Setting the scene –

Session 4:

Green investment

Insights from “Green Investment and Productivity: Main Policy Challenges”

Ettore Gallo (University of Parma)

Cecilia Jona-Lasinio (Luiss Business School)

Benedetta Samoncini (MEF)

Insights from “Green Investment and Productivity: Main Policy Challenges”

Ettore Gallo (University of Parma)

Cecilia Jona-Lasinio (Luiss Business School)

Benedetta Samoncini (MEF)

• Climate change is increasingly recognized as a threat to global health and economic prosperity.

• Achieving the 1.5°C scenario requires significant reductions in greenhouse gas emissions –that would need to be reduced by 45% by 2030 and reach net zero by 2050 – and a transition to cleaner, renewable energy sources (e.g., solar, wind, hydro), as well as energy efficiency measures, improved energy storage, and other low-carbon technologies.

• To do so, quickly scaling up global investment in technologies related to the energy transition is of substantial relevance.

• Annual investments in clean technologies must quadruple to remain on with the 1.5°C scenario outlined in the Paris Agreement .

• The latest IPCC synthesis report estimates that “investment requirements for 2020 to 2030 in scenarios that limit warming to 2°C or 1.5°C are a factor of three to six greater than current levels, and total mitigation investments [...] would need to increase across all sectors and regions” .

• The low-carbon transition is unfolding amid rising geopolitical tensions, trade fragmentation, and energy insecurity.

• These factors risk slowing down climate action, discouraging green investment, while deepening fossil fuel dependencies in countries prioritizing short-term resilience

• International climate coordination is losing momentum, making renewed multilateral engagement both more urgent and more difficult.

• At the same time, the re-emergence of industrial policy has opened a critical window for accelerating green investment , however lacking overall coordination

• Both public and private investment in clean energy remain significantly below the levels required to meet global climate goals.

