The Midwest Region

This proof has not been approved for distribution yet.

This proof has not been approved for distribution yet.

VP, Midwest

NMLS# 228046

As Vice President for the region, Tanner oversees all area functions for the Midwest. These areas include Sales, Operations and P & L management. His focus is pricing and helping each LO be as competitive as possible in the market place. He works with loan officers and managers daily on constructing ways to win each and every deal.

VP, Midwest

NMLS# 240288

As Vice President for the region, Tom oversees all area functions for the Midwest region. These areas include Sales, Operations and P & L management. His focus is on Sales growth, recruiting, teaching and training our sales force. We focus on strategies that have helped himself and many loan originators grow their business year over year.

EVP, Retail Sales

NMLS# 72161

Tony oversees the company’s Retail Sales division, including a nationwide network of branch Loan Officers. Tony is responsible for implementing initiatives and procedures to drive successful growth and profitability in each region, and he collaborates with the Executive Team and Sales Leaders around the country to ensure continued growth, leadership, and retention.

NMLS# 328633

With over 33 years in the mortgage industry, Greg has established himself as a prominent Regional Manager with a remarkable track record. Over the past decade, he has funded more than $700 million in loans and has played a pivotal role in recruiting over $1 billion in new hires over the last four years, including $650 million since his return to New American Funding. Greg’s extensive experience also includes owning a mortgage company for 12 years and a real estate company for four years. After a brief hiatus, he rejoined NAF in 2022, bringing his total tenure with the company to over seven years—a decision he considers among the best he has ever made.

At NAF, Greg oversees strategic growth, embodying a commitment to excellence in the financial services sector. His proficiency in marketing and strong grasp of sales management have made his team a cornerstone for fostering robust growth and exceeding expectations. Greg has honed skills in customer service and recruitment, translating these into substantial contributions to the organization’s expansion. By collaborating closely with leadership, he has consistently delivered solutions that enhance customer satisfaction and drive sales performance. Passionate about recruiting and retention, Greg values the balance between professional success and personal life, striving to create a supportive work environment that reflects his belief in putting family first while driving growth and excellence within his team and the broader organization.

Missouri

St. Louis – Olive

St. Louis – South County

St. Louis – Telegraph

Chesterfield – Score

Chesterfield - EHLT

O’Fallon

O’Fallon – Waterbury Falls

O’Fallon – Waterbury Falls II

Springfield

Lee’s Summit

St. Robert – ASA

Rolla – ASA

Lake of the Ozarks - ASA

Florissant - Desk Rental

St. Louis – Baumgartner - Desk Rental

Springfield - Desk Rental

Illinois

Glen Carbon

O’Fallon

Mt. Vernon

Champaign

Peoria

Alton

Springfield

Knoxville

Bloomington

Champaign – ASA

Danville – ASA

Arkansas

Little Rock

Little Rock - ASA

Bentonville

Iowa

Bettendorf

Cedar Rapids

Des Moines

West Des Moines

Ankeny

West Des Moines – ASA

Indiana

Indianapolis

Nebraska

Coming soon!

With over 30 years of experience in mortgage lending, Alexis is a highly accomplished underwriting professional with deep expertise in FHA, VA, USDA, and state bond programs. She holds FHA and VA underwriter designations, further enhancing her extensive knowledge of loan products. In addition to her underwriting background, Alexis brings seven years of experience in title insurance, having previously owned and operated a local title company.

In her current role, Alexis specializes in navigating complex loan scenarios, working closely with loan officers and underwriters to find solutions and make deals work. Her ability to review and assess loan structures for potential approvals is invaluable, ensuring that loans are positioned for success from the start.

• Primary Role: Find ways to make deals work by assisting both Loan Officers and Underwriters.

• Guideline Interpretation: Addresses escalated questions from Underwriters when guidelines are open to interpretation or unclear.

• Income Calculation: Provides initial income calculations for files including self-employed borrowers and unique income scenarios.

• Midwest Scenario Desk: Reviews loan scenarios to suggest ways to structure deals for approval.

• Guideline Research: Researches and clarifies guidelines for Loan Officers as needed.

• Manual Underwriting: Evaluates potential manual underwrites to determine if they can be approved manually or through Automated Underwriting Systems (AUS).

• Liaison Role: Serves as the communication bridge between Underwriting and Sales Teams.

