$9,995

The average cost of a burial funeral using commonly selected services and merchandise 1

$5,825 The average cost of cremation funeral using commonly selected services and merchandise 1

ADDITIONAL COSTS

$6,385

Based on flowers, obituary notice, grave opening and closing, burial plot, etc. Optional costs could go as high as $10,000 depending on what is purchased. 2

ADDITIONAL COSTS

$1,545

Based on cremation casket, rental casket, alternative cremation container, urn. 1

$15,595+ Total cost of typical burial and funeral services

$7,370+ Total cost of typical burial and funeral services

• Single pay whole life insurance product

• Provides a secure financial protection option for estate planning and end-of-life expenses, when combined with a choice of two free, irrevocable trust options

• The policy value increases daily with simple growth and the maximum face amount is $100,000.

The best part? Everyone qualifies.

NGL’s single pay whole life product, when combined with our trust options, offers an increasing death benefit and provides a secure financial protection option for final expenses and estate planning.

Calculation of premium: Premium is the face amount multiplied by the appropriate premium rate.

AssetGuard earns daily simple growth.

Understanding your client’s needs will help you decide which trust is best.

When combined with the right trust, NGL’s AssetGuard allows your client to transfer up to $100,000 of their assets to a beneficiary while also setting money aside for end-of-life expenses.

By this age, clients have learned how to live in retirement and are familiar with their monthly and annual expenses. Now they’re thinking about how much money they can pass to loved ones.

They have sufficient assets and likely won’t need to qualify for Medicaid. Their goal is to not only set aside and protect funds for their end-of-life expenses but also to pass on a limited amount of accumulated wealth to family or charity.

They have limited assets and may need to qualify for Medicaid. Their goal is to set aside and protect funds for end-of-life expenses.

The NGL Estate Planning Trust makes it easy for clients to transfer wealth to heirs and charities. It’s free to your clients, with no trust fees. It can be used in conjunction with any existing trust they have.

Benefits

• Trust proceeds are income tax-free

• Funds available immediately, exempt from probate

• Assets are safe from creditors

• Trust is totally free

• Funds are totally portable

• Everyone qualifies

• Simple to use – just add a trust assignment form to insurance application

• Funds paid within 48 hours**

• The peace of mind the trust provides your clients is priceless

NGL Estate Planning Trust ($2,500 to $100,000)*

• Set aside up to $100,000 to transfer assets and cover final expenses

• Ideal for leaving a financial legacy to loved ones and charities

• Not designed for Medicaid planning but may be exempt asset under Medicaid guidelines after 60month lookback

• Funeral costs paid first with excess funds directed to named beneficiaries (as many as desired) or the estate of the insured

• Trust is policy owner and beneficiary

*Individual state regulations including product availability, allowed maximum or minimum, may vary by state. We recommend your client contact a legal advisor for complete details on irrevocable assignments, Medicaid eligibility and using a trust to protect their assets, including a life insurance policy. Montana’s maximum for NGL Estate Planning trust is $25,000.

Educate your clients on irrevocable assignments and the resulting permanent transfer or ownership of policy rights.

Not able to surrender, loan or receive a premium refund after free look

Not able to change ownership or beneficiary

Not able to change policy face amount or plan

NGL’s Funeral Expense Trust will protect your client’s assets and possibly help them qualify for Medicaid.* It’s free to your clients with no trust fees. It can be used in conjunction with any other trust they have.

Benefits

• Proceeds are income tax-free

• Funds are available immediately — no need for probate

• Assets are safe from creditors

• Trust is free

• Funds are portable to any funeral home provider

• Everyone qualifies

• Add a trust assignment form to insurance application to use

• Funeral providers are paid within 48 hours**

• Provides peace of mind for your clients

NGL Funeral Expense Trust ($2,500 to $15,000)*

• Set aside up to $15,000 to cover funeral and other final expenses

• May be exempt assets under Medicaid guidelines**

• Can help qualify for Medicaid now

• Funeral costs paid first with any excess funds going to the estate of the insured

• Trust is policy owner and beneficiary

*Individual state regulations including product availability, allowed maximum or minimum, may vary by state. We recommend your client contact a legal advisor for complete details on irrevocable assignments, Medicaid eligibility and using a trust to protect their assets, including a life insurance policy.

**Medicaid limits the face amount of policies assigned to the NGL Funeral Expense Trust which they will consider excluded assets in the following states. Limits as of 07/30/2025: AZ - $9,000; CT - $10,000; DE - $15,000; GA - $10,000; IA - $13,125; IL - $8,212 (Illinois policies that are assigned to the NGL Funeral Expense Trust will be issued up to the current state Medicaid limit ($8,212), or up to the $15,000 limit if we are provided with verbal confirmation that a guaranteed Prefunded Funeral Agreement (PFA/SGS) will be obtained at the time of Medicaid application); IN - $10,000; KS - $11,670 LA - $10,000; MO - $9,999; NE - $6,346; PA$15,000 (premium); SD - $15,000; TN - $6,000; UT - $7,000; VT - $10,000

Educate your clients on irrevocable assignments and the resulting permanent transfer or ownership of policy rights.

