A shop of their own

After years of selling at local farmers markets, Hexagon Bagels settles into a North Adams storefront. Page 7

A shop of their own

After years of selling at local farmers markets, Hexagon Bagels settles into a North Adams storefront. Page 7

By GreG Sukiennik

PITTSFIELD — Artificial intelligence isn’t coming for jobs in long-term care. That’s a person-to-person, labor-intensive field with challenges and rewards a computer can’t handle.

But more than five years after the COVID-19 pandemic, Pittsfield-based Integritus Healthcare, like other long-term care and health care providers, still faces workforce challenges created or worsened during that time.

The workforce pipeline for health care workers has grown scarce, just as the need for long-term care is about to skyrocket.

Integritus decided to build its own pipeline.

Since identifying and beginning that work in 2009, with the launch of its first

strategic plan, Integritus has brought about 200 people into nursing careers through support of higher education, training and career development.

An investment of nearly $3 million has aided in the career development of 70 registered nurses and 84 licensed practical nurses and led to 19 nurses earning bachelors of science in nursing degrees.

Integritus operates 15 skilled nursing centers with 1,950 beds and four senior housing communities with 227 independent living units and 1,789 assisted living units.

“As nurses and aides retired or left the industry altogether, we’ve come to the other side of [the pandemic] with this challenge,” said William Jones, the

nonprofit’s president and CEO. Integritus offers care including independent senior living, rehabilitation, memory care and hospice. Like other longterm care providers, Integritus has relied upon “traveling nurse” staffing services to backfill openings. Those services pay a “significant premium” to those workers, and the cost is passed along to

the long-term care facility, Jones said.

“We’re not alone,” he said. “Every organization has had to deal with this challenge.”

Developing and retaining workforce not only provides jobs for the region but also helps its largest long-term care and rehabilitation provider operate at lower cost, he said.

“We have a strategic partnership with McCann Tech,” Jones said. “If you’re a CNA and want to become an LPN we’ve always paid your tuition and picked up the cost of books and uniforms. Last year we began to pay individuals to go to class as if they were working.”

A paycheck for going to school? Yes, Jones said, and explained why that makes sense.

“Many times we’re dealing with single moms who can’t juggle child care and get to class during the day,” Jones said. “So we’re doing things like that … to moti-

4

BY JIM ZARROLI

The New York Times

The Thornewood Inn in Great Barrington was once the quintessential New England bed-and-breakfast, with its cozy four-poster beds and a wraparound porch, drawing tourists from Boston, New York and beyond.

But these days, many of the Thornewood’s rooms are filled not with leaf-peepers and antique-hunters but with the people who wait on them.

They’re people like Adam Figueiredo, 32, who was working at a coffee shop in town when he was looking for a place to live this summer. After months of not finding anything he could afford, Figueiredo came across the Thornewood. It had been converted into a kind of modern-day boardinghouse by Community Development Corp. of South Berkshire, a nonprofit group that develops affordable housing, and opened this year.

Rent for a room, which comes with a private bathroom and a shared kitchen, starts at $900 a month, in a town where the average rent is $2,500, according to Zillow. Nearby, the Windflower, another inn once popular with

tourists, was also repurposed as housing for workers and opened in 2023.

Both properties are much needed in Berkshire County, where high housing costs and a tight market in towns such as Great Barrington and Stockbridge have made it challenging for workers in sectors such as education and health care to find a place to live. The apartment vacancy rate in the county is 3.7 percent, down from 6.2 percent in 2018, and evictions have nearly doubled, according to the UMass Donahue Institute, which studies housing.

“It’s hard to buy a home on $50,000 a year, or even afford rent at this point,” said Marybeth Mitts, a member of the Lenox Select Board. Mitts said housing in her town had “changed radically since the pandemic.”

“A lot of the available housing stock started to get purchased because people were leaving Boston and New York and coming out to the lovely Berkshires,” she said.

Growth in population leveled off by 2023, but the market remains tight. The number of new building permits issued in Massachusetts has “increasingly lagged the national aver-

age” since the Great Recession that started in 2007, according to the Federal Reserve Bank of Boston. The UMass Donahue Institute estimates that the state will face a shortfall of 222,000 homes by 2036.

In Berkshire County, new construction has been even more anemic, said Brad Gordon, executive director of UpSide413, a nonprofit organization that provides housing services. Many towns have sought to preserve their rural character by passing zoning rules requiring 2- or 3-acre sites for new homes, making it expensive to build, he said. The lack of sewage and water services has further limited new construction.

Last year, Gov. Maura Healey signed the Affordable Housing Act, aimed at encouraging more construction. The bill allows accessory dwelling units to be on the same lot of a single-family house, allowing homeowners to build, for example, a cottage in their backyard that could be rented out. State officials say more than 90,000 new housing units have been built or are under development since the law passed.

The bill also designates re-

HOUSING, Page 3

sort areas, such as Cape Cod, Martha’s Vineyard and Nantucket, as “seasonal communities.” Among other things, the designation allows towns to build housing specifically for workers without violating discrimination laws.

Eight towns in the Berkshires where more than 40 percent of homes are occupied by part-time residents also received the seasonal-housing designation. But towns need to opt into the program to take advantage of the provisions, and none in the Berkshires had done so as of this month. The Berkshire Eagle reported last month that only six people in the county had applied to build accessory housing units.

Officials from several towns, including Lenox and Stockbridge, told The New York Times that they were still weighing the bill and declined to comment.

As Gordon sees it, a certain ambivalence toward the construction of affordable housing has long existed in the region. Many people say they understand the need for more housing, he said, “but if that was something that was next door to them or in their neighborhood, I don’t think that percentage would be as high, unfortunately.”

Efforts to build more housing have sometimes faced opposition. In 2019, for example, residents in Lenox voted down a mixed-income housing project on a town-owned parcel near another new housing development, arguing that it would strain the town infrastructure. A second, 65-unit project, called the Forge, was approved — close to a highway and farther from the town’s center.

Patrick White, who grew up in Stockbridge and is chair of the Stockbridge Affordable Housing Trust, said the housing squeeze threatens to alter the area’s character. Visitors have long been drawn to Stockbridge for its Gilded Age mansions, a certain Norman Rockwell charm and attractions such as Tanglewood, the summer home of the

“It’s hard to buy a home on $50,000 a year, or even afford rent at this point,” said Marybeth Mitts, a member of the Lenox Select Board.

Boston Symphony Orchestra.

But Stockbridge has always had a sizable year-round middle-class population as well — and that’s changing, White said.

“Nine out of 10 sales in Stockbridge are now going to seasonal residents, because the real estate around here

has gotten so expensive,” he said. Forty-four percent of homes in Stockbridge are owned as second homes and by outside investors, according to state data.

White worries that Stockbridge is at risk of becoming another Provincetown, a Cape Cod community with a tiny population of full-time residents. If things don’t change, no one will be left to teach children, put out fires or serve in local government, he added.

“Everything stops working if you don’t have people here from September through May,” he said.

The housing crunch in the state’s resort towns has also been exacerbated by short-term rentals. Homeowners would rather rent to vacationers during peak season over residents year-round because it generates more income, said Edward M. Augustus Jr., the state’s secretary of housing and livable communities. (Nantucket residents voted this month to back a measure that would allow them to rent their properties without a minimum

length of stay.)

“That year-round rental might have gone to a municipal employee or somebody who’s working in a year-round service industry and now has lost that opportunity,” Augustus said.

Even with the slow start, though, Augustus said he believed that many towns would eventually vote to adopt the seasonal housing designation — in large part because of the growing worker shortage.

Schools in particular say they have trouble attracting teachers and other workers. “We live in a community where a starting teacher would find it very difficult to buy a house or even be able to rent year-round,” said William E. Collins, the superintendent at Lenox Public Schools.

In Great Barrington, Fairview Hospital has had to increasingly recruit from outside the area, said Anthony Scibelli, system vice president and chief operating officer.

“We have people that drive in from Connecticut and New York and from farther into the county,” he said.

In the meantime, some employers have had to get creative about the housing squeeze. Josh Irwin confronted a thorny problem a few years ago when recruiting a chef for a restaurant he owns in New Marlborough.

