Lindsey Jensen

Lindsey Jensen’s dad has been a real estate appraiser ever since she was a baby. She grew up being around houses as well as working with her dad’s business –which at one point included flipping. His success inspired her to want the life that he had, and after reading the book Rich Dad Poor Dad, she knew she wanted to be an investor. She attended her first creative deal making seminar in 2016 and was hooked. She purchased her first seller finance deal six months later and now, six years later, she has a $10M portfolio that she landlords and master leases an additional 40 properties. Lindsey is an active of member of Colorado’s Investment Community of the Rockies (ICOR).

Please tell us a little about who you are and what you did before getting into real estate investing:

I have always been an entrepreneur

One Mistake That Will Cost You Thousands

By Jeffery S. Watson

By Jeffery S. Watson

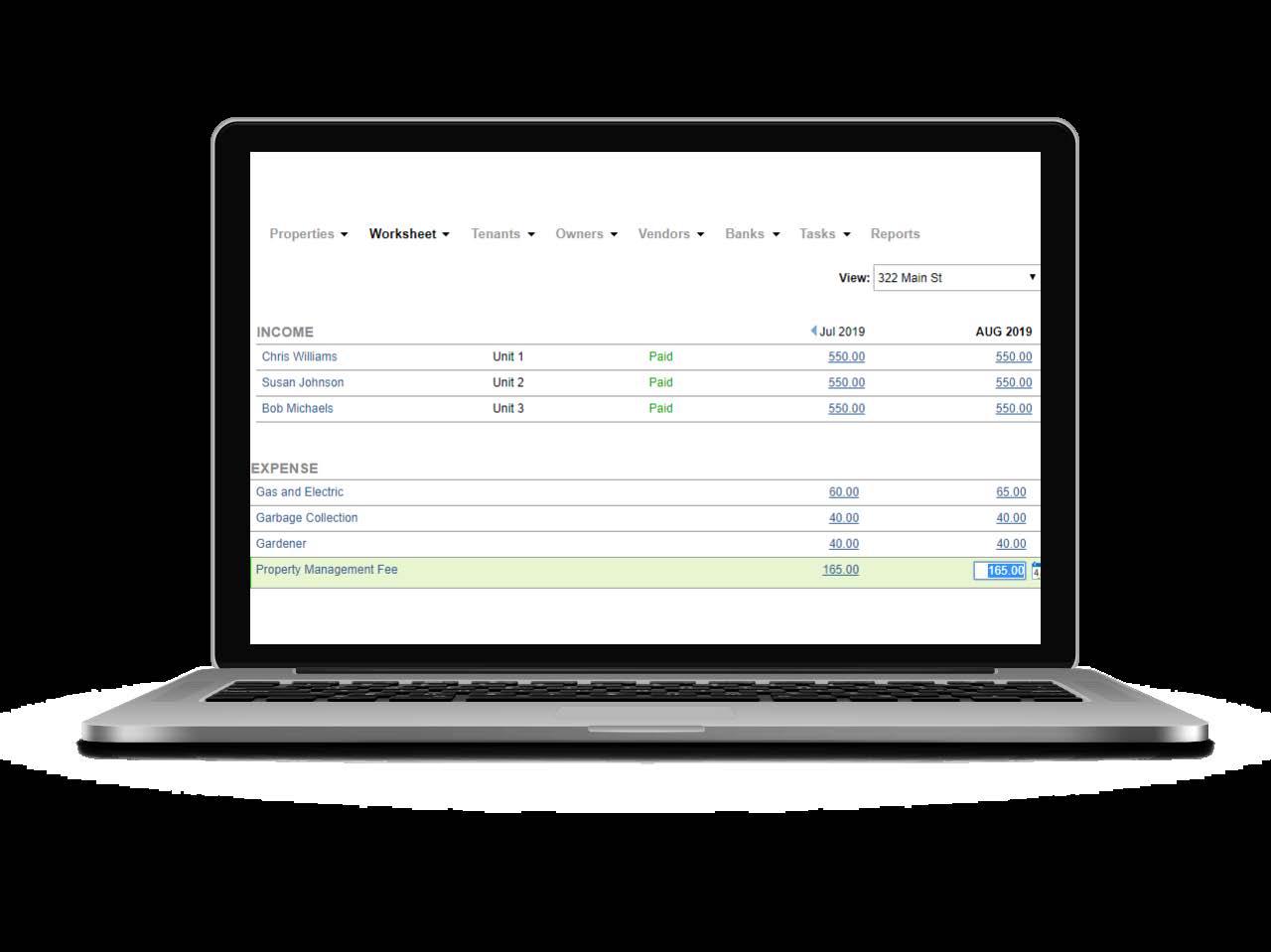

Irecently sat down for a couple of hours with my friend David Richter, author of the book Profit First for Real Estate Investing (you can find it on Amazon). I want to share some of what we talked about that can have a tremendous impact on your financial situation.

We all love control. Even young children want to push the boundaries of their world. Whether it is brushing their teeth or buckling their car seat, they like to feel that they are in control of the situation. This is often the case with adults as well. We want to be in control of when and how we do things rather than have someone tell us what to do and when to do it.

What about your money? Are you in control of your cash? We all have emotional ties to money. Watching your money come in one day only to go right back out the next day can be stressful.

I’m sure we can all relate to feeling frustrated when standing at the gas pump. If you are a real estate investor, rising interest rates can

Is There a Coming Oil Crash?

By Chris Kuehl, Ph.D.

By Chris Kuehl, Ph.D.

This piece is a bit off the beaten track as far as housing and construction are concerned but only by a bit. By now we have all become pretty familiar with all those “headwinds.” The rise in the mortgage rates slowed the demand for single-family housing although there continues to be a great deal of permit activity surrounding multi-family units. The shortage of over 5 million homes remains a factor and that need is being filled by apartments.

The commercial side of construction is still feeding off projects that were started a year or more ago and the biggest concern is what fills the pipeline in 2023 and beyond. The focus for commercial is still logistics and warehousing but

Rental Housing Journal, LLC 4500 S. Lakeshore Drive, Suite 300 Tempe, Arizona 85282 Circulated To Over 40,000 Real Estate Investors Nationwide Vol. 8 Issue 1 REAL ESTATE JOURNA L WINNTER 2022-2023 $4.95 Published In Conjunction With nationalreia.org rentalhousingjournal.com 2. Understanding What Truly Matters 2. Not as Easy as it Seems! 3. NREIA Legislative Update 5. What a Possible HUD Announcement in 2023 Could Mean for Private Landlords 6.What is a Backdoor Roth IRA? 8.Valuing Property in a Changing Market 8.Changing Your Financial Trajectory 9. A Hostage Crisis: Can a CPA Refuse to Give You Your Data? 10. Buying Pre-Foreclosures Today 16. Assistance Animals—A Fourfold Challenge RE Journal Member Spotlight Continued

on Page 12

Continued on Page 18

Continued

Page 14

on

Understanding What Truly Matters

By Rebecca McLean Executive Director, National REIA

If there’s a silver lining to the challenges we’ve experienced over the last two years, it’s that we have developed a greater understanding of what truly matters. And that’s led many of us to renew our commitments to ourselves and our communities.

National REIA’s local associations are filled with leaders and members who have made the commitment to invest in themselves. They do so by taking part in programs that grow their leadership and communication skills and their knowledge of our industry. The lessons they learn fuel their creativity and abilities to successfully manage through tough times, as we witnessed over and over again, during the last few years.

So, what’s the secret to our programs? Warren Buffett could have been describing it when he said, “Surround yourself with people that push you to do better, no drama or negativity. Just higher goals and higher motivation. Good times and positive energy. No jealousy or hate. Simply bringing out the absolute best in each other.”

National REIA is proud of the roles our local leaders play in helping members experience the inherent joy that comes from being part of a community of engaged, optimistic, uplifting, and supportive peers who draw the best from each other.

You can experience this amazing sense of community

at the next meeting of your local REIA. Emerging new investors learn and work alongside experienced longterm investors in a positive, enthusiastic and nurturing environment to learn the investing strategies and skills that will help them perform at their highest levels – as well as build bonds with peers across the industry!

Your local REIA can also teach you how to build your team, if you haven’t done so already, as you head into 2023. All successful investors have a team of advisors that include a real estate attorney, a CPA, your local banker, etc. You will need to establish a highly functioning “advisory team” designed to help you achieve your company goals. Your local REIA can even be a great place to find these team members and get referrals from those already successful in the business.

Speaking of the new year, it is a great time to be surrounded by a strong community of other investors as you create your 2023 goals. Remember to create both stretch goals along with your execution plan, which can work together to deliver high-impact results for your business. REIAs can give you the information, support and tools you need to navigate the transition to the “new normal” and the pitfalls that you will experience without the insights from a community and the resources that you have access to, both at the local and national level through your REIA.

The pandemic has demonstrated that we are indeed stronger together and whether we are introverts or extroverts, there is nothing like finding your community.

The National REIA team looks forward to welcoming you to learn, grow and build community with your peers at your local REIA and through our online portal. Don’t forget to take advantage of our online community, our REIAU education, our monthly REIA Now calls, and of course, your daily updates through our RealEstateInvestingToday.com website.

