POWERED BY

TRANSFORM YOUR SKIN WITH

POWERED BY

TRANSFORM YOUR SKIN WITH

“The SKIN CARE MANAGEMENT SYSTEM™ features five essential formulas to take the guesswork out of creating a proper skin routine and promote healthy, beautiful skin.” NewBeauty® Magazine

POWERED BY

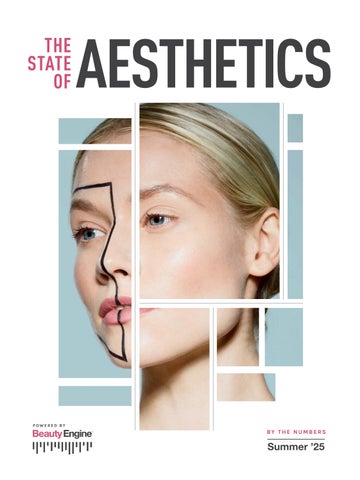

A comprehensive, data-driven guide to how patients navigate beauty treatments

As more patients turn to GLP-1 medications for weight loss, new concerns are emerging from facial volume loss and skin laxity to budgeting for follow-up treatments. This chapter reveals what providers need to know about post–weight loss priorities and planning.

From injectables and skin tightening to high-tech facials and regenerative treatments, new data reveals what’s rising, what’s pausing and how patient preferences are evolving across face and body.

Patients are researching smarter and vetting harder. Here’s what drives provider selection today, including the rise of board certification as a non-negotiable, the role of reviews and referrals, and how many consults it takes to earn patients’ trust.

Beauty spending is steady but strategic. Patients are cutting back in other lifestyle areas to afford treatments, leaning into financing options and increasingly expecting transparency. This chapter explores where the money is going and what they’ll skip to make room for it.

Ingredient savvy and results focused, today’s consumer is shopping for skin care with a clear purpose. This section covers top ingredient interests, shopping channels, including in-office sales, and the growing demand for products that address hormonal and aging skin concerns.

Aesthetic patients in 2025 are making more intentional choices— from the treatments they prioritize to the providers they trust. Based on insights from our highly engaged BeautyEngine panelists, this latest data shows a clear shift: Patients are no longer chasing trends; they’re investing in results that last, treatments that feel natural and providers who make the science make sense.

If 2024 was the year patients learned the word biostimulatory, 2025 is the year they started asking for it by name. Nearly 86% say they’re interested in treatments that work with, not against, the body, with collagen stimulators (65%) and microneedling (62%) leading the charge. But interest alone isn’t enough. More than half of patients want a clear explanation of how the treatments work before committing. In other words, science sells when it’s clearly communicated.

The quest for “natural-looking” results continues, but patients are redefining what that means. It’s not about hiding the work; it’s about looking like themselves on a really good day. In fact, it tops the list of what patients value most, with 69.3% saying “natural-looking” is the most important factor when choosing a neurotoxin, and nearly 70% say they’re more likely to book filler treatments if the conversation is framed around facial balancing. The right message might just be as important as the right product.

GLP-1s are transforming more than just weight—more than two-thirds of users have lost over 20 pounds, and it’s prompting a new wave of aesthetic goals. As patients adapt to their changing bodies, nearly 70% are interested in muscle-defining treatments, fat transfer interest is also up and half report noticing hair thinning. This is more than a weight-loss moment—it’s a full-body reset. Patients are actively seeking solutions to restore balance, strength and confidence.

According to our BeautyEngine panelists, men are stepping further into the aesthetic space. Thirty-one percent say the men in their lives are already getting injectables, and many are re ceiving professional skincare (35.4%) or hair restoration treatments (32.7%). The top concerns include thinning hair (54.8%), skin quality (40.2%), wrinkle prevention (37.9%) and muscle tone (34.8%). The data shows that male aesthetics continues to evolve.

Patients aren’t just Googling, they’re vetting. The majority (72.5%) say they’d only choose a board-certified plastic surgeon for surgery (up 10% from last year). Board certification also ranked as the top consideration for any provider, beating out reviews, results and even price. Only 6.5% reported seeing a non–board certified provider. The message is clear: patients are prioritizing proven expertise over popularity.

Patients are being more deliberate with their dollars, but they’re still investing in what matters. Only 5.5% would cut back on skin care, while 54% would skip dining out first. Financing is gaining traction, with 22.9% now preferring a payment plan, up from last year. Practices that understand the ebb and flow of patient behavior can lean on their most valued, results-driven treatments, and are well positioned to earn lasting loyalty and long-term growth.

Trend Tracker identifies key areas where we track consumer behavior, revealing the evolving preferences over time.