Unchong oversees the mortgage process from application through to funding, ensuring that each step is completed efficiently and accurately. In addition to managing the loan pipeline to meet all necessary deadlines—such as loan contingency, closing, and lock expiration dates— Unchong is responsible for hiring, training, and managing Loan Officers Assistants (LOAs), Personal Assistants (PAs), and Processors. Unchong’s role also includes acting as a liaison between departments to foster a positive and collaborative work environment. This coordination is crucial in maintaining smooth operations across various teams.

With 23 years in the industry and 7 years at NAF, Unchong plays a pivotal role in mentoring, motivating, and assisting team members to achieve the monthly goals set for the region and the company. She ensures that the operations staff and the region stay updated on the latest compliance, regulation, and procedural changes. Additionally, Unchong addresses and resolves any customer and employee complaints, effectively managing and resolving issues to maintain high standards of service and operational efficiency.

Having local processing and underwriting is a significant advantage because it allows for faster decision-making and smoother communication. Our team understands the unique needs of the local market, ensuring a more personalized, efficient experience for both loan officers and borrowers. This localized approach helps resolve issues quickly and ensures faster turnarounds, giving us a competitive edge in providing exceptional service.

Our region utilizes an internal Appraisal Management Company (AMC), which is available to most branches. This gives our branches more control over the appraisal process, as the Branch Manager selects appraisers who are familiar with the local market and understand the unique dynamics of the area. By maintaining an Internal Appraisal Panel, we can ensure faster turnarounds, greater consistency in quality, and stronger relationships with trusted appraisers, all of which lead to a smoother transaction process for both Loan Officers and borrowers.

Our dedicated Condo Department handles all the necessary documentation and works to get the condo complex approved. The Loan Officer only needs to provide the HOA contact information. This process can be completed even before a loan application is submitted, enabling Loan Officers to get a condo complex approved and market it effectively to real estate agents and potential buyersDigital Closings

NAF has partnered with Snapdocs, a leading digital closing platform that facilitates over 3 million closings annually. This partnership allows our borrowers to preview key documents and digitize most of the paperwork, significantly reducing the time spent at the closing table.

LO receives application.

Loan is created, credit pulled and qualified/structured.

LOA prepares the file for initial disclosures and contacts borrowers for any supporting documents not already provided and moves the file to the PA.

Processor reviews and reaches out to the customer via email and phone call within 24-48 hours after initial underwriting review.

Processor discloses any COC LE’s, initial CD’s and any subsequent CD’s until the loan is sent to funding.

Assigned funder will review file same day or next day depending on closing date and other files funding that day.

Processor collects conditions and resubmits the file for midclear or CTC.

Funder will final balance the CD and communicate to LO and Processor the final amount to close.

LO and/or Processor will communicate to the borrower the funds to close.

PA moves documents into correct efolders and orders all third-party services and verifications - appraisal, title, VOE, VOD, VOR, etc and moved the file to the processor within 24-48 hours. 4 PA

Processor works with title/ escrow to pre-balance the CD to ensure there are no cash to close issues.

Processor reviews files within 24-48 hours and submits loan to underwriting.

If digital closing, borrower will esign on closing date prior to going to the title company to usually sign less than a dozen lender documents.

Loan is assigned to an underwriter and reviewed within 24-48 hours (times may vary due to volume and PTO).

Once file is CTC, the file is prepared and sent to our funding dept.

Loan is assigned to a funder usually within the hour.

Your client is now a homeowner!

Lori is a seasoned professional with 25 years of experience in the mortgage industry, currently serving as the Regional Marketing Manager.

With most of that time spent as a successful Loan Officer, Lori brings a unique, firsthand understanding of the mortgage process, which has proven invaluable in crafting effective marketing strategies.

Lori specializes in building strong relationships with real estate agents and builders, using her deep knowledge of the industry to create targeted campaigns that resonate with key partners. Her dual expertise in loan origination and marketing helps drive business growth and strengthen partnerships across the region.

