The RFS acknowledges the Traditional Owners of the lands and waters across NSW and Australia. We are privileged to work across all corners of this state, and we thank them for their expert care, over thousands of generations, of this beautiful Country.

We acknowledge the extreme hardships and exclusion experienced by Aboriginal and Torres Strait Islander peoples since the colonisation of Australia by European settlers.

We are committed to learning how to engage and connect with Aboriginal and Torres Strait Islander peoples in a respectful, caring and healing manner, and to work together in service to community and protection of lands.

We support young people and the future generations of Aboriginal and Torres Strait Islander peoples.

We pay our respects to all Elders, past and present, and recognise their connection to the Country of their ancestors.

Hon. Jihad Dib, MP

Minister for Customer Service and Digital Government

Minister for Emergency Services

Minister for Youth Justice

Parliament House

Sydney NSW 2000

Dear Minister

I am pleased to submit to you for presentation to the NSW Parliament the Annual Report of the NSW Rural Fire Service (RFS) for the year ending 30 June 2025.

This Annual Report has been prepared in accordance with the Government Sector Finance Act 2018, the Disability Inclusion Act 2014 and the Government Information (Public Access) Act 2009.

The RFS has self-assessed as a group 1 agency and has prepared the Annual Report in accordance with TPG25-10a.

Yours sincerely

Trent Curtin Commissioner

To provide a world standard of excellence in the provision of a volunteer-based community fire and emergency service.

To protect the community and our environment by minimising the impact of fire and other emergencies.

Values

Mutual respect

Adaptability and resourcefulness

One team, many players, one purpose

Integrity and trust

Support, friendship, camaraderie

Community and environment

Knowledge and learning

Community

Our members, their families and employers

State and Federal Ministers and Members of Parliament

Our emergency services and government partners across jurisdictions

Peak bodies and organisations representing relevant community, industry, and interest groups

The 2024/25 year again highlighted the breadth and importance of the NSW Rural Fire Service (RFS). Our members responded to challenges at home and abroad, from floods, storms and bush fires in NSW to supporting operations interstate and internationally.

Leading into the 2024/25 fire season, Canada and the USA experienced major fires resulting in a multi-agency response from Australia and New Zealand. Sixty-five RFS members were deployed to work as arduous firefighters, Incident Management Team (IMT) personnel and aviation, heavy plant, safety and fireground supervision specialists. The RFS Large Air Tanker (LAT) ‘Marie Bashir’ deployed more than half a million litres of retardant on 32 fires across California.

In early June 2025, the RFS once again answered the call for assistance to Canada, deploying 54 personnel including arduous firefighters, IMTs, aviation specialists and deployment supervisory personnel.

These contributions reinforced our reputation for expertise and cooperation on the world stage, while locally our role as an all-hazards agency was also clear.

NSW experienced higher than average rainfall through winter and spring, resulting in lower bush fire risk at the start of the statutory Bush Fire Danger Period. During this time, the RFS supported other significant emergency events, including the Western NSW power outage in October, providing significant logistics support including generators, portable cool rooms, fuel pods and portable Starlink devices.

During December 2024, NSW experienced elevated lightning activity associated with storms and in late December, the first Section 44 (s44) bush fire emergency was declared in the Bathurst Regional LGA.

This s44 was subsequently expanded to include Lithgow and a total of seven s44 declarations were made between December and March, including Singleton/Muswellbrook, Tamworth part Uralla, Hawkesbury, Walgett/Coonamble, Namoi/Gwydir, Warrumbungle and part of Narrabri.

The RFS attended 7,217 bush and grass fires throughout 2024/25 with a total of 80,078 hectares (ha) burnt. The burnt area is low in comparison with other years due to a combination of reasons including the compressed season as well as reasonably successful strategies engaged by IMTs to keep remote fires to as small a footprint as possible.

Other Australian states experienced bush fire and cyclone events that necessitated the activation of interstate assistance through the National Resource Sharing Centre (NRSC). The RFS facilitated the deployment of 399 personnel including aviation specialists, firefighters, IMTs and storm teams. Our aircraft were also deployed, supporting operations in all Australian states.

There were several significant flood and storm events in NSW during the 2024/25 operational period. Over the 12 month period, the RFS responded to 5,416 storm related responses, with 2,652 of these in support of NSW State Emergency Service (SES) taskings.

During Tropical Cyclone Alfred in March and the East Coast weather event in May, the RFS provided significant support to the SES including IMT personnel, storm crews, aviation rescue/transport assets, bedding caches for evacuation centres, heavy plant, RPAS, satellite connectivity devices and damage assessment teams. The RFS also established and provided ongoing management of base camps established in Wollongbar and Port Macquarie.

The RFS provided ongoing recovery support to the NSW Reconstruction Authority during June and July. This included the provision of facilities, personnel and systems in support of the protracted recovery operations.

I extend my gratitude to all the RFS members who worked tirelessly during these events to protect and help the communities affected.

When not committed operationally, the RFS and land managers undertook mitigation activities across the state. During the reporting year, the RFS undertook approximately 12,345ha of hazard reduction work protecting a total number of 22,531 assets.

In early 2025, a number of initiatives, including changes to the priorities and responsibilities of the Deputy Commissioners, were developed as part of the organisational realignment. The RFS established an overarching Strategy and Program Management Office (SPMO), signalling an intent to increase capability and capacity for strategic planning, management and delivery. A new Workplace Complaints Resolution Framework was also launched, which provides new avenues for advice and guidance for parties involved in workplace complaints.

Technology continues to transform how we work, with the RFS focusing on the satellite connectivity and Vehicle as a Node (VaaN) projects, reflecting our continued commitment to improving communications and enhancing operational capabilities. Mobile Data Terminals (MDT) are being progressively rolled out across the RFS. Thirty-one districts are now live and operational, with planning under way for the roll out of another eight districts.

We are working to identify the needs of the RFS for our next generation of firefighting appliances, including their design, protection levels and increasing appliance lifespan.

The RFS also partnered with the Australian Centre for Robotics (ACFR) under the Natural Hazards Research and Technology Acceleration Fund to research, develop and undertake field trials to test the potential for integration of several new technologies.

Looking ahead, we will consolidate our strategic priorities and finalise new priorities in line with our new Strategic Direction. In addition to those, we will continue to progress aviation, having made significant investments to build our aerial firefighting capabilities and ensure safety remains at the centre of our approach. Our aircraft have been a vital component not only during fire incidents, but also providing capability to other emergency services during search and rescue operations and flood events.

I would like to extend my sincere thanks to the Hon. Jihad Dib MP, Minister for Emergency Services, for his support of the RFS. Above all, I thank our members, both staff and volunteers, for their professionalism, dedication and service. Your efforts in protecting communities, supporting recovery and building resilience remain the foundation of the RFS.

I also want to express my deep appreciation to the outgoing Commissioner Rob Rogers for his efforts in leading the RFS over the past five years. As a result of his leadership, the RFS remains a trusted and capable organisation, ready to protect the NSW community. The strength of the RFS lies in its people and their willingness to serve and uphold shared values. I am proud to lead this remarkable organisation as it continues to develop its capabilities in the face of climate change and the increased impact on our state.

Trent Curtin Commissioner

VOLUNTEERS

69,624

STAFF

1,333

APPROXIMATELY

67%

OF RFS STAFF ARE ALSO RFS VOLUNTEERS

BRIGADES AREA COMMANDS RFS DISTRICTS

1,999

7

44

TOTAL INCIDENTS WE ATTENDED

32,739

SNAPSHOT OF INCIDENTS

BUSH/GRASS FIRES

7,217

MOTOR VEHICLE FIRES

2,274

STRUCTURE FIRES 114 FLOODS AND STORMS

1,378

MOTOR VEHICLE ACCIDENTS

ASSIST OTHER AGENCIES

5,851 3,053

TOTAL OPERATIONAL VEHICLES, BOATS AND AIRCRAFT

6,218

3,957 13 38 45 2,165

The RFS is the lead combat agency for bush fires in NSW. For more than 120 years, the Service has been a significant part of the history and landscape of NSW and an integral component of rural communities. The RFS works closely with other agencies to respond to a range of emergencies including structure fires, motor vehicle accidents and storms that occur within the rural fire districts that make up more than 95 per cent of NSW.

