Amidst the disruptive tide of FinTech solutions challenging traditional systems, financial organizations are increasingly compelled to integrate technology as a catalyst for elevating customer experience, driving business profitability, and diversifying product portfolios within a secure framework.

The New Age Banking Summit illuminates the dynamic landscape of challenges and opportunities, offering a pivotal platform for knowledge exchange and networking that positions Oman's banking sector on par with global counterparts.

This Summit equips banks with the tools to craft strategies that align with the evolving digital financial ecosystem, ensuring readiness for the future by embracing digital transformation, pioneering product and service innovation, and engaging customers through digital channels while vigilantly mitigating cyber risks. Moreover, it delves into how embracing new business models will ensure the relevance of banks for the next generation, urging proactive steps to be taken today.

UMS Events proudly presents the New Age Banking Summit in 2025, continuing its tradition of fostering interactive platforms to explore the rapid metamorphosis of Oman's banking sector. At its essence, the Summit endeavors to delve into emerging technologies and methodologies poised to catapult the banking industry to unprecedented heights. Featuring interactive panel discussions, focused sessions led by industry luminaries sharing profound insights and experiences, and networking opportunities with seasoned banking professionals, the Summit is a catalyst for transformative dialogue and action.

Panellists:

Manahil

Hussain Al Maimani, Sales Director, GBM

Ali Al Jabri, AGM – Payment Systems, Central Bank of Oman

Dr Haider Al Lawati, Head of AI, Oman Data Park

Mujahid Al Zadjali, GM of IT, Bank Nizwa

Moderator:

Keynote address by Executive President of CBO

Panel Discussion

Participation of leaders from top 10 banks in Oman

Oman Banking & Finance Awards

Interactive presentations on the future of banking

Exclusive platform for BFSI and fintech majors

Participation of 150+ delegates from 100+ BFSI & tech companies

Largest banking and NBFC conference in Oman

His Excellency

Ahmed Al Musalmi Governor, Central Bank of Oman

His Excellency Ahmed Al Musalmi is one of Oman’s most respected banking leaders, widely recognised for his transformative impact on the financial sector A five-time recipient of the “CEO of the Year – Oman,” including in 2024, he is known for driving strategic growth and innovation

From 2018 to 2024, he served as CEO of Sohar International Bank, leading it to become Oman’s fastest-growing financial institution Prior to that, he successfully executed a turnaround at the National Bank of Oman Among his most notable achievements are orchestrating Oman’s largest banking merger – between Sohar International and HSBC Bank Oman – and launching the bank’s first international branch in Riyadh, Saudi Arabia

With over 20 years of experience, H E Al Musalmi combines strategic vision with collaborative leadership, fostering an integrated financial ecosystem that has redefined customer experience and industry benchmarks in Oman

He is an alumnus of Harvard Business School and holds an MBA with distinction from the University of Bedfordshire, along with several international financial credentials. He has also completed executive programs at IMD in Switzerland and Stanford in the USA.

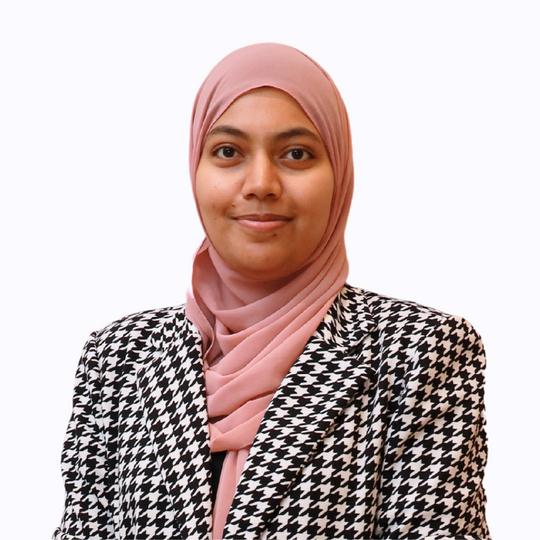

With over 19 years of extensive experience in the banking industry, Mrs Manahil Jaffar is an experienced Credit Bureau Specialist with a strong track record in delivering credit solutions that align with the market needs

