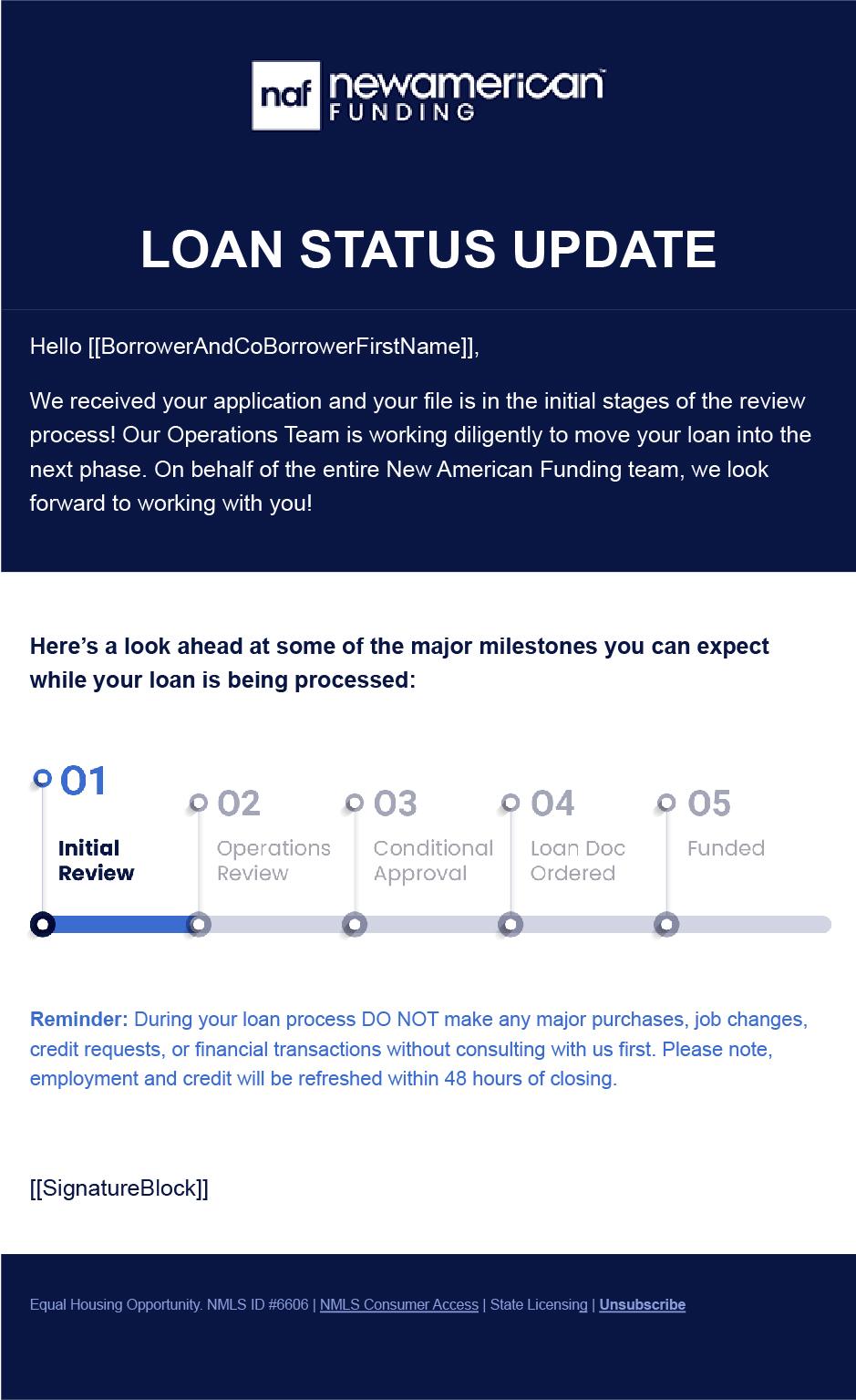

New American Funding keeps you top of mind with co-branded Loan Status update emails to keep the client in the loop every step of the way.

Co-branded closing cards are mailed to our mutual clients with information on how to download closing documents.