The RFS is the largest volunteer fire service in the world, a diverse organisation of almost 70,000 volunteer members and more than 1,300 staff. Members are trained to the highest standards to ensure they can protect the community when responding to emergency situations. The Service aims to minimise the impact of fire and other emergencies not only through operational capability but also by developing and implementing programs that focus on community education, fire prevention and risk management.

The management and operational responsibilities of the RFS are set down in the Rural Fires Act 1997 and can be summarised as follows:

Provision of rural fire services for NSW, including: Services for the prevention, mitigation and suppression of fires in rural districts

The protection of people from dangers to their safety and health, and property from destruction or damage arising from fires in rural fire districts

Protection of infrastructure and environmental, economic, cultural, agricultural and community assets from destruction or damage by fires in rural fire districts

Issuing public warnings about bush fire threats

Provision of advisory services relating to firefighting and other matters in which it has expertise

Provision of emergency assistance to other emergency service organisations

The Rural Fires Regulation 2022 also governs such matters as:

The membership of rural fire brigades and constitutions

The constitution, membership and functions of Bush Fire Management Committees

Fire prevention during Bush Fire Danger Periods

The issuing of various notices

The RFS is part of the Emergency Services portfolio. The Hon. Jihad Dib MP is the Minister for Customer Service and Digital Government, Minister for Emergency Services and Minister for Youth Justice.

Three bodies are empowered by legislation to assist in the operation of the RFS, the:

Bush Fire Co-ordinating Committee

Rural Fire Service Advisory Council

Fire Services Joint Standing Committee

Bush Fire Co-ordinating Committee

The Bush Fire Co-ordinating Committee (BFCC) is established under Part 3, Division 2 of the Rural Fires Act 1997. The Committee is chaired by the RFS Commissioner and its members are drawn from a range of areas, industries and agencies.

The BFCC is responsible for planning in relation to bush fire prevention and coordinated bush firefighting. It advises the RFS Commissioner on bush fire prevention, mitigation and coordinated bush fire suppression. The BFCC constitutes Bush Fire Management Committees (BFMCs) for all rural fire districts and areas with reasonable risk of bush fire. It also approves Bush Fire Risk Management Plans, Fire Access and Fire Trail Plans and Plans of Operation prepared by the BFMCs.

The BFCC is supported by its Standing Advisory SubCommittee, comprising key RFS operational personnel and BFCC stakeholder members.

The Rural Fire Service Advisory Council (RFSAC) is established under the provisions of Part 6 of the Rural Fires Act 1997. The Council:

Advises and reports to the Minister and the RFS Commissioner on any matters relating to the administration of rural fire services under the Act

Advises the Commissioner on public education programs relating to rural fire matters and training of rural firefighters

Advises the Commissioner on the issue of Service Standards

The Fire Services Joint Standing Committee Act 1998 provides for the establishment of the Fire Services Joint Standing Committee (FSJSC). The Committee is chaired alternately by the Commissioners of Fire and Rescue NSW (FRNSW) and the RFS. In exercising its functions, the Committee has regard to infrastructure planning, training activities, community education programs, and equipment design. The Committee’s major functions are to:

Develop and submit to the Minister strategic plans for the delivery of comprehensive, balanced and coordinated urban and rural fire services at the interface of fire district boundaries and rural fire district boundaries

Undertake periodic review of fire district and rural fire district boundaries and, if appropriate, to make recommendations to the Minister concerning those boundaries

Develop and submit to the Minister implementation strategies to minimise duplication and maximise compatibility between the RFS and FRNSW

The Audit and Risk Committee provides assistance to the Commissioner by monitoring, reviewing and providing advice about the Service’s governance and accountability requirements. The Committee consists of three independent members and advises the Commissioner on a range of matters including:

The effectiveness of the Service's internal audit function

The Service’s legislative compliance, the financial statements and financial reporting of the Service Risk and control frameworks

Business continuity and corruption prevention activities

The principal role of the Local Government Liaison Committee (LGLC) is to discuss and resolve significant issues of a strategic nature that are of mutual interest to local government and the RFS. The LGLC may also discuss, resolve and report on issues referred to it by the Minister.

RFS/Rural Fire Service Association Consultative Committees

The Consultative Committees are forums for the RFS to consult with and gain feedback from members of the Rural Fire Service Association, on behalf of the broader membership. The committees are aligned with the four RFS Corporate Pillars.

They are the:

Vibrant and Sustainable Membership Consultative Committee

Research, Innovation and Technology Consultative Committee

Resilient Communities and Valued Partnerships Consultative Committee

Service Delivery, Readiness and Agility Consultative Committee

The Young Members Group is a sub-group of the Vibrant and Sustainable Membership Consultative Committee.

RFS Commissioner

Rob Rogers AFSM

Commissioner Rob Rogers has dedicated more than four decades to the RFS, beginning his journey as a volunteer with the Belrose Rural Fire Brigade in 1979. His commitment led him to a full-time role in 1995, when he was appointed Deputy Fire Control Officer for the Greater Taree District.

Commissioner Rogers has held various executive roles in the RFS since 2001, including responsibility for Regional Management, Community Safety and Operations. He was appointed Deputy Commissioner in 2011 and ascended to the role of Commissioner in July 2020.

During his tenure, Commissioner Rogers has played a pivotal role in modernising the RFS. He has led the implementation of groundbreaking innovations, including the Australian Fire Danger Rating System (AFDRS), the development of Artificial Intelligence for fire prediction and response and advances in aerial firefighting capabilities. He also has overseen the introduction of a state-wide automated Computer Aided Dispatch system and equipped members with real-time technology such as a fireground mapping tool, Mobile Data Terminals and a member availability app. His commitment to firefighter safety has also driven the adoption of new helmets and enhanced personal protective clothing.

Commissioner Rogers represents the RFS on national and state bodies including as Chair of the Australian Fire Danger Rating System Board, the National Aerial Firefighting Centre Strategic Committee, Bush Fire Co-ordinating Committee and Rural Fire Service Advisory Council and Co-chair of the Fire Services Joint Standing Committee.

He is a member of the State Emergency Management Committee, the NSW State Rescue Board, Emergency Services Board of Commissioners, the NSW Telecommunications Authority Advisory Board, Australasian Fire and Emergency Service Authorities Council Commissioners and the Chief Officers Strategic Committee.

Commissioner Rogers was awarded the National Medal in 1995 and the Australian Fire Service Medal (AFSM) in 2004.

Commissioner Rogers retired from the RFS on 4 July 2025, marking the conclusion of a distinguished 45-year career dedicated to safeguarding the communities of NSW.

On 26 June 2025, the Minister for Emergency Services announced Mr Trent Curtin, would be appointed as the new Commissioner of the RFS. Mr Curtin has more than 30 years’ experience in emergency services across NSW and Victoria. He began his career as a volunteer firefighter with Victoria’s Country Fire Authority, before progressing to operational and leadership roles with Fire Rescue Victoria. He later joined Fire and Rescue NSW, where he served as Assistant Commissioner, leading major emergency and natural disaster responses and overseeing key volunteer programs, including the Community Fire Units.

He was appointed the acting head of SafeWork NSW from 2023 to 2025, playing a pivotal role in restoring the agency’s standing as a strong and independent work health and safety regulator.

Mr Curtin will take up his appointment as the Commissioner of the RFS on 14 July 2025.

Peter McKechnie AFSM

Deputy Commissioner Peter McKechnie AFSM joined the RFS in 1994 as a volunteer firefighter with the Narara Brigade on the Central Coast, securing employment as a staff member in 2002. With a passion for the development of operational capabilities, he progressed through the ranks and has been instrumental in the organisation’s strategic management, leadership and operations. He has held the roles of District Manager, Manager State Operations and Aviation, and Director Area Operations. After acting in the role of Executive Director Operations from September 2020, he was appointed Deputy Commissioner of Field Operations in March 2021.