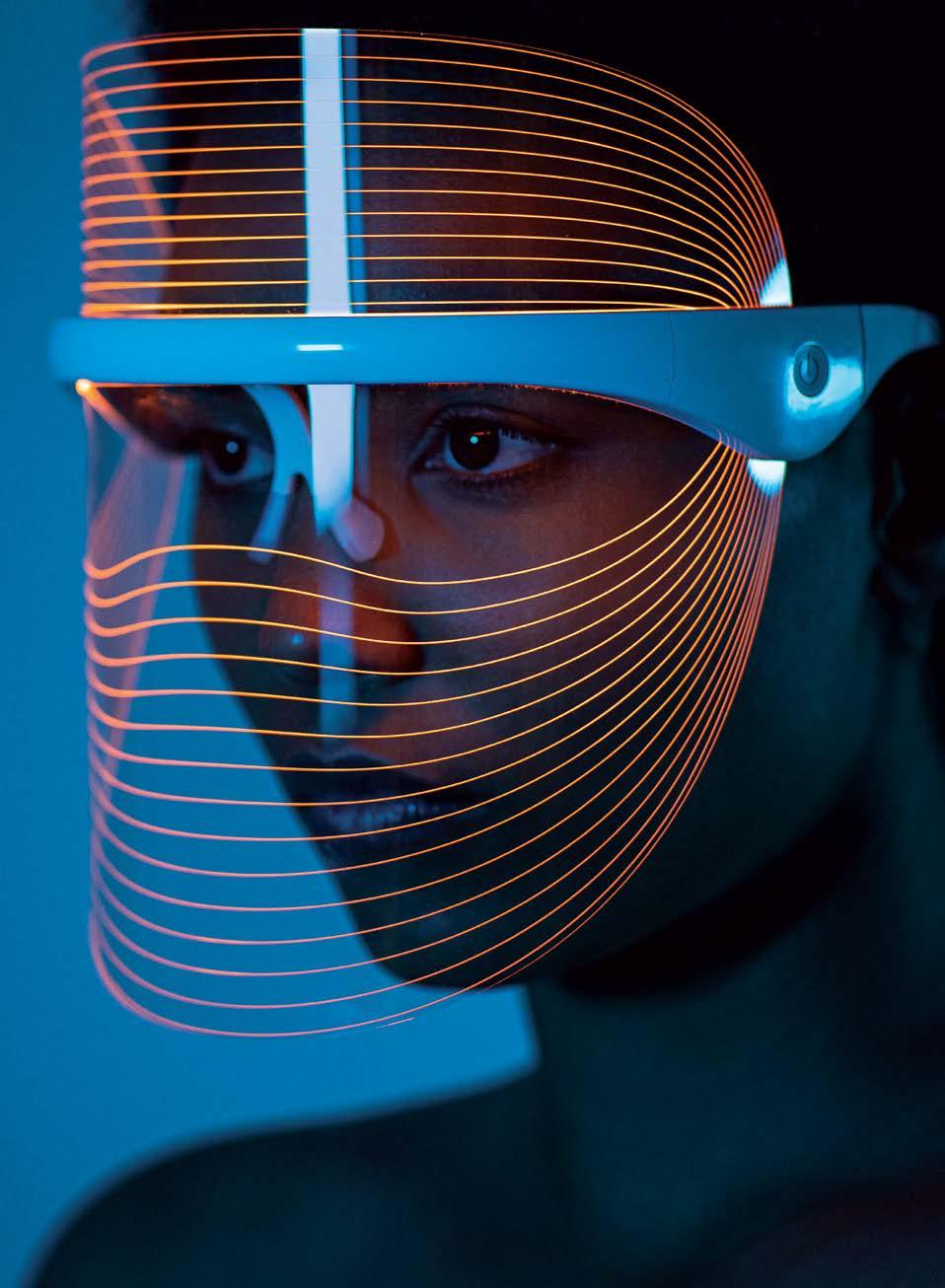

level up your post-procedure skin care with exo booster, a global breakthrough in exosome technology.

Meet Exo Booster, the first bacterial exosome system in regenerative skin care. Instead of sourcing exosomes from humans or plants, they are derived from Lactobacillus bacteria using plant-based fermentation.

Backed by global clinical studies, these vegan exosomes consistently demonstrate superior efficacy over human and plant exosomes, and are more biocompatible and easily absorbed without resistance.

“Our advanced technology harnesses exosomes from Lactobacillus and combines them with omega-3 from algae to reduce redness, boost renewal and deliver healthier, more youthful-looking skin—faster than traditional treatments.”

Dr. Robert Bianchini, Ph.D. AAD Dermalogica Vice President of Research and Development

Minimize Downtime + Maximize Results

Exo Booster is designed to accelerate post-procedure recovery after treatments like microneedling, chemical peels and laser resurfacing. It also improves overall skin texture, tone and resilience.

Scan the QR code to bring Exo Booster into your treatment room.

In a clinical study, microneedling patients who also received Exo Booster had an 86-percent reduction in the appearance of wrinkles compared to those who had microneedling alone.

“THE

MEDICATION WORKED WELL FOR ME IN HELPING ME AD OPT LIFESTYLE CHANGES. HOWEVER, WEIGHT LOSS AGED MY FACE CONSIDERABLY.”

–SHANNON R., 52, IL

“I WISH I HAD KNOWN HOW LOSING WEIGHT SO QUICKLY AND IN SUCH A GREAT AMOUNT WOULD AFFECT THE ELASTICITY OF MY SKIN. AFTER GLP-1S, MY SKIN HAS BECOME EXTREMELY DRY, SAGGY AND CREPE-LIKE.”

–LISA

M., 49, TX

“I DIDN’T KNOW ABOUT ALL THE WEIGHT YOU WOULD LOSE IN YOUR FACE. I’M HAPPY WITH THE WAY I LOOK IN CLOTHES, THOUGH… BUT I GUESS WRINKLES COME WITH WEIGHT LOSS TOO.”

