SUMMER 2023

IN THIS ISSUE

Looking Ahead to NAMB’s 50th! 4

Social Studies: Which App Is For You? 6

BY JILLY MacDOWELL

Navigating the Wholesale Space 8

The Circle of Influence 10

BY MICHAEL COLLINS

NAMB Committees Update 12

IMBF World Summit Debuts 13

BY JOSH STEINFELD

President’s Letter

BY ERNEST JONES, JR.

Greetings, NAMB Family,

The summer has arrived with temperatures exceeding 100 degrees in some states. Many Americans are traveling to second homes where temperatures are cooler. Here at NAMB, we continue to advocate, educate & work on behalf of our members regardless of the season.

NAMB is currently advocating & working with its lobbyist, the Williams Group, in Washington DC to bring together legislators on industry trigger lead bills. NAMB is close to finishing an FHA certification course while offering Veterans Loan & Reverse Mortgage certifications & continuing education classes in several states.

Finally, NAMB is feverishly working on its 2023 annual conference in celebration of its 50 years serving the mortgage industry. The conference is again expected to have more than 100 exhibitors in attendance.

NAMB is proud to be the only mortgage association that has stood the test of time.

LATE BREAKING NEWS

From FHA Committee Chair Ray Edwards: Last week FHA published Mortgagee Letter 2023-13 in recognition of the nation’s growing diverse population and in an attempt to understand borrowers’ language preferences. This letter mandates the use of FNMA/FHLMC form 1103 for all FHA mortgage applications starting August 28, 2023.

Not all loan software programs have been updated to include this form so be sure you have a way to incorporate form 1103 into your new applications by the that date. NC

NAMB STAFF

MARKETING:

Jilly MacDowell

OPERATIONS:

Brandie Starks

PUBLICITY:

