SEPTEMBER 2024 • ndfu.org

Measure 4 would eliminate property taxes, take local control away from communities

SEPTEMBER 2024 • ndfu.org

Measure 4 would eliminate property taxes, take local control away from communities

I was born and raised in Hettinger. I graduated from Hettinger High School, went to college in Bismarck and graduated with a business degree from Bismarck Junior College. After graduation, I started work at West River Regional Medical Center as a pharmacy technician. After seven years, I went back to college and earned a degree in respiratory therapy. I was working parttime at the hospital and filling in at the Jerel Seamands Agency as a Customer Service Representative (CSR).

In 2020, Jerel retired, and I made the decision after 35 years at the hospital to retire and pursue a new career. I became the new agent in Hettinger.

I am married to Corey Seamands, and between the two of us, we have six grown children. Corey retired from the Army as an Airborne instructor after 25 years. Together, we enjoy hunting, fishing, boating and spending as much family time as possible.

My genuine love for people is what has made my insurance career a great fit for me. Knowing I can help someone in a time of need and bringing comfort in knowing we will be there to protect their assets is very important

to me. I hope when people think of me as their agent they think of trust and integrity — all part of what great relationships are based on.

I am a huge supporter of the Hettinger community. I am on the Hettinger Golf Association board, volunteer for the Beautification of Hettinger, help serve luncheons at my church and with any community activity I can.

BY CHRIS AARHUS, NDFU

Braylen Bruns of Valley City wanted an opportunity to share his concerns with decision-makers about what it’s like to be a young and beginning farmer.

Bruns received just that, when he joined fellow young farmers Dalton Wiest of Wyndmere and Isaiah Throener of Cogswell in representing North Dakota Farmers Union on a young farmer and rancher panel Aug. 15 at the Grand Farm near Casselton.

The panel was moderated and hosted by U.S. Deputy Secretary of Agriculture Xochitl Torres Small, who was joined by U.S. Chief Agricultural Negotiator Doug McKalip. Later, the panel was also joined by Sens. John Hoeven (N.D.) and John Boozman (Ark.), who

were on site after holding a field hearing on ag tech and research for the Senate Ag Appropriations Committee.

Bruns — who farms with his parents and grows corn, soybeans, sunflowers and edible beans — said he was pleased to receive a chance to not only have time on the panel, but to visit privately with others like McKalip.

“It’s a really good opportunity to be here and talk to representatives making decisions on programs that are going to directly affect us,” Bruns said. “It’s nice to be able to get some face time. When I told some people I was coming here and that I would be in the same room with (leaders) and talking with them, they (were surprised). I said, I’m going to be able to look them in the eye and shake their hands.

MAIN: Braylen Bruns of Valley City, Dalton Wiest of Wyndmere and Isaiah Throener of Cogswell represented North Dakota Farmers Union on a young farmer panel with USDA Deputy Secretary of Agriculture Xochitl Torres-Small and U.S. Chief Agricultural Trade Negotiator Doug McKalip.

TOP: The trio listens to Torres-Small and McKalip.

BELOW: Wiest and Bruns visit with Sen.

and Farm Service Agency-North Dakota Director

That’s something about Farmers Union I’ve always said. There aren’t a lot of organizations for somebody like me to be able to get that interaction. A pretty cool opportunity.”

Throener spoke during the panel about access to capital as a young farmer-rancher. He and his family have a cow-calf operation, a feedlot operation and also grow corn, soybeans, rye and alfalfa.

“My comments were just about needing quick access to capital, especially in an auction setting where you don’t have a lot of time, especially if people don’t have a parent or somebody else that can purchase the land for them quickly,” Throener said. “It gets very tough for someone (younger) to get in on land deals.”

Throener, Bruns and Wiest — a first generation farmer — heard from Torres Small, as she detailed some of the issues she’s already discovered after being confirmed by the Senate in her role as deputy secretary in July of 2023.

“What really shocked me was how outdated our systems are,” she said. “We hear a lot about access to capital. We need to make sure barriers are removed when it comes to accessing USDA loans.”

Throener said he appreciated the opportunity to give feedback.

“It was cool to connect with the higher-ups (at USDA),” he said.

Studies show that in the United States, public and private research for agricultural technology has been decreasing compared to other exporting countries. This is concerning as one of our advantages in the export market has been technology.

For decades, we have led the world in developing agricultural technology, along

with infrastructure development, which has given us a distinct advantage in remaining a major exporter. If we cannot rely on the best technology and infrastructure to maintain our competitive edge in the export market, we may shift to being a residual supplier of products to other countries. This will have a large impact on our ability as farmers and ranchers to compete

and remain financially solvent.

In North Dakota, we enjoy a 24% return on investment for every dollar spent on agricultural research. When you consider the fact that agriculture makes up nearly a quarter of the state’s economy, it would seem logical to spend dollars on research to keep our ag systems competitive in the global market.

Your organization has been doing its part to try and increase dollars dedicated to ag research. We have testified and presented at the North Dakota Legislature, in Congress and at the White House, urging additional dollars and commitments for research. Public research dollars are essential for maintaining unbiased research results. Private industry investment is important, too, and needed to make research projects more viable through matching contributions.

We have also made the following contributions this year at North Dakota State University:

• $50,000 to the Bolley Agricultural Laboratory (and we’re very active in securing state support for this project).

• $50,000 for the Swine Research Facility.

• $50,000 to Northern Crops Institute (and will match that next year to support their programming which includes the Biofuels Tour, Introduction to Soybean course, Summer Ag Academy for youth, Next 5 Years Conference, and more).

At Dickinson State University, we have invested $250,000 (over five years) into their Agricultural & Technical Studies Legacy Project.

Along with Farmers Union Enterprise states (North Dakota, South Dakota, Wisconsin, Minnesota and Montana), NDFU is committing $1.5 million over five years to fund the Farm Ag Policy Research Endowed Professorship at NDSU. Currently, most research done for farm and ranch program statistics and impact is out of Texas A&M University. Our contribution bolsters research capacity at NDSU, along with federal government funding at $2 million per year for five years. These investments will allow the ability to provide data relevant to our region to elected officials and government agencies.

These contributions are a one-year example of investments we have made to channel research and development funding to research centers. From a technology perspective, we are working with and investing in the Grand Farm. There is an effort to create an Ag Innovation Corridor in North Dakota, conducting the highest level of ag research and development. NDFU is participating in this effort.

Your organization is committed through many avenues to be able to search for income enhancing concepts for family farm agriculture. As we enter further into the world of artificial intelligence, we will need research to determine the value to family farmers for this level of technology. We will continue these efforts, as it is essential to our mission.

On Aug. 2, the Congressional Budget Office released its official cost estimate for the House Farm Bill. The Farm, Food and National Security Act of 2024 would increase the federal deficit by $33 billion over 10 years. The cost estimate underscores the difficult task House Agriculture Committee Chairman G.T. Thompson (R-Penn.) faces in getting his bill across the floor. It also highlights the challenges of improving the farm safety net in the context of a budget neutral farm bill.

