NATIONAL ASSOCIATION OF MORTGAGE BROKERS MAGAZINE |

February is #BlackHistoryMonth, a time to recognize the experiences & achievements of the black community.

BLACK HISTORY MONTH

February is #BlackHistoryMonth, a time to recognize the experiences & achievements of the black community.

BLACK HISTORY MONTH

FEBRUARY 2023

IN THIS ISSUE

#NAMBFocus2023 Recap... 6

BY LISA O’CONNOR BY JACKIE DRUMMUnpacking NAMBPAC... 13

BY MIKE FARRELLMARKETING:

Jilly MacDowell

MEMBERSHIP:

Hunter Higginbotham OPERATIONS:

Brandie Starks

The National Association of Mortgage Brokers is the voice of the mortgage industry, representing the interests of mortgage professionals and homebuyers since 1973.

2022 was a great year for NAMB as it worked tirelessly to advocate for the marketplace while providing tips, tools and thought leadership through public media. We worked with The New York Times, Time Magazine, HousingWire, Inside Mortgage Finance and dozens of media outlets in both the print & broadcast space. Our team’s mission is to state NAMB’s position within legislative items along with news that impacts both the LO and the consumer.

Since November, our executive board has worked to explain complex consumer & endemic issues with Fortune Magazine, The New York Times and digital outlets such as NerdWallet. NAMB enjoys building rapport with reporters to ensure we’re never one-and-done with our commentary, but are invited back for multiple articles, as evidenced by our work with media partners CNET and US News and World Report, along with our industry colleagues at HousingWire, Scotsman Guide and National Mortgage News

In addition to both proactive and reactive media placements, the team developed 30-plus press releases in 2022. Most recently, we have announced partnerships, our roadshow kick-off with Freddie Mac & Rocket Mortgage, as well as renewed & new industry partners such as Floify and Black Knight.

Our mandate is to be the voice of the marketplace and we will push harder & wider in 2023 to serve our members, consumers & the industry overall. Our team of experts is second to none. The public deserves insights that are impartial and accurate. That is our mission. NC

KEN BOYD & CARI SMITH OF WINDSOR MORTGAGE SOLUTIONS WITH NAMB PRESIDENT ERNEST JONES, JR. AT NAMB FOCUS.NAMB is grateful for an opportunity to recognize some of our amazing members who are contributing to a tradition of Black excellence and helping shape our mortgage industry.

With over 20 years of experience as a mortgage loan originator, branch manager & managing partner, Ernest Jones, Jr., was installed as NAMB's first black president in 2022. He graduated from the University of Alabama in 1980 and served 21 years in the U.S. Air Force prior to entering the mortgage industry. After serving as President of the AzAMP board of directors from 2017-2019, Ernest was selected to join NAMB's board in 2019, and served as NAMB’s Membership Chair & Secretary in 2020.

Outside of his professional career, Ernest has served as treasurer for the Southern Arizona Black College Community Support Group, a nonprofit organization with the mission to enhance opportunities for black youth to attain higher education while emphasizing the many contributions of Black Historical Colleges.

He has served as a board member for Boys to Men Mentoring, a nonprofit mentoring program for male teenagers. And he has served as board Vice President of the HEARTH Foundation, an organization that provides affordable housing for low-income families with children.

Ernest’s invaluable experience as an Air Force Officer, licensed insurance & securities agent, real estate investor & realtor, mortgage branch manager & business owner, and nonprofit volunteer contributes immeasurably to his ability to positively

Catherine L. Hall (the “203k Queen”) is the founder & executive director of the National Association of FHA Consultants (NAFHAC), a nonprofit dedicated to the empowerment of all entities involved in the residential renovation industry. She is the creator of the “203k in a Box” consultant certification & training system.

A licensed home inspector in Pennsylvania for more than 28 years, Catherine was the first African American woman certified with the American Society of Home Inspectors (ASHI). For more than 7 years she was the only certified female home inspector in the state!

Catherine owned & operated Value Home Inspections from 1993 until 2019 when she sold the company to devote herself to her responsibilities to NAFHAC. Her work includes training, coaching & mentoring home inspectors in the unique world of FHA consulting, as well as speaking at national conferences and leading organizations such as Montgomery County Partners for Home Ownership.

Catherine lives by the belief that education & information are the keys to success in all areas of life. She is devoted to assisting people from all walks of life to achieve the dream of safe home ownership.