Josh Steinfeld

INDUSTRY PARTNERS & BENEFIT PROVIDERS IN THIS ISSUE

Freedom Mortgage 5

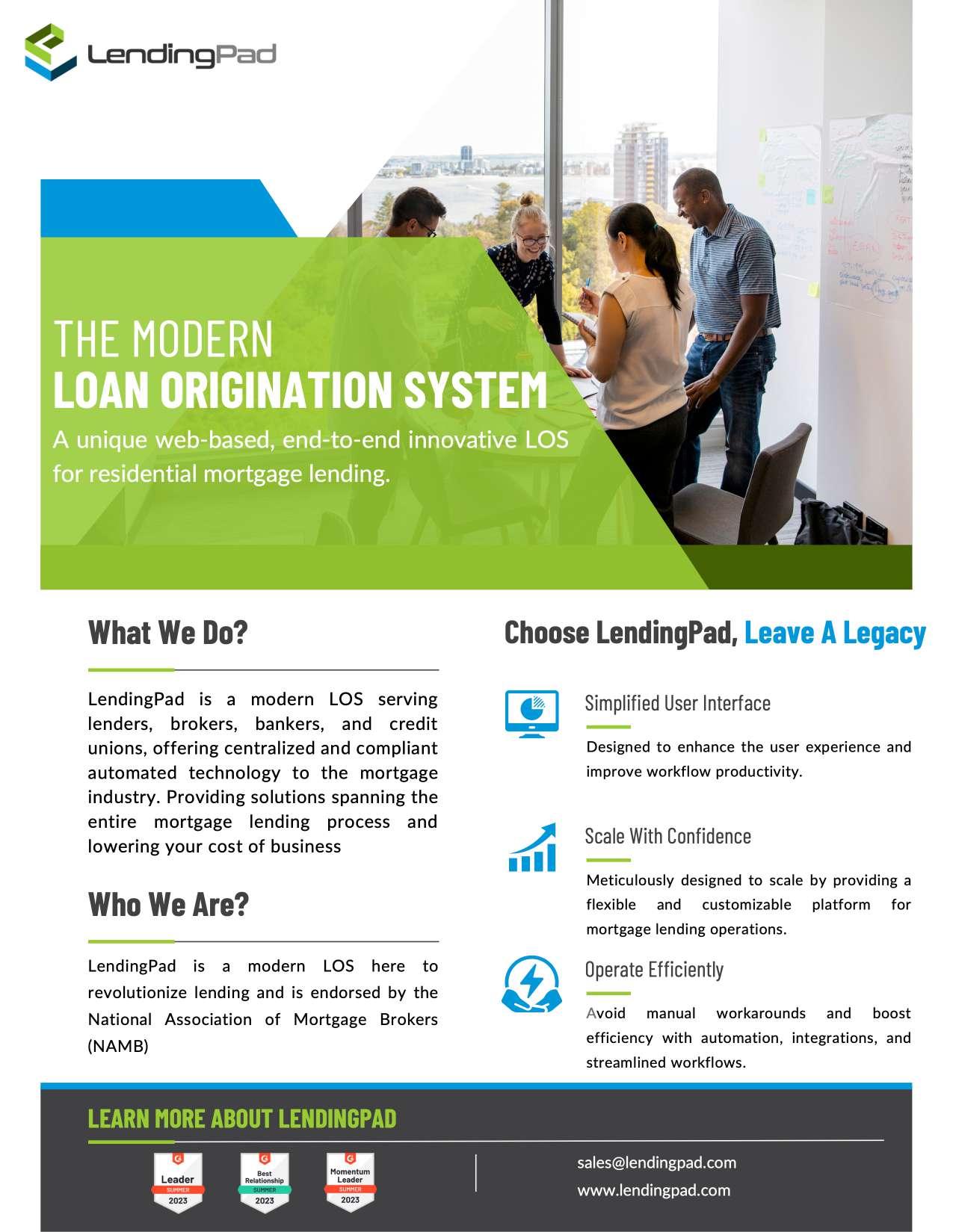

Lending Pad 7

Black Knight 8

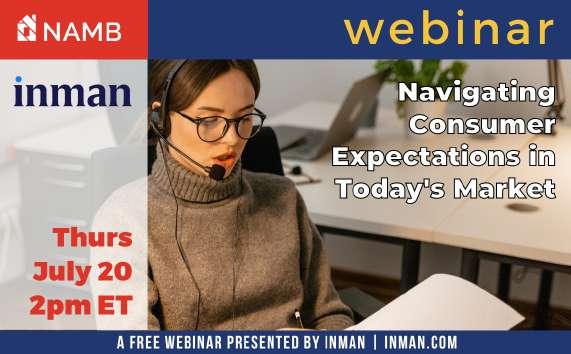

Inman 9

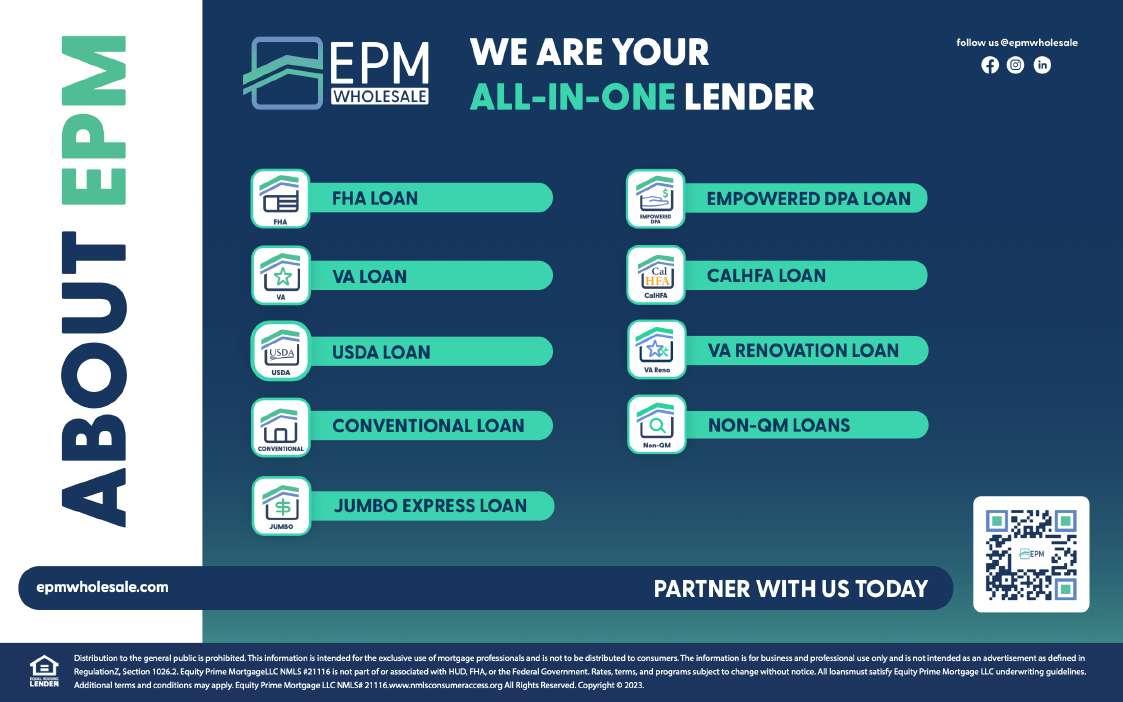

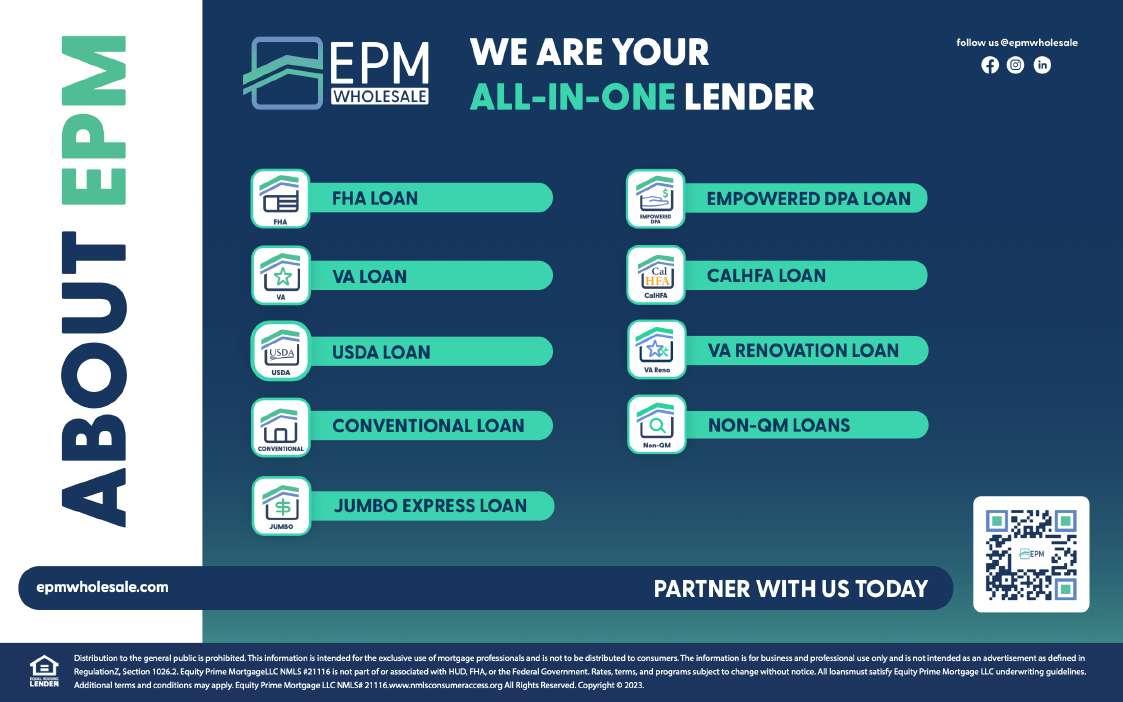

EPM 11

AmeriHome 11

Goosehead 13

Inman 14

Liberty Reverse 16

Thanks for reading this issue of NAMB’s monthly digital magazine; please share it with your industry colleagues. If you’re not a NAMB member, visit namb.org/membership to join the association, which has been the voice of the mortgage industry, representing the interests of mortgage professionals & homebuyers, since 1973. NC

The National Association of Mortgage Brokers is the voice of the mortgage industry, representing the interests of mortgage professionals and homebuyers since 1973.

TRY

Look

Email

©2023

All

APPLY NOW!

nambawards.org

DEADLINE JULY 31

NAMB

FOR FREE!

for “Courtesy Associate Membership” at namb.org/membership.

ADVERTISE OR CONTRIBUTE

TO

magazine@namb.org

NAMB

rights reserved.

Summer 2023 3

Thinking about registering for NAMB National 2023? You should, and by August 15. Here’s why: Our agenda is designed to give you actionable takeaways to build your personal brand. The exhibitor count is over 100 and climbing. We’re throwing three parties. And it’s NAMB’s 50th anniversary! (Plus the hotel room block & discount codes expire.)

Let’s take a look at the long weekend, day by day, with the details available at press time: The NAMBPAC Golf Tournament kicks off the conference – this year, we’ll be at a new venue, the Las Vegas Golf Club! Single players, $150; foursomes, $550. Company sponsors get a free foursome. Shotgun start at 8am!

At Caesars on Friday is the debut of our newest certification, the CFMP (Certfied FHA Mortgage Professional), in partnership with Freedom Mortgage. Celebrate those new credentials at the welcome party that night.

Saturday kicks off with a panel discussion on wholesale lending in 2024, featuring Acra’s Keith Lind, Rocket Pro TPO’s Mike Fawaz, PennyMac’s Kim Nichols, Broker First Funding’s Shabi Asghar & moderator Jim Boghos

After Saturday keynote & lunch with Barry Habib, learn how to turn content into actual business with Neel Dhingra, Forward Academy CEO. This is the exact blueprint he & his students have used to explode their business. In the afternoon we review reverse mortgages with Plaza’s Mark Reeve using statistical reasoning: By 2028, the entire Baby Boomer generation will be 62 or older (71.6 million). It’s literally a market you cannot afford to ignore.

