Traverse City Office 236 1/2 E. Front Street, #26 Traverse City, MI 49684 231-943-6988

Main Office 5931 Oakland Drive Portage, MI 49024 269-385-5888 or 888-777-0216

• We uphold a Fiduciary Standard and work with clients on a fee-only basis.

• We do not receive commissions, kick-backs, or soft dollars from product sales, eliminating inherent conflicts of interest.

• Our team of professionals holds designations and degrees such as CFP®, CFA, CPA, MBA, JD, and PhD.

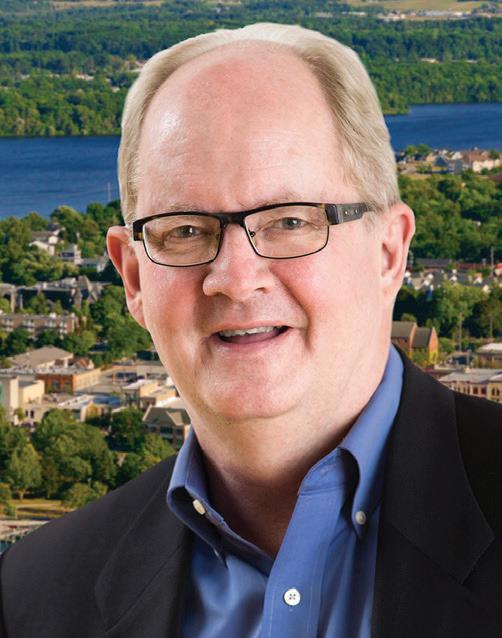

• Charles received his MBA from the Kellogg School of Management - Northwestern University, his MA in Economics from WMU, and Executive Education from Harvard Business School and Columbia University. Charles Zhang, CFP®, MBA, MSFS, ChFC

• Ranked #1 on Barron’s list of America’s TOP Independent Advisors for 2024. Charles has achieved the #1 ranking three times within the past four years.*

• Ranked #4 in the nation on Forbes’ list of TOP Wealth Advisors and is the highest-ranking Fee-Only Advisor on the list.*

Minimum investment: $1,000,000 in Michigan/$2,000,000 outside of Michigan. Assets under custody of LPL Financial and Charles Schwab.

TRANSPLANT CLINIC OPENING

Trinity Health Grand Rapids is expanding its five decades of kidney transplant experience to northern Michigan by opening a new satellite clinic in Traverse City. The clinic will eliminate at least one visit to Grand Rapids for northern Michigan patients at the Trinity Health Grand Rapids Kidney Transplant Center, the only adult kidney transplant center in west Michigan The clinic will be located at Munson Healthcare Kidney & Hypertension Specialists in Traverse City.

EXIT OFFICES MERGE

Holly Hack, broker/owner of EXIT Realty Paramount, and Stephen Karas, broker/owner of EXIT Northern Shores Realty, have announced a strategic merger. “Unifying the EXIT offices in Elk Rapids, Kalkaska and Traverse City, along with our current property management for the Traverse City Horse Shows through Winterwood Property Management, brings a cohesive strategy of real estate to northern Michigan,” said Stephen Karas, who has co-owned the Northern Shores franchise with wife, Carol Karas, since 2006 and since 2022 with associate broker, Vickie Smith. Holly Hack has been the sole owner and broker of EXIT Realty Paramount since 2011. Once finalized later this summer, the newly-merged company will operate under the EXIT Northern Shores Realty name with Stephen Karas as the broker of record.

MOVE: TRAVERSE BAY

INTERNAL MED

Traverse Bay Internal Medicine has relocated to 3963 W. Royal Dr. in Traverse City. The practice has also expanded its team to include two new internists, a gynecologist and two physician assistants. “This move is part of our ongoing effort to better serve the Traverse City community and accommodate our growing practice,” said owner Dr. Angela Pohl.

MICROLOAN RECIPIENTS

ANNOUNCED

Crosshatch Center for Art and Ecology and Oryana Community Co-op have announced the 2025 recipients of their zero interest microloan program: Open Air Farms in Cedar and Traverse City’s Carter’s Compost. Open Air Farms, which produces vegetables and flowers

sold at farmers markets, retail stores and via its community supported agriculture program, will use $7,000 to upgrade its wash/pack facility. Carter’s Compost, which collects food waste, composts it and then returns to customers, will use $3,000 to upgrade its food waste collec tion infrastructure.

AAF - Northern Michigan, the newest chapter of the American Advertising Federation, recently celebrated the work and accomplishments of local advertising professionals and students at the Ameri can Advertising Awards (ADDY) show in Traverse City. Work was judged by a na tional panel of top creative professionals. Professional firms that received recogni tion include PB&J Creative, LeadPlan Marketing, and Image 360

E-bike retailer and renter Pedego Traverse City has added new brands, services and offerings, and is also announcing a new name: Pedego & More Traverse City. Located at 823 S. Garfield Ave., the shop has added new e-bike brands, including Urtopia and Blaupunkt, and is also now a full-service parts and repair center. It has also added Outmore Living battery-powered heated outdoor furniture to the store. Doug Clemens has joined as sales manager and chief fun officer. Former Grand Traverse Cycle owner and founder Matt Klingelsmith has been with the company for four years and will lead e-bike service efforts.

Six businesses and six community professionals have been named finalists for the 2024 Traverse Connect Business and Community Achievement Awards. Finalists for TCYP Member of the Year are: Alexis Chas, product marketing manager at Beneteau Group; Brayton Farr, director of events & member engagement at the Home Builders Association of Northwest Michigan; and Mallory Szczepanski, event and content producer at Recycling Today Media Group. Finalists for Leadership Grand Traverse Alum are: Cindy Evans, executive director at Grand Traverse Industries; Alison Metiva, chief operat-

ing officer at Grand Traverse Regional Community Foundation; and Madeline Saucedo, director of fund development at Traverse Bay Children’s Advocacy Center. The Economic Impact finalists are: Century, LLC; Cherry Republic; and Grand Traverse Industries. Best New Business finalists are: Bushell’s Kitchen + Cocktails and Dreloco Taco; FreshTrippin; and River Club Glen Arbor Award recipients will be selected through live voting at the Distinguished Service Award Luncheon at the Grand Traverse Resort & Spa on May 21.

Time2Shine Fitness is now serving clients in the Traverse City area. Founder Kim Goodrich provides one-on-one personal training, nutrition coaching and lifestyle support, with each program designed around the client’s needs and goals. Sessions are available at Gateway Fitness Gym, in a private studio or in the client’s home. Learn more by calling (231) 625-4808 or emailing kim@thetimetoshine.com.

Apparel and lifestyle brand M22 has opened its third store, adding Suttons Bay to its flagship retail location in downtown Traverse City and a second store in Glen Arbor. Founded by Matt and Keegan Myers in 2004, the new store is located at 305 N. Saint Joseph St., formerly occupied by Laughing Fish Gallery. The Folded Leaf , a new independent bookstore, has opened in downtown Cedar, across the street from the Cedar Tavern. Owner Rachel Zemanek also intends to sell plants and artwork at the store, and to host live music and other events there on Wednesdays and Saturdays. Finally, Baby Dill has opened inside the Mercato at The Village at Grand Traverse Commons. The shop – owned by Tracey Lark, who previously owned and operated Relish in Traverse City for the last 13 years – will focus on natural and organic items for babies, young children and moms.

Dune Bird Winery in Northport has announced a collaboration with the Friends of Sleeping Bear Dunes nonprofit organization. This collaboration is marked by the release of Pink Plover – a sweet rosé crafted to raise awareness and funds for the endangered piping plover and other resource protection efforts along Lake Michigan’s shorelines. “This partnership allows us to bring together our love for wine and our commitment to environmental conservation — not only in our vineyards and wine making, but also in our communities and along our shorelines,” said Bekah Bell of Dune Bird Winery.

The St. Clair Butterfly Foundation (SCBF), a nonprofit organization that provides mentorship programs, life skills, and builds character through the creative arts, is expanding into the Traverse City region. With nearly two decades of success in transforming trauma into healing, SCBF delivers neuroscience-backed, expressive arts programming and professional development that goes beyond behavior management to create lasting behavior transformation. “Our mission is to empower schools, courts and other front-line workers serving the community to become healing-centered environments,” said SCBF co-founder Lisa St. Clair.

got your back! Our thoughtful and knowledgable

agents are here to make sure you're covered from head to toe— protecting what matters most, no matter the

Traverse City is on a roll. From our dynamic downtown to the freshwater landscape that surrounds us, this region is a magnet for people seeking more than just a place to live – they’re looking for a place to thrive.

What’s fueling that momentum? Of course, it starts with people – our business leaders, educators, civic institutions, and bold thinkers. But behind the scenes, a powerful driver often goes overlooked: strategic public investment. These foundational dollars are quietly building the infrastructure, programs and community assets that are making private investment not only possible but irresistible.

When we talk about investing, we often think in personal terms: capital, risk, return. But public investment operates differently – it sets the table. It creates the conditions that attract private sector dollars, amplify them and deliver longterm community value. Public dollars cover costs that the private sector can’t or won’t because there’s rarely an ROI, whereas these investments in the shared goals and objective of our community are government-money sweet spots.