Ashley Thomas III is the founder & owner of LA Top Broker, Inc., a full-service mortgage brokerage based out of Los Angeles, CA. He found his way into the mortgage business in 1999 and has never looked back.

Ashley also serves as the National 1st Vice President for the National Association of Real Estate Brokers (NAREB) whose mission is Democracy in Housing. He has been recognized & received community awards for his commitment to educating & growing sustainable homeownership.

Ashley is married with three children. His hobbies include golf & cooking.

Keenya Kind is the founder & CEO of Keen Mortgage Group LLC, a USBC certified Black-owned mortgage company based in Dallas, TX. Her mission is financing residential real estate for minority homeowners to ensure access to fair & affordable mortgages.

With more than 16 years of experience, Keenya is a highly engaging leader who thrives on making a difference for others. She is passionate about creative financing solutions for her clients, no matter how complex.

Keenya is also dedicated to serving her community. She serves as the Board Treasurer for Spring of Water Living and Mentoring – a nonprofit that helps single mothers & children transition from homelessness.

Christopher Thomas has been in the financial services industry since 1996 ,when he began his home financing career with Blue Ribbon Homes of Tuscaloosa, AL. Since then Chris has helped hundreds of Alabama families realize the American dream of purchasing their first home.

A graduate of the Univeristy of Alabama’s Culverhouse College of Commerce and Business Administration, Chris is now CEO of Greatland Financial Partners, LLC. Chris can offer milllions in capital to buyers & investors through his company’s affiliation with the nation’s largest wholesale mortgage lenders. His goal is to be a trusted advisor & great partner in financing his clients’ dreams!

Jeanine Robbins-Keita, known as “The Loan Angel” has earned her name. A true mortgage hero with over 20 years of experience helping homeowners, she is committed to providing an unsurpassed level of personalized customer service, while operating her business with the utmost integrity.

Jeanine is also a TV host on the Emmy-nominated show “The American Dream,” and has appeared on The Travel Channel, CNBC, Bloomberg and Fox Business Channel. She is also a Past President of the Arizona Association of Mortgage Brokers.

Jeanine recently married her best friend and just had her first grandson.

Mortgage, Plaza Home Mortgage, wemlo. and Windsor Mortgage for supporting us at one of the most successful conferences yet!

We started & ended the event with our two most popular certifications: Certified Credit Specialist Class (CCS) and Certified Veterans Lending Specialist (CVLS). Each provides loan originators & industry partners an opportunity to continue their education, fine-tune their lending skills and be recognized as experts in our industry! Our breakout sessions featured some of the best speakers in the mortgage industry! With the industry shift we’ve all seen due to high interest rates, values climbing in some markets & dropping in others, and lenders pulling out of the market, NAMB’s Focus topics were on point and on time to “Create Success in 2023.”

Mortgage Marketing Animals’ Carl White, who captured the attention of just about everyone in two speaking sessions, reviewed “how to close more loans” and outlined “your 1-page pusiness plan.”

Chris Vinson of Windsor Mortgage combined the three tentpoles of Focus in his in-depth presentation, “How to Set Goals and a Vision for Success.” President of Acra Lending Michael Kirk presented us with how to design & execute an action plan.

Plaza Home Mortgage’s Mark Boleky, who is always an engaging speaker, presented an exceptional sales tool. Chelsea Balak of taught us “How Third-Party Processing Can Recharge Your Business.”

Michael Neef of Preapprove Me taught us how to better serve borrowers & realtors using mobile technology.

Greg Oaks of the Florida Office of Financial Regulation updated us on the state of the industry in Florida and talked about how to protect ourselves & our businesses. And Freddie Mac’s Nora Guerra showed us how unprecedented challenges create opportunities and how to navigate the roads ahead!

Our welcome reception boasted an incredible dinner buffet inside and, of course, we did have the luxury of hosting the event partly outside on an incredible Florida winter evening! Our fabulous 9-piece NAMB House Band performed for hours with sing-alongs & a full dance floor.

Following the music was our first-ever NAMBPAC Event, with bourbon & cigars around the fire pits, exceptional hors d’oeuvres and PAC fundraising into the late hours. Margaritaville was a great location for our NAMB Focus 2023 event! It was intimate enough for the size of our conference – our exhibitors & sponsors made significant connections. We thank Margaritaville – the catering, employees & service were superb.

