GalvestonPropertyTaxStatistics

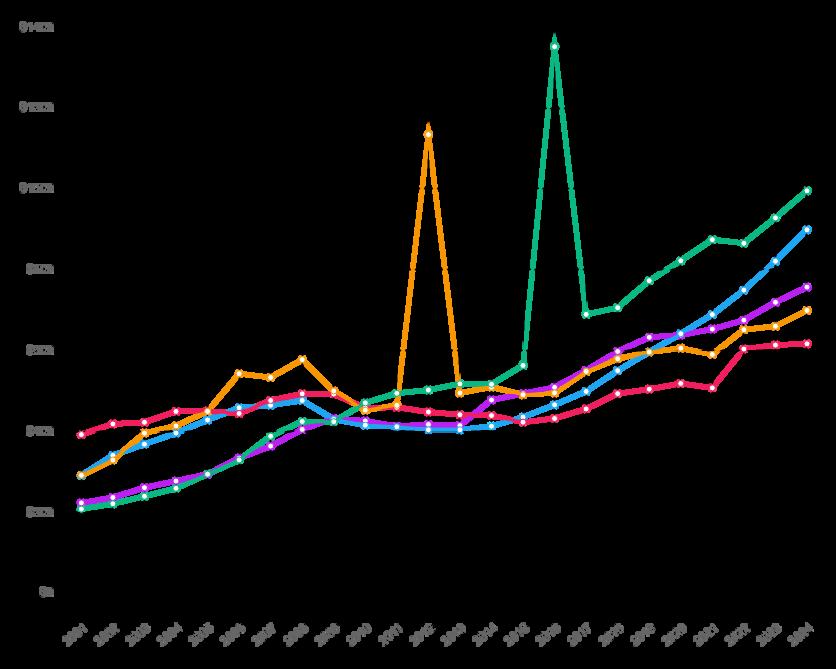

Galveston Property Taxesrose at a significant rate in 2024, about 432% faster than the rate of population + CPI. It is clear that Galveston property taxes are rising at a rate faster than CPI + population growth. Between 2001 and 2024, Galveston property taxes grew by 346% while CPI + population grew at only 65%.

Between 2001 and 2024, Galveston per capita property taxes grew from $208 / person to $995 / person, a 378% increase. This is by far the fastest rate of increase in per capita property taxes when compared to peer cities like Grapevine, Burleson,CedarHill,andTexasCity Percapitapropertytaxes from 2001 to 2024 grew by 175% in Burleson, 123% in Cedar Hill, and 67% in Texas City Grapevine provides its property owners with a slight relief from the massive increases in per capita property taxes occurring across the state. Per capita Grapevine property taxes increased only 57% from 2001 to 2024.

The good news for Galveston property owners is that property tax rates declined from 0.56% in 2001 to 0.41% in 2024. Grapevine saw an even greater drop from 0.37% to 0.24%, or a 35% drop. Elsewhere tax rates increased, for instance, in Texas City, tax rates went from 0.33% to 0.49%. During the same time, tax rates in Cedar Hill stayed consistent despite massive changes in assessedvalueforothercities.Taxratesroseby10%inBurlesonfrom2001to 2024.

Readmore…

propertyaddressbelowandsearchingasstep 1 Yes,O’Connorcanhelpyoureduceyourpropertytaxes

Yes–thereisNEVERafeeunlesswereduceyourpropertytaxes

Simpleon-lineenrollmentinjust2or3minutes

Wedoalltheworkandyoujustshareinthesavings.Wefilethe protestandattendthehearing.Noflatfee;justpayhalfoffirst yearpropertytaxsavings

Personalizedconciergeservicesitevisits

O’Connorsavedclientsover$190millionin2024!

(Byappointmentonly)