GUEST COLUMN

GUEST COLUMN

ARTICLE

ARTICLE

ARTICLE

Combining the proven benefits of the Damen Axe Bow hull with a rounded tunnel design, the FCS 2710 delivers exceptional seakeeping and operational flexibility. Its level foredeck is purpose-built for safe and efficient personnel transfers, while also offering ample space for a wide range of cargo. Designed with comfort in mind, the vessel features bright and spacious accommodation for both crew and passengers. Efficient, fast, safe, and comfortable transfer of up to 100 passengers. While it is a trusted workhorse in the offshore wind sector, the FCS 2710 has also demonstrated its value in offshore oil and gas operations. With a variety of propulsion configurations available, each vessel can be tailored to meet specific operational needs.

Spacious accommodation enables efficient, fast, safe, and comfortable transfer of up to 100 passengers

Available for quick delivery

As the world transitions away from fossil fuels, the offshore energy sector stands at a defining crossroads. While oil and gas continue to play a vital role in meeting today’s global energy demands, it is offshore renewable energy-particularly wind, wave, and tidal power-that will shape the long-term trajectory of our industry. This is not just a question of environmental responsibility; it is a matter of energy security, economic resilience, and strategic foresight for Europe and beyond.

Recent years have seen encouraging growth in offshore wind capacity across European waters. But if we are to meet our net-zero commitments and ensure a stable, secure energy future, this growth must accelerate-and be accompanied by investment in the next generation of marine renewables and the infrastructure to support them. Offshore energy is no longer a niche pursuit. It is becoming the foundation of a new energy system-one capable of delivering clean, reliable power at scale, independent of geopolitics and volatile supply chains.

Europe, with its extensive coastlines and technological leadership, is uniquely positioned to lead this transformation. Yet leadership requires commitment. Long-term development plans must extend beyond the 2030 horizon and envision what a truly post-oil and gas energy system looks like. This includes massive expansion of offshore wind-fixed and floating-alongside grid integration, storage solutions, hydrogen production, and smart digital networks that can manage decentralized, weather-dependent power sources.

At the same time, we must approach this transition pragmatically. Oil and gas will not disappear overnight. The offshore industry’s existing expertise, infrastructure, and workforce are invaluable assets in accelerating the renewables build-out. Moreover, offshore renewables offer more than just sustainability-they offer sovereignty. In a world marked by increasing geopolitical tension and uncertain energy imports, the ability to produce vast amounts of clean electricity from our own seas is a strategic advantage Europe cannot afford to ignore.

This edition of Offshore Energy Magazine explores how developers, and supply chains are responding to this moment. The pages ahead paint a picture of an industry in motion-both proud of its past and ambitious about its future.

The editorial team

These cutting-edge solutions allow us to provide a comprehensive package, ensuring optimal support for our customers’ operations. Our remotely operated valves come in a range of configurations, including hydraulic, pneumatic, electric, and electro-hydraulic options.

Reikon.nl - 0181 61 44 66

Custom naval engineering solutions

The sea is in our DNA. For centuries, Dutch ships have set sail to discover, to trade, to connect. Events like SAIL Amsterdam or World Port Days in Rotterdam remind us: the maritime world is not just our past; it is our future. And that future demands courage.

For me, it’s personal. I grew up between cranes, steel plates, and the smell of fresh paint. My family’s shipyard has been building vessels for over two hundred years. We survived crises, wars, and fierce competition – never by standing still, always by adapting. More than twenty years ago, we already built vessels with diesel-electric propulsion, ready for emission-free sailing. The first hydrogen-powered passenger ship in Amsterdam? It came from our yard.

But tradition alone won’t carry us forward. Innovation today is about more than cleaner engines or alternative fuels. It’s about rethinking how we collaborate, how we connect across sectors, and how we create economic and social value that lasts.

The rules of the game are shifting. Other nations are moving fast with bold new strategies. We cannot afford to let caution slow us down. Curiosity and technology may be in our DNA, but they must be nurtured. That means celebrating risk-taking, not just avoiding mistakes. Successes born from risk should be spotlighted – in boardrooms, classrooms, and even at family dinner tables.

And here, the role of our front-runners is vital. The companies that dare to move

first are not only engines of economic growth, they are also changemakers who make real transitions possible. Their leadership goes far beyond the bottom line: they pull entire ecosystems forward – from SMEs to start-ups, from research institutes to government.

We already see it happening. Allseas is developing a vessel capable of collecting polymetallic nodules from the ocean floor – a potential gamechanger for critical raw materials needed in batteries and high-tech. Shell is building one of Europe’s largest hydrogen plants at Maasvlakte, a project that will help decarbonize heavy industry and transport.

Boskalis is constructing an impressive next-generation 31,000 m3 trailing suction hopper dredger at Royal IHC, equipped with sustainable propulsion and prepared for green methanol. And at our own family yard, we built the ‘Wim Wolff’, a cutting-edge research vessel for NIOZ – combining advanced science with a minimal ecological footprint.

These are not isolated projects. They are proof of a Dutch spirit of pioneering – driven by craftsmanship, collaboration, and courage.

That’s why my message to political leaders is clear: be proud of Dutch industry. Cherish it. Give it the trust, space, and conditions it needs to lead the transitions ahead. Without it, we risk losing not only companies, but also the very people and capabilities that can deliver the solutions the world is waiting for.

Relationships are our true currency. Breakthroughs are built on partnerships – across borders, across industries, across the public–private divide. What we need now is the courage of our ancestors, the creativity of our engineers, the vision of our policymakers, and the executional power of our entrepreneurs.

Every journey begins by leaving safe harbour. Today, the winds of change are strong.

So let me ask you:

What kind of changemaker will you be? Will you stand on the quay and watch? Or will you join the crew and help write the next chapter of the Netherlands at sea?

Thecla Bodewes

Royal T Shipyards (formerly Thecla Bodewes Shipyards)

Chair Dutch Top Sector Water & Maritime

The Trump administration has warned the UK government over security risks as Mingyang Smart Energy plans to build a factory in Scotland to produce offshore wind turbines for the North Sea market. A Chinese analyst has commented saying the talks about security risks are “protectionism under national security guise”.

Mingyang Smart Energy entered the European offshore wind market at the beginning of 2021 as the Italian Taranto project, the country’s first offshore wind farm (now operational), chose to go with the company’s MySE 3.0-135 model instead of the initially planned Senvion technology.

Shortly after delivering the Taranto wind turbines in October 2021, Ming-

yang announced that it secured a second offshore wind contract in Europe for a floating wind project that would use the company’s 11 MW hybrid drive model.

In December 2021, the UK Department for International Trade (DIT) and Mingyang Smart Energy signed a Memorandum of Understanding (MoU) with the wind turbine OEM on its proposed

investment in a blade manufacturing factory, a service center and potentially a turbine assembly factory in the UK.

In July 2022, the Chinese OEM started trading on the Shanghai segment of the London Stock Exchange (LSE), and in September 2022, Hexicon selected Mingyang as the preferred turbine supplier for its 32 MW TwinHub floating offshore wind project in the UK.

The following year, Mingyang and Opergy Group entered a strategic partnership with an aim of accelerating the development of UK offshore wind projects and supporting the entry of Mingyang into the UK offshore wind market, according to the two companies.

In July 2024, Luxcara signed a preferred supplier agreement with Mingyang Smart Energy for the Waterkant offshore wind project in the German North Sea, where the German clean energy asset manager plans to install Mingyang’s 18.5 MW wind turbines.

Shortly after, Mingyang Smart Energy signed a memorandum of understand-

ing (MoU) with its first European offshore wind client, Renexia, and Minister Adolfo Urso from the Ministry of Enterprises and Made in Italy (MIMIT) for the production of Mingyang wind turbines in Italy and the supply of its 18.8 MW model for Renexia’s new project, the Med Wind floating wind farm.

In October 2024, Renexia also signed a contract with Mingyang for the frontend engineering design (FEED) of the 2.8 GW Med Wind project in Italy.

Mingyang is reportedly also being considered as a preferred supplier for the Green Volt project in Scotland, said to be the first large-scale commercial floating wind in Europe, developed by Flotation Energy and Vårgrønn.

Mingyang technology

Over the past several years, Mingyang Smart Energy has introduced a series of increasingly large offshore wind turbines. In 2020, the company released the MySE 11-203, an 11 MW turbine with a 203-meter rotor. This was followed in 2022 by a 12 MW turbine, designed with enhanced durability for typhoon conditions.