Senior Graphic Designer

Senior Marketing Specialist

Lead

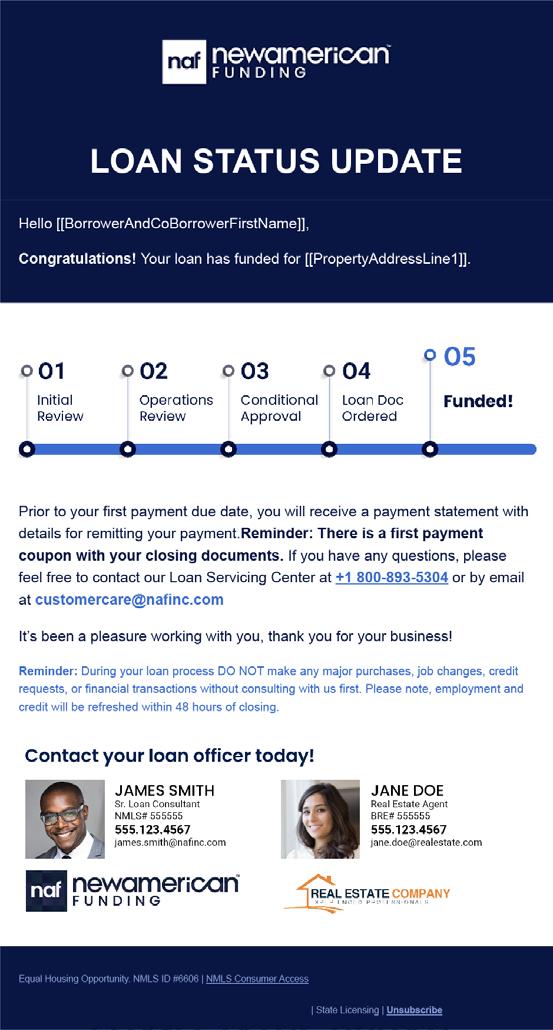

Keep your buyers in the loop with loan status updates and drip email campaigns that can be co-branded with partner real estate agents.

NAF keeps its loan officers at the forefront before, during, and after the deal closes. LOs and their partners appear on mortgage statements for the life of the loan.

