Conference Brochure

Venue: Innside by Melia Manchester

Chairman’s Welcome

Welcome and thank you for joining us for our second NWFF Conference. I am very much looking forward to the event and meeting as many forum members during the day. I want to begin by thanking the Conference speakers for giving up their time today – it is very much appreciated.

Since our relaunch in 2022 the NWFF has continued to grow, and we have managed to increase our membership by over 40% as compared to last year. Can I thank you all for continuing to support the Forum, especially the very active steering committee. We are keen to continue to grow and I would ask that you spread the word and encourage others to join. I thoroughly believe connecting together and supporting one another is one of the major ways we can counter the ever-increasing threat of fraud within the North West region.

Another way of combatting fraud is through education and sharing of ideas and to this end the NWFF has had a busy year of hosting well attended masterclasses covering areas such as cyber fraud, director disqualification and the investigation and prosecution of fraud. I would take this opportunity to thank all those involved in the master classes including Jenny Radcliffe, the CPS, TLT, Grant Thornton, and The Insolvency Service. We are always on the look out for new topics so please do email me if you would like to present or have any ideas of what you would like covered.

Finally, I would like to take this opportunity to thank our sponsors: Altia; The Cabinet Office; City of London Police Economic and Cyber Crime Academy; and in particular North West Regional Organised Crime Unit. Without such support events such as this conference would simply not be possible.

Claire Graham Chair and Director of the NWFF Claire.Graham@tlt.comEmail: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

AGENDA

08.30: REGISTRATION, COFFEE MEET OUR EXHIBITORS

09.00: CHAIRMAN’S WELCOME OPENING OF CONFERENCE

Claire Graham, Chair of North West Fraud Forum

Kate Green, Deputy Mayor of Manchester for policing/GMCA

09.20: UPDATE ON NATIONAL FRAUD STRATEGY

Andy Baguley, City of London Police/Action Fraud

09.55: HOW FRAUD IMPACTS THE NHS

Alex Rothwell, NHS Counter Fraud Authority

10.30: ’THE LATEST CYBERCRIME THREATS TO BUSINESS’

Dan Giannasi, NW Cyber Resilience Centre

11.05: COFFEE, NETWORKING MEET OUR EXHIBITORS

11.35: EMPLOYEE/INSIDER FRAUD

Zoe Newman, Kroll

12.10: ROMANCE FRAUD

Dr Elisabeth Carter, Kingston University

Email:

12.45: LUNCH, NETWORKING MEET OUR EXHIBITORS

13.45: "DEEP SOCIAL ENGINEERING: I AM NOT THE DUKE OF MARLBOROUGH AND NOR AM I CALLING FROM YOUR BANK!"

Alexander Wood, CEO of Ergo Marketing Ltd and Ex HMP resident

14.20: FRAUD RELATING TO THE TRADING STANDARDS REMIT AND FUNCTIONS

Rick Hughes, Trading Standards

15.00: COFFEE, NETWORKING MEET OUR EXHIBITORS

15.30: ‘INVESTIGATING FRAUD – CIVIL AND CRIMINAL PROSECUTION’

Shari Vahl, BBC will lead a ‘Fireplace chat’ with Barrister Claire Bunbury, 23ES; Evan Wright, JMW Solicitors; DI Sean BylinskiGelder, NWROCU; and Julie Barnes, The Insolvency Service.

16.30: CONFERENCE SUMMARY CLOSE NETWORKING POST CONFERENCE DRINKS

SPONSORS

North West Fraud Forum would like to thank our sponsors and exhibitors, whose support is invaluable in helping us to put on events.

Sponsors and Exhibitors

The City of London Police Economic and Cyber Crime Academy (ECCA) is dedicated to developing and delivering the highest quality economic and cyber crime training. Our aim is to support law enforcement, the civil service and the wider public sector to strengthen the UK’s fight against fraud and economic crime. The Academy also provides innovative online continued professional development for law enforcement investigators in partnership with industry experts.

The ECCA considers each organisation’s request for training independently and utilises its expertise to develop bespoke packages. This service has been provided to international partners, working in partnership with the Foreign, Commonwealth and Developmen t Office and the National Crime Agency.