Take FishPass, for example. What might appear to be just a revitalization of aging infrastructure is actually a globally significant research and environmental project. Located on the Boardman/Ottaway River, FishPass integrates fisheries management, scientific research, invasive species control and environmental education, all in one state-of-the-art facility.

This wouldn’t be possible without a diverse mix of funding, including major

EDITORIAL & BUSINESS OFFICE

P.O. Box 4020 Traverse City, MI 49685 231-947-8787

ON THE WEB tcbusinessnews.com

PUBLISHER

Luke W. Haase lhaase@tcbusinessnews.com

CONTRIBUTING EDITOR

Gayle Neu gneu@tcbusinessnews.com

HEAD WRITER

Craig Manning

STAFF WRITER

Art Bukowski

COMMENTARY BY GABE SCHNEIDER

support from the Great Lakes Fishery Commission, federal agencies like National Oceanic and Atmospheric Administration, the State of Michigan and local partners such as the City of Traverse City, the Traverse City Downtown Development Authority, and the Grand Traverse Band of Ottawa and Chippewa Indians.

In fact, just last year, state legislators appropriated an additional $1 million to advance the project. This stack of public commitments has already begun to attract global partners investing in research, technology and education to our region.

FishPass is just one example. The Freshwater Research and Innovation Center (the Center) is another transformative project bringing national and international attention – and capital –to Traverse City. A collaboration between Northwestern Michigan College, Traverse Connect, 20Fathoms, Discovery Center & Pier and Michigan Technological University, the Center is being developed as a hub for freshwater and marine innovation on West Grand Traverse Bay.

Fueled by a $15 million allocation from the Michigan legislature and $1.6 million in federal funding, the Center is already drawing interest from companies in advanced manufacturing, PFAS mitigation, marine sensor development and electric boat technology. This isn’t speculative – it’s already happening.

These projects reflect a powerful truth: public investment builds confidence. Policymakers didn’t fund FishPass or

CREATIVE DIRECTOR Kyra Cross Poehlman

CONTRIBUTING WRITERS

Ross Boissoneau

Kierstin Gunsberg Rick Haglund

COPY EDITOR Becky Kalajian

WEB PRODUCTION: Byte Productions

MAILING/FULFILLMENT

Village Press

DISTRIBUTION

Marc Morris

SERVING

Grand Traverse, Kalkaska, Leelanau and Benzie counties

the Center because of their novelty; rather because they leverage our assets and strengths: environment, talent and capacity to work together.

As the region continues to grow, high-quality healthcare access becomes more than a social priority – it becomes an economic one. The Grand Traverse Mental Health Crisis and Access Center is a prime example of how public investment is delivering real value on both fronts.

This new facility, a partnership between Munson Healthcare and Northern Lakes Community Mental Health, was funded by $5 million in American Rescue Plan Act funds and an additional $5 million from the State of Michigan targeted at pediatric mental health services.

Currently operating Sundays through Thursdays with 24/7 crisis phone support, the center will soon offer aroundthe-clock, in-person care for children and adults, regardless of ability to pay.

This is the kind of local, state and federal investments that supports families, strengthens our workforce and enhances the long-term viability of our community. Access to behavioral health services isn’t just a moral good. It’s an economic development strategy.

Public investment is working in Traverse City. These initiatives are not only creating high-value jobs and increasing property values, they’re making this re -

AD SALES

Lisa Gillespie lisa@northernexpress.com

Kim Murray kmurray@tcbusinessnews.com

Kaitlyn Nance knance@northernexpress.com

Todd Norris tnorris@tcbusinessnews.com

Abby Walton Porter aporter@northernexpress.com

Michele Young myoung@tcbusinessnews.com

gion a national model for collaborative, place-based economic development. But that momentum is fragile. At the federal level, growing concerns about efficiency, waste and fraud are slowing the flow of public dollars into projects like these, in communities like ours. Efforts to cut federal spending could eliminate Medicaid coverage for patients who need care. That’s a real risk – not just to funding, but to people and the collaborative model we’ve built here.

Traverse City’s continued success depends on strong partnerships between all levels of government and the private sector. Policymakers continue to support this region because they see something rare: a shared vision, a willingness to innovate and a proven ability to deliver.This is not a go-it-alone community. It’s an all-of-the-above strategy and it’s paying off.

For all of us, if you live here, visit here or are interested in being a part of Traverse City’s business and investment community, this is your moment. Public dollars have laid the groundwork – now it’s time to leverage those investments and build something enduring.

Whether you’re an entrepreneur, investor, developer, or philanthropist, there’s room at the table. You have the opportunity to invest not just in profit, but in place – in people, in innovation and in a regional economy built to last.

Gabe Schneider is a consultant, policy strategist and founder of Northern Strategies 360. He lives, works and invests in Traverse City.

The Traverse City Business News Published monthly by Eyes Only Media, LLC P.O. Box 4020 Traverse City, MI 49685 231-947-8787

Periodical postage qualification pending at Traverse City, MI.

POSTMASTER: Send address changes to The Traverse City Business News, PO Box 1810, Traverse City, MI 49685-1810.

The Traverse City Business News is not responsible for unsolicited contributions.

Content ©2025 Eyes Only Media, LLC. All rights reserved.

EYES ONLY MEDIA, LLC

Fueling Michigan today and tomorrow.

Every day, Michiganders depend on secure, reliable energy to heat their homes, fuel businesses, and power industries. Enbridge proudly delivers 55% of the propane used in Michigan.

We continue to modernize our energy infrastructure and further protect the Straits of Mackinac crossing by investing in the Great Lakes Tunnel.

As a North American integrated energy company, we’ve been delivering the energy the state needs for decades and we’re investing in Michigan communities and infrastructure. It’s how we’re building toward a better tomorrow.

Discover more at enbridge.com/Michigan.

By Art Bukowski

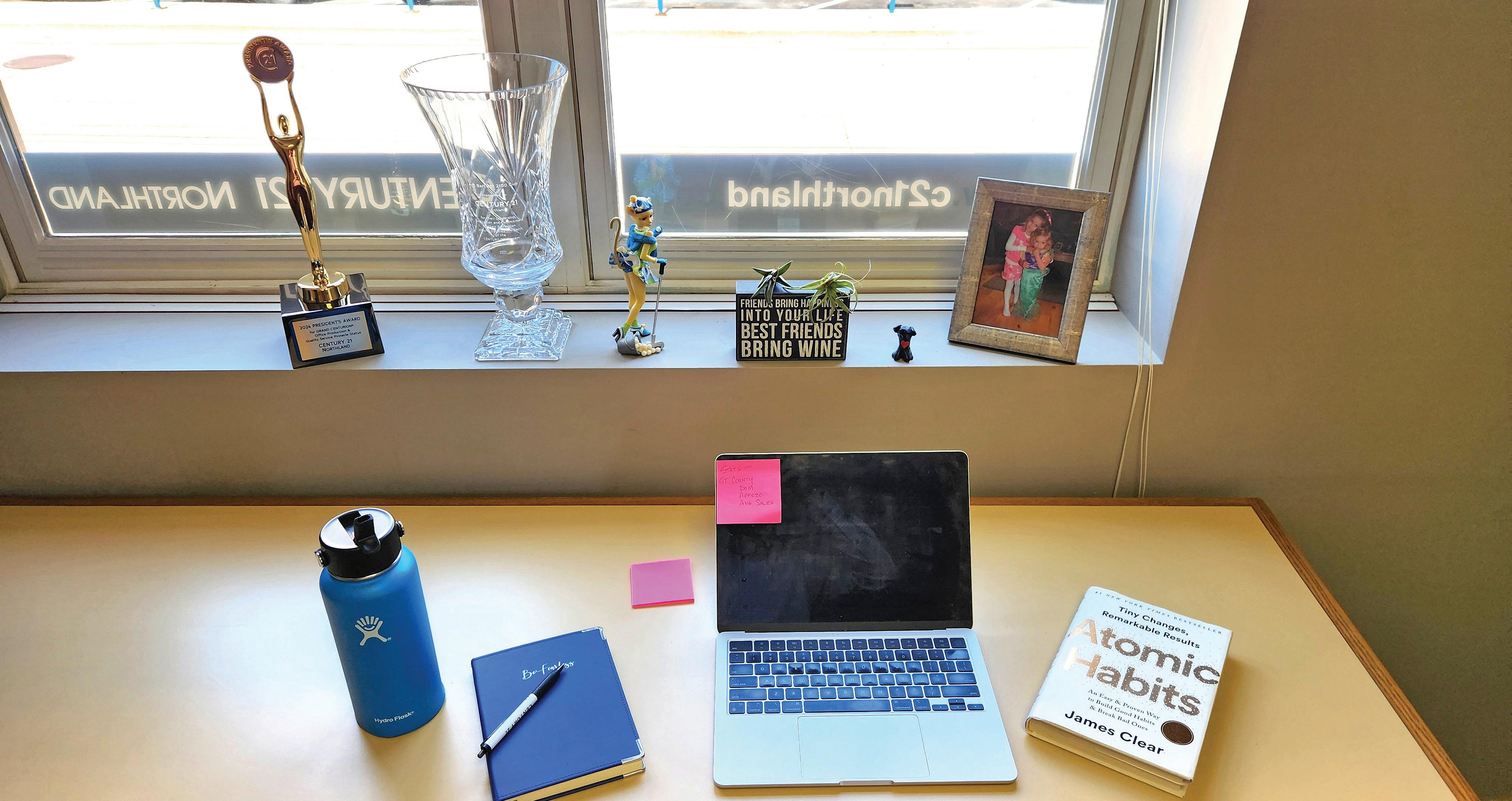

Meagan Luce is a broker/owner at CENTURY 21 Northland, which has 74 agents and multiple offices serving northern Michigan. She’s the first in our ongoing “From The Desk Of” series to not have an actual, permanent office. She likes to be mobile, and for this feature set up in some unused space in her company’s Traverse City office. We appreciate Meagan showing us around, and we welcome ideas for additional From The Desk Of ideas at abukowski@tcbusinessnews.com.