Deputy Commissioner McKechnie has been a part of and led efforts to combat major fires and other emergencies within NSW, interstate and overseas. He has also represented the RFS in international programs in Singapore, Indonesia and the United States and led Australian deployments to the USA and Canada to assist local firefighting authorities.

His achievements over the years include the National Medal, the National Emergency Medal, Commissioner’s Commendation, RFS Long Service Medal and a Graduate Diploma of Executive Leadership in Policing and Emergency Services. Deputy Commissioner McKechnie was awarded the Australia Fire Services Medal as part of the 2023 Australia Day Honours.

Deputy Commissioner, Operational Coordination

Ben Millington

Ben Millington is the Deputy Commissioner, Operational Coordination. With a career spanning more than two decades, he has demonstrated an unwavering commitment to community safety, operational excellence and innovation within the emergency management sector.

DC Millington began his public service career with the NSW Police Force in 2000, serving for over a decade in a range of roles across the state including General Duties, Youth Liaison, Licensing and Target Action Group operations. He later established and led the Police Emergency Management Unit, delivering significant improvements in emergency preparedness and multiagency coordination.

In 2011, Deputy Commissioner Millington joined the RFS, holding several senior leadership roles and ultimately serving as Assistant Commissioner for State Operations. In this capacity, he oversaw numerous large-scale emergency responses and was the State Operations Controller during the catastrophic 2019/20 bush fire season, during which more than 5.5 million hectares were burned and over 2,400 homes lost in NSW. He also played a critical role in the Service’s COVID-19 operational response and led Australian firefighting contingents deployed to Indonesia in 2015 and Canada in 2021.

From 2016 to 2017, he was seconded to the Secretariat of the Pacific Community in Fiji as a Disaster Management Specialist, supporting regional disaster preparedness efforts across Pacific Island nations.

Deputy Commissioner Millington has driven key capability enhancements within the RFS, including the implementation of the Large Air Tanker program, rollout of Computer Aided Dispatch systems, and development of Athena, an advanced bush fire intelligence platform to improve fire prediction and operational decision-making. He also championed the introduction of night-time aerial firefighting training, a first for NSW, and established a dedicated Aviation Services team to strengthen aerial firefighting capability development.

In 2024, Deputy Commissioner Millington served as Acting Chief Officer of the Rural Fire Service Queensland (RFSQ) for 12 months, leading the Service through a period of significant reform as part of the state’s broader emergency services transformation.

Deputy Commissioner Millington's service has been recognised through several national honours, including the National Emergency Medal, Humanitarian Overseas Service Medal National Medal, and the NSW Premier's Bushfire Emergency Citation.

Deputy Commissioner Kyle Stewart joined the Service in April 2021 following a 36-year career with the NSW Police Force. Deputy Commissioner Stewart has extensive experience in the emergency services sector, holding several senior executive roles during his career with the NSW Police Force. Deputy Commissioner Stewart’s experience includes appointments to the positions of the Deputy State Emergency Operations Controller and an extended appointment as the acting Commissioner of the NSW State Emergency Service during 2019.

Deputy Commissioner Stewart holds tertiary qualifications in law and a practicing certificate as a Legal Practitioner in the State of New South Wales. He is a graduate of the United States of America Federal Bureau of Investigations National Academy Program and was awarded the Australian Police Medal in 2008.

Kelly Quandt AFSM

Kelly Quandt’s lifelong dedication to community service began in her childhood, spent among her extended brigade family at her second home fondly referred to as “the Station”. Inspired by her parents’ example, Deputy Commissioner Quandt joined the RFS in 1989 at just 14 years of age, marking the start of a distinguished career in volunteering and firefighting.

Over the past 36 years, Deputy Commissioner Quandt has consistently demonstrated outstanding leadership and operational expertise. Her response to the Waterfall train derailment earned her a Commissioner’s Commendationand she has played pivotal roles in numerous campaign fires and brigade initiatives.

Deputy Commissioner Quandt’s formal leadership journey began in 2002 when she was elected Brigade Captain, a position she held for nine years. In 2014, she made history as the first female Group Captain in the Sutherland District – an exceptional milestone, particularly at a time when women comprised less than 1% of members at that rank.

In addition to her volunteer service, Deputy Commissioner Quandt has built a notable career within the RFS. In May 2025, she was appointed

Deputy Commissioner, People and Corporate Services, with responsibility for People and Culture, Finance and Procurement, and Health and Safety. Her previous roles include Director Area Operations Southern, overseeing Greater Sydney, South Eastern, and South Western Area Commands, which span nearly half of NSW, and Director of ICT, leading the development and support of critical organisational systems.

Deputy Commissioner Quandt was promoted to Assistant Commissioner in 2018 and served as State Operations Controller during the unprecedented 2019/20 Black Summer bush fire season.

Her service has been recognised with numerous honours, including the Australian Fire Service Medal, Emergency Services Medal, National Medal, RFS Long Service Medal, two Commissioner’s Commendations, and two Commissioner Unit Citations for Service.

Deputy Commissioner Quandt holds a Master of Management.

Ms Trina Schmidt was the Executive Director for People and Strategy up until January 2025.

As at 30 June 2025

Director Communications and Strategic Engagement

Director Office of the General Counsel

Director Operations Support

Director Fleet and Infrastructure

Director Information Communication Technology

Director Learning and Development

Director Innovation

Director State Operations

Director Community Resilience

Director Aviation

Director Operational Logistics

Director Area Operations Southern

Director Area Operations Northern

Director Built and Natural Environment

Director Finance and Procurement; Chief Financial Officer

Director Health and Safety

Director People and Culture

Ms Renee Armstrong

Ms Ursula Bouzaid

Assistant Commissioner Stuart Midgley AFSM

Chief Superintendent Nicholas Medianik (acting capacity)

Mr Robert Flanagan

Chief Superintendent Heath Stimson (acting capacity)

Ms Debbie Andreatta

Assistant Commissioner Viki Campbell

Dr Simon Heemstra

Chief Superintendent Christopher Ryder (acting capacity)

Ms Rachel Hanigan (acting capacity)

Chief Superintendent Greg Wardle (acting capacity)

Assistant Commissioner Jayson McKellar AFSM

Superintendent Laurence McCoy (acting capacity)

Mr Myles Foley

Dr Brett Carroll

Ms Narelle Koteff

As at 30 June 2025

Operational Coordination

Aviation

Logistics

Community Resilience

State Operations

People and Corporate Services

Health and Safety

Finance and Procurement

People and Culture

Strategic Capability

Fleet and Infrastructure

Learning and Development Innovation Information Communication Technology

As at 30 June 2025

Field Operations

Area Operations (Northern)

Office of the Commissioner

Communication and Strategic Engagement

Area Operations (Southern) Operations Support

Built and Natural Environment Office of the General Counsel

There are seven Area Commands across NSW that support the 44 Districts, 1,999 Brigades and the NSW community they serve. The Areas assist with the coordination and effectiveness of mitigation crews and staff across their commands. They also help Districts so they can make more localised decision making and enhance support to volunteers.

