This is the third in a three-part series in which Momentum Corporate explores the evolving world of work with the latest trends and insights – unveiling how this world is reshaping the expectations and demands of employees.

This is the third in a three-part series in which Momentum Corporate explores the evolving world of work with the latest trends and insights – unveiling how this world is reshaping the expectations and demands of employees.

Outlook on wellbeing and longevity

How well do employees feel

Longevity in the workplace

Views on retirement

In part 3, we look at the impact of wellbeing and longevity - both positive and negative – in the workplace, and how respondents feel about these two themes in relation to retirement.

In this chapter, we unpack the themes of wellbeing and longevity and the impact, both positive and negative, that these have on the workplace. Wellbeing.

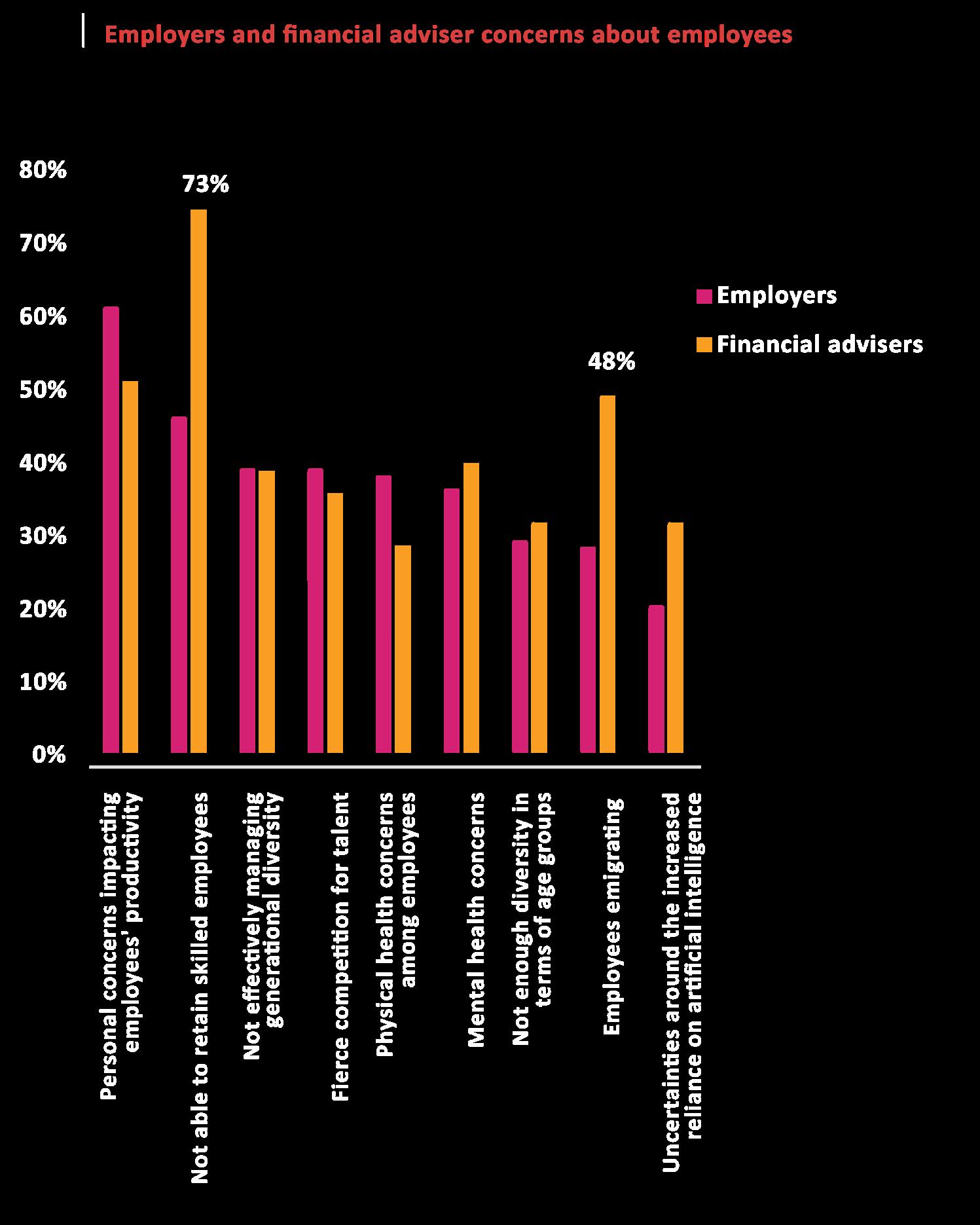

From an employee wellbeing perspective, more than half of employers (60%) are concerned that employees’ personal issues have a negative impact on their productivity at work, and more than a third worry about the physical and mental health of their employees. Half of financial advisers (50%) are similarly concerned that their clients’ employees have personal issues that have a negative impact on their productivity.

