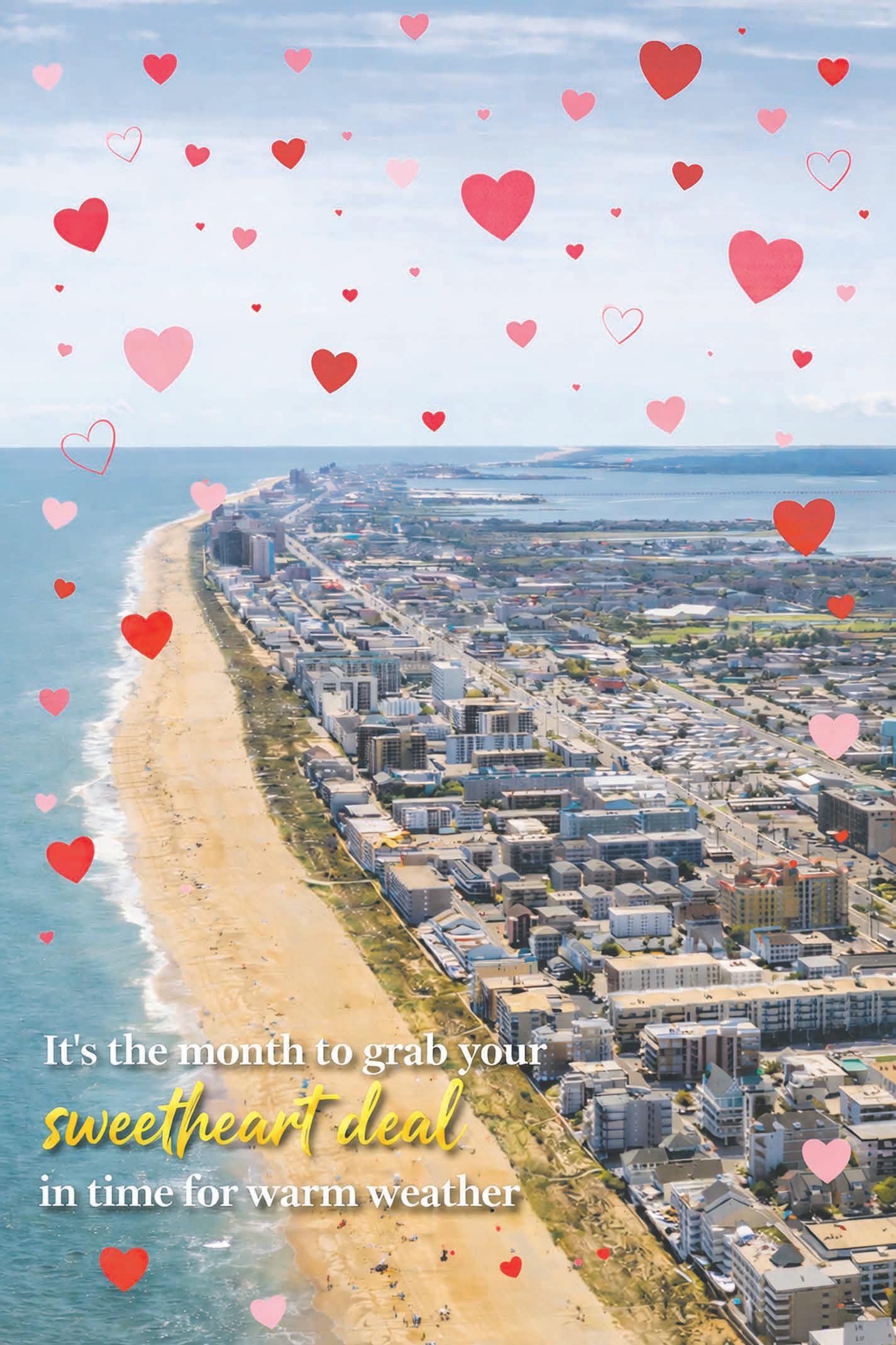

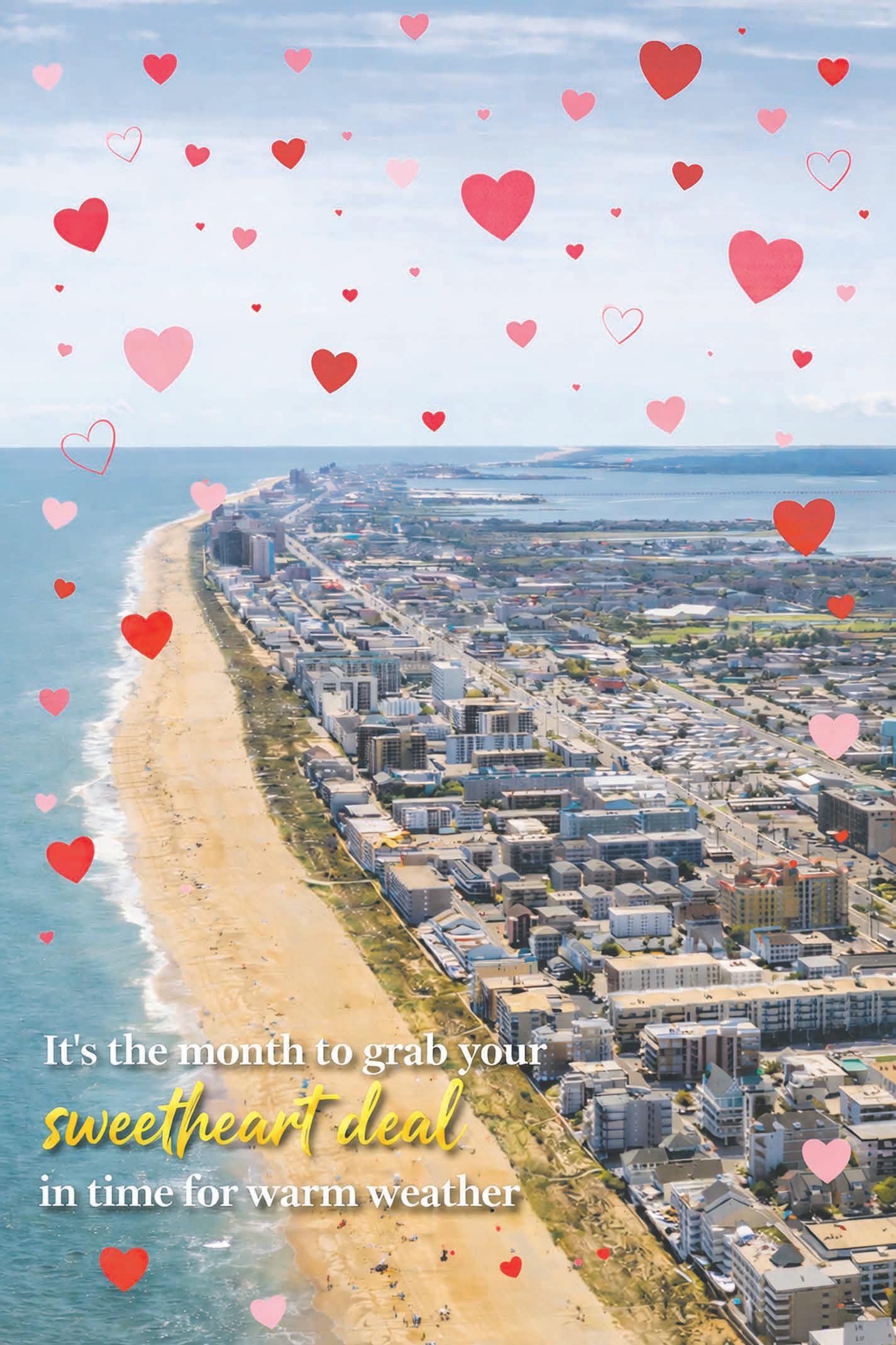

THE COASTAL REAL ESTATE RESOURCE Coastal Association of Realtors/OC Today-Dispatch

THE COASTAL REAL ESTATE RESOURCE Coastal Association of Realtors/OC Today-Dispatch

THE COASTAL REAL ESTATE RESOURCE Coastal Association of Realtors - OC Today-Dispatch