Personalized co-branded greeting cards sent to clients for years after a loan closes on birthdays, holidays and loan anniversaries.

NAFConnect is a platform for Real Estate Agents (REA) to connect to NAF Loan Officers.

Help clients navigate the loan process and communicate with New American Funding.

View your client's loan status and receive notifications as it moves across key milestones.

See documents needed by the New American Funding processing team.

Generate, edit, and download pre-approval letters at the click of a button.

Receive notifications when new milestones are completed and watch real-time loan status updates to keep you and your client up-to-date on the status of their loan.

• Print Mail

• Doorhangers

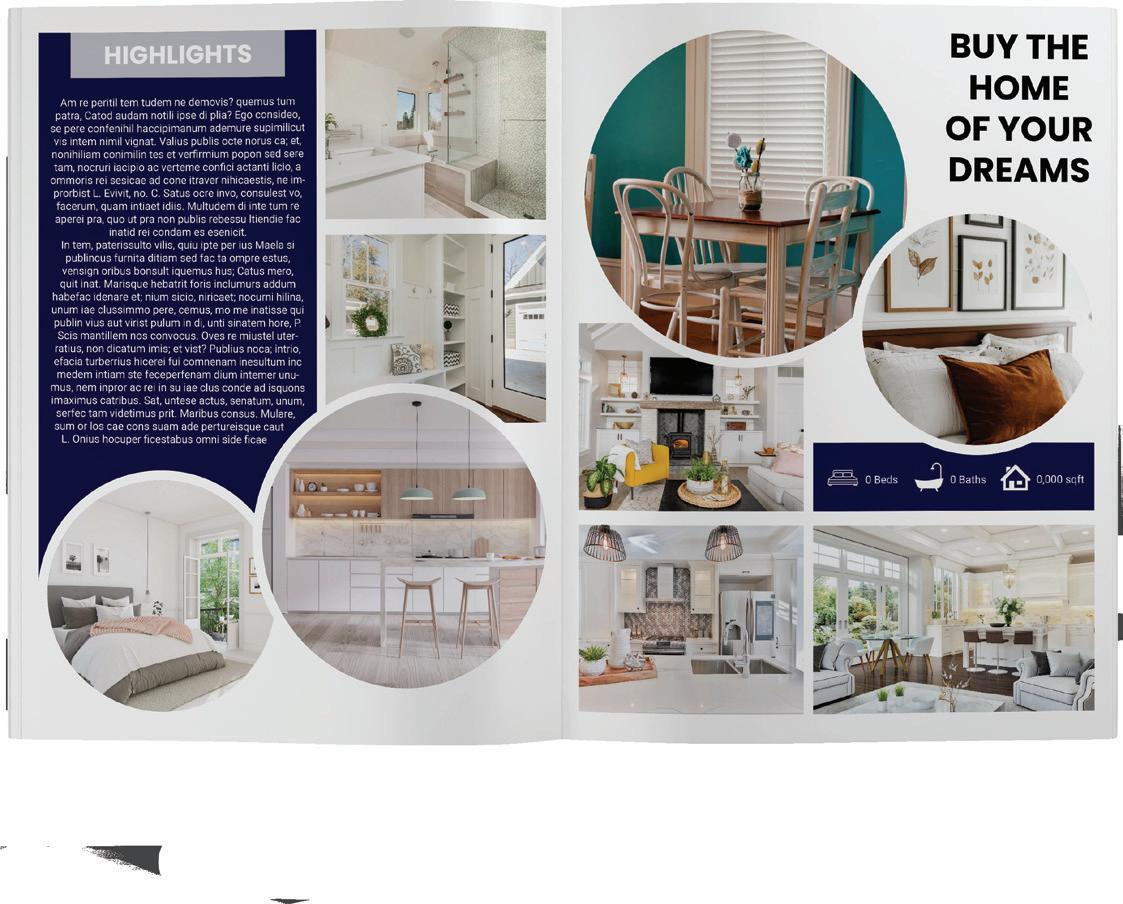

• Listing Booklets

• Flyers

• Luxury Business Cards

• Buyer and Seller Booklets

• Listing/Open House Materials

• Agent Signage

Turn any of our booklets into a virtual flipbook to send digitally to clients via text or email. Scan to see an example.