Co-branded post-close email campaigns

Co-branded mortgage statements

Co-branded marketing

Co-branded closing cards

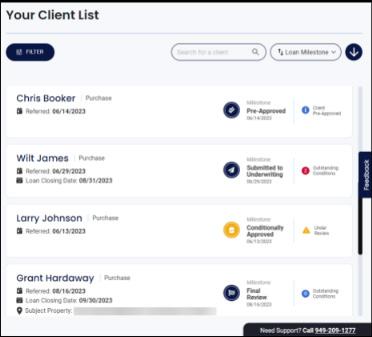

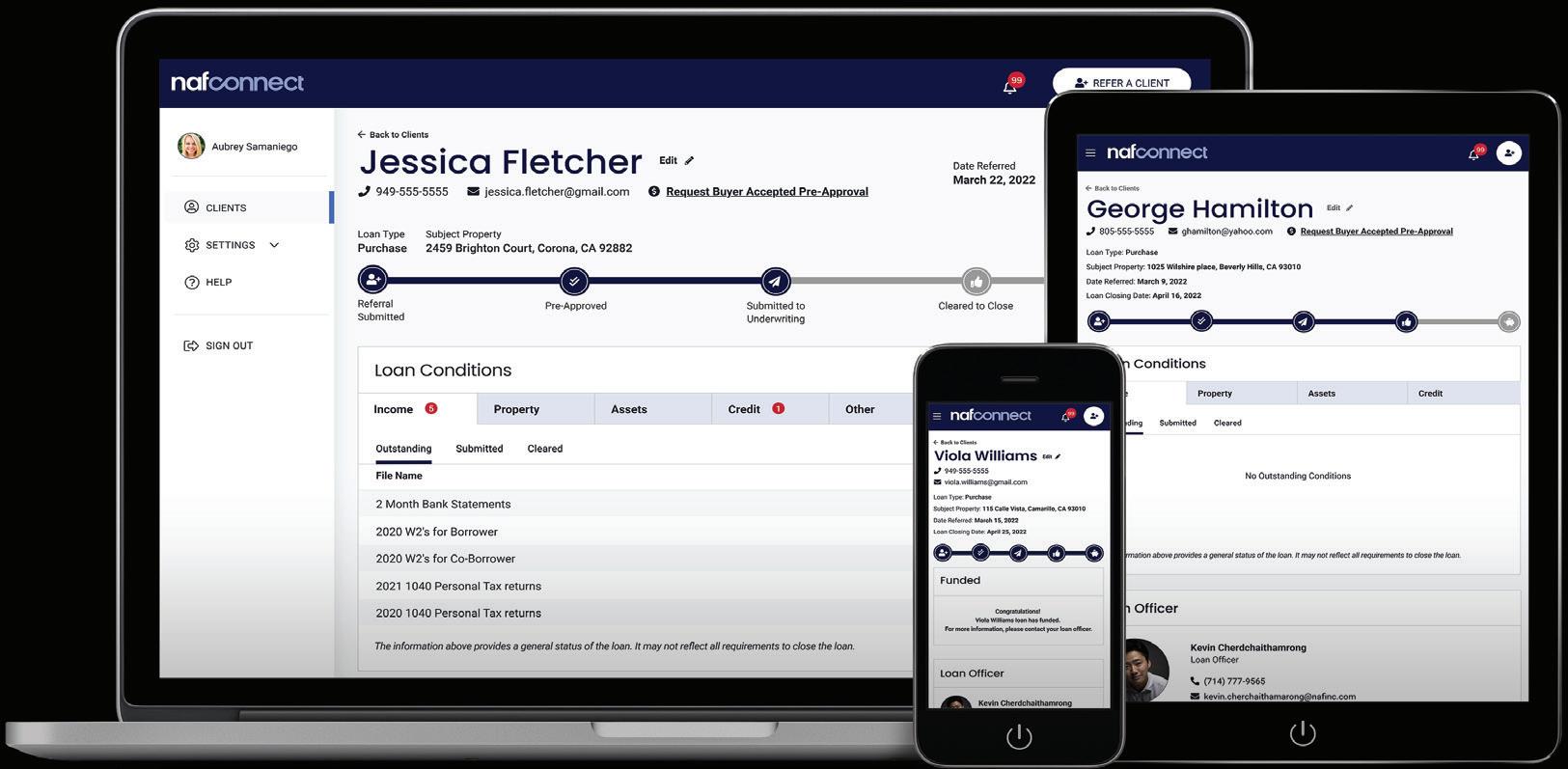

NAF values our real estate agent partners. That’s why we built NAF Connect, which provides agents with clear visibility into the status of a client’s loan throughout the entire process. That helps ensure happy clients for you and your partners.

Real-time and on-demand loan status updates, customizable alerts

Agents can make referrals to loan officers who understand their clients’ needs

Download and edit pre-approval letters on the go

See when a loan will fund

EDDM (Every Door Direct Mail) allows you to reach every address within a specific area without needing a mailing list, making it ideal for targeting entire neighborhoods with consistent messaging. Postcards allow for targeted outreach based on specific demographics or client interests. These mailers build broad local awareness helping the Loan Officer and their Referral Partners connect with both new and existing clients.The cost for this service is 1/3 the cost of regular mailers!