–TAMARA F., 45, AZ

THE OPPORTUNITY

More patients are losing more weight with GLP-1 medications. More than two-thirds (69.7% of respondents) report losing more than 20 pounds on their weight-loss journeys, while patients losing one to 10 pounds has decreased year-over-year from 23% in 2024, to 12.5% in 2025. As patients continue to shed significant weight, practitioners have ample opportunity to introduce supportive treatments during weight loss, as well as refining treatments post–weight loss to help patients fully reach their goals.

Under 10% of respondents indicated they were looking to lose less than 20 pounds. With the majority (52.6%) of patients indicating a moderate weight-loss goal of 20 to 60 pounds, and 37.4% seeking to lose over 60 pounds, it’s clear that the vast majority of patients are seeking transformative weight loss, which practitioners can support with customized approaches to treatments and strategies for maintaining results.

With a large proportion of patients experiencing gastrointestinal issues and fatigue, practitioners can set themselves apart by anticipating potential side effects and preemptively offering potential dietary changes, supplements and supportive therapies to help patients stay on goal.

YOY: HAVE YOU NOTICED ANY HAIR LOSS OR CHANGES IN HAIR QUALITY DURING YOUR WEIGHT-LOSS JOURNEY WITH GLP-1

THE OPPORTUNITY

The number of patients reporting hair loss or changes due to GLP-1 medications has increased by nearly 14% in just two quarters (from 37% in Q4 2024 to 50.5% in Q2 2025). Practitioners are not only a critical touchpoint for patients to begin their hair restoration journey, but they can also serve as an early intervention, offering supportive treatments that help patients retain their hair during their weight-loss journey.

THE OPPORTUNITY

Dietary supplements and topical hair growth treatments are the first line of defense for many patients experiencing hair loss, but they aren’t the only solutions to offer. Practitioners have an opportunity to double down on in-office hair restoration treatments (like PRP and laser treatments) by highlighting results, comparing regrowth timelines and offering patient specials.

THE OPPORTUNITY

Ongoing care is a critical area for practitioners to support patients on their weight-loss journeys, creating the perfect opportunity for milestone-based treatments and regular follow-ups, an approach that can be adjusted after weight-loss goals are reached to help patients maintain their results, even after stopping a GLP-1.

THE TAKEAWAY

It’s clear that GLP-1s are not only helping patients lose weight, but also encouraging lifestyle changes that have cascading positive effects on their health and wellness. From having a fuller understanding of their patients to offering more tailored treatments that take a more active lifestyle into account, practitioners can use this information to better serve patients and their goals.

HAS THE COST OF GLP-1 MEDICATIONS CAUSED YOU TO REDUCE SPENDING IN OTHER

THE TAKEAWAY

Roughly half of respondents indicated the cost of their GLP-1 has impacted their spending, showing a need for practitioners to position supportive treatments as a valuable self-investment that will help patients more fully achieve their goals.

Actual patient. Individual results may vary.

T H E LIPS No. CHOICE INJECTORS † Kysse is the acid that is proven to in addition to and texture.

Restylane® Kysse is the only injectable hyaluronic acid (HA) gel that is proven to improve lip color, in addition to enhancing shape and texture.1,2*

Scan to take the quiz and find out what your lips say about you

*In a phase 4 clinical study, 59 subjects were treated with Restylane® Kysse in the lips (n=19) or Restylane® Kysse in the lips in combination with either Restylane® Refyne or Restylane® Defyne (n=40) in the nasolabial folds or marionette lines.

†Based on a survey with 471 HCPs across US, Brazil, Thailand and Germany.

REFERENCES: 1. Restylane Kysse. Instructions for Use. Galderma Laboratories, L.P., 2023. 2. Data on file. 05DF1807 Clinical study report. Galderma Laboratories, L.P., 2020.

Restylane® Kysse Important Safety Information

Indication: Restylane® Kysse is indicated for injection into the lips for lip augmentation and for correction of upper perioral rhytids in patients over the age of 21.

Restylane Kysse contains traces of gram-positive bacterial protein and is contraindicated for patients with allergies to such material or for patients with severe allergies that have required in- hospital treatment. Restylane Kysse should not be used by patients with bleeding disorders, with hypersensitivity to amide-type local anesthetics, such as lidocaine, or by women who are pregnant or breastfeeding. Use of Restylane Kysse at the site of skin sores, pimples, rashes, hives, cysts, or infection should be postponed until healing is complete. The most commonly observed side e ects are swelling, tenderness, bruising, pain, and redness at the injection site. These are typically mild in severity and usually resolve within 7 days after treatment. Serious but rare side e ects include delayed onset infections, recurrence of herpetic eruptions, and superficial necrosis and scarring at the injection site. Do not implant into blood vessels. Use with caution in patients recently treated with anticoagulant or platelet inhibitors to avoid bleeding and bruising.

Treatment volume should be limited to 1.5 mL per lip per treatment and 1.0 mL for upper perioral rhytid correction, as greater amounts significantly increase moderate and severe injection site reactions. The safety or e ectiveness of treatment in areas other than lips and upper perioral rhytids has not been established in controlled clinical studies.