With Every Door Direct Mail® (EDDM®) service from the U.S. Postal Service®, you can get help reaching potential customers in nearby neighborhoods—and you don’t even need to know names or street addresses. Simply identify the delivery routes you want to reach, prepare your mailpieces, drop o your mailpieces with us, and we’ll deliver the printed pieces to the active addresses in your designated area.

3 2 1 4 5

Go to https://eddm.usps.com/eddm/select-routes.htm

You will be taken to the registration page.

Note: Existing customers, enter your username and password.

Click & enter all of the required information. Select register/sign in within the global header.

Sign Up Now

After your new USPS.com® account has been created, Select [create account].

you will automatically be redirected to the online mapping tool so you can begin to create your order.

1

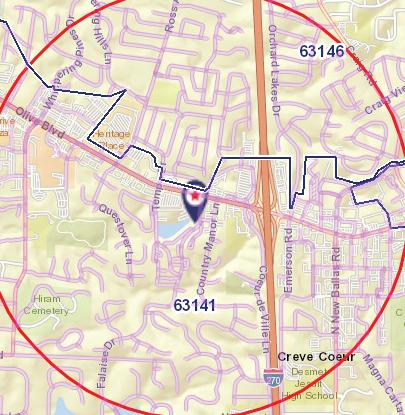

Begin your search to determine your mailing audience.

You can search by street address, city and state, or ZIP Code™ by entering in your search criteria into the text field within the search location box and selecting the magnifying glass button or hitting [Enter] on your keyboard.

Note: If searching by city and state, you may be presented with the option to select up to five ZIP Code™ locations to target for delivery. This is accomplished by selecting the checkboxes that appear to the left of each ZIP Code™. It is also possible your search will result in more than one address result. If this is the case, you will need to select the appropriate address

2

Results are displayed on the route table and map.

Selecting routes is covered on the next section.

When you are ready, click this button!

1

Select the routes you would like to send EDDMs to simply by clicking on the pink highlighted streets. Once selected, they will turn blue.

Results of your selection are displayed in the route table by indicating the total routes and the total possible deliveries. Selecting the [View as Table] tab will reveal the table overlaid on the map. The ‘Order summary’ box on the right will approximate

when you hover the mouse over a route on the map it will tell you at the top how many addresses are on that route, the price & if it is a business or residential

2 Once your desired routes are selected, click 3 Next Step This will redirect you to a page to enter your drop-o date* and your payment options 4

*If the design has been approved, please allow 5 days for printing. We suggest choosing a date in the upcoming week.

and total

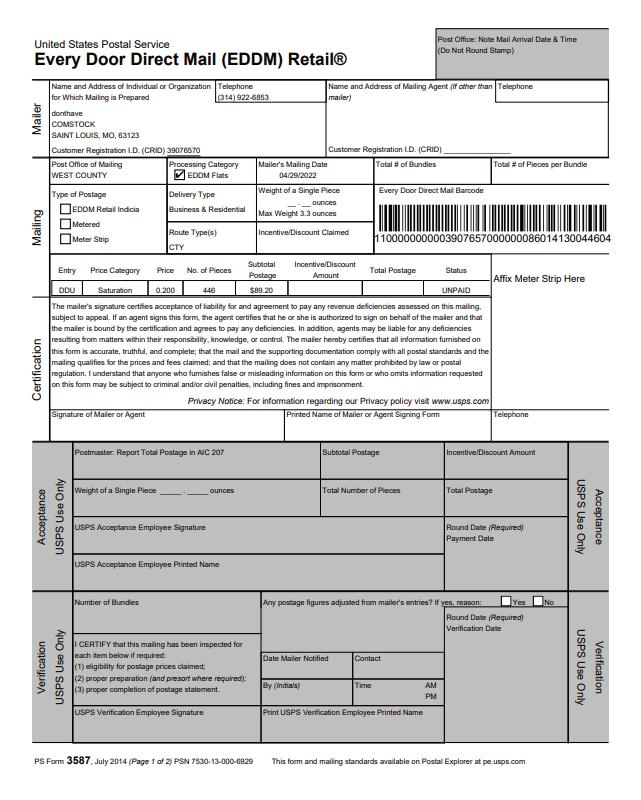

After you have chosen your routes and selected a drop-o date and payment option, you will be redirected to a ‘Thank you for your order’ page. If you would like us to bundle your mailpieces for you, please download & email MidwestMarketing@nafinc.com the facing slips and mailing statement. We need both!

