on us." We all have a responsibility to help the Institute grow, identify resources, tell its story and be champions of the cause.

We continue to execute our mission of strengthening the asset base of diverse populations through policy, education, and economic opportunities. Our four lines of business—Research, Policy & Impact Center, Center for Entrepreneurship, Center for Community Investment, and Center for Professional Services are specifically designed to fulfill our mission.

It is hard to believe that March 2022 marked two years since I joined the National Institute of Minority Economic Development and Institute Capital (ICAP-formerly Initiative Capital) as President and CEO. I am proud that both organizations continue to be intentional about moving forward with determination, impact, and purpose. The Institute team is supported by a board of directors who guide the vision of this great organization. I would be remiss not to mention three exceptional pioneers in the community economic development movement who paved the way for me and many othersFounders Andrea Harris, Lew Myers, and Abdul Sm Rasheed. Their profound leadership and advocacy opened the lens to the challenges of inequities experienced by people of color and women in policy, equitable access, and economic opportunities.

I am constantly surrounded by the presence of Ms. Harris, who inspires these words to resonate throughout my being, "it's not enough to maintain where we are—the Institute must grow and become influential—people are depending

We believe that all people, regardless of race, gender, or social position, should have equal opportunity to live, grow, thrive, produce, and contribute to the economy and civic life on their terms. I am convinced that people are not looking for a hand-out, just a hand-up. Therefore, as we continue to deepen our North Carolina relationships and expand beyond its borders, I am encouraged and excited about the Institute’s future and the countless families, diverse businesses, and strategic partners we will impact. And, like so many others, we weathered the storm of the last two years, coming out stronger than ever. Now, it is time to thrive!

In closing, ENC 2021 was a resounding success and an excellent opportunity to celebrate our traditions and those who paved the way while looking forward with excitement to the future.

Yours on the Journey,

Kevin J. Price President & CEO

To strengthen the asset base of diverse populations through policy, education and economic opportunities.

Economic Prosperity for Diverse Populations

Trust, Excellence, Innovation, Collaboration

For more than 35 years the National Institute of Minority Economic Development (The Institute) has been a catalyst of minority competitiveness, especially on issues of minority-owned businesses and diverse communities and economies.

In addition to providing technical assistance and addressing policy issues, we also lead the state’s collaborative community economic development efforts, driving innovation, investment and action to create prosperous, sustainable communities, via our CDFI. As a result, the Institute maintains its status as a trusted advisor to businesses large and small, government agencies, policy makers and community organizations that understand the key roles that diversity, equity, and inclusion play in ensuring business competitiveness and economic resiliency.

1

We provide education and supportive services to an array of minority and women led small businesses and nonprofits, from the emerging entrepreneur to the mature business.

2

ADVISE

We provide diversity, equity and inclusion consulting services, supplier diversity advising, and other minority small business awareness to government agencies and large corporations.

3

MANAGE

We manage state and federal small business funding, certification, and contracting opportunities, supplier diversity networks, and fee-for-service contracts.

4

ADVOCATE

We advocate on behalf of women and minority small businesses to influence systems change and minimize economic disparities.

5

We provide capital to community development corporations, affordable housing initiatives, and diverse businesses through our Community Development Financial Institution.

Kaye Gantt, COO awarded Harriett Tubman Excellence in Leadership Award by National Association of Minority Contractors (NAMC)

Sr. Vice President, Operations of Institute Capital (ICAP) appointed to Board of Natural Capital Investment Fund (now Partner Community Capital)

Sr. Vice President, Operations of ICAP appointed as Chair to Board of Association of Women’s Business Centers

2021

z Agency Diversity Advocate of the Year Award - City of Durham

z Leadership in Business Sustainability Award - NC Business Council

2019

z Lighting The Way Award - SunTrust Foundation

z SHE Evolve Summit - Strength - Honorable - Empowering Award

2018

z City of Charlotte & Mecklenburg County Crowns of Enterprise Award Diversity Advocate of the Year

2017

z National Training Institute Innovation Award

z Who’s Who Black Charlotte

z Minority Business Development Agency (MBDA) Charlotte MEDWeek Diversity Advocate of the Year

2014

z National Women’s Business Center of the Year by SBA

z National Women’s Business Center of Excellence Award from SBA

z Southeastern Region Women’s Business Center of the Year by SBA (comprised of AL, FL, GA, KY, MS, NC, SC and TN)

z State of North Carolina Women’s Business Center of the Year by SBA

•Data team

•Collaboration with Subject Matter Experts (SMEs)

