Thank you for choosing Nuvei as your payment processing partner. We are committed to providing quality merchant services with exceptional support. Our international presence allows us to offer many services, state-of-the-art terminal hardware, and online payment options.

For more information regarding our products and services, please contact us at:

Your terminal is pre-programmed and ready to be used. We invite you to power it on and begin running transactions. If you run into any problems or just need a little help getting started, one of our customer support team members is available to guide you through the process.

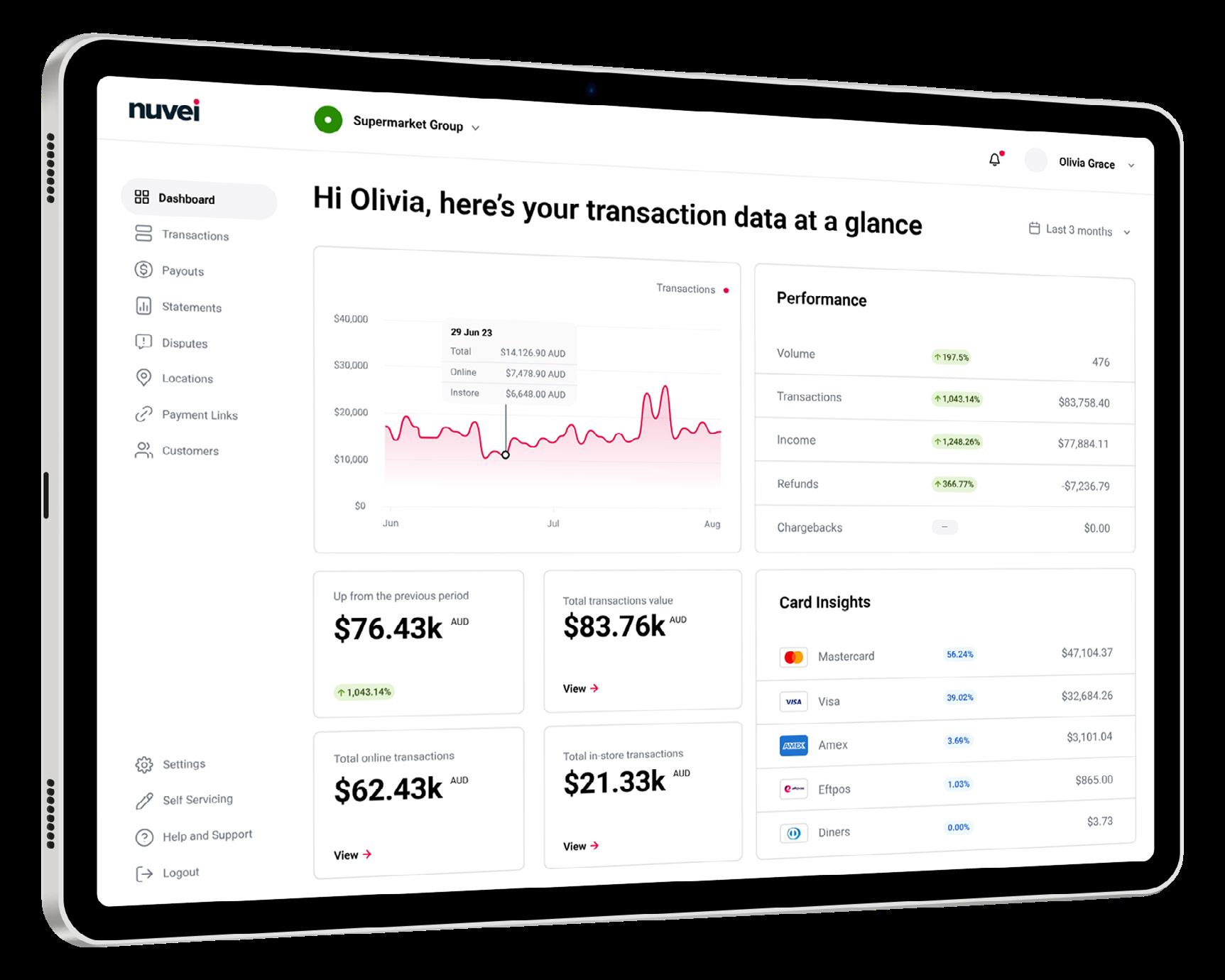

Accessing your statements is easy through our online Merchant Portal. Monthly processing statements are available online, 24 hours/day, 7 days/week. You will also have access to a full-featured online reporting tool, so you can continuously monitor your business from anywhere. Your login details have been emailed to you.

