Traverse City Office 236 1/2 E. Front Street, #26 Traverse City, MI 49684 231-943-6988

Main Office 5931 Oakland Drive Portage, MI 49024 269-385-5888 or 888-777-0216

• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, JD, and PhD.

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University. Charles Zhang, CFP®, MBA, MSFS, ChFC

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors for 2024. Charles has achieved the #1 ranking three times within the past four years.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the highest-ranking Fee-Only Advisor on the list.*

20Fathoms in Traverse City offers a new opportunity for Native American entrepreneurs. IndigiPitch is a pitch competition that will showcase Michigan’s vibrant Native American entrepreneurship and startup community. “IndigiPitch will be a very special evening for the entire community,” said Shiloh Slomsky, tribal liaison and CFO at 20Fathoms. “This is an opportunity for Native American entrepreneurs to showcase their work, compete for cash prizes and meet supportive individuals. But we’re doing it our way at this event, using our voices and traditions to create an evening that inspires, educates and uplifts.” Entrepreneurs are invited to apply (bit.ly/apply-indigipitch) by Oct. 13 to pitch and/or to secure a vendor booth at the event slated for Dec. 5 at Odawa Casino in Petoskey.

Michigan Auto Law has opened an office at 3347 W. South Airport Rd., Suite B, in Traverse City. The firm’s practice areas include car and truck accidents, motorcycle accidents, personal injury and no-fault insurance law. It has offices in Detroit, Ann Arbor, Grand Rapids, Farmington Hills, Flint and Sterling Heights.

The 11th annual Northwest Michigan Housing Summit hosted by Housing North is set for Oct. 27-28 at the Hagerty Center in Traverse City, featuring community leaders, housing agencies, financial institutions and other partners all focused on expanding housing solutions across the region. The theme for this year’s summit is “Rooted in Community Housing Solutions for Collective Impact.” Norm Van Eeden Petersman, director of Movement Building at Strong Towns, is the keynote speaker; housingnorth.org/nwm-housing-summit.

TBA Credit Union in Traverse City recently made its annual contribution to Traverse City Area Public Schools. This year’s $16,100 donation directly supports elementary students by providing dryerase board markers for classroom use. Funds will also provide student opportunities through LEAP and sponsor signage at Thirlby Field.

NMC’s University Partners CMU, Davenport University, Ferris State University, Grand Valley State University, and MSU’s Institute of Agricultural Technol-

ogy have relocated from the University Center campus on Boardman Lake to the James Beckett Building on the Front Street campus to help the partners better serve NMC students. The UC campus has been renamed the Boardman Lake campus and for now remains the home of NMC’s business and human resources offices, Extended Education & Train ing, the NMC Foundation and Strategic Initiatives office.

Plans are taking shape for a new mixeduse development at the corner of State and Cass next to The Omelette Shoppe in downtown Traverse City. In addition to 44 income-restricted apartments on the upper floors, the ground floor is envisioned to be a 4,000 square-foot market featuring fresh produce seven days a week from local farmers, a hot/cold deli, coffee bar, rotating food stalls, grocery staples and fresh sushi. Cherry Capital City Market would provide access to local farmers seven days a week in conjunction with the Sara Hardy Downtown Farmers Market. Details of that partnership are still being finalized, according to DDA Executive Director Harry Burkholder, which will define how active of a role the DDA/Downtown Traverse City Association plays in operations. The partnership includes Harvest Food Systems of Tamarack Holdings, a family of local food companies that includes Cherry Capital Foods, Great Lakes Farm to Freezer, and Food For Thought

NMC has been named a co-principal investigator on a $873,634 National Science Foundation grant led by Grand Valley State University (GVSU). The grant will create a six-week training program focused on artificial intelligence-enabled deployment of autonomous underwater vehicles. Developed in collaboration with GVSU, training will be provided to 72 individuals in four different cohorts. This is the second National Science

Foundation grant awarded to the region for water-related work this year. Earlier this summer, Traverse City startup Wave Lumina won a $305,000 grant supporting the research and development into the science underlying their pioneering product, a portable device that field tests for PFAS, or forever chemicals.

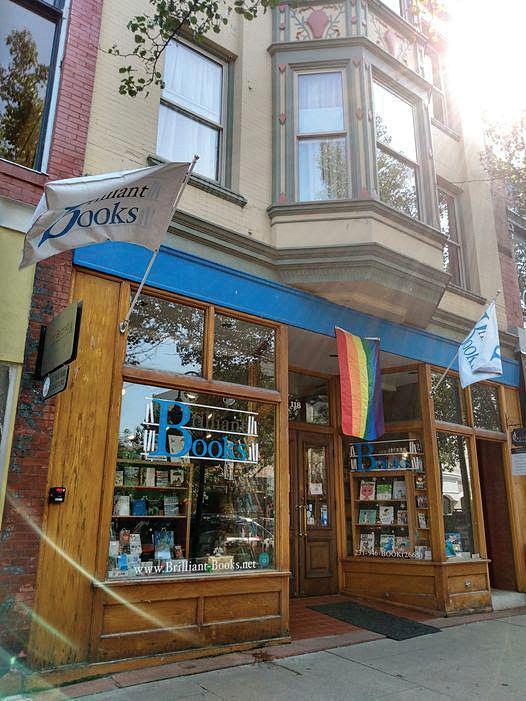

After 14 years in business in downtown Traverse City, Brilliant Books is closing its Front Street retail store. In an announcement discussing the closure, plans are for the website to remain operational and its Brilliant Books Monthly subscription service will be continuing. Founded by Peter Makin, the business first started in Suttons Bay in 2007 – with that location closing in 2013.

TART Trails recently held its annual celebration recognizing the people and partners who help make the trail network thrive. This year’s honorees included Mathew Cooke, Ambassador of the Year; Higher Grounds , Community Partner; 4Front Credit Union , Corporate Partner (pictured above); and Acme Township , Government Partner.

Pryde Athletics and Physical Therapy has opened at 707 Parsons Rd. in Traverse City specializing in combining physical therapy care with strength and conditioning programs to help athletes and others recover and perform at their best; prydeathletics.com/traverse-city.

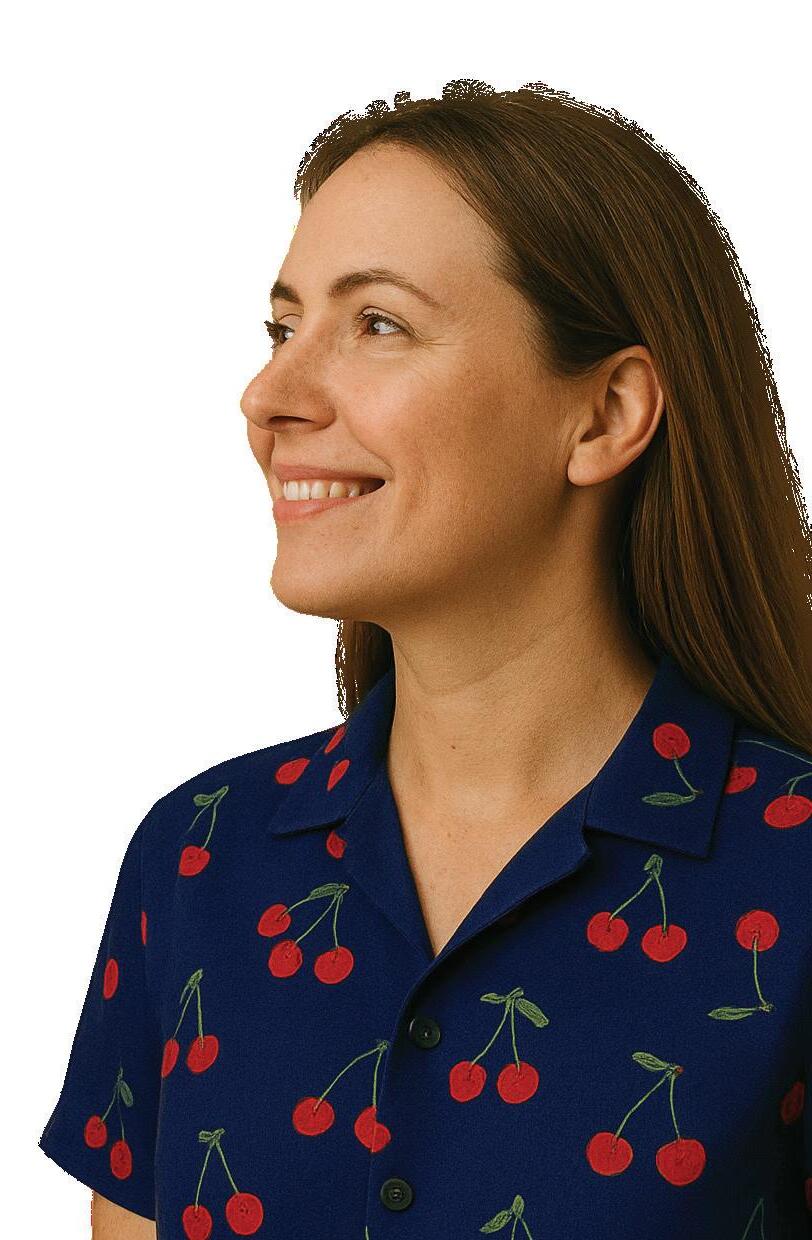

The Festival Foundation announces its 2025/2026 board of directors. Newly appointed officers are: Kelli Mengebier, president (pictured above); Nikki Schweitzer, vice president; Max Anderson, immediate past president; Ian Hollands, treasurer; Brian Beauchamp, secretary. The Foundation also welcomed new board members Greg Maytas and Liz Petrella. Continuing members include Doug Dowdy, Peg Jonkhoff and Kevin Severt, along with Jessica Alpers, who will continue serving as the cherry industry liaison. Ex-officio members are John Lynch of Lynch Law and Festival Foundation CEO Kat Paye.

