The National Association of Mortgage Brokers is the voice of the mortgage industry, representing the interests of mortgage professionals and homebuyers since 1973.

The National Association of Mortgage Brokers is the voice of the mortgage industry, representing the interests of mortgage professionals and homebuyers since 1973.

Happy October Everyone! As I enter into my first month of presidency, I’ve hit the ground running! I had the pleasure to attend the National Association of Hispanic Real Estate Professionals (NAHREP) L’Attitude Conference in Miami, along with NAMB VP & Industry Partner Chair Kimber White. NAMB supported the event by sponsoring a hospitality suite in conjunction with Freddie Mac. I can’t thank Nora Guerra, Senior A ordable Lending Manager with Freddie Mac, enough for the opportunity for NAMB to experience this amazing event through her. The connections that we made with RE professionals across the U.S. was incredible!

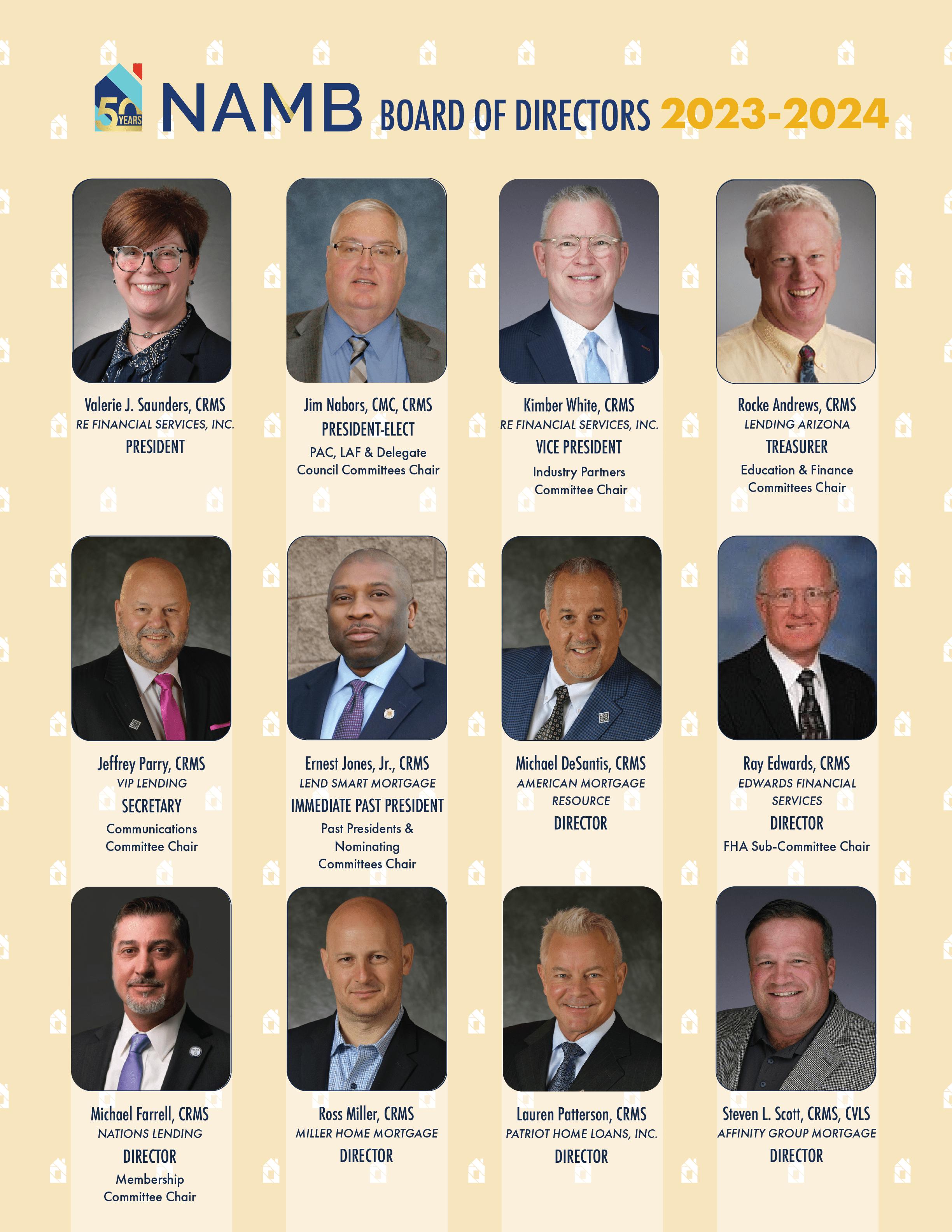

ROCKE ANDREWS

Then I headed to Montana for NAMB’s 2023-2024 Board Retreat. I am excited for the direction of the organization & looking forward to working side by side with this dedicated group of individuals this year.