Restylane Kysse is only available through a licensed practitioner. Complete Instructions for Use are available at www.RestylaneUSA.com.

©2025 Galderma Laboratories, L.P. All trademarks are the property of their respective owners. US-RES-2500144

Where did you obtain your GLP-1 medication?

Primary care provider (PCP)

Telehealth or online prescription service

Medspa

A specialist (e.g. endocrinologist, metabolic health specialist)

Weight-loss clinic

Other

Plastic surgeon’s office

Dermatologist’s office

GLP-1 patients are starting their journey outside of aesthetics, so providers need to meet them early. Sixty-three percent of patients access GLP-1s through primary care or telehealth, long before seeing an aesthetic provider. Less than 2% begin treatment in a dermatology or plastic surgery setting, highlighting a major missed opportunity for early intervention. With 13% getting prescriptions at medspas, these hybrid care environments may be the new front door for aesthetic education and engagement. Practices should build referral networks and messaging strategies that meet patients where they start. Q1

What are your primary reasons for seeking aesthetic treatments after weight loss?

Have you received any nonsurgical aesthetic treatments since starting your GLP-1 medication?

Skin laxity/sagging

Q1 2025 BEAUTYENGINE: AESTHETIC SURVEY [n = 128]

The top three aesthetic concerns after weight loss—skin laxity (50%), looking older (44%) and facial volume loss (34%)—are directly tied to rapid fat reduction. These are issues injectables are designed to treat. Providers can position fillers and biostimulatory injectables as tools to restore lost support, soften signs of aging and bring balance back to the face. Marketing should move beyond product names and speak to what patients are actually experiencing. This is an opportunity to shift the narrative. Post–weight loss patients aren’t avoiding injectables; they’re looking for solutions that match how they feel.

While nearly a third of respondents taking GLP-1 medications have already pursued nonsurgical aesthetic treatments, the majority of these patients have not yet committed, representing an untapped opportunity for practitioners to engage weight-loss patients at every stage of their journey. Supportive treatments can be positioned as the perfect accompaniment to GLP-1 weight loss, while finishing-touch treatments can help capstone weight-loss achievements and help patients realize their complete goals. Q1

When considering a GLP-1 for weight loss, have you thought about how it might affect your facial appearance (e.g. volume loss, skin laxity, looking older)?

“I lost a lot of weight, but it happened very fast, and I’ve lost some of my youthfulness in my face. I have loose skin on my face and upper arms…I wish I had known what that would entail.”

—Evelyn M., 41, WI

Yes, I’m somewhat concerned but unsure what to do

23% No, I haven’t thought about it

“I wish I knew about all the weight I would lose in my face! I’m happy with the way I look in clothes, but now unhappy with the negative changes in my face.”

—Nicole O., 45, CT

13% Yes, I’m already planning for aesthetic treatments

8% No, I don’t think it will be an issue

More than half of GLP-1 intenders are already worried about facial changes like laxity or volume loss but don’t know which steps to take. An additional 13% are already planning for aesthetic support. This is a clear opportunity for early education, consults and messaging that connects facial appearance to the GLP-1 journey, before side effects become a concern.

What type of guidance or education would be most helpful when considering aesthetic treatments post–weight loss from your GLP-1 medication?

54% Comparisons of different treatment options

48% Before-and-after case studies

45% Consultation with a provider

Pricing and financing options

Patients who are ready to begin their aesthetic journeys express a high level of interest in aesthetic education, with 54% indicating a desire for treatment comparisons and 48% wanting to see before-and-after case studies. Practitioners who take the time to clearly lay out their pricing, discuss treatment options and demonstrate results can not only help patients make informed decisions regarding their treatment, but also solidify themselves as a trusted expert that can guide a patient through the entirety of their weight-loss journey and beyond.

41%

Testimonials or experiences from others who have undergone treatments

39% Information on potential risks

31% Insights on timing (e.g. when to start treatments post–weight loss)

I’m considering nonsurgical treatments but still not sure 32%

Yes, I am planning to get nonsurgical treatments soon

Since starting your GLP-1 medication, have you considered nonsurgical aesthetic treatments? 65% 62%

Which of the following skin treatments would you most likely consider if you have experienced changes in your skin quality during your weight-loss journey and wish to treat it?

Collagen

Laser skin resurfacing

Fillers

Chemical peels

Neurotoxins

Topical acne treatments

Patients navigating skin changes after weight loss are seeking more than quick fixes. Sixty-five percent are interested in collagen stimulators, 62% in microneedling, and over half in laser resurfacing. Notably, 50% say they would consider fillers, which challenges the assumption that injectables are off the table for this group. The data points to a clear appetite for comprehensive, in-office solutions that target both skin quality and structural support.

Yes, I am currently undergoing nonsurgical treatments SPONSORED BY

2025 BEAUTYENGINE: AESTHETIC SURVEY [n = 435]

Nearly 30% of GLP-1 users are actively planning or already undergoing nonsurgical treatments, and another 32% are considering them. Combined, the “yes” and “maybe” groups make up nearly two-thirds of respondents. Providers and brands should see this as a signal to act: now is the time to reach, educate and guide this high-intent audience with targeted messaging, treatment plans and patient-first language that speaks to their journey.