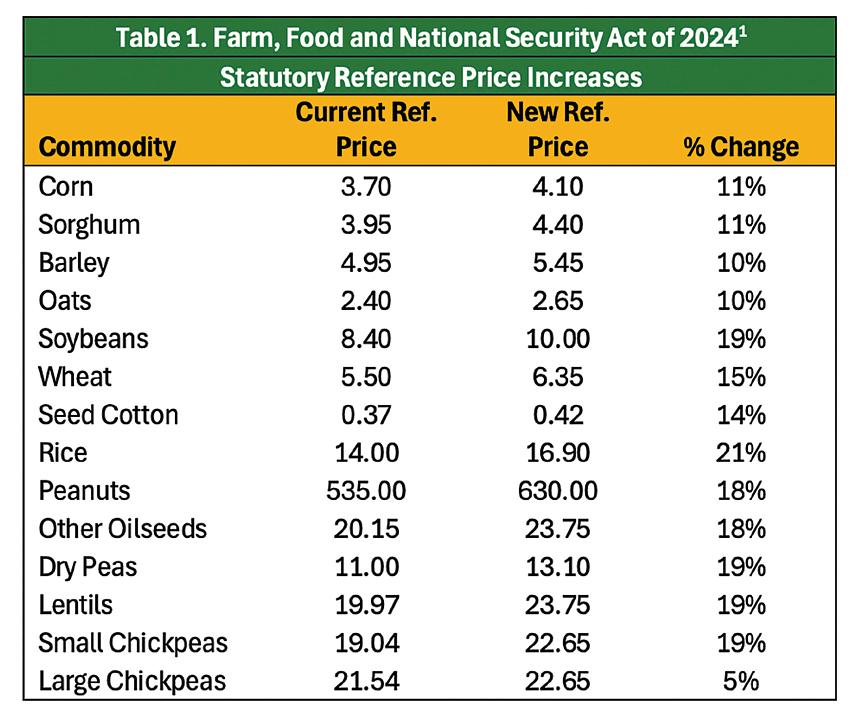

The key drivers of the cost increase in the House Farm Bill are improvements to reference prices. The House bill increases statutory reference prices by 10-20% (see Table 1). The bill also leaves in place the 2018 Farm Bill’s “effective reference price” provision, which boosts reference prices by as much as 15% following periods of high prices.

CBO estimates the improvements to statutory reference prices will increase the cost of Price Loss Coverage and Agricultural Risk Coverage by a total of $45 billion. The bill’s crop insurance provisions, which include enhanced subsidies for the Supplemental Coverage Option and higher administrative and operating funding for insurance carriers, add another $3.5 billion to the bill’s price tag. Improvements to trade, research and other programs generate additional cost increases.

Thompson hopes to offset these costs with two key provisions. The first is a restriction on changes to nutrition program benefits that requires all future changes to food plans to be budget neutral. The second is limitations on the Secretary’s authority to use Commodity Credit Corporation funding. The nutrition changes generate savings of $29.4 billion and the CCC restriction provides another $3.6 billion in cost savings. Both provisions are controversial; however, even if they were to pass, they fall well short of offsetting spending increases (see Figure 1).

CBO is a nonpartisan agency under the purview of Congress. The agency’s responsibility is to analyze the budgetary impacts of legislation to help Congress meet its budgetary goals. CBO estimates loom large over the farm bill and other Congressional debates. While Thompson disputes CBO’s estimate, the projections are likely to have a marked impact on the path forward for his bill.

More broadly, the CBO score highlights the challenge of improving farm safety net programs in the context of a budget-neutral

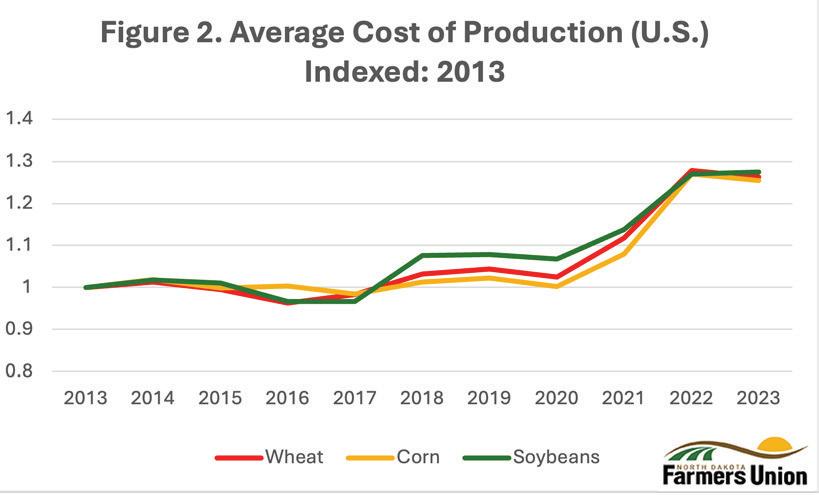

farm bill. NDFU, like others, has stressed the importance of increasing reference prices. Statutory reference prices were established after the 2013 crop year. Since then, the cost of production for wheat, corn and soybeans has increased by over 25% (see Figure 2). As input

costs go up relative to reference prices, the safety net becomes less effective at keeping farmers afloat. However, increasing reference prices is costly.

The cost-saving provisions in the House bill are unlikely to gain the bipartisan support needed to pass a final farm bill and are already inadequate to offset cost increases. Conversely, a bill without reference price increases is unlikely to generate the support required to get it across the finish line. With farmers facing high input costs and low crop prices, there is a growing sense of urgency to complete the farm bill. To do that, Congress must find a way to fund a strong safety net for farmers and consumers.

— Government Relations Director Matt Perdue

1H.R. 8467, Farm, Food and National Security Act of 2024. (2024, May 1). 118th Congress (2023-2024). Retrieved from https://www. congress.gov/bill/118th-congress/house-bill/8467.

2Congressional Budget Office. (2024, August 2). CBO Cost Estimate, H.R. 8467, Farm, Food, and National Security Act of 2024. Retrieved from https://www.cbo.gov/system/files/2024-08/hr8467.pdf; NDFU calculations.

3USDA Economic Research Service. (2024, May 1). Commodity Costs and Returns. Retrieved from https://www.ers.usda.gov/data-products/ commodity-costs-and-returns/; NDFU calculations. 3