Over the past five years, she has played a pivotal role in advancing credit infrastructure, most notably as a key figure in the successful launch of the Oman Credit and Financial Information Center (Mala’a). Mrs. Jaffar brings a wealth of expertise in financial services, strategic banking operations, and regulatory frameworks, combined with a forwardthinking approach to data-driven innovation, fintech collaboration, and digital transformation within the credit ecosystem.

Manahil Jaffar

Acting General Manager, Mala'a

Mr Ali Al Lawati is a seasoned technology leader with over 24 years of experience spanning management, sales, and engineering across multiple industries and verticals

His extensive career has seen him excel in diverse roles and environments – from working with Petroleum Development Oman (PDO), to a system integrator at Nasma Telecommunications, and later as a technology vendor with Cisco At Nasma Telecommunications, a company he founded, he helped position the firm among the top system integrators in the Middle East, with Channel Middle East magazine ranking it 4th in their 2016 SI Power List He also played a pivotal role in the formation of Data Mount, Oman’s first public cloud data center

Currently serving as the Country Leader for Cisco in Oman and Yemen, he has held senior leadership roles including Head of Projects, CEO, and Director of Operations. He has driven large-scale digital transformation initiatives, developing strategic roadmaps and business cases in collaboration with key customers. In recognition of his visionary leadership, he was named one of Oman’s Inspiring CEOs by the Observer newspaper in 2018.

As both an entrepreneur and strategist, he thrives in dynamic, highimpact environments His leadership philosophy centers on empowering teams, fostering innovation, and delivering high performance through clear strategy, motivation, and support

Ali Al Lawati

Country Leader – Oman & Yemen

Cisco

Sheikh Khalil Al Harthy is an experienced leadership practitioner with a demonstrated history of working in the financial and management consulting industry He is skilled in business planning, operations management, HR consulting, coaching, and entrepreneurship From 1992 to 2003, he worked as a portfolio Manager for the Central Bank of Oman and from 2003 to 2010 as Assistant General Manager for Al Ahlia Insurance Oman In 2010, he co-founded the Performance Factory, a management consulting firm. He joined Credit Oman as CEO in 2019.

Sheikh Khalil Ahmed Al Harthy

CEO, Credit Oman

Mr Hussain Al Maimani is an influential leader and advocate for digital transformation, digital economy & economies of scale As the Sales Director at GBM Oman, he oversees sales operations across all sectors, with a strong focus on the Banking Industry with over a decade of experience in spearheading the BFSI business in GBM Hussain has been instrumental in driving key digital transformation initiatives in Automation, Analytics, Customer Experience, Collaboration, Security, RPA, and Artificial Intelligence He holds a bachelor’s degree in Computer Engineering, an MBA from Manchester Business School, and has completed executive education programs from London Business School (LBS) on organizational resilience and MIT Sloan School of Management on Leading Organizations and Change

Hussain

Al Maimani Sales Director, GBM

Dr. Haider Al-Lawati is a Head of Artificial Intelligence at Oman Data Park, drawing upon more than 13 years of dedicated experience within both the telecom industry and academia. Throughout his career, he has spearheaded diverse projects encompassing network planning, strategic and operational planning, project management, and innovative network solutions. His academic journey led him to achieve a Ph.D. from the prestigious University of Toronto in Canada. Following his Ph.D., Haider delved into cutting-edge AI research, contributing to both academia and industry in Canada His recent transition to Oman Data Park reflects his commitment to driving AI initiatives and projects ” Furthermore, Haider shares his knowledge and passion of AI by teaching machine learning courses at the Modern College of Business and Science ”