Loan O cer:

NMLS#:

Title:

O ce #:

Cell #:

Email:

Website:

We cannot start designing until we have received all information.

Agent Name:

Company Name:

Title:

O ce #:

Cell #:

Email:

Website:

Co-Branded LO Only

Link to Photos:

(Please include headshot & logo if first time requesting a design)

(If applicable; we can NOT use realtor.com, zillow.com, or similar site links because of RESPA)

Have you created this design yourself? If so, please share the working file in your email, or include your editable canva link here:

EDDM (8.5 x 7) Every Door Direct Mail

Postcard (8.5 x 5.5)

Flyer (8.5 x 11) with addresses**

Luxury Business Card

Trifold (6x11 folded; 11x17 unfolded)

NOTE: These have an increased turn time

Explanation of design request:

EDDM

Door Hanger (4.25x11)

Social Media And Story Version Luxury Mailer (6x11) with addresses**

Open House Listing Booklet

4 pg. (20 photos required minimum)

8 pg. (40 photos required minimum)

(Include exact verbiage/specifics/etc. NOTE: the marketing team are not loan o cers/real estate agents and will need EXACT verbiage for any programs/home descriptions/etc. you may want to include)

Turn times vary. PROOF turn times and PRINT turn times are not always the same.

* Any design request sent after 2:30pm CST will count as next work-day submittal. These turn times begin at 9am CST next work-day.

** If providing addresses, please include a comma delimited (CSV) Excel file with headers such as Name, Address, City, State, Zip.

***All New Designs will need to be sent to OLA Marketing for compliance approval which can increase turn around time.

Please review all design proofs carefully. Edits after approval will incur a charge of $0.20 p/p for reprints.

Printing will not begin until we receive an approval to print. You will be notified when your design is approved or on-hold

Ship Order to:

• Down Payment as Low as 3%

• Fixed or Adjustable Rates

• Down Payment Assistance Programs Available

• Non-Occupying Co-Borrowers Allowed

• Down Payment as Low as 3.5%

• Lower Credit Score Flexibility

• Higher Allowable Debt to Income Ratios

• 100% Financing with DPA

VA

• 100% Financing

• No Monthly Mortgage Insurance Premiums

• Flexible Underwriting Guidelines

USDA

• 100% Financing

• Lower Credit Score Flexibility

• Gifts for Closing Costs Allowed

• Borrow up to $3 Million

• Credit Score as Low as 700

• Eligible for Primary Residence, Second Home or Investment Property

• Warrantable and Non-Warrantable Condos Permitted

• FHA and Conventional Programs

• Purchase or Refinance

• Principal Residence, Second Home or Investment Property

• Ability to Finance Repairs and Home Improvements

• Allows Buyer to Become a Cash Buyer

• Buyer Can Purchase New Home Without Selling Current Home

• Conventional and VA Loans Allowable

• Lock In Your Rate - Rate Can’t Increase

• If Rates Improve during Locked Period, You Can Float Down to a Better Rate

• Self Employed Borrowers can use Business Bank Statements to Qualify

• Purchase New Home Without Selling Current Home –Exclude Payment in Debt to Income Ratio

• Purchase, Refinance or Cash-Out

• Primary, Second Home or Investment Property Eligible

• Use Equity From Your Existing Home Towards the Purchase of a New Home

• Ability to Present a Strong Non-Contingent Offer, Giving You a Competitive Edge in the Market

• No Monthly Payments During the Loan Term Reducing the Financial Stress of managing Two Mortgage Payments