In 2021, the company announced the MySE 16.0-242, a 16 MW turbine with a 242-meter rotor diameter, which was installed at an offshore wind farm in 2024.

In 2023, Mingyang introduced the MySE 18.X-28X, an 18 MW-class turbine with a rotor diameter exceeding 280 meters and 140-meter blades. By the end of that year, the company rolled out the MySE 18.X-20MW platform, which supports rotor sizes between 260 and 292 meters and is built to operate in extreme wind conditions.

Last year, the Chinese wind turbine OEM installed 18 MW and 20 MW prototypes and is also developing a 22 MW model with a rotor over 310 meters.

Also in 2024, Mingyang installed a V-shaped floating wind turbine for demonstration in China. The platform comprises two MySE8.3-180 hybrid drive wind turbines, each with a capacity of 8.3 MW, mounted on a 369-meter-wide floating foundation.

Security concerns

A few months after Luxcara signed the preferred supplier agreement with Mingyang for its German offshore wind project last year, the German Ministry for Economy and Energy (BMWK) issued an action plan that also addresses the cybersecurity of wind turbines.

The five-point action plan, which specifically mentions Chinese suppliers in a few instances, is said to ensure a level playing field between European and international wind turbine manufacturers and, besides cybersecurity, encompasses measures on fair competition conditions, reducing dependencies on critical components, financing production ramp-up, and a revision of project financing provided by German and EU banks and institutions.

In the UK, concerns over national security were raised as Mingyang proposed to build a wind turbine factory in Scotland and following reports about the Green Volt partners considering Mingyang technology for its Scottish floating wind farm.

The joint venture, which is yet to select a preferred wind turbine supplier, is reportedly waiting on the UK gov-

'Currently, the UK has around

ernment to come to a conclusion on whether using Chinese wind energy technology would pose national security risks.

The Guardian writes that Mingyang’s plans in Scotland and Green Volt potentially using the Chinese company’s technology came under scrutiny as the UK government recently took control of British Steel after claims that Jingye Group, the owner of the British steel manufacturer, wanted to make the steel plant in Scunthorpe 'a dumping ground for Chinese steel', which brought the Chinese companies’ involvement with critical national infrastructure into the spotlight.

On 18 June, the Financial Times reported that the Trump administration warned the UK government about national security risks that could arise if Mingyang is allowed to build its plant in Scotland and supply its technology to North Sea wind farms.

Following the news on the US warning, Chinese media outlet Global Times cited a senior fellow at the Center for China and Globalization, He Weiwen, as saying this was 'protectionism under national security guise' and 'a clear example of Washington’s overreaching jurisdiction and protectionist policies'.

Last year, as news emerged on Vestas’s plan to build a new offshore wind turbine blade factory in Leith, Scottish Deputy Prime Minister, Kate Forbes, said there was 'room' for both Mingyang and Vestas as energy transition ambitions in Scotland require an 'enormous' transformation in the supply chain, according to a Financial Times report from November 2024.

The Guardian cites an industry source as saying the Green Volt joint venture 'tried to get European manufacturers to no avail'. Referring to the UK energy secretary’s visit to China this year to

discuss closer cooperation, the Guardian’s source said Ed Miliband was 'on to something here' as the question is who is going to supply wind turbines if the country wants to reach its offshore wind targets if they are not coming from Chinese companies.

Under its Clean Power 2030 Action Plan, the UK government wants to make renewable energy and nuclear power the cornerstones of the 2030 energy mix, with 43-50 GW of offshore wind in operation by that time. Currently, the UK has around 14.8 GW of installed offshore wind capacity.

For Europe, the plan is to have 111 GW of offshore wind capacity by 2030 and 300-400 GW by 2050. According to the industry, the 2050 target means more than 10,000 wind turbines need to be installed to reach the planned capacity.

By Adrijana Buljan

‘Boreas is world’s largest, most sustainable offshore wind installation vessel’

Oord christened the latest addition to its fleet, Boreas, in June

The company says its new jack-up, set to soon debut on the German Nordseecluster project, is the largest and most sustainable offshore wind installation vessel in the world.

Van Oord christened the latest addition to its fleet, Boreas, in June in Rotterdam. The company says its new jack-up, set to soon debut on the German Nordseecluster project, is the largest and most sustainable offshore wind installation vessel in the world. The Dutch marine contractor ordered the self-elevating vessel at the Yantai CIMC Raffles shipyard in October 2021 and took delivery of the newbuild in January this year. After the christening ceremony, Boreas will head to its first offshore wind project, the Nordseecluster in Germany, owned

by RWE and Norges Bank Investment Management (NBIM).

Van Oord’s scope on Nordseecluster includes the installation of 104 monopiles for the wind turbines, as well as the installation of the foundation of the offshore substation and scour protection. The foundation for the substation and 44 monopiles for the wind turbines at Nordseecluster A, the first phase, are planned to be installed this year, while the 60 monopiles for Nordseecluster B are scheduled for installation in 2027.

The 175-meter-long Boreas, named after the Greek god of the Northern winds, is purpose-built for the transport and installation of the nextgeneration foundations and wind turbines. The vessel has a crane with a 155-meter-high boom, able to lift over 3,000 tons, and can install offshore wind turbines of up to 20 MW with a total height of 300 meters.

According to its owner, the new jack-up is the first vessel of its kind equipped with dual-fuel methanol

engines, and operating on methanol reduces its carbon footprint by over 78%. Boreas also features Selective Catalytic Reduction to minimize NOx emissions and a battery pack of more than 6,000 kWh, which helps further reduce fuel consumption and emissions, Van Oord says.

“The Boreas is the largest investment in our company’s history, a testament to our ambition to remain a frontrunner in offshore wind, accelerate the energy transition and perform our work responsibly. We have been leading our industry in the adoption of more sustainable green marine fuels even more with the capability to sail on methanol. The Boreas adds a new chapter to our net-zero emission

journey”, said Govert van Oord, CEO of Van Oord.

The offshore installation vessel was constructed at the Yantai CIMC Raffles Offshore shipyard in China.

“Undoubtedly Boreas is a benchmark for the whole offshore wind industry for many years to come and will play a significant role for the transportation and installation of the next generation of foundations and up to 20MW offshore wind turbines at sea,” according to Zhao Hui, Vice President of CIMC Raffles Group.

At the christening of its new vessel, Van Oord also shared that the company’s climate goals have been approved by the Science Based Targets initiative (SBTi), making it the first marine contractor to align with the 1.5°C pathway of the Paris Agreement. Van Oord submitted its greenhouse gas (GHG) emissions reduction targets to the SBTi in May 2023 and had a dialogue on sector classification and used the Maritime Guidance for its fleet-related targets. SBTi formally communicated the approval of all Van Oord’s targets on June 1.

By Adrijana Buljan

Statistics Norway, the Norwegian statistics bureau, has revealed a spike in estimates for oil and gas spending in 2026, which is anticipated to hit NOK 230 billion (approximately $22.55 billion), thanks to higher price estimates in the production drilling segment.

As total investments in oil and gas activities, including pipeline transportation, are expected to reach NOK 230 billion next year, this represents an 11% increase from the sum estimated in the previous quarter, according to Statistics Norway, which highlights that oil companies’ investment estimates for 2026 are 4.5% lower than the corresponding estimate for 2025, driven

by lower investment plans in field development.

The Norwegian Offshore Directorate (NOD) warned in 2024 that over $1.42 trillion (NOK 15 trillion) was at risk of being lost if Norway did nothing to ramp up its search for remaining hydrocarbon resources on the Norwegian Continental Shelf (NCS) and

employ new technology to increase production levels.

Following a recent upward revision, the spending for oil and gas extraction and pipeline transport is estimated at NOK 275 billion (around ($26.9 billion) in 2025, which is 2.1% higher than previously estimated and 6.9% higher than the corresponding estimate for last

year, mainly due to much higher investments in fields on stream, alongside exploration and concept studies, onshore activities, and pipeline transport.

On the other hand, the statistics show that field development, shutdown, and removal were higher in 2024; thus, the growth for these areas is on a downward spiral in 2025. Regarding the estimates for next year, the multibillion-dollar investments are expected to be driven by fields on stream, field development, onshore activities, and shutdown and removal.

While the boost will be supported by the decision to initiate new projects and drilling campaigns across several fields, with production drilling contributing the most to the rise within fields that are already online, exploration and pipeline transportation segments are expected to assist in mitigating the hike in estimates.