Venture North Funding and Development in Traverse City has added two individuals to its board of directors: Jennifer Rekasi, community development manager and vice president at Huntington Bank with more than two decades in the banking sector, and Jim Masters, a senior commercial portfolio manager for Fifth Third Bank, who has 29 years of financial services experience with 27 in the Traverse City market. Masters has served on Venture North’s loan committee since 2015.

Choose not just where you want to live, but how. Cordia offers countless opportunities for enrichment, inspiration, connection and personal fulfillment. Where would you like your next great chapter to take you? The choice is all yours.

If history teaches us anything, it’s that strong communities are built on strong foundations. Northern Michigan has long benefited from two pillars that have carried us through change and uncertainty: Munson Healthcare and Northwestern Michigan College. These institutions do more than serve. They sustain us. They shape the quality of our lives, the resilience of our economy and the character of our region.

As we look to the future, the question is not whether we value these institutions – everyone from business leaders to retirees knows their importance. The question is whether the policy environment in Lansing and Washington will allow them to thrive. Decisions made far from Traverse City are influencing the care we receive, the opportunities our learners pursue and the vitality of our workforce.

Employers cannot attract or retain talent if workers fear specialized care is hours away. Retirees, many of whom chose this region for its quality of life, would not have the same confidence if advanced medical care weren’t close at hand. And businesses themselves depend on the stability of a healthcare system that keeps employees healthy and productive.

Munson Healthcare’s regional network – spanning critical access hospitals, outpatient facilities, and specialized services – fills this role. Yet its ability to do so rests heavily on policy decisions beyond its control. More than 60% of Munson’s payments come from state and federal payors, who pay less than the cost of providing care, and more than 200,000 patients rely on Medicaid or Affordable Care Act

EDITORIAL & BUSINESS OFFICE

P.O. Box 4020 Traverse City, MI 49685 231-947-8787

ON THE WEB

tcbusinessnews.com

PUBLISHER

Luke W. Haase lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu

gneu@tcbusinessnews.com

HEAD WRITER

Craig Manning

STAFF WRITER

Art Bukowski

COMMENTARY BY GABE SCHNEIDER

coverage. Regardless of one’s views on government’s role in healthcare, the truth is that it is already deeply involved. To complicate matters further, government reimbursement rates can change at the whim of policymakers. That reality makes state and federal engagement essential for the success of northern Michigan’s largest rural healthcare provider.

One policy that illustrates this tension is the 340B drug pricing program. This federal program requires pharmaceutical companies to provide discounted medications to hospitals serving large numbers of low-income patients, at no cost to taxpayers. Hospitals reinvest the savings in local services, from charity care to rural clinics to expanding outpatient and community services. Unfortunately, the program is under near-constant attack from pharmaceutical companies, which oppose legislative efforts in Lansing to add state-level protections while simultaneously working to weaken it nationally.

Another looming challenge comes from cuts enacted in the most recent federal budget reconciliation bill. As these reductions are fully implemented – along with the forecasted impact of tariffs – Munson Healthcare projects losses of more than $50 million annually over the next several years. While Congress included funding for a new Rural Health Transformation Program, those dollars will cover only a fraction of the shortfall. The Michigan Health & Hospital Association estimates the program will offset just one-sixth of Michigan’s cuts over the next decade. In addition, as federal funding for Medicaid shrinks, Michigan will face significant budget shortfalls, since Medicaid already accounts for half of the state’s Department of Health and Human Services budget.

CREATIVE DIRECTOR

Kyra Cross Poehlman

CONTRIBUTING WRITERS

Ross Boissoneau

Kierstin Gunsberg Rick Haglund

COPY EDITOR Becky Kalajian

WEB PRODUCTION: Byte Productions

MAILING/FULFILLMENT

Village Press

DISTRIBUTION

Marc Morris

SERVING

Grand Traverse, Kalkaska, Leelanau and Benzie counties

The challenges facing Northwestern Michigan College (NMC) are no less significant. If healthcare is our safety net, education is our growth engine. For employers, NMC is the single most important partner in developing the workforce they need. For retirees, the college offers cultural programming and continuing education.

But like Munson, NMC faces headwinds shaped by legislative debate.

One recurring issue involves the “three-legged stool” that has traditionally supported Michigan community colleges: one-third local tax revenue, one-third tuition and one-third state funding. Over the last decade, this balance has shifted. State support has grown slowly while inflation and aging infrastructure have increased costs, leaving students to shoulder a greater share. What was once a predictable budget process that gave colleges certainty about state support now often stretches well into the fiscal and academic year, putting investments in student success at risk.

Take, for example, the proposed Integrated Student Services Hub, which would transform NMC’s 60-year-old Osterlin Building on the Front Street Campus into a one-stop hub for admissions, financial aid, advising, counseling, international outreach, health and veteran services. This $8 million project should be cost-shared through the state’s college capital outlay process, but legislative delays have pushed the timeline back year after year.

And as we think about a foundation for the future, programs like Michigan Reconnect, dual enrollment and short-term training initiatives open doors for students of all ages: recent high school graduates, working adults and career changers

AD SALES

Lisa Gillespie lisa@northernexpress.com

Kim Murray kmurray@tcbusinessnews.com

Kaitlyn Nance knance@northernexpress.com

Abby Walton Porter aporter@northernexpress.com

Michele Young myoung@tcbusinessnews.com

COVER PHOTO

Megan Renae Studios

alike. Each is a proven strategy to help Michigan achieve its “Sixty by 30” goal of 60% credential attainment by 2030. Yet these programs compete annually for state funding, leaving their long-term future uncertain even as their value grows.

Munson Healthcare and Northwestern Michigan College have adapted to decades of change – economic downturns, technological disruption, demographic shifts. But no institution, no matter how resilient, can withstand a policy environment that steadily erodes its foundation.

The future of northern Michigan will be shaped by choices made today. Will federal and state lawmakers provide stable, predictable support that allows our hospitals and colleges to plan with confidence? Or will short-term cuts and policy shifts chip away at the structures that have sustained us for generations?

For businesses and retirees alike, this is not an abstract debate. It is about the kind of community we want to live in – not just today, but a century from now. Strong healthcare and strong education are not luxuries. They are the foundation on which northern Michigan has been built, and the foundation on which it must continue to grow.

Gabe Schneider is a consultant, policy strategist and founder of Northern Strategies 360. He lives, works and invests in Traverse City.

Correction: Kevin Query of Manitou Commercial Real Estate was listed as 39 years old in the September 40Under40 issue. He is 31. We apologize for the error!

The Traverse City Business News

Published monthly by Eyes Only Media, LLC P.O. Box 4020 Traverse City, MI 49685 231-947-8787

Periodical postage qualification pending at Traverse City, MI.

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810.

The Traverse City Business News is not responsible for unsolicited contributions.

Content ©2025 Eyes Only Media, LLC. All rights reserved.

EYES ONLY MEDIA, LLC

Ombudsman volunteers visit older adults in northwest Michigan’s nursing homes, homes for the aged, and adult foster care homes—offering a listening ear, friendly support, and a voice when it’s needed most.

We’ll guide you with step- by-step training, let you shadow a mentor until you’re comfortable, and offer a flexible schedule that works for you. Get involved like you would for your own loved one. Your presence matters more than you know.

By Art Bukowski

James Marsh (yes, he’s Jamie Marsh’s son) is the Chevrolet service manager at the Williams Auto Group in Traverse City. He joined the Williams team about a month ago and has been tasked with, among other things, boosting business at the oil change center at their main campus near the Grand Traverse Mall. We thank James for showing us around his space. If you have an idea for a From the Desk Of feature, email Art Bukowski at abukowski@tcbusinessnews.com.