• Lower Interest Rate for the First Few Years of Mortgage

• Available on Conventional, FHA VA and USDA Loan Products

• 1/0, 1/1/1, 2/1, and 3/2/1 Buydown Options Available

• Additional Funds for Down Payment and Closing Costs

• Chenoa

• Freddie Mac BorrowSmartSM

• Borrower can Reduce the Principal Balance

• New American Funding will Re-Amortize the Loan based on the Remaining Term and Payments will be Reduced

• Multiple Recasts can be Completed during the Life of the Loan

• PMI can be Eliminated in Some Scenarios

Buying in cash means convenience, cer tainty, and may mean cost savings too. In fact, buying in cash may help your clients save up to 11% over those using a traditional mor tgage.1

With NAF Cash, an affiliated company of New American Funding, your buyer can make a competitive, true cash offer that is not contingent on financing and close in as little as seven days. You know what that means for you.

• Clients can buy their new home before selling their current home

• Sellers may be more likely to offer concessions to cash buyers

• Get commissions quickly

• Use potential savings to buy down interest rate

• No fees for agents

• Close on more homes faster

Follow these steps to make your buyer a cash buyer with NAF Cash!

STEP 1

Get Cer tified

Join a FR EE 4 5 - minu te N A F Cash LLC training

STEP 2

Get Your Clie nt Pre -A pproved

Get your client pre - approved with New A merican Funding!

STEP 3

Complete N A F Cash Docume nts

Work with your N A F Cash Transac tion Coordinator to submit the required documents.

STEP 4

Get Ready to Write Cash O f fers

Your N A F Cash Transac tion Coordinator will notif y you once the client has been approved and they can begin making a cash of fer

STEP 5

O f fer Accepted

Close and move in quickly! At this point , you will work closely with your N A F Cash Transac tion Coordinator

A renovation mortgage offers your clients the financial flexibility to meet their home improvement needs for a wide variety of renovation projects, from repairs and energy updates to landscaping and luxury upgrades. This renovation loan includes financing in their conventional purchase or refinanced home loan.

• Purchase the home and include rehabilitation costs in the same transaction

• Finance up to 97% of the “After Improved” appraised value

• Occupancy types include primary residence, second home, or investment properties

• No minimum repair amount

• The maximum repair amount is 75% of the “After Improved” appraised value of the property

We can help your buyers with J umb o Ho m e L oan s from New American Funding

I f your clients want a h ome in a pre mi um nei gh borh ood , a re read y to buy a va cati on h ome , or want to ex pand thei r real estate por t foli o, our fl ex i b le Jumb o loans co u ld b e ju s t w ha t th ey need . With l oans up to $5 milli on and alte rnati ve quali fyin g in come opti ons , your clients can buy more w ith Ne w Ameri can Fundin g!

OUR JUMBO HOME LOANS DELIVER MORE!

Up to $5 million

Down payments of as little as 10%

Debt-to-income ratio up to 50%

Credit score as low as 620

Cash-out Refi up to 85%

Options for bank statements, 1099, asset verification, and DSCR

Primary, secondary, & investment proper ties

Available for 1 - 4 unit single-family, condos, modular homes, and townhomes

Do You Have Buyers Ready For a Bi gg er Home , Investment Property, or Vacation Home?

A mortgage recasting, or loan recast, is when a borrower makes a large, lump-sum payment toward the principal balance of their mortgage and the lender, in turn, reamortizes the loan. This means that your loan and payments are reduced to reflect the new balance. It allows borrowers the opportunity to close with just 5% down. Once the current home is sold, borrower can recast to use the proceeds from the sale to buy down the principle balance to reduce monthly payment and eliminate PMI.

Recasting Highlights:

• Minimum of $5000 principal reduction

• $300 Nominal fee

• Borrower can reduce the principal balance

• New American Funding will re-amortize the loan based on the remaining term and payments will be reduced

• Recast for Conventional Loan (Freddie Mac and Fannie Mae)

• Multiple Recasts can be completed during the life of the loan

• Only one document is needed for recast: Borrowers must provide a Recast Modification Agreement which they will execute and have notarized

• The first principal and interest payment must be made on the original note

• PMI can be eliminated in some scenarios

A temporary buydown lowers the effective interest rate for the first few years of the mortgage. This reduction is a result of the deposit of a lump sum into an escrow account, a portion of which is released each month to reduce the borrower’s payments. Temporary Buydowns can be used on Conventional, FHA, VA, and USDA Loan Products.