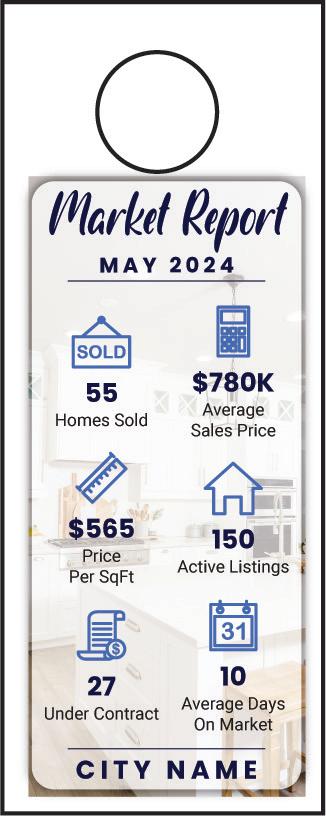

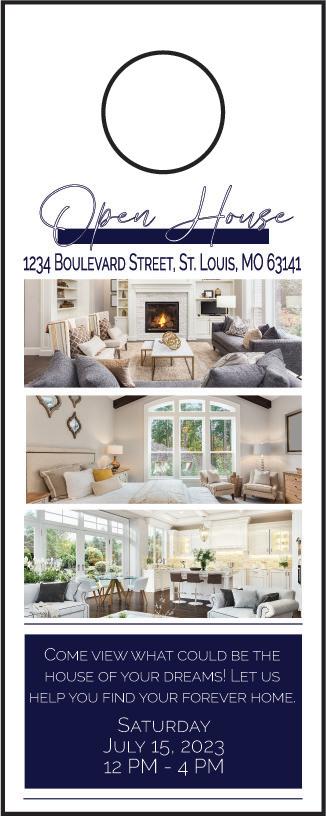

Door hangers deliver a direct, personalized message to homeowners. Their placement on doors ensures they are seen by residents in targeted neighborhoods, making them ideal for announcing open houses, promoting new listings, or offering mortgage services. This hands-on approach not only helps realtors and loan originators reach potential clients directly but also builds local brand awareness and fosters a stronger connection with the community.

Our Marketing Department offers premium Luxury Business Cards that are larger than standard cards, providing more space for important Loan Officer details, including a QR code that directs clients to their website or application link. These cards can also be co-branded, allowing Loan Officers to showcase partnerships with Realtors or Builders, creating a professional and personalized marketing tool that elevates their brand and enhances collaboration.

Our Video Marketing Department offers a range of professional video services to help Loan Officers and their referral partners stand out. From studio-quality videos and market update videos to open house, listing, and ‘out and about’ videos, we provide versatile content that engages clients and drives business. Additionally, we can take personal videos created by Loan Officers, edit them, and add custom branding for seamless use on social media, ensuring a polished and consistent online presence.

Social media offers a dynamic platform to connect with potential clients and build a strong professional presence. You can share valuable content, such as mortgage tips, market updates, and success stories, which helps establish your expertise and build trust with your audience.

Midwest Marketing creates and posts daily mortgage industry content and offers assistance in managing your pages and profiles.