Throughout 2023-2024, NAMB will continue to celebrate our 50th anniversary. Remember to use our discount code NAMB50RENEW to receive $50 o your membership renewal.If you’re not a member of NAMB, please attend a NAMB Road Show, certification class or networking event to learn about the benefits NAMB o ers. NC

NAMB is proud to o er excellent educational opportunities to mortgage professionals across the nation. We partner with several states to provide live education throughout the year. Our instructors are industry experts who have extensive experience in the various certification subjects they teach.

One of our most popular courses is the CVLS class which covers all of the basics of understanding & completing VA loans. Additional certification classes include our Certified Credit Specialist coursem which is a deep dive on the subject of credit scoring.

This year NAMB was thrilled to add two more certifications to its roster of education o erings: Our CREV (Certified Reverse Mortage Specialist) course, sponsored by Liberty Reverse Mortgage, gives mortgage professionals an opportunity to confidently add a new niche loan to their product list. This certification not only provides the tools & knowledge to qualify & process reverse mortgages, it provides best practices to navigate the conversation & educate borrowers on the benefits of reverse mortgages.

Our CFMP course, sponsored by Freedom Mortgage, was o ered for the first time at NAMB National 2023 & was very positively received. The education o ered in this course is similar to the training o ered to FHA DE underwriters and helps ensure that students have all the tools & knowledge necessary to add this essential loan product to their arsenal.

NAMB also o ers live CE classes that meet the state’s 8-hour requirement nationally.* If your state is an approved NMLS course provider the class material NAMB o ers will be available next year for you to o er & submit yourself if you prefer. NAMB is also able to work with you to get your state requirements approved.

For more details on the many educational opportunities we o er visit namb.org. There you will find information about all of our great courses. Then head over to namb.org/calendar to see when a class is being o ered in an area near you!

We are always looking to expand our list or courses. If you have requests for other types of classes please let us know & we will try to accommodate them.

*State components would need to be fulfilled elsewhere. NC Learn more at namb.org/education