These pages will focus on the Seller Paid Buydown.

Year 1 - Monthly Payment calculated using a Rate 1% below Note Rate

Year 2-30 - Monthly Payment would be calculated at the Note Rate

EXAMPLE:

Note Rate 6.625%

Year 1 Rate 5.625%

Year 2-30 Rate 6.625%

Year 1 - Monthly Payment calculated using a Rate 2% below Note Rate

Year 2 - Monthly Payment would be calculated at 1% below Note Rate

Year 3-30 - Monthly Payment would be calculated at the Note Rate

EXAMPLE:

Note Rate 6.625%

Year 1 Rate 4.625%

Year 2 Rate 5.625%

Year 3-30 Rate 6.625%

Year 1-3 - Monthly Payment calculated using a Rate 1% below Note Rate

Year 4-30 - Monthly Payment would be calculated at the Note Rate

EXAMPLE:

Note Rate 6.625%

Year 1-3 Rate 5.625%

Year 4-30 Rate 6.625%

Year 1 - Monthly Payment calculated using a Rate 3% below Note Rate

Year 2 - Monthly Payment calculated using a Rate 2% below Note Rate

Year 3 - Monthly Payment calculated using a Rate 1% below Note Rate

Year 4-30 - Monthly Payment would be calculated at the Note Rate

EXAMPLE:

Note Rate 6.625%

Year 1 Rate 3.625%

Year 2 Rate 4.625%

Year 3 Rate 5.625%

Year 4-30 Rate 6.625%

The cost of the Buydown is simply the difference between the BUYDOWN PAYMENT and the P&I PAYMENT using the Note Rate.

The COST for the Seller is equal to the SAVINGS for the Buyer.

See examples below.

1st Year - Buyer of House B is saving $403.75 per month Compared to Buyer of House A Savings of $51.23 per month

2nd Year - Buyer of House B is saving $206.90 per month Compared to Buyer of House A Savings of $51.23 per month

Our entire team is on-call and available to assist you & your clients with their lending needs!

• Fast Preapprovals

• Rate & Program Flyers

• Open House Materials

• Attend Open House

• Broker Previews

How much can a seller pay towards closing costs?

The more you save, the lower your monthly mor tgage payment will be. Link your bank account, monitor your spending, gain spending insights, and create a budget.

strengthen your credit and correct any errors. Work with a loan coach who knows credit like their ABCs.

The amount of debt you have compared to your income is one of the most impor tant factors for

• Get a $500 lender credit if you close on a home with New American Funding within two years of signing up with Uqual.

• Get access to 1:1 coaching from a team of exper ts who is obsessed with your loan success.

• Gain access to a Loan Readiness Score that shows you how close you are to reaching your loan goal.

It star ts with a 1:1 call with an exper t, giving you a clear path forward. Using ar tificial intelligence, we analyze your finances to create a strategy that will guide you on your path to loan readiness.

When we’re on your side, you’re on your way. We include an Action Plan that shows you step by step what you need to do to progress towards your goals. Plus, we accompany you to encourage and coach you throughout your journey

We don’t just help you achieve your mor tgage, we empower your financial future. As you progress in our program, you open new doors of oppor tunity to create wealth and be the best version of you, relieved of financial stress.

Talk to your New American Funding loan officer today

to Max. Conforming/High Balance Loan Limits

Up to Max. Conforming/High Balance Loan Limits

Total financed renovations cannot exceed 10% of the lesser of purchase price + total renovation cost, or “as completed” appraised value. If property is located in a Duty to Serve High Needs Area, this can be increased to 15%. For manufactured homes this is limited to the lesser of $50,000 or 10% of the “as completed” appraised value (increase to 15% if property located in Duty to Serve High Needs area). No minimum Must be completed within 120 days of closing. Not required