1. I’m big into fitness, big into working out. I pack all my lunches, always have lots of fruits and vegetables. I go to the gym every morning before I come here. I still enjoy a good greasy burger on the weekends, but during the week I just try to stay in really good shape. It gives me more energy so I don’t feel lazy during the day.

2. That’s a hat from a yacht brokerage that I’ve used. I’m a big, big boater. I have a couple of different boats, and I keep one down in the marina. I pretty much live on that thing on the weekends, though unfortunately I’m pulling it out soon. Boating is probably my number one hobby.

3. I love music. And nobody likes the guy who says he likes every kind of music, but I literally do love all kinds. My playlist is anywhere from rave club to relaxing bluegrass country music. I’m all over the place.

4. I do embrace technology, but I can’t get away from the old school stuff like the big calculator. I haven’t got a calendar up in here yet, but I’m a big calendar guy too.

5. I’m a coffee freak. I drink a lot of it – probably too much of it. It’s Americanos every morning.

6. One of these is the National Oil and Lube News, which is dedicated to this industry. One of my tasks when I was hired was to really build up this quick service, and it has a ton of good information about the business. The other publication is from MAC Tools. We always want to have the best equipment here.

7. You might not be able to see it, but there are tire quotes on there. Part of trying to grow this department is pushing tire sales and other upgrades. Before, when we’d tell someone they might need tires, we couldn’t actually do them. What I want them to do now is leave with a quote in their hands so the team in the other building can get them those tires. It’s all about building the business.

8. We’re in the process of completely revamping the oil change center. All the windows are getting replaced, we’re getting all new signage, some new paint. We want to level it up like crazy and be the number one quick lube. Some other places in town have closed, so we see a real opportunity to move up in the market.

By Art Bukowski

You have the dream, the plans, the time and the energy.

But what about the money?

Traverse City has long been a commercial banking hub for all of northern Michigan. Thousands of folks work at regional offices of major corporate banks or at one of many smaller, local “community” banks throughout the area.

The TCBN connected with several familiar faces in the commercial lending world to see what’s going on in this fast-paced (and very competitive) market.

MICHAEL CARUSO

Nicolet Bank

Michael Caruso started with Comerica Bank in Detroit back in 1989, and he’s been banking in Traverse City for almost 12 years.

He speaks proudly about what it means to him to help businesses – and by extension, people – with his work.

“It’s the client experiences, no question about it. The client experiences are what keeps you going in this business,” he said. “Touring the plant. Seeing their excitement. Putting together packages for them that no one else really would put together the same way.”

Caruso says the “smartest” lenders are transactional real estate lenders. Bring in a big strip mall, pad the portfolio with a $2 million outstanding loan and wash your hands of it. Maybe talk to the client once a year. Move on to the next thing.

“The less smart lenders go into the relationship side, and I say less smart because

it’s a tremendous amount of more work,” he said. “But one of the critical factors for me throughout my whole 35-year career has been to not be a transactional lender. My clients are pretty intensive, they’re all relationship based. That’s the side I gravitated towards.”

And Caruso leans in. He knows that being connected at the hip with his clients is good for everyone. Anticipation and planning always pays off.

“I communicate with these people continuously,” he said. “Talk to them if they have a problem. Make sure we’re ahead of the curve when they need to buy something or they’re looking for the next project…we want to always prepare them for the next step.”

Caruso feels lucky to conduct business in and around Traverse City, where he received a warm welcome that never quite wore off.

“I was a new guy in the market when I came here, so I knocked on an awful lot of doors. And I was just extremely impressed

with the friendliness of the people in this area,” he said. “People are happy to be here. They’re smiling when they wake up in the morning.”

It’s also a market that has a lot to offer, especially if you know where to look.

“This market has a really good, almost hidden, base of manufacturers, wholesalers and distributors. They’re all over the place, they’re really, really nice companies to bank, and they’re really nice relationships,” he said. “We are interested in as many of those as we can possibly get on the books.”

Asked about trends, Caruso had plenty to say about interest rates and other matters. He also pointed to a note on the wall that reminds himself to talk to every single client about fraud protection.

“In my first 20 or 25 years of doing business, there was one case of fraud that I remember. And nowadays, we have a couple a month,” he said. “Somebody getting scammed, somebody called and

said they were from someplace. It’s just constant, and it’s time consuming. Is Sam in distribution clicking on a link and letting someone in your back door?”

West Shore Bank

Lori VanAntwerp has been in the game 30 years, the last three of which at West Shore Bank in Traverse City.

She says she loves finding solutions for her clients, of whom she has an immense amount of respect and admiration. It takes a lot of guts to open or expand a business, she said.

“I’m not a risk taker, which is probably why I’m a banker,” she said. “So to see people step out and follow their passion and make money and do good things for the community, I just love it.”

VanAntwerp, like some others on this list, do more than loans. Full-service commercial banking at West Shore means she’s ready to help with anything and everything.

“It’s really fun to see how we can find some banking solutions, whether it be loans or making their life easier with treasury management, ACH, paying bills and paying their employees,” she said. “If we can make their lives easier in that area, then they can focus on what

Honor Bank

Cory VanBrocklin broke into the business as a parttime teller at Empire National Bank in 1991. He rode a wave of buyouts and mergers for many years before coming to Honor Bank in 2021.

“Small-town community banking is really what I enjoyed, so Honor was just a really good fit for me,” he said.

VanBrocklin enjoys the assortment of businesses that come across his desk. It’s never the same day twice, especially in this market, and he considers himself a jack of all trades, master of none.

“In commercial, we’re versed in just about everything, because there’s not just one big industry up here that we can all lend to,” he said. “It might be a Pilates studio, or an Indian restaurant, or it might be a big, huge apartment complex, or a commercial development. The variety of deals is my favorite thing. You never know who’s going to call.”

It’s a bummer when some of those calls don’t really pan out, VanBrocklin says, but it happens.

“Unfortunately, a great idea doesn’t always work into a deal,” he said. “Somebody can have a very great idea, but not have all the tools and plans they need to get financing for that particular project.”

they’re really passionate about.”

The Traverse City market is attractive for a few reasons, VanAntwerp said. It’s a bit more protected from downturns in real estate because it’s such an attractive locale, and its position as an attractive market continues to bring in smart people with fun business ideas.

“One of the things I love about commercial lending is I get to see various different industries and business models and types of collateral. Every deal is a little different and it’s really (enjoyable),” she said. “So having these people coming into the market with different ideas just adds to the fun of commercial lending.”

Over the decades, VanAntwerp has lent to far more women than men. It’s a trend that’s changing, and she’s loving it.

“I’m hoping to see more women in business and the continued trend of more women clients. Volunteering with Impact100 for the last eight years has introduced me to many strong, independent women in our community that are poised to do many great things in the years to come.”

In terms of trends, VanBrocklin pointed to many businesses changing hands in recent years.

“Business acquisition seems to be the most popular thing that I’m seeing right now. A lot of customers are getting out of their business,” he said. “And it doesn’t matter what their age is, but they’re taking advantage of other companies coming into the market (and looking to buy), or selling to a long-time employee. That seems to be happening a lot now.”

VanBrocklin said customers can put themselves in a much better position, acquisition or otherwise, if they stay on top of their books.

“Sometimes we look at the smaller deals in the area and they take more time than some of the larger deals do because of the quality of the financial statements that we’re looking at,” he said. “I highly encourage any business owner to make sure that you have a good handle on your financial statements and you know what they mean and you know how they work.”

Like others at community banks, he’s proud to be there and will speak at great lengths about the benefits of being truly local.

“Another great thing about Honor is I sit on the same floor as the president, the CFO and the senior lender,” he said. “All decisions for us are made here locally. We’re not looking to deal with somebody in a

different state that’s going to make a decision on a deal in northern Michigan. It also allows us to be responsive. If we need to hurry up and get a decision made, we can make it right here.”

Scott Ashurst has been in commercial banking for 40 years, spending the last 11 at State Savings Bank in Traverse City.

He reflected on a recent transaction where he and a customer, both nearing retirement, spoke about their very long-standing business ties. It’s things like this that give Ashurst great satisfaction.

“It’s all about relationships,” he said. “I’ve got some people that I’ve leant money to for over 30 years. It’s been a lot of fun.”

Those relationships allow him to turn a rigid, dollars-and-cents business into something a little bit more.

“Some other institutions might have more of a formula-based type thing, predetermined formulas, that type of stuff, but that’s not really how we do business. It’s more of a person-to-person thing for us,” he said. “Get to know the person and see what makes sense for both of us.”

Ashurst has enjoyed being a part of – and laments the gradual reduction of –truly local banks in the area.

“There’s fewer and fewer community banks, which is where I’ve worked my entire career here in Traverse City,” he said. “It’s local service that truly makes the difference. We live here, we work here and we make the decisions here.”

Customers gravitate to that, he believes, especially around here.