(Skipping ahead to Monday: we’re offering a CREV aka Reverse Mortgage certification class in partnership with Liberty Reverse!)

Get on the list for the first-ever NAMB Omnia Party Saturday night. Overlooking the Strip, the luxurious Terrace is just the spot to transport us to 1973. Admission is limited!

Sunday, after breakfast with Freddie Mac’s Nora Guerra & keynote Jeff Markowitz of FHLMC, Mortgage Marketing Animal Carl White returns to the #NAMBNatl2023 stage to discuss what’s working now for top producers.

Then, TikTok dynamo Danny Ruiz (@dannyhomeloans) explores overcoming your fear of the camera in order to build trust, stay relevant & attract ideal clients.

Sunday night, we close out by partying like it’s 1973! Our 50th anniversary closing party will include the NAMB Awards presentations & music by Live Music Society (LMS). See you in September! NC

4 Summer 2023

| REGISTER AT NAMB.ORG/NATIONAL

CONFERENCE PREVIEW

Carl White Nora Guerra

Barry Habib Jeff markowitz

“Bubbling over with knowledge. Always available to share.” Uncork the expertise of your Freedom Mortgage Wholesale Account Executive WS489(0523) This information is for mortgage professionals and business entities only It may not be distributed to consumers or used, in whole or in part, in any solicitation or advertisement for a mortgage loan Freedom Mortgage Corporation is not, nor i We do not provide legal, tax, or investment advice. Freedom Mortgage Corporation, NMLS # 2767(www nmlsconsumeraccess.org), 951 Yamato Road, Boca Raton, FL 33431; 800-220-3333 Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act. Loans made or arranged pursuant to a California Financing Law license; Massachusetts Mortgage Lender and Mortgage Broker Licenses #MC2767, Debt Collector License # DC2767; Nevada Supplemental Mortgage Servicer License # 4408; Licensed by the N.J Department of Banking and Insurance; Licensed Mortgage Banker – NYS Department of Financial Services and Exempt Mortgage Loan Servicer Registration; Washington Consumer Loan Company License CL-2767, dba www.freedommortgage.com. For complete licensing information, visit www FreedomMortgage.com/State-Licensing Equal Housing Opportunity. © 2023 Freedom Mortgage Corporation. Connect with an Account Executive today. Wholesale411@FreedomMortgage.com 855-915-4800 Celebrate More Closings! Mike Mell, SVP Freedom Mortgage Wholesale

Social Studies

BY JILLY MacDOWELL

Mortgage professionals, you can handle your own social media if you work smarter, not harder. But you can also get help from tools & tech, some free, some paid. One thing you can’t do? Ignore it. It’s the best ROI for marketing time spent, and it does take time. You’ll have to focus, be disciplined, use the right tools and, like with any good habit, be consistent.

As a prelude to NAMB National 2023’s social media curriculum (see page 4), I offer this primer on the top social media channels at your disposal.

You should have, at a minimum, a profile with up-to-date contact information on the following apps: Instagram, Facebook & Linked In. If you’re good on camera, add YouTube & TikTok to that list. Actually, even if you’re not. These apps are the new Rolodexes. You want to be found. (Forget about Twitter & Snapchat.)

Information must be consistent across these profiles. One email address. One phone number. One website. (You have one, right?) Now people can find you. Time to get social. Choose your fighter:

1, Linked In: for writers, industry watchdogs & the introvert-leaning.

The app stands alone, with its emphasis on “professional” dialogue & networking. With a keyboard & some time you can grow your reputation just by engaging with reposts, blogs, comments, legislative matters, employment milestones, etc.

“Social media is meant to be social,” says Alycia Yerves, Founder + Creative Director, Alycia Yerves Creative, whose effervescent marketing & branding newsletter is a must-read. “It's not a soapbox, it's a dinner party you're hosting,” she says. “Engage with your audience!”

2, Instagram & Facebook: for shutterbugs, industry warriors & extroverts.

Instagram is the fastest growing app for mortgage professionals. Facebook is tacked on because you can link them & post simultaneously – and for digging into your personal contact archives, there’s none better.

“[These apps] are fantastic for growing your brand awareness & building your ‘know/like/trust factor,’ Yerves says. “Photos of you & your team, showing your personality, should be a regular part of your content strategy. When

you take the time to share about the actual person or team behind the brand, potential customers feel like they’re getting to know you. People hire people they know, like & trust!”

You can manage both apps’ messages on Facebook, so you don’t have to switch back & forth. Or you can focus on Instagram & let Facebook be more passive. The bottom line is, these apps require photos or graphics, a viewpoint & something to say, as well as the engagement inherent to effective social media. It should also be noted that Reels, Instagram’s video feature, is where the action is on the app now & moving forward. Be prepared to get comfortable on video!