•Quarterly surveys

•Strategic Priorities

•Economic Development

•Policy Development

•Education

•Advocacy

RESEARCH, POLICY & IMPACT CENTER

CENTERFOR ENTREPRENEURSHIP

•Education, training, T/A

•Workshops

•Capacity building (for/nonprofits)

•Construction and Bonding support

•Learning Lab

•Consulting arm

•Public/Private Collaborations

•Diversity, Equity and Inclusion

•Supplier Inclusion

•Minority Executive Education Institute

CENTERFOR PROFESSIONAL SERVICES

CENTERFOR COMMUNITY INVESTMENT

•Non-Profit Capacity Building

•Support CDCs

•Engage HBCUs

•Financing

•Affordable Housing

•Diverse Businesses

100

1921

After its completion in October 1921, the six-story Parrish Street building was dedicated on Saturday, December 17, 1921 and served as the headquarters for North Carolina Mutual Life Insurance Companyone of the nation’s largest companies founded and owned by African Americans.

1920

Our Historic Parrish Street Headquarters

1974-1975

Placed on the National Register of Historic Places in 1974 and designated a National Historic Landmark in 1975, the building remains one of only a handful of landmarks owned by a minority organization.

2020

The Institute merges with the North Carolina Community Development Initiative to form Institute Capital (ICAP), a 501c3 Community Development Financial Institution (CDFI). ICAP deploys $7 million in grant funding to minority and women-owned small businesses.

1999

The Institute purchases the historic Parrish Street building from M&F Bank.

2021

1922

Mechanics & Farmers Bank moves its headquarters to the first floor. An M&F Bank branch remains as the first floor anchor tenant to this day. Along with NC Mutual, Mechanics & Farmers contributed greatly to the prosperity of Durham’s “Black Wall Street” throughout the early 20th century.

1986

The Institute was founded as the North Carolina Institute of Minority Economic Development to diversify North Carolina’s business base as a strategy for expanding economic opportunity.

2021 Institute Capital disburses nearly $5 million in loan capital and $4 million in grant funding to minority and women-owned small businesses. The funds help to address the challenges these firms faced during the recovery from the COVID-19 pandemic.

Institute Capital provides debt and investment capital to a ordable housing developers, community-based development organizations (CBDOs) and small businesses. Our goal is to revitalize and transform diverse communities through a ordable housing, entrepreneurship, HBCU collaborations and community development.

Institute Capital (ICAP), a 501c3 organization, is one of five Black-led CDFIs based in North Carolina. Our mission is to stimulate and encourage community and economic development activities that benefit low¬ to moderate-income communities and individuals; provide financing for community development including affordable housing and commercial real estate, small businesses, and community facilities; and expand economic opportunity, improve the quality of life, and empower minorities and low wealth communities. ICAP specializes in loans up to $500,000 to diverse businesses and up to $750,000 for affordable housing activities. The ICAP team has more than 100 years of

combined banking and finance experience that includes lending, CRA and technical assistance for community and economic development. Over its 20-year history, it has leveraged over $1 billion in community economic development activities throughout North Carolina. ICAP is headquartered in Durham, North Carolina.

z Affordable Housing

z Small Business Lending

z HBCU Business Collaborative

z Community Development Investing

z Reviewed and updated our lending policies to provide greater access to very small businesses and be more aligned with our mission.

z Our 2021 stated goal was $5 million, which we accomplished!

Closed high quality affordable housing and small diverse business loans, mostly real estate secured.

z The 2021 goal contained a persistent poverty county goal of $100,000, which we also accomplished.

z Added three new members to our board of directors, all with banking/finance backgrounds.

z Successfully changed our reporting structure from a fiscal year to a calendar year to align parent and affiliate organizations.

z We expanded our team, with new expertise in banking and finance, to better serve our growing client base.

z As a result of making great progress, we were able to establish automony as a CDFI and we are now self-managing operations.

z Gained a new partner and $3 million in EQ2 funding from Pinnacle Bank.

z We have a very heathy pipeline and have set a goal of $10 million in lending by year-end.

z The Institute opened a consolidated office on the campus of UNC-Charlotte in its PORTAL building, which makes us the only CDFI on any UNC school campus in North Carolina. That consolidated office will contain an office for Institute Capital. We are collaborating with the university to provide financial resources for businesses birthed out of the PORTAL building.