The ECCA team uses a blend of detectives recruited from a variety of specialist fraud departments within the City of London Police’s National Lead Force directorate and professional associates with specific specialist skill sets . This provides access to a unique learning experience that is realised in our dynamic courses. To further enhance our training delivery, an array of guest speakers is invited to provide inputs. These individuals include forensic accountants, CPS lawyers and senior police leaders.

The Academy is currently working on an exciting new approach to building a career pathway for law enforcement and public bodies engaged in the fight against economic crime.

The first of these new courses will be available from May 2024.

Specialist Economic Crime Investigator Programme (formerly know as the Specialist Fraud Investigator Programme).

Management of Economic Crime Investigation

These courses have been developed to make sure they address the current threats and are aligned with the Government Counter Fraud Profession Investigation Standards.

Please visit our website at Home | academy.cityoflondon.police.uk for information about the full suite of Academy learning programmes.

The purpose of the Academy is to develop and deliver the highest quality economic and cyber crime training and continuous professional development activities to satisfy the current and emerging needs of UK policing, the wider UK public sector community and Government-funded international capability building

We are currently working towards all our learning programmes being academically accredited.

The Academy team will be represented at the North West Fraud Forum. Please come and say hello.

Speaker Biographies

Claire Graham, Partner, TLT LLP

Claire is the Chair of the NWFF and a solicitor and partner at TLT LLP.

Claire has extensive expertise in commercial litigation and in claims relating to fraud. Her practice includes advising Insolvency Practitioners on contentious insolvency matters (including fraud, breaches of fiduciary duties and civil recovery actions). Claire heads up a team which carried out investigations for entities such as the Department of Business, and Trade. The team also acts on behalf of Official Receivers in respect of contentious insolvency matters. Such actions arise out of fraud but also include the recovery of extensive director loan accounts, carrying out tracing claims, advising on trusts and preference claims.

Claire has acted for the Insolvency Service for over 25 years advising it in respect of company law and insolvency issues, including director disqualification investigation and applications, and bankruptcy restriction applications. Claire is often instructed to advise the Insolvency Service in respect of public interest winding up matters where she uses her extensive experience in pursuing provisional liquidator appointments and injunctions.

Claire has experience of seeing life from the client’s perspective having been trained as an investigator during an 18-month secondment with the Insolvency Service. Claire has extensive investigation experience and is currently carrying out investigations into targeted limited companies under S447 of the Companies Act 1985 on behalf of the Secretary of State for Business and Trade.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Danielle Haston, Asset Reality

Danielle Haston, a UK-qualified lawyer, spent 15 years in private practice investigating multi-million-pound financial fraud cases and recovering assets from offshore jurisdictions for both the public and private sectors before changing paths to focus on Crypto.

She spent 3 years as Head of Global Asset Management at Chainalysis, the leading blockchain analysis company, educating financial fraud professionals around the globe on the opportunities crypto investigations present in their day-to-day work.

This year, she moved to Asset Reality, the world’s first comprehensive seized asset management platform, supporting the same audience to seize, manage and liquidate their physical and digital assets in a simpler, more effective and more impactful way.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Kate Green, Deputy Mayor of Greater Manchester with responsibility for Policing, Crime, Criminal Justice and Fire

Kate Green was appointed as Deputy Mayor of Greater Manchester with responsibility for Policing, Crime, Criminal Justice and Fire in January 2023. From 2010 to 2022, she served as the Member of Parliament for Stretford and Urmston. While in parliament, Kate held a number of shadow ministerial posts, including Shadow Secretary of State for Education, and Shadow Minister for Women and Equalities.

Prior to her election to parliament, Kate was Chief Executive of the Child Poverty Action Group and before that Director of the National Council for One Parent Families (now Gingerbread). She is a long-standing advocate for families and children, and campaigner against poverty and inequality.