Headquarters

State Operations

4 Murray Rose Avenue

Sydney Olympic Park NSW 2127

Western Area Command

112A Airport Drive

Cowra NSW 2594

North Western Area Command

177 Country Road Westdale NSW 2340

North Eastern Area Command

3/2 Halls Road

North Boambee Valley NSW 2450

Hunter Area Command 1A George Booth Drive

Cameron Park NSW 2285

Greater Sydney Area Command 42 Lamb Street Glendenning NSW 2142

South Western Area Command

5/32 Fallon Street Thurgoona NSW 2640

South Eastern Area Command

7 Kylie Crescent

Batemans Bay NSW 2536

As at 30 June 2025

AREA COMMAND DISTRICTS

Far North Coast

Northern Rivers

North Eastern (NEAC)

North Western (NWAC)

Clarence Valley

Coffs Coast

Northern Tablelands

New England

Namoi/Gwydir

Tamworth

Liverpool Range

Castlereagh

North West

Cudgegong

Chifley Lithgow

Orana

Western (WAC)

Hunter (HAC)

Canobolas

South West Slopes

Mid Lachlan Valley

Far West

Western Border

Lower North Coast

Mid Coast

Lower Hunter

Hunter Valley

Central Coast

AREA COMMAND DISTRICTS

Shoalhaven

Far South Coast

South Eastern (SEAC)

Southern Tablelands

Lake George

Monaro

Riverina Highlands

Bland Temora

Riverina

South Western (SWAC)

Greater Sydney (GSAC)

Southern Border

MIA

Mid Murray

Lower Western

Northern Beaches

Hornsby/Ku-ring-gai

The Hills

Hawkesbury

Cumberland/Macarthur

Blue Mountains

Illawarra/Sutherland

Southern Highlands

Work to develop the new RFS Strategic Direction 2025-30 has progressed, with a draft released to members in early June for consultation.

The draft Strategic Direction represents the culmination of extensive consultation and engagement with members, Directors and the Executive. Input was carefully considered through a series of planning workshops held across the year. The document sets out the future direction and priorities of the organisation, based on current planning insights, while recognising that external factors will necessitate periodic updates to maintain its relevance.

At the conclusion of the member consultation period, updates will be made to address relevant feedback. The Strategic Direction will then be presented for approval and officially launched, enabling the governance structures to be established to oversee implementation.

A range of strategic initiatives will then be identified under each Strategic Pillar and delivery reporting refreshed.

As part of the organisational realignment in Feburary, the RFS established an overarching Strategy and Program Management Office (SPMO), signalling intent to increase capability and capacity for strategic planning, management and delivery. The primary objectives of the enhanced function are:

Supporting the design, development and execution of the organisation’s Strategic Direction in partnership with the leadership team

Supporting our Directorates and Divisions with development of their annual operating plans to align resources with our key strategic and operational priorities

Establishing an internal Program Management Office (PMO), with oversight of all major projects and to provide an in-house project and change management capability delivery service

The SPMO will play a pivotal role in aligning organisational priorities with strategic execution. It will provide enterprise-wide oversight of programs and projects, ensuring they are effectively governed, resourced, and delivered to achieve intended outcomes. The office will partner with the executive and leadership teams, to develop the organisation’s Strategic Direction and lead the implementation of key initiatives. Through robust planning, performance monitoring, and benefits realisation, the SPMO will drive execution, support change adoption, and build internal capability. Its work will strengthen decision-making, foster collaboration, and enable the organisation to deliver measurable value in line with its strategic and operational objectives.

To deliver on our current Strategic Direction, and in response to the 2020 NSW Bushfire Inquiry and Royal Commission into National Natural Disaster Arrangements, the RFS introduced a number of strategic priorities:

Personal Protective Equipment

– Head and Respiratory Protection

Benevolent Fund

Mental Health

Workplace Conduct

RFS ACTIV (Member availability and response system)

CAD (integrated dispatch system)

Mobile Data Terminals (MDTs)

Mapping software

Australian Fire Danger Rating System

Design of Fire Appliances and Next Generation Fleet

Farm Fire Unit Integration

Station connectivity

One RFS Member website

eMembership Portal

Emergency Logistics Program

Digital ID

The priority projects were identified with our members and the community at the forefront, with a focus on keeping our members safe and well, enhancing emergency response and management of incidents and using technology to better optimise logistics and connect people. Updates on the active projects are provided below, with many of the priorities completed on in previous years.

The RFS and Brigades Donations Fund allocated more than $70 million from generous public donations to these initiatives. The Service is indebted to the community for its support, which has helped us accelerate these important projects.

The RFS Mental Health Strategy continues to work towards our goal of achieving a mentally healthy environment in which our members can thrive. Progress has been achieved under each of the following strategic objectives:

Discovery reports have been finalised to inform the development of a Psychosocial Risk Management Framework and a Suicide Awareness Prevention and Postvention Framework

Draft frameworks have been developed for Psychosocial Risk Management and Suicide Awareness Prevention and Postvention. These are to be incorporated into the overall Health, Safety and Wellbeing Framework

The role of the leader in supporting our mental health initiatives continues in the development phase. This will progress to informing comprehensive leadership training to augment the overall RFS leadership framework

Mental health training packages are continually being developed with input from our mental health subject matter experts to coincide with the release of RFS training packages as per the current RFS Learning and Development schedule

Our program to enhance provision of family support is due to start in July 2025

Our program and recently developed Service Standard and Guideline to enhance our Mental Health Services has been approved to go live in July 2025.

The RFS continues to work towards ensuring that our agency, our leaders and our members (and their families) are able to thrive. This includes ensuring all are equipped with the necessary resources to identify and control psychosocial risks and, if required, to be able to access services and pathways to care to facilitate a return to well. This will ensure that we can continue to protect the community and our environment by minimising the impact of fire and other emergencies, contributing to fulfilling the overall RFS purpose.

The RFS has developed a framework that promotes a safe and inclusive workplace for all our members.

The new Workplace Complaints Resolution Framework was officially launched on 15 July 2024.

The framework provides new avenues for advice and guidance for parties involved in workplace complaints, including a third-party hotline and specific training for leaders, investigators and decision-makers. It also changes how the RFS assesses, triages, manages and resolves workplace complaints to ensure more consistent and timely resolution of workplace conduct issues.

A 12-month review of the new framework will be completed in 2025/26.

The Mobile Data Terminal (MDT) project is a strategic initiative aimed at enhancing operational communication, situational awareness and incident management capabilities for frontline personnel. The project involves the installation of tablets (MDTs) into operational firefighting vehicles across the state. Each MDT provides access to a suite of applications and systems that support real-time data sharing and decision-making, including:

Live incident information and mapping

Turnout and dispatch messaging

Navigation and routing

Access to critical safety and operational documents

Integration with the Public Safety Network (PSN) and other radio systems

The MDTs are designed to improve coordination between field crews, Fire Control Centres and other emergency services during both planned and emergency operations.

The project includes the deployment of approximately 5,000 MDTs across the operational fleet, with continued enhancements and support provided in partnership with vendors.

The initiative represents a significant step forward in digital transformation for the RFS, enabling greater efficiency, safety and resilience in emergency response operations.

The RFS is working to identify its needs for the next generation of firefighting appliances, including their design, protection levels, and increasing lifespan. A comprehensive research initiative was completed in conjunction with Monash University’s Accident Research Centre to look at evidence-based safety improvements for our appliances, specifically in relation to roll-over and falling object protection. Members were invited to provide feedback on our Category 1, 7 and 9 tanker designs, their current suitability and key areas for improvement.

The Monash University findings, together with the member feedback, will serve as the foundation for the development of our next generation of firefighting appliances. The project is a major undertaking, spanning several years and impacting across decades.

The RFS Farm Fire Unit (FFU) Operational Guide and Commitment Strategy, co-created with NSW Farmers, was launched in August 2022. This has strengthened the integration of FFUs with firefighting operations to promote the safe, efficient and cooperative involvement of private equipment to control fires. It has also given FFU operators the necessary information to help them make informed decisions and establish a consistent approach to cooperation and communication between FFU operators and RFS crews on the fireground.

In 2023/24 and 2024/25, Transport for NSW undertook trials allowing private vehicles used for firefighting purposes, or Farm Fire Fighting Vehicles (FFFVs), to be driven unregistered on public roads if certain conditions were met. The trials were designed to assist rural fire fighting efforts and enhance collaboration between farmers and the RFS.

More than 350 vehicles participated in the trials and analysis of the data obtained will help Transport for NSW work, in liaison with the RFS and NSW Farmers, towards implementing a safe, permanent solution.

This project aims to better connect brigades to the RFS through internet connectivity, member email addresses and Microsoft software. This has standardised our infrastructure and alleviated the need for brigades to meet costs for these services.

To ensure our brigades have access to high-speed internet, we have made available a Nighthawk M6 mobile router and Telstra internet plan for each brigade station within range of Telstra’s mobile coverage.