In terms of illness prevalence in the workforce, employers say that on average, one in four employees are affected by mental or emotional illness, one in three suffer from a chronic disease, just under half are stressed because of personal responsibilities and family concerns, and a similar percentage have worries and uncertainties about their future.

The mental and emotional health of employees has been a recurring theme over the last few years, exacerbated by the pandemic. In addition to more than a third of employers being concerned about employee mental and emotional wellbeing, 43% also believe that it will disrupt business over the next decade. This is concerning as it has a significant impact on absenteeism and presenteeism in the workplace. Improving employee mental and emotional wellbeing will benefit both the individual and the business.

Another concern for almost half of employers is retaining skilled employees, with more than a third worried about the fierce competition for talent. 73% of financial advisers also expressed great concern regarding their clients not being able to retain skilled employees.

We asked employees to rate themselves on a few key health and wellbeing indicators. When assessing their overall wellbeing, most employees rate this as good or higher (7+), indicating a generally positive sentiment. Yet, one in four employees do not feel physically well, one in five say they are unable to cope with stress at home, and 17% are unable to cope with work-related stress. Although these numbers are slightly lower than the employer estimates, it does confirm a trend that is still higher than desired.

Notably, financial health received the lowest score with an average rating of 6,4.

Our research also shows that average ratings have remained relatively the same when comparing data between 2022 and 2024, reflecting no notable improvements.

Addressing wellbeing holistically is key to improving the quality of life for individuals, which will have a positive impact on productivity, and in turn, a positive impact on the business’s bottom line.

In an earlier series, we noted employers’ desire to improve their ability to retain key skilled employees and that more than half of employers are in favour of keeping employees with key skills beyond the normal retirement age. We also established employee and retiree appetite for working beyond normal retirement age. This lends itself to the topic of longevity and its impact on retirement and the workplace.

The total world population has recently passed the 8 billion milestone. However, one of the most formidable demographic challenges facing the world is no longer rapid population growth, but population ageing. The influence of an ageing population on employers, the workforce and overall business strategies is unparalleled.

Our data reveals that, except for the Covid-19 years (2020 and 2021), mortality rates have been decreasing over time, indicating the effectiveness of medical treatments and advancements in healthcare.

The increase in life expectancy and reduced mortality rates can have a significant impact on retirement savings and from a health perspective. On the financial side, longer lifespans mean clients need to save more for retirement to sustain themselves over an extended period. This is an important consideration for employee benefits providers and for employees, as it requires better financial planning and investment strategies to optimise retirement nest eggs.

Additionally, healthcare costs may rise as people age, affecting both personal savings and public health systems. From a health perspective, longer life requires proactive measures to maintain physical and mental wellbeing. Individuals should consider lifestyle changes, preventive healthcare and long-term care options.

Overall, this demographic shift calls for holistic planning to ensure financial security and quality of life in old age.

We asked our participants how they felt about living longer.

Most (78%) respondents feel younger than their biological age, with 17% feeling their actual age and only 5% feeling older. What is striking is that one in five respondents feel 11+ years younger, suggesting that they anticipate a longer lifespan than the current experience.