Dr. Haider Al Lawati

Sr. Manager – AI, Oman Data Park

Mr Mujahid is the General Manager - IT at Bank Nizwa SOAG, Technology Committee Chairman of Oman Banking Association as well as Deputy Chairman of Information Technology Steering Committee at Bank Nizwa He is heading the Digital Transformation and Innovation projects in the Bank which complements the bank's long-term strategic initiative and Bank Nizwa’s vision to become the “Digital Bank of Choice” for the people of Oman He is a strategic, decisive and result oriented leader, having 20 years of professional expertise with an indepth knowledge in Digital Transformation and Innovation. He possesses the skill of managing a large team and has strong beliefs in ‘human capital’ and ‘staff engagement’.

He graduated from the National CEO Program Cohort-2 2016 developed under the patronage of the Diwan of Royal Court, delivered by the International Institute of Management Development (IMD). Mujahid holds a Master’s degree in Business Administration from Luton University, UK. He holds a Diploma in Leadership & Management from the Institute of Leadership and Management, UK and has been part of the General Management Program at Harvard Business School, USA He has completed his certification in the Islamic Finance Leadership Program from Claire College Cambridge

Mujahid Said Al Zadjaly General Manager IT , Bank Nizwa

Mr Ali Al Jabri is the AGM Payment Systems at CBO, where he leads national efforts to modernize the country’s payment systems infrastructure and advance digital innovation

With over 21 years of experience in payments, and financial technology, Ali has played a pivotal role in shaping Oman’s payment strategy, including implementation of key national payment infrastructures, 24/7 clearing and settlement capabilities, instant payment solutions, comprehensive regulatory frameworks for digital payments, as well as initiatives driving payment innovation and regional cross-border integration.

He represents CBO in major regional and international forums, working closely with financial institutions, fintechs, and regulators to enhance interoperability, resilience, and financial inclusion across the Sultanate. Ali is recognized for his leadership in driving secure, compliant, and forward-looking payment transformation aligned with international best practices

Ali Al Jabri

AGM Payment Systems, CBO

Mr Ken Habson has an extensive background in technology leadership, spanning over 25 years and leads the Data, AI, and Security Technology team for IBM in the Gulf, Levant, and Pakistan

He has worked with leading global organizations to deliver value to clients through their technology investments Previously, Ken had assumed leadership roles at Industry-leading Data and AI organizations across 4 contintents.

Ken is originally from the great State of Maine and has adopted Middle East as his home for the past 14 years. He enjoys learning from and influencing the trends shaping Data and AI.

Ken has an Engineering degree, MBA in Entrepreneurship, Advanced Management training from global tier 1 universities, and is a Candidate for Doctor of Business Administration focused on Artificial Intelligence in the C-Suite.

Ken Habson

Regional Data, AI, and Security Technology Leader, IBM

Dr Kamal Al-Sabahi is a seasoned academic and innovation leader with extensive experience across the banking sector, international AI research, and higher education

He currently serves as the Director of the Centre of Excellence in FinTech at the College of Banking and Financial Studies, where he leads efforts in FinTech education, policy advisory, and digital transformation.

With a career that spans industry and academia, including impactful work in China’s AI sector and the financial services industry, Dr. Kamal brings a global perspective to emerging technologies and their practical application in finance.

His research and leadership focus on building bridges between AI innovation and financial inclusion, shaping the future of FinTech.

Dr.

Kamal Al-Sabahi

Director - Centre of Excellence in FinTech College of Banking & Financial Studies

Mr Jawad Al Zaabi is a Senior Business Development Manager specializing in cloud solutions for the BFSI sector With over 12 years of experience across Telecom, Aviation, and IT services, he brings a diverse and robust skill set to his role He holds a wealth of certifications, including VMware Certified Professional (VCP 5) and expertise in EMC's Symmetrix and Data Domain Administration, demonstrating his proficiency in managing storage solutions with precision and reliability Additionally, his CCNA certifications in both Data Center and Routing & Switching highlight his comprehensive understanding of networking protocols and infrastructure.