We look forward to seeing more of our members, potential members, vendors & partners back in the Sunshine State for NAMB Focus 2024! NC

Lisa O’Connor is NAMB’s Conference Committee Chair.

NAMB operates via many moving parts – specifically a small but mighty staff and more than 20 committees & subcommittees. Part of what NAMBCentral can offer is insight into what NAMB intends to accomplish this year.

At a recent meeting, VA committee chair Jeff Wilson led the discussion of two bills.

H.R. 4191, a bill introduced by Congresswoman Elise Stefanik (NY-21) and Congressman Andy Kim (NJ-3), which intends “to restore non-monetary survivor benefits to the remarried spouses of fallen U.S. service members.”

The Gold Star Spouses Non-Monetary Benefits Act is in the first stage of the legislative process. The Department of Defense and Department of Veteran Affairs provide various benefits to assist with those hardships. However, many of those benefits are forfeited once a surviving spouse remarries before age 57, or in some cases, age 55.

“By suspending survivor’s benefits because of remarriage,” said Rep. Stefanik, “we are breaking faith with Gold Star spouses who are depending on us to help them through some of the most difficult circumstances. This bill seeks to change that, and instead honor our

military families and support them through the tragic and unfortunate loss of their loved ones.”

H.R. 2827, the Captain James C. Edge Gold Star Spouse Equity Act, was introduced by Congressmen Michael Waltz (FL-6) & Seth Moulton (MA-6) and would “amend titles 10 and 38, United States Code, to restore benefits to widows & widowers of servicemembers killed in the line of duty.”

“Under current law, these widows & widowers are forced to forfeit earned benefits should they remarry before 55 [or] 57,” said Rep. Waltz. “These arbitrary age limits are completely nonsensical and only punishes those who forever mourn the loss of their spouse. We owe a debt that cannot be fully repaid to Gold Star families. We must fix this for them.”

These bills are in the first stage of the legislative process, and will be on NAMB’s lobbying agenda at the Legislative & Regulatory Conference in April. NC

Learn more about our 20-plus committees at namb.org/committees.

Necessity is the mother of invention, as the saying goes. It was true when it came to the innovations that were borne of the pandemic. Professionals quickly figured out new ways to work with clients & colleagues to keep their businesses afloat when we all needed to stay 6 feet apart. Video conferencing took hold and now, three years later, their efficiency has made video calls a mainstay in the business world.

Video conferencing remains an effective way for mortgage brokers to facilitate the mortgage process, deepen client relationships and provide convenience for their customers (and themselves!).

Here are five ways in which mortgage brokers are benefiting from using video conferencing:

Sixty-three percent of consumers believe that an online

mortgage process would make buying a home easier than an in-person process. Video conferencing allows brokers to meet with homebuyers who may not have the time, ability or desire to meet in person but still have questions about options and the home-buying process. Offering video conferencing gives brokers an edge over their competitors who don’t provide the same flexibility.

Sixty-two percent of executives say that, relative to phone calls, video conferencing significantly improves the quality of communication. Video conferencing can be as quick and easy as communicating by phone or email, but provides greater opportunities for reading non-verbal cues such as body language and facial expressions. This allows brokers to ensure they’re com pletely answering clients’ questions and meeting their needs. Talking face to face can also help build trust and break the ice with new clients.

Just as real estate agents do, mortgage brokers can use screen sharing to show and explain potentially confusing documents, such as Loan Estimates, to bring additional clarity to the process and reduce the need for a lot of back-and-forth communication. Brokers can also use screen sharing to help clients understand how to use the secure file transfer system and upload the documents needed for approval and underwriting.

