DentonCentralAppraisalDistrict

LocalAppraisalDistrict

PropertyownersselectO’Connortorepresenttheminpropertytaxprotests moreoftenthananyotherfirmbecause:

O’Connor’saggressiveapproachiswellalignedwiththepropertyowners’ interest. We pay the fees and costs regardless of the level of appeal. Many competitors require the property owner to pay the binding arbitration deposit or costs related to judicial appeal such as legal fees, expert witness fees and court costs. We will not ask you to pay any of thecostsorfeesrelatedtoyourpropertytaxprotest.

O’Connor has spent years developing relationships with Denton CAD staff and well understands the information needed to win your property taxappeal.

We know the processes and appropriate contracts at Denton Central AppraisalDistrict.

While relationships are important, so is having credible evidence. Proprietary software and databases with over 50 million sales format evidencepartiallybasedontheappraisaldistrictsthinkingonevaluating evidence.

O’Connor has the experience and expertise necessary to assemble uneven appraisal data and sales to satisfy the guidelines set by the DentonCountyARBandDentonCAD

SearchforyourProperty

Starttheprocesstoreduceyourpropertytaxesbyenteringyour propertyaddressbelowandsearchingasstep 1

Yes,O’Connorcanhelpyoureduceyourpropertytaxes

Yes–thereisNEVERafeeunlesswereduceyourpropertytaxes

Simpleon-lineenrollmentinjust2or3minutes

Wedoalltheworkandyoujustshareinthesavings.Wefilethe protestandattendthehearing.Noflatfee;justpayhalfoffirst yearpropertytaxsavings

Personalizedconciergeservicesitevisits

O’Connorsavedclientsover$190millionin2024!

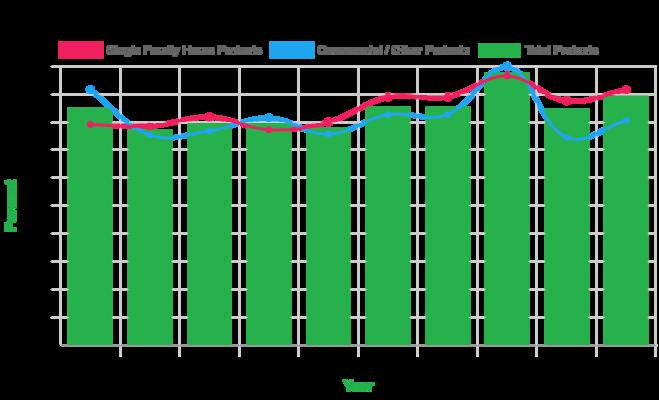

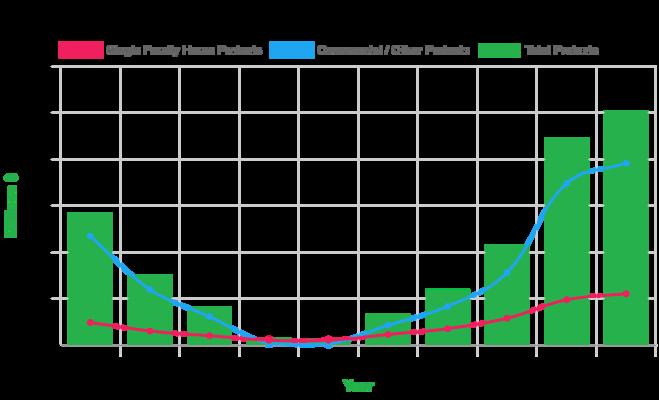

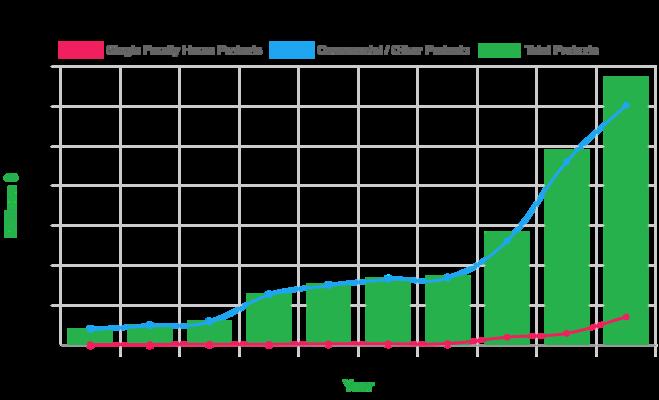

DentonCentralAppraisalDistrict’s(CAD)holdsbothformalandinformalhearingswherepropertyownersandtheiragentsprovideevidencetoargue forlowerpropertyvalues.Theresultsofthesehearingsaredisplayedbelow:

Due to protests, property owners in Denton County saw a total of $562 million in tax savings in 2023, up from $429 million in 2022. As many as 133,780 accountsinDentonCountywereprotestedbypropertyownersin2023.

InDentonCounty,63%ofinformalpropertytaxprotestand89%ofARBprotestsweresuccessful.

AtDentonCAD,homeownerssavedabout$28millionviainformalprotests,andatARB,theysaved$45millionthroughpropertytaxprotests.

A total of 28% of Denton County’s property parcels were subject to an appeal in 2023, up from 20% in 2021. As a result of protestsraised at the informal hearings,ownersinDentonCountysaved$129millioninpropertytaxes.

Formalprotestsresultedinasavingsof$432,720millionintaxesin2023.

PropertyTaxLocations

HoustonOffice (Corporate)

2200NorthLoopWest,Suite 200 Houston,TX77018

713-686-9955

AtlantaOffice (Byappointmentonly)

4751BestRoad,Suite316 CollegePark,GA30337

770-835-4126

DallasOffice (Byappointmentonly)

4101McEwenRd,Suite200 Dallas,TX75244

972-243-9966

ChicagoOffice (Byappointmentonly)

75ExecutiveDrive,Suite349 Aurora,IL60504

708-630-0944

SanAntonioOffice (Byappointmentonly)

8632FredericksburgRd,Suite 105 SanAntonio,TX78240

210-226-0829

NewYorkOffice (Byappointmentonly)

70EastSunriseHwy,Suite500 ValleyStream,NY11581 934-203-9917