayed, CEO, Bank Nizwa, and Ahmad Abdullah Al Khanji, Chairman of the Executive Committee, Board Member of the ATHAR Foundation, in the presence of senior officials from both institutions.

The memorandum aims to strengthen institutional cooperation between the two parties, with Bank Nizwa providing logistical and technical support to the ATHAR Foundation in implementing its strategic and operational plans— particularly in the areas of endowment investment and the development of health-related projects with sustainable impact. The collaboration also includes capacity-building initiatives designed to enhance professional competencies, as well as promoting ATHAR’s financial services and activities through Bank Nizwa’s various communication channels. Under the agreement, ATHAR will maintain its primary banking relationship with Bank Nizwa and recognize the bank as its strategic partner across all relevant media platforms. Commenting on the occasion, Khaled Al Kayed stated, “At Bank Nizwa, we firmly believe in

This partnership stands as a model for effective integration between Islamic finance and the endowment sector, reinforcing our shared commitment to sustainable development and delivering long-term value to Omani society.”For his part, Ahmad bin Abdullah Al Khanji emphasised that the MoU represents a strategic step towards developing an integrated health endowment model based on partnership and specialization. He stated, “We are committed to advancing institutional and professional health endowment services that benefit all segments of Omani society. This partnership with Bank Nizwa will further strengthen our capabilities and expand our positive impact.”

Reaffirming its position as a distinguished employer of choice in the region, Sohar International was recently awarded the prestigious ‘Middle East Best Employer Brand’ award, an accolade conferred by the World HRD Congress in association with the Employer Branding Institute. Known for its rigorous and multi-tiered selection process—comprising expert recommendations, independent research, and jury evaluation by global industry leaders—the Employer Branding Awards celebrates organisations that exemplify excellence in talent strategy and forward-thinking people practices. Sohar International’s recognition underscores its steadfast commitment to fostering a performance-driven, inclusive culture—anchored in the belief that human capital is central to long-term value creation and institutional growth. Representing the bank at the ceremony, Mahira Saleh Al Raisi, Chief People Officer at Sohar International, attended the event and received the award on behalf of the bank—further highlighting the leadership’s active role in driving the bank’s people agenda forward.

Commenting on the achievement, Mahira Saleh Al Raisi, stated, “Our people are integral to every milestone we achieve and every transformation we lead. At Sohar International, we believe that sustained performance stems from an environment where talent is nurtured, ideas are valued, and purpose is shared. We approach human capital with the same clarity and ambition that drives our business strategy—ensuring our people grow as the organization evolves. From fostering inclusive leadership to building next-generation capabilities, our focus on empowering individuals at every level is a strategic imperative that supports our broader goals of being a resilient and future-forward institution. This recognition reaffirms that the investment we place in our people is both meaningful and measurable.”

Sohar International’s selection for the award was based on its ability to

United Finance Company SAOG has announced the successful completion of its privately placed, senior unsecured bond issuance, which was oversubscribed by 71 per cent. Strong investor demand enabled the Company to upsize the offer from the originally targeted RO10mn to a final issue size of RO15mn.

The bonds carry a fixed coupon of 7 per cent per annum, payable semi-annually, and will be listed on the Muscat Stock Exchange (MSX). ahlibank SAOG acted as Issue Manager and Collection Bank, while Al Busaidy, Mansoor Jamal & Co. served as Legal Advisor. Nasser Al Rashdi, CEO, commented, “The overwhelming response

to this offering reflects investors’ confidence in UFC’s financial strength and strategic direction. The additional capital enhances our balance-sheet flexibility as we execute our growth roadmap and continue to deliver innovative, customer-centric financing solutions.” The proceeds will support UFC’s ongoing transformation initiatives, digital expansion, and selective portfolio growth—all aligned with prudent risk management and long-term shareholder value creation. With a strengthened capital base, the company is poised to capture emerging opportunities across its target segments while maintaining robust liquidity and capital adequacy ratios.

Built on trust, insight, and long-term perspective.

From transaction banking to research intelligence, Oman Investment Bank equips clients with tools to thrive in a changing world. Driven by innovation and guided by purpose, we’re redefining investment banking in emerging markets, empowering businesses with clarity, agility, and confidence.

Through one of the nation’s most ambitious campaigns – Space Samsoom – Bima is redefining how Oman experiences insurance: making it fun, personal, and boldly digital, with a clear five-year vision to transform industry norms. Alvin Thomas, Assistant Editor of OERLive sits down with Abdullah Al Kharousi, Marketing and Sales Manager at Bima

When you eye greatness, sometimes, the sky is the limit. But every so often, a bold idea challenges that very notion – daring not just to meet the sky, but to go beyond it. While most marketing campaigns chase attention with flashy visuals and catchy slogans, one Omani company quietly did something extraordinary. Not louder. Not flashier. Just… higher.