Here’s to a great 2023! Thank you for your commitment and support to our industry. We look forward to serving you in the coming year.

Not as Easy as it Seems!

By Charles Tassell

Since the depths of the housing recession in 20092010, the eyes of Wall Street funds have focused on the single-family housing market. Banks, dispensing with various tranches of mortgages, sold tapes of hundreds and thousands of houses to equity groups. At pennies on the dollar to their value, some were wholesaled, but many were renovated to varying degrees and rented out. A small percentage were demolished providing a tax write-off for the fully inflated value loss. Needless to say, the success of these early equity groups reverberated around the world as increasingly liquid monetary policy, and a flight to U.S. safe havens poured billions into the U.S. housing market.

With a multi-year appreciating housing market and seemingly boundless demand, savings and treasuries were anemic by comparison. Equity groups bought into plans by tech firms recognized as experts in their fields, to cross over into SFH investing. The combination of a fear of missing out and a feeling of financial wealthiness was driving consumers to roll their equity up into larger housing. Few saw that the scars of the housing recession created a decade-long under-build of new single-family housing, especially in urban markets, as well as a long-term shortage of multifamily and rental housing. Local government opposition to anything but

luxury or luxury-senior was seen as risky, especially to politicians neighboring the NIMBYs of the world.

Millennials like to buy and move in to a ready-tolive-in home. Rehabbing is not their cup of tea. With fewer foreclosures overall there are fewer to purchase/ rehab and with the HGTV crowd once again entering the market as weekend warriors, many SFH rehabbers have become marginalized and experienced one of two outcomes: patient purchases with down time and substantial profitability on those few, or churning and burning to re-engage the money resulting in smaller and smaller profits.

When this same process is tried at the corporate level, and with corporate efficiency (tongue in cheek), the 40,000-foot spreadsheet view can look really good, right up until it doesn’t. In other words, at some point the reality of contingencies – the kind that change your plans when you open a wall – don’t fit into the corporate cookie-cutter plan. Zillow exited the rehabber market even though they were the technological value oracles. Their losses were mounting, and that was before interest rate hikes. Recently, Redfin announced they would be shuttering their renovation department and shared expected losses to be in the hundreds of millions of dollars.

It really begs the question: If Institutional rehabbers are getting killed in the market, even with massive appreciation, what happens when there is a slight

decline in values?

Considering many people shop for houses by payment, just like a car, the interest rate has a huge impact, especially if inflation is eating away at their paycheck. The young couple trying to purchase a $2K payment has changed their plans from a $600K house at 3 percent interest to a $375K at 7.5 percent. In most regions across the country, those are two very different markets. With substantial inflation keeping most longer-term homeowners’ proverbial head above water, the newer owner – and especially the small down payment buyer of the last couple years – is getting nervous. Several high-flying cities, such as Denver and Phoenix, and states like Florida and California are seeing price drops and large increases for time-onthe-market offerings. The seller’s market, where letters pleading for the chance to buy the house on “first day over-bids” has converted to a more conventional buyer’s market.

Let’s diverge for a moment and consider the next likely real estate headlines: China’s housing and property bubble. Little by little information on the bubble that is China’s housing and property market has been leaking out. From protests in regions unable or unwilling to pay mortgage payments and large investments in empty apartment buildings, office

Real Estate Journal Real Estate Journal · Winter 2022-2023 2

Rebecca McLean is the Executive Director of National Real Estate Investors Association.

Continued on Page 18

NREIA Legislative Update

Federal Flood Insurance…Good news!

In positive news from the United States government: HUD Secretary Marcia Fudge, in conjunction with Federal Housing Commissioner Julia Gordon, have lifted the requirement for federal flood insurance only for FHA-insured mortgages. This is a great step forward for citizens and consumers in FEMAdesignated flood zones. Secretary Fudge stated, “Flood insurance is required to ensure families and individuals are prepared if disaster strikes. Increasing consumer options for this important protection is one way we are building more resilient communities in the face of climate change.” While insurance might not be the best form of resiliency, it will definitely help bring market forces to bear on FHA-insured mortgages and could greatly assist struggling buyers. As a personal example, the federal flood insurance proposal for a project of mine was estimated at $27,000 annually. The private market offered it for $1,200. Apples to apples. Thank you, Secretary Fudge and Commissioner Gordon!

Midterm Elections:

The midterms are over and the fallout will affect the country for at least the next two years. The split control of the legislative branch from the executive branch is just one of the key checks and balances designed by the founding fathers. Divided leadership is often good for Wall Street and Main Street, as stability, often referred to as gridlock, provides longer-term planning with no large legislative changes. Whether or not there is any final legislative drama, the split control will not preclude the White House from moving aggressively with various regulatory changes. As is often the case when a president (of either party) cannot accomplish their goals legislatively, they turn to their own cabinet and focus on regulatory changes.

Two recent cases have helped to reign in out-ofcontrol bureaucratic rule-making from the executive branch. The first, on June 30, 2022, West Virginia et al, v. EPA et al, began curtailing the regulatory authority of the EPA. The case is specific to the Clean Air Act of 1970; however, it is viewed as a harbinger of a more restrictive (originalist) reading of the Constitution by the Supreme Court for future regulatory challenges. This may have helped lay the ground work for the advancement of the next case. The second, a ruling on Oct. 19 by the Fifth Circuit Court of Appeals in Community Financial Services Association, et al v. CFPB, et al, finding that funding through the Federal

Reserve rather than Congressional appropriations, violates the Constitution’s structural separation of powers, which were purportedly set up through the Dodd-Frank Act as a funding mechanism to avoid issues of political influence during appropriations. According to the National Housing Council: “While the court was dismissive of the substantive arguments raised by the payday lender advocates who filed the lawsuit, it vacated the entire 2017 payday lending rule because of CFPB’s funding. In its ruling, the court cited Article I Section 1 of the U.S. Constitution, which states “that assignment of power to Congress is a bar on its further delegation.” The ruling noted that the Supreme Court has long delimited this general principle: “So long as Congress ‘lay[s] down by legislative act an intelligible principle to which the person or body authorized to [act] is directed to conform, such legislative action is not a forbidden delegation of legislative power.’ The Appeals Court found the CFPB’s structure went too far.”

While the CFPB continues on, basically ignoring the ruling, additional cases are being prepared to see about re-asserting Constitutional restraints on the agency, something the agency will aggressively oppose.

The administration is continuing to meet with progressive housing advocates on ways to sidestep the 10th Amendment and override state management of various real estate and rental issues. An upcoming topic is a federal regulation to address rent caps, rent increases and housing as a right. With the pervasiveness of video conferences in a post-COVID world, the speed of the national meetings has increased. The meetings can be more targeted on individual issues, yet still planned for scalability with pilot programs in receptive states.

An example of these kinds of broad regulatory over-reach is the enduring 30-day notice requirement being foisted on housing providers who receive federal money or insurance. The notice was a remnant of one of the initial COVID-19 funding programs prior to the federal eviction moratorium, requiring all properties with federally issued or backed mortgages, or receiving federal funding, to provide 30-day notices for evictions that typically required three to 10 days depending on the state. When drafted, it was understood to be “sunsetted” with the initial law. That has since been “reconsidered” by bureaucrats to now be an ongoing mandate regardless of a COVID-19 emergency. Without specific legislation to countermand the bureaucrats it

will likely take a court of appeals precedent or higher to cause it to cease and desist. Housing-provider associations are working together to expedite the process. Recently in a bit of good news, judges have started to distance their states from the over-extended mandate by recognizing the end, albeit perfunctory, of the COVID-19 emergency and separating the state law (eviction) which they are over-seeing from the federal law, which would need to be dealt with in another court venue. National REIA will continue to work on this issue, supporting the case moving forward and sharing good rulings as they occur.

Resilience:

Get ready for this word to become very commonplace. While some parts of the federal government are using it in the context of so-called climate change, the more traditional history has to do with cold-war survivability. In fact, the Internet was one of those Pentagon (sorry, Al Gore) innovations focused on the development of a resilient form of communication. With more than 60 missiles launched from North Korea in 2022 alone, and a host of increasing cyber and physical attacks on U.S. infrastructure, resiliency is rapidly becoming much more important. Resilience on the business level can mean a variety of things. First focus on the cyber aspect: With the war in Ukraine, cyber-attacks have increased considerably and are typically U.Sfocused. Start simply, back up computers and data to third parties or separate hard drives on a regular basis. Using quality virus and malware protection is equally helpful. Along those same lines is implementing a basic cyber awareness, first and foremost: don’t download files from people you don’t know, or click on links, even from people you do know. Hackers are relying on your overall business fatigue and A-type personality to move through email backlogs without looking too closely at the details. The results can be ransomware or a burned-out computer. Neither is good and both are time-consuming and costly. Please take time to practice cyber protections and resiliency.