Our customer support team is here to help. If you have any questions about fraud protection, do not hesitate to contact us:

AU: 1300 369 692

NZ: +64 800 44 96 97

Email: support-anz@nuvei.com

Nuvei is designed to accelerate your business. Our future-proof technology allows businesses to accept cutting-edge payment options, optimise new revenue streams, and get the most out of their stack. With a single integration and advanced customisation tools, Nuvei delivers flexibility that enables businesses to adapt quickly and enter new markets seamlessly. From finding new opportunities to converting more sales.

Exceptional service. each and every time.

Tools for every stage of the commerce journey. Across all channels –unattended, in-person, online or on the go. Brought together by a unified payments experience.

Access more markets and payment methods than ever before while Nuvei offers localised expertise to help you navigate cross-border commerce with confidence.

As part of Nuvei’s commitment to providing more value to its clients, we have made it our goal to reach out to business owners using online social networking sites.

Nuvei provides the ultimate security and protection for partners and merchants, by minimising risks of fraud and payment disputes.

Count on Nuvei’s dedicated support team to deliver solutions quickly and efficiently, freeing you to focus on growing your business.

At Nuvei, we value your business and encourage you to call if you require assistance with your payment processing needs.

Merchant Support

Phone: 1300 369 692 (AU) or +64 800 44 96 97 (NZ)

Email: support-anz@nuvei.com

Help centre: support.tillpayments.com

The Merchant Portal is an online reporting tool giving you access to payment information and the ability to manage your merchant account data anytime, anywhere.

Founders of the PCI Security standards council are American Express, discover financial services, JCB, Mastercard worldwide and Visa international.

The PCI Data Security Standard represents a common set of industry tools and measurements to help ensure the safe handling of sensitive information. Initially created by aligning Visa’s Account Information Security (AIS)/ Cardholder Information Security (CISP) Programs with Mastercard’s Site Data Protection (SDP) program and Discover Information Security Compliance (DISC), the standard provides an actionable framework for developing a robust account data security process—including preventing, detecting and reacting to security incidents.

The core of the PCI DSS is a group of principles and accompanying requirements, around which the specific elements of the DSS are organized:

• Requirement 5: Protect all systems and networks from malicious software.

• Requirement 6: Develop and maintain secure systems and software.

• Requirement 7: Restrict access to system components and cardholder data by business need to know.

• Requirement 8: Identify users and authenticate access to system components.

• Requirement 9: Restrict physical access to cardholder data.

• Requirement 1: Install and maintain network security controls.

• Requirement 2: Apply secure configurations to all system components.

• Requirement 10: Log and monitor all access to system components and cardholder data.

• Requirement 11: Test security of systems and networks regularly.

• Requirement 3: Protect stored account data.

• Requirement 4: Protect cardholder data with strong cryptography during transmission over open, public networks.

• Requirement 12: Support information security with organizational policies and programs.

As a merchant, a chargeback starts when a cardholder disputes a charge on their bank’s card statement, and the bank lodges the chargeback through the card scheme. The cardholder is either out of pocket until the bank investigates and rules on it – or the bank gives ‘back’ the ‘charge’ while they investigate, depending on the bank’s policy. (Sometimes to instill confidence in using their cards.) During the investigation, the card schemes pass on the chargeback amount to Nuvei and that, in turn, appears in your merchant portal account as a debit.

If the evidence is insufficient or insufficiently strong, or the cardholder is not to blame, the debit will remain.

Chargebacks are regulated by the Credit Card Schemes and Nuvei is bound by them.