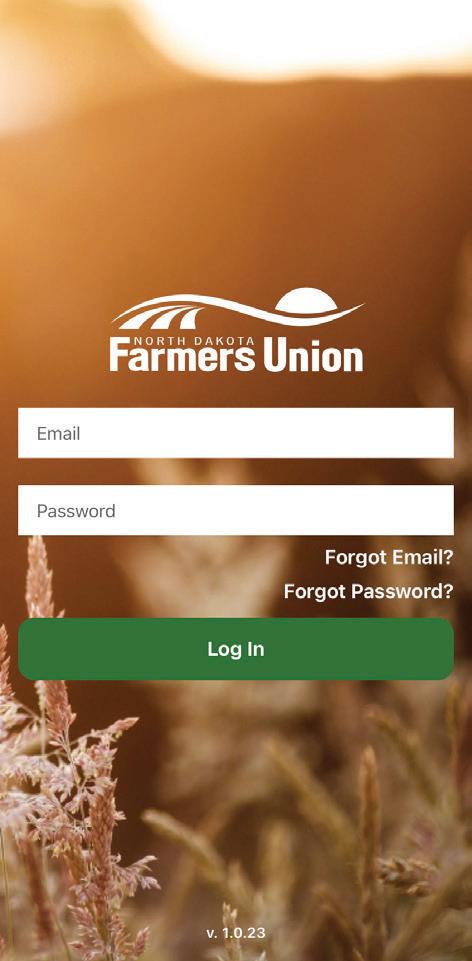

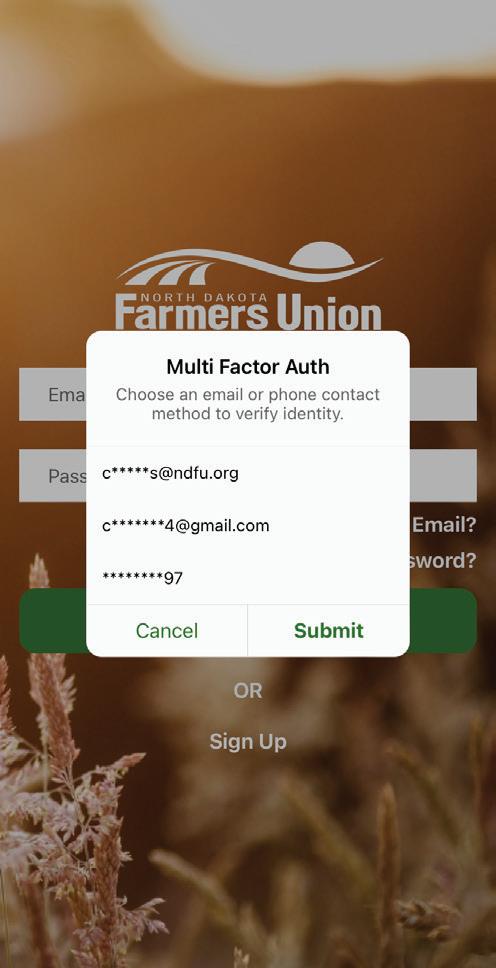

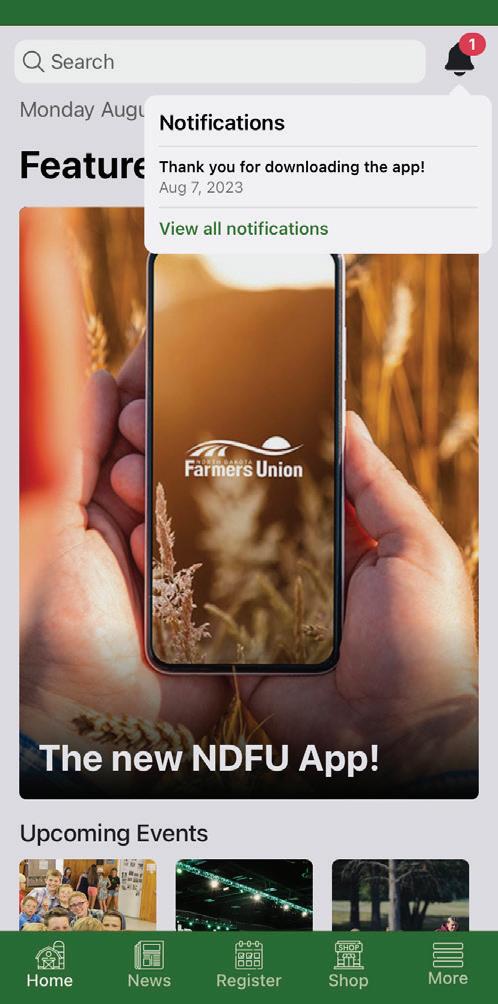

Members can use the same email address and password they use for the NDFU portal to log into the app. If you do not know your password, use the “Forgot Your Password” option. NDFU must have an email address on file for you to use the app. If we do not have an email address for you, please call 1-800-366-6338 or email us at ndfu@ndfu.org to have it attached to your account.

1

Login with your email address and password. Use the email address where you receive your NDFU communications.

If you don’t know your portal password, use the Forgot Your Password option!

2

Follow the on-screen prompts to login. NDFU utilizes two-factor authentication for security purposes.

Choose to receive your two-factor code via text or email!

3

Enter the code to get into the app. If the texting option does not work the first time, try again and choose the email option.

You will stay logged into the NDFU app continually, providing you open the app once a month!

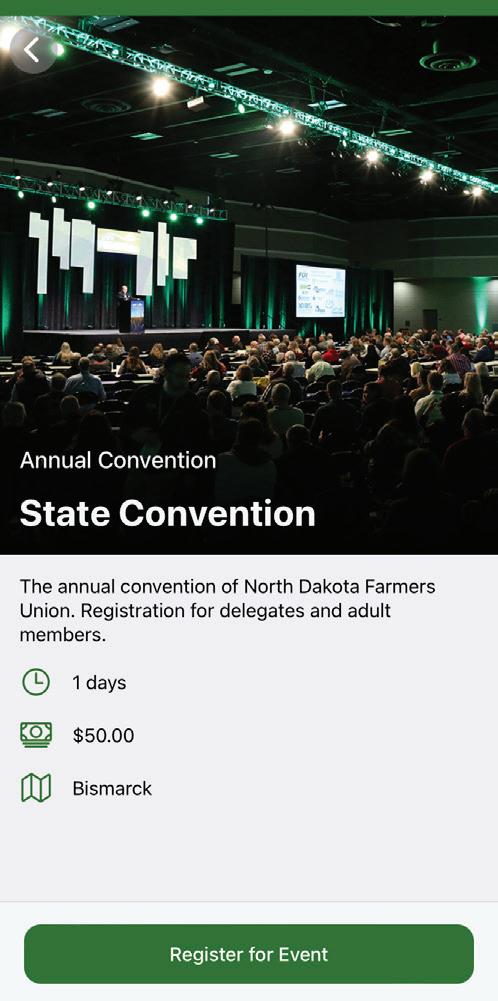

Three of the features of the app include a home screen with notifications, state convention registration and the ability to find and contact your legislators about important issues!

Do I have to be a member to log into the app?

Yes. The app is for NDFU members. Those who would like to become members can sign up at NDFU.org!

What if NDFU doesn’t have my email address? Like any online service, we require an email address to use the mobile app. Contact us at 1-800-366-6338 or ndfu@ndfu.org to have an email address added to your account. Additionally, if we have a different email address on file than the one you’re currently using, you can use the one we have on file or contact us with your new address.

NDFU has my email, but I’ve never used the online portal. What’s my password? Search NDFU in the app store or scan the QR code. Download the app, use the Forgot Password link on the login screen and follow the on-screen prompts to set a new password!

If you continue to have trouble logging in, contact Chris Aarhus in the Communications Department at 701-952-0118 or caarhus@ndfu.org.

Earlier this summer, U.S. Secretary of Agriculture Tom Vilsack announced the fourth in a series of ongoing updates to the Packers and Stockyards Act (P&S Act). The proposed rule, titled “Fair and Competitive Livestock and Poultry Markets,” aims to strengthen P&S Act enforcement by creating a framework to assess “unfair practices” claims by family livestock producers who are harmed by meatpackers.

Known as the “unfair practices” rule, the proposal puts forth a framework for defining what the term “unfair practices” means, under section 202(a) of the P&S Act. It follows the finalization of two other P&S Act rules – the “inclusive competition” and “poultry transparency” rules – and the recent issuance of the “poultry tournament” proposed rules.

Under the “unfair practices” rule, Section 202(a) states it is unlawful for any packer, swine contractor, or live poultry dealer to “engage in or use any unfair, unjustly discriminatory, or deceptive practice or device.” The recently completed P&S Act “inclusive competition” rule deals with discrimination and deception, but “unfair” requires further clarification. The term “unfair practice” is at the center of a long-running problem with P&S Act enforcement regarding whether, for conduct to be considered “unfair,” there needs to be proof of competitive injury – a showing of harm not to

Sept. 9-11, 2024 • Washington, D.C.