CONTINUED ON PAGE 12

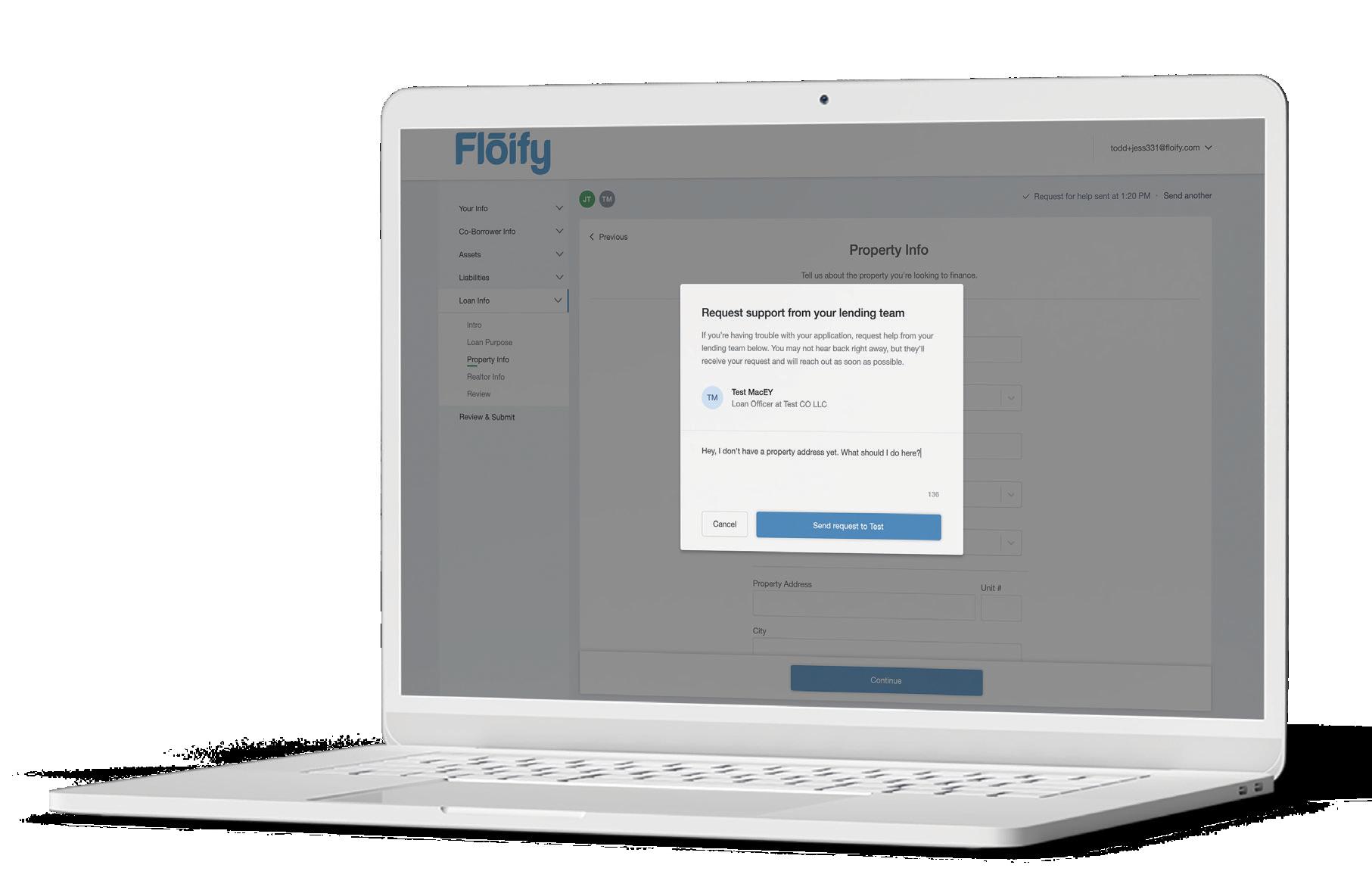

Originate loans up to 10 days faster and provide borrowers with a world-class lending experience by integrating Floify to-end mortgage point-of-sale system into your origination workflow

Scan the code below or visit schedule a demo and learn how Floify can help improve your lending operation.

CONTINUED FROM PAGE 10

Video conferencing allows mortgage brokers to work from anywhere with internet access. Eighty-seven percent of people prefer remote work after all! Additionally, video conferencing also allows brokers to more easily build relationships with prospects and clients in a larger geographic area.

Video conferencing helps mortgage brokers save money on travel expenses, like gas or Uber rides, since they have the option to meet with clients remotely. This also helps reduce their carbon footprint!

Not only does meeting with clients by video save money, but limiting travel also saves a lot of time for both brokers and their clients. Additionally, faster decisions can often be made virtually, especially when there are multiple people involved. If an important discussion is needed where everyone needs to refer to documents, files, or videos, access to video conferencing can make that process much more simple.

Video conferencing is a useful tool for mortgage brokers to continue serving their clients effectively and efficiently from wherever they are. NC

LiveSwitch Video is the video conferencing partner of NAMB. Try it for free: liveswitch.com/video

I am both honored & fully charged to be your 2023 PAC Chair. Llet’s take a moment to recognize the great role models & industry leaders before me; those who led the charge to garner political alliances with lawmakers, regulators & agencies who understand the service brokers & originators provide. They paved the way, and did so voluntarily & with great passion for our industry.