The candidate “kind of put the ball in my court: ‘You find me a place to live, ’cause I’ve had no luck yet,’” Irwin said. So Irwin did something increasingly common among business owners in the area. He bought a small cottage on a nearby lake for his employees to live in. Irwin had also planned to turn Windflower into worker housing, but the plan was later carried out by Construct, a housing nonprofit.

The housing problem has become only more urgent, Irwin said. Some businesses have had to reduce hours or close because they can’t find workers.

“It’s hard to ignore it when you go to your neighborhood coffee shop and the door’s locked, and there’s a sign out front saying, ‘Sorry, no staff.’”

This article originally appeared in The New York Times.

Naturalgasisoneofthesafestandcleanestburningenergysourcesavailable. That’swhyitisAmerica’snumberonefuelchoice.Deliveringsafe,reliablenatural gasservicetoourcustomersisourtoppriority.

Usingyoursenses

Despiteanexcellentsafetyrecord,naturalgasmayposeahazardandhasthe potentialtoignite.Anaturalgasleakisusuallyrecognizedbysmell,sightorsound.

SMELL Adistinctive,pungent,“rotteneggs”odor.

SIGHT Awhitecloud,mist,fog,bubbles,blowingdustordeadvegetation.

SOUND Anunusualnoiselikeroaring,hissingorwhistling.

Whatyoushoulddoifyoususpectaleak

MOVE toasafeenvironment.

CALL usimmediately.Weareavailabletorespond24hoursaday,7daysaweek.

DONOT strikeamatch,usetelephones,orswitchon/offappliances,lights,oreven aflashlightintheareawhereyousmellnaturalgas.

Pipelinesafety

Thenaturalgaspipelinesystemisthesafestmethodoftransportingenergy,and pipelinesunderneathstreetsplayavitalrole.Whilerare,pipelinefailurescanoccur duetocorrosion,materialdefects,eventsofnature,excavationdamageandmore. Weensurepipelinesafetythroughtheplanning,design,operation,maintenance, inspectionandtestingofpipelines.Andweworkcloselywithemergency responderstoprepareforandrespondtoemergencies.

CallBeforeYouDig(www.digsafe.com)

Thegreatestrisktoundergroundpipelinesisaccidentaldamageduringexcavation onpublicandprivateproperty.Toprotectnaturalgaspipelines,thelawrequires thatallcontractors–evenhomeownersplanningtobuildadeck,patiooraddition –notifyDigSafeat811atleasttwofullworkingdaysbeforeexcavating.Wewill markourfacilitiesintheareaofwork,andatnocost.

vate and inspire individuals who want to advance their career by making opportunities like that available to them.”

Integritus also has a long-established relationship with Berkshire Community College, which is seeing its nursing program grow in part thanks to the state making community college tuition free.

“We’re having some good results this year,” Jones said of Integritus’ investment in training and education.

“Looking at net hires, the difference between new hires and people who leave is significantly improved from where it was a year ago,” he said. “It’s going to take some time, unfortunately, but we’re making the necessary investment to be here for the long run.”

Integritus employs 2,850 people, with 1,263 of those workers, or 44 percent, employed in its Pittsfield headquarters and eight Berkshire County entities, including HospiceCare in the Berkshires. It also operates facilities in Greenfield, Leeds, Holyoke, East Longmeadow, Danvers, Peabody, New Bedford, Bourne and South Yarmouth.

Integritus operates 15 skilled nursing centers with 1,950 beds and four senior housing communities with 227 independent living units and 1,789 assisted living units.

Jones said Integritus has “a terrific group of people who do a remarkable job making a difference in the lives of the people they serve.”

The need for long-term care will only grow as the region’s

as of Oct. 1, Jones said, and he’s thankful for the local statehouse delegation’s advocacy. That said, he remains concerned about the federal and state picture.

“We do a lot of work to educate decision-makers on the impact of the decisions they make and try to help them see the reality of what we’re dealing with,” Jones said.

“We went into pandemic organizationally with an outstanding balance sheet,” he said. ”I always thought … there would come a day we’d have to lean on that balance sheet. I never thought it would be a pandemic.”

Post-pandemic, the company’s financial position is “very strong.” Jones said.

“Our volume levels are at or better than pre-pandemic levels and our teams across the commonwealth have done a remarkable job navigating pandemic in a way that ensures our longterm viability and sustainability,” he said. “We have tremendous confidence in where we’re at and where we’re going.”

According to data provided by Integritus, it recorded revenues of $301 million in 2024, an increase of 11.3 percent.

population ages. As of the 2020 U.S. Census, 36 percent of the county population was at least 60 years old. The largest age range in the county, at 18 percent, is people between the ages of 60 and 69, according to that data.

In August, Gov. Maura Healey’s Viability and Sustainability of Long-term Care Facilities Task Force, citing projections by the UMass Donahue Institute, reported the state could be facing a deficit of skilled nursing beds by 2035.

That crunch could come as soon as 2029, a former state official analyzing the same data told State House News Service.

To that end, Integritus is making an investment that it hopes will result in additional housing as well as long-term revenue. It’s partnering with the owners of the Berkshire Mall in Lanesborough on a proposed 420-unit senior housing community. The project, estimated at more than $100 million, also would include re-

tail shops.

“I thought we should reach out, because this is what we do: It’s our mission,” Jones said in August of Integritus’ involvement. “If there truly is a need for additional senior housing in the Berkshires, we want to be involved in that.”

Insurance reimbursements, especially those from Medicaid, don’t match the cost of providing care and are often not paid in a timely fashion. Massachusetts increased its Medicaid payments

The organization intends to stick around for the long haul, Jones said when asked if it would ever consider a sale to a larger provider.

“We’re not for sale. Our roots are over 100 years deep here in the Berkshires,” Jones said. “We have a strong balance sheet. We’re the largest not-for-profit post-acute operator in the state and we take that responsibility seriously. We’re focused on providing high-quality post-acute services, and we’re committed to doing that in the long run.”

Cain Hibbard and Bulkley Richardson have merged, creating a strategic alignment of two

Cain Hibbard has a rich history spanning more than six decades and with Bulkley Richardson

Berkshire Bounty nets

$30K food rescue gift

Berkshire Bounty, a nonprofit food rescue organization, has received a donation of $30,000 from Warrior Trading to support its end-of-year fundraising campaign.

Warrior Trading, founded in 2012 by Ross Cameron, is an online educational platform for individuals interested in day trading.

Berkshire Bounty aims to raise $175,000 from individual donors and local businesses by the end of 2025, an increase from previous years due to growing community need and greater reliance on private funding.

In 2025, Berkshire Bounty provided nutritious food for 21,000 individuals weekly through partnerships with 32 emergency food sites, including food pantries, schools and senior centers; continued a program that purchases locally grown foods for the food-insecure population; and expanded a food box program delivering food directly to homes of food-insecure people in Berkshire County.

For more information, visit berkshirebounty.org.

PITTSFIELD

Credit union continues Spanish training for staff

Early in 2026, Greylock Federal Credit Union will offer its fifth cohort of Spanish for Bankers, a free 16-week program offered to all Greylock employees who wish to gain and improve Spanish language skills.

Taught during business hours, the course includes eight weeks focused on vocabulary and punctuation, followed by eight weeks of cultural perspectives shared by native speakers and real-world scenario practice.

This initiative is part of Greylock’s ongoing commitment and service to Hispanic and immigrant communities.

Four Greylock branches — West and Kellogg streets in Pittsfield, Lee, and Greenport-Hudson, N.Y. — hold the Juntos Avanzamos (“Together We Advance”) designation bestowed on credit unions who serve and empower Hispanic and immigrant consumers.

For information about Greylock’s Inclusion, Diversity, Equity, and Accessibility (IDEA) initiatives, visit tinyurl. com/yuekbmdn.

PITTSFIELD Habitat for Humanity offers financial training

Central Berkshire Habitat for Humanity is expanding its focus on financial empowerment and sustainable homeownership through two new initiatives.

In September, Habitat launched a Financial Coach Training Program with Sarah Singer, a professional coaching consultant, and Coral Cook, a part-time Habitat financial education trainer, to prepare volunteers to mentor future Habitat homebuyers. Graduates will offer one-on-one coaching to guide families

Paul Kaplan of Berkshire Bounty delivers a van full of food to the South Community Food Pantry in Pittsfield. In 2025, Berkshire Bounty provided nutritious food for 21,000 individuals weekly through partnerships with 32 emergency food sites, including food pantries, schools and senior centers, among other programs.

through budgeting, goal-setting and overcoming financial challenges.