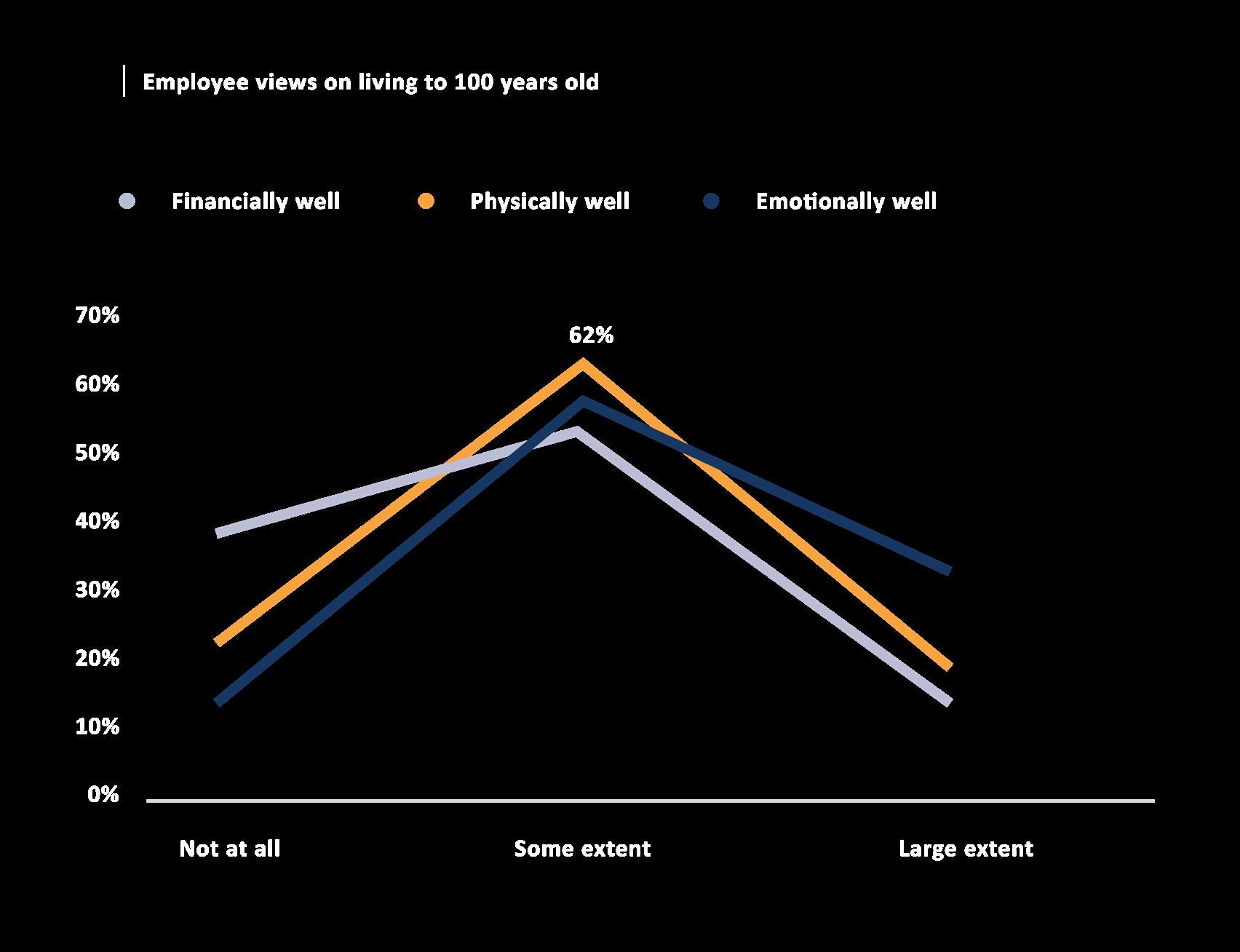

Respondents were also asked to anticipate the state of their financial, physical and emotional wellbeing should they live to 100 years. Both employees and retirees exhibited similar trends in their responses. But more employees (36%) than retirees (24%) believed they would be financially unwell.

Some 70% of retirees anticipated their physical health to be somewhat well, compared to 62% of employees who said the same.

When asking for reasons why people felt financially well, 12% of employees and 18% of retirees who expressed strong confidence in their financial wellbeing said it was due to meticulous planning, strategic investments and effective saving strategies.

The employees (36%) and retirees (24%) who feel financially unwell cited inflation, high living costs and outliving their retirement savings as reasons for their concern about insufficient funds.

Overall, the sentiment varied, highlighting the challenges of planning for a lengthy lifespan.

The responses regarding ageing and physical wellbeing also exhibit a mix of perspectives.

Some 21% of employees and retirees expressed scepticism about how physically well they will be during old age. They emphasise that reaching such an advanced age inevitably comes with physical decline. Phrases like “too old”, “parts only last so long”, and “body will deteriorate over time” and concerns about frailty, becoming a burden and having physical ailments were common.

For those who subscribe to proactive health measures, the responses were more hopeful.

Almost one in five employees and one in ten retirees believe they will be physically well to a large extent. Terms such as “exercise regularly”, “keep fit” and “active lifestyle” suggest that some individuals believe maintaining physical wellbeing is possible with effort, healthy eating habits, regular medical check-ups and general healthy habits. References to genetics and family history also implied an acknowledgment of factors beyond our control.

When asked about emotional wellbeing at the age of 100, employees (12%) and retirees (10%) felt that they would not be emotionally well and either did not have the desire to live that long or were worried about cognitive decline.

For the one in three respondents who believe they will stay emotionally well, resilience and coping mechanisms were frequently mentioned as factors that could contribute to emotional stability at such an advanced age. Several individuals highlighted their current emotional strength or stability as indicative of future wellbeing. Others said they place their trust in spirituality or religion as a source of comfort for their future selves. The overall sentiment for this group was cautiously optimistic but heavily dependent on health, social connections and personal coping strategies.

We’re living longer.

Now what?