Second is communication and planning. In the event of crisis, what will happen next? If there is a massive power outage or cell disruption, how will your company survive? This is a good lunch or after-work conversation to start developing a plan. Just like when essential workers became noteworthy, what business functions must continue? And how will communications be

Real Estate Journal · Winter 2022-2023 3 Real Estate Journal

Continued on Page 15

Real Estate Journal *Potential returns and appreciation are never guaranteed and loss of principal is possible. Please speak with your CPA and attorney for tax and legal advice.*The Debentures will bear non-compounded interest at the annual rate of 9.75% per annum (365-day year basis) on the outstanding principal, payable monthly on between the twentieth and twenty fifth day of the following month. An investment in the Debentures will begin accruing interest upon acceptance and closing of the Investor’s Subscription Agreement. There is a risk Investors may not receive distributions, along with a risk of loss of principal invested. This material does not constitute an offer to sell nor a solicitation of an offer to buy any security. Such offers can be made only by the confidential Private Placement Memorandum (the “Memorandum”). Please read the entire Memorandum paying special attention to the risk section prior investing. IRC Section 1031, IRC Section 1033 and IRC Section 721 are complex tax codes therefore you should consult your tax or legal professional for details regarding your situation. This material is not to be construed as tax or legal advice. There are material risks associated with investing in real estate securities including illiquidity, vacancies, general market conditions and competition, lack of operating history, interest rate risks, general risks of owning/operating commercial and multifamily properties, financing risks, potential adverse tax consequences, general economic risks, development risks and long hold periods. There is a risk of loss of the entire investment principal. Past performance is not a guarantee of future results. Potential cash flow, potential returns and potential appreciation are not guaranteed. Securities offered through FNEX Capital. Get More Out of Your 1031 Exchange on the kpi1031.com Marketplace DST Offerings from 25 Different Real Estate Sponsors 20-40 available Delaware Statutory Trust 1031 listings at any given time Investment options from $100K - $200M FREE DST 1031 Exchange Tool Kit Call Today to Also Learn About a Real Estate Fund With: Register at or call 855.875.2781 www.kpi1031.com • All-New 1031 DST Digest Magazine • 1031 Exchange Property Listings • Introductory DST Book for Investors 9.75% ANNUALIZED DISTRIBUTION POTENTIAL* 9.75% Annualized Distribution Potential Monthly ACH Distribution Payments Available for Cash Investments and IRAs

Published quarterly for chapters, associated real estate investor associations, their members and guests.

Editor

Brad Beckett brad@nationalreia.org

For inquiries regarding Membership, Legislative, REIA organization information or to become a industry partner, call National REIA toll free at 888-762-7342 Fax: 859-422-4916

Hours of operation: 9:00am to 6:00pm Eastern time zone Find us online at: info@nationalreia.org www.NationalREIA.org

RE Journal is published by Rental Housing Journal, LLC, publishers of Rental Housing Journal www.rentalhousingjournal.com

Publisher John Triplett john@rentalhousingjournal.com Editor Linda Wienandt linda@rentalhousingjournal.com Associate Editor Diane Porter Advertising Manager Terry Hokenson terry@rentalhousingjournal.com

The articles in RE Journal written by all authors are presented to you for educational purposes only. The authors and the National Real Estate Investors Association strongly recommend seeking the advice of your own attorney, CPA or other applicable professional before undertaking any of the advice or concepts discussed herein. The statements and representations made in advertising and news articles contained in this publication are those of the advertiser and authors and as such do not necessarily reflect the views or opinions of National REIA or Rental Housing Journal, LLC. The inclusion of advertising in this publications does not, in any way, comport an endorsement of or support for the products or services offered. To request a reprint or reprint rights contact Rental Housing Journal, LLC, 4500 S. Lakeshore Drive, Suite 300, Tempe, AZ 85282. (480) 454-2728 - (480) 720-4385. © 2022 All rights reserved.

What a Possible HUD Announcement in 2023 Could Mean for Private Landlords

By David Pickron

Have you ever been punished for something you didn’t do or that was completely out of your control? My guess is you have and that the thought that flashed through your mind at the time went something like this; I didn’t do anything wrong! Frustration sets in as you try and figure our what you could have done differently, reaching the conclusion that sometimes these things are out of your control. The situation below might be one of those times.

For property owners, although it hasn’t happened yet, this scenario may soon play out based on some recent actions being considered by HUD.

On April 12, 2022, Marcia Fudge, Secretary of the U.S. Department of Housing and Urban Development, issued a memorandum to her staff with the subject line: Eliminating Barriers That May Unnecessarily Prevent Individuals with Criminal Histories from Participating in HUD Programs.

In short, HUD is trying to determine what criminal criteria HUD programs should use, if any, when qualifying an applicant. At that time, she called for a six-month study period that ended October 14, 2022. History shows, when HUD makes a policy for government housing, they slowly try to implement it into the private sector. And even though it hasn’t happened yet, it may be coming.

This is where the “unfair” results kick in. Think about those jurisdictions who have source of income as a protected class, where it is illegal to discriminate against people who use Section 8 vouchers as income. As a private landlord, whether you want to or not, you are required to take section 8 housing if your rents are in line with the standard rental rate of local housing providers. If this happens, the government just took your private housing and turned it into Government Housing, and you must follow all of HUD’s rules and recommendations or else.

As an example, I have an income producing rental home in Tucson, Arizona. The market value of rent is $1100 per month and a Section 8 voucher is willing to pay $1100. Section 8 rationalizes that your financial risk is covered by the government so there is no need for me as a private landlord to financially qualify them any further. The most I can require is three times the applicant’s portion of the rent which is usually zero to begin with. As part of my normal tenant onboarding process, I then run the applicant through a background check to see if there is any criminal history and subsequently find this individual has several felony drug convictions. Right now, I can decline this individual based on a “no felony

drug conviction in the last 7 years” that is a key part of my rental applicant criteria. This is where it gets tricky based on what HUD could propose regarding criminal history because of the memo referenced above. They are trying to justify mandating the removal of any criminal history search, claiming that a criminal history has no correlation with you as a private landlord receiving the rent because the Government is covering that part. That is a scary thought process.

As more jurisdictions vote to add source of income as a protected class, more private rentals will be sucked into Government Housing Rules and criminal histories could become a thing of the past. And it won’t stop there as HUD will slowly try and use a similar disparate impact argument in the other areas that we as private landlords use to protect our investments, forcing the private market to follow the direction of HUD, leading to the demise of criminal history and ultimately private landlords.

Knowing the Section 8 payment tables in your area and comparing them with market rent will help you decide if you want the government as a partner or not. If you have homes or rentals that can demand higher rents than what the housing authority is willing to pay you will be able to duck this discrimination claim for now. But you never know how long that is going to last as the market has something to say about it.

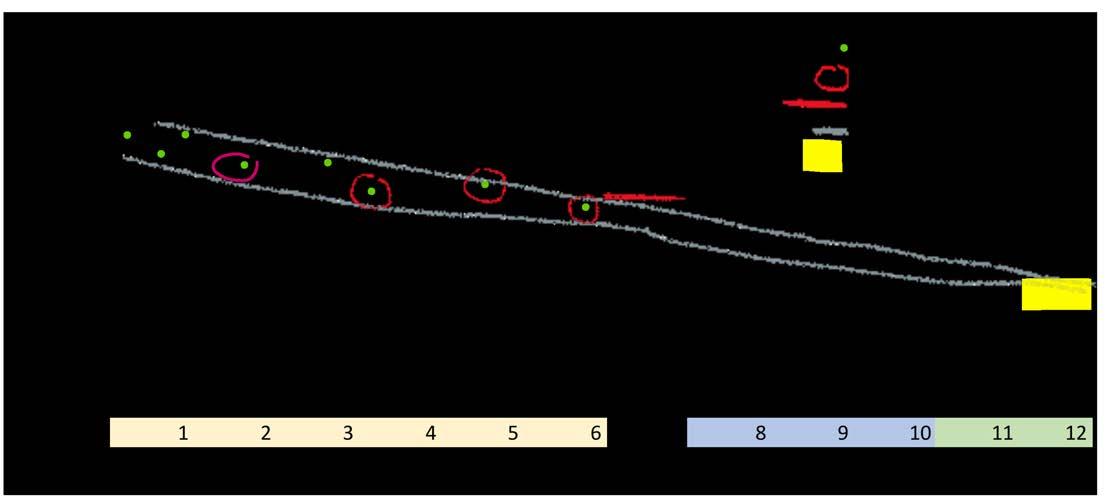

All these moves have made me look at landlords in the private market and get to the root of the HUD study by asking this critical question; does criminal history affect a person’s ability to pay rent? I accessed my own data sets from our tenant background screening company, Rent Perfect, and analyzed actual and factual numbers to answer this question. We took all applicants who applied for a qualification to rent either a single-family or multifamily rental across all fifty states from January 1, 2022, through October 15, 2022. See the graphic for specific results. Generally speaking, applicants with NO criminal history are twice as likely to have a credit score over 600, which translates to rent getting paid more consistently and ontime. As a landlord, those are the type of odds that play in my favor.

Getting rid of criminal history as a

qualifying factor for HUD properties now, and inevitably for private individuals in the future would put you and your property at risk financially and physically. At Rent Perfect we know different criminal histories pose more of a threat than others, but we also know Landlords are not the judge and jury and hold no special training on how to determine recidivism rates or risk based on each crime. Our research results clearly show that no matter what the crime is, whether felony or misdemeanor, credit scores go down and collecting rent is riskier for those with a criminal history than without.

So, what do you do about it? Rather than sulk in the corner which may have been your childhood response to unfair treatment, we all need to band together and fight to protect our rights as private landlords. Uniting your voice with a local Real Estate Investment Association (REIA) can help us as landlords stand our ground and protect our investments. After all, we didn’t do anything wrong.