Habitat has also relaunched “Building for Tomorrow,” a free, 10-week financial education program led by Cook. Open to the public and required for Habitat homebuyers, the course covers budgeting, credit, home maintenance, mortgages, inspections, appraisals and insurance.

The current session is underway, with another planned in the new year. For information or to join the waitlist, email Cook at MoneyEd@berkshirehabitat.org.

PITTSFIELD Western Mass. firms forge strategic merger

The law firms of Cain Hibbard & Myers and Bulkley, Richardson and Gelinas have announced a merger, effective Dec. 1 to forge a strategic alignment in Western Massachusetts.

Cain Hibbard, a firm with a long history in Berkshire County, has offices in Pittsfield and Great Barrington; Bulkley Richardson has offices in Springfield and Hadley. The merged firm will be the largest full-service law firm in the region with 45 lawyers.

“With this merger, Cain Hibbard will step into a new chapter of its rich 60-year history,” said Lucy Prashker, Cain Hibbard’s managing partner and president. “Our practices are highly complementary, as is our firm culture, including a tradition of giving back to our communities.”

Dan Finnegan, managing partner at Bulkley Richardson, called it an “ideal union.”

“Combined, we are even stronger, sharing an unwavering commitment to client service, and a collaborative spirit that brought us together,” he said.

The merged firm will maintain all four offices and it will operate under the

Bulkley Richardson name. It will retain all lawyers and support staff of both firms.

1Berkshire is accepting applications for the 2026 class of the Berkshire Leadership Program.

The program seeks, prepares, involves, and sustains individuals from diverse backgrounds who are committed to and competent in addressing community challenges and improving the quality of life in the Berkshires. Close to 700 community-minded individuals have graduated from the program since its inception in 1997.

The Class of 2026 will kick off with a two-day retreat April 24-25. The retreat is followed by weekly sessions on Thursdays, April 30 through June 25, focusing on areas of economic development, health care, tourism, creative economy, education and community involvement.

Application deadline is 4 p.m. Jan. 7. The cost of tuition is $800; some scholarship dollars are available.

Visit tinyurl.com/2w6d4u8k for the application and full program schedule. For questions, email blp@1berkshire.com.

PITTSFIELD

BMC earns distinction for joint replacement

Blue Cross Blue Shield of Massachusetts has selected Berkshire Medical Center as a Blue Distinction Center for Knee and Hip Replacement, part of the Blue Distinction Specialty Care program.

Blue Distinction Centers are nationally designated healthcare facilities shown to deliver improved patient safety and better health outcomes, based on objec-

By M itchell c hapM an

PITTSFIELD — TD Bank is closing its 99 West St. location in Pittsfield early next year.

It’s among six branches and one drive-thru that will close in the state by Jan. 29, part of a nationwide wave of 51 TD Bank closures, according to Mary-Catherine Wright, a spokesperson for TD Bank. She did not say how many employees would be impacted or if the closure will result in layoffs, but did say the company will support “impacted colleagues with resources to assist with the

transition.”

Wright did not say if the West Street store’s closure was tied to its performance and did not respond to follow-up questions seeking clarity. She did provide a statement by the company.

“At Investor Day last month, TD shared plans to deliver a stronger, more scalable U.S. retail presence through significant store enhancements, tech-forward digital banking capabilities, and personalized, advice-led services,” the statement read. “We also regularly evaluate our network to en-

sure we’re serving our communities where they need us, which at times results in store closures or relocations to nearby neighborhoods.”

TD’s strategy also includes significant investment in artificial intelligence tools.

TD Bank told the Boston. com that the closures are unrelated to an October 2024 settlement in which TD pleaded guilty to conspiring to fail to maintain an anti-money laundering program and file accurate Currency Transaction Reports. As part of the agreement, TD Bank agreed to pay $1.8 billion in pen-

tive measures that were developed by Blue Cross and Blue Shield companies with input from the medical community. Hospitals designated as Blue Distinction Centers for Knee and Hip Replacement demonstrate expertise in total knee and total hip replacement surgeries, resulting in fewer patient complications and hospital readmissions. Designated hospitals must also maintain national accreditation.

For more information about the program and for a complete listing of the designated facilities, visit bcbs.com/ bluedistinction.

PITTSFIELD

Co-op Bank partners with insurance firm

Pittsfield Cooperative Bank is forming a partnership with Brown & Brown, one of the nation’s leading insurance brokerages.

Together, the two organizations will offer customers and community members throughout the Berkshires access to a wide range of insurance products backed by trusted, local service.

This partnership brings together two organizations with deep ties to Berkshire County. Brown & Brown’s regional team of insurance professionals live and work in the community, offering local personal attention and providing responsive support.

Through this partnership, customers can access comprehensive insurance coverage including auto, home, umbrella, life, recreational vehicles, commercial property, liability, and organizational employee benefits.

To learn more or request a no-obligation quote, call 866-636-0244 or visit pittsfieldcoop.com or BBrown.com.

Afreemonthlypublicationby TheBerkshireEagle 75SouthChurchStreet, Pittsfield,MA01201

Visitberkshirebusinessjournal.comfor advertisinginformationandtosubscribe.

NEWSDEPARTMENT 413-447-7311 news@berkshireeagle.com

ADVERTISINGDEPARTMENT

AMYFILIAULT,AdvertisingManager 413-496-6322 afiliault@berkshireeagle.com

CHERYLGAJEWSKI,Directorof AdvertisingSales 413-841-6789,413-496-6330 cmcclusky@berkshireeagle.com

alties, which resulted in a $181 million loss in the third quarter last year. It has since bounced back, posting $3.3 billion in earnings during the third quarter of this year.

After the closure, three TD Bank branches will remain in the Berkshires. They are located at 660 Merrill Road in Pittsfield, 271 Main St. in Great Barrington, and 57 Spring St. in Williamstown. It’s the second TD Bank branch to close in Berkshire County in four years; in 2021, the company shuttered its North Adams location on Main Street.

ShareyournewswiththeBerkshire BusinessJournal. Ifyouhaveacompany promotion,anewbusinessoranewventure,let theBerkshiresknowaboutit.Rememberthe 5Wsandthatbrieferisbetter.Emailtextand photostoBBJ@newenglandnewspapers.com. ProvideyourexpertiseintheBerkshire BusinessJournal. Doyouhavetheanswer toapersistentquestionaboutbusiness andtheBerkshires?Doyouhaveideasand suggestionsonhowourbusinesscommunity cangrow?Ifyouhaveacommenttomake aboutdoingbusinessintheBerkshiresor ifyou’relookingtoraiseanissuewiththe businesscommunity,thisisthevenuefor that.Wewelcomelettersupto300wordsand commentaryupto600words.Sendtheseto BBJ@newenglandnewspapers.com

BerkshireBusinessJournalispublished monthlybyNewEnglandNewspapersInc., 75S.ChurchSt.,Pittsfield,MA01201. PeriodicalspostagepaidatPittsfield,MA01201. BerkshireBusinessJournalisdeliveredfree tobusinessesinBerkshireCountyviathird classmail.Additionaldistributionismade viadrop-offatselectareanewsstands.The publisherreservestherighttoedit,rejector cancelanyadvertisementatanytime.Only publicationofanadvertisementshallconstitute finalacceptanceofanadvertiser’sorder.All contentsarecopyrightedbyNewEngland NewspapersInc.

The move will not a ect local services or employees, the bank said.

BY I ZZY BRYARS

NORTH ADAMS — MountainOne Bank and Taunton-based Mechanics Cooperative Bank have been approved to merge under the same holding company.

After the merger Jan. 1, the consolidated holding company will have 15 locations and about $1.8 billion in assets. MountainOne’s assets are just over $1 billion, and Mechanics just over $800 million, said Bob Fraser, MountainOne president and CEO. MountainOne has six branches, three in the Berkshires and three on the South Shore. Mechanics has 10 branches across southeastern Massachusetts.

HOW WILL THE MERGE AFFECT CUSTOMERS?

Fraser said customers should experience no disruptions, no branches will close, and no employees will lose their jobs. MountainOne employs about 190 employees and Mechanics employs about 100, he said.