Kate is a member of the board of governors at Manchester Metropolitan University, and a member (and former chair) of the executive committee of the Fabian Society. She served as a magistrate for 16 years and has taken a particular interest in the experience of women in the penal system and how best to rehabilitate them to prevent reoffending.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Andy Baguley, National Coordinators Office, City of London Police

Andy has now entered his 42nd year in the Police Service. Starting his career in Nottinghamshire in 1983 he worked in a number of roles including Neighbourhoods, CID, Homicide, Guns and Gangs before becoming the force’s Economic Crime Unit Lead In 2011. He has since worked in the NPCC Financial Crime Portfolio where he worked alongside HMT and the Home Office with responsibility for coordinating the policing response to the FATF (Financial Action Task Force) Mutual Evaluation of the UK where the UK’s ability to counter terrorism funding and money laundering are assessed against other countries across the world. Andy now works as the Head of Performance and Force Engagement for the City of London Police where his primary role is to build relationships with forces and regions across the country, whilst identifying good practice and sharing it across policing. Over the last two years he has visited every force in the country, conducting assessment from which his published guidance now forms part of the recently released Economic Crime National Policing Strategy.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Alex Rothwell, NHS Counter Fraud Authority

Alex joined the NHS Counter Fraud Authority in November 2021 after a 30yr policing career with the Metropolitan and City of London Police, leaving as a Detective Chief Superintendent. He has performed investigative, intelligence gathering and strategic roles as well as undertaking secondments with Customs and Excise, the Serious Organised Crime Agency and the National Crime Agency. From 2012-2015 Alex led a multi-agency task force tackling organised crime before returning to lead the Metropolitan Police Cyber Crime Unit and Fraud teams. Prior to joining the City of London Police in 2017 Alex was the lead for a major transformation project focused on the Met’s Specialist Operations Business Group. For City of London Police, Alex performed a national role focused on improving the policing response to economic crime and leading the coordination of economic crime investigation and training for policing. Whilst performing this role Alex was actively involved in improving the wider UK response to Economic Crime, working closely with private and public sector organisations to shape and deliver on the UK’s Economic Crime Strategy. In addition to day to day responsibilities, Alex was also an active hostage and crisis negotiator right through to the end of his policing career and has considerable experience in the investigation and management of kidnap for ransom.

Alex joined the NHSCFA as CEO In November 2021 after a 30yr policing career focused on organised crime, fraud and cyber-crime. From 2017-21 he was the Deputy National Coordinator for improving the policing response to economic crime and led the coordination of investigation and training for policing. Alex was also actively involved in improving the wider UK response to economic crime, working closely with private and public sector organisations to shape and deliver on the UK’s Economic Crime Strategy.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

From 2012-2015 Alex led a multi-agency task force tackling organised crime before returning to lead the Metropolitan Police Cyber Crime Unit and Fraud teams. Prior to joining the City of London Police in 2017 Alex was the lead for a major transformation project focused on the Met’s Specialist Operations Business Group. For City of London Police, Alex performed a national role focused on improving the policing response to economic crime and leading the coordination of economic crime investigation and training for policing. Whilst performing this role Alex was actively involved in improving the wider UK response to Economic Crime, working closely with private and public sector organisations to shape and deliver on the UK’s Economic Crime Strategy.

In addition to day to day responsibilities, Alex was also an active hostage and crisis negotiator right through to the end of his policing career and has considerable experience in the investigation and management of kidnap for ransom.

Alex is now responsible for ensuring the NHSCFA fulfills its vision, strategy and objectives to counter fraud against the NHS.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

DI Dan Giannasi, Detective Inspector - Head of Cyber and Innovation, North West Cyber Resilience Centre

Dan Giannasi is a Detective Inspector seconded to the NWCRC, with 17 years of experience specialising in digital and cyber crime with Greater Manchester Police and the North West Regional Organised Crime Unit (NWROCU).

About the North West Cyber Resilience Centre:

The North West Cyber Resilience Centre is a not-for-profit policeled partnership, providing affordable, professional cyber security services to small businesses.

The NWCRC works with the business community to raise awareness, and offer free and paid memberships options to businesses. Members gain access to a range of cyber security guidance and resources online, alongside regular updates of emerging threats.

Alongside membership, the centre provides affordable cyber security services, including security awareness training, vulnerability assessments and phishing exercises. The services are delivered by a talented group of students under the supervision of cyber security experts.

www.nwcrc.co.uk

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Zoë Newman, Regional Managing Director, EMEA and Global Co-Head of the Financial Investigations Practice, Kroll