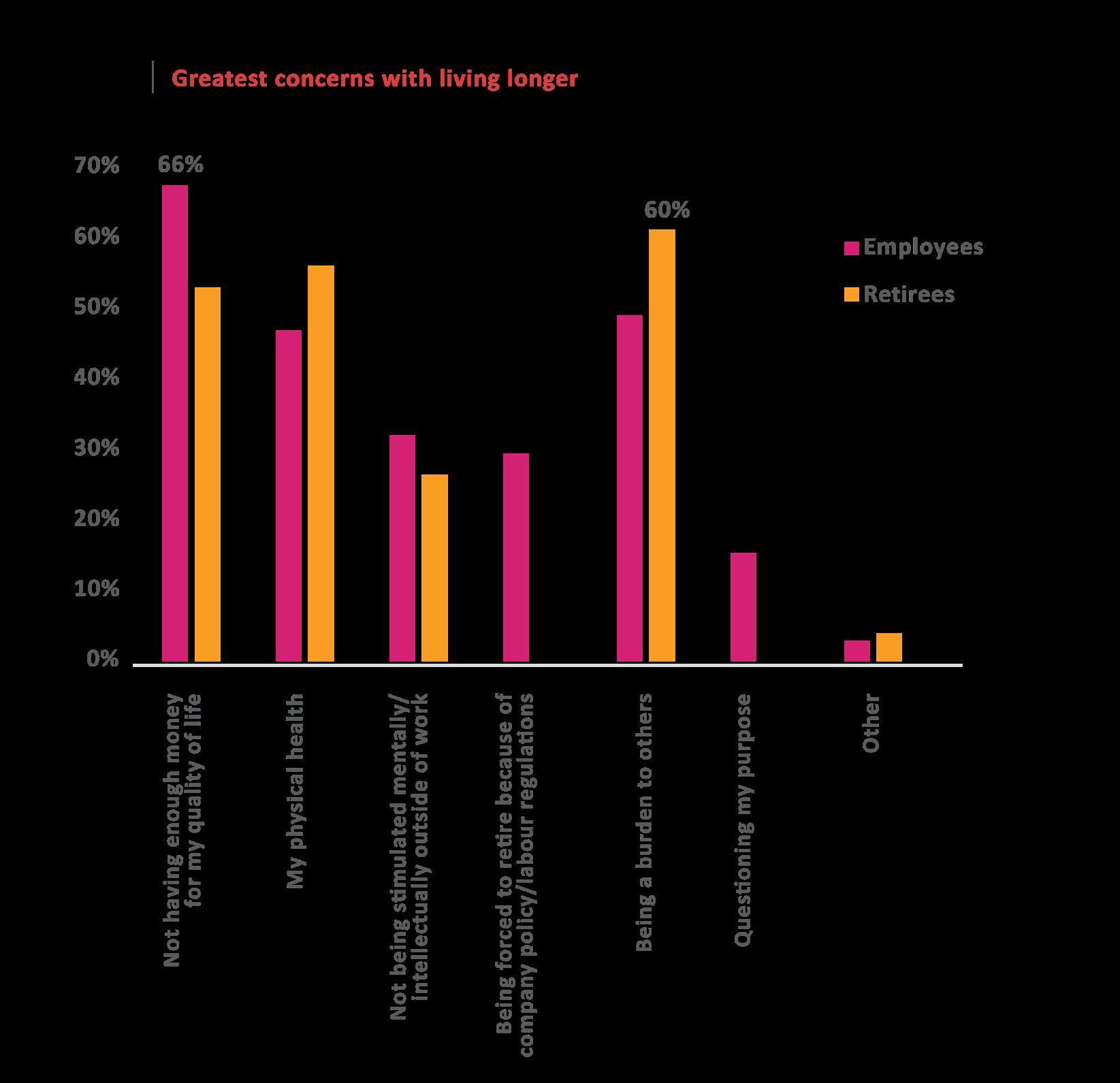

As people contemplate the prospect of living longer, new worries emerge. The next graph shows that before retirement, two out of three employees are primarily concerned about financially maintaining their quality of life. In contrast, only half of retirees share this concern. For 60% of retirees their most significant worry is being a burden to others versus 48% of employees.

As individuals age, physical health becomes a more pressing issue, with over half of retirees expressing concern in this area. Some retirees are concerned about developing health conditions such as heart problems, strokes, arthritis and mobility issues, while others are more optimistic.

“Staying healthy is my priority. I plan to exercise and explore new hobbies.”

“As I get older and see what my parents and in-laws do after retirement, I think about what I would and will be physically able to do in my retirement age.”

We asked participants to guess what age they would live until, to compare employee responses with those from retirees. Interestingly, retirees anticipate longer lifespans compared to employees.