Equinor, the Norwegian state-owned energy giant, revealed its investment game plan last year, outlining annual injections of $5.7 – $6.6 billion into the Norwegian oil and gas ecosystem by

2035 to keep the daily production level at around 1.2 million barrels during the next ten years while halving emissions by 2030 in line with the Paris Agreement.

Based on the Norwegian statistics bureau’s data, investments of NOK 132 billion ($12.9 billion) in the first half of 2025, said to be up 11% from the sum made in the first half of 2024, are forecast to be eclipsed by investments of NOK 143 billion ($13.98 billion) in the second half of the year, mostly prompted by increased planned activity in production drilling, which is perceived to be sensitive to changes and volatility in oil and gas prices.

Statistics Norway’s Ståle Mæland emphasized: "With lower and more volatile oil prices over the past four months and lower gas prices so far this year, there is a risk that some of the planned drilling campaigns may be postponed. Historical figures from the statistics show that the estimate for investment measurement in August in the statistical year has averaged about 3.2 percent higher than the final investment figures over the past 20 years.

"However, in two of the last three years, the estimate given in August has been lower than the final figures.

This, along with the relatively low growth projected for the second half in the census’s estimate, makes it entirely possible that the investments currently estimated for 2025 will be realized."

By Melisa Cavcic

Liquefied natural gas (LNG) can play a key role in speeding up Asia’s transfer from coal to more renewable sources in power generation and help the region–and consequently, the world–meet its decarbonization objectives, a new study by S&P Global Commodity Insights (SPGCI) has found.

Being home to more than half of the global population, Asia represents nearly half of the world’s emissions and energy consumption, accounting for 45% in the first and 49% in the second category. Its rapid development is expected to drive global economic and energy demand growth.

However, while the world is moving away from fossil fuels, they still play a prominent and persistent role in Asia’s energy mix, and the region faces major challenges in its transition to cleaner energy.

Inadequate economic incentives for decarbonization, the legacy of entrenched coal dependence, and uneven renewable energy resource distribution are listed as some of the

reasons for Asia’s slow pace of power transition.

Coal remains a major energy source in the region, representing around 80% of global coal use. Furthermore, its use has grown at an approximately 2% compound annual growth rate (CAGR) from 2015 to 2024, the study states. Since efforts need to shift into a higher gear to meet the Paris Agreement targets, an independent study, the ‘Pathways to Accelerate Power Emissions Reduction in Asia,’ was commissioned by the Asia Natural Gas & Energy Association (ANGEA).

In it, emissions reduction pathways to 2050 for power generation in Japan, the Philippines, and Vietnam–and by extension, other nations in Asia–are

discussed. An approach described as technology-agnostic was used to explore viable pathways for accelerating coal reduction.

In addition to a balanced case scenario for each country, SPGCI modelled a base case scenario reflecting a business-as-usual trajectory, as well as an accelerated approach, thanks to which full decarbonization would be achieved by 2035.

Balanced vs. accelerated transition: Weighing the costs

Based on the study, one way to cut emissions affordably would entail a balanced approach to energy transition in the power sector, with LNG-fired power supporting expanded use of renewables.

Coal would be substituted with renewables and available alternatives by country, with generation and emissions determined via least-cost hourly dispatch. SPGCI claims this would enable 50% of coal-fired power to be phased out by 2035.

This study underscores the critical role that LNG should play in reducing emissions in Asia and debunks the myth that nations must choose between rapid decarbonisation and economic growth,” ANGEA CEO Paul Everingham said.

Everingham pointed out that more than 90% of power sector emissions in Asia result from coal-fired power. Therefore, the region’s ability to phase out coal affects global decarbonization efforts.

The report highlights pathways for the three focus countries to phase out coal and reduce emissions by 33–38% by 2035. Additionally, unlike some other decarbonization efforts, this does not

come with a hefty price tag, as it would require the countries to increase their energy systems spending by around 8–16%.

In contrast, to achieve full decarbonization by 2035, the Philippines and Vietnam would need to more than double their current investment in energy systems, while Japan would have to invest nearly 75% more.

"And that’s before you take into account the average marginal electricity prices – the costs paid by communities and industries – which would more than double for the Philippines and more than triple in Japan and Vietnam," noted Everingham.

"No country can entertain that type of financial burden, but especially not emerging nations such as the Philippines and Vietnam, where continued economic growth is needed to raise living standards."

Recognizing that multiple transition pathways exist, and that cost is only one factor, the study aimed to offer indicative metrics that can inform stakeholder discussions on potential decarbonization actions.

Role of LNG imports in decarbonization

The study also looked at the contributions that LNG produced in Australia, the U.S., Qatar, and other exporting nations could make to emissions reduction efforts by trade partners in Asia.

Based on the study, the average lifecycle carbon intensity for LNG sourced from Australia, the U.S., and Qatar and used for electricity production in the three countries was 47% lower than for coal.

Additionally, for each ton of CO2 emitted when producing and shipping LNG to Asia, more than 3 tonnes of CO2 emissions are avoided on a lifecycle basis when it replaces coal in power generation.

"We think this study is an important piece of research that can contribute to discussions in the region about how decarbonisation and coal phasedown can best be pursued and progressed, by providing quantitative data points to inform trade-offs of different pathways," said SPGCI Director, Energy Transition Consulting, Allen Chan.

In conclusion, SPGCI believes efforts should be focused on addressing structural barriers to coal phase-out and decarbonizing the gas/LNG value chain, while incentivizing and scaling renewable power to achieve the decarbonization of Asia’s power sector.

By Dragana Nikše

The Hong Kong International Convention for the safe and environmentally sound recycling of ships (HKC) has officially entered into force. It marks a long-awaited turning point in how the world dismantles and recycles end-of-life vessels.

Over two decades in the making, the convention-for which full compliance is not obligatory before 2030-sets global standards for shipowners, flag states, and recycling yards, seeking to bring long-overdue accountability to an industry plagued by safety and environmental abuses.

Numerous organizations in the maritime industry have welcomed the commencement of the Hong Kong Convention, including shipping association BIMCO, the International Chamber of Shipping (ICS) and ECSA European Shipowners.

"We believe the convention has the potential to change the face of ship recycling, support the circular economy and provide safe jobs to the people that

need them," David Loosley, Secretary General and CEO of shipping association BIMCO, remarked.

As understood, ICS and ECSA have been pushing for the HKC to be passed since its adoption over twenty years ago.

"Today marks a welcome and historical development after two decades of work on the issue. At ICS, we have long been championing safe and sustainable ship recycling practices. Now that the Hong Kong Convention has entered into force, we can look forward to even more progress in improving ship recycling around the world," Thomas A. Kazakos, Secretary General of the ICS, commented.

What is the HKC Convention?

The Hong Kong Convention was first adopted in May 2009 at a diplomatic conference in China. It was crafted with input from IMO Member States and non-governmental organizations, as well as in co-operation with the International Labour Organization (ILO) and the Parties to the Basel Convention on the Control of Transboundary Movements of Hazardous Wastes and their Disposal (otherwise known as the Basel Convention).

HKC represents a cradle-to-grave framework for the lifecycle of ships, from design and construction to operation and preparation of ships so as to facilitate safe and environmentally sound recycling.

It mandates that vessels ≥ 500 GT maintain an inventory of hazardous materials (IHM), a documented list of the types, quantities and location of substances onboard, such as asbestos, PCBs, ozone-depleting chemicals, heavy metals, hydrocarbons and anti-fouling agents. This inventory must be verified, kept current-when toxic materials are added or removed-and certified via an International Certificate on IHM.

The treaty also imposes strict rules on recycling infrastructure: only authorized facilities may dismantle ships. These must prepare a Ship Recycling Facility Plan (SRFP), covering worker safety, environmental controls, emergency response, waste handling, and record-keeping.

"The global requirements entering into force today already represent significant progress for the sustainability of our industry. We now need to build on this foundation and further strengthen

the Hong Kong Convention to raise the bar and continue to make meaningful progress towards safe and sustainable ship recycling practices," Sotiris Raptis, Secretary General of ECSA European Shipowners, remarked.

Ratification of the HKC, however, moved at a snail’s pace. Regions like the European Union (EU) implemented the EU Ship Recycling Regulation (EU SRR) by 2013, with the goal of minimizing negative impacts associated with ship recycling, particularly concerning human health and the environment. Meanwhile, the IMO developed detailed technical guidelines by 2012, with a further update in 2023 when the IHM protocols were ‘refined.’

To enter into force, the HKC required ratification by at least 15 States, accounting for 40% of world merchant tonnage. Despite early momentum, these thresholds were not met until June 2023, when Bangladesh and Libe-

ria deposited their instruments, unlocking a 24-month countdown.