Where are you gathering information about nonsurgical aesthetic treatments to address the effects of weight loss?

Medspa

Dermatologist

Plastic surgeon

Social media

Friends or family

Magazines

Celebrity or influencer endorsements

Patients aren’t turning to TikTok for answers—they’re doing their homework. Online research leads the way, with 58% of GLP-1 users turning to articles and websites before anything else. Medspas (39%), dermatologists (33%) and plastic surgeons (28%) follow as key influencers, showing strong trust in professional guidance. Social media (28%) and friends or family recommendations (25%) still play a role, but expert-led, self-guided research remains the driving force behind decision-making.

OF RESPONDENTS SAY THEY ARE VERY INTERESTED OR SOMEWHAT INTERESTED IN TREATMENTS THAT STIMULATE THE BODY’S NATURAL PROCESSES TO REGENERATE SKIN AND RESTORE VOLUME

“IT’S PRIMARILY ABOUT ACHIEVING NATURAL RESULTS THAT REVERSE THE CLOCK SUBTLY AND IN A POSITIVE WAY. I DON’T RELY ON THIS FOR MY CONFIDENCE, BUT BRINGING MY NATURAL LOOK BACK HELPS ME FEEL MORE LIKE MYSELF.”

–ROBIN D., 46, IN

“I’M GENUINELY EXCITED ABOUT REGENERATIVE AESTHETIC TREATMENTS BECAUSE THEY REPRESENT A BLEND OF INNOVATION AND NATURAL REJUVENATION...HARNESSING MY BODY’S OWN HEALING MECHANISMS TO IMPROVE MY SKIN IS FASCINATING.”

—CATHRYN H., 31, TX

No, but I’m considering it

Yes, I’ve received regenerative treatments 24%

No, and I’m not interested 13%

Unsure 10%

Q1 2025 BEAUTYENGINE: AESTHETIC SURVEY [n = 1680]

Most consumers haven’t tried regenerative treatments yet, but they’re interested. More than half (53%) say they’re considering it, while less than a quarter have actually undergone one. With just 13% expressing no interest, the opportunity is clear: better education and clearer messaging could help turn curiosity into action.

How important is it that your healthcare provider explains the science behind regenerative aesthetic treatments?

Have you received any regenerative aesthetic treatments in the past? 53% 55%

Somewhat important 32%

Very important

Q1 2025 BEAUTYENGINE: AESTHETIC SURVEY [n = 1680]

THE OPPORTUNITY

With 87% of patients rating scientific explanation as important, there’s a clear call for providers to lead with knowledge. Education builds trust and can elevate confidence in newer or less familiar regenerative treatments.

SPONSORED BY

Do you plan to receive filler treatments within the next 12 months?

56% Yes No

Unsure

More than half of past filler patients plan to return, and one in five are undecided. This “unsure” segment presents a valuable opening for re-engagement through transparent communication and holistic consults that address common concerns.

What did you like most about your filler results?

How satisfied are you with your filler results?

Somewhat satisfied

Neutral Very satisfied

Somewhat dissatisfied

Very dissatisfied

Nearly 80% of patients were satisfied with their results, confirming filler’s strength as a retention treatment. Practices can build on this trust with consistent follow-up and long-term plans for subtle maintenance.

What would make you feel more confident about trying filler?

56% 51%

Achieved

Enhanced features desirably

Boosted confidence/self-image

Quick recovery/minimal downtime

Results lasted longer than expected

Personalized consultation

Comfortable procedure

Knowing how to avoid an unnatural

Knowing results can be natural-looking

Understanding costs and maintenance

Recommendations from a trusted source

A thorough consultation and full-face assessment

More education on risks/benefits

Seeing real before-and-after photos Value

Natural-looking results consistently lead in patient satisfaction, followed closely by confidence and feature enhancement. Messaging should focus on subtle outcomes, comfort and emotional impact—not just visible change.

Fear of looking unnatural remains the biggest barrier for potential filler patients, even above cost. Half want reassurance that results will look natural, and nearly 40% want a full-face consult. Leading with education, visuals and personalized planning can turn hesitation into confidence.

Actual patient. Individual results may vary.

regenerate natural collagen and elastin for long-lasting improved skin quality2-3† Visit AspireRewards.com to save $20 o your first treatment

*95% of clinical trial participants had improved skin glow 2 years after Sculptra treatment when injected into the cheek region. †When injected into the broader cheek area.

REFERENCES: 1. Goldberg D, et al. Single-arm study for the characterization of human tissue response to injectable poly-L-lactic acid. Dermatol Surg 2013;39(6):915-922. 2. Bohnert K, et al. Randomized, controlled, multicentered, double-blind investigation of injectable poly-L-lactic acid for improving skin quality. Dermatol Surg 2019;45:718-724. 3. Data on file. 43USSA1812EXT Clinical study report. Fort Worth, TX: Galderma Laboratories, L.P., 2022. 4. Sculptra. Instructions for Use. Galderma Laboratories, L.P., 2023. 5. Waibel J, Nguyen TQ, Le JHTD, et al. Gene Analysis of Biostimulators: Poly-L-Lactic Acid Triggers Regeneration While Calcium Hydroxylapatite Induces Inflammation Upon Facial Injection. J Drugs Dermatol 2025;24(1):34-40. doi:10.36849/JDD.8464.