Hopefully, being on camera is a no-brainer for you! Because, according to Helga James, CCS, CVLS, President & Loan Officer, Barr Group Mortgage, “finding the right topics to talk about is the hardest thing. Keep a scratch pad with you when you’re at the office making calls,” she recommends. “Think about that question you’ve answered so many times – it’s basically scripted for you! How often have you explained an escrow account?”

3, YouTube & TikTok: for videographers, techies & industry experts who are comfortable on camera.

These apps are very different & perceived as such (loosely, YouTube, boomer/Gen X; TikTok, millennial/Gen Z), but it’s another case of, make one video, post on two apps. Because they’re so visual (and, not insignificantly, musical), these apps are truly global, so building an audience takes some heavy lifting.

6 Summer 2023

ON PAGE 15

Social status: how the top social media apps compare, from the fantastic e-newsletter, Chartr

CONTINUED

Navigating the Wholesale Mortgage Space

EXCERPTED FROM NATIONAL MORTGAGE NEWS

The recent rate rise has challenged the mortgage market & highlighted the key role the wholesale channel can play in navigating rough conditions. Mortgage brokers can have an edge over consumerdirect origination segments like digital in this environment because they more proactively go after the more complex purchase loans that come into ascendance when rate-driven refinances fade.

The challenge in this situation tends to be whether lenders can operate profitably. Given the particularly heated & often price-based competition between wholesalers seen recently, some have left the channel.

NMN asked Ernest Jones Jr., president of NAMB, how third-party originators are navigating this market & what NAMB is doing to help push for policies that could reduce hurdles to financing homes as rates rise.

What does lender competition & consolidation mean for brokers?

Generally, if a broker loses a wholesaler, seldom is there a void that's not filled. You may lose the experience of having worked with that lender, but I don't know many situations where brokers had to say, “We can't get this loan done because there's not a player there to do it.”

Pricing can still be competitive, not only between lenders. Now that the FHA has cut their mortgage insurance premium their loans are more competitive with others.

Overall, interest rates may decline a little or rise for borrowers depending on where or who they are, so whatever your situation is, you just have to deal with it. I try to focus on the things we can control as opposed to the things we cannot. You can't control rates.

What about the 203(k) loan the FHA wants to improve?

Everything goes back to education on how the product works. It takes patience with the 203(k); the realtor community does not generally encourage the use of the 203(k). When a potential homebuyer walks into a home & it's already done, he or she does not have to imagine what it's going to look like when remodeled.

There is no one specific reason why the 203k product is not used more often. It can be challenging if not properly executed. Technology may be able to help increase the use of this product by showing what the home will look like after repairs. NC

Read the complete article on NationalMortgageNews.com by Bonnie Sinnock, Capital Markets Editor.

Buying Brain Cells

BY MICHAEL COLLINS

Early in my career, there were no mortgage gurus or real sales trainers. I was given a territory & told to visit real estate offices to drop off rate sheets & donuts. Probably a foreign concept to some of you! I was also given leads of borrowers who were customers of the bank where I worked.

Both approaches worked out pretty well but I knew there had to be better ideas. Like you, I was always looking for a better way. I had the supreme luck to meet the very experienced & successful Debra Jones. Debra was a Loan Officer who owned a mortgage brokerage, but she also put out a Loan Originator newsletter.

Of the many things Debra shared, what really stuck with me & became the foundation of my marketing was, “We are in the business of buying brain cells.”

Now, what the heck does that mean?

It means we have an obligation in our career to make sure that as many people as possible know what we do for a living & how we can assist them. It sounds simple, even logical, but do you actually do this? Does everyone you know, in your family & friendships, know what you do & how you can help them?

I have known loan officers who were reluctant to do this as they “did not want to be pushy” or “take advantage of

a relationship or friendship.” They believed it was better to do business with strangers. Bull hockey!

When I was young, I got involved in NuSkin, an MLM (multi-level marketing) company. The goal of an MLM is to sign people up under you in a pyramid structure, wherein you earn commissions from them. I met people who did well with the MLM but it was not my cup of tea. However, I was exposed to some great marketing concepts through NuSkin, one of which is the concept that everyone we meet has a circle of influence – of potentially 250 people!

But what does this have to do with buying brain cells?

One of the suggestions Debra gave me was to send snail mail to my past customers so one year I sent out Thanksgiving Day cards. I only had about 50 people in my database at that time so it was pretty easy to do.

The next week, I received a call from a woman who said I was the topic of conversation at her holiday dinner. “You did a mortgage for my sister last spring,” she said. “She got your card with your business card in it. At dinner I mentioned that I was buying a house & needed a mortgage so she gave me your card.” So I bought brain cells remotely, at a Thanksgiving dinner!

