PropertyTaxProtectionProgram EnrollNow Freeonlineenrollmentin3minutes. Nocostunlesstaxesreduced,guaranteed.

DentonCentralAppraisalDistrict’s(CAD)holdsbothformalandinformalhearingswherepropertyownersandtheiragentsprovideevidencetoargueforlower propertyvalues.Theresultsofthesehearingsaredisplayedbelow:

The$327millionoveralltaxsavingsforDentonCountypropertyprotestwinnersin2022surpassesthe$190milliontotalpropertytaxreductionsin2021. PropertyownersinDentonCountyprotestedvaluesof105,990accountsin2022.

Sixty-eightpercentofinformalandeighty-fivepercentofAppraisalReviewBoard(ARB)propertytaxprotestsinDentonCountyweresuccessful.

Homeownerssavedjustover$5millionatDentonCADininformalprotestsandalmost$19millioninARBpropertytaxprotests.

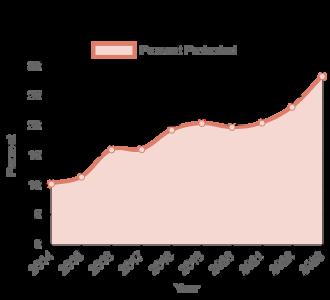

In2017,about15%ofDentonCountypropertyparcelswereprotestedandby2022,23%ofpropertyinthecountywasbeingappealed.InDentonCountythere was$13millioninpropertytaxsavingsgainedfromprotestsattheinformalhearings Theamountoftaxsavingsthefollowingyearin2022roseamassiveamounttoover$114million

PropertyownersselectO’Connortorepresenttheminpropertytaxprotestsmoreoftenthananyotherfirmbecause:

O’Connors aggressive approach is well aligned with the property owners’ interest. We pay the fees and costs regardless of the level of appeal. Many competitorsrequirethepropertyownertopaythebindingarbitrationdepositorcostsrelatedtojudicialappealsuchaslegalfees,expertwitnessfeesand courtcosts.Wewillnotaskyoutopayanyofthecostsorfeesrelatedtoyourpropertytaxprotest.

O’ConnorhasspentyearsdevelopingrelationshipswithDentonCADstaffandwellunderstandstheinformationneededtowinyourpropertytaxappeal.

WeknowtheprocessesandappropriatecontractsatDentonCountyAppraisalDistrict.

Whilerelationshipsareimportant,soishavingcredibleevidence.Proprietarysoftwareanddatabaseswithover50millionsalesformatevidencepartially basedontheappraisaldistrictsthinkingonevaluatingevidence.

O’ConnorhastheexperienceandexpertisenecessarytoassembleunevenappraisaldataandsalestosatisfytheguidelinessetbytheDentonCountyARB andDentonCAD

PERCENTOFINFORMALHEARINGSRESULTING INAREDUCTION PERCENTOFFORMALPROTESTSRESULTING

August2023

DentonCentralAppraisalDistrictinformalhearingsgeneratedanestimatedpropertytaxsavingsof$51million.FormalhearingswiththeAppraisalReviewBoard generatedanadditionaltaxsavingsofapproximately$167million,bringingthetotaltaxsavingstoaround$218millionfor2021.

July2023

TheDentonCentralAppraisalDistrictyielded$6.7billioninpropertytaxassessmentreductionsatappraisalreviewboardhearings.Asaresult propertyownersin thecountycollectivelyrealizedcloseto$167millionintaxsavings! June2023

TheDentonCentralAppraisalDistrictstatesthetotalamountofvaluereductionachievedthroughtheinformalprocessin2021was$2billion Thattranslatesto arounda$50.9milliontaxsavingsforDentonCountypropertyowners.

May2023

InDentonCounty54,769accountswereresolvedinformallyanddidnotadvancetotheAppraisalReviewBoardin2021.Ofthisnumber36,477oftheaccounts,or 67%weresettledwithareductioninvalue.

April2023

Bymarketvalue,43%ofpropertyinDentonCountywasprotestedattheARBin2021.Themarketvalueprotestedfor91,691propertieswasinitiallyvaluedat$63 billion.

March2023

In2021,thetotalmarketvalueofallpropertyinDentonCentralAppraisalDistrictis$147billion.Ofthisamount,housesmakeup58%or$86billion,accordingto TexasComptrollerdata.

February2023

In2021,therewere448,531parcelsintheDentonCentralAppraisalDistrict.Theappraisaldistrict’sbudgetfortheyearwas$14million,whichcomestoaround $32pertaxparcel.

January2023

DentonCentralAppraisalDistrictestimatesthevalueofland,houses,commercial,multifamilyindustrial,utilitiesandpersonalpropertyat$147billionfor2021. DentonCountypropertytaxestotal$3.6billionannuallybasedonthesepropertytaxassessmentsbyDentonCAD

EnteryourinformationbelowtoenrollinthePropertyTaxProtectionProgramandhaveyourpropertytaxes protested.

2025Protest:AppliestothemajorityofTexaspropertyownerswhose2024valuenoticefromthe countyisdatedmorethan30daysagoandthedateispastMay15,2024.