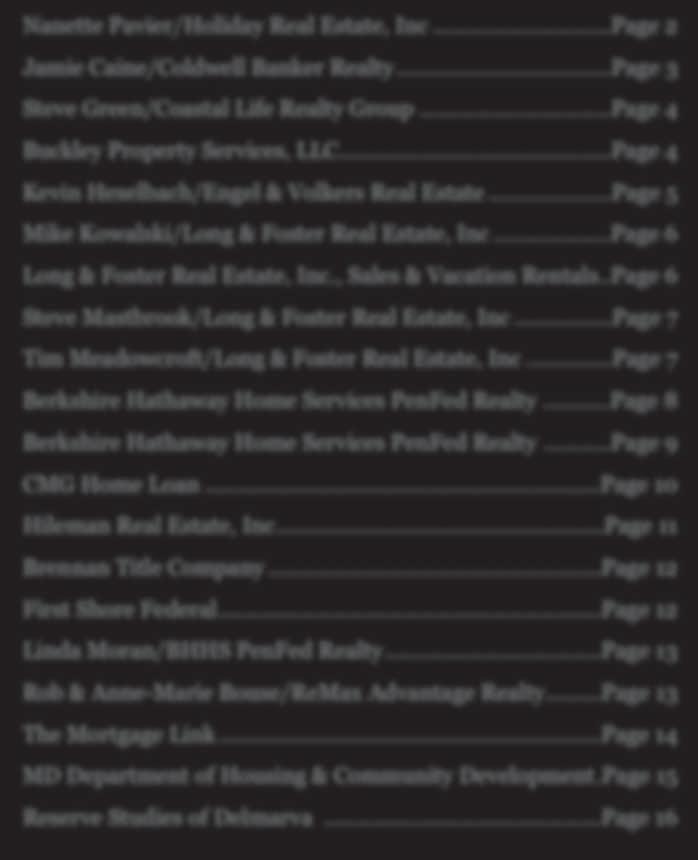

Published by OC Today-Dispatch for the Coastal Association of Realtors. Advertising in this publication is limited to members and affiliated members of the Association.

The COASTAL ASSOCIATION OF REALTORS® (CAR) is a trade organization for real estate professionals in Wicomico, Worcester and Somerset Counties on the Eastern Shore of Maryland. Its membership consists of more than 1,000 REALTORs® and affiliate members serving the home-buying and homeselling needs of the public since 1957.

The term REALTOR® is a registered collective membership mark, which may be used only by real estate professionals who are members of the NATIONAL ASSOCIATION OF REALTORS® and subscribe to its strict Code of Ethics.

The COASTAL ASSOCIATION OF REALTORS is located at 314 Franklin Avenue, Suite 106 • Berlin, MD 21811. Phone: 410-641-4409. On the Web: www.coastalrealtor.org

OC TODAY-DISPATCH is the leading newspaper publisher on the Maryland coast, with OC Today-Dispatch publishing weekly on Friday, Bayside Gazette and Ocean City Digest publishing on Thursdays and Real Estate, the Coastal Real Estate Resource publishing key weekends throughout the year. On the Web: www.octodaydispatch.com

Editor......................................................................... Stewart Dobson

Executive Editor................................................................ Steve Green

Account Managers....................... Mary Cooper, Renée Kelly, Terri French

Classifieds/Legals ........................................................ Pamela Green

Art Director....................................................................... Cole Gibson

Senior Page Designer....................................................... Susan Parks

Senior Ad Designer............................................................ Kelly Brown

Publisher..................................................................... Christine Brown

Administrative Asistant.......................................................... Gini Tufts

Nanette

New carpeting, paint & elegant Italian Calacatta quartz kitchen countertops. 3 BRs & 3 full BAs. Wrap-around water view balconies. Modern kitchen flows to living area, hardwood cathedral ceilings & fireplace. Secure lobby, indoor pool & smart-home app-controlled fans & lights.

•

•

•

•

•

•

The Coastal Association of REALTORS® (CAR) proudly welcomed 9 new real estate professionals at its New Member Orientation held on February 2, 2026 at the association’s headquarters in Berlin. This comprehensive session introduced incoming members to the many tools, benefits, and support systems available through CAR.