Sculptra Important Safety Information

Indication: Sculptra® (injectable poly-L-lactic acid (PLLA-SCA)) is indicated for use in people with healthy immune systems for the correction of shallow to deep nasolabial fold contour deficiencies, fine lines and wrinkles in the cheek region, and other facial wrinkles. Sculptra should not be used by people that are allergic to any ingredient of the product or have a history of keloid formation or hypertrophic scarring. Safety has not been established in patients who are pregnant, lactating, breastfeeding, or under 18 years of age. Sculptra has unique injection requirements and should only be used by a trained healthcare practitioner. Contour deficiencies should not be overcorrected because they are expected to gradually improve after treatment.

Sculptra should not be injected into the blood vessels as it may cause vascular occlusion, infarction or embolic phenomena. Use at the site of skin sores, cysts, pimples, rashes, hives or infection should be postponed until healing is complete. Sculptra should not be injected into the red area (vermillion) of the lip or in the peri-orbital area.

The most common side e ects after initial treatment include injection site swelling, tenderness, redness, pain, bruising, bleeding, itching and lumps. Other side e ects may include small lumps under the skin that are sometimes noticeable when pressing on the treated area. Larger lumps, some with delayed onset with or without inflammation or skin discoloration, have also been reported. Sculptra is available only through a licensed practitioner. Complete Instructions for Use are available at www.SculptraUSA.com/IFU.

44.3%

42.2% Neurotoxin Neurotoxin

Neurotoxin remains the top planned procedure, with 42.2% of respondents indicating interest (down slightly from 44.3% in Q4 2024). Skin treatments like microneedling (33.8%) and high-tech facials (29.9%) held steady, while body contouring and fat transfer showed a slight uptick. Interest in procedures like necklifts and veneers declined slightly, suggesting these may be shifting into longer-term planning. This is a chance for providers to guide patients early and build treatment roadmaps.

WISH LIST: WHICH OF THE FOLLOWING

WOULD YOU CONSIDER DOING AT SOME POINT IN THE FUTURE (MORE THAN 12 MONTHS FROM NOW)?

40.7% Skin tightening

THE OPPORTUNITY

Short-term plans may favor injectables, but long-term intent leans surgical. Skin tightening (40.7%), high-tech facials (37.7%) and microneedling (37.5%) top the list, but interest in facelifts and necklifts climbed compared to near-term data. This signals a delayed but definite demand for more permanent solutions. For providers, it’s a chance to start the conversation early, introducing long-term treatment plans, setting realistic expectations and positioning surgical options as part of a future strategy. Patients may not be ready now, but the interest is there, and early guidance builds lasting trust.

Duration (how long results last)

Onset (how quickly results appear)

Patients care most about results that last and look natural. Nearly 70% said longevity and natural-looking outcomes are their top priorities when choosing a neurotoxin. Onset speed matters to some, but less so—only 28.1% rated it as extremely important. Price ranked even lower, with just 39.9% calling it a top factor, and only half said provider recommendation was most important. The takeaway: Patients are making decisions based on what delivers, not just what’s affordable or well-known.

Core neurotoxin areas like the forehead (84.8%), crow’s-feet (63.2%) and glabellar lines (61.9%) continue to lead with little change year-over-year. More advanced applications such as lips, jawline, chin and temples remain stable, while tear trough interest dropped slightly (from 11.8% to 10.5%). These results suggest that while foundational zones remain a top priority, demand for more nuanced applications is holding steady, presenting an opportunity to educate patients on full-face strategies using neurotoxin.

While lips remain the most popular filler area (54% in Q2 2025 vs. 58.9% in Q4 2024), interest is shifting. Under-eye filler declined by nearly 8% (from 28.8% to 21%), and chin filler dropped slightly (from 21.9% to 17.7%), pointing to a possible pause on more specialized areas. At the same time, interest in cheek (35.3%) and jawline (26.5%) treatments held steady. This signals a growing opportunity for providers to reframe filler as a full-face balancing tool rather than a single-feature fix.

12 12%

10 11% Dark circles

Hyperpigmentation

26% Wrinkles

THE TAKEAWAY

10 10% Fine lines

8 9%

Droopy eyelids

6 7%

Under-eye puffiness

Wrinkles are the top complaint, with 26% choosing them as the one concern they’d eliminate permanently. Hyperpigmentation (12%) and dark circles (11%) also ranked high, underscoring the importance of treatments that address both texture and tone. Together, these stats reinforce the need for multimodal treatment plans that combine injectables with topicals, energy devices and lifestyle-based prevention.

Very likely

THE OPPORTUNITY

Nearly 70% of respondents said they’d be likely to move forward with a treatment if it was framed as “facial balancing.” This signals a strong appetite for subtle, harmonious results rather than isolated enhancements. Positioning filler consultations around overall symmetry, proportion and personal goals may lead to greater patient buy-in and more natural, long-term outcomes.

THE OPPORTUNITY

Cellulite (18%), crepey skin (13%) and loose skin (12%) top the list of body concerns patients would eliminate permanently. This signals strong long-term demand for solutions that improve skin texture and firmness, especially nonsurgical ones. Providers who highlight body treatments that address these issues with lasting results may capture patient interest and position themselves as proactive partners in body confidence.