As at 30 June 2025, almost 1,200 brigade stations received a Nighthawk M6 mobile router. The Service is exploring other options to supply internet service to those outside Telstra's Service Area.

The RFS has completed a Microsoft 365 roll out to provide every member their own RFS email and access to Microsoft Office 365 products, including Teams and Outlook, supporting easier communication between members and with the Service.

The RFS is exploring a new digital identity system to enable our members to access a secure and efficient means of identifying themselves. This plan is to provide an official RFS member ID, with the convenience of using a mobile app as a proof of identity. This would provide a simplified verification process for members with less administrative effort.

Ahead of the NSW 2024/25 fire season, Canada and the USA experienced major fires resulting in a multi-agency response from Australia and New Zealand from July to September 2024. The RFS coordinated the deployment of NSW personnel with 75 deployed to Canada and 27 to the USA. Of these, the 65 were from the RFS with personnel from National Parks and Wildlife Service (NPWS), Forestry Corporation of NSW (FCNSW) and NSW State Emergency Service (SES) making up the remaining 37. The main capabilities requested by Canada and USA included aviation, heavy plant, safety and fireground supervision specialists. IMT personnel and arduous firefighters were also deployed.

The RFS Large Air Tanker (LAT) ‘Marie Bashir’ departed for California, USA on 15 May 2025. The LAT deployed 511,019 litres of retardant over 32 fires across California. The LAT is due to return to NSW in late August in preparation for the 2025/26 Australian fire season.

Locally, NSW experienced higher than average rainfall through winter and spring, resulting in lower bush fire risk at the start of the statutory Bush Fire Danger period. During this time, the RFS supported other significant emergency events including the Western NSW power outage in October, providing significant logistics support including generators, portable cool rooms, fuel pods and portable Starlink devices.

During December 2024, NSW experienced elevated lightning activity associated with storms and in late December, the first Section 44 (s44) bush fire emergency was declared in the Bathurst Regional LGA. This s44 was expanded to include Lithgow and a total of seven s44 declarations were made between December and March including Singleton/Muswellbrook, Tamworth part Uralla, Hawkesbury, Walgett/Coonamble, Narrabri/ Gwydir and Warrumbungle.

The RFS attended 7,217 bush and grass fires throughout 2024/25, with a total of 80,078ha burnt. The burnt area is low in comparison with other years due to a combination of factors including the compressed season and reasonably successful strategies engaged by

Incident Management Teams (IMTs) to keep remote fires to as smaller footprint as possible.

Other Australian States experienced bush fire and cyclone events that necessitated the activation of interstate assistance through the National Resource Sharing Centre (NRSC). The RFS facilitated the deployment of 621 NSW personnel including aviation specialists, firefighters, IMT personnel, and storm teams. Of these, 399 were from the RFS. RFS owned aircraft also deployed to support operations in all Australian states between November and April.

The 2024/25 operational period had several significant flood and storm events in NSW. Over the 12-month period, the RFS responded to 5,416 storm related responses, with 2,652 of these being in support of SES taskings. During Ex-Tropical Cyclone Alfred in March, and the East Coast weather event in May, the RFS provided significant support to the SES, including IMT personnel, storm crews, aviation rescue/transport assets, bedding caches for Mass Evacuation Centre/local evacuation centres, heavy plant, RPAS, Starlink devices, and damage assessment teams. RFS also established and provided ongoing management of base camps established in Wollongbar and Port Macquarie.

During the recovery operations for the East Coast storm event the RFS provided ongoing recovery support to the NSW Reconstruction Authority during June and July. This included the provision of facilities, personnel and systems in support of the protracted recovery operations.

In early June, the RFS again answered the call for assistance to Canada, which was experiencing significant and sustained fire activity across most of its provinces for the third consecutive year. NSW had deployed 95 personnel (54 of these RFS personnel) by the end of June including arduous fire fighters, IMT, aviation specialists and deployment supervisory personnel.

A summary of strategic operations during 2024/25 is outlined below:

July Canada deployments

August Canada and USA deployments

September Canada and USA deployments

October Western NSW power outage

November Queensland deploymentsStrike teams for Dirranbandi and Goondiwindi. Aviation specialists deployed to Queensland, WA and SA. Significant storm events in Walgett, Byron and Wollondilly.

December s44 bush fires at Singleton, Muswellbrook, Hawkesbury, Lithgow, Bathurst, Tamworth, Uralla, Yass, Mid Western

Significant storm events in Lismore, Griffith, Hilltops and Lockhart

Interstate deployment to Victoria

January s44 bush fires at Narrabri, Gwydir and Walgett.

Significant storm events in Hunter, Greater Sydney, Wagga Wagga and Snowy Valleys

February s44 bush fire at Warrumbungle

Victoria, Tasmania and WA bush fire deployments. Queensland cyclone deployment. Significant storm event at Hilltops.

March s44 bush fire at Warrumbungle.

Ex-Tropical Cyclone Alfred - NE

NSW and interstate deployment to SE Queensland.

Tasmania bush fire deployment and aviation specialists deploy to WA and SA.

NSW Bushfire Inquiry

The 2019/20 bush fire season was one of the most devastating in NSW history, with 11,774 fire incidents recorded over an eight-month period from July 2019 to February 2020.

Tragically, 26 lives were lost in NSW, including four RFS volunteers and three RFS-contracted air crew members. The fires destroyed 2,476 homes and damaged a further 1,034, along with 5,559 outbuildings and 284 public facilities. More than 2.7 million hectares of national park land were also affected.

In response, the NSW Government established the independent NSW Bushfire Inquiry, which was led by Professor Mary O’Kane AC, Chair of the Independent Planning Commission and former NSW Chief Scientist and Engineer, and Mr Dave Owens APM, former Deputy Commissioner of the NSW Police Force.

The final Inquiry report was released on 24 August 2020, with the NSW Government accepting all 76 recommendations. Several of these included detailed sub-recommendations, resulting in a total of 148 individual actions to be implemented. Progress on these actions is being tracked and reported by the Premier’s Department.

The majority of recommendations were directed to the RFS, which has accordingly made a significant contribution to the whole-of-government Inquiry response. By the end of the Quarter 1, 2025 reporting period the RFS had completed all but one of its recommendations.

The NSW State Coroner’s Report on the findings and recommendations from the inquests and inquiries into the 2019/20 NSW bush fire season was handed down on 27 March 2024.

April

May

Western Queensland floods deployment

Western NSW floods

NSW East Coast severe weather

June Canada deployments

The Coroner made 28 recommendations, with 23 of these directed to RFS and two directed to RFS and NSW Police jointly. These included recommendations in relation to aerial firefighting operations, training, technology, research into fleet safety and continuing collaboration between the RFS and the Bureau of Meteorology.

As required, the RFS reported to the Attorney General at the end of September 2024 outlining actions to implement the recommendations.

The 2022 NSW Flood Inquiry, commissioned by the NSW Government in March 2022, aimed to assess the causes, preparedness, response and recovery efforts related to the catastrophic floods earlier that year. Led by Professor Mary O’Kane AC and former NSW Police Commissioner Michael Fuller APM, the inquiry received 1,494 submissions and conducted 144 meetings with stakeholders, including community forums in affected areas such as Lismore, Tumbulgum, Mullumbimby and the Hawkesbury-Nepean region.

The final report, released in August 2022, presented 28 recommendations. The Government supported six recommendations in full and a further 22 in principle.

The RFS contributed to the implementation of recommendations four and 12, both of which were completed during 2025.

The NSW State Coroner’s Report on the findings and recommendations from the inquiry into the Yankees Gap Road, Bemboka fire in March 2018 was handed down on 8 November 2024.

The Coroner made 17 recommendations to the RFS and three notations and recommendations were put forward to the Minister in respect of potential legislative change. Of the recommendations directed to RFS, nine were supported in full and a further six in principle.

As required, the RFS reported to the Attorney General in June 2025, outlining actions that had been or would be undertaken to implement the recommendations.