During his tenure at Ooredoo, Mr. Jawad spearheaded the company's transition to the cloud, ensuring a seamless and successful migration of systems. He also played a crucial role in the readiness team for Oman Airports, contributing to the successful openings of Muscat and Salalah's new airports. More recently, with the Midis Group, Jawad has been instrumental in facilitating numerous companies' digital transformation journeys in his business development capacity

Jawad Al Zaabi Senior Business Development Manager, Oman Data Park

Mr.

Hamoud Al-Shidhani Chairman of the Board

Mr. Saleh Al-Taie Sign Language Interpreter

Ms. Reem Al-Maamari

Director

Raga, Talent Learning Consultant, RAB Consult

Core modernization for building future banking experiences

Next disruption in fintech

Tokenisation - the future of finance?

Emerging partnerships for innovating together

Accelerating the financial inclusion agenda

Deep-dive into borderless financial ecosystem AI, 5G & Cloud services leading to new opportunities

Green financing for a sustainable future

Mala’a is Oman’s National Databank, offering a range of services and solutions for financial and credit institutions, and playing a pivotal role in supporting regulatory functions, supporting FinTech’s, data registries, corporates, and government entities

The core objectives focus on fostering financial inclusion and ensuring access to credit for all segments of society It also aspires to elevate the financial well-being of the Sultanate and promote responsible lending practices, thus effectively mitigating credit risks in Oman. Mala’a stands as a critical enabler in realizing the ambitious goals outlined in Oman Vision 2040, particularly the Economic Diversification and Financial Sustainability.

Mala’a offers a range of products tailored for both individuals and corporates, with the Credit Report and Credit Score standing as the flagship offerings. The Credit Report is a comprehensive document that encapsulates financial and credit information. It includes not only demographic and firmographic data but also provides a detailed account of both positive and negative credit history, guarantees, and records of bounced checks, among other pertinent details

Sohar International is Oman’s fastest-growing bank, guided by a clear vision to become a world-leading Omani service company that helps customers, communities, and people prosper and grow

With a purpose to help people ‘win’ by delivering responsive banking for their ever-changing world, the bank offers innovative solutions across Commercial and Investment Banking, Wealth Management, Islamic Banking, and more Operating with a strong digital-first approach and an expanding regional footprint – including presence in the Kingdom of Saudi Arabia Sohar International is committed to driving value through strategic partnerships and a dynamic customer experience Learn more at www soharinternational com

Gulf Business Machines Oman (GBM Oman) is a trusted technology partner delivering end-to-end digital solutions tailored to the evolving needs of the banking and financial sector in Oman. With a strong local presence and decades of regional experience, GBM Oman supports critical infrastructure, IT modernization, and secure digital transformation for some of the country’s leading institutions.

Backed by world-class vendor partnerships and a team of in-country experts, GBM Oman provides advanced solutions in business automation, data and AI, cybersecurity, cloud infrastructure, and managed services From hybrid and public cloud environments to disaster recovery and secure networking, GBM Oman ensures scalable, compliant, and resilient technology foundations

By combining local insight with global innovation, GBM Oman plays a key role in shaping the digital future of Oman’s financial services industry, enabling banks to accelerate growth, enhance customer experience, and achieve operational excellence with confidence

Established in 2013, Bank Nizwa stands as the first and leading Islamic bank in the Sultanate of Oman. Since its inception, the bank has assumed a pivotal role in cultivating the flourishing landscape of Islamic finance within the country Offering unparalleled Sharia-compliant banking solutions alongside exceptional customer service, Bank Nizwa has garnered acclaim as a trusted banking partner nationwide