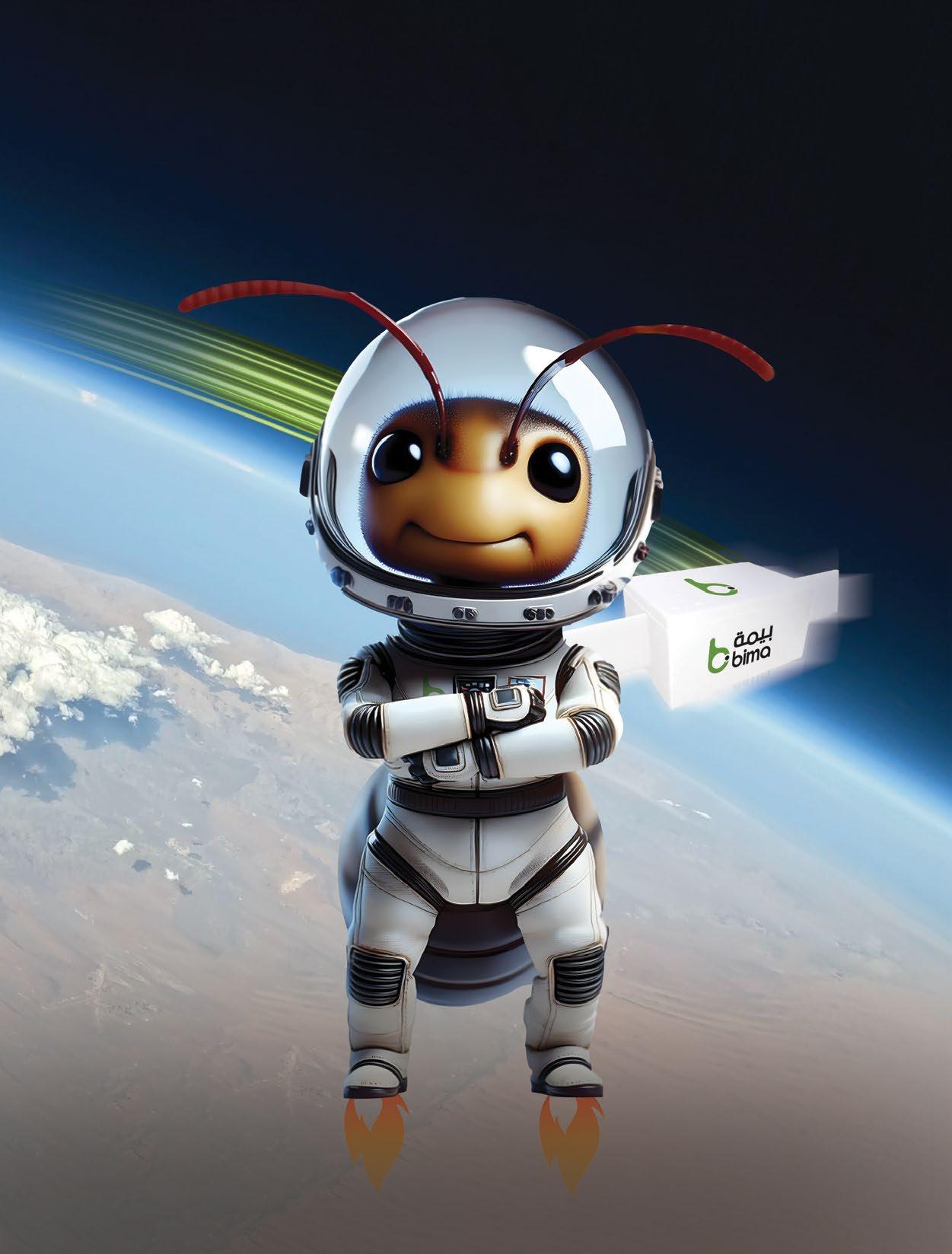

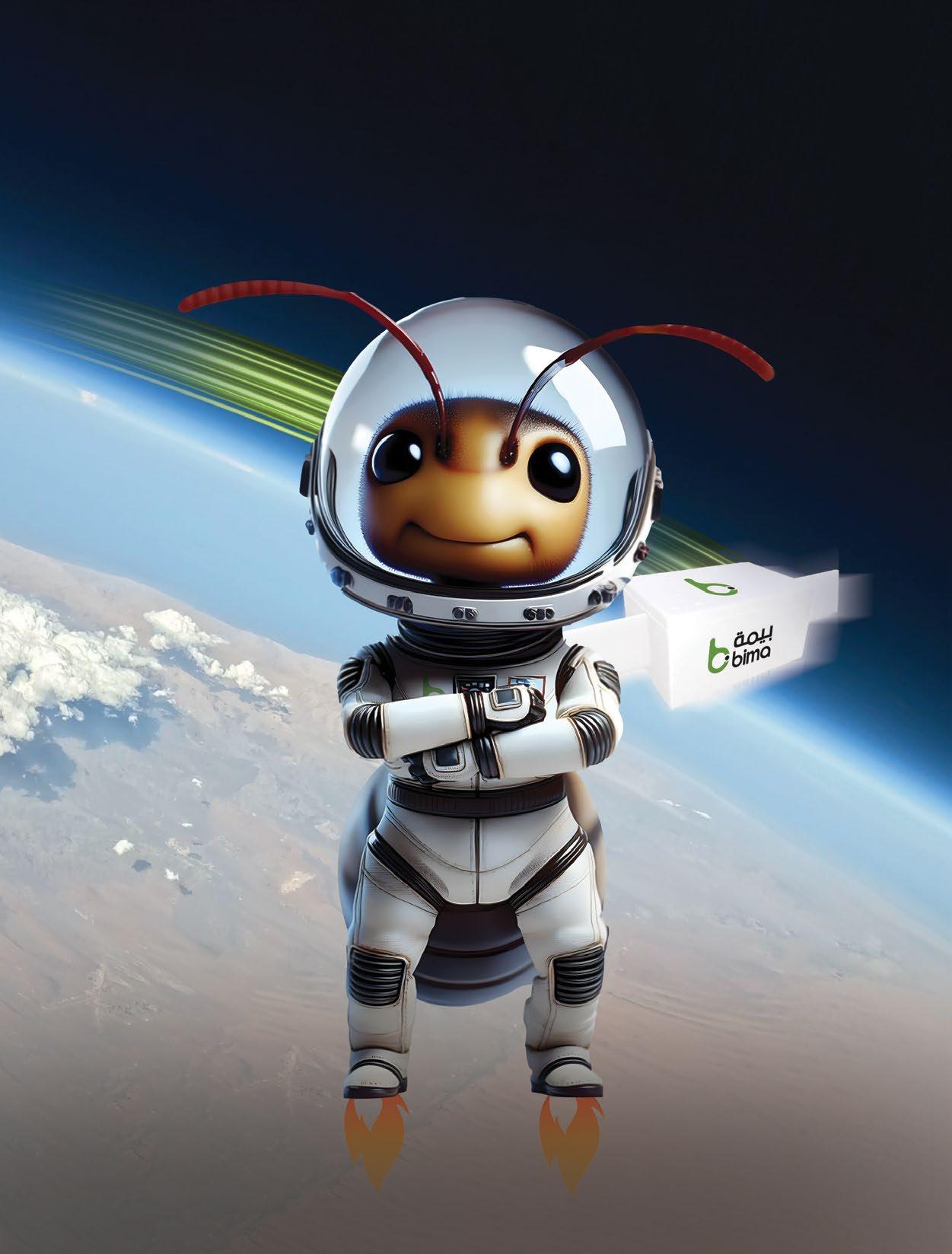

Bima, Oman’s leading digital insurance aggregator, charted a course that no brand in the Sultanate of Oman had dared to venture before – into space. Or more precisely, the stratosphere, some 130,000 feet above sea level, where the Earth curves and the blue fades into black. Their unconventional

hero? A tiny ant, affectionately named Samsoom – a nod to the Arabic word for ant, “Samsoon.”

In an unprecedented brand activation titled “Space Samsoom,” Bima launched Samsoom aboard a highaltitude balloon to the edge of space. The ant – symbolising endurance, determination, and small-but-mighty resilience – became an unlikely yet unforgettable ambassador of innovation and ambition. From that staggering height, Samsoom looked down on Oman in all its majestic glory – its deserts, mountains, and coastlines shimmering under the vast expanse of space. It was a moment that made people stop, smile, and wonder: Did an Omani ant just go to space?

It’s not every day that a brand dares to rewrite the rules of advertising and storytelling. And in doing so, Bima didn’t just promote a product but spark imagination. They proved that even in an industry as traditional as insurance, there is room for spectacle, for joy, for boldness. They reminded us that the smallest ideas – like a humble ant – can carry immense power. As we dive into the story behind this ambitious campaign, we speak with Abdullah Al Kharousi, Marketing and Sales Manager at Bima, to uncover how the idea was born, how it took flight, and what it means for marketing in Oman going forward. This is the story of Space Samsoom, an idea that quite literally reached new heights.

Bima has taken marketing to stratospheric heights – literally. Can you walk us through the inspiration behind the ‘Space Samsoom’ campaign? What did space represent for the brand, and how did this bold creative push tie into Bima’s core identity and message?

Absolutely. The Space Samsoom campaign wasn’t just about spectacle but rather about making a statement. At Bima, we’ve always believed in pushing boundaries, especially when it comes to accessibility and convenience.

It’s that idea – limitless accessibility – that sparked the concept of Space Samsoom. We asked ourselves: If people can buy insurance from literally anywhere on Earth, what’s stopping us from symbolically going even further? That’s how space entered the equation. What better way to demonstrate our “always available, always connected” promise than by launching a message, and a tiny ant, into space?

And beyond the brand message, there was another layer that meant a great deal to us. Space has always symbolised wonder, curiosity, and the boundless dreams of children. Every child dreams of reaching the stars – and in a way, Space Samsoom carried those dreams along with it.

We wanted this campaign to spark the imagination of the next generation, to show them that no idea is too small, and no dream too far-fetched. If a tiny ant from Oman can make it to space, so can the aspirations of a child watching from the ground.

We’ve seen people using Bima while studying abroad, insuring their cars from outside the country, or even during national holidays in the middle of the night. That level of 24/7 availability is rare in our industry.

So yes, the campaign was playful and unexpected, but it was also deeply symbolic. It was our way of saying: We’re here for you, no matter where you are, no matter how big your dreams.

The ‘Space Samsoom’ campaign is bold, imaginative, and unlike anything we’ve seen from a brand in the region. How did this campaign come to life – from the creative spark to the technical execution? And how does it fit within Bima’s broader, always-on brand storytelling strategy?