Zoë Newman is a regional managing director and global co-head of the Financial Investigations practice, based in London. Zoë leverages over 20 years of experience working across Eastern Europe, the Commonwealth of Independent States (CIS) and the Middle East and has led numerous international cross-border investigations. These investigations required the tracing of complex fund flows, dissection of corporate structures and assessment of the integrity of transactions to support both civil and criminal asset recovery proceedings and disclosures to regulators. In more recent years, Zoë has advised emerging and frontier market banking regulators on systemic issues relating to distressed banks, the integrity of their capital and the identification of abuse of the financial system by the banks’ shareholders and senior management. She has significant expertise in advising both government and corporate clients and their counsel in critical matters concerning the prevention, detection and investigation of fraud and corruption and associated moneylaundering mechanisms and related asset recovery strategies. She has a proven track record in advising and presenting to boards, regulators and government bodies on how best to approach and structure financial investigations into some of the most sensitive issues they face.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Dr Elisabeth Carter, Associate Professor of Criminology, Forensic Linguist, Department of Criminology, Politics and Sociology, Faculty of Business and Social Sciences, Kingston University London

Dr Elisabeth Carter is a criminologist and forensic linguist who conducts interdisciplinary research at the intersection of language and the law. She examines how interactional, ethical, and social drivers are manipulated by fraudsters, and the intricate balancing act between power and persuasion, credibility, and vulnerability. She is best known as the UK’s foremost scholar on romance fraud, however she uses interactional methodologies to unpick persuasion and manipulation in fraudulent communications of all types. Elisabeth has been awarded two Tackling Economic Crime Awards (TECAs) for Outstanding Tackling Economic Crime Professional, and for Outstanding Female Economic Crime Professional, and can be regularly found on television series and radio shows bringing understandings of fraud to life, including on BBC One, ITV, Radio 4, Channel 5 and Paramount+. She uses her cutting edge research to advance academic understandings of economic crime, and across the public, private and third sector through informing law enforcement campaigns, driving police operations, and delivering practical strategies that disrupt the power of fraudulent communications and pervasive negative narratives of victimhood.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Rick Hughes, Trading Standards and Community Protection Manager, Cheshire East Council

Rick Hughes, Trading Standards & Community Protection Manager at Cheshire East Council. Rick has worked in Trading Standards since 2006 and currently manages Trading Standards, Financial Investigations, CCTV and Community Protection services, prior to this he served in the Police. Rick has 23 years in regulatory, community and enforcement functions and is a member of numerous strategic groups within the profession.

Away from work, Rick recently retired from playing American Football, plays the drums and is a qualified football (soccer!) coach.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

Alex Wood, Cybercrime, Social Engineering & Counter Fraud Speaker

Alex's early career was in the music industry. Aged 13 he began to tour the world as a violin soloist and performed under the greatest conductors of the modern era. He was awarded prestigious scholarships to attend the Purcell School, the Royal Academy of Music and the Royal College of Music, won an array of prizes along the way and became a regular guest at Buckingham Palace and Windsor Castle.

Aged 24 his career was abruptly halted by the onset of repetitive strain injury (RSI) in his right hand and faced with mounting debts and no source of income, his criminal career began. His life spiralled out of control, culminating in several years spent in prison for a number of dishonesty offences - everything from impersonating the 13th Duke of Marlborough to committing multi -million pound cyber-crime.

Since his release from jail in early 2022 Alex has turned his life around and become an immensely powerful force in the Counter Fraud profession.

In February 2023 he was a Keynote Speaker at CounterFraud 2023 (organised by the Cabinet Office, the Public Sector Fraud Authority and GovNet). Since then, Alex has presented dozens of Keynote speeches including for:

- LBFIG (London Boroughs’ Fraud Investigators’ Group) AGM at Pinsent Masons’ HQ

- National Investigations Conference (NICONF23) in Birmingham (a speech entitled ‘Inside the Mind of a Criminal’)

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Speaker Biographies

- LA Financial Investigators Forum (talking about everything from social engineering to underworld banking)

- Fraud Prevention Network

- #RISK23 (Excel Centre)

- Anti Financial Crime Summit 2023, and

- Transform Finance 2023 (a speech entitled 'Future Threats for Generative AI').

In October 2023 Alex was featured on BBC R4 (File on 4) and TalkTV (Vanessa Feltz show).

In addition to Public Sector speaking and advisory, he consults for leading global financial institutions (including Tier 1 banks, insurance providers, law firms and risk experts) so as to enable a deep understanding of the ‘Fraud Mindset’ as well as sophisticated ‘Social Engineering’ techniques and the threat of emerging tech (including AI).