The orientation, which is a requirement for all new REALTOR® members, included a morning session focused on association resources, professional standards, and networking opportunities, followed by the Maryland Ethics (“D”) course in the afternoon.

“We are thrilled to welcome this new group of REALTOR® profes-

sionals to our association,” said CAR President Terrence McGowan. “Our goal is to provide them with the tools, education, and advocacy they need to succeed in today’s real estate market. We’re excited to support their growth and celebrate their future accomplishments.”

CAR’s New Member Orientation highlights essential services includ-

ing advocacy at the local and state levels, member-exclusive tools like FOREWARN and SentriLock, continuing education opportunities, and a full calendar of networking events. New members were also introduced to the Coastal Member Portal, where they can register for classes, events, and manage their accounts.

Call or Text : 301.807.6454 bigmike@lnf.com WATERFRONT 2 BR, 2 BA

Incredible top floor southern views from covered balcony. Personal dock directly below your unit. View fireworks, airshow aircraft, skyline & wide canals. Restaurants, grocery stores & beach less than mile away. Furnished condo has wet bar, stack washer/dryer & assigned off street parking.

Make this your main getaway from the world – your perfect beach place awaits.

$449,000

MOVE-IN READY 2 BR, 1.5 BA CONDO CLOSE to the BEACH!

Your perfect place at the beach! Totally furnished, with turn-key ownership. Drop your suitcases & you are home. Park in your off-street space & never drive while you are here. Close to restaurants, entertainment & only 1.5 blocks to the beach & Boardwalk. Enjoy ocean breezes from your covered porch, rain or shine. Easily rented, with possible GRI of $15,000 for the season, or just use it yourself with friends & family. Come own your own slice of the Ocean City life today!

$350,000

One shouldn’t judge a book by its cover. However, that often is hard to do, particularly when it comes to homes. Curb appeal bears significant influence regarding how a property is perceived. A property that is neat and aesthetically appealing probably will be preferable to one that looks like the homeowners did not maintain it.

Boosting curb appeal is a common focus of sellers before listing a property. But what can those who don’t have big budgets for major overhauls do to improve their curb appeal? Plenty of projects can offer maximum output with minimal investment. Refresh the front door. Painting the front door can add brightness and improve the look of a home’s entryway. Most exterior paint costs between $30 and $40 per gallon, so this is undeniably a budget-friendly improvement. If money allows, replacing the door altogether will generate bang for your buck.

Improve or add landscaping elements. Landscaping should be designed to highlight the home’s best features. It should look symmetrical and feel manicured. If it’s not possible to plant new flowers or bushes, simply cleaning up debris and weeds,

and trimming existing greenery can make it feel neater and more polished.

Clean up! Power-washing the siding, cement walkways and garage door can create instant impact. It’s amazing how much dirt and mildew can reduce the luster of a home. Cleaning off years of grime can be a fast and inexpensive refresh.

Reseal the driveway. Make sure the driveway is clean and tidy. If it has cracks or discoloration, filling in cracks and applying a new coat of sealer will make a big difference. Homeowners can hire someone to reseal the driveway or do the work on their own.

Add lighting. Updating front porch lights and accent lights around the property will cast a more positive glow on a home, both literally and figuratively.

More Seating. If space by the front door allows, add a bench or some chairs to create a welcoming seating area. A potted plant or two nearby will help the area seem intentional.

Improving curb appeal doesn’t have to cost a lot of money. A few easy touches can boost the look of any property.

Never-rented lovely, 2 bedroom/2 bath condo in Caine Woods section of North Ocean City just a few blocks to the Ocean beaches. This condo end unit has side windows bringing in additional light to the interior and has been beautifully maintained over the past 20 years by owners. ALL NEW CARPETING IN MAIN LIVING AREA. There is a gorgeous community pool just to the rear of the condo. Lost Colony is close to Fenwick Island with many fine restaurants & shops of all types nearby.