You can either accept the chargeback or defend it with precise, documented evidence.

Nuvei notifies you immediately and debits your account on that day.

Before you dispute a chargeback, Nuvei strongly recommends you take into account what is best for your business and carefully consider the type and amount of the chargeback, plus whether you have sufficient evidence to defend it.

• Fraud

• Unauthorised transaction

• Goods or services not received

• Goods or services not as described

• Duplicate charge

Nuvei has developed technology that minimises fraud, plus free fact sheets that will help you implement best practice:

• De-risk your business

• Minimise fraud

Defend disputes

If a customer disputes a charge for $100, say on April 4, you will be notified and that $100 will be deducted from your account on the day you’re notified. If another chargeback happens, say on April 12 for $1000, you’ll be notified and again, that will be deducted on that day.

Suppose a third chargeback occurs on April 22 for $350, you’ll be notified and debited on that day, totalling $1350 chargebacks for April. Nuvei’s admin fee of $25 will only be applied at the end of the month, appearing as a total of $75 on your statement for April.

Be alert when purchases are made through the phone or over the internet. Several common fraud schemes begin this way.

• Customers emailing credit card numbers. Always follow up email orders with a telephone call.

• Customer offering more than one card. While many of us do carry more than one credit card in our wallet, it is not usual for a customer to try different credit card numbers after repeated declines or similar error messages.

• Orders placed by a telephone relay service. Fraudsters use these services to gain the sympathy and trust of a merchant, then obtain products with a stolen card.

• Customers who seem to care little for the finer details of their order. Fraudsters will often seem careless to the amount being charged, the colors, sizes, models, etc.

• Be wary of orders with domestic billing addresses and international shipping addresses.

• Most cardholders will be confident in the buying power of their credit card. If a customer is contacting you to confirm if the transaction was successful, or to obtain the 6-digit authorization code received on your terminal, you should regard that customer as suspicious.

• Messages to look out for: Lost Card (or LC, combined with another message like Please Call), Do Not Honour, Pick Up Card, Restricted Card, Please Call. If you get these messages, please call our customer support number.

• Wire scams. Be suspicious when a customer who shops online requests the value of the purchased item as well as an additional amount of money to be charged on their credit card. Fraudsters would typically request the excess amount to be wired to them through a currency exchange office to presumably pay for alternate shipping arrangements.

Our customer support team is here to help. If you have any questions about fraud protection, do not hesitate to contact us:

AU: 1300 369 692

NZ: +64 800 44 96 97

Email: support-anz@nuvei.com

We realise that one size doesn’t fit all. That’s why we’ve developed industry-specific solutions that help our clients make more money for their businesses. Nuvei creates a bespoke payment solution for the merchant – with all the included services and complimentary benefits.

Merchant portal is an online reporting tool giving you access to payment information and the ability to manage your merchant account data anytime, anywhere.

Merchants can have a secured transactional page for a frictionless customer experience and also one API integration gives them access to mainstream payment methods such as Alipay, GooglePay, Amex, EFTPOS

The full list of Quick Reference Guides (QRG) for all terminal types is located at: e.nuvei.com/qrg-anz/

Nuvei empowers merchants with cutting-edge Online Checkout, discreetly operating in the background, and offering a PCI-compliant payment pathway tailored for every business, regardless of the industry or location. Merchants are able to expand their footprint through Nuvei Online Checkout technology.

Nuvei’s unattended payments enable merchants to accept transactions from kiosks, vending machines, and parking meters with full PCI compliance and seamless remote management. This solution provides 24/7 selfservice convenience, transforming merchants into ‘anytime’ businesses and delivering efficient, secure customer experiences.

For more information, please contact our Customer Support Team at: Telephone: 1300 369 692 (AU) or +64 800 44 96 97 (NZ) Email: support-anz@nuvei.com

Merchants can now send payment links via email or SMS, directing customers to a secure Nuvei-hosted payment page to complete transactions in minutes. With 3DS2 security, Payment Links ensure PCI compliance, reduce risks from noncompliant data capture, and support direct refunds to the original card.