At the core of its operational ethos lies a dedication to customer-centricity and a relentless pursuit of innovation. In line with the ever-evolving needs of its customers, the bank has focused on developing products that seamlessly blend with contemporary lifestyles, but are deeply grounded in the tenets of Sharia. A keen emphasis on digitalizationepitomized by a robust mobile application, streamlined digital onboarding procedures, and a fully integrated digital branch - has augmented the accessibility and convenience of Bank Nizwa's services, even on the go

Through active participation in national-level events and conferences, Bank Nizwa has distinguished itself as a cherished thought-leader and educator, assuming a pivotal role in fostering awareness surrounding Sharia-compliant banking practices, while proactively addressing industry challenges The bank has also been instrumental in promoting Islamic finance practices through a series of Islamic Finance Knowledge Sessions (IFKS), as well as its recentlylaunched Sairafah program

With an extensive network comprising 23 strategically located branches, Bank Nizwa reaffirms its position as the preferred banking partner for a diverse array of communities Furthermore, the bank underscores its commitment to financial inclusivity by offering a comprehensive suite of products catering to the distinctive needs of individuals, women, minors, SMEs, corporations, and entrepreneurs alike

Equipped with a multifaceted growth strategy and a rich legacy as the leading and most-trusted Islamic bank in the Sultanate, Bank Nizwa remains poised for a promising trajectory, contributing substantively towards the socioeconomic advancement of the country

The College of Banking and Financial Studies is a government college, established in 1983 by Royal Decree No. (64/83). It operates under the supervision of the Central Bank of Oman. The College is the first public higher education institution in the Sultanate of Oman to receive institutional accreditation.

The college offers undergraduate, graduate, professional and management development programs

The programs and courses offered by the college are of high quality and professional, and some of them are accredited by prestigious universities internationally A major achievement of the college is its pivotal role in Omanizing jobs in the banking sector, where the Omanization rate has reached 92% so far

Liva Insurance is the region’s leading multi-line insurer, widely recognized for our unwavering commitment to excellence, innovation, and customer satisfaction. Our story began with the strategic integration of National Life & General Insurance Company (NLGIC) and Al Ahlia Insurance – two established names with decades of experience and deep-rooted trust across the market This integration brought together complementary strengths, uniting expertise, resources, and a shared vision to form a more dynamic, resilient, and customer-centric organization

Today, we continue to build on that legacy, offering a comprehensive suite of insurance solutions designed to meet the evolving needs of individuals, families, and businesses across the region With a forwardlooking approach, robust digital capabilities, and a relentless focus on service, we are redefining what it means to be an insurer delivering peace of mind, empowering our customers, and shaping a more secure future for all

Established in 2012, Oman Data Park is the Sultanate’s premier IT Managed Services provider offering superior Managed Data Centre, Cyber Security and Cloud Services utilising our locally hosted TIA 942 Rating 3 certified certified Data Centres. With a vision to transform the future, where ICT services will be available on demand, we serve over 500 local and international corporates ranging from large, and mid-tier to small companies.

Whether it’s a Government, Corporate or SME entity operating in Oman or internationally, we are fully equipped to serve them with cost-effective and secure IT services offering and lead the customer’s business into the future while they comfortably focus on their core business activities.

The winner of Best Digital Data Centre in the Middle East at the Telecom World Middle East Awards 2019 as well as Fortinet’s Best Managed Security Services Provider (MSSP) Award 2019, We operate Oman’s only Virtual Data Center – Nebula. Our Cyber Security Centre and the newly launched Professional Services as a Service (PSaaS) are all a part of our Opex-based models offering economical pay-as-you-grow models that facilitate Infrastructure as a service (IaaS), Network as a Service (NaaS), Data Centre as a Service (DCaaS), Disaster Recovery as a Service (DRaaS), as well as Application as a Service (AaaS)