When we first launched Bima, our mission was clear: we wanted people to know that Bima existed. That was the starting point. Awareness was everything in those early days, getting the word out, showing up on billboards, and making sure people associated insurance with simplicity, speed, and digital access.

Fast forward to today, and we’ve achieved that initial goal. Bima is now a well-known name across the country. We’ve become part of the everyday landscape – whether it’s the quirky cups you see in some cafés, the Bimabranded cars weaving through city traffic, the rooftop signage standing tall above the skyline, or the iconic leopard-chase campaign that people still talk about. We’ve carved out our space.

But with recognition comes a new challenge: how do we keep surprising people? How do we remind them that Bima isn’t just known but innovative, fearless, and capable of doing things that others wouldn’t even consider?

That’s where Space Samsoom comes in. This campaign wasn’t just about doing something different – it was about creating a moment. It started with a simple, almost playful internal conversation: What’s the craziest campaign we could pull off to really show that Bima is everywhere? We threw around wild ideas. We considered insuring someone while they were on a rollercoaster. Then skydiving. We even got in touch with Skydive Dubai to explore possibilities.

But then someone asked: Why stop at the sky? Why not go beyond it? And suddenly, the idea of space wasn’t so far-fetched. After all, we constantly emphasise that Bima is accessible anywhere, anytime – as long as

there’s internet. So, what could make that message louder than sending it into space?

From there, the campaign evolved into something bigger than we could have imagined. We considered doing a realtime insurance transaction from space. It was technically possible. But then we thought, what if we sent a living being from Oman to the edge of space? Something symbolic. Something no one would forget.

That’s when Samsoom, the ant, entered the picture. Small in size, but massive in meaning. If a humble ant could make the journey, it would stand as a metaphor for every Omani dream: small beginnings, limitless ambition.

The technical execution was a whole other adventure. We chose a highaltitude weather balloon to carry our capsule to the stratosphere – one of the few realistic ways to reach up to 130,000 feet.

But it wasn’t just about sending something up. There were layers of planning involved: coordination with aviation authorities to ensure flight paths were clear, calculating payloads, estimating burst altitudes, and tracking wind speeds to predict where it might land. As the balloon ascends, the atmosphere becomes significantly thinner – at around 120,000 feet, we’re talking about just 1 per cent of the atmospheric pressure at sea level. Because of this, the balloon expands dramatically. A balloon initially inflated to about 1 meter on the ground can reach nearly 10 meters in diameter at that altitude before it finally bursts.

Now, predicting when and where that burst will happen is critical. It depends on precise calculations involving the amount of helium used, the size and elasticity of the balloon, and the prevailing wind patterns. We ran into a small hiccup during our launch: a problem with the helium meter. It wasn’t clearly indicating how much helium we were pumping in, and as a result, we ended up using less than intended.

That small miscalculation had a big impact. It extended the balloon’s flight

duration, altered its trajectory, and ultimately meant that it would land far from the originally planned zone. Once the helium is filled and all the numbers are crunched, the next step is determining the best launch location – not based on where you want to launch from, but where you want to recover it.

We had to reverse-engineer the route. Our goal was to land near Saham, so we chose a launch site that would work backwards based on wind predictions. Why Saham? Because it’s a safe, open area. The worst-case scenario would be the capsule crashing into a mountain, falling into the sea, or landing on a rooftop. That level of risk had to be accounted for.

Then came building the capsule. We gathered and built the payload container ourselves. We cut openings for the cameras, fixed in power banks, and designed the insulation to fight off the freezing temperatures of the upper atmosphere.

One of the big technical hurdles was ensuring the cameras wouldn’t freeze. We did our best, but one camera still shut down mid-flight; meaning, we lost some of the descent footage.

And then, of course, there was Samsoom. We had to build an air-tight, pressure-sealed chamber to protect him. Without the right environment, he wouldn’t survive. So we surrounded the chamber with heat sources – mainly power banks – to keep the interior warm, added a little sugar for sustenance, and prayed for the best.

Thankfully, the launch was a success. The mission achieved what we’d hoped it would, and more. It wasn’t just about visuals or reach. We realised that it became a moment of national imagination. Children were fascinated. Adults were intrigued. And across Oman, people were talking about how a digital insurance company had just sent an ant to space.

Can you walk us through the behind-the-scenes journey of your first space launch – what were your

expectations, the challenges you faced, and how the team responded in real time?

So this is actually interesting. Our successful launch was also our first and test launch. But even for a test, we went all in, fully equipped with Samsoom, onboard cameras, GPS tracking, the whole setup. Everything was built and loaded like it was the real deal.

We had actually prepared for two launches. That was the plan from the start: treat the first one as an experiment, and if anything failed, regroup and retry with the backup. We had two sets of equipment, two capsules – everything duplicated. We were ready for failure. Not hoping for it, obviously, but absolutely willing to embrace it if it meant learning.

There was even a discussion around making the second launch a public event, which would have been something big and open, where people could witness it live. That idea was floating in the background, but first, we had to see how this initial launch would go.

The launch itself was fast. Surprisingly fast. We barely had time to blink before the balloon shot up and disappeared into the sky. From there, the estimated flight time was around three hours – up to the stratosphere, and then drifting back down. So we went to grab lunch. Spirits were high. Everything seemed to be going smoothly. Initially, though, we had a bit of a scare.

The balloon drifted slightly offcourse from the planned route, and for a moment, we were nervous. But then the GPS showed that the winds at higher altitudes were behaving exactly as expected. Once it reached a specific height, it corrected itself and started heading in the right direction – crossing over the Haba desert, right on track.

Then things got interesting. First, the balloon’s horizontal speed increased dramatically. It was moving at about 80 kilometers per hour across the sky – much faster than anticipated. That made it harder to predict where it

would eventually come down. Second, the balloon just kept going... and going. We had predicted a certain burst altitude, the point at which the helium would expand and the balloon would pop, releasing the payload, but that didn’t happen when we expected it to. It climbed past that threshold and kept drifting further and further west.

Here’s the tricky part: our GPS device, a Garmin unit, only transmitted its location every ten minutes. So we were stuck in this pattern – waiting, checking, refreshing, holding our breath. Every ping felt like a suspenseful movie scene. “Is it still climbing? Is it coming down yet?”

Eventually, we started asking the big question: Do we give up? We were honestly that close to packing up and going home. It looked like it might end up all the way in Fahud. Or worse, cross into the UAE. We were mentally preparing ourselves for the idea that we might’ve lost it.

Then the balloon finally reached its max altitude: 130,000 feet. We received that reading from the GPS, though it’s possible it reached slightly higher before the data updated. It was pushing the limits.

At one point, it looked like it was going to land near the mountains between Sinaw and Adam – a terrifying possibility. If it landed there, we wouldn’t be able to retrieve it easily. But we were already brainstorming backup plans. We even considered reaching out to local tracking or rescue teams or chartering a helicopter if needed. That’s how committed we were. The anxiety was real. We just wanted to recover the capsule. Not for the gear or the cost. But to see Samsoom. To check the footage and to know what happened up there. The idea of it crashing onto some remote cliffside and disappearing forever was honestly painful.

Eventually, the burst did happen but not where we’d hoped. It exploded over a populated area. That was another wave of concern. The capsule might land on a house, a road, or worse. It

was also a windy day, and that added a new layer of unpredictability. Once the parachute deployed, the payload could drift significantly.

Thankfully, the wind carried it away from the populated area and into an open field. Not just open but remarkably clear and flat. Destiny, perhaps. It was the perfect landing zone. Suddenly, everything shifted. Now we were excited. We jumped in the car and raced to the projected landing site near Adam. But the conditions had turned surreal. It was raining heavily, with strong dusty winds. Visibility dropped to almost nothing; you couldn’t see more than a couple of meters ahead. The landscape was rough, filled with bushes and uneven ground, and we were driving blind in the storm.