Nearly three in four retirees expect to live beyond the age of 80, while only three in five employees expect the same. Almost a third of retirees expect to live between 86 and 90 years, while only onefifth of employees share the same belief.

This is significant, since when people think about how long they will live, it affects how they plan for retirement. Younger individuals often underestimate their lifespan. This leads them to spend more freely, save less and make suboptimal retirement decisions. As people grow older, they tend to overestimate how long they will live. Consequently, they become more cautious with spending and start to preserve their retirement savings.

The first three words or phrases that spontaneously come to mind when thinking of retirement reveals much about what employees believe retirement will be like compared to retirees already in this period of their lives.

The results reveal intriguing insights into people’s associations with retirement:

• “Travel” tops the list for employees (25%) and takes second spot for retirees (24%).

• 41% of retirees emphasise “health” as most important, while this is ranked fourth by employees (19%).

• Employees (20%) and retirees (18%) mention “money” in second and third position, respectively.

• “Freedom” in terms of “financial freedom” and “freedom from the daily grind” is mentioned by 19% of employees (ranking third) and by 9% of retirees (ranking fourth).

Other words including “rest”, “saving” and “time” resonated with employees but not retirees, suggesting shifting priorities post-retirement. While some terms evoke positivity (“happiness”, “comfort”), others hint at concerns (“boredom”, “scary”). “Financial security” and “good health” also matter to retirees, reflecting their focus on stability and wellbeing.

When comparing different income groups, lower-income individuals mentioned “health” the most often, followed by “money” and then “relaxation”. Middle-income respondents placed “relaxation” first, followed by “freedom” and “money”. Lastly, upper-income individuals mentioned “travel” first, followed by “health” and “money”.

Overall, these data underscore the multifaceted nature of retirement expectations and experiences.