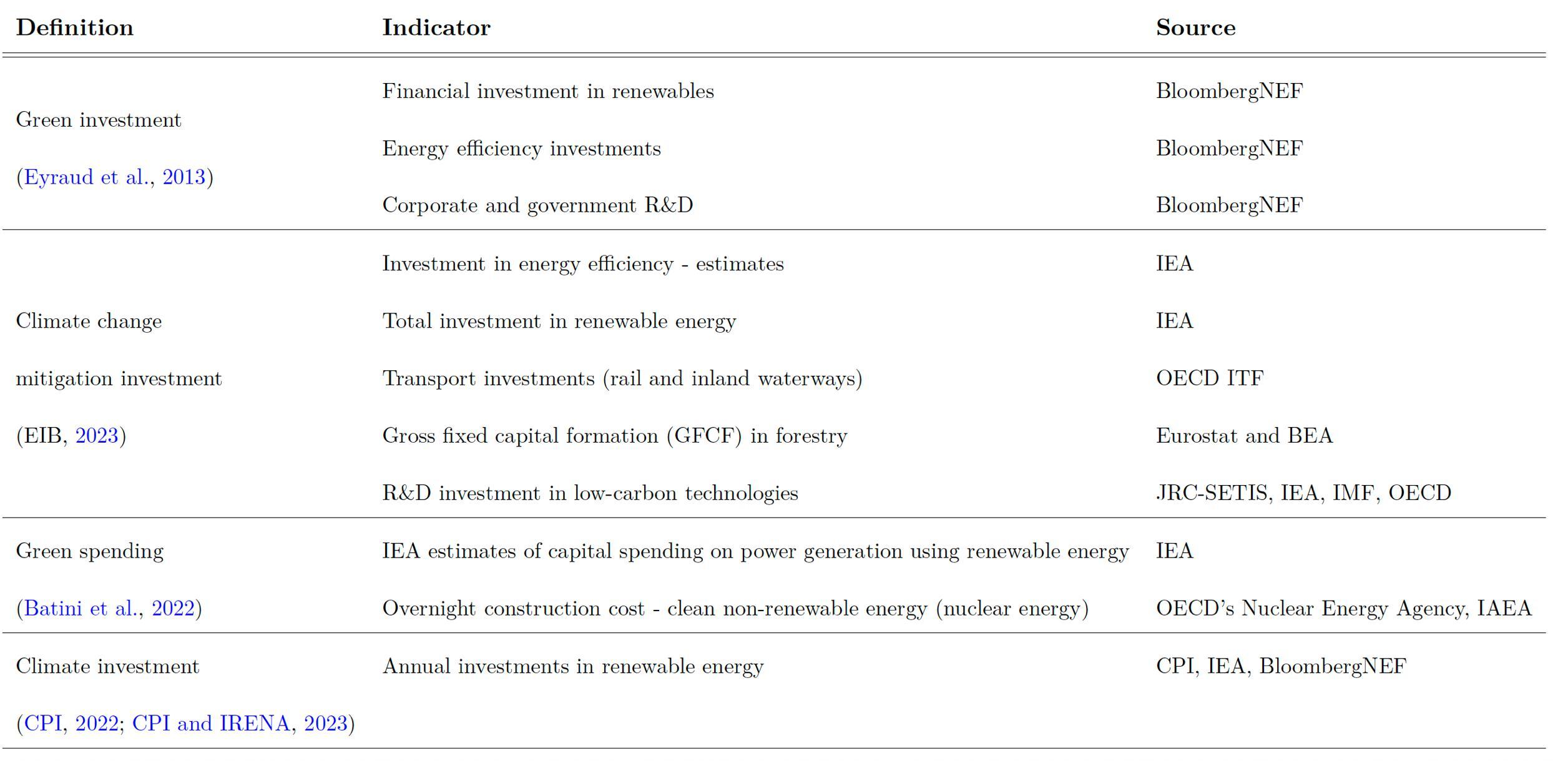

• Offer an overview of green investment definitions and measurement approaches.

✔ Provide a measurable definition of green investment, building a database of 18 OECD countries over 2004-2020.

• Test the effect of scaling up green investment and environmental regulation on productivity. ✔ Expected outcomes:

1. Positive productivity gains from green investment (green capital deepening).

2. Stricter environmental regulations leads to positive productivity returns through innovation (Porter hypothesis)

• Our findings show that, albeit small, scaling up renewable green capital has a positive and significant effect on productivity growth

• The results suggest that strengthening environmental regulation does not hamper productivity growth.

○ Market policies, e.g. carbon taxes and trading schemes, could lead to productivity effects that, however, are not statistically significant.

○ At the same time, non-market policies – such as emission limits – appear to be the most effective in fostering innovation in our sample.

○ Last, the stringency associated with technology support measures has a positive but not significant impact on productivity growth.

✔ However, one might notice that the sub-index groups together two sets of policies which have arguably different effects (Becker 2015), i.e. public R&D expenditures on low-carbon energy technology and renewable energy support measures.

• When interacted with renewable green capital, green skill intensity has a positive and statistically significant impact on productivity

• A major obstacle to effective policymaking is data uncertainty: there is no consistent, internationally agreed-upon definition of green investment.

• Official statistics currently lack clarity on:

○ What assets qualify as “green” (e.g., is retrofitting green? What about circular economy assets?)

○ Whether financial expenditure flows are a valid proxy for macroeconomic measures of green capital formation.

• This hampers not only research, but also policy monitoring, coordination, and evaluation especially at the supranational level.

• Improving cross-country coordination on green investment data, possibly via a standardized taxonomy and harmonized statistical reporting (e.g., through OECD, G7, or G20), should be a key priority.

● It’s important to look at how to further improve green investment measurements to provide data and instruments that allow a better policy evaluation of the green transition and better define environmental mitigation strategies

● The empirical analysis conducted suggests some potential policy issues that might be worth further developing:

○ an increase in renewable green investment leads to positive and significant effects on productivity growth;

○ there may not necessarily be a trade-off between climate change mitigation objectives and economic growth;

○ potential synergies may exist between the two goals: government may decide to pursue climate change mitigation objectives and spur productivity growth at the same time.

The results of our analysis suggest a deeper exploration of the following preliminary findings:

• more stringent environmental regulatory measures may have a potential positive role to play: stricter regulation does not necessarily constrain productivity growth and might even stimulate innovation thus favoring adaptation

• we found that non-market policies appear to be the most effective in fostering innovation and likely productivity;

• policymakers should also consider the potential positive role of green technology support measures.

Overall, scaling public investment alone is not enough: to fulfill climate ambitions, policymakers has a role to play also in mobilizing private capital and creating favorable conditions for private investment.

THANK YOU!