Breaking the Google cycle

Cross-channel strategies for sustainable growth

Paid Search is part of the furniture when it comes to ecommerce marketing. Since the first PPC ad ran in 1996, it has remained a popular, reliable source of sales across both new and existing customers. This stems from its ability to capture demand from people demonstrating purchase intent, at a favourable price compared to other online and offline media.

The channel’s provision of highly measurable, easily trackable conversions is a key factor on many marketers’ reliance on the channel. Paid Search consistently outperforms other channels in terms of ROAS, particularly when looking through a last-click attribution lens. And this relationship hasn’t been a one-way street. Paid Search’s success cemented the lastclick measurement model as the go-to for digital activity for almost 25 years. But platforms didn’t become complacent. Google has evolved its offering to maintain dominance within ecommerce marketing. One of the most notable innovations was the launch of Google Shopping in 2002, which marked a shift from keywords to products, thereby facilitating a clear link between trading priorities and marketing efforts.

However, Paid Search isn’t the only pillar of ecommerce marketing’s success. Paid Social has increasingly become another key channel for ecommerce marketing, particularly with the launch of Facebook ads in 2007. This enabled businesses to showcase their brand and product in front of new people while they consumed content from friends, family and later influencers, kickstarting the trend of product discovery. The proliferation of platforms (including the introduction of social networks such as Instagram and TikTok), and launch of mobile apps and improved targeting capabilities, made Paid Social an attractive option for brands trying to capture consumer attention across various stages of the buying journey.

Fast forward to today and the digital marketing landscape is at a crossroads. Many omnichannel retailers still rely too heavily on bottom-of-funnel (BOF) strategies, with Paid Search their primary vice - an antiquated set-up that’s unfit for purpose. In contrast, many D2C and omnichannel brands have embraced a more holistic strategy, with greater focus on Paid Social for acquisition.

This is the real cornerstone for sustainable growth (and the secret to rediscovering Paid Search’s efficiency). Implementing a full-funnel, social-first strategy that places greater emphasis on incrementality opens the door to more diverse marketing that can engage customers at every stage of the funnel.

A quick glance at the history books reveals that, from a narrative perspective, Paid Social isn’t much of a departure from Paid Search. And it’s not just their role as performance channels that reads similarly.

Much like Paid Search, Paid Social enjoyed significant, sustained growth. For example, Facebook had 1.39B monthly active users (MAU) at the end of 2014. By April 2024, this had almost doubled to 3.06B . And just as Paid Search channels such as Google refused to stand still, Paid Social’s frontrunners continuously innovated to allow brands to have their cake and eat it - in this case, drive brand awareness and sales from new and old customers alike. The introduction of Advanced+ Shopping Campaigns (ASC) in 2022 only served to increase retailers investment in the platform even further.

On the surface, it looks like this resonated with the wider market. WARC’s data shows that Paid Social is forecast to overtake Paid Search as the world’s largest channel by ad spend ($247.3B in 2024). However, a closer look reveals a more nuanced picture. Whilst early adopters such as Wonderbly, Zappos and Gymshark twigged to the channel’s potential, this was not the universal trend.

So what’s the problem? The reality is that although the majority of brands crossed this bridge years ago, shifting their cross-channel strategy focus from demand-capture to demand-generation, not everyone understood the assignment.

Brands that have traditionally set great store in BOF investment and skewed heavily towards Paid Search have been slow to depart from a model that has previously delivered success. Instead, they cling to a “if it ain’t broke, don’t fix it” mentality.

Unfortunately, the model is brokenand was arguably always suboptimal. The environment in which it previously thrived, and today’s digital landscape, are vastly different. This shift can be attributed to three factors:

Google’s share of the desktop search engine market was 81.9% in January 2024, marking the lowest rate in over a decade. Similarly, Facebook’s user growth rate is forecast to be 0.6% in 2025, a 0.4 percentage point (pp) decrease from 2023 . The days when businesses could rely on a continuously expanding customer pool are over - the “rising tide lifts all boats” ideology has run aground.