David Pickron is President of Rent Perfect, a private investigator, and fellow landlord who manages several shortand long-term rentals. Subscribe to his weekly Rent Perfect Podcast (available on YouTube, Spotify, and Apple Podcasts) to stay up to date on the latest industry news and for expert tips on how to manage your properties.

Members of National REIA can take advantage of special pricing from RentPerfect; the solution for rental property owners and managers for screening & managing tenants. Learn more by visiting www.rentperfect.com or calling 1-877-922-2547.

Real Estate Journal · Winter 2022-2023 5 Real Estate Journal

What is a Backdoor Roth IRA?

By John Bowens

Have you been told you don’t qualify to make a Roth IRA contribution because you make too much money? If so, there is an option you can explore, and it is referred to as the Backdoor Roth IRA contribution.

No, you will not find this terminology in an Internal Revenue Code (IRC) section, or Internal Revenue Service (IRS) Publication 590. This is a little-known, vastly misunderstood tax strategy that came into existence in 2010 when the tax laws changed, allowing all income earners to convert funds from a Traditional IRA to a Roth IRA.

A few months ago I wrote the article, “The Great Retirement Plan Savings Crisis,” (RE Journal, Fall 2022) which addressed the grim truth about a majority of Americans’ financial health in their retirement years. Over the last 15 years, I’ve taught thousands of investors about self-directed IRA investing in real estate and other alternatives. If there is one thing I learned, it is that individuals fail to maximize the potential of savings vehicles like Roth IRAs because they don’t understand the rules or were misguided.

What is a Roth IRA?

A Roth IRA is referred to as an after-tax savings account, while a Traditional IRA is referred to as a pretax savings account. In other words, with a Traditional IRA, you don’t pay taxes on the money going in, but you are required to pay taxes when you begin pulling the money out. Be aware that if you withdraw funds for non-investment purposes prior to the age of 59½, you face a 10 percent penalty and income taxes. With a Roth IRA, you pay taxes on the money going in; therefore, there are no taxes when you distribute funds.

An easier way to think of the difference in tax environments: with a Traditional IRA you don’t pay taxes on the seed (contributions), so you have to pay taxes on the crop (withdrawals at retirement). On the other hand, with a Roth IRA, you pay taxes on the seed, so you don’t have to pay taxes on the crop. The Roth IRA can potentially be a powerful tax savings tool, as you are leveraging compounding interest in the absence of taxation.

How do you define earned income? Think W-2 or 1099 income on which you are paying income taxes and payroll taxes (Social Security and Medicare).

As a real estate investor and teacher of real estate investors across the country, I find some individuals have a lot of income, but it is all classified as passive income. For example, if you only have rental income, none of which you would likely be paying payroll tax on, you are not eligible to contribute to a Roth IRA.

That said, if you have existing Traditional IRA funds, you can convert to a Roth IRA, which we will detail further in a moment. If you are retired and only have Social Security income, or pension or other retirement savings account income, this also is not considered earned income.

2. If you make too much money, you don’t qualify for a direct contribution to a Roth IRA.

To understand income limits for a Roth IRA, you need to know your Modified Adjusted Gross Income (MAGI). Your AGI could very well be the same as your MAGI: check with the IRS website or your CPA or tax professional for more details.

These MAGI limits are going to depend on whether you are a single filer, married filing jointly or separately, and of course, the year in which are you making the contribution. For tax year 2022, the limits are as follows:

• Single filer:

• If you make under $129,000 MAGI, you can make a full contribution.

• If you make $129,000-$144,000. you are only permitted to contribute a portion of the full contribution amount. This is called the “phase-out” range. As you get closer to $144,000, you can only put a small fraction of the total annual contribution.

• If you make above $144,000, you cannot contribute at all to the Roth IRA. (Don’t worry, there is a solution for this, hence the topic of this article.)

• Married Filing Jointly: The phase-out range is $204,000-$214,000.

• Married Filing Separately: If you make over $10,000, you cannot contribute at all to a Roth IRA.

Another potential option: the backdoor Roth IRA

How is this possible? Prior to 2010, if you made over $100,000 MAGI, you were not permitted to convert from a Traditional IRA to a Roth IRA. In an effort to increase tax revenues, the law changed in 2010 allowing all income earners to convert funds from a Traditional IRA to a Roth IRA, opening up this backdoor approach.

Please be sure to read on as there are important considerations before initiating this process with your IRA custodian.

What is the “Pro-Rata Rule?”

First, you have to understand non-deductible Traditional IRA contributions. When you or your spouse have a workplace retirement plan, such as a 401(k), 403(b), TSP, etc., and you are over a certain income amount, then your contributions to a Traditional IRA are not tax-deductible.

People are told, or wrongly believe, “You can’t contribute to a Traditional IRA because you or your spouse have a workplace retirement account and make too much money.”

This is so far from the truth – you can still contribute; you just don’t receive a tax deduction. It is important to understand tax-deferred savings vs. taxable savings, whereby you are paying taxes on income in each year you generate profit. If you make a non-deductible contribution, you will need to complete a Tax Form 8606 included in your tax return. We encourage you to speak to your CPA or accountant who prepares your taxes.

The MAGI limits are as follows (2022):

• Single filer:

• Under $68,000: you deduct the full amount of your contribution.

• $68,000-$78,000: phase-out range. As you get closer to $78,000, you can only deduct a fraction of your total contribution.

• Over $78,000: you cannot deduct any amount.

• Married filing jointly (account holder has workplace retirement plan): $109,000-$129,000 phase-out range

• Married filing jointly (spouse of account holder has workplace plan): $204,000-$214,000 phaseout range

• Married filing separately: $10,000+: you cannot deduct your Traditional IRA contribution

Tax law imposes income restrictions on those who want to contribute to a Roth IRA:

1. You must have earned income to contribute to a Roth IRA.

If your income falls beyond the MAGI limits discussed above, you may want to consider the “backdoor Roth” approach: First contribute to a Traditional IRA, which carries no MAGI restrictions, then immediately convert the Traditional IRA to a Roth IRA.

When you make non-deductible contributions to a Traditional IRA, those funds are considered aftertax, so you don’t pay taxes on the amount when you withdraw it.

Real Estate Journal Real Estate Journal · Winter 2022-2023 6

“I was told I cannot contribute to a Roth IRA”

Continued on Page 15

Real Estate Journal · Winter 2022-2023 7 Real Estate Journal ET-0039-80 © 2021 Equity Trust®. All Rights Reserved. Equity Trust Company is a directed custodian and does not provide tax, legal or investment advice. Any information communicated by Equity Trust Company is for educational purposes only, and should not be construed as tax, legal or investment advice. Whenever making an investment decision, please consult with your tax attorney or financial professional. Exclusive National REIA Member Benefits at Equity Trust Open a self-directed account at Equity Trust and receive: 844-732-9404 www.TrustETC.com/NationalREIA $99 SELF-DIRECTED IRA FOR 1-FULL YEAR* *$50 SETUP FEE APPLIES TWO FREE WEALTH BUILDING WORKSHOP TICKETS EDUCATIONAL MATERIALS COMPLIMENTARY GOLD LEVEL MEMBERSHIP TWO FREE EXPEDITED PROCESSING CERTIFICATES & TWO FREE WIRE TRANSFER CERTIFICATES $720 MINIMUM SAVINGS ET-0039-80 © 2021 Equity Trust®. All Rights Reserved. Equity Trust Company is a directed custodian and does not provide tax, legal or investment advice. Any information communicated by Equity Trust Company is for educational purposes only, and should not be construed as tax, legal or investment advice. Whenever making an investment decision, please consult with your tax attorney or financial professional. Exclusive National REIA Member Benefits at Equity Trust Open a self-directed account at Equity Trust and receive: 844-732-9404 www.TrustETC.com/NationalREIA $99 SELF-DIRECTED IRA FOR 1-FULL YEAR* *$50 SETUP FEE APPLIES TWO FREE WEALTH BUILDING WORKSHOP TICKETS EDUCATIONAL MATERIALS COMPLIMENTARY GOLD LEVEL MEMBERSHIP TWO FREE EXPEDITED PROCESSING CERTIFICATES & TWO FREE WIRE TRANSFER CERTIFICATES $720 MINIMUM SAVINGS ET-0039-80 © 2021 Equity Trust®. All Rights Reserved. Equity Trust Company is a directed custodian and does not provide tax, legal or investment advice. Any information communicated by Equity Trust Company is for educational purposes only, and should not be construed as tax, legal or investment advice. Whenever making an investment decision, please consult with your tax attorney or financial professional. Exclusive National REIA Member Benefits at Equity Trust Open a self-directed account at Equity Trust and receive: 844-732-9404 www.TrustETC.com/NationalREIA $99 SELF-DIRECTED IRA FOR 1-FULL YEAR* *$50 SETUP FEE APPLIES TWO FREE WEALTH BUILDING WORKSHOP TICKETS EDUCATIONAL MATERIALS COMPLIMENTARY GOLD LEVEL MEMBERSHIP TWO FREE EXPEDITED PROCESSING CERTIFICATES & TWO FREE WIRE TRANSFER CERTIFICATES $720 MINIMUM SAVINGS

Valuing Property in a Changing Market

By Jane Garvey

The art of valuing property has long been a challenge for beginning investors, and it remains a challenge on occasion for all investors. I have chosen to call it an art rather than a science because there are so many variables, and even then, what really matters is someone else deciding what they are willing to pay. Values change with time. They change with condition. So, the same property will have a different value depending on when you ask and whom you ask.