Although MountainOne’s holding company will encompass both banks, Fraser said the banks made a commitment to stay independent for at least five years.

“It was a commitment as part of the merger from each organi-

zation and board of trustees that we are not doing this just to consolidate,” said Fraser, who will become chairman of the consolidated holding company while Mechanics Cooperative President Joseph Baptista will become president and CEO. “This is a commitment to the organizations and the localness of each that we feel is very important.”

The state Board of Bank Incorporation approved the transaction on Oct. 8, and it was announced this month. MountainOne’s holding company, MountainOne Financial, MHC and its mid-tier holding company, MountainOne Financial Inc., would be the mutual holding company and mid-tier holding company for both MountainOne Bank and Mechanics Cooperative Bank.

A mutual holding company or cooperative is a member-owned firm — commonly in banking or insurance — that owns other businesses. It sits at the top of a three-tier corporate structure where customers, like depositors or policyholders, are the owners. Beneath it, a mid-tier holding company can issue stock to raise money while the mutual company keeps control. This setup helps protect owners from losses

and can reduce tax burdens.

In January, customers of MountainOne will be able to use Mechanics ATMS without fees and vice versa. Fraser said that eventually they want customers of both banks to be able to use either bank’s branches.

WHY MERGE HOLDING COMPANIES?

Fraser said he and Baptista started discussing the possibility of a merger at the beginning of the year. It was announced publicly in March. The two holding companies needed to go through the regulatory approval process with the Board of Bank Incorporation and statutorily the Federal Reserve and the Massachusetts Housing Partnership.

State law requires these deals to gain approval also from the Massachusetts Housing Partnership, which works to ensure more affordable housing. To meet this requirement, the holding company had to offer loans for such housing that amounted to 0.09 percent of the acquired assets, or $7.5 million.

Fraser said that the merger will create more leverage with their many shared technology providers by integrating costs of services, enable both banks to be more competitive in their markets by aiding each oth-

er in giving loans, and create more opportunity for growth for younger employees because there will be more ability to move up the ranks instead of leaving to a bigger firm.

“In the banking world, size does matter,” Fraser said. “[Baptista] and I share the same vision in regards to the potential growth and potential for our loan employees as the organization grows. We have a fair number of young and very talented employees and we want them to have this opportunity to grow and develop within our company.”

He said both banks are financially strong and well capitalized.

Fraser and Baptista have known each other for 15 years and say their banks share common interests. Both banks have a strong lending focus on commercial real estate and multifamily residential development.

Because the two banks will be independent, they can aid each other in commercial customer loans, in which multiple lenders fund a single loan.

“If a borrower is starting to bump against our limits, we can participate in some of that loan to Mechanics,” Fraser said. “Say our loan limit to a customer is $15 million but we

are looking at a new one that is at $22 million, we can participate the money to Mechanics, keep the relationship with that customer and vice versa.”

Fraser said MountainOne and Mechanics’ business strategies and culture are aligned.

“We operate above industry average and our capital base is very strong,” he said. “We are dealing from a position of strength and combining these enables us to focus on development of our folks internally as well as our external growth.”

WHAT’S NEXT?

After Jan. 1, Fraser said the holding company will start looking at ways for the banks to operate more efficiently.

“We both have contracts with the same [technology providers], so our strategy is to make those contracts co-terminous,” he said.

They will also look at possible integration of operating departments, Fraser said, through retirement or “other synergies that occur.”

MountainOne traces its roots back to 1848 in the Berkshires with the formation of its first entity, the North Adams Savings Bank. Mechanics Cooperative dates back to 1877, according to its website.

BY I ZZY BRYARS

WILLIAMSTOWN — With offices in south and central county, Berkshire Money Management is putting down roots in the heart of Williamstown. Its fi rst fi nancial advisor is a North County native.

The local fi nancial advisory group started in 2001 and already has offi ces in Great Barrington and Dalton. Founders Stacey Carver and Allen Harris say they’re adding a Northern Berkshire offi ce to be closer to their clients in North County and southern Vermont. They also need more space.

“We just keep growing and adding more staff members, we’ve outgrown our other offices,” said Carver, who purchased the new Williamstown property

at 136 Water St. earlier this year that was previously wellness spa Tsubo Massage.

Berkshire Money Management provides county-wide financial planning services for retirement, college, estates and businesses.

Carver owns the Great Barrington office, Harris owns the Dalton office and they each rent out the properties to Berkshire Money Management. They looked “all over” North County for a space and landed in Williamstown.

“We loved the area on Water Street and it seemed pretty perfect,” she said. “As we hire advisors, they will likely be working out of here because that’s the only place there is space.”

The first financial adviser to work out of the new office will be North Adams

native Brendan Bullett, who joined Berkshire Money Management this fall. For 20 years, Bullett helped employees plan for retirement at Williams College, North Adams Regional Hospital, Berkshire Health Systems and other local organizations. He’ll also be joined by an office support specialist.

The search for more financial advisors has started, she said, and for office support roles, client care specialists and certified financial planners.

The front downstairs space that was a spa will be office space from the time it opens, said Carver, and renovations on that area have begun. The remaining space will be built out once they need more room. Advisors will begin meeting with clients later this year, and a grand

opening is planned for early 2026.

“The property is in great shape,” Carver shared. “We’re making a few cosmetic updates, including new flooring and fresh furniture, but we’re nearly ready to welcome clients.”

It was a full circle moment for Carver, who said that before she and Harris started Berkshire Money Management, they worked for Dion Money Management in Williamstown.

”Were really excited to be in Williamstown,” she said. “We’re reminiscing because before we started this, we did work up here, it’s been a while. The community up here is fantastic, they’ve been so embracing.”

BY I ZZY BRYARS

NORTH ADAMS — Peter Dudek unwrapped a plain bagel with salted maple schmear and took a bite.

“Very delicious,” said Dudek, who splits time between North Adams and Brooklyn. “They even asked me if I wanted a schmear, which is the correct way to ask about a bagel.”

Dudek was among the customers who got a first taste of Hexagon Bagels, which held a soft opening last month at its shop in North Adams.

After three years of serving long lines at North Adams and Pittsfield farmers markets, Hexagon Bagels will held its grand opening recently in a storefront at 55 Main St. The shop will be open from 8 a.m. to 1 p.m. Thursday to Sunday.

Finding the right physical space was an “important” part of the project, said founders Patrick Lang and Nick Riggers.

Hexagon serves hand-rolled sourdough bagels with schmear, limited pastries, coffee and tea. Hot and cold sandwiches are coming soon. Bagels available at the soft opening included pumpernickel, poppy seed, plain, pumpernickel everything, everything, and sesame alongside plain, scallion and salted maple schmears.

“The last almost three years of farmers market-based sales have fueled a lot of our small equipment and acquisition,” Lang said.

If not for the success of the farmers market, Lang said they would’ve pursued other full-time jobs. Now, the couple will work full time at Hexagon with five parttime employees. They financed the rest with their savings and some loans to purchase a walk-in cooler, new ovens, a new mixer, a proofer, and a prep cooler.

Lang and Rigger signed the lease on the space, owned by Scarafoni Associates, in May and started work in June.

“We were trying to save some money

and do it ourselves, which takes time,” said Rigger, 38, who worked as an assistant director of MOSAIC at Massachusetts College of Liberal Arts before going full-time at Hexagon.

Lang and Riggers met on a date in Minneapolis and eventually moved to Wisconsin where they opened a vegetable farm, Hexagon Projects and Farm. Riggers, from Minnesota, and Lang, from Great Barrington, moved to North Adams in 2022 after the pandemic.

After experimenting with bagel recipes for six months, the two opened up the farmers market stand. Before opening at

the market, Lang said they looked at the Main Street storefront, but didn’t feel quite ready. The first day at the market, they sold out in less than an hour.

“The demand has been more than we can handle,” said Lang, whose graduate education in chemistry and farming background played a key part in crafting their sourdough recipe.

They baked out of All Saints Church for about a year and then at Red Shirt Farms in Lanesborough until September.

Riggers and Lang wanted to create a space with modern updates but also preserve some of the original aspects of

the space, including the rounded edged bar and checkered tile floors. Old photos of the space from its days as the Capitol Restaurant in the ‘70s hung from walls, prints that they found when cleaning out the building.