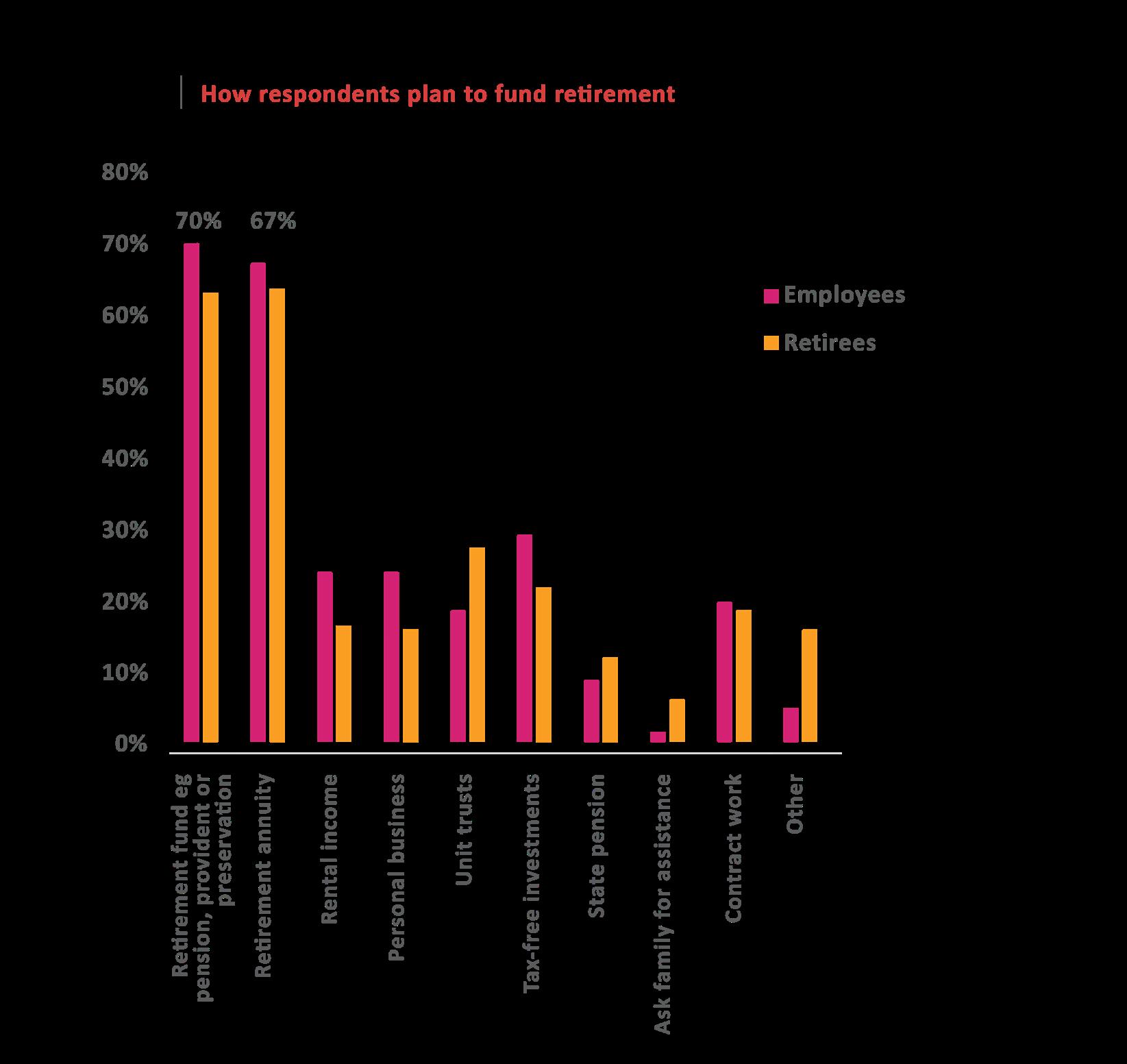

We asked the respondents how they believed they would fund their retirement.

Respondents said they believed funding would be mainly through retirement funds such as pension, provident, preservation (70%) or state pension funds (8%). Other retirement vehicles include retirement annuities (67%), tax-free investments (29%) and unit trusts (18%). Some additional strategies include creating passive income streams through rental income (23%), personal business ventures (24%) and contract work (19%). Only 1% of respondents said they would turn to family to fund their retirement.

A significantly higher number of lower-income individuals said they would rely on state pensions for their retirement, whereas middle- and upper-income individuals are more likely to use retirement funds such as pension, provident or preservation funds.

Many employees are relying on their pension from their retirement fund and/or retirement annuity to fund their retirement years. But, with average retirement savings not being adequate to replace a pre-retirement income, many may not realise that their retirement savings will very likely be insufficient to maintain their lifestyles in

Next, we tested employees’ views on retirement in general.

The factors influencing retirement decisions were company policies that mandated retirement (38%), closely followed by financial considerations (37%). Only 16% mentioned health as the determining factor, and just one in ten respondents referred to labour regulations.

Almost half of employees (45%) indicated that they would like to continue working part-time after retirement with two out of five (43%) saying that they are too young to retire. One out of four employees mentioned that they cannot afford to retire and 22% indicated that retirement makes them feel anxious.

When analysing the results by income, the lowerincome groups more often express that they cannot afford to retire and must seek additional sources of income. Unsurprisingly, individuals in higher income brackets tend to look forward to retirement more than those in middle- and lowerincome brackets.

Are you ready for retirement? Are you looking forward to it?

A third of employees say they are ready for retirement. Of these, two thirds say the reason for this positive outlook is that they feel emotionally well and ready for the next chapter in their lives. Over half feel physically fit and 43% say they are financially secure.

Other positive influences include:

• Consulting with financial advisers (30%).

• Having achieved professional milestones (27%).

• Having someone to care for them postretirement (4%).

• Intention to pursue a small business or contract work (28%).