Although my former business partner Peter & I both originated loans, he was able to originate loans purely on his personality. Peter was a big gregarious guy who could walk into a room & within 15 minutes be surrounded by an audience laughing along with his story. It was truly a gift.

What kept his business going year after year was that there was no one Peter knew who did not know what he did for a living & how he could help them or their friends. To this day, at almost 70 years of age, he remains a very successful mortgage originator.

You’ve probably heard of Johnny Appleseed. He was actually a real person named Johnny Chapman & he really did walk across the Midwest planting apple trees, so much so that he ended up personally owning 1,200 acres of apple trees. (Back then, if you planted a tree you owned it.) Ultimately those trees provided a significant amount of fruit & cider to American pioneers as they traveled west to settle.

I encourage all my clients to think like Johnny Appleseed. The more seeds you plant, the more fruit you will get. Whether it is sending out emails, mailing cards, making cold calls or meeting people face to face, you have to be “planting seeds.” You can’t keep what you do a secret! NC

Michael Collins is a business strategist, success mentor & creator of “Street Smart Marketing for Loan Originators.” If you would like more information about “Buying Brain Cells” and how & where to start, email coach@michaelcollinscoaching.com or call 732-620-8541 for a complimentary strategy call.

10 Summer 2023

Summer 2023 11 © 2023 AmeriHome Mortgage Company, LLC, A Western Alliance Bank Company. Information herein intended solely for mortgage bankers, mortgage brokers, financial institutions and correspondent lenders. Licensed by the Department of Financial Protection and Innovation under the California Residential Mortgage Lending Act, License #4131116. NMLS #135776 INCREASE PRODUCTS PROCESS CONTROL RESOURCES PROFITS HIGHLIGHTS • Competitive Pricing • Wide range of conventional and government products o Minimal overlays o FHA and VA • Easy to use technology platform o Pricing engine to select and lock product and price o Pipeline and loan level management • Specialized onboarding and training o Dedicated operational support o Loan level guidance • $250,000 minimum tangible net worth (unaudited) Relationships. Reliability. Resu NON-DELEGATED PROGRAM EMERGING BANKERS For program eligibility and information email: CLSales@amerihome.com Contact your regional AmeriHome Sales Representative at: correspondent.amerihome.com/sales-team WITHOUT ADDITIONAL OVERHEAD AND RISK EXPOSURE

What Does NAMB Do?

NAMB COMMITTEES MAKE MOVES

NAMB shares a reciprocal relationship with numerous states: AL, AZ, CO, GA, HI, IO, LA, NE, UT & Ohio, whose state association leadership partnered with NAMB to host a Zoom outreach recently. Not only an opportunity to meet potential member-leaders & explore the “why” of membership, but it was a chance to hear what mortgage brokers are looking for in an association.

“Being involved, sharing ideas, being a voice to what

daily,” said Matthew Shields of USA Mortgage in Columbus.

said Teresa Rose, CMB, CRMP, of Western Ohio Mortgage Corporation (and Ohio Mortgage Bankers Past President).

Charles

Loan

Now, with this presentation blueprint, NAMB looks forward to creating conversations with mortgage professionals in affiliated states across the country. But don’t wait! Get involved now.

The Awards committee is pleased to announce awards season at NAMB! Apply now for a 2023 Recognition Award at nambawards.org. The categories are Mortgage Broker of the Year, New Broker of the Year & Service Partner of the Year. These will be awarded across 5 regions: Midwest (IL, IN, IA, KY, MI, MN, MS, OH & WI), Northeast (CT, DE, DC, ME, MD, MA, NH, NJ, NY, PA, RI & VT), Southeast (AL, AR, FL, GA, LA, MS, NC, SC, TN, VA & WV), Southwest (CO, KS, NE, NM, ND, OK, SD, TX & WY) & Western (AK, AZ, CA, HI, ID, MT, NV, OR, UT & WA).

Submissions must be received no later than Sun, July 31, 2023. Winners will be announced on Mon, Aug 7, 2023. Awards will be presented in Las Vegas at NAMB National on Sun, Sept 10, 2023!

The GA committee is pleased to present the second installment of Coffee and Conversation. The quarterly GA-focused webinar will take place on Tues, July 18, 2pm ET and will feature the Majority & Minority Staff Directors for the House Financial Service Committee. NC

Learn more at namb.org/committees

I see

“Education – knowing all I can & what’s coming down the pike,”

King, new both to the industry & to

Factory, said, “Grow my network, educate myself, build a book of business.”

12 Summer 2023

JULY 18 2PM ET namb.org/calendar

NAMB.ORG/EVENTS/IMBF-2023

World Affairs

BY JOSH STEINFELD

In a “global first” for the mortgage & finance industry, the International Mortgage Brokers Federation (IMBF) is excited to announce its inaugural 2023 World Summit. IMBF was jointly developed by the Finance Brokers Association of Australia (FBAA) & the Canadian Mortgage Brokers Association (CMBA) in 2018. It was formed to “share ideas, refer clients, gather market intelligence, identify trends and stay up to date on regulatory matters & industry best practices,” says Peter White, FBAA managing director & chairperson of the IMBF global board of governors.