Founded in 2015, Granit Training Group LLC is a Disabled USMC Veteran and woman owned business that has a strong following across the state of North Carolina for custom curriculum design, training development and program deployment. The owners of Granit Training Group LLC recently purchased a 94-acre property to handle the customer demand across the state. The 94acre property hosts 4 primary buildings which include classroom and office structures that will allow their company to expand its training facility to accommodate the demand of community organizations, Small Business Centers, network partners and rural farm training networks. The newest addition to the Granit Training Group Programs includes, Farm School on Wheels, which was ribbon cut this spring in 2021.

The property hosts multi-use facilities, including training buildings that have appraised for $1.3 million-dollar in 2021, and is in the perfect location, central to Charlotte, Boone, Appalachian State University and Raleigh along with easy highway access to all clients and events across North Carolina. Granit’s Training Teams can get from the Mountains the Coast in under 4 hours.

Public Allies North Carolina (PANC) is a social justice organization committed to changing the face and practice of leadership by recruiting and training talented young leaders, with a passion for social impact, to create meaningful change in our community. Our Allies are diverse, equitycentered, innovative problem solvers, dedicated to mobilizing community assets to develop solutions to local challenges. In partnership with nonprofit and municipal government partners, we deliver our nationally recognized, values-driven, results-led apprenticeship to advance our mission to create a just and equitable society and the diverse leadership to sustain it. As a member of the AmeriCorps National Service Network, our work is made possible through the funding of the Corporation of National Community Service.

We weave together four key elements that constitute an experiential journey of self-discovery,

leadership and professional development:

z Practical, on-the-job learning through a paid, full-time nonprofit apprenticeship,

z Weekly, rigorous leadership training,

z Building community through our cohort model, and

z Mentoring, coaching, and continual selfreflection.

We have helped hundreds of partners increase their capacity to achieve their mission by matching them with diverse, talented individuals from the community. Our Allies are placed with organizations to help address critical community needs such as social justice advancement, youth development, education, environmental issues, arts programming and community healthmaking us a dynamic pipeline to leadership in the nonprofit sector.

34 Allies matched with partner organizations

8 NC counties served

57,800 hours Allies worked building capacity for organizations

FUNDING SOURCES Corporation for National & Community Service (CNCS) $749,300

85% People of Color

19% Men of Color

69% Women

31% Men

19% Opportunity Youth

15% LBGTQ+

74% Bachelor’s

19% Graduate

26% Non-Degree

62% Economically Disadvantaged

70% of Allies were offered permanent jobs with their Partner Organization

50% of Allies pursued further education attainment

30% of Allies elected to complete a 2nd term of service

2021 was one of the most challenging periods in Public Allies National history. It was a year marked by both tragedy and success, from the loss of dear colleagues, friends, and family members to the historic momentum of the national $75M Racial Equity Capital Campaign and the promise of breaking through long standing challenges.

COVID-19 continued to have an impact on the economy, and especially on nonprofit organizations in North Carolina. As a result, Public Allies was not able to provide intermediary work for as many nonprofits in the communities as we would traditionally serve. However, we were able to maintain our support and continue to provide critical capacity building and racial equity training to all the organizations we served, uninterrupted. We equipped our Allies to operate in new and unfamiliar ways, to support organizations that desperately needed new technology, changed methods of service delivery, adapted new management tools, and operated with less staff capacity.

While our numbers did not increase, our internal capacity did. The Corporation for National Community Service increased our grant revenue, and provided additional funding made available from AmeriCorps by the American Rescue Plan (ARP) legislation. This will enable our Site to invest in more human capital, expand our Triangle borders to the Queen City and serve even more nonprofits in 2022.

The racial unrest in our country was tragic for us all, but it provided Public Allies additional bandwidth to share the experience and expertise we were founded on to catalyze a dramatic shift and ultimately create a more diverse, inclusive, and equitable future for all. To that end, the Public Allies National Office launched a $75M Racial Equity Capital Campaign and have already secured $30M of the funds to help our country emerge from the structural racism that pervades virtually every aspect of America today. This work will be done locally, through Sites like ours.

As the uncertainty of our times continues, Public Allies remains committed to systems-change to support the nonprofits who are lifting our most vulnerable communities.