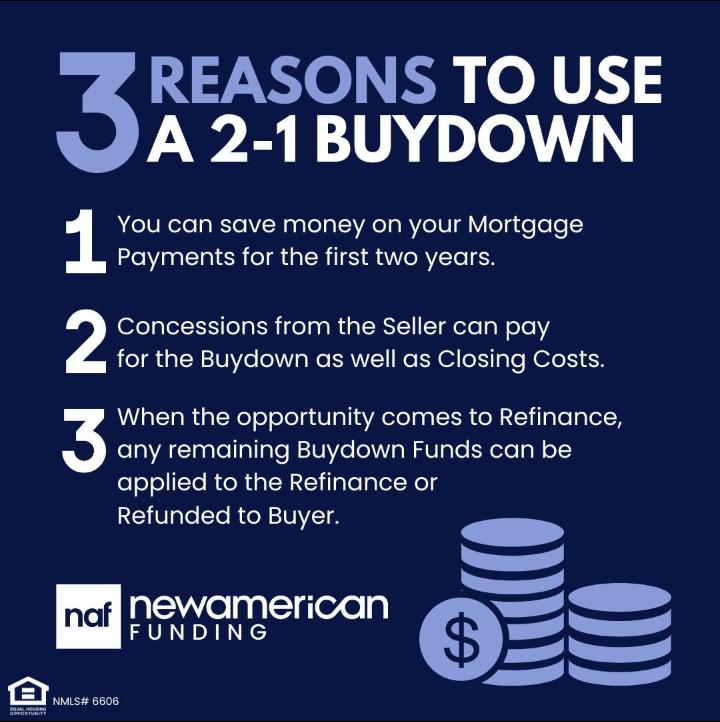

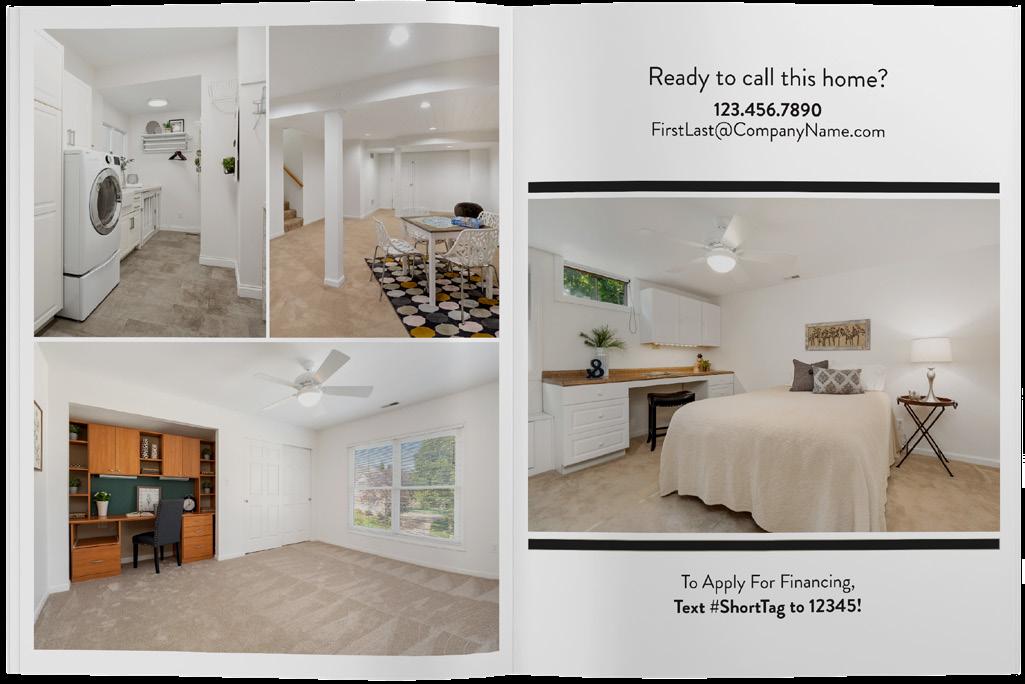

In today’s competitive real estate market, marketing to the Listing Agent is more important than ever. Our Listing Agent Suite of Marketing Options is tailored to showcase the property in a way that stands out. This includes elegant Listing Booklets that provide a more sophisticated presentation than a typical flyer, giving potential buyers a premium feel for the property. Additionally, our suite offers a variety of marketing tools designed to help both the Listing Agent and Loan Officer make a lasting impression on buyers during showings and open houses.

As a loan officer considering joining a new mortgage company, a full-service onboarding department can make a significant difference in your success and experience. Here’s how:

• Seamless Transition: A dedicated onboarding team ensures your transition into the company is smooth and stress-free. They handle all administrative tasks, from paperwork to setting up your systems, so you can focus on what matters most—originating loans and building client relationships.

• Comprehensive Training: The onboarding team provides thorough training on the company’s technology, processes, and products. This means you’ll quickly get up to speed on how to navigate the systems and use the tools to boost your efficiency, saving you valuable time.

• Faster Start: With all your tools, resources, and systems set up and ready, you can start closing loans faster. The onboarding department gets you up and running quickly, minimizing downtime and maximizing your earning potential from day one.

• Ongoing Support: Even after the initial setup, a full-service onboarding team continues to offer support. They help with troubleshooting issues, provide updates on company processes, and ensure you’re always operating at peak performance.

• Professional Image: A well-organized onboarding process shows that the company values you and is committed to helping you succeed. It reflects a professional culture that focuses on supporting its loan officers from the very beginning.

A full-service onboarding department allows you to hit the ground running, empowers you with the right tools, and offers support throughout your journey, making your transition into a new company as smooth and productive as possible.

Regional Trainer

NMLS# 1534426

Benefits of a Dedicated Trainer for a Loan Officer Moving to a New Company

• Personalized Learning Experience

• In-Depth Product Knowledge

• Boosted Confidence

• Better Use of Technology and Tools

• Increased Productivity and Earnings

With 8 years at NAF and experience as a licensed originator, Paige brings valuable expertise to her role as a regional trainer, making her an exceptional asset to our team.

AMBER ERNST

Sales Manager

NMLS# 406037

Sr. Loan Consultant

NMLS# 318322

Branch Manager

NMLS# 965518

Sr. Loan Consultant

NMLS# 1840439

Sr. Loan Consultant

NMLS# 1700670

Sr. Loan Consultant

NMLS# 1718338

VICTORIA ADKINS

Sr. Loan Consultant

NMLS# 2018724

DAN WEILER

Loan Consultant

NMLS# 1680769

Loan Consultant

NMLS# 2058523

DIMAGGIO

Loan Consultant

NMLS# 1269995

MIKE BERTARELLI

Sr. Loan Consultant

NMLS# 1553457

BOBBY BURGETT

Sr. Loan Consultant

NMLS# 501467

A Retail Branch at NAF is primarily a physical location where Loan Officers work directly with clients to provide mortgage solutions. These branches serve as local hubs, offering personalized service to borrowers throughout the loan process, from application to closing. Retail branches often focus on building strong relationships within the community, working closely with real estate agents, builders, and other referral partners to generate business and offer tailored mortgage products to meet the specific needs of local homebuyers.