With over 30 years of excellence as the leading investment management company in Oman, United Securities has grown and evolved to meet the expanding investment needs of its clients. Supported by the Muscat Stock Exchange and supervised by the Capital Market Authority, United Securities provides a wide array of services such as Investment Banking, Brokerage Services in the MENA region and US markets, Asset Management, Corporate Finance, Issue Management, Bonds Trading, and Equity Research Additionally, United Securities introduced E-tadawul, Oman’s first online trading platform that enables customers to trade securely and conveniently online

The company ’ s strength lies in its extensive experience, unwavering track record, and dedication to client satisfaction As trailblazers in the market, the company possesses a flair for identifying opportunities and driving investment avenues forward This has solidified the company ’ s status as the preferred consultants for high-net-worth individuals and esteemed investment companies, both domestically and internationally

At United Securities, it is the company ’ s unwavering commitment and responsibility to take care of the clients’ assets with the utmost detail and ensure the client’s interests are represented and protected

The company ’ s services are tailored to meet the unique investment needs of individuals, investment managers, corporations, pension funds, and other institutional clients The current leadership position is a testament to the meticulous application of our services and skills over the past 30 years This commitment has not only garnered the company numerous awards but has also earned us a stellar reputation for delivering exceptional customer service, perfectly aligned with the individual needs of each client

Today, United Securities embraces emerging opportunities in Oman and the world while continuing to exceed its clients' expectations.

Credit Oman was founded in 1991, under the name of Export Guarantee Financing Unit (EGFU). Since its inception, Credit Oman has played a pivotal role in facilitating domestic and export trade and contributing to Oman’s economic development. For over 30 years, Credit Oman has both shaped domestic trade, and catalyzed exports from the country to regional and international markets.

As the leading credit insurer of Oman, registered as an independent legal entity and fully owned by the government, Credit Oman is in a unique position to support the growth of Omani non-oil exports, to create a more developed, robust and diversified economy

Taageer Finance, established in the year 2000, is a leading public joint stock company listed on the Muscat Stock Exchange. As of this year, the Company holds the top position among all finance and leasing companies currently operating in Oman Headquartered in Al Khuwair, Taageer has a network of offices in Wattayah, Seeb, Barka, Suhar, Nizwa, Salalah, and Al Kamil wal Wafi, ensuring excellent accessibility for its valued customers

Over the past two decades, Taageer Finance has carved a niche for itself among finance and leasing companies, demonstrating sustained and stable growth The company has a strong track record of profitability and consistent dividends for shareholders, solidifying the brand within the industry

Focused on achieving the highest levels of customer satisfaction and quick service, Taageer Finance has enhanced its digital offerings with a user-friendly mobile application, providing convenient services at customers' fingertips

Boasting a dedicated and enthusiastic team, the Company is also committed to delivering top-notch services. With unwavering support from its shareholders, Taageer Finance continues to reach new heights, cementing its position as an industry leader.

Oman Banks Association (OBA) is a non-profit professional association created to represent the banking sector, to promote Omani banking activities, coordinate with the Regulators on matters of policy and strategy, and to support banking excellence in Oman

Central Bank of Oman

Oman Banks Association

Bank Muscat

Bank Dhofar

National Bank of Oman

Oman Arab Bank

HSBC Oman

Oman Data Park

ahlibank

Sohar International

Bank Nizwa

Alizz Islamic Bank

Meethaq

Maisarah

Muzn

Ahli Islamic

Sohar Islamic

Ominvest

First Abu Dhabi Bank

Oman Development Bank

Qatar National Bank

Standard Chartered Bank

Oman Housing Bank

Bank of Beirut, Bank Saderat Iran

Habib Bank

Bank Melli Iran

Oracle GBM

Microsoft Cisco OBM

Logicom

Ripple

Creditinfo Gulf Omantel

Ooredoo

Vodafone

KPMG

Infosys

Saxo Bank

InfrasoftTech

CompassPlus Comarch

Volante

Finanteq

HPS Thawani

Mala’a

Global ITS OmPay

Idenfo and many more…