If you don’t need as much house as you used to, it’s time to start thinking small

The day a child leaves home can be bittersweet for parents. Parents typically lament the quiet that comes from empty rooms and a change to the daily routine they'd grown accustomed to when the kids were around.

After some time, some couples decide to downsize to a home more befitting the empty nester lifestyle. Down-sizing presents an option for homeowners whose kids have left the nest.

A survey of 2,500 empty nesters commissioned by Regency Living found that 30% choose to downsize and move from their original family homes.

When retirement is just around the corner, many professionals shift focus to how they want to live and where. Moving to a new home presents plenty of opportunities for older adults, including a chance to choose a home based on what's right for them in this stage of life.

Homeowners should be asking themselves:

How much upkeep can I handle? A lifelong family home may be well-loved, but chances are it requires

significant upkeep and repairs. Empty nesters may choose to move to a home in a “lifestyle community” with an HOA, and maintenance built into a monthly fee.

Is this layout still a fit? Many empty nesters may not immediately feel the effects of aging, but before selecting a next home, individuals should think about aging in place and any unique needs they may have. Opting for a single-level home, or at least one with the owner's suite on the main level, can be advantageous.

Can I make do with less square footage? A cavernous home with many rooms often isn't desirable for empty nesters. All of that square footage requires heating, cooling and maintenance. Rattling around inside a big, empty house may precipitate the decision to downsize. Downsizing also can free up home equity, which can be used to fund retirement needs.

Which features do you desire? Many empty nesters want the next home to focus on some luxury items they may have bypassed in the first home when priorities lay elsewhere. Upscale environments like gourmet kitchens, spa-like bathrooms and outdoor living spaces may be in the budget when moving into a home with a smaller footprint.

Will my home be secure while I travel? Empty nesters might want to choose homes in gated communities or condominium complexes for safety reasons. Should they opt to spend a portion of time at a vacation rental or second home as snowbirds, secure communities enable residents to leave their primary residence with

the peace of mind that those homes will be less vulnerable to thieves.

Does this home have enough light? The American Optometric Association says many adults start to have problems seeing clearly beginning at age 40. Homes with more light from large windows and artificial lighting can reduce accident risk.

It’s well-documented that kitchens are popular gathering spaces in homes. Perhaps that’s one reason why homeowners looking to sell their homes direct so much attention to the kitchen before listing their properties.

Cabinets and countertops garner considerable attention when pondering kitchen renovations, but it’s equally important that homeowners pay attention to flooring when planning a remodel. The following are some notable flooring materials homeowners may want to consider as they plan to remodel their kitchens.

• Ceramic tile: Ceramic tile is a popu-

lar kitchen flooring material. The flooring experts at Avalon Flooring note that ceramic tile boasts an elegant and clean feel. Ceramic tile also is durable and easy to maintain. That simple maintenance includes ease of cleaning, as ceramic tile can be quickly cleared of spills and dirt tracked into a kitchen from outside. Ceramic tile also comes in a wide variety of colors, a versatility that undoubtedly adds to its popularity.

• Porcelain tile: Porcelain tile is another versatile option that can add instant aesthetic appeal to a kitchen. Porcelain tile is waterproof, which appeals to many

homeowners looking to renovate their kitchens. Porcelain also is easily cleaned and durable, as flooring experts estimate that porcelain tiles can last anywhere from 15 to 50 years. Porcelain tile also requires minimal maintenance, which appeals to busy homeowners.

• Engineered hardwood: Engineered hardwood is a popular choice that many homeowners appreciate due to its strength and aesthetic appeal. This flooring material is made with real wood that’s reinforced to make it even more durable and water-resistant. The result is an easily maintained product that also

can last as long as solid wood flooring so long as it’s well-maintained. Various shades, designs and textures are available, which makes this a versatile option. • Laminate flooring: Laminate flooring is a budget-friendly option that’s available in a wide range of styles, colors and patterns. The smooth surface of laminate flooring makes it easy to clean, and it’s resistance to water is another characteristic that appeals to homeowners. But spills on laminate floors are best cleaned up quickly, and the material is vulnerable to warping and staining if exposed to moisture for extended periods of time.