NAF gives business owners the support they need to succeed, plus unparalleled flexibility and transparency that you won’t find anywhere else. Your business, your way. Backed by the power of NAF.

VP, SCORE Mortgage Group

NMLS# 738508

VP, 217 Mortgage

NMLS# 611367

VP, EHLT

NMLS# 281228

VP, EHLT

NMLS# 289958

New American Funding offers Local Banks, Credit Unions, Real Estate Companies and Builders the opportunity to refer loans to NAF under our TPO Platform. We believe in establishing strong partnerships and are committed to helping you build long-lasting relationships in your communities.

• Increased Loan Volume: TPO partnerships allow lenders to increase their reach and origination volume without needing a larger in-house sales force.

• Access to Different Markets: Through TPOs, lenders can access a broader range of markets, including borrowers who might not otherwise come to them directly.

• Cost Efficiency: Lenders can grow their loan portfolio without the overhead costs associated with managing a larger internal team of loan officers.

NAF REALs is a dual-licensing program for Real Estate Agents to become licensed Mortgage Loan Officers. The NAF Loan Agents (REALs) program is built to increase and retain production volume for the Real Estate Agent as well as the Loan Officer.

We proudly service over 98% of our Conventional, FHA, and VA loans in-house. We offer regionalized underwriting, processing, and an in-house condo approval team, enabling you to build your brand and area appraisal panel. And we have in-house experts who remove unnecessary red tape and make difficult things easier, helping you help your clients.

By servicing our own loans, we are able to build deeper relationships with our customers. Servicing isn’t just about making sure that homeowners’ taxes and insurance are paid on time. It’s also about supporting our customers through the highs and lows of life. As part of our commitment to creating a truly customer-centered experience for our borrowers, we’ve opened a Servicing Center in Austin, Texas.

Our New Servicing Center In Austin, TX!

266,760+ We Service 98% of All Conventional, FHA & VA Loans Funded

Total Loans in Servicing Center

Servicing Portfolio $70.0 Billion Reviews 315,000+

As of 8/24

JULY 2024

Employee retention is crucial because it fosters stability, builds a strong company culture, and ensures consistent service to clients. The fact that New American Funding has retained most of its employees, even in today’s challenging industry, speaks volumes about our supportive work environment, commitment to growth, and dedication to our team’s success. This high retention rate highlights our ability to provide both career longevity and professional fulfillment.

Out of 276 Employees...

15 have been here for 10+ Years

35 have been here for 7-9 Years

37 have been here for 5-6 Years

28 have been here for 3-4 Years

Clients can make a true cash offer that may not be contingent on the sale of their current home

Provides first-time buyers in select areas up to $8,000 in assistance

Can reduce buyers’ first-year, second-year, and third-year payment rate

Cash-out refinance, HELOC, FHA 203(k) loans, VA Reno

If rates drop, buyers can refinance into a lower rate with no repeat fees

For new construction, a single loan covers property, construction and mortgage

We have a full suite of loans to fit borrowers of all shapes and sizes, no matter how unique their situation is

Enables older homeowners to convert a portion of their home equity into cash

Client may qualify for a home loan using the ITIN number

Self-employed clients may qualify using bank statements or asset depletion

Provides the ability to secure an interest rate with the option to lower it if the market improves before closing

Offers clients solutions for investment properties using non-traditional income sources

PATTY ARVIELO

Co-Founder, CEO

NMLS# 49166

Patty has been a leader in the mortgage industry for nearly 40 yeras. She has worked her way up from the bottom rung and gained extensive knowledge of the entire industry along the way. Over the course of her career, she functioned in a variety of capacities, from underwriting to processing to her current role as Co-Founder and CEO of New American Funding.

Co-Founder, CEO

NMLS# 6683

Rick transformed the company from a small call center into a leading national mortgage firm with over 260 branches. His focus on automating processes and integrating advanced technology streamlined operations and improved efficiency. Under his leadership, New American Funding expanded its services to include both refinances and purchase transactions, becoming a major direct lender and servicer.