At the same bar in the photos, Rob Patterson took bagel orders at Hexagon’s soft opening for members of Hexagon’s email list.

“It’s been great so far, we had a line out the door this morning,” said Patterson, who is on the farmers market committee and helped with the color scheme for the shop. “It’s warm but still feels very much the brand and welcoming.”

Resident Jim Andrews waited at the bar for a side of extra schmear and predicted that the place would be “quite the hit.”

“[Before this,] your options were whatever your grocery store had,” he said.

Sharon Wyrrick walked out of Hexagon Sunday morning with a bag of her favorite sesame bagels, calling the spot a “great addition to downtown life.”

“It’s hard as heck to get a good sandwich around here, so this is good,” she said.

For now, Hexagon won’t be back at North Adams and Pittsfield farmers markets; that is on hold at least until things at the shop are running smoothly, Lang said. They hope to resume providing wholesale bagels to other businesses, but will need another license.

Lang said it feels like what they wanted to create all along. For Riggers, it was refreshing to see customers using the space after four months of redesign.

“It is important for people to have a place to go that isn’t home or work and just hang and meet other friends and family,” Riggers said. “And just meeting others by happenstance, and that has certainly happened today. That makes a stronger North Adams.”

By M aryjane Willia Ms

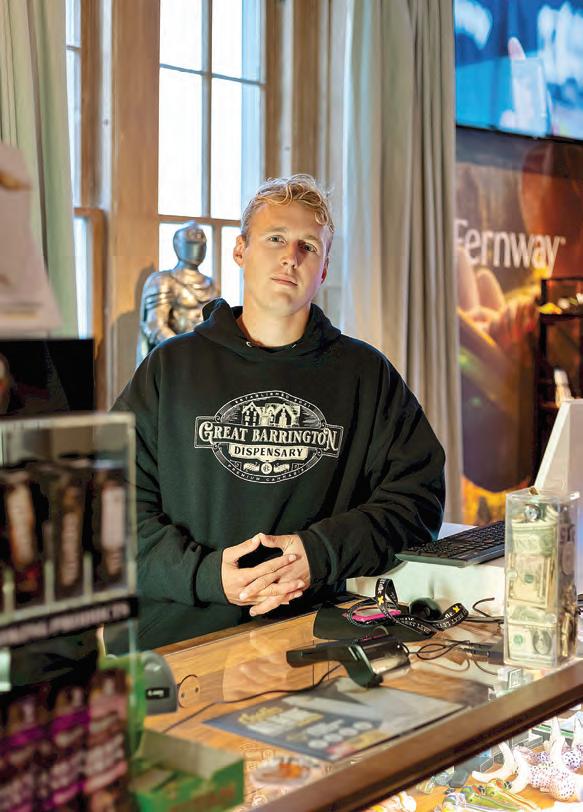

PITTSFIELD — With sweeping changes to Massachusetts’ cannabis laws on the horizon, a Pittsfield wellness shop is transforming to stay ahead.

Jim Bronson, owner of Your CBD Store in the Elm Street Plaza, is converting his business — known for its hemp-based products and wellness focus — into Great Northern Wellness, a licensed cannabis dispensary.

The change comes in response to a bill passed by the Massachusetts House last spring that will overhaul the state’s cannabis regulations. The new law will sharply limit the sale of THC products outside licensed dispensaries and cap THC content in wellness goods.

Under the legislation, consumable CBD items, like the gummies Bronson offers for sleep, pain stress relief and more, will no longer be allowed to contain “more than a trace amount” of THC, a key component of his current product line.

While the store’s mission — to provide high-quality CBD and THC products — remains the same, the new dispensary will operate under stricter state regulations and expand into a full-service cannabis retailer.

The dispensary will offer a variety of products, from premium CBD topicals and tinctures to cannabis flower, prerolled joints, vapes and edibles.

“We’re gonna have the full range of budget-friendly to the higher-priced, premium stuff,” Bronson said. “It just takes care of everybody.”

The change comes in response to a bill passed by the Massachusetts House last spring that will overhaul the state’s cannabis regulations.

“We have products with and without THC in our wellness side, but having a little THC present makes CBD better,” Bronson said. He explained that the THC isn’t meant to create a “high,” but to produce what’s known as the “entourage effect,” which helps enhance the impact and potential therapeutic benefits of CBD.

“So it’s always good to have a little THC, even though you don’t exactly feel it,” he said. “I say it’s like having a sip of wine.”

For Bronson, the implications were clear: “Go out of business or turn us into a dispensary that will still feature premium CBD.”

All hemp and cannabis products will be sourced from within Massachusetts, and Bronson said he intends to keep it “as local as possible.”

To comply with dispensary regulations, the store will undergo several renovations, including an interior vestibule for ID checks, a secure storage area accessible only to employees and upgraded security measures such as cameras, alarms and electronic locks.

Outside, the storefront will look much the same — aside from a new sign bearing the Great Northern Wellness name, a nod to two of Bronson’s passions: railroads and the Grateful Dead.

Bronson expects to hire about 10 additional employees, both part- and fulltime, once the transition is complete.

He also plans to maintain the store’s strong reputation for customer service and product knowledge.

“If you have a question for us, we’re going to have the answer,” Bronson said. “If you want to take a minute and talk to us about what’s the best product, in our opinion, to help you with this or that, we take the time to talk to you. That’s still

going to be the case as a dispensary.”

Bronson said he hopes to cultivate a “coffee shop” atmosphere — a friendly, welcoming space where customers feel comfortable chatting with staff.

As vice president of the Pittsfield Rotary Club, Bronson said that giving back to the community is a commitment that he plans to strengthen even further with the store’s new direction.

“What I want to do with some proceeds, assuming we have them from Great Northern, is to help support our food banks,” he said. “I think all of us should be helping out our community when we can.”

Bronson hopes to secure all city and

state approvals, complete renovations and train new staff over the winter, with the goal of reopening as a licensed dispensary by early April 2026.

He also plans to expand the store’s hours, likely from 9 a.m. to 7 p.m. Monday through Thursday, 9 a.m. to 8 p.m. on Fridays and Saturdays, and 10 a.m. to 6 p.m. on Sundays.

“It’s great when you help people feel better, sleep better, whatever, you know, whatever they’re using our products for to improve their lives,” Bronson said. “We’re looking forward to helping our community … hopefully even in a larger way than we do now.”

TALIA LISSAUER

While sitting in a booth in front of a wall of pictures that takes a visitor through his family’s history with food, the owner of Hilltown, Rafi Bildner, described how ingrained food culture has always been in his life.

By Talia l issauer

EGREMONT — From making pizzas in a trailer in dusty parking lots to a newly renovated kitchen and restaurant, Hilltown has come a long way since Rafi Bildner first started it in 2019, then known as Hilltown Hot Pies.

“My greatest hope for this place was that it was obviously delivering pizza and food that we’re all extremely proud of,” Bildner said. “But more than that, it is just a place for connection and a place for many different segments of the Berkshire, Hudson Valley Regional ecosystem to coexist in.”

Since opening the restaurant on Hillsdale Road in mid-October, Bildner has been overwhelmed by the positive response from the community, which brings the restaurant to capacity almost every day.

The 64-seat restaurant, doubling when the patio is open, is meant to be a space for a family night out, a date night and after-work release. This communal-friendly restaurant style goes well with pizza, Bildner said, because it’s a food that is “meant to be shared.”

“It’s a happy food,” Bildner said. “It’s not too pretentious, it’s not too serious. We take the craft very seriously, but it just makes people happy, and it’s as simple as that.”

It started as a pop-up at Dream Away Lodge.

It started as a pop-up at Dream Away Lodge. Bildner spent the next few years serving from his portable outdoor pizza oven all over the Hudson Valley and the Berkshires.

In 2022, after looking for the perfect location to build his dream pizza shop, Bildner started negotiating for the John Andrews Farmhouse, and the deal closed in 2023. After lots of planning, construction started at the end of last summer and wrapped up just before opening.

“We are sitting here in the culmination of really six years of working towards opening this brick and mortar,” Bildner said. “We brought the building down to its complete shell, and a year plus later, it’s just filled with people and filled with life.”

The last month has been “weird, surreal and everything in between,” Bildner said recently. Many of the customers are among their 11,000 Instagram followers who have been following Hilltown’s journey from the start.