Most people rely on comps to determine value. Other than brand-new tract homes on identical lots, being sold all at the same time, there are few actual comps. So, this still takes some work. Getting an appraisal would supposedly take all the variables into consideration and give you the “value.” Unfortunately, there are still flaws in the system.

First, appraisals are backwardlooking. They look at similar properties, in similar condition, similarly situated, that have sold in recent months. If prices are increasing, this backward-looking approach yields a lower value than the property is likely to sell for today. If prices

are decreasing, this approach yields a higher value than the property would sell for today. If an investor is looking at a four- to six-month hold time while they are rehabbing and remarketing the property, the effect of elapsed time on the value will be even greater.

Appraisals do not look at competition in the market. This leaves out some valuable information. What other choices do buyers have now? What

properties will be used as comps four months from now when your property sells? The properties that are currently on the market are relevant. Given that you are usually figuring the ARV for your property as you buy it, I would recommend looking at property that is on the market and adjusting the asking prices by the marketplace’s current ratio of asking to sales price.

You should also look at the trends in

sales price and estimate where you will be when you go to market your property. Obviously, a market with increasing values will cover for many amateur mistakes. We see evidence of this all around us.

There is no reason to stop buying because a market is declining, but you must be smart about it. Buying for quick resale in declining markets requires extra caution. Only buy properties that appeal to a wide range of buyers. Make sure that there are buyers active in the market.

Have a “what-if” strategy, or Plan B, just in case, and be sure that the property would make sense for that too. Make offers that will make sense for the long term.

Beware of fools’ gold. Some things may seem like an incredible bargain, but because of their location, layout, or quirkiness they will take a long time to resell in a buyer’s market. These properties can eat up all your potential profit with holding costs.

Changing Your Financial Trajectory

By Jason K. Powers

By Jason K. Powers

In the book, How Privatized Banking Really Works by L. Carlos Lara and Robert P. Murphy, it says “It is possible to salvage your household’s financial situation, despite the shackles put in place by powerful forces. But you don’t stand a chance if you allow these same forces to design your blueprint for escape…”

We are in strange times, financially speaking. Any given day, we can turn on the television and hear someone talking about the inflation rate, consumer debt, a boom-or-bust cycle, investment decline and more. At the time of this writing, the U.S. national debt is up over $30 trillion, student loan debt is up past $1.7 trillion and credit card debt has surpassed $1.1 trillion. Just 10 years ago, the U.S. national debt was at $15 trillion with credit card debt hovering around $852 billion. Let those numbers sink in.

Let’s take a minute and visualize what $1 trillion looks like. If you spent $1 per second you will have spent $86,400 in one day or $31.5 million in a year. It would take you nearly 32,000 years to spend $1 trillion. Again, our country is $30 trillion in debt. You can draw your own conclusions on the impact of this kind of spending.

Personal finances for thousands are in shambles or at best traumatized. Savings accounts are being depleted,

retirement accounts are taking a beating, interest rates are rising, and the list goes on.

How do we protect our hard-earned money? Where do we store money besides our bank accounts and qualified employer or government-controlled environments?

In our financial world, most of us prefer to have our money in something that is safe, liquid, has a high rate of return, is tax-advantaged, can provide a (future) source of income, isn’t correlated with the stock market if it can be helped, acts as a hedge against inflation, and is creditor-protected. It is OK to dream, right?

Change the way you think about your finances, and it will change your future.

One little-known strategy used by the wealthy is putting money through a properly structured whole life insurance policy and utilizing the cash value access to create financial velocity. We call this the Infinite Banking Concept. It is an avenue where you can warehouse your wealth, allowing it to compound year over year (internally) even while you’re using it (externally) to make even more money. It is a place to warehouse your wealth while at the same time borrow against it to use for real estate investing, private money lending, financing your own car, putting a down payment on a house, buying a house outright, and even

retiring on.

One may wonder why the wealthy use this strategy. One has to wonder if simply changing the way we think about money can change our financial trajectory, while still allowing us to do the things we love.

What would your life be like if you never had to pay high interest to an outside bank again? Imagine financing your own deals. Imagine what it would be like if you could be your own bank.

The time to start is now.

Jason K Powers is a multi-business owner, real estate investor, life insurance agent and an Authorized IBC Practitioner. Jason works with clients across the country showing them how to achieve their financial goals by taking control of the banking function in their life and creating financial velocity that can last for generations. Learn more by visiting https://1024wealth.com.

Real Estate Journal Real Estate Journal · Winter 2022-2023 8

Jane Garvey is president of the Chicago Creative Investors Association.

A Hostage Crisis: Can a CPA Refuse to Give You Your Data? What

By Gita Faust

By Gita Faust

Imagine hiring a tax preparer, a CPA, a bookkeeper, a QuickBooks consultant, a coach—somebody you decide to trust with your data—only for them to turn around and refuse to deliver anything you were promised. The unfortunate reality is that this sometimes does happen, and it sometimes even happens after you have already paid up. There is no single explanation for this, and it can happen with any kind of professional, as I mentioned before… so what can you even do when someone you hired is holding your data hostage?

First Steps

After you stop panicking and pulling your hair out in frustration, take a deep breath. If you find yourself in this situation, there are three things you should look at: the root, the past, and the agreement.

• First, you need to focus on the root of the issue— a.k.a. why your CPA might be withholding your data and deliverables. You need to become a detective and identify a motive! Start by checking to make sure that you paid all bills in full and try to remember if you had any disagreements while they were working. If you cannot think of any reason, do what you can to contact them and find out!

• The past encompasses their past performance and how they worked. Did you regularly communicate with them? Did they provide ongoing reports? Did they ask questions? It is a major red flag if your accounting professional does not ask questions and verify specific transactions with you—it could mean that they are not doing their work or that they are just not very professional. No matter who you hire or what they’re doing, you should repeatedly request that they update you regularly on their progress.

• The agreement refers to your consultant contract, letter of engagement, or any other binding document that stipulates the do’s and don’ts of your arrangement. Read over it to check if there are any instances in which they do not have to hand over your data (hopefully, there are not!). You should have full control of your documents and software containing any data. If not, you should think twice before agreeing to the engagement!

There are sometimes very obvious causes that are overlooked in all the chaos. If all goes well, your issue should be resolved by investigating these three things. If not, well, you will have to go a few steps further.

And… Action!

So, nothing has worked. Your CPA, bookkeeper, or whoever you hired is still refusing to give you your data. If your investigation has yet to be fruitful, it is time to move into action. Three proactive steps will surely get their attention and hopefully convince them to give you what should be yours.

1. Show up. If you are the type who is not afraid of confrontation (and in situations like these, that’s important!), then you may as well find out where the CPA works. We are not advising that you go there and steal the data back, but show up early in the morning, strike up a conversation with whomever you see first (if you can identify the owner, try to talk to him or her!), and wait for your bookkeeper. This method will take more time than others, so make sure you clear your schedule.

2. Send it. Nothing is scarier than receiving a letter from somebody’s lawyer. Ask a lawyer or attorney to send the CPA a simple letter

requesting your data and documentation return. While you might not be threatening legal action, people will take your demands more seriously if it comes from a legal professional.

3. Shout out. Social media has become a very easy way for us to interact with other people in the industry, and because of this, you have a very accessible way to ask for help. Share your story on social media and request help from other professionals. Who knows? They may have been in your situation before! When you do this, be wary of tagging or mentioning the actual company causing you trouble; leaving a publicly bad review usually does not have the effect you want. However, post it where that company or CPA can see it—you want to bring your issue to their attention.

If you manage to get your data back (which you hopefully do!), keep in mind that they will likely give you the bare minimum: no calculations, no draft work papers, and nothing except for the hard data.

Lesson Learned

Situations like these are no fun for anybody. If you have ever experienced this, I am truly sorry for the stress you probably endured. If you have not, take heed and learn from those who have. Here are a few tips to prevent the loss or withholding of your data:

• Maintain control: I cannot stress this enough. When drawing up a letter of engagement or any contractual agreement where somebody else will be handling your accounting data, make sure that your agreement stipulates that you own your data and can request it at any time (and that they cannot withhold it from you!). Suppose something happens, like a natural disaster, a pandemic, or something else that causes businesses to shut down overnight. In that case, you want access to the reports and documents that outline your company finances.

• Create backups: This should be a no-brainer, but so many people still hand over the only copy of their data to a CPA, bookkeeper, or somebody else, trusting that they will get it back safe and sound. That is only sometimes the case. You should always keep original copies of any documents, data, or files in case of an emergency.

• Get the necessary documents: You want all the important documents at your disposal once tax returns are filed. Make sure you have them! This includes depreciation schedules, amortization schedules, supporting documents, and adjusting entries for the year.

• Request reports: When you hire somebody to handle your accounting data, you should request reports regularly. Many important reports spell out the performance of your business, including profit and loss by summary, by detail, by month; balance sheet by summary and by details; general ledger; expenses by vendor by summary and by detail … and the list goes on.

