4410 Fairway Boulevard

Wichita Falls, TX 76308

P: 940.692.2211

www.nthba.com

February 2026

4410 Fairway Boulevard

Wichita Falls, TX 76308

P: 940.692.2211

www.nthba.com

February 2026

Recently, I had the opportunity to travel to Abilene and spend time meeting with local leaders while touring several major projects that are actively reshaping that market. One of the most notable stops was a visit to what is being referred to as the “Stargate Project” -- a large-scale data center development backed by OpenAI, Oracle, and SoftBank. The scale of this investment, and its long-term implications for employment and housing demand, are difficult to overstate. Initial development is expected to represent roughly $100 billion in investment, with an additional $400 billion potentially deployed across future phases. From that activity alone, the City of Abilene anticipates annual tax revenues exceeding $40 million during the first ten years of data center operation, with the potential for an even greater fiscal impact beyond that initial period.

Related to that growth, I also visited what is now considered the world’s largest RV park project, being driven directly by Meta to support workforce housing tied to its nearby secondary data center development in Abilene. The 2300 individual camper locations are being pushed by Mark Zuckerberg’s Meta to accommodate the influx of workers required to construct and support that facility. Seeing this level of interim housing infrastructure put in place underscores just how quickly housing demand can shift when large employers enter a market at scale.

While in Abilene, I also visited with current city councilmember Blaise Regan, and we discussed the city’s intentional approach to promoting housing development within city limits. Abilene has implemented a

redevelopment program focused on infill opportunities created by years of demolition, condemnation, and clearance of dilapidated homes. To encourage participation, the city is offering meaningful incentives to builders who enroll in the program, including waived permitting and other fees, expedited processes, and additional city-provided services designed to reduce friction and cost. Participation is structured to maximize accountability and quality, requiring builders to be members of Abilene’s local home builders’ association. The overarching goal is to return long-vacant lots to productive use and generate new, attainable homes -- targeting a maximum price point of around $200,000 – specifically for families who want to live in the heart of their Abilene community.

At the same time, many Abilene builders are choosing to build outside city limits, where development costs are materially lower. That dynamic has allowed builders to deliver homes at more affordable price points in comparison to the options we have locally in Wichita Falls. In multiple conversations, it became clear that rural and fringe-area lot prices are often roughly half of what comparable lots are marketed for within Wichita Falls city-proper limits.

The result is a noticeable difference in overall affordability when comparing home size, features, amenities, and pricing between our two markets. From my perspective, much of that gap traces directly back to land development costs -something many of us have experienced firsthand as civil and infrastructure expenses continue to escalate. These realities reinforce how deeply land policy, development costs, and regulatory environments influence housing affordability long before a home ever goes vertical.

Overall, Abilene carries a notably positive, forward-looking attitude toward growth. The city has reached over 130,000 residents according to recent census figures, and local projections suggest that population could exceed 250,000 by 2050 if current trends hold. That confidence is reflected not just in planning documents, but in the way public and private stakeholders are actively aligning to accommodate growth before it fully arrives. The takeaway for us is clear -when communities intentionally plan for housing, infrastructure, and workforce needs, development momentum can become self-reinforcing. Wichita Falls is positioned to experience many of these same benefits as business investment continues to materialize locally. With the right alignment between policy, development costs, and housing strategies, that momentum can create a similar “runaway” effect -- one that supports long-term affordability, strengthens neighborhoods, and ensures our city remains competitive and livable for the next generation.

J. Tanner Wachsman President, NTHBA & RJ Wachsman Homes

Each month, I read and save articles I believe are worth sharing with our members. I take time to digest them and break them down so you can get quick, relevant updates on issues affecting our local, state, and national housing markets. I wanted to share that context in case you were curious how these articles make their way into the newsletter — if they’re included, it’s because I felt they were important or interesting and worth passing along.

Best, Tanner

President Donald Trump has outlined a housing proposal aimed at improving affordability by making it easier for buyers to access capital and enter the market. While details are still evolving, the concepts discussed could influence buyer demand, financing options, and market dynamics that directly affect homebuilders. Key takeaways are outlined below.

• 401(k) funds for home purchases: Proposal would allow buyers to access retirement funds for down payments with reduced or no early-withdrawal penalties, potentially expanding the buyer pool -- especially first-time buyers.

• Focus on demand-side affordability: The plan emphasizes helping buyers qualify and close rather than directly increasing housing supply.

• Builder impact: Could increase near-term demand, but without parallel supply reforms, may also add upward pressure on pricing in constrained markets.