WHICH AREAS WOULD YOU MOST WANT TO TARGET FOR IMPROVED MUSCLE TONE OR DEFINITION?

THE OPPORTUNITY

Nearly 70% of respondents are either actively considering or curious about treatments that build muscle and improve body definition. With demand strongest among the “curious but not yet committed” group (40.4%), there’s clear value in educational messaging. Providers who position musclebuilding tech as a complement to diet, exercise and other treatments may increase conversion and satisfaction.

The abdomen is the top muscle-targeting zone (77.6%), followed by arms (63%), thighs (60%) and buttocks (51.3%). With over half of respondents selecting multiple zones, interest extends beyond just “six-pack” aesthetics. Full-body sculpting that targets key areas of strength continues to gain traction as both a wellness and confidence investment.

Respondents indicated that the men in their lives are most concerned with hair loss (54.8%) and visible signs of aging, such as skin quality (40.2%) and wrinkles (37.9%). Muscle tone also ranked highly at 34.8%, revealing that men are becoming increasingly attentive to both facial and bodyrelated aesthetic concerns. These patterns suggest that male interest in medical aesthetics continues to expand beyond traditional hair-related treatments.

More than one in three respondents said the men in their lives currently receive professional skin-care (35.4%) and hair restoration treatments (32.7%), while nearly one in three (31%) reported the use of neurotoxin or filler. These findings suggest a shift toward more proactive treatment habits among men. Brands and providers have an opening to normalize and expand education around male aesthetics, especially in categories like injectables, muscle toning and skin maintenance.

“ MY PROVIDER WAS GENUINELY ATTENTIVE DURING MY CONSULTATION. THEY DIDN’T RUSH ME, ANSWERED MY QUESTIONS CLEARLY AND EXPLAINED THE PROCESS IN A WAY THAT MADE ME FEEL INFORMED AND AT EASE. I COULD TELL THEY TRULY C A RED ABOUT GETTING RESULTS THAT WO ULD LOOK NATURAL AND SUIT ME PERSO NALLY—THEY WEREN’T JUST SEL LING A TREATMENT. I L EFT T HEIR OFFICE FEELING COMPLETELY CONFIDENT, EVEN BEFORE GETTING ANYTHING DONE. IT WAS AN EASY DECISION FOR ME.”

–CASSIE E., 37, AZ

Board certification of the provider

75

Before-and-after cases

and

Credentials carry the most weight. Seventy-five percent of respondents said board certification was the most important factor when selecting a provider, with education, reviews and visible results following closely. Convenience-based considerations like location, social presence and recovery time fell lower on the list, reinforcing that safety and skill still drive trust in aesthetic care.

Awareness is growing. The number of respondents who specifically seek out board-certified plastic surgeons jumped by 10% (from 62.5% in Q4 2024 to 72.5% in Q2 2025) over the past year. Consumers are becoming more informed about the difference between a general or cosmetic surgeon and a board-certified plastic surgeon, signaling a shift toward more research-driven provider choices.

More than half of respondents say they’ve received treatments in a medspa setting, making it critical for physician-owned practices to evaluate how their offerings align with this experience. While medspas remain a trusted access point for care, only 6.5%

respondents

Online search engines (Google, Bing, etc.):

THE TAKEAWAY

Patients rely most on trusted personal and peer-to-peer sources when researching providers. Referrals from friends and family were rated highly by nearly 80% of respondents, followed closely by online reviews and search-engine results. These organic, reputation-based sources far outweigh influencer or entertainment-style channels like podcasts and YouTube, which rank significantly lower in helpfulness.

Visibility matters, but where you show up matters more. While conversion may happen through trusted sources like referrals and reviews, brand recognition still stems from visual and social exposure. Investing in high-quality, strategically placed social and print campaigns can build the recall that drives future interest and clicks.

57.1% Checked the provider’s reviews or ratings 39.6% Followed the provider on social media

Contacted the provider for more information

Scheduled an appointment

I have not taken any actions from advertisements

Shared the advertisement with others

THE OPPORTUNITY

Ads should act as a gateway, not a standalone effort. Ensure your digital presence supports the curiosity your ad generates. A seamless experience from ad click to Google search to practice website to Instagram feed is key to converting awareness into action.

Prevention of aging signs

Boost to confidence/self-esteem

Endorsement by a provider 60.7% Researched the provider online 80.4% Long-term results

THE OPPORTUNITY

Patients are doing the math and longevity wins. More than 80% say long-term results are what make a treatment feel worth it, followed closely by prevention of aging signs and confidence boosts. Trust in the product or technology also plays a significant role, while provider endorsements matter less than proven outcomes. To appeal to today’s value-focused patient, practices should emphasize longevity, credibility and the impact treatments can have on both appearance and self-confidence.

Simplify the payment process

Once patients are approved for the CareCredit credit card, they can use it to pay that day and come back again for future care without having to reapply. Patients

CareCredit can help simplify care through faster payments, enhanced satisfaction, and support for

Help

YOY: THINKING ABOUT THE NEXT 12 MONTHS, PLEASE TELL US IF YOU THINK YOU’LL SPEND MORE, THE SAME, OR LESS THAN YOU DID THE PREVIOUS 12 MONTHS FOR EACH OF THE FOLLOWING.

