A unique and luxurious experience...

with the sound of the waves, the warm sand, the fresh air and the cool water. Aware of how important home is to every individual, Sea Shore builds upon wellness with a focus on expanding homeownership and security, inextricably linked with luxury.

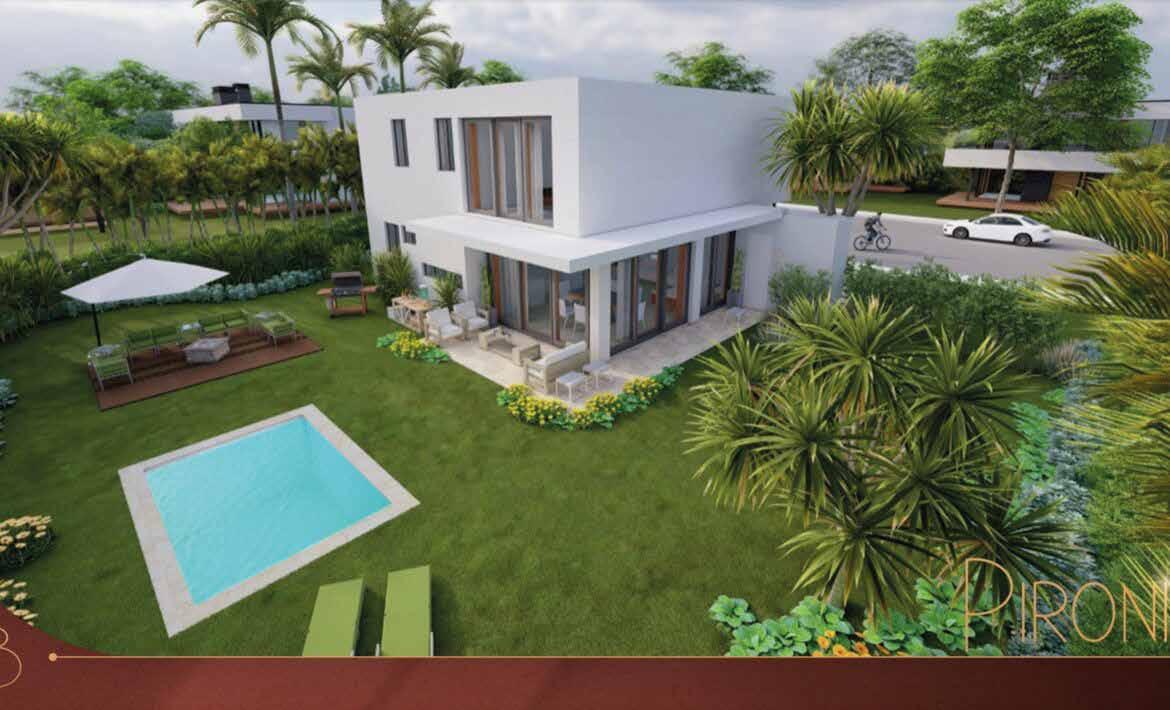

With apartments, penthouses, and villas, Sea Shore’s properties have luxury and style to suit every taste, combining the traditional with iconic high-rolling atmosphere.

Even though there are many properties to choose from, Sea Shore keeps in mind that luxury doesn’t always mean opulent furnishings and indulgent decor, it also means discovering quiet hidden gems and legendary spaces - they got you covered!

Let Sea Shore submerge you into this unique real estate experience. Immersive and innovative, that not only simplifies your research, but fully promotes the offer of professionals in the field, with a higher sense of purpose.

SELL YOUR PROPERTY

Frequent Asked Questions

What type of financing is available?

There is different ways of financing, based on the property or development the client chooses to. Options includes: Financing previous construction (which can be negotiated directly with the developer). Traditional bank financing, and some cases, owners who are willing to provide financing through land contract.

How does financing previous construction works?

The new construction provides a great opportunity for clients to finance their property at a special rate and pay for their investment over time. An specific set amount must be provided to reserve the unit, which will be applied to the initial payment, which is normally 20% of the total cost of the unit.

The next 40% should be paid in constant payments throughout the construction of the property. Finally, the final balance must be made at the handover of the property. A bank loan can be requested to finance this final amount, if desired.

What insurance do you recommend?

Building insurance: it is an insurance that any sudden damage that affects the property, including natural phenomena such as hurricanes, earthquakes, fires, floods, explosions, etc. This type of insurance is mandatory for villas and multiple properties. This type of insurance is mandatory for villas and multiple properties.

Furniture insurance: it is insurance that protects the contents of your home. The coverage includes furniture, appliances, and other equipment against the risks to which they may be exposed.

Condo Insurance: it protects buildings and houses that are under condominium management. Protects against different risks that may affect the buildings and common areas of the property. In most cases, the association requests an insurance policy, which is divided among all the owners of that association and is usually paid twice a year. This fee is also sometimes included in property maintenance fees.

The owner can also request an insurance of civil duty, which will support and protect the owner in case of an accident during the rent of the property.

What taxes are paid when buying a property?

The IPI (property tax) is 1% per year of the appraised value of the property, and only applies after RD$7,700,000 or approximately US$130,000. If the property is less than that amount, you will NEVER have to pay property taxes.

If you buy a property valued at more than US$130,000, you will only pay taxes on the dollar amount that exceeds US$130,000. E.G, if you buy a unit for $180,000, you’ll pay 1% on $50,000 per year. Property taxes are usually split into two payments per year, but can also be paid in full.

There is also a 3% tax for transferring the title/deed to the property in your name. This is part of the closure. However, these taxes are exempt if the CONFOTUR Law applies to the property.

What is the CONFOTUR law?

The properties that are protected by the CONFOTUR Law are exempt from tax commitments that other properties would have to pay, such as:

Transfer Tax on real estate rights (3% of the value of the property).

Real Estate Property Tax (IPI). It is equivalent to 1% of the annual tax of the excess of +/- RD $8,150,000. That is, if you have several properties, they are added together and only what adds up to that value will be exempt.

You, as a future buyer, will be exempt from paying that 1% for the time that determines the approval of the law in that project, which is usually between 10 and 15 years.

How is the process of residence in the country?

Marry a citizen. Investment (valid for one (1) year and you must have invested a minimum of US $200,000). Definitive residence (if you have resided in the Dominican Republic for 10 years or more). Pensioner and/or retired.