1. This note reminds me to pull stats. I’m always running stats and teaching agents how to run stats. They’re significant because they will show trends before the public or even our agents fully understand them. You need to know statistics if you’re a Realtor.

2. I’m using this notebook to help teach myself Portuguese. My girlfriends and I are going on a golf trip to Portugal this year, and this is where I’m putting things as I learn. I’m using my notebook for basic words and phrases. It helps me keep my thoughts clear as I’m taking lessons.

3. I talk about my girlfriends a lot. One of them is my business partner, Julia (Lilley). She and I are both very strong women, and we love encouraging other strong women. So we started a book club end asked other women to join us. It’s all about self growth and business growth. We read a book each month, then we sit together and talk about how we’re going to implement what we learned into our business lives and personal lives.

4. Those are my little babies. Lauren is now 22 and Alexis is 20. This is my favorite picture because it’s when they loved to cuddle me. Now it’s just when they want to, if they’re in the mood. It used to be whenever I wanted it!

5. In the United States, and globally, each Century 21 is individually owned. We’re usually one of the top one or two offices in the state of Michigan in terms of sales and customer satisfaction. Not only are we a high volume brokerage, but our agents also get very high reviews from customers. Nationally, we are in the top 10 percent of companies for these metrics.

6. I grew up with my mom golfing. She shot 36 holes a day. I just started three years ago, and I’m obsessed. My mom got me this little golfer because she was so excited.

7. I have a little dog. Her name is Pepper, and we’re all obsessed. She’s seven, and she’s fat and sassy – totally spoiled rotten. My daughter made this little model of her.

8. I’m super proud to be an owner and leader in this industry. I think it’s the best industry you could be in. We’re completely engaged with the community, and we’re advising people on the biggest sale or purchase of their entire lives. At Century 21 Northland we make sure our agents are the most professional, most ethical, most well-educated agents in the industry. We don’t have to worry about the consumer; we know they’re taken care of.

PRESENTED BY KEEN

KEEN has had the pleasure of implementing energy efficiency solutions throughout OPTITEMP facility in areas such as their production, warehouse, and front offices.

Installing LEDs to provide brighter, more consistent light with better color accuracy. These LEDs are far more durable and environmentally friendly, lacking hazardous materials and producing minimal heat. Making LEDs a smart and sustainable choice for any space.

Here it is, our annual list of the region’s top 50 single-family residential sellers in the five-county area and top 10 commercial sellers.

2024 was another banner year for northern Michigan real estate sales, as reported by The Ticker in January. Residential sales for 2024 in the five-county area more or less followed the same year-over-year price jumps experienced in the last half decade. According to real estate group Aspire North, 2024 closed with an average residential sale of $542,681 and a median sale of $399,975 across 2,506 sales (up from $502,697 and $380,000 in 2,538 sales in 2023).

Editor’s note: For the past eight years the TCBN has published the ranking for single-family residential sales in Grand Traverse, Leelanau, Benzie, Kalkaska and Antrim counties by local sellers. The ranking is based on the official MLS data provided by Realtors to their regional association. TCBN did not receive any MLS database access nor any information directly from Aspire North Realtors or Northern Great Lakes Realtors MLS for these rankings. Data is published as provided with no changes or manipulations. Those with an asterisk, in the top 25 only, are Realtors in 2024 who worked as a “team,” where properties sold by 2+ individuals are listed under one person’s name.

1

2 3 For commercial-only sales, see the list on page 15.