The pandemic’s enforced closure of brick-and-mortar stores, alongside online shopping’s rapid popularity spike, forced swathes of traditional advertisers to switch budget allocation to online channels. A few years down the road, this has led to cost inflation on both Paid Search and Paid Social platforms. For example, the average CPC on Google Ads was $1.98 in 2020 - this has risen to $2.53 in 2024.

The combination of Apple’s ATT Update, which made it easier for users to opt-out of Identifier for Advertisers (IDFA) tracking, and the increasing depreciation of thirdparty cookies across browsers (including Safari and Mozilla Firefox) fundamentally altered digital marketing’s measurement and targeting foundations.

The model’s struggles are painted in an even starker light when looking at some of the largest internet businesses. These retailers built their success on Paid Search, long before Paid Social emerged. This meant that their entire marketing culture - from budget allocation to measurement systems - was tailored towards Paid Search. More importantly, the channel was cheap and constantly expanding, enabling them to acquire new customers at a cut-price rate while continually increasing volume.

However, the costs associated with Paid Search have only trended upwards - with the investment required to secure satisfactory returns spiking to unprecedented levels post-pandemic. This has left many brands needing to scale-back their Paid Search activity in a bid to find alternative sources of growth.

In terms of brass tacks, Paid Social presents better investment opportunities. This is the environment where users are spending the majority of their time - in 2024, the average internet user spends 143 minutes per day on social media sites . Visual-heavy platforms like these not only capture attention and build brand awareness, but enable brands to acquire customers at more cost-effective rates.

However, the traditional measurement frameworks for Paid Search and Paid Social differ wildly. Paid Search caps-out at a certain volume and price. Once you hit the ceiling, you’re left looking for more efficient buys - or risk scaling inefficiently.

Attempting to use Paid Search measurement frameworks to buy Paid Social will leave you blind to its full potential. However, this shouldn’t be seen as the end of the line. For marketers, the challenge is to find a framework that is fair, consistent - and most importantly, extracts maximum value from each channel.

“To many, this story will sound all too familiar. Overreliance on BOF, and particularly Paid Search, is the single most-common challenge that we have seen amongst prospective clients over the past 18 months. However, it isn’t all doom and gloom. Shifting to a cross-channel strategy that balances investment across the funnel can be the catalyst to supercharging your growth.”

- Chris Howard, Chief Operating Officer, Nest Commerce.

Naturally, brands will be daunted by the prospect of taking the next step in their growth journey - especially if this means ripping up the search-first playbook. Thankfully, they can look to existing success stories to instil confidence in their decision.

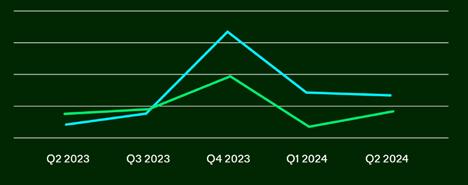

Many businesses within Nest’s portfolio have pivoted to a fullfunnel, social-first approach which leans on each platform’s USP to great effect. Meta ad spend across Nest’s previously Googlefirst clients increased by 60% YoY between Q2 2023-24.

Case History 1

To those brands that argue that they’re already using Paid Social - it’s important to remember that practice makes perfect. Tweaking strategies so that they align with current trends (both technological and cultural), and have an optimal investment split between channels, can unlock improved results.

Take fashion retailer Nadine Merabi. It previously relied on organic Instagram to grow its brand, with Paid Search capturing this demand. A change to Instagram’s algorithm meant that its feed, which previously favoured posts from followed accounts, took on a more discovery-led focus. Reels were prioritised instead. To resolve this issue, Nest advocated diversifying paid activity - specifically, reducing spend on Paid Search and finding a reliable alternative to organic Instagram for brand-building activity via Paid Social.

Prior to working with Nest, Google accounted for 41% of Nadine Merabi’s budget allocation, compared to 59% for Meta. In 2024 - one year later - Google’s share had been reduced to 28%, whilst spend on Meta had been scaled up to 72%. Meanwhile, during peak, the retailer could be confident in doubling spend. This strategic shift paid dividends, with Meta-driven revenue in the UK up by 48% YoY in May 2024. Meanwhile, Googledriven revenue experienced a 19% YoY improvement, with Search ads capturing the increased demand.

