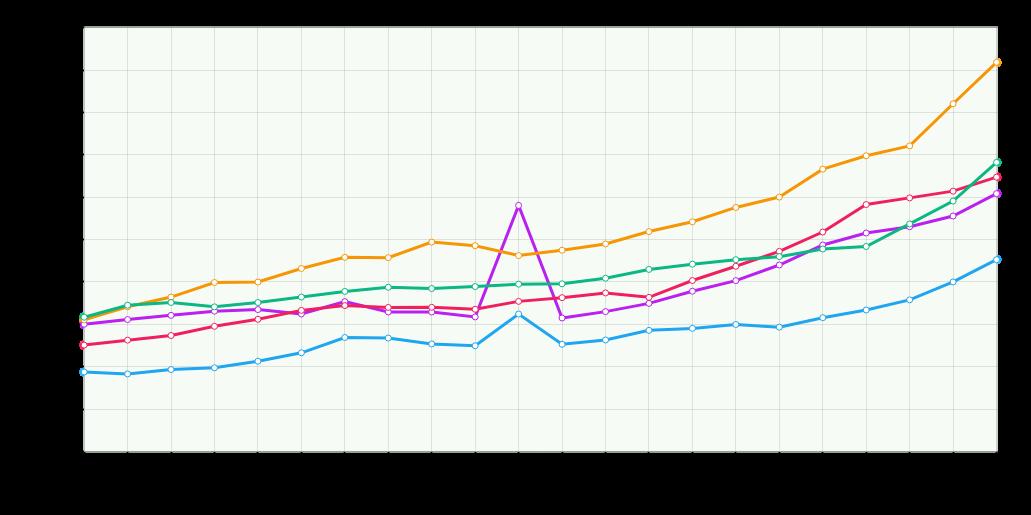

Friendswood Property Taxes areexplodingataratemuchfasterthanCPI+populationgrowth.Between2003and2023,Friendswoodpropertytaxes grewby157%whileCPI+populationgrewatonly98%.Stateddifferently therateofpropertytaxgrowthwas60%fasterthantherateofpopulation+ CPI.

Friendswood property taxes per capita are higher than peer Texas cities. Friendswood per capita property taxes grew from $345/ person to $682/ personbetween2003and2023,an98%increase.Percapitapropertytaxesfrom2003to2023grewby146%inHurst,163%inWaxahachie,148%in WeslacoandDuncanvillegrewby96%.

TexaspropertytaxrateshavefinallybeguntocompressduetoSB2passedin2019.Friendswoodpropertytaxratesfellfrom64%in2003to50%in 2023, it decreased 22%. Tax rates decreased by about 10% in Duncanville and 1% in Weslaco during the same period. However, Hurst increased by 50%to58%,butWaxahachiedecreasedfrom62%to61%.

Taxratecompressionshouldoccurinmostcitiesevenifassessedvaluescontinuetheirupwardspiral.

What can you do? Protest your property taxes each and every year About 60 to 80% of tax appeals are successful. Galveston Central Appraisal Districtpropertyownerswhoappealedtheirpropertytaxesin2020savedabout$113.03millioncollectively