“The biggest realization I’ve had, and the thing that’s made me the most proud, is just seeing how many people who have been waiting for the space to emerge are finally here and feeling so much joy and coming back time and time and again,” Bildner said.

With a “sourdough-crust Neapolitan-ish” pizza focus, the menu also features house-made gelato, mozzarella sticks, one of Bildner’s favorite foods, and, joining soon, a rotation of fresh pasta.

Many of the ingredients are locally sourced, including the dairy coming from High Lawn Farm and beef from North Plain Farm. Some items are even inspired by random produce available, like a winter squash pizza that was added to the menu because a farm has an influx of squash coming in.

He is from four generations of the food distribution industry on his father’s side. But it was Bildner’s mom’s mom who introduced him to the art of baking bread and working with dough. Attending dinners at her house growing up is where he saw how food can bring people together.

“And really, my earliest memories of baking bread were with granny when she taught us how to bake challah,” Bildner said. “And I saw the love and kind of connection that existed around her Passover Seder tables, so this journey has always been unfolding since I was young.”

Pizza combines baking bread and traditional savory cooking methods, which have both been a great love in life for him as a self-called gluten-obsessed human who loves the different bread cultures.

“Bread is just this intoxicating thing for me, mostly because of how it just brings people together and it’s such a communal share because at its core, bread and pizza and all these other things are just meant to be ripped and shared,” Bildner said.

He fell in love with pizza while he was a Yale student. On some of the most stressful nights, he would go and hang out with the owner of the local pizza shop, stretching pizza and answering the phone. In the years after college, he traveled around the world as a hiking and cycling trip leader for a travel company, where he got to experience the various rich bread cultures every region has in some form.

“And I just fell in love with this idea of the pizzeria as a community center and as like a communal hub,” Bildner said. “And Kadir [the pizzeria owner], more than anyone, taught me about the power of that.”

After looking all over New England for his ideal location, he landed on the Egremont property. He said the area is a “perfect canvas” for a food system with farms in the area looking for business and residents looking for a good place to eat.

Bildner said he plans to continue using the food trailer where it all started for offsite events. During the peak season, he hopes to utilize the large property with an outdoor pizza garden once a week.

Hilltown is open from 5 to 9 p.m. Wednesday, Thursday and Sunday, and until 10 p.m. Fridays and Saturdays.

By M aryjane Willia Ms

PITTSFIELD — After nearly two years of planning and building, a new car wash was expected to open this month on South Street near the Lenox border.

Construction was in the final stages at the site of the former Dakota restaurant, where Lipton Inc. is preparing it for opening day.

“We’ve been looking to put a car wash in Berkshire County for a while,” said Michael Lipton, the company’s owner and president. “[We’re] excited, but cautiously excited. We want to do it right. … We want to anticipate anything that comes our way … and we want to put our best foot forward.”

Founded by Lipton’s great-grandfather in 1910, Lipton Inc. began as a steel and coal business and gradually expanded into gas stations, convenience stores, propane and heating oil sales, and now car washes — with the Pittsfield location becoming the company’s second wash.

The new facility will occupy 1035 South St., the former home of Enso Asian Bistro, which had sat vacant for years. Lipton purchased the property for $1.75 million in 2023 after a previous owner’s plans to turn it into a cannabis dispensary fell through. The building, which had fallen into “disrepair” according to Lipton, was demolished in December 2023 to make way for the car wash.

Delays in permitting and planning slowed the project, Lipton said, but cars should be able to go through the wash by the first or second week of December.

The car wash will feature a 150-foot tunnel — the largest in the area, according to Lipton — with three entry lanes, one including a teller window for personalized assistance.

“So [if] people have questions or need advice or help, they’ll be there to assist them, and then that’ll sort of get them

in the queue quickly and through the wash,” Lipton said.

Behind the building, customers who purchase a wash will have access to 18 wide-stall vacuums at no extra cost, along with vending machines and automated mat washers.

Ten full-time employees will staff the car wash, most of whom already have been brought on board and are currently in sales training, Lipton said.

of an eyesore,” Lipton said. “It’s literally right as you come into Pittsfield. So I think that’ll help a lot.”

The car wash will feature a 150-foot tunnel — the largest in the area, according to Lipton — with three entry lanes, one including a teller window for personalized assistance.

“We’re bringing jobs to the area, which it needs, and kind of getting rid

As one of the busiest stretches of the city, South Street is especially sensitive to traffic disruptions — a concern that delayed the permit request for the wash in 2024. To avoid similar issues, the car wash has been designed to move vehicles efficiently.

The wash can hold up to six vehicles at once, with up to 35 cars able to stack on-

site without spilling into traffic, Lipton said. It also uses a license plate–reading entry system that allows drivers to pull up, buy a wash or enroll in a plan with a few on-screen steps and return without additional verification.

“We’ll be able to, kind of get people in and out quickly … so there won’t be people backed out onto the road,” Lipton said.

The company also is launching a loyalty program to run alongside the car wash, offering savings on gasoline, propane, heating oil and in-store items, which can be combined with unlimited wash plans.

“We just wanted to bring a car wash to the area and leverage our brands,” Lipton said.

The Social Security Administration recently announced 2026 cost-of-living adjustments (COLA) for current beneficiaries of 2.8 percent—an increase that reflects the recent increase in prices as measured by the Consumer Price Index.

The 2026 COLA isn’t likely to be life-changing for current beneficiaries. In fact, most people think this COLA isn’t enough to keep up with rising prices. According to a survey by AARP, only 22 percent of respondents think that “a cost-of-living adjustment of right around 3 percent for Social Security recipients is enough to keep up with rising prices.”

Although the financial media tends to focus on CPI-based annual COLAs, a lesser-known metric of the Social Security Administration — the National Average Wage Index (AWI) — has a bigger impact on future benefits. While the COLA adjusts existing benefits, the AWI affects how future benefits are calculated. For anyone age 60 and under, it’s the more important measure.

The AWI is based on the national average wage. In general, wages tend to increase faster than prices. Since 2000, the AWI has outpaced the CPI by an average of about 0.8 percent per year. The index is projected to increase by about 4.4 percent this year—significantly more than the CPI.

Here’s how that wage growth, reflected in the AWI, translates into future Social Security benefits.

Social Security benefits are based on a worker’s lifetime earnings. Past earnings are adjusted higher to reflect how wages have grown over time. The computation starts with something called Average Indexed Monthly Earnings, or AIME. To calculate AIME, Social Security starts with your 35 highest-earning years. Each year’s earnings are “indexed” to bring past earnings up to today’s wage levels, using the AWI. After adjusting for wage growth, those 35 years of earnings are averaged and divided by 12 to get a monthly figure, your AIME.

From there, Social Security applies a formula to determine your Primary Insurance Amount (PIA). The PIA is the base monthly benefit you’d get at the full retirement age. The formula is progressive, replacing a relatively higher percentage of earnings at lower income. The formula

also uses “bend points” that determine the progressiveness of benefits. Those bend points are updated each year as well, based on the AWI.

This formulation gives the AWI a critical role in shaping future benefits. Higher AWI numbers raise the indexing factors used to adjust past earnings. That means a worker’s historical income is converted into higher, wage-indexed amounts, which pushes up their AIME. At the same time, the bend points in the benefit formula rise along with the AWI, making the overall payout more generous for future retirees.

The AWI in 2024 was 4.84 percent, as compared with a COLA of just 2.5 percent. This higher AWI increased workers’ AIME and PIA. For a worker expecting a $2,000 monthly benefit, that difference could mean roughly $45 more per month (for someone turning 60 in 2024).

In short, an increase in the AWI means that both past earnings and benefit formulas are scaled up with wage growth. According to the Social Security Administration, “Such indexation ensures that a worker’s future benefits reflect the general rise in the standard of living that occurred during his or her working lifetime.” So although the CPI gets all the attention for current retirees, the AWI may be more important for

anyone under age 60.

WHY IT CAN PAY TO WORK LONGER

Social Security protects against three key financial risks. First, benefits are not contingent on stock or bond returns, avoiding the market risk that comes with other retirement assets. Second, benefits receive cost-of-living adjustments, mitigating the risk that rising prices could lead to a reduced standard of living. Finally, Social Security benefits should last as long as you live, protecting against the financial risk associated with longevity.