DONALD FEDRIGON RE/MAX of Elk Rapids, $56.9M

SAM FLAMONT * The Mitten Real Estate Group, $53.6M

Atlanta - ATL

Boston - BOS

Charlotte - CLT

Chicago - ORD

Dallas/Fort Worth - DFW

Denver - DEN

Detroit - DTW

Fort Lauderdale - FLL

Houston - IAH

Minneapolis - MSP

Newark - EWR

New Haven - HVN

New York - LaGuardia - LGA

Orlando/Sanford - SFB

Philadelphia - PHL

Phoenix/Mesa - AZA

Punta Gorda - PGD

Tampa/St. Pete - PIE

Washington DC - Dulles - IAD

Washington DC - Reagan - DCA

Cherry Capital Airport

26. RYAN CRAIG @properties Christie’s Intl. $17.6M

27. CORLISS BEUERLE Century 21 Northland $17.6M

28. STEVE SCHEPPE Viewpoint Realty $17.4M

29. CHRISTINE STAPLETON Stapleton Realty $17M

30. MATTHEW GEIB Viewpoint Realty $16.9M

31. BEN STREET Coldwell Banker Schmidt $16.7M

32. TAMARA MCLEOD HELSEL City2Shore Real Estate-NM $16.6M

33. TED SCHWEITZER Real Estate One $16.2M

34. AUBREY VANDEMARK The Mitten Real Estate Group $16.1M

35. GARY SCHEITLER Paradise Properties USA $16M

36. THOMAS ALFLEN EXIT Realty Paramount $15.5M

37. ROBIN VILTER Five Star Real Estate $15.4M

38. JONATHAN OLTERSDORF Oltersdorf Realty $15.3M

39. PAM DEPUY The Martin Co. $15.1M

40. ERICA MOHR Real Estate One $14.8M

41. KATHY WITTBRODT Wittbrodt Waterside Properties $14.8M

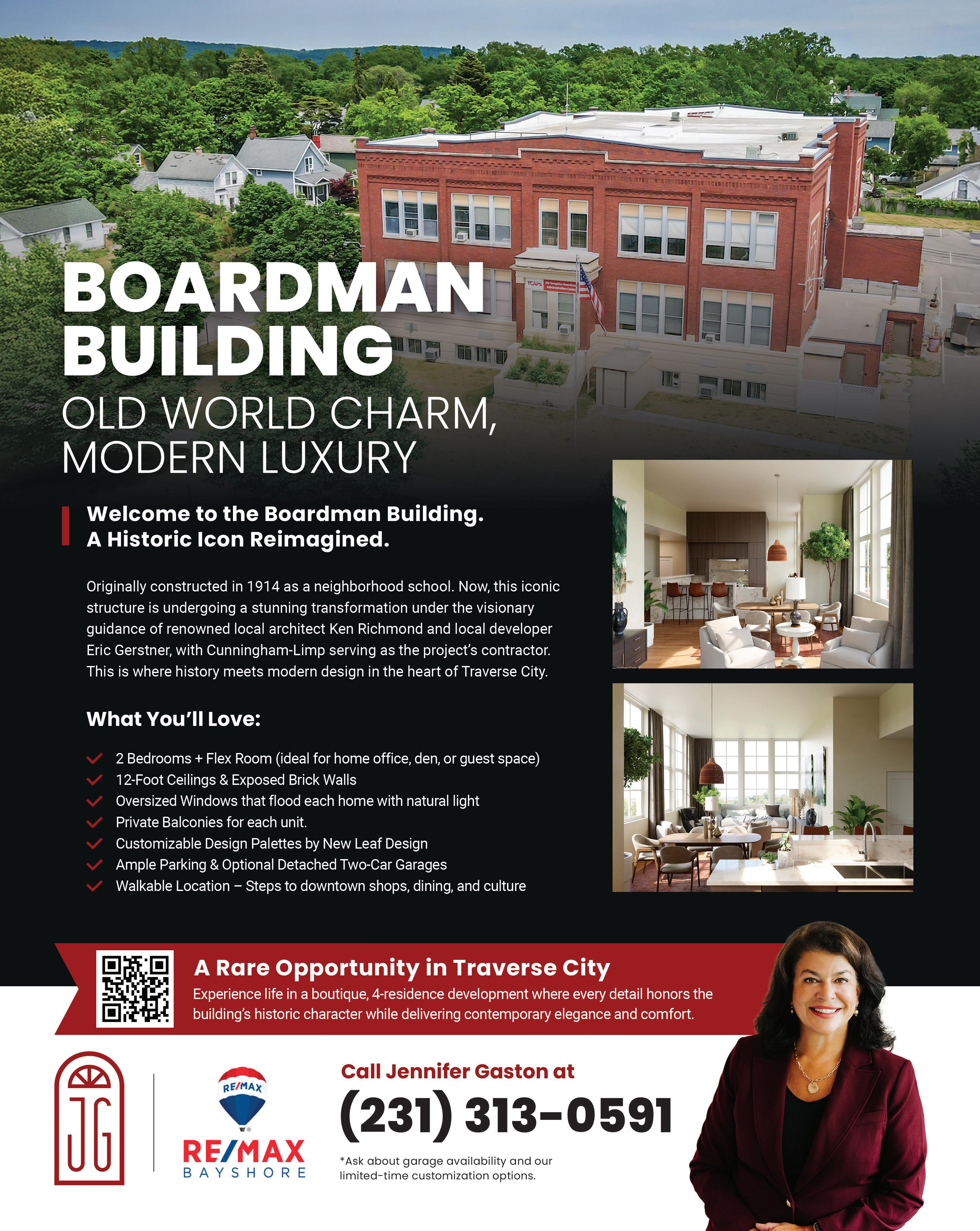

43. JENNIFER GASTON RE/MAX Bayshore $14.6M

44. TIA RIECK Coldwell Banker Schmidt $14.5M 45.

To live longer and healthier isn’t always lucky or by accident. Thankfully, we can identify the markers of longevity and start working backwards from there to slow down aging. Aevitas Medical is a “Medicine 3.0” practice in Traverse City that crafts personalized roadmaps to optimal health, designed specifically for your unique biology and lifestyle goals. We move beyond simply treating illness to actively optimize your health through advanced diagnostics, preventative strategies, and evidence-based interventions that traditional healthcare can overlook.

How is Aevitas Different?

The name ‘Aevitas’ draws from the Latin word for ‘eternity’ or ‘age,’ perfectly capturing our mission of extended, vibrant living. Our cutting-edge medical practice features state-of-theart equipment and advanced diagnostic testing, all housed in our premium facility with breathtaking views overlooking the Bay in Traverse City.

We assess our clients through comprehensive testing to precisely measure their longevity markers. Our evaluation includes body composition analysis via Dexa Scan, VO2 Max measurement, age-appropriate strength assessment, and optional advanced cardiovascular labs, hormone panels, and more.

Traditional “Medicine 2.0” waits until you’re sick to help. That’s not us. At Aevitas, we work to proactively optimize your health at every age. And let’s be honest— there’s no magic pill. Getting healthier takes expertise, guidance, and some effort. That’s exactly why we’re here.

Who started it?

Aevitas Medical was founded by a group of innovative doctors in Traverse City who want to push medicine forward. Our team includes physicians from Internal Medicine, Radiology, and Plastic Surgery.

You’ll be seeing Dr. Jeffrey Valice, the primary physician at Aevitas. He personally meets with all patients and brings impressive credentials—he’s a Certified Clinical Lipidologist and working towards becoming a Menopause Society Certified Provider, with extensive background in Exercise

Science and Fitness. His journey into longevity medicine started when he was helping loved ones live healthier lives.

What is your approach?

We’re pioneering Medicine 3.0—a game-changing approach to maximize both how long you live and how well you live. Instead of just reacting to disease, we proactively optimize your health using advanced diagnostics. We use comprehensive biomarker panels and genetic analysis instead of general recommendations, apply data-driven protocols tailored to your needs, address the biological mechanisms of aging, and spot problems before conventional medicine would even notice them.

You’ll get hour-long appointments, direct communication with your doctor, and specialized testing that uncovers hidden health risks—truly transforming healthcare from just managing disease to actually optimizing your health.

What services do you offer?

Think of benchmarking as your health starting point. This two-day deep dive shows where you stand today and where your health is headed. You’ll get a review of your medical history

and detailed blood work, a 90-minute testing session (VO2 max, DEXA scan, metabolic and strength testing), a personalized health assessment including a custom booklet, and a one-hour sitdown with Dr. Valice to make a plan. This service runs $3,000—significantly less than similar services elsewhere.

Our primary care patients get both cutting-edge longevity optimization and concierge care, including direct text messaging with Dr. Valice, same-day appointments when needed, access to our complete testing suite, and unlimited visits. Membership is $7,500 per person per year (potentially lower for couples or families). We keep our patient numbers limited to ensure personalized attention.

Our Executive Health Physical goes beyond benchmarking with additional cardiac and cognitive testing and a complete physical exam, all completed in one day. This service rivals what

you’d find at major health centers like Mayo Clinic, but with more personalized attention and longevity expertise.

We work with patients from 18 to 80+ years old. While starting earlier helps, we welcome people at any stage of their health journey. We take clients who have medical problems already and love to work with any level of health to optimize. All of us deserve the best chance at longevity.

As Dr. Valice says, “Investing in your health is the ultimate retirement savings plan. Being wealthy with poor quality of life isn’t what most of us want as we age.”

As we get older, health declines more rapidly, making optimization increasingly important. While insurance doesn’t cover these services yet, many patients use HSA funds. Consider it an investment to prevent the much higher costs of managing chronic disease later.

For more information, call (231) 2013376 or visit www.aevitasmedical.com

RECOGNIZING OUR TEAM

TCBN 40 UNDER 40

TOP 3 INDIVIDUAL AGENT REMAX BAYSHORE

• NEW TEAM OF THE YEAR REMAX BAYSHORE

The Live Traverse City Team is proud to announce it s partnership with PoWeR Book Bags! PoWeR Books Bags! is a volunteer-run nonprofit in Northern Michigan that boosts childhood literacy by providing free book bags filled with bo oks, writing tools, and playful materials to children—especially those in need—encouraging them to play, write, and read. Their mission is to help kids grow through language-rich experiences that build communication, connection, and confidence. A portion of all procee ds are donated directly to this 501(c)(3).

By Art Bukowski

There’s always something fun on the market in northwest Michigan. Here’s a look at some notable listings throughout the region. While these were active at the time this story was written, we can’t guarantee they weren’t already snapped up by the time this issue went to press!

501 Michigan Ave., Frankfort

Here’s a rare opportunity to own one of those homes up on the big bluff immediately north of Frankfort, and this is a particularly majestic example. This seven-bedroom, eight(!!)-bath, 4,800-square-foot home offers stunning panoramic views surrounded by a landscape that’s matured over the 90-year life of the home. Despite its age, the home offers dazzling mid-century modern details, “flawless” wood flooring throughout and many other updated amenities. The home’s location and surrounding landscape make it particularly secure from erosion issues that threaten other parts of this bluff.

$2.4 million

MLS#: 1931537

106 Oak St., Elk Rapids

$4.2 million

9500 Wilamont Circle, Mancelona

$579,000

MLS#: 25008923

Touted as “the pinnacle of waterfront living,” this 5,300 square-foot home has 350 feet of private shoreline and the perfect angle for blazing sunset views. It’s positioned on a slight point and is only four blocks from downtown Elk Rapids, giving it the perfect mix of lakefront seclusion and small-town charm. The expansive home was built in 1900 and is a nice blend of rich, opulent historical charm (ornate wood carving is featured throughout) with modern updates like heated floors and a loaded kitchen.

Looking for something different? Get in on the shipping container craze! This 2022 home was built using three 40foot shipping containers. It features a ground-level patio with an outdoor dining area, wood fire pit, gas grill and a six-person hot tub. A spiral staircase leads to a spacious rooftop deck, perfect for relaxation with outdoor furniture and a propane fire table. Inside, the open-concept design offers a contemporary and inviting living space with three bedrooms and two full bathrooms. Perfect for a personal getaway or to keep as a successful short-term rental investment.

Isn’t it time you splurged on a fully loaded equestrian estate? This luxury six-acre gated estate is adjacent to Flintfields Horse Park, home to the famed and increasingly prestigious Traverse City Horse Shows. The property, known as Pinecone Farm, was completed in 2024 with “no expense spared.” Among the many features and amenities include a main barn with four-bedroom, three-and-a-half bathroom residence above, an auxiliary barn with four-bedroom, two-bath staff accommodation and loads of state-of-the art stall space and supporting infrastructure. There’s also a spacious viewing lounge overlooking the show ring with plenty of space for indoor and outdoor entertaining.

6424 Brackett Rd., Williamsburg

$12 million

MLS#: 192675

15722 Waters Edge, Traverse City (Old Mission)

You’ll never get tired of soaking in all the shades of blue from this newly built Old Mission Peninsula waterfront gem. Perched 80 feet above East Grand Traverse Bay, the home is part of the gated Peninsula Shores community and offers cathedral ceilings, an oversized steam shower, a second-floor mezzanine, large covered patio and fully loaded kitchen. It also comes with a dedicated boat slip in the development’s designated marina, free of wait lists, additional dues or hassle. A whole-home Generac generator provides peace of mind when the weather takes a turn.

$3.6 million

You don’t get a lot of chances to own on the river in Leland, and it’s extremely rare for a property with this much potential to hit the market. Promoted as a “prime redevelopment property,” the 6,875 square-foot building for years has housed the popular sandwich shop Trish’s Dishes. The L-shaped lot is well suited for residential redevelopment, and includes approximately 178 feet of frontage on S. Main St./M-22 and 50 feet of frontage on the river. Aside from the café, the building currently houses office space in the middle and a residential townhome on the river, which is currently being used as a short-term rental unit.