The Research, Policy & Impact Center is a non-partisan research center that believes the sustainable growth of diverse businesses, the workforce and the economy are critical to the success of our communities.

Our goal is to be a change agent that provides information and data to transform ideas into action.

Advocacy

Retain and strengthen a core of expert advisors which consist of economists, demographers, statisticians, financial analysts, and policy makers to provide relevant information that informs key stakeholders, corporate partners and business clients.

Policy Development

Issue periodic reports to inform the general public and key stakeholders on issues relevant to opportunities and barriers to the growth of net worth by minorities and women.

Education

Serve as the center of knowledge on the status of minority and women owned business and relevant public sector policies and private sector practices.

Host forums and symposia on key areas of interest in economic development and net worth growth of minorities, women and under-resourced populations.

Economic Development

Monitor and analyze relevant policies that impact the state of minority and women owned businesses, as well as institutions that help build net worth among under-resourced populations and neighborhoods such as HBCUs, faith-based organizations and cultural organizations.

Provide education, training and support to institutions such as HBCUs that bring economic value and impact to the success of minorities and historically low wealth populations and neighborhoods.

An information packed, two-hour event! During this conference, The Institute brought together community stakeholders, partners, small business owners and government officials from national, state and local levels to discuss current information regarding key issues impacting the current state of equity challenges such as housing affordability, homelessness, healthcare, entrepreneurship, education, workforce development and unequal access to jobs and economic opportunity throughout communities in North Carolina.

Beginning in April 2020 we conducted quarterly surveys in an effort to understand the challenges and long term effects of the COVID-19 pandemic on diverse small businesses and offer suggestions regarding how we can provide additional support and assistance.

Summary of June 2021 Survey Findings

z Most of the diverse suppliers are very small, however many are less than 5 employees

z Over half of respondents have been in business over 5 years, showing long term establishment

z Nearly 80% of businesses have had to rely on relief funding to remain operational

z Still, more than 80% of respondents answered that they are in need of additional financial assistance to remain operational

$250,000 Ewing Marion Kauffman Foundation Rebuild Better Grant

$25,000 Duke Energy Social Justice and Racial Equity Grant

The South Atlantic Region Small Business Transportation Resource Center (SBTRC) serves as a regional office for the Office of Small and Disadvantaged Business Utilization (OSDBU). SBTRC works closely with prime and subcontractors as well as state and local transportation agencies within the South Atlantic Region. The main focus of the SBTRC is assisting firms that are interested in doing business with the U.S. DOT directly, or with state and local agencies receiving U.S. DOT funding.

SBTRC supports small businesses in the District of Columbia and the four-state region of Kentucky, North Carolina, Virginia, and West Virginia.

The SBTRC is a grantee of the U.S. Department of Transportation, Office of Small Disadvantaged Business Utilization.

SBTRC provides small businesses with the tools, resources, expertise and technical assistance required to bid, win and successfully perform on federal and state transportation contracts. The program targets all modes of transportation: rail, highway, maritime, airports and mass transit systems. Programs include:

z Bonding Education Program (BEP)

z Capital Access Program (CAP)

z Women in Transportation Initiative (WITI)

69 Events hosted. Areas served include KY, NC, VA, WV and metro DC region

123 Clients

1,057 Entrepreneurs Trained

4 Business Starts

38 Jobs Created/ Retained

Assisted clients in obtaining $40,506,962 Contracts Awarded

$15,748,118 in capital & bonding

Brandt Smith, President of SGS Contracting became a client of the SBTRC in September 2021. Brandt attended several outreach sessions including the American Tobacco 2.0 in September. Brandt participated in the Lane I-40 Orange County BEP in October and November. SGS Contracting was also awarded “Outstanding Achievement Award in General Construction” during Durham MED Week 2021.

“Over the last several months, the SBTRC has been instrumental in assisting SGS Contracting in growing our capacity to successfully win and perform projects. Through the SBTRC-sponsored Bonding Education Program Series, we successfully obtained our first bid bond, and subsequent performance bond, which contributed to SGS being awarded a project with the local ABC Commission. SGS also began developing a relationship with Fifth Third Bank to obtain a line of credit to increase our working capital. SBTRC assisted SGS with the posting of projects for bids, which allows us to increase and diversify our subcontractor pool. The SBTRC has been great to work with and their assistance will continue to enable many years of success for SGS Contracting.”