We were bouncing across terrain, swerving around thorny shrubs, barely seeing through the fog. And then... we saw it. The capsule. On the ground. Safe. That moment was unbelievable. After all the uncertainty, the waiting and the close calls, there it was. Samsoom had made it to space and back.

Can you walk us through the most memorable moments and challenges you faced during the recovery of your high-altitude payload, and what you discovered when you finally opened the box?

Opening the sealed payload box was surreal. But what made it even more unexpected was discovering that we had actually captured footage of ourselves approaching the payload. That wasn’t planned at all.

Here’s what happened: one of the cameras, which hadn’t functioned properly at launch, somehow smacked the ground hard and turned on upon landing. It was pointed upward and ended up filming us as we cautiously approached the box, wide-eyed and reaching out. We had three different angles, but this particular shot felt cinematic – like the camera had been waiting for us.

It was a mix of bad luck and good luck, really. During launch, the conditions

were extremely windy. I was holding the balloon while we scrambled to secure the payload, parachute, and spacing rope, all in real time. The balloon itself is delicate: it can’t touch the ground, and even the oils from your skin can cause it to burst early. We were wearing gloves, but even a minor mishandling could jeopardise everything.

That day, while assembling the payload, one of the cameras was mounted facing downward. Unfortunately, the power button was located on the same side and was likely pressed during setup. So, while we got sideways and upward footage, we missed capturing the downward view during the flight. A bit of a loss – but what we got made up for it. Thankfully, Samsoom, our “space traveller,” made it back intact. So did the cameras. In fact, everything performed well enough that we questioned whether we even needed a second launch. We had already achieved what we set out to do: send a payload to the edge of space and bring back extraordinary footage. From that test flight alone, we had enough material and insights to move forward confidently.

And the footage? Incredible. We watched it while driving back to Muscat and it was mind-blowing. Crisp visuals from space, with black skies and a full view of the country below. It truly looked like space.

Bima has always been a bold disruptor in an otherwise traditional industry. But as your campaigns evolve and your market presence deepens, how has your brand ethos matured and how is that translating into customer perception today? A lot has changed and a lot has evolved. But one thing that has remained consistent is our mindset. We’ve always positioned Bima as a different kind of company. Some might call it disruptive; we think of it as ‘unusual’ in the best possible way.

That word really captures it. We don’t follow the rulebook for the sake of tradition. We’re willing to take risks,

push boundaries, and lean into ideas that might raise eyebrows at first but will absolutely be remembered. And we’ve seen the impact. Our campaigns have sparked conversations across the industry. We know other players are watching and, in many cases, recalibrating their own marketing approaches because of what we’ve done.

But taking risks also means managing cultural perception. A good example is our leopard chase campaign. It was unexpected, even shocking to some. There were parents who called saying it scared their kids. And we understood that. But we also believed that once people let it sink in, they’d see it for what it was: a fun, exaggerated metaphor. The man wasn’t terrified – he was almost smiling. The point wasn’t fear; it was familiarity. Life can be unpredictable and even chaotic but Bima is your comfort in that chaos.

We’re not in the business of fearmongering. You won’t hear us say, “You’ll crash your car tomorrow, so buy insurance today.” That narrative is outdated. We’re here to say: Things happen. We’re here for you when they do. We embrace the unpredictability of life but we also show how preparation, protection, and peace of mind can make all the difference.

But beyond campaigns, what really drives loyalty is the experience. And this is where our ethos shows up most powerfully. Let me share a quick story of our Founder and CEO of Bima. He was once at the airport, about to board an international flight with his family. They suddenly discovered his son’s passport needed a signature, which, on the new passports, means you need to get a completely new one. They were just hours from their flight.

He grabbed his son, jumped into a taxi, rushed to the ROP office, explained the situation, and thanks to their efficiency and kindness, managed to get a new passport and catch the flight. That moment stayed with him. It also taught him something: when time is saved in moments of stress, it changes everything.

That lesson is part of Bima’s DNA. Insurance used to be a painful, bureaucratic process. You’d take a token, sit for hours, part with your money and your mood. We changed that. Today, people compare our experience to ordering food online: quick, intuitive, and satisfying.

And we’ve heard that directly from customers. One senior executive at a major Omani company once told me that Bima quite literally saved his family’s weekend. He was headed to Jabal Al Akhdar when checkpoint police informed him his insurance had expired. He thought his entire trip was ruined. But a quick recommendation to try Bima changed everything. Within minutes, he had his new insurance and was back on the road. That interaction led to a strategic partnership with his company, because he saw firsthand the value we bring, especially when it matters most.

We’ve also built loyalty by being available when no one else is. In the early days, we operated 24/7 even when it wasn’t financially viable. Sometimes we’d get just a handful of sales in the middle of the night – but those were critical for the people who needed us then.

That’s how we earned trust. And it continues today. Just last Eid, we insured over 100 cars… on Eid Day. No one does that unless they urgently need help. And we were there for them.

This is what we mean when we talk about shifting the perception of insurance. We’re not just making it digital. We’re making it human, responsive, and emotionally intelligent. That’s the true ethos of Bima.

In a sector that’s typically seen as transactional and even tedious, Bima has brought deep disruption. How have you managed to build and retain such a strong and growing customer base? What does your retention rate look like, and are there any key figures you’re willing to share that speak to your market impact?

We’re proud to say our customer base has doubled – 2x growth – year-on-year since inception. Today, Bima holds nearly 20 per cent of the national motor insurance market, which means one out of every five cars on the road is insured through Bima. That’s a huge milestone, but retention in our industry is complex.

You see, while the raw retention numbers might not tell the full story, because vehicles change hands, names shift between spouses, or customers change cars. The real proof of loyalty lies in our customer sentiment metrics. And on that front, we’ve been very consistent.

After every transaction, we ask our customers for feedback. And over 95 per cent say yes. Not only that, but more than 95 per cent also say they would return to Bima again. That’s a number we’re deeply proud of.

In fact, we’re also the highest-rated service provider in Oman on Google – across all categories, not just insurance – with more than 10,000 reviews and a 4.9 out of 5 rating. That kind of validation from real users speaks volumes, especially in a service sector where expectations are high and things can go wrong fast.

What makes this more special is that, in insurance, people don’t wake up excited to buy a policy. No one says “Today’s the day I buy insurance!” But when we make that experience smooth, fast, even a little fun, that’s what builds loyalty.

To keep our customers engaged, we go beyond just fulfilling a transaction. We invest in personalised, human-centric operations – from reminders, followups, and 24/7 customer support, to sending birthday greetings in the form of AI-generated Omani cartoon videos. It’s a small but thoughtful touch that people remember. And yes, our team calls back unhappy customers one by one, to listen, resolve, and learn.

We’ve learned that in a low-margin industry like ours, scale and creativity are key. Rather than offer small

discounts that chip away at our margins, we focus on big, bold loyalty campaigns, like car giveaways and benefit programmes with 100+ local partners. It’s more impactful and aligns with our high-growth, high-loyalty model.

Bima is constantly evolving beyond just being a digital insurance platform. In that context, what are some of the ways you’re broadening your business offerings or deepening customer value?

We’re expanding in two key directions. One of them is through introducing adjacent, non-core services that enhance the insurance journey itself.

Just recently, for example, we launched a new Claim Assistance programme. If you’re insured through Bima, you now have the option to opt into this feature, where we handle your entire claims process… end-to-end. Got into an accident? You don’t need to run around coordinating with your insurance provider. Just raise the claim, and Bima steps in to handle the rest.

We’re offering this as a complimentary service during the launch month, but it will become a premium feature going forward. It’s our way of redefining what “peace of mind” means in the insurance world.

