By Paul Donohue, CRMS

6

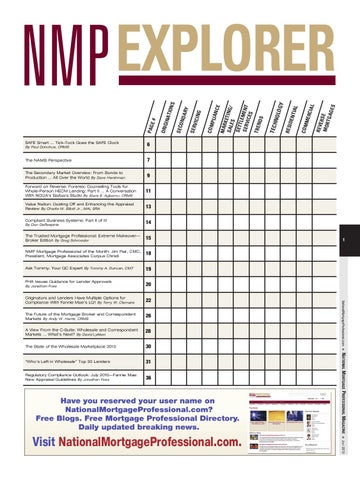

The NAMB Perspective

7

The Secondary Market Overview: From Bonds to Production … All Over the World By Dave Hershman

9

SAFE Smart … Tick-Tock Goes the SAFE Clock

Value Nation: Dusting Off and Enhancing the Appraisal Review By Charlie W. Elliott Jr., MAI, SRA

13

Compliant Business Systems: Part II of III By Don DeRespinis

14

The Trusted Mortgage Professional: Extreme Makeover— Broker Edition By Greg Schroeder

15

NMP Mortgage Professional of the Month: Jim Pair, CMC, President, Mortgage Associates Corpus Christi

18

Ask Tommy: Your QC Expert By Tommy A. Duncan, CMT

19

FHA Issues Guidance for Lender Approvals By Jonathan Foxx

20

Originators and Lenders Have Multiple Options for Compliance With Fannie Mae’s LQ1 By Terry W. Clemans

22

The Future of the Mortgage Broker and Correspondent Markets By Andy W. Harris, CRMS

26

A View From the C-Suite: Wholesale and Correspondent Markets … What’s Next? By David Lykken

28

The State of the Wholesale Marketplace 2010

30

“Who’s Left in Wholesale” Top 30 Lenders

31

Regulatory Compliance Outlook: July 2010—Fannie Mae: New Appraisal Guidelines By Jonathan Foxx

36

S

AL COM MER CI

DEN TIAL

RESI

GY

NOL O TECH

MAR KE SALE TING/ S SETT LE SERV MENT ICES TREN DS

NCE COM PLIA

SERV

ICIN G

Y NDA R

SECO

INAT

REVE R MOR SE TGA GE JULY 2010

Visit NationalMortgageProfessional.com.

1

NATIONAL MORTGAGE PROFESSIONAL MAGAZINE

11

NationalMortgageProfessional.com

Forward on Reverse: Forensic Counseling Tools for Whole-Person HECM Lending: Part II … A Conversation With NCOA’s Barbara Stucki By Atare E. Agbamu, CRMS

ORIG

PAG

E#

IONS

EXPLORER NMP