• Check their status: An enrolled agent has to be registered with the IRS, and you can check this by following the directions on the IRS website. Similarly, you can check to ensure they have an active CPA license with either cpaverify.org or by contacting the State Board of Accountancy, where the CPA obtained his or her license. It’s as easy as that! Also, if they are labeled as a QuickBooks Advanced Certified ProAdvisor, you can look them up on Intuit’s website. If a person is registered to an organization and active, it is much easier to hold them accountable.

My team and I are heavily involved with CPAs, CFOs, bookkeepers, and consultants. In fact, we often work with CPAs, we train consultants and QuickBooks advisors, and we offer outsourced bookkeeping services. I understand how complicated and frustrating situations like these can become, but as long as you follow the tips above, you should not have anything to worry about!

If you have any questions about anything discussed above, ranging from bookkeeping services to helping you solve this very issue, do not hesitate to contact my team or me. We are always more than happy to help!

Gita Faust is the founder & CEO of HammerZen, which helps businesses save time and money by keeping track of The Home Depot purchases and efficiently importing receipts and statements into QuickBooks. National REIA members receive discounts on QuickBooks services and software. Learn more by visiting www.hammerzen. com/nreia.

Real Estate Journal · Winter 2022-2023 9 Real Estate Journal

to Do About an Uncooperative CPA, Bookkeeper, or Consultant

By Tony Youngs

Ever since the foreclosure moratorium ended last summer, there has been a sizable increase in pre-foreclosures nationwide. As I go out in the field to find the hidden market properties, I am amazed at the number of homeowners facing foreclosure and their willingness to sell. I go all over our nation pursuing property acquisitions and am actually getting deals from foreclosures. Why is this surprising?

Ever since the great foreclosure crises of 2007 through 2010, as I visit owners, they usually tell you they have no interest in selling. They would say things like, I haven’t made a payment in two years, why would I sell, and then during the pandemic and foreclosure moratorium, they would say the same thing. You can’t blame them. If they did sell to us during that time frame, they would have to make payments at the place they moved

to. Also, during the pandemic it would have been much harder to find a place for them to live because of the low inventory around the nation.

Fast-forward to today, as I knock on doors of distressed houses, they are willing to sell much more than they were in the past. It’s probably because when the moratorium ended, lenders started working with the defaulted loans on their

books and they would earnestly try to do a workout plan with the owners. They verify their incomes, bank statements, and tax returns to see if there is a feasible solution and if it does not look like the owners can afford the house, then the lender has no choice but to proceed with the foreclosure. What I’m seeing today, is a lot of those situations and that is why they are willing to sell. The owners have

simply exhausted all their options.

In 1986, I started my real estate career in the highly competitive arena of the foreclosure business and made a good living doing it. I have dealt with just about every kind of personality you can encounter, especially since I door-knock all over the nation as I train investors. With the new batches of foreclosures coming down the pike, I just want to give you my opinion on dealing with this type of homeowner.

If you were to visit 10 foreclosure properties in person, you are going to find that six to seven of them are in great condition. The other three or four are in bad condition. In today’s market, I don’t even visit the owner of a foreclosure unless it needs work. Why?

As an investor, we use a formula to calculate how much we can pay for the property. If you visit a foreclosure that is immaculate, and you write an offer below market value, the homeowner usually gets ticked off, and quite frankly we can’t blame him or her for that. If their house is in great shape and needs no work, doesn’t that make us look like we are taking advantage of their financial hardship? I personally only visit the ones that need repair, because they understand why the offer is below market value. Everyone understands that repairs are expensive. If a foreclosure is in great shape, I tell the owner to contact a real estate agent, and list it on the MLS.

You see, I love to fix up and renovate houses, it’s very rewarding, So I am only interested in properties that need work, and the more the better. That is why my main property source is the hidden market. All hidden-market properties are fixer-uppers.

Another point I would like to make is that if you run across an occupied foreclosure, do not to mention the word foreclosure. Just simply say, I’m looking to buy a house in this neighborhood and wanted to know if you would be interested in selling. If they want to tell you it’s in foreclosure, that’s their business; I am a house purchaser, not a consultant. If you want to sell, I can buy, but if you need a consultant, I’m not the right guy. There are several states that have rules that you are a purchaser or a consultant, so do one or the other. Though not all states have those rules, that is how I operate my business no matter what state I’m in.

I would also emphasize how important it is to attend your local REIA meetings to stay up to date on all legislative actions. There can be rules about the way you contact people in foreclosure that you are completely unaware of and could lead to trouble down the road. Over the years, there have been many states with updated laws about buying foreclosure property, and you must keep yourself up to date.

Tony Youngs has been an investor, trainer and a national speaker for over 32 years. He is the Author of The Hidden Market System and is best known in the industry for his “Hands on In the Field” trainings that take place around the country. Learn more about him by visiting www.tonyyoungs.com.

Real Estate Journal Real Estate Journal · Winter 2022-2023 10

TEL: (877) 744-3660 WWW.NREIA.ARCANAINSURANCEHUB.COM UNIQUE COVERAGE, INTELLIGENTLY DESIGNED. Call us or visit our website for more information on our property and liability programs Investment Property Insurance Tenant Discrimination Program Landlord Supplemental Protection Tenant Renters Program Buying Pre-Foreclosures

Today

Get

Real

Access To A Steady Stream of Buys

HomeVestors® directly connects huge numbers of homeowners motivated to sell, often before they try the MLS, to our team members. And that could be you.

Get Real Results And Better Opportunity

Real Estate Journal · Winter 2022-2023 11 Real Estate Journal

Buyer, we

you

our

Only HomeVestors offers you the powerful brand, experienced personal support and marketing muscle to grow your business faster, along with flexible business opportunities that allow you to choose the one that best fits your life. Contact us today. *Each franchise office is independently owned and operated. 844-256-0860 getHVAdeals.com/NREIA Call us today or sign up for our free webinar Ready for a real opportunity in real estate? JOB # 20-HOM-10215 FILE NAME: FZ-Sales-Ad_10x15.5_2021-03-19 MISC: INKS: 4/0 SIZE: 8.375x10.5 BLEEDS: Yes STATUS: MECH

As America’s #1 Home

can give

access to

financial portal, accurate offers powered by our proprietary ValueChek™ software, decades of expertise to share, and more. Even during tough times, our team members have seen consistent growth. Be The Next Real Deal In Real Estate

at heart so I got my degree in marketing and got into sales right after college. I worked as a loan officer and an account executive for lenders, and was in and out of different types of marketing jobs. Then I started my own internet marketing business in 2012.

Where is your current market and what is your focus or area of expertise?

I live in Colorado Springs, Colorado. My main focus and area of expertise is master leasing, subject-to, and lease purchases. I can do cash and I’m an experienced rehabber as well, but it is not my passion. However, I love to help tired landlords and I like to solve real estate problems.

How did you get started?

I know this is the answer that so many give, but I read Robert Kiyosaki’s Rich Dad Poor Dad and it just made so much sense to me. I wanted money and time freedom and real estate felt like the best vehicle to give that to me. And then, when I started learning about being an investor full time, I fell in love with creative deal making and financing because I can help SO many people. I like to solve the problems that seem scary or difficult to the seller and I like to make it easy for them.

Describe a typical work week for you as a real estate investor:

Ha-ha! There is no typical week. That may be why I like investing. I am always marketing and networking so those are pretty consistent but, along with that, I am constantly meeting new people. But generally, I go on seller appointments, take care of my rentals and whatever else pops up that week. In addition, I usually have a rehab going on somewhere in the background as well. On top of all that, I am a mom of two little ones. They keep me pretty busy as I am the main caretaker since my husband has a regular W2 job.

How long have you been investing in real estate?

Well, I have been actively investing for about six years. But I purchased my first house when I was 21 and became a landlord a couple years later. By 24, I had my second house. While there were many lessons learned during those early years, I would not consider that the same kind of investing I have been doing for the last six years.

Tell us about your first deal:

I started by sending out mailers in my home town and viewing a lot of houses. Eventually I found a tired landlord and who wanted a reasonable price for his property. I took over the property, complete with tenants, in a seller-finance deal for 18 months at 0% and $5,000 down. By the time I refinanced it I had almost 50% equity!

How do you fund your investments?

In the beginning it was mostly my mentor that funded the deals and we would JV (joint venture) them. Now I have a mixture of my own money, JV’s, banks, and private lenders.

Do you have a real estate license?

No, I do not.

A LOT – and it is so important! You really need to stay up to date with laws and regulations plus I want to continue to grow my knowledge. There is no limit to learning how you can structure deals to help people.

Has coaching or mentoring played a part in your success?

I would not be where I am without it. My mentor in Colorado Springs, Michael Jake, changed my life. David Tilney and Bill Cook have also played a huge part in my success.

What are your current and future goals?

My immediate goals include buying another 30 houses for my portfolio and growing the number of houses that I am landlording. I also have a big passion for teaching. I would not be where I am now without the help of my teachers and I would love to pass on my knowledge.

What has been your top struggle in this business?

Quite simply, time. I am a onewoman show. But I continue to grow and delegate more and more because the ultimate goal is time freedom.