Farmers Union members will hear from U.S. Department of Agriculture officials about initiatives the department is undertaking on behalf of farmers. They expect to meet with officials from the Biden Administration about their important work on competition and with the farm bill. Participants will also receive briefings from key Congressional leaders, especially related to the preparations for the 2023 Farm Bill.

an individual or group of individual producers, but to the entire industry.

In the rule’s preamble, USDA addresses this issue and states clearly it is a central reason for this rulemaking:

“…some courts have recently required proof of competitive injury before finding that conduct is unfair. Those courts were not offered an alternative definition for unfair, which this rulemaking would propose. A competitive injury requirement cannot be imposed in a way that abrogates part of a statute. To the degree requiring a “competitive injury” precludes finding conduct is unfair when it satisfies criteria in the proposed rule, such a requirement would unduly limit the reach of section 202(a) and is improper. Moreover, the statute and P&S Act case law make plain that competitive injury under the P&S Act is broader than harm to competition under the antitrust laws.”

In this proposed rule, USDA seeks to settle the “competitive injury” or “harm to competition” issue by defining an “unfair practice” with respect to both “market participants” (individual producers or groups of producers) and to “markets.” Thus, there would be cases where an unfair practice claim is valid based on individual harm, and in other cases where it is valid on the basis of harm to the broader marketplace.

BY CHRIS AARHUS, NDFU

Neal Messer knows he could personally and professionally benefit from not paying property tax. As a farmer and owner of a real estate company in Dickinson, there’s no question it’s good for his pocketbook.

“I’m in two industries highly influenced by property taxes,” Messer said.

But as a Stark County commissioner, he also believes some form of property tax must be assessed locally to meet the needs of each community.

That local control could be undone by Measure 4, a constitutional measure that would eliminate property taxes in North Dakota. Measure 4 is officially on the ballot and will be decided by voters on Nov. 5.

Former state legislator Rick Becker chairs the sponsoring committee that put forward the ballot initiative, which would amend and repeal sections of Article X of the state constitution relating to finance and public debt. It would prohibit the legislature and local subdivisions from “the levying of any tax on the assessed value of real or personal

property.” Full language of the measure can be found on the North Dakota Secretary of State’s website.

Any replacement funding handed down from the legislature would be frozen at 2024 levels. The North Dakota Legislative Council estimates the state would have to find $1.3 billion to replace the lost revenue.

North Dakota Farmers Union (NDFU), per its policy and action, opposes the elimination of property tax and is part of the Keep It Local coalition working to defeat the measure. Last December, NDFU members passed a special order at the state convention directing the organization to work toward property tax relief, but to oppose any effort to eliminate property tax.

“NDFU opposes efforts to eliminate property tax,” the special order reads. “Eliminating property taxes will force political subdivisions to rely on the state for funding critical needs. This will disproportionately harm rural communities and lead to

CONTINUED ON PAGE 18

• Public services should be provided to all people equitably, and the cost of service should be paid by taxes collected in accordance with the principle of the ability to pay. Less of the total tax burden should come from property taxes and more from income and corporate taxes.

• We support a balanced tax structure and local control. As a result, we support restructuring the state tax system with property tax relief being a priority. However, we oppose elimination of property taxes, and we oppose elimination of income taxes. To meet these goals, we propose increasing the percentage of sales, gross receipts, use, and motor excise tax collections to be deposited in the state aid distribution fund for allocation to political subdivisions. We also support a property tax system that imposes property taxes on the value of minerals.

• State funding for elementary and secondary schools should be based on at least 70 percent per pupil. We oppose increased reliance on local property taxes for funding schools because it discriminates against rural schools and places an unfair burden on property owners.

declining services and infrastructure.”

Messer doesn’t argue for the status quo — he believes property tax reform needs to happen.

“I’m all in on reform, and that’s why I want to be part of the solution,” he said. “A lot of this is not anti-property tax — they want property tax reform.”

He understands the complaints, because he hears them regularly as a county commissioner. One big complaint is that a homeowner never really owns their property with property tax.

“My argument has always been that owning personal property or real property comes with an enormous set of rights and responsibilities,” Messer said, “and property tax is one of those components. This is not unique to county government. Right here in Dickinson not long ago, the IRS was auctioning off a piece of property because the individual didn’t pay his income tax. The IRS sold it. It’s part of taxation.”

Messer said another complaint is that homeowners feel the valuation of their property is too high and rises too fast.

“They paid $250,000 for their house, their valuation goes up 5% every year and five years later, all of a sudden it’s valued at $300,000,” Messer said. “That increase does them no good until the day they sell it. The comparison for the valuation of a property should be an arm’s length transaction, and we don’t do that. We kind of bury (properties) in a pool and increase (all) valuations by 4.5%. That’s not how we should be doing it. We need to change

that.”

But is that enough to consider eliminating property tax completely? Messer doesn’t think so. After all, this is revenue that stays in communities, he said.

“Property tax is the only tax that is 100% controlled locally,” Messer said. “If you go buy a hamburger from a restaurant and pay sales tax, (most of) that goes to Bismarck. They put it in a pot, stir it up and distribute it. Same with income tax.

“With property tax, it never leaves without us having the ability to control it. We have 3,100 political subdivisions in this state, and they’re all unique. Without a doubt, the best way to spend that money is at the grassroots level.”

Messer said Stark County levied $6.7 million in property tax dollars in 2021, the first year he took office as a commissioner. For 2024, the county levied $5.5 million.

“We’ve fought hard to be fiscally responsible,” Messer said. “There are political subs who are doing what we’re doing and being responsible, and some that aren’t. But they’ll get rewarded for not cutting their assessments (if the measure passes), and we’ll get penalized because we were fiscally responsible, if at some point we have to potentially come back up.”

Messer said voters should have all the information about who pays property tax, and that it’s not just homeowners. Marathon Oil, for instance, pays $1.6 million in property tax each year, he said.

“They’re a great company, and they have great involvement with the community, but do you think they’re just going to take that savings and then arbitrarily send it back to Stark

Each year, delegates at North Dakota Farmers Union’s annual convention conclude the Policy and Action debate by passing special orders of business. These documents address specific, timely issues and highlight strong priorities for NDFU’s advocacy work. Last December, delegates passed a special order opposing the elimination of property taxes:

NDFU supports a tax structure that provides a reasonable balance of income, property and sales tax revenues. We are concerned by the growing burden of property taxes on landowners. We support efforts to reduce the property tax burden while maintaining local services and infrastructure funding. We encourage the state legislature and political subdivisions to work toward a more balanced tax structure.

However, NDFU also recognizes the important role property taxes play within a balanced tax structure. Property taxes are levied locally and controlled locally to address local needs. Property taxes are important for upgrading and maintaining rural roads and supporting public schools. Property taxes also fund many local services, including fire, ambulance and public safety, water systems and public libraries.

NDFU opposes efforts to eliminate property tax. Eliminating property taxes will force political subdivisions to rely on the state for funding critical needs. This will disproportionately harm rural communities and lead to declining services and infrastructure.

County? No, and we shouldn’t expect them to. They’re a for-profit company. So why would we eliminate property tax for everybody?”