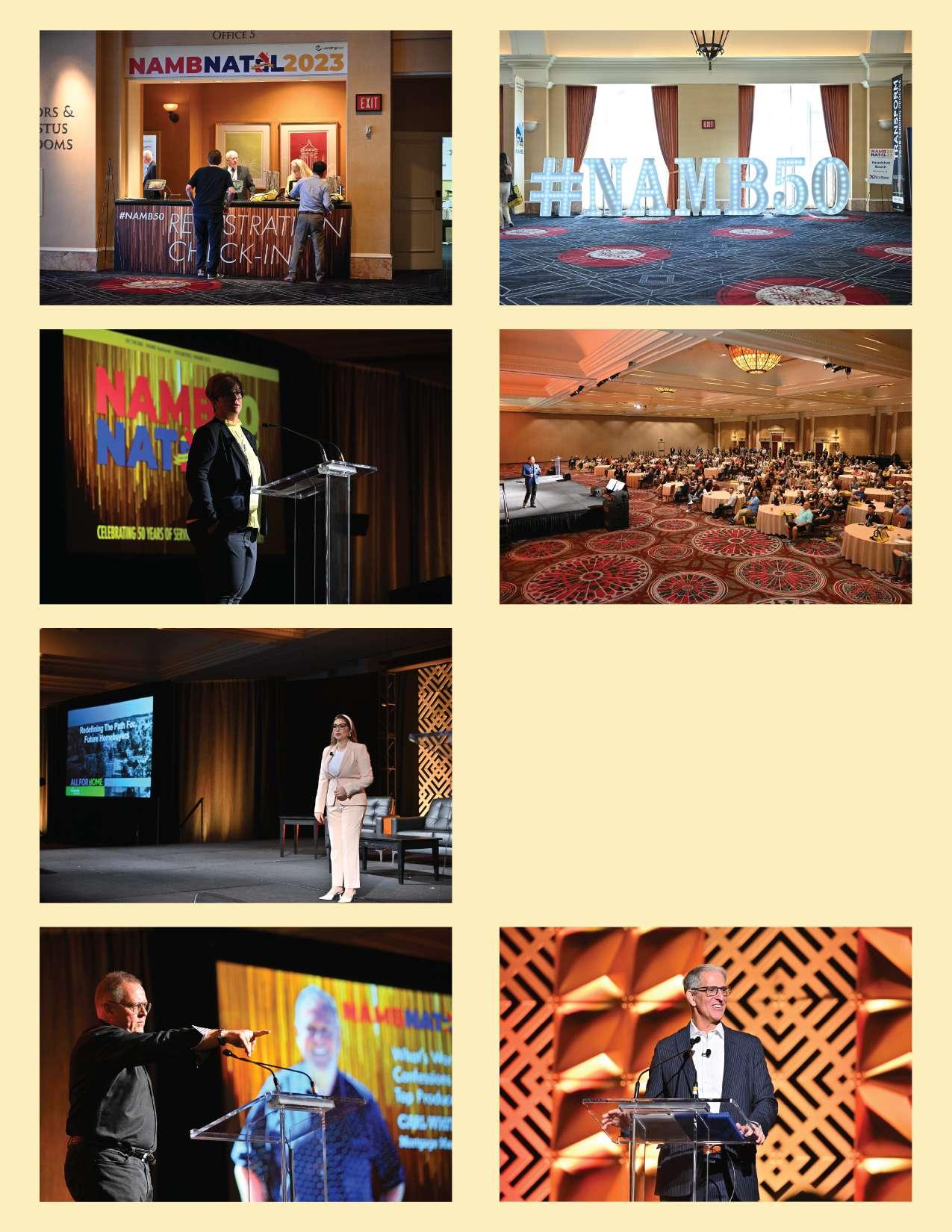

We presented individual awards to these top industry professionals at #NAMB50:

Mortgage Professional of the Year: Lisa O'Connor

Kathy Love Volunteer of the Year: Cathy Lee

A liate of the Year:

Freddie Mac & Liberty Reverse Mortgage

Harry Dinham Distinguished Industry Service Award: Jim Pair, CMC

Leadership Award: Nora Guerra

Complete gallery & recap on namb.org/national!

PHOTOGRAPHY BY EDDIE ARROSSI/EAPHOTO

#NAMB50, our 50th anniversary & annual conference at Caesars Las Vegas, Sept 8-11, 2023.

WHOLESALE LENDING PANEL DISCUSSION

#NAMB50, our 50th anniversary & annual conference at Caesars Las Vegas, Sept 8-11, 2023.

WHOLESALE LENDING PANEL DISCUSSION

In the complex tapestry of Austin's real estate & financial landscape, Daniel Pryce stands as a beacon of reliability & expertise.

Pryce's unparalleled knowledge, shaped by more than 15 years of experience in operations, processing & on-the-ground mortgage lending, ensures that every transaction is smooth, transparent & beneficial for all parties. His recent tenure on the board of AYREP (Austin Young Real Estate Professionals) is a testament to his dedication to evolving industry standards & practices.

Outside of crafting mortgage solutions, Pryce pours his heart into the community. From mentoring at-risk teens to helping seniors & retired veterans, his dedication radiates. For Daniel Pryce, a thriving community is one where everyone can find a place to call home.

With an impressive track record of more than 30 years, Michelle Velez is a seasoned mortgage professional who has dedicated her career to helping individuals & families achieve their homeownership dreams. Her commitment to excellence & her passion for making a di erence in the mortgage industry have set her apart as a leader & trusted advisor.

Velez served on the NAMB board of directors from 2016-2021, holding positions for NAMB as Government A airs Chair, Bylaws Chair, DEI/ Fair Lending Chair, Vice President, Secretary & Director.

Her professional achievements include the current presidency of California Association of Mortgage Professionals (CAMP), where she continues to advocate for industry excellence, integrity & professionalism (and where she served as president in 2014-15).

George L. Duarte, broker/owner of Wentworth Enterprises, has had his broker’s license since 1992 & has been in mortgage loan origination since 1986. He is a fully independent realtor & mortgage broker.

In 2022 Duarte received the SF Bay Area Better Business Bureau Torch Award for Ethics for small business, the only one in the Bay Area; the Best Mortgage Broker in the West from NAMB; & the 5-Star Professional Award for Mortgage Loans in the East Bay. He has served in association leadership for 25 years, on the Bay East Ass’n of Realtors Board of Directors, as President of CAMP (2013-2014) & as a committee chair at NAMB. Duarte continues to serve his clients & community with a variety of solutions, particularly reverse mortgages for seniors & loans for self-employed, impaired credit, first-time buyers & veterans.