The mission of the Women’s Business Center of Charlotte (WBCC) is to empower women with the tools, resources, and opportunities needed to establish businesses, stabilize their companies, generate sustainable profits, strategize for future growth and contribute to the growth, and economic development of our community.

The WBC of Charlotte is funded in part through a cooperative agreement with the U.S. Small Business Administration (SBA) and the City of Charlotte.

WBCC services include:

z Customized one-on-one counseling

z Workshops & Monthly Seminars

z Financial Assistance

z Business Plan & Certification Assistance

z Networking Opportunities

z Leadership & Business Development Training

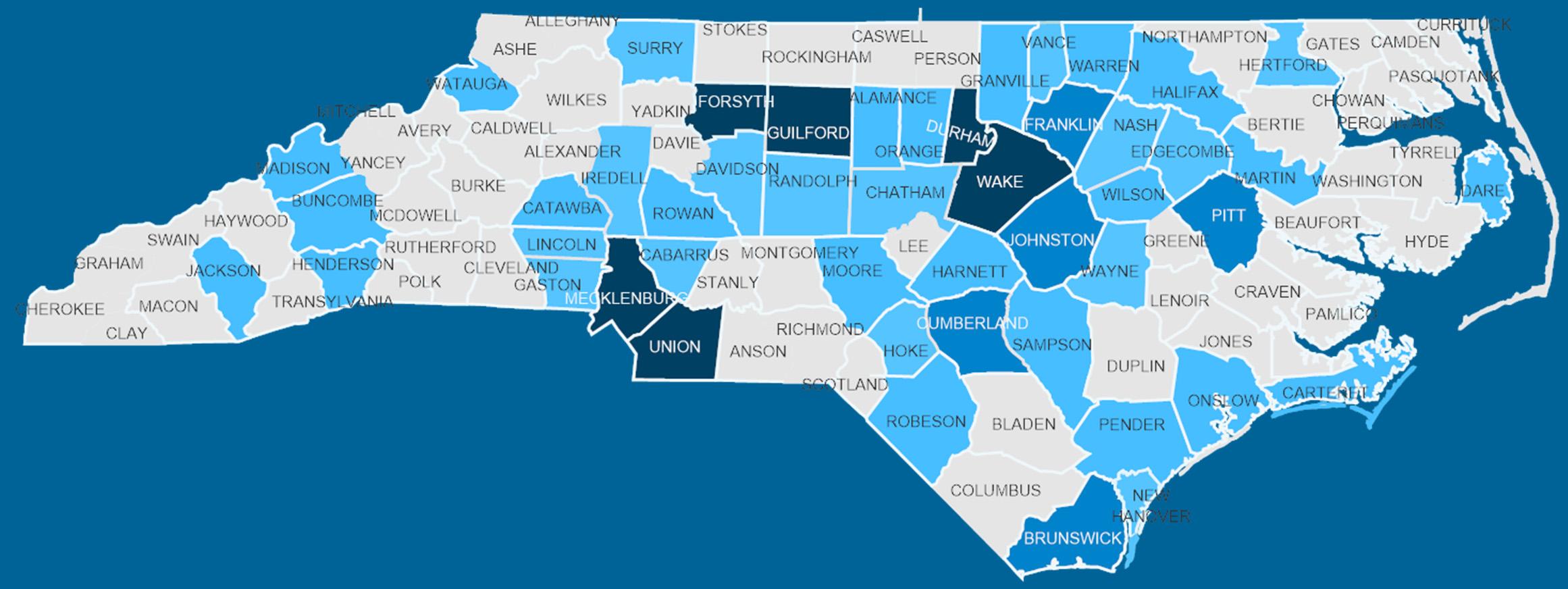

12 NC counties served [Alexander, Anson, Cabarrus, Catawba, Cleveland, Gaston, Iredell, Lincoln, Mecklenburg, Rowan, Stanly and Union]

2,603 Clients $35,000 Contracts Awarded

4,635 Entrepreneurs Trained

47 Business Starts

2 Jobs Created/ Retained

$2,634,093 Capital Formation

“WBCC has been an integral part of my business growth! I began with individual counseling with Natalie Williams in May 2019, and she immediately provided external resources such as contact information for CPAs, attorneys, business certification organizations, etc. We discussed strategic best practices for working on my business and why having a team of experts would help me free up my time to focus on important goals that I had for my business. Natalie provided a list of free workshops that I could join with the WBCC for taking a deeper dive into starting a business, which have all proven to be invaluable.