There are few buildings in Traverse City more iconic than the stately Hannah Lay building, which has graced the corner of Front and Union streets for 140 years. Developers Tom and Nick Darga have been working meticulously in recent years to develop the top floor of the building into seven truly luxury condos with a variety of high-end features, including bay side balconies and rooftop living spaces. The location, historic charm and amenities in this 2,200 square-foot condo can’t be beat.

By Art Bukowski

The Grand Traverse region has never been short on real estate agents and brokers.

Hundreds of them are out there buying and selling little slices of northern Michigan paradise one closing at a time, and each has a different story about how they got there and what drives their passion for the industry.

The TCBN connects with four local agents who have a tale to tell.

How many local agents have been shot, stabbed and tased over the course of their lives?

We’re guessing it’s a list of one: Kelly Price of Century 21 Northland in Traverse City. Kelly is a New York City (Queens, to be specific) native who began her career in Florida, first as an emergency dispatcher and then a police officer.

She served in many roles over the course of her police career, she says, including narcotics officer, crime scene investigator, detective, DARE officer and more. She has stories for days, of course, including driving around to crime scenes with her young kids in the car, busting the local mayor in a prostitute sting and catching a bullet while responding to a bank robbery.

“I didn’t even realize I was hit at first. Thank God it missed my spine and it actually hit me in the fat part of the ass,” she said. “I just kept going because the adrenaline was pumping.”

It was an enjoyable chapter of her career, she says, but it was incredibly demanding.

“You do your regular job for eight hours,

but then the beeper is going off during the other 16,” she said. “When you’re crime scene, when you’re vice, three out of four nights that thing is going off.”

After the better part of 20 years in that life, Price came to Traverse City, where her husband (also a Florida police officer) is from. After another career chapter as an event coordinator for local dining establishments, Price has been in real estate since 2021 and loves every minute.

She admits to having a by-the-book, matter-of-fact way of going about business that comes from her time in law enforcement.

“I’m able to be very forward and ask the questions that I need answers to. I just don’t fuddle around. I have a unique class of clients who want that,” she says. “I’m a strong advocate for my clients, and I think that loyalty is a big deal.”

Price, of course, expects straight talk in return.

“Don’t call me up and tell me you have a 720 credit score because I know you’ve got a 450 and it just ain’t gonna work,” she said. “We’re not going to look at houses with a 450 credit score.”

Aside from closing deals, Price runs safety classes for local and downstate brokerages. She’s trained hundreds of agents in matters of awareness and self-defense, she says, with most local agents having taken the class.

“When I became a realtor, I wanted to bring my police experience to the realtor world,” she said. “Listen, this is the only occupation besides a prostitute

The Cop: Kelly Price Century 21 Northland Traverse City

where you bring a gentleman into the bedroom that you’ve never met before. Safety is important.”

And while she was president of the Women’s Council of Realtors of Northern Michigan, she’s adamant that these safety classes are not just for women.

“Men are assaulted (too), they just never report it,” she said.

Greenleaf Trust is here to help design the future you envision. Our team is exclusively dedicated to providing the highest level of comprehensive wealth management services, trust administration, and retirement plan services. Client relationships begin at $2 million.

Many agents come to real estate after time spent in another job, but it’s not all that common for them to leave a successful white-collar career to do so.

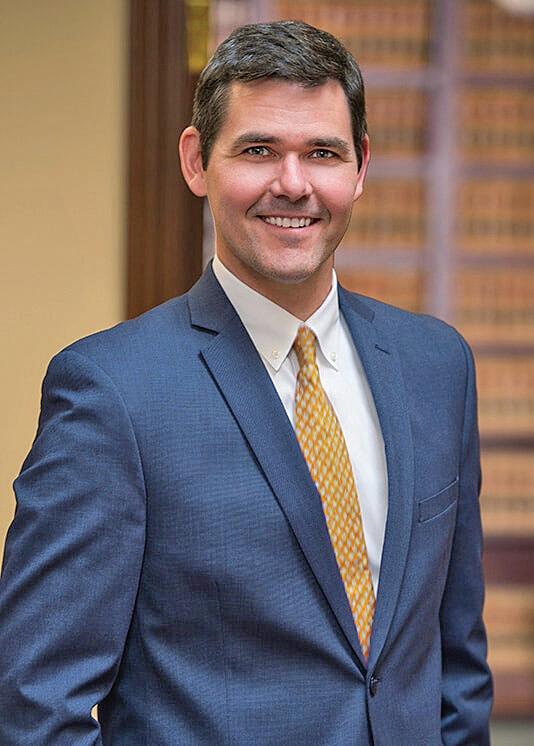

Alex MacKenzie earned his bachelor’s and master’s degrees in accounting from Michigan State University before passing the CPA exam and beginning his career in private and public accounting in the metro Detroit area. He got married and returned home to Traverse City, where he worked for a local CPA firm for a few more years.

As an accountant he worked with plenty of clients with commercial real estate holdings, and he found that world fascinating. After speaking with a few friends in the business, he made the leap in 2021.

“I didn’t make any money for two years in real estate. It was scary, but it was one of those things where I didn’t want to look back in 10 years and regret it if I didn’t do it,” he said. “My wife was very supportive.”

His value proposition as an agent is that his background gives him a clear picture of all the aspects of a commercial property.

“I was able to ramp up in this business because of the referrals I got from other agents in the industry,” he said. “If somebody has a complicated commercial real estate project ... and they don’t feel comfortable doing it themselves, they’ll refer it to me, and I think they have the confidence in doing that partially because of my background.”

He feels his accounting background makes him especially equipped to handle the buying and selling of both businesses and physical real estate.

“Commercial real estate is a lot more complex than the residential side of things a lot of the time … and understanding the nuances involved with the businesses that are operating in these commercial properties is important,” he said. “There’s a lot of people in the real estate business that understand the property side of it, but when there’s a business involved, I’m able to look at financial statements and understand what’s going on.”

This expertise allows him to provide “all-inclusive” service that his clients appreciate, he says.

“Often time it’s more efficient for the client because they don’t have to go get a full-blown business evaluation, which can cost significantly more money,” he said.

Now a few years in, things are going well for MacKenzie. He did 10 times the business in 2024 that he did the year prior, he says, and he continues to build his reputation while also managing 150,000 square feet of real estate and serving some

Build a welcoming, ‘up north lodge’ community center for a new manufacured housing development.

Burdco interpreted and fulfilled my greater vision for this building amidst major challenges, including design constraints, budget limitations and product shortages. Burdco executed the plan smoothly. The client communications were excellent. The details and workmanship are impressive and set a positive tone for the entire development. ”

The proliferation of real estate “teams” means that many sales attributed to an agent may not have been made by the agent themselves. The $40 million in sales under “John Smith” may actually be the product of his work in addition to that of one or more agents who work under him.

Over in Frankfort, hometown native Kari King racked up more than $28 million in sales in 2024 all by herself, roughly doubling her sales from the year prior. Some of these sales were outside of the MLS used for this issue’s realtor rankings, which shows her at $23.4 million.

“It was a crazy year for me,” she said. “It really came out of nowhere.”

While there isn’t a group of agents working under a “Kari King Team,” she’s quick to give credit to a combination of people and factors that have contributed to her success.

“Everything starts with the brokerage and their support of agents. I use a transaction coordinator who I think probably saved my life last year,” King said. “She’s been such amazing support behind the scenes.”

King knows her genuine local roots have also allowed her to get an edge in the real estate world.

“Connection to the community is the basis of my entire business,” she said. “Being born and raised here, I think it makes it easier for me to have that connection. The

people I’m working with are the people I grew up with.”

Finally, she credits her immediate and extended family for supporting her work, which isn’t contained to a 9-5 schedule. Her parents and husband help her juggle a busy home life with a demanding professional schedule.

“I definitely couldn’t do it without them,” she said.

King was born and raised in Frankfort before moving out to Sun Valley, Idaho for eight years while she worked as a sales manager for a sporting goods company. After she started having children, the pull of home became too strong, and she returned to Frankfort.

Her father was a broker at Crystal Mountain for more than 30 years, and her sister is a real estate agent in Grand Rapids. So, she decided to try her hand in the business.

“It ran in the family, plus I had a lot of sales background with my past career, so it was a natural fit,” she said.

About a decade on and she’s firing on all cylinders. And while strong sales numbers are always nice, she derives the most joy from continuing to serve her community.

“To be able to help some local families that I know really well find homes and be

Rebecca Brown is a Traverse City native who went to Central Michigan University for marketing and public relations. She started started pinching her pennies immediately upon landing a job at a local marketing agency.

“When I graduated college and got my first big girl job, I took saving really seriously,” she said. “I knew I wanted to get a home young – I didn’t want to rent or anything like that.”

She bought her first home at 23. She didn’t have the best experience with real estate agents during this process, and it was then that she first thought about the value she could provide to clients, especially young ones like herself.

“I had to do a lot of work on my own, but I loved being able to answer all of these questions because I had done the research,” she said. “What really sparked my interest was the need for a young real estate agent who really understands what young home buyers need. I didn’t feel like there was anybody like me out there in real estate.”