President Donald Trump has signed an executive order aimed at limiting federal support for large institutional investors purchasing single-family homes. The order does not ban institutional buying outright, but instead targets federally backed financing and approval channels, while carving out specific exceptions. How broadly this policy affects the market will depend on definitions and implementation still underway.

• No outright ban on institutional buying: The order does not prohibit institutions from purchasing single-family homes or require them to sell existing portfolios.

• Federal financing restrictions: Federal agencies are directed to restrict guarantees, insurance, securitization, and other federally backed financing pathways for large institutional investors acquiring single-family homes.

• Build-to-rent carve-out: Purpose-built, planned, and permitted build-to-rent communities are explicitly excluded, providing clarity for BTR developers while limiting bulk purchases within for-sale subdivisions.

• Definitions matter: Treasury has been tasked with defining “large institutional investor,” with thresholds that could significantly influence whether impacts fall mainly on Wall Street-scale buyers or extend to smaller regional operators.

• Potential impact on builder sales: The order introduces uncertainty around bulk and investor sales that have helped stabilize absorption during slower retail demand periods.

• Limited immediate market effect: Many large institutional buyers rely on private capital rather than federal financing, which may limit near-term disruption depending on final rules.

A recent Texas appeals court decision has affirmed that certain low-income housing developments can qualify for a property tax exemption when developers strictly follow statutory requirements — particularly around community input and documentation. The ruling provides useful clarity for builders and developers considering affordable or mixed-income projects in Texas.

• Exemption upheld by appeals court: The court ruled that a low-income housing development southwest of San Antonio qualified for a property tax exemption after the developer demonstrated compliance with Texas law.

• Community input is critical: A key factor was the developer’s formal process for notifying and receiving feedback from nearby low-income households regarding the project’s design, siting, and management.

• Procedural compliance matters: The appraisal district failed to show that the developer did not meet statutory requirements, reinforcing that proper documentation and process—not just project intent—drive exemption eligibility.

• Applies to specific affordable housing uses: The exemption stems from provisions in the Texas Tax Code applicable to qualifying low-income housing developments, not general residential construction.

• Builder takeaway: Developers pursuing affordable or workforce housing should pay close attention to required notice, outreach, and recordkeeping steps early in the planning process, as these can materially affect long-term property tax treatment.

Phone (940) 692-5734 Fax (940) 692-0239 tco@h

The North Texas Home Builders Association kicked off the new year with a deeper look into how local sales tax dollars are shaping Wichita Falls’ growth and development. At the January 13th General Membership Meeting, held at the Forum, members heard an informative and engaging presentation from Assistant City Manager Paul Menzies and Wichita Falls 4B Sales Tax Corporation Chair Glenn Barham.

Menzies, who serves as the staff liaison to both the 4A and 4B sales tax corporations, began by breaking down the City’s various revenue sources and explaining how each cent of sales tax is allocated. He noted that the 4B Sales Tax Corporation generates approximately $5.2 million annually, providing a significant funding stream for quality-of-life improvements, economic development, and major capital projects throughout the city.

He also explained the structure and oversight of the 4B Corporation:

• The board meets monthly or as needed

• All expenditures require City Council approval

• The corporation is supported by part-time City staff

• The City serves as the fiscal agent

• The City Attorney provides legal counsel to the board

Barham followed with a comprehensive overview of both completed and ongoing 4B-funded projects, highlighting the corporation’s long-term impact on Wichita Falls.

Some of the significant investments made through the 4B Sales Tax Corporation include:

• Petroleum Building (“The Kate”)

• Castaway Cove Waterpark

• Maplewood Avenue improvements (Kemp to Lawrence)

• Lawrence/Rhea Realignment

• Regional Airport Terminal

• MPEC Conference Center, with funding support extending through 2050

Menzies and Barham also highlighted several successful initiatives that have already made a visible difference in the community:

• Downtown Matching Grant Program

• Downtown Economic Development (Forward Wichita Falls)

• Softball Complex Turf upgrades

• Sikes Senter acquisition

• Hotel by the Falls demolition

The presentation also showcased a robust list of current and upcoming projects that continue to enhance the city’s infrastructure, recreation, and economic vitality:

• Midwestern State University – Student Success & Military Education Center

• YMCA Aquatic Center, now offering designated access for non-members

• Sheppard AFB – BASH (Bird/Wildlife Aircraft Strike Hazard) initiatives

• Engage Sheppard Program, which introduces new airmen to Wichita Falls’ retail, cultural, and historic attractions

• Hamilton Park Tennis Center improvements

• The Falls – pending City Council approval to hire a firm to assess structural needs and develop engineering plans

• Public Safety: New Police Headquarters at the Kirby site

• Circle Trail Completion, with the final stretch near Lake Wichita expected to utilize adjacent

Take full advantage of your membership by using Texas Association of Builders member-exclusive programs and services not available to the public. These include...