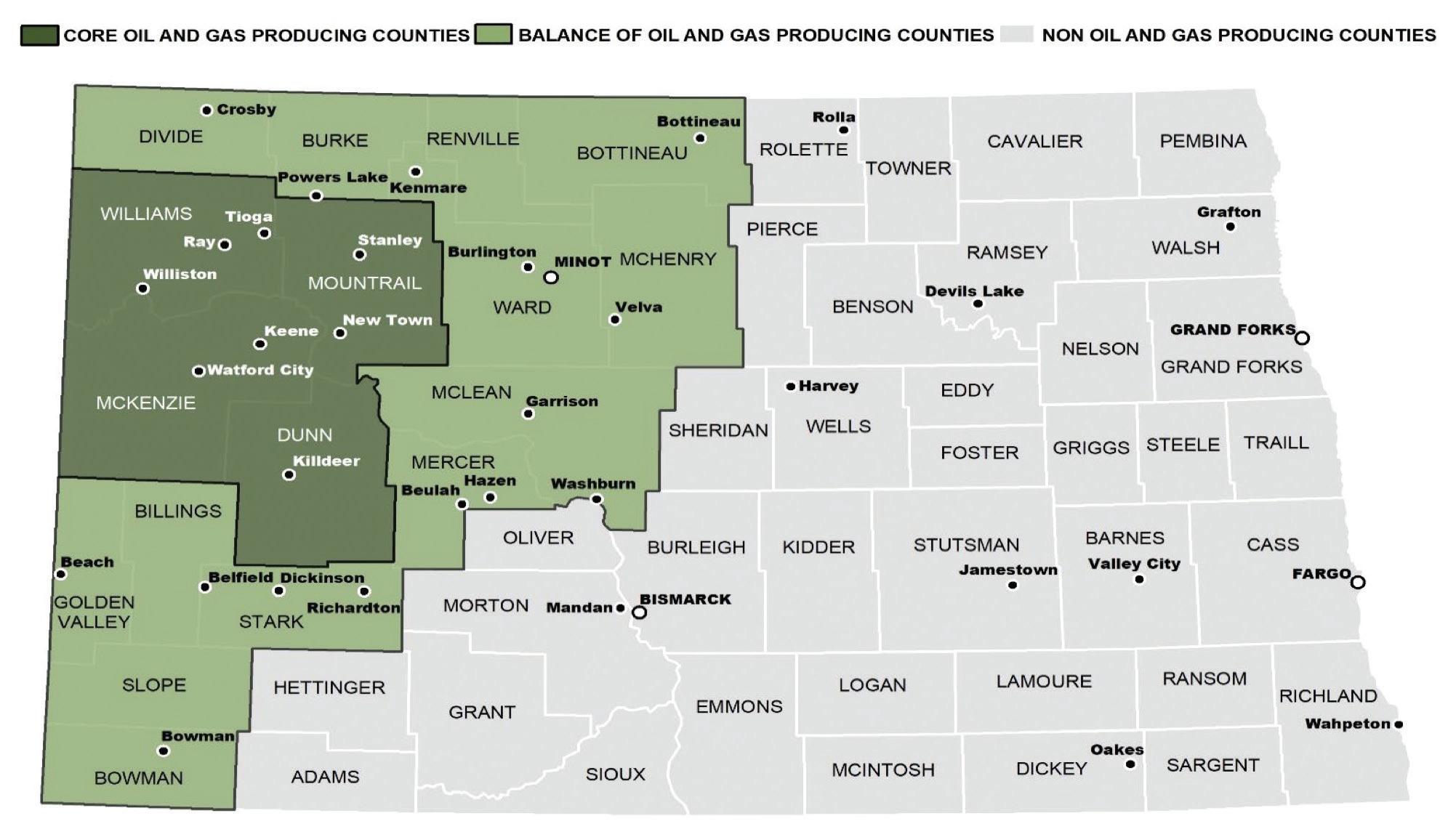

If the measure passes, the legislature would likely have to tap the interest earned on the Legacy Fund to make up the difference, Messer said. That doesn’t sit right with him, as the Legacy Fund is funded through oil and gas taxes. All of North Dakota’s oil and gas activity is in the western half of the state, and more than 75% of the activity happens within just four counties — Dunn, McKenzie, Mountrail and Williams.

“So, what we’d be doing is funding this constitutional measure on the backs of four counties,” he said. “What if oil goes downhill? What if oil drops to $30 a barrel for an extended period of time? We’re basing a lot here on a single revenue stream.”

Carrington Fire Chief Ken Wangen has the responsibility of making sure his 32 volunteer firefighters have what they need to serve their community.

For the past two years, Wangen has been quoting the cost of a new mainline engine and preparing to build it into the budget. Inflation isn’t just hitting consumers in grocery stores, though. It also affects local government when it comes time to buy fire trucks, snowplows and school buses.

“We bought our truck new in 2001 for about $180,000,” he said. “If I was to replace it now with the same truck without the same equipment, it’s going be over a half-million dollars.”

A common refrain from those supporting the measure is that local officials are not being good stewards with taxpayer dollars. Wangen encourages citizens to look at the budgets of their local subdivisions.

“There isn’t some magic fund pulling money out,” he said. “Every one of these entities puts together a budget.”

Wangen’s concerned that future large costs like a fire truck will have to essentially be lobbied for in Bismarck, rather than taken to the

CONTINUED FROM PREVIOUS PAGE

Carrington community.

“If this turns into one big lump sum, our volunteer-based fire department will have to go to Bismarck and justify it to state legislators,” Wangen said. “And when we all start fighting over money, the larger population centers always win.”

It’s an issue that raises concern with both Wangen and Messer. If state government is deciding where these dollars will be allocated from Bismarck, how do rural communities compete with larger communities?

“I have a friend on the Slope County Commission in southwest North Dakota, and he has access to three legislators,” Messer said. “My buddy on the Cass County Commission has access to 36 legislators within 50 miles of his house. You can say these legislators will be unbiased and fair, but their phones will be ringing off the hook to serve their own constituents.”

If the measure passes, Messer said funding could be the first domino to fall, and eventually, local services could follow.

“They’ll have to tighten their budgets, and,

inevitably, you will force these rural districts to consolidate,” Messer said. “The consolidation of the local political subs and the elimination of a lot of them is very real.”

If that happens, Carrington might end up covering for smaller departments like Sykeston, Wangen said. And in the case of fire emergencies, the clock is everything.

“Houses can be gone in 10 minutes,” he said. “If we start losing fire departments, it’ll be scary.”

Wangen acknowledges the pain may not be immediate, as local governments can likely weather inflation with budgets frozen at 2024 levels. However, it won’t be long before Carrington is competing with Fargo and Bismarck, he said.

“Four years down the road, where else will you be able to cut?” he said. “Then I have to go back to the legislature and fight for funding, and Fargo has the population that they have to protect. We can’t compete with that. We don’t have the clout.”

Needing to find money in the budget for bigticket items isn’t unique to fire departments. For

schools, replacing an HVAC system takes meticulous budget planning.

Amanda Olson serves on the board for the Anamoose Elementary School and said the school is looking at repairs to its gymnasium’s heating and cooling system. That repair is one of several that will likely use up a large chunk of the small school’s building fund the next few years.

“It’s a modest building fund, but that money is going to be depleted soon,” said Olson, who farms with her husband and daughter near Anamoose. “Some of our heating infrastructure is from the 1960s. We need to be able to maintain and repair that system, as a new heating and cooling system could cost our district hundreds of thousands of dollars to replace brand new.”

As a school board member in a rural community, Olson said she knows she’s not alone. Rural facilities are often much older than their urban counterparts.