The darker tides

As of right now, twenty-four countries in total have ratified the HKC. Four of the largest ship-recycling nations, namely, Pakistan, Bangladesh, India and Türkiye, are among them, having authorized a number of recycling yards under this framework. In India, for example, it is said that well over 100 ship recycling facilities have secured a Document of Authorization (DASR).

Nonetheless, although the Hong Kong Convention has attempted to install the guardrails needed for the maritime industry to sail toward net zero ‘more safely’, some critics have underscored that it stops short of addressing and, ultimately, banning some of the most hazardous recycling and dismantling methods typically done in a number of countries in South Asia: beaching.

Defined as the practice of deliberately grounding ships at tidal flats for dismantling, beaching has been a colossal issue in the shipbreaking/ship recycling sector(s), drawing considerable attention and criticism in countries such as India and Bangladesh in particular. The two nations are home to yards infamous for beaching, like Alang, where a string of tragic accidents has already claimed numerous workers’ lives.

Some of these yards have also claimed to be HKC-compliant, despite the reality being different. As the Belgium-based NGO Shipbreaking Platform organization noted, many of these sites do not have hospitals nearby in case of acci-

'HKC represents a cradle-to-grave framework for the lifecycle of ships'

dents, no capacity to dispose of hazardous materials and no track record of monitoring the health of their workers.

Compounding the matter are shipping players that go around international ship recycling rules with the aim of ‘profiting’ from vessel dismantling operations. NGO Shipbreaking Platform has revealed that these companies tend to re-flag their units to sail under the flags of St Kitts and Nevis, Comoros, Tuvalu and Mongolia, which are currently the most popular choices for stakeholders sending off their vessels to be scrapped in South Asia.

These so-called flags of convenience have been quite a weak link in the HKC chain, as they can allow the circumvention of tougher oversight and, therefore, threaten the treaty’s foundations.

Numbers back this up, with a study done by the Belgian organization showing that, in 2024 alone, as much as 80% of the world’s aging fleet was scrapped

under these conditions. A number of the units were previously re-flagged.

In light of the Hong Kong Convention’s entry into force, and particularly since, according to BIMCO, there are over 15,000 vessels that need to be recycled, the NGO Shipbreaking Platform has once again underlined the importance of tackling these issues.

"The HKC does not set a roadmap for sustainable ship recycling, but will instead serve the interests of shipping companies that want to avoid paying the true cost of safe and environmentally sound end-of-life management. Tragically, it also risks to undercut efforts to level the playing field for responsible ship recyclers to compete," Ingvild Jenssen, Executive Director & Founder of the NGO Shipbreaking Platform, remarked.

"The shipping industry cannot settle with a Convention designed to accommodate the industry’s worst practice.

Beaching should be phased out, not endorsed," she added.

That said, certain nations, which have been plagued with irregularities, have made steps to align better with the HKC and with other global environmental stipulations.

Bangladesh is one of them. In February this year, the IMO shared that draft amendments to Bangladesh’s ship recycling and hazardous waste management legislation have been developed to align the shipbreaking industry with international environmental standards and safety regulations.

The amendments were presented and reviewed during a workshop held in Dhaka. The workshop also examined how the sector could be aligned with the most important provisions of the Basel, Rotterdam and Stockholm conventions.

By Sara Kosmajac

Minesto, a Swedish tidal energy developer, is leading a consortium of four that has been awarded a SEK 25 million (approximately $2.6 million) grant funding from the Swedish Energy Agency to build a complete microgrid installation in the Faroe Islands.

The consortium includes Minesto, microgrid technology provider Capture Energy, Faroese utility company SEV, and IVL Swedish Environmental Research Institute.

The total project budget over two years amounts to SEK 56 million, of which SEK 25 million is covered by the Swedish Energy Agency grant.

The project aims to demonstrate a tidal-based microgrid solution that delivers baseload power. According to Minesto, it builds on a partnership with Capture Energy, a technology provider specializing in microgrid

management. By integrating Minesto’s tidal power plants with Capture Energy’s systems, the project is said to seek to access the global market for autonomous and island-mode grid solutions.

SEV, an existing customer of Minesto, is said to contribute as a microgrid user and support feasibility work for future commercial installations. IVL will assess the environmental footprint of the system.

Targeting remote, non-grid-connected sites in the Faroe Islands, the project

is scheduled to begin in August and deliver a complete microgrid by 2026.

"The global multibillion-Euro microgrid business is a vital parallel track to build-out of larger Dragon Farms (multimegawatt arrays) based on the same Dragon-class systems.

This new partnership with Capture Energy makes it possible for us together to offer turn-key microgrid tidal power generation to local customers in need of renewable baseload energy," said Martin Edlund, CEO of Minesto.

The microgrid market is a key strategic focus for Minesto, with an estimated €300 billion (approximately $352 billion) in addressable value spanning small kW installations to large multimegawatt (MW) installations.

"The microgrid business has significant strategic value for Minesto. It is in itself a substantial global market and it also offers market entry projects with new commercial partners to create confidence in our unique technology and to speed up collection of local data for environmental permitting and certification," Edlund added.

Minesto said the Faroe Islands face energy challenges common to remote island communities, including dependency on imported fossil fuels,

price volatility, and supply disruptions. The region is said to have untapped tidal energy potential that the company aims to harness.

"This award from the Swedish Energy Agency adds vital financial support and recognition to Minesto’s commercial agenda," Edlund concluded.

Minesto recently also secured a SEK 22 million loan from Fenja Capital to be used as working capital for its ongoing operations and business development.

The Swedish company’s upgraded Dragon 12 tidal energy device, deployed in Vestmannasund, Faroe Islands, reached a performance milestone, delivering a 25% increase in power output following the installation of a longer tether.

Minesto slashes costs, closes Wales office in major reorganization

Minesto has finalized a reorganization process aimed at aligning the business for commercial rollout and reducing fixed costs. The changes include geographic consolidation, a trimmed management structure, and tighter product development integration. The company reports a 35% reduction in fixed costs as a result.

Minesto has shut down its Holyhead office in Wales, co-locating its Support and Operations management with the leadership team at its Gothenburg headquarters. Operations now center on the existing site in Vestmanna, Faroe Islands, where the company is working closely with local partners.

"We have concentrated the Minesto organization at the head-office in Göteborg and closed-down the office in Wales for efficiency and synergy reasons. We remain fully committed to our tidal site and build-out plan for Holyhead Deep, retaining local presence regarding site development. Our ability to get Holyhead Deep financed and built is not affected by this shift," said Martin Edlund.

According to Minesto, the management team has been reduced from eight to six members. Conventional line functions remain, with broader responsibilities assigned for commercialization and project delivery.

"We are grateful for the lasting value that David Collier – Chief Strategy Officer and Hans Lindström – Chief Supply Chain Officer contributed to Minesto. In our new smaller team, we have found a good balance in dividing and sharing responsibilities.

Notably, the cross-functional nature of commercial development in our emerging business makes it a successfactor to have customer involvement from the whole team. Further, our partnership with EY working on investment cases, financing and investor interactions has proved to be very constructive," Edlund added.

Product development and operations have been more tightly integrated, covering array installation methods and scaling up manufacturing for Dragon systems. The research and development (R&D) team has been

reduced as the company shifts from broad-based research to projectspecific customization.

"We have improved our ability to source external resources for site development and operations. Our international partners TCC Green Energy, Hydrokite, Poseidon & Sev to name a few are involved hands on in site development work targeting sites for Minesto Dragon build out," noted Edlund.

"Also, closer relationships with suppliers on product development

and manufacturing have expanded our resource-base whilst not increasing our headcount, for example with SKF on drive trains and steering modules, Future Fibres (a part of North Technology Group) on the unique anchoring tether and Elitkomposit on planning for scale-up of the critical wing manufacturing."

Following the reorganization, Minesto now operates with 36 employees. The company says it retains the flexibility to scale up as needed.

By Zerina Maksumic

For over 75 years already, REINTJES Benelux –based in Antwerp – handles sales and services of REINTJES gearboxes and reversing gears for Dutch shipping for short-sea, sea going, dredging, fishery, inland vessels and luxurious yachts.

Our service department is available for all spare parts as well as repairs. Whether it is an inspection or repair, our team of experienced service engineers is always there for you and assures you the reliability and quality REINTJES represents.