After being moved into sales at her marketing job and becoming disillusioned with that world, she connected with old boss and prolific Traverse City businessman Troy Daily, who (among many, many other ventures) is also a real estate agent with The Mitten Group.

Daily brought her on to handle social media and marketing for his businesses while she trained to be a real estate agent. That appealed to Brown as it allowed her to be selective about her real estate endeavors.

Marketing is also something Brown truly enjoys, so she wasn’t ready to give it up entirely.

“I feel like it’s something I’m naturally really good at,” she said. “I’m just chronically online.”

She’s also using marketing (videos on social media, in particular) to build her own personal brand and business.

“If you ask any top producer right now, I guarantee that cold calling is a major part of their business. And I have so much respect for it, but that’s not something that I want to do or that I’m good at,” she said. “So for me it was: How can I use social media? How can I put my personality out there? If I can use this tool and this resource and connect with a younger audience and get business from it, then that’s awesome.”

So far, it’s working. She’s closing deals, and the focus has been where she always wanted it to be.

“I think I’ve done maybe just under $3 million in volume, and 100% of my closed buyers from my first year on the buy side were all first-time home buyers … who were all primarily young,” she said. “That’s very important to me.”

Like all young agents, Brown is still learning. The key, she says, is to recognize that fact and embrace it. Giving yourself the time (and patience) to learn and grow will help build a much stronger and successful agent in the long-term, she says.

“When you first start, they talk a lot about how you have to have confidence. But how am I going to have confidence when I literally just started this? I didn’t have a transaction for the first four months,” she said. “So I looked at: How am I presenting myself? How am I walking into a room? How am I shaking somebody’s hand? What is my answer when I don’t know the answer? That’s a big one.” The

“It puts me in a position where I’m not desperate to sell. I never want me keeping my lights on and food in my belly dependent on somebody needing to buy a home,” she said. “I don’t want them to ever feel like I’m pushing them into buying a home because I need a sale.”

Remember the 80’s?

Lori’s hair is smaller, and so are her interest rates

By Eric Braund, columnist

Investing in real estate has long been a reliable way to build wealth and can effectively diversify your overall investment portfolio. Based on our experience, buying or selling real estate necessitates a thorough analysis of various financial aspects, including financing options, cash flow analysis, tax considerations and how these decisions align with your overall financial planning goals.

Many of our clients with real estate investments typically fall into one of two categories:

1. Planning to buy. They own a primary residence and are planning to purchase an additional property in a warmer climate, such as Florida or Arizona.

2. Planning to simplify. They own multiple residences or investment properties and have decided to simplify their lives by downsizing, reducing the burden of managing several properties.

When thinking about acquiring a second home for retirement or as a rental investment property, it is essential to assess how this second home will affect your annual lifestyle budget and the overall costs associated with investment real estate.

Some aspects to consider:

• Financing: Options include refinancing the primary mortgage, opening a home equity line of credit, outright purchase or a conventional mortgage. Consider the cash flows involved and how self-funding or loan payments might affect the overall financial situation.

• Interest rates: Interest rates and the terms of financing are critical factors in analyzing the viability of the purchase. Even half a point on the interest rate may be the difference as to whether a property is affordable or if the rental will be “cash-flow positive.”

• HOA, insurance, taxes, and other expenses: Many second and retirement homes are purchased in exclusive communities where the burden of property maintenance is outsourced. These conveniences come at a cost and fees tend to rise each year. Insurance in warmer climates

and coastlines is expensive and property tax assessments have risen substantially.

Between 2019-2023, insurance coverage in Florida has risen 60% and some insurers have canceled coverage altogether.[1] There may also be travel costs or property management expenses.

• Legal titling: Consider alternative titling for the additional property, such as a revocable trust to avoid dual-state probate issues or holding rental property in an LLC to avoid personal liability risks. These are important legal questions best answered by a qualified attorney.

For those looking to downsize or simplify their lives, it is essential to carefully analyze the tax implications involved. Strategies to minimize taxes, as well as considerations for special tax issues and other selling costs, should be discussed well in advance of the sales process. Depending on future objectives and in collaboration with your financial and tax advisor, it may be possible to defer or even eliminate taxes entirely.

Strategies may include: • Strategic use of the residency exclu-

sion: If you’ve declared the property as your residence for any two of the previous five years, you (and your spouse) may exclude up to $250,000 each in capital gains from taxation. The rules are specific, but with careful documentation and planning, the tax savings could be substantial.

• Depreciation and other deductions: With rental real estate, annual depreciation deductions taken are brought back in the final tax calculations for the sale of the property. Figuring these into the sales analysis is critical to avoid surprises. Past improvements to the property may raise the cost basis (and lower capital gains), so keep records of these expenses.

• Utilizing a Section 1031 Exchange Election: Simultaneously selling and buying similar-type investment property may defer capital gains taxes on the sold property using this tax strategy. 1031 rules are strict, so it’s critical to work with your advisor, tax professional, and a “1031 specialist” to coordinate the sale and purchase and to maintain compliance with the criteria.

While the financial and legal aspects of real estate should be a priority, it’s also important to consider other factors that can

impact your potential investment. These factors include location attributes, property type and your overall game plan and exit strategy. These are crucial criteria to keep in mind when making your decision.

Navigating the complexities of real estate investing, especially when trying to align it with your overall financial strategy, can be overwhelming. A wise first step is to seek professional guidance from a fee-only Certified Financial Planner® and a tax advisor. They can help you determine which strategies will be most beneficial for your individual situation and goals.

Eric Braund, CFP®, CRPC® is the founder and CFO at Black Walnut Wealth Management, a fee-only financial advisory firm providing counsel and fiduciary financial services to individuals, families and private foundations throughout the Traverse City and northern Michigan region. Contact him at (231)421-7711 or visit BlackWalnutWM. com. Braund is an investment advisor representative with Dynamic Wealth Advisors, dba Black Walnut Wealth Management. All investment advisory services are offered through Dynamic Wealth Advisors.

By Art Bukowski

If you haven’t already heard terms like “direct primary care” and “concierge medicine,” you will soon enough.

While there is considerable variation and overlap with how these terms are used, both generally involve making direct payments to a healthcare provider outside of the traditional insurance system.

Direct primary care (DPC) practices often operate on a flat monthly or annual membership fee that covers most primary care services with no insurance billing at all. Concierge medicine practices often combine a membership fee of some sort for certain services while continuing to bill insurance for additional services.

Practitioners that adopt these models, particularly DPC, tout patient benefits that include cost savings, improved access to care, enhanced doctor-patient

Table Health

Location: Traverse City and Petoskey

Founded: 2018

Employees: 12 between two offices

Patients: 991 DPC (3,250 total for all services)

Describe your services. Table Health offers direct primary care (DPC) in Traverse City and Petoskey for individuals and businesses featuring an affordable monthly fee for comprehensive primary care. This includes same-day, next-day, and after hours care from your doctor, discounts on labs and common medications, with the elimination of insurance billing and surprise costs. Beyond DPC, Table Health provides functional medicine, wellness services (bodywork, nutrition), and mental health. Practitioner-led workshops and events are also available.

How do people pay for your services?

Almost all services are membership based, with a one-time enrollment fee followed by a monthly fee, which most people choose to have automatically charged to their credit card for ease and convenience. That’s it. No insurance billing or balance billing. No explanation of benefits form. No copay. No deductible. Not billing insurance allows us to keep our operations streamlined, fees reasonable, and everyone less focused on billing and more focused on the patient. Everyone is happier in this model.

Pricing structure: For DPC, $100 one time enrollment fee followed by a $57 or $99 per month payment depending on age and type of membership.

What is special or unique about your office or the way it does business?

Table Health distinguishes itself among

relationships and a focus on preventative care. Providers love not dealing with insurance paperwork or claims and often have much lower administrative burden. Many speak of having more time to focus on patients instead of bureaucracy.

Both DPC and concierge medicine are experiencing significant growth nationwide, with hundreds of practices coming online in recent years.

Pure DPC practice Table Health was the pioneer of this method in the Traverse City area. Since Table Health opened its doors in 2018, several other DPC or concierge outfits have arrived. Some are fully local while others are local offices of larger groups. In addition, at least one established local office has providers moving to a concierge model.

What follows is a roundup of some local DPC/concierge practices, with their operations described in their own words. Please note that this should not be considered a complete list – a few practices that classify themselves in this way did not respond to TCBN’s inquiries.

DPC practices through three core elements. First, it operates as a mission-driven business, prioritizing community impact over profit. This commitment shapes all decisions, fostering a palpable sense of purpose for staff, patients, and employer clients. Second, Table Health offers a comprehensive suite of primary and

preventative services within one location, enabling a collaborative and convenient healthcare experience. Finally, its unique company culture, symbolized by its name, emphasizes equality and respect. This “horizontal” approach empowers both staff and patients, creating an inclusive and valued environment.