Not able to surrender, loan or receive a premium refund after free look

Not able to change ownership or beneficiary

Not able to change policy face amount or plan

Existing Funds

Use money from savings, 1035 Exchanges, etc.

If your client is interested in easily transferring wealth, as well as funding their final expenses, please see information available on the NGL Estate Planning Trust.

Protected funds earn interest (income tax-free) until time of need

Claim paid Funeral provider paid within 2 business days

If your client is interested in protecting assets for Medicaid qualification and funding their funeral, please see information available on the NGL Funeral Expense Trust.

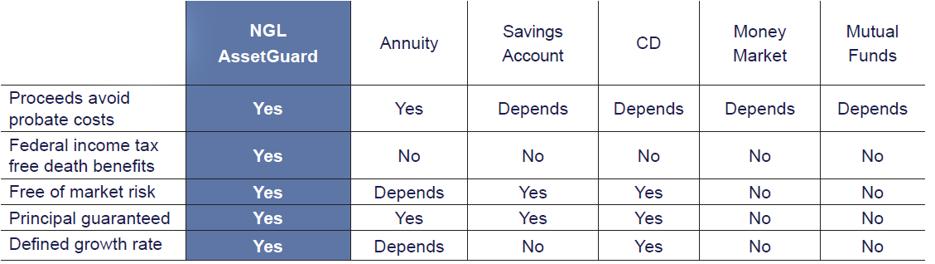

AssetGuard provides funding for funerals, other final expenses and allows the easy transfer of a portion of assets while avoiding some of the common disadvantages of other funding options.

Are your funds protected?

Transferring ownership into one of NGL’s trusts is another step that may help protect assets and the easy transfer of wealth. The trusts ensure that funeral expenses are paid first and that you are protected from any creditors .

The policy may be considered an excluded asset to qualify for Medicaid and Supplemental Security Income (SSI). If you are assigning ownership to the NGL trust and apply for public assistance, you may be required to provide a list of services and products you have selected from your funeral home of choice.

*Not available in Indiana. Indiana residents may use the NGL Final Expense Trust, which offers similar benefits using an Indiana-based trust.

**Some states may vary on Medicaid rules and eligibility is not guaranteed; please consult an Elder Law Attorney in your state for assistance.

***Unless put into trust for funeral expenses.

What about clients with ample financial resources?

This has been the standard advice given by attorneys and financial planners, but the reality is that their clients rarely follow through and nothing gets done.

Your clients may have ample resources, but following their death, they may not be readily available to pay end-of-life expenses. This poses a problem with most funeral homes requiring immediate payment prior to providing service.

What is the leverage value of AssetGuard?

The goal of AssetGuard isn’t to leverage or increase an asset — it’s to protect it. AssetGuard is a guaranteed issue, whole life insurance product, typically sold to older adults (ages 66-99) through a simplified underwriting process.

With funeral homes typically requiring payment prior to providing services, the lack of proper planning shines through, and this puts a heavy strain on the family. It could even lead to a delay of the funeral.

An AssetGuard policy irrevocably assigned to one of NGL’s trusts avoids many of these issues.

AssetGuard, combined with the NGL Estate Planning Trust, ensures the liquidity of funds when they’re needed. This allows the family to focus on grieving rather than finances.

What is the standard for claim payouts?

• For policies assigned to the NGL Funeral Expense Trust (FET) and NGL Estate Planning Trust (EPT), our goal is to process 100% of claims within two business days, once all claim requirements are received.

• Payment is typically sent via check or EFT the following business day after it is processed. The check may be sent via overnight mail for an additional fee, if elected.

What are the requirements for filing a claim?

• A completed claim form (who signs the form depends upon whether the funeral home or beneficiary is filing).

• A copy of the funeral bill showing either paid in full or the outstanding balance.

• Additional information may be required if the cause of death is not natural or under other circumstances.

• If the policy is not assigned to either the FET or EPT, please allow 5-10 days for the claim to be processed.

When is a death certificate required?

• If the death occurred in IN, KY, LA, or MA.

• If the cause of death is not natural (accidental, suicide or homicide).

• Whenever a beneficiary is filing direct, a copy of the death certificate is always required.

How can I assist the family in filing a claim?

• Notify the funeral home performing the services and request they file the claim.

• Call NGL at 800.988.0826, provide the date of death and request a claim form be sent via mail, email or fax.

• If the beneficiary is filing direct, assist them in completing the claim form and in acquiring the necessary documents including the funeral bill (proof of payment, if paid in full) and a copy of the death certificate. Paperwork can be sent to NGL via fax at 866.228.9450 or securely email it to nglclaims@nglic.com.

The policy first pays for funeral expenses, burial and cremation for the Insured (a list of services and merchandise qualifying for reimbursement with proper documentation can be found on either Funeral Expense Trust or Estate Planning Trust Irrevocable Assignment forms).

Any funds left over after funeral expenses are paid will be paid to one of the following:

• Policies in the Funeral Expense Trust

Paid to the Estate of the Insured

• Policies in the Estate Planning Trust

Paid to named beneficiary(ies)

If the insured received Medicaid/State Assistance, proceeds may be required to be paid to the state in which the insured resided.