“Many of our school buildings were built 50, 60, 70 or even 100 years ago,” she said. “It’s a difficult decision. How do we spend responsibly but still maintain a comfortable

CONTINUED ON NEXT PAGE

Keep It Local is a statewide coalition against Measure 4 that seeks to abolish property tax in North Dakota. The coalition is an ideologically broad group with a central goal of maintaining local control and keeping our communities great places to live. The coalition has many members.

AGRICULTURE/ ENERGY/ NATURAL RESOURCES

Lignite Energy Council

Lower Yellowstone Irrigation Project District #2

ND Association of Rural Electric Cooperatives

ND Farmers Union

ND Corn Growers Association

ND Grain Growers Association

ND Petroleum Council

ND Soybean Growers Association

ND Stockmen’s Association

ND Water Users Association

North Central Electric Cooperative

McKenzie Electric Cooperative

Red River Valley Sugarbeet Growers Association

PUBLIC SAFETY

Chiefs of Police Association of ND

ND EMS Association

ND Fire Chief’s Association

ND Sheriffs and Deputies Association

Professional Firefighters of ND

HEALTH CARE

Health Policy Consortium

Minnesota Nurses Association

ND Hospital Association

ND Long Term Care Association

ND Medical Association

ND Senior Service Providers

ND State Association of City & County Health Officials

EDUCATION

ND Association of Secondary School Principals

ND Association of County Superintendents

ND Association of Elementary School Principals

ND Association of School Administrators

ND Association of School Business Officials

ND Association of Technology Leaders

ND Career and Technology Education Administrators

ND Council of Educational Leaders

ND Library Association

ND of Interscholastic Athletic Administrators Association

ND Regional Education Association Leaders

ND School Boards Association

ND Small Organized Schools

ND Special Education Study Council

ND Student Activity Association

ND Student Honor Society

ND United

Bismarck Mandan Chamber EDC

Devils Lake Chamber of Commerce

Dickinson Area Chamber

Fargo/Moorhead/West Fargo Chamber

Grand Forks/East Grand Forks Chamber

Greater North Dakota Chamber

Jamestown Area Chamber

Minot Area Chamber EDC

Valley City Area Chamber of Commerce

Williston Area Chamber

ASSOCIATIONS/ NONPROFITS

AARP ND

American Council of Engineering Companies ND

The Associated General Contractors of ND

Broadband Association of ND

Downtown Development Association

Economic Development Association of ND

Independent Community Banks of ND

ND AFL-CIO

ND Association of Counties

ND Association of County Engineers

ND County Auditors and Treasurers Association

ND League of Cities

ND Recreation and Park Association

ND Retail Lumbermen’s Association

ND Township Officers Association

Valley Prosperity Partnership

Vision West

Western Dakota Energy Association

REAL ESTATE

Badlands Board of Realtors

Bismarck/Mandan Board of Realtors

Building Industry Association of the Red River Valley

Fargo Moorhead Area Association of Realtors

Grand Forks Area Association of Realtors

High Plains Association of Realtors

Minot Association of Builders

Minot Board of Realtors

ND Association of Builders

ND Association of Realtors

Williston Board of Realtors

CONTINUED FROM PREVIOUS PAGE

environment for children and staff? If we could afford a brand-new system, we would do it. It’s not feasible right now, and it won’t be even considered if we don’t have a property tax base to use.”

It’s not uncommon for schools to be a small town’s largest employer, and that’s the case for Anamoose. Olson said a funding hit to their school could put it at risk if the measure passes.

“I believe many rural schools would consider consolidation to help alleviate rising costs,” Olson said. “If a school closes in a small town in North Dakota, it’s very difficult to keep that town thriving. Shutting down a school means loss of jobs, which means loss of population, and so much more.”

Like Messer and Wangen, Olson doesn’t believe using Legacy Fund earnings to replace property tax dollars is a good idea, adding, “It sounds risky to me to base funding from something not concrete.”

Olson said she can’t support eliminating property taxes with no real blueprint for how local governments will be funded going forward.

“If there is no solid backup plan, it’s just gambling,” she said. “As farmers, we know

that gamble and aren’t willing to do that with our daughter’s future. My husband and I, as landowners, are proud that our property taxes are used to fund education and the future wellbeing of our daughter Mia. And we know our property taxes are spread around to support our community.”

Messer said the legislature does need to find a solution to make sure North Dakotans get more property tax relief.

Proposals range from doubling the recent property tax credit of $500 — which Messer doesn’t believe is enough — to eliminating property tax up to a certain valuation.

“My idea is up to $250,000, and if you owned a house that was valued at that or lower, you’d pay no tax,” Messer said. “If it was worth $300,000, you’d pay tax on $50,000.”

While Messer admits he’s not sure if the numbers even work for something like that, he believes some form of it would have various benefits.

“It would help lower-income families,” he said. “And if you were dead set against paying property tax, you might think about moving to a smaller community where you would pay zero.”

The point, Messer said, is to provide the help where it’s needed — for North Dakota families.

North Dakota has 17 active oil and gas producing counties. An oil and gas producing county is a county that has had oil and gas production in the last five calendar years. Four counties are considered core oil and gas producing counties. Core counties must be top oil and gas producers and, when combined, account for at least 75 percent of North Dakota's oil and gas production. If Measure 4 passes, legislators could need funding from Legacy Fund earnings to help bridge the gap, putting the responsibility on a handful of counties. Information and graphic courtesy of North Dakota Job Service.

NDFU has been heavily engaged in property tax reform discussions, but has yet to endorse any specific proposal.

“A large oil company or Bill Gates (with his farmland) — they can pay the tax, as they should,” Messer said.

North Dakota isn’t the only state tackling high property tax.

Colorado has three measures on property tax going before the voters. One would cap revenue growth for property tax at 4%. Another would cut residential and commercial assessment rates, with the state reimbursing local governments the difference. A third would expand the disabled veterans property tax credit. New Mexico and Virginia also have ballot measures to expand property tax credits to veterans.

In Florida, a measure would require the state’s homestead tax credit to be adjusted for inflation.

In Georgia, a measure would increase the personal property exemption from $7,500 to $20,000 per person (North Dakota does not tax citizens on the value of their personal property).

In Wyoming, voters will decide on whether to put primary residences in a separate property tax category from rental property.

In Arizona, homeowners would receive a full property tax refund if the local municipality doesn’t enforce laws against illegal camping or loitering in a measure meant to target the state’s homelessness problem.

In total, eight states are trying to find a solution with the upcoming ballot. Only one is trying to eliminate property tax altogether.

“It’s an answer, but it’s the wrong answer,” Wangen said.

This initiated measure would amend sections 1, 14, 15, and 16 and repeal sections 4, 5, 7, 9 and 10 of Article X of the North Dakota Constitution. It would prohibit political subdivisions from levying any tax on real or personal property except for the payment of bonded indebtedness incurred before the end of the thirty-day period following the date this amendment was approved by the voters, until such debt is paid, and would require the state to provide replacement payments to political subdivisions of no less than the amount of tax levied on real property during the 2024 calendar year.

It would limit the debt of a political subdivision to an amount not to exceed two and one-half percent of the full and true value of the real property in the political subdivision, except that an incorporated city, by a two-thirds vote, could increase the indebtedness of the city one and one-half percent beyond the two and one-half percent limit and a school district, by a majority vote, could increase the indebtedness of the school district two and one-half percent beyond the two and one-half percent limit.

It would allow an incorporated city, without regard to the existing indebtedness of the city, to become indebted in an amount not exceeding two percent of its full and true value for water and sewer projects. It would require a political subdivision incurring indebtedness to provide for annual revenues to pay the debt payments when due and would prohibit a political subdivision from issuing general obligation bonds secured with tax levied on the assessed value of property on or after January 1, 2025.