What do you like most about what you do?

PEOPLE…100%. From my mentors, to my peers, to the sellers I help, my contractors and my tenants. I am so blessed to know and work with each and every one of them.

What projects are you currently working on?

I take care of about 70 rentals and I am working to grow that portfolio. Currently, I also have a flip that we are close to putting on the market that I JV’d with a local contractor.

How much time do you put into your real estate education?

Do you have a tip or advice that you would pass along to other investors?

Find yourself a mentor that has done what you want to

Real Estate Journal Real Estate Journal · Winter 2022-2023 12

continued

Page 1 Continued on Page 13

Member Spotlight - Lindsey Jensen ...

from

Lindsey loves to teach creative deal structuring. Here she is teaching for Colorado’s REIA, ICOR

Lindsey, Wayne, and their 2 kids Carter and Skylar

do. Share deals with them or whatever else they need so they will teach you the business. Then, believe in what they tell you! I see so many people second guess the same things I have been taught. They think it won’t work for them or that these mentors are only teaching these things to make money. I never second guessed what they told me. I just followed and it allowed me to grow quickly. And, once I knew what I was doing, I could tweak things to how I worked. But believe me, if it worked for them it will work for you, you just have to believe it and work for it.

How important is joining a local REIA to a new investor?

Very important. They give you knowledge and

bring in experts that you will want to learn from. They work hard to give a lot of value to their members. It isn’t just the knowledge but the networking and even the financial benefit of the discounts they get for their members.

What are your favorite selfhelp or business books?

Psycho Cybernetics by Maxwell Maltz, Rich Dad Poor Dad and Cashflow Quadrant by Robert Kiyosaki, and Crushing It by Gary Vaynerchuk.

Do you have any interesting hobbies or something unique that you like to do?

I love art and I used to be a cake decorator. So, when my kids’ birthdays come around, I get to be creative!

Does your business have a website? www.newgenerationhomebuyers.com www.cleverkittyinvesting.com

Social media accounts www.facebook.com/cleverkittyinvesting www.facebook.com/newgenerationhomebuyers

Real Estate Journal · Winter 2022-2023 13 Real Estate Journal

Member Spotlight - Lindsey Jensen ... continued from Page 12

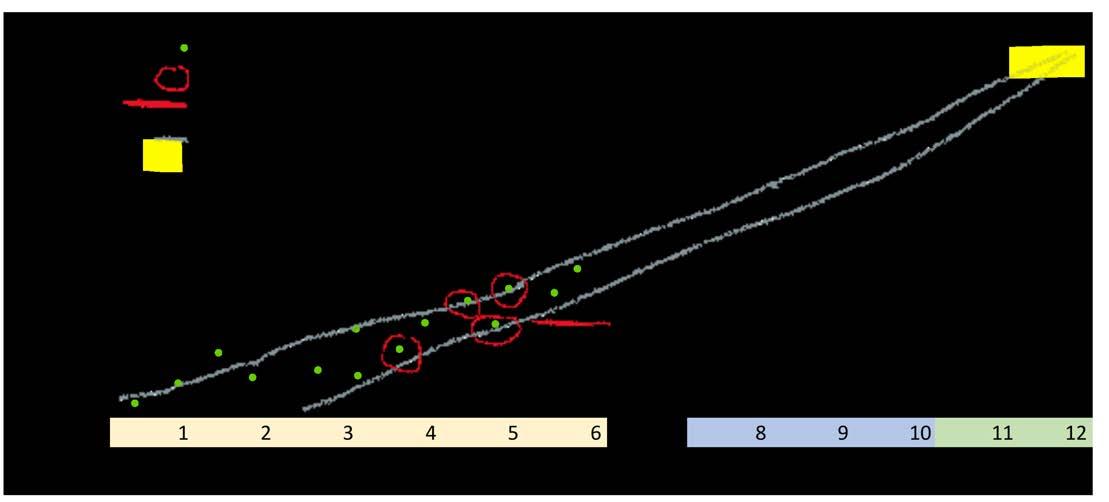

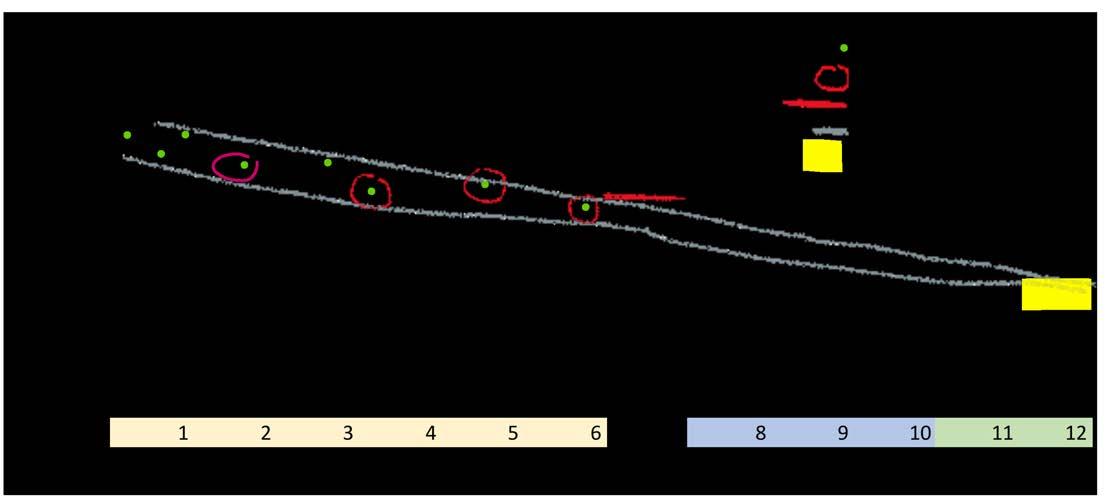

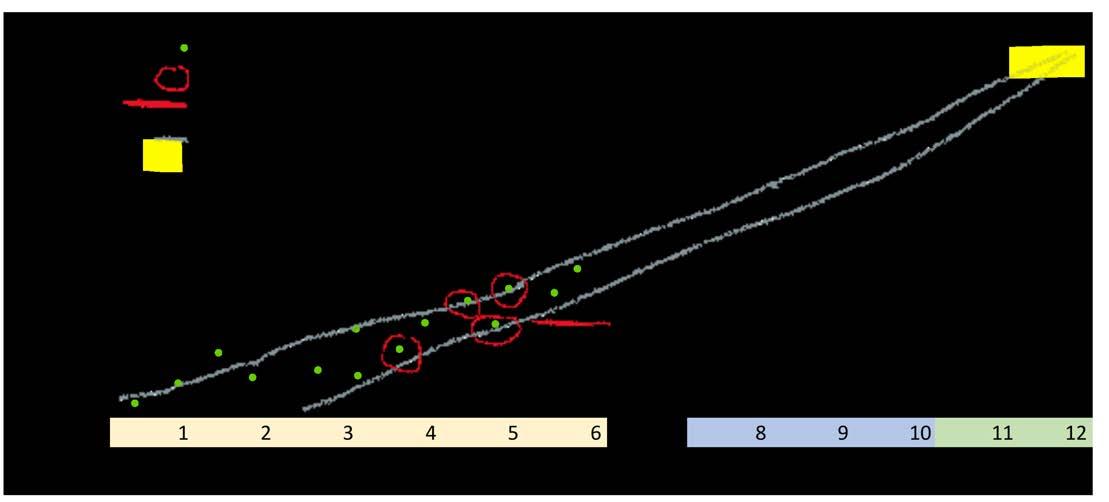

Before and after photos of a 6-figure flip done in Colorado Springs during the Summer of 2022. This purchase helped a mom who had lost her daughter the previous year.

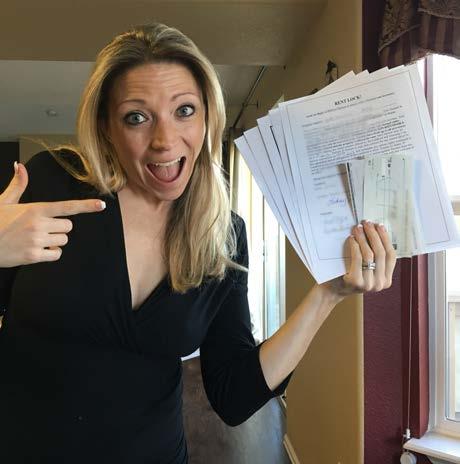

Lindsey’s first Masterlease deal. She sent this to her mentor David Tilney.

manufacturers are creating a lot of demand as reshoring continues to surge. Commodities have started to stabilize a little and that has affected everything from steel to lumber. The most pressing issue for construction – residential or commercial – continues to be labor. It is in short supply and expensive. But on top of all this is the commodity that seems to drive all the others and the one that started the inflation surge (along with supply chain breakdown) at the start of the year.

There is rarely a moment when oil politics fails to play a major role in the world. Today that is more the case than ever. It was only a couple of years ago that the world’s oil players all seemed to be on the same page as they coped with the global COVID lockdown. The cooperation managed to avoid an all-out OPEC+ price war as every nation tried to secure a place in the collapsing market. The days of that kind of united response ended with the Russian invasion of Ukraine. Putin has weaponized natural gas shipments to Europe and is now attempting to utterly destroy the electricity grid in Ukraine. Consumers of energy have become bitter rivals as they seek to secure their own supply – driving up prices. The United States is at odds with Saudi Arabia to a degree not seen since the oil embargo in the 1970s. Even the rush to clean energy is threatened by trade disputes and nationalism. The world’s energy situation has rarely been this fragile.