Up to allowable loan limits including cost of home repairs/ improvements. Total financed renovations cannot exceed 75% of the lesser of purchase price + total renovation cost, or “as completed” appraised value. For manufactured homes this is limited to the lesser of $50,000 or 50% of the “as completed” appraised value. No minimum Must be completed within 9 months of closing. Not required

Up to allowable loan limits including cost of home repairs/ improvements. Total financed renovations cannot exceed 75% of the lesser of purchase price + total renovation cost, or “as completed” appraised value. For manufactured homes this is limited to the lesser of $50,000 or 50% of the “as completed” appraised value. No minimum

which will include the

Must be completed within 12 months of closing. Required

on FHA County Loan

Up to allowable loan limits including cost of home upgrades, contingency reserves and allowable fees.

$5,000 Must commence within 30 days of closing and be completed within 6 mos. Required to review contractor bid and complete formal write up on the project. completing all progress inspections throughout project.

Required. Ranges from 10-20% depending on the project. May be financed or paid in cash.

Required. Ranges from 10-20% depending on the project. May be financed or paid in cash.

Manufactured home provided subject remains in compliance with

Manufactured home provided subject remains in compliance with HUD’s property acceptability criteria and all Freddie Mac requirements Accessory Dwelling Unit (ADU), including a manufactured home ADU

Required. Ranges from 10-15% depending on the project. May be financed or paid in cash. 1-4 Units 1 Unit 2nd Home 1 Unit Investment Condo/PUD Manufactured Home (provided improvements do not require structural changes) Newly built home when the home is at least 90% complete. The remaining improvements must be related to completing non-structural items the original builder was unable to finish.

Required. Ranges from 10-20% depending on the project. May be financed or paid in cash.

Required. Ranges from 10-20% depending on the project. May be financed or paid in cash.

Same as FHA Standard 203(k)

Complete tear down & reconstruction. Alterations to allow for commercial or business use. New construction. Purchase of personal property (built in appliances allowed).

Complete tear down & reconstruction. Alterations to allow for commercial or business use. New construction. Purchase of personal property (built in appliances allowed).

Complete tear down & reconstruction.

Alterations to allow for commercial or business use. New construction. Purchase of personal property (built in appliances allowed).

Same as FHA 203k Standard, plus no structural alterations or foundation repair.

FHA Approved Condo Bank owned REO All properties must be completed with a min. of 12 mos. since Certificate of Occupancy Manufactured home double wide or larger Luxury items, including new swimming pools, hot tubs, outdoor fireplaces, gazebos. Existing inground swimming pools may be repaired. Complete tear down & reconstruction. Alterations to allow for commercial or business use. New construction. Purchase of personal property (built in appliances allowed).

cations.

Disclaimer: Terms and conditions apply. Subject to borrower and property qualifications. Not all applicants will qualify. This is not a loan commitment or guarantee of any kind. Rates and terms are subject to change without notice. NMLS #6606. © New American Funding, LLC. Corporate office 14511 Myford Rd., Suite 100 Tustin, CA 92780. Phone (800) 450-2010. http://nmlsconsumeraccess.org.

Buydown Program Disclaimer: Rate and payment information for example purposes only.

Lock In & Float Disclaimer: Float Down options subject to additional terms and conditions, ask a New American Funding Loan Officer for more information. Borrower must pay required taxes and insurance.

Renovation Loan Disclaimer: Homestyle ® is a registered trademark of Fannie Mae. Homeownership education required by one borrower if all borrowers are first-time homebuyers.

NAF Cash Disclaimer: https://www.newamericanfunding.com/legal/statelicensing/. NAF Cash is fulfilled by NAF Cash, LLC, an affiliated real estate company of New American Funding that is managed and operated in compliance with applicable legal and regulatory requirements. NAF Cash, LLC. MI Real Estate Broker #6502431375. NAF Cash, LLC does not originate loans or issue loan commitments. NAF Cash, LLC charges a Transaction Fee of 1.5%-3.5% of purchase price for its service (fee varies by state). Terms and conditions apply, not available in all states. 41050 W 11 Mile Rd, Ste 220, Novi, MI, 48375. Phone 844-344-0531.

NAF Bridge Loan not available in TX or MA. 4/2025.