“I think there’s a greater expectation of a local relationship in northwestern lower Michigan,” he said. “I think businesses here appreciate that service.”

And you’d better bring the best service possible when customers have as much choice as they do in northern Michigan.

“There’s a lot of competition in town, and that’s a challenge for sure,” he said. “You always have to earn the business, add how you differentiate yourself is service. That’s what we pride ourselves on.”

Autumn Gillow has been at Fifth Third Bank for about eight years, and in her role serves bigger fishes – think companies with sales of at least $30 million stretching up to $1 billion (believe it or not, a category referred to as “middle market” in banking).

“In northern Michigan, there’s obviously only so many companies that are of that size, so I’m traveling a lot to see them,” she said. “My market is all of northern Michigan, basically Cadillac over to Alpena and up into the Upper Peninsula.”

The people Gillow works with are hands down her favorite part of the job, she said.

“I have the best clients in northern Michigan, and I work with some of the most talented bankers,” she said. “Commercial banking isn’t glamorous, but the people make it so much fun.”

Fifth-Third offers a “full suite” of banking services to these clients, so Gillow handles far more than loans.

“I have a handful of clients where I might have a one-off loan, but for the most part when we onboard a client, the client and I have the expectation that I’m going to be managing all of their banking needs.”

Competition for her services exists, but it helps that she’s the only one right here in the market.

“It’s certainly competitive, but I don’t think there are many people locally that are executing and providing this service,” she says. “I’m not certain of this, but I think that Fifth Third is the only middle market bank that has a presence in north-

John Hyatt joined Team One Credit Union in 2014 to establish the company in the Traverse City market. He’s been in the business in one way or another since he graduated from Michigan State University in 2000, and he’s loved every minute.

“When you can help people achieve their dreams and goals, it’s amazing,” he said.

Ultimately, Hyatt sees commercial lending as a vital community service. He works with startups all the way up to larger, established companies to help with growth, and this growth almost always has a tremendous ripple effect.

“The health of our small businesses has a big impact on the health of our communities,” he said. “If you can help a business owner with funding that

equipment expansion or getting them the working capital that they need, it’s not just a big deal for them, but it’s a big deal for their team and all their teams’ households, and it’s a big deal for the community.”

He’s been involved in many major projects – his outstanding book is over $200 million, he says – but it’s not the size that matters.

“A deal that I’m very proud of was when we stuck our neck out on a startup salon, and I don’t think anyone else in town would have said yes on that deal,” he said. “She built a great business and sold it, and did extremely well. To me, those are the huge success stories…that personally mean a lot.”

Hyatt said credit unions are rapidly gaining market share in a commercial lending world that was once entirely dominated by banks.

“When I first started calling on folks

ern Michigan. At this point everyone else has those resources in the Grand Rapids and Detroit markets.”

Gillow is glad to see at least a bit more stability return in recent months.

“The last few years have been volatile, with higher interest rates, uncertain political environment, global issues with wars and tariffs – just a lot of macro noise in the market and that impacts business owners’ confidence in investment,” she said. “Things seem to be settling down, and we are seeing a strong uptick in commercial investment in the second half of the year.”

Finally, Gillow is a Traverse City native who is proud to serve others in her community.

“For the most part, if people are here, it’s because they’ve chosen to be here, and if I can in some small way help a family to be successful in their businesses and get to be in northern Michigan, that’s a win for sure.”

in 2014, the responses I would get from all kinds of businesses owners would be ‘Are you kidding me? Credit unions are doing this?’” he said. “And today, we’re the number one call.”

Like everyone else in his business, Hyatt has to judge and balance risk. You want to help people, but they have to be able to hold up their end of the deal.

“You look at the buyers’ ability to make adjustments or be nimble and turn things around if there are speed bumps,” he said.

Hyatt likes being in Traverse City, where there’s still plenty of momentum despite more marked slowdowns elsewhere.

“We’ve had persistent higher rates now for a few years, and the market may have slowed down a little bit, but the value is still there,” he said. “This market maintains its value, and we constantly see folks that want to be in this market.”

New law cuts seniors’ taxes, jeopardizes their health care

By Rick Haglund

Covering 940 pages, the One Big Beautiful Bill Act is a sweeping piece of legislation that will have a significant impact – good and bad – on the finances and health care of millions of seniors.

“It gives something to everybody, almost. They’ve packed a lot in there,” said Eric Braund, founder of Black Walnut Wealth Management in Traverse City. Braund and other financial advisors agree that the gargantuan tax-and-spending bill, signed into law in July, is mostly positive for those on the AARP magazine subscription list.

“We have a lot of retirees who will owe little or no taxes. It’s huge,” said Holly Gallagher, founder and president of Horizon Financial in Traverse City.

But Gallagher and others say seniors will likely need the tax breaks to help offset continued high prices for groceries, health care and other living costs. Many will be hit by the law’s changes to Medicare and Medicaid that could result in higher premiums and lost coverage.

That pain will migrate to Munson Healthcare, the largest hospital group in northern Michigan. The eight-hospital system said it expects to lose more than $50 million a year because of Medicaid cuts kicking in over the next several years.

“We are doing everything we can to still care for our patients and neighbors, but this legislation puts our collective community health at risk,” Megan Brown, Munson’s chief marketing and communications officer, said in a statement.

The act also is estimated to boost the federal budget deficit by about $4 trillion over the next 10 years, possibly putting seniors’ Social Security benefits at risk, one local financial advisor said.

Those deficits make “future benefit cuts more likely as we move closer to (Social Security) being depleted,” said Marc Hudson, president of Hudson Wealth Management in Traverse City.

But there are lucrative tax benefits for seniors in the new law, ranging from low-income retirees to those who employ financial advisors to protect retirement income.

The new law provides a bonus deduction of up to $6,000 for those 65 and older. The full deduction is available to taxpayers with a modified adjusted gross income of up to $75,000 for individual filers and $150,000 for couples filing jointly. Older taxpayers can take the deduction regardless of whether they itemize.

Each spouse can take the deduction, for a total of $12,000 if both are 65-plus, according to AARP. The deduction is reduced for single filers making up to $175,000 and couples earning $250,000. Those earning above those levels aren’t eligible for the bonus deduction, which ends in 2028.

“That’s a lot of money, as far as a deduction goes,” Braund said. “That helps a lot.”

What’s more, those 65 and older get an extra standard deduction this year of $2,000 for single taxpayers and $1,600 per qualifying spouse for couples filing jointly.

Those deductions will reduce the taxable income of a 65 year-plus couple with a combined income of $120,000 by $46,700, according to an example cited by AARP.

“For those who are not quite ready to retire [and buy insurance on the ACA Marketplace], their insurance plans are going to be very expensive.”

– Dawn McConnell, Medicare and Individual Health Insurance Specialist, Ford Insurance

An analysis by the White House Council of Economic Advisers found that 51.4 million Social Security beneficiaries, or 88%, will no longer pay federal tax on their Social Security benefits because of tax changes in the new law.

And as Gallagher notes, the law makes permanent personal income tax cuts that were approved during President Donald Trump’s first term in 2017 for all tax filers. Those cuts, among the largest in history, were due to expire this year.

Much of the savings from the new tax law will go to higher income tax filers. The bottom 20% of earners will save an average $150 while the top 20% will pocket $12,540, according to the Urban-Brookings Tax Policy Center.

Another provision in the new law will benefit many middle-to-high income seniors, financial advisors say.

Tax filers earning up to $500,000 can deduct $40,000 in state and local property taxes, known as SALT, from their federal returns, up from the current $10,000. Braund says that will aid many retirees and near retirees with more than one home. The benefit goes back to $10,000 in 2030.

“That one affects a lot of our clients,” Braund said. “It helps those who are wealthy, but not super wealthy.”

But many seniors are likely to see tax savings eaten away by rising health care costs. And some, who are under 65 and insured by Medicaid, might get kicked off their health insurance because of work requirements and onerous paperwork requirements under the new law.

As many as 200,000 Michigan residents could lose Medicaid benefits over the next decade because of the new work require-

ments and tighter eligibility standards, according to the Citizens Research Council of Michigan.

An estimated 10% of Munson’s 200,000 patients who are insured by Medicaid or through the Affordable Care Act Marketplace will lose their coverage because of the new federal law, Brown says. Most of the Medicaid cuts take effect at the end of 2026.

Enhanced ACA premium tax credits, enacted during Covid by the American Rescue Plan, are set to expire at the end of the year. Unless Congress extends those credits, premiums for the 24 million people now receiving them will rise by

as much as 90%, according to the Kaiser Family Foundation, a health policy research organization.

“It’s not going to be a good scene in 2026” for anyone now getting ACA premium credits, said Geoffrey Harris, vice president of Medicare sales at Michigan Planners, an employee benefits agency in Traverse City. “The whole Medicare space is in transition.”