The IMBF 2023 World Summit, hosted by NAMB, will welcome more than 100 brokers & stakeholders from Australia, Ireland, Canada, the US, the UK & the world to workshop the issues & challenges facing brokers in their respective countries.

The aim is that this “international think tank” will develop a white paper for the governments of the countries represented at the summit, highlighting solutions that will assist the industry in the future.

“This is the first time ever that something like this has been done – what it does do is give people the opportunity to meet brokers from all around the world in one spot,” says White. “It’s a global first.”

The summit aims to assist the industry globally to understand each country’s regulatory & lending journeys.

are part of a global community, and we are working together for best practice in our industries,” White says.

NAMB's immediate past president & member of the IMBF board of governors for Linda McCoy agrees. “Gathering the top mortgage thought leaders from across the world will empower the global marketplace,” she says. “The white paper we develop after the event, as a team, will serve as a key benefit to guide & support those in attendance, as well as colleagues who aren't able to travel to Nevada this fall."

White encourages invested brokers, lenders & aggregators who want to be part of the solution to register for the event. “It’s for people who want to be engaged in a bigger conversation, he says. “It’s about looking at what’s happening around the world and bringing resolution & resolve to dealing with certain issues.”

“We’re all doing basically the same thing – just at different speeds,” he continues. “We can learn so much from each other, as it’s more than likely that one of these countries has already been through it.”

Registration for the IMBF 2023 World Summit, hosted by NAMB, includes both the summit, hotel, breakfasts and NAMB National 2023! Details & early bird discount: namb.org/events/imbf-2023.

“It’s an important piece for us to be able to show our politicians & regulators that we

Closing STATEMENTS

For more than 25 years, agents, brokers, executives & technology providers have turned to Inman to discover what’s new, what’s now & what’s next in the business of real estate. Now Inman is bringing together professionals in the mortgage space who play such an integral role in the transaction.

Understanding the connection between real estate professionals and mortgage & title professionals, Inman just launched two endeavors to help everyone improve the entire experience for the consumer – network at the Inman Mortgage & Finance Forum next month, and stay connected with the Mortgage Brief

“For more than 25 years, Inman has brought together the real estate community to learn, network & problem-solve at our flagship events & with our industry coverage. Now, we’re doing the same for professionals in the mortgage space.,” said Emily Paquette, Inman chief executive officer. The Inman Mortgage & Finance Forum is specifically for the lending community & will take place August 9 at the Aria Resort & Casino in Las Vegas. This single-day event will cover a wide range of topics, including mortgage lending strategies, regulatory updates, customer experience, risk management and the latest trends, challenges & opportunities shaping the mortgage & lending landscape.*

Attendees can expect a rigorous agenda featuring keynote presentations, panel discussions & workshops for attendees in the mortgage & lending industry, along with real estate agents & brokers from Inman's sister event, Connect Las Vegas For detailed event information including the full agenda, speaker lineup, registration & venue details, please visit the official event website Mortgage Brief is written specifically for mortgage professionals and covers the mortgage, title, settlement & escrow industries. It’s filled with a timely mix of news, trend analysis, coverage of newest tech that help boost productivity, and profiles of important people & companies in residential lending. Mortgage Brief delivers a weekly report on what’s happening in mortgages & closings. Stay at the front of the financial side of real estate with Mortgage Brief NC

*NAMB is proud to partner with Inman for the Mortgage & Finance Forum. Registration is now open & FREE for professionals in the mortgage & finance space. Click Inman Connect at inman.com

14 Summer 2023

SPONSORED CONTENT

What you need here is a viral moment, or at least a good strategy for growth. Either way, you’ll need a video set-up. James, who also serves as NAMB’s Education/Certification Committee Chair, has developed a friendly but authoritative voice on social media. She recommends you keep videos to less than 40 seconds.

“Have your kids or your partner watch them,” she suggests. “If you can’t keep their attention for the whole video, redo it! Use them as a test audience to get comfortable in front of the camera.”

So, first: Clean up those profiles! Pick a social media lane. Don’t worry about posting right away. Spend time on your app or apps of choice. Find & follow your peers & associated businesses. Comment on & repost content that engages you. Follow hashtags like #mortgageindustry or #loanofficer to see what’s working & what’s not. Find the “save” function in the app & save the posts you want to copy... er, be inspired by. Practice in the mirror.