Hileman

Well-kept one-level

with bright and open great room, Vaulted Ceilings, Gas Fireplace, Recessed Lighting, Luxury Vinyl Plank Flooring & Central Stereo. Kitchen includes a spacious pantry, gas range w/griddle, & a passthrough to the 16x12 Florida room with rear deck access. The sizable Primary Bedroom is 14x14. An extra wide driveway leads to an oversized one car garage with automatic opener. Located on a quiet street in the award-winning Ocean Pines community!

DebbieHileman07 @gmail.com

BRAND NEW BY GEMCRAFT HOMES!

71 HINGHAM LANE • OCEAN PINES

The great room contains a fireplace, which opens up to a classically designed kitchen. The Owner’s Suite is a private haven, offering a walk-in closet and a Venetian style bath with a large glass enclosed shower. Features include 3 additional bedrooms, all with ample closet space, a laundry room, mud room, flex room, & double garage. Enjoy this award-winning, amenity-filled community!

$599,990

A helping hand every now and again is vital as people pursue a wide range of goals. Financial assistance can be particularly helpful in modern life thanks to the significant increase in traditionally high-priced items like vehicles and homes.

A recent analysis from Kelley Blue Book (KBB) found that the average sale price of a new car in September 2025 exceeded $50,000, marking the first time that threshold had ever been crossed. Home prices also have soared over the last half decade, and the analysts at Cotality anticipate an average home price increase of 3.9 percent between July 2025 and July 2026.

As the cost of automobiles and homes rise, older individuals who are comfortable financially may be asked by their grown children or adult relatives to co-sign loans for these bigticket items. While co-signing a loan is a selfless gesture, it's important that adults recognize the stakes of such decisions.

What does co-signing mean? A person who co-signs a loan is agreeing to be responsible for the primary borrower's debt should that individual prove incapable of repaying the loan on their own. The Federal Trade Commission notes that co-signers are responsible for making payments the

primary borrower misses. A co-signer also is responsible for the balance if the loan defaults because the primary borrower stops making payments. Which loans tend to require a cosigner? The FTC notes just about any type of loan can be co-signed. But cosigners tend to be necessary when younger borrowers with limited or nonexistent credit histories attempt to borrow money. Creditors who issue student loans, auto loans and mortgage loans may require young borrowers or applicants with checkered credit histories to find a cosigner before they will loan such individuals any money. The cost of higher education, automobiles and real estate is higher than ever, which underscores the gravity of the decision to co-sign a loan.

What can I do to safeguard myself as a co-signer? The FTC urges prospective co-signers to read a document known as the Notice to Cosigner, which lenders must provide to anyone co-signing a loan. This simple notice spells out exactly what it means to co-sign a loan and urges cosigners to be certain they can afford to pay the loan if the primary borrower defaults.

Vetting the borrower is another vital step for co-signers. If asked to co-sign a loan, even if the request is

made by a relative, it's best to ask for documentation detailing the prospective borrower's finances. An income statement, bank statements, an upto-date credit report, and a list of existing financial obligations can give potential co-signers an idea of how capable the prospective borrower will be in regard to making each monthly payment on time and doing so without jeopardizing their co-signer's finances.

Does co-signing affect my credit?

The FTC notes creditors can report the loan to credit bureaus as the cosigner's debt. Should that occur and the borrower misses payments, that could be a black mark on co-signer's financial reputation.

Co-signing a loan can be a selfless but risky venture. Anyone asked to co-sign a loan is encouraged to speak with a financial advisor to determine if doing so is in their best interest

Provide a Comprehensive Report Detailing Reserve Funding Recommendations to Help Your Condominium, Homeowners Association and/or Marina Make Informed Decisions & Obtain Financial Insights To Protect Your Valuable Assets.

Reserve Studies of Delmarva is led by Eugene Jubber, a certified Reserve Specialist through CAI (Community Association Institute) with a PCAM Designation (Professional Community Association Manager). His goal is to reduce unnecessary and/or unforeseen special assessments. In his 25-plus years' experience, Eugene knows what is important for his clients. Contact Eugene to discuss the Level of Reserve Study that is most appropriate for the goals of your community.