2x ZWVSA 440 U 1081 kW @ 2000 rpm

REINTJES Benelux BVBA | Luithagen Haven 2 | Unit F | 2030 Antwerpen Tel +32 (0)3 541 92 33 | www.reintjes-gears.com

The maritime -heavy duty industryis your world. 24/7 full speed ahead. Conquering the elements of nature. Meeting goals. Beating the competition. The focus on your business. Saving costs, optimizing processes, delivering in time; Making profit. In all of this, you rely on your team, equipment... and TrustLube.non-stop

We design, manufactor and fit custom made lubricating- and monitoring systems. Our goal is 100% uptime, and a substantial reduction in the amount of lubricant used.

A staged ban on scrubber discharges in coastal waters in the North-East Atlantic area (OSPAR region) has been approved. Believed to be “the first” regional regulation on scrubber discharges, the ban sets a precedent for other areas to follow.

The ban will apply to discharges from open-loop scrubbers by July 2027, and to closed-loop scrubbers by January 2029 in OSPAR’s ports and internal waters.

Ministers and senior representatives from the 16 Contracting Parties to the OSPAR Convention gathered in

Vigo on July 27, 2025, for a landmark OSPAR Ministerial Meeting. In the aftermath of the United Nations Oceans Conference in Nice, OSPAR adopted a series of collective actions.

The OSPAR Commission is the regional marine protection convention for the Northeast Atlantic. Its members

include fifteen states and the EU – including Germany, France, the United Kingdom, Norway, Spain, and the Scandinavian countries.

The OSPAR maritime area encompasses, among other areas, the North Sea, the English Channel, the Irish Sea, and large parts of the North Atlantic.

Hosted by the Spanish government, the meeting marked a ‘critical’ midpoint in the implementation of the North-East Atlantic Environment Strategy (NEAES) 2030, OSPAR’s roadmap for ocean health in the region.

At the heart of the meeting was the adoption of the Vigo Ministerial Declaration, an ambitious and shared political commitment to accelerate progress in response to the triple planetary crisis of climate change, biodiversity loss, and pollution. Contracting Parties reaffirmed that the OSPAR Commission not only has the mandate-but also the

responsibility-to lead globally in the protection of the marine environment.

"The decisions taken today in Vigo reflect our shared commitment to protect our ocean through cooperation, ambition, and accountability. With these new measures, OSPAR continues to lead the way in regional marine protection," Dominic Pattinson, OSPAR Commission Executive Secretary, commented.

Reducing pollution from shipping

The meeting participants expressed concerns about hazardous discharges

from all types of exhaust gas cleaning systems (EGCS) on ships, particularly in coastal zones.

As a result, OSPAR agreed a staged ban on the release of discharge water from ships’ exhaust gas scrubbers in coastal waters. A roadmap to examine strengthening this by 2027 was also agreed.

To note, the wastewater released by scrubbers is said to contain a toxic mix of heavy metals, acidic compounds, and polycyclic aromatic hydrocarbons (PAHs), posing a significant threat to marine ecosystems and the health of coastal communities.

In the 2000s, scrubbers became widely adopted to curb sulphur emissions from ships. These systems were introduced and governed under the Protocol to the International Convention for the Prevention of Pollution from Ships (MARPOL), serving as a compliance tool within Emission Control Areas (ECAs). Despite their intended environmental purpose, scrubbers allow ships to keep burning heavy fuel oil and can lead to higher emissions of carbon dioxide, black carbon, and particulate matter than if marine gas oil were used. Studies have shown that scrubbers discharge hazardous wastewater containing heavy metals, acidic substances, and polycyclic aromatic hydrocarbons (PAHs) straight into the sea, endangering marine life and potentially affecting the health of coastal populations.

By 2023, 45 jurisdictions, including various countries and port authorities, had implemented bans or restrictions on scrubber discharges. Long-term protection of marine environments and achievement of climate goals require investment in genuinely clean technologies, such as wind propulsion, green e-fuels, and renewable energy solutions, tools that are already available and capable of delivering significant reductions in pollution and emissions.

OSPAR’s decision to ban scrubbers has been welcomed by numerous environmental organizations such as for instance Seas at Risk. The Brussels-based marine organization welcomed the decision to ban the discharge of scrubber wash waters in internal waters and

port areas throughout the North-East Atlantic area by July 2027.

"This is a landmark moment for marine protection, showing that regional cooperation can drive real environmental progress in the maritime sector. Toxic waste water from scrubbers has no place in the ocean. This ban will not only be a boost for marine life, but also for coastal communities that rely on a healthy sea for their livelihoods," Sian Prior, Shipping Director, Seas At Risk, highlighted.

While a majority of OSPAR states wanted to ban scrubber discharges throughout the full extent of territorial seas, such extension lacked full consensus and was therefore included

only as a recommendation, with a review scheduled for a decision by 2027.

"Turning air pollution into ocean pollution is not an acceptable trade-off. It is vital that all OSPAR Members support the proposal to extend the ban to territorial waters, especially as cleaner, widely available alternatives exist. Such a ban will improve water quality and protect marine life in the coastal areas of the entire North-East Atlantic," Maarten Verdaasdonk, Project Manager, North Sea Foundation, said.

Prior to the meeting, Seas at Risk coordinated an open letter signed by 21 NGOs that was released ahead of the Ministerial Meeting, to urge OSPAR to ban toxic wastewater from scrubbers in their area.

One of the signatories of the open letter was German association NABU. NABU welcomed the latest OSPAR’s move but emphasized that ‘comprehensive’ protection of the oceans can only be achieved with a ban in all waters. It called on the OSPAR states to extend the discharge ban to all coastal waters of the OSPAR maritime area by 2029.

"Scrubber wastewater is not an unavoidable byproduct of shipping, but a direct consequence of the use of toxic heavy fuel oil. The pollutant emissions are washed into the sea by the exhaust stream. This is not a solution, but avoidable environmental pollution," Raija Koch, NABU’s Shipping Policy Officer, stressed.

Finland, Denmark, and Sweden have already issued national bans on scrubber wastewater.

"This is commendable, but without a common solution, a regulatory patch-

work threatens. Uniform regulations create clarity for shipping companies and ensure the protection of the particularly sensitive coastal areas along the entire Northeast Atlantic," Koch added.

Other key outcomes of the meeting

At the meeting, ministers also agreed to extend the OSPAR maritime area by over 2.5 million square kilometers to include Macaronesian waters, encompassing the Azores, Madeira, and the Canary Islands. This historic decision brings these biodiversity-rich areas under OSPAR protection, recognizing the critical importance of regional cooperation.

The meeting also resulted in new bans on plastic pollution from pontoons/ buoys and best practices to reduce marine litter as well as new action plans on underwater noise and benthic habitats.

What is more, the countries agreed to increase Arctic protections and engagement with indigenous peoples.

In addition, OSPAR reaffirmed its 1998 Sintra Statement commitment to not treat the sea as a dumping ground and committed to reduce derogations from the requirement to remove disused offshore installations.

Two new OSPAR indicators were adopted on environmental concentrations of artificial radioactive substances, and on radioactive discharges from the nuclear sector.

Finally, the future-proofing of the OSPAR Convention has been launched. Ministers initiated a process to examine how the convention can evolve to respond to new and emerging pressures, including offshore renewables, space launch debris, carbon dioxide capture and storage, hydrogen production linked to offshore oil and gas, and a clarification of provisions on land-based sources of pollution.

By Naida Hakirevic Prevljak

France’s energy giant TotalEnergies has pinpointed the acceleration of artificial intelligence (AI) as a roadmap paving the way toward the realization of its multi-energy strategy, primarily in low-carbon energies, which are expected to be among the key beneficiaries of its partnership with a compatriot generative AI player, Mistral AI, that will enable the duo to set up an innovative lab focused on artificial intelligence.

TotalEnergies and Mistral AI will focus on enhancing the application of AI to improve the French energy giant’s performance, bringing its multi-energy strategy to life by establishing a joint innovation lab, staffed by teams from both companies. While Mistral AI will contribute its AI technologies, TotalEnergies will bring its expertise in the energy production business, particularly renewables and low-carbon energy, to test and design advanced digital solutions.

The first use cases will allow the firm to design an assistant for its 1,000 researchers to support them in their mission to develop new energies and reduce the company’s environmental footprint.

In addition, decision-support solutions will be developed to enhance the performance of its industrial assets and lower its CO2 emissions, while support solutions get implemented to improve the customer experience and help them save energy.

Arthur Mensch, Chief Executive Officer at Mistral AI, remarked: “This partnership illustrates the positive impact generative AI can have on a sector as strategic as that of TotalEnergies.