Next time, we’ll dig into some tools & tech that can help you no matter where you’re getting social. NC

Get help building your online presence: alyciayerves.com, edumarketing.com, homemadesocial.com, wisestamp.com, vonkdigital.com If you’re still not sure where to start, email me at jilly.macdowell@namb.org.

Summer 2023 15

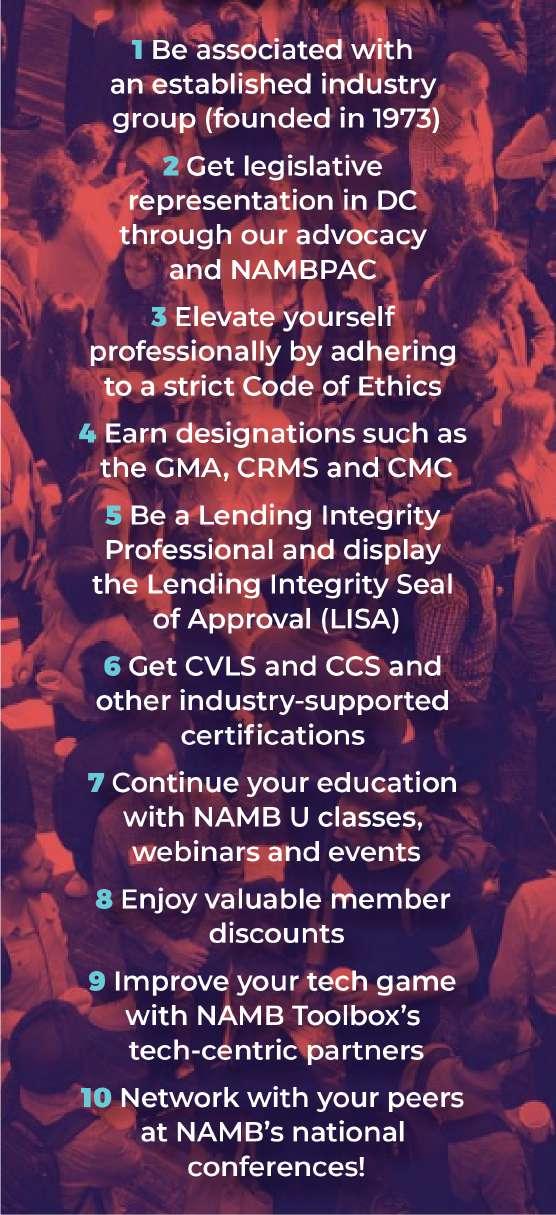

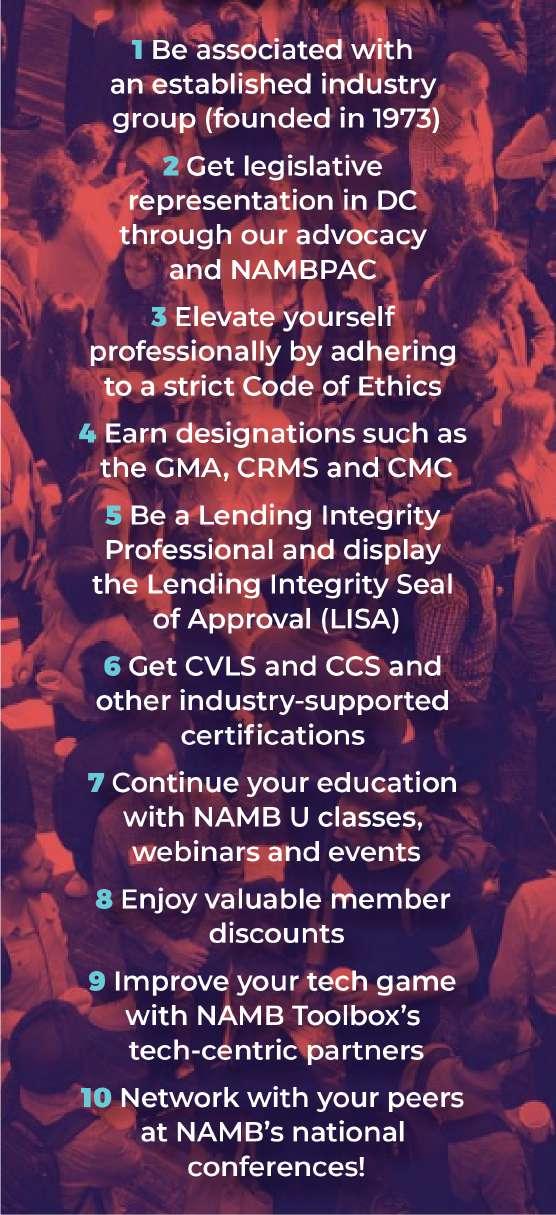

namb.org/membership Top 10 Reasons to Join NAMB

FROM PAGE 6

CONTINUED