Nora Guerra & her family were displaced from their home when she was 15. “That moment defined my purpose,” she says. “I negotiated the exit from our home because I was the only one who could speak English. I recall thinking, ‘When I grow up, I need to aid families like mine!’”

Thus began Guerra’s career in the housing & finance industry –professionally, more than 24 years ago. She has helped create & lead emerging markets programs since early in her career.

“As a proud immigrant,” she explains, “I am passionate about empowering minority first-time homebuyers through financial education to close the generational wealth gap.”

Today, as an a ordable lending manager at Freddie Mac, Guerra educates industry stakeholders nationwide – including with the NAMB Road Show, which visits Tacoma, Wash., on Nov. 3 –about Freddie Mac’s a ordable products for first-time buyers & communities of color.

magazine@namb.org to advertise or contribute

NAMB was honored to host the inaugural International Mortgage Brokers Foundation this year at NAMB National. Mortgage professionals from Australia, Canada, Ireland, the U.K., and the U.S. met in Las Vegas to discuss industry issues and identify common concerns & share best practices. The result was a stimulating discussion and collaboration of ideas, suggestions & solutions which culminated in the creation of a white paper outlining what these mortgage professionals want to share with their respective governments.

Some of the challenges delegates of the summit identified included lax licensing requirements, inconsistent foreclosure processes, financial literacy deficiencies, ongoing rate & product volatility, over-regulation, and open banking issues. The common sentiment was that regulators' & legislators' views often di er significantly from those in the industry.

Mortgage professionals from around the world would like to see their respective governments sit down with them as industry experts. They would like to ask lawmakers to take the time to consider the impact government policies have on people in the businesses to whom they are legislating. They want policymakers to recognize that global housing supply challenges are not just a political agenda item but a human rights issue, and that the answer rests in legislators bringing mortgage professionals to the table to find real solutions that provide relief to borrowers while also considering lenders.

This summit served as an essential first step in helping mortgage professionals worldwide raise their collective voices to unite to address issues we all face. Next year, the IMBF looks forward to its 2nd annual World Summit in Canada and to welcoming South Africa & New Zealand to its roster of participants. NC

In the ever-evolving landscape of the wholesale mortgage industry the value of continuous education cannot be overstated. Education is the bedrock on which mortgage brokers & lenders build their success. Knowledgeable mortgage professionals profoundly influence the borrower experience. Let’s explore why mortgage brokers must prioritize continuous education and why mortgage lenders & trade organizations should actively support this endeavor.

The mortgage industry is a dynamic ecosystem shaped by a myriad of factors including economic shifts, regulatory changes, & evolving borrower needs. Mortgage professionals who continue to learn gain a critical edge by comprehending the trends that drive our industry. The ability to anticipate shifts in demand, interest rates & borrower preferences empowers us to make informed decisions to benefit both brokers & their borrowers.

Regulatory agencies play a pivotal role in mortgage lending; their rules & requirements are subject to change and di er in interpretations. Mortgage professionals who invest in education help ensure they are always in compliance with these regulations. It is paramount to safeguarding your businesses from legal complications & fosters trust with borrowers who seek knowledgeable, compliant experts.

Knowledge is power, especially in an industry as fluid as mortgage lending. Staying informed provides mortgage professionals with foresight into upcoming trends & potential challenges. Armed with this insight, you can proactively adapt strategies, secure financial stability & provide borrowers with the best possible options even in uncertain markets.

Change is inevitable & the mortgage industry is no exception. Obtaining a new certification or taking a course equips you with a balanced perception of these changes. Now, you can embrace innovations that enhance e ciency & service quality while being cautious about trends that might pose risks. This adaptability helps ensure long-term success.

Ultimately, the knowledge gained through continuous learning directly impacts the growth of mortgage businesses. Informed professionals are better equipped to cater to the diverse needs of borrowers and navigate market fluctuations. This, in turn, enhances your reputation, fosters client loyalty & drives sustainable business growth.

Mortgage brokers & lenders are inextricably linked; mutual success is interdependent. Brokers who prioritize education are better positioned to select the best loan options for borrowers, navigate market fluctuations & identify opportunities for financial stability.

Lenders, in turn, have a responsibility to assist brokers by staying informed about origination guidelines, o ering relevant loan programs & preparing for market shifts. This collaborative e ort fortifies the entire mortgage ecosystem providing financial strength & stability for both parties.