At the same time, we’re pushing deeper into customer engagement by reaching out not just to new users but also to serve our existing customers better, ensuring they’re aware of added-value features that enhance their experience with us.

The second area we’re expanding is in terms of audience reach. Today, the vast majority of our customer base is Omani, but we’re now actively positioning ourselves to engage the expatriate population as well through targeted outreach on popular local and ethnic channels, especially among communities like the Asian diaspora.

We’re also adapting to the realities of the market. While non-residents can’t insure vehicles unless they meet certain residency criteria, there’s still a

wide array of services – like domestic worker insurance or health policies – that can be tailored based on the individual’s residence status and needs.

The key is that our offerings are dynamic. Customers don’t just come to Bima to buy a fixed product, they come for a curated experience, personalised to their profile, preferences, and lifestyle.

As we look ahead, it’s clear that the insurance space is evolving rapidly digitally, operationally, and in terms of customer expectations. With that in mind, what’s the long-term vision for Bima? Where do you see the company in the next five years, not just in terms of market share, but in the role you aim to play within the wider ecosystem?

Volume-wise, Bima is already a dominant player, particularly in the motor insurance segment. But we’re not just chasing numbers. The real ambition is to lead a shift in mindset: to make insurance feel intuitive, accessible, and even empowering for everyday users.

Right now, there are still people in Oman who physically wait in line to get insured. That’s not acceptable in 2025, and definitely not five years from now. Our goal is to eliminate that friction entirely. We want Bima to represent comfort, convenience, and confidence in how insurance is experienced – from onboarding to claims.

Beyond motor insurance, we’re actively expanding into other verticals such as health, domestic, and more so that we’re not just a provider, but a trusted ecosystem. We want to guide customers through every step, making insurance feel less like a chore and more like a well-designed service.

And we’re lucky to have a sharp, forward-thinking team driving this. People in our team and on our leadership bench are pushing boundaries, not just following the playbook. That’s why we’re excited about what’s ahead.

Securado, a trusted cybersecurity partner for prominent organisations in banking, oil and gas, and manufacturing in Oman, has introduced a unique cybersecurity framework called the Digital Vaccine. Unlike traditional solutions that simply block threats, our approach targets their root causes and resolves them, says Krishnadas KT, Co-Founder and Partner in an interview with Oommen John

Can you share details of Securado’s operations in Oman?

Since we started in 2008, Securado has been a trusted cybersecurity partner for top organisations in banking, oil and gas, and manufacturing, logistics the public sector in Oman. We began as a system integration company, which gave us valuable insights into the changing technology landscape and the growing cybersecurity needs in the region. Noticing the growing importance of cybersecurity, we shifted our focus to delivering security as a service driven by value and results. This change helped us position ourselves uniquely in the market. We offer not just technology but a complete approach that combines services and solutions tailored to our clients’ risk environments.

Today, Securado is proud to be one of the top Managed Security Services Providers (MSSP) in Oman, accredited by the Ministry of Transport, Communications and Information Technology (MTCIT). We have two distinct service lines within our managed cybersecurity defence portfolio, supported by our proprietary Adaptive Cloud Security Stack.

What makes us different is our ability to combine governance, compliance, and risk management frameworks in our offerings. This delivers complete cybersecurity solutions that not only reduce threats but also address them. Our flagship framework, the Digital Vaccine, shows this approach by actively improving our clients’ digital resilience. With a solid foundation in both technology and services, Securado continues to lead the way in securing Oman’s digital future.

What specific technologies does Securado utilise in its cybersecurity offerings?

At Securado, we developed a unique cybersecurity framework called the Digital Vaccine. Unlike traditional solutions that only focus on stopping threats, our approach goes a step further. It also helps fix the root causes of those threats. To do this, we combine smart technology with expert services. Our solutions are built on a strong foundation of compliance and governance. This means they are designed to meet both technical and regulatory needs. What makes our approach stand out is how we work closely with our clients. We don’t just install tools. We help them build fast, effective responses to today’s complex and ever-changing cyber threats. This hands-on method ensures that our clients are not only protected but also prepared.

What sets Securado apart from other cybersecurity providers in the region?

In today’s world, cybersecurity is no longer just a business issue. It has become a national priority. With cyberattacks increasingly used in modern conflicts, every country needs its own “cyber army” supported by strong local skills and infrastructure. What makes Securado truly unique in the region is our locally hosted cloud security gateway, the only one of its kind in Oman. This allows our customers to use advanced cybersecurity controls through a simple subscription model, without needing complex setups. It offers plug-and-play security, designed for speed and ease. But technology alone is not enough. That is why we have invested heavily in developing national talent. Through our Abtikar platform, we train and grow the cybersecurity skills needed in the market. Today, we proudly operate with one of the most skilled local cybersecurity workforces, providing 24/7 services entirely from within Oman. This combination of local infrastructure, national expertise, and a commitment to skill development is what sets Securado apart and explains why we are trusted by some of the most critical sectors in the country.

Can you describe the key cybersecurity challenges currently

facing organisations in Oman?

As Oman moves forward with its digital transformation, organisations are facing a new set of cybersecurity challenges that are complex and fast-paced. One major challenge is the use of multicloud environments. Data is no longer limited to a single system; it is spread across various cloud platforms. This makes it tough for organizations to keep strong and consistent security measures in place, raising the risk of gaps and weaknesses. Another big concern is the rapid growth of Artificial Intelligence (AI). While AI improves the ability to spot and respond to threats quickly, it also provides cyber attackers with sophisticated tools to launch quicker and more complex attacks. This ongoing struggle between defenders and attackers is changing the cybersecurity landscape. Additionally, the widespread use of AI tools, particularly large language models (LLMs), brings new risks. Organisations may unintentionally leak sensitive data while using these systems, effectively training public AI models with private or confidential information. This can make managing data and ensuring privacy more difficult than ever.

What emerging cybersecurity threats do you predict for the next few years?

Cybersecurity threats are expected to become more intelligent, targeted, and harder to detect in the future. One major development is the use of Artificial Intelligence by cyber attackers. AI allows them to launch faster, more adaptable attacks that can get around traditional security systems. Another rising concern is deepfake technology. These hyperrealistic fake videos and audio can be used to impersonate trusted individuals, making people more susceptible to social engineering scams. As these tools become easier to access, the risk of deception increases significantly. Phishing attacks are also changing. Attackers now create highly personalized emails using relevant information instead of sending generic messages. These smarter phishing attempts are harder to recognize and need better security measures to defend against. Critical infrastructure is becoming a prime target as cyber warfare grows. Systems that support essential services,

like energy, water, and transportation, face an increasing risk, making their protection a national priority.Looking ahead, quantum computing is emerging as a serious threat. Although still in the works, attackers are already collecting encrypted data today to decrypt it later when quantum technology becomes practical. This poses a long-term danger to sensitive communications, especially in areas like finance, government, and national security. In short, as the digital world becomes more connected and smarter, the risks increase. Organisations in Oman need to embrace innovative cybersecurity strategies that tackle current issues, such as cloud security, AI governance, and quantum resilience, while also getting ready for future challenges.

How is Securado planning to adapt its strategies to meet future cybersecurity challenges? At Securado, we are focused on staying ahead in the changing world of cybersecurity. Our strategy combines Artificial Intelligence and human expertise. This approach ensures our defenses are both smart and flexible. Our AI analysts play a key role in improving threat intelligence. They continuously train localised AI models that grasp the unique context of our clients’ environments. This leads to faster and more accurate detection of anomalies and possible threats.