By dedicating our AI solutions and experts to the R&D effort, the operational teams and, ultimately, the company’s customers, we are contributing to improved operations and the digital transition of this global energy giant.”

Testing digital tools for renewables on lab’s menu

The new lab will also test digital solutions for other use cases, especially renewable energy production. Given the issue of digital sovereignty in Europe, the duo will jointly examine opportunities for TotalEnergies to adopt AI infrastructure. AI is a major pillar of the French energy player’s technological ambition; thus, the deal with Mistral AI reflects the firm’s decision to leverage digital technology and artificial intelligence to improve performance at its industrial facilities and support its transition.

Previously, the company used artificial intelligence mostly in earth science

and as a way to improve predictive maintenance or detect any issues with the machinery at its facilities.

However, AI has now been given a vital role in helping the French heavyweight develop new opportunities, especially in the production of renewables, reduction of CO2 emissions, and the development of innovative services that allow its customers to control and optimize their energy use.

Patrick Pouyanné, Chairman and CEO of TotalEnergies, commented: “We are delighted to work with Mistral AI, a leading French player in artificial intelligence. This deal reflects our intention to contribute to the emergence of a tech-

nological ecosystem in Europe, and will allow us to explore new opportunities to further embed AI into our activities.

“AI has huge potential to transform energy systems, and this partnership was motivated by our pioneering spirit and ongoing search for innovation.”

Meanwhile, TotalEnergies is actively pursuing more oil and gas opportunities and optimizing its existing upstream portfolio, as illustrated by a deal to exchange its non-operated interest in a deepwater development project in Brazil for Shell’s partial stake in its producing field.

By Melisa Cavcic

Gulliver at work at the Thor Offshore Wind Farm, located in the Danish North Sea off the west coast of Jutland. Scaldis SMC was responsible for the transportation and installation of the OSS of Denmark’s largest offshore wind project to date, which will have the capacity to generate enough green electricity to power over one million households.

Although China, the United States (US) and the European Union (EU) remain frontrunners in clean industry development, a bloc of emerging markets spanning Africa, Asia and South America is quickly catching up, showing the potential to overthrow the ‘longstanding dominance’ of these leading economies.

According to the newly released 'Clean Industry: Transformational Trends' report by Mission Possible Partnership (MPP), a decarbonization-oriented coalition launched in 2021, nations from the fast-expanding 'new industrial sunbelt' , such as Brazil, Morocco, Indonesia, Egypt and India, now account for 59% of the global $1.6 trillion pipeline of announced but not yet financed projects.

In comparison, the US represents 18%, the EU 10% and China just 6%, the report revealed, with related projects comprising ‘key’ clean sectors

such as aluminium, chemicals, cement, aviation, and steel.

It is worth noting that China has been a leading nation in the maritime industry, especially in shipbuilding, where it has consistently been number one, followed by ‘neighbouring’ South Korea and Japan. The US has been falling behind the ‘big three’.

The report, supported by the Industrial Transition Accelerator (ITA), has noted here that governments of almost 70 countries could also ensure early mover advantage, similarly to

the EU and others, by crafting policies that would support the construction of announced initiatives.

Adequate policy support has been spotlighted as a core element of the decarbonization momentum, with studies suggesting emissions in the maritime transportation industry, for example, could be cut by over 95% by 2050 owing to regulatory frameworks.

As disclosed, the industrial shift points to a possible global realignment as the production of materi-

als, chemicals and fuels increasingly moves to countries offering abundant renewable energy, favorable policies and cost advantages. The sunbelt has made significant headway here by harnessing natural resources, particularly solar energy, to power new clean manufacturing.

"Just like the industries of yesterday located near the coal mines which powered them, the new generation of energy-intensive industrial plants will go to where they can access abundant, reliable, cheap, clean electricity to produce materials, chemicals and fuels. The industrial heartlands of the past will have to be smart and cooperate if they want to retain their leading positions," CEO of MPP and Executive Director of the ITA, Faustine Delasalle, commented.

Moreover, while China clinched a quarter of the $250 billion of investment in clean plants to date, closely followed by the US at 22% and the EU at 14%, sunbelt nations such as Indonesia and Morocco, per data from MPP’s analysis, secured a fifth of investment thus far.

However, a staggering $948 billion opportunity is said to exist for their announced projects, especially as economies dominated by agriculture increasingly see lower-cost clean ammonia for fertilizer as both an economic advantage and a chance to increase food security.

Ammonia as an energy source has also been identified as a path toward climate neutrality in these emerging markets.

In total, MPP’s Global Project Tracker (launched in April last year) records 826 commercial-scale clean industrial plants across 69 countries. Of these, 69 are operational, 65 have reportedly secured financing, and eight have reached final investment decision (FID) within the past six months. As elaborated, the remaining 692 projects have been revealed but are awaiting financing.

"Perhaps surprisingly, developing economies have an enormous opportunity to leapfrog fossil fuels in heavy industry and transport, creating the infrastructure for sustainable economic growth in the 21st century. We now need to unlock the full potential of the clean industrial revolution and exponentially accelerate the existing pipeline," Christiana Figueres,

Co-Founder of Global Optimism, remarked.

Despite growing competition, MPP unveiled that $450 billion in clean industrial investment has been announced in the US and EU, with policymakers in these regions now facing pressure to better the investment conditions or 'risk losing ground.'

Per the report, investment in these regions tends to thrive where stable regulations, public funding, demand-boosting measures, and lower capital expenditure (capex) costs align.

Meanwhile, Europe unpacked its Clean Industrial Deal in February 2025, a long-awaited business plan outlining concrete actions to turn decarbonization into ‘a driver of growth‘ for European industries by supporting renewable energy sources and transitioning away from fossil fuels. The plan is to provide at least €100 billion to support EU-made clean manufacturing.

According to MPP, the fastest-growing clean industry sectors are green ammonia-with 28 plants at FID and 344 announced-and sustainable aviation fuels (SAF), which count 22 operational plants, seven at FID, and 144 announced.

As explained, green ammonia presents a strong business case, particularly in agriculture, as a low-cost drop-in solution for fertiliser production, while sustainable aviation fuels benefit from strong regulatory support and continued demand for air travel.

In addition to this, in the maritime industry, using ammonia as fuel is seen as one of the most ‘viable’ paths toward net zero, with the International Maritime Organization’s (IMO) 2050 Net Zero Framework (NZF) appearing to tilt in favor of this environmentally friendly fuel and ships powered by it.

As per MPP’s analysis, the new industrial sunbelt nations host over three-quarters of all commercial-scale green ammonia production facilities planned globally (at both FID and announced). What is more, declining electricity and electrolyser costs in these markets mean that the production of this sustainable fuel could undercut fossil-fuel-based grey ammonia by 2035, with production costs potentially halving compared to Western Europe or the US.

Concerning the total pipeline, worldwide green ammonia production capacity from first-mover sunbelt countries is anticipated to play a ‘huge’ part in global supply chains.

MPP has added that for many lowand middle-income economies, this transition is said to offer the chance to leapfrog conventional carbon-intensive development, access export markets, create jobs, enhance food and energy security, and secure longterm competitive advantage in future clean commodity markets.

Discrepancies between commitments and FID

Despite the potential as shown, the pace of translating commitments into financed projects appears to remain sluggish.

At the current rate, MPP’s report put forward that it would take approximately 40 years for all announced projects to reach construction.

Additionally, unlocking the full potential of the pipeline is estimated to require a fivefold increase in investment and decisive action by governments, financiers, and corporate buyers.

Because of this, the MPP and ITA have proposed some policy actions that could accelerate project financing, including fuel standard programs, carbon pricing, and state-backed intermediaries.

By Sara Kosmajac

The National Wealth Fund (NWF), the UK’s sovereign wealth fund is making a multimillion equity investment in the development of a CCS project that will store carbon dioxide (CO2) emissions in the East Irish Sea.

The £28.6 million investment is described by NWF as the cornerstone of a £59.6 million equity raise, which also includes investment through a joint venture between Summit Energy Evolution, part of Sumitomo Corporation, and Progressive Energy Peak, as well as the cement and lime producers in the Peak Cluster: Tarmac, Breedon, Holcim, and SigmaRoc.

John Egan, Chief Executive Officer (CEO) of Peak Cluster, stated: "Peak Cluster is focused on securing a sustainable future for the cement and lime industry. Together with MNZ, the UK’s biggest carbon store, we will capture, transport and store CO2 to support industry to thrive in a low carbon future."