NAMBPAC is the voice & honor guard of our industry, and that voice starts in the ears of our politicians. To get there, we must support our allies in Congress and continue to build strong relationships with lawmakers at the local & state levels.

NAMBPAC works closely with legislators & regulators to promote policies that support the mortgage industry & protect consumers. By supporting NAMBPAC, you help to ensure that the voices of mortgage brokers & originators are heard in the policymaking process, and that the industry continues to have a strong and positive influence on the housing market.

Another of NAMBPAC’s key values is the importance of providing consumers with access to affordable homeownership opportunities. Mortgage brokers & originators play a crucial role in the homebuy-

ing process, helping to connect borrowers with the financing options that are best suited to their goals. By supporting NAMBPAC, you help to ensure that brokers have the tools & resources they need to continue serving their communities and helping families achieve the dream of homeownership.

But, if NAMB is to be the voice of our industry, we must find ways in which every member can participate in NAMBPAC. I’m happy to say the PAC Committee has found a solution, one that fits every level of membership: Allow me to introduce our new FiveStar PAC Officer Supporter Club!

It should be noted that all contributions throughout the year will accumulate & raise your PAC Officer Star Level. As well, discounting for NAMB events will increase as your PAC Officer Stars increase. So, as you can see, every level of participation counts, from a $25 contribution to a recurring commitment, and all members will be recognized with their “Star Officer” Level throughout the year. Every little bit helps to brings your voice into the

★★★★★ 5 Star Officer: Annual contribution of $5,000, participation in NAMB LRC

★★★★ 4 Star Officer: Annual contribution of $3,500, participation in 2 NAMB conferences

★★★ 3 Star Officer: Annual contribution of $2,500, participation in 1 NAMB conference

★★ 2 Star Officer: Annual contribution of $1,000 or (be a $99 monthly Club Member)

★ 1 Star Officer: Annual contribution of $99-$999 to NAMBPAC or entry to NAMB events

solutions needed to protect our industry. To all who have served & supported NAMBPAC, I say, thank you very much! Thanks also to those who have served on NAMB’s board & committees to ensure that brokers & originators can continue to help borrowers achieve the American Dream of homeownership, while also making sure their livelihood is protected. NC

Lastly, as NAMB’s Technology Committee chair I must again share the new NAMB mobile app! Simply txt “NAMBAPP” to 36260 to download, and get access to all things NAMB, at your fingertips.

Homeownership is one of life's biggest milestones – but it also requires careful planning and a hefty budget. Although it's the largest purchase most people will ever make, it can come as a surprise just how much goes on during the closing process, including purchasing the right home insurance.

In order to get to closing, buyers feel rushed to accept the rate they’re given, leaving a disconnect between what new homeowners understand about how their biggest investment is being covered. In a recent consumer survey, Goosehead Insurance found that nearly 65 percent of U.S. homeowners don’t know what their insurance actually covers.

With inflation rates on the rise, 49% of consumers are leveraging independent agents, resulting in greater options, along with an expert, unbiased opinion — making the process simple and efficient.

In the insurance industry, captive & direct models are losing their grip due to a lack of product offering to consumers. If there is a rate increase within a single-carrier platform, there is no option to shop the market to make sure clients have the best option.

Goosehead was founded on the principle of creating a solution to this broken industry by focusing on the power of choice. We partner with not only nationally recognized carriers but also regional carriers to focus on the needs of our clients & mortgage partners.

With direct binding authority, our expert agents can provide a customized policy for homeowners and then provide you with a binder, checking another item off the closing to-do list. Along with a robust product portfolio, we have agents licensed in all 50 states.

Our cutting-edge technology takes the complex process of buying insurance and makes the entire experience, from running quotes to signing documents, extremely simple. Our Digital Agent Platform is a direct-to-consumer insurance quoting platform that provides a simple, transparent & efficient way to get insurance quotes from more than 150 insurance carriers.

Within two minutes, you and your client can see insurance rates and be connected with a local agent, providing regional expert guidance throughout the entire process, so your clients secure the right coverage at the best price. By connecting you with a like-minded business professional, we can personalize the relationship and create a partnership that embodies trust & consistency for you and your clients.

Partner with our agents and give your clients the best experience, start to finish, by utilizing our Digital Agent today. NC