At the same time, our automation team has created a solid library of over 100 playbooks. These playbooks are designed to respond to and fix the latest and most complex cyber threats. They help us significantly cut down the Mean Time to Detect (MTTD) and Mean Time to Respond (MTTR).We are also leading the way with digital vaccines. These are automated, pre-emptive measures that protect systems against known vulnerabilities and new threats. We continuously update and deploy these digital vaccines across our infrastructure. This adds another layer of proactive defense. By combining insights from AI, expert human judgment, and effective automation, Securado is not just dealing with cybersecurity challenges. We are anticipating and neutralising them before they can do any harm.

To understand global financial markets today, one must acknowledge that asset allocation has become a threedimensional chessboard—or perhaps more accurately, a high-stakes poker game—between three key players: US President Donald Trump, China’s Communist Party General Secretary Xi Jinping, and Federal Reserve Chairman Jerome Powell.

In just six months, The Economist went from calling the U.S. dollar “the envy of the world” to asking “how a Trump dollar crisis would unfold.” And on April 25, 2025, Bank of America made headlines by advising investors to “dump the U.S. dollar while they still can.” In foreign exchange markets driven by momentum, perception can quickly become reality.

As technical analysts say, “The trend is your friend”—until it is not. For decades, traditional U.S. centric portfolio models assumed the dollar and U.S. assets to be risk-free. Gold, not yielding cash flows, was often sidelined. But those models were built on assumptions of American economic stability, legal predictability, and geopolitical dominance. Today, all three are being questioned.

On April 2, 2025, Trump proclaimed “Liberation Day” with the announcement of sweeping new tariffs, declaring an end to “decades of unfair trade practices.” It was positioned as a declaration of U.S. economic independence. But for global investors, it was a declaration of risk. Legendary investor George Soros once said, “I am looking for changes in the rules of the game.” Trump and Senator J.D. Vance appear determined not just to change the rules of global trade—but to rewrite

them altogether. That has serious implications for gold, silver, bitcoin, and even the euro. The notion that the U.S. is the undisputed anchor of global trade is under review. Pension funds, global investors, and central banks— particularly in the Gulf and Asia—are revisiting the assumption that the U.S. dollar is a “risk-free” asset. When fundamental assumptions collapse, capital market dislocations—sometimes known as crashes—often follow.

Bitcoin, once dismissed by most major banks, soared from under $1,000 to nearly $80,000. Ironically, it was the very institutions that dismissed crypto that failed to recognise the shift in investor trust. Meanwhile, silver’s performance, weighed down by its industrial links, diverged from gold, which surged to all-time highs amid global uncertainty. Investors are now asking: Is the United States still a zero-risk country? HSBC Private Bank once ran a campaign with the tagline: “Assume nothing.” That advice may be more relevant than ever, as the idea of U.S. exceptionalism— and the sanctity of the dollar—faces unprecedented scrutiny.

Trump’s tariffs disrupted more than just global stock markets—they rattled the global economic order. Silver, heavily used in solar and electronics, remains economically sensitive and vulnerable to any trade-driven slowdown. While silver dipped by over 5 per cent in the last month, gold climbed to new highs— up nearly 11 per cent—fuelled by investor demand for a safe haven amid geopolitical and economic stress. Gold’s resilience underscores its role as a store of value. In times of fiscal, geopolitical, and market uncertainty, that demand spikes. And uncertainty, today, is in no short supply.

Meanwhile, China is actively preparing for a post-dollar world. Beijing is ramping up gold accumulation, promoting trade settlement in yuan, and seeking greater influence in global gold pricing. Xi Jinping’s regional diplomatic tour underscores China’s strategy to strengthen non-dollar trade ties across ASEAN and beyond. It is a contrast in symbolism as well as policy: the U.S. dollar still bears George Washington’s image, while the Chinese yuan features Mao Zedong—a reminder that China’s Communist legacy is still firmly imprinted on its currency and policies.

Nowhere is the cost of dollar dominance more evident than in Africa. Though the U.S. represents less than 9 per cent of Africa’s trade, over 50 per cent of transactions are still settled in dollars. This disconnect costs the continent over $5bn annually in conversion fees, exchange risks, and over-reliance on foreign financial infrastructure. The Global South, led by African nations, is beginning to realise that currency independence is not just a political goal—but an economic necessity.

Group CEO, Oman International Development and Investment Company (Ominvest)

AbdulAziz Mohammed Al Balushi serves as the Group CEO of Oman International Development and Investment Company SAOG (Ominvest). With over 39 years of professional experience in financial services sector, he possesses a profound understanding of global market dynamics. Since joining Ominvest in 2014, AbdulAziz and his management team have successfully implemented a transformative vision articulated by the Board of Directors, reshaping the company’s culture, structure and policies.

Under his leadership, the team executed the merger between Ominvest and ONIC Holding, establishing Oman’s largest publicly listed investment company. His tenure

CEO, National Bank of Oman

Abdullah Zahran Al Hinai is the CEO of NBO. Having held a number of senior management positions in the banking sector, he is an industry veteran with over two decades of experience. Prior to his current role, he was the Chief Wholesale Banking and Strategic Growth Officer at a leading financial institution, and was credited for setting up the organisation’s Strategic Growth function and architecting a number of ground-breaking transactions in both investment and commercial banking. Al Hinai serves as a Board Member of Oman Banks Association. He has also held several board memberships

also saw several significant initiatives, including the IPO of its flagship insurance company National Life, the development of the Ominvest Business Centre, and the merger of National Finance and Orix Leasing Company. Furthermore, he spearheaded capital-raising efforts, including a perpetual bond issuance, and played a vital role in the merger of Oman Arab Bank with Alizz Islamic Bank, which facilitated Oman Arab Bank’s listing on the Muscat Stock Exchange as an SAOG. AbdulAziz also led NLGIC’s acquisition of RSA Middle East, positioning NLGIC among the top ten insurance companies in the region. Currently, he holds the position of Chairman of Ubhar Capital, Chairman of Oman Real Estate investment and services LLC, Deputy Chairman of Jabreen International Investment Company SAOC. Additionally, he is a board member of Oman Arab Bank SAOG, National Finance Company SAOG, and LIVA SAOG Bahrain, as well as Injaz Oman.

across various industries including manufacturing, investment and urban development. Al Hinai holds an Executive Masters in Business Administration from the International Institute for Management Development (IMD) in Lausanne, Switzerland, a Postgraduate Diploma from Manchester Business School, UK, and a B.Sc. in Business Administration from Boston University, USA.

He also attended the Advanced Management Program (AMP) at INSEAD, Fontainebleau, France, the General Management Program (GMP) at Harvard Business School, Boston, MA, USA, and is a holder of Chartered Financial Analyst designation as well as being a Certified Public Accountant (USA).

Group CEO, Asyad

Abdulrahman Salim Al Hatmi is the Group CEO of ASYAD, Oman’s flagship logistics and supply chain group, offering end-to-end solutions from ports, free zones, maritime shipping and last-mile express delivery. Abdulrahman is a logistics pioneer and a business-growth leader; building startups, establishing competitive businesses and advancing homegrown companies to become global brands. Al Hatmi was a key player in the development of Oman’s National Logistics Strategy 2040 – now overseeing

CEO, Sohar International

Abdul Wahid Mohamed Al Murshidi is the CEO of Sohar International. He has over 18 years of extensive experience in various banking functions, including Audit, Finance,

Investment, and Islamic Banking. He joined Sohar International in July 2019 and previously served as Deputy General Manager at a prominent local Islamic bank. Al Murshidi is spearheading the bank’s initiatives aimed at achieving exponential and sustainable growth. He holds an Executive MBA from the London Business School and a Bachelor of Science from Sultan Qaboos University.