Whilst there’s no one-size-fits-all approach to implementing a crosschannel strategy, Nest’s approach is built on three fundamental pillars:

a) Start with the business objective

b) Funnel before channel c) Strive for incrementality

It’s easy to become fixated with day-today efficiency metrics such as ROAS or CAC - after all, businesses will always want to turn a healthy profit. However, whilst important, overreliance on these short-term measurements can hinder long-term growth and strategic direction. These should be your rudder, not your compass.

Brands that want to establish a healthy marketing set up should establish a North Star metric. This is a clear, overarching business objective that aligns with the longterm vision and guides all marketing activity, both paid and organic. Some progressive advertisers have even suggested that this could mean increasing branded search volume instead of boosting ROAS.

Here are some metrics we suggest at Nest:

Growing sales by a target percentage YoY by focussing on new customer acquisition

Increase US presence so that it contributes a target percentage of total revenue

Grow market share by acquiring a predetermined number of new customers

Increase lifetime value (LTV) of new subscriptions by a target percentage to ensure more sustainable, profitable growth

Focussing on your business objectives offers much-needed clarity when setting KPIs. Perhaps more importantly, it ensures there are no crossed wires when determining your level of spend across the funnel.

Overinvesting in Paid Search jeopardises your ability to show up where your customers are, or where they’re browsing - a surefire way to see your marketing budget go up in smoke. Brands that want to ensure that every pound works as hard as it can should adopt a channel-agnostic approach. Instead of making a predetermined channel section, map out the entire funnel - awareness, consideration and conversion - and identify the best mix of channels for each stage of the funnel.

For example, if a brand is trying to build brand awareness, it needs to invest in topof-funnel (TOF) activity. The question then becomes which platforms and campaign types are going to more effectively fulfil TOF objectives for a specific brand and target audience - Meta, YouTube or TikTok?

Similarly, brands that are concerned about generating immediate sales have to evaluate which channels are delivering premium BOF results at the time. Answering these questions will shine a light on how to prioritise your budget.

In cross-channel set-ups, adopting a ‘funnel before channel’ mentality comes with an additional benefit in the form of improved insight sharing. Whereas relying on separate teams can lead to biased budget recommendations, keeping things under one roof and focussing on the overall customer journey - rather than channelspecific outcomes - lends itself to a more cohesive operation.

Without stating the obvious, spending money without seeing tangible results is counterproductive.

If your digital marketing activities aren’t delivering measurable value, the budget could be better allocated elsewhere. However, this doesn’t mean putting all your faith in in-platform metrics, which prioritise easy-to-measure, short-term impacts.

Incrementality should be your ultimate differentiator. Unfortunately, proving these gains can be challenging. On Paid Social, testing methodologies such as lift studies can help bridge the gap in understanding. For example, use of Meta’s Search Lift tool showed how TOF ads directly impact users’ searches for brands. Running Meta awareness ads for a month drove an average of 3,359 incremental branded search visits, or a 22.3% search lift, alongside 5,082 incremental non-branded search visits, or a 9.4% search lift.

Averge incremental branded and non-branded search visits after one month of Meta awareness ads

Case History 2

Similarly, conversion lift studies show whether conversions are incremental, or whether a brand would have captured the sale regardless.

Nest delivered a conversion lift study for Mint Velvet, a women’s clothing brand, in order to understand the incremental impact of Meta, as well as the percentage of traffic that Meta drove that had potentially been attributed to Google Search. The study, which took place between the 3rd-28th June 2024, identified:

3,790 incremental conversions

$647,000 incremental sales

1,693 incremental Branded Search visits, or a 17% increase

From a Paid Search perspective, it may be easier for brands to link sales - but they still face an uphill battle proving they’re incremental (particularly when bidding on their own brand terms). And the absence of a lift product on Google does little to ease the strain, with brands forced to take manual responsibility for geographic hold-outs. Not only are these harder to manage, but they’re also less statistically-significant.