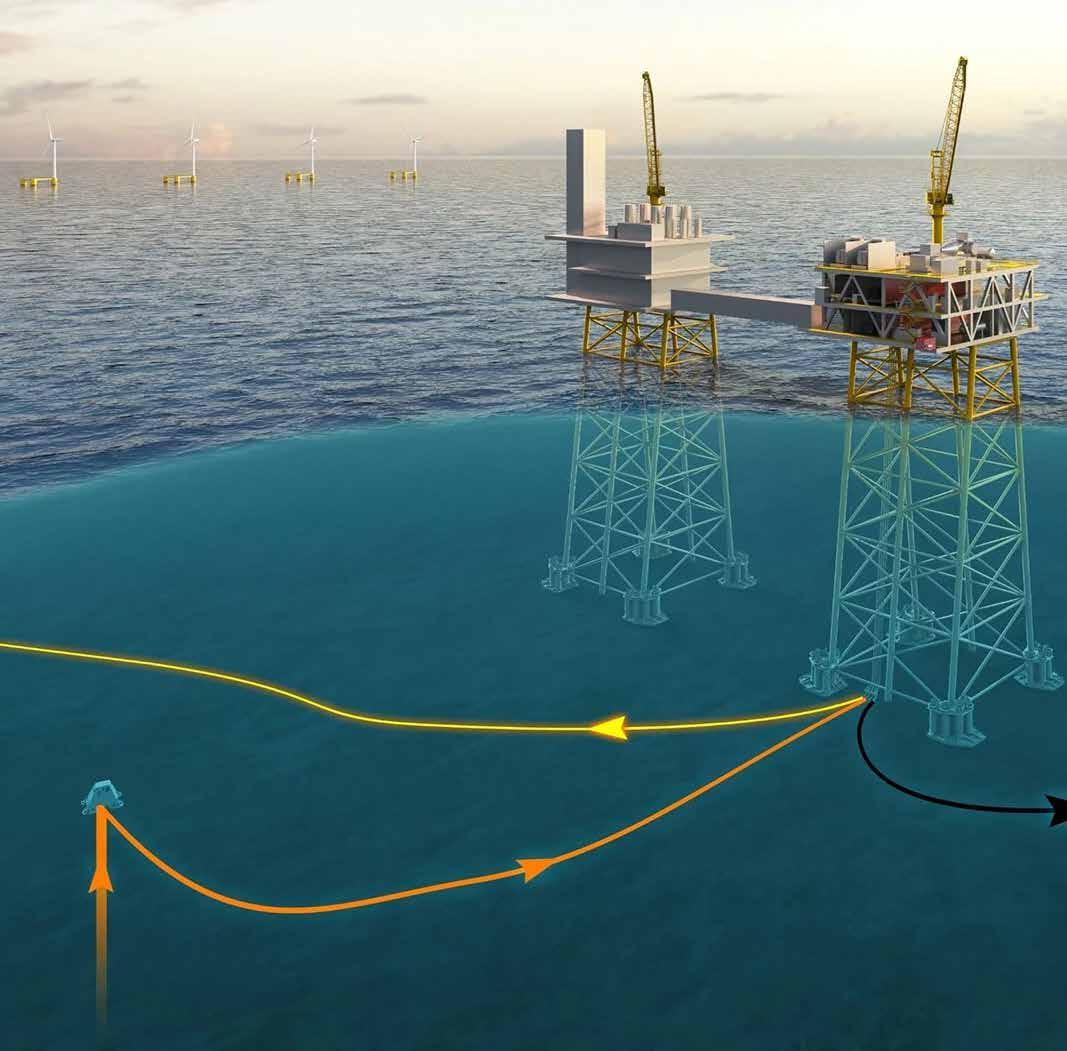

Spirit Energy is currently converting its Morecambe gas fields in the East Irish Sea to create what has the potential to become the UK’s biggest carbon dioxide (CO2) store. The Peak Cluster pipeline will then transport CO2 emissions captured on its industrial plants across Derbyshire and Staffordshire to be stored by Morecambe Net Zero (MNZ).

While being foundation materials for many UK industries, cement and lime are said to be two of the hardest industrial sectors to decarbonize due to the high levels of CO2 emissions generated in the manufacturing process, which cannot be abated through transitioning to low carbon fuels.

The MNZ project aims to provide a permanent decarbonization solution for this hard-to-abate sector by converting the depleted South and North Morecambe gas fields to provide permanent carbon storage. The two fields form part of the Morecambe Hub, 100%-owned and operated by Spirit Energy.

"The NWF’s investment sends a crucially important and thoroughly positive message to those eyeing the UK for investment in the low carbon developments needed to power our economy and help deliver the government’s economic growth and decarbonisation," commented Neil McCulloch, CEO of Spirit Energy.

NWF said its financing will be used to further develop the Peak Cluster pipeline project through to a final investment decision (FID) as early as 2028, including the completion of front-end engineering and design (FEED) and other studies that underpin the planning consent process.

The UK’s Energy Secretary, Ed Miliband, said: "This landmark investment will catalyse our carbon capture sector to deliver thousands of highly skilled jobs and growth across our industrial heartlands, as part of our Plan for Change. Workers in the North Sea and Britain’s manufacturing heartlands will drive forward the country’s industrial renewal, positioning them at the forefront of the UK’s clean energy transition."

Once repurposed, the gas fields will be able to accept up to 1 gigaton of CO2 in the project’s lifetime. This is said to be

the equivalent of three years’ worth of UK emissions.

The NWF believes its investment will remove some of the barriers faced by private investors to further develop and build the project in the future. As CCS is one of the five priority sectors announced by Chancellor Rachel Reeves, the fund wants to help amplify government policy, and de-risk and accelerate the financing and delivery of these vital projects.

Centrica Group Chief Executive and Chair of Spirit Energy, Chris O’Shea, noted: "This landmark first investment in carbon capture by the National Wealth Fund is an important and exciting step forward for the UK’s net zero ambitions, and our plans for Morecambe specifically. By transforming the Morecambe gas fields into the UK’s largest carbon store,

Spirit Energy will provide the critical infrastructure needed to decarbonise hardto-abate industries like cement and lime."

The Morecambe Hub comprises three fields in the East Irish Sea – North Morecambe, South Morecambe, and Rhyl, covering blocks 110/2a, 110/3a, 110/8a, and 113/27b, in water depths ranging from 17 to 35 meters. Gas from all the fields is processed at Barrow Gas Terminals, located near Barrow-in-Furness in Cumbria, before entry into the National Transmission System.

Described as one of the largest gas fields in the UKCS, the Morecambe Hub met 20% of the UK’s domestic gas demand at its peak. Spirit Energy aims for the field to remain in production until the end of the decade.

South Morecambe was discovered in 1974 and was the first to be developed, with production starting in 1985. The field has been developed using seven fixed jacket platforms, including the three-platform manned central processing complex (CPC), four normally unmanned installations (NUIs), and 36 development wells.

North Morecambe was discovered in 1976, with first gas in 1994. The development includes the normally unmanned Drilling and Processing Platform Alpha (DPPA) platform, which acts as the main gathering hub for the area, and ten development wells.

Situated north of the North Morecambe field, Rhyl was discovered in 2009 and started producing in March 2013. It has been developed as a two-well subsea tieback to DPPA.

By Dragana Nikše

Swedish wave energy developer CorPower Ocean has secured a €40 million grant from the EU Innovation Fund to support the development of VianaWave, a 10 MW pre-commercial wave energy project planned off northern Portugal.

The VianaWave project will comprise 30 wave energy converters (WECs), grouped in a CorPack array, expected to generate around 30 GWh of electricity annually, which is said to be enough to power 7,500 homes.

According to CorPower Ocean, the project aims to contribute to Portu-

gal’s National Energy and Climate Plan (NECP) target of 200 MW of installed wave capacity by 2030.

Operations are set to begin in 2028 or 2029, building on CorPower’s HiWave-5 project, which marked the company’s transition from pilot testing to commercial deployment.

The project includes onshore infrastructure investments, such as the expansion of grid facilities in Aguçadoura and Póvoa de Varzim, and the establishment of CorPower’s operations base at the Port of Viana do Castelo.

According to CorPower, around 75% of the project’s lifetime expenditure will

occur in Portugal, supporting the local supply chain and generating jobs in engineering, construction, and operations.