I have attended countless workshops through the WBCC and all of them have been beneficial for creating a solid foundation for HR Unequivocally. In 2019 when I landed on the WBCC doorstep, I thought I knew what I was doing, but with the resources, workshops, and cohorts I have had the pleasure of being a part of, I realize now that I only knew a very small portion of what I needed to know to run a successful business. In addition to the workshops and resources, I have established friendships and relationships with other likeminded women to help me through this entrepreneurial journey.

During COVID, being a part of Game Changers helped me pivot and ultimately sustain the business. The year 2020 proved to be challenging for a lot of small businesses but with the help of the Game Changers program, I was inspired and motivated to keep going! I subsequently won the pitch competition at the end of the Game Changers program. Winning the competition was the highlight of the hard work I put into the business with the help of the Women’s Business Center of Charlotte.

I can’t thank you all enough for your love and support! “

- Nikki Pounds, HR UnequivocallyShaundrelle Green is the owner and CEO of a nonprofit organization, “Sisters Healing & Evolving, Inc.” (SHE). She has been in business since April 2020. Her business is a non-profit organization that has been in business for 1 year. Her target market is African American women ages 34-45 that make an annual salary of $40k and have some college education. She currently has 5 clients and has 3 volunteers, including herself. SHE, Inc. helps transcend deceptive thinking to moving with purpose!!! The website does not function the way she wants it to function, and she needs automation in her business. She wants to build out something that is interactive and collaborative!

After completing the Catch the Tech Fever program, Shaundrelle stated, “Thanks for all the shared wisdom and encouragement. Truly a blessing to have been in this program. The one on one allowed me to save approximately $1,300.00 that I reinvested in the organization to be able to purchase a CRM and laptop.”

- Shaundrelle Green, Sisters Healing & Evolving, Inc. (SHE)

The mission of the Women’s Business Center of North Carolina is to promote economic selfsufficiency for all women in North Carolina through entrepreneurship. We empower women by offering tools and support to establish businesses, stabilize their companies, generate sustainable profits, strategize for future growth and contribute to the growth and economic development of the community.

The Women’s Business Center of North Carolina is funded in part through a cooperative agreement with the U.S. Small Business Administration.

z Customized, one-on-one business counseling

z Seminars and classes focused on key business topics, such as marketing, finance, certification, and small business resources

z Review and feedback on business plans

z Loan package preparation assistance

z Certification assistance and review

z Networking opportunities

PROGRAM MILESTONES

52 NC counties served [Starting from the Piedmont area to the East Coast]

1,375 Entrepreneurs Trained

13 Business Starts

1,096 Clients $30,000 Contracts Awarded $1,754,011 Capital Formation

455 Jobs Created/ Retained

Durham, NC

Pamela Bennett is a sole provider day care home in Durham North Carolina. Ms. Bennett had started her business before the beginning of the COVID crisis.

Ms. Bennett approached the Women’s Business Center for assistance in pursuing the NC RETOOL Grant, in addition to helping her obtain a status on re-consideration for the EIDL. She also wanted assistance in identifying additional forms of financial assistance.

During consultations, Ms. Bennett stated she was late in getting her 2019 tax returns submitted. When they were submitted, the processing got held up at the beginning of the COVID 2020 crisis. She shut her doors in March 2020. She was denied financing, but did get an SBA grant advance of $1000. She applied for the EIDL target advance in Feb 2021 and got a notice in August that the reevaluation was underway.

She also needed some assistance with a business plan to consider future growth, so we provided business plan resources. We also assisted her with the NC RETOOL application as well as applying for her NC Historically Underutilized Business (HUB) Certification, which she obtained on September 24, 2021.

We referred Bennett’s In-home Daycare to the LISC-Recovery Growth of BIPOC Business grant/ education program and Bennett’s In-home Daycare was accepted for the program. She recently indicated that she had received her SBA EIDL advance. We will continue to monitor funding efforts for her and provide ongoing business capacity building, marketing, and business planning services.

On March 18, 2021, the National Institute of Minority Economic Development, in partnership with Virginia Union University, opened the doors of the Women’s Business Center of Richmond.

