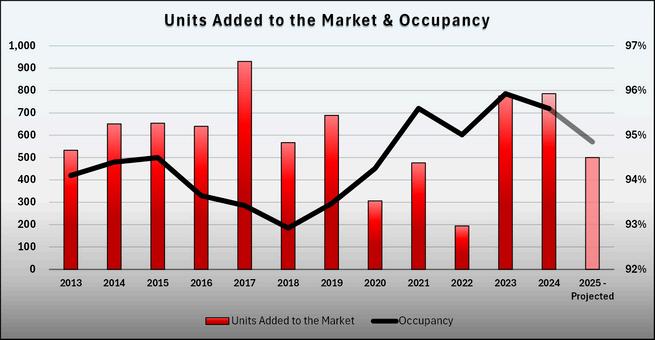

New development in the Wichita MSA declined from 2020 – 2022 due to COVID-19 and sharp increase in construction costs during this time During this timeframe an average of 325 units were added to the market per year, compared to over 700 per year in the three proceeding years. However, new development rebounded in 2023 with nearly 800 units added and a similar expected to be completed by the end of 2024 Estimates based on announced projects predict that this rate of new development will continue over the next few years

Following the same trend as previous years, Northeast Wichita continues to see the largest growth with over 2,100 units completed from 2016 - 2023, with that number continuing to grow in the coming years The Northwest quadrant was the second largest growth sector from 2016 - 2023, accounting for about 30% of new development Both the Northeast and Northwest quadrants will continue to have a decent rate of growth in the coming years However, it is expected that there will be over 800 units added to the Central Business District within the next few years, making this the largest growing sector The largest multifamily inventory in Wichita are properties constructed between 1970-1989, comprising nearly 45% of the apartment units

Comparatively, only 14% of the current inventory was constructed from 1990-2009 and 23% from 2010 to present. Therefore, only 37% of the inventory was constructed in the past 35 years The increase in development over the past 10-15 years is justified given the age of the apartment unit stock. While Wichita has not experienced a development boom as seen in the 1970s, Wichita is making progress in lessening the housing gap As older developments start to become unappealing, demand for new projects increases as tenants seek more modern living options and community amenities

Liberty Gardens in Northwest Wichita, a luxury Class A 180-unit complex with 48 units completed in mid-June 2024. The remaining units are expected to be completed during August Ovation Apartments in Northwest Wichita, a luxury Class A 252unit complex is set to deliver their first units in Spring 2025, with remaining units to follow

Wichita is preparing for a major development with the new Biomedical Campus downtown This partnership between Wichita State University, WSU Tech, and the University of Kansas aims to bring about 3,000 students and 200 faculty and staff to the area The campus, initially covering 471,000 square feet, promises to significantly impact both education and the local economy

During the first half of 2024, occupancy remained flat after strong increases in the previous year. No specific quadrant saw significant year-over-year changes Occupancy is expected to slightly decrease during 2025 resulting from two consecutive years of strong development

Class C units are predicted to see the largest decrease in occupancy resulting from strong rental rate increases in 2023 and year-to-date 2024 As rental rates for Class C properties approach Class B rates, more people are inclined to opt for Class B properties

The Northwest, Southeast and core areas of Wichita have the highest occupancy rates, despite the number of new units added to the Northwest sector Closely behind is the Southwest quadrant with an occupancy rate of about 95%, followed by the Northeast at around 94 5% During 2023, the Southwest sector had the 2nd highest occupancy at 96 6%, but now falls to the 4th The CBD broke into the top three this year, increasing from 95% in 2023 to 96.1% year-to-date 2024.

The overall average monthly rent in Wichita increased 3.5%. Locally, rent increases fluctuate every other year, experiencing a large increase one year, followed by a more moderate increase the following year Class A rents remained relatively flat, increasing from $1.41 to $1 42 per square foot

However, rates for Class A properties downtown experienced a decrease in the average asking rent of about $100 per month, which is due to the increased supply in recent months Conversely, Class A properties in other sectors increased, particularly in Northwest Wichita with the addition of Avante Apartments

Rents for Class B properties were also mostly flat, decreasing from $1 07 to $1 06 per square foot Class C properties saw the largest increase, about 6%, and is believed to be the result of Class C properties

playing catching up, after the strong increases in Class A and B properties during the previous year. For the first time locally, Class C rents have achieved average rents of $1.00 per square foot.

2021-2022 had record breaking years in MF transactions, with a combined 8,000 units sold, totaling $600 million in transaction volume Climbing interest rates may have impacted 2023 transactions, along with other variables. During 2023, the number of units sold was about half of the previous year.

compared to the previous year. This adjustment is indicative of the broader economic trends influenced by rising interest rates and treasury yields Despite these changes, the multi-family market continues to stand out as an appealing investment option, driven by robust demand for rental apartments and promising growth prospects Conversely, cap rates for Class C properties have shown stability throughout the 20232024 period, maintaining a balance between risk and from investors in the Class C segment, particularly those seeking value-add opportunities The consistent performance of Class C properties reflects their resilience in varying market

expected returns This stability underscores the steady