The reality is that regardless of which stage of the funnel you’re looking at, there’s a challenge surrounding incremental measurement. BOF channels - particularly Paid and Branded Search - are often overvalued by in-platform reporting. Meanwhile, TOF channels are typically undervalued, due to there being a longer gap between ad exposure and the actual conversion.

Clear identification of each channel’s contribution is paramount. However, businesses that invest simultaneously in multiple channels often struggle with overlapping results. Attribution platforms such as Fospha and North Beam can help unify and dedupe data, providing a single, less flawed view of performance as opposed to in-platform attribution.

LeMieux had already established itself as one of the UK’s leading equestrian brands before working with Nest.

The business’ turnover exceeded £42M in April 2023, representing a 16% increase from the previous year. However, LeMieux recognised that it needed to expand into the US market to achieve its next phase of growth.

Prior to partnering with Nest, LeMieux’s digital marketing efforts were limited. Google ad spend was minimal, and there was no activity across Meta platforms. Understanding the business objective, Nest proposed a cross-channel strategy that would enable LeMieux to break new ground and drive awareness amongst new audiences without sacrificing conversions.

Managing both Paid Search and Paid Social allowed Nest to share learnings seamlessly across channels. For example, Nest set up specific audiences in observation on Google, tracking which segments converted best. These insights were then used to refine audience targeting on Meta, enhancing overall efficiency.

This technique paid dividends again when Nest started using YouTube as an awareness tool on Google. Comparing CPMs and engagement rates against Meta revealed which was the most effective awareness driver - information that subsequently informed budget allocation.

LeMieux’s results for FY 2024

38% YoY growth

32% YoY growth in new customers

56% YoY growth from existing customers

Reducing your reliance on Paid Search can look simple on paper - particularly when you’re armed with a list of benefits and a framework for putting the changes into practice. However, gaining the support of stakeholders who are accustomed to BOF activity and are comfortable with their last-click mentality can be challenging.

We’ve identified the three roadblocks that cause friction during the early stages of your transition to a social-first approach, as well as the practical solutions that can help you overcome these hurdles:

a. Implementation

b. Measurement

c. Creative

You may understand the importance of ending your Google dependence, but does your boardroom? What about your CFO or CEO?

Internal blockers can be found across the business, particularly when there’s a risk to short-term revenue. The onus is on you to showcase that a potential dip in immediate efficiency will be a stepping stone to longterm growth.

Best-in-class cross-channel strategies are built by identifying your business goal, and using this to inform channel selection. If driving conversions is the priority, for example, which channel will maximise BOF opportunities? Conversely, which TOF channels will have the biggest impact on the target audience and boost brand awareness?

Next, establish if your business has the building blocks required to immediately roll out a full-funnel strategy - and if not, evaluate how it can get there. Some of the questions that you can ask include:

This groundwork enables you to set channel-specific targets. Ensure that these goals are realistic, play to each channel’s strengths and ladder up to the overarching business objective. One option is to use business data to set proxy KPIs that reflect your broader, long-term objective.

Finally, focus on extracting maximum potential from your budget. Continuously monitor for opportunities to increase spending based on performance - or red flags that prompt a strategic readjustment. Regularly reviewing your budget allocation enables you to adapt to real-time trends, preventing stagnation and ensuring that both Paid Search and Paid Social are delivering premium performance.

Once you’ve got your social-first crosschannel strategy off the ground, the next point of call is navigating the complexities surrounding measurement.

In regards to BOF activity, each platform’s attribution system is biased towards that channel’s unique metrics.

For example, both Google’s Performance Max and Meta’s ASC may demonstrate strong ROAS. However, this stems from targeting low-hanging fruit, meaning that they don’t necessarily translate to significant incremental gains. In short: what looks good in-platform may not always align with what truly drives business growth.

This is where attribution partners can play a key role in your marketing mix. The click-based model used by GA4 makes it a valuable tool for understanding which channel secured the final conversion. Meanwhile, Fospha’s impression-based model provides visibility on the channels that impacted the customer journey during the build-up. Best-in-class businesses combine both strategies, in order to get a comprehensive view.

In an ideal world, your measurement approach would triangulate incrementality, attribution and media mix modelling (MMM). However, this is the gold standard, meaning it comes with significant resource and investment requirements.