TAB HBA Rebate Program — Receive rebates on your favorite products.

Small Business Growth Partners — Grow your business with a plan.

National Purchasing Partners — Receive discounts from select retailers.

TAB Product Depot — Do business with members easier. And more!

Go to https://www.texasbuilders.org/tab-member-programs/ for more information on member programs.

If you have any questions, please feel free to reach out to me at nthba.teri@gmail.com or 940-692-2211 and I will be happy to help you.

February 17th-19th

NAHB International Builder Show

February 19th

GM Meeting - Career Education Center

March 30th - April 1st

TAB Spring Meetings

April 10th

Annual Clay Shoot

June 5th-7th & 12th-14th

2026 Parade of Homes

July 21-24

TAB Meetings & Sunbelt Builders Show®, San Antonio, TX

November 10 – 12

TAB Fall Meetings, Dallas Plano Marriott at Legacy Town Center

September 11th

Eddie Holcomb Memorial Golf Tournament & Bunco Tournament

940.322.3129 • www.breegle.com 2213 Grant Street • Wichita Falls, Texas 76309

Carpet • Ceramic Tile • Wallpaper Hardware • Mini Blinds • Formica Vinyl & Hardwood Flooring • Carpet Supplies

• The Falls reconstruction and renovation

• Sikes Redevelopment

• 401 Broad redevelopment efforts

• Ongoing support for Downtown revitalization

The presentation offered members a clear and comprehensive understanding of how the 4B Sales Tax Corporation operates and the substantial role it plays in Wichita Falls’ continued progress. As the North Texas Home Builders Association moves into the new year, this insight equips members to stay engaged with the city’s evolving landscape and the opportunities it creates for the building and development community.

(by Eric Lynch)

Every quarter, the National Association of Home Builders (NAHB) conducts a survey of professional remodelers. The first part of the survey collects the information required to produce the NAHB/Westlake Royal Remodeling Market Index (RMI). The survey collects information required to produce an overall reading which is calculated by averaging two indices: 1) the Current Conditions Index and 2) the Future Indicators Index. The Current Conditions Index is an average of three components: the current market for large remodeling projects ($50,000 or more), moderately sized projects (at least $20,000 but less than $50,000) and small projects (under $20,000). The Future Indicators Index is an average of two components: the current rate at which leads and inquiries are coming in, and the current backlog of remodeling projects. Results for Q4 2025 were released earlier this month which can be accessed (by visiting www.nahb.org , eye on housing section).

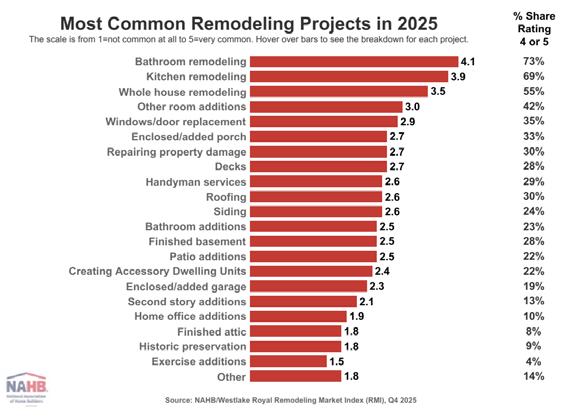

In addition to the questions required for the RMI, the quarterly survey often also includes a set of “special” questions on a topic of current interest to the remodeling industry. For the fourth quarter 2025 RMI survey, NAHB asked remodelers how common 22 remodeling projects were for their company in 2025 on a scale of 1 to 5 where 1=not common at all and 5=very common.

Bathroom remodeling was the most common project in 2025, with an average of 4.1 and 73% of remodelers rating it common to very common (4 or 5). Two other remodeling jobs received average ratings above 3.0: kitchen remodeling (3.9) and whole house remodeling (3.5). Over 50% of remodelers rated both projects as common to very common. Historically, bathroom, kitchen, and whole house remodeling have been the three most common types of projects undertaken by NAHB remodelers.