The WBC Richmond provides services that are desperately needed as female entrepreneurs and women-owned small businesses struggle to recover during an economic downturn and worldwide pandemic. The Women’s Business Center of Richmond is funded in part through a cooperative agreement with the U.S. Small Business Administration.

z Entrepreneurial Assistance

z Marketing and Branding

z Intellectual Property Protection

z Network-building events

z Social Integration activities

z Credit Profile Assessment

z Loan Readiness & Preparation

z Financial Sustainability

159 Clients

477 Entrepreneurs Trained

6 Business Starts

68 Jobs Created/ Retained

$6,000 Capital Formation

∣

∣

∣

The Eastern North Carolina Entrepreneurial Promise ("ENCEP") is a virtual regional accelerator delivering mentoring, 1:1 coaching, targeted strategic advisory services, and access to capital to 15 small and emerging businesses from across eastern NC. ENCEP is a two-year project of The Institute and Natural Capital Investment Fund, which received funding from the NC IDEA Foundation to launch the program.

Participating companies must have revenues of $250,000 or less and the potential to grow to employ more than 50 people and/or generate revenues greater than $1M. The focus is on women-owned businesses ("WBE") or minority-owned businesses ("MBE") in Tier 1 or Tier 2 counties (33 of 38 counties East of I-95).

z Intensive training to participants (10 weeks)

z 1:1 coaching focused on specific identified needs for development

z Mentoring with an experienced business owner

z Peer networking

z Connections to capital

z Targeted strategic advisory services

Thrive High Point: Minority Entrepreneurship Initiative is a program offered by Business High Point: Chamber of Commerce, formally launched in Fall 2021. High Point, NC has a diverse population of business owners and budding entrepreneurs. Thrive has been developed to support the broad needs of minority and women-owned businesses in the city.

The concept for the program originated from the High Point Equity Project. Launched in Summer 2021, the High Point Equity Project is a sustainable course of action that supports the growth and development of minority-owned and economically challenged businesses in the City of High Point through the provision of non-traditional business financing, technical assistance, entrepreneurial mentorship, and business coaching.

Several new partnerships helped to generate the project’s momentum, starting with High Point University’s $500,000 challenge gift and the High Point Community Foundation’s agreement to act as

the fiduciary agent. These commitments prompted a steering committee of local leaders, facilitated by High Point’s social innovation consulting firm Change Often, to identify the National Institute of Minority Economic Development (The Institute) as the best partner for collaborative programming.

Thrive High Point is a driving force in enhancing and broadening High Point’s inclusive economic ecosystem.

z Coaching and counseling

z Mentorship

z Networking opportunities

z Shared working space

z Access to capital and grant opportunities

z Training, group sessions, courses, and interactive activities

The National Institute of Minority Economic Development (NIMED) hosted an Open House and Program Presentation on December 1, 2021 to announce a major expansion effort in Charlotte; opening new offices in the Partnership, Outreach, and Research to Accelerate Learning (PORTAL) building on UNC Charlotte’s campus.

The four-story, 96,000-square-foot, PORTAL building, which sits on a prominent site at the Tryon Street entrance of the Charlotte Research Institute campus, was formally dedicated on February 28, 2014. The facility was designed to stimulate business growth and job creation along with promoting research and innovation.

The Institute’s turnkey economic development services and lending products are a unique contribution to UNC Charlotte’s Industry-University Partnership Hub, and to building a more equitable entrepreneurial ecosystem for the Charlotte region.

z Center for Professional Services - the Institute's consulting arm, offers uniquely customized professional development, supplier diversity strategies, and diversity, inclusion and equity education to corporations and governments.

z The Women's Business Center of Charlottewhich helps women-owned businesses start and grow by offering tools and support to establish businesses, stabilize their companies, generate sustainable profits, strategize for future growth and contribute to the growth and economic development of the community.

z Institute Capital (ICAP) - our CDFI, provides access to capital for minority-owned small businesses, non-profit affordable housing developers, and HBCU ventures, improving the financing environment with fair and equitable lending practices.

Our extensive network of investors and partners, developed over three decades, connects clients with business assistance and opportunity for achieving their business objectives.