Aesthetic treatments

Skin-care products

Spa/salon treatments

dentistry treatments

THE TAKEAWAY

The percentage of respondents planning to spend “more” has decreased across all categories, potentially signaling a flux of economic anxiety, resulting in a larger percentage planning to spend “less.” This downward shift may indicate a tightening of belts, a moment which practitioners can meet by positioning high-value offerings as an essential self-care investment, highlighting the longevity of results and the efficacy of treatments and products on offer.

YOY: WHICH OF THE FOLLOWING BEST

A moderate increase in the percent of patients who prefer financing options (22.9% in Q2 2025, compared to 20.2% in Q4 2024) indicates an increased need for practitioner flexibility, as well as the growing presence of aesthetic financing in the market. Practitioners offering payment plans while continuing to incentivize upfront payment can meet diverse patient needs while maintaining accessibility to treatments, therefore maximizing their potential clientele.

THE TAKEAWAY

All signs point to a period of heavier budgeting and belt tightening across all spending areas, leading consumers to be more intentional in their spending. Practitioners who are aware of current market trends and proactively plan for these periods will be better equipped to weather economic uncertainties. This may include exploring financing options, appealing to the longevity of benefits and offering specials to incentivize clients.

Sciton’s BBL® HEROic™ redefines landscape of pulsed light technology groundbreaking Intelligent Control™ (IC™) the exclusive Skin Positioning System™ (SPS™ deliver consistent treatments without guesswork and ensure staff of all experience achieve optimal results for every patient. redefines the of pulsed with ) and the exclusive ). Effortlessly consistent treatments without guesswork and ensure staff of all levels

22 22%

Organic (made with organically grown ingredients)

WHEN SELECTING SKIN-CARE PRODUCTS, WHICH OF THE FOLLOWING DO YOU TAKE INTO CONSIDERATION? THE TAKEAWAY

(free from harmful chemicals)

Vegan (contains no animal-derived ingredients) Eco-friendly (sustainably produced and packaged)

Cruelty-free (not tested on animals)

Made for menopausal or hormonal skin concerns

Clean and cruelty-free products are high priorities for patients when choosing which skin care to invest in, indicating a preference for ethical and conscientiously made options. By not only carrying effective, quality products, but also highlighting how they meet this patient standard, practitioners can appeal to market preferences while maintaining their expert authority.

THE OPPORTUNITY

Instagram is the home of skin-care content online, holding the lion’s share of consumer viewership at 77%, demonstrating the platform’s longevity after years of fierce competition with TikTok over the beauty space. As a space for skin-care research, practices with well-updated Instagram platforms can engage with consumers by regularly focusing on skin-care education, including topics like active ingredients, common mistakes, expert recommendations and formula breakdowns.

Aesthetic patients are increasingly informed when it comes to active ingredients in their body care, prioritizing hydration and barrier repair alongside

By appealing to patient knowledge, practitioners can position

targeted body care as an

of in-office treatments and a critical part of maintaining results.

ABOUT THE PAST 12 MONTHS, WHERE HAVE YOU PURCHASED SKIN-CARE PRODUCTS?

1 0.5% I haven’t purchased skin-care products in the past 12 months

23 23% Spa or salon

30 30% Drugstore (i.e. CVS, Walgreens, etc.)

61 61%

Directly from a brand’s website

75 72% Retail store (i.e. Sephora, Ulta Beauty, Bluemercury, etc.)

34 34% Department store (i.e. Macy’s, Nordstrom, etc.)

Q2 2025 BEAUTYENGINE: AESTHETIC STUDY [n = 1313]

THE OPPORTUNITY:

57 57% Online retailer (i.e. Dermstore, SkinStore, etc.)

41 41% Amazon

35 35% Aesthetic provider/ doctor’s office

Beauty retailers like Ulta Beauty and Sephora command a large percentage of skin-care purchases (72% of respondents report shopping in retail stores), with other popular options like purchasing from a brand’s website (61%) and online retailers (57%) trailing behind by significant percentages. Though only 35% of respondents indicated purchasing skin-care products from an aesthetic provider or doctor’s office, practitioners can position their offers as in-office exclusives that aren’t available elsewhere and leverage their expertise to capture this market.

Update your consultations and marketing language to reflect what patients care about now: longevity, value and natural results.

Check-Square

Use clear, relatable explanations when discussing treatments. Patients are more likely to commit when they understand how and why something works.

Check-Square

Consider which treatments address current priorities like skin quality, volume loss and overall wellness. Adjust your offerings or bundle services accordingly.

Check-Square

Check-Square

Reinforce board certification across platforms and ensure that your patients know about flexible payment options or packages that deliver lasting results. Check-Square

Think about how you’re engaging men, younger patients or those on GLP-1 medications affecting their appearance. Tailor entry points for each group.

A daily peptide-powered multi-tasker that amplifies skin’s natural regenerative abilities at every age to:

Support skin’s natural production of collagen, elastin and high-molecular weight HA

Improve long-lasting hydration

Promote visible, long-term volumization

For 10 years, ALASTIN® has been amplifying skin’s natural regenerative abilities to deliver visible results. Everything we do takes skincare to a whole other level.