TAKE YOUR FAMILY TO A MINNESOTA VIKINGS GAME, AND LEAVE THE HASSLE TO US!

Join North Dakota Farmers Union as we cheer on our Minnesota Vikings! It’s a welcoming experience with our lower bowl season tickets, luxury motor coach and professional staff. This is a fun, smooth and relaxing adventure for your whole family.

Sunday, Oct. 20 vs. Detroit

Open to members statewide

Sunday, Nov. 3 vs. Indianapolis

Open to members statewide

Sunday, Dec. 1 vs. Arizona

Open to members statewide

Sunday, Dec. 8

*Sargent County Farmers Union has 12 seats set aside for its members with a $185 discount per person.

Sunday, Dec. 29 vs. Green Bay

*Richland, Cavalier and Bottineau counties each have 12 seats set aside for their members with a $185 discount per person.

The Community Ambulance Service of New Rockford helds its Lifesavers in the Park event Aug. 13 at Centennial Park in New Rockford. The event was partially made possible by a $500 Community Stewards grant from North Dakota Farmers Union. The event featured booths, live demonstrations, ambulance tours, kid games and more.

Dalton Wiest of Wyndmere, Chris Lundeby of Osnabrock, NDFU

Member Relations

Specialist Mary Mertens, Madelyn Oster of Ray and Dylan Witte of Regent represented NDFU at the Farmers Union Enterprise Leadership summit in Whitefish, Mont.

NDFU Government Relations Director

Matt Perdue (far right) recently moderated a producer perspectives panel in Little Rock, Ark., at the Alliance to Advance ClimateSmart Agriculture summit.

the fourth children’s book from North Dakota Farmers Union

$16.95 plus tax

Dusty learns about generations of family and equipment on their farm, and the latest in soil technology. Find out how Dusty makes Gramps a new thingamajig for his tractor to save the day!

Ads must be submitted through the online form at www.ndfu.org. Click “Classifieds” at the very bottom of ndfu.org and fill out the online form. Ads must be re-submitted each month. No exceptions! Deadline is the 15th of every month. Limit 75 words.

MEMBERSHIP DUES MUST BE CURRENT!

ANTIQUES, disks, plows, 3-pt attachments, cultivators, planters, manure spreader, etc. Too much to list. If interested, please contact us. 701-320-7099, Rita Rivinius, Gackle.

1964 F-600, steel box and hoist. 292 V8 4 barrel with about 6000 miles on the engine. Good tires all around. 4X2 speed trans. $2500 obo. 1930 Model A 4-door. Runs and drives. Original condition. $5500. Call evenings or weekends. 701-216-0094, Doug Perdue, Ray.

LOADER MOUNTS, Miller P Series Loader mounts for John Deere Utility Tractor, $200. Top Beater for Du Al 600 Manure Spreader $100. 1975 Chevy C65 truck fame, would make good bale wagon $250. Black Case IH Vibra Shank complete shank assemblies $75 each.1980s Chevy Bus Hood $100. Misc Vibra Chisel parts. 701-833-3882, Todd Fjeldahl, Minot.

JD 9610 combine, with 30 ft straight header (230) and pickup header. 701-728-6580, Gladys Kraft, Norwich.

2011 CASE IH 50 tractor, L350 loader, 330 hours, very good condition. 701-661-0122, Joe Price, Douglas.

MASSEY FERGUSON MODEL 65 tractor with 3 point attachments. Box scraper, Ford blade, TSC post hole drill (without auger) and 2 bottom plow. Tractor runs great, has power steering, lights and 540 PTO. $5,000 for tractor and attachments. 701-351-3305, Arne Berg, Devils Lake.

15-30 MCCORMICK TRACTOR, 1 New Tire LT245-75R-Load Range E. 2- Cream Separators, One David Bradley Metal Grain Box like new, 4-wheel Steel Running Gear, Covered Wagon Running Gear, 12’ Kirschman Drill, Horse Potato Cultivator, 4 Btm. Pony & Packer, Saddle and 2 Bridles. Email: larryn@westriv.com. 701-5488020, Larry Nagel, Shields.

VERMEER STUMP GRINDER, 2 Electric 1 HP motors - Singal phase, 1750 RPM, runs forwarding & reverse, Buggy wheels. Horse farm equipment - rake, plater, cultivators, plow. $25 each or best offer for all of them; Fold up ice fishing house on skids. 509-389-9562, Wade Wipperling, New Rockford.

HAY RAKE, 12 ft, alternate 115 and 230, ½ hp jet pump tank system. 701-270-0184, Harold Severson, Lakota.

RADIATORS for IHC M & H tractors. Flat belt pulleys for IHC M & H tractors. Antique leather horse collar and 2 sets of hames. 3 wooden yoke evener bars. 1950's men's Columbia bicycle and a woman's Schwinn bicycle. Leather horse/cow halter. Will send pic of any item if requested. Any interest, please make a reasonable offer. Text for more info. 701-7890679, Anne Vig, Aneta.

DRILL, John Deere 16 ft, in 2-8 ft pieces, LLA. 701-830-9854, Matthew Mathern, Edgeley.

GRAIN CART, used 450 bu. J-Kraft, PTO drive, 12" unloading auger, bottom bin auger, roll tarp, 28LX26 single tires, rear tow hitch, used last season, good condition, pictures available, $3,000 OBO; Tandem axle grain truck, 1980 GMC General, L10 Cummins, twin screw, duel tanks, 10 speed, 19'X8'X60" steel box, hoist, ladder, roll tarp, 3 pc endgate with grain door, pintle hitch, plumbed for pup trailer, 11R22.5 tires, $13,000 OBO, pictures available. 701251-1486, Glen Nagel, Jamestown.

FARM AUGER, 60 ft, 10 inch diameter; Surrey cover, John Deere, was on 2830; 2 way radio base station, repeater; Antique metal bed complete. 701-263-1206, Lathan Romsos, Bottineau.

2001 JD 9750 COMBINE, PRWD, Cont Master - Eng -4968/Sep- 3331. Above avg condition; Starfire 3000 Globe, new shroud, good shape; JD 2014 DB60 Parts: 36 JD Pro-Series XP meters with mini hoppers/Trimble true count air clutches/Seed tub sensor wire harnesses 3 control boxes/Air tanks to run clutches for 3 row shutoff. Trimble Wiring/Hoses. 36+ Steel closing wheels and dry rate controller ; Used 22.5 semi tires & rims. 701-321-5711, John Kempf, Ashley.

GUARDS/LIFTERS, combine pickup guards/ lifters;1950s farm scale with steel wheels; old front tine rototiller; Used 16" cultivator shovels; Bourgault knock on cultivator sweeps; transition for adding aeration to an existing grain bin/ screens/fans; 3 triangular grain auger hoppers w/straps/chains to fasten onto grain auger; Simer water pump; used nitrolator w/hyd shut off hoses. 701-629-9003, Doug Halden, Stanley.

FEEDER CHAIN for IHC 402 or 403 combine, new feeder chain for 503 IHC combine. New "Lowen" concave for late model 914 or 915 combine, wide wire for corn or soybeans. Used Peterson non-adjustable chaffer sieve, 61 7/8 by 45 inches fits 914, or 915, 1440, 1460 combines. Parts for IHC model 75 windrower, canvases for 18 foot, and one new nylon (short canvas for 18 foot, also new nylon short for 21 foot). 701-465-3749, Arlo Blumhagen, Drake.