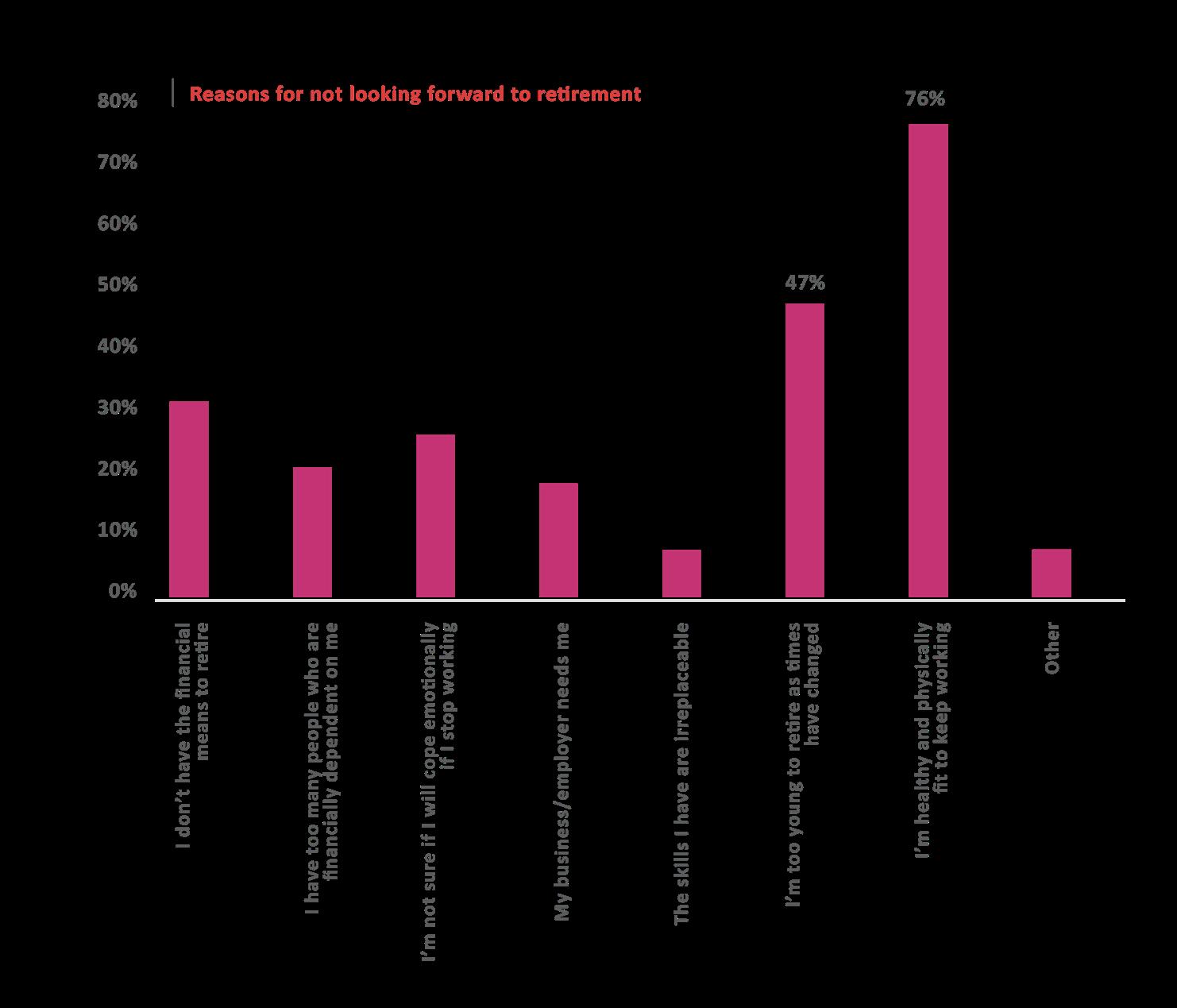

Of the 9% who said they do not plan to retire, the reasons for not wanting to retire include:

• 76% feel healthy and physically fit so want to continue working.

• 47% feel too young to retire.

• One in three employees say that they do not have the financial means.

• One in four employees are concerned about their ability to cope emotionally if they stop working.

When looking at the age when employees plan to retire, we find that on average the older the individual, the later the retirement age.

Are there differences in retirement age preferences by generation? Yes.

Millennials want to retire at 62 years

“Want to continue to be mentally engaged for as long as possible.”

“To delay eating into retirement savings for as long as possible.”

Gen X want to retire at 66 years

“I think staying in the workforce as long as possible is good for mental wellbeing.”

“Want to spend time with loved ones before it’s too late.”

Boomers have already, or want to, retire at 68 years

“Poor working conditions.”

“I was retrenched.”

Again, the overarching insight is that views are very dependent on the circumstances, overall wellbeing and perspectives of the individual. But what is clear is that people want to work until they are ready to retire and, for most, that is beyond the company policy’s normal retirement age.

Next, we considered the employer views on retirement.

Comparing our sample of employers’ normal retirement age to last year’s, we observe a slight increase in age overall. In 2023, 32% indicated their normal retirement age as 60 years, while in 2024 this reduced to 28%. In 2023, half of employers indicated 65 years, but this has now increased significantly to 61% of employers.

Analysing our own book of business, we observe that our clients’ average retirement age has remained relatively constant over the years (62 –63 years). This could be due to various factors; for example, employees who reach normal retirement age exit their retirement fund but may stay on at their employer as contractors.