The sanctions on Russia were supposed to bring Putin to heel but Russian oil exports have barely felt it. The Russians have found alternative buyers in China, India and many other nations. They have seen almost no interruption in revenue as the sanctions caused the per barrel price to rise sharply. Europe is now set to impose the most stringent sanctions yet – essentially setting a cap on Russian oil prices through control of how that oil and gas is shipped.

Almost every aspect of the energy supply system is in flux now. Russia seems willing to break from Europe completely and permanently, the OPEC states have

essentially sided with Russia but for their own reasons as they seek to protect a per barrel price of at least $80 to $90. European consumers are just as eager to cut ties with Russia and now pursue relationships with nations they shunned just a few months ago (Algeria, Libya and even Iran). The United States is draining its petroluem reserves in an effort to keep fuel prices down and there have been some new bedfellows here as well (namely Venezuela).

At the moment the price of energy has been falling and swiftly. The per barrel price for oil has been in the high 70s and low 80s and gasoline prices in the United States have fallen. Diesel prices are still high but the spikes have been fewer. The United States continues to ship a great deal of diesel to Europe and Russia was a major supplier of diesel fuel to Europe and elsewhere in the world. Natural gas prices have steadied to a degree although they remain very high as compared to what was considered normal a few years ago. Could this period of lower prices reverse in the near future?

There are three factors contributing to the recent price reduction and if these changed the impact on oil and gas costs would be dramatic and swift. At the top of the list is the performance of the Chinese economy. Right now it is moribund and probably in a Chinese version of recession. The lockdowns have crippled the ability of the industrial sector to grow and then there is the impact of the real estate market meltdown. If the leadership decides to back away from the restrictions the rebound could be rapid and China would be back to its position as one of the world’s biggest oil and gas consumers. That would put pressure on supply and drive up costs.

The second factor is weather. The mild winter thus far is not expected to last. This is the fourth year in a row for the “La Nina” impact and that generally means colder temperatures in Europe and much of North America — another strain on energy supply.

The third factor is overall performance of the

economies in North America and Europe. Much of the assessment regarding energy prices has been based on an assumption these regions will be facing recession or at least a downturn in 2023. What if that is not the case? Much of the recent data has been less menacing than expected and that may signal a milder recession than assumed and maybe no recession at all. That means more energy consumption coming at a low point for production.

It is more than a little ironic that a lack of an immimnent recession could provide the motivation for a deeper recession later. If the price of energy spikes to the levels seen at the first of this year the impact on the global economy would be profoundly negative.

This is the “Sword of Damocles” that hangs over the economy. A surge in energy costs similar to what was experienced at the start of the year would shove the overall economy back on a track towards recession. The United States has not had the same energy crisis as Europe has experienced but if consumers suddenly have to face double the costs for fuel to heat homes and propel vehicles it will affect their ability to make housing decisions. Likewise the businesses that face higher costs are more likely to delay projects.

Chris Kuehl, PhD., is an economist and Managing Director of Armada Corporate Intelligence. Visit www. armada-intel.com for more information.

Real Estate Journal Real Estate Journal · Winter 2022-2023 14

MINNESOTA’S PREMIER PROPERTY MANAGEMENT COMPANY We shoulder the operational responsibilities to make it both more profitable and enjoyable for our clients to own investment property. www.skylineliving.info 952-444-2092

Is There a Coming Oil Crash? ... continued from Page 1

Chris Kohler, President

For example, let’s say you made a $6,000 Traditional IRA contribution that was considered after-tax. Through earnings and deductible contributions, you grow the account to $100,000. Now let’s say at 60 years old, you take $10,000 from the plan as a distribution. A portion of that amount will be taxable, and a portion won’t be taxable, attributable to the after-tax portion. This determination of taxes upon withdrawal is what’s known as the Pro-Rata Rule.

The calculation is as follows:

$6,000 non-deductible contribution / $100,000 total balance of Traditional IRA = 6%.

$10,000 distribution x 6% = $600

$600 is non-taxable and $9,400 is taxable

When converting funds from a Traditional IRA to a Roth IRA, the same rules apply.

Keep in mind, the Pro-Rata Rule only takes into account money and assets held in a Traditional IRA, SEP IRA, or SIMPLE IRA. If you have 401(k)s, 403(b) s, TSPs, etc., those are not included in the calculation.

Should I be afraid of the Pro-Rata Rule?

There is no reason to be fearful of the Pro-Rata Rule; you just have to understand the tax accounting associated with it. It’s always good to team up with a competent and understanding tax accountant or CPA. If they don’t understand, show them this article and ask them to research it for you. I work with many alternative asset investors, including real estate investors and private equity/hedge fund investors. I have found these investors to be incredibly passionate about tax-free savings and tax-free withdrawals and will pay extra to achieve that desired result.

My financial advisor doesn’t understand or has misguided me on this situation. What do I do?

Don’t allow this misunderstanding to create an adversarial relationship. This happens frequently, and it just takes some patience and understanding. Investing,

financial planning, and wealth preservation is a team sport.

Should I consider a Roth 401(k)?

Many 401(k)s now offer a Roth component, allowing you to make post-tax contributions. When you leave an employer, those funds can be rolled over into a Roth IRA. Note: there are no MAGI limits with a Roth 401(k).

If you are self-employed with no employees (with the exception of a spouse), you might consider a Solo 401(k) which, if set up properly, allows you to make post-tax contributions to a Roth component. Be aware that you have to meet the proper qualifications.

Can I just convert Traditional IRA funds to a Roth IRA?

Yes, you don’t have to perform this backdoor Roth IRA. If you have existing Traditional IRA/SEP IRA funds, you can simply convert them to a Roth IRA. The amount you convert is added to your ordinary income and you pay taxes accordingly. Some investors will convert in stages, meaning they will convert chunks year over year, thus lessening the tax burden over time.

How do I get started?

The first step is locating the right financial institution. If you are interested in investing in real estate and other alternative investments, you need a custodian that specializes in the custody of these unique assets. Equity Trust Company is a custodian that enables investors to invest beyond the stock market, in assets like real estate, notes, private equity, gold & silver, crypto currency and much more.

To fund a Roth IRA the “backdoor” way, you will need to request to open a Traditional IRA first and then a Roth IRA. Once you have contributed funds to the Traditional IRA, you then instruct your custodian to

convert the funds to the Roth IRA.

Special self-directed IRA offer for National REIA members only

Equity Trust Company is a national sponsor for the National Real Estate Investor Association (NREIA) and is offering NREIA members and its affiliated chapter members a special introductory self-directed account offer.

NREIA members can open an Equity Trust account for a discounted rate of $99 and receive bonuses worth $720 or more:

• National REIA GOLD Level membership (includes priority processing and an experienced client service team dedicated to members) for one year

• Digital download of #1 ranked book on Amazon - Self-Directed IRAs: Building Retirement Wealth Through Alternative Investing

• More exclusive wealth-building education

Visit www.trustetc.com/nationalreia or call 844-7329404 to learn more.

John Bowens is Director, Head of Education and Investor Success at Equity Trust Company. Visit www. TrustETC.com for more information.

Equity Trust Company is a directed custodian and does not provide tax, legal or investment advice. Any information communicated by Equity Trust is for educational purposes only, and should not be construed as tax, legal or investment advice. Whenever making an investment decision, please consult with your tax attorney or financial professional.

performed?

Third, is that of actual back-up power. Whether using solar power, geothermal, or wind, there is still the functional limitation of batteries. However, isolation of the system from the grid –not in the prepper sense, but through electronic devices –is being encouraged. New products can isolate a breaker panel (and everything inside it) from an electro magnetic pulse, or EMP. Whether from the sun, a cyber spike, or a rogue actor, there is an increasing concern about this on the mainland. Please consider this a word to the wise.

Manufactured Housing:

As mentioned earlier this year, the Biden Administration has asked HUD to instruct FHA to develop more and better ways to underwrite chattel loans for manufactured housing. FHA recently announced it is working to develop a three-part program to assist in the (re) financing of manufactured homes, lots, and homes on lots. This is one of the first steps seeking comment on expanded rules. More to come as this develops.

Rent Control:

Wherever rent control is tried, it has failed spectacularly. It is the short-sighted solution to a long-term problem that eventually exacerbates the housing undersupply and increasing disinvestment, all without helping those it supposedly is intended to assist. Much like the proverb, housing undersupply that local elected officials inherit from their predecessors must be addressed

now. Delaying the development helps no one, and hurts many. Please reach out to local elected officials and leaders in a coordinated effort to offer stakeholder experiences and advice!

The best time to plant a tree was 20 years ago. The second best is now. – Chinese proverb

Stay up to date:

Stay up to date with all the current industry news and updates by visiting RealEstateInvestingToday. com. Likewise, please visit the website NationalREIA.org/advocacy to stay up today with current legislation and governmental actions.

Real Estate Journal · Winter 2022-2023 15 Real Estate Journal