A more accessible alternative is to use bespoke regression analysis. This forecasting technique establishes how different variables impact one another - for example, whether a particular keyword achieves improved CTR or if CVR benefits from boosted ad spend. This enables you to apply a consistent method across platforms and demonstrate how each contributes to overall business uplift.

Nest conducted regression analysis for a UK D2C. By analysing total revenue and order volume data from Google and Meta, and aligning these to the brand’s revenue goals (based on the expected performance from each platform), we could recommend the required budget based on current performance data and budget splits. Currently, the budget is skewed 60:40 in Paid Social’s favour. However, it’s essential to keep the budget fluid, with adjustments based on ongoing performance.

Juggling the creative demands of both Paid Search and Paid Social is familiar territory for brands.

However, whilst not underplaying Google’s content needs (which have only increased due to advancements to Performance Max), reducing activity on this channel whilst scaling-up your social-first, TOF approach presents a new challenge entirely.

The need to find a solution to this is brought into sharper focus given that navigating the logistical challenges and identifying the optimal measurement framework will count for nought if you don’t know how to cut through the noise on Paid Social. This is particularly true given, as previously mentioned, metrics such as ROAS or CAC don’t provide the full picture of creative performance.

But simply compiling a broad base of assets won’t suffice. Look at TikTok, often labelled the most demanding ad platform in terms of creative requirements. For brands to stave off combat fatigue, it’s vital to increase the amount of content at their disposal. To put it simply, if content is fatiguing twice as fast, you’ll have to create content twice as quickly. In order to offset the commercial strain this puts on your business, you need to find innovative, more sensitive ways to tackle the content creation process.

There are also algorithmic challenges to take into account. Each platform’s algorithm identifies which type of content speaks to different audiences. For those businesses that are pivoting to full-funnel, it’s important to have creative diversity within the content and use new, interesting concepts to teach the algorithm what to serve to which customers. This could involve listicles that spell out the benefits of your products, or more aspirational content that illustrates how they can fit into your audiences’ lifestyle.

So how can brands ensure they don’t stumble at any of these hurdles?

First, develop a comprehensive creative strategy. This is the glue that holds everything together, ensuring all work undertaken supports your goals and is tailored to the specific stages of the marketing funnel.

This also means using a hypothesis-led approach. Before publishing any creative, establish what you want to learn from its performance. This could involve testing different content styles - such as product demos and lifestyle images - to ascertain which is more effective at engaging users at the consideration stage. Not only does this provide an understanding of which creative direction to go for each platform and funnel stage. Adhering to this hypothesis and monitoring the relevant KPIs also allows for robust learnings and insights.

“One of the most common misconceptions amongst advertisers is that a particular platform or ad format isn’t performing. However, this is often based on testing with a single creative concept. At Nest, we know that creative is the single largest driver of performance results. Therefore, it’s important to be continuously experimenting with new creatives, as well as to adapt your view of the relative performance of different platforms and placements as your creative quality improves.”

- George Wiscombe, Creative Services Director,

Nest Commerce.

This is a call to arms for brands that have allowed their marketing strategies to stagnate. The days in which BOF tactics alone were enough to drive growth are over. Continuing blindly down this path will leave brands battling with rising acquisition costs and diminishing returns.

The future of digital marketing success lies in flexibility. It’s not about pitting different channels against each other - it’s about implementing a cross-channel, full-funnel marketing strategy that leverages both Paid Search and Paid Social to uncover new growth and engagement opportunities. Brands that understand that their objectives should be set in stone, not their tactical setup, are poised to thrive amidst everchanging marketing conditions.

“The road to sustainable growth is fraught with challenges - from securing internal buy-in to mastering the creative conundrum. But those that rethink their marketing mix and invest in building a robust marketing ecosystem will be rewarded with an agile, resilient framework that empowers them to traverse the shifting digital marketing landscape with confidence.”

- Luke Jonas, Chief Growth Officer, Nest Commerce.

Want to learn more about how to effectively implement a full-funnel, cross-channel digital marketing strategy?

Click here to secure your place at our upcoming webinar