Overall, Michigan health insurers have proposed a rate increase of 15% to 20% for next year because of rising health care costs, Harris says. He noted that Blue Cross Blue Shield of Michigan, the state’s largest health insurer, reported an operat-

ing loss of $1.7 billion in 2024.

Dawn McConnell, a Medicare and individual health insurance specialist at Ford Insurance in Traverse City, concurs that the loss of ACA premium tax credits will hit many seniors hard.

“For those who are not quite ready to retire [and buy insurance on the ACA Marketplace], their insurance plans are going to be very expensive,” she said.

An estimated 15 million Americans could become uninsured because of changes to Medicaid, which provides health insurance to low-income families, and Medicare, which insures those over 65, according to Kaiser. Those changes

have put many of McConnell’s customers on edge.

“They’re definitely concerned about their health insurance,” she said. “When people come into my office there’s a level of anxiety about the future. It’s made us start thinking out of the box a little bit.”

One option her agency offers customers is an indemnity plan that protects against costs incurred from catastrophic medical events. Another is a concierge plan in which a patient pays a health care provider a certain amount of cash up front to treat them throughout the year.

“I’m a busy woman these days,” McConnell said.

With relocation rates hitting a record low and more people choosing to stay put to make the house they’re already in a home, interior designers like Tansy LeBlanc are stepping up to the growing demand. “We’re seeing a lot of clients in existing homes who are either doing renovations or wanting their home to have a little more character and they just need some help with that,” said LeBlanc, who along with her husband Marty, opened her first design showroom, LeBlanc House in Traverse City’s NoBo District over the summer.

Neighboring Commongrounds on East Eighth Street, the 1,000 square foot studio is a warmly lit display for LeBlanc’s 25 years of experience in the interior and kitchen design industry. Much of that experience has been gained working all over the country. “I’ve learned that the most important thing is starting with the foundation – focusing on what’s going to stay relevant instead of what’s trending at the moment and also being true to the area.”

Taking design cues from the greatest lake

In Northern Michigan, staying true to the area has meant bringing elements of the natural world into LeBlanc’s designs, both literally and figuratively. Elements like beach-stones and bare branches frequently make their way into her projects while her colorway inspiration comes from places like Esch Beach where the shifting blues of Lake Michigan set against the muted dunes creates its own palette of neutrals.

The same serene aesthetic can be found in the items she curates for the retail component of LeBlanc House, from vintage French paintings depicting seaside holidays to antique pale aqua glass bottles repurposed as bud vases. “Everything in the store is bespoke but also functional for everyday use,” said LeBlanc. “It’s all things I’d use – or already do – in my own home, like

horsehair brooms and Denby Pottery dinnerware from England.” Currently, LeBlanc is working to grow her network of local makers with the goal of stocking her shop with pieces that reflect the artisan talent right here at home. She also scours online and travels hundreds of miles to estate sales and antique markets for one-of-a-kind pieces to bring back to her northern Michigan clients and LeBlanc House retail customers. “It’s hours of hunting,” she said.

A calming signature style

While LeBlanc uses her eye for nostalgia to draw personality into modern spaces, she says that older homes are her specialty. One of her biggest projects to date is set to kick off this fall with a full reno in a downtown Traverse City Victorian. “We’re going to be turning an attic into a master suite and adding a balcony and then eventually a carriage house will also be built onto the back of the home,” said LeBlanc, adding that for her interior designs she spends many hours just going over the plans and details while helping clients create cohesion and function with a low-clutter, simple elegance that’s become signature to her style.

Her approach has been especially successful in breaking up the monotony of the open floor plans that became status quo for new builds in the 90’s and 2000’s. “For those clients, they want their home to feel like it’s cozy so they’re reaching out asking, ‘how can we get some personality?’” said LeBlanc, who mixes textures in similar neutral colors to add intrigue without overwhelming the eyeline. Lampshades, rugs, bed linens – they’re all utilitarian components that, when chosen with intention, can elevate an otherwise generic space.

Curating the (functional) clutter

Kitchens, added LeBlanc, are the “bread and butter” of her industry –

probably because they’re one of those spots that goes overlooked when it comes to finishing touches, even after big renovations. “It’s a big investment and they’ll have this beautiful result,” LeBlanc said. But, the potential for a stunning revamp is dulled when a mish-mash of black plastic utensils and worn out dish-towels get thrown back into view. “It’s important that your functional pieces also be pieces you’re excited about, and that create harmony within the space” said LeBlanc. Her philosophy is if the toaster’s going to be out in plain sight anyway, why not go for one that com -

plements everything around it? Both in her store and in her interior work, LeBlanc provides “things that are very practical and beautiful.”

A self-proclaimed introvert, LeBlanc says she’s energized by bringing homes into balance. And when it comes to those behind-the-scenes headaches, whether it’s tracking down an old table weathered to perfection or playing phone tag with vendors, taking the pressure of a home design so her clients can exhale is her strength and also her joy: “That’s the essence of my job.”

Former GM attorney forms estate planning firm after son’s death

By Ross Boissoneau

Dealing with something as painful and profound as death is never easy. But the challenges are eased for those left behind when plans are made beforehand.

That’s what Mary Ann Wehr and her family learned when her son James died from COVID at 33, leaving his pregnant wife to probate his house in the wake of losing her husband just days before their second wedding anniversary.

“I wish people would think more practically. Sometimes the worst does happen,” Wehr said. “Life does have its twists and turns.”

Wehr was a practicing attorney for General Motors for a decade and a half. Her son’s death prompted a change of focus, and she founded Great Lakes Center for Estate Planning. Wehr says her firsthand experience gave her both the desire to help others and the understanding of how to do so.

She says pre-planning provides peace of mind for the entire family. Interpersonal dynamics can shift and/or become strained in the wake of an unexpected death, or even one that’s anticipated. A child may wonder who would take care of them if mom or dad or both died. Siblings may disagree on how to divide assets, whether a home, business or both. With blended families, things can get even murkier. Planning ahead eases the strain for all involved.

For example, when there’s a family cottage and multiple children, the questions are many: Who wants it versus who wants the money a sale would bring, who will provide the upkeep, who will take responsibility for taxes ... it quickly becomes a legal and family challenge. That’s where

pre-planning is invaluable, she says.

“Set rules to keep them out of conflict,” Wehr noted.

Wehr says it can also alleviate the intrusion of third parties, be it the courts or outside trustees. She also notes creating a plan can be – in her estimation, should be – an ongoing process, one that continues past the point of initially creating a will or trust to include annual reviews for changes in circumstances or desires, as well as any necessary legal updates.

Determining how to deal with one’s assets and wishes is a complex matter.

Wehr says the first step for her is to get to know her clients. Learning their values, what they want and what they don’t want enables her to help them move forward, whether it’s preparing a simple will or a complex trust. She says she approaches the process with the client’s individual needs in mind, rather than trying to fit everyone into the same box.

Wehr tries to approach it in a way that’s reassuring rather than alarming.

“I work for you during your life, and who gets your stuff,” she said, deliberately using the term “stuff” rather than possessions or assets. “If I use the word assets, it sounds … intimidating.”

A will dictates asset distribution – the dispensation of stuff, in Wehr’s words – and guardianship after death. It goes through probate, a public court process. A trust, on the other hand, is a more complex, private legal arrangement which bypasses probate and can manage assets both during life and after death.

Wills are generally simpler and cheaper to create, take effect only after death, and allow for naming a guardian for minor children. Trusts, however, offer greater con-

“I wish people would think more practically... Life does have its twists and turns.”

– Mary Ann Wehr, Personal Family Lawyer, Great Lakes Center for Estate Planning

trol over how and when assets are distributed, provide privacy, and can manage assets –okay, stuff – if in the case of incapacitation. It might include planning for those with special needs, even who will take care of your pets. Wehr says it is important to make sure everything is protected against unforeseen claims and creditors.

Even within the world of trusts there are differences, primarily between revocable and irrevocable.

“Revocable trust offers flexibility for future years,” said Wehr, while irrevocable trusts offer less control but stronger financial and tax benefits.

Great Lakes Center for Estate Planning is Wehr’s third act professionally. Preceding her first foray into law at GM and her current work was her initial career in IT, before she transitioned to law.

Under Michigan law, only an attorney can do estate planning, says Wehr. Her fee varies depending on the amount of

work, but she suggests looking at it as an investment rather than a cost. She puts her cost somewhere in the mid-range of such plans, ranging from $2,000 to $7,000, depending on what her clients need.

While she is technically not in sales, Wehr says she does sell peace of mind.

“Think about pre-planning,” she advised.

It’s not only about making things go smoothly for those left behind, though that is important.

“There are aspects of estate planning that are helpful during your life,” said Wehr. “If you don’t have financial power of attorney, you have to petition the court so you don’t have some stranger doing it. Same with medical power of attorney. Get a health care directive.”