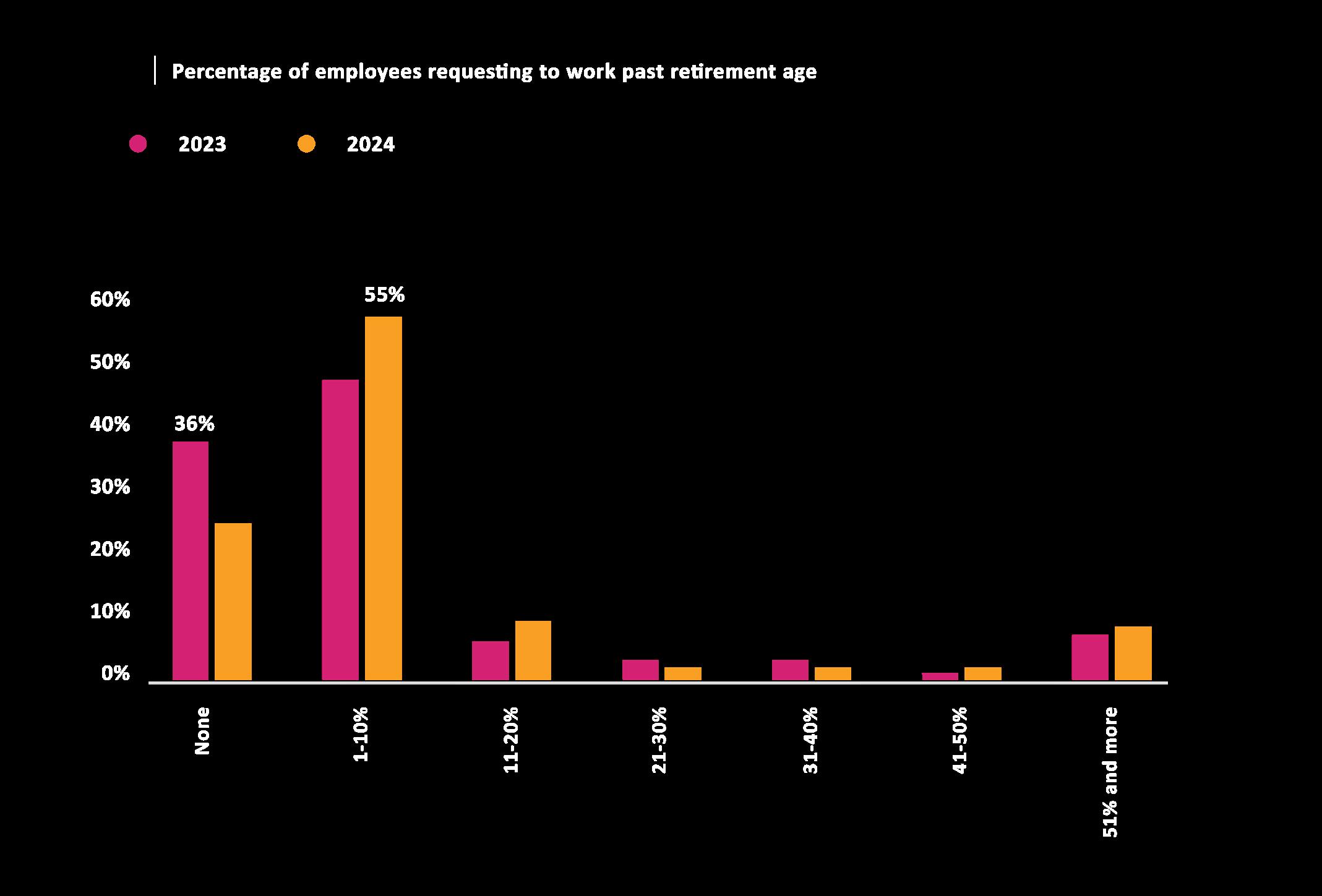

When asking employers what percentage of their workforce has worked past their normal retirement age or requested to do so, an increase in requests was seen.

2023: 67% of businesses received requests 2024: 77% of businesses received requests

Within the 1-10% of workforce who worked or requested to work beyond the retirement age, we saw a 10% increase, followed by a 3% increase in the 11-20% bracket.

For those employees who could not be accommodated past their normal retirement age, the following reasons were given:

• Not having a rare skillset (40%).

• Having to operate within a legislative framework (27%).

• Individuals being too expensive (24%).

Would YOU work beyond retirement age if you were given the opportunity?

Eight out of 10 employees say yes. Down 6% from 2023.

Five out of 10 retirees say yes.

Reasons for this include intellectual stimulation (82%), to improve finances (64%) and boost emotional wellbeing (35%).

Key takeouts from this chapter:

• The employer sample findings reveal a marginal rise in the typical retirement age.

• Employers report a surge in requests to extend work beyond the normal retirement age.

• Both working individuals and retirees expressed a readiness to prolong their careers if the opportunity arises.

• Employers cite the lack of specialised skills and legislative constraints as the primary reasons for denying such requests.

• There is potential for companies to re-assess their company policies regarding retirement age, and effect change where viable. We see this trend emerging internationally.

Retirement at some point in one’s life is inevitable. What our data reflects is that we are all unique: physically, mentally and emotionally, and our perceptions differ. Therefore, it is important for employers and employee benefits providers to understand that retirement is a unique journey for the retiree and to be able to provide the most relevant, necessary and timely support.

In part 4, we look at the role of employee value propositions (EVPs) and delve into the role of digital transformation and its impact on business.

Note:

Please find references for the above chapter in the full insights paper on the Momentum Corporate website.