AARP

AARP Virginia

Akerman

AmeriCorps

Association of Women’s Business Centers

Balfour Beatty

Bank OZK

BEFCOR

Cabarrus Center for Innovation & Entrepreneurship

Carolina Small Business Development Fund

Carolinas-Virginia Minority Supplier Development Council (CVMSDC)

Catalyst Surety Partners

Centennial Surety Associates

Center City Partners

Central Piedmont Community College

Central Virginia African American Chamber of Commerce (CVAACC)

Charlotte Area Transit System (CATS)

Charlotte Business Inclusion

Charlotte Business Resource

Charlotte Mecklenburg Library

Charlotte Mecklenburg Schools

Charlotte Works

City of Charlotte

City of Durham

City of Greenville

City of Hampton, Economic Development

City of Louisville (KY)

City of Norfolk

City of Raleigh

City of Virginia Beach

Civic Credit Union

Construction Bonds Inc.

Courageous Life Academy

CT Wilson Construction

Department of Small and Local Business Development (DSLBD)

District Department of Transportation (DDOT)

Duke Energy

Edward Jones

FAM Construction

Fayetteville Area System of Transit (FAST)

Fayetteville State University

Fifth Third Bank

First Citizens Bank

Foodbuy

Groopworks, LLC

Hampton Roads Connector Partners

Hines Development

IFB Insurance Services

Internal Revenue Services (IRS)

Kentucky Transportation Cabinet

Kerr-Tar Regional Council of Governments

L A Surety

The Lane Construction Co.

Lincoln Harris

LISC

Louisville Metro Sewer District (KY)

Metropolitan Washington Airport Authority

My Local CFO

NC Department of Administration – Office for Historically Underutilized Businesses (HUB)

NC Department of Labor (DOL)

NC Department of Revenue (DOR)

NC Department of Transportation (NC DOT)

NC Education Lottery

NC IDEA

NC School of Science & Mathematics

NC Secretary of State

Owens & Minor

Pacific Western Bank

Partner Community Capital (PCAP)

Piedmont Virginia Community College

PNC Foundation

Prospera

PTAC

Raleigh-Durham Airport Authority

Rowan Cabarrus Community College (RCCC)

The Rural Center

Self Help Credit Union

South Piedmont Community College (SPCC)

SunTrust Foundation

Tami Jaffi Consulting

Thread Capital, a division of The Rural Center

Transit Authority of River City (TARC-KY)

Truist Bank

Turner Construction

U.S. Department of Transportation - Office of Small and Disadvantaged Business Utilization (OSDBU)

U.S. Small Business Administration (SBA)

Virginia Asian-Am Chamber of Commerce

Virginia Department of Small Business & Supplier Diversity (SBSD)

Virginia Department of Transportation

Virginia Hispanic Chamber of Commerce

Virginia Union University

Wake Technical Community College

Washington Metropolitan Area Transit Authority

Wells Fargo Bank

Woodforest National Bank

Worth Advisors

Z. Smith Reynolds Foundation

Irma Alvarez Urbina Funding Processor Institute Capital

Talitha Batts, MEd Director Research, Policy & Impact Center

Christian Boyle Accounting Associate Administration

Tanya Branch, CPA Chief Financial Officer Administration

TF Congleton Lending Officer Institute Capital

Regina Durham, MA Executive Administrator II Administration

Kaye Gantt, MBA, MCA Chief Operations Officer Administration

Shara Gibson, MBA Program Director

Women’s Business Center of Richmond

Dannellia Gladden-Green, PhD Executive Director

Women’s Business Center of Richmond

Rocio Gonzalez Executive Director

Women’s Business Center of Charlotte

John Ham Director Center for Professional Services

Bryle Henderson-Hatch, PhD Executive Director, High Point Equity Project Center for Professional Services

Linda Hughes, MS Program Director

Women’s Business Center of Charlotte

Tianna Leger, MS Program Director

Women’s Business Center of North Carolina

Alyssa Mako, CGBP Executive Director South Atlantic Region Small Business Transportation Resource Center

Roberta McCullough Senior Vice President of Operations Institute Capital

Lynn Mitchell Program Manager Center for Professional Services

Janet Nghiemlee Office Manager Administration

Vanessa Nicholas Corporate Marketing Administration

Angela Poole, CPA Vice President of Finance Administration

Kevin Price, MBA, MHA President & CEO

Dan Stafford, MBA, CGBP Client Counselor

Women’s Business Center of North Carolina

Jenine Stevenson Project Coordinator South Atlantic Region Small Business Transportation Resource Center

Phyllis Thornton Administrative Support

Women’s Business Center of North Carolina

Suling Walker Executive Director

Women’s Business Center of North Carolina