PropertyTaxProtectionProgram EnrollNow

Freeonlineenrollmentin3minutes. Nocostunlesstaxesreduced,guaranteed.

CollinCentralAppraisalDistrict(CAD)commercialandresidentialpropertyownershaveclaimedpropertytaxsavingsfromformalandinformalhearings.The resultsofthesearedisplayedbelow:

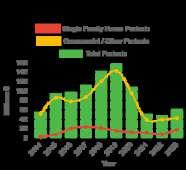

In2022,CollinCountyownersachievedtotaltaxsavingsin2022of$226million,whichexceedsthe2021totalpropertytaxsavingsof$137million.

Theappraisalvalueof99,550CollinCountyaccountswerecontestedbythepropertyownersin2022.

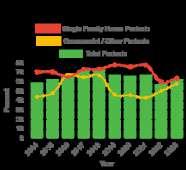

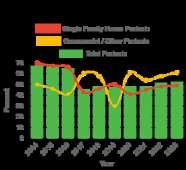

56%ofinformaland51%ofAppraisalReviewBoard(ARB)propertytaxprotestsinCollinCountyweresuccessful.Theinformalstepintheappealprocess resultedin$9millioninpropertytaxsavingsforaccountsvaluedbyCollinCAD Anadditional$11millionsavingsforpropertyownerswasaccomplishedin ARBprotests

In2014,lessthan11%ofCollinCountypropertyparcelswereprotested.By2022,greaternumbersofaccountsbegantoleveragethebenefitoftheappeal process,with23%ofpropertyownersfilingforreduction.

In2021,CollinCountyaccountsfoundtaxsavingsfrominformalhearingsworth$50million.Thisamountstayedconsistentin2022with$48millionin savingsfrominformalappeals.

PropertyownersselectO’Connortorepresenttheminpropertytaxprotestsmoreoftenthananyotherfirmbecause:

O’Connors aggressive approach is well aligned with the property owners’ interest. We pay the fees and costs regardless of the level of appeal. Many competitorsrequirethepropertyownertopaythebindingarbitrationdepositorcostsrelatedtojudicialappealsuchaslegalfees,expertwitnessfeesand courtcosts.Wewillnotaskyoutopayanyofthecostsorfeesrelatedtoyourpropertytaxprotest.

O’Connorhasbuiltrelationshipswithappraisaldistrictstaffduringthelast30yearswhileconductingliterallymillionsofpropertytaxappeals.

O’Connordevelopsanextensivefileforeachpropertytaxprotest,often50to100pagesofevidenceregardingbothmarketvalueandunequalappraisal.Our proprietarysoftwaretailorstheevidencetoaformattheappraisaldistrictprefers.

OurexperiencehasallowedustocompilesalesandunequalappraisaldataconsistentwiththeformatexpectedbytheCollinCADandtheCollinCountyARB.

DisclaimerO’Connorisapropertytaxconsultantandisnotaffiliatedwithanyappraisaldistrict.DataforgraphsprovidedbyTexascomptroller

August2023

In2021,CollinCentralAppraisalDistrictgrantedanestimated$47millioninpropertytaxsavingsatinformalhearingsand$80.4millioninpropertytaxsavingsat ARBorformalhearings.Theseproteststotaledcloseto$127milliontotaltaxsavingsforCollinCountypropertyowners.

July2023

TheCollinCentralAppraisalDistrictprotestsatARBhearingsresultedinvaluereductionsworth$3.2billion,translatingtopropertytaxsavingsofnear$80.4 million.

June2023

In2021,CollinCentralAppraisalDistrictinformalhearingsloweredthe2021assessedvaluesby$1.8billion.CollinCountypropertyownersrealizeanestimated $46.9millionsavingsinpropertytaxesasaresult.

May2023

TheCollinCentralAppraisalDistrictsettled40,211accountsthroughtheinformalprocessin2021.67%or26,918oftheseaccountssawaresultwithalower value.

April2023

TheCollinCentralAppraisalDistrictdocuments56%ofthetotalmarketvalue,equaling$112billionwasprotestedwiththeAppraisalReviewBoardin2021. Protestsfiledby78,825propertyownersaccountforthesenumbers.

March2023

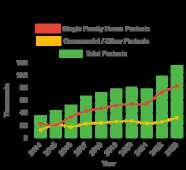

Themarketvalueofsingle-familyhomesis$108billionor54%ofthetotalmarketvalueforallpropertycategoriesinCollinCentralAppraisalDistrictin2021.The totalmarketvalueofCollinCentralAppraisalDistrictpropertytypesis$201billion.

February2023

TheCollinCentralAppraisalDistrictpropertytaxparcelsincludesingle-familyresidentialpropertymulti-familyresidentialproperty,commercialpropertyutilities, andindustrialpropertyaswellasotherpropertytypesforatotalof402,482taxparcels.Atatotalbudgetin2021of$23million,anaverageof$58wasspenton theappraisalofeachtaxparcel.

January2023

CollinCentralAppraisalDistrictestimatesthevalueofland,houses,commercial,multifamily industrial,utilitiesandpersonalpropertyat$201billionfor2021. CollinCountypropertytaxestotal$5billionannuallybasedonthesepropertytaxassessmentsbyCollinCAD

2025Protest:AppliestothemajorityofTexaspropertyownerswhose2024valuenoticefromthe countyisdatedmorethan30daysagoandthedateispastMay15,2024.

2024Protest:AppliestoselectTexaspropertyownerswherethe2024valuenoticeisdatedLESSthan 30daysago.