Infrastructure program

Six new co-located Fire Control Centres and Emergency Operations Centres are in development: three in construction and three in planning phase. These projects are being developed in response to recommendations in the NSW Bushfire Inquiry to address facilities without the capacity to accommodate an onsite Emergency Operations Centre (EOC).

These new facilities apply the current RFS Fire Control Centre (FCC) Standard Design to meet the contemporary needs of an FCC, including the essential EOC. They will equip the local staff and volunteers with modern, fit for purpose operational and day-to-day workspaces, training rooms and amenities as well as improved parking and storage capacities. These projects aim to improve preparedness and service delivery for RFS members and their wider communities.

Clarence Valley FCC (Grafton)

Construction of the new Clarence Valley FCC is under way with detailed excavation and installation of building services. The project is strategically located adjacent to the Grafton Airport, providing proximity to the district airbase to facilitate improved air operations, incident management oversight and increase efficiency of aerial response and reconnaissance capabilities during bush fire and other emergencies.

Cost to date: $10.4m (to end of financial year 2024/25)

Current forecast completion: March 2026

Delays: Ex-Tropical Cyclone Alfred and a sustained period of wet weather resulted in over 1000mm of rainfall across the site. This delayed site establishment, the start of physical works and caused some latent site conditions that needed to be addressed before bulk earthworks could start. A cumulative 40-day extension of time has been approved.

Namoi Gwydir FCC (Narrabri)

Construction of the new Namoi Gwydir FCC has started with the first concrete pour for the FCC complex completed. The new FCC will be located at a much larger site and feature a new station for the Narrabri Headquarters Brigade and a helipad. The helipad will support aerial capabilities during major incidents and will double as a space for brigade and district training activities.

Cost to date: $11.4m (to end of financial year 2024/25)

Current forecast completion: January 2026

Delays: Several factors including a sustained period of wet weather impacted the project resulting in the need to rectify some latent site conditions as part of the bulk earthworks. A cumulative 34-day extension of time has been approved.

Civil works to facilitate the Monaro FCC project have begun for both the road extension to the site and the FCC site. The new facility is located next to the existing FCC and the Polo Flat Aerodrome. In addition to the FCC development, the project also includes an Aviation Facility that will provide a helipad and accommodation for a large RFS rotary aircraft and its crew. The inclusion of the aviation facility will be a significant advantage to aerial response and reconnaissance capabilities during bush fires and other emergencies throughout the southern part of the state.

Cost to date: $14.4m (to end of financial year 2024/25)

Current forecast completion: May 2026

Delays: Several factors have resulted in a four-week delay, however, it is anticipated that there is enough capacity within the current forecast completion date to avoid impacting the forecast completion date.

Environmental investigations, cultural and heritage assessments and design works are progressing for the Hawkesbury, Far South Coast and Riverina Highlands FCCs. It is anticipated that these projects will achieve tender readiness for design and construct contracts during financial year 2025/26. Construction will start as planning and certification processes are completed.

During 2024/25, the RFS invested more than $52m in Brigade Station, Fire Control Centre and Training Facility capital works across NSW. A total of 93 projects received funding to support delivery with a mix of completed and ongoing projects including:

New build facilities from initial feasibility investigations and design, through the construction phase, and to the completion of defect liability periods; and,

Upgrades to facilities including the provision/ improvement of amenities, extensions and major renovations, communications and utilities upgrades, and safety/security upgrades

During the reporting year, the Service continued its comprehensive refurbishment and maintenance program to align older appliances in the RFS fleet to contemporary crew safety standards. Rural suppliers across the state were engaged to implement a range of safety enhancements by installing ring mains, radiant heat curtains, wheel spray kits, livery and emergency lighting.

In addition to the refurbishment and maintenance program, the Service continues to enhance operational capability, with the handover of over 230 appliances, which includes 143 new firefighting appliances, 92 second-hand or refurbished appliances and 27 support vehicles allocated to brigades across the state.

The Service has maintained momentum on its extensive refurbishment and maintenance program, aimed at aligning legacy RFS fleet appliances with modern crew safety standards. Rural suppliers across NSW played a key role in delivering a suite of safety upgrades, including ring main cabin protection systems, radiant heat curtains, wheel spray kits, upgraded communications equipment and emergency warning and lighting systems.

Beyond refurbishment efforts, operational capability was further strengthened with the delivery of more than 291 appliances. This included 191 brand-new firefighting units, 126 second-hand or refurbished appliances (comprising 36 second-hand and 90 refurbished units), and 10 support vehicles, all allocated to brigades across the state.

In addition to fleet upgrades, several strategic projects were launched this financial year to ensure the RFS remained equipped to meet evolving operational demands:

Procurement began for new Euro 6-compliant appliance cab chassis to prototype and trial

A retrofit solution was designed and developed for overhead fill points in Category 1 and Category 9 appliances

Contracts were executed with vendors for slip-on water and modular solutions tailored to existing Category 17 mitigation appliances

Construction began on the medium mitigation appliances, alongside the procurement of additional remote Radio-Controlled Compact Track Loaders

These enhancements to the mitigation fleet will significantly bolster crew capability, equipping teams with modern, fit-for-purpose tools that support both preparedness and response and contribute meaningfully to the overall effectiveness of mitigation operations.

In addition to the refurbishment and maintenance program, the Service continues to enhance operational

capability, with the handover of over 230 appliances, which includes 143 new firefighting appliances, 92 second-hand or refurbished appliances and 27 support vehicles allocated to brigades across the state.

This financial year has seen the implementation of several key projects aimed at ensuring the RFS continues to be well-equipped to meet the evolving operational requirements:

The initiation of the CABA Filling Station Project, which involves the installation and commissioning of new CABA filling stations in strategic locations to meet the demands of the evolving structural firefighting capability.

The design and development of a retrofit solution for the overhead fill points in Category 1 and Category 9 appliances.

The execution of contracts with vendors, following an open market tender process, to provide slip-on water solutions for existing mitigation Category 17 appliances and Radio-Controlled Compact Track Loaders, both of which positively contribute to mitigation’s capabilities.

Ahead of the 2024/25 fire season, the RFS bolstered its aviation capabilities with the installation of an internal tank into Boeing CH-47 Chinook heavy helicopter, increasing its capability to deliver 11,000 litres of retardant and undertaking night firebombing operations. The RFS further increased its aerial supervision, scanning and transport capability through the addition of a King Air fixed wing aircraft with a LiDAR unit.

The RFS owns 13 aircraft including:

One 737 Large Air Tanker (LAT)

One heavy helicopter (Chinook)

Six medium helicopters, with three based in regional NSW to enable the rapid deployment of aviation support to rural and regional areas of the state during bush fires and other emergencies.

Three fixed wing lead planes

Two demilitarised Black Hawk helicopters gifted by the Australian Defence Force.

The RFS entered an agreement with Australian UAV Service (a commercial arm of Surf Life Saving NSW) in mid-2024 for managed RPAS services, which includes provision of UAVs and ancillary equipment, training of pilots, maintenance of equipment and management of flight approvals. The RFS currently operates under the AUAVS Remote Operating Certificate (ReOC).

RPAS capability (including pilots, small and medium RPAS) has been established in each of the seven Area Commands, with additional capability established within state level teams including Media, Fire Investigation and Operational Field Support.

In late 2024, 24 new pilots were trained and an additional five members previously trained were approved to operate under the ReOC. Under the agreement, 14 UAVs were provided by AUAVS (seven mini and seven small) and 24 pilots trained. In addition, five pilots and three UAVs already in place within the RFS were transitioned under the ReOC.

In December 2024, the first operational flight was undertaken, with eight of the remote pilots successfully trained as equipment maintenance officers.

An additional 11 UAVs were acquired in May 2025, with each Area Command receiving an additional UAV unit. A larger UAV with winch capability has been acquired to test capability of resupply during incidents.

To date, RFS UAV pilots have flown more than 120 missions (operational and training). An additional 24 remote pilots will be trained in 2025/26.