"This is a pivotal milestone for CorPower Ocean and the wave energy sector as a whole. VianaWave shows that wave energy is ready to scale. With strong support from the Innovation Fund and the Portuguese ecosystem, we are accelerating the transition to a sustainable, resilient energy system while delivering local economic value," said Kevin Rebenius, Commercial Director at CorPower Ocean.

The initiative also aligns with findings from the EU-funded EVOLVE study, which estimates Portugal’s wave energy potential at 15 GW. The project is expected to strengthen local supply chains, attract additional investment, and support Portugal’s position as a clean tech hub.

CorPower Ocean’s WECs incorporate a tuning and detuning mechanism that adjusts to ocean conditions, limiting response in storms while amplifying power capture in regular waves.

The HiWave-5 project aims to commercialize wave energy by 2030, according to CorPower Ocean. It is a research and technological development project focused on deploying a full-scale WEC system off the coast of Aguçadoura.

Wave energy picks up pace as CorPower Ocean lands two new investors CorPower Ocean has secured new strategic backing from Acario, the venture arm of Tokyo Gas, and GTT Strategic Ventures, part of French LNG tech group GTT, as part of its Series B funding round.

The investment builds on CorPower’s earlier €32 million Series B1 raise, supporting efforts to scale wave energy as a bankable clean electricity source.

"We are delighted to welcome GTT and Tokyo Gas via Acario as shareholders. They bring significant engineering and industrial scale-up expertise, and we are looking forward to having their support in making wave energy a mainstream energy source," said CorPower Ocean CEO Patrik Möller.

“The potential of co-locating CorPack wave arrays with offshore wind and solar installations around the world to enable 24/7 clean power is a major opportunity that we are excited to develop together with strong partners.”

Both Tokyo Gas and GTT are said to bring technical and industrial alignment to CorPower’s commercialization push. Tokyo Gas is one of Japan’s largest utilities, supplying energy to around 13 million customers, and has committed to net-zero emissions by 2050.

GTT is a global leader in cryogenic containment systems for liquefied gases and is expanding its role in the energy transition through its venture arm.

They join existing investors, including NordicNinja VC, SEB Greentech, InnoEnergy, Cisco Investments, Santander Asset Management, and Iberis Capital.

"We are proud to support CorPower Ocean in its mission to unlock the vast potential of wave energy," added Hélène Loncin, Head of GTT Strategic Ventures.

"As a clean, ocean-based power source, wave energy can play a critical role in addressing key challenges of the energy transition – from ensuring the availability of green electricity to enabling local production and supporting grid balancing. This investment reflects GTT’s commitment to fostering pioneering technologies that contribute to a sustainable energy future."

Wave energy is gaining attention as a firm clean power source. The UK recently launched a new Marine Energy Taskforce, led by Energy Minister Michael Shanks, backed by the Crown Estate and Crown Estate Scotland. The initiative aims to unlock 25 GW of wave and 11 GW of tidal capacity through targeted actions in site development, finance, innovation, and supply chains.

CorPower says wave energy’s consistent profile helps stabilise wind and solar output, enabling 24/7 renewables with lower storage and grid requirements. Compared to solar and wind-only systems, wave-inclusive mixes may cut total installed capacity and storage needs by up to 50%.

"We are excited to join CorPower Ocean and support the goal of realizing wave energy as a stable utility scale renewable resource globally," said Kenji Maeda, CEO of Acario.

"The ocean demonstrates incredible potential to meet the world’s rapidly growing need for clean energy and energy security. CorPower Ocean is in a unique position to fulfil this opportunity by delivering high-capacity factor clean power at an affordable cost – with high reliability. Our participation demonstrates Acario’s dedication to supporting remarkable innovators that are building the future of energy systems."

At scale, wave energy is also expected to undercut nuclear in cost and deployment timelines. Global wave energy potential exceeds 500 GW, comparable to total installed nuclear or hydropower capacity, according to the Swedish wave energy developer.

As fossil fuels still meet over 80% of global energy demand, CorPower positions wave energy as an important part of delivering firm, clean electricity for grids, data centres, and heavy industry. In May, CorPower Ocean signed a berth agreement to develop a 5 MW wave energy array at the European Marine Energy Centre (EMEC) in Orkney, Scotland.

By Zerina Maksumic

Brazil’s SENAI Institute of Innovation in Renewable Energy (ISI-ER) and SENAI’s Rio Grande do Norte branch, SENAI-RN, expect to receive an installation permit for their pilot project-the country’s first offshore wind project to be granted a preliminary license-by mid- to late 2026 and to have it operational within three years.

Following the award of the preliminary license by the Institute for the Environment and Natural Resources (IBAMA) on June 24, SENAI ISI-ER and SENAI-RN told offshoreWIND.biz in May this year that work had commenced on detailed design and gathering Joint Industry Project (JIP) partners, and that these activities will run in parallel with the work on obtaining the installation license.

This August, a public call was launched to invite investors and partners who want to join the 24.5 MW, two-turbine pilot project.

SENAI-RN has begun the fundraising phase and the setup of the JIP for the first stage of the project, which includes the development of the basic and exec-

utive engineering design, along with a detailed timeline and budget.

"This phase should take up to 18 months, during which we also expect to secure the installation license, as we will submit the plan with the conditions required under the preliminary license. So, these steps will progress in parallel", Rodrigo Mello, Director of SENAI-RN and SENAI ISI-ER, said in May.

The construction, assembly, and commissioning of the pilot offshore wind farm will be carried out in the second phase of the project, which will take another 18 months.

While it usually takes less time in a commercial setting, the pilot project will involve developing and analyzing solutions throughout each stage of the

process to provide data to the industry as part of its research and development (R&D) activities, according to SENAI ISI-ER.

"From the moment we contract the first phase - which is expected to happen in the second half of 2025 - we aim to have the pilot plant commissioned within up to 36 months. But that can, and ideally should, happen in less time", Rodrigo Mello told offshoreWIND.biz.

SENAI ISI-ER plans to bring in multiple partners, so instead of a single partner making a large investment, each one contributes a smaller investment and assumes less risk in the project.

"In the Brazilian market, there are specific regulations for the energy sector and for the oil and gas sector. And I mention

oil and gas because these companies are involved in the energy transition and are investing in it", Mello said.

"The public call aims to attract funding from both the oil and gas and electric energy sectors, especially through the legal framework in Brazil designed to support R&D investments."

Investment and solutions

Rodrigo Mello said that the offshore wind pilot was a project of national scope and interest to the country, and with the public call to the wider energy sector, SENAI is opening it up to the market for multiple players to join in the investment.

The JIP public call is also an invitation to companies to help build the solutions for the 24.5 MW pilot offshore wind project.

The public notice calls for companies to take part in a research, development and innovation project for the offshore wind sector under Brazil’s maritime conditions, specifically in the Equatorial Margin.

"The project focuses on a development program for solutions that should also result in the development of the supplier chain. The main goal is to develop a foundation and tower solution for the shallow-water conditions of Brazil’s equatorial coast", Rodrigo Mello said.

SENAI ISI-ER and its future JIP partners will develop a few different engineering paths for the foundation and the tower. After that, the turbines and the entire system, including the foundation, with a tower on top and a wind turbine installed and operating, will be analyzed so that the pilot can inform future commercial offshore wind projects.

"It’s a development project, but as a result, we will have a foundation and tower built and operating under real-world conditions", SENAI ISI-ER’s Rodrigo Mello said.

When asked if the project would use Mingyang Smart Energy’s wind turbines, given that SENAI ISI-ER and Mingyang signed a cooperation agreement in October last year and that one of the project’s two turbines is planned to have a 16 MW capacity, Mello said that the final decision about the wind turbines to be used in the pilot project is yet to be made and that it will be made known publicly through the upcoming public call.

"For this project, we are finalizing the details of the public call, and we have signed Non-Disclosure Agreements (NDAs) with some partners, including Mingyang. The specifics-whether it will be a Mingyang machine, the model, etc.will be announced in the public call once it is finalized. What we can say at this moment is that Mingyang is a partner of SENAI in Rio Grande do Norte and is discussing the project conditions with us", Mello said.

‘Historic milestone’

Roberto Serquiz, President of the Federation of Industries of Rio Grande do Norte (FIERN) and the Regional Council of SENAI-RN, pointed out that the project will play a key role in adapting offshore technologies to Brazil’s conditions.

"Now we need to accelerate, because we will have one and a half years to design the entire concept, meet the conditions, complete the projects, and then move forward with the implementation of this pilot plant, which will mark the beginning of real offshore wind energy generation for Brazil. This is a very important vanguard", Roberto Serquiz pointed out.