For more information, see greatlakescenterforestateplanning.com.

How northern Michigan’s senior housing shortage is exacerbating every other market hurdle

By Craig Manning

“It’s really bad.”

That’s Yarrow Brown’s quick and blunt status report on the senior housing situation in northern Michigan. Despite the Grand Traverse area’s status as a desirable retirement destination, the numbers show that the region is woefully unprepared to house its ever-growing population of senior citizens – at least without some major changes to local zoning and development trends.

As executive director for Housing North, Brown is no stranger to the often-dire facts and figures that characterize northern Michigan’s housing problem. A nonprofit organization formed in 2018, Housing North works to “build awareness, influence policy and grow capacity and resources for housing solutions” across the 10-county region of Antrim, Benzie, Charlevoix, Emmet, Grand Traverse, Kalkaska, Leelanau, Manistee, Missaukee and Wexford counties.

Every few years, Housing North embarks upon a data-rich deep dive to prepare a housing needs assessment covering all 10 counties. The most recent of

those reports, published in 2023, looked at existing and projected housing gaps across the 10 counties from 2022 and 2027, estimating that northern Michigan would be more than 30,000 residential units short of its housing needs by 2027, including 8,813 rental units and 22,455 for-sale units.

Those numbers, Brown acknowledges, are severe enough to guarantee that virtually every local resident is affected in some way by the housing shortage, whether in the form of skyrocketing housing costs or staffing challenges at local businesses. For seniors, though, Brown says the problem is even more complicated because of how it compounds with other factors, like the need to live on a fixed income or the desire to find a home that is conducive to aging in place.

Susan Leithauser-Yee, a real estate industry professional and a technical support coordinator for Housing North’s Housing Ready program, says a big part of the challenge around senior housing in the region is the broad and amorphous definition for what “senior housing” actually looks like.

“We are especially seeing a lot of people on fixed incomes being displaced more rapidly, and that’s mostly people who are 55 and older.”

– Yarrow Brown, Executive Director, Housing North

“When we are talking about senior housing, seniors could be in their own homes; they could be in a downsized home they moved into after retiring; they could be living with a loved one; or they could be in a senior community, where there’s this whole spectrum of independent, assisted, skilled nursing or primary care facilities,” Leithauser-Yee explained.

“There are just a lot of different segments within senior housing, and that makes it hard to track where the need is.” Hard to track or not, the need is there. In a stakeholder survey done as part of the 2023 Housing Needs Assessment, senior-specific housing – including independent living, assisted living and nursing care communities – was consistently rated

as a moderate to high need, particularly for groups with lower incomes of $25,000 or less. Brown expects those needs will only grow as some of the cheapest real estate inventory in the region increases in price, thereby displacing the people –including fixed-income seniors – that call those places home.

“Susan’s been sitting on a Grand Traverse County workgroup looking specifically [at housing displacement],” Brown said. “It came up a lot during the election, when people were canvassing. One of the state reps was hearing from a lot of people being displaced, especially in the manufactured home communities around here. We are especially seeing a lot of people on fixed incomes being displaced more rapidly, and that’s mostly people who are 55 and older.”

A few new senior living communities have come online in the past year or so that could help matters. One example is Meadow Valley Senior Living in Garfield Township, which brought 174 units to the table in independent, assisted and memory-care categories when it opened in 2024. But the region has also lost some facilities in recent years, leading to a “two steps forward, one step back” type situation. In 2021 for

year, now as a hotel called The Vic.

One of the biggest problems, according to Leithauser-Yee, is that aging adults rely on a continuum of options for housing

would be able to age to a certain point in their long-term homes, downsize to smaller, more accessible dwellings to age in

place and lean on in-home care as needed, and then move to senior living communities or nursing facilities as health and ability demand. Without enough capacity or affordability in all or most of those categories, though, the continuum breaks apart, which then causes a domino effect that impacts the entire housing market.

“There are a lot of seniors in our area right now who live in these larger homes, but they don’t really have anywhere to go to downsize into a lower-cost situation,” Leithauser-Yee explained.

Brown adds that this immobility causes additional complexities.

“And then when people aren’t leaving

“Some say he’s the cat-whisperer, but we call him the cash-whisperer”

their homes because there’s nowhere else to go, not only does that impact the senior looking to downsize, but it also means that you have all these four-bedroom houses that are locked up with one or two-person households,” she said.

All told, the Housing Needs Assessment found that nearly 57% of households in the 10-county region have heads-of-household who are 55 years old or older. Moreover, virtually all of the projected household growth in the region by 2027 is expected to come in the form of older households, including 3,758 additional 75-plus households and 2,114 more 65-74 households. For comparison’s sake, in the same time frame, the region is expected to see a net loss of 1,157 households aged 25-34, and a gain of just 841 households in the 35-44 demographic.

The solution, Brown and Leithauser-Yee say, will involve a lot of different components. More senior living communities setting up shop in the area would help, particularly if they were focused on providing space and services at a more affordable price point. (“I don’t want to pick on local providers, but at one of the newer senior living communities in town, a one-bedroom is $5,200 a month,” Leithauser-Yee noted.) More housing developers focusing on designing and building age-in-place-ready homes would help, too.

“We’re noticing that, with Habitat for Humanity, they’re building their homes completely ADA-accessible now, which is a great trend,” Brown said.

More than likely, though, younger people will have to get involved and be proactive to ensure that their parents and grandparents have living options. Depending on income level, that might mean getting on a waiting list for a Traverse City Housing Commission unit – waiting lists that Brown says “are years long” – or normalizing roommate arrangements for older adults.

“We’re definitely looking at how we can teach people how to be roommates again, and at giving them best practices to follow for sharing a kitchen space or other living spaces,” Brown said.

Leithauser-Yee, for her part, is also a strong proponent of popularizing accessory dwelling units (ADUs) as a senior housing option. ADUs have been a bit of a political football in northern Michigan over the years, with some locals worrying about them being used as short-term rentals or simply adding too much density to local neighborhoods. When it comes to older loved ones looking to downsize into smaller, more manageable, and more affordable living situations, though, Leithauser-Yee argues that families could solve a lot of problems by going down the ADU path.

“If we had an ADU added to every

“If we had an ADU added to every block in the city, that would solve part of the problem.”

– Susan Leithauser-Yee, Technical Support Coordinator, Housing North

block in the city, that would solve part of the problem,” Leithauser-Yee said. “Now, if you build a free-standing backyard apartment, which is the concept we often think about with ADUs, that’s probably going to be cost-prohibitive for a lot of people, both in terms of construction costs and because of the big bump in taxes from adding square footage. But we’ve started trying to educate people on a lower-cost solution, where maybe you can convert existing square footage in your home to house a family member, and if you want some privacy, maybe add a bathroom and a second entrance.”

Brown says that kind of thinking is “definitely” needed now.

“We need to encourage these different types of living spaces and get people comfortable with the resources of how you would create that kind of space,” she said.

More than anything else, though, Brown thinks locals need to let go of their “resistance to zoning changes,” whether that means rules that bar or limit ADUs or even the city’s closely guarded building height limitations.

“We can’t keep putting up barriers to housing,” she said flatly.