Alex is working on a national strategy, in partnership with banks, lawyers, Police forces and Government in order to educate children about the risks of involvement in mule activity.

While in prison, Alex was signed by the world-leading literary agent Andrew Lownie. His story is now the subject of a major documentary (in production) by the renowned film makers Chris Atkins and Louis Theroux (Mindhouse Productions).

Alex is exclusively represented by Sara Butler at SCAMP Speakers.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

TheNorthWestCyberResilience Centre(NWCRC)isapolice-led teamthatsupportssmalland mediumorganisationsacrossthe regioninbecomingmoreresilient againstcybercrimeandfraud.

The centre provides long-term support and guidance tailored for businesses and charities to help reduce the risks from cybercrime.

Panel Speaker Biographies

Shari Vahl, Investigative journalist for Radio 4’s consumer programme You And Yours

Shari Vahl is an investigative journalist for Radio 4’s consumer programme You And Yours, Based at Media City UK in Salford. She specialises in fraud affecting consumers young and old. This year alone she’s exposed how criminals can steal your house, and you can’t have it back, how thousands of homeowners have had fake companies registered at their home, then loans taken out in their names, and shown how thieves can spend all your money in 20 minutes after breaking into your gym locker., Just recently she’s exposed how organised criminal gangs are using squats in Luton to house industrial scale shoplifters. Many of Shari’s investigations Shari are picked up by Law enforcement, and her advice and expertise is often sought by industry. Shari is a skilled investigator and broadcaster of more than 30 years’ experience.

Claire Bunbury, Barrister, 23ES Chambers

Claire Bunbury is a barrister specialising in insolvency and commercial litigation, and regularly encounters issues relating to fraud in the course of her work. She was called to the Bar in 2006, and is a member of the Business and Property team at 23ES Chambers in Manchester.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Panel Speaker Biographies

Evan Wright, Partner, JMW Solicitors LLP

Evan Wright began his career in the police in the 1980s and moved to the Crown Prosecution Service before joining JMW as a defence lawyer in 1997. Focusing mainly on financial crime cases, Evan developed a practice in professional and corporate regulation as well as private prosecutions.

Julie Barnes, Chief Investigator for Crime, The Insolvency Service

In 2017 Julie Barnes completed a 30 year Police career with the Greater Manchester Police. Her career spanned Public Protection, leading the way with the introduction of Adult Abuse, Financial Investigation, qualifying under POCA and concentrating on Money laundering and Cash seizure under part 5 powers of POCA. The last six years leading a serious and organised money laundering investigation with the RART, collaborating with HMRC and the criminal division of the British Transport police.

In 2017, Julie began a new and exciting career with the Insolvency Service, now the Chief Investigator for Crime in the northern region. she is contributing to the transformation of the workplace with the introduction of digital interviewing, criminal prosecutions in Scotland and the delivery of the Companies House Economic Crime and Transparency Bill.

Julie has introduced a Bounce Back Loan Abuse Team, working alongside the British Business Bank, UK Finance and the Cabinet Office. This work required delivering at pace, with recovery being at the heart of every investigation.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Panel Speaker Biographies

DI Sean Bylinski Gelder, North West Regional Organised Crime Unit (NWROCU)

I joined Merseyside Police in 2007 and having gained experience in response and neighbourhood policing roles, in 2011 I moved into the Criminal Investigations Department (CID) where I trained as a Detective. In CID I worked within the Vulnerable Persons Unit (domestic violence, child protection, vulnerable adults and hate crime), the Acquisitive Crime Unit (burglary and robberies) and Reactive CID (e.g., drug supply, serious assault, sexual offences, anything serious and complex).

In October 2014 I moved to the Fraud Squad of the forces Economic Crime Team (ECT) where I trained as a Specialist Fraud Investigator and Financial Intelligence Officer. In 2016 I became the Detective Sergeant of the Financial Investigations Unit (FIU) also within the ECT where I trained as a Financial Investigator. In 2019 I promoted to Detective Inspector of the FIU in which I was responsible for writing and implementing force policy, strategies and processes in respect of asset recovery and high-risk financial intelligence. In 2021 ran a project to rationalise and implement departmental change within the ECT which resulted in substantial increases in investigative, safeguarding and intelligence posts to enhance departmental capacity.

