This report aims to delve into the local trends and activities within the Wichita market, while also shedding light on some national trends. It's important to note that economic conditions often have little sway on health-related needs. Regardless of economic ups and downs, patients require treatment for illnesses, chronic conditions, injuries, and other health issues, ensuring a steady demand for medical services. This resilience has been a hallmark of the medical office sector, consistently offering attractive returns with minimal volatility across economic cycles.

Throughout the COVID-19 pandemic, demand for medical office buildings (MOBs) remained robust, with vacancies maintaining pre2020 levels Consequently, medical offices continue to provide some of the most favorable long-term, risk-adjusted returns among major property types.

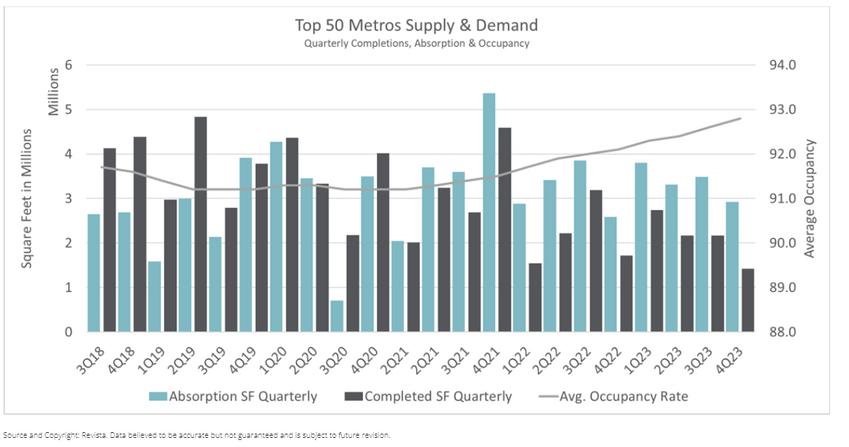

Both occupancy expansion and rental rate growth have been on a steady upward trajectory for several years In the fourth quarter of 2023, the national occupancy rate stood at 92.8%, continuing the upward trend that began in the first quarter of 2021 and marking an increase of 160 basis points since 2021.

The ongoing demographic phenomenon of macroeconomic population aging, alongside the sustained expansion of the healthcare sector, will continue to underpin industry growth not only through 2024 but also well into the foreseeable future. The pronounced shift towards increased healthcare utilization and expenditure remains a primary driver of this expansion. This trend is further compounded by the proliferation of outpatient facilities, exemplified by the notable expansion of ambulatory surgery centers, which underscores the persistent demand for quality healthcare real estate (HRE) space at a notably accelerated pace

However, a notable obstacle to sectoral expansion lies in the realm of labor. While the expansion of healthcare services persists, the recruitment and staffing of personnel for newly established facilities have presented significant challenges.

In terms of prevailing trends in location selection and asset categories, there persists a discernible preference for high-quality assets within major metropolitan markets. Paradoxically, there has been a concurrent surge of interest and activity in tertiary market rental rates, occupancy levels, and transaction volumes. The robust fundamentals characterizing these markets, coupled with a scarcity of viable opportunities, have prompted available capital to explore alternative investment avenues.

Plans for the downtown Wichita biomedical campus continue to move forward. The $300-million project should be open in time for the fall semester in 2026

The Kansas College of Osteopathic Medicine opened it’s doors and welcomed the first inauguralof85students in August The college now serves close to 600 students.

Andover Family Optometry plans to break ground in the summer of 2024 on an 11,400 SF office in Wichita’s The Heritage Development, with the goal of opening a year later

Redbud Pediatrics broke ground for a new 13,000 SF location in Maize. To improve the future by making kids stronger and healthier; opening is anticipatedfor2024

COMCARE of Sedgwick County purchased property at 235 S. Topeka. It will be the home of multiple programs including the Community Crisis Center and Sedgwick County Offender Asscessment Program. Plans are for an openinginconjunctionwith phase one of the

NAI Martens is the largest full-service commercial real estate firm in Kansas. Founded in 1948 and headquartered in Wichita, NAI Martens provides a vast array of commercial real estate services throughout south-central Kansas. President Grant Glasgow, SIOR leads a team of professionals with over 150 years of combined commercial real estate experience.

Member of NAI Global with 300 + Offices Worldwide

“Marisa has been wonderful to work with. She is incredibly knowledgeable and responsive. Marisa is doing a great job for us!”

-Elyssa Carter, Director, Real Estate- Kansas, Oklahoma, Medxcel Real Estate