CHRISTY

President

Christy is involved with every aspect of NAF’s business and has helped the company expand into the successful organization it is today. Christy oversees New American Funding’s entire mortgage lending pipeline, managing the lender’s operations, sales, and servicing operations.

PAT BOLAN

Chief Production Officer

NMLS# 732712

Pat leads the effort to grow the company’s retail lending platform and focuses on ensuring the long-term success of NAF’s retail division. He is passionate about recruiting and developing strong leaders.

SVP, Managing Director of Retail

SVP, National Retail Sales

NMLS# 230147

Tim has consistently delivered outstanding results and played a pivotal role in driving the growth of NAF’s Retail Division. His leadership, dedication, and collaborative approach have been exceptional. Tim maintains oversight of the Recruiting team and leads the Retail Onboarding team. He also serves as the key liaison for Marketing, Facilities, Compliance, Tech, Legal, HR, and Finance.

Sam works closely with the core sales force to increase their loan production while coming alongside regional managers to expand their market share. He also simultaneously recruits new loan teams to build upon New American Funding’s existing workforce and to continue increasing its profitability.

• Adding 250 loan officers and operations staff

• Increasing branch locations concentrating on Nebraska, Indiana and Arkansas

• Adding $1B in additional production yearly

• Increasing our partnership group by 5

AND WE’RE JUST GETTING STARTED...

328633

Our loan officers are the number one customer! At New American Funding, we are dedicated to coaching and growing loan officers to help scale your business.

Our goal is to provide loan originators with the strongest array of products, technology, marketing, and support, so you can reclaim valuable time back into your day and spend more time doing what you do best: selling and providing high-value proposition to your clients and referral partners.

228046 Tanner.Hurrelbrink@NAFinc.com

SINAK

240288

72161 Tony.Blodgett@NAFinc.com

Probably a super long disclaimer goes here. Antis quidita sam simus, optatur millece strumquis dis doles maxim ute et videse reptatquas ea provitistio. Ut explit essitam et faccupt asperuptas maximolorem vernam in etur sitiam senis endaeceres diandi dolupti voloriatem fugit archicia quas molupicatium ute re de pel inis modio inisit volora qui dolore ium faccuptaque natur autemped ut mincius et unt.

Poribus mint officates iliqui omniet fugitatet audis quunt quia vellam dem etur, quam aut et provid quas exerci conserem quaspienda pore, tendae ipsum ipicitatur sim quatium consequi dolenem imin reres qui temo quos et laute voloremquid untur? Pores se doluptatur sam, saecusc ilibuscillo intur aut omnimi, ipsum aspel is derspeleces es solupta tiorem netur, si officimagnis autatum, qui occustis pro dolupta ssinum restion perum atest laborunt, te siti ut plam dolorescimus iduscia ndisit doles sim eos magnienes verorem re omnis dolupta volorer atectent quatiae sequati uscium sae vent ute nosti sequo et volorit ilitas estio. Itatur alicatibus est laut la nus dolor re ende porestem non et magnati orenet voluptat re maximen isquam corpostin cus, ipsanitat evenderum aut aut veribus ad ut ut volut omnitium sa con consed modignatem aboreiu ntibus. Ovide es am atet ellessum sinctur? Imeniendunt et et estium qui volorit, et eaquo magnis archilique nitibusam autate disquod excestor re dit ra venita velecatate offictore eliquatus ma dolorro vitiur aliquis inulla ipsae eatate volore veles autem rehento elessed ex et rerro con ne plia volupie ndunder sperit ipitibus aut occatur, que ide ad quam asi que eost vidis et, sae volorit andit as et doluptas debis dolorati tempori ut aut idipis is delit veriae antus exeritem re nem hariamus con poresedit eum harum nes doluptas am autem. Qui odiaspe ipsuntem quam, sequossusdae vitio vit molorempore soloreium que excepelit quis voluptam volorporiae eaquasi aut aut qui de sim evel molor re nonemporest pore, tempor sit event, consendae. Imagnitae. Lorpor restota tustotati dusandandi qui dem voles eic temporp orendio nesciis maio odis nullatur, ut ium hil id ma aut di beaqui is maio imus di ut volorum est quiam eos aut fugias poreperum lanihil id exceptum re solut minvenda qui dolorehenis molorerror aut ut inulla dolorro eum facium