JOHN DEERE 3940 CORN CHOPPER, 2 row-30 inch head. Richardton 12 ft silage wagon. Case IH SC416-16 ft mower conditioner. John Deere 7200 vacuum planter with e-set corn discs, soybean disc and sunflower discs, 8 row 30 inch. 701-674-3185, Francis House, Grace City.

BALER, John Deere 569 Baler $32,000; 2007 Honda 4-wheeler, 4,700 miles, $3,250. Postal auger $67; 2008 Dodge Ram 1500, 150,000 miles, $6,500; Bobcat T590 skidsteer with tracks $37,400; Hay – contact for price. 701-516-2920, Aaron Subart, Robinson.

SILAGE BOX, 20 ft, with auto tail gate, $500; Mixed hay, net-wrapped, $50. Dual 5000 12’ dump wagon, good tires, $1,800; Two 11:00x20 military tread tires, never been mounted, $150 each; 3975 corn chopper, 3-row, 30-inch, $11,000; 701-391-1852, Marc Sundquist, Baldwin.

BALE FEEDERS, four steel round bale feeders, 250 5 1/2 foot . steel T fence posts; two (2) Feterl hay racks, 21 feet long, on running gear. All in good condition. 701-830-8011, Kenneth Kellogg, Monango.

TWO TRACTOR LOADERS with grapple forks. One is a Farmhand F-11 and the other is a Ezze-on. Both are good useable units. Make me an offer on either one or both of them. Pictures on request. 701-290-5200, Loren Myran, Taylor.

LAYMEN CHAIN STACK MOVER $1800; Rowse double 9 ft mower reconditioned, $8200.00; 8 wheel rake 8 new rake wheels, new paint, $2300; New Holland Model 1000 sq bale stacker $2900; John Deere 10 ft box manure spreader. All items field ready. Can deliver. 701400-5742, Gerald Miller, Mandan.

TRACTORS, IH 706, 806, 1206, 856, 1256, 1456, 966, 1066, 1466, 1566, others; JD 5010, 5020, 4520, 4620, 6030, others; MM 950s on up; Olivers 1963 on up; ACs 200, 210, 220, D-21. Will buy all running or not. 701-6282130, Jerry Lumley, Stanley.

VERY OLD COMBINES, IHC self-propelled combines, #125SP or #127SP. Any old IHC implements for my public display. 701-2905200, Loren Myran, Taylor.

MOTORCYCLE, Suzuki Boulevard 800 motorcycle, excellent road bike for getting to and from work or for a leisurely evening ride. 7,180 miles, yellow and black in color, and it has a brand new battery! $3700 or best reasonable offer. Please call or text for more information. 701-799-1468, Heidi Benke, Fargo.

LIFT CHAIR, cat napper lift chair $500; Gas generator 18 amp $100; 2 stage 24 inch walk behind snow blower $200; Cub Cadet SForce 48 inch riding lawnmower, $1500. All reasonable offers considered. Leave voice message. 701484-5365, Peggy Nyberg, Gardner.

2003 FORD MUSTANG GT Deluxe 2-door Coupe with 61,552 actual miles. Like new 17" tires, has traction control, 4-wheel ABS brakes, power steering, tilt wheel, AM/FM stereo with CD player, a/c, power windows, power door locks, cruise control, and leather seats. Kelly Blue Book is listing it at $9239, I'll sell it for $8800 cash. Great running car, always covered inside garage. Pictures upon request. Please leave message. 701-597-3107, Ken Koch, Shields.

CAR SEAT, Britax Boulevard Clicktight, like new, used only occasionally with our grandson. $150. 701-297-9634, Larry Lampl, West Fargo.

Farmers Restaurant Group is expanding with the purchase of a new building, including space for a large commercial kitchen, in Prince George’s County in Maryland. The impressive 17,300 square-foot space already houses our contact center and is being outfitted for the Founding Farmers Co. Catering & Events team to expand their operations.

Two years ago, Farmers Restaurant Group created its catering company. Since then, the catering unit has operated from the restaurants. As the business has grown, so has the need for space. With this new “Culinary

RUNNING BOARDS, 2024 new factory installed crew cab 6 in. chrome rectangular wheel to wheel assist running boards, includes mounting hardware. Fits 2019 - 2024 GMC and Chevy crew cab models. MSRP $950, sell for $450. Also, original factory installed skid plate with mounting hardware $25. Leave message if no answer. 701-222-2276, Clyde Fenster, Bismarck.

CUTTING TORCH, Smith cutting torch with cart, bottles, attachments $600, Welding table $75; Miller Ideal Arc AC/DC 250 amp, 220 volt stick welder with 2 helmets and many rods $600; Rosebud tip for Welder $50; Grinder on stand $100; Dewalt Chop Saw $100; 2014 Dodge Ram Big Horn, 41,000 miles with less than 1000 miles on new Wrangler Tires $25. 701226-1060, Donald Scheeler, Bismarck.

2005 WINNEBEGO VECTRA. 400 cummins, 4 slides, 41,000 miles; 2000 Lund fishing boat and trailer. Hummingbird and Lawrence depth finder. I pilot trolling motor; JD 425 riding lawn mower. All for sale. $68,000. Text for more info. 701-789-0679. Anne Vig, Aneta.

Barn,” Founding Farmers Co. Catering & Events will be able to operate more efficiently to plan and cook, as well as host tastings.

Catering expansion and the contact center aren’t the only operations the “Culinary Barn” supports.

The company has moved its coffee roasting program and will eventually use the space for crafting Founding Farmers chocolates, baking pies and pastries, and cooking the large to-go holiday meals. Eventually, they hope to expand into direct-to-consumer sales out of the new space.

METAL SIGNS, Co-op 8' oval DSP, Hardware sign SSP, Paint sign SSP, and cast iron sign bases. 701-220-5746, Val Ganje, Bismarck.

BOAT, 2008 Glastron GT 185, 3.0 liter inboard Mercruiser $12,700, easily pulls 2 people on tube, yet easy on gas. Has 134 hours, swim platform, bimini top, stereo system and ladder. Comes with bunk trailer with swing away hitch, bumpers, oars, skis and a few life jackets and anchor. Store mostly in doors. This boat has been well maintained, washed and cleaned after each use, used on the lake. No trades. 701426-3369, Gene Miller, Mandan.

PRAIRIE DOG HUNTERS to hunt on my land. Make reservations now; Email: larryn@westriv. com. 701-548-8020, Larry Nagel, Shields.

OLD FARMSTEAD or old wooden house on a few acres, for sale by owner, Barnes County, North Dakota, or surrounding areas. Wanting to relocate back to North Dakota from Tennessee with extended family of 11 cats, 4 dogs. 423329-1133, Marc Bush, Greeneville, Tenn.

DUALLY WHEELS, 16" Chevy or GMC 1-ton dually wheels, pre-1988. 1973-78 GMC motorhome for parts; Oldsmobile tornado front wheel drive type. 701-240-4459, Colin St. Croix, Minot.

OLD STUFF, ND license plates from older cars and motorcycles. Advertising signs, old gas pumps, old metal oil cans, advertising thermometers, or most anything that has small town advertising on it. Looking for old ND road signs, ND Highway Patrol door metal sign. ND arrowheads, ND metal trade tokens, Red Wing crocks. Will travel to your location. 701-2205746, Val Ganje, Bismarck.