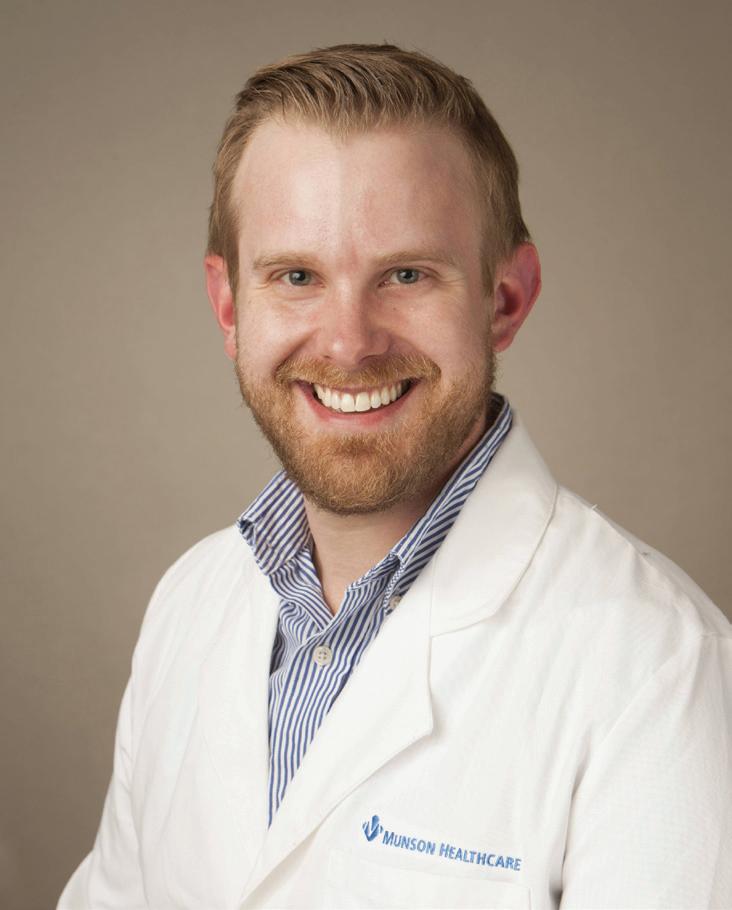

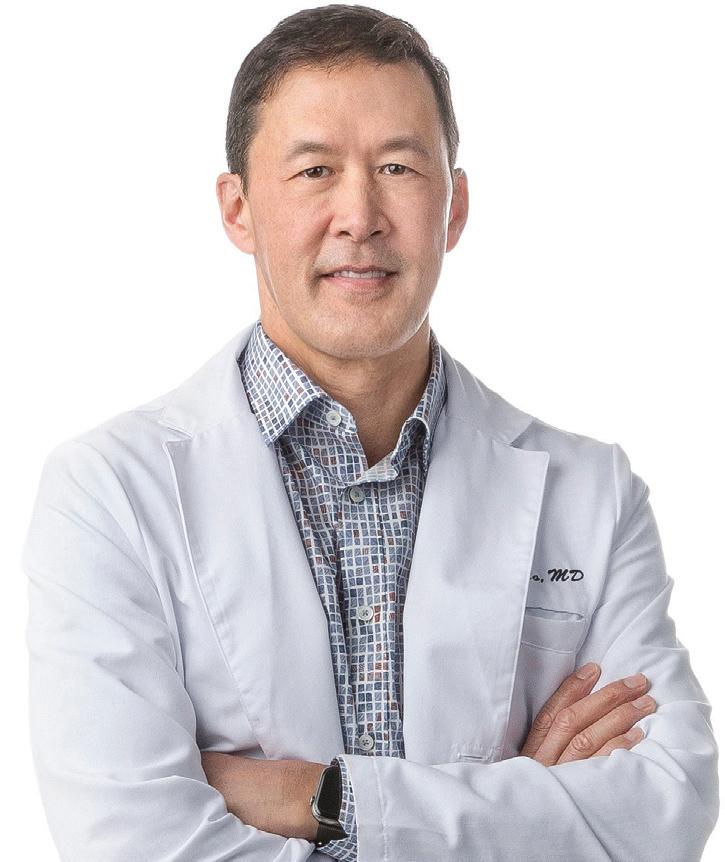

By Kierstin Gunsberg

Seniors now make up nearly a quarter of Grand Traverse County’s population, and they’re driving close to half of Munson Medical Center’s inpatient admissions, says Dr. Jonathan Beaulac, a geriatric and internal medicine physician at Munson Healthcare (MHC).

“It is a vast majority,” he said. With baby boomers aging into retirement and Gen X not far behind, that number is only going to grow over the next two decades, says Beaulac, and with it, the demand for quality geriatric care.

“[There’s] always pressure from the community to provide appropriate complex care management for our aging adults,” he said.

But as that population booms, MHC –which serves over half a million residents across 14,667 square miles – is surrounded by federally designated Healthcare Professional Shortage Areas (HPSAs). That is, communities the Health Resources and Services Administration identifies as medically underserved, where access to primary care, dental appointments and mental health checkups are, like so many things Up North, in high demand and low supply.

Just this past summer, the main Traverse City campus broke records with

more than 400 inpatient admissions on multiple consecutive days during July.

One of the reasons for the spate is what most here have mumbled under their breath for the last decade: This area is white-hot and getting more crowded by the year, making it tricky for healthcare providers across the board to keep up.

Grand Traverse County alone added nearly 10,000 residents in the past 15 years, many of them retirees.

Where is this retirement aged population boom coming from?

While conversations around northern Michigan’s rapid development sometimes point to wealthy seniors flocking north and wrenching our resources, Beaulac says that’s not what he’s seeing.

Instead, most older adults in the area are life-long residents whose health needs are naturally increasing with age.

“Not every patient or individual here is a retiree from the corporate or business world,” he said. “A lot of people are born and raised in the area,” and, as he puts it, “aging in place.”

That “place” is wide and often rural and as MHC’s specialties expand, so does its number of referrals, which now come from all across the state. Facilities like

“Munson leadership is aware of the challenges. It’s an ever-changing landscape and trying to stay up to speed and ahead of some of these demographic and population trends is a tough task.”

– Dr. Jonathan Beulac, Geriatric and Internal Medicine, Munson Healthcare

its many outpatient cancer and infusion clinics and Traverse City’s Comprehensive Stroke Center (the only one of its kind north of Grand Rapids) draw patients from as far as the U.P. explains Beaulac.

“It’s kind of like, if you build a thing, they will come,” he said.

Rapidly multiplying needs – and barriers

But even with more clinics and satellite services popping up throughout the system, getting to those locations can be hard for

older patients. As more seniors find it tough to access timely primary and specialty care, it’s creating another problem. More seniors are landing in the ER. That’s far from ideal, says Beaulac, citing travel to and from appointments as one of the biggest barriers to healthcare for seniors Up North. Another, not so surprising hurdle is housing.

“I can’t tell you how many patients this last month have come in where their housing situation is kind of unknown,” Beaulac said.

Whether it’s rent becoming unaffordable or older patients living in homes that are unequipped for the vulnerabilities they face after surgery, Munson’s nurses and social workers are jumping through extra hoops to coordinate safe, realistic discharge plans, all while contending with a national nursing shortage that’s made its way to northern Michigan.

Meanwhile, as the need for care grows, many of the very people providing it are also retiring (and then, ironically, entering that growing segment of demand). The American Association of Colleges of Nursing projects that by 2030, one million nurses will retire nationwide without enough new graduates waiting in the wings to take their place.

The conundrums of addressing the ballooning senior patient load isn’t lost on MHC. Leaders of the 29-county system are actively working to compensate for both the larger overall patient population and those patients whose age-related health needs are multiplying, says Beaulac.

“Munson leadership is aware of the challenges,” he said. “It’s an ever-changing landscape and trying to stay up to speed and ahead of some of these demographic and population trends is a tough task.”

But as someone who’s served with other networks throughout the state, Beaulac says he’s reassured by what he sees.

“I do think that the leaders here are impacting positive change, and only

greater change will occur in the near future,” he said.

Some of those changes, aimed at knocking down barriers to access, are already underway.

close

This summer, MHC landed $500,000 in MSHDA funding for an Employee Assisted Housing Fund, money that will provide stipends for 40-60 more employees, including nurses, to help ease the clinical staffing deficit and bring better patient care coverage across northern Michigan.

The system is also looking for ways to redirect as much of their existing workforce towards patient care. Earlier this year, MHC started testing drones to move lab samples, medications and supplies between facilities in Traverse City. If it all pans out, the drones could cut down on courier trips and keep more staff inside the hospitals and clinics where they’re needed most.

And in March, the Grand Traverse Mental Health Crisis and Access Center opened on Munson’s main campus, following an estimated 40% rise in mental health-related ER visits among patients 65 and older over the past two years. The new center, which is available to patients of all ages, is in collaboration with community partners like Northern Lakes Community Mental Health Authority and

is currently in its second phase, offering psychiatric urgent care and in-home crisis intervention, something especially relevant to those seniors struggling with transportation access.

Behavioral health, says Beaulac, is a major care gap for older patients.

One reason, says Dr. Cody Overmyer, an outpatient psychiatrist with Munson’s behavioral health department, is that stigma surrounding mental health keeps many seniors from seeking care. To counter that, Overmyer says that MHC has been working to make sure that “behavioral health needs are screened for by their primary care providers,” where patients can then either receive treatment or be referred to specialty care.

“The behavioral healthcare needs of older adults can be similar to other ages,” noted Overmyer.

Starting with primary care, though, allows providers to identify contributing factors unique to this population – social isolation, age-related medical issues and changes in functioning – and intervene before patients land in the ER for issues that could be better managed outside of it.

Looking ahead, MHC is also working to cut wait times for senior-focused sub-specialties like neurology and to bring more care closer to patients who live outside the Traverse City hub. That means placing specialists at community partner hospitals across the region and expanding virtual care.

All of these efforts are part of MHC’s larger strategy of getting patients the right care in the right place at the right time, whether that’s at their doctor’s office or even at home, to balance caring for their aging patient population in an inundated system.

“We try to have patients evaluated and treated outside the hospital by their primary care doctors as best they can,” Beaulac reiterated. “But if they’re not able to get to those resources on time, a lot of times it does fall to the ER to get some of these critical resources in place for them. So, we try to triage these things so patients are cared for in the appropriate location.”