I have implemented a Home Office pilot project to protect vulnerable adults from fraud and financial crime. Adopting a multi-agency approach I identified key stakeholders and facilitated delivery of specialist fraud/financial and cyber-crime awareness between regional and national partner organisations within the public, private and third sectors. To embed the on-going initiative, I delivered training to Community Officers for awareness of

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

Panel Speaker Biographies

crime trends and community vulnerabilities ensuring a holistic partnership crime prevention approach. In 2019, this project was a finalist in the Inaugural Tackling Economic Crime Awards under the ‘Outstanding Prevention Initiative’.

I was acknowledged for my contribution to the Investigation of Fraud and Economic Crime Manual published by Blackstone's Practical Policing in 2017 and I am a Guest Lecturer on Economic Crime at Liverpool John Moore’s University (LJMU). I am on the College of Policing’s Problem-Solving Guideline Committee, and currently a Practitioner Fellow of the UK’s Policing Think Tank ‘The Police Foundation’.

Email: admin1@northwestfraudforum.co.uk

Website: northwestfraudforum.co.uk

LinkedIn: North-West-Fraud-Forum

Twitter: @FraudWest

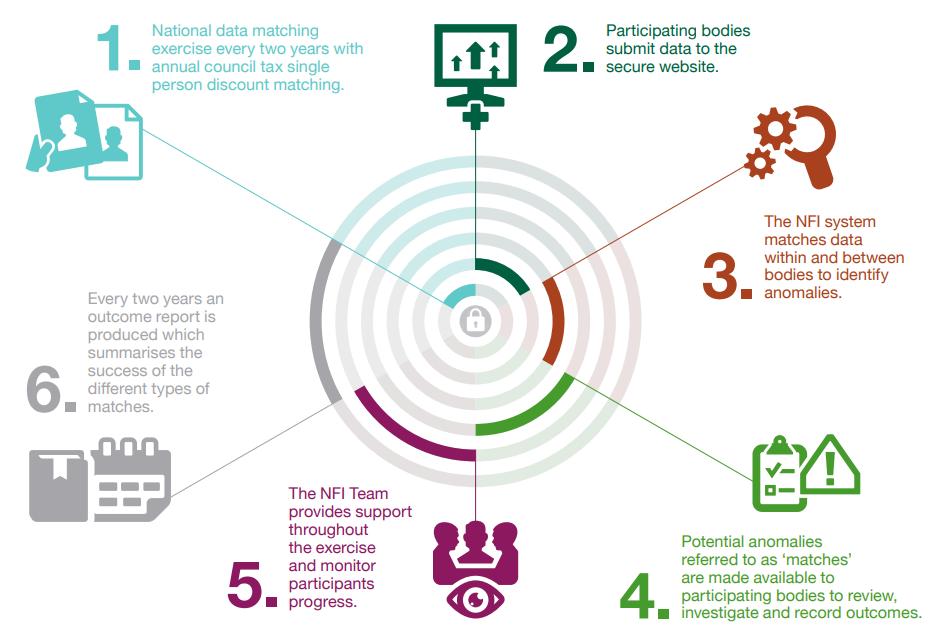

Establishedin1996,theNFIsupportsc.1100publicandprivatesectororganisationsinenhancing theirfraudresponsethroughtheuseofdataandanalytics.Itworksprimarilywithlocalauthorities andtheNHSacrosstheUK.TheNFIspecialisesindatamatching,usingarangeofproductsand datamatchingtechniquestohelpdetectandpreventfraud.

TheNFIuseslegislativepowersintheLocalAuditandAccountabilityAct2014andrelevantdevolved legislationtomandatedatacollection,processinganddisclosureforfraud.Thereisalsoanopportunity fornonmandatedparticipationandthisistakenupbyorganisationssuchasgovernmentdepartments, pensionprovidersandhousingassociations

TheNFIiscostneutraltogovernment,fundingitsactivities(includingpay)throughfeesleviedon participantsandcharged-forservices.

Datamatching

Datamatchingcomparessetsofdataelectronically,suchasthepayrollorbenefitrecordsofan organisation,againstotherrecordsheldbythesameoranotherorganisation,toseetowhatextentthey match.

TheNFIdatamatchingidentifiesinconsistenciesthatrequirefurtherinvestigationandallowspotentially fraudulentclaimsandpaymentstobeidentified.Participatingorganisationsreceivetheresultingdata matchesforconsiderationandinvestigationwhereappropriate.