For these reasons, the Center for Retirement Research at Boston College has repeatedly found that working longer and delaying Social Security benefits can have a sizable impact on long-term financial security. Workers who have the capacity to work longer can dramatically improve their standard of living in retirement by waiting to claim.

The modest 2026 COLA may barely offset rising Medicare premiums. But for those still in the workforce, rising wages are the real story. The AWI — not the COLA — is what will determine how well your standard of living holds up in retirement.

Luke Delorme is director of financial planning at Tableaux Wealth in Stockbridge. Reach him at (413) 264-2404 or Luke@ TableauxWealth.com.

Sanda J. Carroll

Real estate

The Berkshire County real estate market showed strong momentum through the third quarter of 2025, recording increases in both sales and total dollar volume. Overall, the residential sector led the way with a 10 percent jump in the number of homes sold, while the total dollar volume climbed 14 percent, reflecting continued buyer demand and limited inventory.

Total Sales: 1,218 properties sold year-to-date, up 3 percent from 2024’s 1,188.

Total Dollar Volume: $549 million, up 10 percent from $500 million in 2024.

Average Sale Price: $450,814, an increase from $420,948 last year.

Pending Sales: Down slightly, with 113 in September 2025 versus 123 last year.

Inventory: Up modestly, with a 5-month absorption rate—still considered low.

Average Days on Market: Down overall to 95 days from 103 a year ago.

Hottest Price Range: $300,000–$500,000 homes continue to see the most activity.

The single-family residential sector remains the engine of Berkshire real estate. By the end of Q3 2025, 861 homes had sold, representing a 10 percent increase over the same period last year (782 sales).

North Berkshire: Home sales surged 16 percent, with dollar volume up 39 percent — the strongest performance in the county. Towns like Adams, Cheshire, Lanesborough, North

REAL ESTATE, Page 12

771SouthChurchSt|NorthAdams,MA bfair.org

HelpUsBuildtheFuture:OurFirstSmartHome forPeoplewithDisabilities

Thisyear,yourgifttotheHeartofBFAIRCampaignwillhelp bringassistivetechnologytolifeinournewresidentialhome— ourfirst-everSMARThome.

Thishomewillbemorethanjustaroofoversomeone’shead. Withcutting-edgeaccessibilitytechnology—suchasvoiceactivatedlighting,smartappliances,andadaptivedevices— residentswillgaingreaterindependence,safety,anddignityin theireverydaylives.

Forindividualswhohavelongbeentoldwhattheycannotdo, thishomewillrepresentpossibility,empowerment,anda futurefilledwithchoice.

Ray Smith

Money Matters

As the festive shopping season ramps up, many of us rely more than ever on the speed and convenience of credit cards, debit cards, tap-and-go payments, and mobile wallets. Whether you’re buying gifts online, picking up last-minute items in-store, or making quick purchases on the go, these payment tools make checkout almost effortless. But with increased spending comes increased risk — fraudsters know this is their prime time, and they’re ready to take advantage of distracted shoppers. A little extra attention now can

Middle Berkshire: Sales rose 7 percent, and total dollar volume grew 10 percent, reaching $212 million. Gains were recorded in Becket, Dalton, Pittsfield and Washington, though Lenox, Peru and Richmond posted mixed results.

Southern Berkshire: Sales rose 10 percent with 149 homes sold, and total dollar volume increased 7 percent. Strong performances in Alford, Egremont, Great Barrington, Sandisfield and West Stockbridge offset declines in Monterey and Sheffield.

While average prices rose 20 percent in the north, they increased only 2 percent in middle Berkshire and dipped slightly (3

prevent a lot of headaches later.

One of the biggest threats during this season is card-notpresent fraud, which occurs when your credit or debit card information is stolen and used online. To help prevent this, always shop on secure websites — look for “https” and a small padlock icon in your browser bar.

Consider using virtual card numbers if your card issuer offers them, which mask your real number during online purchases. And remember: if a deal seems too good to be true, it probably is. Fraudsters often build fake storefronts during peak shopping months to lure shoppers into entering payment and personal information. In stores, tap-and-go cards and contactless payments offer

percent) in the southern region. Overall, the average residential sale price reached $491,482, up 4 percent from 2024.

CONDOMINIUM MARKET

Condo sales are up 16 percent year-to-date, with gains in all areas of the county. Northern Berkshire led with 40 units sold (up from 36 last year), while middle Berkshire rose by 8 percent. Southern Berkshire saw the biggest proportional increase — from 4 to 11 units sold — as tight single-family inventory drove more buyers toward condominium options. The appeal of maintenance-free living continues to attract both locals and second-home buyers, though supply remains limited.

MULTIFAMILY MARKET

The multifamily sector showed

both speed and an added layer of security — each transaction generates a one-time code, making it much harder for thieves to steal usable card data. Still, it’s a good idea to remain alert.

Be cautious of anyone standing unusually close while you’re making a purchase, as criminals sometimes use hidden devices or shoulder-surfing tactics to capture information. When using chip or swipe methods, cover the keypad during PIN entries, and never let your card leave your sight at restaurants or service counters.

Mobile wallets — such as Apple Pay, Google Wallet, or Samsung Pay — are among the safest ways to pay during the busy season. They require biometric authentication, like your face or fingerprint, and

a mixed performance across the region. Sales between one and four units declined in the northern and central areas but rose sharply in southern Berkshire. North County, typically a strong multifamily market, slowed as single-family sales gained steam. Central Berkshire transactions dropped about 4 percent, though the dollar volume rose by a similar margin. In South County, activity increased, but multifamily inventory remains very limited overall.

LAND MARKET

Land sales represent the most significant slowdown of 2025. Transactions have fallen sharply across the county, reaching the lowest level since 2019. North Berkshire saw stalled activity, and Central Berkshire experienced a drastic decline in both volume and

they encrypt your actual card number. If your phone is lost or stolen, you can remotely lock or erase it to prevent access. Still, it’s important to set a strong passcode and avoid public Wi-Fi when making purchases or managing accounts. Using your phone’s data connection is safer than using an unsecured network where thieves might intercept your information.

Whether using cards or digital payments, an essential part of protecting yourself is monitoring your accounts. During the festive shopping rush, check your balances and transaction history frequently — daily if possible. Turn on alerts for purchases, withdrawals, or suspicious activity. These real-time notifications can help you catch fraud early, when it’s easier to resolve.

dollar value. While parcel prices vary too widely for meaningful comparison, one thing is clear: construction costs, regulatory challenges and infrastructure hurdles continue to stifle new development. As Berkshire County faces ongoing housing shortages, advocates stress the need for legislative incentives that encourage smart growth while preserving the area’s rural charm.

COMMERCIAL MARKET

Commercial sales also declined in both number and dollar volume during the first three quarters of 2025. However, this may reflect reporting limitations within the Berkshire MLS, as not all commercial transactions are listed there. Nationally, Moody’s Analytics notes that the office sector stabilized in Q3 2025 after years of tur-

Finally, keep in mind that your financial institution is your partner in security. If anything looks off — wrong merchant name, odd purchase location, or duplicated transactions — report it right away. Banks have tools to freeze cards, issue replacements, assist with disputes, and help ensure your accounts stay protected.

This season should be filled with joy, not worry. By staying mindful, using secure payment methods, and keeping a close eye on your accounts, you can shop with confidence — and spend more energy on celebrating with the people who matter most.

bulence since the pandemic, signaling a possible turning point despite lingering uncertainty.

With demand for residential property still healthy and inventory levels remaining modest, the Berkshire market continues to lean toward sellers — though rising prices and limited supply could temper growth heading into winter. Meanwhile, the land and commercial sectors will be worth watching in 2026 as policymakers and investors respond to ongoing housing and development pressures.

Sandra J. Carroll is the chief executive officer of the Berkshire County Board of Realtors and the Berkshire County Multiple Listing Service.

When Congress finally passed the bill to reopen the federal government this fall, the headlines were about ending a shutdown. What most people not associated with or following the legal cannabis industry would have missed was what else was buried in that deal. Namely, a new federal law that changes the rules for hemp nationwide. Inside the fiscal 2026 Agriculture Appropriations Bill, signed on Nov. 12, was language that closed a loophole in the 2018 Farm Bill and set off another round of uncertainty for operators trying to follow the law. It’s being called a hemp ban. In truth, it’s another reminder that in this industry, stability is an illusion.