Abdullah Nasser Al Hadhrami is the CEO of Gulf Mushroom Products Company. He has served over 30 years in the government and private sector in Oman. He has travelled extensively across the globe and attended numerous seminars and workshops for senior corporate executives on industry, business and management practices and corporate governance. He has a Master’s

CEO, SalamAir

Adrian Hamilton-Manns is the CEO of Oman’s budget airline SalamAir. With a career spanning over eight years as a CEO in the aviation sector, HamiltonManns brings a wealth of experience and a fresh strategic vision to the airline. Hamilton-Manns’ appointment marks a significant phase for SalamAir,

CEO, Al Omaniya Financial Services

degree in Science from University of New Haven, USA. The Gulf Mushroom Products Company is an Omani public company listed on the Muscat Stock Exchange.

Established in 1997, it has its head office and flagship mushroom farm in Barka besides a state-of-art compost factory in Thumrait and a branch in UAE. The company is largely export oriented and moves about 90 per cent of its production to markets outside Oman.

as the airline seeks to expand its horizons and enhance operational efficiencies. His career spans 28 years in aviation executive management, with a notable 14 years dedicated to the low-cost airline industry.

His previous roles at renowned airlines such as South African Airways, Virgin Australia and FlyArystan highlight his capability to drive significant growth in challenging market environments.

Managing Director, Petroleum Development Oman (PDO)

Dr Aflah al Hadhrami was recently appointed as the managing director of Petroleum Development Oman (PDO). He is the first Omani national to head the company. Dr Aflah has been working in the Oil and Gas sector for almost three decades starting in the early 1990s and has excelled in executive, operational and commercial roles, in multinationals and government. Prior to his appointment at PDO, he served as the CEO of Integrated Gas Company (IGC). He also served as the CEO of Alshawamikh Oil Services, where he drove exponential business growth. His professional career started with Petroleum Development of Oman (PDO), and thereafter

Aftab Patel is the founding member, promoter, and CEO of Al Omaniya Financial Services, the premier non-banking financial institution in the Sultanate. Al Omaniya has evolved from a humble beginning in 1997 to a pioneer and unequivocal leader in its industry. Aftab Patel is a commerce graduate and a chartered accountant. He started his career with AF Ferguson and Co in Mumbai and then moved to Associated Cement Company. He moved to Muscat in 1984 and was with Omar Zawawi Establishment (OMZEST). In 1990, he was appointed profit centre head for Bank Muscat. In 1997, he helped found Al Omaniya along with a group of investment bankers and pension funds. Patel was listed among 50 best CEOs in the GCC in

followed increasingly important and senior leadership roles at various oil and gas organisations namely in senior supply chain management positions at Oman Refinery LLC, Schlumberger Overseas S.A, and Occidental Oil and Gas Corporation where he was VP of Middle East Supply Chain Management (VP ME SCM). Dr. Aflah also worked in BP, managing the Middle East Region as Regional Director for BP Exploration Middle East.

He holds a PhD from the University of Liverpool (UK) in Business Management. He is also a member of the Royal Chartered Institute (MCIPS UK) and CILT. In addition to his work in Oil and Gas, he lectured for 5 years at Sultan Qaboos University as an adjunct lecturer at the College of Economy and Political Science.

a ranking by INSEAD Business School and Deloitte for the year 2016, and was conferred with Lifetime Achievement Award at the GCC Banking Summit in 2016. Under his stewardship and vision, the company has been rated as the number one Non-Banking Financial Institution by Ernst & Young in 2006, 2008, 2010, 2011 and 2012.

The company has also been rated as number one Non-Banking Financial Institution by OER and GBCM, when they first instituted this award in the year 2012. Patel is on the board of directors of Dhofar Cattle Feed SAOG and also chairs the board Audit Committee. He is a board member of Oman India Friendship association since its inception in 2020 and has also been nominated as the Board member of Indo Gulf chamber of Commerce Oman Chapter (under formation).

Eng. Ahmed Al Amry is the CEO of Oman Airports. He has extensive leadership experience in several major companies, with a proven track record in managing strategic projects, implementing governance frameworks, and leading institutional transformation programs in multiple sectors. He also oversaw the execution of several major projects in the oil and gas sector during his tenure as Vice President of Project Delivery at OQ, Additionally, he led and executed technical and operational projects at both Oman LNG and Qalhat LNG, gaining

Managing Partner EY Muscat and MENA Tax Leader

Ahmed Al Esry is the Managing Partner of EY Muscat office and MENA Tax Leader. Ahmed’s experience spans across servicing oil and gas, construction, manufacturing and financial services industries where he has led tax advisory, audit, and consulting assignments across the region. He has assisted with the acquisition of new businesses for both

deep expertise in managing large-scale projects.

Throughout his career, he has held a number of prominent leadership positions, including Chief Transformation Officer at Oman Air and Oman Airports, and Acting Chief of Commercial Operations Unit at Oman Airports.

Eng. Al Amry holds a Master’s degree in International Construction Management and Engineering from the University of Leeds – United Kingdom, in addition to a Bachelor’s degree in Civil and Structural Engineering from the University of Bradford.

local and multinational companies, leading on multi country tax due diligence projects. Ahmed was actively involved in introducing Islamic Banking in Oman, working closely with the banking industry and Central Bank of Oman. He joined EY over 20 years ago from Petroleum Development Oman, the national oil company of Oman. Ahmed holds a Bachelor of Commerce Degree from the University of Nairobi, Kenya. He is also a member of the ACCA, UK.

Group CEO, Nama Group

Ahmed Amur Al Mahrizi is a transformative leader at the helm of one of Oman’s most vital national groups. As Group CEO of Nama, he spearheads the strategic oversight of the Sultanate’s electricity, water, and wastewater sectors— industries central to the country’s economic resilience and future readiness. Renowned for driving bold reforms and unlocking long-term value, Al Mahrizi has led Nama through one of the most ambitious restructuring and privatisation programs in the region. His leadership has been instrumental in modernising utility governance, optimising

operational performance, and setting a new benchmark for public-private collaboration in critical infrastructure.

Prior to joining Nama, Al Mahrizi held senior executive roles in the telecommunications industry, including more than a decade with Virgin Mobile Middle East & Africa. There, he played a foundational role in launching and scaling disruptive mobile ventures across highgrowth markets. His approach to leadership is shaped by global exposure and executive education from leading institutions including IMD, reinforcing his commitment to governance excellence and sustainable transformation.

and inventory in OQ and was the CEO of Oman Logistics company SAOC (Khazaen) before joining OQ.

He is the board member of Abraj Energy Services and Musandam Power Company, with previous board appointments as the chairman of OQGN, OQ logistics, a member of the board of trustees in the International Maritime College, a member of the Sultanate of Oman Logistics Strategy 2040. He holds a BSc. in Physics from Imperial College London and an MEng in Petroleum Engineering from Heriot-Watt University, Edinburgh.

CEO, Muna Noor

Ahmed Barwani is the CEO of Muna Noor, a leading Omani manufacturing company specialising in advanced piping systems and innovative water solutions. With a strong engineering and business administration background, Ahmed has spearheaded numerous initiatives to enhance sustainability and efficiency within the industry.

CEO, Nama Power and Water Procurement

Ahmed bin Salim Al Abri is the CEO of Nama Power and Water Procurement Company, the exclusive procurer of all electricity and desalination projects in Oman. He previously served as the General Counsel for the same company. His background includes extensive experience in corporate and commercial legal work, as well as expertise in various areas like contract drafting, negotiation, and

Under his leadership, Muna Noor has expanded its market reach, embracing cutting-edge technologies and fostering a culture of continuous improvement. Ahmed’s vision and strategic acumen have positioned the company as a key player in the region’s infrastructure development, driving progress and contributing to the economic growth of Oman.

litigation. He holds a Master’s degree in International Business Law and a Bachelor’s degree in Law.

Ahmed has been actively involved in discussions and initiatives related to Oman’s sustainability agenda and the development of renewable energy.