Stowe Farm Pediatrics

Location: Suttons Bay

Founded: 2023

Employees: 1 full-time, 3 part-time

Patients: About 200

Describe your services: I am a board-certified pediatrician offering full-spectrum primary care pediatrics in a warm, caring, and personalized setting. I describe it as practicing modern pediatrics in an old-fashioned way. Families pay a monthly membership fee for services, and in turn receive an unparalleled level of access and direct communication to me and to my nurse practitioners. Our appointments are longer and unhurried, it’s easy to schedule an urgent visit quickly, and we offer home visits as well. We strive to provide thoughtful, comprehensive, evidence-based care for newborns through young adults, with the patient and family at the center, and with a focus on relationships, trust, and continuity. How do people pay for your services? Families pay a monthly membership fee in exchange for our primary care services. We do not bill insurance for our services, which allows us to maintain a small patient panel where we know every family well, to provide quick and direct communication with families, to offer longer/ less rushed appointments, to offer home visits, and more. Families are still able to utilize their insurance for other aspects of healthcare when needed: for prescription coverage, for specialist visits, for labs and

Dr. Phoebe Danziger

imaging when needed. We partner with a company called Vaxcare to provide immunizations in the office, and Vaxcare is able to bill these through families’ insurance. Pricing structure: We have a tiered pricing structure. For one child, membership is $150/month for infants from 0 to 12 months, $125/month for children ages 1-5, and $95/month for children 5 and older. There are more routine well child visits and often more frequent needs in the younger age groups, so the pricing accounts for this. For families with multi-

ple children, there is a family maximum of $300 per month. Families sometimes find that with such a high level of primary care, DPC membership often ends up being less expensive than care provided elsewhere because of how frequently we are able to avoid expensive urgent care or ER visits and co-pays, unnecessary specialist referrals, and more. What is special or unique about your office or the way it does business? Practicing in a direct primary care model allows us to offer an environment that feels like

an intimate, old-fashioned medical practice. Our appointments are more relaxed and unrushed, we have a clean, fun, and comfortable space for kids to play, and we offer communication through a secure texting app which allows easy ongoing communication with families as needed. We are able to offer fun community events like children’s yoga classes and our annual “Farm Animals and Flu Shots” event where families can come for seasonal vaccines and visit with some sweet animals like goats and mini horses!

hemming& Wealth Management truly believes in financial planning for life-long fulfillment. Whether you’re dreaming of a forever home, new car, your retirement lifestyle, or a lasting legacy, we’ll help you make purposeful decisions and ensure your financial plan is well-coordinated and effective in reaching your goals.

Life looks good on you.

Location: Services provided in-home across 10 northern Michigan counties

Founded: 2023

Employees: 4

Patients: 100

Describe your services: Waterfront Wellness Primary Care transcends traditional titles, blending aspects of both DPC and concierge models. While we do not accept insurance, our practice emphasizes the convenience and direct access characteristic of affordable concierge care. We provide straightforward, old-fashioned unlimited access to healthcare at an affordable price; no office staff or middlemen involved. Recognizing the value of your time, we offer personalized in-home medical visits tailored to your specific needs, eliminating travel hassles. Our board-certified practitioners are committed to delivering high-quality care with convenience, privacy, and affordability in mind. Additionally, we accommodate one-time visits for you and your loved ones, making our services accessible to both seasonal and permanent residents.

How do people pay for your services?

We offer flexible membership Primary Care contracts of 3, 6, or 12 months,

with the option to cancel anytime with 30 days’ notice. For those seeking simple one-time services for themselves or area visitors, we provide an introductory visit at $150, ensuring no copays or hidden fees. Additionally, we accept HSA/FSA payments but we do not bill insurance.

Pricing structure: $200 per month. What is special or unique about your office or the way it does business?

Waterfront Wellness Primary Care is a locally-owned practice that provides unique at-home medical visits, offering a fresh and personalized approach to healthcare. Patients can easily schedule

timely visits and directly contact their board-certified practitioners via cell, email, or tele-health. Our services include in-home lab work, along with the convenience of portable x-rays and other necessary in-home diagnostics, all designed to enhance your healthcare experience.

Molly Buttleman

Camille Campbell

The Shawn Schmidt Group

International President’s Circle

Kevin Perkins

Bob & Tia Rieck Team

Dean Templeton International

Bart Ford

Mark Hagan Real Estate

Katie Hanson

Pam Klumpp

Sue Louiselle

Adam Miller

Vera Owen

Shannon

Judy Robinson

Karen Schmidt

Milda Stapleton

The Bill Stireman Team

The Street Team

Leslie Young

Location: Grand Rapids, with Traverse City office opening in a few months

Founded: 2024

Employees: 17 total, 6 in TC

Patients: 5,000; expect an additional 2,000 in Traverse City

Describe your services: MIPH features a team-based care model, which means we utilize experienced physicians and other providers, including physician assistants, nurse practitioners, nurses, medical assistants and health coaches, all of whom are supported by physicians who are board-certified in pediatrics, internal medicine and family medicine with expertise in caring for children, older adults and substance use disorders. Patients enjoy an increased ability to connect with our primary care team with benefits such as same day or next day appointments, longer appointments and closer relationships with their provider. Our model includes in-person and telemedicine visits, phone consultation and secure messaging. MIPH focuses on prevention and wellness, along with diagnosis and treatment of common chronic diseases and acute illnesses.

How do people pay for your services? Individuals/families pay a monthly membership fee that includes unlimited primary care encounters (in-person visits, virtual visits, secure texts, phone calls) and in-office procedures. Employers contract with MIPH for primary care services for their employees and dependents. Employers offer on-site primary care services, shared near site locations or direct their employees to an MIPH office. We don’t bill insurance for primary care services, but coordinate with each individual’s health plan to make sure they get the best value for their insurance. Insurance is still needed for labs, imaging, specialty visits, and hospital care.

Pricing structure: Individual memberships range from $60 to $160 per month and family memberships are capped at $300 per month. Employer pricing is variable depending on the site of care, number of employees enrolled and services provided. On a per employee per month formula, it ranges from $45$60/month. This is generally paid for entirely by employers. What is special or unique about your office or the way it does business? MIPH provides customized company-wide employer healthcare to employers to help improve wellness, lower healthcare costs, and support recruitment and retention efforts through easily accessible primary care services. While it will always be important to us to offer plans for individual patients outside of employer plans, the vast majority of our current patients are enrolled through employers. We have a multifaceted leadership team with industry insights, high patient satisfaction and care delivery that lowers the use of urgent care and emergency department visits. We navigate complex health systems at a lower cost and are connected with a broad specialty physician network. MIPH provides premier primary care services and manages most conditions without having to leave our care.

Location: Traverse City

Founded: 2024

Employees: 6

Patients: 200

Describe your services: We are a comprehensive primary care practice providing personalized healthcare for patients ages 14 and older. Our services include preventive care, annual physicals, and the management of chronic conditions such as diabetes, hypertension, thyroid disorders, and gastrointestinal issues. In addition to general primary care, we specialize in hormone optimization for both men and women, addressing issues such as hormonal imbalances, low testosterone, and perimenopause/menopause. Our weight management programs are tailored to each individual, focusing on sustainable, results-driven strategies that support overall health and wellness. We emphasize patient education, lifestyle modification, and evidence-based treatments to help our patients achieve their long-term health goals. Our approach combines compassionate care with clinical expertise to ensure every patient receives the attention and support they deserve.

How do people pay for your services? We offer flexible payment options to accommodate a variety of patient needs. We accept most major insurance plans and also provide a monthly membership plan for those seeking ongoing care without traditional insurance. Additionally, we offer an exclusive concierge service for a limited number of patients, providing highly personalized care and enhanced access to our providers. Our goal is to make quality healthcare accessible, convenient, and tailored to each individual’s preferences.

Pricing structure: Along with most insurance plans we offer direct primary care at $75 per month after an $100 enrollment fee. Our employer program is $50 per employee (minimum of 5) after a $50 enrollment fee per person.

What is special or unique about your office or the way it does business? What sets our practice apart is the intentional and thoughtful selection of our care team. Each provider was hand-picked not only for their clinical expertise, but also for their deep commitment to patient-centered care. Our team brings specialized knowledge in key areas such as gut health, weight management, female hormone balance, primary care, and chronic disease management. This allows us to offer comprehensive, personalized treatment plans tailored to each patient’s unique health journey. We prioritize quality over volume, ensuring our patients receive attentive, compassionate, and evidence-based care. By fostering strong patient-provider relationships and staying current with the latest medical advancements, we create an environment where people feel heard, supported, and empowered in their wellness goals.

Location: Traverse City

Founded: 2004

Employees: 10

Patients: 3,500 (about 750 and growing enrolled in MDVIP, a concierge service)

Describe your services: As MDVIP affiliates, we maintain smaller practices, which allows us to spend more time with each patient to focus on disease prevention and early detection, as well as help manage chronic conditions. We schedule same- or next-day appointments that last an average of 30 minutes and our patients can reach us 24/7. The cornerstone of our services is the Annual Wellness Program, which encompasses advanced screenings and diagnostic tests that focuses on important health and wellness areas including heart health, emotional well-being, diabetes risk, respiratory health, quality of sleep, hearing and vision, sexual health, nutritional assessment, weight management, bone health, risk factor analysis. Using the results we work with patients to create a personalized wellness plan and provide ongoing physician coaching to help them make lifestyle changes to achieve their health goals.

How do people pay for your services?