Mortgage lenders & trade organizations are integral in fostering a culture of education within the industry. They should make resources accessible to industry professionals, ensuring knowledge is readily available to those who seek it. Furthermore, brokers should carefully select partners in the mortgage business, aligning themselves with organizations that support their growth & have a proven track record in the industry.

Continuous education for mortgage professionals is not a luxury but a necessity. Having the latest knowledge empowers mortgage brokers & lenders to excel, provide superior service & thrive in an ever-changing industry. It’s a shared responsibility & a collective investment in the future of the mortgage business.

NAMB & Freedom Mortgage Wholesale Division share a common commitment to o er educational courses so you can hone your expertise. Our shared focus led to the creation of the CFMP certification program. With more than 20 years in the mortgage wholesale industry, I’m proud to have helped structure this course with insights into the intricacies of FHA loans and how to help borrowers qualify.

Whether you sign up for this course or another class, the benefits of additional education will enable you to o er an array of mortgage solutions to any borrower & close the deal. NC

Allen Middleman is a Senior Vice President at Freedom Mortgage. He is the Chairman of the Corporate Board for NAMB, Chairman for the Mortgage Bankers Association (MBA) Wholesale Committee & serves on the National Association of Hispanic Real Estate Professionals (NAHREP) Corporate Board of Governors. His professional activities are entirely focused on fulfilling Freedom Mortgageʼs vision of Fostering Home Ownership in America.

Coming out of NAMB’s 50th anniversary conference and celebration is the perfect time for Change Wholesale to take stock of our business and the great industry we’re privileged to be a part of. From our perspective, so many opportunities and possibilities lie ahead.

Here’s a closer look at some key performance indicators that give Change assurance and confidence about the future.

Since our founding, we have been providing borrowers of various financial backgrounds with fair and equal access to capital to achieve their homeownership dreams. Central to that mission, we have continued to remove financing barriers and roadblocks that frankly make little or no sense in determining borrowers’ creditworthiness.

Our current standing as the nation’s largest non-QM lender o ers the strongest evidence that our mission is succeeding. By using a variety of our products, our broker partners are telling us that we are hitting the mark in terms of helping make homeownership more a ordable, accessible, and attainable for their borrowers. Notably, we also cut rates in August by 25 basis points on all our non-QM loan products, across-the-board savings that our broker partners were immediately able to pass on to their customers.

Our AEs truly understand the space their broker partners live in. They know that for every salaried borrower walking through a broker’s door is another who generates their income in less conventional ways. These are the contractors and consultants, freelancers and foreign nationals, and investors and entrepreneurs, to name a few, who don’t generate W-2s, but are just as creditworthy and deserving of home financing as traditional borrowers.

Creating solutions for brokers and their customers -- and backing them up with world-class service and support -- is our AEs’ secret sauce. They’re terrific at doing government and agency loans, of course, but what sets them apart is their success in helping people who don’t neatly fit into conventional lending boxes -- the

borrower with seasonal income or the owner of several di erent business entities with complex financials. Our AEs use their experience and deep product knowledge to assess each application on its merits.

To win the Indianapolis 500, you need a top driver, but you also need a vehicle that performs at the highest level under a variety of conditions. For us, that winning vehicle is our product suite. We’ve designed all our loans to be fast and flexible, like our Bank Statement loans that require only a front-page summary for making an underwriting decision.

Equally, our investor/DSCR, foreign national, and other alt-doc programs assess creditworthiness and financial stability in comprehensive and holistic ways that go beyond traditional credit scores and tax returns.

In response to the Great Recession, our industry saw the lending pendulum swing toward excessive regulation, inadvertently and unfairly blocking many creditworthy borrowers from obtaining credit. Today, as the nation’s largest non-QM lender, we’ve been restoring a fair and equal balance to home financing by helping our brokers partners serve their qualified, mortgage-ready buyers with an array of non-QM loans that perform as well as QM loans.

Indeed, noting the industry’s increase in non-QM lending in 2022, CoreLogic’s principal economist, Archana Pradhan, said, “today’s non-QM loans are high-quality loans,” helping “creditworthy borrowers who cannot otherwise qualify for traditional mortgage loan programs.”* She further noted that the average credit score between QM and non-QM borrowers, 776 and 771, respectively, was virtually indistinguishable.

With our mission clear, and with proven people and products solidly and steadfastly supporting and executing that mission, we’re excited about our role in expanding homeownership for more Americans. NC

*https://www.corelogic.com/intelligence/share-of-non-qualified-mortgages-increases-in-2022/