Here’s what happened. The law redefines what counts as legal hemp, expanding the limit from just Delta-9 THC to include Total THC — which now captures the precursor compound THCA. It also bans cannabinoids that are chemically converted outside the hemp plant, like Delta-8 and Delta-10, and it imposes a hard cap of 0.4 milligrams of THC per container on any finished hemp product. In plain terms, this shuts down nearly every intoxicating hemp product on the market. HighTHCA flower, Delta-8 gummies, and most hemp beverages you can buy online or in some liquor stores are now effectively outlawed. Those that remain will have to pass the strictest test in the book: stay under 0.4 milligrams total THC, or else.

The impact on the national

hemp market could be swift and severe. This was a $28 billion sector that grew in the gray space of the 2018 Farm Bill. Now, about 95 percent of that market disappears with this new law.

The law gives a 365-day grace period before full enforcement begins next November. In that time, the FDA is expected to clarify how it will enforce it. But there’s no sugarcoating it: a lot of hemp companies will close before those answers arrive.

Massachusetts already has a law in place that covers many of these products, although it’s not enforced in many municipalities. The new federal change removes the unregulated competition that’s been undercutting licensed dispensaries for years with dangerous products like THC-P, HHC, THC-O; many of which sold in gas stations and bodegas with no requirement for age gating or lab testing.

every product.

The other side of the coin is the supply chain. And right now, hemp edibles are illegal in Massachusetts, period. However, some licensed Massachusetts manufacturers use hemp-derived compounds to create balanced formulations in legal cannabis products — 1:1 gummies, tinctures and beverages that combine THC with minor cannabinoids like CBN, CBC or CBG.

These compounds are essential to the product variety our customers value. Now, even responsible hemp inputs could become harder to source as the federal definition tightens and suppliers shutter.

The impact on the national hemp market could be swift and severe.

These hemp-derived THC products can be as or more potent than what can legally be sold in many regulated markets, including Massachusetts, and are able to be shipped right to your door because of the loophole. Some of these are even from known brands in legal cannabis.

For the consumers, the unknowns add up. How safe are these products? What testing is done or required? But now it seems, the new federal rule closes that loophole and levels the field for those of us in cannabis following every rule, paying every tax, testing

Happy Holidays and all the best in the New Year!

All of us at October Mountain Financial Advisors, are grateful for your partnership.

Most of all, each of us appreciate the privilege and trust.

Helping you reach your goals matters to us.

It’s why we’re here. We’re here for you.

Many hemp farmers are busy right now with this year’s crop while anxiously awaiting more clarity on how this is all going to play out. Those that followed every rule now have to wonder if their crops will have a market next year, as hemp grown for grain or fiber is still fine, but hemp grown for cannabinoids may fall into a new gray area.

That uncertainty also affects the manufacturers who rely on their compounds, the retailers who stock their products, and the customers who trust us to deliver safe, effective, transparent options.

And while we’re absorbing that change, another threat is already taking shape. A 2026 ballot initiative aims to repeal adult-use legalization in Massachusetts. If it passes it would shut down

every licensed recreational grow, processor and dispensary, ban home grow, and erase the system that voters approved in 2016. Possession would stay decriminalized, but all legal adult-use supply would vanish. It’s prohibition by another name. And it’s being marketed as “sensible reform.”

If that sounds familiar, it should. We’ve seen what happens when fear and confusion drive policy instead of facts. We saw it in the drug war. We saw it in the early years of legalization. And now we’re seeing it again, dressed up as protection.

So where does that leave us? Well we will do what we’ve always done in this business: prepare, educate and run a responsible business. We will continue to stay vigilant with ingredients, product selection and ensuring our customers have safe access to cannabis.

Consumers have a role here too. If you care about safe, tested products and about keeping cannabis out of the hands of minors, this is the moment to pay attention. Support the businesses that play by the rules.

We’ve built an industry that supports jobs, funds local budgets, and treats customers with respect. We’ve proven that regulation can work, and that trust and transparency build real community benefit.

The coming year will demand that same discipline. Because in the end, the only way to protect the progress we’ve made is to keep showing up, keep leading with integrity, and keep building an industry worth defending.

Meg Sanders is CEO and co-founder of Canna Provisions.

When we opened the Berkshire Innovation Center in February 2020, our mission was straightforward: give the region’s manufacturers, engineers, technologists and educators a shared home.

At the time, advanced manufacturing and technology already played an important role in our region’s economy, but we lacked a central place to bring people together, share equipment, and run high-level training programs. The building and our organization filled that gap. Five years later, that foundation is real and it’s humming. Today, the question facing us is no longer about launching the BIC — it’s about maturing the BIC. How do we take five years of momentum, partnerships and activity and channel it into long-term, sector-driven impact for the region and the commonwealth?

One answer lies in the creation of the BIC Leadership Groups: new, cross-sector working groups designed to focus the BIC’s energy on the industries where the Berkshires have the most upside and potential to lead.

FROM BERKSHIRE BLUEPRINT TO BIC BLUEPRINT

To understand where these leadership groups come from, it helps to look back to 2019, when 1Berkshire released the Berkshire Blueprint 2.0, a 10-year strategic economic imperative that identified the region’s five core industry clusters. One of those clusters — Advanced Manufacturing & Engineering Services — is where the BIC naturally lives.

While the BIC was not created because of the blueprint, the opening of the BIC in 2020 helped anchor that cluster. It gave

the region a central node: a modern facility where manufacturing companies, subject-matter experts, students, startups and educators could work shoulder to shoulder, test ideas, and build capacity.

As the BIC’s network deepened over the years, patterns emerged. Inside that advanced manufacturing cluster, we saw concentrated activity — and growing opportunity — in areas like clean energy and climatetech, advanced optics, robotics and automation, AI and data, and life sciences. These are not separate from manufacturing; they are part of its natural evolution, and represent the technologies shaping the

future of the commonwealth’s economy.

The BIC Leadership Groups are our way of digging deeper into that cluster — of turning broad regional strategy into sector-specific action.

The BIC was built as a platform — a physical and organizational infrastructure meant to support our regional innovation economy.

Each BIC Leadership Group is built around a simple set of goals:

• Bring industry, academia and community partners together.

• Identify a small number of shared challenges or opportunities in that sector.

• Mobilize the people who have the expertise — and motivation — to take action.

• Create projects that link regional

needs with state priorities.

• Build long-term capacity here in the Berkshires.

Every group has a similar structure but a different focus. Clean energy was the earliest mover. AI, advanced manufacturing, advanced optics, robotics, and life sciences will follow in a staggered sequence. Some already have early membership forming; others are still in the design phase. But together, they give the BIC a framework for organizing complex work across multiple industries.

The leadership groups aren’t designed to be advisory boards. They’re meant to be small, durable teams that move real work forward, each one representing a blend of company leaders, researchers, educators, engineers and community partners.

The furthest along of these new groups is the Clean Energy Leadership Group (CELG). It formed organically during the development of BIC’s clean-energy initiatives and is led by a mix of BIC board members, industry partners, academic leaders and climate-tech entrepreneurs.

That diversity is not an accident — it’s the reason the group works. Clean energy is a systems problem, and solving complex systems issues requires people who don’t usually sit at the same table. CELG has become the prototype for what the other leadership groups can and should be: focused, cross-sector and rooted in real projects that serve regional and statewide goals.

That structure was visible during the group’s first public event on Sept. 17, 2025, which brought dozens of people together at the BIC. Instead of a single keynote, the morning unfolded as a set of tightly connected perspectives on the

According to the Chronicle of Philanthropy, public trust in nonprofits has remained stable, despite the Trump administration’s attacks on the sector including negative rhetoric, harmful policy changes, and funding cuts.

And while individuals with Donor Advised Funds stepped up during COVID and the subsequent financial downturns in 2022, and large philanthropic organizations also accelerated their giving, philanthropy will never be able to make up for the loss of government funds. We must all figure out how we, as individuals, businesses and nonprofits can help.

Conversations are taking place across the nation and in the Berkshires about how best to meet this moment in which many nonprofits face funding cuts and increased need, compounded by the long government shutdown and the combined effect of disruptions to SNAP, heating assistance, immigration, Medicare policy and more.