Noassumptioncanbemadeastowhetherthereisfraud,errororanotherexplanationforthose matchesuntilaninvestigationprocessiscompleted.Anorganisationcanthentaketheappropriate action.Thismaybetoprosecutecasesoffraud,recoveroverpayments,correctunderpaymentsand updaterecords.

A NationalExercise takesplaceeverytwoyears.

As well as the National Exercise, the NFI has three additional products Participants pay an additional fee in order to use any of these three services

Our impact

Since it began, the NFI has delivered £2.4bn in audited cumulative savings. Of which, £443m was prevented and detected/recovered across the UK between April 2020 to March 2022 - the NFI’s best result from a National Exercise period

Some further examples of the NFI’s recent achievements from the 2020-22 National Exercise period include:

● 102 local authorities identified c.7,000 people waiting on social housing waiting lists, despite being ineligible, were identified and removed, helping to open up affordable housing for those who need it;

● Over 225,000 concessionary travel passes were cancelled in England alone as the passholder was deceased;

● Over 42,000 blue badges were cancelled as the badge holder was deceased; and

● Over 32,500 incorrect claims for council tax single person discount were identified and resolved, with a further 3000 cases identified whereby council tax reductions had been claimed incorrectly

How can we help you?

If your organisation is already a participant we offer:

- Comprehensive guidance in the secure NFI web app

- Key Contact training

- System User training

How to find out more?

If your organisation would be interested in taking part on a voluntary basis we would be very happy to speak with you and explain the process

If you have any questions, want to request training or if you want to know more about our work:

- We have a stand at the NWFF call and see us

- visit our pages on govuk

- email us at nfiqueries@cabinetoffice govuk

Altia

for intelligence and investigation organisations

We specialise in improving the management of criminal and civil investigations, fraud and financial investigations, incident management and covert operations.

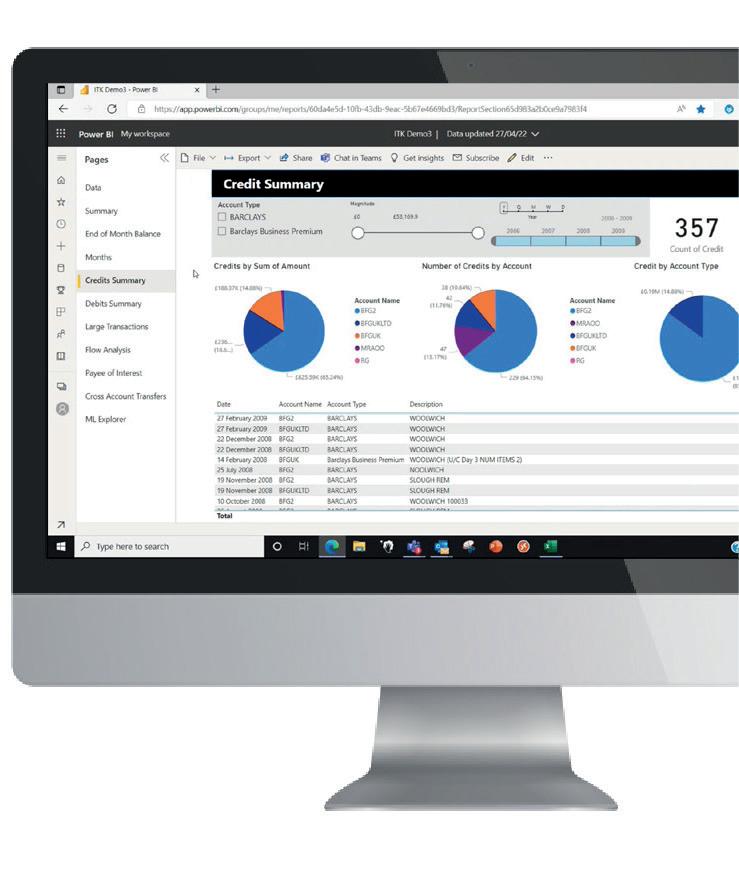

Fully automate the process of converting paper-based information, and analysing it to identify entities, trends, relationships and investigative avenues.

Create accurate Excel-based records and use specialist tools to speed up the process of interrogating financial data.