The annual MDVIP membership fee pays for preventive care medical services, notably the Annual Wellness Program, which insurance does not typically cover. We bill insurance and collect copays/

deductibles as is customary for other medical services like sick visits. The MDVIP program is compatible with most health savings accounts. Patients outside of the MDVIP program use insurance.

Pricing structure: The annual membership fee is $2,100 and can be paid annually, semi-annually or quarterly. What is special or unique about your office or the way it does business?

The current healthcare system is pushing providers toward a “make it quick” medicine model, forcing them to hurry patients in and out the door to stay afloat. At Bay Area Family Care, with help from MDVIP, we offer another option to our patients. With longer visit times, we are able to connect with our patients on another level. We use this extra time to learn more about our

patient’s healthcare needs, lifestyle goals and obstacles. We are able to craft a customized plan for the individual, work to overcome insurance push-back and help achieve their goals. Our providers are wonderful listeners and have a tremendous capacity for empathy. Our support staff is genuinely invested in the health of our patients. Together, our family care team is like no other.

Four months in, northern Michigan’s new mental health crisis center is thriving

By Craig Manning

“A soft opening.”

That’s how Munson Healthcare officials describe the first few months at the new Grand Traverse Mental Health Crisis and Access Center.

After years of planning and buildout – not to mention big funding allocations from the American Rescue Plan Act (ARPA) and from the Michigan Health & Hospital Association (MHA) – Traverse City’s new mental health crisis center finally opened its doors on January 5. Come July, the facility will transition out of its “soft opening” era and into full 24/7 operations.

Ahead of that big milestone, the TCBN sat down with the core leadership of the crisis center to get an update on patient volumes, timeline for new services and more.

The new center is a partnership between Munson Healthcare and Northern Lakes Community Mental Health Authority, two entities that have been looking to expand northern Michigan’s continuum of mental health care services for years.

“The best practice in a community crisis continuum is that everybody knows a place to call, so a crisis hotline; a place to go, so a crisis center; and someone to come to you, which is a mobile crisis

unit,” explained Terri Lacroix-Kelty, executive director of behavioral health for Munson Healthcare. “When you have those pieces in place, then you have a really good crisis continuum – a system where, if people are getting into crisis, you’re intervening early.”

According to Lacroix-Kelty, northern Michigan has had the crisis hotline and mobile crisis unit parts of that equation

opening “a long time coming,” and praises the project as proof “that patience and persistence pays off.”

“We’re really grateful, because without that support from the ARPA funding and then the MHA grant, we wouldn’t be as far along as we are. You really do need that money piece squared away to get things started,” Lacroix-Kelty said.

The ARPA money for the center was

“We’re hoping people come before crisis. So, if parents are realizing, ‘Wow, my child seems to be struggling; I don’t know what to do,’ we want them come to us with those access and support questions sooner rather than later.”

– Terri Lacroix-Kelty, Executive Director of Behavioral Health, Munson Healthcare

covered for years, thanks to Northern Lakes. Until now, the Grand Traverse region did not have a crisis center dedicated specifically to mental health services.

That changed this past January, when Munson and Northern Lakes opened the Grand Traverse Mental Health Crisis and Access Center in a 22,000-square-foot building on the Munson Medical Center campus. Lacroix-Kelty calls the center’s

allocated all the way back in December 2022, when, during their final meeting of that year, Grand Traverse County commissioners apportioned out the county’s $18.1 million in ARPA funding to 30 local recipients. The single largest of those allocations was a $5 million earmark for mental health services and infrastructure in Grand Traverse County – money that led eventually to the new center.

In September 2023, Munson landed an additional $5 million in funding from the MHA, for “adding much-needed pediatric mental health and crisis services in northern Michigan.” That grant came from a larger $50 million appropriation in the 2023 state budget, aimed at improving access to youth behavioral health services throughout Michigan.

Right now, the crisis center is operating Sundays through Thursdays from 8am to 8pm. Munson Healthcare COO Laura Glenn says the idea was to treat the first few months “as kind of a soft opening,” with opportunities to introduce the new center to the community and for the staff to navigate the learning curve before expanding to round-the-clock service. That pivot to 24/7 operations is intended to take place in July – as is the opening of a “psychiatric urgent care” component, which will serve both adults and children.

“Those are really the next big milestones for us,” Glenn said.

During its first phase, the center has been offering a Northern Lakes-operated welcome center, with services including behavioral health assessments, referrals to higher levels of care, crisis phone screening, mobile crisis services and peer support services.

With the second phase kicking off in

July, the center will add not just 24/7 operations, but also the aforementioned psychiatric urgent care, which will be operated by Munson staff. Northern Lakes, meanwhile, will continue to focus on the center’s current more relaxed approach, which Michael Corby, behavioral health director for the center, describes as a “living room model” of mental health care.

“We’ve got a combination of social workers and peer support specialists in the building, and we have this big, beautiful new space where we’re able to de-escalate patients and help them figure out what the next steps are for them,” Corby said of the living room model, noting that the center was specifically designed to be a more comfortable and relaxing environment than the typical hospital setting. “A lot of the time, what we’re seeing is individuals brought in by a support – so either a family member or a concerned boyfriend, girlfriend, or roommate – and typically it’s folks who are experiencing a crisis and they just don’t know what to do next.”

Patients in need of de-escalation are welcome to stay at the center “until they’re in a better frame of mind.” That de-escalation aspect has been the core selling point of the center’s first phase, though Corby stresses the facility’s professionals have also been able to help patients and their families make game plans for the future.

“Sometimes that’s plugging the patient into resources and appointments for

outpatient care,” Corby explained. “Sometimes that’s doing a hospital screening assessment, and we have admitted some people to the hospital. But we’re also finding that this center is a great resource to be able to talk with folks who are thinking they want to go inpatient, because maybe that’s what they’ve done in the past. But after talking with them for a while, we’re able to de-escalate, create a safety plan for them to go home, and provide resources.”

Because Traverse City hasn’t had a

crisis center of this ilk before, Glenn and Corby say one of the big priorities of the first few months has been to rewire the thinking around mental health in the community. Historically, Glenn says patients experiencing mental health crises in the Traverse City area have taken those concerns to the emergency department at Munson Medical Center (MMC) – a costlier and less well-suited course of action.

“Part of what we were trying to accomplish with the center was to have it be lo-

cated close to the emergency department,” Glenn said, noting that the proximity will make it easy for ED staff to refer patients experiencing mental health crises to a facility better-equipped to meet their needs.

Lacroix-Kelty echoes Glenn’s point, explaining that having a recognized “hub” for mental health services in the community will make a big difference.

“The center will be the known place to go when people need information or treatment around mental health,” Lacroix-Kel-

ty said. “We’re hoping people come before crisis. So, if parents are realizing, ‘Wow, my child seems to be struggling; I don’t know what to do,’ we want them come to us with those access and support questions sooner rather than later.”

Based on patient numbers, Corby is confident the community is becoming more aware of the center and more used to accessing its services. Across the first three months of operations, the center tallied 155 “contacts,” or patients who came through the door seeking care. In January, just 40 people visited; by March, the monthly visitor count had roughly doubled.

“Part of that increase is probably just seasonality, but I think a far bigger part is people becoming more comfortable at the center,” Corby said. “It’s proof that we’re getting the word out.”

Corby expects the center will continue to see more patients as summer rolls in, especially with the shift to 24/7 service in July. Another bump will come later, when Munson and Northern Lakes open phases three and four of the center’s evolution: a nine-bed adult crisis residential unit and a six-bed pediatric crisis residential unit, respectively.

Both of those residential units will be situated inside the 22,000 square-foot footprint of the center. The adult unit is already built out and is “just working through the licensing and staffing,” per

Glenn. That unit, which will be operated by Northern Lakes, is likely to open sometime this year. The pediatric unit, meanwhile – which Munson will lead – is still awaiting a buildout.

“Youth crisis residential is a relatively new kind of model, and the licensing requirements are a bit complex,” Glenn said. “We’ve been in the design process on that unit, and we have blueprints in with the state for their review. We’re excited to begin construction, hopefully this summer or early fall. But we don’t have an exact date on which that will open, just because we’re still working through the design and build process.”

Once those residential components open, Glenn is confident the center will become an even more valuable tool for reducing strain on other aspects of Munson’s operations.

“A component of the population that we will serve in these crisis residential units are people that have historically ended up in our emergency departments, and have ended up staying there for prolonged periods of time because they’re not safe to go home,” Glenn explained. “A lot of those people will be able to receive care in these crisis residential units, which honestly is a way more appropriate place for them to receive care than in an emergency department.”

MMC does have a small inpatient psychiatric unit already, but Glenn says that part of the hospital is “frequently at

capacity,” with plenty of opportunities to relocate patients into a “less acute environment” of care.

Crisis residential units, Corby says, will provide that “step-down” in care, in that they will still offer a “24/7 monitored environment,” but without the intensive, “locked door” approach of an inpatient wing at the hospital.

Right now, northern Michigan’s closest crisis residential units are in Gaylord and

Oscoda, making them less than ideal for Traverse City patients. Having those types of units right at the center of the Munson system has been on the wish list for quite some time.