By Kierstin Gunsberg

Maybe it’s the long winters stretching straight to spring break or the daily reminder that we’re surrounded by one of the world’s biggest freshwater marvels that’s turning a town of less than 16,000 into a hub for creative, problem-solving startups. And if there’s one resource nearly every Traverse City startup founder credits with their early success, it’s SCORE.

Yet outside of the small business community, the organization – which offers no-cost online business classes and pairs fledgling entrepreneurs with seasoned mentors for free, one-on-one guidance – has mostly flown under the radar.

The Voice of Reason

Tanya Berg,

Years with SCORE Traverse City: 16

Quick, confident, and to the point, Tanya Berg’s long-time career as a marketing and communications leader for Fifth Third Bank no doubt made her into one of the Traverse City small business community’s greatest behind-the-scenes assets. And with nearly two decades as a SCORE mentor, she’s watched that community change a lot over the years.

One of those changes is the rise in young founders.

“When I first began mentoring with SCORE, often you would have folks that were in a kind of semi-retirement or they’d been very successful in their prior careers and decided they wanted to launch off into a business venture,” said Berg. “And now you’ll find lots of young folks that are coming right out of college that are following the entrepreneurial path.”

It’s refreshing to see, says Berg, but mentoring those who still have years of variables like babies and relocation opportunities ahead of them means that her guidance has to dig down deeper than just strategizing their brand mission.

“You have to think about your life plan as well as your business plan,” she said.

Then again, those mentees seem to already value a work/life balance more than their older counterparts, even if their enthusiasm for both sometimes distracts them from the grind ahead.

“Sometimes they underestimate the challenge and the difficulties and the time commitment that might be required in building a successful business,” said Berg,

The Grounded Guide

Jeff Hamilton, Mentor and Chair

Years with SCORE Traverse City: 10

When Jeff Hamilton and his wife moved to northern Michigan full-time in 2014, it took the former Chicago business consultant less than a year to join up with SCORE. Since then, he’s helped roughly 100 entrepreneurs by sharing insights on financial readiness and how to stay afloat as a micro-business, something he learned the ins and outs of during his time running a small photography studio with his wife back in the Windy City.

“It was just the two of us and one employee,” said Hamilton. “Which is pretty typical of what you see up here.”

That experience also helps him ground his mentee’s entrepreneurial daydreams with some essential pragmatism.

“Somebody who is looking to start a business often knows what they know,” he said. “But they don’t necessarily know all the aspects of starting and running a small business. That might [mean] helping them put together a business plan, helping them validate their idea, and put some rigor behind the financial and marketing aspects of it.”

Launched in 1989, Traverse City’s SCORE chapter is one of nearly 400 across the U.S., and is run in partnership with nonprofits like Venture North and the Traverse Area District Library.

But it couldn’t accomplish anything if not for its 25 (or so) volunteer mentors who are passing the baton by spending their retirement years hopping onto calls and into meetings to share hard-won lessons with the next generation of business leaders. Without their guidance, companies like Cultured Kombucha Co. and Shark Tank winner Action Glow might not be where they are today.

Here’s a closer look at four of those mentors, the past careers that honed their knowledge, and how they’re helping grow northern Michigan’s entrepreneurial scene now.

who advises SCORE’s clients to avoid burnout by considering the future challenges of scaling up and ask themselves, “Can I afford to expand my resources, hire more people so I’m not doing everything?”

It’s a thought-process that’s helped her mentees build sustainable success, and she’s watched many of them go from fresh-faced newbies to leaders in their niche, Berg says.

“There’s something just really fun and rewarding when you can establish a relationship with a client and see them succeed,” she said. “If you have in some small way contributed to their journey, that’s really exciting.”

Francis “Tex” Criqui, Mentor

His driver’s license may say Francis, but to his SCORE mentees, he’s Tex.

“I don’t answer to Francis real well,” he joked.

On his “third or fourth retirement” following 38 years at GM and later work as a business consultant, Criqui’s latest venture leading up to his time with SCORE was launching an incubator at Lawrence Tech in Southfield that helped nearly 70 startups get off the ground, thanks in no small part to their partnership with SCORE‘s Southeast Michigan chapter.

Each founder participating in the incubator was required to pair up with a SCORE mentor, explains Criqui. So, when he made his way north a few years ago, he decided it was time to return the favor.

Now a mentor himself, Criqui’s main focus is bringing order to the early chaos of entrepreneurship.

“My areas of expertise are startups, business models, business planning, project management,” he said, adding that over the many years he’s worked with startups, a major pitfall for founders is obsessing a little too much over their initial idea instead of considering how it might play – or fizzle – out in the real world.

“Probably more than 75% of them are working to refine their ideas and make it better and better,” he explained, “and they’re not talking to their customers.”

That’s why he urges his mentees to focus on one market to start, then build from there.

“If you’re going to launch a company, it’s a little bit like building a house,” he said. “You don’t start on the upstairs bedrooms.”

An Air Force veteran and Silicon Valley pioneer, Jim Radabaugh’s preamble to SCORE includes 25 years in the tech industry where he helped introduce “time-sharing,” the pre-internet precursor to today’s apps. But after the early 2000s tech bust, he pivoted Up North where he launched a boutique acquisition company that supported business owners in expanding or selling their businesses, along with building exit plans come retirement.

That career, explains Radabaugh, gave him two areas of expertise to help Traverse City’s small business community. The first is offering an outsider’s perspective.

“The challenge is very basic for some of these folks in the very early stages,” he said. “They haven’t thought through a business plan … part of it is just helping them focus.”

The second is guiding people through big transitions and navigating what he calls inflection points, helping entrepreneurs seeking growth to ask themselves, “Okay, now what do I get? What are my options? How do I handle it?”

Radabaugh, who joined SCORE just this last winter, says that besides getting a peek at the creative minds and ideas behind the startup community, it’s been neat to glean from the organization’s other mentors too.

“I came thoroughly impressed with some of the skills that these people were bringing into things,” said Radabaugh.

By Art Bukowski

Riding off into the sunset, so to speak, is what a lot of working folks dream of. Put in your time, hang up your hat and enjoy the fruits of retirement.

But for a variety of reasons, more retirement-aged folks than ever before are still working. A recent CNBC study found that the number of Americans aged 65 and older in the workforce surged by 33% from 2015 to 2024, one of several studies that show such increases.

Some of these people are doing it because they need the money. Others choose to stay working because it keeps them busy, sharp or involved. Plenty do it for a combination of these reasons.

The TCBN checked in with four locals who are still working in retirement age, albeit for far less time than they did during their careers.

Michael Matts, 76, is often spotted at American Spoon or Robert Frost Quality, two downtown retailers that are beyond glad to have him in a time when dependable employees are very hard to come by.

Matts, an Army “brat” with Michigan roots, served in Vietnam before spending a nearly four-decade career in historic preservation. He played a role in helping save the historic Building 50 at the Grand Traverse Commons and for many years ran the Chicago office of the National Trust for Historic Preservation.

He largely retired from that work in 2022 and later moved to Traverse City, where it soon became apparent that he’d need to get at least a part-time job to make ends meet.

“After several months of looking at the finances, I said ‘Hold on here,’” he said. “I need to have extra income from somewhere.”

Matts lives and spends plenty of time walking around downtown, where he made friends with Joe and Bob Frost, the owner and founder, respectively, of apparel and footwear boutique Robert Frost Quality. They invited him to start grabbing a few shifts, and he obliged. Matts himself asked to work at American Spoon, where he had come to know the manager. He now works up to 40 hours a week between the two locations in the busy season, though it’s often much less. He’s proud to do it and feels strongly that he and others like him are very important cogs in the downtown machine.

“I think that without people like myself doing this, the retail and probably restaurant industry would collapse,” he said. “We serve an important role.”

Retired folks are often more flexible and most don’t need health insurance, Matts says, two huge checks in the plus

column from the employer’s perspective. Both American Spoon and Robert Frost have leaned into other retired workers to grab shifts as the many young people who work in retail head back to school, Matts says.

“You can really sense their need, and you’re aware that you’re helping make their lives better,” Matts said of his employers. “And I take pride that they have confidence in me. I have run both stores

by myself, and there’s just great pride in knowing that you’re trusted.”

Ultimately, Matts’ work at this age and in this environment is a huge net-positive, he feels.

“It keeps you busy, it gets you out of the house and then it stops the bleeding [financially],” he said. “And it gives you a sense of community, both in terms of the associates you work with, but also with just interacting with people that come

into the store.”

Matts finds great purpose in those interactions, which are just as helpful to people as his expertise in selecting great retail products.

“You’re really an ambassador for all of Traverse City, too. People ask you about where to go get lunch, or where can I find this, where can I find that?” he said. “So we try to be aware of what’s going, what’s open, things like that.”

In a lot of ways, Steve Somers has got it made.