Country Leader for Oman & Yemen-CISCO

Ali Al Lawati is the Country Leader for Oman and Yemen- CISCO. With more than 20 years of experience in the Omani ICT market, Al Lawati has held various roles within the sector, including as CEO and Consultant and Head of Projects, in addition to having served on the Board of Directors for a commercial data centre entity. Prior to joining Cisco, Al Lawati was the CEO of Nasma Telecommunications and the Head of

CEO, Mazoon Dairy Company

Ali Al Buali, the CEO of Mazoon Dairy SAOC, is an accomplished C-level professional with over 16 years of experience in private equity, oil and gas, food, financial management, and audit. He has been the CEO of Mazoon Dairy SAOC since September 2022. He has a strong background in finance and accounting with experience in various companies, including

IT and Telecommunications Projects at Petroleum Development Oman. Ali holds a double master’s degree: one for communications systems and signal processing from Bristol University in the UK and the second in business administration (MBA) from the Strathclyde University, also in the UK. He earlier received his bachelor’s degree in electrical and electronics engineering from Sultan Qaboos University in Oman.

Fisheries Development Oman, Oman Investment Fund, and Shell. Ali completed their Bachelor’s degree in Accounting from Sultan Qaboos University.

Ali then pursued a Master of Business Administration (M.B.A.) with a specialisation in Business/Managerial Economics from Sultan Qaboos University. Ali also holds a certification as a Certified Public Accountant (CPA) from the American Institute of Certified Public Accountants.

CEO, Salalah Mills Group SAOG

Eng. Ali Bakhit Hassan Kashoob is the CEO of the group. He has about 20 years of experience in strategic management, growth planning, and management of change, Strategic marketing and corporate communications.

Prior to joining the group, Eng. Kashoob was the CEO of Atyab Food Industries. Eng. Kashoob has a Master’s degree in Business Management from Strathclyde Business School in the UK. He also has a Bachelor of Science

CEO, Alizz Islamic Bank

Ali Al Mani is the CEO of Alizz Islamic Bank. Ali has over 22 years of experience in the Finance and Banking industry in both Islamic and Conventional banks, with expertise across areas of Corporate Banking, Retail Banking, Operations, Finance, Project Management and Technology.

He has held various leadership positions at major local banks and prior to joining Alizz Islamic Bank,

degree from Sultan Qaboos University. In addition, he graduated the CEOs Programmes from IMD Institute in Switzerland. In his capacity as the CEO of Salalah Mills Group, Eng. Kashoob aspires to lead the group to a new phase of innovation, operative excellence, and strategic expansion and to further its role in supporting food security and industrial progress in Oman.

Al Mani was the Deputy CEO of National Finance Company overseeing the performance of one of the largest finance companies in Oman.

Ali Al Mani holds a Master’s degree in Innovation, Leadership and Management from York University, United Kingdom. He also has a Bachelor’s of Arts in Computer Applications and Internet from the University of Bedfordshire, United Kingdom, in addition to a number of specialised qualifications in Banking and Finance.

CEO, Hutchison Ports Sohar

With an impressive work history and knowledge of three decades in the maritime logistics industry, Anacin Kum started his career in the shipping business and held various senior executive positions in P&O Nedlloyd before joining Hutchison Ports in 1998. Kum was assigned to its investment in the Sultanate of Oman as the CEO of Hutchison Ports Sohar since 2018, overseeing the container terminal business. Prior to Sohar Port, Kum held various CEO and senior management positions of

Group CEO, OQ

Ashraf Al Mamari has over 19 years of experience in various organisational leadership roles, including Human Resources, Corporate Affairs, and Strategic Management.

He holds a Bachelor’s degree in General Management from Sultan Qaboos University and is currently enrolled in a Doctor of Business Administration (DBA) programme with Coventry University. Al Mamari has held multiple leadership positions in the energy

Yantian & Hong Kong in China. Hutchison Ports is the port and related services division of CK Hutchison Holdings Limited (CK Hutchison). Hutchison Ports is the world’s leading port investor, developer and operator with a network of port operations in 52 ports spanning 26 countries throughout Asia, the Middle East, Africa, Europe, the Americas and Australasia.

sector in Oman and abroad. He joined OQ in 2013 as a Learning and Development Manager in one of the Company’s legacy companies, Takatuf Oman.

He then worked in OQ Exploration and Production and OQ Chemicals in Germany before leading the People, Technology and Culture function of OQ. He is also a member of the Board of Directors of Abraj since 2017 and a member of the Board of Directors of Marafiq since 2023. He was previously a member of the Board of Directors of OPAL and InstOG.

CEO, Vodafone Oman

Bader Al Zidi was appointed CEO of Vodafone in Oman in October 2021, with almost two decades of experience working in ICT. His business and strategic acumen, coupled with a forward-thinking digital perspective, helped him navigate the successful set-up and launch of the third telecom operator in the Sultanate of Oman.

Al Zidi’s career started with Omantel, before moving to Oman Broadband, where he ascended to become CEO in 2020. Under his leadership, the company surpassed targets and achieved several operational milestones, including the introduction of new products

CEO, Mwasalat

Badar Mohammed Al Nadabi is the CEO of Mwasalat, Oman’s national transport company. He has experience that spans over 26 years in senior leadership positions, including Marketing, Technology, Finance, Human Resources, Supply Chain & Corporate Affairs. He also has extensive experience in developing corporate culture and driving change & digital transformation projects.

Oman National Transport Company “Mwasalat,” a member of ASYAD Group, has been engaged in

such as Leased Capacity services; significant growth of its annual revenues to more than RO18mn; and increased sales volumes to more than 150,000 active broadband connections across Oman, in line with the Sultanate’s National Broadband Strategy. During his time at Oman Broadband, he represented the company as a Board Member in the FTTH MENA council and chaired the Policy and Regulation Committee. Al Zidi holds a Bachelor of Applied Science (BASc) and a Master’s (MBA) in Business Administration and Management from the University of Strathclyde, UK. In addition, he has a certification in Corporate Finance and Strategy from London School of Economics, UK, and a Master of Program Management from George Washington University, United States.

offering a modern and efficient public transport system. Mwasalat is reshaping its business units to ensure they are equipped to take advantage of emerging trends in public service sector.

These steps are targetted at making Mwasalat more agile, cost-efficient with the focus to improving safety, reliability, and quality of public transport services. Mwasalat has invested in developing intelligent transportation system, with the aim of creating additional values and enhancing customer satisfaction and is working on a daily basis with its stakeholders to provide a World-Class Public Transport service.

CEO, Oman Air

Con Korfiatis is the CEO of Oman Air. He has extensive aviation experience, including leadership roles across Asia Pacific and the Middle East. A highly accomplished leader with over 30 years of experience in the aviation industry, he is set to steer Oman Air’s ongoing transformation, which aims to turn the airline’s financial operations around.

CEO, Madayn

Eng. Dawood bin Salim Al Hadabi is the CEO of Madayn. With his Master in Business Administration and Information Technology from Coventry University and Bachelor of Science in Civil Engineering from Glasgow Caledonian University, Eng. Dawood Al Hadabi has over 24 years of expertise

His three-decade-long career includes numerous CEO appointments across Asia-Pacific and the Middle East, with notable accomplishments including founding four start-up initiatives in Saudi Arabia, Indonesia, Singapore and China. He has also held a string of other executive management roles in finance, strategy, commercial, alliances, operations, network, branding and marketing, across some of the world’s most successful airlines.

and fruitful track record in various fields.

Al Hadabi served as the Director General of Samail Industrial City during the period from 2010 to 2023, and as the Director of Technical Affairs and Acting Director General of Al Rusayl Industrial City during the period from 2008 to 2010.

Group CEO, Bahwan CyberTek Group

Executive Director, Al Tasnim Group