Significant updates have been made to the Athena platform, with new features integrating weather data with fire predictions and providing critical insights into aviation operations on firegrounds. The legacy COP system was successfully transitioned into Athena COP prior to the start of the fire season. Athena COP included several data management and user experience improvements including more data layers able to be displayed in the map, improved mapping features and faster ability to manage data and user loads during high operational tempo. It also consolidates information from various operational systems to present effective options for bush fire suppression, member availability and emergency logistics, ensuring our systems remain robust and fit for purpose.

The rollout of Mobile Data Terminals continued through 2024/25 with 29 Districts (3,167 units) operational as of 30 June 2025.

Following the successful implementation of FireMapper, further enhancements have been implemented to improve interagency sharing. The fireground information gathered in FireMapper is also displayed in Athena COP.

The RFS completed the first phase of its Risk Modelling Platform, providing new capability to run risk assessment modelling in-house. Bush Fire Management Committees (BFMC) have access to a range of modelling projects to identify the impact on assets of value and supporting the development of bush fire risk management plans. The project will continue in 2025/26.

The RFS led the continued enhancement of the Australian Fire Danger Rating System with the development of Fire Ignition and Suppression and Impact Indices. These products will enhance agency capability by providing improved access to critical data to support community preparedness, and tools for more targeted and effective risk reduction. Development of the Operational Trial Sandpit will continue over 2025/26.

Progress has been made in improving the suite of digital tools offered to members and the public. Enhancements to the Hazards Near Me and Fires Near Me Australia apps included expanded NSW hazard types and improved user experience.

The completion of user research and designs for the public RFS website and One RFS focused on accessibility and user-friendly navigation. A media app was also developed to assist in streamlining fireground media requests and safety.

The Vehicle as a Node (VaaN) project is focused on improving communications in the field, particularly in areas without reliable telecommunications coverage.

The VaaN solution combines Low Earth Orbit (LEO) satellite connectivity with an in-vehicle modem capable of connecting to 4G/5G carrier services. This enables appliances to provide network connectivity to members and onboard systems via both Wi-Fi and physical network connections.

The system intelligently switches between LEO satellite and cellular networks to deliver the best available connectivity for the longest possible duration. Importantly, the solution extends the Public Safety Network (PSN) by enabling Public Safety Mobile Radios (PSN) to remain connected, even when operating outside the traditional network footprint. The scope of the project includes developing the solution and designing the physical units for installation across the 5,000 vehicles in the RFS operational fleet.

The project is being delivered through an internal RFS capability, leveraging personnel to manage installation and support. This approach enables installations to occur in close proximity to brigade locations, minimising the impact on members' time. It also establishes a sustainable, ongoing support capability within the organisation.

The VaaN project has continued to progress and has now entered the rollout phase. A key focus during this stage has been the installation design, ensuring an efficient rollout program and a supportable product post-installation. The initial design phase has concluded, resulting in two installation types – internal and external – which are now in production. The RFS continues to work closely with the NSW Telco Authority and other emergency service organisations to expand this capability across the broader emergency services sector.

Over the past 12 months, in parallel with progress on the VaaN project, the RFS has significantly improved its capability to deploy Wi-Fi operationally in support of members. This includes multiple successful deployments of Starlink technology to support both RFS operations and those of other emergency service organisations.

Starlink has been deployed operationally during key events, including Ex-Tropical Cyclone Alfred and the East Coast Low event affecting Taree and surrounding areas. The technology also has been used internationally, supporting RFS members deployed to assist efforts in Canada.

The Innovation Division was formed under Strategic Capability, as part of the 2025 organisational restructure. The Division brings together four specialist teams, each contributing distinct capabilities to enable innovation, delivery, and performance improvement across the organisation.

Firefighting advancement and research

This team leads applied research and innovation to improve operational outcomes and enhance firefighter safety. By exploring emerging technologies, analysing evolving practices, and partnering with internal and external experts, the team supports evidence-informed decision-making and contributes to the continuous improvement of frontline capabilities.

Business partnering

Acting as the bridge between strategic intent and operational execution, the Business Partnering team works with stakeholders to assess demand, shape project scopes and support the mobilisation of key initiatives across the Service.

Strategy and program management office

This team provides oversight and delivery support for key programs aligned with the RFS Strategic Direction. The team ensures effective governance, integrated planning, and structured delivery across priority initiatives, ensuring alignment, driving execution, and supporting change adoption across the organisation.

Performance reporting and analysis

Responsible for generating data-driven insights, this team supports evidence-based decision-making by delivering high-quality reporting, analytics and research. It plays a key role in monitoring performance, evaluating progress, and identifying opportunities for improvement.

As a world leader in bush fire and emergency management, the RFS is committed to outcomes that: enhance firefighter and community safety and wellbeing

empower individuals to make informed decisions during natural hazard events

advance our understanding of fire behaviour and introduce systems and processes to manage bush fire risk

promote our understanding and approaches towards climate change and the environmental factors that contribute to bush fire; and drive best practice in the provision of emergency services.

Research and innovation play a significant role in achieving these outcomes. The RFS invests in research and forms partnerships with universities, research bodies and other government agencies to ensure our agency remains ‘future fit’ and responsive to the challenges faced by natural hazards and other emergencies. In the past our partnerships have delivered industry changing research into community risk, firefighter safety and bush fire management.

Research, innovation and technology are fundamental to the strategic direction of the Service, reflecting our commitment to research that informs new ways of operating and technology that supports better field-based capability and decision-making.

During 2024/25 the RFS continued to engage with Natural Hazards Research Australia (NHRA), contributing to the national natural hazard research agenda and supporting projects relevant to our strategic priorities including:

Managing smoke impacts on firefighter eye surface health

Predictions in public: understanding the design, communication and dissemination of predictive maps to the public

Integrated solutions for bush fire-adaptive homes

Capturing uncertainty in bush fire spread prediction

Bush fire risk at the rural-urban interface

Awareness, education and communication for compound natural hazards

The RFS remains a partner in the NSW Bushfire and Natural Hazards Research Centre (BNHRC) as one of eight NSW Government end-user agencies. RFS is a lead agency on the following BNHRC research:

Evaluating backburning and firebreak operations (UOW)

Effectiveness of mechanical fuel management treatments including grazing (The University of Melbourne)

Fire management on ridgelines (UNSW)

Incorporating fire extent severity mapping into fuel accumulation curves (Western Sydney University)

Identifying burn windows and opportunities for remote monitoring of moisture conditions (Western Sydney University)

Validating satellite-derived fuel moisture content in NSW (ANU)

Understanding the effects of VLS on backburn escape (UNSW)

Understanding extreme fire/pyrocumulonimbus regimes (UNSW)

Understanding present and future impacts of critical fire weather (UNSW)

The RFS is also involved with research projects studying evacuation and bush fires including:

Evacuation risk research that identifies areas of high risk for Bush Fire Management Committees (CSIRO Data 61)

Case studies to understand evacuation behaviours (Compass Io T)

As a world leader in bush fire and emergency management, the RFS is committed to outcomes that: enhance firefighter and community safety and wellbeing

empower individuals to make informed decisions during natural hazard events

advance our understanding of fire behaviour and introduce systems and processes to manage bush fire risk

promote our understanding and approaches towards climate change and the environmental factors that contribute to bush fire; and drive best practice in the provision of emergency services.

Research and innovation play a significant role in achieving these outcomes. The RFS invests in research and forms partnerships with universities, research bodies and other government agencies to ensure our agency remains ‘future fit’ and responsive to the challenges faced by natural hazards and other emergencies. In the past our partnerships have delivered industry changing research into community risk, firefighter safety and bush fire management.

The RFS partnered with the Australian Centre for Robotics (ACFR) under the Natural Hazards Research and Technology Acceleration Fund to research, develop and undertake field trials to test the potential for integration of five new technologies. The objective was to provide vision and rapid situational awareness to first responders, divisional commanders or Incident Controllers regardless of weather conditions (including smoke or darkness) and allow an inbound aerial asset to rapidly identify the precise geo-location of personnel, particularly in the event of an urgent extrication of crew injured or under threat.

This research aimed to address several recommendations from the NSW Bushfire Inquiry, and involved field trials of technologies researched and developed by the ACFR, along with workshops with key stakeholders, to develop a technology roadmap and increase the technology maturity of the following devices and capabilities:

Tethered drones

Wearable devices

Helicopter-based tracking of personnel

Vehicle telemetry

Ground robotics (fire droid)

This research proved successful, with all five technologies exceeding the desired Technology Readiness Levels (TRLs) and showing potential to improve both firefighter and community safety during emergency events.

This research concluded on June 30, 2025, with the Innovation Team investigating opportunities to further progress this research and technology.

Numerous activities were undertaken during the year to assist in the professional development of members of the RFS. An Effective Writing skills program delivered by CCE has been very successful. The Young Members Group has been very active and a Young Leaders College successfully conducted.

The Boost Program, which has focused on upskilling members with training qualifications, is nearing completion. Nationally accredited qualifications offered were Enterprise Skills Trainer (EST), Certificate IV in Training and Assessment and Volunteer Trainer Delivery and Assessment Contribution Skill Set.

The program began in May 2022 and, as of 30 June 2025, had enrolled 1,060 members across 97 dedicated courses and 70 individual enrolments. To date, 724 members have achieved a qualification, with a projected total of 788 qualifications by the end of the program.

Volunteer Leadership Training in conjunction with the DGR Trust has begun, with pilot programs to roll out in second half of 2025. Professional Development will evaluate pilots for suitability for a statewide volunteer leadership training program.

In September 2023 an online version of Bush Fire Awareness (BFA) training was developed and offered to external organisations. As of 30 June 2025, 4,737 individuals had completed the online training across 91 organisations.

The Professional Development Committee exists to deliver fair and meaningful professional development to all RFS salaried members. In the 2024/25 financial year, 36 applications were received, totalling $178,000.

The RFS completed the roll out of its new structural firefighting helmets to members in August 2024. The MSA Gallet F1XF helmet, which incorporates inbuilt communications and lighting, was delivered to all members with Structural Firefighter (SFF) qualifications.

'Push to talk' units, which are used to connect standard RFS radios with the communications unit in the helmets, were rolled out at the same time. The delivery of about 1,900 helmets and 1,200 'push to talk' units, was made possible by public donations to the RFS and Brigades Donations Fund.

The RFS is working to develop a tailor-made female firefighting boot designed to meet the characteristics of female feet.

In 2025, the RFS launched a six-month uniform trial that will see the distribution of 4,000 new uniform sets to RFS brigades, Mitigation Crews and staff across NSW. The trial is designed to evaluate the new uniform’s functionality, comfort and durability in operational, station and office environments.

The trial participants will test the uniforms across a range of shifts, weather conditions and operational scenarios. Participants will provide ongoing feedback through a wearer’s log, with more detailed input to be collected at the midpoint and end of the trial. This feedback will be critical in identifying any improvements required before broader service-wide implementation.

* This report is based on the Workforce Profile Report submitted to the Public Service Commission

Minister-approved travel

9-18 June 2025 Deputy Commissioner Strategic Capability NEMA Australia-US Fire and Emergency Management Technical Exchange, USA

19-23

22–29 March 2025 Manager Bush Fire Risk Planning International Association of Fire Chiefs (IAFC) 2025 Wildland Urban Interface Conference and International Fire Department Exchange Program, USA

22-30 March 2025 Manager Operational Field Support

Tangent Link 2025 Conference, France

9-16 March 2025 Supervisor Aircraft Capability Verticon 2025 Helicopter Expo, USA

25–29 November 2024 Supervisor RFS Operational Communications Centre National Emergency Communications Working Group – Australia/NZ Conference, NZ

18-23 November 2024 Area Commander North Western Master of Public Administration course, NZ

In late 2023 the Public Service Association (PSA) brought a case to the Supreme Court of NSW regarding the interpretation of overtime under the Crown Employees (Rural Fire Service) Award (RFS Award). The RFS and PSA have agreed a settlement. The settlement included new practices for overtime under the current RFS Award, a settlement fund available to eligible employees to claim overtime and recommencement of negotiations of the RFS Award. The RFS has begun to implement measures required to give effect to the agreed settlement with some changes in practice to apply from 1 August 2025.

The NSW Government introduced Treasury Policy Guideline ‘TPG 24-33 Reporting framework for climate-related financial disclosures’ in October 2024 (revised June 2025). This policy guideline mandates reporting requirements for NSW Government annual reporting agencies pertaining to the level and extent of risk that climate change poses to their operations and its fiscal outlook. In response, the RFS has established a working group with representation across each of the directorates.

The NSW Procurement Board issued Procurement Board Direction ‘PBD-2024-01 Mandate for the publication of NSW Government supply opportunities on buy NSW’ on 25 July 2024, which requires publication of procurements where the total engagements exceed the GIPA disclosure threshold of $150,000 (inc GST). Full implementation is required by 31 December 2025. In addition, Procurement Board Direction ‘PBD 2024-02 Increasing Opportunities for local suppliers to supply to government’ was issued on 9 September 2024 and required NSW Government agencies to assess opportunities for local suppliers to supply to government in procurement processes. Implementation was required from 1 January 2025. The RFS has revised its procurement documentation and processes to implement these measures as required.

*The 2024/25 Workers Compensation for volunteers' premium contribution, together with interest income, has turned a prior year deficit (i.e. $5.4 million) to a net $2.2 million surplus at 30 June 2025. This funding surplus will offset any future contribution to maintain a sustainable funding position determined by icare.

Insurance coverage is provided by the NSW Treasury Managed Fund (TMF) for all areas except workers’ compensation coverage for volunteers. RFS volunteers are covered by the Bush Fire Fighters Compensation Fund.

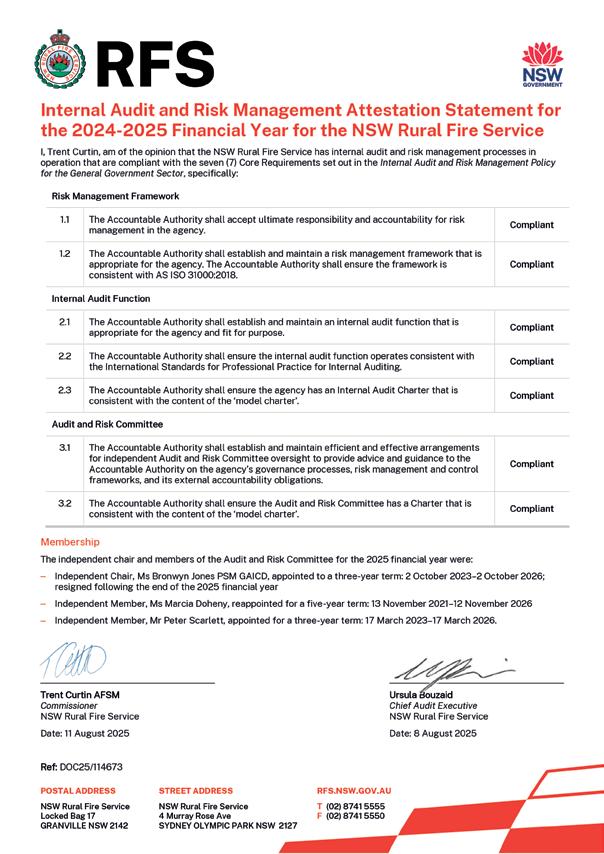

Audit and Risk Management Statement

The Privacy and Personal Information Protection Act 1998 (PPIPA) establishes certain principles governing the manner and circumstances in which personal information may be collected and used. The Health Records and Information Privacy Act 2002 (HRIPA) also stipulates the responsibilities of private organisations and public agencies in dealing with health information.

The RFS Service Standard 1.1.14 Personal Information and Privacy sets out the manner in which members of the RFS shall collect and use personal information in carrying out the functions of the RFS, so as to comply with the provisions of the PPIPA and HRIPA. The RFS Privacy Management Plan also forms part of this Service Standard and articulates the responsibilities of the RFS under PPIPA and HRIPA.